SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting under § 240.14a-12

VASCULAR SOLUTIONS, INC.

(Name of Registrant as Specified in its Charter)

_______________________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | | Title of each class of securities to which transaction applies:______________________ |

| (2) | | Aggregate number of securities to which transaction applies: _____________________ |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):________________ |

| (4) | | Proposed maximum aggregate value of transaction: |

| | [ ] Fee paid previously with preliminary materials. |

| | [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: ________________________ |

| | (2) | | Form, Schedule or Registration Statement No.: ________________________ |

| | (3) | | Filing Party: ________________________ |

| | (4) | | Date Filed: ________________________ |

Dear Fellow Shareholder:

You are cordially invited to attend the 2005 annual meeting of shareholders of Vascular Solutions, Inc., which will be held at the Radisson Hotel & Conference Center, 3131 Campus Drive, Plymouth, Minnesota beginning at 3:30 p.m. on Tuesday, April 19, 2005.

This booklet contains your official notice of the 2005 annual meeting of shareholders and a proxy statement that includes information about matters to be acted upon at the annual meeting. Officers and Directors of Vascular Solutions, Inc. will be on hand to review the company’s operations and to answer questions and discuss matters that may properly arise.

Whether or not you plan to attend the annual meeting, please complete, sign, date and mail the enclosed proxy card promptly. If you attend the annual meeting, you may revoke your proxy and vote in person if you wish, even if you have previously returned your proxy card.

I sincerely hope that you will be able to attend our annual meeting to review the past year and our future plans.

| Sincerely, |

|  |

|

Howard C. Root

Chief Executive Officer |

March 18, 2005

VASCULAR SOLUTIONS, INC.

6464 Sycamore Court

Minneapolis, Minnesota 55369

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 19, 2005

The 2005 annual meeting of the shareholders of Vascular Solutions, Inc., a Minnesota corporation, will be held at the Radisson Hotel & Conference Center, 3131 Campus Drive, Plymouth, Minnesota, beginning at 3:30 p.m. on Tuesday, April 19, 2005 for the following purposes:

| 1. | | To elect seven directors to serve on the Board of Directors for a term of one year and until their successors are duly elected and qualified. |

| 2. | | To ratify the appointment of Virchow, Krause & Company, LLP as our independent auditor for 2005. |

| 3. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors recommends that an affirmative vote be cast in favor of all director nominees and for ratification of the independent auditor.

Only holders of record of common stock at the close of business on February 21, 2005 will be entitled to notice of and to vote at the annual meeting or any adjournment thereof.

It is important that your shares of common stock be represented at the annual meeting. You are urged to complete, sign and date the accompanying proxy card, which is solicited by the Board of Directors of Vascular Solutions, and mail it promptly in the enclosed envelope. Your proxy will not be used if you attend and vote at the annual meeting in person.

By order of the Board of Directors

Michael Nagel

Secretary

March 18, 2005

IMPORTANT: PLEASE RETURN EACH PROXY CARD SENT TO YOU.

PROXY STATEMENT

This proxy statement is provided in connection with the 2005 annual meeting of shareholders of Vascular Solutions, Inc. and any adjournment or postponement of the meeting. The accompanying proxy is solicited by the Board of Directors of Vascular Solutions. This proxy statement, the accompanying form of proxy and Vascular Solutions’ annual report are first being sent or given to shareholders on or about March 18, 2005.

Record Date; Shareholders Entitled to Vote; Quorum

Holders of record of the shares of our common stock at the close of business on February 21, 2005, will be entitled to vote on all matters at the annual meeting. Each share of common stock will be entitled to one vote. On February 21, 2005, a total of 14,397,547 shares of common stock were outstanding. A majority of the voting power of the outstanding shares of common stock entitled to vote, represented in person or by proxy, will be required to constitute a quorum for the annual meeting.

Voting Your Shares

The Vascular Solutions Board of Directors is soliciting proxies from our shareholders. By completing and returning the accompanying proxy, you will be authorizing Howard Root and Michael Nagel to vote your shares. If your proxy is properly signed and dated, it will be voted as you direct. If you attend the annual meeting in person, you may vote your shares by completing a ballot at the meeting.

Changing Your Vote by Revoking Your Proxy

Your proxy may be revoked at any time before it is voted at the annual meeting by giving notice of revocation to Vascular Solutions, in writing, by execution of a later dated proxy or by attending and voting at the annual meeting.

How Proxies Are Counted

If you return a signed and dated proxy card but do not indicate how the shares are to be voted, those shares will be voted FOR each of the nominees and for ratification of the independent auditor. Votes cast by proxy or in person at the annual meeting will be tabulated by the election inspectors appointed for the annual meeting.

Shares voted as abstentions on any matter (or a “withhold vote for” as to directors) will be counted for purposes of determining the presence of a quorum at the annual meeting and treated as unvoted, although present and entitled to vote, for purposes of determining the approval of each matter as to which a shareholder has abstained. If a broker submits a proxy that indicates the broker does not have discretionary authority as to certain shares to vote on one or more matters, those shares will be counted for purposes of determining the presence of a quorum at the meeting, but will not be considered as present and entitled to vote with respect to such matters.

-1-

The Board of Directors knows of no other matters to be presented for action at the annual meeting other than those set forth herein. If any other matters properly come before the annual meeting, however, the persons named in the proxy will vote on such other matters and/or for other nominees in accordance with their best judgment. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies.

Cost of Solicitation

All expenses in connection with this solicitation will be paid by Vascular Solutions. Officers, directors and regular employees of Vascular Solutions, who will receive no extra compensation for their services, may solicit proxies by telephone or electronic transmission.

PROPOSAL 1:

ELECTION OF DIRECTORS

Seven directors have been nominated for election to our Board of Directors at the 2005 annual meeting of shareholders to hold office for a term of one year and until their successors are duly elected and qualified (except in the case of earlier death, resignation or removal). In the unlikely event that the nominees are unable to stand for election at the annual meeting, the persons named as proxies will vote for such other persons as the Board of Directors or proxies may designate.

Information regarding the nominees to the Board of Directors is set forth below.

Gary Dorfman, age 53, has served on our Board of Directors since October 2002. Dr. Dorfman has served as the President of General Vascular Services, LTD, a medical device firm, since 1996 and has served as Professor Emeritus of Diagnostic Radiology at Brown University School of Medicine since 2002. Previously, Dr. Dorfman was Medical Director, Office of Clinical Management at Rhode Island Hospital. Dr. Dorfman is a Fellow of the American College of Radiology and a past President of the Society of Cardiovascular and Interventional Radiology.

John Erb,age 56, has served on our Board of Directors since October 2002. Mr. Erb has over 25 years of experience in the medical device industry. Since 2001, Mr. Erb has served as the Chief Executive Officer of CHF Solutions, a medical device company involved in the treatment of congestive heart failure. From 1997 through 2001, Mr. Erb was President and Chief Executive Officer of IntraTherapeutics, Inc., a medical device company involved in the development, manufacturing and distribution of peripheral stents. IntraTherapeutics was acquired by Sulzer Medica in 2001. Previously, Mr. Erb was Vice President of Worldwide Operations for Schneider Worldwide, a division of Pfizer, Inc. Mr. Erb also serves as a director of CryoCath Technologies, as well as several private companies.

