Exhibit 99.1

MINERA ANDES INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2010

March 28, 2011

TABLE OF CONTENTS

PRELIMINARY NOTES | | 3 |

DEVELOPMENT AND DESCRIPTION OF THE BUSINESS | | 5 |

ARGENTINA | | 13 |

RISK FACTORS | | 18 |

SAN JOSÉ MINE | | 25 |

LOS AZULES COPPER PROJECT | | 43 |

OTHER PROPERTIES | | 53 |

DIVIDEND POLICY | | 53 |

DESCRIPTION OF CAPITAL STRUCTURE | | 53 |

MARKET FOR SECURITIES | | 54 |

DIRECTORS AND OFFICERS | | 54 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 58 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 58 |

TRANSFER AGENT AND REGISTRAR | | 59 |

MATERIAL CONTRACTS | | 59 |

INTERESTS OF EXPERTS | | 60 |

AUDIT COMMITTEE AND RELATIONSHIP WITH AUDITORS | | 60 |

ADDITIONAL INFORMATION | | 61 |

SCHEDULE “A” | | 62 |

PRELIMINARY NOTES

Basis of Presentation

Unless the context otherwise requires references to “Minera Andes”, the “Company”, “us”, “we” or “our” include Minera Andes Inc. and each of its subsidiaries.

The Company prepares and files its annual information form (“AIF”), consolidated financial statements and management discussion & analysis in United States (“US”) dollars and in accordance with Canadian generally accepted accounting principles.

Date of Information

All information in this AIF is as of December 31, 2010, unless otherwise indicated.

Exchange Rate Information

This AIF contains reference to United States dollars, Canadian dollars and Argentinean pesos. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars, Canadian dollars are referred to as “Canadian Dollars” or “C$” and Argentinean pesos are referred to as ARS$.

The high, low average and closing exchange rates for Canadian dollars in terms of United States dollars and Canadian dollars in terms of Argentinean pesos for each of the three years ended December 31, 2010, 2009, and 2008 as quoted by the Bank of Canada, were as follows:

Canadian dollar per United States dollar

| | High | | Low | | Average(1) | | Closing(1) | |

Year ended December 31 | | | | | | | | | |

2010 | | 1.0778 | | 0.9946 | | 1.0299 | | 0.9946 | |

2009 | | 1.3000 | | 1.0292 | | 1.1420 | | 1.0466 | |

2008 | | 1.2969 | | 0.9719 | | 1.0660 | | 1.2246 | |

Canadian dollar per Argentinean peso

| | High | | Low | | Average(1) | | Closing(1) | |

Year ended December 31 | | | | | | | | | |

2010 | | 0.2746 | | 0.2423 | | 0.2593 | | 0.2423 | |

2009 | | 0.3633 | | 0.2692 | | 0.3037 | | 0.2713 | |

2008 | | 0.3814 | | 0.3050 | | 0.3319 | | 0.3464 | |

(1) Daily noon rates used in average and closing calculation.

On March 28, 2011, the Bank of Canada noon spot exchange rate for the purchase of one United States dollar using Canadian dollars was C$0.9758 (C$1.00=US$1.0248).

On March 28, 2011, the Bank of Canada noon spot exchange rate for the purchase of one Argentinean peso using Canadian dollars was C$0.2346 (C$1.00=ARS$4.2626).

Forward-Looking Statements and Information

Certain statements and information in this AIF, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable US and Canadian securities laws. Such forward-looking statements or information include, but are not limited to, statements or information with respect to the cash from operations at the San José Mine and the future cash requirements of Minera Santa Cruz, the

3

operating company of the San José Mine owned by Minera Andes (49%) and Hochschild Mining plc. (“Hochschild”), the estimated operating and capital costs of the San José Mine, the Company’s interest in the San José Mine being maintained at 49%, the future price of gold, silver, copper and other base metals, production estimates, estimation of mineral reserves, exploration and development capital requirements, our goals and strategies and the possible outcome of pending or contemplated litigation. Often, these statements include words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

In making the forward-looking statements and providing the forward-looking information included in this AIF, we have made numerous assumptions. These assumptions include among other things, assumptions about the price of gold, silver, copper and other base metals, decisions to be made by our joint venture partner in respect of the management and operation of the San José Mine, anticipated costs and expenditures, future production and recovery, that the supply and demand for gold, silver and copper develop as expected, that there is no unanticipated fluctuation in interest rates and foreign exchange rates, that there is no further material deterioration in general economic conditions and that we are able to obtain the financing, as and when, required to, among other things, maintain our interest in the San José Mine. Although our management believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking statements will prove to be accurate. By their nature, forward-looking statements and information are based on assumptions and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from future results, performance or achievements expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include among other things the following: actions by, and our relationship with, our joint venture partner, including decisions regarding the amount and timing of future cash calls, that any cost overruns or cash shortfalls at the San José Mine may result in a requirement for additional investment by us, our lack of operating cash flow and dependence on external financing, availability of financing, as and when, required to meet any future cash calls in respect of the San José Mine (to maintain our interest therein), and to finance our day-to-day operations and planned growth and development, any decline in the price of gold, silver, copper and other base metals, changes in general economic and business conditions, interest rate and exchange rate fluctuations, economic and political instability in Argentina, discrepancies between actual and estimated production and mineral reserves and resources; operational and development risk; the speculative nature of mineral exploration and regulatory risks.

See this AIF for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information. Although we have attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking statements or information, there may be other factors that cause actual results, performances, achievements or events not to be anticipated, estimated or intended. Also, many of the factors are beyond our control. Accordingly, readers should not place undue reliance on forward-looking statements or information. We undertake no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date of this AIF except as may be required by law. All forward-looking statements and information made in this document are qualified by this cautionary statement.

Cautionary Note to U.S. Investors — Information Concerning Preparation of Resource and Reserve Estimates

The AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. National Instrument 43-101- Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the SEC, and reserve and resource information incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. One consequence of these differences is that “reserves” calculated in accordance with Canadian standards may not be “reserves” under the SEC standards.

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms defined in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) in the CIM Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as the same may be amended

4

from time to time by the CIM. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7.

Under U.S. standards mineralization may not be classified as a “reserve” unless a determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

Under SEC Industry Guide 7 standards, a “Final” or “Bankable” feasibility study is required to report reserves, the three-year historical average precious metals prices are used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category.

Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this report and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under U.S. federal securities laws and the rules and regulations thereunder.

DEVELOPMENT AND DESCRIPTION OF THE BUSINESS

Overview

Minera Andes Inc. was formed upon the amalgamation of Scotia Prime Minerals, Incorporated and Minera Andes Inc. pursuant to the Business Corporations Act (Alberta) on November 6, 1995. Commencing on February 7, 2007, Minera Andes was listed on the Toronto Stock Exchange (the “TSX”) (symbol: MAI). Prior to February 7, 2007 Minera Andes was listed on the TSX Venture Exchange (the “TSXV”), having initially been listed thereon on December 20, 1995. Minera Andes’ common shares are also quoted on the NASD OTC Bulletin Board (symbol: MNEAF).

Our corporate head office is 99 George Street, 3rd Floor, Toronto, Ontario M5A 2N4 Canada, and our principal business address is Abraham Pizzi 5045, Barrio San Roberto — Dep. Rivadavia (5400) San Juan. Our registered and records office and address for service is 3700-205 5 Avenue S.W., Calgary, Alberta, T2P 2V7, Canada.

Our principal business is the exploration and development of mineral properties, located primarily in the Republic of Argentina, with a focus on gold, silver and copper mineralized targets. We carry on our business by acquiring, exploring and evaluating mineral properties through our ongoing exploration program. Following exploration, we either seek to enter into joint ventures to further develop these properties or dispose of them if they do not meet our requirements.

