QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

UTSTARCOM, INC. |

(Name of Registrant as Specified in Its Charter) |

UTSTARCOM, INC. |

(Name of Person(s) Filing Proxy Statement) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transactions applies:

|

| | | (2) | | Aggregate number of securities to which transactions applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

UTSTARCOM, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 10, 2002

To The Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of UTStarcom, Inc. (the "Company"), a Delaware corporation, will be held on May 10, 2002 at 10:00 a.m., local time, at the Hilton Oakland Airport, 1 Hegenberger Road, Oakland, California 94621, for the following purposes:

1. To elect two Class II directors to serve for a term expiring on the date on which the Annual Meeting of Stockholders is held in the year 2005.

2. To ratify and approve the appointment of PricewaterhouseCoopers LLP as the independent public accountants of the Company for the fiscal year ending December 31, 2002.

3. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 27, 2002 are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to complete, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she returned a proxy.

| | | By Order of the Board of Directors |

|

|

Michael J. Sophie

Assistant Secretary |

Alameda, California

April 10, 2002

YOUR VOTE IS IMPORTANT

To assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope, which requires no postage if mailed in the United States.

UTSTARCOM, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of UTStarcom, Inc. (the "Company") for use at the Annual Meeting of Stockholders to be held May 10, 2002 at 10:00 a.m., local time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Hilton Oakland Airport, 1 Hegenberger Road, Oakland, California 94621. The Company's telephone number at that location is 510/635-5000.

These proxy solicitation materials and the Company's Annual Report to Stockholders for the year ended December 31, 2001 were mailed on or about April 10, 2002 to all stockholders entitled to vote at the Annual Meeting.

Record Date and Voting Securities

Only stockholders of record at the close of business on March 27, 2002 are entitled to notice of and to vote at the Annual Meeting. As of March 27, 2002, 111,283,652 shares of the Company's Common Stock were issued and outstanding. No shares of the Company's Preferred Stock were outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Assistant Secretary of the Company at the Company's principal executive offices located at 1275 Harbor Bay Parkway, Alameda, California 94502, a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. The mere presence at the Annual Meeting of a stockholder who has appointed a proxy will not revoke the prior appointment. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the instructions indicated on the proxy card, or if no instructions are indicated, will be voted FOR the slate of directors described herein, FOR Proposal Two, and as to any other matter that may properly be brought before the Annual Meeting, in accordance with the judgment of the proxy holders.

Voting and Solicitation

Each stockholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

This solicitation of proxies is made by the Company, and all costs associated with soliciting proxies will be borne by the Company. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may be solicited by certain of the Company's directors, officers and regular employees personally or by telephone, facsimile or telegram. No additional compensation will be paid to these persons for such services.

Quorum; Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the Annual Meeting is a majority of the shares of Common Stock issued and outstanding on the record date. All shares represented at the

meeting, whether in person or by a general or limited proxy, will be counted for the purpose of establishing a quorum. While there is no definitive statutory or case law authority in Delaware as to the proper treatment of abstentions, the Company believes that abstentions should be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of shares present and entitled to vote (the "Votes Cast") with respect to a proposal (other than the election of directors). In the absence of controlling precedent to the contrary, the Company intends to treat abstentions in this manner. Accordingly, abstentions will have the same effect as a vote against the proposal.

Under current Delaware case law, while broker non-votes (i.e. the votes of shares held of record by brokers as to which the underlying beneficial owners have given no voting instructions) should be counted for purposes of determining the presence or absence of a quorum for the transaction of business, broker non-votes should not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted. Accordingly, the Company intends to treat broker non-votes in this manner. Thus, a broker non-vote will make a quorum more readily obtainable, but the broker non-vote will not otherwise affect the outcome of the voting on a proposal.

Deadlines for Submission of Stockholder Proposals for 2003 Annual Meeting

Stockholders of the Company are entitled to present proposals for consideration at forthcoming stockholder meetings provided that they comply with the proxy rules promulgated by the Securities and Exchange Commission (the "SEC") and the Bylaws of the Company. Stockholders wishing to present a proposal at the Company's 2003 Annual Stockholder Meeting must submit the proposal to the Company by December 11, 2002 if they wish for it to be eligible for inclusion in the proxy statement and form of proxy relating to that meeting. In addition, under the Company's Bylaws, a stockholder wishing to make a proposal at the 2003 Annual Stockholder Meeting must submit the proposal to the Company prior to February 24, 2003.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The authorized number of directors is currently established at six. The Company's Certificate of Incorporation provides that the directors shall be divided into three classes, with the classes serving for staggered, three-year terms. Currently there are two directors in each of class I, II and III. In March 2002 Director Shey resigned as a Class II director. The vacancy created by Director Shey's resignation in March 2002 was filled by Betsy S. Atkins in March 2002. Each of the two Class III directors will hold office until the 2003 Annual Meeting or until his successor has been duly elected and qualified, and each of the two Class I directors will hold office until the 2004 Annual Meeting or until his successor has been duly elected and qualified. The two Class II directors are to be elected at this Annual Meeting.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company's two nominees named below. Larry D. Horner and Betsy S. Atkins are currently directors of the Company. In the event that any nominee of the Company becomes unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director.

The names of the two Class II nominees for director and the current Class I and Class III directors with unexpired terms, their ages as of the date of this Proxy Statement and certain information about them are set forth below:

Name of Director

| | Age

| | Principal Occupation

| | Director

Since

| | Term

Expires

|

|---|

| Nominees for Class II Director: | | | | | | | | |

| Betsy S. Atkins | | 46 | | Chief Executive Officer of the Operating Group of Accordiant Ventures and Member of the Board of Directors of Lucent Technologies | | 2002 | | 2002 |

| Larry D. Horner | | 68 | | Member of the Board of Directors of Phillips Petroleum Company, Atlantis Plastics, Inc. and Newmark Homes Corp. | | 2000 | | 2002 |

| Continuing Class I Directors: | | | | | | | | |

| Thomas J. Toy | | 47 | | Managing Director of Pacrim Venture Partners | | 1995 | | 2004 |

| Ying Wu | | 42 | | Executive Vice President and Vice Chairman of the Board of Directors of UTStarcom, Inc., President and Chief Executive Officer of UTStarcom (China) and Chairman of the Board of Directors of UTStarcom (Hangzhou), Ltd. | | 1995 | | 2004 |

| Continuing Class III Directors: | | | | | | | | |

| Hong Liang Lu | | 47 | | President and Chief Executive Officer of UTStarcom, Inc. | | 1991 | | 2003 |

| Masayoshi Son | | 44 | | Chairman of the Board of Directors of UTStarcom, Inc., President, Chief Executive Officer and Director of SOFTBANK Corp., Chairman of the Board of Directors of SOFTBANK Holdings Inc. and Chairman of the Board of Directors of SOFTBANK America Inc. | | 1995 | | 2003 |

3

Except as set forth below, each nominee or incumbent director has been engaged in his principal occupation described above during the past five years. There is no family relationship between any director or executive officer of the Company.

