UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-QSB

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2007

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number: 000-28837

NEW JERSEY MINING COMPANY

(Exact name of registrant as specified in its charter)

| Idaho | 82-0490295 |

| (State or other jurisdiction | (IRS employer identification no.) |

| of incorporation) |

89 Appleberg Road, Kellogg, Idaho 83837

(Address of principal executive offices)

Registrant’s telephone number, including area code: (208) 783-3331

| Common Stock | The OTC-Bulletin Board |

| Title of each class | Name and exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(D) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period as the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [X]

On August 1, 2007, 30,506,280 shares of the registrant’s common stock were outstanding.

Transitional Small Business Disclosure Format (Check one): Yes [ ] No [X ]

1

| NEW JERSEY MINING COMPANY |

| QUARTERLY REPORT ON FORM 10-QSB |

| FOR THE QUARTERLY PERIOD |

| ENDED JUNE 30, 2007 |

| TABLE OF CONTENTS |

[The balance of this page has been intentionally left blank.]

2

PART I-FINANCIAL INFORMATION

| Item 1: | FINANCIAL STATEMENTS |

| NEW JERSEY MINING COMPANY |

| (A Development Stage Company) |

| BALANCE SHEET |

| June 30, 2007 |

| (Unaudited) |

| ASSETS | |||

| Current assets: | |||

| Cash and cash equivalents | $ | 537,923 | |

| Investment in marketable equity security at market (cost-$7,500) | 993,750 | ||

| Interest receivable | 1,366 | ||

| Inventory | 22,055 | ||

| Deposits | 45,525 | ||

| Total current assets | 1,600,619 | ||

| Property, plant, and equipment, net of accumulated depreciation | 1,313,677 | ||

| Mineral properties, net of accumulated amortization | 877,051 | ||

| Reclamation bonds | 123,676 | ||

| Total assets | $ | 3,915,023 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||

| Current liabilities: | |||

| Accounts payable | $ | 81,572 | |

| Accrued payroll and related payroll expenses | 35,794 | ||

| Obligation under capital lease-current portion | 37,640 | ||

| Notes payable-current portion | 36,712 | ||

| Total current liabilities | 191,718 | ||

| Accrued reclamation costs | 18,000 | ||

| Obligation under capital lease-non-current | 64,518 | ||

| Notes payable-non-current | 139,522 | ||

| Total liabilities | 413,758 | ||

| Stockholders’ equity: | |||

| Preferred stock, no par value; 1,000,000 | |||

| shares authorized; no shares issued or outstanding | |||

| Common stock, no par value; 50,000,000 shares | |||

| authorized; 30,506,280 shares issued and outstanding | 6,267,101 | ||

| Deficit accumulated during the development stage | (3,752,086 | ) | |

| Accumulated other comprehensive income | |||

| Unrealized gain in marketable equity security | 986,250 | ||

| Total stockholders’ equity | 3,501,265 | ||

| Total liabilities and stockholders’ equity | $ | 3,915,023 |

3

The accompanying notes are an integral part of the financial statements.

| NEW JERSEY MINING COMPANY |

| (A Development Stage Company) |

| STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) |

| For the Three and Six Month Periods ended June 30, 2007 and 2006 and for the period from inception |

| (July 18, 1996) through June 30, 2007 |

| (Unaudited) |

| From Inception | |||||||||||||||

| (July 18, 1996) | |||||||||||||||

| Through | |||||||||||||||

| June 30, 2007 | June 30, 2006 | June 30, 2007 | |||||||||||||

| Three Months | Six Months | Three Months | Six Months | ||||||||||||

| Revenue: | |||||||||||||||

| Sales of gold | $ | 43,250 | $ | 43,250 | $ | $ | 40,429 | $ | 92,959 | ||||||

| Sales of concentrate | 1,762 | 50,507 | 60,563 | 138,035 | 601,168 | ||||||||||

| Total revenue | 45,012 | 93,757 | 60,563 | 178,464 | 694,127 | ||||||||||

| Cost and expenses: | |||||||||||||||

| Production costs | 94,600 | 199,296 | 131,031 | 246,886 | 775,327 | ||||||||||

| Management | 68,014 | 131,198 | 58,446 | 110,687 | 779,706 | ||||||||||

| Exploration | 144,244 | 224,939 | 124,434 | 127,392 | 1,315,525 | ||||||||||

| Gain on sale of mineral property | (90,000 | ) | (90,000 | ) | (90,000 | ) | |||||||||

