Filed by: National Bank of Canada

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Canadian Western Bank

A registration statement is expected to be filed by National Bank of Canada

On June 11, 2024, National Bank of Canada (“National Bank”) first used or made available the following communications:

1. Slides used in connection with a presentation first made available by conference call on June 11, 2024; and

2. Transcript of the presentation delivered by conference call on June 11, 2024.

NOTICE TO U.S. HOLDERS

National Bank intends to file a registration statement on Form F-8 or Form F-80, which will include Canadian Western Bank’s management information circular and related documents, with the United States Securities and Exchange Commission (“SEC”) in respect of National Bank’s common shares to be offered or issued in the Transaction to U.S. holders of Canadian Western Bank (“CWB”) common shares. SHAREHOLDERS ARE URGED TO READ SUCH REGISTRATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE OFFER AS THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain a free copy of such registration statement, as well as other related filings, through the SEC’s website (www.sec.gov).

NO OFFER OR SOLICITATION

This announcement is for informational purposes only and does not constitute an offer to purchase or a solicitation of an offer to sell CWB common shares or an offer to sell or a solicitation of an offer to buy National Bank common shares.

[Materials begin on the following page]

1

2

3

4

5

6

7

8

9

10

11

12

13

National Bank of Canada to acquire

Canadian Western Bank | |

|

June 11, 2024 / 4:45 PM EDT |

Call Participants

Christopher H. Fowler

President, CEO & Director

Canadian Western Bank

Laurent Ferreira

President, CEO & Director

National Bank of Canada

Marianne Ratte

VP & Head of Investor Relations

National Bank of Canada

Marie Chantal Gingras

CFO & Executive VP of Finance

National Bank of Canada

Presentation

Operator

Good afternoon, and welcome to National Bank of Canada’s conference call. I would now like to turn the meeting over to Marianne Ratte, Vice President and Head of Investor Relations. Please go ahead, Marianne.

Marianne Ratté - Vice President and Head, Investor Relations

Thank you, and welcome to National Bank’s conference call regarding the Bank’s intention to acquire Canadian Western Bank. Please note that the presentation accompanying today’s announcement is available in the investor relations section of our website under Presentations and events.

Today’s call will include remarks from Laurent Ferreira, President and CEO of National Bank; Chris Fowler, CEO of CWB; and Marie Chantal Gingras, CFO of National Bank. Given the concurrent equity offering, note that we will not be holding a Q&A period today.

Before we begin, I would like to refer you to Slides 2 and 3 of the presentation, for information on forward-looking statements, non-GAAP financial measures and disclaimers. The Bank uses non-GAAP measures, such as adjusted results, to assess its performance. Management will be referring to adjusted results unless otherwise noted.

I will now turn the call over to Laurent.

Laurent Ferreira, President & CEO

Thank you Marianne, and thank you everyone for joining us on such short notice.

Today, we are very pleased to announce that National Bank and Canadian Western Bank have agreed to join forces.