We currently hold mineral rights and applications for mineral rights covering approximately 244,500 hectares (604,173 acres) in Argentina, however our principal assets currently consist of:

5

(i) a 49% interest in Minera Santa Cruz S.A. (“MSC”), which owns and operates the San José Mine, an operating silver and gold mine in Santa Cruz Province, Argentina, covering 50,491 hectares (not included in the acres noted above); and,

(ii) a 100% interest in the Los Azules Copper Project, a porphyry copper exploration project in San Juan Province, Argentina; and,

(iii) a portfolio of exploration properties in the prospective Deseado Massif region of Southern Argentina.

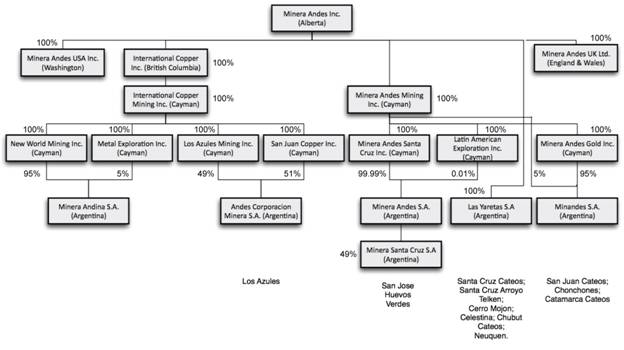

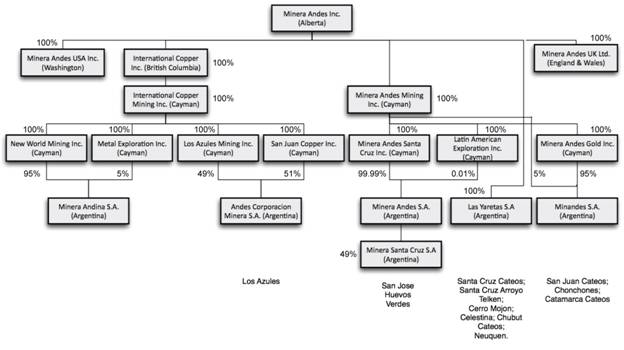

The following chart illustrates the Company’s subsidiaries, together with the governing law of each company and the percentage of voting securities beneficially owned or over which control or direction is exercised by the Company, as well as the Company’s principal mineral properties.

As indicated above, the Company’s interest in the San José Mine is held by Minera Andes S.A. (“MASA”) and the Company’s interest in the Los Azules Copper Project is held by Andes Corporación Minera S.A. (“Andes Corp.”).

The San José Mine and History

The San José Mine is a silver-gold mine located in Santa Cruz Province, Argentina. The San José Mine is a joint venture pursuant to which title to the assets is held by Minera Santa Cruz S.A. (“MSC”), an Argentinean company. MSC is owned, as to 49%, by MASA and, as to 51%, by Hochschild Mining (Argentina) Corporation S.A., a subsidiary of Hochschild Mining plc (together with its affiliates and subsidiaries “Hochschild”).

The history of the San José Mine is as follows:

In October 2005 MSC completed a bankable feasibility study at the San José Mine that led to the development of the San José Mine. In March 2006, an environmental impact assessment, the primary document for permitting the San José Mine, was approved by the province of Santa Cruz, Argentina and a final decision was made to place the San José Mine into production. In March 2007, an aggressive exploration program was approved for the San José Mine by MSC, with an objective of adding new reserves and resources, and identifying new veins to increase mine life. Pre-commissioning production commenced at the San José processing facility during the second half of 2007.

6

The Company’s interest in, and the affairs of, MSC are governed by an option and joint venture agreement dated March 15, 2001 between MASA and Hochschild, as amended by agreements dated May 14, 2002, August 27, 2002, September 10, 2004, and September 17, 2010, the (“OJVA”). See “Option and Joint Venture Agreement”.

Under the OJVA we are entitled to appoint one of the three members of the Board of Directors of MSC and Hochschild is entitled to appoint the balance of the members of the Board of Directors of MSC. The OJVA grants us a “veto” in respect of certain and very limited matters regarding the affairs of MSC and the operation of the San José Mine. In particular, we have limited ability to control the timing or amount of cash calls and decisions made in that regard may have an adverse affect on our operations and financial position. However, the OJVA grants the Company certain approval rights with respect to new project capital expenditures and exploration.

We have the right to receive, upon request, information regarding the San José Mine. The Company’s personnel regularly communicate with MSC’s staff, make periodic visits to the mine and hold scheduled conference calls with MSC’s operations management twice a month. In addition, a formal protocol for the transfer of information from MSC to Minera Andes was established during 2009, which has improved the quality and timeliness of information available to it regarding the operation of the San José Mine.

The construction of the San José Mine as a 750 tonnes per day facility and the subsequent expansion to a 1,500 tonnes per day facility was financed by the Company and Hochschild under successive project finance letter and loan agreements.

Financing for the initial development of the San José Mine was provided pursuant to a loan agreement dated September 10, 2004, as amended, (the “Shareholder Loan Agreement”) and was structured as loans to MSC by the Company and Hochschild in amounts proportionate to their shareholdings in MSC. The amounts advanced under the Shareholder Loan Agreements are subordinated to those advanced under the Project Finance Loan Agreements and form part of our investment in MSC. The amounts advanced under the Shareholder Loan Agreement bear a fixed interest rate of 7.00%.

Definitive project finance loan documentation (the “Project Finance Loan Agreement”) was completed September 17, 2010 between the Company, MSC and by assignment, Hochschild Mining Holdings Limited (the “Hochschild Lender”), an affiliate of Hochschild Mining plc.

Prior to this date, project financing for the San José Mine was governed by an agreement dated June 29, 2007, as amended, (the “Project Loan Letter Agreement”) between the Company, MSC and by assignment, the Hochschild Lender.

Pursuant to the Project Finance Loan Agreement, which reflects earlier documentation, the Hochschild Lender and the Company agreed to provide MSC with a permanent secured project loan (the “Project Loan”) in the aggregate amount of $65 million. The Project Finance Loan Agreement was structured as loans to MSC by the Company and the Hochschild Lender in amounts proportionate to their shareholdings in MSC.

The Project Finance Loan Agreement affirms the concepts of the Project Loan Letter Agreement, which provides that the loan to be made by the Company to MSC would be structured as (i) a loan by the Hochschild Lender to the Company (the “Project Loan Payable”); and (ii) a corresponding loan by the Company to MSC (the “Project Loan Receivable”) on the same terms as the preceding loan by the Hochschild Lender to the Company. Both the Project Loan Payable and the Project Loan Receivable bear interest at the same rate and upon the same terms (including repayment).

The amounts owed under the Project Finance Loan Agreement by the Company to the Hochschild Lender are currently unsecured except that, as security for the loan made by the Hochschild Lender to the Company, the Company has pledged to the Hochschild Lender, its right to the repayment of the corresponding loans made by the Company to MSC. The amounts advanced under the Project Finance Loan Agreement bear a fixed interest rate of 7.00%.

7

The San José processing facility commenced production during the second quarter of 2007 and full commercial production of 750 metric tonnes per day (“MTPD”) was reached in the first quarter of 2008. The first sale of metals from the San José Mine occurred in December 2007.

In August 2007, before achieving commercial production, MSC initiated a project to double the capacity of the San José processing facility. In October 2008 capacity at the San José processing plant was increased from 750 MTPD to 1,500 MTPD. The plant operated at an average daily rate of 1263 MTPD in 2009 and 1263 MTPD in 2010. Approximately 50% of the concentrate produced at the mill is converted on site to doré bullion.