| Depreciation and amortization | 27,126 | 56,295 | 23,303 | 44,803 | 236,871 | ||||||||||

| General and administrative expenses | 82,408 | 194,547 | 115,443 | 168,581 | 1,379,982 | ||||||||||

| Total operating expenses | 416,392 | 806,275 | 362,657 | 608,349 | 4,397,411 | ||||||||||

| Other (income) expense: | |||||||||||||||

| Timber sales (net) | (487 | ) | (487 | ) | (51,389 | ) | |||||||||

| Royalties and other income | (1,501 | ) | (200 | ) | (591 | ) | (69,815 | ) | |||||||

| Royalty expense | 5,120 | 5,703 | 5,189 | 9,478 | 32,779 | ||||||||||

| Interest income | (8,599 | ) | (16,851 | ) | (16,851 | ) | |||||||||

| Interest expense | 3741 | 7,541 | 1,626 | 5,052 | 33,128 | ||||||||||

| Write off of goodwill | 30,950 | ||||||||||||||

| Write off of investment | 90,000 | ||||||||||||||

| Total other (income) expense | (225 | ) | (5,595 | ) | 6,615 | 13,939 | 48,802 | ||||||||

| Net loss | 371,155 | 706,923 | 308,709 | 443,824 | 3,752,086 | ||||||||||

| Other comprehensive income: | |||||||||||||||

| Unrealized gain on marketable | |||||||||||||||

| equity security | (75,000 | ) | (986,250 | ) | |||||||||||

| Comprehensive loss | $ | 371,155 | $ | 631,923 | $ | 308,709 | $ | 443,824 | $ | 2,765,836 | |||||

| Net loss per common share-basic | $ | 0.01 | $ | 0.02 | $ | 0.01 | $ | 0.02 | $ | 0.23 | |||||

| Weighted average common shares | |||||||||||||||

| outstanding-basic | 30,485,293 | 30,112,861 | 27,233,896 | 25,233,985 | 16,491,545 | ||||||||||

4

The accompanying notes are an integral part of these financial statements.

| NEW JERSEY MINING COMPANY |

| (A Development Stage Company) |

| STATEMENTS OF CASH FLOWS |

| For the Six-Month Periods ended June 30, 2007 and 2006 and for the period from inception (July 18, 1996) through |

| June 30, 2007 |

| (Unaudited) |

| From Inception | |||||||||

| (July 18, 1996) | |||||||||

| June 30, | June 30, | Through | |||||||

| 2007 | 2006 | June 30, 2007 | |||||||

| Cash flows from operating activities: | |||||||||

| Net loss | $ | (706,923 | ) | $ | (443,824 | ) | $ | (3,752,086 | ) |

| Adjustments to reconcile net loss to net cash | |||||||||

| used by operating activities: | |||||||||

| Depreciation and amortization | 56,295 | 44,803 | 236,870 | ||||||

| Write-off of equipment | 11,272 | ||||||||

| Write-off of goodwill and investment | 120,950 | ||||||||

| Gain on sale of mineral property | (90,000 | ) | (90,000 | ) | |||||

| Stock issued for: | |||||||||

| Management and directors fees | 42,000 | 42,688 | 566,537 | ||||||

| Services and other | 10,700 | 51,336 | 144,854 | ||||||

| Exploration | 22,560 | 58,881 | |||||||

| Change in: | |||||||||

| Inventories | 110,031 | 28,050 | (22,055 | ) | |||||

| Accounts receivable | 13,628 | (61,117 | ) | ||||||

| Interest receivable | (1,366 | ) | (1,366 | ) | |||||

| Other assets | (778 | ) | |||||||

| Accounts payable | (18,856 | ) | (1,814 | ) | 90,807 | ||||

| Accrued payroll and related payroll expenses | 4,273 | (5,479 | ) | 35,794 | |||||

| Accrued reclamation costs | 18,000 | ||||||||

| Net cash used by operating activities | (467,658 | ) | (435,357 | ) | (2,582,320 | ) | |||

| Cash flows from investing activities: | |||||||||

| Purchases of property, plant, and equipment | (146,742 | ) | (123,047 | ) | (928,682 | ) | |||