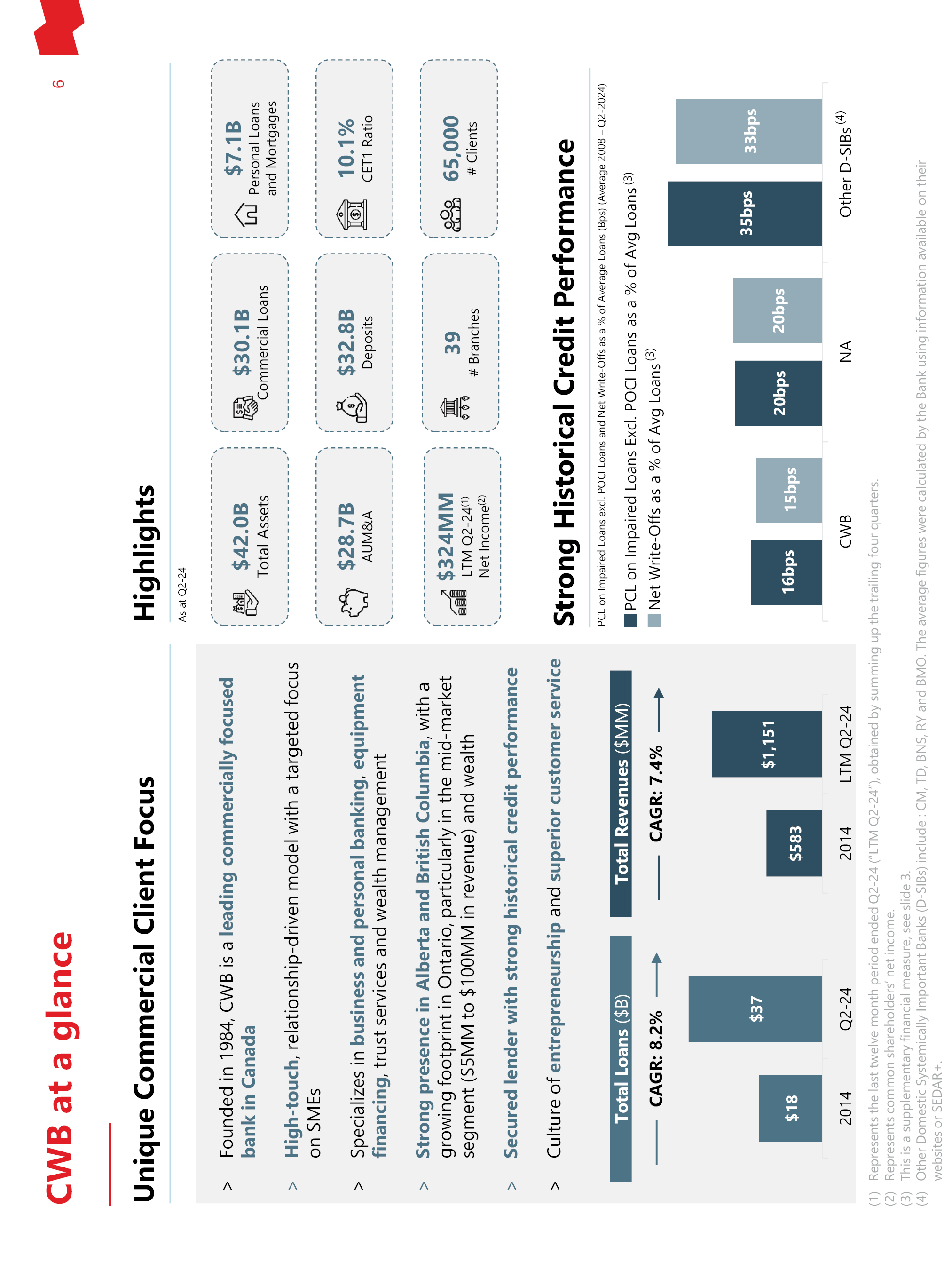

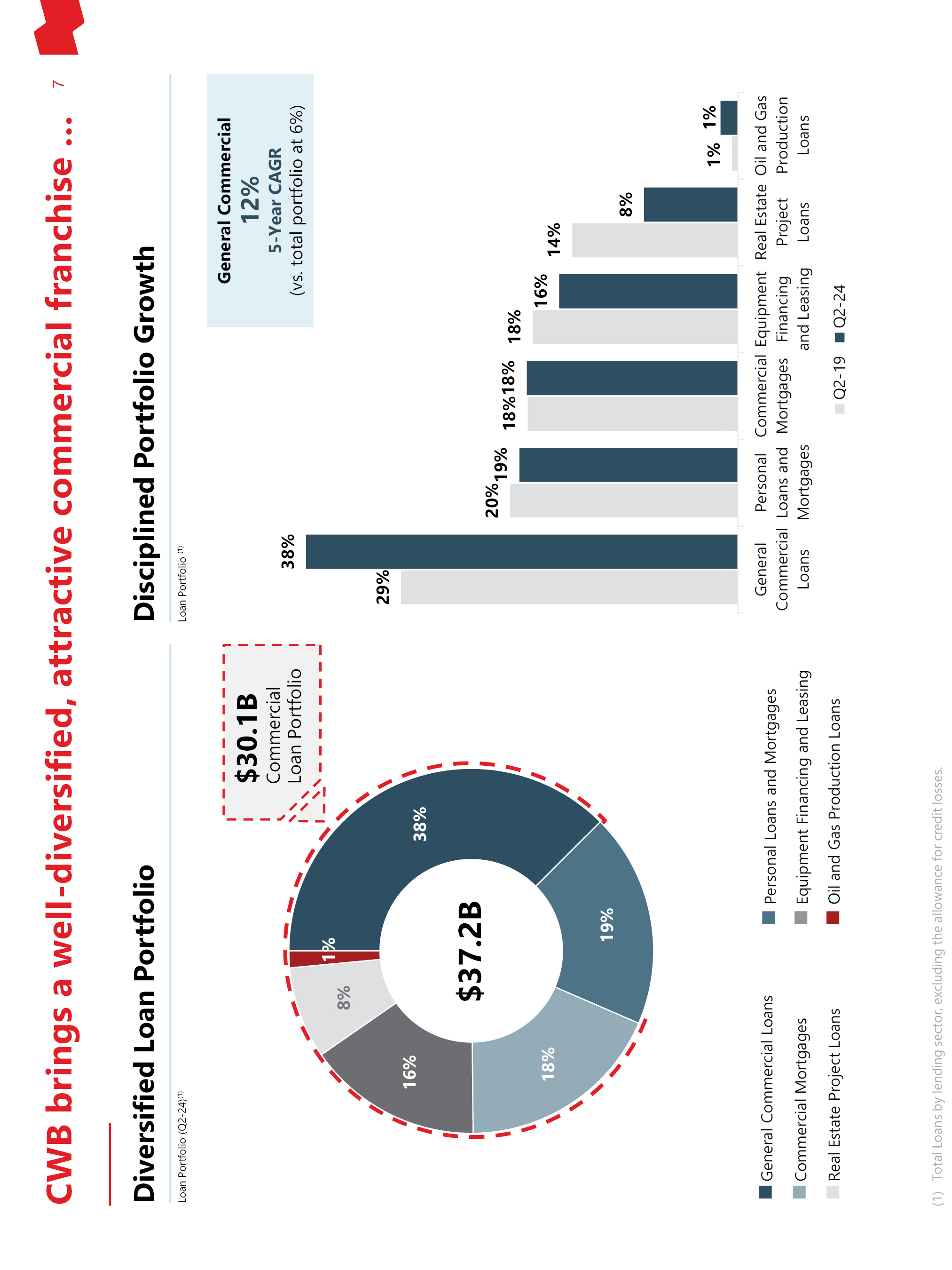

CWB is a leading bank in Canada focused on commercial banking, with a strong presence in Alberta and British Columbia.

This transaction will accelerate National Bank’s strategic plan and pan-Canadian growth, and expand our domestic earnings power.

We are bringing together two strong teams and highly complementary platforms — from a capabilities, geographic and cultural standpoint.

And we are looking forward to welcoming CWB employees.