Hong Liang Lu has served as President and Chief Executive Officer and as a director of the Company since June 1991. Mr. Lu co-founded the Company under its prior name, Unitech Telecom, Inc., in June 1991 which subsequently acquired StarCom Network Systems, Inc. in September��1995. From 1986 through December 1990, Mr. Lu served as President and Chief Executive Officer of Kyocera Unison, a majority-owned subsidiary of Kyocera International, Inc. From 1983 until its merger with Kyocera in 1986, he served as President and Chief Executive Officer of Unison World, Inc., a software development company. From 1979 to 1983, he served as Vice President and Chief Operating Officer of Unison World, Inc. Mr. Lu holds a B.S. in Civil Engineering from the University of California at Berkeley.

Betsy S. Atkins has served as Chief Executive Officer of the Operating Group of Accordiant Ventures since 1994. Ms. Atkins is also currently a director of Polycom, Inc. and Lucent Technologies, Inc., where she sits on the audit and compensation committees. Ms. Atkins was a founder of Ascend Communications Corp. in 1989 and formerly served as a director. Ms. Atkins was Chief Executive Officer of NCI, Inc. a nutraceutical company, from 1992 to 1994. Ms. Atkins served as a member of the Board of Directors for Olympic Steel from 1998 to 2000, Selectica, Inc. from 1996 to 1999, and Secure Computing, Inc. from 1997 to 1999. Ms. Atkins is a presidential appointee to the Pension Benefit Guarantee Trust Corporation. Ms. Atkins holds a B.A. from the University of Massachusetts.

Larry D. Horner has served as a director of the Company since January 2000. He is a director of Phillips Petroleum Company, Atlantis Plastics, Inc. and Newmark Homes Corp. From 1994 until May 3, 2001, Mr. Horner served as Chairman of Pacific USA Holdings Corp and as Chairman of the Board and Chief Executive Officer of Asia Pacific Wire & Cable Corporation Limited. Mr. Horner formerly served as Chairman and Chief Executive Officer of KPMG Peat Marwick from 1984 to 1990. Mr. Horner is a Certified Public Accountant, holds a B.S. from the University of Kansas and is a graduate of the Stanford Executive Program.

Masayoshi Son has served as Chairman of the Board of Directors of the Company since October 1995. For more than 16 years, Mr. Son served as President and Chief Executive Officer and as a director of SOFTBANK Corp., a leading global provider of Internet content, technology and services. Mr. Son also serves as a director of BB Technologies Corporation, Yahoo Japan Corporation and Aozora Bank, Ltd. Mr. Son also serves as Chairman of the Board of Directors of SOFTBANK Holdings Inc. and Chairman of the Board of Directors of SOFTBANK America Inc. From April 1998 to October 1999, Mr. Son served as a director of Ziff-Davis, Inc. Mr. Son holds a B.A. in Economics from the University of California at Berkeley.

Thomas J. Toy has served as a director of the Company since February 1995. Since March 1999, Mr. Toy has served as Managing Director of Pacrim Venture Partners, a professional venture capital firm specializing in investments in the information technology sector. Prior to that he was a partner at Technology Funding, a professional venture capital firm, from January 1987 to March 1999. While at Technology Funding, Mr. Toy was Managing Director of Corporate Finance and headed the firm's investment committee. Mr. Toy also serves as a director of White Electronic Designs Inc. and several private companies. Mr. Toy holds B.A. and M.M. degrees from Northwestern University.

Ying Wu has served as the Executive Vice President and Vice Chairman of the Board of Directors of the Company since October 1995. Mr. Wu has also served as the President and Chief Executive Officer of one of the subsidiaries of the Company, UTStarcom China, since October 1995. Mr. Wu was a co-founder of, and from February 1991 to September 1995 served as Senior Vice

4

President of, StarCom Network Systems, Inc., a company that marketed and distributed third party telecommunications equipment. From 1988 to 1991, Mr. Wu served as a member of the technical staff of Bellcore Laboratories. From 1987 through 1988, Mr. Wu served as a consultant at AT&T Bell Labs. He holds a B.S. in Electrical Engineering from Beijing Industrial University and an M.S. in Electrical Engineering from the New Jersey Institute of Technology.

Board Meetings and Committees

The Board of Directors of the Company held a total of six meetings during the fiscal year ended December 31, 2001. During fiscal 2001, each of the directors attended 75% or more of the meetings of the Board of Directors and the Committees of the Board on which he served held subsequent to his becoming a director or his appointment to such committee, except for Director Son. The Board of Directors has an Audit Committee and a Compensation Committee. The Board of Directors has no nominating committee or any committee performing similar functions.

The Audit Committee of the Board of Directors currently consists of Directors Atkins, Horner and Toy, and held four meetings during the last fiscal year. Director Shey served on the Audit Committee until his resignation in March 2002 and was replaced by Director Atkins in March 2002. The Audit Committee recommends engagement of the Company's independent accountants, and is primarily responsible for approving the services performed by the Company's independent accountants and for reviewing and evaluating the Company's accounting principles and its system of internal accounting controls.

The Compensation Committee of the Board of Directors currently consists of Directors Horner and Toy, and held one meeting during the last fiscal year. The Compensation Committee establishes the policies upon which compensation of and incentives for the Company's executive officers will be based, reviews and approves the compensation of the Company's executive officers, and administers the Company's stock option and stock purchase plans.

Director Compensation

The Company's directors do not receive cash for services they provide as directors. The Company's employees do not receive any compensation for serving on the Board of Directors.

Pursuant to the Company's 2001 Director Stock Option Plan, the following stock options were granted to directors during fiscal year ended December 31, 2001:

Director Horner was granted options to purchase 80,000 shares of common stock at an exercise price of $22.71 per share on May 11, 2001. The options granted to Director Horner vest in equal yearly portions on each anniversary of the date of grant for four years.

Director Shey was granted options to purchase 80,000 shares of common stock at an exercise price of $22.71 per share on May 11, 2001. The options granted to Director Shey vest in equal yearly portions on each anniversary of the date of grant for four years.

Director Son was granted options to purchase 80,000 shares of common stock at an exercise price of $22.71 per share on May 11, 2001. The options granted to Director Son vest in equal yearly portions on each anniversary of the date of grant for four years.

Director Toy was granted options to purchase 80,000 shares of common stock at an exercise price of $22.71 per share on May 11, 2001. The options granted to Director Toy vest in equal yearly portions on each anniversary of the date of grant for four years.

5

Required Vote

The two nominees receiving the highest number of votes of the shares entitled to be voted for them shall be elected as directors. Votes withheld from any director will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting, but have no other legal effect upon election of directors under Delaware law.

THE COMPANY'S BOARD OF DIRECTORS RECOMMENDS VOTING "FOR" THE NOMINEES SET FORTH HEREIN.

6

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT

PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP, independent public accountants, to audit the financial statements of the Company for the fiscal year ending December 31, 2002 and recommends that the stockholders ratify this selection. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. Representatives of PricewaterhouseCoopers LLP are expected to be available at the Annual Meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Fees billed to the Company by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2001

Fees for the fiscal year ended December 31, 2001 audit and interim reviews were $825,046 for which an aggregate amount of $578,459 has been billed through December 31, 2001.

