UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| | o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ________

Commission file number: 0-27605

VASCULAR SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | | 41-1859679 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

6464 Sycamore Court North

Minneapolis, Minnesota 55369

(Address of principal executive offices, including zip code)

(763) 656-4300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | | Name of each exchange on which registered: |

| Common Stock, par value $.01 per share | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.406 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated, or a smaller reporting company. See the definitions of “large accelerated filer,” accelerated filer,” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on June 28, 2013 was $233,096,719.

As of January 31, 2014, the number of shares outstanding of the registrant’s common stock was 17,015,776.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2013 Annual Meeting of Shareholders to be held on April 30, 2014 are incorporated by reference in Part III of this Annual Report on Form 10-K.

PART I

Overview

Vascular Solutions, Inc. (we, us or Vascular) is focused on bringing clinically advanced solutions to interventional cardiologists, interventional radiologists, electrophysiologists, and vein practices worldwide. As a vertically-integrated medical device company, we generate ideas, create new minimally invasive medical devices, and then deliver these products and related services to physicians through our direct domestic sales force and our international distribution network. The innovative products and services we offer are divided into three categories:

| · | Catheter products consist principally of catheters used in minimally invasive medical procedures for the diagnosis or treatment of vascular conditions, such as the GuideLiner® catheter used to access discrete regions of the coronary anatomy and the Pronto® extraction catheters used in treating acute myocardial infarction. This category also includes products used in connection with gaining percutaneous access to the vasculature to perform minimally invasive procedures, such as micro-introducer kits. |

| · | Hemostat products consist principally of blood clotting products, such as the D-Stat® Dry hemostat, a topical thrombin-based pad with a bandage used to control surface bleeding, and the D-Stat Flowable, a thick yet flowable thrombin-based mixture for preventing bleeding in subcutaneous pockets. This category also includes our line of devices used in radial artery procedures, such as our Accumed™ wrist positioning splints and Vasc™ Band inflatable compression bands. |

| · | Vein products and services consist principally of the Vari-Lase® endovenous laser, a laser console and procedure kit used for the treatment of varicose veins, and a reprocessing service for the ClosureFAST® radiofrequency vein ablation catheter. |

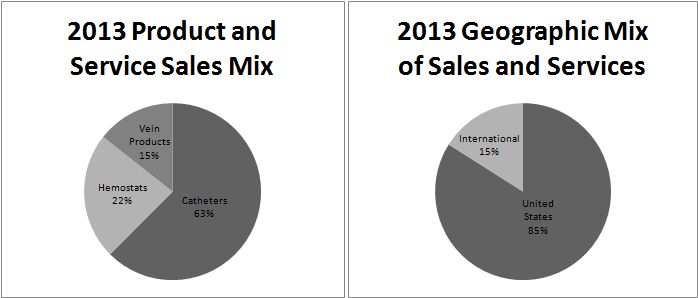

During 2013, 63% of our product and service sales were derived from catheter products, 22% from hemostat products, and 15% from vein products and services. Approximately 85% of our 2013 product and service sales were generated in the United States through our direct sales force and approximately 15% of our sales were to our network of independent distributors outside the United States.

History

We were incorporated in the state of Minnesota in December 1996, and began operations in February 1997. In 2000, we received FDA clearance for our first product, the Duett™ sealing device, which was used to seal the puncture site following catheterization procedures. In 2001, we made the strategic decision to develop additional products and to de-emphasize our Duett product. We have grown from net revenue of $6.2 million in 2000 solely from sales of our Duett product to net revenue of $110.5 million in 2013 from sales of over 80 products we have developed, licensed, or acquired since 2002. This increase in revenue represents a compound annual growth rate of 25% and is driven by our commitment to the development and launch of multiple new devices to diagnose and treat vascular conditions.

Interventional Cardiology and Interventional Radiology Industry Background

According to data from the United States Centers for Disease Control and Prevention (CDC), an estimated 80 million Americans have one or more types of cardiovascular disease—diseases of the heart and blood vessels. The CDC data indicate that cardiovascular disease is the number one cause of death in the United States and is replacing infectious disease as the world’s pre-eminent health risk. Advances in medicine have enabled physicians to perform an increasing number of diagnostic and therapeutic treatments of cardiovascular disease using minimally invasive methods, such as catheters placed inside the arteries, instead of highly invasive open surgery.

Cardiologists and radiologists use diagnostic procedures, such as angiography, to confirm, and interventional procedures, such as angioplasty and stenting, to treat, diseases of the coronary and peripheral arteries. Each angiographic procedure using a catheter requires a puncture in an artery, usually the femoral artery in the groin area and sometimes the radial artery in the wrist, to gain access for the catheter. The catheter then is deployed through an introducer sheath into the vessel to be diagnosed or treated. Upon completion of the procedure and removal of the catheter, the physician must seal this puncture in the artery and the tissue tract that leads from the skin surface to the artery to stop bleeding. Based on industry statistics, we estimate that cardiologists and radiologists performed over nine million diagnostic and interventional catheterization procedures worldwide in 2013.

During the past few years, the number of catheterization procedures performed worldwide has been declining gradually due to a number of factors – among them, the effects of weak economies on overall health care utilization rates, efforts by third-party payers to lower costs associated with medical procedures, investigations by government agencies into potential over-utilization of procedures, the implementation by hospitals of policies designed to reduce the incidence of unnecessary procedures in the wake of these outside investigations, and new diagnostic imaging and functional assessment modalities that more effectively screen patients to determine the need for treatment. Although worldwide demographic factors, including the growing incidence of cardiovascular disease, seem to favor long-term growth in the number of interventional procedures, we believe that the recent structural pressures on utilization rates are likely to continue and to result in relatively flat catheterization volumes for the foreseeable future. Based on our analysis of the publicly-available sales figures from several companies that participate in the cardiovascular device sector, we estimate the worldwide market for interventional medical devices used in cardiovascular procedures in 2013 exceeded $12 billion.

The interventional medical device industry is characterized by intense competition, cost-containment efforts by hospitals and other providers, rapidly-evolving technology, and a high degree of government regulation. To grow our business, we have focused on continually developing and commercializing new products and services. Looking ahead, we expect our business may be impacted by the following trends and opportunities:

| · | The future regulatory approval of newly-developed products. Any new product that we develop must be approved by the Food and Drug Administration (FDA) in the United States and by similar regulatory bodies in other countries before they can be sold. The requirements for obtaining product approval have undergone change, and the FDA frequently implements changes to the product approval process. We monitor the changing regulatory landscape and modify our regulatory submissions as necessary to obtain product approvals. |

| · | Successfully integrating acquired products and services into our existing operations. The acquisition of products and services complementary to our existing product portfolio and customer call points provides an additional business opportunity, but is dependent on the successful integration of the acquired products into our existing business structure. |

| o | In September 2013, we made an initial payment to Northeast Scientific, Inc. (NES) for the acquisition of exclusive eight-year rights to sell reprocessing services in the U.S. for an existing commercial medical device, pending FDA approval of the reprocessing procedure, which NES is pursuing in 2014. |

| o | In December 2012, we acquired the Teirstein EdgeTM device organizer and the AngioAssistTM docking station assets from Shepherd Scientific, Inc. (Shepherd Scientific). Prior to the acquisition, we had been distributing these products under an agreement with Shepherd Scientific. |

| o | In August 2012, we acquired the Venture® wire control catheter (Venture) assets from St. Jude Medical, Cardiology Division, Inc. (St. Jude Medical) and during 2013 fully integrated this product into our operations. |

| o | In June 2012, we acquired the Accumed wrist positioning splint assets from Accumed Systems, Inc. (Accumed) and have integrated this product into our operations. |

| o | In January 2012, we acquired the rights, patents and intellectual property relating to our Pronto catheter from Dr. Pedro Silva and his affiliates. |

| o | In December 2011, we acquired exclusive five-year rights to sell reprocessing services for the ClosureFAST catheter in the United States from Northeast Scientific, Inc. |

| o | In January 2011, we acquired the Guardian® hemostasis valve assets from Zerusa Limited (Zerusa) and have established a subsidiary in the Republic of Ireland to continue the manufacturing of these products. |

