Exhibit 99.2

UTStarcom Holdings Corp. Fourth Quarter and Full Year 2014 Results NASDAQ: UTSI March 13, 2015 Mr . William Wong, CEO Mr . Xu Min, CFO 1

Disclosure & Forward Looking Statements This investor presentation contains forward - looking statements, including statements regarding the Company's expectation regarding its strategic initiatives and business outlook . Forward - looking statements are based on current expectations, estimates, forecasts and projections about the Company, the Company’s future performance and the industries in which the Company operates as well as on the Company management's assumptions and beliefs . These forward - looking statements are only predictions and are subject to risks and uncertainties that may cause actual results to differ materially and adversely from the Company’s current expectations . These include risks and uncertainties related to, among other things, changes in the financial condition and cash position of the Company, changes in the composition of the Company’s management and their effect on the Company, the Company’s ability to realize anticipated results of operational improvements and benefits of the divestiture transaction, successfully operate and grow its services business, execute its business plan and manage regulatory matters, as well as the risk factors identified in the Company’s latest Annual Report on Form 20 - F, and Current Reports on Form 6 - K, as filed with the Securities and Exchange Commission . We undertake no obligation to update these forward - looking statements to reflect events or circumstances occurring after the date of this investor presentation . The Company is in a period of significant transition and the conduct of its business is exposed to additional risks as a result . 2

3 Earnings Call Agenda Introduction Business Update Our Go - Forward Strategy Update on Shareholder Value Initiative Overview of Fourth Quarter and Full Year 2014 Results Company Outlook 1 2 3 4 5 6

1 Introduction 4

Introduction 5 □ We performed relatively well throughout in 2014 as we continue to transform our business. We demonstrated solid top line performance and have consistently exceeded revenue expectations for the past several quarters. □ Financial Highlights •; For the fourth quarter, we surpassed initial expectations, reaching $32.9 million in revenue. And we achieved $129.4 million in revenue for the full year. •; Importantly, we remained resolute in our commitment to cost control and we further decreased operating expenses by 32.3% for the full year. •; We maintained a strong balance sheet, ending the year with $80.1 million in cash, cash equivalents and short - term investments and zero debt. □ We are experiencing a shift of expected new and higher margin revenue from 2014 into the second half of 2015, due to a delay in the deployment of our higher margin product line.

Operating Highlights 6 □ There are a number of things to highlight: •; Evolving product mix Successfully transitioned a number of our customer to higher - margin and more sophisticated products, like PTN 765 . We are expecting more uptake in the coming months of 2015. •; Expanding key relationships Strengthened our relationship with existing customers such as Chunghwa Telecom Co. Ltd, the leading integrated telecommunications service provider in Taiwan and Oi in Brazil. •; Geographic diversification •; Focused on three key target markets and made significant progress in doing business in these locations: Japan, North American and India o We opened a new larger Silicon Valley office to enhance sales and marketing efforts with telecommunications carriers and cable service providers in the U.S. o We have made important new executive appointments in India and the U.S. as part of our effort to invest in growing our team. •; We are also experiencing strong demand for our products in diverse geographies all around the world, with successful customer wins in South East Asia and Latin America.

2 Business Update 7

Driving The Broadband Business 8 □ The flagship TN765 with 100G services support continue to draw widespread interest from tier - one service network providers and we expect production and shipment to reach critical mass in 2015. □ The field trial for the TN765 packet optical transport product continued up until the end of the year into Q1 2015. □ We continued to lead the market in WiFi data offloading from 3G/4G wireless networks and we expect this to be a high - growth segment in the future. □ Started to the shipment MSAN product to BSNL in Q3. □ Completed a successful proof of concept test of our Software Defined Open Packet Optical Network technology with Softbank in Japan and extended the investment in our trademarked SOO technology. Broadband continues to be an engine of growth for the Company and we are making great advances in key product categories:

Strategic Investment in New Media 9 As the single largest investor in UiTV (formerly iTV Media) and aioTV, we continue to benefit from their growth and we actively support the development of their businesses. In addition, we are exploring ways to package their media services and technology with our broadband products. UiTV □ Thailand continues to be an important growth market for UiTV Media. □ Pursuing opportunities in China, India and the United States. □ Launched several Key advanced features in its technology platform including 4K video support as well as network based DVR. aioTV □ Signed an agreement with a strategic operator in the US that will launch the best Hispanic streaming service. □ Deployed with strategic operators in the U.S. and Latin America. □ Received key patents that are core enablers in the entertainment industry as the shift to streaming video services is gaining momentum across the globe.