The Company did not engage PricewaterhouseCoopers LLP to provide services to the Company regarding financial information systems design and implementation during the fiscal year ended December 31, 2001.

Other fees during the year ended December 31, 2001 totalled $1,434,572 and consisted of $380,233 for audit related services, $188,138 for tax compliance and planning, $284,167 for assistance with tax audits and $582,034 for tax services related to international expansion and tax services related to global compensation. Audit related services included assistance with the Company's registration statements and procedures performed surrounding certain of the Company's acquisitions.

The Audit Committee of the Board of Directors has considered whether the provision of non-audit services is compatible with maintaining the principal accountant's independence. The Audit Committee believes that the provision of the non-audit services mentioned above to the Company by PricewaterhouseCoopers LLP is compatible with maintaining PricewaterhouseCoopers LLP's independence.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent public accountants is not required by the Company's Bylaws or other applicable legal requirement. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board at its discretion may direct the appointment of a different independent accounting firm at anytime during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Required Vote

The affirmative vote of the holders of a majority of the Votes Cast will be required to ratify the selection of PricewaterhouseCoopers LLP as the Company's independent public accountants for the fiscal year ending December 31, 2002.

7

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY'S INDEPENDENT PUBLIC ACCOUNTANTS.

Other Matters

The Company knows of no other matters to be submitted at the meeting. If any other matters properly come before the meeting or any adjournment or postponement thereof, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation Tables

The table below sets forth information for the three most recently completed fiscal years concerning the compensation of (i) the Chief Executive Officer of the Company and (ii) the six other most highly compensated executive officers of the Company who were serving as executive officers at the end of the fiscal year ended December 31, 2001, including those who tied as the fourth most highly compensated executive officers (the "Named Executive Officers"):

Summary Compensation Table

| |

| |

| |

| |

| | Long-Term

Compensation

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

| |

|---|

| |

| |

| | Securities

Underlying

Options/SARs

(#)

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary

($)

| | Bonus

($)(1)

| | Other Annual

Compensation

($)

| | All Other

Compensation

($)

| |

|---|

Hong Liang Lu

President, Chief Executive

Officer and Director | | 2001

2000

1999 | | $

| 280,000

250,000

205,500 | | $

| 140,000

50,000

10,000 | | $

| —

—

— | | —

350,000

400,000 | | $

| 14,942(3

6,110(2

5,550(2 | )

)

) |

Ying Wu

Executive Vice President,

Chief Executive Officer,

China, and Director | | 2001

2000

1999 | | | 230,000

200,000

157,250 | | | 115,000

50,000

7,500 | | | —

—

5,000 | | —

185,000

80,000 | | | 12,765(3

8,491(2

8,127(2 | )

)

) |

Michael J. Sophie(4)

Chief Financial Officer and

Vice President, Finance | | 2001

2000

1999 | | | 230,000

210,000

66,667 | | | 115,000

50,000

20,000 | | | —

—

— | | —

100,000

740,000 | | | 11,253(3

5,944(2

1,188(2 | )

)

) |

Gerald Soloway

Senior Vice President, Engineering | | 2001

2000

1999 | | | 185,000

155,000

136,913 | | | 92,500

50,000

50,000 | | | —

—

— | | 100,000

200,000

164,000 | | | 5,737(3

4,224(2

2,629(2 | )

)

) |

Shao-Ning J. Chou

Senior Vice President and

Chief Operating Officer, China Operations | | 2001

2000

1999 | | | 185,000

165,000

150,000 | | | 92,500

50,000

— | | | —

—

— | | 50,000

210,000

120,000 | | | 12,765(3

8,491(2

8,127(2 | )

)

) |

Bill Huang

Chief Technology Officer,

Senior Vice President | | 2001

2000

1999 | | | 185,000

165,000

158,587 | | | 92,500

30,000

4,688 | | | —

—

— | | —

105,000

— | | | 8,942(3

6,110(2

5,511(2 | )

)

) |

Paul Berkowitz

Vice President, International Sales | | 2001

2000

1999 | | | 170,000

155,000

134,124 | | | 128,833

20,000

3,500 | | | —

—

— | | —

115,000

20,000 | | | 15,636(3

3,235(2

2,936(2 | )

)

) |

- (1)

- Includes bonuses earned during the fiscal year and paid in the subsequent year.

8

- (2)

- Consists of health insurance premiums paid by the Company on behalf of the officers.

- (3)

- Consists of health insurance premiums paid by the Company and 401(k) match payments paid by the Company on behalf of the officers.

- (4)

- Mr. Sophie began his employment with the Company in August 1999.

Option Grants

The following table sets forth certain information with respect to stock option grants to the Named Executive Officers during the fiscal year ended December 31, 2001.

Option Grants in Last Fiscal Year

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation

For Option Term (1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| | % of Total

Options

Granted to

Employees in

Fiscal Year(2)

| |

| |

|

|---|

| | Exercise or

Base Price

($/sh)

| | Expiration

Date

|

|---|

Name

| | 5% ($)

| | 10% ($)

|

|---|

| Hong Liang Lu | | — | | — | | $ | — | | — | | $ | — | | $ | — |

| Ying Wu | | — | | — | | | — | | — | | | — | | | — |

| Michael J. Sophie | | — | | — | | | — | | — | | | — | | | — |

| Gerald Soloway | | 100,000 | | 3.0 | | | 20.75 | | 08/03/2011 | | | 1,304,956 | | | 3,307,016 |

| Shao Ning J. Chou | | 50,000 | | 1.5 | | | 20.75 | | 08/03/2011 | | | 652,478 | | | 1,653,508 |

| Bill Huang | | — | | — | | | — | | — | | | — | | | — |

| Paul Berkowitz | | — | | — | | | — | | — | | | — | | | — |

- (1)

- Potential realizable values are computed by (a) multiplying the number of shares of Common Stock subject to a given option by the exercise price per share, (b) assuming that the aggregate stock value derived from that calculation compounds at the annual 5% or 10% rate shown in the table for the entire ten-year term of the option and (c) subtracting from that result the aggregate option exercise price. The 5% and 10% assumed annual rates of stock price appreciation are mandated by the rules of the SEC and do not represent the Company's estimate or projection of future Common Stock prices.

- (2)

- Based on an aggregate of 3,326,957 shares subject to options granted to the Company's employees in 2001.

Option Exercises and Values

The following table sets forth information for the Company's Named Executive Officers relating to the number and value of securities underlying exercisable and unexercisable options they held at December 31, 2001 and sets forth the number of shares of common stock acquired and the value realized upon exercise of stock options held as of December 31, 2001 by the Company's Named Executive Officers.