PAGE 1 OF 5

National Bank of Canada to acquire

Canadian Western Bank | |

|

June 11, 2024 / 4:45 PM EDT |

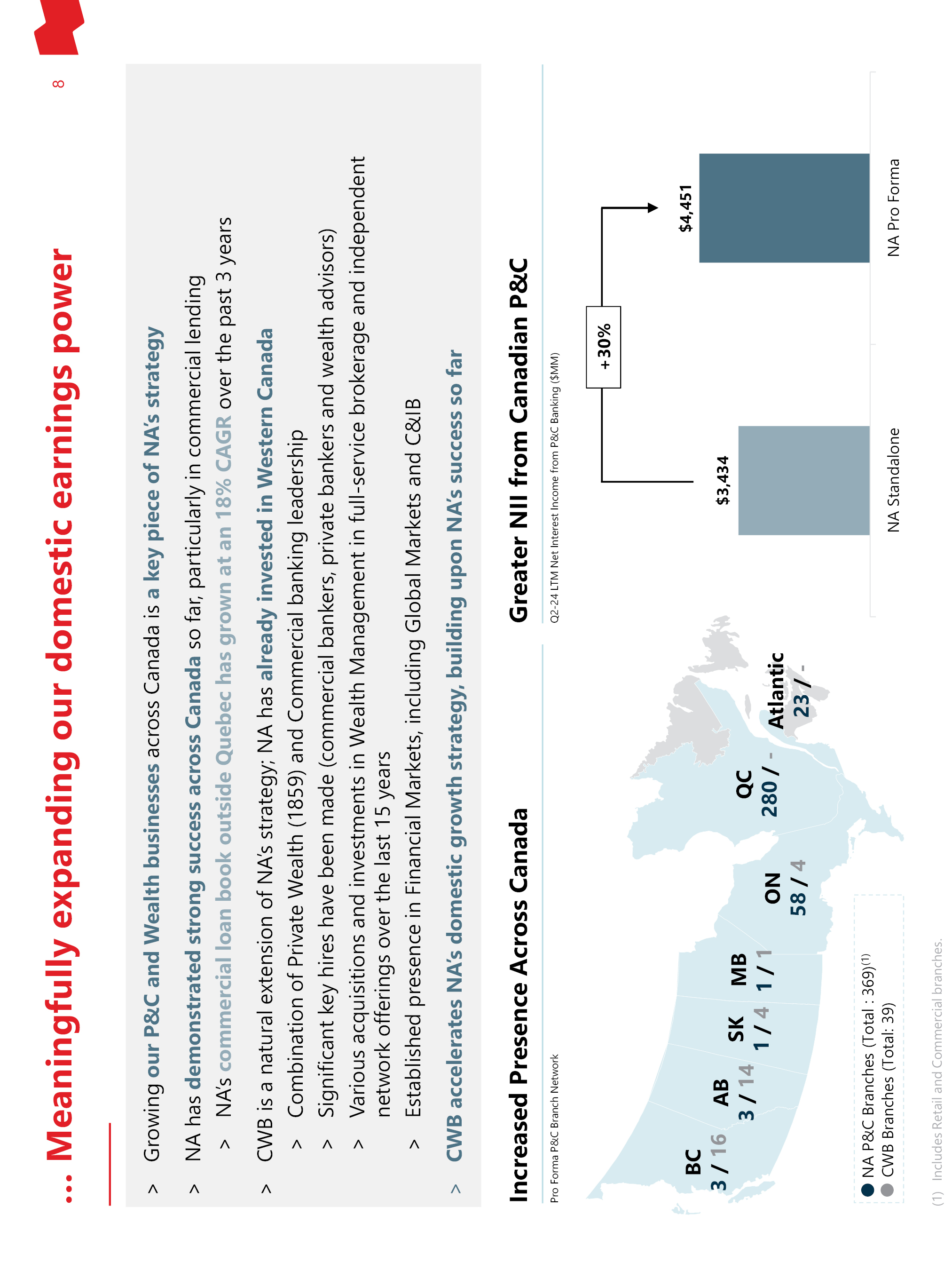

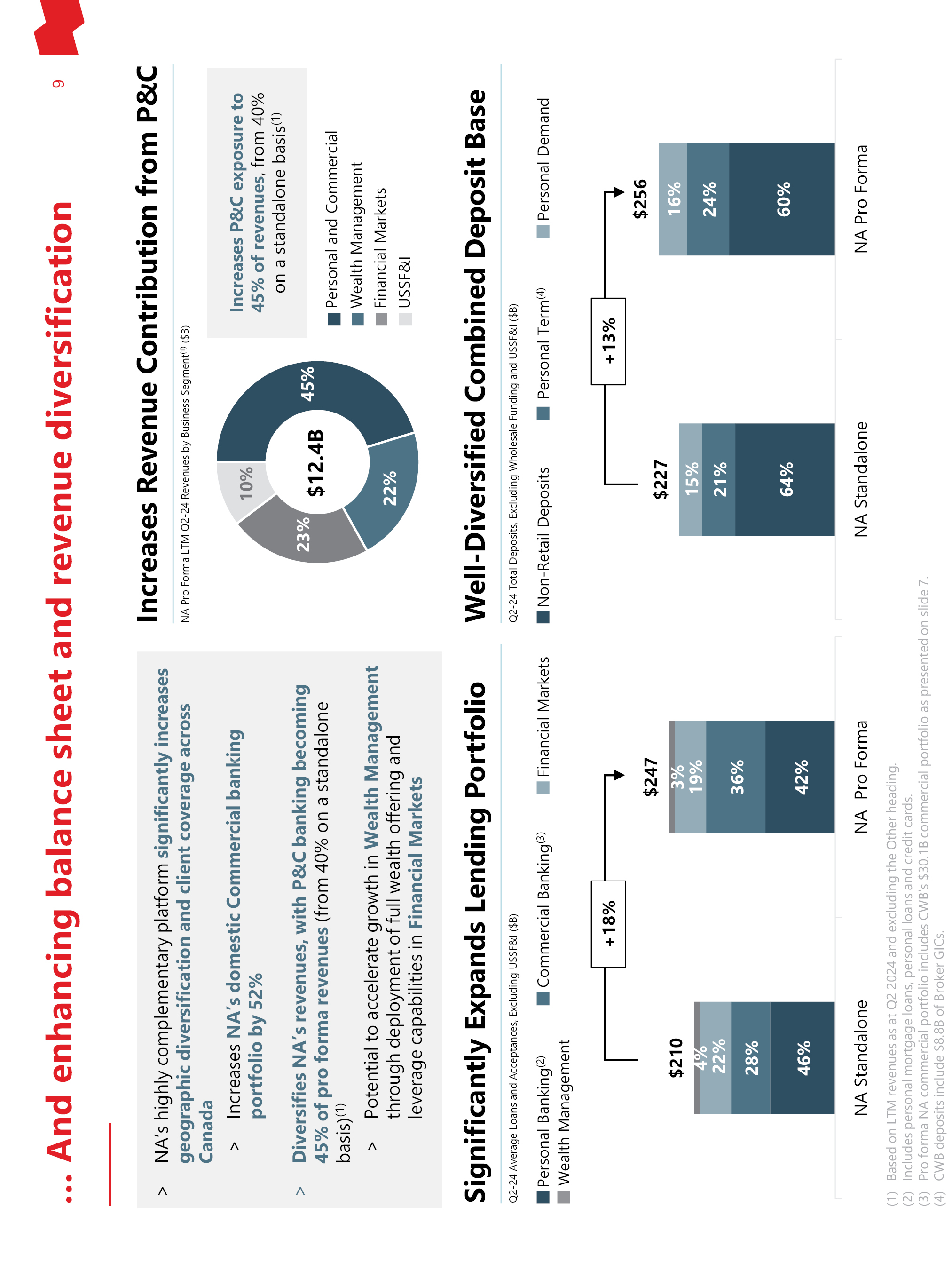

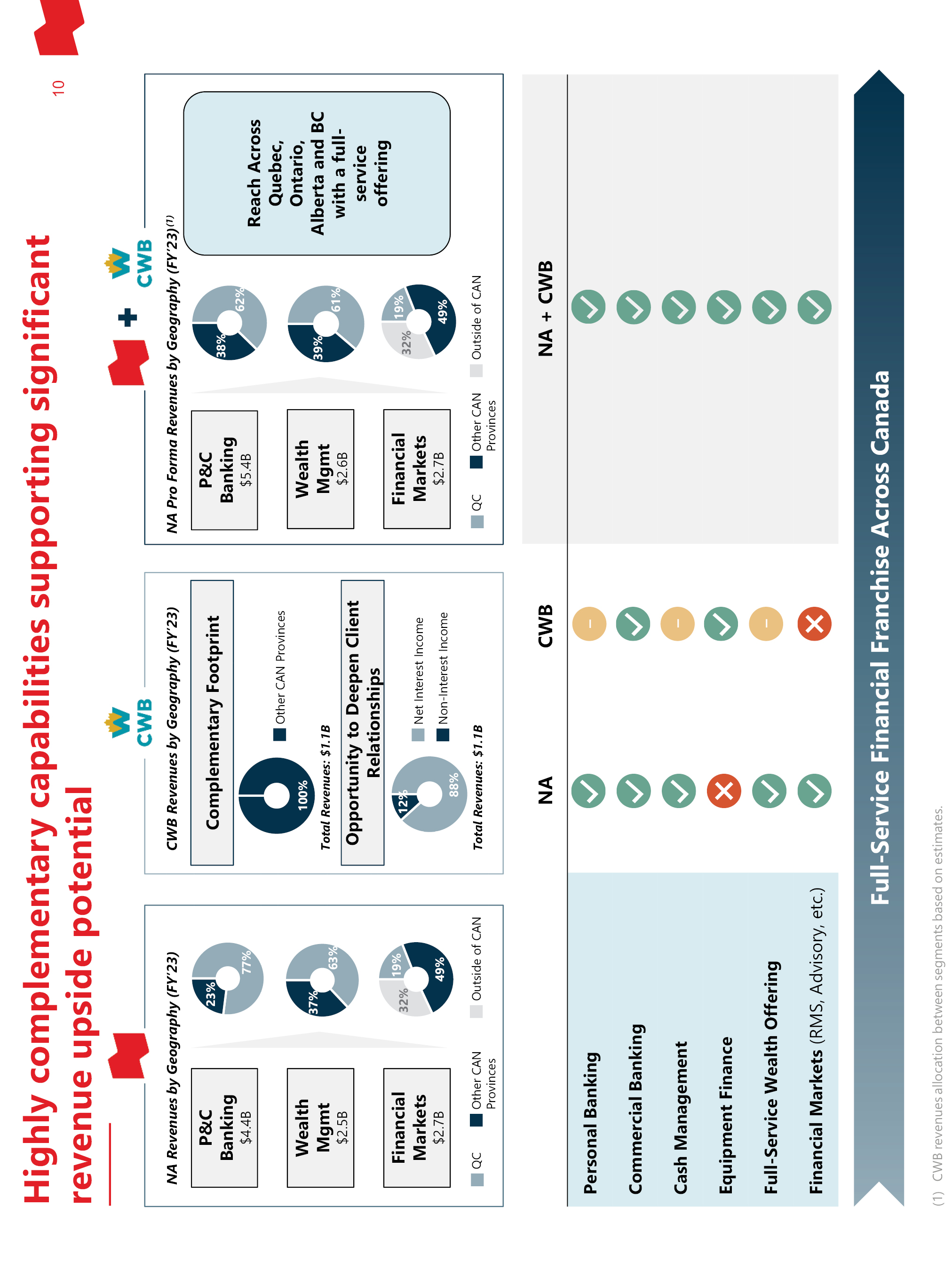

CWB will expand our Canadian P&C franchise.

• It will increase our domestic commercial loan book by over 50%.

• It will further diversify our revenues, with P&C’s revenue contribution increasing to 45%, up from 40%.

• And, net interest income from P&C Banking will increase by 30%.

These are on a pro forma, last twelve month basis, and before taking into account any revenue upside potential.

CWB will strengthen our national reach by increasing our presence and branch network, providing us the opportunity to grow our retail segment.

Together, our clients will have greater access to banking services across Quebec, Ontario, Alberta and BC.

We will also grow and extend National Bank’s domestic top-line by leveraging our complementary capabilities across our combined business lines.

The integrated platform will enable the extension of full-service banking relationships through CWB’s deep customer relationships across a number of priority industries.

This includes:

• Deploying National Bank’s digital capabilities for all clients

• A full service offering for cash management

• And various solutions from our Financial Markets business, such as risk management and advisory services.

And, we also plan on growing our Wealth Management segment through this acquisition.

These are all areas where there is little to no existing overlap with CWB.

By combining two successful banks, we will create a stronger, full-service coast-to-coast competitor, providing more choice to individuals, entrepreneurs and businesses across the country.

This will be delivered through a regionally focused service model, supported by an extensive branch network and client-first service approach.

With CWB, we have found strong cultural alignment and similar values and vision. We both believe that our focus on client experience and our entrepreneurial spirit set us apart.

