Exhibit 99.1

NI 43-101 Technical Report

Minera Andes Inc.

San José Silver-Gold Project

Santa Cruz, Argentina

Prepared for:

Minera Andes Inc.

111 East Magnesium Rd., Suite A

Spokane, WA 99208

United States

(509) 921-7322

SRK Project Number: 171602

Prepared by:

7175 W. Jefferson Ave.

Suite 3000

Lakewood, CO 80235

Effective Date: January 30, 2009

Report Date: May 29, 2009

Endorsed by QP’s:

Leah Mach, CPG, MSc

Chris Elliott, B.Eng.(Mining), MAusIMM

Exhibit 99.1

| |

Minera Andes Inc. | i |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table of Contents

| | | | |

1 | INTRODUCTION (ITEM 4) | 1-1 |

| 1.1 | Terms of Reference and Purpose of the Technical Report | 1-1 |

| 1.2 | Reliance on Other Experts (Item 5) | 1-1 |

| | 1.2.1 | Sources of Information | 1-1 |

| 1.3 | Effective Date | 1-1 |

| 1.4 | Qualifications of Consultants (SRK) | 1-2 |

| | 1.4.1 | Site Visit | 1-3 |

2 | PROPERTY DESCRIPTION AND LOCATION (ITEM 6) | 2-1 |

| 2.1 | Property Location | 2-1 |

| 2.2 | Mineral Title in Argentina | 2-1 |

| 2.3 | Mineral Tenure for the San Jose Property | 2-3 |

| 2.4 | Location of Mineralization | 2-5 |

| 2.5 | Royalties, Agreements and Encumbrances | 2-5 |

| 2.6 | Environmental Liabilities and Permitting | 2-8 |

| | 2.6.1 | Environmental Liabilities | 2-8 |

| | 2.6.2 | Required Permits and Status | 2-8 |

3 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY (ITEM 7) | 3-1 |

| 3.1 | Topography, Elevation and Vegetation | 3-1 |

| 3.2 | Climate and Length of Operating Season | 3-1 |

| 3.3 | Physiography | 3-1 |

| 3.4 | Access to Property | 3-1 |

| 3.5 | Surface Rights | 3-1 |

| | 3.5.1 | Estancia Carmancita | 3-2 |

| | 3.5.2 | Estancia San José | 3-2 |

| 3.6 | Local Resources and Infrastructure | 3-2 |

| | 3.6.1 | Access Road and Transportation | 3-2 |

| | 3.6.2 | Power Supply | 3-3 |

| | 3.6.3 | Water Supply | 3-3 |

| | 3.6.4 | Camp Site, Buildings and Ancillary Facilities | 3-3 |

| | 3.6.5 | Waste Disposal Area | 3-4 |

| | 3.6.6 | Manpower | 3-4 |

4 | HISTORY (ITEM 8) | 4-1 |

| 4.1 | Ownership | 4-1 |

| 4.2 | Past Exploration and Development | 4-1 |

| 4.3 | Historic Mineral Resource and Reserve Estimates | 4-3 |

| 4.4 | Historic Production | 4-4 |

5 | GEOLOGIC SETTING (ITEM 9) | 5-1 |

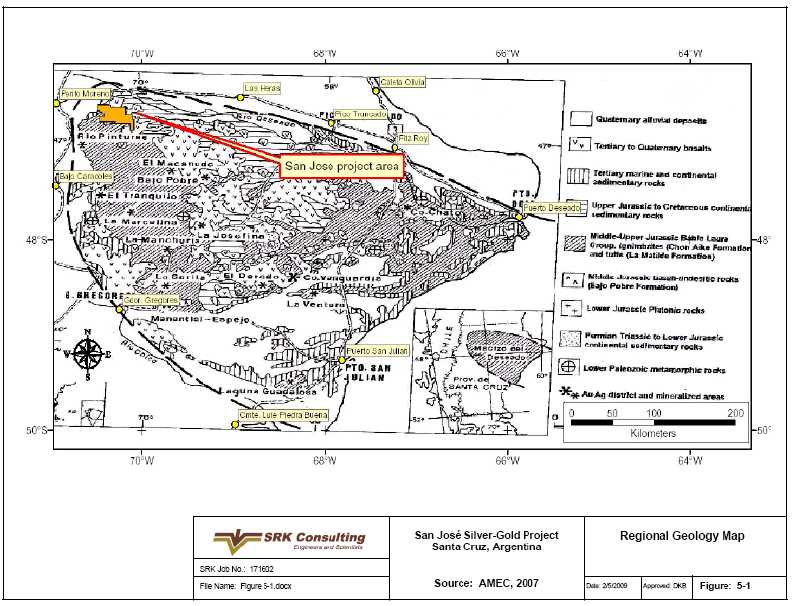

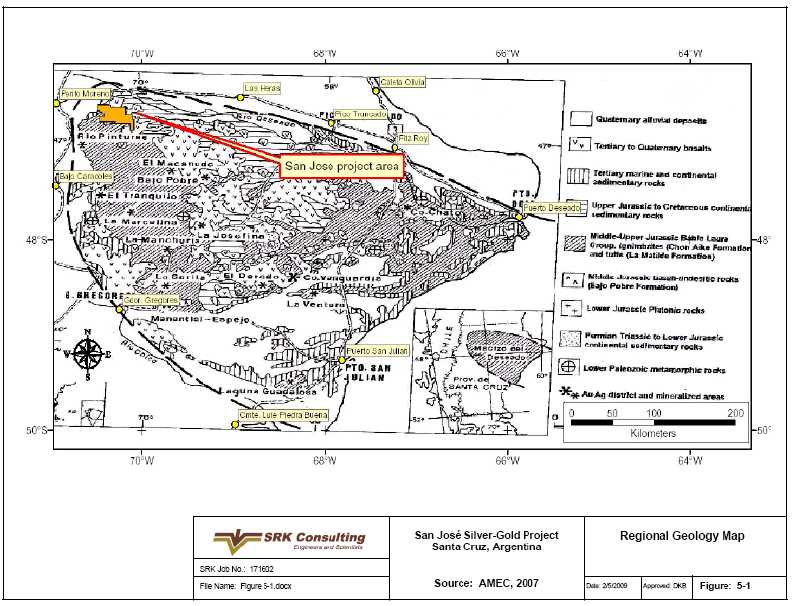

| 5.1 | Regional Geology | 5-1 |

| 5.2 | San José Regional and Local Geology | 5-1 |

| | 5.2.1 | Bajo Pobre Formation (Upper Jurassic) | 5-1 |

| | 5.2.2 | Chon Aike/La Matilde Formation (Upper Jurassic) | 5-3 |

| | 5.2.3 | Castillo Formation (Cretaceous) | 5-5 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | ii |

San José Silver-Gold Project | NI 43-101 Technical Report |

| | | | |

| | 5.2.4 | Alma Gaucha Formation (Tertiary) | 5-5 |

| | 5.2.5 | Fluvio-glacial Till Deposits | 5-6 |

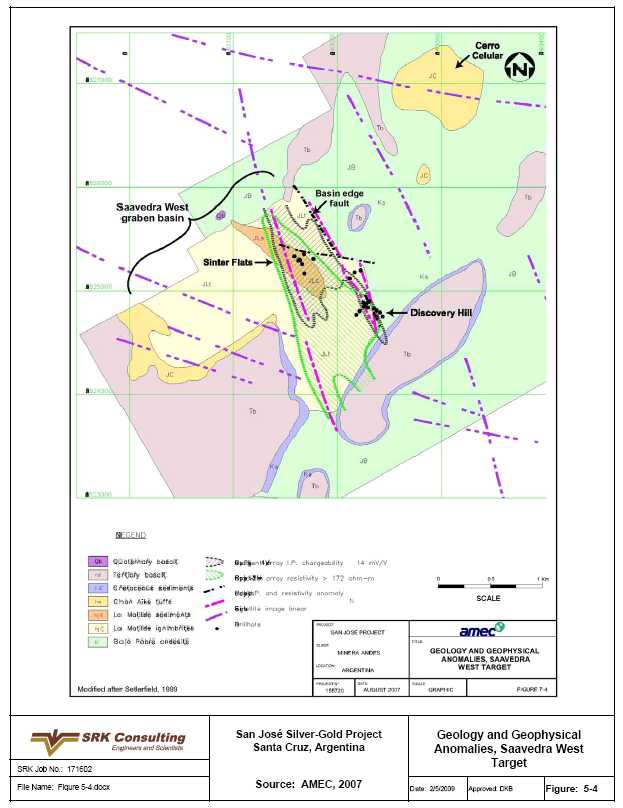

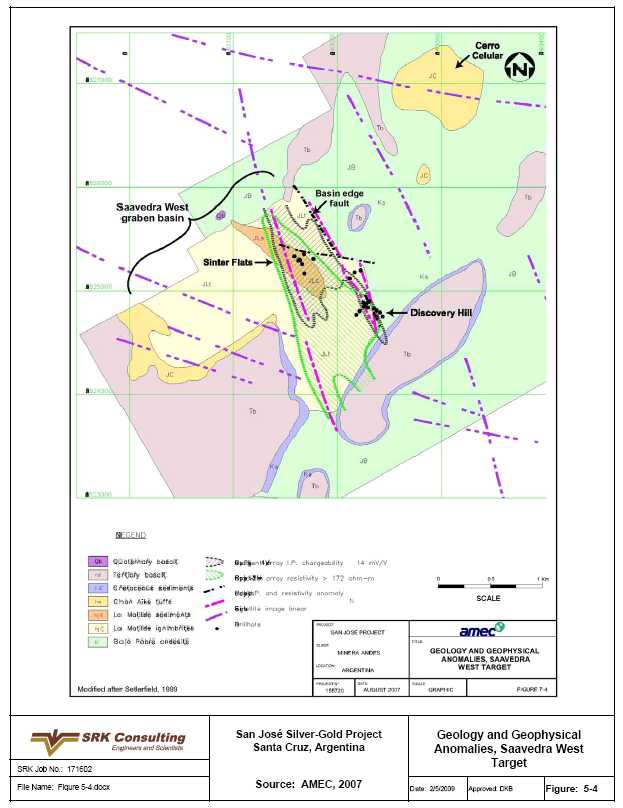

| | 5.2.6 | Geology of the Saavedra West Zone | 5-6 |

| | 5.2.7 | Structure | 5-7 |

6 | DEPOSIT TYPE (ITEM 10) | 6-1 |

| 6.1 | Introduction | 6-1 |

| 6.2 | Some General Characteristics of Low Sulphidation Epithermal Gold Deposits | 6-1 |

7 | MINERALIZATION (ITEM 11) | 7-1 |

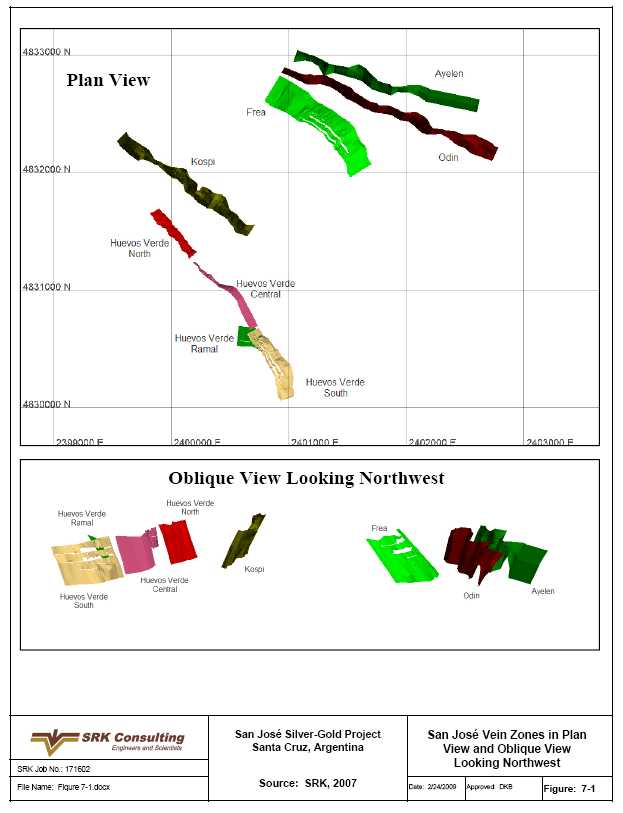

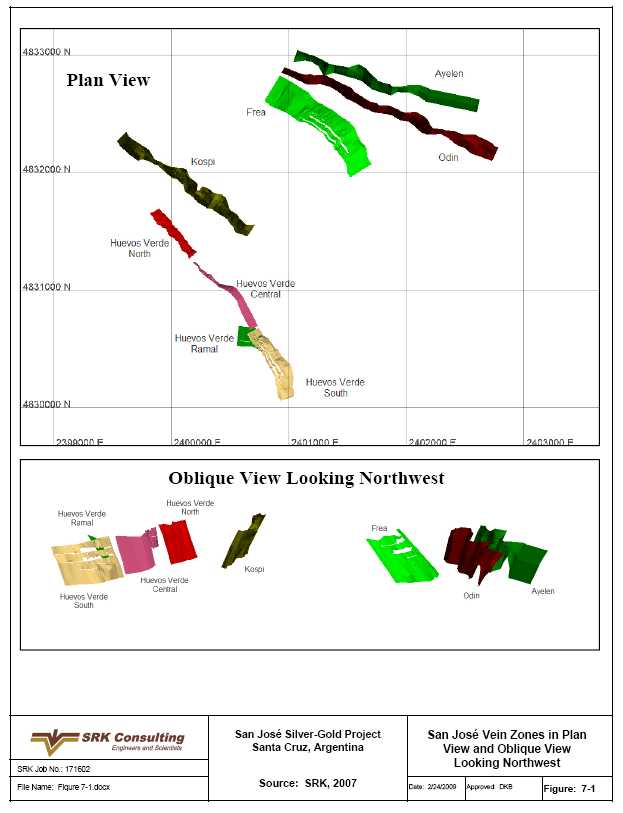

| 7.1 | Mineralized Zones | 7-1 |

| | 7.1.1 | Huevos Verdes | 7-1 |

| | 7.1.2 | Kospi | 7-2 |

| | 7.1.3 | Frea | 7-2 |

| | 7.1.4 | Odin and Ayelin | 7-2 |

| | 7.1.5 | Regional Exploration Targets | 7-2 |

| 7.2 | Surrounding Rock Types | 7-3 |

| 7.3 | Relevant Geological Controls | 7-3 |

| | 7.3.1 | Structural Model | 7-4 |

| 7.4 | Type, Character and Distribution of Mineralization | 7-5 |

8 | EXPLORATION (ITEM 12) | 8-1 |

| 8.1 | Surveys and Investigations | 8-1 |

| | 8.1.1 | Minera Andes | 8-1 |

| | 8.1.2 | MSC | 8-2 |

| 8.2 | Summary | 8-5 |

| 8.3 | Interpretation | 8-6 |

| 8.4 | Exploration Potential | 8-7 |

9 | | DRILLING (ITEM 13) | 9-1 |

| 9.1 | Type and Extent of Drilling | 9-1 |

| 9.2 | Procedures | 9-1 |

| 9.3 | Results | 9-3 |

10 | | SAMPLING METHOD AND APPROACH (ITEM 14) | 10-1 |

| 10.1 | Drilling Programs | 10-1 |

| | 10.1.1 | Minera Andes RC Drilling (1998 to 2000) | 10-1 |

| | 10.1.2 | Minera Andes Diamond Drilling (2000) | 10-1 |

| | 10.1.3 | MSC Core Drilling (2001) | 10-2 |

| | 10.1.4 | MSC Core Drilling (2002 to 2007) | 10-2 |

| 10.2 | Trenching | 10-3 |

| | 10.2.1 | Minera Andes Trenching (1997 to 2000) | 10-3 |

| | 10.2.2 | MSC Trenching (2002) | 10-3 |

| 10.3 | Underground Channel Chip Sampling (2004 to 2007) | 10-4 |

| 10.4 | 2008 Sampling | 10-4 |

| 10.5 | Factors Impacting Accuracy of Results | 10-5 |

| 10.6 | Sample Quality | 10-5 |

11 | | SAMPLE PREPARATION, ANALYSES AND SECURITY (ITEM 15) | 11-1 |

| 11.1 | Drilling Programs | 11-1 |

| | 11.1.1 | Minera Andes RC Drilling (1998 to 2000) | 11-1 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | iii |

San José Silver-Gold Project | NI 43-101 Technical Report |

| | | | | |

| | 11.1.2 | Minera Andes Diamond Drilling (2000) | 11-1 |

| | 11.1.3 | MSC Core Drilling (2001) | 11-1 |

| | 11.1.4 | MSC Core Drilling (2002 to 2005) | 11-2 |

| | 11.1.5 | MSC Core Drilling (2006-2007) | 11-2 |

| 11.2 | Quality Assurance/Quality Control Programs | 11-2 |

| | 11.2.1 | Minera Andes RC and Core Drilling Programs (1998 to 2000) | 11-2 |

| | 11.2.2 | MSC Core Drilling Programs (2001 to 2003) | 11-2 |

| | 11.2.3 | MSC Core Drilling and Underground Programs (2004 to 2005) | 11-2 |

| | 11.2.4 | MSC Core Drilling and Underground Programs (2006-2007) | 11-5 |

| | 11.2.5 | AMEC Recommendations (2007) | 11-8 |

| 11.3 | MSC Analytical and QA/QC 2008 | 11-9 |

| 11.4 | Interpretation | 11-11 |

12 | DATA VERIFICATION (ITEM 16) | 12-1 |

| 12.1 | Verification | 12-1 |

| 12.2 | Limitations | 12-1 |

13 | ADJACENT PROPERTIES (ITEM 17) | 13-1 |

14 | MINERAL PROCESSING AND METALLURGICAL TESTING (ITEM 18) | 14-1 |

| 14.1 | Ore and Mineralogy Description | 14-1 |

| | 14.1.1 | Gold | 14-1 |

| | 14.1.2 | Silver | 14-1 |

| 14.2 | Metallurgical Test Programs | 14-2 |

| | 14.2.1 | Degerstrom – U.S. (1998-1999) | 14-2 |

| | 14.2.2 | Tecsup - Peru (2002) | 14-2 |

| | 14.2.3 | Plenge (2004) | 14-3 |

| | 14.2.4 | Lakefield/SGS - Canada (2004-2005) | 14-3 |

| | 14.2.5 | Gekko - Australia (2006-2007) | 14-4 |

| | 14.2.6 | Tecsup - Peru (2007) | 14-4 |

| 14.3 | Metallurgical Test Results | 14-5 |

| | 14.3.1 | Degerstrom – U.S. (1998-1999) | 14-5 |

| | 14.3.2 | Tecsup - Peru (2002) | 14-5 |

| | 14.3.3 | Plenge (2004) | 14-5 |

| | 14.3.4 | Lakefield/SGS - Canada (2004-2005) | 14-5 |

| | 14.3.5 | Gekko - Australia (2006-2007) | 14-6 |

| | 14.3.6 | Tecsup - Peru (2007) | 14-7 |

| | 14.3.7 | Summary of Metallurgical Test Results | 14-8 |

| 14.4 | Process Circuit Selection | 14-8 |

| | 14.4.1 | Metallurgical Basis for Process Circuit Selection | 14-9 |

15 | MINERAL RESOURCES AND MINERAL RESERVE ESTIMATES (ITEM 19) | 15-1 |

| 15.1 | Resource Estimation | 15-1 |

| | 15.1.1 | Database | 15-1 |

| | 15.1.2 | Geology | 15-1 |

| | 15.1.3 | Capping | 15-3 |

| | 15.1.4 | Compositing | 15-3 |

| | 15.1.5 | Specific Gravity | 15-4 |

| | 15.1.6 | Variogram Analysis and Modeling | 15-5 |

| | 15.1.7 | Grade Estimation | 15-5 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | iv |