9

Aggregated Option Exercises In Last Fiscal Year and FY-End Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at FY-End(#)

| | Value of Unexercised

In-the-Money

Options at FY-End($)(2)

|

|---|

| | Shares

Acquired on

Exercise(#)

| | Value

Realized

($)(1)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Hong Liang Lu | | 200,000 | | $ | 3,647,320 | | 364,584 | | 385,416 | | $ | 7,659,379 | | $ | 7,215,621 |

| Ying Wu | | — | | | — | | 597,860 | | 147,497 | | | 15,529,472 | | | 2,455,574 |

| Michael J. Sophie | | 345,000 | | | 5,721,512 | | 73,490 | | 371,510 | | | 1,413,028 | | | 8,146,772 |

| Gerald Soloway | | 128,962 | | | 2,369,085 | | 177,835 | | 191,203 | | | 1,757,318 | | | 2,914,355 |

| Shao Ning J. Chou | | 428,305 | | | 7,431,800 | | 111,023 | | 224,372 | | | 2,190,832 | | | 2,877,529 |

| Bill Huang | | 230,000 | | | 3,604,258 | | 57,407 | | 74,581 | | | 1,215,423 | | | 1,102,049 |

| Paul Berkowitz | | 309,000 | | | 6,745,191 | | 43,258 | | 84,998 | | | 721,195 | | | 1,320,175 |

- (1)

- The "Value Realized" is based on the closing price of the Company's Common Stock as quoted on The Nasdaq National Market on the date of exercise, minus the per share exercise price, multiplied by the number of shares issued upon exercise of the option.

- (2)

- The value of unexercised in-the-money options is calculated based on the difference between the closing price of $28.50 per share as quoted on The Nasdaq National Market on December 31, 2001, and the exercise price for the shares, multiplied by the number of shares underlying the option.

Employment Contracts and Change of Control Arrangements

Hong Liang Lu is a party to an employment and non-competition agreement dated October 6, 1995. Under this agreement, Mr. Lu is to be paid a minimum of $150,000 annually, which amount may be increased by the Board of Directors, and is entitled to a bonus each year as determined by the Board. Although Mr. Lu's employment is "at will," we must give him 60 days notice of termination for any reason other than voluntary termination, termination as a result of death or disability or termination for cause.

Ying Wu is a party to an employment and non-competition agreement dated October 6, 1995. Under this agreement, Mr. Wu is to be paid a minimum of $150,000 annually, which amount may be increased by the Board of Directors, and is entitled to a bonus each year as determined by the Board. Although Mr. Wu's employment is "at will," we must give him 60 days notice of termination for any reason other than voluntary termination, termination as a result of death or disability or termination for cause.

Bill Huang is a party to an employment and non-competition agreement dated October 6, 1995. Under this agreement, Mr. Huang is to be paid a minimum of $90,000 annually, which amount may be increased by the Board of Directors, and is entitled to a bonus each year as determined by the Board. Although Mr. Huang's employment is "at will," we must give him 60 days notice of termination for any reason other than voluntary termination, termination as a result of death or disability or termination for cause.

On March 29, 2002, the Board of Directors approved the terms and conditions of the Change of Control Severance Agreements to be entered into between the Company and each of Michael J. Sophie and Gerald Soloway. The Company expects these agreements to be entered into on or before April 30, 2002.

The Change of Control Severance Agreement between the Company and Mr. Sophie will provide that if Mr. Sophie's employment with the Company terminates as a result of an involuntary termination at any time within 12 months after a change of control, (i) Mr. Sophie will be entitled to receive 24 months of base salary as in effect as of the date of termination payable in a lump sum within 30 days of termination and 100% of the bonus for the year in which the termination occurs, (ii) all stock options granted to Mr. Sophie will become fully vested and exercisable and all stock held by him that is subject to a right of repurchase by the Company will have such right lapse and (iii) the Company will continue to provide Mr. Sophie health coverage until the earlier of the date Mr. Sophie

10

is no longer eligible to receive continuation coverage pursuant to COBRA or 12 months from the termination date.

The Change of Control Severance Agreement between the Company and Mr. Soloway will provide that if Mr. Soloway's employment with the Company terminates as a result of an involuntary termination at any time within 12 months after a change of control, or terminates as a result of an involuntary termination done in contemplation of a change in control (i) Mr. Soloway will be entitled to receive 24 months of base salary as in effect as of the date of termination payable in a lump sum within 30 days of termination and 100% of the bonus for the year in which the termination occurs, (ii) all stock options granted to Mr. Soloway will become fully vested and exercisable and all stock held by him that is subject to a right of repurchase by the Company will have such right lapse and (iii) the Company will continue to provide Mr. Soloway health coverage until the earlier of the date Mr. Soloway is no longer eligible to receive continuation coverage pursuant to Consolidated Omnibus Budget Reconciliation Act of 1985, as amended ("COBRA") or 12 months from the termination date. The agreement will also provide that if Mr. Soloway's employment with the Company terminates other than as a result of an involuntary termination or resignation within 12 months following a change in control, he will be entitled to receive 12 months of his base salary in effect as of the date of termination, payable in a lump sum within 30 days of termination. In the event that the severance and other benefits provided pursuant to the Change of Control Severance Agreement between the Company and Mr. Soloway constitute "parachute payments" within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code") and subject to an excise tax, Mr. Soloway will receive payments from the Company sufficient to pay such excise tax (including any additional amounts necessary to pay the excise tax and federal and state income taxes arising from such payments).

For the purpose of the Change of Control Severance Agreements, "involuntary termination" includes (i) a significant reduction of the employee's duties, position or responsibilities, or the removal of the employee from such position, duties and responsibilities without the executive's express written consent, unless the employee is provided with comparable duties, position and responsibilities, (ii) a substantial reduction, without good business reasons, of the facilities and perquisites (including office space and location) available to the employee immediately prior to such reduction without the employee's express written consent, (iii) a reduction by the Company of the employee's base salary as in effect immediately prior to such reduction, (iv) a material reduction by the Company in the kind or level of employee benefits to which the employee is entitled immediately prior to such reduction with the result that the employee's overall benefits package is significantly reduced, (v) the relocation of the employee to a facility or a location more than 50 miles in the case of Mr. Sophie and 20 miles in the case of Mr. Soloway from his current location without the employee's express written consent, (vi) any purported termination of the employee by the Company which is not effected for cause or for which the grounds relied upon are not valid, or (vii) the failure of the Company to obtain the assumption of the Change of Control Severance Agreement by any successor to the Company. "Change of control" in these agreements is defined as (a) the approval by the stockholders of the Company of a merger or consolidation of the Company with any other corporation other than a merger or consolidation in which the voting securities of the Company outstanding immediately prior to such merger or consolidation would constitute more than 50% of the total voting power of the surviving entity immediately after such merger or consolidation, (b) the approval by the stockholders of the Company of a plan to complete liquidation of the Company or an agreement for the sale or disposition by the company of all or substantially all of the Company's assets, (c) any "person" (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended) becoming the "beneficial owner" (as defined in Rule 13d-3 under said Act), directly or indirectly, of securities of the Company representing 50% or more of the total voting power represented by the Company's then outstanding voting securities; or (d) a change in the composition of the Board, as a result of which fewer than a majority of the directors are incumbent directors.

