Exhibit 99.1

Great assets... | | strong growth potential |

•First full yearof production

The San José silver/gold mine has a successful first year of produc- tion. The mine produces 4,381,000 ounces of silver and 54,260 ounces of gold. Minera Andes owns 49 percent of this high-grade mine through its joint venture with Hochschild Mining plc, who is the operator. Operating cash costs for the year were $166 per tonne of ore processed. This equates to $6.42 per ounce for silver, and $375 per ounce for gold.

•Expansion readied For 2009

Concurrent with San José’s silver/gold output, construction was underway throughout 2008 to substantially increase the mine’s silver and gold production. Underground workings have been increased to18 kilometers, and the mill and process plant capacity now handles1,500 tonnes of ore per day, compared to the first stage’s 750 tpd production level.

•Mine production increases significantly

As planned, San José’s silver and gold production began to increase late in the first quarter of 2009. During 2009, production is forecast to increase by about 70% compared to 2008. •A great asset for Minera Andes becomes a greater asset

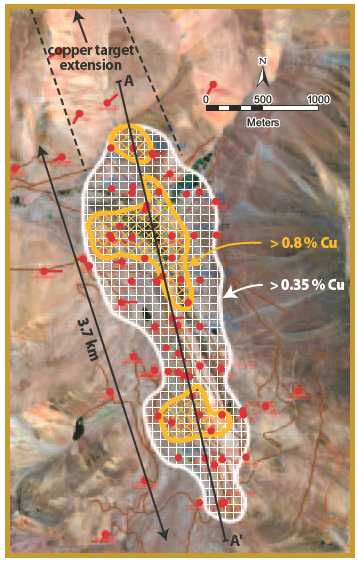

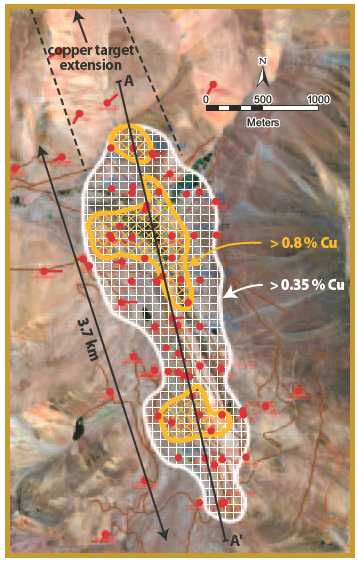

San José’s increase in production now ranks the mine as one of the world’s largest primary silver producers. Already a relatively low cost, high-grade mine, the expansion means San José’s costs have been reduced even more because fixed costs are spread over more production. Operating costs per tonne have decreased from $160 per tonne to $112 per tonne in the first quarter of 2009, equivalent to a per-ounce operating cost of $4.99 for silver, and $357 per ounce forgold on a co-product basis. •Great assets — copper Minera Andes’ proven business plan has brought it success with San José. The Los Azules copper discovery in Argentina is another Minera Andes discovery. Los Azules is a great asset with strong growth potential. Based on a third-party estimate, Los Azulescurrently contains an inferred resource of 922 million tonnes of copper mineralization, or 11.2 billion pounds of contained copper.

In addition, a preliminary assessment suggests a mine, if developed, would also produce an average of 38,000 ounces of gold and 1.26 million ounces of silver a year as supplemental metals. | |

•New reserve and resource potential

Exploration drilling in 2008 at the San José mine suggests good poten- tial to further increase the silver/gold ore reserves and resources at the mine. One hole intersects 63.63 grams/tonne (2.05 ounces per tonne) gold and 1,158 g/t (37 opt) silver over 1.94 meters. During 2008, mine exploration successfully delineates 785,000 tonnes of new resources. In addition, a new discovery is made during the 2009 exploration program when a mineralized structure is intersected in drilling near the Huevos Verdes vein, Minera Andes’ first discovery at San José. The discovery was made in the first hole of a 22,000-meter drilling program, and includes 8.9 g/t (0.26 opt) gold and 517 g/t (15.1 opt) silver intersected over one meter.

•Exploration extends Los Azules to the north

A Minera Andes-managed 2008 exploration program at its Los Azules copper discovery confirms that the prospect is open to the north, and therefore may be larger than currently known. Drilling and geologic mapping suggest that copper mineralization may extend another threekilometers to the north. One hole drilled at the northern limit of the 2008 exploration program encountered 112 meters of 0.98 percent copper within a larger zone of 217 meters of 0.77 percent copper. Drilling extends known mineralization 400 meters to the north. •Los Azules expands east and west

Exploration drilling of 15 holes in 2008 at Los Azules expands the limits of copper mineralization to the east and west. Four holes to the east confirmed that medium to high-grade copper mineralization is present at the eastern limits of the drilling. Another hole expanded known copper mineralization to the west. Continuity of mineraliza- tion is established, and indicates that Los Azules may have further potential to increase in size. •Los Azules copper recoveries

As part of an economic scoping study, tests determine that coppermineralization at Los Azules responds well to established, well under- stood flotation extraction methods. Metallurgical testing indicates 92 percent recovery of copper using this technology. Both factors suggest cost-effective extraction of copper from host ores. •New discoveries in Santa Cruz

Minera Andes has expertise in silver, gold and copper exploration. The Company has always been interested in Santa Cruz province, a highly prospective and relatively underexplored silver and gold region. Minera Andes owns a number of new discoveries in northern Santa Cruz. All are early stage discoveries, and drill-testing is foreseen for some targets. |

Los Azules long section | |

| To Our Shareholders: | | generated interest, and currently Xstrata Copper, a commodityunit of Xstrata plc, has an option to become a partner with MineraAndes at this discovery. A preliminary assessment report andscoping study developed and compiled by Minera Andes’ independent engineers is with Xstrata now, and their decision to exercisethe option is anticipated in the second half of the year. |

The year 2008 has proven that Minera Andes has great assets in itsSan José silver/gold mine and Los Azules copper discovery. Theseassets, as well as numerous new precious metals discoveries inArgentina, strongly indicate that the Company has potential for agreat future.

|

| GREAT ASSETS | | STRONG GROWTH POTENTIAL |

San José experienced its first full year of silver and gold production in 2008. The mine, built upon a discovery made by MineraAndes’ geologists, produced 4.38 million ounces of silver and54,260 ounces of gold from 295,963 tonnes of ore. Minera Andesis a 49 percent partner in Minera Santa Cruz, the owner of SanJosé. San José’s value rose in the first quarter of 2009 becauseseveral construction projects designed to raise production andreduce operating costs were completed. For 2009, total mineproduction is forecast to increase substantially over the 2008production. This increase in production, combined with reducedelectric power costs has reduced operating costs from $168 pertonne to $112 per tonne in 2009. Thus, our asset value hasincreased not only from greater production, but also reducedoperating costs.

Minera Andes is also moving forward with another of its highlyprospective discoveries. The Los Azules copper discovery wasconfirmed as a great asset in 2008 when an independent technicalreport placed its initial size at 922 million tonnes of an inferredcopper resource, containing 11.2 billion pounds of copper. Subsidiary values in gold and silver also exist. The size of Los Azules ha | |

Minera Andes is a successful exploration company conducting itswork program in an underexplored country whose discoverypotential is still unfolding. Our most advanced properties,San José and Los Azules, continue to be exciting. Only a smallportion of the San José discovery area has been drill-tested, andthe 99,000-acre joint venture area of which it is part may withtime become a mining district. Further work may well reveal thatthe open-ended copper mineralization at Los Azules can host alarger deposit. In addition, Minera Andes’ geologists haveidentified numerous other gold and silver targets in SantaCruz province. We’re looking forward to the excitement thesediscoveries may hold.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cordially,

Allen V. Ambrose

President

May 11, 2009 |  |

| | | To Our Shareholders: |

| |

Los Azules resources: a 922-million-tonne copper deposit, open at depth and for 3km to the North

| | In 2008, as one grassroots discovery by Minera Andes, the San José gold/silver mine, commenced full production, our exploration team brought a major new copper discovery to the public’s attention. At Los Azules an independent report confirmed a resource of almost one billion tonnes at potentially mineable grades. Los Azules shows every indication ofdeveloping into a mine that will eventually be in the upper quartile of porphyry coppers worldwide in terms of contained metal. |  |