For additional information on these acquisitions, see Note 15 to our Consolidated Financial Statements in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2013.

| · | Managing intellectual property. The interventional medical device industry is characterized by numerous patent filings and litigation claims made to protect new and evolving product ideas. To maximize the profitability of new product ideas, we seek patent protection for those product design and method concepts which we believe have the potential to provide substantial product revenue. On October 14, 2013 we reached an agreement with Terumo Corporation and Terumo Medical Corporation (Terumo) to settle a patent and trademark infringement lawsuit brought by Terumo against us related to a prior version of our Vasc Band radial compression device in exchange for a one-time payment to Terumo in the amount of $812,500. On May 16, 2013, we filed a patent and copyright infringement complaint in the U.S. District Court for the District of Minnesota against Boston Scientific Corporation alleging that it is infringing three of our United States patents related to our GuideLiner guide extension product. Boston Scientific filed a counterclaim alleging that our GuideLiner catheter infringes a Boston Scientific patent that has recently expired. The Boston Scientific patent litigation is ongoing. Managing intellectual property assets and claims is a significant challenge for our business. |

Products and Services

Our product and service offerings are divided into three categories: catheter products, hemostat products, and vein products and services. The competitive advantages of our products and services are enhanced by the experience of our direct U.S. sales employees and international independent distributors, the experience of our management team, and our dedication to bringing clinically unique solutions to the markets we serve worldwide.

For information about our revenue, profits and total assets, see our Consolidated Financial Statements included in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2013.

Catheter Products

Catheter products represent the largest of our three product categories. In 2013, worldwide sales of our catheter products totaled $69.9 million, an increase of 14% from the 2012 level of $61.3 million. Catheter products represented approximately 63% of our total product and service sales during 2013. Our catheter products consist of a variety of devices used to gain access, diagnose, and treat vascular conditions during minimally invasive catheterization procedures.

Our largest selling catheter products during 2013 are listed in the table below.

| Product | Market Introduction | 2013 Sales ($MM) | Estimated Market Potential ($MM) | Description |

| GuideLiner | 2009 | $20.8 | >$50 | Guide extension catheter used for deep-seating, back-out support, and optimal stenting in challenging interventions |

| Pronto | 2003 | $20.3 | $100 | Manual aspiration catheter for the removal of fresh, soft thrombus and emboli |

| Micro-Introducers | 2003 | $8.9 | $75 | Access kit products used to gain percutaneous access to the vasculture for performing arterial and venous catheterization procedures |

Langston® | 2004 | $5.8 | >$10 | Dual lumen catheter used to measure intravascular pressure gradients, primarily for the diagnosis of aortic valve stenosis |

SmartNeedle® | 2010 | $3.8 | >$5 | Doppler-guided needle device designed to provide auditory ultrasound-guided access to arteries and veins during catheterization procedures |

| Venture | 2013 | <$3 | >$5 | Deflectable tip catheter used for steering guidewires in challenging interventions, acquired from St. Jude Medical in 2012 |

Guardian | 2007 | <$3 | $100 | Hemostat valve used in catheterization procedures to allow placement of multiple devices simultaneously in the artery while minimizing blood loss |

| SuperCross™ | 2011 | <$3 | >$20 | Microcatheters for support and delivery of guidewires during challenging coronary and peripheral catheterization procedures |

| Snares | 2008 | <$3 | > $40 | Interventional snares used to retrieve or manipulate objects in the cardiovascular system |

Minnie® | 2009 | <$3 | $30 | Support catheter used to facilitate placement and exchange of guidewires and other interventional devices. |

Our highest selling catheter product is the GuideLiner guide extension device. We received CE Mark and launched GuideLiner in Europe in October 2009 and we received 510(k) clearance and launched GuideLiner in the U.S. in November 2009. With the introduction of the GuideLiner, Vascular Solutions pioneered the interventional technique of rapid exchange guide extension. The GuideLiner catheter is a unique coaxial “mother and child” guide extension with rapid exchange convenience that enables deep seating, guide back-up support, and selective intubation in challenging coronary interventions. In December 2011, we launched the second generation of our GuideLiner catheter with increased flexibility, a smaller size version, and a longer extension. In August 2013, we launched the third generation version, GuideLiner V3, which features a polymer “half-pipe” collar to enhance stent and wire deployment. In December 2013, we received Shonin approval from the Japanese Ministry of Health, Labour and Welfare (MHLW) to sell GuideLiner in Japan. We also received Japanese reimbursement designation, effective January 1, 2014. With the addition of the Japanese market, we believe the worldwide market opportunity for GuideLiner is in excess of $50 million per year.

Our Pronto catheters consist of a catheter with a proprietary distal tip and large extraction lumen that can be delivered into arteries to mechanically remove blood clots using simple vacuum suction. The original Pronto extraction catheter was developed by Dr. Pedro Silva of Milan, Italy, who exclusively licensed the design to us in 2002. We received CE mark approval and commenced international sales of the Pronto in August 2003, and received FDA clearance in December 2003 and commenced sales in the United States in early 2004. In the fourth quarter of 2005, we launched the third generation design of the Pronto, named the Pronto V3. The V3 version of the Pronto resulted in a substantial increase in Pronto sales in 2006. In January 2011, we commenced the launch of the Pronto V4, which utilizes an embedded longitudinal wire for maximum extraction with enhanced deliverability and kink resistance. On January 6, 2012, we purchased the intellectual property relating to the Pronto extraction catheter from Dr. Silva and his affiliates in exchange for $3.25 million, which thereby eliminated royalty payments on sales of Pronto catheters occurring after December 31, 2011. We believe that the market size for the removal of soft thrombus is approximately $100 million per year worldwide.

In addition to the Pronto V3 and V4, we have developed and launched five additional versions of extraction catheters - the Pronto-Short, Pronto 035, Pronto LP, QXT® and XL™. The Pronto-Short is a shorter and larger version, designed for use in clotted dialysis grafts that was launched in August 2005. The Pronto 035 is a much larger version, designed for use in large vessels that was launched in August 2007. The Pronto LP is a low profile version, designed for use in smaller vessels that was launched in January 2008. The QXT is a low-cost version, designed to be sold in certain international markets that was launched in March 2008. The XL extraction catheter is a larger version with either a straight or pigtail tip, designed for use in larger vessels that was launched in January 2012.

In July 2003, we launched a variety of access kit products used to gain percutaneous access to the vasculature for performing arterial and venous catheterization procedures. These products include a full line of micro-introducer kits and a variety of specialty guidewires.

