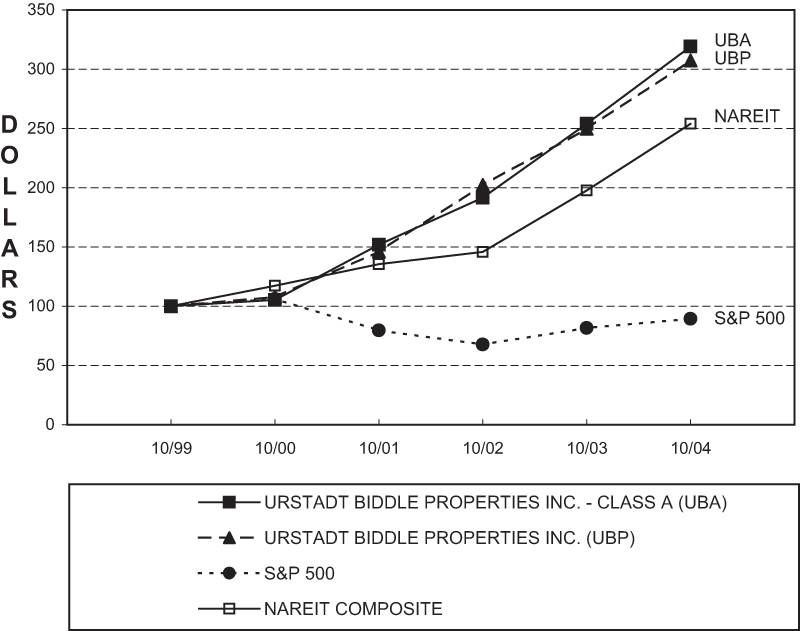

The following graph compares, for the five-year period beginning October 31, 1999 and ended October 31, 2004, the Company’s cumulative total return to holders of the Company’s Class A Common Shares and Common Shares with the returns for the NAREIT All REIT Total Return Index (a peer group index) published by the National Association of Real Estate Investment Trusts (NAREIT) and for the S&P 500 Index for the same period.

The stock price performance shown on the graph is not necessarily indicative of future price performance.

SOLICITATION OF PROXIES AND VOTING PROCEDURES

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, solicitations may also be made by personal interview, facsimile transmission or telephone. Directors and officers of the Company may participate in such solicitation and will not receive additional compensation for such services. Arrangements will also be made with custodians, nominees and fiduciaries for forwarding of proxy solicitation material to beneficial owners of Class A Common Shares and Common Shares and the Company will reimburse such custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith.

The presence, either in person or by properly executed proxy, of a majority of the Company’s outstanding Class A Common Shares and Common Shares is necessary to constitute a quorum at the Annual Meeting. Each Common Share outstanding on the Record Date entitles the holder thereof to one vote and each Class A Common Share outstanding on the Record Date entitles the holder thereof to 1/20 of one vote. An automated system administered by the Company’s transfer agent tabulates the votes.

The election of the Directors and the ratification of the appointment of the Company’s auditor each requires the affirmative vote of a majority of the total combined voting power of all classes of stock entitled to vote and present, in person or by properly executed proxy, at the Annual Meeting. Abstentions will thus be the equivalent of negative votes and broker non-votes will have no effect with respect to such proposals, as any Class A Common Shares or Common Shares subject to broker non-votes will not be present and entitled to vote with respect to any proposal to which the broker non-vote applies.

Each of the Proposals presented to the Company at the Annual Meeting is being presented as a separate and independent Proposal and no Proposal is conditioned upon adoption or approval of any other Proposal.

AVAILABLE INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements, and other information with the SEC. Such reports, proxy statements and other information may be inspected without charge at the principal office of the SEC, 450 Fifth Street, N.W., Washington, D.C. 20549, and at the regional offices of the SEC located at 233 Broadway, New York, New York 10279 and 175 W. Jackson Blvd., Suite 900, Chicago, Illinois 60604, and copies of all or any part thereof may be obtained at prescribed rates from the SEC’s Public Reference Section at such addresses. Also, the SEC maintains a World Wide Web site on the Internet at http://www.sec.gov that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. Such reports, proxy and information statements and other information also can be inspected at the office of the New York Stock Exchange, Inc., 20 Broad Street, New York, NY 10005.

The Company’s Annual Report to Stockholders for the fiscal year ended October 31, 2004 (which is not part of the Company’s proxy soliciting materials) has been mailed to the Company’s stockholders with or prior to this proxy statement. A copy of the Company’s Annual Report on Form 10-K, without exhibits, will be furnished without charge to stockholders upon request to:

Thomas D. Myers, Secretary

Urstadt Biddle Properties Inc.

321 Railroad Avenue

Greenwich, CT 06830

Upon request, copies of exhibits to the Annual Report on Form 10-K also may be obtained from the Company after payment of the reasonable costs to furnish such exhibits.

The Company’s Corporate Governance Guidelines, Code of Business Conduct and Ethics and the Charters for each of the Audit Committee, Compensation Committee and the Nominating and Corporate Governance Committee are available on the Company’s website at http:\\www.ubproperties.com and are available in print to any stockholder upon request to the corporate secretary at the address set forth above.

20

CONTACTING THE BOARD OF DIRECTORS

Any shareholder who desires to contact the Company’s Board of Directors may do so by writing to: Board of Directors, c/o Secretary, Urstadt Biddle Properties Inc., 321 Railroad Avenue, Greenwich, CT 06830. Communications received will be distributed to the Chairperson of the appropriate committee of the Board depending on the facts and circumstances outlined in the communication. The Board of Directors maintains special procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the submission by employees of the Company, on a confidential and anonymous basis, of concerns regarding questionable accounting or auditing matters. Such communications may be made by writing to the Audit Committee of the Board of Directors, c/o Secretary, at the address set forth above. Any such communication marked “confidential” will be forwarded by the Secretary, unopened, to the Chairperson of the Audit Committee.