James Jacoby, Jr., age 42, has served on our Board of Directors since February 1999. Mr. Jacoby has been a Managing Director of the Health Care and Life Sciences Group of the Corporate Finance Department of Stephens Inc., an Arkansas-based investment banking firm, since December 1999 and previously was Vice President in the Corporate Finance Department of Stephens Inc. from

-2-

1994 to 1999. From 1990 through 1994, Mr. Jacoby was Vice President in the Mergers and Acquisitions Department of Chemical Banking Corporation in New York and London.

Michael Kopp, age 48, has served on our Board of Directors since November 2000. Mr. Kopp has over 20 years of experience in the medical device industry. He has been a private investor and industry consultant since September 1999. From April 1995 to August 1999 Mr. Kopp was President and CEO of IsoStent, Inc., a medical device company which was acquired by Johnson and Johnson. From January 1994 to March 1995 Mr. Kopp was President and CEO of Devices for Vascular Intervention, Inc., a medical device company which was acquired by Eli Lilly and Company.

Richard Nigon, age 57, has served on our Board of Directors since November 2000. Mr. Nigon has been Director of Equity Corporate Finance for Miller Johnson Steichen Kinnard since February 2001. From February 2000 to February 2001, Mr. Nigon served as the Chief Financial Officer of Dantis, Inc., a web hosting company. Prior to joining Dantis, Mr. Nigon was employed by Ernst & Young, LLP from 1970 to 2000, serving as a partner from 1981 to 2000. While at Ernst & Young, Mr. Nigon served as the Director of Ernst & Young’s Twin Cities Entrepreneurial Services Group and was the coordinating partner on several publicly-traded companies in the consumer retailing and manufacturing industries.

Paul O’Connell,age 52, has served on our Board of Directors since January 2002. Mr. O’Connell has been Vice President of the Vascular Interventional Products Group of B. Braun Medical, an international medical device company, since July 2001. From 1999 through 2001, Mr. O’Connell provided marketing and technical support consulting services to medical device companies. Mr. O’Connell was the owner of Sablier, a medical device company, from 1998 through 1999 where he developed new technologies for the treatment of thromboembolic diseases and for distal protection during carotid endartorectomy. From 1993 through 1998, Mr. O’Connell was Vice-President and General Manager of the Vena Tech division of B. Braun Medical, a medical device business he originally co-founded in 1988 and sold to B. Braun Medical in 1993.

Howard Root, age 44, has served as Chief Executive Officer and on our Board of Directors since he co-founded Vascular Solutions in February 1997. From 1990 to 1995, Mr. Root was employed by ATS Medical, Inc., a mechanical heart valve company, most recently as Vice President and General Counsel. Prior to joining ATS Medical, Mr. Root practiced corporate law, specializing in representing emerging growth companies, at the law firm of Dorsey & Whitney LLP for over five years.

The Board has determined that all of the members of the Board continuing in office after this Annual Meeting are “independent directors” under the current NASDAQ stock market listing standards, other than Mr. Howard Root, who is not considered independent because he is one of our executive officers.

-3-

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES.

In accordance with a recent change in Minnesota law, the nominees for election as directors at the 2005 annual meeting will be elected by a plurality of the votes cast at the meeting. This means that since shareholders will be electing seven directors, the seven nominees receiving the highest number of votes will be elected. Votes withheld from one or more director nominees will have no effect on the election of any director from whom votes are withheld. Proxies will be voted FOR the nominees unless otherwise specified.

Meetings Attendance

Each of our directors is expected to make a reasonable effort to attend all meetings of the Board, applicable committee meetings and our annual meeting of shareholders. All of our directors attended our 2004 annual meeting. During 2004, the Board of Directors held five meetings. Each director holding office during the year attended at least 75% of the total number of meetings of the Board of Directors (held during the period for which they were a director) and committees of the Board on which they served.

Committees of the Board of Directors

The Board of Directors has an Audit Committee and a Compensation Committee, which are described below. The Board of Directors does not have a Nominating Committee. The Board believes that the entire Board of Directors should be involved in nominating directors.

The Board of Directors has an Audit Committee composed of Mr. Jacoby, Mr. Erb and Mr. Nigon, all of whom are “independent” under the current NASDAQ stock market listing standards. The Board has identified Mr. Jacoby, Mr. Erb and Mr. Nigon as meeting the definition of an “Audit Committee Financial Expert” as established by the Securities and Exchange Commission. The Audit Committee’s responsibilities include facilitating our relationship with independent auditors; reviewing and assessing the performance of our accounting and finance personnel; communicating to our Board of Directors the results of work performed by and issues raised by our independent auditors and legal counsel; and evaluating our management of assets and reviewing policies relating to asset management. The Audit Committee held four meetings during 2004.

The Board of Directors has a Compensation Committee composed of Mr. Kopp, Mr. Jacoby and, Mr. O’Connell. The Compensation Committee’s responsibilities include establishing salaries, incentives, and other forms of compensation for our directors and officers; administering our incentive compensation and benefits plans; and recommending policies relating to such incentive compensation and benefits plans. The Compensation Committee held one meeting during 2004.

The Board of Directors is responsible for determining the slate of director nominees for election by shareholders. All director nominees approved by the Board and all individuals appointed

-4-

to fill vacancies created between our annual meetings of shareholders are required to stand for election by our shareholders at the next annual meeting.

The Board of Directors determines the required selection criteria and qualifications of director nominees based upon the needs of Vascular Solutions at the time nominees are considered. A candidate must possess the ability to apply good business judgment and must be in a position to properly exercise his or her duties of loyalty and care. Candidates should also exhibit proven leadership capabilities, high integrity and experience with a high level of responsibilities within their chosen fields, and have the ability to quickly grasp complex principles of business, finance, international transactions and medical technologies. In general, candidates will be preferred who hold an established executive level position in the medical field, finance, law, education, research or government. The Board of Directors will consider these criteria for nominees identified by the Board, by shareholders, or through some other source. When current Board members are considered for nomination for re-election, the Board also takes into consideration their prior Board contributions, performance and meeting attendance records.

The Board of Directors will consider qualified candidates for possible nomination that are submitted by our shareholders. Shareholders wishing to make such a submission may do so by sending the following information to the Board of Directors c/o Corporate Secretary, Vascular Solutions, Inc., 6464 Sycamore Court, Minneapolis, MN 55369: (1) name of the candidate and a brief biographical sketch and resume; (2) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and (3) a signed statement as to the submitting shareholder’s current status as a shareholder and the number of shares currently held.

The Board of Directors conducts a process of making an assessment of each proposed nominee based upon the resume and biographical information, an indication of the individual’s willingness to serve and other information. On the basis of information learned during this process, the Board of Directors determines which nominee(s) to submit for election at the next annual meeting. The Board uses the same process for evaluating all nominees, regardless of the original source of the nomination.