Despite the growing economic uncertainty in 2008 and early 2009 Minera Andes continued with its primary mission in Argentina: the exploration and discovery of new mineral deposits. In San Juan province the Los Chonchones porphyry copper prospect was extensively sampled at the grassroots level and is a strong candidate for further work. In Santa Cruz drilling has just begun at our Celestina gold/silver prospect, some 40 kilometers southwest of AngloGold Ashanti’s producing Cerro Vanguardia mine. Drilling at Celestina will explore an area of 2.0 x 2.5 kilometers containing about 10 epithermal veins. Also, at the Martes 13 project, northwest of the Cerro Vanguardia mine, we recently completed gradient array IP/resistivity and ground magnetic surveys and a drill program is planned for later this year. In addition, we completed a drill program at Arroyo Telken in late 2008. Even though only weakly anomalous gold-silver values were encountered in the drilling, we plan additional reconnaissance work to evaluate the possibility of potential extensions of mineralized zones from the adjoining Cerro Negro property, where the Eureka vein is proving to be a significant gold resource. Consistent with our exploration philosophy since 1993, Minera Andes controls many other grassroots gold-silver epithermal targets in the Deseado Massif of Santa Cruz province. We plan to continue exploring these properties and look forward to continued exploration success in 2009. Sincerely,

Brian Gavin

Vice President, Exploration

May 11, 2009 |

MINERA ANDES, INC.

Consolidated Financial Statements

December 31, 2008 and 2007

(U.S. Dollars)

| |

Index | Page |

Auditors’ Report to the Shareholders | 1-3 |

Consolidated Financial Statements | |

Consolidated Balance Sheets | 4 |

Consolidated Statements of Operations | 5 |

Consolidated Statements of Shareholders’ Equity | 6 |

Consolidated Statements of Cash Flows | 7 - 8 |

Notes to Consolidated Financial Statements | 9 - 43 |

Management’s Discussion and Analysis | 44 - 70 |

| | | |

| BDO DunwoodyLLP | 600 Cathedral Place |

| Chartered Accountants | 925 West Georgia Street |

| | Vancouver, BC, Canada V6C 3L2 |

| | Telephone: | (604)688-5421 |

| | Facsimile: | (604)688-5132 |

| | E-mail: vancouver@bdo.ca |

| | www.bdo.ca |

Independent Auditors’ Report

To The Shareholders of

Minera Andes Inc.

We have completed an integrated audit of the consolidated financial statements and internal control over financial reporting of Minera Andes Inc. as of December 31, 2008 and 2007. Our opinions, based on our audits, are presented below.

Consolidated financial statements

We have audited the Consolidated Balance Sheets of Minera Andes Inc. as at December 31, 2008 and 2007 and the Consolidated Statements of Operations, Changes in Shareholders’ Equity, and Cash Flows for each of the years in the two year period ended December 31, 2008 and 2007. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

With respect to the consolidated financial statements for the years ended December 31, 2008 and 2007 we conducted our audits in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2008 and 2007 and the results of its operations and its cash flows for each of the years in the two years in the period ended December 31, 2008 and 2007 in accordance with Canadian generally accepted accounting principles.

1

Internal control over financial reporting

We have also audited Minera Andes Inc.’s internal control over financial reporting as of December 31, 2008, based on criteria established inInternal Control – Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO criteria). Minera Andes Inc.’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or time ly detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as at December 31, 2008 based on criteria established inInternal Control — Integrated Frameworkissued by the COSO.

(Signed)BDO Dunwoody LLP

Chartered Accountants

Vancouver, Canada

March 24, 2009

2

Comments by Auditors for U.S. Readers on Canada-U.S. Reporting Differences

In the United States, reporting standards for auditors require the addition of an explanatory paragraph (following the opinion paragraph) when the financial statements are affected by conditions and events that cast doubt on the Company’s ability to continue as a going concern such as those described in Note 1 of the consolidated financial statements. Our report to the shareholders dated March 24, 2009 is expressed in accordance with Canadian reporting standards which do not present a reference to such conditions and events in the auditor’s report when these are adequately disclosed in the consolidated financial statements.

(Signed)BDO Dunwoody LLP

Chartered Accountants

Vancouver, Canada

March 24, 2009

3

MINERA ANDES INC.

CONSOLIDATED BALANCE SHEETS

(U.S. Dollars)

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| ASSETS | | | | | | |

| Current: | | | | | | |

| Cash and cash equivalents | $ | 3,409,593 | | $ | 23,101,135 | |

| Receivables and prepaid expenses | | 315,962 | | | 340,674 | |

| Project loan interest receivable (Note 7) | | 4,983,680 | | | 2,357,753 | |

| Total current assets | | 8,709,235 | | | 25,799,562 | |

| Project loan receivable (Note 7) | | 31,850,000 | | | 31,850,000 | |

| Mineral properties and deferred exploration costs (Note 6) | | 16,390,524 | | | 8,337,881 | |

| Investment in Minera Santa Cruz (Note 7) | | 77,282,120 | | | 64,726,565 | |

| Equipment, net (Note 5) | | 31,456 | | | 40,931 | |

| Total assets | $ | 134,263,335 | | $ | 130,754,939 | |

| LIABILITIES | | | | | | |

| Current: | | | | | | |

| Accounts payable and accruals | $ | 1,488,013 | | $ | 2,886,550 | |

| Project loan interest payable (Note 7) | | 4,983,680 | | | 2,357,753 | |

| Bank loan (Note 8) | | 16,455,267 | | | -- | |

| |

| Related party payable (Note7) | | 11,270,000 | | | 16,905,000 | |

| Total current liabilities | | 34,196,960 | | | 22,149,303 | |

| Bank loan (Note 8) | | -- | | | 14,591,830 | |

| |

| Project loan payable (Note 7) | | 31,850,000 | | | 31,850,000 | |

| Asset retirement obligation | | 90,000 | | | 90,000 | |

| Total liabilities | | 66,136,960 | | | 68,681,133 | |

| Commitments and contingencies (Notes 2, 7 and 11) | | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | |

| Share capital (Note 9): | | | | | | |

| Preferred shares, no par value, unlimited number authorized, | | | | | | |

| none issued | | | | | | |

| Common shares, no par value, unlimited number authorized | | | | | | |

| Issued December 31, 2008—190,158,851 shares | | 99,652,302 | | | 88,512,349 | |

| Issued December 31, 2007—180,974,912 shares | | | | | | |

| Contributed surplus – (Note 10) | | 18,020,608 | | | 16,007,350 | |

| Accumulated deficit | | (49,546,535 | ) | | (42,445,893 | ) |

| Total shareholders’ equity | | 68,126,375 | | | 62,073,806 | |

| Total liabilities and shareholders’ equity | $ | 134,263,335 | | $ | 130,754,939 | |

Approved by the Board of Directors:

/s/ Allen V. Ambrose /s/ Allan J. Marter

Allen V. Ambrose, Director

Allan J. Marter, Director

The accompanying notes are an integral part of these consolidated financial statements.

4

MINERA ANDES INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND ACCUMULATED DEFICIT

(U.S. Dollars)

| | | | | | |

| | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| Income (loss) from Investment in MSC (Note 7) | $ | 1,965,238 | | | ($4,665,885 | ) |

| Less amortization of deferred costs (Note 7) | | 720,000 | | | -- | |

| Net income (loss) from MSC, net of amortization | | | | | | |

| (Note 7) | | 1,245,238 | | | (4,665,885 | ) |

| Consulting fees | | 1,353,614 | | | 426,742 | |

| Depreciation | | 5,037 | | | 8,200 | |

| Insurance | | 168,492 | | | 149,049 | |

| Legal, audit and accounting fees | | 884,903 | | | 812,699 | |

| Office overhead and administration fees | | 614,990 | | | 499,228 | |

| Telephone | | 35,148 | | | 36,769 | |

| Transfer agent | | 15,522 | | | 22,219 | |

| Travel | | 177,377 | | | 144,437 | |

| Wages and benefits (Note 9 (c)) | | 1,367,312 | | | 736,764 | |

| Expenses before under-noted | | (4,622,395 | ) | | (2,836,107 | ) |

| Foreign exchange gain (loss) | | (1,220,061 | ) | | 699,459 | |

| Rental of access roads on construction property | | 122,600 | | | -- | |

| Interest income | | 284,266 | | | 225,810 | |

| Interest expense (Note 8) | | (2,817,118 | ) | | (240,130 | ) |

| Project loan interest expense (Note 7) | | (2,625,927 | ) | | (2,309,423 | ) |

| Project loan interest income (Note 7) | | 2,625,927 | | | 2,309,423 | |

| Write-off of mineral properties and deferred | | | | | | |

| exploration costs (Note 6) | | (3,817 | ) | | (1,378,284 | ) |

| Total expenses | | (8,256,525 | ) | | (3,529,252 | ) |

| Net loss for the year | | (7,011,287 | ) | | (8,195,137 | ) |

| Other comprehensive income(loss) | | -- | | | -- | |

| Comprehensive loss | | (7,011,287 | ) | | (8,195,137 | ) |

| Accumulated deficit, beginning of year | | (42,445,893 | ) | | (33,883,266 | ) |