On March 19, 2009 the San José Mine processing facility was connected to the national power grid through the construction of a 130 kilometer 132 kV electric transmission line. Diesel generating capacity, which is sufficient to run the mill at its full capacity, remains on site as backup.

MSC purchased part of the equipment necessary to expand the concentrate leaching and electrowinning circuit so that 100% of the concentrates produced by the operation can be converted to doré on site. Basic and detailed engineering have been completed, but construction of the project has been suspended because the completion of the circuit is not economically attractive given the current market conditions for concentrate sales. As such, the related project and plant costs and plant have been impaired for accounting purposes by $5.7m USD during 2010.

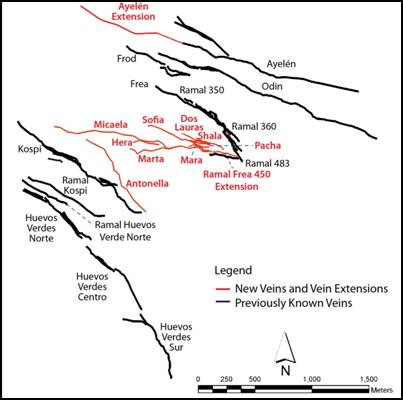

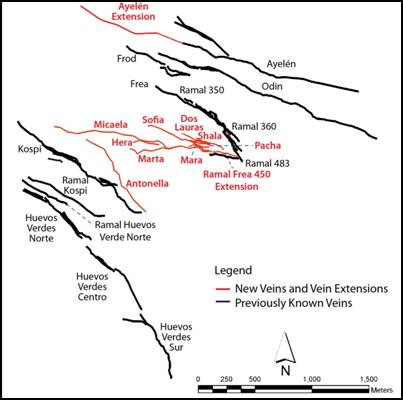

In 2010 approximately 54,476 meters of core drilling in a total of 265 drill holes were completed at the San José Mine. The 2010 drilling program represented a significant increase compared to the 2009 program, which consisted of approximately 25,094 meters of core drilling in a total of 115 drill holes. Drilling focused primarily on eleven new veins discovered during the year. The most important new veins are the Micaela and Sofia veins. The veins are located in the main mine area. In fill and step-out drilling was also completed on the Frea, Odin and Ayelén veins. Outside of the main mine area, drilling was carried out on the Cerro Portugués, Aguas Vivas and Saavedra West to explore for new resources.

The 2011 exploration program at San José consists of surface geophysics and a diamond core drilling program totaling approximately 56,400 meters of drilling. The goal of the 2011 exploration program is to upgrade existing resources to replace reserves depleted during 2010 and to discover new mineralized veins (new resources) on the San José property, which covers approximately 50,491 ha (124,700 acres).

The Los Azules Copper Project and History

The Los Azules Copper Project is an advanced-stage exploration project located in San Juan Province, Argentina. The Los Azules Copper Project was previously subject to an option agreement between the Company, MASA, MIM Argentina Exploraciones S.A. (later known as “Xstrata Copper”) and Xstrata Queensland Limited (together with Xstrata Copper, “Xstrata”) dated November 2, 2007 (as amended by assignment and amending agreement dated May 15, 2009, collectively the “Los Azules Option Agreement”). As of October 1, 2009, Xstrata elected not to exercise its one-time right to back in to a 51% interest in the project. Consequently, Xstrata transferred those properties held by it and forming part of the Los Azules Copper Project to Andes Corp., a wholly owned subsidiary of the Company, and Xstrata no longer retains any ownership in or rights with respect to the project. Minera Andes, through a wholly owned subsidiary, now owns 100% of the Los Azules Copper Project. A portion of the Los Azules Project is currently the subject of litigation in the Supreme Court of British Columbia, which if resolved adversely to the Company may affect the Company’s ownership of the Los Azules Project. See “Legal Proceedings and Regulatory Actions”.

The history of the Company’s involvement in the Los Azules Project is as follows:

In November 2005, the Company signed a term sheet with Xstrata Copper, in respect of the matters provided for in the Los Azules Option Agreement.

In May 2006, the Company reported the discovery of significant high-grade copper at its Los Azules Copper Project with an eleven hole drill program returning intervals up to 1.6% copper over 221 meters and 1% copper over 173 meters in separate holes.

8

In November 2007, the Los Azules Option Agreement was executed. The Los Azules Option Agreement provided for the consolidation of adjoining properties owned indirectly by Minera Andes and Xstrata straddling a large copper porphyry system.

Between 2006 and 2008 the Company drilled 64 core holes totaling 11,572 meters at the Los Azules Copper Project and commenced preparation of the preliminary assessment contemplated by the Los Azules Option Agreement.

In September 2008, the Company completed a metallurgical testing program indicating that the mineralized material at the Los Azules Copper Project is amenable to conventional flotation recovery methods and that the overall metal recoveries and the copper concentrate grades are high.

Also, in September 2008, an independent resource estimate was completed in respect of the Los Azules Copper Project and a initial technical report (subsequently revised in January 2009) was prepared in accordance with NI 43-101 and filed.

In February 2009, the preliminary assessment was completed and the results thereof announced by news release dated February 5, 2009. A technical report, in support thereof, was subsequently filed in March 2009.

On May 29, 2009, in accordance with the terms of the Los Azules Option Agreement, Minera Andes delivered to Xstrata the preliminary assessment, thereby exercising its earn-in option and acquiring a 100% interest in those properties comprising the Los Azules Copper Project held by Xstrata, subject to a one-time option held by Xstrata to back-in to a 51% interest in the Los Azules Copper Project.

On October 1, 2009, the back-in right expired, unexercised, and Minera Andes, through its wholly owned subsidiaries, now holds 100% of the Los Azules Copper Project, subject to litigation that is currently ongoing in the Supreme Court of British Columbia. See “Legal Proceedings and Regulatory Action”.

In December 2009, the Company initiated a seasonal drilling program at the Los Azules Copper Project and during the 2009-2010 field season 10,007 meters of diamond core drilling was completed in 23 drill holes. The results of the drilling as well as an updated resource estimate were reported in an updated 43-101 Technical Report dated December 16, 2010.

In December 2010, the Company initiated a seasonal drilling program at Los Azules. Results of the 2010-2011 drilling will be released as they become available.

Corporate Developments

In December 2005, Mr. Robert McEwen, Chairman and CEO of U.S. Gold Corp, and founder and former Chairman and CEO of Goldcorp Inc., agreed to invest a total of C$10 million in Minera Andes by private placement.

In March 2006, Mr. McEwen purchased 1.2 million shares of Minera Andes in the market at a price of C$1.10 per share. In addition, in May 2006, Mr. McEwen exercised all the common share purchase warrants then held by him. As a result, a total of 14,285,714 common shares were issued resulting in gross proceeds of C$7,857,143 to Minera Andes. Mr. McEwen then held 30% of the then issued and outstanding common shares of the Company.

In February 2007, the Company’s shares were listed on, and commenced trading on, the TSX. The Company’s shares were previously listed and traded on the TSXV.

In March 2007 and October 2007, the Company entered the Macquarie Credit Agreement.

Between December 2007 and February 2008, the Company completed private placements consisting of the issue of a total of 22,085,668 units, at a price of C$1.55 per unit, for gross proceeds of C$34.23 million. The proceeds from the offering were primarily used to fund the Company’s share of the costs at the San José Mine and for exploration drilling and completing the preliminary assessment on the Los Azules Copper Project.