Historically, we have not adopted a formal process for shareholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of shareholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to shareholders in a timely manner. Shareholders who wish to communicate with the Board of Directors may do so by writing to: Vascular Solutions, Inc., Board of Directors, 6464 Sycamore Court, Minneapolis, MN 55369.

No candidates for director nominations were submitted to the Board of Directors by any shareholder in connection with the 2005 annual meeting. Any shareholder desiring to present a nomination for consideration by the Board of Directors prior to our 2006 annual meeting must do so prior to November 18, 2005 in order to provide adequate time to duly consider the nominee.

-5-

Director Compensation

During 2004, we paid our non-employee directors $1,500 for each meeting attended in person, and $500 for each meeting attended by telephone. In addition, we paid our non-employee committee members an additional $500 for each meeting attended in person or by telephone. We also reimbursed directors for out-of-pocket expenses incurred in attending board meetings. Each non-employee director also receives an option to purchase 10,000 shares of our common stock on the date of his or her election to our Board of Directors and the date of each re-election thereafter with an exercise price equal to fair market value on such date.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of our Board of Directors is composed of the following non-employee directors: Mr. Jacoby, Mr. Erb and Mr. Nigon. Mr. Nigon currently serves as the Chairman of the Audit Committee. All of the members of the Audit Committee are independent for purposes of the Nasdaq listing requirements. The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is attached to this Proxy Statement as Exhibit A. The Audit Committee recommends to the Board of Directors, and submits for shareholder ratification, the appointment of our independent auditor Virchow, Krause & Company, LLP.

Management is responsible for our internal controls and the financial reporting process. Our independent auditor is responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted auditing standards and to issue a report on our financial statements. The Audit Committee’s responsibility is to monitor and oversee these processes.

In this context, the Audit Committee has met and held discussions with management and the independent auditor. Management represented to the Audit Committee that Vascular Solutions’ consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditor. The Audit Committee discussed with the independent auditor matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees).

Our independent auditor also provided to the Audit Committee the written disclosure required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditor the auditing firm’s independence. The Committee also considered whether non-audit services provided by the independent auditor during the last fiscal year were compatible with maintaining the independent auditor’s independence.

Based upon the Audit Committee’s discussion with management and the independent auditor and the Audit Committee’s review of the representation of management and the report of the independent auditor to the Audit Committee, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Vascular Solutions’ Annual

-6-

report on Form 10-K for the fiscal year ended December 31, 2004 filed with the Securities and Exchange Commission.

Members of the Audit Committee

Richard Nigon, Chairman

John Erb

James Jacoby, Jr.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of our Board of Directors is composed of the following non-employee directors: Mr. Kopp, Mr. Jacoby and Mr. O’Connell. Mr. Kopp currently serves as Chairman of the Compensation Committee. The Compensation Committee advises the Chief Executive Officer and the Board of Directors on matters of compensation philosophy and recommends salaries, incentives and other forms of compensation for our officers and other key employees. The Compensation Committee has reviewed and is in accord with the compensation paid to executive officers in 2004.

General Compensation Policy

We are committed to attracting, hiring and retaining an experienced management team that can successfully manufacture and sell our existing medical devices and develop new products. The fundamental policy of the Compensation Committee is to provide our executive officers with competitive compensation opportunities based upon their contribution to our development and financial success and long-term shareholder interest, as well as the officers’ personal performance. It is the Compensation Committee’s objective to have a portion of each executive officer’s compensation contingent upon overall company performance as well as upon such executive officer’s own level of performance. Accordingly, the compensation package for each executive officer is comprised of three elements: (i) base salary which reflects individual performance and is designed primarily to be competitive with salary levels in the industry; (ii) bonus payments contingent upon specific corporate and individual milestones; and (iii) long-term stock-based incentive awards which strengthen the mutuality of interests between the executive officers and our shareholders.

Base Salary

The base salary is established as a result of the Compensation Committee’s analysis of each executive officer’s individual performance during the prior year, our overall performance during the prior year and historical compensation levels within the executive officer group. The Compensation Committee believes executive salaries must be sufficient to attract and retain key individuals. Salaries are also based on experience level and are intended to be competitive with salaries paid to comparable executives in similar positions at other medical device companies of comparable size.

-7-

Bonus Awards for 2004

Bonus awards are provided under a Management Incentive Compensation Plan. At the beginning of each year certain performance objectives, including corporate, department and personal goals, are set. At the end of the year management personnel that are eligible for bonus awards have their performance measured against these goals. Based upon progress toward meeting these goals, bonus awards are paid. In December 2004, the Compensation Committee approved bonuses for executive officers and certain other employees for recognition of accomplished objectives during 2004.

Long-Term Incentive Compensation

Long-term incentives are provided through the grant of stock options. The grants are designed to align the interest of each executive officer with those of our shareholders and provide each individual with an incentive to manage our business from the perspective of an owner with an equity stake in the business. In general, we view option grants as incentives for future performance and not as compensation for past accomplishments. Executive officers are granted a stock option at the time they commence service and are eligible for annual grants thereafter. In determining the number of shares subject to stock option grants, the Committee takes into consideration the job responsibilities, experience and contributions of the individual as well as the recommendations of the Chief Executive Officer. The options vest over a period of several years and are generally not exercisable for at least one year after the date of grant. Each option grant allows the individual to acquire shares of our Common Stock at a fixed price per share over a ten-year period of time. Executive officers receive gains from stock options only to the extent that the fair market value of the stock has increased since the date of the option grant.

CEO Compensation

The Compensation Committee’s determination of our Chief Executive Officer’s salary, bonus and stock option grants follows the policies set forth above for all executive compensation. The Committee seeks to establish a level of base salary competitive with that paid by companies within the industry which are of comparable size, and a bonus contingent upon specific corporate objectives. In addition, a significant percentage of the total compensation package is contingent upon Vascular Solutions’ performance and stock price appreciation.

During 2004, Mr. Root, our Chief Executive Officer, was paid a base salary of $260,000. In addition, a bonus of $55,478 was paid in January 2005 based upon the accomplishment of specific milestones in 2004. Those milestones included development and launch of two new products for our future growth, the continued increase in our revenue and the continued reduction in our operating loss. Mr. Root received a stock option grant for 50,000 shares during 2004. These stock option and bonus awards reflected the Compensation Committee’s judgment as to Mr. Root’s individual performance and the overall performance of Vascular Solutions. The Committee also believes that stock options granted to Mr. Root to date provide a significant and appropriate tie between overall compensation and our performance over the long term.

-8-

Compliance with Internal Revenue Code Section 162(m)

As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), which was enacted into law in 1993, we will not be allowed a federal income tax deduction for compensation paid to certain executive officers to the extent that compensation exceeds $1 million per officer in any one year. This limitation will apply to all compensation paid to the covered executive officers which is not considered to be performance based. Compensation which does qualify as performance-based compensation will not have to be taken into account for purposes of this limitation. The Committee believes that options granted under the Vascular Solutions Stock Option Plan will meet the requirements for qualifying as performance-based.