2 Our Go - Forward Strategy 10

Our post - restructuring plan includes three specific initiatives: □ Broadband will continue to be the driver of business globally in terms of future revenue growth. •; Investing in our team to ensure the right talent on the ground to execute go - to - market strategy. •; Focused on R&D and focused on developing new innovative technologies and products in our core broadband product portfolio to help telecom and cable service providers. Our Go - Forward Strategy 11

□ We will maximize our investment return in UiTV Media and aioTV •; Continue to actively support these companies to realize their full potential, which in turn will allow us to generate a solid return on our investment. •; Both assets are maturing and evolving. •; Seeking additional capital investment or strategic alternatives. •; Both companies offer complementary insights and new media products, providing opportunities for us to package a broader offering to the market. □ We will continue to improve operational efficiency •; Constantly looking for ways to make our business operate more efficiently . Need to have a nimble global business as we expand into new markets. •; Reorganized R&D department into Business Innovation Groups in Q4. Our Go - Forward Strategy 12

3 Update on Shareholder Value Initiative 13

□ The Company’s Board of Directors approved a share repurchase program of up to $40 million of its outstanding shares over the next 24 months. □ This reflects the Board’s confidence in our Company and our determination to deliver enhanced value for our shareholders. □ As of March 12, 2015, the Company repurchased approximately 615K shares. Returning Cash to Shareholders 14

4 Overview of Fourth Quarter and Full Year 2014 Results 15

16 Summary Overview □ Revenue was better than the expected in the fourth quarter. □ Gross margin decrease sequentially due to unfavorable product mix and zero margin legacy IPTV revenue recognition. □ Continued to take significant OPEX out of the business. □ Maintained a strong balance sheet with $80.1 million in cash, cash equivalents and short - term investment and no debt.