On August 5, 2008, Mr. McEwen joined the Board of Directors of the Company, upon exercise of a right to nominate an individual to the Board of Directors of the Company granted to him as part of the 2006 financing.

9

In February 2009 Mr. McEwen, completed the McEwen Financing, as a result of which Mr. McEwen held 37.3% of the issued and outstanding shares of the Company. The proceeds from the McEwen Financing were used: (i) as to $11.3 million, to pay the Company’s portion of the cash call made by MSC in December 2008 in respect of the San José Mine; (ii) as to approximately $17.5 million, to repay all amounts due by the Company under the Macquarie Credit Agreement; and (iii) as to the balance, for general corporate purposes.

In connection with the McEwen Financing, Mr. McEwen was granted the right to appoint two additional directors, to the Company’s Board of Directors, which combined with Mr. McEwen’s existing rights to board representation entitles him to nominate a total of three directors to the Company’s board of directors. On February 2, 2009 Mr. Clark resigned from the Company’s Board of Directors. On February 23, 2009 Mr. Drummond resigned from the Company’s Board of Directors. On February 23, 2009, Mr. Richard Brissenden and Mr. Michael Stein were appointed to the Company’s Board of Directors, as nominees of Mr. McEwen.

On February 23, 2009 Mr. McEwen was appointed Executive Chairman of the Company.

On March 13, 2009 James K. Duff was appointed Chief Operating Officer of the Company. Mr. Duff has more than 30 years of diverse international mining experience and is responsible for managing the Company’s interests in the San José Mine and the Los Azules Copper Project.

On June 18, 2009, following the Company’s annual general and special meeting, Robert R. McEwen was appointed President and Chief Executive Officer of the Company effective immediately, replacing Mr. Allen Ambrose. Mr. Ambrose was re-elected to the Board of Directors of the Company.

The Company completed an equity offering on August 19, 2009, by way of short form prospectus pursuant to which Minera Andes issued 30,705,000 units, each unit consisting of one common share and one half of a common share purchase warrant at a price of C$1.25 per unit. The equity offering was completed on a “bought deal” basis and resulted in net proceeds to the Company of approximately C$22 million.

On September 9, 2009, Brian Gavin, Vice President, Exploration of the Company submitted his resignation effective October 9, 2009. On September 30, 2009, Nils Engelstad, formerly corporate legal counsel to the Company, was appointed Vice President, Corporate Affairs.

In February 2010, the Company announced that Perry Ing would be appointed CFO effective April 5, 2010. Henry John, formerly CFO, will continue on as a consultant to the Company for a period of one year.

On March 17, 2010, the Company announced that it has received a Summons and Complaint in connection with a lawsuit commenced by affiliates of Hochschild against the Company (and a subsidiary) in the State of New York. The lawsuit pertained to the project finance loans made by Hochschild to MSC. Hochschild, among other claims, claims the Company refused to sign formal project loan documentation and caused undue delay in the same. Neither party could receive any funds from MSC until such agreements were signed. In addition, no funds were due to Hochschild from the Company under these agreements unless such funds are first provided to the Company by MSC.

On April 1, 2010, the Company filed a Statement of Claim in the Supreme Court of British Columbia against TNR Gold Corp. See “Legal Proceedings and Regulatory Actions”.

On September 17, 2010, Hochschild signed an agreement with the Company and its subsidiary, MASA, regarding the project financing loan provided by Hochschild to the San José Mine. The parties also agreed to restructure the shareholder loan agreement. The parties agreed to a repayment schedule for the project finance loan and the shareholder loan over a maximum period of eight years, with fixed interest rates of 7% per annum. Future payments on both loans may be accelerated based on mine performance and metal prices. Hochschild agreed to provide the Company the right to consent to certain extraordinary capital expenditures in certain limited circumstances.

On December 30, 2010, the Company issued an accelerated expiry notice to holders of 15,244,000 outstanding share purchase warrants which were issued pursuant to the “bought deal” underwritten financing completed on August 19, 2009.

10

Pursuant to the terms of the warrant indenture, the expiry of the warrants was accelerated to January 31, 2011 as the volume weighted average trading price of the underlying common shares listed on the TSX was greater than C$2.50 for 20 consecutive trading days. 15,213,733 warrants were exercised for proceeds of C$19 million and the remaining 30,267 unexercised warrants were cancelled.

On March 17, 2011, the Corporation announced that it intends to complete a spin-out its Los Azules Copper Project into a new publicly traded company. The spin-out transaction will be affected under a statutory plan of arrangement in the Province of Alberta (the “Arrangement”). Under the proposed terms of the Arrangement, the shareholders of Minera Andes will retain their common shares in Minera Andes and will be entitled to receive one common share of the new company for every share of Minera Andes held on the record date for the Arrangement. The completion of the Arrangement will be subject, among other things, to Toronto Stock Exchange, Court and shareholder approval; as well as, a favourable tax ruling from the Canada Revenue Agency. Additional prospective copper exploration assets currently owned by Minera Andes will be included with the Los Azules Copper Project in the Arrangement. Further details regarding the Arrangement will be set out in an Information Circular that will be sent to shareholders in advance of the extraordinary shareholders meeting, anticipated to be held in late June 2011 to seek approval for the Arrangement and related matters.

Production and Operations

The following table summarizes the total production and operation information for the San José Mine for the year ended December 31, 2010:

Production | | 2010

Total | | 2010

Fourth Quarter | | 2010

Third Quarter | | 2010

Second Quarter | | 2010

First Quarter | |

Ore production (metric tons) | | 461,134 | | 135,710 | | 112,681 | | 116,259 | | 96,484 | |

Average head grade-silver (g/t) | | 397 | | 475 | | 423 | | 368 | | 293 | |

Average head grade-gold (g/t) | | 6.14 | | 6.34 | | 6.42 | | 5.81 | | 5.92 | |

Silver produced (ounces) | | 5,323,842 | | 1,871,440 | | 1,408,501 | | 1,220,794 | | 823,107 | |

Gold produced (ounces) | | 84,303 | | 26,141 | | 22,025 | | 19,707 | | 16,430 | |

Silver equivalent produced (ounces) | | 10,382,041 | | 3,439,929 | | 2,729,995 | | 2,403,214 | | 1,808,907 | |

Net silver sold (ounces) | | 5,169,675 | | 1,916,163 | | 1,219,676 | | 1,294,677 | | 739,159 | |

Net gold sold (ounces) | | 83,326 | | 26,900 | | 19,932 | | 22,168 | | 14,325 | |

Note: Minera Andes has a 49% interest in the San José Mine

Reserves and Resources

The Company has estimated mineral resources and mineral reserves for the San José Mine and Los Azules Copper Project as follows:

Mineral Resource Estimates

Property | | Category | | Tonnes

(000’s) | | Ag

(g/t) | | Au

(g/t) | | AgEq

(g/t) | | AgEq

(M oz) | | TCu % | |

San José(1) | | Measured | | 1,035 | | 570 | | 8.10 | | 1,056 | | 35.14 | | | |

| | Indicated | | 2,020 | | 426 | | 6.14 | | 795 | | 51.63 | | | |

| | Measured and Indicated | | 3,055 | | 475 | | 6.80 | | 883 | | 86.77 | | | |

| | Inferred | | 2,986 | | 373 | | 5.96 | | 731 | | 70.18 | | | |

Los Azules(2) | | Indicated | | 137 | (3) | 1.7 | | 0.07 | | | | | | 0.73 | |

| | Inferred | | 900 | | 1.7 | | 0.07 | | | | | | 0.52 | |

11

Notes:

(1) Updated mineral resource estimates by P&E Mining Consultants Inc. The MSC San José property December 31, 2010 resources and reserves were based on a gold (Au) price of $900/oz and silver (Ag) price of US$15/oz. See “San José Mine - Mineral Resource and Mineral Reserve Estimates”, page 41. Contains 100 percent of the resources, as of December 31, 2010. Minera Andes’ ownership of the mine is 49 %. Minera Andes calculates the silver / gold equivalency as 1 oz gold = 60 oz silver Equivalent.