Section 162(m) of the Code did not affect the deductibility of compensation paid to our executive officers in 2004 and is not anticipated to affect the deductibility of such compensation expected to be paid in the foreseeable future. The Committee will continue to monitor this matter and may propose additional changes to the executive compensation program if warranted.

Members of the Compensation Committee

Michael Kopp, Chairman

James Jacoby, Jr.

Paul O’Connell

Employment Agreements

We have entered into employment agreements with each of our executive officers. The employment agreements provide for employment “at will” which may be terminated by either party for any reason upon ten working days’ prior written notice. The base salary and any discretionary bonus for each of the executive officers is determined by the Compensation Committee of our Board of Directors. During the term of his or her employment agreement and for a period of one year after its termination, each executive officer is prohibited from competing with us in any entity whose business is directly competitive with our business.

The employment agreements provide for the payment of certain benefits to the executive officers if their employment terminates following a “change in control.” The agreements provide for benefits if an officer’s employment is terminated within 12 months following a change in control unless such termination was by Vascular Solutions for cause, by the officer other than for “good reason,” or because of the officer’s disability or death. “Good reason” is defined as the termination of employment as a result of either a diminution in the officer’s responsibilities, a reduction in salary or benefits, or a relocation of Vascular Solutions office of more than 50 miles. A “change in control” is generally defined as an acquisition of more than 50% of our outstanding common stock by any person or group, the merger or sale of Vascular Solutions or the replacement of a majority our Board of Directors with directors not recommended by the existing Board of Directors. The agreements provide for lump sum payments or payments periodically in accordance with our normal payroll practices in

-9-

effect from time-to-time following termination in amounts equal to 12 times the officer’s monthly base salary.

Code of Ethics

We have adopted a code of ethics that applies to all of our directors, officers (including our chief executive officer, chief financial officer, chief accounting officer, and any person performing similar functions) and employees. We have made our Code of Ethics available by filing it as Exhibit 14 with our 2004 Form 10-K.

-10-

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table sets forth all compensation awarded to, earned by or paid for services rendered to us in all capacities during each of the last three fiscal years by our Chief Executive Officer and the four other most highly compensated executive officers whose salary and bonus earned in 2004 exceeded $100,000.

Summary Compensation Table

| | Annual Compensation

| Long-Term

Compensation

| |

|---|

Name and Principal

Position

| Year

| | | Salary

| | Bonus

| Securities

Underlying

Options(1)

| All Other

Compensation(2)

|

|---|

| Howard Root | | | 2004 | | | $ | 260,000 | | $ | 55,478 | | | 50,000 | | $ | — | |

| Chief Executive Officer | | | 2003 | | | | 245,000 | | | 41,895 | | | 50,000 | | | — | |

| | | | 2002 | | | | 210,000 | | | 30,000 | | | — | | | — | |

Michael Nagel | | |

2004 | | | |

230,000 | | |

39,244 | | |

25,000 | | |

2,207 | |

| Vice President of Sales | | | 2003 | | | | 215,000 | | | 26,513 | | | 115,000 | (3) | | 1,982 | |

| and Marketing and | | | 2002 | | | | 200,000 | | | 25,000 | | | — | | | 1,806 | |

| Secretary | | | | | | | | | | | | | | | | | |

James Quackenbush | | |

2004 | | | |

168,000 | | |

27,615 | | |

15,000 | | |

2,056 | |

| Vice President of | | | 2003 | | | | 160,000 | | | 23,450 | | | 65,000 | (4) | | 2,157 | |

| Manufacturing | | | 2002 | | | | 150,000 | | | 15,000 | | | — | | | 1,994 | |

Deborah Neymark | | |

2004 | | | |

180,000 | | |

30,150 | | |

20,000 | | |

2,246 | |

| Vice President of | | | 2003 | | | | 170,000 | | | 22,791 | | | 45,000 | (5) | | 1,856 | |

| Regulatory Affairs, | | | 2002 | | | | 150,000 | | | 20,000 | | | — | | | 1,975 | |

| Quality Systems & | | | | | | | | | | | | | | | | | |

| Clinical Research | | | | | | | | | | | | | | | | | |

James Hennen | | |

2004 | | | |

130,000 | | |

27,625 | | |

10,000 | | |

1,637 | |

| Chief Financial Officer(6) | | | 2003 | | | | 100,000 | | | 13,601 | | | 10,000 | | | 1,337 | |

_________________

| (1) | | Represents options granted pursuant to our Stock Option and Stock Award Plan. |

| (2) | | Represents matching contributions to our 401(k) plan. |

| (3) | | Includes 90,000 options re-granted to Mr. Nagel under the stock option exchange offer. |

| (4) | | Includes 50,000 options re-granted to Mr. Quackenbush under the stock option exchange offer. |

| (5) | | Includes 25,000 options re-granted to Ms. Neymark under the stock option exchange offer. |

| (6) | | Mr. Hennen became an executive officer effective December 31, 2003. |

-11-

The following table contains information concerning the grant of stock options under our Stock Option and Stock Award Plan during 2004 to each of the executive officers named in the Summary Compensation Table.

| Stock Options Granted in 2004 |

|---|

| Individual Grants(1)

|

|---|

| | | Number of Securities Underlying Options | | | Percent of Total Options Granted To Employees in Fiscal | | | Exercise Price | | | Expiration | | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appriciation for Option Term (3)

|

|---|

Name

| | | Granted

| | | Year (2)

| | | Per Share

| | | Date

| | | | 5%

| | | 10%

| |

|---|

| Howard Root | | | 50,000 | | | 17.3% | | | $6.74 | | | Feb. 18, 2014 | | | | $211,937 | | | $537,091 | |

| | | | | | | | | | | | | | | | | | |

| Michael Nagel | | | 25,000 | | | 8.7 | | | 6.74 | | | Feb. 18, 2014 | | | | 105,969 | | | 268,546 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| James Quackenbush | | | 15,000 | | | 5.2 | | | 6.74 | | | Feb. 18, 2014 | | | | 63,581 | | | 161,127 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Deborah Neymark | | | 20,000 | | | 6.9 | | | 6.74 | | | Feb. 18, 2014 | | | | 84,775 | | | 214,836 | |

| | | | | | | | | | | | | | | | | | |

| James Hennen | | | 10,000 | | | 3.5 | | | 6.74 | | | Feb. 18, 2014 | | | | 42,388 | | | 107,418 | |

_________________

| (1) | | Each option represents the right to purchase one share of our common stock. The options shown in this table are granted pursuant to our Stock Option and Stock Award Plan. The options vest in 12 monthly installments beginning three years after the date of grant. The term of each option is ten years. |

| (2) | | In 2004, Vascular Solutions granted employees options to purchase an aggregate of 288,500 shares of common stock. |

| (3) | | The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission and do not represent our estimate or projection of our future common stock prices. These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall stock market conditions. The amounts reflected in the table may not necessarily be achieved. |

-12-

The following table sets forth information concerning the exercise of options during 2004 and unexercised options held as of December 31, 2004 by each of the executive officers named in the Summary Compensation Table.