At the end of the third quarter of 2004, we received regulatory clearance in the United States for the Langston dual lumen pigtail catheter. The Langston catheter is used for the measurement of intravascular pressure gradients, primarily measured to diagnose aortic valve stenosis. In March 2011, we launched the second version of our Langston catheter with improved pressure measurement and reduced kinking. We believe our Langston catheter is the only dual lumen pigtail catheter on the U.S. market that is designed specifically for this clinical purpose. We believe the U.S. market opportunity for the Langston catheter product line is greater than $10 million per year.

In April 2010, we acquired the SmartNeedle and pdACCESS Doppler guided needle products from Escalon Vascular Access, Inc. The SmartNeedle and pdACCESS products consist of a hand-held monitor and one-time use needles designed to provide auditory ultrasound guided access to arteries and veins during catheterization procedures.

In August 2012, we acquired the Venture catheter from St. Jude Medical. After integrating manufacturing operations into our own facilities, we re-launched Venture in the U.S. in April 2013 and in international markets in August 2013. There are three versions of the Venture catheter: rapid exchange (Rx), over-the-wire (OTW), and coronary sinus (CS). The Venture catheters are indicated for directing, steering, controlling, and supporting a guidewire to access discrete regions of the coronary and peripheral vasculature. The device features a tip that deflects up to 90 degrees for precise direction of 0.014” guidewires around tortuous anatomy.

During 2007, we entered into an agreement with Zerusa Limited (Zerusa) to act as the exclusive U.S. distributor of Zerusa’s Guardian hemostatic valve. The Guardian hemostatic valve is a valve used in catheterization procedures to allow the placement of multiple devices simultaneously in the artery with a unique push-button operation that is designed to minimize blood loss. In November 2009, we began distribution of a second generation version called the Guardian II hemostatic valve. In January 2011, we acquired substantially all of the assets of Zerusa, including the Guardian hemostasis valves and established a wholly-owned subsidiary in the Republic of Ireland to continue the manufacture of the Guardian product.

In January 2011, we launched the SuperCross microcatheters. The SuperCross microcatheters are used in conjunction with steerable guidewires to access discrete regions of the coronary and peripheral vasculature and are sold in multiple versions. Straight tip versions are designed for superior wire tracking, while angled tip versions in 45, 90, and 120 degree pre-formed tips are designed to direct wire placement in bifurcated vessels. In December 2013, we received Shonin approval from the MHLW to market our SuperCross FT, the flexible tip version, in Japan. SuperCross FT also received Japanese reimbursement designation, effective January 1, 2014.

During 2008, we entered into an agreement with Radius Medical, Ltd. to distribute its Micro Elite™ and Expro Elite™ Snares within the United States. The Elite snares feature a highly torqueable shaft design for control and maneuverability when accessing distal targets. In October 2010, we acquired the entire snare and retrieval product line from Radius. We believe the market opportunity for snares within interventional cardiology and radiology is over $40 million per year.

In January 2009, we launched the Minnie support catheter. The Minnie support catheter is designed to provide guidewire support and exchange during complex interventions. We believe the current market size for support catheters is approximately $30 million per year.

Hemostat Products

Our second product category, hemostat products, generated 2013 sales of $23.8 million, a 5% increase from the 2012 level of $22.7 million. Hemostat products represented 22% of our total product and service sales during 2013.

Our hemostat products primarily utilize thrombin, a powerful bovine-derived blood clotting protein, to deliver a rapid seal of bleeding with a variety of shelf-stable product configurations. Internally, we have development a proprietary manufacturing process to terminally sterilize our thrombin-based hemostats, which has resulted in our ability to create unique advantages in storage, shipping, preparation and application of our hemostat products. With the recent rapid adoption of radial artery catheterizations in the U.S., we have added a major emphasis on products for use in radial procedures in our hemostat products category.

Our five largest selling hemostat products during 2013 are listed in the table below.

| Product | Market Introduction | 2013 Sales ($MM) | Estimated Market Potential ($MM) | Description |

D-Stat Dry, Thrombix® | 2003 | $13.1 | $50 | Thrombin-based hemostat bandages used in conjunction with manual compression to control bleeding at the site of femoral artery punctures created for interventional access |

| D-Stat Flowable | 2002 | $5.7 | $10 | Flowable mixture of collagen, thrombin, and diluent used to control bleeding in the pectoral pockets created in pacemaker and implantable cardioverter defibrillator (ICD) implants |

| Vasc Band radial hemostat | 2013 | <$3 | $50 | Compression device using an inflatable balloon to assist with bleeding control following a catheterization or other puncture into a blood vessel in the patient’s arm |

| D-Stat Radial | 2004 | <$3 | $25 | Wrist band that combines a thrombin pad with a compression collar to control bleeding at the radial artery access site created for interventional access |

| Accumed wrist positioning splint | 2012 | <$3 | $15 | Splint that positions and stabilizes the hand, wrist, and forearm for arterial puncture and support during radial artery catheterizations |

Our most popular hemostat product is the D-Stat Dry hemostat bandage. In September 2003, we received regulatory clearance and commenced sales of our D-Stat Dry hemostat bandage in the United States and international markets. The D-Stat Dry hemostat bandage is a version of our proprietary blood clotting substance that is lyophilized (freeze-dried) into a gauze pad and combined with an adhesive bandage for application. The D-Stat Dry is used as an adjunct to manual compression for managing bleeding after catheterization procedures.

The traditional method for sealing the puncture site after catheterization procedures has been a manual process whereby a healthcare professional applies direct pressure to the puncture site, sometimes using a sand bag or a large C-clamp, for 20 minutes to an hour in order to form a blood clot. The healthcare professional then monitors the patient, who must remain immobile in order to prevent dislodging of the clot, for an additional two to 24 hours. Patients subjected to manual compression generally experience significant pain and discomfort during compression of the puncture site and during the period in which they are required to be immobile. Many patients report that this pain is the most uncomfortable aspect of the catheterization procedure. In addition, patients can develop a substantial coagulated mass of blood, or hematoma, around the puncture site. Finally, the need for healthcare personnel to provide compression and the use of hospital beds during the recovery period results in substantial costs to the institution, which, under virtually all current healthcare payment systems, are not separately reimbursed.

Until 1996, manual compression was used following virtually all catheterization procedures. In late 1995, the first vascular sealing device which did not rely on compression was introduced in the United States. In addition to invasive (below the skin surface) sealing devices, starting in 2000, non-invasive “patches” began to be used as an assist to manual compression following catheterizations. Non-invasive patches are used by physicians who (principally due to cost, complexity or risk of complications) do not wish to use invasive sealing devices, and for those patients who are contra-indicated for an invasive sealing device. Based on the number of catheterization procedures performed annually by cardiologists and radiologists, industry sources report that the total market opportunity for vascular sealing devices (invasive and non-invasive) is more than $1 billion annually.