OTHER MATTERS

The Directors know of no other business to be presented at the Annual Meeting. If other matters properly come before the Meeting in accordance with the Articles of Incorporation, the persons named as proxies will vote on them in accordance with their best judgment.

The Company encourages, but does not require, that members of its Board of Directors attend the Annual Meeting of Stockholders. All of the Directors attended the Annual Meeting of Stockholders held March 10, 2004.

Any stockholder who intends to present a stockholder proposal for consideration at the Company’s 2006 Annual Meeting of Stockholders by utilizing Rule 14a-8 under the Exchange Act, must comply with the requirements as to form and substance established by the SEC for such proposals to be included in the Company’s proxy statement for such Annual Meeting and such proposals must be received by the Company by October 10, 2005.

Any stockholder who intends to present a stockholder proposal for consideration at the Company’s 2006 Annual Meeting of Stockholders without complying with Rule 14a-8 or who intends to make a nomination for election to the Company’s Board of Directors at the 2006 Annual Meeting of Stockholders, must comply with certain advance notification requirements set forth in the Company’s bylaws. The Company’s bylaws provide, in part, that any proposal for stockholder action, or nomination to the Board of Directors, proposed other than by the Board of Directors must be received by the Company in writing, together with specified accompanying information, at least 75 days prior to an annual meeting in order for such action to be considered at the meeting. The year 2006 Annual Meeting of Stockholders is currently anticipated to be held on March 8, 2006. Any notice of intent to consider other matters and/or nominees, and related information, must therefore be received by the Company by December 23, 2005. The purpose of the bylaw is to assure adequate notice of, and information regarding, any such matter as to which shareholder action may be sought.

You are urged to complete, date, sign and return your Proxy Card promptly to make certain your Shares will be voted at the Annual Meeting, even if you plan to attend the meeting in person. If you desire to vote your Shares in person at the meeting, your proxy may be revoked. For your convenience in returning the Proxy Card, a pre-addressed and postage paid envelope has been enclosed.

YOUR PROXY IS IMPORTANT

WHETHER YOU OWN FEW OR MANY SHARES.

PLEASE DATE, SIGN AND MAIL THE ENCLOSED PROXY CARD TODAY.

21

URSTADT BIDDLE PROPERTIES INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

To be held on March 9, 2005

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF URSTADT BIDDLE PROPERTIES INC.

The undersigned hereby constitutes and appoints Willing L. Biddle and Thomas D. Myers, and each of them, as Proxies of the undersigned, with full power to appoint his substitute, and authorizes each of them to represent and vote all Class A Common Stock or Common Stock, par value $.01 per share, as applicable, of Urstadt Biddle Properties Inc. (the “Company”) held of record as of the close of business on January 25, 2005, at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Stamford Marriott, Two Stamford Forum, Stamford, Connecticut, on Wednesday, March 9, 2005, and at any adjournments or postponements thereof.

When properly executed, this proxy will be voted in the manner directed herein by the undersigned stockholder(s). If no direction is given, this proxy will be voted (i) FOR the election of three Directors of the Company to serve for three years, as set forth in Proposal 1; and (ii) FOR the ratification of the appointment of Ernst & Young LLP as the independent auditors of the Company for the ensuing fiscal year, as set forth in Proposal 2. In their discretion, the Proxies are each authorized to vote upon such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. A stockholder wishing to vote in accordance with the Board of Directors’ recommendations need only sign and date this proxy and return it in the enclosed envelope.

The undersigned hereby acknowledge(s) receipt of a copy of the accompanying Notice of Annual Meeting of Stockholders, the Proxy Statement and the Company’s Annual Report to Stockholders and hereby revoke(s) any proxy or proxies heretofore given. This proxy may be revoked at any time before it is exercised by filing a notice of such revocation, by filing a later dated proxy with the Secretary of the Company or by voting in person at the Annual Meeting.

| | | | |

| (Continued and to be signed and dated on reverse side.) | | | URSTADT BIDDLE PROPERTIES INC.

P.O. BOX 11040

NEW YORK, N.Y. 10203-0040 |

| To change your address, please mark this box. | o | | |

| 6 DETACH PROXY CARD HERE 6 |

| | | | | |

| Please vote and sign on this side and return promptly in the enclosed envelope. Do not forget to date your proxy. | | x |

| | Votes must be indicated

(x) in Black or Blue ink. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THESE PROPOSALS

Proposal 1. To elect three Directors to serve for three years.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | FOR | | AGAINST | | ABSTAIN | |

| FOR all nominees listed below | | o | | WITHHOLD AUTHORITY to vote for all nominees listed below | | o | | *EXCEPTIONS | | o | | Proposal 2. | | To ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for one year. | o | | o | | o | |

| | | | | | | | | | | | | | | | | | | | |

| Nominees to serve for three years: Charles D. Urstadt, Peter Herrick and George J. Vojta. |

| | | | | | | | | | | | | | | | | | | | |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.)

*Exceptions

| | Please sign name exactly as shown. When there is more than one holder, each should sign. When signing as an attorney, administrator, guardian or trustee, please add your title as such. If executed by a corporation or partnership, the proxy should be signed by a duly authorized person, stating his or her title or authority. |

| | | | | | | | | | | | | | | | | | | | |

| Please sign exactly as your name appears hereon. When signing in a representative capacity, please give full title. | | | |

| | | Date Share Owner sign here Co-Owner sign here | |