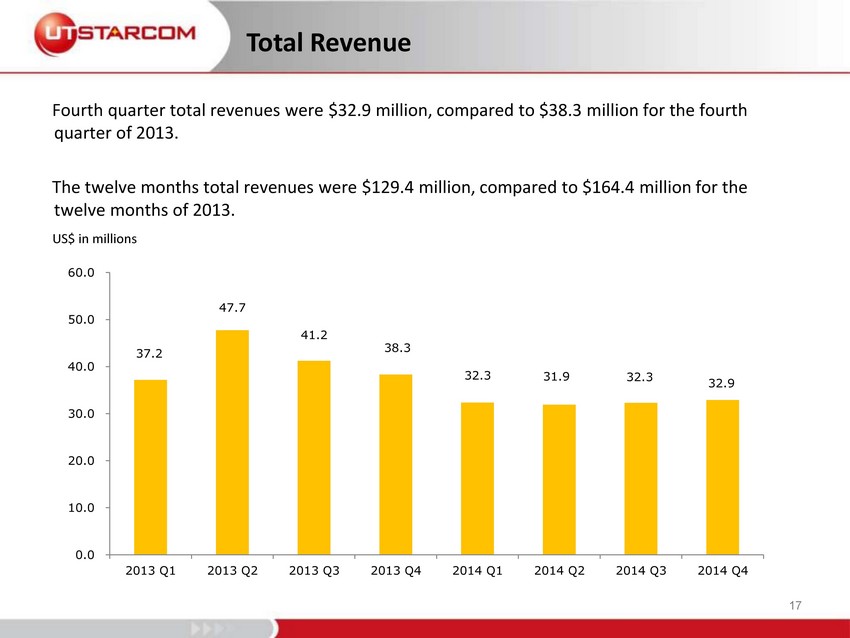

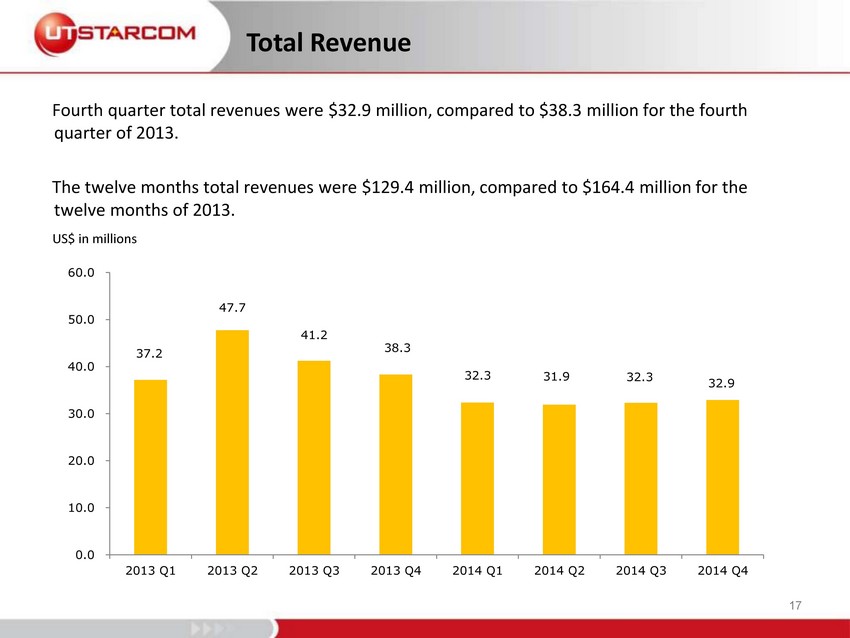

Total Revenue Fourth quarter total revenues were $32.9 million, compared to $38.3 million for the fourth quarter of 2013. The twelve months total revenues were $129.4 million, compared to $164.4 million for the twelve months of 2013. 17 US$ in millions 37.2 47.7 41.2 38.3 32.3 31.9 32.3 32.9 0.0 10.0 20.0 30.0 40.0 50.0 60.0 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