| Deposits on equipment purchases | (45,525 | ) | (45,525 | ) | |||||

| Purchases of mineral property | (10,404 | ) | |||||||

| Proceeds from sale of mineral property | 120,000 | 120,000 | |||||||

| Purchase of reclamation bonds | (121,176 | ) | (123,676 | ) | |||||

| Proceeds from maturity of certificates of deposit | 200,000 | ||||||||

| Purchase of marketable equity securities | (7,500 | ) | |||||||

| Cash of acquired companies | 38,269 | ||||||||

| Deferral of development costs | (76,078 | ) | (301,613 | ) | |||||

| Net cash used by investing activities | (189,521 | ) | (3,047 | ) | (1,259,131 | ) | |||

| Cash flows from financing activities: | |||||||||

| Exercise of stock purchase warrants | 120,000 | 797,600 | |||||||

| Sales of common stock, net of issuance costs | 1,025,319 | 1,320,000 | 3,717,626 | ||||||

| Principal payments on capital lease | (17,211 | ) | (9,994 | ) | (101,630 | ) | |||

| Principal payments on notes payable | (9,827 | ) | (34,222 | ) | |||||

| Net cash provided by financing activities | 1,118,281 | 1,310,006 | 4,379,374 | ||||||

| Net change in cash | 461,102 | 871,602 | 537,923 | ||||||

| Cash, beginning of period | 76,821 | 16,863 | 0 | ||||||

| Cash, end of period | $ | 537,923 | $ | 888,465 | $ | 537,923 | |||

| Supplemental disclosure of cash flow information: | |||||||||

| Interest paid in cash | $ | 7,541 | $ | 5,521 | $ | 27,865 | |||

| Non-cash investing and financing activities: | |||||||||

| Common stock issued for: | |||||||||

| Property, plant, and equipment | $ | 7,000 | $ | 2,000 | $ | 41,526 | |||

| Mineral properties | $ | 279,300 | |||||||

| Payment of accounts payable | $ | 12,205 | $ | 12,205 | |||||

| Acquisitions of companies, excluding cash | $ | 743,653 | |||||||

| Capital lease obligation incurred for equipment acquired | $ | 178,588 | |||||||

| Notes payable issued for property and equipment acquired | $ | 145,938 | $ | 33,927 | $ | 191,225 |

5

The accompanying notes are an integral part of these financial statements.

| New Jersey Mining Company |

| Notes to Financial Statements |

| (Unaudited) |

| 1. | Basis of Presentation: |

The unaudited financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America for interim financial information, as well as the instructions to Form 10-QSB. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of the Company’s management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair presentation of the interim financial statements have been included. Operating results for the three and six month periods ended June 30, 2007, are not necessarily indicative of the results that may be expected for the full year ending December 31, 2007.

For further information refer to the financial statements and footnotes thereto in the Company’s Annual Report on Form 10-KSB for the year ended December 31, 2006.

The Company presents its financial statements in accordance with Statement of Financial Accounting Standards (SFAS) No. 7, “Accounting for Development Stage Entities,” as management believes that while the Company’s planned principal operations have commenced, the revenue generated from them is not sufficient to cover all corporate costs. Additional development of the Company’s properties is necessary before a transition is made to reporting as a production stage company.

| 2. | Description of Business |

New Jersey Mining Company (“the Company”) was incorporated as an Idaho corporation on July 18, 1996. The Company's primary business is exploring for and developing gold, silver and base metal mining resources in Idaho.

| 3. | Net Loss Per Share |

SFAS No. 128, “Earnings per Share,” requires dual presentation of basic earnings per share (“EPS”) and diluted EPS on the face of income statements for all entities with complex capital structures. Basic EPS is computed as net income divided by the weighted average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution that could occur from common shares issuable through stock options, warrants, and other convertible securities. For the three and six month periods ended June 30, 2007 and 2006, the effect of the Company’s outstanding warrants would have been anti-dilutive. Accordingly, only basic EPS is presented. As of June 30, 2007, the Company had 6,170,543 outstanding warrants that could potentially dilute basic EPS in the future.

| 4. | Reclassifications |

Certain prior period amounts have been reclassified to conform to the 2007 financial statement presentation. These reclassifications have no effect on net loss as previously reported.

| 5. | Notes Payable |

Two of the notes assumed by the Company in the second quarter of 2007 were personally guaranteed by the president of the Company. The assets pertaining to these notes are held by the Company and will revert to Company’s possession upon payment in full of the notes to the respective lenders.