11

REPORT OF THE COMPENSATION COMMITTEE

Compensation Committee Report

The information contained in the following report shall not be deemed to be "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

Introduction

The Compensation Committee of the Board of Directors (the "Committee") was established on January 31, 1997 and is comprised solely of outside directors. In general, the Committee is responsible for reviewing and recommending for approval by the Board of Directors the Company's compensation practices, including executive salary levels and variable compensation programs, both cash-based and equity-based. With respect to the compensation of the Company's Chief Executive Officer, the Committee reviews and approves the various elements of the Chief Executive Officer's compensation. With respect to other executive officers, the Committee reviews the recommendations for such individuals presented by the Chief Executive Officer and the bases therefor and approves or modifies the compensation packages for such individuals. Base salary levels for executive officers of the Company have been generally established at or near the start of each fiscal year, and final bonuses for executive officers have been determined at the end of each fiscal year based upon such individual's performance and the performance of the Company.

Executive Compensation

The Company's compensation program consists of two principal components: cash-based compensation, both fixed and variable, and equity-based compensation. These two principal components are intended to attract, retain, motivate and reward executives who are expected to manage both the short-term and long-term success of the Company.

Cash-based Compensation

The Committee believes that the annual cash compensation paid to executives should be commensurate with both the executive's and the Company's performance. For this reason, the Company's executive cash compensation consists of base compensation (salary) and variable incentive compensation (annual bonus).

Base salaries for executive officers are established considering a number of factors, including the Company's profitability, the executive's individual performance and measurable contribution to the Company's success and pay levels of similar positions with comparable companies in the industry. The Committee supports the Company's compensation philosophy of moderation for elements such as base salary and benefits. Base salary decisions are made as part of the Company's formal annual review process.

An executive's annual performance award generally depends on the financial performance of the Company relative to profit targets and the executive's individual performance. These targets are reviewed at least annually to meet the changing nature of the Company's business. The incentive portion is set at a higher percentage for more senior officers, with the result that such officers have a higher percentage of their potential total cash compensation at risk.

Equity-based Compensation

The Committee administers an option program pursuant to which members of management, including the Company's executive officers, may receive annual option grants as of the time of their

12

reviews each year from a pool of shares set aside by the Company. The purpose of the option program is to provide additional incentive to executives and other key employees of the Company to work to maximize long-term return to the Company's stockholders. The allocation of the option pool, other than the shares allocated to the Chief Executive Officer, is recommended by the Chief Executive Officer for approval by the Committee. The allocation of shares from the option pool to the Chief Executive Officer is determined solely by the Committee. In granting stock options to the executive officers and the Chief Executive Officer, the Committee consider a number of objective and subjective factors, including the executive's position and responsibilities at the Company, such executive's past and anticipated individual performance, current survey data with respect to market rates for option compensation and other factors that they may deem relevant. Options generally vest over a four year period to encourage optionholders to continue in the employ of the Company. The exercise price of options is the market price on the date of grant, ensuring that the option will acquire value only to the extent that the price of the Company's Common Stock increases relative to the market price at the date of grant.

Chief Executive Officer Compensation

The Committee generally uses the same factors and criteria described above for compensation decisions regarding the Chief Executive Officer. During the fiscal year ended December 31, 2001, Mr. Lu received a base salary of $280,000 for serving as the Chief Executive Officer of the Company and a bonus of $140,000. In the fiscal year ended December 31, 2001, the Committee did not grant to Mr. Lu any options to purchase the Company's Common Stock pursuant to the Company's stock option plan.

Tax Deductibility of Executive Compensation

The Internal Revenue Code limits the federal income tax deductibility of compensation paid to the Company's Chief Executive Officer and to each of the other four most highly compensated executive officers. For this purpose, compensation can include, in addition to cash compensation, the difference between the exercise price of stock options and the value of the underlying stock on the date of exercise. Under this legislation, the Company may deduct such compensation with respect to any of these individuals only to the extent that during any fiscal year such compensation does not exceed $1 million or meets certain other conditions (such as stockholder approval). The Company's policy is to qualify, to the extent reasonable, its executive officers' compensation for deductibility under applicable tax laws. However, the Committee believes that its primary responsibility is to provide a compensation program that will attract, retain and reward the executive talent necessary to the Company's success. Consequently, the Committee recognizes that the loss of a tax deduction may be necessary in some circumstances.

Summary

The Committee believes that its compensation program to date has been fair and motivating, and has been successful in attracting and retaining qualified employees and in linking compensation directly to the Company's success. The Committee intends to review this program on an ongoing basis to evaluate its continued effectiveness.

13

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Directors Horner and Toy, none of whom has interlocking relationships as defined by the SEC.

| | | The Compensation Committee |

|

|

Larry Horner

Thomas Toy |

14

REPORT OF THE AUDIT COMMITTEE

The following is the report of the Audit Committee with respect to the Company's audited financial statements for the fiscal year ended December 31, 2001. The information contained in this report shall not be deemed to be "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the 1934 Securities Exchange Act, as amended, except to the extent that the Company specifically incorporates the information by reference in such filing.

Established on January 31, 1997, the Audit Committee makes recommendations to the Board of Directors regarding the selection of independent auditors, reviews the results and scope of audit and other services provided by the independent auditors and reviews the accounting principles and auditing practices and procedures to be used in the Company's financial statements. Management is responsible for the Company's financial reporting process including its systems of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company's independent auditors are responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures. We have relied, without independent verification, on management's representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent auditors included in their report on the Company's financial statements.

The Audit Committee held four meetings during the last fiscal year. Each of the members of the Audit Committee is independent as defined by our standards as set forth in the Audit Committee Charter and the Nasdaq listing standards. Director Shey, who was appointed to the Audit Committee in April 2001 and served until his resignation from the Board of Directors in March 2002 was not independent as defined by our standards as set forth in the Audit Committee Charter and the Nasdaq listing standards. Director Atkins was appointed to the Audit Committee effective March 2002. Consequently, Director Atkins was not present at any of the Audit Committee meetings during fiscal year 2001 and did not take part in any of the decisions, recommendations or approvals described herein. A copy of the current Audit Committee Charter is attached to this Proxy Statement as Appendix A.

Audited Financial Statements

The Audit Committee has reviewed the audited financial statements prepared for the fiscal year ended December 31, 2001. The Audit Committee has discussed the audited financial statements with various members of management of the Company.

In addition, the Audit Committee has discussed the audited financials with PricewaterhouseCoopers LLP, the Company's independent auditors for the last fiscal year ("PricewaterhouseCoopers"), including such items as Statement on Auditing Standards No. 61 requires. The Audit Committee has also received from PricewaterhouseCoopers a letter and other written disclosures required under Independence Standards Board Standard No. 1, and has had discussions with PricewaterhouseCoopers regarding the independence of the Company's independent accountants.