We completed a 376-patient; five center randomized clinical study that demonstrated a 50% reduction in the median time-to-hemostasis when using the D-Stat Dry bandage compared to simple manual compression. In the third quarter of 2006, we received FDA clearance of our claim that the D-Stat Dry reduces the time-to-hemostasis in diagnostic catheterizations. In the first quarter of 2008, we received FDA clearance and began selling two new versions of the original D-Stat Dry bandage. The first new version, the D-Stat Dry Clear hemostatic bandage, is packaged with a clear bandage which allows for better visibility of the site while the bandage is in place. The second new version, Thrombix, uses a lower cost manufacturing process which offers price flexibility within the product line. In the first quarter of 2009, we received FDA clearance and began selling a new version of the original D-Stat Dry bandage. This new product, the D-Stat Dry Wrap hemostatic bandage, contains a pre-cut specifically designed for the control of bleeding around indwelling lines. In May 2011, we received FDA clearance and began selling a new version of our D-Stat Dry bandages with silver impregnated into the gauze pad to help prevent the colonization of microorganisms on the pad. We believe that the market for hemostat pads following catheterization procedures has grown substantially since the first competitive patch was introduced in 2000, with a market size of approximately $50 million.

The market for hemostat patches used to stop bleeding of femoral artery punctures is mature, with multiple competitors and ongoing pricing pressures. In addition, two trends are negatively affecting the demand for our D-Stat and Thrombix patches: the recent slow-down in growth of catheterization procedures in general and the movement toward greater reliance on using the radial artery in the arm, rather than the femoral artery in the leg, as the access site for diagnostic and interventional procedures.

Radial artery access, otherwise known as transradial access, is undergoing rapid adoption in the U.S. According to industry data, the proportion of U.S. procedures performed using radial access grew from just 1.2% during the first quarter of 2007 to 16.1% by the third quarter of 2012. The level of penetration for radial artery access in the U.S. is still far behind most other parts of the world – such as Canada at 50%, Japan at 60%, and the average for European countries at around 35% of catheterization procedures, according to industry data. Based on projected continued growth in radial access, we believe the number of radial artery access procedures performed in the U.S. will grow to approximately one million by the end of 2016.

While the movement to radial access has presented obstacles to expansion of our femoral hemostat patch business, the trend has created opportunities for growth through our new hemostat products. For example, our D-Stat Radial hemostat band is a version of the D-Stat Dry that includes a compression band to allow it to be applied over the radial artery in the wrist. The D-Stat Radial is the first device for radial artery hemostasis that contains an active blood clotting agent together with a compression collar for this purpose. We received regulatory clearance for the D-Stat Radial hemostat band in September 2003, and made manufacturing improvements to the product before launching it in the United States in early 2004. In December 2009, we made further manufacturing improvements and launched a new version called the D-Stat Rad-Band® in the United States.

During 2012, we expanded our strategic focus on launching hemostat products that cater to the significant growth opportunity in the radial access market. In May of 2013, we launched the first version of the Vasc Band radial compression device under an exclusive U.S. distribution agreement with Lepu Medical Technology (Beijing) Co., Ltd. The Vasc Band is placed around the patient’s wrist after a radial catheterization procedure and uses an inflatable compression band to assist hemostasis. In June 2012, we acquired the Accumed wrist positioning splint device from Accumed Systems, Inc. The Accumed wrist positioning split consists of a molded plastic brace that simplifies access to the radial artery by holding the hand, wrist, and forearm in an appropriate, comfortable position. The device is also designed to facilitate placement of a hemostatic band to control bleeding after the procedure.

Our D-Stat Flowable hemostat, which we began selling worldwide in February 2002, is a thick yet flowable mixture of collagen, thrombin and diluent that can be delivered topically and into voids and open spaces to control active bleeding. The D-Stat Flowable hemostat can be used in a wide variety of procedures as an adjunct to hemostasis. In December 2006, we received FDA approval of our premarket approval (PMA) supplement for the use of D-Stat Flowable in the prepectoral pockets created in pacemaker and implantable cardioverter defibrillator (ICD) implants. Our PMA supplement was supported by the results of our 269-patient “Pocket Protector” clinical study that demonstrated a 48% reduction in the incidence of clinically relevant hematomas through the use of D-Stat Flowable compared to the standard of care. We estimate that the U.S. market opportunity for this prepectoral pocket indication is greater than 100,000 procedures or $10 million annually.

Vein Products and Services

Our third business category, vein products and services, generated $16.5 million in revenues during 2013, an increase of 17% from the 2012 level of $14.1 million. Vein products represented approximately 15% of our total product and service sales during 2013.

Our two largest selling vein products and services during 2013 are listed in the table below.

| Product/Service | Market Introduction | 2013 Revenue ($MM) | Estimated Market Potential ($MM) | Description |

| ClosureFAST reprocessing service | 2012 | $8.2 | >$20 | Reprocessing offered in the U.S. in collaboration with Northeast Scientific, Inc. for Covidien’s ClosureFAST radiofrequency ablation catheters |

| Vari-Lase procedure kits, laser consoles and procedure packs | 2003 | $7.4 | >$200 | Procedure kits consist of laser fibers and other components used in endovenous laser ablation procedures (e.g., access needles, and guidewires). Laser consoles consist of an 810 nm wavelength, 15 watt laser used to perform endovenous laser ablation procedures. Procedure packs are sterile bundles of access components used in venous procedures, such as syringes, needles, scalpels; gowns and dressings |

Our vein products are generally used in the treatment of reflux of the great saphenous vein, commonly referred to as varicose veins. More than one million people in the United States seek treatment each year for varicose veins. Left untreated, varicose veins can result in serious clinical consequences, including limited mobility and venous stasis ulcers. Historically, an invasive surgical procedure known as vein stripping was the only treatment for severe varicose veins. While vein stripping is still performed, since 2002 a non-surgical procedure using energy (laser or radiofrequency) to treat and close the diseased vein has become a preferred alternative. We believe the current market size for treating varicose veins using endovenous therapy is greater than $200 million per year.

On December 22, 2011, we entered into an exclusive five-year license agreement with NES, under which we sell a reprocessing service to customers utilizing the ClosureFAST radiofrequency catheter in the treatment of varicose veins in the United States. The ClosureFAST catheter is owned and marketed by VNUS Medical Technologies, Inc., a subsidiary of Covidien, and our reprocessing service is not licensed by or associated with Covidien. Under the reprocessing service provided by NES, the customer sends its used ClosureFAST catheters to NES, where they are inspected, cleaned, tested, repackaged, resterilized, and shipped back to the customer. Customers benefit from a reprocessing service by significantly reducing their costs and cutting down on medical waste. Since the reprocessing service was launched in January of 2012 through the end of 2013, more than 40,000 ClosureFAST catheters have been successfully reprocessed by NES and sent to customers of the service. We have reprocessed catheters for more than 500 accounts and approximately 65% of these customers were entirely new accounts for Vascular Solutions. We believe the U.S. market opportunity for reprocessing the ClosureFAST catheter is greater than $20 million per year.

In addition to this reprocessing service, we have leveraged our expanded vein products customer base by selling ancillary products used in vein procedures. In September 2013, we launched our VSI 0.025” Guidewire which can be used during radiofrequency ablation procedures to facilitate placement of the ClosureFAST catheter into desired treatment locations. We also launched a 0.018” guidewire designed for venous access in vein ablation procedures. We now offer a full range of accessory products for the vein ablation procedures, including 7F introducer sheath systems, an 18-gauge ecogenic needle for percutaneous entry, syringe kits and infiltration pumps for administration of local anesthesia, and a broad line of procedure packs.