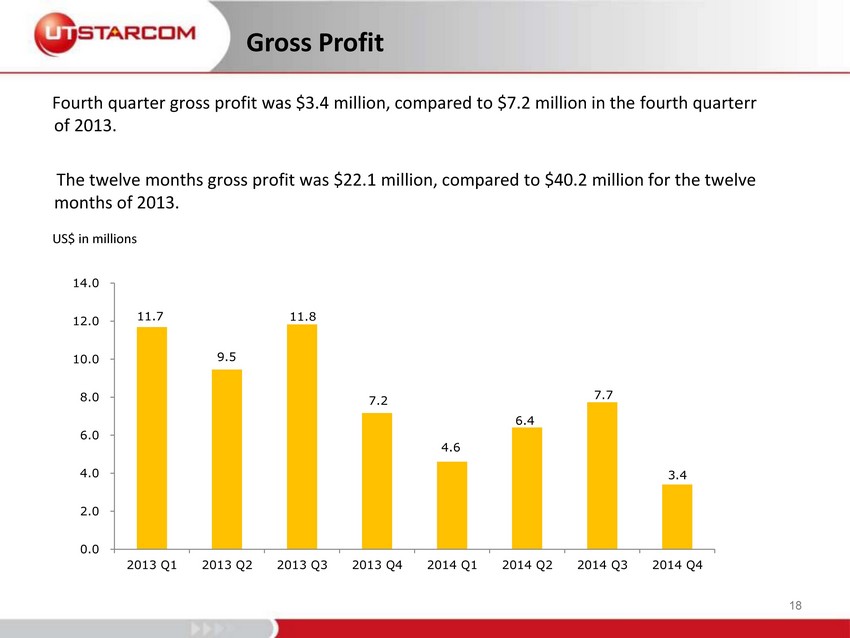

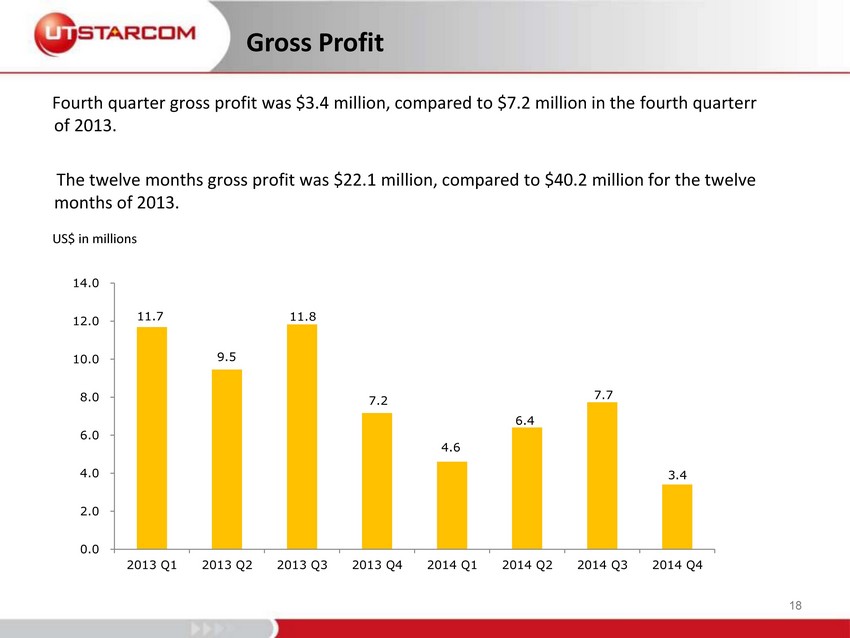

Gross Profit 18 US$ in millions Fourth quarter gross profit was $3.4 million, compared to $7.2 million in the fourth quarter r of 2013 . The twelve months gross profit was $22.1 million, compared to $40.2 million for the twelve months of 2013. 11.7 9.5 11.8 7.2 4.6 6.4 7.7 3.4 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