After review of all discussions and all written correspondence described above, as well as such other matters deemed relevant and appropriate by the Audit Committee, the Audit Committee

15

recommended to the Board of Directors that the audited financial statements for the last fiscal year be included in the Company's Annual Report on Form 10-K.

| | | The Audit Committee |

|

|

Larry Horner

Thomas Toy |

16

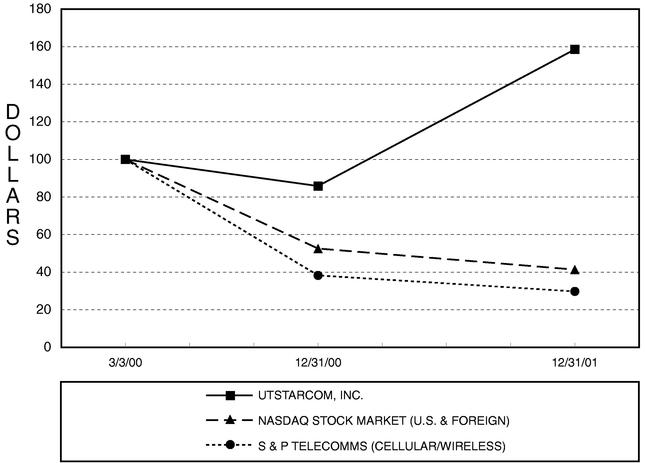

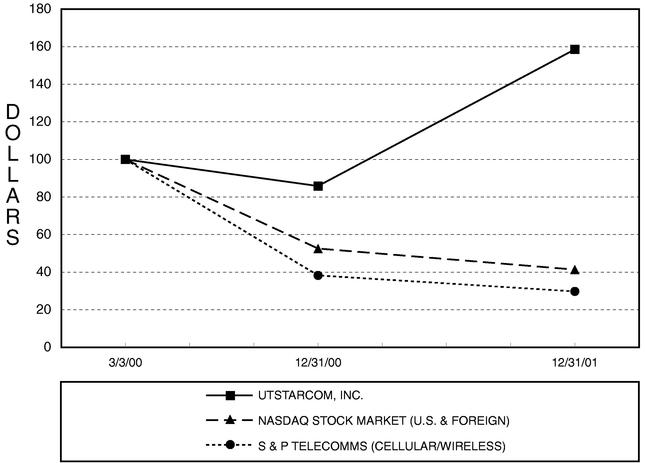

COMPANY'S STOCK PERFORMANCE

Set forth below is a line graph comparing the annual percentage change in the cumulative return to the stockholders of the Company's Common Stock with the cumulative return of the Nasdaq composite (U.S. and foreign) index and S&P Telecommunications (Cellular/Wireless) index for the period commencing on March 3, 2000, the first day the Company's Common Stock was traded on The Nasdaq National Market, and ending on December 31, 2001. The information contained in the performance graph shall not be deemed to be "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

The graph assumes that $100.00 was invested on March 3, 2000 in the Company's Common Stock and in each index (based on the initial public offering price of $18 per share), and that all dividends were reinvested. No cash dividends have been declared or paid on the Company's Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns. The Company operates on a 52-week fiscal year which ended on Monday, December 31, 2001. Under the assumptions stated above, over the period from March 3, 2000 to December 31, 2001 the total return on an investment in the Company would have been 58.33% as compared to -59.89% for the Nasdaq composite (U.S. and foreign) index and -70.45% for the S&P Telecommunications (Cellular/Wireless) index shown below.

17

STOCK PRICE PERFORMANCE GRAPH FOR

UTSTARCOM, INC.

COMPARISON OF 22 MONTH CUMULATIVE TOTAL RETURN*

AMONG UTSTARCOM, INC., THE NASDAQ STOCK MARKET (U.S. & FOREIGN) INDEX

AND THE S & P TELECOMMUNICATIONS (CELLULAR/WIRELESS) INDEX

- *

- $100 invested on 3/3/00 in stock or on 2/29/00 in index-including reinvestment of dividends. Fiscal year ending December 31.

Copyright © 2002, Standard & Poor's, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to beneficial ownership of the Company's Common Stock as of February 28, 2002 (except as otherwise indicated), by: (i) each person who is known by the Company to own beneficially more than five percent of the Common Stock, (ii) each of the Named Executive Officers, (iii) each of the Company's directors, and (iv) all directors and executive officers as a group. Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable.

Calculations are based on a total number of outstanding shares of 109,702,223 shares as of February 28, 2002.

Beneficial Owner

| | Shares

Beneficially

Owned(1)

| | Approximate

Percent

Owned(1)

| |

|---|

Entities affiliated with SOFTBANK CORP(2)

c/o SOFTBANK CORP.

24-1 Nihonbashi-Hakozakicho

Chuo-ku, Tokyo 103-8501 JAPAN | | 34,651,630 | | 31.59 | % |

Masayoshi Son(3)

c/o SOFTBANK CORP.

24-1 Nihonbashi-Hakozakicho

Chuo-ku, Tokyo 103-8501 JAPAN | | 34,659,130 | | 31.59 | % |

Ying Wu(4)

c/o UTStarcom (China) Ltd.

11th Floor, CNT Manhattan Building

No. 6 Chao Yang Men Be Da Jie Street

Beijing, 100027 China | | 5,064,887 | | 4.59 | % |

Chauncey Shey(5)

788 Hong Xu Road, #43

Suite 1501

Shanghai, 201103 China | | 3,741,594 | | 3.40 | % |

| Hong Liang Lu(6) | | 3,504,264 | | 3.18 | % |

| Thomas J. Toy(7) | | 63,300 | | * | |

| Shao-Ning J. Chou(8) | | 327,926 | | * | |

| Bill Huang(9) | | 888,354 | | * | |

| Gerald Soloway(10) | | 221,308 | | * | |

| Michael J. Sophie(11) | | 198,553 | | * | |

| Larry Horner(12) | | 42,500 | | * | |

| Paul Berkowitz(13) | | 242,481 | | * | |

| Betsy S. Atkins | | — | | * | |

| All current directors and officers as a group (13 persons) (14) | | 48,981,381 | | 43.76 | % |

- *

- Less than 1%

- (1)

- Includes any shares issuable pursuant to options held by the person or group in question which may be exercised within 60 days of February 28, 2002.

- (2)

- Includes 34,651,630 shares registered in the name of SOFTBANK America, Inc., a Delaware corporation. SOFTBANK America, Inc. is a wholly owned subsidiary of SOFTBANK

19

Holdings Inc., a Delaware corporation. SOFTBANK Holdings Inc. is a wholly owned subsidiary of SOFTBANK Corp., a Japanese corporation.