(2) From the Los Azules December 16, 2010 Technical Report.

(3) Using a cut-off grade of 0.35% Total Copper.

Mineral Reserve Estimates

Property | | Category | | Tonnes

(000’s) | | Ag

(g/t) | | Au

(g/t) | | AgEq

(g/t) | | AgEq

(M oz) | |

San José(1) | | Proven | | 713 | | 511 | | 7.26 | | 947 | | 21.71 | |

| | Probable | | 756 | | 394 | | 5.45 | | 721 | | 17.52 | |

| | Proven and Probable | | 1,469 | | 451 | | 6.33 | | 831 | | 39.23 | |

Notes:

(1) Updated mineral reserve estimates by P&E Mining Consultants Inc. The MSC San José property December 31, 2010 resources and reserves were based on a gold (Au) price of $900/oz and silver (Ag) price of US$15/oz. See “San José Mine - Mineral Resource and Mineral Reserve Estimates”, page 41. Contains 100 percent of the reserves, as of December 31, 2010. Minera Andes’ ownership of the mine is 49 %. Minera Andes calculates the silver / gold equivalency as 1 oz gold = 60 oz silver Equivalent.

Option and Joint Venture Agreement

Under the OJVA, MASA transferred all of its rights in the San José Mine to MSC, a newly formed company organized under the laws of Argentina and wholly owned by the Company. In July 2003, Hochschild earned a 51% ownership interest in MSC by expending a total of $3 million, including a minimum of $100,000 per year on exploration targets. Upon Hochschild acquiring a 51% ownership in MSC, Minera Andes elected to participate in the development of the San José Mine on a pro-rata basis.

The OJVA and the by-laws of MSC provide, in relevant part, that:

(i) the Board of Directors of MSC shall, at all times, consist of three directors and that, in effect, two of such directors shall be nominated by Hochschild and one director shall be nominated by MASA;

(ii) the Board of Directors of MSC shall meet at least once every calendar quarter, without any stipulation that a nominee of each of Hochschild and MASA be present;

(iii) at any meeting of the Board of Directors of MSC, each of MASA and Hochschild shall have that number of votes equal to the number of directors it is entitled to appoint;

(iv) MSC shall finance its operations and activities from such sources as the Board of Directors of MSC sees fit;

(v) the only actions by MSC requiring unanimous approval of both MASA and Hochschild are (a) a sale of all or substantially all of the assets of MSC; (b) any amendment to the articles of MSC that would have an adverse effect on the rights of any particular shareholder to receive its share of the profits of MSC; (c) entering into any new line of business; (d) acquiring real property or conducting exploration, development or mining outside of the property initially transferred to MSC for the purposes of establishing the joint venture; or (e) any merger or other corporate combination involving MSC; and

(vi) in the event of a disagreement between Hochschild as “majority owner” and MASA as “minority owner”, concerning any act of MSC that requires the unanimous approval of the Board of Directors of MSC, Hochschild has the option to purchase all of the shares of MSC held by MASA for “fair value”.

12

The OJVA provides that MSC shall finance its operations from such sources as the Board of MSC shall determine, including by issuing additional shares. In such event, each shareholder of MSC has a pre-emptive right to subscribe for its pro rata share of the additional shares. Any shares not subscribed by a shareholder shall be offered to the other, participating, shareholder. As a result, full exercise of a shareholder’s pre-emptive right (assuming full exercise by other shareholder) maintains its shareholdings in MSC at current levels while a failure to exercise its pre-emptive rights, in full, may result in dilution (the extent of such dilution depending on whether the other shareholder exercises its pre-emptive right and to what extent and whether such shareholder also purchases shares not purchased by the first shareholder). Historically, a portion of the operating and capital costs of the San José Mine have been financed by issuing additional shares of MSC.

The OJVA also provides that it shall be the policy of MSC to maintain excess distributable cash and that unless the Board of MSC unanimously decides otherwise, MSC shall distribute, on a semi-annual basis all cash not reasonably required for operations or expansion.

Competitive Conditions

The base and precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive base and precious metal mineral properties. The ability of the Company to acquire precious and base metal mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for metal development or mineral exploration.

Environmental Protection Requirements

The Company’s mining, exploration and development activities are subject to various levels of federal, provincial and state laws and regulations relating to the protection of the environment, including requirements for closure and reclamation of mining properties. See “Risk Factors — Legal, regulatory and permitting requirements significantly affect our mining operations and may have a material adverse effect on our business, financial conditions, results of operations and cash flows”.

Employees

As at December 31, 2010, the Company had 18 employees and 3 contractors.

Foreign Operations Risks

The San José Mine and the Los Azules Copper Projects are both located in Argentina. Any changes in regulations or shifts in political attitudes in such foreign country are beyond the control of the Company and may adversely affect its business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. The effect of these factors cannot be accurately predicted. See “Risk Factors — The Company is subject to risks relating to economic and political instability in Argentina”.

ARGENTINA

Recent Mining and Economic History in Argentina

Argentina is the second largest country in South America, over 2.7 million square kilometers in area. In 1983, Argentina returned to a multiparty democracy, which brought an end to nearly a half century of military intervention and political instability. The country then began to stabilize; however, it was not until 1989, with the election of the government under President Carlos Menem, that Argentina’s economy began to improve. President Menem initiated economic reforms that included the privatization of many state companies and the implementation of the Convertibility Plan, which fixed the Argentine peso to the U.S. dollar at par. Results of the reforms were positive; Argentina’s gross domestic product grew at up to 8% per annum in the early 1990s and inflation dropped to between

13

1% and 3% per annum. However, following a recession in 1999 and 2000, a severe political and economic crisis occurred in late 2001.

Between 2003 and 2007, Argentina sustained a significant economic growth cycle, with an average annual growth rate of approximately 8%. However, during the last quarter of 2007, economic growth in Argentina decreased, as a result of the current global financial crisis and in particular, significant reduction in commodity prices.

In 1993, the Mining Investments Act instituted a new system for mining investment to encourage mineral exploration and foreign investment in Argentina. Key incentives provided by the Act include guaranteed tax stability for a 30-year period, 100% income tax deductions on exploration costs (in addition to the deductions available under the Income Tax Act (Canada)), accelerated amortization of investments in infrastructure, machinery and equipment, an exemption from the tax on “Minimum Presumed Income” and an exemption from import duties for capital goods, equipment and raw materials used in mining and exploration. Repatriation of capital or transfer of profits is unrestricted. Argentina’s mineral resources are subject to a provincial royalty capped at 3% of the “mouth of mine” value of production, which provinces are entitled to waive or reduce.

In January 2008, the Argentinean Government re-assessed regulations levying export duties on mining companies operating in the country, negatively affecting many operators. This change in governmental policy and practice in respect of export duties did not impact the San José Mine as MSC is party to a fiscal stability agreement that specifically fixes the export duty for doré bars at 5% and at 10% for concentrates.

Property and Title in Argentina

The laws, procedures and terminology regarding mineral title in Argentina differ considerably from those in the United States and in Canada. According to Argentine Political State Organisation, the mines (and their mineral thereof) belong to the provinces in which they are located, which grant the exploration permits and mine concessions to the applicants.