Aggregated Option Exercises in 2004 and Year-End Option Values

| Shares

Acquired | | Value | | Number of Securities

Underlying Unexercised

Options at December 31, 2004

| | Value of Unexercised

In-the-Money Options

as of December 31, 2004(1)

| |

|---|

| Name | On Exercise | | Realized | | Exercisable | Unexercisable | | Exercisable | Unexercisable |

|---|

| |

| Howard Root | | | | — | | | — | | 283,711 | | | | 82,500 | | | | $1,367,453 | | | | $453,165 | | |

| |

| Michael Nagel | | | | — | | | — | | 162,100 | | | | 42,900 | | | | $1,432,326 | | | | $238,974 | | |

| |

| James Quackenbush | | | | — | | | — | | 60,800 | | | | 24,200 | | | | $551,631 | | | | $131,819 | | |

| |

| Deborah Neymark | | | | — | | | — | | 40,050 | | | | 32,450 | | | | $357,890 | | | | $177,136 | | |

| |

| James Hennen | | | | — | | | — | | 10,840 | | | | 19,160 | | | | $93,276 | | | | $113,344 | | |

_________________

| (1) | | “Value” has been determined based on the difference between the last sale price of our common stock as reported by the Nasdaq National Market System on December 31, 2004 ($10.02) and the per share option exercise price, multiplied by the number of shares subject to the in-the-money options. |

-13-

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information about our common stock that may be issued upon exercise of options and rights under all of our equity compensation plans as of December 31, 2004, including the Stock Option and Stock Award Plan, and the Employee Stock Purchase Plan. Our Shareholders have approved all of these plans.

Plan Category

| | Number of

securities to be

issued upon

exercise of

outstanding

options and

rights

| Weighted-average

exercise price of

outstanding options

and rights

| Number of securities

remaining available

for future issuance

under equity

compensation

plans (excluding

outstanding options

and rights)

|

|---|

| Equity compensation | | | | | | | | | |

| plans approved by | | | | | | | |

| shareholders | | | | 1,645,161 | | | $3.68 | | 1,652,465 (1) (2) |

| | | | | | | | |

| Equity compensation | | | | | | | |

| plans not approved | | | | | | | |

| by shareholders | | | | None | | | None | | None |

| | | | | | | | |

| Total | | | | 1,645,161 | | | $3.68 | | 1,652,465 |

| (1) | Includes 1,236,839 for our stock option plan. The available shares for our stock option plan automatically increases, on an annual basis through 2006, by the lesser of: |

- 500,000 shares;

- 5% of the common-equivalent shares outstanding at the end of our prior fiscal year; or

- a smaller amount determined by our Board of Directors or the committee administering the plan.

| (2) | Includes 415,626 for our employee stock purchase plan. The available shares for our employee stock purchase plan automatically increases, on an annual basis through 2010, by the lesser of: |

- 200,000 shares;

- 2% of the common-equivalent shares outstanding at the end of our prior fiscal year; or

- a smaller amount determined by our Board of Directors or the committee administering the plan.

-14-

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of February 21, 2005 by each person, or group of affiliated persons, who is known by us to own beneficially more than 5% of our common stock, each of our directors and nominees for director, each of our executive officers named in the Summary Compensation Table above and all of our directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock under options held by that person that are currently exercisable or exercisable within 60 days of February 21, 2005 are considered outstanding. These shares, however, are not considered outstanding when computing the percentage ownership of each other person. The number of shares subject to options that each beneficial owner has the right to acquire within 60 days of February 21, 2005 are also listed separately under the column entitled “Number of Shares Underlying Options Beneficially Owned.”

Except as indicated in the footnotes to this table, each shareholder named in the table has sole voting and investment power for the shares shown as beneficially owned by them. Percentage of ownership is based on 14,397,547 shares of common stock outstanding on February 21, 2005.

| Name | | Number of

Shares

Beneficially

Owned | | Number of

Shares

Underlying

Options

Beneficially

Owned | | Percent of

Shares

Outstanding |

|---|

| Entities affiliated with Stephens, Inc. (1) | | | | 2,182,954 | | | 50,000 | | | 15.1 | % |

| James Jacoby, Jr. (1) | | | | 2,191,977 | | | 50,000 | | | 15.2 | |

| Howard Root | | | | 580,500 | | | 304,711 | | | 3.9 | |

| Michael Nagel | | | | 189,900 | | | 152,200 | | | 1.3 | |

| James Quackenbush | | | | 72,899 | | | 66,899 | | | * | |

| Deborah Neymark | | | | 56,174 | | | 48,250 | | | * | |

| Richard Nigon (2) | | | | 45,500 | | | 40,000 | | | * | |

| Michael Kopp | | | | 30,000 | | | 10,000 | | | * | |

| Gary Dorfman | | | | 30,000 | | | 30,000 | | | * | |

| John Erb | | | | 30,000 | | | 30,000 | | | * | |

| James Hennen | | | | 19,440 | | | 15,440 | | | * | |

| Paul O'Connell | | | | 10,000 | | | 10,000 | | | * | |

| All directors and executive officers as a group | | |

| (11 persons) | | | | 3,256,390 | | | 757,500 | | | 21.5 | |

__________________________

*Less than 1%

-15-

| (1) | | 1,610,036 of the shares are held by Stephens Vascular Preferred, LLC, 522,918 of the shares are held by Stephens Vascular Options, LLC and all of the options are held by Stephens Investment Partners III LLC. The address is 111 Center Street, Suite 2500, Little Rock, AR 72201. Mr. Jacoby is a Managing Director of Stephens Inc. and a member of Stephens Vascular Preferred, LLC and Stephens Vascular Options, LLC. Stephens Vascular Preferred, LLC, Stephens Vascular Options, LLC and Stephens Investment Partners III LLC are affiliates of Stephens Inc. and have contributed their shares of our common stock to a voting trust pursuant to which the trustee of the trust has sole voting power. The voting trust is required to vote such shares "for" or "against" proposals submitted to our shareholders in the same proportion as votes cast "for" and "against" those proposals by all other shareholders, excluding abstentions. The voting trust agreement also imposes substantial limitations on the sale or other disposition of the shares subject to the voting trust. The voting trust agreement expires in June 2010 or such earlier time as Stephens Inc. ceases to be a market maker of our common stock. The name and address of the trustee of the voting trust agreement are: Steve Patterson, 349 Colony Drive, Naples, FL 34108. Mr. Jacoby disclaims beneficial ownership of the shares subject to the voting trust agreement. |

| (2) | | Includes 500 shares held by Mr. Nigon's wife. Mr. Nigon disclaims beneficial ownership of the shares held in the name of his wife. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Such executive officers, directors and greater than 10% beneficial owners are required by the regulations of the Securities and Exchange Commission to furnish Vascular Solutions with copies of all Section 16(a) reports they file.

Based solely on a review of the copies of such reports furnished to us and written representations from the executive officers and directors, we believe that all Section 16(a) filing requirements applicable to our executive officers and directors and greater than 10% beneficial owners have been timely met.

