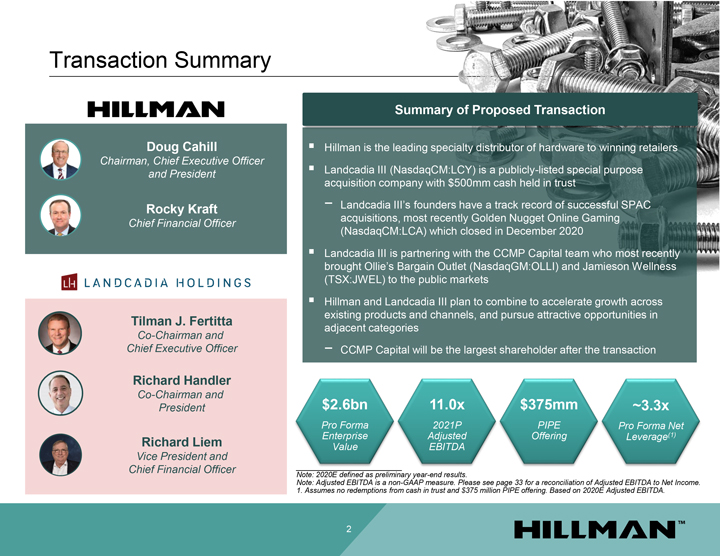

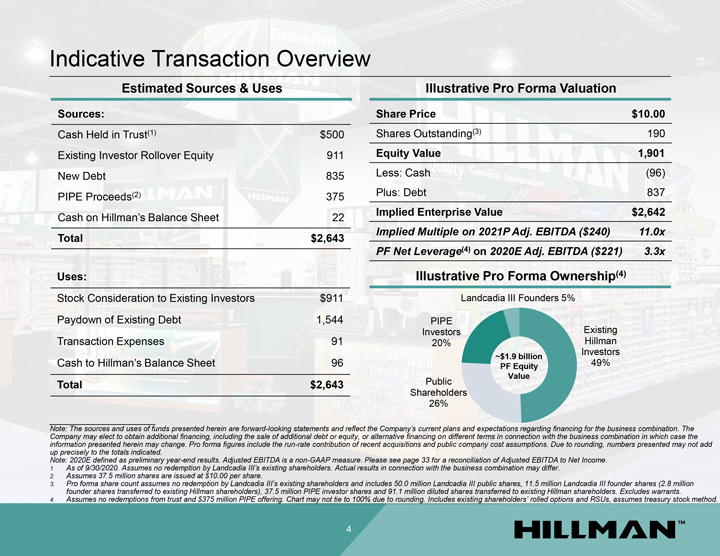

Disclaimer This presentation (the “presentation”) is being delivered to a limited number of parties for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debtor other financial instruments of Landcadia Holdings III, Inc. (“Landcadia”) or The Hillman Companies, Inc. (“Hillman”) or any of their respective affiliates. The presentation has been prepared to assist parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Landcadia and Hillman and for no other purpose. It is not intended to form the basis of any investment decision or any other decisions with respect of the Business Combination. No Representation or Warranty. No representation or warranty, express or implied, is or will be given by Landcadia or Hillman or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the Business Combination, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. This presentation does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to Landcadia or Hillman, and does not constitute investment, tax or legal advice. The recipient also acknowledges and agrees that the information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Landcadia and Hillman disclaim any duty to update the information contained in this presentation. Any and all trademarks and trade names referred to in this presentation are the property of their respective owners. The only obligations of any such person shall be those of Landcadia and Hillman set forth in a definitive agreement executed by Landcadia and Hillman regarding a possible negotiated transaction with Landcadia and Hillman. The proposed Business Combination is subject to, among other things, the negotiation and execution of a definitive agreement providing for the Business Combination, the approval by Landcadia’s stockholders, satisfaction of the conditions set forth in the definitive agreement. Accordingly, there can be no assurance that a definitive agreement will be entered into or that the proposed Business Combination will be consummated. Forward looking statements. This presentation contains “forward looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. Forward looking statements include, without limitation, statements regarding the estimated future financial performance, financial position and financial impacts of the Business Combination as well as of Landcadia, Hillman and the combined company following the Business Combination, the satisfaction of closing conditions to the Business Combination, the level of redemption by Landcadia’s public stockholders and purchase price adjustments in connection with the Business Combination, the timing of the completion of the Business Combination, the anticipated pro forma enterprise value and projected revenue of the combined company following the Business Combination, anticipated ownership percentages of the combined company’s stockholders following the potential transaction, and the business strategy, plans and objectives of management for future operations, including as they relate to the potential Business Combination. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this presentation, words such as “pro forma,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “will”, “would” and similar expressions may identify forward looking statements, but the absence of these words does not mean that a statement is not forward looking. When Landcadia discusses its strategies or plans, including as they relate to the Business Combination, it is making projections, forecasts and forward looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, Landcadia’s management. These forward looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of Landcadia’s and Hillman’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) Landcadia’s ability to complete the Business Combination or, if Landcadia does not complete the Business Combination, any other initial business combination; (2) satisfaction or waiver (if applicable ) of the conditions to the Business Combination, including with respect to the approval of the stockholders of Landcadia; (3) the ability to maintain the listing of the combined company’s securities on Nasdaq or another exchange; (4) the risk that the Business Combination disrupts current plans and operations of Landcadia or Hillman as a result of the announcement and consummation of the transaction described herein; (5) the impact of COVID-19 on Hillman’s business and operations and/or the ability of the parties to complete the Business Combination; (6) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (7) costs related to the Business Combination; (8) changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals required to complete the Business Combination; (9) the possibility that Hillman and Landcadia may be adversely affected by other economic, business, and/or competitive factors; (10) the out come of any legal proceedings that may be instituted against Landcadia, Hillman or any of their respective directors or officers following the announcement of the Business Combination; (11) the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated stockholder redempti ons and purchase price and other adjustments; and (12) other risks and uncertainties indicated from time to time in the preliminary proxy statement of Landcadia related to the Business Combination, including those under “Risk Factors” therein, and