We are equally committed to a disciplined approach to execution, governance and risk management. And, we also share the same enthusiasm for what the future holds for our combination.

This commitment is key to a successful integration and we plan on working together to achieve operational synergies and, most importantly, future growth.

Part of that plan includes a continued commitment to Alberta and Western Canada, and investing in the future of the Western Canadian economy.

National Bank already has roots and a longstanding presence in the region. Western Canada is already a priority growth market for us, we have a strong team in place of commercial bankers, private bankers and wealth advisors, as well as Financial Markets team, including Global Markets and C&IB.

We will work with CWB’s clients to increase banking services and increase investments in Western communities.

We believe in local leadership.

PAGE 2 OF 5

National Bank of Canada to acquire

Canadian Western Bank | |

|

June 11, 2024 / 4:45 PM EDT |

We will maintain Western headquarters, where executive and operational leaders overseeing our growth in the region will be based. And, two CWB nominees will join National Bank’s Board of Directors.

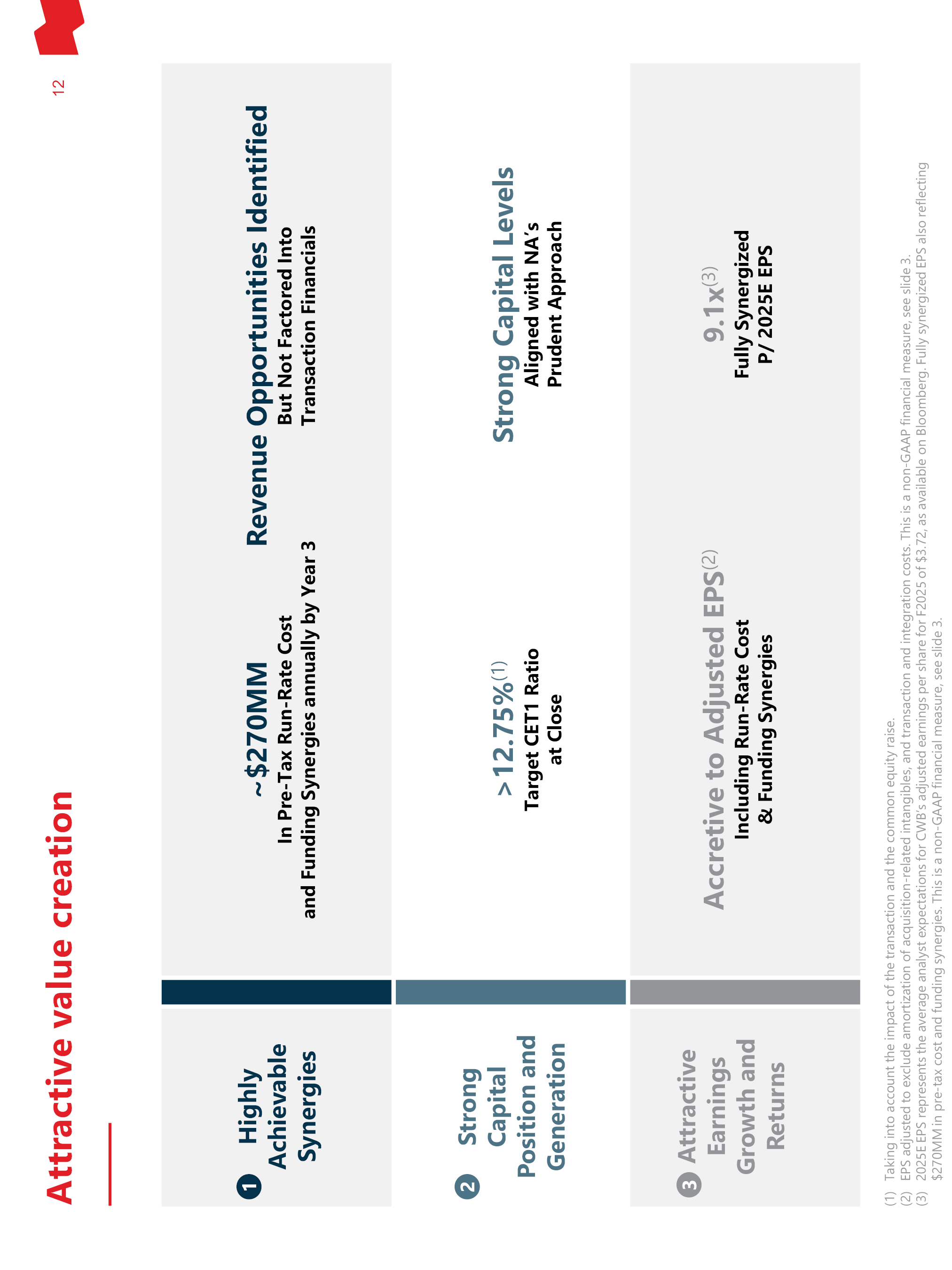

This transaction is very compelling from an earnings and value creation perspective. It will be accretive to earnings on a run rate, cost and funding synergies basis, and brings significant untapped revenue potential.