| | | (49,457,180 | ) | | (42,078,403 | ) |

| Share issue costs | | (89,355 | ) | | (74,111 | ) |

| Incentive warrant payment (Note 9 (b)) | | -- | | | (293,379 | ) |

| Accumulated deficit, end of year | | ($49,546,535 | ) | | ($42,445,893 | ) |

| Basic and diluted loss per common share | | ($0.04 | ) | | ($0.05 | ) |

| Weighted average shares outstanding | | 189,696,255 | | | 164,712,170 | |

The accompanying notes are an integral part of these consolidated financial statements.

5

MINERA ANDES INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(U.S. Dollars)

| | | | | | | | | | | | |

| | | | | | | | | Accumulated | | | | |

| | | | | | | | | Other | | | | |

| | | | | | | Contributed | | Comprehensive | Accumulated | | | |

| | | Common Stock | | Surplus | | Income | Deficit | | Total | |

| | | # | | $ | | $ | | $ | $ | | $ | |

| |

| Balance, December 31, 2006 | | 156,539,415 | | 63,642,152 | | 8,440,457 | | – | (33,883,266 | ) | 38,199,343 | |

| Private placement (Note 9b(ii)) | | 13,880,645 | | 20,551,618 | | – | | – | – | | 20,551,618 | |

| Fair value of warrants granted | | | | | | | | | | | | |

| for private placement (Note | | | | | | | | | | | | |

| 9b(ii)) | | – | | (3,058,362 | ) | 3,058,362 | | – | – | | – | |

| |

| Fair value of agent's options | | | | | | | | | | | | |

| and warrants granted for private | | | | | | | | | | | | |

| placement (Note 9b(ii)) | | – | | (518,852 | ) | 518,852 | | – | – | | – | |

| Exercise of warrants (Note 9d) | | 8,904,852 | | 7,106,556 | | | | | | | 7,106,556 | |

| Incentive warrant payment | | | | | | | | | | | | |

| (Note 9b(i)) | | – | | – | | 293,379 | | – | (293,379 | ) | – | |

| Share issue costs | | – | | – | | – | | – | (74,111 | ) | (74,111 | ) |

| Exercise of stock options (Note | | | | | | | | | | | | |

| 9c) | | 1,650,000 | | 789,237 | | – | | – | – | | 789,237 | |

| Debt discount - third tranche | | | | | | | | | | | | |

| (Note 8) | | – | | – | | 1,731,100 | | – | – | | 1,731,100 | |

| Debt discount - fourth tranche | | | | | | | | | | | | |

| (Note 8) | | – | | – | | 1,925,200 | | – | – | | 1,925,200 | |

| Stock based compensation | | | | | | | | | | | | |

| (Note 9c) | | – | | – | | 40,000 | | – | – | | 40,000 | |

| Net loss for the year | | – | | – | | – | | -- | (8,195,137 | ) | (8,195,137 | ) |

| |

| Balance, December 31, 2007 | | 180,974,912 | | 88,512,349 | | 16,007,350 | | – | (42,445,893 | ) | 62,073,806 | |

| Private placement (Note 9b | | | | | | | | | | | | |

| (iv)) | | 7,778,023 | | 11,165,368 | | – | | – | – | | 11,165,368 | |

| Private placement (Note 9b (v)) | | 427,000 | | 663,836 | | – | | – | – | | 663,836 | |

| Exercise of stock options Note | | | | | | | | | | | | |

| 9c) | | 260,000 | | 202,157 | | – | | – | – | | 202,157 | |

| Exercise of warrants (Note 9d) | | 718,916 | | 313,804 | | – | | – | – | | 313,804 | |

| Fair value of warrants granted | | | | | | | | | | | | |

| for private placement (Note | | | | | | | | | | | | |

| 9b(iv)(v)) | | – | | (1,293,340 | ) | 1,293,340 | | – | – | | – | |

| Fair value of agent's options | | | | | | | | | | | | |

| granted for private placement | | | | | | | | | | | | |

| (Note 9b(iv)(v)) | | – | | (159,959 | ) | 159,959 | | – | – | | – | |

| |

| Agent option valuation on | | | | | | | | | | | | |

| exercise of options | | – | | 164,674 | | (164,674 | ) | – | – | | – | |

| Warrant valuation on exercise | | | | | | | | | | | | |

| of options | | – | | 83,413 | | (83,413 | ) | – | – | | – | |

| Share issue costs | | – | | – | | – | | – | (89,355 | ) | (89,355 | ) |

| Stock based compensation | | | | | | | | | | | | |

| (Note 9c) | | – | | – | | 808,046 | | – | – | | 808,046 | |

| Net loss for the year | | – | | – | | – | | – | (7,011,287 | ) | (7,011,287 | ) |

| Balance, December 31, 2008 | | 190,158,851 | | 99,652,302 | | 18,020,608 | | – | (49,546,535 | ) | 68,126,375 | |

The accompanying notes are an integral part of these consolidated financial statements.

6

MINERA ANDES INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. Dollars)

| | | | | |

| | Year Ended | |

| | December 31, | | | December 31, | |

| | 2008 | | | 2007 | |

| Operating Activities: | | | | | |

| Net loss for the year | ($7,011,287 | ) | | ($8,195,137 | ) |

| Adjustments to reconcile net loss to net cash | | | | | |

| used in operating activities: | | | | | |

| Write-off of deferred exploration costs | 3,817 | | | 1,378,284 | |

| Interest expense, accretion of debt | | | | | |

| discount (Note 8) | 1,863,437 | | | 120,671 | |

| (Income) Loss from Investment in MSC | | | | | |

| (Note 7) | (1,965,238 | ) | | 4,665,885 | |

| Amortization of deferred costs (Note 7) | 720,000 | | | -- | |

| Depreciation | 5,037 | | | 8,200 | |

| Stock option compensation (Note 9) | 713,729 | | | 40,000 | |

| Project loan interest expense (Note7) | 2,625,927 | | | 2,309,423 | |

| Project loan interest income (Note7) | (2,625,927 | ) | | (2,309,423 | ) |

| Change in: | | | | | |

| Accounts receivable and prepaid | | | | | |

| expenses | 24,711 | | | (72,124 | ) |

| Accounts payable and accrued | | | | | |

| expenses | (958,355 | ) | | 1,520,585 | |

| |

| Cash used in operating activities | (6,604,149 | ) | | (533,636 | ) |

| |

| Investing Activities: | | | | | |

| Purchase of equipment | (11,719 | ) | | (21,265 | ) |

| Mineral properties and deferred exploration | (8,403,206 | ) | | (3,580,453 | ) |

| Changes in due to related party | (5,635,000 | ) | | 16,905,000 | |

| Investment in Minera Santa Cruz | (11,310,317 | ) | | (37,801,299 | ) |

| |

| Cash used in investing activities | (25,360,242 | ) | | (24,498,017 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

7

MINERA ANDES INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. Dollars)

| | | | | | |

| | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| |

| Financing Activities: | | | | | | |

| Shares and subscriptions issued for cash, less | | | | | | |

| issue costs | | 12,255,811 | | | 28,373,300 | |

| Bank loan proceeds received (Note 8) | | -- | | | 17,500,000 | |

| Bank loan interest payable (Note8 ) | | 17,038 | | | 14,867 | |

| Project loan receivable (Note 7) | | (2,625,927 | ) | | (22,050,000 | ) |

| Project loan payable (Note 7) | | 2,625,927 | | | 22,050,000 | |

| Cash provided by financing activities | | 12,272,849 | | | 45,888,167 | |

| Increase (decrease) in cash and cash equivalents | | (19,691,542 | ) | | 20,856,514 | |

| Cash and cash equivalents, beginning of year | | 23,101,135 | | | 2,244,621 | |

| Cash and cash equivalents, end of year | $ | 3,409,593 | | $ | 23,101,135 | |

| |

| Supplementary disclosure cash flow information: | | | | | | |

| Capitalized interest paid | $ | -- | | $ | 590,603 | |

| Non-cash investing and financing activities and | | | | | | |

| other information: | | | | | | |

| Stock option compensation (Note 9c) | $ | 808,046 | | $ | 40,000 | |

| Capitalized accreted interest expense (Note 8) | $ | -- | | $ | 748,130 | |

| Depreciation capitalized to mineral properties | $ | 12,799 | | $ | 28,345 | |

| Asset retirement obligation | $ | -- | | $ | 45,000 | |

The accompanying notes are an integral part of these consolidated financial statements.