-16-

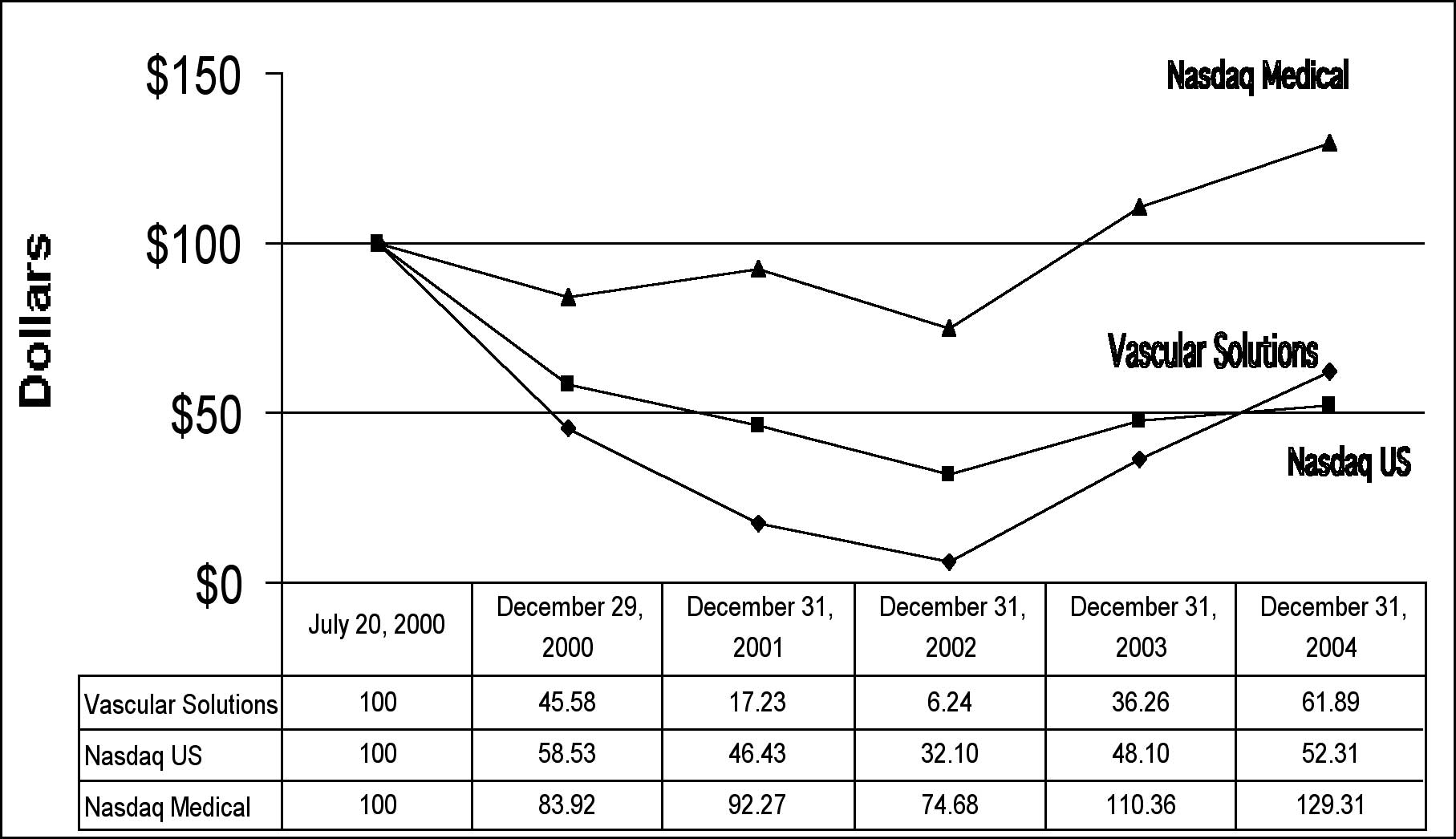

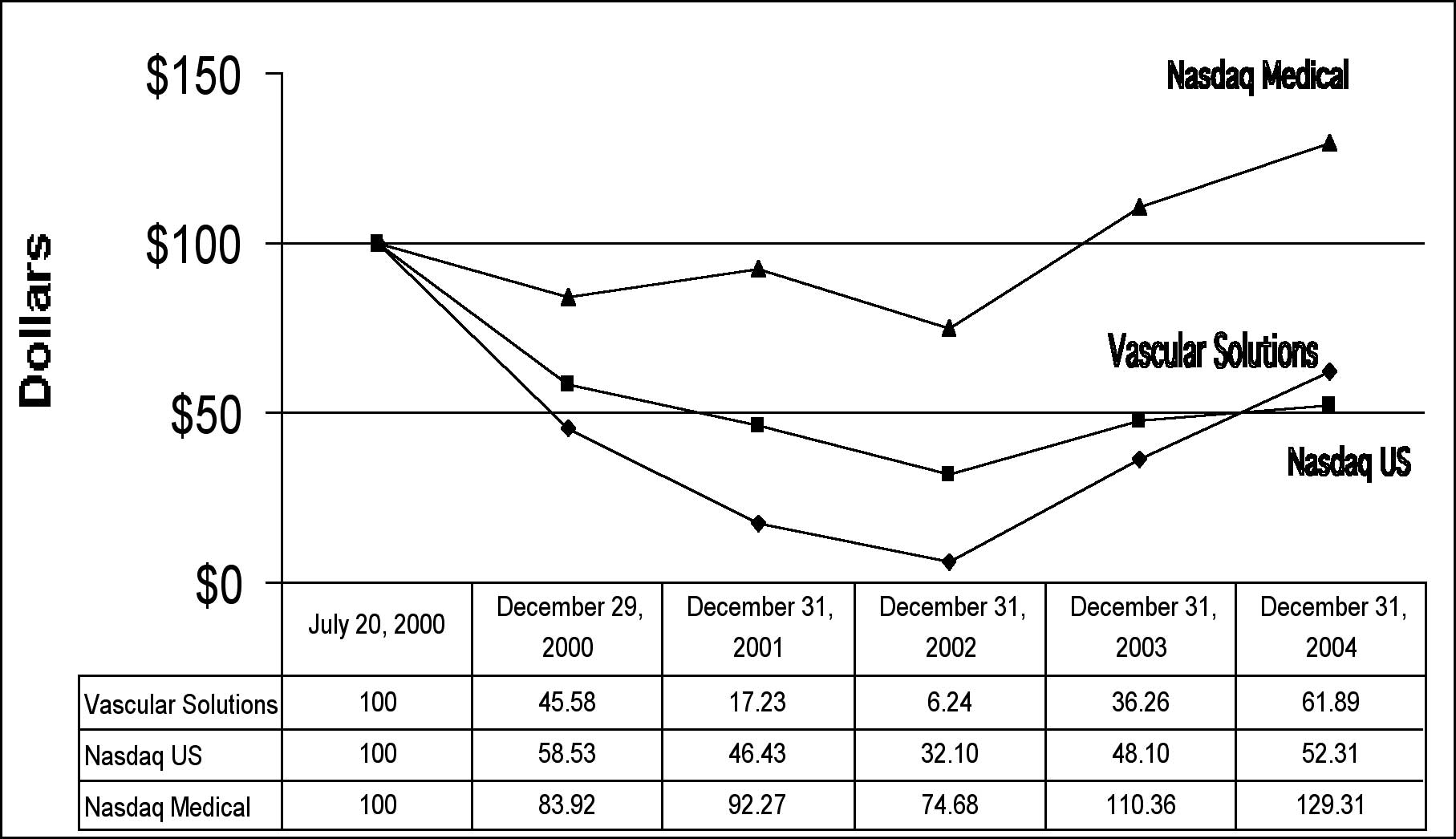

SHAREHOLDER RETURN PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total returns for our common stock, the NASDAQ Stock Market Index (U.S.) and the NASDAQ Medical Industry Index (Medical Devices, Instruments and Supplies), assuming the investment of $100 in our common stock and each index on July 20, 2000 (the date our common stock began trading) and the reinvestment of dividends, if any.