Before I pass it over to Chris,

I would like to thank our shareholders for their confidence in us as we pursue our strategic objectives. I also wish to recognize our clients for their trust and loyalty.

And finally, I want to thank our dedicated employees. It is with all of your support that we are welcoming CWB and together, creating a Canadian banking leader with growth priorities from coast to coast.

Chris, over to you.

Chris Fowler, CWB’s CEO

Thank you, Laurent, I appreciate the opportunity to address everyone on this call today.

Let me first reiterate what Laurent has said about the combination of our respective institutions being highly complementary, both from a cultural and strategic standpoint.

I also want to share my enthusiasm for the opportunity to join a team of likeminded entrepreneurs where together, we can make a significant impact within the Canadian banking ecosystem.

CWB was founded by Western Canadian entrepreneurs and has spent the last 40 years building a strong banking franchise for business owners in Canada. With this transaction, we have the opportunity to build on our legacy to expand our services to our long-standing clients. At CWB, we are obsessed with our clients’ success and we look forward to even greater opportunities in the years to come.

National Bank is an ideal partner who recognizes our unique value and leadership in our core markets, and brings scale, complementary market expertise and the technological capabilities necessary to accelerate our growth, and deliver compelling benefits to our clients, people and investors.

Clients will benefit from uniting our network and relationships with National Bank’s comprehensive platform to provide new opportunities and capabilities to meet their unique financial needs.

Our people will benefit from a chance to grow and develop their full potential by tapping into an expanded network of opportunities from coast to coast, and to unite with a bank that shares similar values and approach to talent and client service. We also know that National Bank has strong roots in Western Canada, and is committed to building on our legacy and leadership here.

Investors will benefit from the compelling value offered by this transaction, and the opportunity to participate in the significant growth potential of this strategic combination.

We believe this combination provides an exciting opportunity for all our stakeholders.

Personally, I am also looking forward to working with Laurent and National Bank’s leadership team as we embark on this next chapter for CWB.

I’ll now hand it over to Marie Chantal, to discuss the key components of the transaction.

PAGE 3 OF 5

National Bank of Canada to acquire

Canadian Western Bank | |

|

June 11, 2024 / 4:45 PM EDT |

Marie Chantal Gingras, CFO

Thank you, Chris. I’m excited by today’s announcement and I look forward to working with our colleagues at CWB as we accelerate our domestic growth across Canada and position ourselves to do even more for our clients.

Let me now review some of the key transaction details.

As per our agreement, National Bank will acquire all the issued and outstanding common shares in the capital of CWB by way of a share exchange, excluding shares we already own, which represent approximately 6% of CWB’s shares outstanding.

CWB shareholders will get 0.45 of a National Bank common share for each one of their CWB common shares, valuing CWB at approximately $5.0 billion. On a pro forma basis, CWB shareholders are expected to have an approximate 10.5% ownership in National Bank.

The acquisition is anticipated to close by the end of 2025, subject to regulatory approvals, as well as the approval of CWB shareholders.

From a financial perspective, the transaction is attractive on several fronts.