San José Silver-Gold Project | NI 43-101 Technical Report |

| | | | | |

| | 15.1.8 | Model Validation | 15-7 |

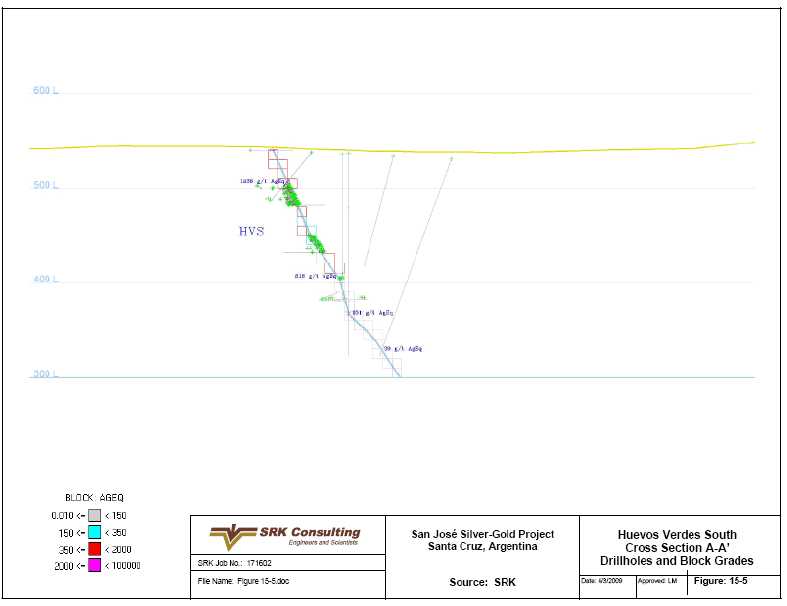

| | 15.1.9 | Resource Classification | 15-7 |

| | 15.1.10 | Mineral Resource Statement | 15-8 |

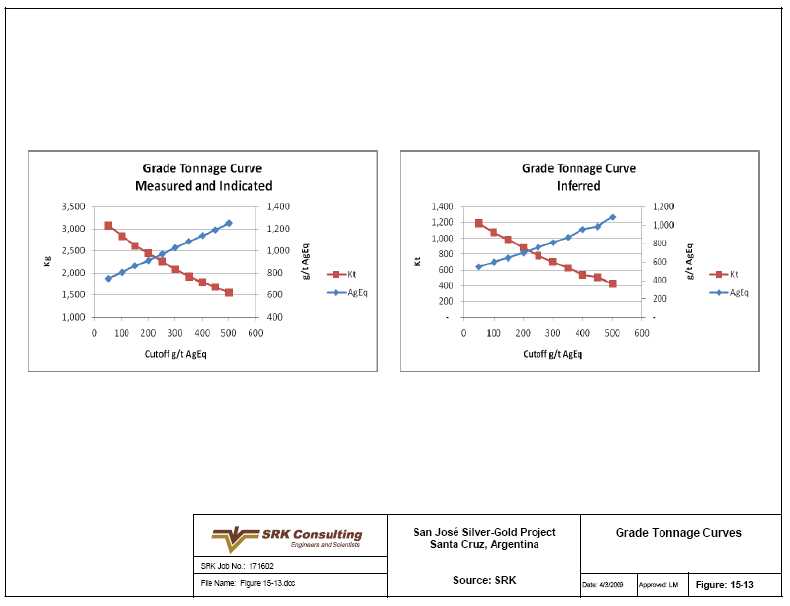

| | 15.1.11 | Mineral Resource Sensitivity | 15-8 |

| 15.2 | Reserve Estimation | 15-9 |

| | 15.2.1 | Contained Value Calculation | 15-10 |

| | 15.2.2 | Cut-off Value Estimate | 15-11 |

| | 15.2.3 | Mining Dilution | 15-12 |

| | 15.2.4 | Mining Recovery | 15-13 |

| | 15.2.5 | Comparison of Modifying Factors | 15-13 |

| | 15.2.6 | Reserve Estimate | 15-14 |

| | 15.2.7 | Conversion of Mineral Resources to Mineral Reserves | 15-14 |

16 | OTHER RELEVANT DATA AND INFORMATION (ITEM 20) | 16-1 |

| 16.1 | Depletion of Resources and Reserve | 16-1 |

| 16.2 | Comparison of Reserve Estimates | 16-1 |

| 16.3 | Material Occurrences in the Six Months to December 31, 2008 | 16-2 |

17 | ADDITIONAL REQUIREMENTS FOR DEVELOPMENT AND PRODUCTION PROPERTIES (ITEM 25) | 17-1 |

| 17.1 | Mining Operations | 17-1 |

| | 17.1.1 | Rock Mechanics | 17-2 |

| | 17.1.2 | Mine Access and Development | 17-3 |

| 17.2 | Mining Method | 17-4 |

| | 17.2.1 | Mining Equipment | 17-5 |

| | 17.2.2 | Services | 17-6 |

| | 17.2.3 | Mine Ventilation | 17-7 |

| | 17.2.4 | Waste Rock | 17-7 |

| | 17.2.5 | Mining Method Outlook | 17-7 |

| 17.3 | Processing | 17-8 |

| | 17.3.1 | Recoverability | 17-9 |

| 17.4 | Markets and Contracts | 17-10 |

| 17.5 | Environmental Considerations | 17-10 |

| 17.6 | Taxes and Royalties | 17-10 |

| 17.7 | Capital and Operating Costs | 17-12 |

| | 17.7.1 | Capital Costs | 17-12 |

| | 17.7.2 | Operating Costs | 17-12 |

| | 17.7.3 | Payback | 17-13 |

| 17.8 | Economic Analysis | 17-13 |

| | 17.8.1 | LoM Plan and Economics | 17-13 |

| | 17.8.2 | Sensitivity | 17-14 |

18 | INTERPRETATION AND CONCLUSIONS (ITEM 21) | 18-1 |

| 18.1 | Geology and Mineralization | 18-1 |

| 18.2 | Field Surveys | 18-1 |

| 18.3 | Analytical and Testing Data | 18-1 |

| 18.4 | Mineral Resources | 18-2 |

| 18.5 | Mineral Reserves | 18-2 |

| 18.6 | Economics | 18-2 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | v |

San José Silver-Gold Project | NI 43-101 Technical Report |

| | | | |

| 18.7 | Other Relevant Information | 18-2 |

| | 18.7.1 | Mine Development and Production | 18-2 |

19 | RECOMMENDATIONS (ITEM 22) | 19-1 |

| 19.1 | Geology and Resources | 19-1 |

| 19.2 | Mining and Reserves | 19-1 |

| 19.3 | Metallurgy and Processing | 19-1 |

20 | REFERENCES (ITEM 23) | 20-1 |

21 | GLOSSARY | 21-1 |

| 21.1 | Mineral Resources and Reserves | 21-1 |

| | 21.1.1 | Mineral Resources | 21-1 |

| | 21.1.2 | Mineral Reserves | 21-1 |

| 21.2 | Glossary | 21-3 |

List of Tables

| |

Table 1: Mineral Resource Statement, Including Reserves* | IV |

Table 2: Mineral Resources, 49% Attributable to MAI, Including Reserves* | IV |

Table 3: Mineral Reserve Statement, June 30, 2008 | IV |

Table 4: Mineral Reserve Attributable to Minera Andes, June 30, 2008 | V |

Table 5: LoM Economic Results | VIII |

Table 6: Project NPV Sensitivity to discount rate(US$000’s) | VIII |

Table 2.3.1: San José Mineral Concessions | 2-4 |

Table 2.6.2.1: Permits, Applied for or Granted | 2-9 |

Table 4.2.1: General Exploration History of San José Property | 4-2 |

Table 4.3.1: San José - Mineral Resources, June 30, 2007* | 4-3 |

Table 4.3.2: Proven and Probable Mineral Reserves – June 30, 2007* | 4-4 |

Table 4.4.1: Mine Production, 2007 and 2008 | 4-4 |

Table 8.2.1: Surface Samples Collected at San José | 8-5 |

Table 8.2.2: Trenches and Trench Sample Summary | 8-6 |

Table 8.2.3: Geophysical Surveys Completed at San José | 8-6 |

Table 9.1.1: San José Exploration Yearly Drilling Summary | 9-1 |

Table 11.1.4.1: Analytical Methods | 11-2 |

Table 11.2.3.1: Summary of 2004 to 2005 QA/QC Program | 11-3 |

Table 11.2.4.1: Summary of 2006 QA/QC Program (Kospi Vein Core Drilling) | 11-5 |

Table 11.2.4.2: Duplicate Sample Evaluation, Kospi Vein | 11-6 |

Table 11.2.4.3: Summary of 2005-June 2007 QA/QC Programs* | 11-7 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | vi |

San José Silver-Gold Project | NI 43-101 Technical Report |

| |

Table 11.2.4.4: Twin Sample Evaluation, Channel Samples | 11-8 |

Table 11.3.1: Standards in Use at San José | 11-9 |

Table 14.3.4.1: Metallurgical Results from Test Work | 14-6 |

Table 14.3.5.1: Summary Results of Gekko Test Program | 14-6 |

Table 14.3.5.2: Concentrate Leach Test Results for Gekko | 14-7 |

Table 14.3.6.1: Test Results for Initial Metallurgical Amenability | 14-7 |

Table 14.3.6.2: Test Results for Metallurgical Amenability Tests | 14-7 |

Table 14.4.1.1: Production Results for the San José Process Plant for 2008 | 14-11 |

Table 15.1.2.1: Summary of Geologic Sections | 15-2 |

Table 15.1.2.2: Statistics of Assays within Mineralized Zone, by Area | 15-2 |

Table 15.1.3.1: Gold and Silver Capping Values | 15-3 |

Table 15.1.4.1: Statistics of Composite Interval Lengths | 15-3 |

Table 15.1.4.2: Statistics of Uncapped and Capped Composites in Mineralized Zones | 15-4 |

Table 15.1.5.1: Density Measurements, Huevos Verdes, Frea and Kospi | 15-4 |

Table 15.1.6.1: Relative Variogram Parameters | 15-5 |

Table 15.1.7.1: Block Model Definition | 15-6 |

Table 15.1.7.2: Estimation Parameters by Area | 15-6 |

Table 15.1.8.1: Comparison of Kriged and Nearest Neighbor Block Grades | 15-7 |

Table 15.1.9.1: Resource Classification Criteria | 15-8 |

Table 15.1.10.1: Mineral Resource Statement, Including Reserves* | 15-8 |

Table 15.1.10.2: Mineral Resources, 49% Attributable to MAI, Including Reserves* | 15-8 |

Table 15.1.11.1: Mineral Resource Sensitivity, Measured and Indicated | 15-9 |

Table 15.1.11.2: Mineral Resource Sensitivity, Inferred | 15-9 |

Table 15.2.2.1: Calculation of Cut-off Value | 15-11 |

Table 15.2.5.1: Comparison of Modifying Factors | 15-13 |

Table 15.2.6.1: Mineral Reserve Statement, June 30, 2008 | 15-14 |

Table 15.2.6.2: Mineral Reserve Attributable to Minera Andes, June 30, 2008 | 15-14 |

Table 16.1.1: Summary of Depletion to December 31, 2008 | 16-1 |

Table 16.2.1: Comparison of Modifying Factors | 16-2 |

Table 17.2.1.1: Major Equipment Inventory | 17-6 |

Table 17.3.1.1: SRK’s LoM Production Forecast for San José | 17-10 |

Table 17.7.1.1: LoM Capital Cost Estimates for San José (US$000s) | 17-12 |

Table 17.7.2.1: LoM Operating Cost Estimates for San José | 17-13 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | vii |

San José Silver-Gold Project | NI 43-101 Technical Report |

| |

Table 17.8.1.1: LoM: LoM Economic Results | 17-14 |

Table 17.8.2.1: Project Sensitivity (NPV8%, US$000’s) | 17-15 |

Table 17.8.2.2: Project NPV Sensitivity to discount rate (US$000’s) | 17-15 |

Table 21.2.1: Glossary | 21-3 |

Table 21.2.2: Abbreviations | 21-4 |

List of Figures

| |

Figure 2-1: Location Map of the San José Silver-Gold Project | 2-10 |

Figure 2-2: Mining and Exploration Concessions with Mineralized Zones at San José | 2-11 |

Figure 2-3: Project Concessions with Areas of Surface Right Agreements and Mineralization | 2-12 |

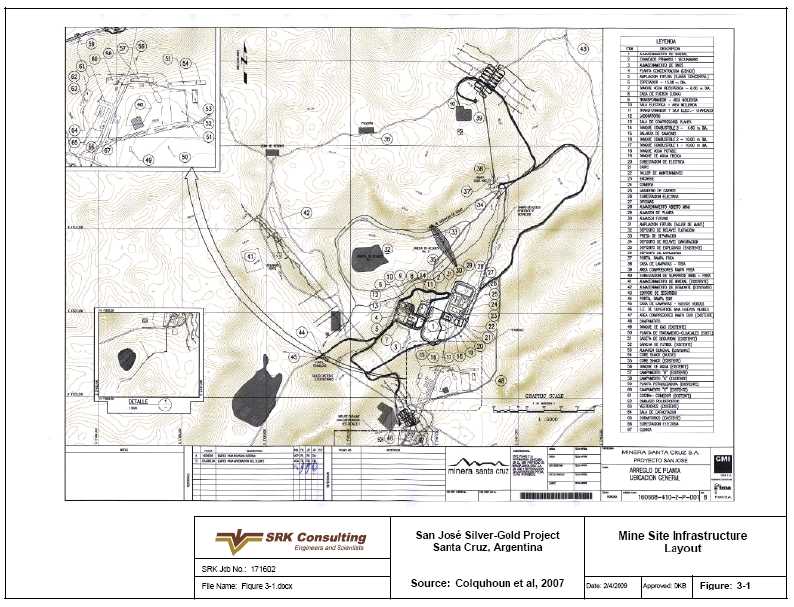

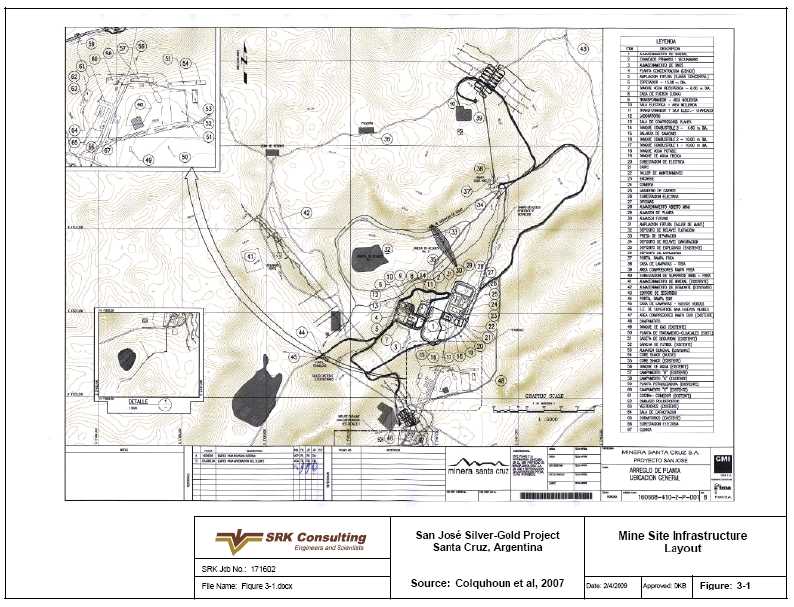

Figure 3-1: Mine Site Infrastructure Layout | 3-5 |

Figure 5-1: Regional Geology Map | 5-9 |

Figure 5-2: Local Geology Map | 5-10 |

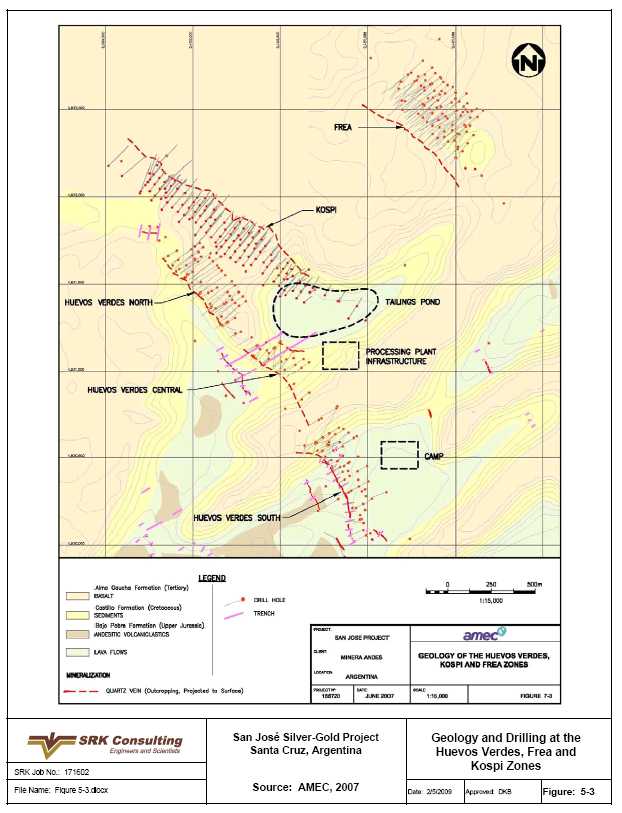

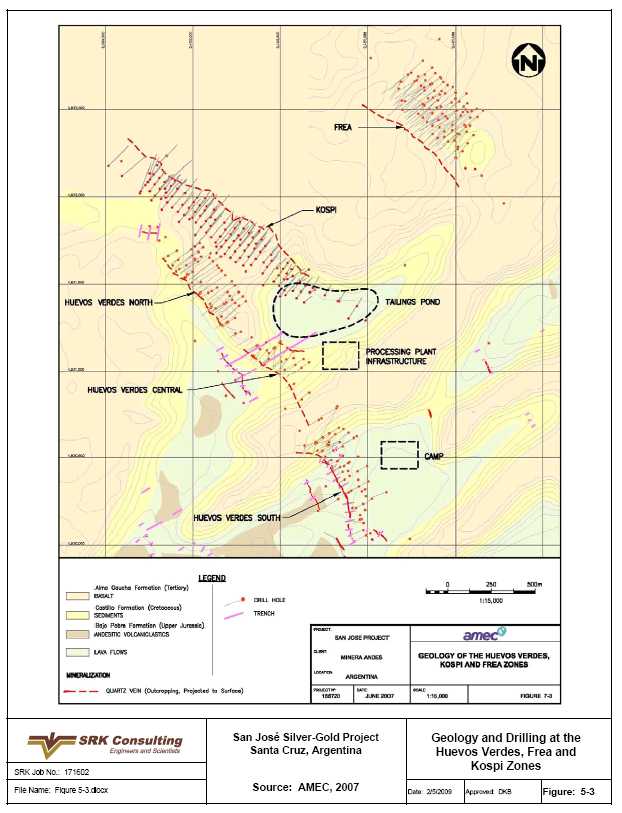

Figure 5-3: Geology and Drilling at the Huevos Verdes, Frea and Kospi Zones | 5-11 |