6

| 6. | Reclamation Bonds |

Various laws and permits require that financial assurances be in place for certain environmental and reclamation obligations and other potential liabilities. The reclamation bond balance at June 30, 2007, represents an investment in U.S. government agency bonds. The bonds are restricted to ensure that reclamation is performed at certain properties where the Company is conducting mining and exploration activities.

| 7. | Adoption of New Accounting Principles |

On January 1, 2007, the Company adopted SFAS No. 155 “Accounting for Certain Hybrid Financial Instruments,” which amends SFAS No. 133 “Accounting for Derivative Instruments and Hedging Activities” and SFAS No. 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.” SFAS No. 155 resolves issues addressed in Statement 133 Implementation Issue No. D1 “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets,” and:

- Permits fair value remeasurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation;

- Clarifies which interest-only strips are not subject to the requirements of SFAS No. 133;

- Establishes a requirement to evaluate interests in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation;

- Clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives; and

- Amends SFAS No. 140 to eliminate the prohibition on a qualifying special-purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument.

The Company adopted SFAS No. 155 using the modified prospective transition method, which requires the application of the accounting standard as of January 1, 2007. There was no impact on the financial statements as of and for the three and six month periods ended June 30, 2007 as a result of the adoption of SFAS No 155. In accordance with the modified prospective transition method, the financial statements for prior periods have not been restated to reflect, and do not include, the impact of SFAS No. 155.

On January 1, 2007, the Company adopted Financial Accounting Standards Board Interpretation No. 48 (“FIN No. 48”) “Accounting for Uncertainty in Income Taxes.” FIN No. 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with SFAS No. 109 “Accounting for Income Taxes,” prescribing a recognition threshold and measurement attribute for the recognition and measurement of a tax position taken or expected to be taken in a tax return. In the course of our assessment, we have determined that we are subject to examination of our income tax filings in the United States and state jurisdictions for the 2004 through 2006 tax years. In the event that the Company is assessed penalties and or interest, penalties will be charged to other operating expense and interest will be charged to interest expense.

The Company adopted FIN No. 48 using the modified prospective transition method, which requires the application of the accounting standard as of January 1, 2007. There was no impact on the financial statements as of and for the three and six month periods ended June 30, 2007 as a result of the adoption of FIN No. 48. In accordance with the modified prospective transition method, the financial statements for prior periods have not been restated to reflect, and do not include, the impact of FIN No. 48.

| 8. | New Accounting Pronouncements |

In February 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (SFAS 159), which will permit entities to choose to measure many financial assets and financial liabilities at fair value. Unrealized gains on items for which the fair value option has been elected are to be reported in earnings. SFAS 159 will become effective in our 2008

7

financial statements. We have not yet determined the effect that adoption of SFAS 159 may have on our results of operations or financial position.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (SFAS 157), which will become effective in our 2008 financial statements. SFAS 157 establishes a framework for measuring fair value and expands disclosure about fair value measurements, but does not require any new fair value measurements. We have not yet determined the effect that adoption of SFAS 157 may have on our results of operations or financial position.

| Item 2: | MANAGEMENT'S DISCUSSION, PLAN OF OPERATIONS, ANALYSIS OF FINANCIALCONDITION, AND RESULTS OF OPERATIONS |

Plan of Operation

The Company is executing its strategy to conduct mining and mineral processing operations on higher grade ore reserves it has located on its exploration and development properties. The financial strategy is to generate cash from these operations to pay for corporate expenses and to provide additional funds for exploration, thus reducing the need to raise funds through financing activities including sale of common stock. The Company plans to continue exploration for gold, silver and base metal deposits in the greater Coeur d’Alene Mining District of northern Idaho. The strategy includes finding and developing ore reserves in order to increase production of gold, silver, and base metals.