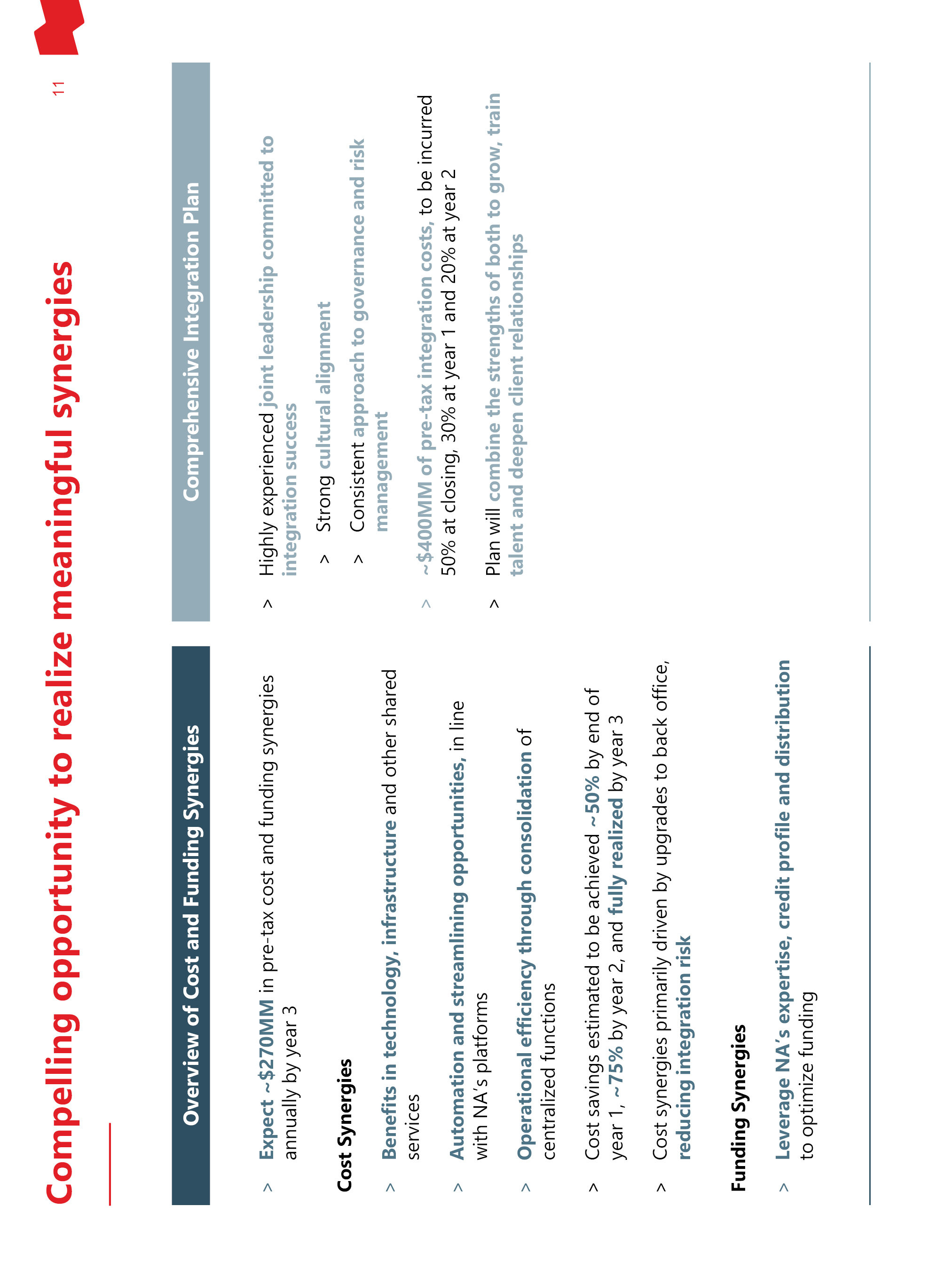

First, it is expected to be accretive to adjusted EPS on a run-rate synergies basis. We have identified run-rate cost and funding synergies of approximately 270 million dollars per year before tax, which we expect to be fully realized by the end of year three after closing.

Second, as outlined by Laurent, we see significant revenue opportunities from growing together, none of which is factored into the accretion metrics.

And third, to set all teams up for success, a joint and aligned leadership team will lead a comprehensive integration plan, guided by our cultural fit and shared approach to governance and risk.

Cost synergies will be primarily driven by back-office upgrades and efficiency gains, reducing execution and integration risk.

These include, but are not limited to, scale benefits from technology, infrastructure and shared services; as well as automating processees and integrating centralized functions.

On the funding side, we intend to leverage our scale, credit profile and distribution to optimize our combined funding structure.

We expect pre-tax integration costs of $400 million to be incurred over two years.

While the plan is to gain highly achievable synergies, ultimately, it is about combining our strengths to grow and deepen client relationships, leveraging our combined platforms.

Turning to the concurrent common equity raise for total gross proceeds of a 1 6billion dollars. Half will be raised via private placement from leading Canadian institutional investor and long-term shareholder of the Bank, Caisse de dépôt et placement du Québec, and the other half through a public bought deal offering.

The net proceeds from the combined equity offering will go towards maintaining strong capital levels upon closing, aligned with our prudent approach to capital management. We are targeting a pro forma CET1 ratio above 12.75% at closing, supported by the equity raise, and reflecting the following:

• Favourable pre-tax mark to market of approximately $650 million, partly offset by a pre-tax credit mark of $150 million and an $80 million pre-tax expense related to CWB employee incentive plans;

• A $140MM pre-tax gain on CWB shares currently owned by National Bank;

• And CWB’s regulatory capital treatment which is expected to be under standardized methodology at close.

PAGE 4 OF 5

National Bank of Canada to acquire

Canadian Western Bank | |

|

June 11, 2024 / 4:45 PM EDT |

To echo Laurent and Chris, this strategic combination with CWB is attractive from a financial and business perspective. The team is excited for the future and highly motivated to move ahead with this transaction to the benefit of our combined clients, communities, employees and shareholders.

With that, I’ll turn it back to Laurent.

Laurent Ferreira, President & CEO

Thank you, Chris and Marie Chantal.

I speak on behalf of the entire National Bank team when I say that we are all excited to be joining forces with CWB. Together, we can bring more choice and value to all Canadians and Canadian businesses.

Thank you all for joining us. Operator, back to you to end the call.

Operator

Thank you. The conference has now ended. Please disconnect your lines at this time, and we thank you for your participation.

PAGE 5 OF 5