Our Vari-Lase endovenous laser products consist of a laser console, procedure kits, procedure packs and accessories used in the treatment of varicose veins. The first product we launched in our vein product line was our Vari-Lase procedure kit in July 2003 in the United States. Our Vari-Lase procedure kit is custom-designed for the endovenous procedure. In December 2003, we received FDA clearance for our Vari-Lase laser console, which is manufactured to our specifications by MedArt, a Denmark-based medical laser manufacturer. Since 2004, we have continued our expansion by adding several accessory items to our vein product line. In April 2007, we launched the Vari-Lase Bright Tip™ fiber which utilizes a ceramic sleeve to the distal tip of the laser fiber to provide improved ultrasound visibility and prevent contact between the energy-transmitting fiber tip and the vein wall during the application of laser energy. In January 2010, we launched a new 15 Watt version of our Vari-Lase laser console.

The amount of total revenue contributed by each of our product lines and by geographic areas for the last three fiscal years is set forth in Notes 2 and 11 to our Consolidated Financial Statements in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2013.

Agreements with King Pharmaceuticals, Inc.

In January 2007, we entered into a License Agreement with King Pharmaceuticals, Inc. (King), which is now a subsidiary of Pfizer, Inc. Under the terms of the License Agreement, we granted to King an exclusive, royalty-free, fully-paid up, perpetual, worldwide right and license to all of our patents and know-how relating to the development, manufacture, use, sale, importation or other exploitation of our Thrombi-Pad® trauma bandage, Thrombi-Gel® hemostats, Thrombi-Paste™ hemostat (collectively, the “Products”) and all future medical devices having application in the Field (as defined below) and intended to produce hemostasis by accelerating the clotting process of blood (a “hemostat device”). The “Field” is defined as all applications of hemostat devices in all areas other than catheterization laboratories (cardiac and peripheral), electrophysiology laboratories and holding and recovery rooms for such laboratories. Upon execution of the License Agreement, King paid us a one-time payment of $6.0 million. No other payments are due from King to us under the License Agreement. The term of the License Agreement commenced on January 9, 2007 and continues until the later of the expiration of each licensed patent or King’s relinquishment of its license rights under the licensed know-how.

Also in January 2007, we entered into a Thrombin-JMI® Supply Agreement with King. Under the terms of the Thrombin-JMI Supply Agreement, King agreed to manufacture and supply thrombin to us on a non-exclusive basis. King agreed to supply us with such quantity of thrombin as we may order for use in devices not intended for sale by King in the Field at a fixed price throughout the term of the Thrombin-JMI Supply Agreement as adjusted for inflation, variations in potency and other factors. King also agreed to provide thrombin to us under the Thrombin-JMI Supply Agreement at no cost for incorporation into Products and hemostat devices intended for sale in the Field by King. The Thrombin-JMI Supply Agreement has an initial term of 10 years, followed by successive automatic one-year extensions, subject to termination by the parties under certain circumstances, including (1) termination by King without cause any time after the fifth anniversary of its execution upon five years prior written notice to us and (2) termination by us without cause any time after the fifth anniversary of its execution upon five years prior written notice to King, provided that a Device Supply Agreement we entered into with King in January 2007 has expired on its terms or the parties have agreed to terminate it.

Business Strategy

Our primary objective is to establish ourselves as a leading supplier of clinically superior medical devices and services for substantial, unique opportunities within interventional medicine. The key steps in achieving our primary objective are the following:

| Ÿ | Maintain and Improve our Clinically-Oriented Direct Sales Force in the United States. During 2000 we commenced sales of our products in the United States through a direct sales force of clinically trained account managers who sell and train interventional cardiologists, radiologists and catheterization laboratory personnel on the use of our products. As our product lines have increased, we have increased the size of our sales force to 91 at the end of 2013, which provides substantially complete geographic coverage of the United States. |

| Ÿ | Expand our Existing Products to Our Existing Market. Since the beginning of 2003, we have launched multiple new products and services in the United States through our direct sales force to our existing markets. Pursuing this multiple product and services strategy has generated material sales growth, and we believe that each of our current product lines has the potential to generate continued sales growth during 2014 and beyond. |

| Ÿ | Develop New Devices and Services to be Sold Through our Direct Sales Force to our Existing Customers. Since the beginning of 2003, we have created and developed multiple new products that are sold to our existing customers. We intend to continue to leverage our direct sales force by creating, developing and launching additional new products and services to the interventional physician. |

| Ÿ | Acquire Additional Products or Services to be Sold Through our Direct Sales Force to our Existing Customers. We intend to continue to leverage our direct sales force by bringing additional products and services to the interventional physician through acquisitions. Over the past three years, we have acquired products and services from Zerusa, NES, Accumed, St. Jude Medical, and Shepherd Scientific (see Note 15 to our Consolidated Financial Statements in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2013). We expect to continue to acquire complementary products and services and to enter into distribution agreements for the distribution of other companies’ products through our direct U.S. sales force. |

| Ÿ | Explore Corporate Relationships to Augment our Direct Sales Force. In markets for our products beyond the interventional physician (such as occurred with our Thrombi-Gel, Thrombi-Paste and Thrombi-Pad products) and in other situations where synergistic sales can result, we intend to enter into corporate relationships to broaden our products’ reach and increase our revenues without distracting our direct sales force. |

Sales, Marketing and Distribution

In 2000, we commenced sales of our first product, the Duett sealing device, in the United States through our direct sales organization. As of December 31, 2013, our U.S. direct sales force consisted of 91 employees, all of whom sell our entire line of products and services. We believe that the majority of interventional catheterization procedures in the United States are performed in high volume catheterization laboratories, and that these institutions can be served by our focused direct sales force.

Our international sales and marketing strategy has been to sell to interventional cardiologists and interventional radiologists through established independent distributors in major international markets, subject to required regulatory approvals. We currently have independent distributors that cover 49 countries outside the U.S. We have entered into multi-year written distribution agreements with each of our independent distributors, and we ship our products to these distributors upon receipt of purchase orders. Each of our independent distributors has the exclusive right to sell our products within a defined territory. These distributors also market other medical products, although they have agreed not to sell directly competitive products. Our independent distributors purchase our products from us at a discount from list price and resell the device to hospitals and clinics. Sales to international distributors are denominated in United States dollars, with the exception of sales from our subsidiary in Ireland and sales to our German distributor, which are denominated in Euros. The end-user price is determined by the distributor and varies from country to country.

As part of our sales strategy, our direct U.S. sales force and international independent distributors are clinically trained to be able to train physicians and other healthcare personnel on the use of our products and services. We believe that effective training is a key factor in encouraging physicians to use interventional medical devices and services. We have created, and will continue to work to improve, an in-the-field training program for the use of all of our products and services. We also develop and maintain close working relationships with our customers to continue to receive input concerning our product and service development plans.

We are focused on building market awareness and acceptance of our products and services. Our marketing department provides a wide range of programs, materials and events that support our sales force. These include product and service training, conference and trade show appearances and sales literature and promotional materials.

New Product and Service Development

Our growth depends in large part on the continuous introduction of new and innovative products and services, together with ongoing enhancements to our existing products and services, through internal product development, technology licensing and strategic alliances. We recognize the importance of, and intend to continue to make investments in, research and development. We incurred expenses of $13,191,000 in 2013, $11,870,000 in 2012, and $10,240,000 in 2011 for research and development activities, which constituted 12%, 12%, and 11%, respectively, of net sales. R&D activities include research, product development and intellectual property development. We expect that our R&D expenditures will be approximately 11 to 12% of net sales in 2014.