8

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

1.

NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Minera Andes Inc. (“Minera Andes” or the “Corporation”) is in the business of acquiring, exploring and evaluating mineral properties, and based on the results of such evaluation, either developing these properties further (by way of joint venture or otherwise) or disposing of them.

The Corporation’s assets are comprised primarily of a 49% equity interest in Minera Santa Cruz S.A. (“MSC”) which owns the San José gold/silver mine in the Santa Cruz province of Argentina (theSan José Project”) plus interests in exploration stage properties in the San Juan, the Santa Cruz and the Chubut provinces of Argentina.

The San José Project is a joint venture between the Corporation and Hochschild Mining plc pursuant to which title to the assets is held by Minera Santa Cruz S.A. (“MSC”), an Argentinean corporation. MSC is owned, as to 49%, by Minera Andes S.A. (“MASA”), an indirect wholly-owned subsidiary of Minera Andes and, as to 51%, by Hochschild Mining (Argentina) Corporation S.A., a subsidiary of Hochschild Mining plc (together with its affiliates and subsidiaries, “Hochschild”). The San José mine entered into production in 2007 and is operated by Hochschild.

The Los Azules Project is an exploration project comprised of properties owned by MASA and to a lesser extent by Andes Corporacion Minera S.A., also an indirect wholly-owned subsidiary of Minera Andes (collectively, the “MASA Properties”) and adjoining properties owned by MIM Argentina Exploraciones S.A. for Xstrata Copper, one of the commodity business units within Xstrata plc (“MIM” and the “MIM Properties”). Under the terms of an option agreement among MASA, Minera Andes, Xstrata Copper (through MIM) and Xstrata Queensland Limited (Xstrata plc, together with its affiliates, is hereinafter referred to as “Xstrata”) dated November 2, 2007 (the “Los Azules Option Agreement”): (i) MIM granted MASA an option (the “MASA Option”) to acquire a 100% interest in the MIM Properties, exercis able on or before November 24, 2010 upon satisfaction of certain conditions including delivery of a scoping study/preliminary assessment whereupon the MIM Properties and the MASA Properties would be consolidated and held by MASA (the “Combined Property”); and (ii) MASA granted MIM (upon the exercise of the MASA Option) an option to acquire a 51% interest in the Combined Property upon, among other things, payment to the Corporation of an amount equal to three times the amount of the direct expenditures paid by MASA and its affiliates since November 25, 2005 on exploration of the Combined Property.

Certain of the MIM Properties are subject to an underlying option agreement, which is the subject of a dispute between Xstrata, as option holder, and Solitario Argentina S.A. (“Solitario”), as the grantor of that option and the holder of a back-in right of up to 25%, exercisable upon the satisfaction of certain conditions, within 36 months after the exercise of the option by Xstrata. The dispute surrounds the validity of the 36 month restriction described above. If Solitario is successful, MIM’s interest in substantially all of the MIM Properties may be reduced by up to 25% and upon exercise of the MASA Option, MASA’s interest in that part of the Combined Property may be similarly reduced (the “Solitario Claim”).

We also have various other properties in the preliminary exploration stage.

2.

GOING CONCERN, FINANCIAL CONDITION, AND LIQUIDITY

The operation of the San José Project is subject to a number of risks, including the risk that the price of gold and silver may decline further. If, and to the extent that cash from operations is insufficient for any reason including cost-overruns and/or lower than expected sales or production,

9

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

2.

GOING CONCERN, FINANCIAL CONDITION, AND LIQUIDITY- continued

additional investment by the shareholders of MSC (including the Corporation) may be required. As a result, there can be no assurance that cash from operations at San José will be sufficient for these purposes, that additional cash calls will not be made or that the Corporation will be able to satisfy any such cash call, as and when required.

With the exception of its interest in the San José Project, the Corporation is in the process of exploring its other properties and has not yet determined whether these properties, other than the San José Project, contain reserves that are economically recoverable. The amounts shown on the balance sheet as mineral properties and deferred exploration costs represent net costs incurred to date, less amounts recovered from third parties and/or written off, and do not necessarily represent present or future values. The recoverability of amounts shown on the balance sheet for mineral properties and deferred exploration costs depend upon the existence of economically recoverable reserves, securing and maintaining title and beneficial interest in the properties, obtaining the financing required to explore and develop the properties, entering into agreements with others to explore and develo p the mineral properties, and upon future profitable production or proceeds from disposition of the mineral properties. In the future, the Corporation’s ability to continue its exploration and production activities, if any, will depend in part on the Corporation’s ability to continue commercial production and generate material revenues or to obtain financing through issuance of equity securities, debt financing, joint venture arrangements or other means. There can be no assurance that the Corporation will commence commercial production at any of its projects or generate sufficient revenues to meet its obligations as they become due or obtain necessary financing on acceptable terms, if at all. The Corporation’s failure to meet its ongoing obligations on a timely basis could result in the loss or substantial dilution of the Corporation’s interests (as existing or as proposed to be acquired) in its properties.

While these consolidated financial statements have been prepared on the basis of a going concern which contemplates the realization of assets and satisfaction of liabilities in the normal course of operations, there are conditions, events and material uncertainties that may cast significant doubt about the validity of that assumption. As at December 31, 2008, the Corporation had an accumulated deficit of $49.5 million and negative working capital of approximately $25.5 million. These consolidated financial statements do not reflect the adjustments to the carrying value of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary were the going concern assumption inappropriate, and these adjustments could be material.

The Corporation also faces material uncertainties including: continued and expected operating losses, negative operating cash flows, ability to obtain or renew financing, declining copper, gold and silver prices and expected returns from the Corporation’s equity interest in the San José Project and the timing of cash receipts related to that investment.

Subsequent events have resolved some of these concerns. In February 2009, the Corporation raised gross proceeds of C$40 million through a private placement of 40 million shares at C$1.00 per share. Some of these funds were used to pay the related party cash call payable of $11.3 million owing at December 31, 2008, and the bank loan of $17.5 million (Note 9(b)(vii). On March 24, 2009, the Corporation had $3.2 million in cash and cash equivalents.

3.

SIGNIFICANT ACCOUNTING POLICIES

These consolidated financial statements have been prepared by the Corporation in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) using the following

10

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES- continued

significant accounting policies.

a.

Basis of Presentation and Principles of Consolidation

These consolidated financial statements include the accounts of the Corporation and all of its subsidiaries and investments, including its principal subsidiaries, MASA and Minera Andes (USA) Inc. (“MUSA”) as well as other non-significant subsidiaries. As stated above, MASA holds the Corporation’s interest in MSC.

Our investment in MSC, is accounted for by the equity method, whereby the Corporation records its investment and its share of the earnings and losses of MSC. All significant intercompany transactions and balances have been eliminated from the consolidated financial statements.

b.

Foreign Currency Translation

The statements are reported and measured in U.S. dollars, which is the currency which the majority of the Corporation’s transactions are incurred. Our consolidated operations are integrated and balances denominated in currencies other than U.S. dollars are translated into U.S. dollars using the temporal method. This method translates foreign currency monetary assets at the exchange rates prevailing at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated using the rate of exchange at the transaction date; and foreign exchange gains and losses are included in the statement of operations.

c. Cash and Cash Equivalents

Cash and cash equivalents include cash, and those short-term money market instruments that are readily convertible to cash with an original term of less than 90 days.

d.