Figure 5-4: Geology and Geophysical Anomalies, Saavedra West Target | 5-12 |

Figure 5-5: Principal Structural Lineaments | 5-13 |

Figure 7-1: San José Vein Zones In Plan View and Oblique View Looking Northwest | 7-6 |

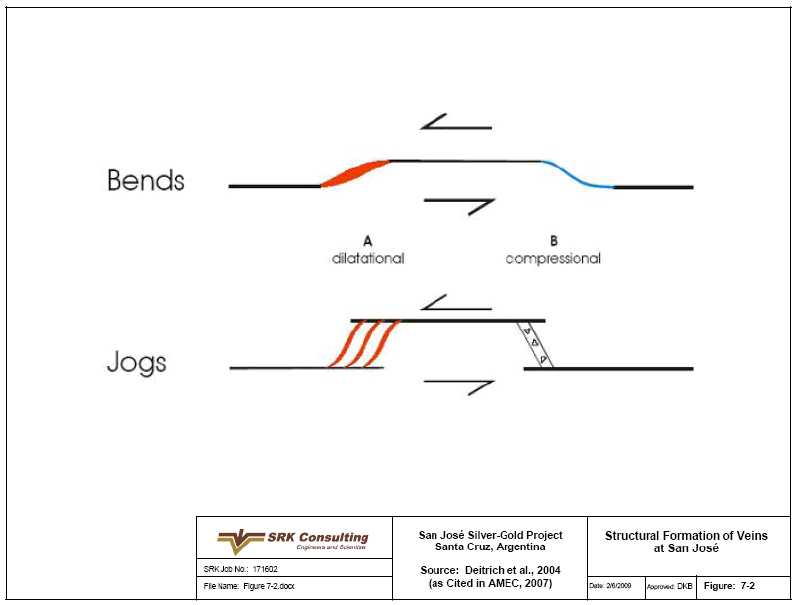

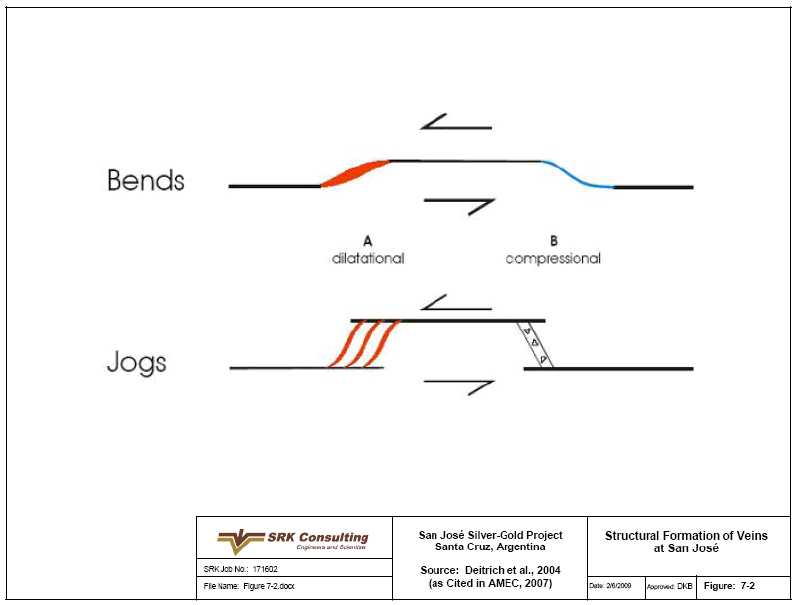

Figure 7-2: Structural Formation of Veins at San José | 7-7 |

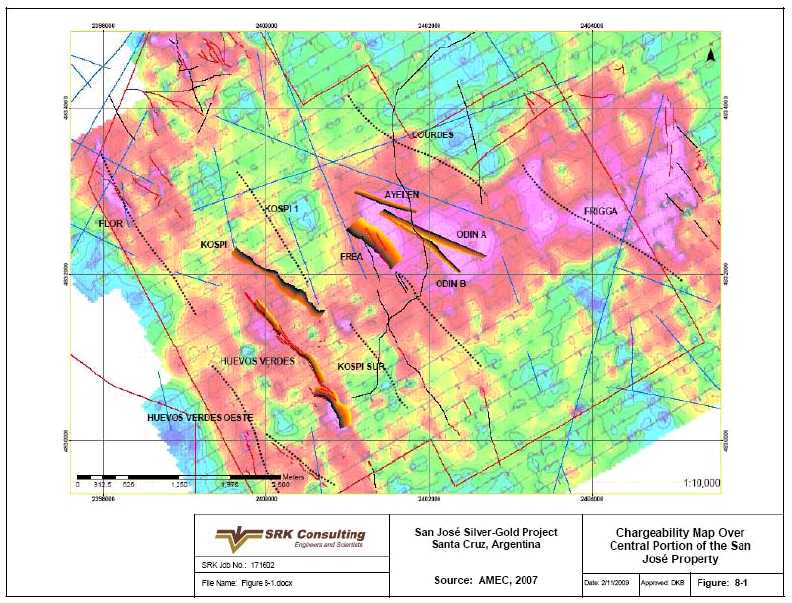

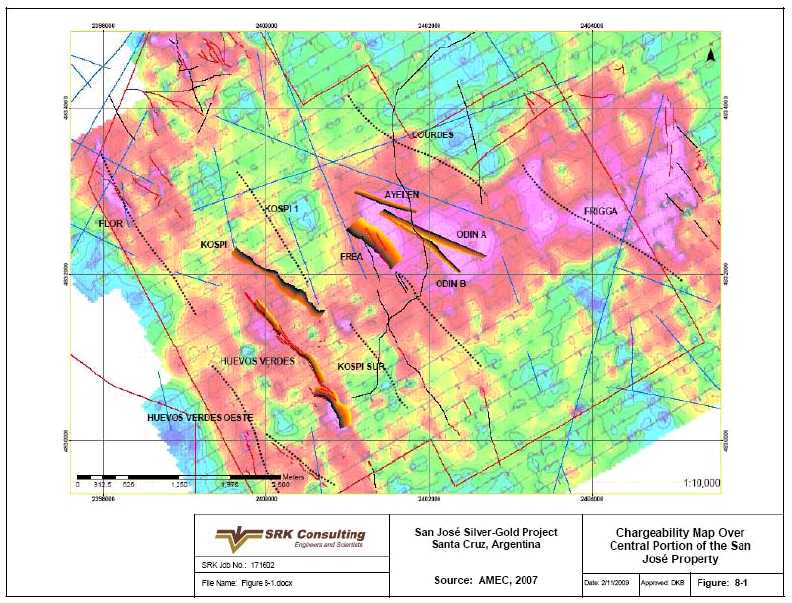

Figure 8-1: Chargeability Map Over Central Portion of the San José Property | 8-8 |

Figure 8-2: Resistivity Map Over Central Portion of the San José Property | 8-9 |

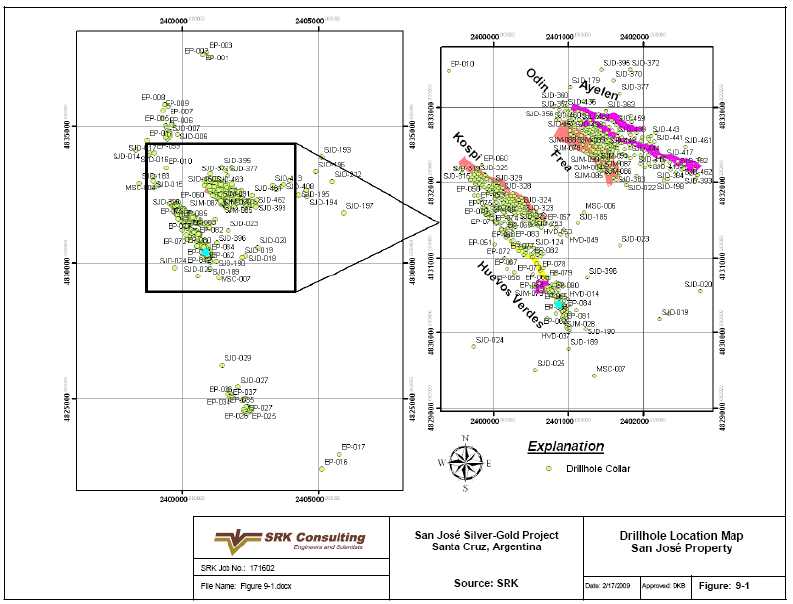

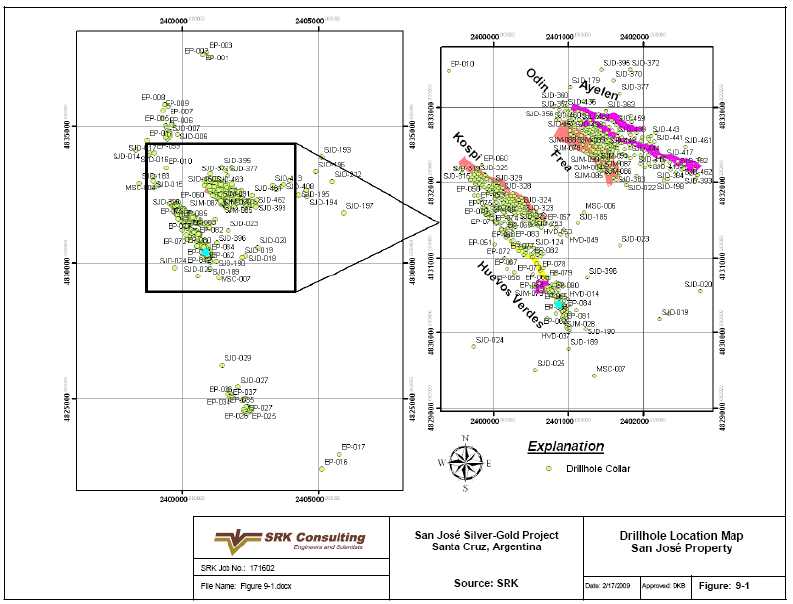

Figure 9-1: Drillhole Location Map at the San José Property | 9-5 |

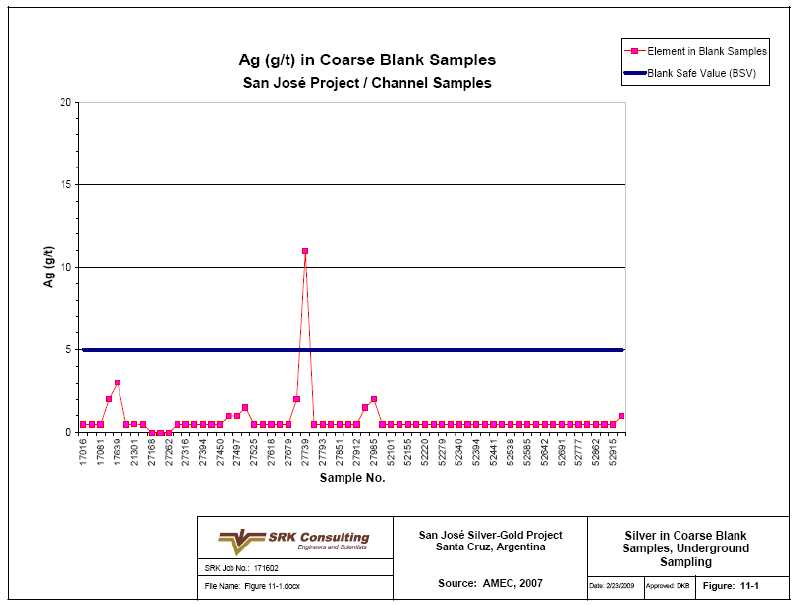

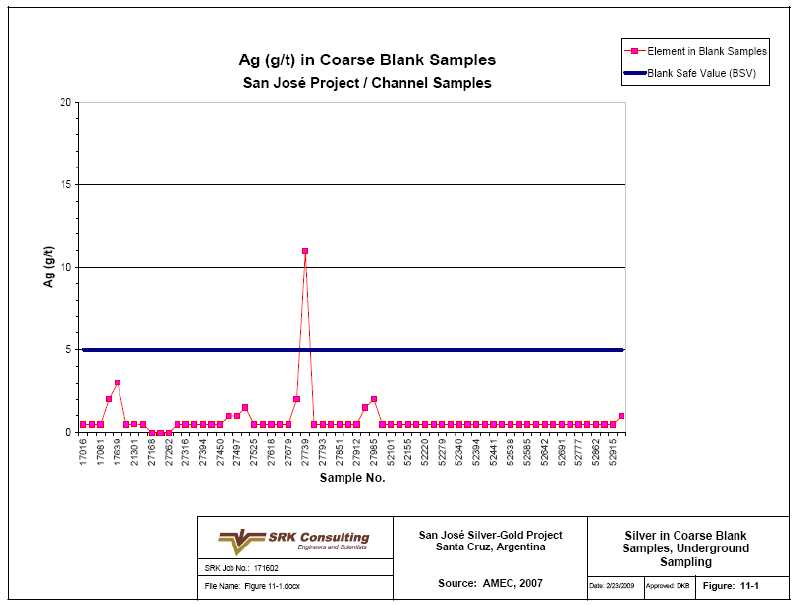

Figure 11-1: Silver in Coarse Blank Samples, Underground Sampling | 11-13 |

Figure 14-1: Average Gekko Batch Leach Test Results | 14-12 |

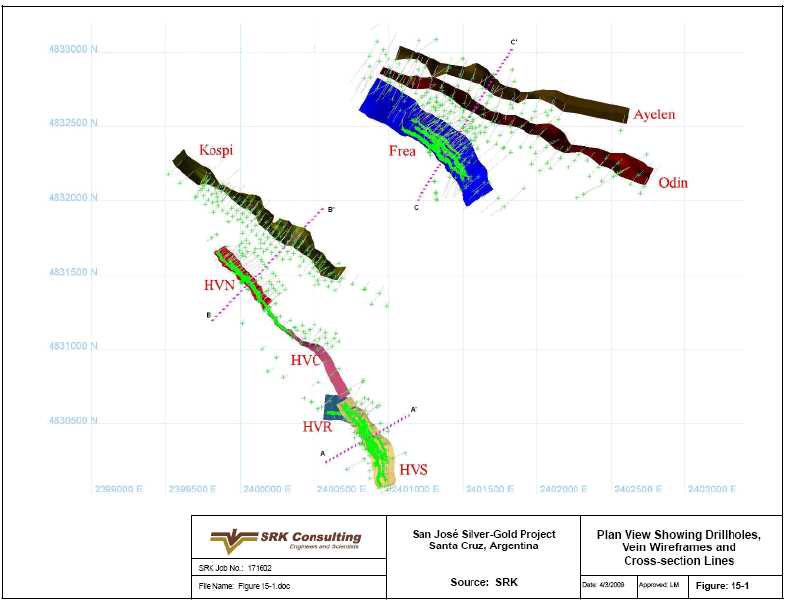

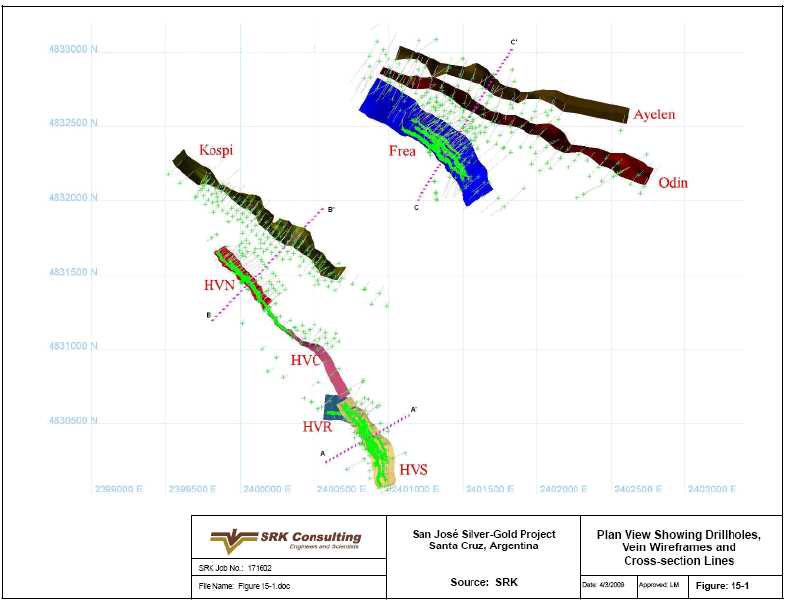

Figure 15-1: Plan View Showing Drillholes, Vein Wireframes and Cross-section Lines | 15-16 |