The Company has four properties at which most exploration and development is being conducted; the Niagara, the Golden Chest, the Silver Strand, and the Coleman. The Niagara copper-silver deposit was acquired during late 2006. The Niagara deposit was drilled in the 1970’s, and although more drilling is needed, the Company is conducting economic studies to determine if the deposit can be mined profitably. Production of gold ore at the Golden Chest mine is suspended while a ramp is being driven to access a block of reserves discovered by drilling from the surface. Permitting has been completed and preparations are being made for some production of silver-gold ore at the Silver Strand mine in 2007. A drift on the vein at the Coleman underground mine exposed some ore grade mineralization during the quarter, but drifting was suspended until November 2007 because the mining crew was sent to the Silver Strand. Production from the reserves at the Coleman open pit mine and from material mined from the underground drifting operation will be processed until ore from the Silver Strand mine is available.

At the Silver Strand mine, development of infrastructure began during the quarter. Mining plans are to develop infrastructure, drive a new adit, and mine a reserve block above the main adit level in 2007. Drilling plans are to test geophysical anomalies which were found in 2004.

Management also thinks exploration in the New Jersey mine area has promising potential. Previous drilling has indicated higher grade mineralization in the North Coleman vein area and at the Scotch Thistle prospect. Higher grade mineralization was encountered during the quarter on the 740 level Coleman drift. Drifting will resume on the 740 level Coleman vein when work at the Silver Strand is suspended for the winter season, and further drilling may be conducted at the Scotch Thistle prospect.

The concentrate leach circuit at the New Jersey mineral processing plant was completed and commissioning activities were conducted during the quarter. Commissioning is planned to be completed during the third quarter. Concentrate will be leached and a gold-silver dore’ produced for sale. The reason for adding the concentrate leach circuit was to obtain more revenue compared to selling concentrates by increasing recovery and eliminating concentrate freight as well as to avoid any potential difficulties in marketing concentrates.

In the 2007 season, exploration is being conducted in the Murray area where the Golden Chest mine is located. The Company’s exploration program has been very successful in finding new drilling targets. During the quarter, a new prospect called the Mineral Ridge was located where wide zones of gold mineralization were detected by soil and float sampling. Another promising target is called the Gold Butte prospect where a 50 m wide breccia

8

zone with gold mineralization occurs. The Niagara deposit, which was acquired as part of the 2006 exploration effort, was examined for open pit mining potential during the quarter. The open pit study has so far indicated that closer spaced drilling is needed, but that the deposit may be amenable to open pit mining. The Company acquired a core drilling rig for $186,174 on July 1st,2007 and drilling operations started early in the third quarter. The cost of the core drill, less the 10% down payment, was financed upon delivery through a note payable. The backlog of drilling targets is sufficient to keep drilling operations going on a continual basis. Operating permits have been submitted to the U.S. Forest Service for exploration drilling in the Murray area. The Company’s long term objective in the Murray area is to establish enough ore reserves to justify construction of a larger mineral processing plant in the area. A feasibility study for the processing plant has commenced with a pre-feasibility report due in about 12 months.

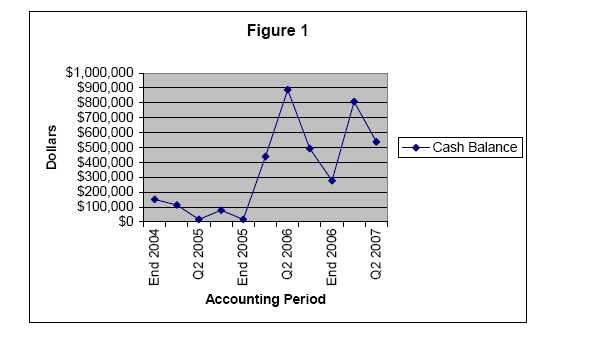

Financial Condition-The Company maintains an adequate cash balance by increasing or decreasing its exploration and development expenditures as limited by availability of cash from operations or from financing activities. The cash balance on June 30, 2007 was $537,923, a decrease from $807,449 at the end of the first quarter. Figure 1 shows the corresponding balances for previous accounting periods.

Results of Operations-Revenue for the second quarter 2007 was $45,012 compared to $60,563 in the second quarter of 2006. Figure 2 shows the net loss for the second quarter of 2007 of $371,155 and the net losses in previous accounting periods. The net loss increased in the second quarter of 2007 because of less revenue due to lower tonnes milled and lower grade ore than the second quarter of 2006 and higher exploration and general and administrative costs. Additionally, during the second quarter of 2006 the Company saw a gain from the sale of the Camp project.