However, the rights, obligations, and procedures for the acquisition, exploration, exploitation, and use of mineral substances in Argentina are regulated by the federal government, pursuant to the National Mining Code (the “Mining Code”) while the Provinces have the power to regulate procedural aspects of the Mining Code through Provincial Mining Procedure Codes and to organise the concession and enforcement authorities.

In general, a similar concept applies to the environmental aspects related to mining activities. Although the Mining Code regulates the main aspects of environmental regulations, the provinces act as enforcement authorities. Furthermore, in application of Section 41 of the Argentine Constitution, many provinces have also enacted additional environmental laws, which are directly or indirectly, applicable to mining activities.

The following summarizes the material aspects of Argentinean mining law.

Mining Code

The Mining Code establishes three classes of minerals, two of which are: (i) the main metalliferous substances such as gold, silver, copper, lead, etc. whose ownership is vested in the provincial government, which in turn grants exploitation concessions to private companies; and (ii) the other metalliferous substances, earthy minerals, industrial minerals, etc. that belong to the land owner. Except for minerals described in preceding item (ii), mineral rights in Argentina are separate from surface ownership rights. Creek bed and placer deposits, as well as abandoned tailings and mine waste rock deposits, are included in the latter mineral class.

Cateo

A cateo is an exploration concession which does not permit mining but gives the owner a preferential right to a mining concession for the exploitation of minerals discovered in the same area. Cateos are measured in 500 ha unit areas. A cateo cannot exceed 20 units (10,000 ha). No person may hold more than 20 permits or 400 units in a single province. The term of a cateo is based on its area: 150 days for the first unit (500 ha) and an additional 50 days for each unit thereafter. After a period of 300 days, 50% of the area over four units (2,000 ha) must be

14

relinquished. At 700 days, 50% of the area remaining must be relinquished. Extensions may be granted to allow for bad weather, difficult access, or similar issues. Cateos are identified by a file number or dossier number.

Cateos are awarded by the following process:

(i) an application is made in respect of a designated area, describing a minimum work program and providing an estimate of the investment to be made and a schedule for exploration;

(ii) approval is granted by the province and a formal placement on the official map or graphic register is made provided, the requested area is not superseded by a previous mining right;

(iii) publication of the claim is made in the provincial official bulletin so as to notify third parties of the claim, and;

(iv) upon expiry of a period following publication in the official bulletin, the cateo is awarded.

The length of this process varies depending on the province, and often takes up to two years. Applications are processed on a first-come, first-serve basis. During the application period, the first applicant has rights to any mineral discoveries made by third parties in the area of the cateo without its prior consent.

Until August 1995, a “canon fee”, or tax, of ARS$400 per unit was payable upon the awarding of a cateo. A recent amendment to the law requires that this canon fee be paid upon application for the cateo. The canon fee for the cateo is paid once for the entire term of the exploration permit.

Manifestación de descubrimiento (elsewhere referred to as “manifestation of discovery”)

This is the status of a tenement in respect of which a discovery has been reported to the relevant authority during the exploration stage. It is effectively a procedural stage between exploration rights being converted into mining rights. At this stage, the tenement boundaries are redefined to encompass the specific are of the discovery.

Mina

Although the prior grant of a cateo is not a pre-condition for the granting of a exploitation right, the most common way to acquire a mina is to discover a mine as a consequence of an exploration process under a cateo. To convert an exploration concession to a mining concession, some or all of the area of a cateo must be converted to a “mina”. Minas are mining concessions which permit mining on a commercial basis. The area of a mina is measured in “pertenencias”. Each mina may consist of one or more pertenencias. “Common pertenencias” are six ha and “disseminated pertenencias” are 100 ha (relating to disseminated deposits of metals rather than discrete veins). Once granted, minas have an indefinite term assuming exploration development or mining is in progress in accordance with applicable law and the annual canon is paid.

To convert an exploration concession to a mining concession requires a declaration of manifestation of discovery wherein a point within a cateo must be nominated as a discovery point. The manifestation of discovery is used as a basis for location of the pertenencias. Manifestations of discovery do not have a definite area until pertenencias are proposed. Within a period following designation of a manifestation of discovery, the claimant may do further exploration, if necessary, to determine the size and shape of the ore body.

Following a publication and opposition period and approval by the province, a formal survey of the pertenencias (together forming the mina) is completed. A surveyed mina provides the highest degree of mineral rights in Argentina.

The application to the mining authority must include official cartographic coordinates of the mine location and of the reconnaissance area, and a sample of the mineral discovered. The reconnaissance area, which may be as much as twice the surface area projection of the mine, is intended to allow for the geological extent of the ore body and for site layout and development. Excess area is released once the survey plans are approved by the mining authority.

15

Once the application for a mine has been submitted, the holder of the mining concession may commence the mining operation, as long as the environmental impact assessment has been approved. Any person may oppose to the granting of the mining concession, whether a holder of an overlapping cateo, a land-owner disputing the existence of the ore deposit or the class of the economic mineral, or a partner in the discovery who claims to have been neglected,

Within 30 days after the resolution of any dispute against the location, nature, or assignment of the mining concession, the holder of the mining concession must submit a legal survey of the properties (lots) requested for the mine, within the maximum property limits allowed by the Mining Code. The request is published in the official bulletin and may also be subject to dispute. Approval and registration of the legal survey request by the mining authority constitutes formal title of the mining property.

New mining concessions may also be awarded for mines that were abandoned or for which their original mining concessions were declared to have expired. In such cases, the first person claiming an interest in the property will have priority. A new mining concession will be awarded for the mine in the condition left by the previous holder.

The titleholder of a mine must fulfill three conditions as part of its mining concession in order to maintain its title in good standing: (i) payment of mining canons; (ii) provision of minimum investment; and (iii) reactivation of the mine if it is shut down for more than four years, if so demanded by the mining authority.

Mining canons are paid to the state (national or provincial) under which the mining concession is registered, and are paid in equal installments twice yearly. The canon is set by national law according to the category of the mine. In general, the canon due per year is ARS$80 per 6 ha pertenencia for common ore bodies held by the mining concession, or ARS$800 per 100 ha pertenencia for disseminated ore bodies. Failure to comply with this obligation for fourteen months results in the cancellation of the mining right. However, the titleholder can recover the mining right for a period of 45 days after being so notified by the Mining Authority, by paying the outstanding canon plus a fine equal to 20% of the unpaid canon. The discoverer of the mine is exempt from paying canons for three years from the date on which formal title was awarded to the mine.

The holder of the mining concession must also commit to investing in the fixed assets of the property to a minimum of at least 500 times the value of the annual mining canon, over a period of five years. In the first two years, 20% of the total required investment must be made each year. For the final three years, the remaining 60% of the total required investment may be distributed in another manner. The mining concession expires if the minimum required investment schedule is not met. If the exploration or exploitation works at the mine are suspended for more than four years in a row, the mining authority can require the holder of the concession to prepare and undertake a plan to activate or reactivate work. Failure to file such reactivation plan within 6 months results in the cancellation of the mining right. Such work must be completed on the property within a maximum period of five years.

A new mining operation is entitled to national, provincial, and municipal tax exemptions for five years. The exemptions commence with the awarding of formal title to the mine. As discussed above, the Mining Investment Act has established a 30-year guarantee of fiscal stability for new mining projects and/or extension of existing projects which applies retroactively, once approved, to the date of presentation of the feasibility study for the project. The law allows for accelerated depreciation of capital goods, deductions in exploration costs, and access to machinery and equipment at international prices. Depreciation of infrastructure occurs over a three year time period (60% depreciation in the first year, 20% in the second and 20% in the third) while all other depreciation occurs in a straight-line method of 33.33%.