-17-

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF AUDITORS

On September 28, 2004, Ernst & Young LLP (“Ernst & Young”) informed us that it would resign as our independent auditor effective upon the completion of the quarterly review of our fiscal quarter ended September 30, 2004. On October 21, 2004, our Audit Committee approved the appointment of Virchow Krause & Company as our independent auditor commencing with work to be performed in relation to our fiscal year ended December 31, 2004. We have had no occasions in the past two years upon which we have consulted with Virchow Krause & Company on any matters. Our Board of Directors has appointed Virchow, Krause & Company, LLP as our independent auditor for 2005.

No report of Ernst & Young on our financial statements for the past two fiscal years contained an adverse opinion or disclaimer of opinion or was qualified or modified as to uncertainty, audit scope or accounting principles. In connection with its audits for each of the two most recent fiscal years and through October 22, 2004, the date on which Ernst & Young completed its review of the fiscal quarter ended September 30, 2004, there were no disagreements with Ernst & Young on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference thereto in its report on the financial statements for such years. During the two most recent fiscal years and through October 22, 2004, there were no reportable events (as outlined in Regulation S-K Item 304(a)(1)(v)).

We reported the resignation of Ernst & Young on Form 8-K on October 1, 2004. The Form 8-K contained a letter from Ernst & Young, addressed to the Securities and Exchange Commission, stating that it agreed with the statements concerning Ernst & Young in such Form 8-K. On October 22, 2004, we filed an amendment to the Form 8-K in order to update the disclosures made in the original Form 8-K pursuant to Regulation S-K Items 304(a)(1)(iv) and (v) so as to cover the period from September 28, 2004 through the date on which Ernst & Young concluded its work for us. The amended Form 8-K contained a letter from Ernst & Young, addressed to the Securities and Exchange Commission, stating that it agreed with the statements concerning Ernst & Young in the amended Form 8-K.

While we are not required to do so, we are submitting the appointment of Virchow, Krause & Company, LLP as our independent auditor for 2005 for ratification in order to ascertain the views of our shareholders on this appointment. If the appointment is not ratified by the shareholders, the Audit Committee will reconsider its selection. It is not, however, obligated to appoint another auditor.

Representatives of Virchow Krause are expected to be present at the annual meeting of shareholders and will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

-18-

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF VIRCHOW, KRAUSE & COMPANY, LLP AS OUR INDEPENDENT AUDITOR.

The affirmative vote of a majority of the shares of our common stock present and entitled to vote at the 2005 annual meeting of shareholders is necessary to ratify the appointment of Virchow, Krause & Company, LLP. Proxies will be voted FOR ratifying the appointment unless otherwise specified.

ADDITONAL INFORMATION ABOUT OUR INDEPENDENT AUDITOR

Audit Fees

Fees billed or expected to be billed for audit services to us by Virchow, Krause & Company, LLP for the audit of our financial statements for the fiscal year ended December 31, 2004 were $100,000. Fees billed for audit services to us by Ernst & Young LLP for the audit of our financial statements and for reviews of our financial statements included in our quarterly reports to Form 10-Q for the fiscal year ended December 31, 2004 and 2003 were $25,700 and $66,000, respectively.

Audit-Related Fees

Fees billed or expected to be billed to us by Virchow, Krause & Company, LLP for audit-related services provided during the fiscal year ended December 31, 2004 were $0. Fees billed to us by Ernst & Young LLP for audit-related services provided during the fiscal year ended December 31, 2003 were $1,500.

Tax Fees

Fees billed or expected to be billed to us by Virchow, Krause & Company, LLP for tax compliance, tax advice and tax planning for the fiscal year ended December 31, 2004 were $0. Fees billed to us by Ernst & Young LLP for tax compliance, tax advice and tax planning for the fiscal year ended December 31, 2003 were $5,074.

All Other Fees

No fees were billed or are expected to be billed to us by Virchow, Krause & Company, LLP for other services not included above during the fiscal year ended December 31, 2004. No fees were billed to us Ernst & Young LLP for other services not included above during the fiscal year ended December 31, 2003.

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax, and other services performed by the independent auditor. The policy provides for pre-approval by the Audit Committee of specifically defined audit and non-audit services. Unless the specific service has been previously pre-approved with respect to that year, the Audit Committee must

-19-

approve the permitted service before the independent auditor is engaged to perform it. The Audit Committee has delegated to the Chair of the Audit Committee authority to approve permitted service, provided that the Chair reports any decisions to the Audit Committee at its next scheduled meeting. All of the services performed by our independent auditors during 2004 and 2003 were pre-approved by the Audit Committee.

OTHER MATTERS

As of this date, the Board of Directors does not know of any business to be brought before the annual meeting of shareholders other than as specified above. However, if any matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on such matters.

PROPOSALS FOR THE NEXT ANNUAL MEETING

Any shareholder proposals to be considered for inclusion in our proxy material for the 2006 annual meeting of shareholders must be received at our principal executive office at 6464 Sycamore Court, Minneapolis, Minnesota 55369, no later than November 18, 2005. In connection with any matter to be proposed by a shareholder at the 2006 annual meeting, but not proposed for inclusion in Vascular Solutions’ proxy material, the proxy holders designated by Vascular Solutions for that meeting may exercise their discretionary voting authority with respect to that shareholder proposal if appropriate notice of that proposal is not received by Vascular Solutions at its principal executive office by February 1, 2006.

By order of the Board of Directors

Michael Nagel

Secretary

Dated: March 18, 2004

-20-

Exhibit A

Vascular Solutions, Inc.

Audit Committee Charter

Organization

The audit committee of the board of directors shall be comprised of at least three directors who are independent of management and the Company. Members of the audit committee shall be considered independent if they have no relationship to the Company that may interfere with the exercise of their independence from management and the Company. All audit committee members will be financially literate, and at least one member will have accounting or related financial management expertise.

Statement of Policy

The audit committee shall provide assistance to the directors in fulfilling their responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices of the company, and the quality and integrity of financial reports of the company. In so doing, it is the responsibility of the audit committee to maintain free and open communication between the directors, the independent auditors, the internal auditors, and the financial management of the company.