9

Gold and silver production in pyrite concentrates were 19 ounces and 210 ounces, respectively, in the second quarter compared to 137 ounces and 0 ounces, respectively, for the second quarter of 2006. Gold production was lower in 2007 due to lower grade ore than 2006 and fewer tonnes processed. Gold production is expected to be approximately 30 ounces for the third quarter and then to increase, along with silver production, when Silver Strand ore processing starts.

Mining operations at the Golden Chest mine are expected to be suspended for approximately one year while the access ramp is being extended to the Idaho vein reserves. Once the Idaho vein ramp development is completed there will be enough reserves for many years of mining at the current rate of 4,000 tonnes/year. If a larger mill is built in the Murray area, the production rate from Idaho vein reserves would be increased.

Mining operations are planned to start at the Silver Strand mine in the third quarter of 2007. Operating results at the Silver Strand mine will depend upon the price of silver as well as gold. Present silver and gold prices are sufficient in management’s estimation to generate a gross profit at the Silver Strand mine based on the operating plan which was part of the permitting process.

No major capital expenditures are required for the mineral processing plant for the remainder of 2007. Mill feed will come from the Coleman open pit, Coleman underground and the Silver Strand mine for the next two quarters of 2007.

The amount of money to be spent on exploration at the Company’s mines and prospects will depend upon the amount of gross profit generated by operations and the amount of money raised by financing activities. Basically, management expects to be able to continue the present operating scenario with its three active mines and mineral processing plant indefinitely, but expanded exploration or production activities depend upon the results of financing activities.

10

| Item 3. | CONTROLS AND PROCEDURES |

An evaluation was performed by the Company’s president and principal financial officer of the effectiveness of the design and operation of the Company’s disclosure controls and procedures. Upon that evaluation, the Company’s president and principal financial officer concluded that disclosure controls and procedures were effective as of June 30, 2007, in ensuring that all material information required to be filed in this quarterly report has been made known to them in a timely fashion.

As disclosed in our 2006 Form 10KSB, it was determined that there were material weaknesses affecting our internal control over financial reporting. These material weaknesses are as follows:

- The Company lacks proper segregation of duties. As with any company the size of the Company’s, this lack of segregation of duties is due to limited resources.

- The Company lacks accounting personnel with sufficient skills and experience to ensure proper accounting for complex, non-routine transactions.

Management’s Remediation Initiatives

We are aware of these material weaknesses and have procedures in place to ensure that independent review of material transactions is performed. In addition, we plan to consult with independent experts when complex transactions are entered into.

There has been no change in the Company’s internal controls over financial reporting during the quarter ended June 30, 2007, that has materially affected, or is reasonably likely to materially affect, the Company’s internal controls over financial reporting.

PART II - OTHER INFORMATION

| Item 1. | LEGAL PROCEEDINGS |

None

| Item 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

Neither the constituent instruments defining the rights of the registrant’s securities filers nor the rights evidenced by the registrant’s outstanding common stock have been modified, limited or qualified.

The Company issued 29,836 shares of restricted common stock to President Fred W. Brackebusch for management services rendered in the second quarter of 2007. The shares were valued at a price of $0.664 per share. In management’s opinion, the securities were issued pursuant to exemption from registration under Section 4(2) of the Securities Act of 1933, as amended.

During the second quarter of 2007, the Company issued 200,000 shares at a price of $0.60 with regards to the exercise of outstanding warrants, 15,250 shares at an average price of $0.66 and an additional 1,700 shares at an average price of $0.80 to other accredited and sophisticated individuals for goods and services. In management’s opinion, the securities were issued pursuant to exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended.

| Item 3. | DEFAULTS UPON SENIOR SECURITIES |

The Company has no outstanding senior securities.

11

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None

| Item 5. | OTHER INFORMATION |

None

| Item 6. | EXHIBITS AND REPORTS ON FORM 8-K |

Reports on Form 8-K.

None

[The balance of this page has been intentionally left blank.]

12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| NEW JERSEY MINING COMPANY | ||

| By: | /s/ Fred W. Brackebusch | |

| Fred W. Brackebusch, its | ||

| President, Treasurer & Director | ||

| Date: August 10, 2007 | ||

| By: | /s/ Grant A. Brackebusch | |

| Grant A. Brackebusch, its | ||

| Vice President & Director | ||

| Date: August 10, 2007 | ||

13