The major taxes that affect the mining sector are National Income Tax (35%), Gross Revenue Tax (1% of revenue (depending on province) and Mining Royalties (up to a maximum of 3% of the “mouth of mine” value of production, depending on the province).

Royalties and Export Taxes

Under the Mining Investment Act, Argentina’s mineral resources are subject to a provincial royalty capped at 3% of the “mouth of mine” (pit-head) value of production, which provinces are entitled to waive or reduce, provided the

16

province on where the mineral resources are located adheres to said law. The province of Santa Cruz, where the San José Mine is located, adhered to the Mining Investment Act by provincial law nº 2332.

In accordance to the applicable regulations, the Province of Santa Cruz is entitled to impose different royalty tax rates after evaluating the economic and social benefits that each particular mine operation brings to the Province, provided, the royalty does not exceed the 3% cap determined by the Mining Investment Act.

In that respect, the Province of Santa Cruz has issued local regulations setting for a range of royalties rates up to a maximum rate of 3% of the “mouth of mine” value of production applicable to mineral exploitation in the province.

In the specific case of MSC, the Provincial Mining Authority has established that doré from the San José Mine will be subjected to the 1.85% royalty rate and that concentrates and precipitates will be subjected to the 2.55% royalty rate.

Under the Mining Investment Act, MSC has been granted two tax stability certificates in relation to provincial and federal taxes in Argentina in respect of the San José Mine. The stability certificates have a term of 30 years commencing on November 18th, 2005 (date of filing of feasibility study).

Under this general framework, the mining royalties and export duties applicable to the San José Mine can be summarized as follows:

(i) the mining royalty is fixed at 1.85% of the pit-head value for doré and 2.55% for mineral concentrates or precipitates; and

(ii) the National Export Tax is fixed at 5% for doré and 10% for concentrates or precipitates although rebates are available if the final products are shipped from a Patagonian maritime port (depending on the port of exportation these rebates will be reduced to nil as from 2009 and 2010).

Environmental Regulation

The Environmental Protection Section of the Mining Code of Argentina, enacted in 1995, that each Provincial government monitor and enforce the laws pertaining to subscribed development and protection of the environment.

The National Constitution establishes that the Federal Government has to set the minimum standards. Provinces are entitled to strengthen those standards.

Provinces are allowed to withdraw areas from the normal cateo/mina process. These lands may be held directly by the province or assigned to provincial companies for study or exploration and development.

A party wishing to commence or modify any mining-related activity as defined by the Mining Code, including prospecting, exploration, exploitation, development, preparation, extraction, and storage of mineral substances, as well as property abandonment or mine closure activity, must prepare and submit to the Provincial Environmental Management Unit (“PEMU”) an Informe de Impacto Ambiental or Environmental Impact Assessment (“EIA”) prior to commencing the work. Each EIA must describe the nature of the proposed work, its potential risk to the environment, and the measures that will be taken to mitigate that risk. The PEMU has a 60-day period to review and either approve or reject the EIA. However, the EIA is not considered to be automatically approved if the PEMU has not responded within that period. If the PEMU deems that the EIA does not have sufficient content or scope, the party submitting the EIA is granted a 30-day period in which to resubmit the document.

If accepted by the PEMU, the EIA is used as the basis to create a Declaración de Impacto Ambiental or Declaration of Environmental Impact (“DEI”) to which the party must swear to uphold during the mining-related activity in question. The DEI must be updated every two years, with a report on the results of the protection measures taken. If protection measures are deemed inadequate, additional environmental protection may be required. Mine operators are liable for environmental damage. Sanctions and penalties for non-compliance to the DEI are outlined in the Environmental Protection Section of the Mining Code, and may include warnings, fines, suspension of

17

environmental Quality Certification, restoration of the environment, temporary or permanent closure of activities, and removal of authorization to conduct mining-related activities.

Further to the provisions of the Mining Code on Environmental Protection, mining activities are also subject to other environmental regulations issued at the federal and provincial level (from the province in where such activities are carried out).

All mineral rights described above are considered forms of proprietary rights and can be sold, leased or assigned to third parties on a commercial basis. As described before, cateos and minas can be forfeited if minimum work and investments requirements are not performed or if annual payments are not made. Generally, notice and an opportunity to cure defaults is provided to the owner of such rights.

In the fall of 2009, Legislation was passed in the Province of Santa Cruz, Argentina that provides for the creation of a special interest area in which mining activities may occur. Within the special interest area mining and processing activities would be restricted near cities and certain rivers and lakes. As at the date of this AIF the Company does not anticipate that San José mine operations will be impacted. Although certain of the Company’s grassroots explorations properties may be affected, the Company does not expect such restrictions to materially impact its exploration targets or exploration plans. The provincial government has not issued the administrative regulations to accompany the legislation. As such, no assurances can be made and the Company does not believe it is possible at this time to fully assess the impacts of this legislation.

RISK FACTORS

We do not control (jointly or otherwise) the San José Mine and have no control over the timing or amount of future cash calls.

We hold 49% of the voting shares of MSC and Hochschild holds the balance. The Board of MSC consists of three members, only one of which is a nominee of Minera Andes. Hochschild is entitled to appoint the balance of the members of the Board of Directors of MSC. The OJVA grants us a “veto” in respect of certain and very limited matters regarding the affairs of MSC and the operation of the San José Mine. Accordingly, MSC and the San José Mine are under the control of Hochschild.

As a result, we have a limited, if any, ability to control the timing or amount of cash calls or any other matter relating to the management of MSC and the San José Mine and decisions made in that regard may have an adverse effect on our operations and financial position.

Furthermore, the OJVA provides that the Board of MSC may elect to raise additional funds by issuing shares of MSC, and in such event, each shareholder of MSC shall have a pre-emptive right to subscribe and pay for its pro rata share of such additional shares of MSC. Historically, MSC’s operations have been financed in this manner. Any shares not purchased by Minera Andes pursuant to its pre-emptive right may be purchased by Hochschild. Accordingly, in the event of a cash call by MSC financed by share subscriptions, a failure by Minera Andes to exercise its pre-emptive right, in full or at all, may result in a reduction of the Company’s interest in the San José Mine.

There can be no assurance that if a cash call is made, we will have the funds available to satisfy such cash call when due and that our interest in the San José Mine will not be reduced accordingly.

18

We may continue to be dependent on external financing.

The OJVA provides that it shall be the policy of MSC to maintain excess distributable cash and that unless the Board of MSC unanimously decides otherwise, MSC shall distribute, on a semi-annual basis all cash not reasonably required for operations or expansion. Despite operational cash-flow and repayment of loans from MSC, there can be no assurance if and when cash distributions will be received from MSC, or if such distributions will be sufficient by themselves to fund our continuing exploration and development activities.

As a result we may continue to depend on third party financing to pay future cash calls by MSC, fund future working capital, capital expenditures, operating and exploration costs and other general corporate requirements. Failure to obtain sufficient financing, as and when required, may result in a delay or indefinite postponement of exploration, development or production on any or all of our properties or even a loss of our assets. There can be no assurance that additional capital or other types of financing will be available or that, if available, the terms of such financing will be favourable to the Company.

A substantial or prolonged decline in metal prices, particularly gold, silver or copper, would have a material adverse effect on us.