Mineral Properties and Deferred Exploration Costs

Mineral properties consist of exploration and mining concessions, options and contracts. Acquisition and leasehold costs and exploration costs are capitalized and deferred until such time as the property is put into production or the properties are disposed of either through sale or abandonment. If put into production, the costs of acquisition and exploration are amortized over the life of the property, based on the current production and estimated economic reserves. Proceeds received from the sale of any interest in a property are first credited against the carrying value of the property, with any excess included in operations for the period. If a property is abandoned, the property and deferred exploration costs are written off to operations. On a quarterly basis, we evaluate the future recoverability of our mineral properties and deferred exploration costs. Long-lived assets, including mineral pr operties and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Impairment is considered to exist if the total estimated future undiscounted cash flows are less than the carrying amount of the assets. Any asset impairment is measured and recorded based on discounted estimated future cash flows. Future cash flows are estimated based on expected future production, commodity prices, operating costs and capital costs.

e. Investment

Investments over which we exert significant influence, are accounted for using the equity method. Under this method, our share of earnings and losses is included in the statement of operations and the balance of the investment is adjusted by a like amount. Where there has

11

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES - continued

e. Investment – continued

been a loss in value that is other than a temporary decline, the carrying value is reduced to estimated realizable value.

Expenses related to the construction of a mining facility, interest expense on the debt, debt discount, and other legal and consulting expenses are capitalized until the mining facility is placed into commercial production. Once in commercial production, expenses related to the mining facility, interest expense on the debt, debt discount and other legal and consulting expenses are expensed as incurred.

f.

Equipment and Depreciation

Equipment is recorded at cost, and depreciation is provided on a declining–balance basis over estimated useful lives of up to five years to a residual value of 10%.

g.

Accounting for Income Taxes

Income taxes are calculated using the asset and liability method of accounting for income taxes. Under the liability method, future tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and for tax losses and other deductions carried forward.

Future income tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply when the asset is realized or the liability settled. A reduction in respect of the benefit of a future tax asset (a valuation allowance) is recorded against any future tax asset if it is not more likely than not to be realized. The effect on future tax assets and liabilities of a change in tax rates is recognized in income in the period in which the change is substantively enacted.

h.

Basic and Diluted Loss per Common Share

Basic loss per share is calculated by dividing net loss applicable to common shareholders by the weighted-average number of common shares outstanding for the year.

For the years ended December 31, 2008 and 2007, potentially dilutive common shares (relating to options and warrants outstanding at year end) totaling 33,128,947(2007 – 29,554,140) were not included in the computation of loss per share because their effect was anti-dilutive. Therefore, diluted loss per share is the same as basic loss per share.

i.

Estimates

The preparation of consolidated financial statements in conformity with Canadian GAAP requires that the Corporation’s management make estimates and assumptions about future events that affect the amounts reported in the consolidated financial statements and related notes to the financial statements. Actual results may differ from those estimates.

Significant estimates used in the preparation of these consolidated financial statements include, but are not limited to, the recoverability of mineral properties and deferred exploration expenses, investment, and long-lived assets, asset retirement obligations, stock-based compensation, income taxes, the recording of liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenditures during the reporting period. Actual results could differ from management’s best estimates.

12

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

3.

SIGNIFICANT ACCOUNTING POLICIES - continued

j.

Stock-Based Compensation

The Corporation has a stock option plan as described in Note 9(c). The value of stock options granted is estimated on the date of grant using the Black-Scholes option-pricing model. The Black-Scholes option-pricing model requires the input of subjective assumptions, including the expected term of the option and stock price volatility. The expected term of options granted is determined based on historical data on employee exercise and post-vesting employment termination behavior. Expected volatility is based on the historical volatility of the share price of the Corporation. These estimates involve inherent uncertainties and the application of management judgment. Compensation expense for options granted to non-employee consultants is re-measured on each balance sheet date. The fair value of stock options granted is recognized as a charge to operations on a straight line basis over the applicable vesting period, with an offset to contributed surplus. Where stock options are granted in exchange for services directly related to specific mineral properties, the expense is capitalized against the mineral property. The amount of compensation cost recognized at any date at least equals the value of the vested portion of the options at that date. When stock options are exercised, the consideration paid by employees is credited to share capital. See Note 9 for details of assumptions used in the calculations.

k.

Asset Retirement Obligations

The Corporation’s exploration activities are subject to various governmental laws and regulations relating to the protection of the environment. These environmental regulations are continually changing and are generally becoming more restrictive. The Corporation has made, and intends to make in the future, expenditures to comply with such laws and regulations. The Corporation has recorded a liability and a corresponding asset for the estimated future cost of reclamation and closure, including site rehabilitation and long-term treatment and monitoring costs, discounted to net present value. However, these estimates are subject to change based on changes in circumstances and any new information that becomes available. This policy is directed only at MAI properties. The asset retirement obligation related to the investment in MSC is recorded on the financial statements of MSC.

l.

Share consideration

Agent’s warrants, stock options and other equity instruments issued as purchase consideration in non-cash transactions, other than as consideration for mineral properties, are recorded at fair value determined by management using the Black-Scholes option pricing model. The fair value of the shares issued as purchase consideration for mineral properties is based upon the trading price of those shares on the TSX on the date of the agreement to issue shares as determined by the Board of Directors.

m.

Warrants

Proceeds from unit placements are allocated between shares and warrants issued according to their relative fair value. The value of the share component is credited to share capital and the value of the warrant component is credited to Warrants, a separate component of shareholders equity. Upon exercise of the warrants, consideration paid by the warrant holder together with the amount previously recognized in warrants is recorded as an increase to share capital.

13

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

4.

CHANGES IN ACCOUNTING POLICIES AND RECENT ACCOUNTING PRONOUNCEMENTS

a.

Accounting Policies Implemented Effective January 1, 2008

Capital Disclosures

Effective January 1, 2008, the Corporation adopted Section 1535, “Capital Disclosures”, of

the Canadian Institute of Chartered Accountant’s (“CICA”) Handbook (the “Handbook”). Section 1535, which applies to financial years beginning on or after October 1, 2007, requires disclosure of a Corporation’s objectives, policies, and processes for managing capital, quantitative data about what the entity regards as capital and whether the entity has complied with any capital requirements and, if it has not complied, the consequences of such non-compliance. Disclosures required by Section 1535 are included in Note 14.

Financial Instruments

Effective January 1, 2008, the Corporation adopted Section 3862, “Financial Instruments – Disclosures”, and Section 3863, “Financial Instruments – Presentation”, of the Handbook. Sections 3862 and 3863, which apply to financial years beginning on or after October 1, 2007, replace section 3861, “Financial Instruments – Disclosures and Presentation”. Sections 3862 and 3863 increase the disclosure currently required, in order to enable users to evaluate the significance of financial instruments for an entity’s financial position and performance, including disclosures about fair value. In addition, disclosure is required of qualitative and quantitative information about exposure to risks arising from financial instruments, including specified minimum disclosures about credit risk, liquidity risk and market risk. The quantitative disclosures must provide information about the extent to which the entity is exposed to risk, based on information provided internally to the entity’s key management personnel. The impact of adopting these sections is included in Note 15 to the Corporation’s consolidated financial statements for the year ended December 31, 2008.

Inventories

In June 2007, the CICA issued Section 3031, “Inventories”, which replaces Section 3030 and harmonizes the Canadian standard related to inventories with International Financial Reporting Standards (“IFRS”). Section 3031 provides more extensive guidance on the determination of cost, including allocation of overhead, narrows permitted cost formulas, requires impairment testing, and expands the disclosure requirements to increase transparency. Section 3031 was adopted on January 1, 2008, and did not have an impact on the Corporation’s consolidated financial statements.

Going Concern

In June 2007, CICA Section 1400 was amended to clarify requirements for management to assess and disclose an entity’s ability to continue as a going concern. This section was adopted on January 1, 2008. Disclosure required by this section is disclosed in Note 2 of the Corporation’s consolidated financial statements.

Income Statement Presentation

In August 2008, the CICA issued EIC-172, “Income statement presentation of tax loss carryforward recognized following an unrealized gain recorded in other comprehensive income”. EIC-172 provides guidance on whether the tax benefit from the recognition of tax loss carry forwards consequent to the recording of unrealized gains in other comprehensive income, such as unrealized gains on available-for-sale financial assets, should be recognized in net income or in other comprehensive income. EIC-172 should be applied retrospectively, with restatement of prior periods from the date of adoption of Section 3855

14

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

4.