Our research and product development group works closely with our sales force to incorporate customer feedback into our development and design process. We believe that we have a reputation within interventional cardiology and interventional radiology as a good partner for product and service development because of our tradition of close physician collaboration, dedicated market focus, responsiveness and execution capabilities for product and service development and commercialization.

To further leverage our efficiencies, our research and development group continues to develop in-house capabilities to manufacture some of the components currently produced by outside vendors.

We expect our research and development activities to continue to expand to include evaluation of new concepts, products and services for the interventional cardiology and interventional radiology field. We believe that there are many potential new interventional products and services that would fit within the development, clinical, manufacturing and distribution network we have created for our existing products and services.

Manufacturing

We manufacture our products in our facilities located in the suburbs of Minneapolis, Minnesota and in the country of Ireland. The manufacturing and packaging processes generally occur under a controlled clean room environment. Our quality system, manufacturing facilities and processes have been certified to be compliant with the European Medical Device Directive 93/42/EEC, ISO 13485:2012, the Canadian Medical Device Regulations SOR/98-282, and they comply with FDA Quality System Regulations.

We purchase components from various suppliers and rely on single sources for several parts of our products. We purchase our thrombin (a component in all of the D-Stat products) for use in manufacturing products sold in the U.S. under the Thrombin-JMI® Supply Agreement with King. To date, we have not experienced any significant adverse effects resulting from shortages of components.

The manufacture and sale of our products entails significant risk of product liability claims. Although we have product liability insurance coverage in an amount which we consider reasonable, it may not be adequate to cover potential claims. Any product liability claims asserted against us could result in costly litigation, reduced sales and significant liabilities and divert the attention of our technical and management personnel away from the development and marketing of our products for significant periods of time.

Competition

We encounter significant competition across our product lines and in each market in which our products are sold. These markets are characterized by rapid change resulting from technological advances and scientific discoveries. We face competitors ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of products.

Our primary competitors include: Medtronic, Boston Scientific, Covidien, Merit Medical, Marine Polymer Technologies, Cook Medical, Spectranetics, AngioDynamics and Terumo.

Many of our competitors have substantially greater financial, technological, research and development, regulatory, marketing, sales and personnel resources than we do. Competitors may also have greater experience in developing products, obtaining regulatory approvals, and manufacturing and marketing such products. Additionally, competitors may obtain patent protection or regulatory approval or clearance, or achieve product commercialization before us, any of which could materially adversely affect us. We compete on the basis of our clinically differentiated products and services and focused opportunities within this interventional medical device and service market.

In each of our product and service areas, we believe that several other companies are developing new devices and services. The medical device industry is characterized by rapid and significant technological changes as well as the frequent emergence of new technologies. There are likely to be research and development projects related to these market areas of which we are currently unaware. A new technology, product or service may emerge that results in a reduced need for our products and services or results in a product or service that renders our product or service noncompetitive.

Regulatory Requirements

United States

Our products and services are regulated in the United States as medical devices by the FDA under the Federal Food, Drug and Cosmetic Act. The FDA classifies medical devices and services into one of three classes based upon controls the FDA considers necessary to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls such as labeling, adherence to good manufacturing practices and maintenance of product complaint records, and are usually exempt from premarket notification requirements. Class II devices are subject to the same general controls and also are subject to special controls such as performance standards and FDA guidelines, require premarket notification (510k clearance) prior to commercialization, and may also require clinical testing prior to clearance. Class III devices are subject to the highest level of controls because they are used in life-sustaining or life-supporting implantable devices. Class III devices require rigorous clinical testing prior to their approval and generally require a premarket approval (PMA) or supplement application prior to commercialization.

If a medical device manufacturer can establish that a device is “substantially equivalent” to a legally marketed Class I or Class II device, or to an unclassified device, or to a Class III device for which the FDA has not called for PMAs, the manufacturer may seek clearance from the FDA to market the device by filing a 510(k) premarket notification. The 510(k) notification must be supported by appropriate data establishing the claim of substantial equivalence to the satisfaction of the FDA. Following submission of the 510(k) notification, the manufacturer may not place the device into commercial distribution in the United States until a clearance letter is issued by the FDA.

Manufacturers must file an investigational device exemption (IDE) application if human clinical studies of a device are required and if the FDA considers experimental use of the device to represent significant risk to the patient. The IDE application must be supported by data, typically including the results of animal and mechanical testing of the device. If the IDE application is approved by the FDA, human clinical studies may begin at a specific number of investigational sites with a maximum number of patients, as approved by the FDA. The clinical studies must be conducted under the review of an independent institutional review board to ensure the protection of patient rights.

Generally, upon completion of human clinical studies, a manufacturer seeks approval of a Class III medical device from the FDA by submitting a PMA application. A PMA application must be supported by extensive data, including the results of the clinical studies, as well as literature to establish the safety and effectiveness of the device.

Our D-Stat Flowable is classified as both a Class III and Class II device based on the three distinct indications for use that have been assigned to this product.

Our remaining products generally are classified as Class II products and therefore require FDA clearance of a 510(k) notification prior to being sold in the United States. Each of our Class II product lines was initially subject to a 510(k) notification and determined to be “substantially equivalent” to a legally marketed predicate device by the FDA, thereby allowing commercial marketing in the United States. In some instances, we are able to launch a modified product without filing a 510(k) with the FDA.

We also are subject to FDA regulations concerning manufacturing processes and reporting obligations. These regulations require that manufacturing operations be performed according to FDA standards and in accordance with documentation, control and testing standards. We are subject to inspection by the FDA on an on-going basis. We are required to provide information to the FDA on adverse events and maintain a document and record keeping system in accordance with FDA guidelines. The advertising of our products is subject to both FDA and Federal Trade Commission jurisdiction. If the FDA believes that we are not in compliance with any aspect of the law, it can institute proceedings to detain or seize products, issue a recall, stop future violations and assess civil and criminal penalties against us, our officers and our employees.

International

The European Union has adopted rules which require that medical products receive the right to affix the CE mark, an international symbol of adherence to quality standards and compliance with applicable European medical device directives. As part of CE mark certification, manufacturers are required to comply with certain quality systems standards. We received CE mark certification for our first product and certification of our quality system in July 1998, and we have subsequently received CE mark certification for other products we distribute in the European Union.

Our hemostatic products contain bovine-derived thrombin and are subject to additional regulatory review within the European Union to minimize the risk of exposure to viral and Bovine Spongiform Encephalopathy (BSE) pathogens. The regulations in this area continue to evolve and our products may be subject to additional regulatory scrutiny in the future.

International sales of our products are subject to the regulatory requirements of each country in which we sell. These requirements vary from country to country, but generally are less stringent than those in the United States. Regulatory approvals are obtained, usually by our distributors, where required to sell our products in those countries.

Third Party Reimbursement

In the United States, healthcare providers that purchase medical devices generally rely on third-party payors, principally the Centers for Medicare and Medicaid Services or CMS and private health insurance plans, to reimburse all or part of the cost of catherization procedures. We believe that in the current United States reimbursement system, all of our products are subject to reimbursement rules depending on the specific medical procedure in which they are utilized.