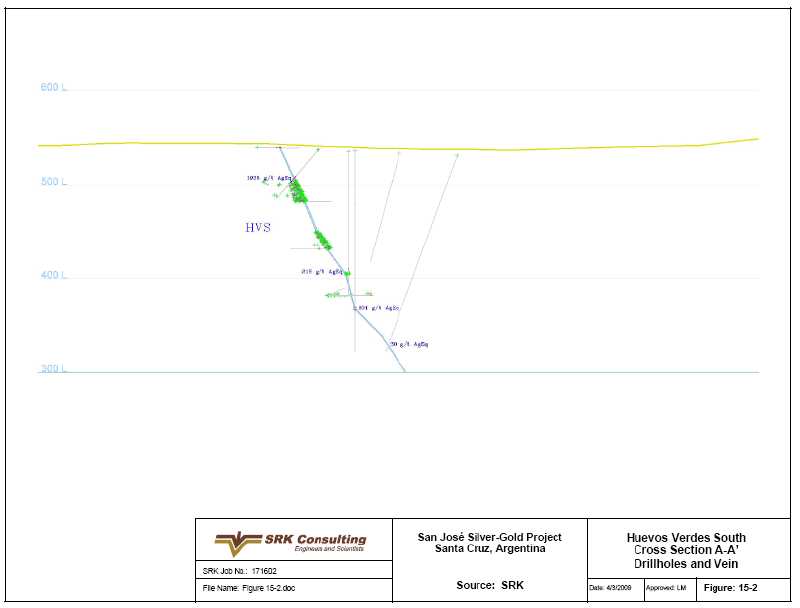

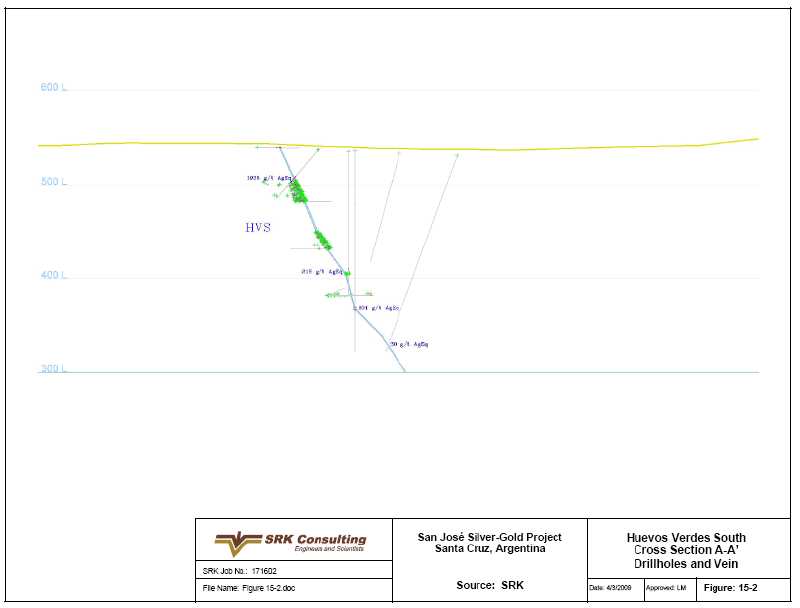

Figure 15-2: Huevos Verdes South Cross Section A-A’ Drillholes and Vein | 15-17 |

Figure 15-3: Huevos Verdes North and Kospi Cross Section B-B’ Drillholes and Veins | 15-18 |

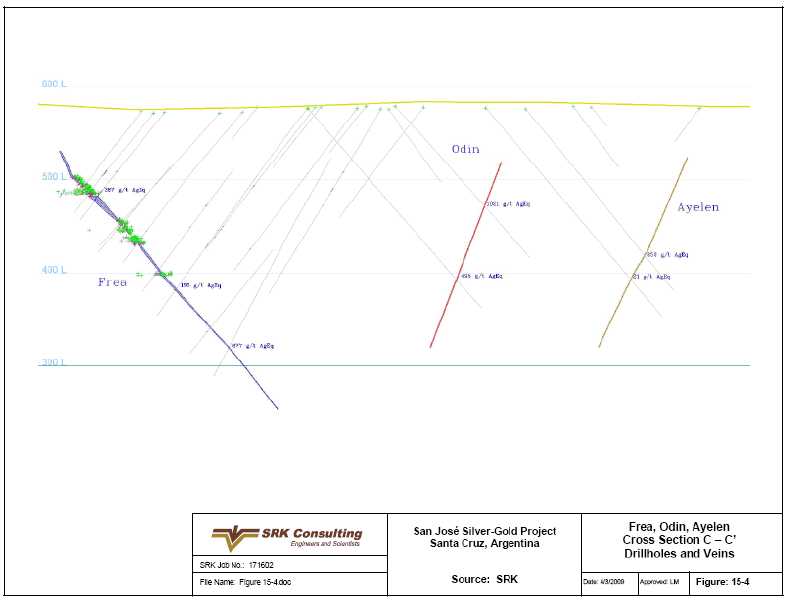

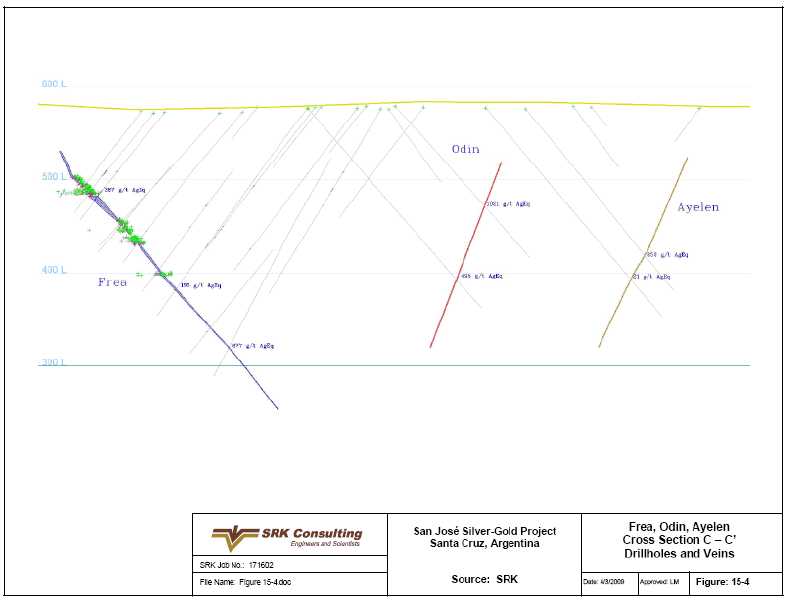

Figure 15-4: Frea, Odin, Ayelén Cross Section C – C’ Drillholes and Veins | 15-19 |

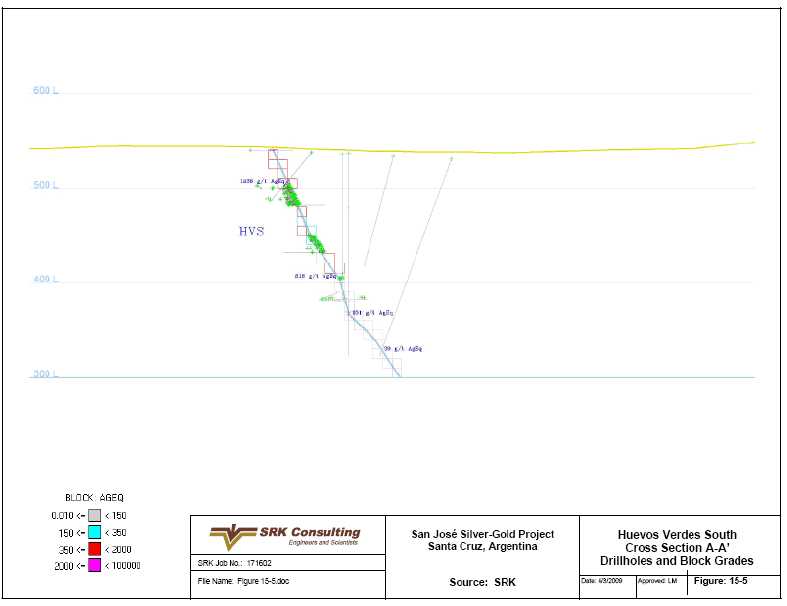

Figure 15-5: Huevos Verdes South Cross Section A-A’ Drillholes and Block Grades | 15-20 |

Figure 15-6: Huevos Verdes North and Kospi Cross Section B-B’ Drillholes and Block Grades | 15-21 |

Figure 15-7: Frea, Odin, Ayelén Cross Section C-C’ Drillholes and Block Grades | 15-22 |

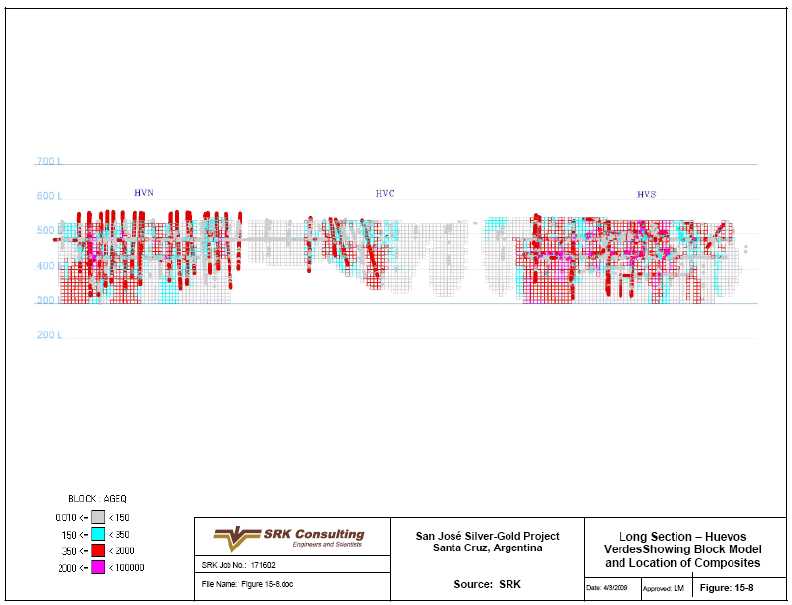

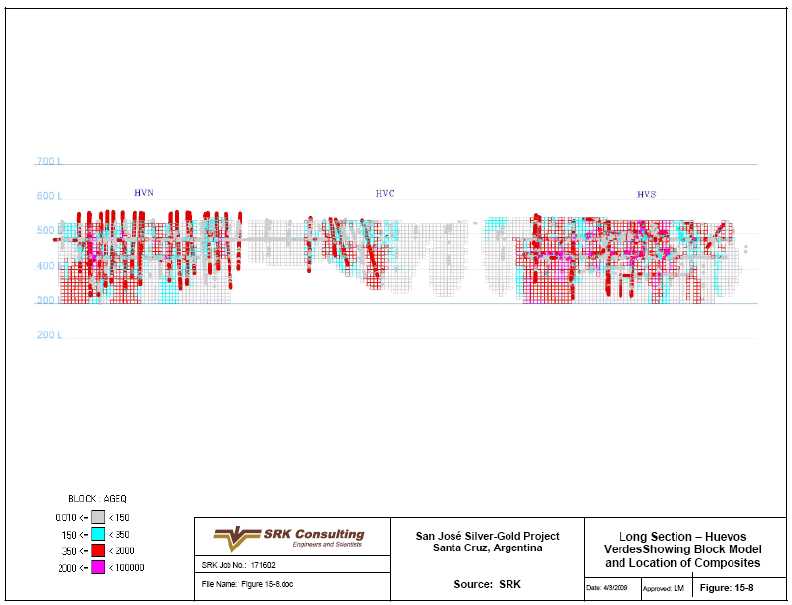

Figure 15-8: Long Section – Huevos Verdes Showing Block Model and Location of Composites | 15-23 |

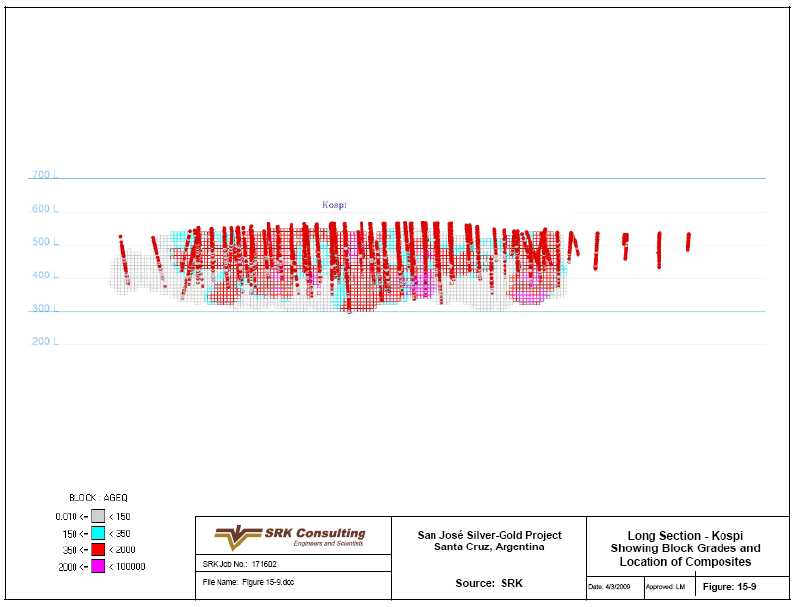

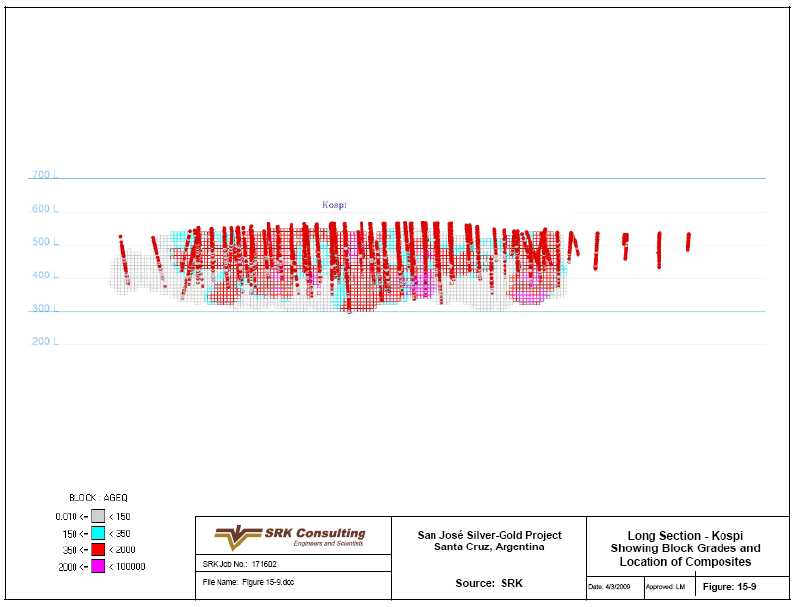

Figure 15-9: Long Section – Kospi Showing Block Grades and Location of Composites | 15-24 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | viii |

San José Silver-Gold Project | NI 43-101 Technical Report |

| |

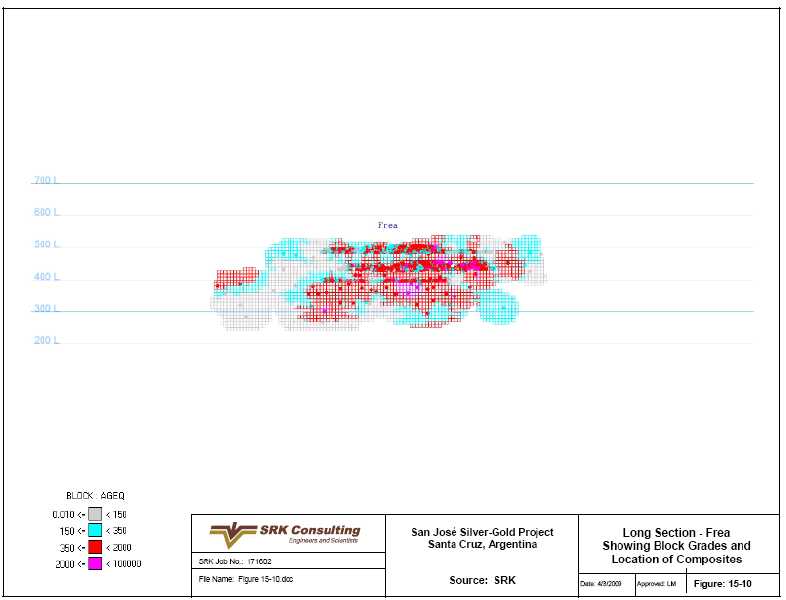

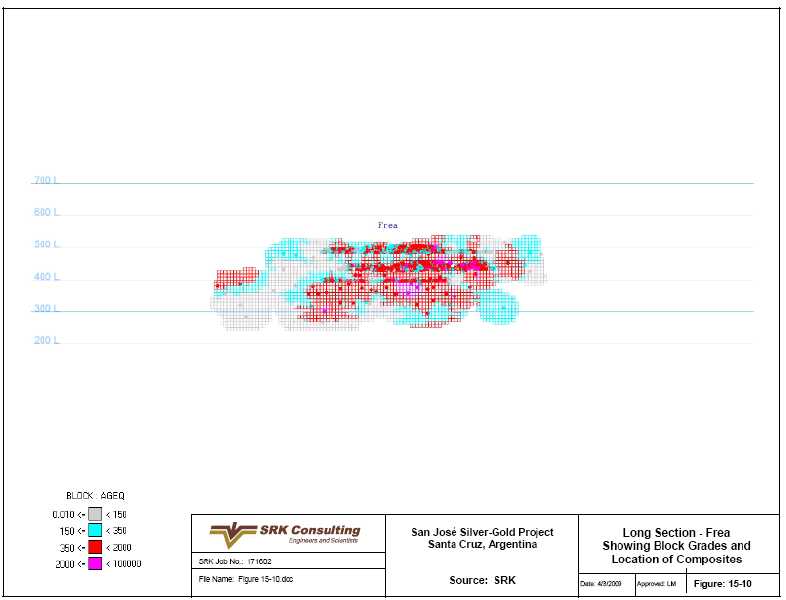

Figure 15-10: Long Section – Frea Showing Block Grades and Location of Composites | 15-25 |

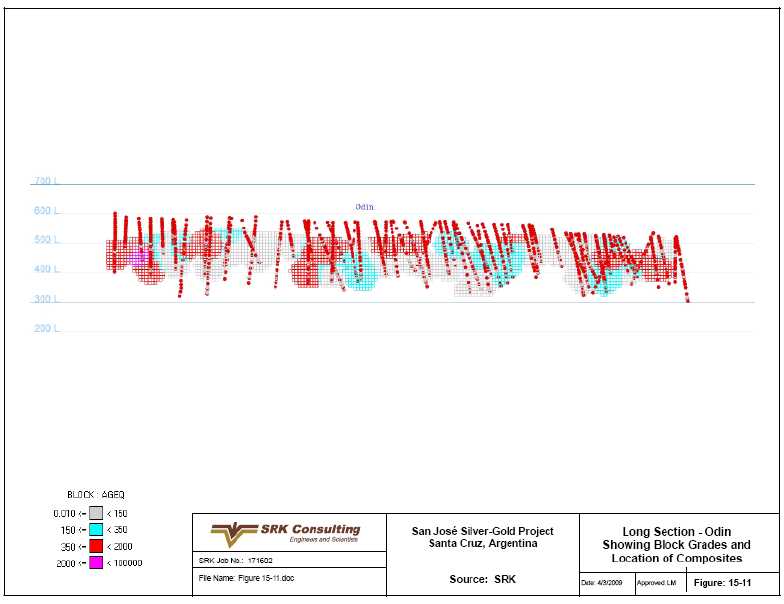

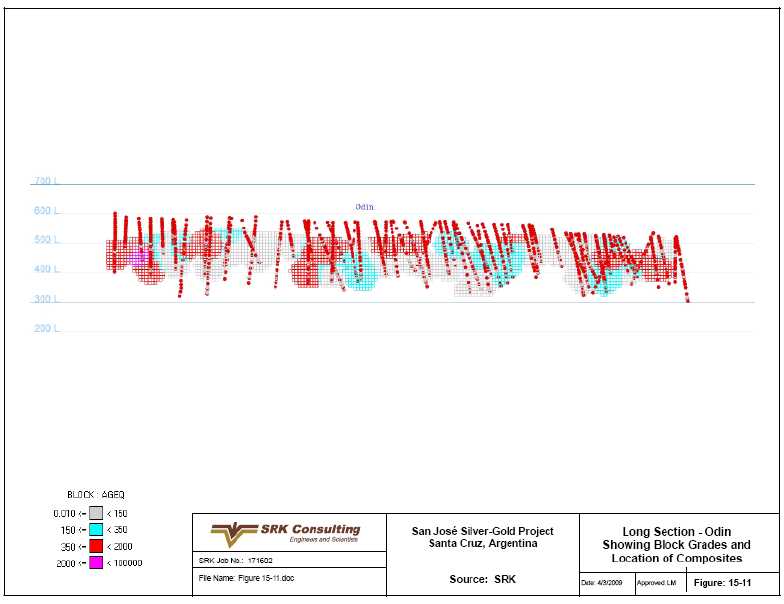

Figure 15-11: Long Section – Odin Showing Block Grades and Location of Composites | 15-26 |