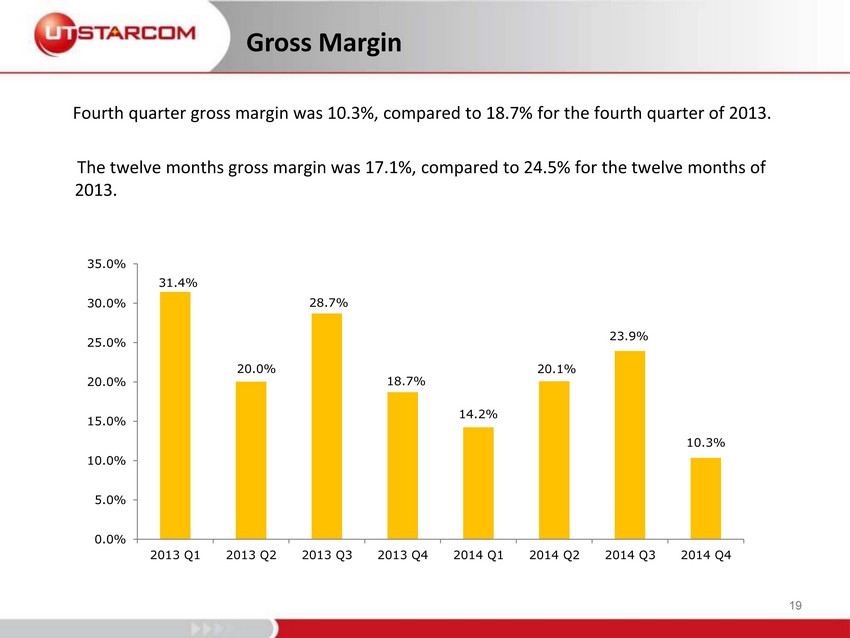

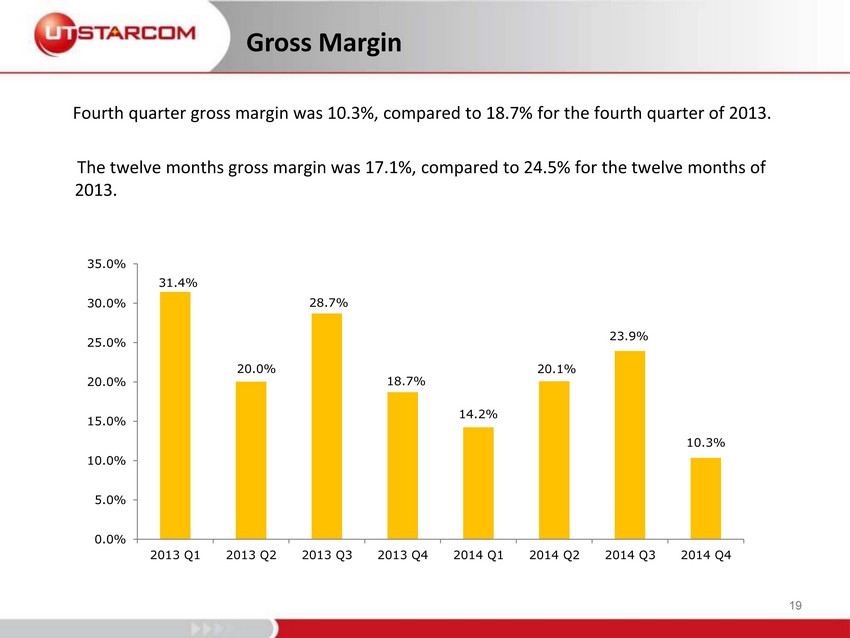

Gross Margin 19 Fourth quarter gross margin was 10.3%, compared to 18.7% for the fourth quarter of 2013. The twelve months gross margin was 17.1%, compared to 24.5% for the twelve months of 2013. 31.4% 20.0% 28.7% 18.7% 14.2% 20.1% 23.9% 10.3% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

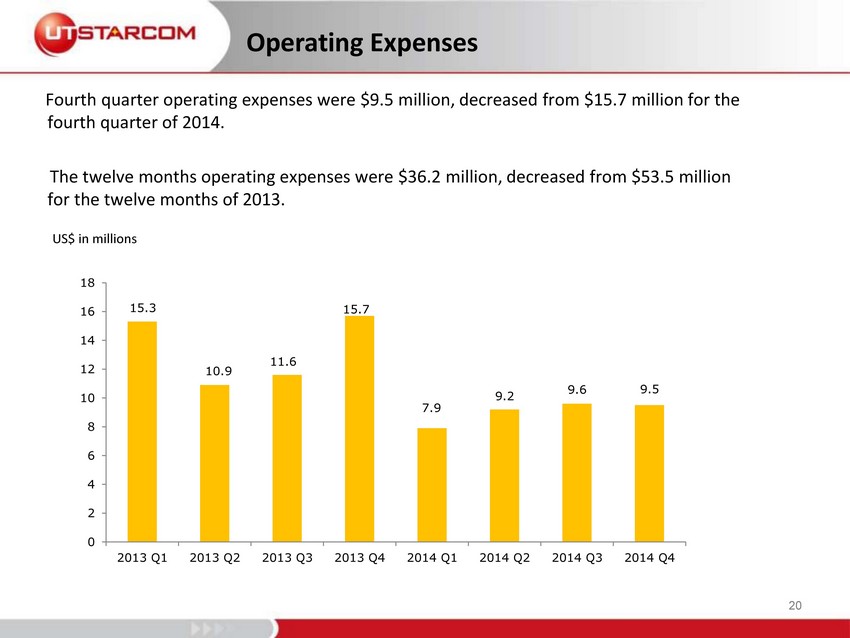

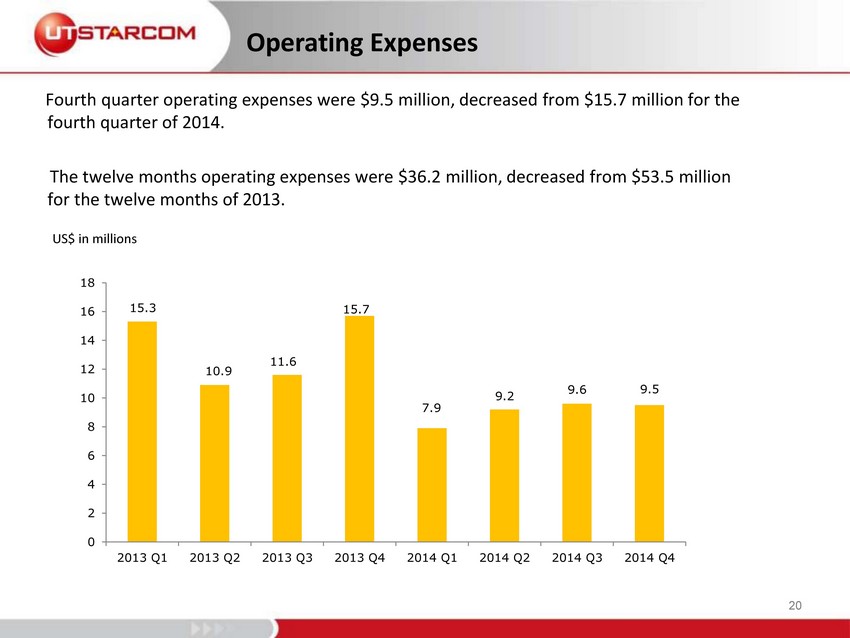

Operating Expenses 20 Fourth quarter operating expenses were $9.5 million, decreased from $15.7 million for the fourth quarter of 2014. The twelve months operating expenses were $36.2 million, decreased from $53.5 million for the twelve months of 2013. US$ in millions 15.3 10.9 11.6 15.7 7.9 9.2 9.6 9.5 0 2 4 6 8 10 12 14 16 18 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