Market acceptance of our products in international markets is dependent in part upon the availability of reimbursement from healthcare payment systems. Reimbursement and healthcare payment systems in international markets vary significantly by country. The main types of healthcare payment systems in international markets are government-sponsored healthcare and private insurance. Countries with government-sponsored healthcare, such as the United Kingdom, have a centralized, nationalized healthcare system. New devices are brought into the system through negotiations between departments at individual hospitals at the time of budgeting. In most foreign countries, there are also private insurance systems that may offer payments for alternative therapies.

Intellectual Property: Patents, Trade Secrets, and Trademarks

We file patent applications to protect technological innovations related to new medical devices and improvements on existing medical devices that are significant to the development of our business, and use trade secrets and trademarks to protect other areas of our business. We currently have 22 U.S. patents issued and 9 additional U.S. patent applications pending relating to our GuideLiner catheter, Langston dual lumen catheter, Venture catheter and multiple products in development. We also have obtained issued international patents and are currently pursuing additional international patent applications. Our 22 issued U.S. patents have expiration dates ranging from May 2018 to July 2031.

The interventional medical device market is characterized by frequent and substantial intellectual property litigation. Intellectual property litigation in recent years has proven to be complex and expensive, and the outcome of such litigation is difficult to predict. The interpretation of patents, for example, involves complex and evolving legal and factual questions.

Currently, we are involved in patent litigation with Boston Scientific Corporation (Boston Scientific). On May 16, 2013, we filed a patent infringement complaint in the United States District Court for the District of Minnesota against Boston Scientific alleging that Boston Scientific has infringed three U.S. patents we own concerning rapid exchange guide extension technology by manufacturing and selling its Guidezilla™ guide extension catheter. On July 11, 2013, Boston Scientific filed its answer and counterclaim, alleging that our patents are invalid, that the Guidezilla catheter does not infringe our patents, and that our past manufacture and sale of the GuideLiner catheter violates a U.S. patent owned by Boston Scientific that has recently expired (see Item 3 – Legal Proceedings of Part I of this Annual Report on Form 10-K for the year ended December 31, 2013).

We may become the subject of additional intellectual property litigation in the future related to our products or services. Our defense of any intellectual property litigation claims, regardless of the merits of the complaint, could divert the attention of our technical and/or management personnel away from the development and marketing of our products and services for significant periods of time. The costs incurred to defend these claims could be substantial and adversely affect us, even if we are ultimately successful.

We rely on trade secret protection for certain aspects of our technology. We typically require our employees, consultants and vendors for major components to execute confidentiality agreements upon their commencing services with us or before we disclose confidential information to them. These agreements generally provide that all confidential information developed, or otherwise made known to the other party, during the course of that party’s relationship with us is to be kept confidential and not disclosed to third parties, except in special circumstances. The agreements with our employees also provide that all inventions conceived or developed in the course of providing services to us shall be our exclusive property.

We register trademarks for certain products in the United States and use unregistered trademarks for other products. United States trademark registrations are generally for a term of 10 years, renewable every 10 years as long as the trademark is used in the regular course of trade.

The registered trademark “ClosureFAST®” is owned by Covidien LP Limited Partnership.

Employees

As of December 31, 2013, we had 406 full-time employees. Of these employees, 145 were in manufacturing activities, 133 were in sales and marketing activities, 53 were in regulatory, quality assurance and clinical research activities, 47 were in research and development activities, and 28 were in general and administrative functions. We have never had a work stoppage and none of our employees are covered by collective bargaining agreements. We believe our employee relations are good. We are an Equal Opportunity Employer.

Executive Officers of the Registrant

Our executive and other officers as of January 31, 2014 are as follows:

Name | Age | Position |

| Howard Root | 53 | Chief Executive Officer and Director |

| James Hennen | 41 | Chief Financial Officer, Senior Vice President of Finance and Corporate Secretary |

| Charmaine Sutton | 54 | Senior Vice President of Operations |

| William Rutstein | 61 | Senior Vice President of Worldwide Sales |

| Jonathan Hammond | 46 | Vice President of Manufacturing Engineering |

| Brett Demchuk | 50 | Vice President of Product Quality |

| Susan Christian | 45 | Vice President of Sales Operations |

| Carrie Powers | 39 | Vice President of Marketing |

| Phillip Nalbone | 52 | Vice President of Corporate Development |

| Gordon Weber | 50 | General Counsel |

Howard Root has served as Chief Executive Officer and a member of our Board of Directors since he co-founded Vascular Solutions in February 1997. From 1990 to 1995, Mr. Root was employed by ATS Medical, Inc., a mechanical heart valve company, most recently as Vice President and General Counsel. Prior to joining ATS Medical, Mr. Root practiced corporate law, specializing in representing emerging growth companies, at the law firm of Dorsey & Whitney LLP for over five years.

James Hennen has served as our Chief Financial Officer since January 2004. Mr. Hennen served as our Controller & Director of Finance from February 2002 through December 2003. Prior to joining us, Mr. Hennen served in various accounting positions, most recently as International Controller with WAM!NET, Inc., a globally networked information technology company for media transfer, where he worked from December 1997 through February 2002. From October 1995 through December 1997, Mr. Hennen was an auditor for Ernst & Young, LLP. Mr. Hennen is a Certified Public Accountant (inactive).

Charmaine Sutton has served as our Senior Vice President of Operations since March 2010. Ms. Sutton previously served on our Board of Directors from July 2007 to March 2010. Ms. Sutton is an expert in regulatory strategies for gaining market authorization of Class II and III devices and diagnostics, and in the development, implementation, troubleshooting and improvement of ISO 13485 and FDA QSR quality systems. From 1991 to 2011, Ms. Sutton was principal consultant and co-founder of The Tamarack Group, an association of consultants assisting developers and manufacturers of medical devices, diagnostics, pharmaceuticals, biologics and combination products with regulatory and quality system activities. Prior to co-founding The Tamarack Group, Ms. Sutton held Director and VP level Engineering, Regulatory, Quality and Clinical positions in start-up companies, and was a research scientist in the laser fusion program at Lawrence Livermore National Laboratory. From 2006 to 2011 Ms. Sutton was an adjunct instructor for the Regulatory Affairs and Services graduate program at St. Cloud State University.

Bill Rutstein has served as our Senior Vice President of Worldwide Sales since July 2010. Mr. Rutstein previously served as our Vice President of International Sales starting in October 2008, Senior Director of International Sales starting in January 2008, and Director of International Sales upon joining Vascular Solutions in August 1999. Prior to joining us, Mr. Rutstein was the Business Unit Director for the cardiosurgery division of Minntech Corporation, a medical device company, from April 1997 to July 1999. From November 1988 to March 1997, Mr. Rutstein worked for Daig Corporation (a St. Jude Medical Company), a medical device company specializing in cardiology and electrophysiology catheters, where he served as Regional Sales Manager, National Sales Manager, OEM Sales Manager and International Sales Manager.

Jonathan Hammond has served as our Vice President of Manufacturing Engineering since January 2010. Mr. Hammond previously served as our Director of Process Development from January 2008 to December 2009, our Process Development Manager from January 2007 to December 2007, and our Senior Process Development Engineer from the time he joined us in July of 2005 until December 2006. Prior to joining us, Mr. Hammond served as Senior Manufacturing Engineer with Enpath Medical, a leading supplier of venous vessel introducers, where he worked from November 2002 through June of 2005. From March 1993 through October 2002, Mr. Hammond served in various engineering and technical product management roles for MICROVENA Corporation (ev3).