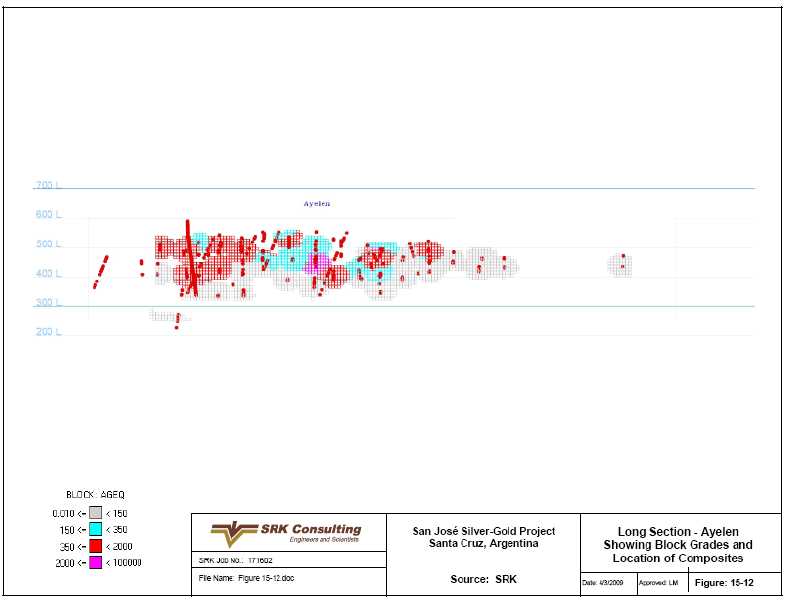

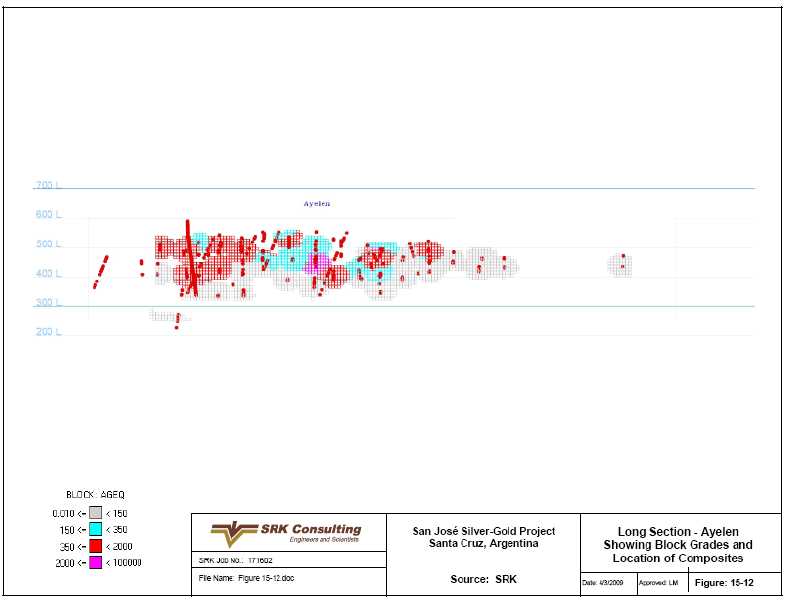

Figure 15-12: Long Section – Ayelén Showing Block Grades and Location of Composites | 15-27 |

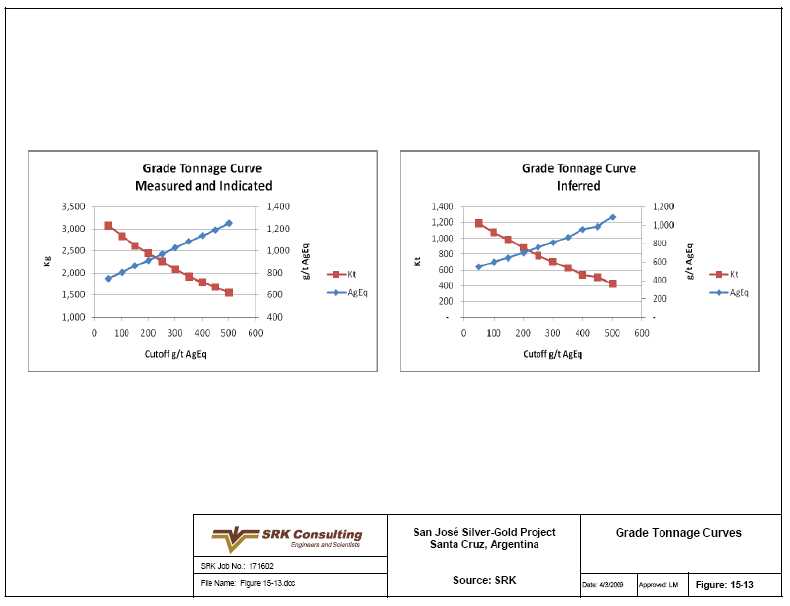

Figure 15-13: Grade Tonnage Curves | 15-28 |

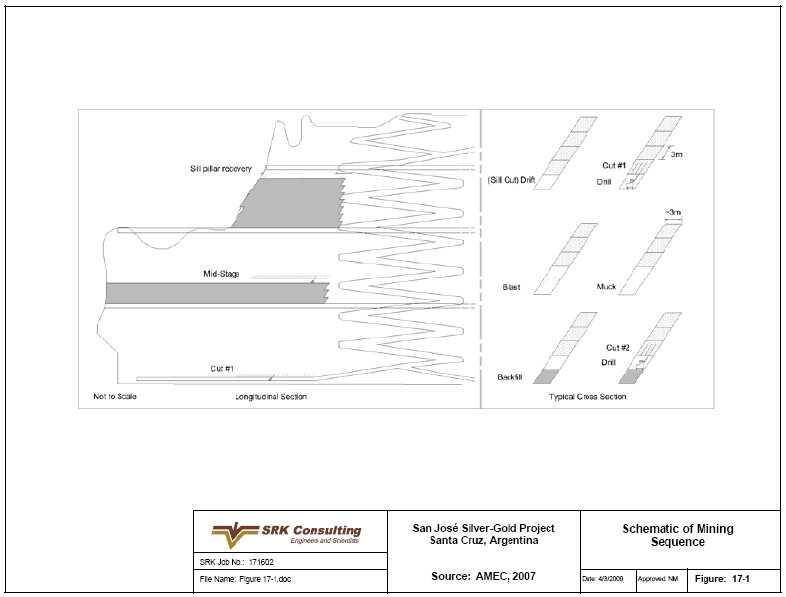

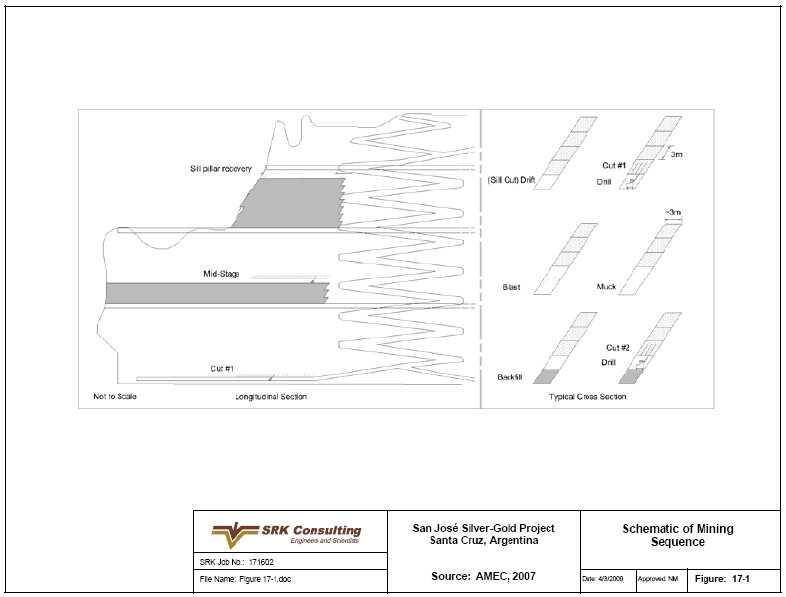

Figure 17-1: Schematic of Mining Sequence | 17-16 |

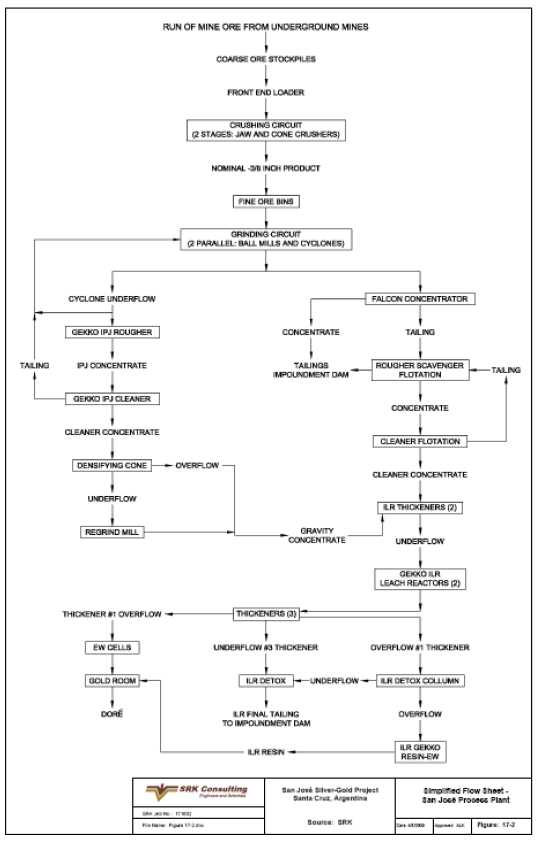

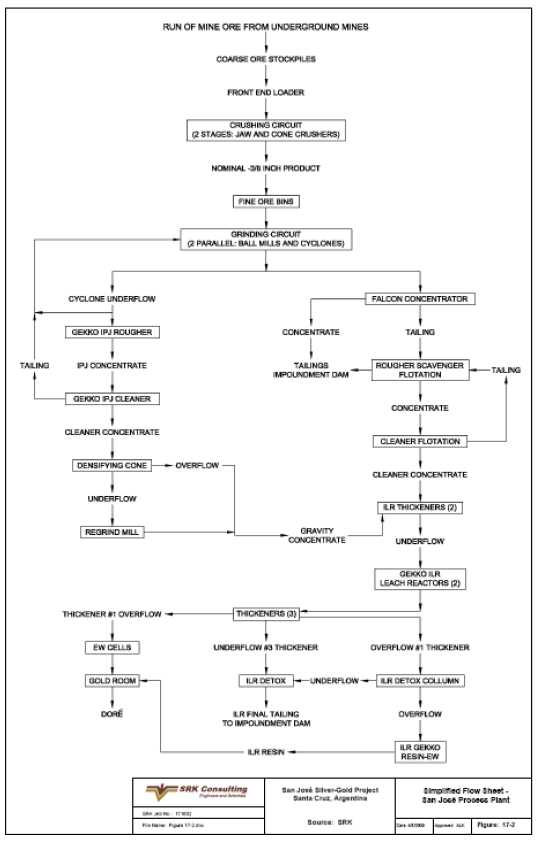

Figure 17-2: Simplified Flow Sheet - San José Process Plant | 17-17 |

List of Appendices

Appendix A

Certificates of Authors

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | I |

San José Silver-Gold Project | NI 43-101 Technical Report |

Summary(Item 3)

Property Description and Location

The San José Silver-Gold Project (San José or the Project) is in southern Argentina in the Patagonian steppe, east of the Andes Mountains. The area is dominated by low rolling hills and incised valleys. Elevation ranges from 300 to 700masl. Vegetation is characteristic of arid to semi-arid steppes with tussock grasses and low growing bushes. The soil is poor, typical of harsh environments, and is not suitable for agriculture but supports sheep and cattle grazing.

The Project can be accessed from Buenos Aires by flying to the town of Comodoro Rivadavia, then driving 350km along paved and unpaved roads.

Ownership

Minera Santa Cruz S.A. (MSC) holds 100% interest in the Project. MSC is a joint venture between Minera Andes S.A. (MASA) (49%) and Hochschild Mining (Argentina) Corporation (HMC) (51%). MASA is an indirect wholly-owned subsidiary of Minera Andes Inc. (MAI). HMC is a wholly owned subsidiary of Hochschild Mining plc (HMP).

The Project covers 50,491ha, comprising 46 contiguous Mining Claims (eight “Minas” or approved mining claims; and 38 “Manifestations” or claims that are in the application process for mining claim status) and one exploration claim (Cateo). Mineral Reserves are hosted on “Minas” El Pluma E3 and El Pluma 4. The claims are all in good standing, with the appropriate annual holding costs paid. MSC holds the surface rights to the “San José Estancia,” where the mine and associated infrastructure are constructed and the “La Carmancita Estancia,” which provides right of way access between the mine and closest paved highway.

In Argentina, surface rights are not associated with minas or exploration claims and must be negotiated with landowners. MSC has agreements with two property owners for surface rights at the Project. These surface rights cover the main access route to San José from the highway and all required mine infrastructure, tailings, dumps and included compensation for exploration activities. The local landowners are the Beitía Family, who control the Estancia San José, from which the Project takes its name, and the Flores Family who own the Estancia Carmancita. The Estancia San José includes land over the mine and the Estancia Carmancita includes land between the Project and the highway. These surface rights are sufficient for access, mining and exploration activities.

Geology and Mineralization

The Project is located in the northwest corner of the Deseado massif in Southern Argentina. The massif consists of Paleozoic metamorphic rocks overlain by Jurassic volcanics which host several gold and silver bearing deposits such as Cerro Vanguardia, Martha, Manantial Espejo and San José.

The host rock of the San José deposit is the Jurassic Bajo Pobre Formation, the lowermost stratigraphic unit on the property which comprises a Lower Andesite Volcaniclastic Unit and an Upper Andesite Lava Flow Unit. The formation is approximately 120m in thickness. Andesitic volcanic rocks of the Bajo Pobre Formation are overlain by volcanic rocks of the Chon Aike Formation.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | II |

San José Silver-Gold Project | NI 43-101 Technical Report |

The main structural trend of faults and the majority of vein systems on the San José property is northwest to north–northwest. Less prominent are faults and mineralized features strike east and to a minor extent north to north–northeast.

The San José District is transected by two north–northeast-striking major lineaments. The Rio Pinturas lineament follows the Rio Pinturas valley and is one of the main structural features of the northwestern Deseado massif. This lineament can be traced over a distance of 100km. A second subparallel lineament is located approximately 2km east of the Rio Pinturas lineament.

There are currently five mineralized vein zones of economic interest on the San José property. These veins and their currently explored strike lengths from south to north are:

·

Huevos Verdes—2km long, striking 325º, average dip 75ºE (42ºE in the south);

·

Kospi—1.3km long, striking 307º, average dip 56ºW;

·

Frea—1km long, striking 312º, average dip 50ºE;

·

Odin—1.9km long, striking 291º, average dip 67ºW; and

·

Ayelin—1.6km long, striking 285º, average dip 60ºW.

All of the veins average 1 to 2m in thickness but can be up to 4m wide. They are found within a north-south trending mineralized belt approximately 2.5km in length. All five vein zones are hosted by the Bajo Pobre Formation, strike northwest and have similar metal zoning. Metal zoning is characterized by a decrease in Ag and Au grade and increasing base metal concentrations with depth. Huevos Verdes South (HVS) was exposed at surface, but all other veins were “blind” targets and discovered through drilling and geophysical surveys.

The vein systems at Huevos Verdes, and possibly also at Frea, developed along northwest-striking sinistral strike-slip faults that were possibly reactivated during a period of Triassic rifting.

The gold and silver mineralization on the San José property is considered to be typical of low-sulfidation (LS) epithermal-style deposits. The epithermal environment is typically shallow in depth, hosting deposits of Au, Ag, and base metals plus Hg, Sb, S, kaolinite, alunite and silica (Hedenquist et al., 2000). Historically, epithermal–hydrothermal deposits have been exploited for a wide variety of metal and minerals; however, many of the more economically significant deposits are mined for their precious metal contents.

Exploration

Most of the vein zones at San José are blind targets and require indirect exploration methods to identify favorable targets. MAI and subsequently MSC have used a combination of several techniques to successfully identify exploration targets. These have included various types of soil sampling and geophysical surveys. Once the target is identified, trenching and drilling are used to confirm mineralization. Drilling is further used to delineate resources and with additional detail, underground mining is started.

Because most of the targets at San José are blind, remote sensing has been an integral part of locating and defining the orebodies. Resistivity/IP surveys have been used to find many of the vein zones at San José.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | III |

San José Silver-Gold Project | NI 43-101 Technical Report |

A total of 702 RC and diamond drillholes in 124,556.34m have been drilled at San José between 1998 and June 2008. Drilling conducted by MAI between 1998 and 2000, included 85 RC holes and three diamond drillholes. Since 2001, all drilling has been conducted by MSC, and during this time, MSC has completed five RC holes and 609 diamond drillholes within the Project area The majority of drilling has been from surface but also includes underground drilling in the Kospi area. Exploration drilling has been used in conjunction with geophysical and geochemical surveys to identify potential mineralized zones. Since 2004, the majority of drilling has been focused in the Huevos Verdes, Frea and Kospi vein systems, to provide infill drilling for resource definition and delineation. Recently, MSC has conducted drilling programs at the Ayelen and Odin veins and has added those areas to its resource base.

MSC is conducting underground channel sampling and underground drilling for use in resource estimation and has an on-going exploration program to identify and drill new target areas.

Mineral Resources

The mineral resource estimates for the San José were prepared by employees of MSC and MHP, the majority owner and operator of MSC. The processes were reviewed and the results were audited by SRK.