Responsibilities

The audit committee is responsible for the appointment, compensation and oversight of the work of any registered public accounting firm employed by the Company for the purpose of preparing or issuing an audit report or other related work. Any such accounting firm will report directly to the audit committee. The audit committee’s oversight role includes responsibility for resolving disagreements between management and the accounting firm regarding the Company’s financial reporting.

The Chairman of the audit committee will be designated and publicized as the person responsible for the receipt, retention and presentation to the full audit committee for action of complaints regarding accounting and internal accounting controls or auditing matters. Submissions by the Company’s employees of concerns regarding questionable accounting or auditing matters (which may be submitted on a confidential or anonymous basis) will be instructed to be communicated to the Chairman of the audit committee.

The audit committee has the specific authority to engage independent counsel and other advisors, as the committee deems appropriate, and may commit the financial resources the audit committee deems appropriate for such purposes.

In carrying out its responsibilities, the audit committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the company are in accordance with all requirements.

In carrying out these responsibilities, the audit committee will:

- Obtain the full board of directors’ approval of this Charter and review and reassess this Charter as conditions dictate.

- Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the company and its divisions and subsidiaries.

- Have a clear understanding with the independent auditors that they are ultimately accountable to the board of directors and the audit committee, as the shareholders’ representatives, who have the ultimate authority in deciding to engage, evaluate, and if appropriate, terminate their services.

- Review and concur with management’s appointment, termination, or replacement of the director of internal audit.

- Meet with the independent auditors and financial management of the Company to review the scope of the proposed audit and timely quarterly reviews for the current year and the procedures to be utilized, the adequacy of the independent auditor’s compensation, and at the conclusion thereof review such audit or review, including any comments or recommendations of the independent auditors.

- Review with the independent auditors, the company’s internal auditor, and financial and accounting personnel, the adequacy and effectiveness of the accounting and financial controls of the company, and elicit any recommendations for the improvement of such internal controls or particular areas where new or more detailed controls or procedures are desirable. Particular emphasis should be given to the adequacy of internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper.

- Review reports received from regulators and other legal and regulatory matters that may have a material effect on the financial statements or related company compliance policies.

- Review the internal audit function of the company including the independence and authority of its reporting obligations, the proposed audit plans for the coming year, and the coordination of such plans with the independent auditors.

- Inquire of management, the internal auditor, and the independent auditors about significant risks or exposures and assess the steps management has taken to minimize such risks to the Company.

- Receive prior to each meeting, a summary of findings from completed internal audits and a progress report on the proposed internal audit plan, with explanations for any deviations from the original plan.

- Review the quarterly financial statements with financial management and the independent auditors prior to the filing of the Form 10-Q (or prior to the press release of results, if possible) to determine that the independent auditors do not take exception to the disclosure and content of the financial statements, and discuss any other matters required to be

A-2

| | communicated to the committee by the auditors. The chair of the committee may represent the entire committee for purposes of this review. |

- Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and content of the financial statements to be presented to the shareholders. Review with financial management and the independent auditors the results of their timely analysis of significant financial reporting issues and practices, including changes in, or adoptions of, accounting principles and disclosure practices, and discuss any other matters required to be communicated to the committee by the auditors. Also review with financial management and the independent auditors their judgments about the quality, not just acceptability, of accounting principles and the clarity of the financial disclosure practices used or proposed to be used, and particularly, the degree of aggressiveness or conservatism of the organization’s accounting principles and underlying estimates, and other significant decisions made in preparing the financial statements.

- Provide sufficient opportunity for the internal and independent auditors to meet with the members of the audit committee without members of management present. Among the items to be discussed in these meetings are the independent auditors’ evaluation of the company’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of audit.

- Report the results of the annual audit to the board of directors. If requested by the board, invite the independent auditors to attend the full board of directors meeting to assist in reporting the results of the annual audit or to answer other directors’ questions (alternatively, the other directors, particularly the other independent directors, may be invited to attend the audit committee meeting during which the results of the annual audit are reviewed).

- Review the nature and scope of other professional services provided to the company by the independent auditors and consider the relationship to the auditors’ independence.

- On an annual basis, obtain from the independent auditors a written communication delineating all their relationships and professional services as required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. In addition, review with the independent auditors the nature and scope of any disclosed relationships or professional services and take, or recommend that the board of directors take, appropriate action to ensure the continuing independence of the auditors.

- Review the report of the audit committee in the annual report to shareholders and the Annual Report on Form 10-K disclosing whether or not the committee had reviewed and discussed with management and the independent auditors, as well as discussed within the committee (without management or the independent auditors present), the financial statements and the quality of accounting principles and significant judgments affecting the financial statements. In addition, disclose the committee’s conclusion on the fairness of presentation of the financial statements in conformity with GAAP based on those discussions.

- Submit the minutes of all meetings of the audit committee to, or discuss the matters discussed at each committee meeting with, the board of directors.

A-3

- Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose if, in its judgment, that is appropriate.

- Review the Company’s disclosure in the proxy statement for its annual meeting of shareholders that describes that the Committee has satisfied its responsibilities under this Charter for the prior year. In addition, include a copy of this Charter in the annual report to shareholders or the proxy statement at least triennially or the year after any significant amendment to the Charter.

A-4

VASCULAR SOLUTIONS, INC.

ANNUAL MEETING OF SHAREHOLDERS

Tuesday, April 19, 2005

3:30 p.m.

Radisson Hotel & Conference Center

3131 Campus Drive

Plymouth, MN 55441

Vascular Solutions, Inc.

6464 Sycamore Court, Minneapolis, MN 55369 | proxy |

|

This proxy is solicited by the Board of Directors for use at the Annual Meeting on April 19, 2005. The shares of stock you hold will be voted as you specify on the reverse side. If no choice is specified, the proxy will be voted “FOR” Items 1 and 2. By signing the proxy, you revoke all prior proxies and appoint Howard Root and Michael Nagel, and each of them, with full power of substitution, to vote your shares on the matters shown on the reverse side and any other matters which may come before the Annual Meeting and all adjournments.

See reverse for voting instructions. |

\/ Please detachhere \/

The Board of Directors Recommends a Vote FOR Items 1 and 2.

| 1. | Election of directors: | 01 Paul O’Connell

02 James Jacoby, Jr.

03 Michael Kopp | 04 Gary Dorfman

05 Richard Nigon | 06 John Erb

07 Howard Root | | o | Vote FOR

all nominees

(except as marked) | o | Vote WITHHELD

from all nominees |

(Instructions: To withhold authority to vote for any indicated nominee,

write the number(s) of the nominee(s) in the box provided to the right.) | | |

| 2. | Proposal to ratify the selection of Virchow, Krause & Company, LLP as independent auditor of the Company for the year ending December 31, 2005. | | o | For | o | Against | o | Abstain |

| 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTEDFOR EACH PROPOSAL.

Address Change? Mark Box o

Indicate changes below:

Date _____________________________________________________

|

|

Signature(s) in Box

Please sign exactly as your name(s) appears on Proxy. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy.

|