CHANGES IN ACCOUNTING POLICIES AND RECENT ACCOUNTING PRONOUNCEMENTS- continued

b.

Recent Accounting Pronouncements - continued

Income Statement Presentation - continued

“Financial Instruments”, for all interim and annual reporting periods ending on or after September 30, 2008. The adoption of this new accounting policy did not have any impact on the Corporation’s consolidated financial statements for the year ended December 31, 2008.

International Financial Reporting Standards

In February 2008, the Canadian Accounting Standards Board confirmed that publicly accountable enterprises will be required to adopt IFRS for fiscal years beginning on or after January 1, 2011, with earlier adoption permitted. Accordingly, the conversion to IFRS will beapplicable to the Corporation’s reporting no later than in the first quarter of 2011, withrestatement of comparative information presented. The conversion to IFRS will impact the Corporation’s accounting policies, information technology and data systems, internal control over financial reporting, and disclosure controls and procedures. The transition may also impact business activities, such as foreign currency and hedging activities, certain contractual arrangements, debt covenants, capital requirements and compensation arrangements.

Goodwill and Intangible Assets

In February 2008, the CICA issued Section 3064, “Goodwill and Intangible Assets”, which establishes revised standards for recognition, measurement, presentation and disclosure of goodwill and intangible assets, other than the initial recognition of goodwill or intangible assets acquired in a business combination. Concurrent with the introduction of this standard, the CICA withdrew EIC-27, “Revenues and Expenses During the Pre-operating Period”. As a result of the withdrawal of EIC-27, companies will no longer be able to defer costs and revenues incurred prior to commercial production at new mine operations. The

changes are effective for interim and annual financial statements beginning January 1, 2009. The Corporation is in the process of evaluating the impact of this new standard for adoption on January 1, 2009.

Business Combinations

In January 2009, the Accounting Standards Board (AcSB) issued the following new Handbook sections: 1582 – Business Combinations, 1601 – Consolidations, and 1602 – Non-Controlling Interests. These standards are to be applied prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after January 1, 2011. The Corporation has not yet determined the impact of the adoption of these standards on its consolidated financial statements

Credit Risk and the Fair Value of Financial Assets and Financial Liabilities

In January 2009 the EIC issued EIC-173. In this EIC, the Committee reached a consensus that in determining the fair value of financial assets and financial liabilities an entity should take into account the credit risk of the entity and the counterparty. The Corporation has not yet determined the impact of the adoption of this standard on its consolidated financial statements.

15

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

5.

EQUIPMENT

| | | | | | | | | | | | | |

| | | | | December 31, 2008 | | | | December 31, 2007 |

| | | | | Accumulated | | | | | | Accumulated | | |

| | | | Cost | | Depreciation | | Net | | Cost | | Depreciation | | Net |

| Field | | | | | | | | | | | | |

| Equipment | $ | 100,952 | $ | 93,448 | $ | 7,504 | $ | 100,952 | $ | 88,099 | $ | 12,853 |

| Office | | | | | | | | | | | | |

| Equipment | | 132,039 | | 108,087 | | 23,952 | | 120,320 | | 92,242 | | 28,078 |

| Total | $ | 232,991 | $ | 201,535 | $ | 31,456 | $ | 221,272 | $ | 180,341 | $ | 40,931 |

6.

MINERAL PROPERTIES AND DEFERRED EXPLORATION COSTS

At December 31, 2008, through our subsidiaries and investment, we hold interests in approximately 304,221 acres (123,133 hectares (“ha”)) of mineral rights and mining lands in three Argentine provinces. Under our present acquisition and exploration programs, we are continually acquiring additional mineral property interests and exploring and evaluating our properties. If, after evaluation, a property does not meet our requirements, then the property and deferred exploration costs are written off to operations. All properties in Argentina are subject to royalty agreements as disclosed in Note 11. Mineral property costs and deferred exploration costs, net of mineral property option proceeds, are as follows:

16

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

6.

MINERAL PROPERTIES AND DEFERRED EXPLORATION COSTS - continued

2008 COSTS BY PROPERTY

| | | | | | | |

| | San Juan | Santa | | | |

| | Los | San Juan | Cruz | Chubut | General | |

| Description | Azules | Cateos | Cateos | Cateos | Exploration | Total |

| Balance, beginning of year | $6,034,844 | $341,100 | $1,951,937 | $10,000 | -- | $8,337,881 |

| Assays and analytical | 125,356 | -- | 12,151 | -- | 223 | $137,730 |

| Construction and trenching | 10,178 | -- | -- | -- | -- | $10,178 |

| Consulting fees | 227,469 | -- | 3,437 | 878 | 58,493 | $290,277 |

| Depreciation | -- | -- | -- | -- | 12,799 | $12,799 |

| Drilling | 3,644,050 | -- | -- | -- | -- | $3,644,050 |

| Equipment Rental | 799,953 | -- | 346,974 | -- | -- | $1,146,927 |

| Geology | 1,206,616 | 6,085 | 127,096 | 1,432 | 130,383 | $1,471,612 |

| Geophysics | -- | -- | 9,377 | | -- | $9,377 |

| Insurance | -- | -- | -- | -- | 6,091 | $6,091 |

| Legal | 52,824 | 1,788 | -- | -- | 71,240 | $125,852 |

| Maintenance | 3,851 | -- | 7,131 | -- | 9,280 | $20,262 |

| Materials and supplies | 350,113 | 3,724 | 115,383 | -- | 12,411 | $481,631 |

| Project overhead | 38,910 | 69 | 2,753 | 12 | 153,868 | $195,612 |

| Property and mineral rights | 22,370 | -- | 45,445 | -- | (1,667) | $66,148 |

| Telephone | 8,040 | -- | 4,073 | -- | 1,889 | $14,002 |

| Travel | 156,611 | 434 | 38,092 | -- | 37,832 | $232,969 |

| Wages and benefits | 30,528 | -- | 10,673 | -- | 149,741 | $190,942 |

| Overhead allocation | 609,235 | -- | 33,239 | 109 | (642,583) | $-- |

| Write-off of deferred costs | -- | -- | (1,385) | (2,431) | -- | ($3,816) |

| Balance, end of year | $13,320,948 | $353,200 | $2,706,376 | $10,000 | -- | $16,390,524 |

17

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

6.

MINERAL PROPERTIES AND DEFERRED EXPLORATION COSTS - continued

2007 COSTS BY PROPERTY

| | | | | | | |

| | San Juan | Santa | | | |

| | Los | San Juan | Cruz | Chubut | General | |

| Description | Azules | Cateos | Cateos | Cateos | Exploration | Total |

| Balance, beginning of year | $2,790,553 | $327,540 | $2,234,259 | $252,796 | -- | $5,605,148 |

| Assays and analytical | 55,567 | -- | 8,156 | -- | -- | $63,723 |

| Construction and trenching | 146,528 | -- | 40,581 | -- | -- | $187,109 |

| Consulting fees | -- | 933 | 13,224 | 3025 | 141,527 | $158,709 |

| Depreciation | -- | -- | -- | -- | 28,345 | $28,345 |

| Drilling | 1,088,551 | 55 | 195,037 | -- | -- | $1,283,643 |

| Equipment Rental | 496,901 | -- | 58,683 | -- | 83 | $555,667 |

| Geology | 543,514 | 7,541 | 172,931 | 2,360 | 30,695 | $757,041 |

| Insurance | -- | -- | -- | -- | 3,687 | $3,687 |

| Legal | 1,120 | -- | -- | -- | 182,556 | $183,676 |

| Maintenance | 5,022 | -- | 1,563 | -- | 9,887 | $16,472 |

| Materials and supplies | 149,250 | 316 | 28,029 | -- | 15,964 | $193,559 |

| Project overhead | 34,710 | 119 | 7,004 | 129 | 168,040 | $210,002 |

| Property and mineral rights | 13,831 | 56 | 31,700 | 334 | - | $45,921 |

| Telephone | 3,319 | 17 | 14,417 | -- | 19,844 | $37,597 |

| Travel | 191,887 | 396 | 27,499 | -- | 48,348 | $268,130 |

| Wages and benefits | 12,134 | -- | 6,066 | -- | 54,536 | $72,736 |

| Asset retirement obligation | 35,000 | -- | 10,000 | -- | -- | $45,000 |

| Overhead allocation | 466,957 | 4,127 | 230,075 | 2,353 | (703,512) | -- |

| Write-off of deferred costs | -- | -- | (1,127,287) | (250,997) | -- | ($1,378,284) |

| Balance, end of year | $6,034,844 | $341,100 | $1,951,937 | $10,000 | -- | $8,337,881 |

a.