The samples database contains information for drilling (RC and core), underground channel samples and surface trenches. Channel and trench samples are treated as drill samples in the database, with collars, bearing and inclination and sample intervals. The assay intervals are coded with a variable “ore” that denotes its presence in a structure. The coding is based on a minimum length of about 0.9m and a silver equivalent value based on US$600/oz gold and US$10.50/oz silver, without consideration to recovery. Vertical cross-sections were constructed perpendicular to the strike of the structures. Polygons were drawn on each cross-section to outline the mineralization. Wireframe solids were constructed from the polygons for each vein.

Log-normal probability plots of the raw assays were examined to determine capping limits for gold and silver. Assays were composited on 2m intervals using only the intercepts defined as “ore”, except Huevos Verdes where the interval length was 1m. The capping values were applied to the composites after the compositing run. Variography studies were completed using composites at Huevos Verdes, Frea and Kospi.

Six block models were created, one for each of the resource areas. The block models were oriented parallel to the strike of the mineralized zone with cell size of 10m x 10m x 10m. The block model contains variables for percent of block within the structure, thickness of the vein, diluted vein thickness, Ag, Au, number of composites used in estimation, distance to the nearest composite and number of drillholes used in estimation. The block grades at Huevos Verdes, Frea and Kospi were estimated with Ordinary Kriging within the vein structures and using composites which had been designated as “ore” as described above. The block grades of Huevos Verdes Ramal (HVR), Ayelén and Odin were estimated with the Inverse Distance Squared (ID2) algorithm. The resources were classified as measured, indicated, or inferred based on the distance to the nearest composite and the n umber of composites used in the estimation. The resources, including reserves, for the San José Project as of June 30, 2008 are presented in Table 1 and the 49% of the resources attributable to MAI is contained in Table 2.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | IV |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table 1: Mineral Resource Statement, Including Reserves*

| | | | | | | | | | | | |

| Measured | Indicated | Measured and Indicated | Inferred |

Vein | kt | Ag

g/t | Au

g/t | kt | Ag

g/t | Au

g/t | kt | Ag

g/t | Au

g/t | kt | Ag

g/t | Au

g/t |

Huevos Verdes | 292 | 649 | 8.57 | 268 | 398 | 4.88 | 560 | 529 | 6.80 | 25 | 249 | 3.46 |

Frea | 446 | 415 | 8.77 | 299 | 312 | 7.63 | 745 | 374 | 8.31 | 113 | 181 | 4.27 |

Odin | 0 | 0 | 0.00 | 196 | 298 | 5.27 | 196 | 298 | 5.27 | 371 | 237 | 4.88 |

Kospi | 0 | 0 | 0.00 | 887 | 609 | 6.86 | 887 | 609 | 6.86 | 58 | 813 | 11.38 |

Ayelén | 0 | 0 | 0.00 | 79 | 466 | 6.22 | 79 | 466 | 6.22 | 334 | 476 | 5.31 |

HVR | 12 | 446 | 5.16 | 19 | 420 | 4.67 | 31 | 430 | 4.86 | 11 | 414 | 4.43 |

Total | 750 | 507 | 8.63 | 1,749 | 483 | 6.46 | 2,499 | 490 | 7.11 | 912 | 356 | 5.33 |

*June 30, 2008 at a cut-off of 181g/t AgEq

Table 2: Mineral Resources, 49% Attributable to MAI, Including Reserves*

| | | | | | | | | | | | |

Vein | Measured | Indicated | Measured and Indicated | Inferred |

kt | Ag g/t | Au g/t | kt | Ag g/t | Au g/t | kt | Ag g/t | Au g/t | kt | Ag g/t | Au g/t |

Huevos Verdes | 143 | 649 | 8.57 | 131 | 398 | 4.88 | 274 | 529 | 6.80 | 12 | 249 | 3.46 |

Frea | 218 | 415 | 8.77 | 147 | 312 | 7.63 | 365 | 374 | 8.31 | 55 | 181 | 4.27 |

Odin | 0 | 0 | 0.00 | 96 | 298 | 5.27 | 96 | 298 | 5.27 | 182 | 237 | 4.88 |

Kospi | 0 | 0 | 0.00 | 435 | 609 | 6.86 | 435 | 609 | 6.86 | 28 | 813 | 11.38 |

Ayelén | 0 | 0 | 0.00 | 39 | 466 | 6.22 | 39 | 466 | 6.22 | 163 | 476 | 5.31 |

HVR | 6 | 446 | 5.16 | 9 | 420 | 4.67 | 15 | 430 | 4.86 | 5 | 414 | 4.43 |

Total | 368 | 507 | 8.63 | 857 | 483 | 6.46 | 1,224 | 490 | 7.11 | 447 | 356 | 5.33 |

*June 30, 2008 at a cut-off of 181g/t AgEq

Mineral Reserves

Mineral reserves at the HVS, Huevos Verdes Central (HVC), Huevos Verdes North (HVN), Frea and Kospi veins were estimated by MSC staff and reviewed/adjusted by Christopher Elliott (MAusIMM) from SRK, as seen in Table 3. The estimate reported in the tables are in accordance with CIM Mineral Resource and Mineral Reserve Standards.

Table 3: Mineral Reserve Statement, June 30, 2008

| | | | | | |

Vein | Category | Tonnes (kt) | Ag (g/t) | Au (g/t) | Ag (koz) | Au (koz) |

Huevos Verdes | Proven | 249 | 470 | 6.43 | 3,768 | 52 |

Probable | 143 | 443 | 5.41 | 2,044 | 25 |

Proven & Probable | 393 | 460 | 6.06 | 5,812 | 77 |

Frea | Proven | 270 | 449 | 6.13 | 3,901 | 53 |

Probable | 254 | 264 | 9.82 | 2,157 | 80 |

Proven & Probable | 524 | 360 | 7.92 | 6,058 | 133 |

Kospi | Proven | - | - | - | - | - |

Probable | 698 | 596 | 6.55 | 13,361 | 147 |

Proven & Probable | 698 | 596 | 6.55 | 13,361 | 147 |

Total San José | Proven | 519 | 459 | 6.28 | 7,669 | 105 |

Probable | 1,095 | 499 | 7.16 | 17,563 | 252 |

Proven & Probable | 1,615 | 486 | 6.88 | 25,231 | 357 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | V |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table 4: Mineral Reserve Attributable to Minera Andes, June 30, 2008

| | | | | | |

Vein | Category | Tonnes (kt) | Ag (g/t) | Au (g/t) | Ag (koz) | Au (koz) |

Huevos Verdes | Proven | 122 | 470 | 6.43 | 1,846 | 25 |

Probable | 70 | 443 | 5.41 | 1,002 | 12 |

Proven & Probable | 193 | 460 | 6.06 | 2,848 | 38 |

Frea | Proven | 132 | 449 | 6.13 | 1,912 | 26 |

Probable | 124 | 264 | 9.82 | 1,057 | 39 |

Proven & Probable | 257 | 360 | 7.92 | 2,969 | 65 |

Kospi | Proven | - | - | - | - | - |

Probable | 342 | 596 | 6.55 | 6,547 | 72 |

Proven & Probable | 342 | 596 | 6.55 | 6,547 | 72 |

Total San José | Proven | 255 | 459 | 6.28 | 3,758 | 51 |

Probable | 537 | 499 | 7.16 | 8,606 | 124 |

Proven & Probable | 791 | 486 | 6.88 | 12,363 | 175 |

SRK modified the MSC reserve parameters in accordance with CIM standards and SRK's judgment.

The following parameters were applied by SRK to derive the reserve estimate.

·

Conventional Cut and Fill (CC&F) minimum mining width

0.8m

·

Mechanized Cut and Fill (MC&F) minimum mining width

2.0m

·

Planned dilution

0.2m HW + 0.2m FW

= 0.4m total

·

Unplanned dilution

5%

·

Economic stope outlines from BECOV

US$115/t

The mineral reserves are considered sufficient to support a four year mine life at an average mining rate of 1,500t/d for 2009 and 2010, 750t/d during 2011 and 500t/d during 2012.

Development and Operations

Precommissioning production commenced during the last half of 2007, and the mine formally entered into commercial production on January 1, 2008. During the first six months of 2008 the mill processed an average of 20,083t/m. There are a total of five separate production areas at the mine – HVS, HVC, HVN, Frea and Kospi.

According to the 2008 production plan, the target rate of 1,500t/d should have been achieved by September 2008, however delays with the Kospi decline prevented the necessary additional production areas from being brought into production. The Kospi vein will be intersected in early 2009, and initial production is expected to commence soon after, thus providing the additional working areas to achieve the mining rate of 1,500t/d.

The Huevos Verdes complex, Frea and Kospi are all accessed by separate decline systems. The adverse ground conditions encountered in the Kospi decline required the use of steel arched sets and shotcrete.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | VI |

San José Silver-Gold Project | NI 43-101 Technical Report |

The Huevos Verdes vein is the narrowest and is exploited mostly by the CC&F mining method. Frea is generally wider than 2m and utilizes the MC&F method. Kospi is planned to be mined by the MC&F method.

Mine dewatering is achieved with a combination of natural drainage, settling sumps and Grindex 50hp submersible pumps. Water pumped from underground is discharged to a surface settling pond. Fresh water for use underground is sourced from the surface settling pond.

Compressed air is required in the underground mines for the operation of hand-held drills, small water pumps, explosives loading apparatus (ANFO loader), small hoists and raise boring. There are air compressors located at each portal for that purpose.

Electrical power is currently sourced from diesel-fired power generators. An over-head power transmission line, connecting to the national power grid, is currently being installed and expected to be brought on line in the first quarter of 2009. The cost of electrical power will be reduced accordingly.

The primary ventilation at Huevos Verdes, Frea and Kospi all utilize the negative pressure system in which the main (primary) ventilation fan draws used air from the mine. Fresh air enters the mine through either the main access decline or a dedicated fresh air raise where it is directed to each of the working areas by a secondary ventilation system.

Waste rock from development is used as backfill in the cut and fill stopes. The development waste is usually hauled to a surface stockpile and then rehandled to waste passes when it is required underground. When the demand for backfill exceeds the supply from waste development, MSC will establish a borrow pit to quarry the local till.

MSC is currently exploring the possibility of implementing the long-hole stoping mining method with a view to improving operational efficiencies This is expected to reduce the mining cost with increased dilution and lower mining recovery.

Environmental

On March 1, 2006, MSC received approval of the Environmental Impact Assessment (EIA) for the Project. The approved EIA became the basis of a Declaration of Environmental Impact (DEI) for the Project which was issued March 16, 2006. In accordance with Argentinean law, the DEI must be renewed every two years. The 2008 updated report for the DEI was submitted in a timely manner.

In order to continue mining operations, an Environmental Quality Certificate (EQC) is required for the Project and must be renewed annually. Currently, MSC maintains a valid EQC for the Project. A valid EQC indicates compliance with primary environmental approvals associated with the DEI.

The estimated cost for reclamation and closure of the San José mine is US$3,300,000.

Economic Analysis

The SRK LoM plan and economics are based on the following:

·

Gold and silver prices of US$850/oz and US$12.50/oz respectively;

·

Reserves at June 30, 2008 (1.6Mt at an average grade of 6.88g/t-Au and 486g/t-Ag) were depleted for the production to December 31, 2008. Depletion is shown in Table 16.1.1. The economic model used the remaining reserves of 1.5Mt at an average grade of 6.94g/t-Au and 484g/t-Ag, containing a total of 339koz of gold and 23.7Moz of silver;

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | VII |

San José Silver-Gold Project | NI 43-101 Technical Report |

·

A remaining mine life of four years, with 2009 and 2010 at 1500t/d 2011 at 750t/d and 2012 at 500t/d, at a total average rate of 375kt/y as of December 31, 2008;

·

An overall average metallurgical recovery rate of 86.4% for gold and 84.6% for silver, producing 142koz of gold in doré, 151koz gold in concentrate, and 9.8Moz of silver in doré and 10.2Moz silver in concentrate over the LoM;

·

A cash cost of US$156/ore-tonne;

·

Total capital costs of US$26.9 million are comprised of US$23.5 million for sustaining mining and process capital, US$2.1 million for on-going exploration and US$1.3 million for information technology; and

·

No provision has been made for salvage value.

Technical-economic analysis results, shown in Table 5, indicate a pre-tax Net Present Value (NPV) of US$205 million at an 8% discount rate.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | VIII |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table 5: LoM Economic Results

| |

Description | LoM Value |

Ore | |

Ore Milled | 1.520kt |

Gold Grade | 6.94g/t |

Silver Grade | 483.7g/t |

Contained Gold | 339koz |

Contained Silver | 23.6Moz |

Gold Recovery Dore | 83.7% |

Silver Recovery Dore | 83.3% |

Gold Recovery Concentrate | 89.0% |

Silver Recovery Concentrate | 86.0% |

Doré Production | 10.2Moz |

Gold in Doré | 142koz |

Silver in Doré | 9.8Moz |

Gold in Concentrate | 151koz |

Silver in Concentrate | 10.2 Moz |

Total Gold | 293koz |

Total Silver | 20.0Moz |

Estimate of Cashflow (US$000s) | |

Gross Revenue | $499,205 |

Doré Treatment Charges | ($12,782) |

Concentrate Treatment Charges | ($39,560) |

Net Smelter Return(LoM average US$293.89/t-ore) | $446,863 |

Royalties | ($98) |

Gross Income From Mining | $446,765 |

Operating & Capital Cost | |

Mining and Geology | ($56,606) |

Plant | ($44,781) |

Infrastructure and G&A | ($84,177) |

Operating Costs | ($185,564) |

Cash Cost (US$/t-ore) | $156.40/t |

Cash Operating Margin (EBITDA) | $261,201 |

Capital Cost | |

Sustaining | ($23,451) |

On-going Exploration | ($2,140) |

Information Technology | ($1,300) |

Salvage | 0 |

Capital Costs | ($26,891) |

Cash Flow | $234,310 |

Cash Flow (NPV8%) | $205,058 |

NPV sensitivity to discount rate is shown in Table 6.

Table 6: Project NPV Sensitivity to discount rate(US$000’s)

| | | | |

0% | 5% | 8% Base Case | 10% | 15% |

$234,310 | $215,404 | $205,058 | $198,540 | $183,459 |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | IX |

San José Silver-Gold Project | NI 43-101 Technical Report |

Conclusions and Recommendations

1.

The standard of documentation for mineral reserve estimates needs to be improved. SRK had difficulty substantiating the MSC conversion of resources to reserves due to a paucity of supporting documentation.

2.

MSC have been overly optimistic with estimates of dilution in the C&F stopes. Moreover, the reconciliations undertaken by MSC are somewhat biased due to the nature of the stoping operation – although stopes are designed according to a grade cut-off, it appears that MSC generally manage the C&F stoping according to a lithological cut-off, taking all of the mineralization regardless of grade.

3.

The higher mining recovery factors used by MSC need to be substantiated with operational experience and thorough reconciliations.

4.

Based on the current understanding of the mineralization at San José, SRK recommends that MSC continue with planned exploration activities to extend the mine life beyond 2012. In 2008, both the Au and Ag recoveries in the San José process plant were very erratic on a monthly basis with Au varying from a low of 72.6% to a high of 89.6% and Ag varying from a low of 72.7% to a high of 88.8%. These wide variances in both Au and Ag recoveries suggests that there may be a problem in the monthly metallurgical balances for the San José process plant. SRK recommends that a metallurgical audit of the process plant be conducted by an independent third-party to determine the reason(s) for the wide variances in Au and Ag recoveries and the actual low Ag recovery versus the Gekko test results.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 1-1 |

San José Silver-Gold Project | NI 43-101 Technical Report |

1

Introduction(Item 4)

SRK Consulting (U.S.), Inc. (SRK) was commissioned by Minera Andes Inc. (MAI) to prepare a Technical Report on the San José Silver-Gold Project (San José or the Project) located in the Province of Santa Cruz, Argentina, in accordance with the requirements of Canadian National Instrument 43-101 (NI 43-101) of the Canadian securities regulators. The Project is owned and operated by Minera Santa Cruz S.A. (MSC), a joint-venture company 49% owned by Minera Andes S.A. (MASA), a subsidiary of MAI, and 51% owned by Hochschild Mining plc (HMP).

1.1

Terms of Reference and Purpose of the Technical Report

This Technical Report is intended to provide MAI with an independent review of the resource and reserve estimate updated to June 30, 2008.

All measurements in this Technical Report are metric, and currency is expressed in United States dollars, unless stated otherwise. A conversion of US$0.3337/ARS1.00 (Argentine Peso) has been used for the purpose of this Technical Report. A glossary of terms and abbreviations are listed in Section 21.2 of this Technical Report.

Resource and reserve definitions are as set forth in the "Canadian Institute of Mining, Metallurgy and Petroleum – Definitions Adopted by CIM Council, December 11, 2005”.

1.2

Reliance on Other Experts(Item 5)

SRK’s opinion contained here is based on information provided to SRK by MAI and MSC throughout the course of SRK’s investigations.

SRK has not independently verified the legal status or ownership of the mineral rights in the Project area or underlying property agreements, but has relied on legal opinion supplied to MAI for this information.

SRK has not independently verified the surface rights, road access and permits and has relied on legal opinion supplied to MAI for this information.

1.2.1

Sources of Information

SRK’s opinion contained herein is based on information provided to SRK by MSC and MAI and their consultants throughout the course of SRK’s investigations, which in turn reflect various technical and economic conditions at the time of writing. The information so provided has been taken in good faith by SRK and SRK has checked and/or verified the information wherever possible.

This report includes technical information, which requires subsequent calculations to derive subtotals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, SRK does not consider them to be material.

1.3

Effective Date

The effective date of the resource estimation is June 30, 2008.

The effective date of the reserve estimation is June 30, 2008.

The effective date of this Technical Report is December 31, 2008.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 1-2 |

San José Silver-Gold Project | NI 43-101 Technical Report |

1.4

Qualifications of Consultants (SRK)

The SRK Group is comprised of over 850 staff, offering expertise in a wide range of resource engineering disciplines. The SRK Group’s independence is ensured by the fact that it holds no equity in any project and that its ownership rests solely with its staff. This permits SRK to provide its clients with conflict-free and objective recommendations on crucial judgment issues. SRK has a demonstrated record of accomplishment in undertaking independent assessments of Mineral Resources and Mineral Reserves, project evaluations and audits, technical reports and independent evaluations to bankable standards on behalf of exploration and mining companies and financial institutions worldwide. The SRK Group has also worked with a large number of major international mining companies and their projects, providing mining industry consultancy service inputs.

This Technical Report has been prepared based on a technical and economic review by a team of consultants sourced principally from the SRK Group’s Denver, US office. These consultants are specialists in the fields of geology, exploration, mineral resource and mineral reserve estimation and classification, underground mining, mineral processing and mineral economics.

Neither SRK nor any of its employees and associates employed in the preparation of this Technical Report has any beneficial interest in MAI it subsidiaries or JV partners. SRK will be paid a fee for this work in accordance with normal professional consulting practice.