- (3)

- Represents 34,651,630 shares beneficially owned by entities affiliated with SOFTBANK CORP. Mr. Son is President, Chief Executive Officer and major stockholder of SOFTBANK CORP. Mr. Son disclaims beneficial ownership of these shares except to the extent of his pecuniary interest, if any, therein. Includes 7,500 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (4)

- Includes 1,505,500 shares registered in the name of Wu Partners, a California Limited Partnership, of which Mr. Wu is general partner. Also includes up to 250,000 shares issuable upon redemption by Wu Partners of its interest in the Altavera Capital Fund LLP. Includes 25,307 shares registered in the name of Ashley Wu and 25,307 shares registered in the name of Richard Wu. Ashley Wu and Richard Wu are Mr. Wu's children. Mr. Wu may be deemed the beneficial owner of the shares. Includes 619,946 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (5)

- Includes 1,756,019 shares registered in the name of Shey Partners, a California Limited Partnership, of which Mr. Shey is general partner. Also includes up to 150,000 shares issuable upon redemption by Shey Partners of its interest in the Altavera Capital Fund LLP. Includes up to 71,112 shares issuable upon redemption by Shey Partners of its interest in the ML-Montclair Capital Fund LLP. Includes 19,000 shares registered in the name of Qiwei Qiu, trustee of the Rebecca Shey Trust-1997 UTA dated December 20, 1997. Qiwei Qiu, trustee, is Mr. Shey's wife and Rebecca Shey is Mr. Shey's daughter. Mr. Shey may be deemed the beneficial owner of the shares. Includes 408,050 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002. Mr. Shey resigned from the Company's Board of Directors effective March 22, 2002.

- (6)

- Includes 229,000 shares owned by The Lu Family Limited Partnership, of which Mr. Lu is a general partner. Includes 5,332 shares registered in the name of Brian Lu, 5332 shares registered in the name of Benjamin Lu, and 5,332 shares registered in the name of Melissa Lu. Brian Lu, Benjamin Lu, and Melissa Lu are Mr. Lu's children. Mr. Lu may be deemed the beneficial owner of the shares. Includes 427,087 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (7)

- Includes 62,500 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (8)

- Includes 138,526 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (9)

- Includes 106,000 shares owned by the 2000 Huang Family Limited Partnership, of which Mr. Huang is a general partner. Includes 5,700 shares registered in the name of Alexander Huang, and 5,700 shares registered in the name of Helen Huang. Alexander Huang and Helen Huang are Mr. Huang's children. Mr. Huang may be deemed the beneficial owner of the shares. Includes 66,158 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (10)

- Includes 207,171 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (11)

- Includes 180,776 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (12)

- Includes 32,500 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (13)

- Includes 54,510 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

- (14)

- Includes 2,231,808 shares issuable upon exercise of options that are exercisable within 60 days of February 28, 2002.

20

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October 1996, the Company loaned Bill Huang, an executive officer and stockholder of the Company, the sum of $156,627 to purchase a house. The loan bears simple interest at the rate of 3% per annum, payable within ten years. The outstanding balance, including accrued interest, as of December 31, 2000 was $146,615. Bill Huang repaid this loan in full on March 30, 2001.

In February 1999, the Company loaned Bill Huang $153,453 to allow him to exercise expiring stock options. The loan is secured by a deed of trust. The loan bears no interest and is due and payable within three years. Bill Huang repaid this loan in full on April 10, 2001.

During 2001, the Company entered into a Professional Services Agreement with VoDa Tech, Corp. whereby the Company pays VoDa Tech, Corp. $12,500 per month for services rendered by VoDa Tech, Corp. The Company paid VoDa Tech, Corp. $104,000 during 2001 for services rendered under the agreement. Bill Huang and his wife Minnie Huang, together, own all of the outstanding shares of VoDa Tech, Corp. This agreement terminated as of December 15, 2001.

In 2001, the Company entered into a Purchase Contract with BB Technologies Corp., an affiliate of SOFTBANK Corp. During 2001, the Company recognized revenue of $13.9 million with respect to sales of telecommunications equipment to BB Technologies Corp. Included in accounts receivable on December 31, 2001 was $13.5 million related to this agreement, which has been paid in full with cash as of March 31, 2002.

The Company believes that all of the transactions set forth above were made on terms no less favorable to the Company than could have been obtained from unaffiliated third parties except for the interest rates associated with the October 1996 and February 1999 loans to Bill Huang. The Company intends that all future transactions, including loans, between itself and its officers, directors, principal stockholders and their affiliates will be approved by a majority of the Board of Directors, including a majority of the independent and disinterested directors on the Board of Directors, and will be on terms no less favorable to the Company than could be obtained from unaffiliated third parties.

21

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all officers, directors and greater than ten percent beneficial owners complied with all Section 16(a) filing requirements except for the following inadvertent late filings:

- •

- On September 10, 2001, Shao-Ning J. Chou timely filed a Form 4 that failed to reflect the sale of 80,000 shares. Subsequently, Mr. Chou filed an amended Form 4 on October 10, 2001 to disclose the omitted information.

- •

- On September 10, 2001, Paul Berkowitz timely filed a Form 4 that failed to reflect the sale of 10,000 shares. Subsequently, Mr. Berkowitz filed an amended Form 4 on September 19, 2001 to disclose the omitted information.

- •

- On March 9, 2001, Chauncey Shey timely filed a Form 4 that failed to reflect the transfer into an exchange fund of 150,000 shares. Subsequently, Mr. Shey filed an amended Form 4 on April 13, 2001 to disclose the omitted information.

- •

- On March 9, 2001, Ying Wu timely filed a Form 4 that failed to reflect the transfer into an exchange fund of 250,000 shares. Subsequently, Mr. Wu filed an amended Form 4 on April 13, 2001 to disclose the omitted information.

- •

- Hong Liang Lu failed to disclose on Form 4 filed on October 5, 2001 an acquisition of 500 shares by his son Brian Lu. Subsequently, such acquisition was reported on Form 5 filed on February 13, 2002.

- •

- Howard Kwock became a Section 16(a) reporting person on October 1, 2001 and failed to timely file a Form 3. Mr. Kwock filed his Form 3 on November 27, 2001.

22

OTHER MATTERS

The Company knows of no other matters to be submitted to the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed Proxy to vote the shares they represent as the Board of Directors may recommend.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

Michael J. Sophie

Assistant Secretary |

Dated: April 10, 2002

23

Appendix A

Charter for the Audit Committee

A-1

CHARTER FOR THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF

UTSTARCOM, INC.

PURPOSE:

The purpose of the Audit Committee of the Board of Directors of UTStarcom, Inc. (the "Company") shall be:

- •

- to provide oversight and monitoring of Company management and the independent auditors and their activities with respect to the Company's financial reporting process;

- •

- to provide the Company's Board of Directors with the results of its monitoring and recommendations derived therefrom;

- •

- to nominate to the Board of Directors independent auditors to audit the Company's financial statements and oversee the activities and independence of the auditors; and

- •

- to provide to the Board of Directors such additional information and materials as it may deem necessary to make the Board of Directors aware of significant financial matters that require the attention of the Board of Directors.

The Audit Committee will undertake those specific duties and responsibilities listed below and such other duties as the Board of Directors may from time to time prescribe.

MEMBERSHIP:

The Audit Committee members will be appointed by, and will serve at the discretion of, the Board of Directors and will consist of at least three members of the Board of Directors. On or before June 14, 2001, the members will meet the following criteria:

- 1.

- Each member will be an independent director, in accordance with The Nasdaq National Market Audit Committee requirements;

- 2.

- Each member will be able to read and understand fundamental financial statements, in accordance with The Nasdaq National Market Audit Committee requirements; and

- 3.