Brett Demchuk has served as our Vice President of Product Quality since July 2007. Prior to joining us, Mr. Demchuk worked at ATS Medical, Inc. where he was Senior Director of Operations from 1998 to July 2007 and Quality Manager from 1992 to 1998. Prior to ATS Medical, Mr. Demchuk held quality assurance engineering positions at Orthomet and GV Medical.

Susan Christian has served as our Vice President of Sales Operations since October 2008. Ms. Christian previously served as our Senior Director of Sales Operations and Director of Sales Administration upon joining the company in September 2006. Prior to joining us, Ms. Christian served as the Senior Vice President of Finance & Operations of Tad Ware & Company, Inc., a marketing communications agency, where she worked from April 1992 to September 2006. From August 1990 through March 1992, Ms. Christian was a Tax Accountant for Arthur Andersen & Co. Ms. Christian is a Certified Public Accountant (inactive).

Carrie Powers has served as our Vice President of Marketing since July 2009. Ms. Powers previously served as our Senior Director of Product Management and Training from July 2008 to June 2009, Director of Training from March 2007 to July 2008, Product Manager for the Hemostasis Product Line from July 2006 to March 2007 and began her employment with us as an Associate Product Manager for the Hemostasis Product Line from January 2006 to July 2006. Prior to joining us, Ms. Powers was employed by St. Mary’s Hospital in Madison, Wisconsin from 2002 to 2006, most recently as a Registered Nurse in the Interventional Cardiac Catheterization Lab.

Phillip Nalbone has served as our Vice President of Corporate Development since September 2011. Prior to joining us, Mr. Nalbone spent nearly 20 years as a medical devices analyst at various investment firms, including Hambrecht & Quist, Volpe Brown Whelan & Co., Solomon Smith Barney, RBC Capital Markets, and Wedbush Securities.

Gordon Weber has served as our General Counsel since February 2013. Prior to joining us, Mr. Weber served as Associate General Counsel – Commercial for Smiths Medical, a global provider of medical devices for the hospital, emergency, home and specialist environments, from October 2010 to February 2013. Before joining Smiths Medical, Mr. Weber practiced law for 13 years, most recently as a Partner in the Corporate group, with the law firm currently known as Faegre Baker Daniels LLP. Mr. Weber began his career with the accounting firm currently known as KPMG.

Available Information

We make available free of charge on or through our internet website at www.vasc.com our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, required Interactive Data files and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of the following risks occur, our business, financial condition or results of operations could be seriously harmed.

We will not be successful if the interventional medical device community does not adopt our new products or services.

We have launched over 80 new products or services since 2003. Our success will depend on the continued launch of new products and services and the medical community’s acceptance of our new products and services. We cannot predict how quickly, if at all, the medical community will accept our new products and services, or, if accepted, the continuation or extent of their use. Our potential customers must:

| · | believe that our products or services offer benefits compared to the methodologies and/or devices that they are currently using; |

| · | use our products or services and obtain acceptable clinical outcomes; |

| · | believe that our products or services are worth the price that they will be asked to pay; and |

| · | be willing to commit the time and resources required to change their current methodology. |

Because we are often selling a new technology, we have limited ability to predict the level of growth or timing of sales of these products or services. If we encounter difficulties in growing our sales of our new medical devices or services, our business will be seriously harmed.

We are involved in, and may face additional, intellectual property litigation, which could prevent us from manufacturing and selling our products or services or result in us incurring substantial costs and liabilities.

The interventional medical device industry is characterized by numerous patent filings. As a result, participants in the industry frequently experience substantial intellectual property litigation.

Some companies in the interventional medical device industry have employed intellectual property litigation in an attempt to gain a competitive advantage. In addition, non-practicing patent assertion entities have accumulated patent rights related to the medical device industry and are asserting them against operating companies in an attempt to collect settlements or licensing fees. Intellectual property litigation has proven to be very complex, and the outcome of such litigation is difficult to predict. While we do not believe that any of our products or services infringe any existing patent or other intellectual property right, we have been, and are, involved in substantial intellectual property litigation and expect to continue to become subject to intellectual property claims with respect to our new or existing products or services.

On February 14, 2013, Terumo Corporation and Terumo Medical Corporation (Terumo) filed a complaint for patent and trademark infringement against us and Lepu Medical Technology (Beijing) Co. in the United States District Court for the District of New Jersey. The complaint alleged that a prior version of the Vasc Band radial compression device manufactured by Lepu Medical Technology infringed a Terumo patent. On October 11, 2013, we reached an agreement with Terumo to settle the litigation. Under the settlement, we made a one-time payment to Terumo in the amount of $812,500 and Terumo agreed that the current design of our Vasc Band product does not infringe any claim of any issued Terumo patent and agreed that it will not sue the Company on any future issued patent concerning the current design of the Vasc Band product.

On May 16, 2013, we filed a patent and copyright infringement complaint in the U.S. District Court for the District of Minnesota against Boston Scientific Corporation alleging that it is infringing three of our United States patents by manufacturing and selling its Guidezilla guide extension catheter. Boston Scientific filed a counterclaim alleging that our GuideLiner catheter infringes a Boston Scientific patent that has recently expired. We cannot be sure of the outcome of our claim or the counterclaim. If we prevail in our claim, we cannot be sure whether any remedy will adequately protect our intellectual property. If Boston Scientific prevails in its counterclaim, we may be required to pay damages.

An adverse determination in any intellectual property litigation or interference proceedings against us could prohibit us from selling a product or service, subject us to significant immediate payments to third parties and require us to seek licenses from third parties. The costs associated with these license arrangements may be substantial and could include substantial up-front payments and ongoing royalties. Furthermore, the necessary licenses may not be available to us on satisfactory terms, if at all. Adverse determinations in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent us from manufacturing and selling a product or service.

Our involvement in intellectual property claims, whether ongoing or filed in the future and regardless of the merits of any asserted claim against us, could divert the attention of our technical and management personnel away from the development and marketing of our products and services for significant periods of time. Furthermore, the penalties involved with an adverse outcome may be severe, and the costs incurred related to defending such claims could have a material adverse effect on our results of operations or financial condition, even if we ultimately prevail in them.

The medical device industry is the subject of numerous governmental investigations into marketing and other business practices, and we currently are the subject of a pending government criminal investigation. A governmental criminal investigation could result in the commencement of litigation, indictment of the company, substantial fines, penalties and administrative remedies, including the potential disqualification from participation in government health care programs including Medicare and Medicaid. An adverse determination in the current government criminal investigation or any future civil or criminal litigation could have a material adverse effect on our ability to continue to operate our business as currently conducted and negatively impact our financial results and stock price.

The products and business activities of medical device companies are subject to rigorous regulation by the FDA and other federal, state and international governmental authorities under statutes and regulations governing health care fraud. The U.S. Attorney’s Offices have increased their scrutiny over the medical device industry in recent years. The U.S. Congress, Department of Justice, Office of Inspector General of the Department of Health and Human Services, and Department of Defense have all issued subpoenas and other requests for information to conduct investigations of, and commenced civil and criminal litigation against, medical device manufacturers, primarily related to financial arrangements with health care providers, regulatory compliance and product promotional practices.