Listed below are the individuals who have provided input to this Technical Report:

·

Leah Mach, CPG, MSc;

·

Chris Elliott, B.Eng.(Mining), MAusIMM;

·

Patrick Hollenbeck, B.A. Geo.;

·

Joanna Poeck, B.Eng.;

·

Alva Kuestermeyer, MS Mineral Economics, CP, SME;

·

Dorinda Bair, BSc. Geo.;

·

Martin Raffield, P.Eng., PhD.; and

·

Dante Ramirez-Rodriguez, PhD.

Leah Mach is the QP responsible for the compilation and editing of Sections 2.1 through 2.3, 3.1 through 3.5, 4 through 13, 15.1, 18.1 through 18.4 and 19.1 of this Technical Report. By virtue of her education and relevant past experience, Ms. Mach a QP as this term is defined in NI 43-101. Ms. Mach is a Principal Resource Geologist in the SRK Denver office.

Chris Elliott is the QP responsible for the compilation and editing of Sections 1, 2.4 through 2.6, 3.6, 14, 15.2 through 17.8.2, 18.5 through 18.7 and 19.2 through 21of this Technical Report. By virtue of his education and relevant past experience, Mr. Elliott is a QP as this term is defined in NI 43-101. Mr. Elliott is a Principal Mining Engineer based in the SRK Vancouver office.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 1-3 |

San José Silver-Gold Project | NI 43-101 Technical Report |

1.4.1

Site Visit

The key Project personnel contributing to this Technical Report are Leah Mach, Martin Raffield, Chris Elliott and Alva Kuestermeyer. Mr. Kuestermeyer visited the property from September 16 through 18, 2008, and visited the MSC head office in Buenos Aires on September 19, 2008. Leah Mach and Martin Raffield visited the property on September 29 through October 1, 2008 at which time Ms. Mach confirmed the site data, including access, drilling and sampling methods and drillhole locations, and examined geology, alteration and mineralization in field outcrops and drill core. Chris Elliott visited the property on January 28 through 30, 2009. The Certificate of Author forms are provided in Appendix A.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-1 |

San José Silver-Gold Project | NI 43-101 Technical Report |

2

Property Description and Location(Item 6)

2.1

Property Location

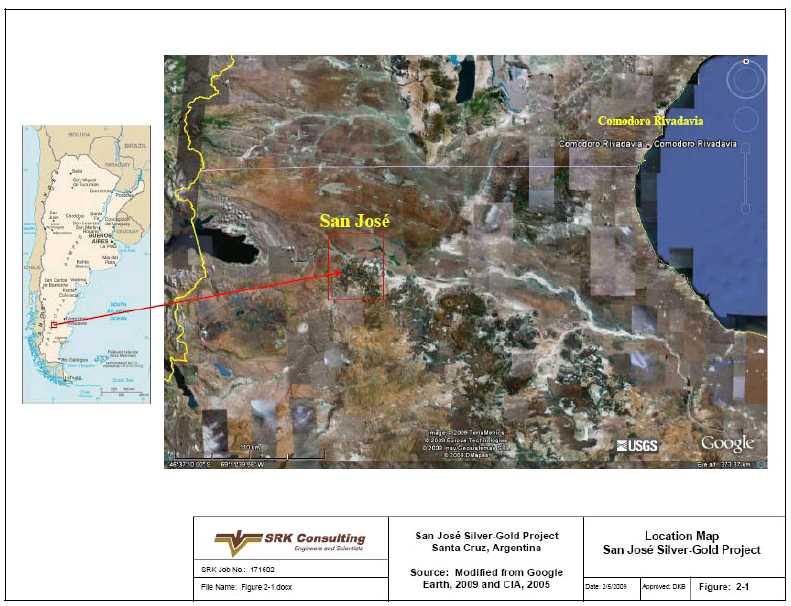

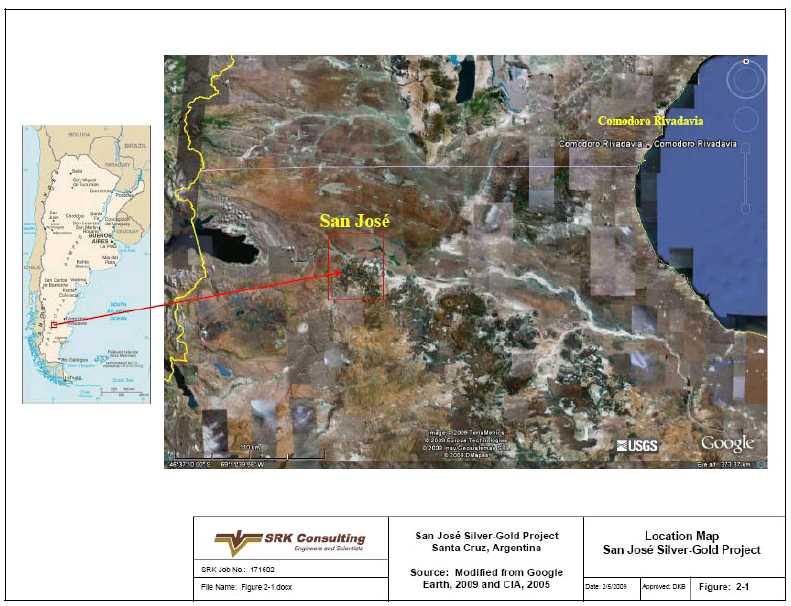

San José is located in Perito Moreno District, Santa Cruz Province, Argentina within the Patagonia Region. The Project lies between latitude 46º41'S and 46º47'S and longitude 70º17'W and 70º00'W. This is approximately 4,810,000N, 2,415,500E and 4,840,500N, 2,385,000E in Gauss-Krüger coordinates Zone 2 (POSGAR 94). San José is 1,750km southeast of Buenos Aires by air, and 350km southwest of Comodoro Rivadavia by road. Comodoro Rivadavia is the largest city in Chubut Province and very close to the provincial boundary with Santa Cruz Province. Comodoro Rivadavia has the closest commercial airport to the Project with regularly scheduled flights to Buenos Aires. Comodoro Rivadavia is also an important port in southern Argentina. Project location is shown in Figure 2-1.

2.2

Mineral Title in Argentina

Argentina is a federal republic, composed of 23 provinces and one autonomous city, the capital Buenos Aires. Argentina has Federal, Provincial and Municipal governments each with input into mining regulation. The National Mining Code regulates mining activities in Argentina and is administered by the Federal government. In Santa Cruz province, all concessions are granted by an administrative action under the authority of the Provincial Mining Office according to Provincial Law No. 990 (Godoy, 2007). The following section discusses mining and exploration concessions specific to Santa Cruz Province, Argentina.

This section on Mineral Title in Argentina is summarized fromMinera Andes Inc. Management’s Discussion and Analysis of Financial Conditions and Plan of Operations, (Minera Andes, 2008).

The laws, procedures and terminology regarding mineral title in Argentina differ considerably from those in the United States and Canada. Mineral rights in Argentina are separate from surface ownership and are owned by the federal government and administered by the provinces. Mineral titles consist of:

·

Cateo: an exploration concession which does not permit mining but gives the owner a preferential right to a mining concession for the same area. Cateos are measured in 500ha units and cannot exceed 20 units. No person may hold more than 400 units in a single province. The term of a cateo is based on its area: 150 days for the first unit and an additional 50 days for each unit thereafter. After a period of 300 days, 50% of the area over four units must be dropped. At 700 days, 50% of the remaining area must be dropped. Cateos are awarded by the following process;

1.

Application for a cateo covering a designated area, including a minimum work program for exploration.

2.

Approval by the province and formal placement on the official map or register.

3.

Publication in the provincial official bulletin.

4.

A period following publication for third parties to oppose the claim.

5.

Awarding of the cateo.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-2 |

San José Silver-Gold Project | NI 43-101 Technical Report |

The length of time required for this process varies and commonly takes up to two years. The cateo status is therefore divided into those that are in the application process and those that have been awarded. If two entities apply for cateos on the same land, the first to apply has the superior right. The first applicant has rights to any mineral discoveries made by third parties operating in the cateo without its prior consent during the application period. Applicants may be allowed to explore on the land pending formal award of the cateo, with the approval of the surface owner of the land. The term of the cateo begins 30 days after the cateo is formally awarded.

A “canon fee” or tax of AR$400 per unit is payable upon application for the cateo.

·

Mina: a mining concession which permits mining on a commercial basis. The area of a mina is measured in “pertenencias” and each mina may consist of two or more pertenencias. A “common” pertenencias consists of 6ha and a “disseminated” pertenencia consists of 100ha; the designation refers to discrete veins (common) or disseminated deposits (disseminated). The mining authority may determine the number of pertenencias required to cover the geologic extent of the mineral deposit in question. Minas have an indefinite term assuming exploration development or mining is in progress. Minas are awarded by the following process;

1.

A Declaration of Manifestation of Discovery in which a point within a cateo is nominated as a discovery point. The Minifestation is used as a basis for location of pertenencias. Within a period following designation of a Manifestation of Discovery, the claimant may do further exploration, if necessary, to determine the size and shape of the orebody.

2.

“Mensura”, or survey, of the mina. Following a publication and opposition period and approval by the province, a formal survey of the pertenencias is completed before granting of a mina. The status of a surveyed mina provides the highest degree of mineral land tenure and rights in Argentina.

A canon fee of AR$80 per pertenencia is payable to the province on an annual basis.

·

Estaca Minas: Extensions to surveyed minas, consisting of 6ha. New Estaca Minas were eliminated from the mining code in August 1996; and

·

Provincial Reserve Areas: provinces are allowed to withdraw areas from the normal cateo/mina process which are then held directly by the province or assigned to provincial companies for study or exploration and development.

All mineral rights are considered forms of real property and can be sold, leased or assigned to third parties on a commercial basis. Cateos and minas can be forfeited if minimum work requirements are not performed or if annual payments are not made.

Grants of mining rights, including water rights, are subject to the rights of prior users. The mining code also contains environmental and safety provisions administered by the provinces. Environmental Impact Reports (EIR) must be submitted to the provincial government prior to conducting mining operations. The EIR must describe the proposed operation and the methods that will be used to prevent undue environmental damage and must be updated biennially. Mine operators are liable for environmental damage and violators of environmental standards may be required to shut down mining operations (Minera Andes, Inc. 2007).

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-3 |

San José Silver-Gold Project | NI 43-101 Technical Report |

There are two additional types of exploration concession in Argentina. These are air survey and underground permits. These are considered expensive and ineffective and are seldom used in favor of cateos. Cateos are also referred to as ground survey permits (Godoy, 2007).

Exploration permits are essentially paper locations. Once an exploration permit is converted to a mina or mining concession, the land must be surveyed and monuments placed at the corners.

2.3

Mineral Tenure for the San Jose Property

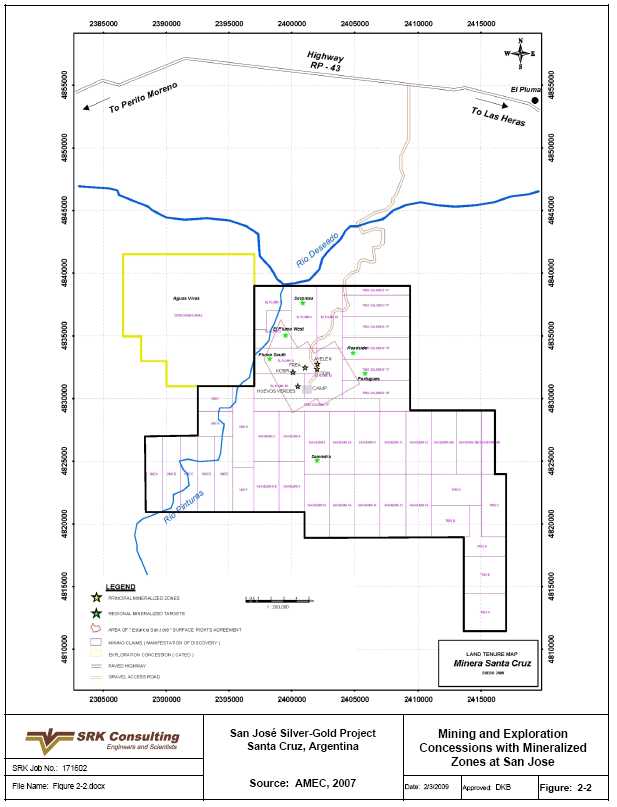

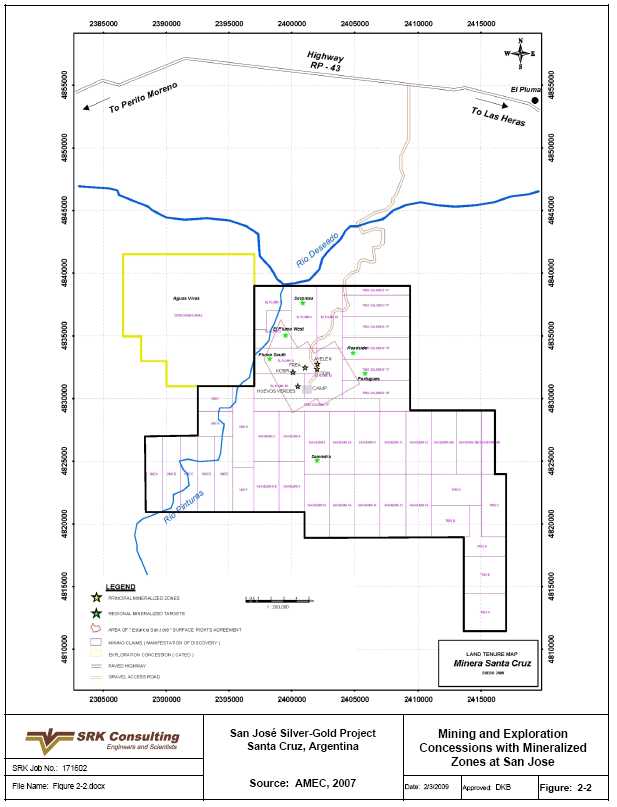

The Project covers 50,491ha, comprising 46 contiguous Mining Claims (eight “Minas” or approved mining claims; and 38 “Manifestations” or claims that are in the application process for mining claim status) and one exploration claim (Cateo). Mineral Reserves are hosted on “Minas” El Pluma E3 and El Pluma 4. The claims are all in good standing, with the appropriate annual holding costs paid. MSC holds the surface rights to the “San José Estancia,” where the mine and associated infrastructure are constructed and the “La Carmancita Estancia,” which provides right of way access between the mine and closest paved highway. Of these, 46 mining concessions covering 40,498.69ha, and one cateo covering 9,992.5ha. Of the mining concessions, 17 are minas containing 15,450.5ha and 29 manifestations of discovery containing 25,048.19ha. The mining an d exploration concessions included in the Project are listed in Table 2.3.1 and shown in Figure 2-2.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-4 |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table 2.3.1: San José Mineral Concessions

| | | | | | | |

| | | Initial | Mina | Mina | Annual | Conversion |

| | Area | Application | Application | Approval | Holding Cost | to Mina |

Claim | File Number | (ha) | Date | Date | Date | (AR$)** | Status* |

Tres Colores A | 411.332/MA/99 | 1,000 | 8/4/1999 | 7/1/2005 | 8/9/2006 | 8,000 | 1 |

El Pluma E1 | 410.412/MA/99 | 1,000 | 4/16/1999 | 4/11/2005 | 8/9/2006 | 8,000 | 1 |

El Pluma E2 | 412.278/MA/99 | 1,000 | 11/22/1999 | 8/12/2005 | 8/9/2006 | 8,000 | 1 |

El Pluma 3 | 412.279/MA/99 | 750 | 11/22/1999 | 8/12/2005 | 10/18/2006 | 6,400 | 1 |

El Pluma 4 | 412.281/MA/99 | 1,000 | 11/22/1999 | 8/12/2005 | 10/18/2006 | 8,000 | 1 |

El Pluma E3 | 412.280/MA/99 | 800 | 11/22/1999 | 8/12/2005 | 10/18/2006 | 6,400 | 1 |

Saavedra 7a | 10.090/MA/99 | 1,000 | 3/10/1999 | 4/15/2002 | 7/26/2007 | 8,000 | 1 |

Saavedra 11 | 401.874/MA/01 | 1,000 | 8/2/2001 | 12/10/2004 | 12/11/2006 | 8,000 | 1 |

Saavedra 1a | 410.093/MA/99 | 1,000 | 3/10/1999 | 5/5/2004 | - | 8,000 | 2 |

Saavedra 2a | 410.091/MA/99 | 1,000 | 3/10/1999 | 5/5/2004 | 8/13/2007 | 8,000 | 2 |

Saavedra 5 | 410.089/MA/99 | 800 | 3/10/1999 | 10/30/2002 | 11/20/2007 | 6,400 | 2 |

Tres Colores G | 414.639/MA/00 | 397.5 | 9/1/2000 | 2/15/2006 | - | 3,200 | 2 |

Saavedra 8 | 410.092/MA/99 | 1,000 | 3/10/1999 | 2/15/2006 | 5/15/2008 | 8,000 | 3 |

Saavedra 9 | 413.396/MA/00 | 1,000 | 4/6/2000 | 12/10/2004 | - | 8,000 | 3 |

Saavedra 13 | 401.876/MA/01 | 1,000 | 8/2/2001 | 11/3/2005 | 9/13/2007 | 8,000 | 3 |

Tres Colores B | 411.331/MA/99 | 998.5 | 8/4/1999 | 7/1/2005 | - | 8,000 | 3 |

Tres Colores D | 414.640/MA/00 | 901 | 9/1/2000 | 4/17/2006 | 10/17/2007 | 7,200 | 3 |

Tres Colores E | 414.643/MA/00 | 901 | 9/1/2000 | 4/17/2006 | 10/1/2007 | 7,200 | 3 |

El Pluma 1 | 410.411/MA/99 | 750 | 4/16/1999 | 7/1/2005 | - | 6,400 | 4 |

El Pluma 2 | 412.277/MA/99 | 1,000 | 11/22/1999 | 8/12/2005 | 9/1/2008 | 8,000 | 4 |

Saavedra 3 | 410.096/MA/99 | 800 | 3/10/1999 | 7/1/2005 | - | 6,400 | 4 |

Saavedra 4 | 410.095/MA/99 | 800 | 3/10/1999 | 7/1/2005 | 8/29/2007 | 6,400 | 4 |

Saavedra 6b | 410.094/MA/99 | 800 | 3/10/1999 | 7/1/2005 | - | 6,400 | 4 |

Saavedra 10 | 413.395/MA/00 | 1,000 | 4/6/2000 | 12/10/2004 | - | 8,000 | 4 |

Saavedra 12 | 401.875/MA/01 | 1,000 | 8/2/2001 | 7/1/2005 | - | 8,000 | 4 |

SaavNE2 | 400.626/MA/01 | 1,000 | 3/21/2001 | 12/10/2004 | - | 8,000 | 4 |

SaavNE3 | 400.627/MA/01 | 500 | 3/24/2001 | 12/10/2004 | - | 4,000 | 4 |

SaavNEI | 400.625/MA/01 | 1,000 | 3/21/2001 | 12/10/2004 | - | 8,000 | 4 |

Tres E | 414.266/MA/00 | 999.93 | 6/24/2000 | 10/20/2005 | - | 8,000 | 4 |

Tres F | 414.267/MA/00 | 999.93 | 6/24/2000 | 12/12/2005 | - | 8,000 | 4 |

Tres Colores C | 414.642/MA/00 | 901 | 9/1/2000 | 3/29/2006 | 10/8/2007 | 7,200 | 4 |

Tres Colores F | 414.641/MA/00 | 901 | 9/1/2000 | 12/12/2005 | - | 7,200 | 4 |

Uno F | 400.764/MA/01 | 594 | 4/4/2001 | 5/17/2005 | - | 4,800 | 4 |

Uno G | 401.507/MA/01 | 1,103.70 | 6/20/2001 | 2/15/2006 | - | 9,600 | 4 |

Uno I | 401.509/MA/01 | 560.4 | 6/20/2001 | 12/10/2004 | - | 4,800 | 4 |

Uno D | 400.765/MA/01 | 840 | 4/4/2001 | 5/17/2005 | - | 7,200 | 5 |

Uno E | 400.766/MA/01 | 840 | 4/4/2001 | 12/10/2004 | - | 7,200 | 5 |

Uno H | 401.508/MA/01 | 560.4 | 6/20/2001 | 7/1/2005 | - | 4,800 | 5 |

Saavedra 14 | 401.877/MA/01 | 1,000 | 8/2/2001 | 7/1/2005 | - | 8,000 | 6 |

Tres A | 411.333/MA/99 | 1,000 | 8/4/1999 | 7/1/2005 | - | 8,000 | 6 |

Tres B | 411.334/MA/99 | 750 | 8/4/1999 | 8/12/2005 | - | 6,400 | 6 |

Tres C | 414.264/MA/00 | 980 | 7/24/2000 | 8/12/2005 | - | 8,000 | 6 |

Tres D | 414.265/MA/00 | 770.13 | 7/24/2000 | 2/15/2006 | - | 6,400 | 6 |

Uno A | 413.095/MA/00 | 840 | 3/6/2000 | 8/12/2005 | - | 7,200 | 6 |

Uno B | 413.096/MA/00 | 840 | 3/6/2000 | 8/12/2005 | - | 7,200 | 6 |

Uno C | 413.097/MA/00 | 820.2 | 3/6/2000 | 8/12/2005 | - | 7,200 | 6 |

Total of Manifestations and Minas | 40,498.69 | | | | 329,600 (US$109,988) | |

"Cateo" | 403.089/MSC/01 | 9,992.50 | 12/12/2001 | - | - | 8,000 | |

Total of All Claims | 50,491.19 | | | | 337,600 (US$112,670) | |

*Conversion to Mina Status:

1.