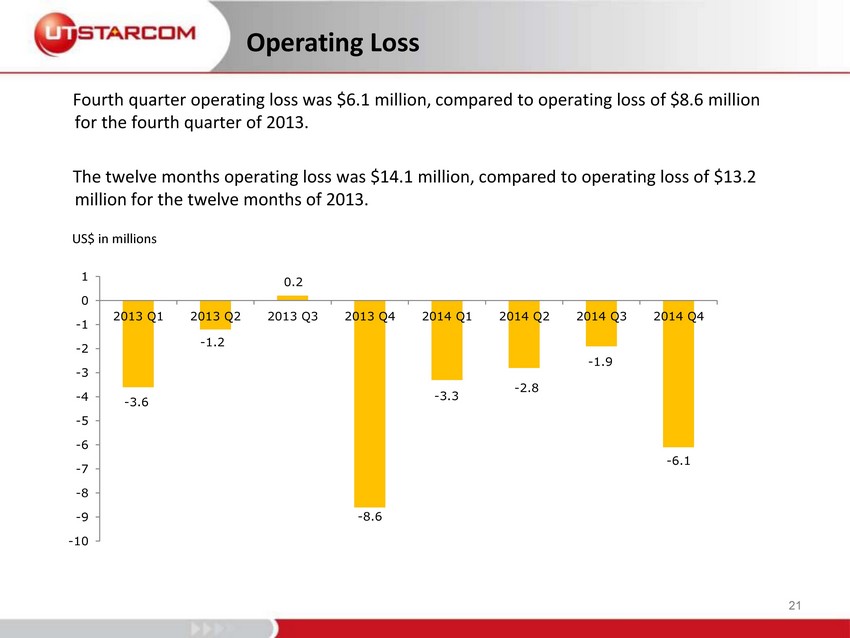

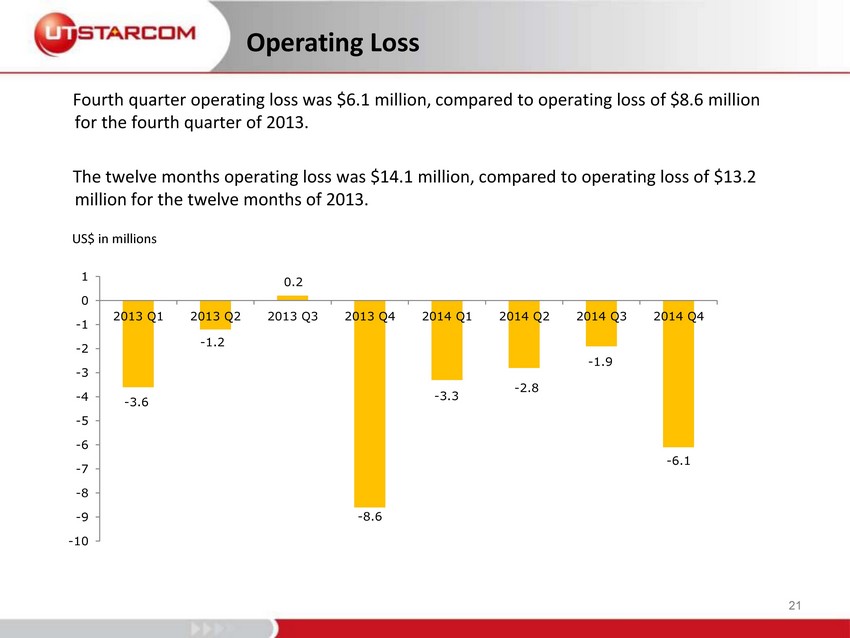

Operating Loss 21 Fourth quarter operating loss was $6.1 million, compared to operating loss of $8.6 million for the fourth quarter of 2013. The twelve months operating loss was $14.1 million, compared to operating loss of $13.2 million for the twelve months of 2013. US$ in millions - 3.6 - 1.2 0.2 - 8.6 - 3.3 - 2.8 - 1.9 - 6.1 -10 -9 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