San Juan Project

The San Juan Province project comprises four properties (2007 – four properties), which includes Los Azules, totaling 64,392 ha (2007 – 48,547 ha) in southwestern San Juan province. At present, these lands are not subject to a royalty; however, the government of San Juan has not waived its rights to retain up to a three percent "mouth of mine" royalty from production. Land holding costs for 2009 are estimated at $20,000.

Expenditures in 2008, as in 2007, were primarily for an on-going exploration program at the Los Azules project.

In order to exercise the MASA Option, MASA must incur $1 million in expenditures on the MIM Properties, deliver to MIM an independent scoping study and technical report in respect of the Combined Property (the “Los Azules Preliminary Assessment”) and deliver a notice of

18

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

6.

MINERAL PROPERTIES AND DEFERRED EXPLORATION COSTS - continued

a.

San Juan Project - continued

exercise. MASA has incurred and paid in excess of $1 million in expenditures ($13.3 million to December 31, 2008) and expects to deliverthe Los Azules Preliminary Assessment to MIM by the end of March 2009. MASA however has not, as of yet, formally exercised the MASA Option.

On exercise of the MASA Option, MIM is required to transfer the MIM Properties to MASA. However, if in the opinion of MIM, the Los Azules Preliminary Assessment shows the potential to economically produce 100,000 tonnes (200 million pounds) of contained copper per year for 10 years or more then MIM has the right to earn a 51% interest in the Combined Property (the “Back-in Right”). To satisfy the conditions of the Back-in Right, MIM must assume control and responsibility for the Combined Property, make a cash payment to Minera Andes of three times MASA’s and its affiliates’ direct expenditures incurred and paid on the Combined Property after the 25th of November 2005 and complete a bankable feasibility study within five years of its election to exercise the Back-in- Right. In the event that the Los Azules Preliminary Assessment does not, in MIM’s opinion, meet the criterion conte mplated above, MIM’s interest is reduced to a right of first refusal on a sale of the Combined Property, or any part thereof.

b. Chubut Projects

We hold one (2007 – one) manifestation of discovery in the Precordilleran region of Chubut, totaling 1,480 ha (2007 – 1,480 ha). Expenditures in 2008 and 2007 relate primarily to land maintenance costs. As at December 31, 2008 and December 31, 2007, based on management’s assessment of the future recoverability of certain mineral properties and deferred exploration costs, $2,431 and $250,997 were written off, respectively. Land holding costs for 2009 are estimated at $3,500.

c.

Santa Cruz Projects

We currently control 9 (2007 – 15) cateos and 36 (2007 – 29) manifestations of discovery totaling 66,274 ha (2007 – 73,195 ha) in the Santa Cruz province. Land holding costs for 2008 are estimated at $10,000. We have been actively exploring in the region since 1997. The properties have been acquired on the basis of geologic and geochemical reconnaissance. Expenditures in 2007 and 2008 relate to land acquisition and reconnaissance geologic surveys on the acquired properties. Geologic evaluation of these targets is ongoing. As at December 31, 2008 and December 31, 2007, based on management’s assessment of the future recoverability of certain mineral properties and deferred exploration costs, $1,385 (2007 – $1,127,287) was written-off.

7. INVESTMENT IN MINERA SANTA CRUZ (MSC) – the San José Project

MSC is owned, as to 49%, byMASA, an indirect wholly-owned subsidiary of Minera Andes Inc. and, as to 51%, by Hochschild Mining (Argentina) Corporation S.A., a subsidiary of Hochschild Mining plc (together with its affiliates and subsidiaries, “Hochschild”).

The Corporation’s interest in, and the affairs of, MSC are governed by an option and joint venture agreement dated March 15, 2001 between MASA and Hochschild (as amended by agreements dated May 14, 2002, August 27, 2002 and September 10, 2004, the (“OJVA”).

19

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

7. INVESTMENT IN MINERA SANTA CRUZ (MSC) – the San José Project – continued

Under the OJVA we are entitled to appoint one of the three members of the Board of Directors of MSC and Hochschild is entitled to appoint the balance of the members of the Board of Directors of MSC. The OJVA grants us a “veto” in respect of certain and very limited matters regarding the affairs of MSC and the operation of the San José Project. Although we are permitted to vote against or otherwise disagree with decisions made by Hochschild in respect of the San José Project, many decisions have been made, notwithstanding our express disagreement.

In particular, we have a limited, if any, ability to control the timing or amount of cash calls and decisions made in that regard may have an adverse affect on our operations and financial position as there can be no assurance that if made, we will have the funds available to satisfy any such cash call when due and that our interest in the San José Project will not be reduced as a result.

The investment in MSC is comprised of the following:

| | | | | | | |

| | | | Year Ended |

| | | December 31, | | | December 31, |

| | | 2008 | | | 2007 |

| Investment in MSC, | | | | | | |

| beginning of year: | $ | 64,726,565 | | $ | 30,963,692 | |

| Plus: | | | | | | |

| Deferred costs incurred | | -- | | | 2,217,758 | |

| Amortization of deferred costs | | (720,000 | ) | | -- | |

| Advances during the period | | 11,310,317 | | | 36,211,000 | |

| Income (loss) from equity investment | | 1,965,238 | | | (4,665,885 | ) |

| | | | | | | |

| |

| | Investment in MSC, end of year | $ | 77,282,120 | | $ | 64,726,565 | |

| | | | | | | |

| | | | | | | |

| | | | Year Ended | |

| | | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| Summary of MSC's financial information | | | | | | |

| from operations: | | | | | | |

| Sales | $ | 111,255,558 | | $ | 1,253,361 | |

| |

| Net income (loss) - MSC | $ | 4,010,689 | | $ | (9,522,074 | ) |

| |

| Minera Andes Inc. portion - 49% | $ | 1,965,238 | | $ | (4,665,885 | ) |

| |

| Payable to MSC for cash call | $ | 11,270,000 | | $ | 16,905,000 | |

Effective January 1, 2008, the San José Project began commercial production. During the fiscal year 2007, the expenses related to the construction of the mining facility, interest expense on the

20

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

7. INVESTMENT IN MINERA SANTA CRUZ (MSC) – the San José Project - continued

debt, debt discount and other legal and consulting expenses had been capitalized as the mining facility had not been placed into commercial production.

Commencing in 2008, expenses related to the mining facility, interest expense on the debt, debt discount and other legal and consulting expenses are being expensed as incurred. In addition, the deferred capitalized costs are being amortized based on the units of production to the total reserves.

The San José project area covers approximately 50,491 ha and is comprised of 46 contiguous mining claims (“Minas” and “Manifestations of Discovery”) totalling approximately 40,498.69 ha and one exploration claim (“Cateo”) totalling 9,992.5 ha located in the western half of the province of Santa Cruz. The mining claims include 17 Minas (15,450 ha) and 29 Manifestations of Discovery (25,049 ha), “Manifestations” are claims that are in the application process for mining claim status. The cateo is controlled 100% by MSC. Any production from these lands may be subject to a provincial royalty.

Project financing for the San José Project has been primarily provided pursuant to a letter agreement dated October 10, 2006 (as amended by agreements dated October 17, 2006, October 24, 2006,

January 5, 2007, January 25, 2007, February 26, 2007, February 28, 2007, March 29, 2007, April 26, 2007 and June 29, 2007, the “Project Loan Letter Agreement”) between the Corporation, MSC and by assignment, Hochschild Mining Holdings Limited (the “Hochschild Lender”), an affiliate of Hochschild Mining plc.

Under the Project Loan Letter Agreement, the Hochschild Lender and the Corporation agreed to provide MSC with an unsecured bridge loan in the aggregate amount of $20 million (the “Bridge Loan”). The Project Loan Letter Agreement provides that the Bridge Loan was to be structured as loans to MSC by each of the Corporation and the Hochschild Lender, in each case, in amounts proportionate to the shareholdings of the Corporation and Hochschild in MSC.