other documents filed or to be filed with the Securities and Exchange Commission (“SEC”) by Landcadia or Hillman. You are cautioned not to place undue reliance upon any forward looking statements. Forward looking statements included in this presentation speak only as of the date of this presentation. Neither Landcadia nor Hillman undertakes any obligation to update its forward looking statements to reflect events or circumstances after the date hereof. Additional risks and uncertainties are identified and discussed in Landcadia’s and Hillman’s reports filed with the SEC. No Offer or Solicitation. This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This presentation does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Use of Projections. This presentation contains financial forecasts. Neither Landcadia’s nor Hillman’s independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of Landcadia’s or Hillman’s control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of Landcadia, Hillman or the combined company after the Business Combination or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representati on by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data. In this presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which Hillman competes and other industry data. We obtained this information and statistics from third party sources, including reports by market research firms and company filings. Being in receipt of the presentation you agree you may be restricted from dealing in (or encouraging others to deal in) price sensitive securities. Non-GAAP Financial Matters. This presentation includes certain non GAAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and free cash flow. EBITDA is defined as net income plus tax expense, interest expense and depreciation and amortization. Adjusted EBITDA is defined as EBITDA, less non-recurring expenses. Free cash flow is defined as Adjusted EBITDA less capital expenditures. Note that free cash flow does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations. These financial measures are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and may be different from non-GAAP financial measures used by other companies. Landcadia and Hillman believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. See the footnotes on the slides where these measures are discussed for a description of these non-GAAP financial measures and reconciliations of such non-GAAP financial measures to the most comparable GAAP amounts can be found. This presentation includes certain forward looking non-GAAP financial measures. To the extent a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures is not provided in this presentation, it is because neither Landcadia nor Hillman is able to provide such reconciliation without unreasonable effort. Additional Information. Landcadia intends to file with the SEC a preliminary proxy statement in connection with the Business Combination and, when available, will mail a definitive proxy statement and other relevant documents to its stockholders. The definitive proxy statement will contain important information about the Business Combination and the other matters to be voted upon at a meeting of stockholders to be held to approve the Business Combination and other matters (the “Special Meeting”) and is not intended to provide the basis for any investment decision or any other decision In respect of such matters. Landcadia’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement, the amendments thereto, and the definitive proxy statement in connection with Landcadia’s solicitation of proxies for the Special Meeting because the proxy statement will contain important information about the Business Combination. When available, the definitive proxy statement will be mailed to Landcadia stockholders as of a record date to be established for voting on the Business Combination and the other matters to be voted upon at the Special Meeting. Landcadia’s stockholders will also be able to obtain copies of the proxy statement, without charge once available, at the SEC’s website at www.sec.gov or by directing a request to Landcadia’s secretary at 1510 West Loop South Houston, Texas 77027. Participants in the Solicitation. Landcadia, Hillman and their respective directors and officers may be deemed participants in the solicitation of proxies of Landcadia stockholders in connection with the Business Combination. Landcadia’s stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Landcadia in Landcadia’s Registrati on Statement on Form S-1, which was initially filed with the SEC on September 17, 2020 and is available at the SEC’s website at www.sec.gov or by directing a request to Landcadia’s secretary at the address above. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Landcadia stockholders in connection with the Business Combination and other matters to be voted upon at the Special Meeting will be set forth in the proxy statement for the Business Combination when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Business Combination will be included in the proxy statement that Landcadia intends to file with the SEC, including Jefferies Financial Group Inc.’s and/or its affiliate’s various roles in the transaction. You should keep in mind that the interest of participants in such solicitation of proxies may have financial interests that are different from the interests of the other participants.