Conversion to Mina Finalized.

2.

Pending Finalization

3.

Pending Finalization, once April 16 observations have been removed

4.

Awaiting Approval

5.

Missing Plans

6.

Without Landowner approval to complete perimeter survey

**US$0.3337=AR$1.00

MSC’s annual canon payments for concession holding are divided between the first and second semesters and paid in February and June, respectively. Canon payments for all of the mining claims and cateos in 2007 were approximately US$103,000. The first semester 2008 holding cost payments were paid in February 2008 and were approximately US$55,000. The second semester payments were paid in June 2008 and totaled approximately US$55,000. The total paid in 2008 was approximately US$112,670.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-5 |

San José Silver-Gold Project | NI 43-101 Technical Report |

2.4

Location of Mineralization

Project mineralization zones and targets are contained within the mine concession block in the following eight concessions:

·

El Pluma 2—La Sopresa regional mineralized target;

·

El Pluma 3—El Pluma West mineralized target;

·

El Pluma 4—Pluma South mineralized target and Ayelén, Frea, Kospi and Odin mineralized zones;

·

El Pluma E2—Ayelén and Odin mineralized zones;

·

El Pluma E3—Huevos Verdes mineralized zone;

·

Tres Colores C—Portugués mineralized zone;

·

Tres Colores D—Roadside mineralized zone;

·

Saavedra 8—Saavedra mineralized zone; and

·

Cateo—Agua Vivos.

These regional mineralized targets and mineralized zones are shown on Figure 2-2. Resources and reserves for the Project are contained in El Pluma E3 and El Pluma 4. Both of these have been converted from Manifestation of Discovery to minas.

2.5

Royalties, Agreements and Encumbrances

2.5.1

Joint Venture Agreement

Minera Santa Cruz S.A. (MSC) holds 100% interest in the Project. MSC is a joint venture between Minera Andes S.A. (MASA) (49%) and Hochschild Mining (Argentina) Corporation (HMC) (51%). MASA is an indirect wholly-owned subsidiary of Minera Andes Inc. (MAI). HMC is a wholly owned subsidiary of Hochschild Mining plc (HMP).

The joint venture is governed by an option and joint venture agreement dated March 15, 2001 between MASA and Hochschild (as amended by agreements dated May 14, 2002, August 27, 2002 and September 10, 2004) (the “OJVA”).

Under the OJVA, MASA transferred all of its rights in the San José Project to MSC, a newly formed corporation organized under the laws of Argentina and wholly owned by the Corporation. In July 2003, Hochschild earned a 51% ownership interest in MSC by expending a total of $3 million, including a minimum of $100,000 per year on exploration targets. Upon Hochschild acquiring a 51% ownership in MSC, Minera Andes elected to participate in the development of the San José Project on a pro-rata basis.

The remainder of Section 2.5.1 is quoted from MAI’s Annual Information Form (2008):

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-6 |

San José Silver-Gold Project | NI 43-101 Technical Report |

The OJVA and the by-laws of MSC provide, in relevant part, that:

i.

the Board of Directors of MSC shall, at all times, consist of three directors and that, in effect, two of such directors shall be nominated by Hochschild and one director shall be nominated by MASA;

ii.

the Board of Directors of MSC shall meet at least once every calendar quarter, without any stipulation that a nominee of each of Hochschild and MASA be present;

iii.

at any meeting of the Board of Directors of MSC, each of MASA and Hochschild shall have that number of votes equal to the number of directors it is entitled to appoint;

iv.

MSC shall finance its operations and activities from such sources as the Board of Directors of MSC sees fit;

v.

the only actions by MSC requiring unanimous approval of both MASA and Hochschild are (a) a sale of all or substantially all of the assets of MSC; (ii) any amendment to the articles of MSC that would have an adverse effect on the rights of any particular shareholder to receive its share of the profits of MSC; (c) entering into any new line of business; (d) acquiring real property or conducting exploration, development or mining outside of the property initially transferred to MSC for the purposes of establishing the joint venture; or (e) any merger or other corporate combination involving MSC; and

vi.

in the event of a disagreement between Hochschild as “majority owner” and MASA as “minority owner”, concerning any act of MSC that requires the unanimous approval of the Board of 13 Directors of MSC, Hochschild has the option to purchase all of the shares of MSC held by MASA for “fair value”.

The OJVA provides that MSC shall finance its operations from such sources as the Board of MSC shall determine, including by issuing additional shares. In such event, each shareholder of MSC has a pre-emptive right to subscribe for its pro rata share of the additional shares. Any shares not subscribed by a shareholder shall be offered to the other, participating, shareholder. As a result, full exercise of a shareholder’s pre-emptive right (assuming full exercise by other shareholder) maintains its shareholdings in MSC at current levels while a failure to exercise its pre-emptive rights, in full, may result in dilution (the extent of such dilution depending on whether the other shareholder exercises its pre-emptive right and to what extent and whether such shareholder also purchases shares not purchased by the first shareholder). A portion of the operating and capital costs of the San José Project have been f inanced by issuing additional shares of MSC.

The OJVA also provides that it shall be the policy of MSC to maintain excess distributable cash and that unless the Board of MSC unanimously decides otherwise, MSC shall distribute, on a semi-annual basis all cash not reasonably required for operations or expansion.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-7 |

San José Silver-Gold Project | NI 43-101 Technical Report |

2.5.2

Surface Rights

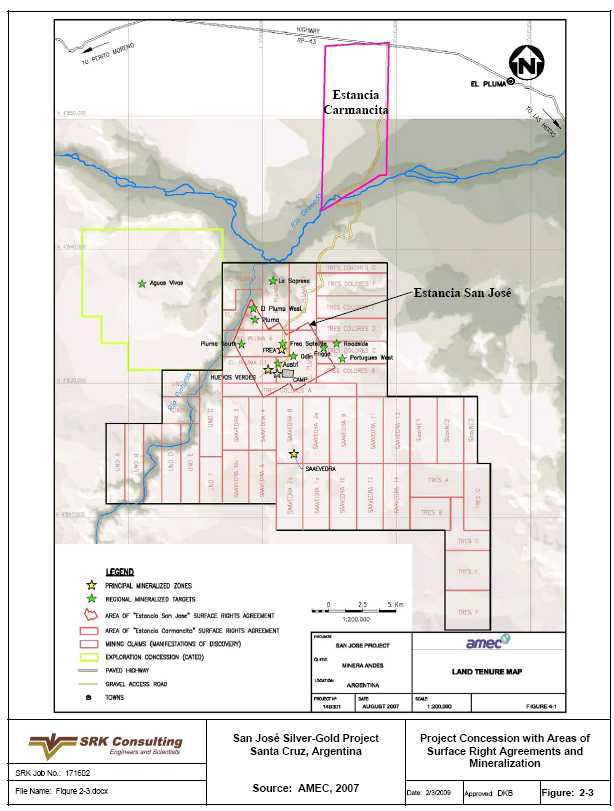

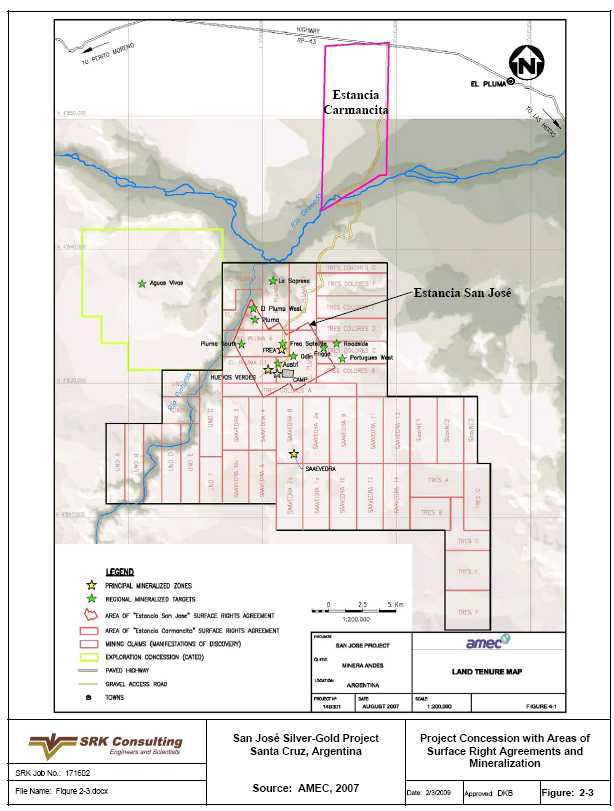

MSC has negotiated surface rights agreements with two families, the Beitía Family and the Flores Family, for general and internal access and construction of mine infrastructure. The details of these agreements are discussed in below and summarized in Section 3.5. Figure 2-3 shows the areas where surface rights were negotiated.

Between 2002 and 2008, agreements were negotiated with MSC and the Beitía Family for a contiguous 2,875ha property within the Estancia San José for the construction of the San José Mine and associated infrastructure. MSC paid the Beitía Family US$353,400. This agreement was amended in 2005 and gives MSC surface rights for construction of the mine and its infrastructure, easement rights and use of all existing roads within Estancia San José. MSC does not compensate the Beitía Family for use of existing roads, but additional amendments in 2006 and 2008 requires the following compensation for road construction and widening of existing roads:

·

If MSC quarries material from Estancia San José for road construction or for any other mining operation, the owners of Estancia San José will be entitled to collect US$0.90 plus VAT/m3 of rock extracted from Estancia San José. During the first 12 months from the execution of the New Agreement (2006), the price will be decreased to US$0.40/m3 plus VAT;

·

If MSC performs exploration activities, compensation to the owners of Estancia San José will be paid as follows:

1.

Construction of Mining Road: US$150/km.

2.

Construction of roads: US$250/km.

3.

Construction of trenches: US$250/km.

·

A monthly payment of US$800 will be paid to the owners of the Estancia San José for the use of a house located in the Estancia San José. Payment of this price also entitles MSC to use roads connecting Estancia San José and the neighboring properties.

In September 2008, a new agreement was signed with the Beitía family. In this agreement, MSC agreed to compensate the Beitía family for wider access roads. The previous agreement was for 12m, but in some areas the access road was actually 24m. MSC compensated the Beitía family by building a 60m2 house and an additional bedroom at the San José ranch. In addition, MSC relocated some existing wire fences at the San José ranch (AMEC, 2007b).

In August of 2004, MSC signed an agreement with Mr. Roberto Flores that granted access rights from RP-43 across the Estancia Carmancita to San José. In addition to a US$56,000 cost for access, a payment of US$1,000 was to be paid monthly during the mine life. This agreement was replaced February 14, 2006 by a land purchase. The land was purchased by MSC and several members of the Flores Family from Mr. Roberto Flores. The purchase includes 5,543ha of contiguous land in the Estancia Carmancita. MSC now holds 66.66% of the surface rights and the Flores family holds 33.33%, which grants MSC free right of access. The price of US$74,009 has been paid to Mr. Roberto Flores and the new agreement replaces the previous agreement with Mr. Flores (AMEC, 2007b).

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-8 |

San José Silver-Gold Project | NI 43-101 Technical Report |

2.5.3

Royalty

The property is subject to a provincial royalty of 2.55% on the value of the concentrate and 1.85% on the value of the doré produced from the property.

2.6

Environmental Liabilities and Permitting

Mining activities in Argentina are regulated by the National and Provincial Governments through several legal instruments. The San José mine entered into full-scale commercial production on January 1, 2008. MSC obtained the necessary environmental approvals for the Project and maintained compliance with the primary environmental permits.

2.6.1

Environmental Liabilities

Known environmental liabilities for the San José mine include site reclamation and closure. These costs are described in Section 17.

2.6.2

Required Permits and Status

In order to commence mining, MSC prepared an Environmental Impact Assessment (EIA) for the Project. The Provincial Environmental Management Unit (PEMU) was responsible for review and approval of the EIA. The document was approved by the PEMU on March 1, 2006. The approved EIA became the basis of a Declaration of Environmental Impact (DEI) for the Project. In accordance with Argentinean law, the DEI must be renewed every two years. The 2008 updated report for the DEI was submitted in a timely manner.

Acceptable water, soil and air conditions are declared in the DEI. In order to continue with mining operations, an Environmental Quality Certificate (EQC) is required and must be renewed annually. MSC needs to prove its environmental performance that needs to be in accordance with the DEI. After the approval and an annual fee payment, the EQC is issued. Currently, MSC maintains a valid EQC for the Project. A valid EQC indicates compliance with primary environmental approvals associated with the DEI.

As reported in the NI 43-101 Technical Report (AMEC, 2007b), Table 2.6.2.1 presents the permits which have been applied for or granted.

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-9 |

San José Silver-Gold Project | NI 43-101 Technical Report |

Table 2.6.2.1: Permits, Applied for or Granted

| | |

Permit | Agency | Observation |

Exploration permit | Provincial Department of Mining Santa Cruz (DPM) | One Cateo |

Mining Claim (Mina) | DPM | Mina status for 17 claims (covers all areas of production) |

Mining Claim (Manifestations) | DPM | Remaining 29 Manifestations registered to MSC, awaiting final title |

Investment plan | DPM | Presented on February 15, 2005 for each of the 46 claims |

Mineral Producer Certificate | DPM | Registered since January 29, 2002 (403.305/02); renewed annually before March |

Environmental Impact Report | DPM | Approved by DPM on March 1, 2006. Biannual updated report filed with DPM on June 2008. |

Hazardous Waste Generator | Secretary of Environment (SMA) | Registered with the Provincial Environmental Department (SMA) since May 2, 2006 (Res. N° 046-SMA/06). Request of incorporation of Hazardous Waste corresponding to categories Y1 and Y33 has been submitted to SMA. |

EQC | DPM | EQC 2006 – issued, EQC 2007 issued, EQC 2008 in process of being issued. |

Explosives Use | National Arms Registry | “User that receives explosive services” Register Number RE7082, issued on August 2004. Registration was dropped on August 2008. “User that manipulate explosives” Renewed each year: Register Number 980007082, issued on May 2006. Extended up to August 2009. |

Explosives Storage | National Arms Registry | Issued on May 31, 2006 for 4 deposits Date of expiration: May 31, 2011 |

Water Use | Department of Water Resources (DRH) | Permit for water issued on July 7, 2006 (5 year period); water use fee paid to September 2008 – invoices not yet received by MSC beyond this; monthly reports, regularly submitted by MSC |

Registry of Importers and Exporters | Import/Export National Administration (Dirección General de Aduana) | Registered since January 28, 2004. Renewed on June 10, 2008. |

Radio Frequency use | National Committee of Communications (CNC) | Permit issued for use of the assigned frequency and equipment. |

Registry of Mining Investors | National Direction of Mining Investors (depending on National Mining Secretary) | Registered Since April 18, 2002 (Registry Number 422) |

Fiscal Stability Certificate | National Mining Secretary | Certificate issued May 15, 2006 (valid 30 years) |

Hydrocarbon storage permit | Secretary of Energy (National level) | Storage of hydrocarbons, tank Certification from Secretary of Energy was not requested yet. |

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-10 |

San José Silver-Gold Project | NI 43-101 Technical Report |

Figure 2-1: Location Map of the San José Silver-Gold Project

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-11 |

San José Silver-Gold Project | NI 43-101 Technical Report |

Figure 2-2: Mining and Exploration Concessions with Mineralized Zones at San José

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 2-12 |

San José Silver-Gold Project | NI 43-101 Technical Report |

Figure 2-3: Project Concessions with Areas of Surface Right Agreements and Mineralization

| |

SRK Consulting (U.S.), Inc. | May 29, 2009 |

Exhibit 99.1

| |

Minera Andes Inc. | 3-1 |

San José Silver-Gold Project | NI 43-101 Technical Report |

3

Accessibility, Climate, Local Resources, Infrastructure and Physiography(Item 7)

3.1

Topography, Elevation and Vegetation

San José is in southern Argentina in the Patagonian steppe, east of the Andes Mountains. The area is dominated by low rolling hills and incised valleys. Elevation ranges from 300 to 700masl. Vegetation is characteristic of arid to semi-arid steppes with tussock grasses and low growing bushes. The soil is poor, typical of harsh environments, and not suitable for agriculture but supports sheep and cattle grazing (AMEC, 2007b).

3.2

Climate and Length of Operating Season