The price of our common shares, our financial results, and our exploration, development and mining activities have previously been, and may in the future be, significantly adversely affected by declines in metal prices. Metal prices are volatile and are affected by numerous factors beyond our control such as the sale or purchase of metals by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major mining countries throughout the world. Any future serious decline in the price of metals could adversely impact our future revenues, profits and cash flows. In particular, sustained low metal prices could:

· reduce cash from operations at the San José Mine, requiring additional investment by, or loan from, the Company;

· cause suspension of the development of mine development at the San José Mine;

· delay or render uneconomic development of our Los Azules Copper Project;

· reduce or eliminate our ability to obtain credit;

· force us to lose our interest in, or to sell, all or some of our properties;

· halt or delay the development of new projects; and

· reduce funds available for exploration.

Furthermore, declining commodity prices could impact our operations by requiring a re-assessment of the feasibility of any of our projects. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed. In addition, mineral reserve calculations and life-of-mine plans using significantly lower metal prices could result in reduced estimates of mineral reserves and non-reserve mineral resources and in material write-downs of our investment in mining properties and increased amortization, reclamation and closure charges.

Global economic conditions combined with our financial position could make financing our operations and business strategy more difficult.

The Company had a net income of $23.2 million for the year ended December 31, 2010 compared to a net income of $4.1 million for the year ended December 31, 2009. Although we have been generating income, there is no assurance that we will not incur losses in the future. Numerous factors, including declining metal prices, lower than expected ore grades or higher than expected operating costs (including increased commodity prices), and impairment write-offs of mine property and/or exploration property costs, could cause us to continue to be unprofitable in the future.

19

In the short term, these factors may impact our ability to obtain equity or debt financing in the future and, if obtained, on terms favourable to us. In the longer term these factors could have important consequences, including the following:

· increasing our vulnerability to general adverse economic and industry conditions;

· limiting our ability to obtain additional financing to fund future working capital, capital expenditures, operating and exploration costs and other general corporate requirements;

· limiting our flexibility in planning for, or reacting to, changes in our business and the industry; and

· placing us at a disadvantage when compared to our competitors that have cash flow from operations.

We are subject to fluctuations in currency exchange rates, which could materially adversely affect our financial position.

We maintain most of our working capital in Canadian and United States dollars. However, a significant portion of our operating costs are incurred in Argentinean pesos. Accordingly, we are subject to fluctuations in the rates of currency exchange between the Canadian, United States dollar and Argentinean peso, and these fluctuations could materially affect our financial position and results of operations as construction, development and other costs may be higher than anticipated. Specifically, the costs of goods and services could increase due to changes in the value of the Canadian dollar, the United States dollar, or the Argentinean peso. Consequently, operation and development of our properties might be more costly than we anticipate.

The Company is subject to risks relating to economic and political instability in Argentina.

All of the Company’s material properties are located in Argentina. There are risks relating to an uncertain or unpredictable political and economic environment in Argentina.

During an economic crisis in 2002 and 2003, Argentina defaulted on foreign debt repayments and on the repayment on a number of official loans to multinational organizations. In addition, the Government has renegotiated or defaulted on contractual arrangements.

In January 2008, the Argentinean Government reassessed its policy and practice in respect of export duties and began levying export duties on mining companies operating in the country. Although this particular change does not affect the Company as its fiscal stability agreement explicitly fixes export duties at 5% for doré bars and 10% for concentrates, there can be no assurance that the Argentinean Government will not unilaterally take other action which could have a material adversely affect the Company’s interests in Argentina, including in particular the San José Mine.

There also is the risk of political violence and increased social tension in Argentina and Argentina has experienced periods of civil unrest, crime and labour unrest.

Certain political and economic events such as acts or failures to act by a government authority in Argentina, and acts of political violence in Argentina, could have a material adverse effect on the Company’s ability to operate.

There have been recent indications in Argentina that refunds of VAT (IVA) may be delayed. Delays in the payment of VAT refunds may have an impact on the cash flow from the operations of MSC.

Estimates of mineral reserves and mineral resources could be inaccurate.

The figures for mineral reserves and mineral resources contained in this AIF are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that mineral reserves can be mined or processed profitably. There are numerous uncertainties inherent in estimating proven and probable mineral reserves and measured, indicated and inferred mineral resources, including many factors beyond our control. The estimation of reserves and resources is a subjective process and the accuracy of such estimates is a function of the quantity and quality of available data and of the assumptions made and

20

judgments used in engineering and geological interpretation, which could prove to be unreliable. These estimates may not be accurate and there can be no assurance that mineral reserves and resources can be mined or processed profitably. Short-term operating factors relating to mineral reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that gold, silver or copper recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Fluctuation in metal prices, results of drilling, metallurgical testing, production costs or recovery sales, and the evaluation of mine plans subsequent to the date of any estimate could require revision of reserve and resource estimates. The volume and grade of mineral reserves mined and processed and recovery rates might not be the same as currently anticipated. Any material reduction in estimates of mineral reserves and resources, or our ability to extract these mineral reserves and resources, could have a material adverse effect on our further cash flow, results of operation and financial condition.

Mining activities are subject to a number of risks and hazards that may result in damage to property, delays and possible legal liability.

The Company’s business operations are subject to risks and hazards inherent in the mining industry. The exploration for and the development of mineral deposits involves significant risks, including:

· environmental hazards;

· discharge of pollutants or hazardous chemicals;

· industrial accidents;

· �� labour disputes and shortages;

· supply and shipping problems and delays;

· shortage of equipment and contractor availability;

· difficulty in applying technology such as bio-oxidation processing;

· unusual or unexpected geological or operating conditions;

· cave-ins of underground workings;

· failure of dams;

· fire;

· marine and transit damage and/or loss;

· changes in the regulatory environment; and

· natural phenomena such as inclement weather conditions, floods and earthquakes.

These or other occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, delayed production, monetary losses and possible legal liability. We could (directly or through a project in which we have an interest) incur liabilities as a result of pollution and other casualties. Satisfying such liabilities could be very costly and could have a material adverse effect on our financial position and results of operations.

We need to continually discover, develop or acquire additional mineral properties and a failure to do so would adversely affect our business and financial position in the future.

Mineral exploration, in which we are significantly engaged at this time, both directly and indirectly, is highly speculative, involves substantial expenditures, and is frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our exploration efforts will be successful. The success of exploration is determined in part on the following factors:

· the identification of potential mineralization based on superficial analysis;

21

· availability of prospective land;

· availability of government-granted exploration and exploitation permits;

· the quality of our management and our geological and technical expertise; and

· the availability of capital for exploration and development.

Substantial expenditures are required to determine if a project has economically mineable mineralization. It could take several years to establish proven and probable mineral reserves and to develop and construct mining and processing facilities. As a result of these uncertainties, we cannot assure you that current and future exploration programs will result in the discovery of mineral reserves, the expansion of existing mineral reserves and the development of mines.

Whether income will result from projects undergoing exploration and development programs depends on the successful establishment of mining operations. Factors including costs, actual mineralization, consistency and reliability of ore grades and commodity prices affect successful development.

Developed mines have limited lives based on proven and probable mineral reserves. The ability to maintain or increase annual production depends in significant part on the identification of new reserves and resources.

Legal, regulatory and permitting requirements significantly affect our mining operations and may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our activities are subject to numerous environmental laws, regulations and permitting requirements that can delay production and adversely affect operating and development costs. Compliance with existing regulations governing the discharge of materials into the environment, or otherwise relating to environmental protection, in the jurisdictions where we have projects or interests in projects may have a material adverse effect on our exploration activities, results of operations and competitive position. New or expanded regulations, if adopted, could affect the exploration or development of these projects or otherwise have a material adverse effect on operations. To the extent such approvals are required and not obtained, the Company or any operator of a project in which we have an interest, may be curtailed or prohibited from continuing its mining operations or from proceeding with planned exploration or development of mineral properties, or projected production commencement dates, production amounts and costs could be adversely affected.