The Project Loan Letter Agreement however, further provides that the loan to be made by the Corporation to MSC would be structured as (i) a loan by the Hochschild Lender to the Corporation (the “Project Loan Payable”); and (ii) a corresponding loan by the Corporation to MSC (the “Project Loan Receivable”). As a result, the Bridge Loan was made by way of (i) a loan by the Hochschild Lender to MSC in an amount equal to 51% of the amount of the Bridge Loan; (ii) a loan by the Hochschild Lender to the Corporation in an amount equal to 49% of the amount of the Bridge Loan; and (iii) a corresponding loan by the Corporation to MSC in the same amount and on the same terms as the preceding loan by the Hochschild Lender to the Corporation. Both, the Project Loan Payable and the Project Loan Receivable bear interest at the same rate and upon the same terms (including repayment).

The Project Loan Letter Agreement also provides for a permanent secured project loan in the aggregate amount of $65 million (the “Project Loan”), structured in the same manner as the Bridge Loan, and replacing the Bridge Loan, to be documented in definitive agreements, which, have not yet been entered into.

Amounts advanced under the Project Loan Letter Agreement by the Hochschild Lender to the Corporation and then by the Corporation to MSC are currently unsecured except that, as security for the loan made by the Hochschild Lender to the Corporation, the Corporation has pledged to the Hochschild Lender, its right to the repayment of the corresponding loans made by the Corporation to MSC.

21

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

7. INVESTMENT IN MINERA SANTA CRUZ (MSC) – the San José Project - continued

The current drafts of the definitive agreements (the “Draft Loan Documents”) and the Project Loan Letter Agreement provide that the Project Loan will be secured by a security interest granted by MSC in favour of the Hochschild Lender and the Corporation in certain MSC bank accounts. In addition, under the Draft Loan Documents, the Corporation will be required to (i) continue to pledge, to the Hochschild Lender, the Corporation’s right to receive repayment of the loans made by the Corporation to MSC; and (ii) grant to the Hochschild Lender a security interest in the Corporation’s security interest in MSC’s bank accounts. The Corporation will also be required to direct MSC to pay all amounts owing by it to the Corporation directly to the Hochschild Lender with such amounts being concurrently applied against amounts owing by MSC to the Corporation and the corresponding amounts owing by the Corporation to the Hochschild Lender.

The Hochschild Lender and MSC have agreedthat until the definitive agreements are finalized, no payment of interest or principal will be due. Thereafter principal will be repaid in quarterly installments, however non-payment (in and of itself) will not constitute an event of default.

The Project Loan currently bears fixed interest at LIBOR plus 2.50%, 8.21%, based on the rate at inception. It has been agreed that once the definitive agreements are finalized, interest will increase to LIBOR plus 2.85% and will be subject to interest rate fluctuations.

As at December 31, 2007 and December 31, 2008, the entire Project Loan ($65 million), had been advanced. The Corporation’s 49% share of the Project Loan was $31.85 million. Therefore, the Corporation has recorded the Project Loan Payable and the Project Loan Receivable in offsetting amounts. The project loan receivable/payable was advanced to MSC by Hochschild on the Corporation’s behalf. The related interest income/expense will be paid to the Hochschild Lender by MSC on the Corporation’s behalf.

The future minimum payments for the next four years ending December 31 are estimated to be:

| | |

2009 | $ | -- |

2010 | | 13,475,000 |

2011 | | 13,475,000 |

2012 | | 4,900,000 |

| $ | 31,850,000 |

8.

BANK LOAN

In October 2007, we entered into the second amended and restated credit agreement dated as of October 22, 2007 (the “Macquarie Credit Agreement”) with Macquarie Bank Limited (“Macquarie”), under which Macquarie made two non-revolving term loans to us, in the aggregate principal amount $17.5 million. The first non-revolving term loan was in the principal amount of $7.5 million (the “First Loan”) of which $5.9 million was for the development of the San José project and $1.6 million was for general purposes. The second non-revolving term loan was in the aggregate principal amount of $10 million (the “Second Loan” and together with the First Loan, the “Bank Loan”) of which $8.6 million was for the development of the San José project and $1.4 million was for general purposes.

The commercial terms of the First Loan includes a facility fee of 1.5% of the principal amount and interest of LIBOR plus 2% per annum. In addition, the Corporation issued Macquarie share

22

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

8.

BANK LOAN– continued

purchase warrants to acquire 4,227,669 common shares of the Corporation at an exercise price of C$2.06 per share. The warrant exercise price was calculated at a 25% premium to the volume weighted average of the Corporation’s common shares determined from the twenty business days prior to February 21, 2007. Each warrant is exercisable for two years. The warrants and the underlying common shares had a four month hold period. The fair value of the warrants was calculated using the Black-Scholes option pricing model with the following assumptions: dividend yield – Nil; risk free interest rate – 3.87%; expected volatility of 59.18% and an expected life of 24 months. The difference between the allocated fair value of the warrants and the face value of the First Loan of $1,731,100 was initially recorded as a debt discount with a corresponding entry to contributed surplus. A success fee of $7 5,000, being 1% of the principal amount of the First Loan, was paid to Xystus Limited for assisting with the structuring and negotiation of the First Loan.

The commercial terms of the Second Loan included a facility fee of 1.5% of the principal amount, interest of LIBOR plus 2.75% per annum and a maturity date of September 30, 2009. In addition, the Corporation issued Macquarie share purchase warrants to acquire 4,066,390 common shares of

the Corporation at an exercise price of C$2.41 per share. The warrant exercise price was calculated at a 20% premium to the volume weighted average of the Corporation’s common shares determined from the twenty business days prior to October 22, 2007. Each warrant is exercisable for two years. The fair value of the warrants was calculated using the Black-Scholes option pricing model with the following assumptions: dividend yield – Nil; risk free interest rate – 4.12%; expected volatility of 62.35% and an expected life of 24 months. The difference between the allocated fair value of the warrants and the face value of the Second Loan of $1,925,200 was initially recorded as a debt discount with a corresponding entry to contributed surplus. The warrants and the underlying common shares had a hold period until February 25, 2008. A success fee of $100,000, being 1% of the principal amount of the Second Loan, was paid to Xystus Limited for assisting with the structuring and negotiation of the Second Loan.

| | | | | | | | |

| | | | | | | | | Carrying |

| | Face Amount | | Discount | | Value |

| Current portion | | | | | | | |

| |

| First Loan, due March 2009 | $ | 7,500,000 | $ | 1,731,100 | | $ | 5,768,900 |

| Debt accretion at December 31, 2007 | | -- | | (596,578 | ) | | 596,578 |

| Accretion of debt discount | | -- | | (892,491 | ) | | 892,491 |

| Repayment of First Loan | | -- | | -- | | | -- |

| First Loan at December 31, 2008 | $ | 7,500,000 | $ | 242,031 | | $ | 7,257,969 |

| |

| Second Loan, due September 2009 | $ | 10,000,000 | $ | 1,925,200 | | $ | 8,074,800 |

| Debt accretion at December 31, 2007 | | -- | | (151,552 | ) | | 151,552 |

| Accretion of debt discount | | -- | | (970,946 | ) | | 970,946 |

| Repayment of Second Loan | | -- | | -- | | | -- |

| Second Loan at December 31, 2008 | $ | 10,000,000 | $ | 802,702 | | $ | 9,197,298 |

| |

| Totals | $ | 17,500,000 | $ | 1,044,733 | | $ | 16,455,267 |

23

MINERA ANDES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(U.S. Dollars)

8.

BANK LOAN– continued

During the year ended December 31, 2008, interest expense incurred on the Bank Loan was $2,817,118 of which $953,681 was interest expense and $1,863,437 was accreted interest expense (2007 – $479,974 interest expense incurred, and accreted interest expense of $627,459 related to the debt discount were capitalized to the Corporation’s investment in MSC (Note 7) using the effective interest rate method and $119,459 of interest expense incurred and accreted interest expense of $120,671 for general purposes were expensed to net loss).

Under the terms of the Macquarie Credit Agreement the Corporation was required to maintain minimum amounts of cash and cash equivalents and at December 31, 2008, the Corporation did not hold such cash and cash equivalents. This was an event of default under the Macquarie Credit Agreement. As such, Macquarie was entitled to demand immediate repayment of all amounts due thereunder. The Bank Loan was subsequently paid in full on March 4, 2009. Our obligations to Macquarie were secured by, among other things; all of our assets (see Subsequent Events Note 18).