- At least one member will have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a chief executive or financial officer or other senior officer with financial oversight responsibilities.

RESPONSIBILITIES:

The responsibilities of the Audit Committee shall include:

- •

- Providing oversight and monitoring of Company management and the independent auditors and their activities with respect to the Company's financial reporting process;

- •

- Recommending the selection and, where appropriate, replacement of the independent auditors to the Board of Directors;

- •

- Reviewing fee arrangements with the independent auditors;

- •

- Reviewing the independent auditors' proposed audit scope, approach and independence;

- •

- Reviewing the performance of the independent auditors, who shall be accountable to the Board of Directors and the Audit Committee;

A-2

- •

- Requesting from the independent auditors of a formal written statement delineating all relationships between the auditor and the Company, consistent with Independent Standards Board Standard No. 1, and engaging in a dialogue with the auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditors;

- •

- Directing the Company's independent auditors to review before filing with the SEC the Company's interim financial statements included in Quarterly Reports on Form 10-Q, using professional standards and procedures for conducting such reviews;

- •

- Discussing with the Company's independent auditors the matters required to be discussed by Statement on Accounting Standard No. 61, as it may be modified or supplemented;

- •

- Reviewing with management, before release, the audited financial statements and Management's Discussion and Analysis in the Company's Annual Report on Form 10-K;

- •

- Providing a report in the Company's proxy statement in accordance with the requirements of Item 306 of Regulation S-K and Item 7(e) (3) of Schedule 14A;

- •

- Reviewing the Audit Committee's own structure, processes and membership requirements; and

- •

- Performing such other duties as may be requested by the Board of Directors.

MEETINGS:

The Audit Committee will meet at least quarterly. The Audit Committee may establish its own schedule, which it will provide to the Board of Directors in advance.

The Audit Committee will meet separately with the independent auditors as well as members of the Company's management as it deems appropriate in order to review the financial controls of the Company.

MINUTES:

The Audit Committee will maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board of Directors.

REPORTS:

Apart from the report prepared pursuant to Item 306 of Regulation S-K and Item 7(e) (3) of Schedule 14A, the Audit Committee will summarize its examinations and recommendations to the Board from time to time as may be appropriate, consistent with the Committee's charter.

A-3

Dear Stockholder:

Please take note of the important information enclosed with this Proxy. There are a number of issues related to the operation of the Company that require your immediate attention.

Your vote counts, and you are strongly encouraged to exercise your right to vote your shares.

Please mark the boxes on the proxy card to indicate how your shares will be voted. Then sign the card, detach it and return your proxy in the enclosed postage paid envelope.

Thank you in advance for your prompt consideration of these matters.

Sincerely,

UTStarcom, Inc.

DETACH HERE

PROXY

UTSTARCOM, INC.

1275 Harbor Bay Parkway

Alameda, California 94502

SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

P

R

O

X

Y | | The undersigned hereby appoints Michael J. Sophie with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side, all shares of common stock of UTStarcom, Inc. (the “Company”) held of record by the undersigned on March 27, 2002 at the Annual Meeting of Stockholders to be held on May 10, 2002 and any adjournments thereof. |

| |

| THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED. IF NO DIRECTION IS GIVEN WITH RESPECT TO A PARTICULAR PROPOSAL, THIS PROXY WILL BE VOTED FOR SUCH PROPOSAL. |

| |

| PLEASE MARK, DATE, SIGN, AND RETURN THIS PROXY CARD PROMPTLY, USING THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. |

SEE REVERSE

SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE

SIDE |

UTSTARCOM, INC.

C/O EQUISERVE

P.O. BOX 43068

PROVIDENCE, RI 02940

Vote by Telephone | | | Vote by Internet | |

It's fast, convenient, and immediate!

Call Toll-Free on a Touch-Tone Phone

1-800-PRX-VOTE (1-877-779-8683). | | It's fast, convenient, and your vote is immediately

confirmed and posted. |

Follow these four easy steps: | | Follow these four easy steps: |

| | | | |

1. | Read the accompanying Proxy Statement and Proxy Card. | | 1. | Read the accompanying Proxy Statement and Proxy

Card. |

| | | | |

2. | Call the toll-free number

1-877-PRX-VOTE (1-877-779-8683). | | 2. | Go to the Website

http://www.eproxyvote.com/utsi |

| | | | |

3. | Enter your Voter Control Number located on your

Proxy Card above your name. | | 3. | Enter your Voter Control Number located on your

Proxy Card above your name. |

| | | | |

4. | Follow the recorded instructions. | | 4. | Follow the instructions provided. |

Your vote is important! | | Your vote is important! |

Call 1-877-PRX-VOTE anytime! | | Go to http://www.eproxyvote.com/utsi anytime! |

Do not return your Proxy Card if you are voting by Telephone or Internet

DETACH HERE

| | | | | | |

ý | Please mark

votes as in

this example. | | | | | |

| | | | |

| | | | |

| | | | | | |

| 1. Election of directors.

Nominees: (01) Larry D. Horner and (02) Betsy S. Atkins. | 2. | Ratify the appointment of PricewaterhouseCoopers LLP as independent auditors. | FOR

o | AGAINST

o | ABSTAIN

o |

| | | | | | | | |

| | | | | | | | |

| | FOR

o | WITHHELD

o | | | | | | | |

| | | | | | | | | | |

| o | | o | MARK HERE

IF YOU PLAN

TO ATTEND

THE MEETING | | |

| | For all nominees except as noted above | | | In their discretion, the proxies are authorized to vote upon such other business that may properly come before the meeting. |

| | | | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT | | o |

| | | | | | Please sign exactly as name appears hereon. Joint owners should each sign. Executors, administrators, trustees, guardians or other fiduciaries should give full title as such. If signing for a corporation, please sign in full corporate name by a duly authorized officer. |

| | | | | | | | | | | | | | | | |

Signature: | | | Date: | | | Signature: | | | Date: | |

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held May 10, 2002YOUR VOTE IS IMPORTANTPROXY STATEMENTINFORMATION CONCERNING SOLICITATION AND VOTINGPROPOSAL ONE ELECTION OF DIRECTORSPROPOSAL TWO RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTSEXECUTIVE COMPENSATION AND OTHER MATTERSSummary Compensation TableOption Grants in Last Fiscal YearAggregated Option Exercises In Last Fiscal Year and FY-End Option ValuesREPORT OF THE COMPENSATION COMMITTEEREPORT OF THE AUDIT COMMITTEECOMPANY'S STOCK PERFORMANCESTOCK PRICE PERFORMANCE GRAPH FOR UTSTARCOM, INC. COMPARISON OF 22 MONTH CUMULATIVE TOTAL RETURN* AMONG UTSTARCOM, INC., THE NASDAQ STOCK MARKET (U.S. & FOREIGN) INDEX AND THE S & P TELECOMMUNICATIONS (CELLULAR/WIRELESS) INDEXSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEOTHER MATTERSAppendix A Charter for the Audit CommitteeCHARTER FOR THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF UTSTARCOM, INC.