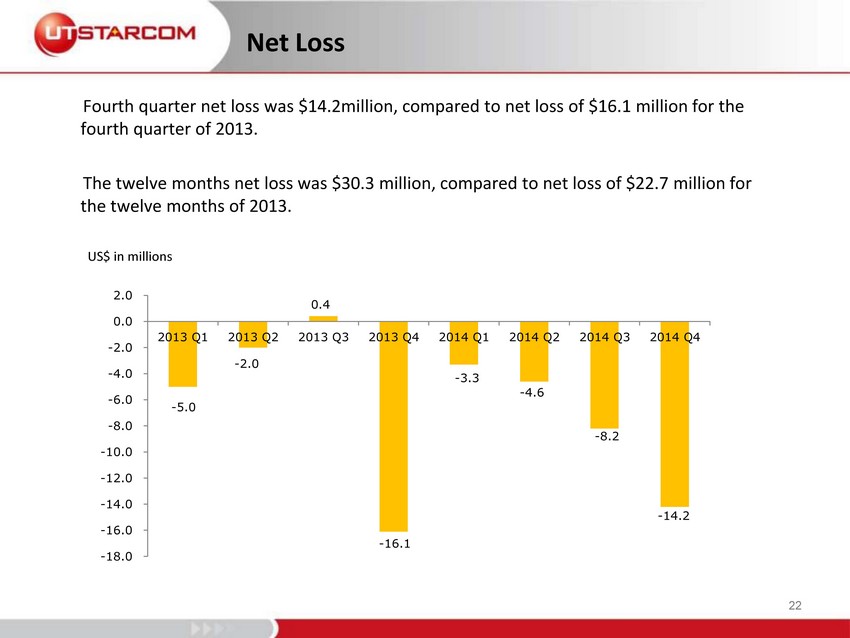

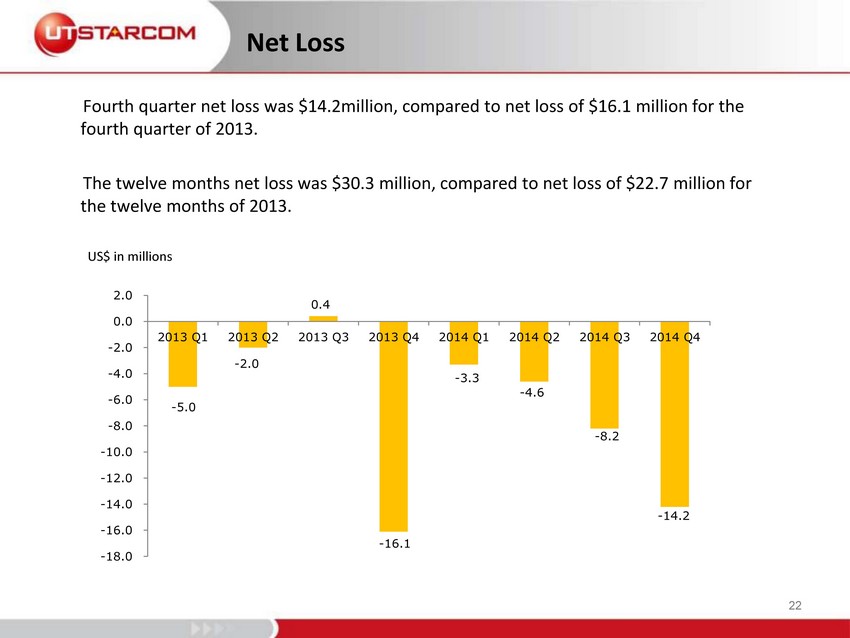

Net Loss 22 Fourth quarter net loss was $14.2million, compared to net loss of $16.1 million for the fourth quarter of 2013. The twelve months net loss was $30.3 million, compared to net loss of $22.7 million for the twelve months of 2013. US$ in millions - 5.0 - 2.0 0.4 - 16.1 - 3.3 - 4.6 - 8.2 - 14.2 -18.0 -16.0 -14.0 -12.0 -10.0 -8.0 -6.0 -4.0 -2.0 0.0 2.0 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4

□ Cash balance of $ 80.1 million in cash, cash equivalents and short - term investment, and no debt. □ Cash used in operating activities for the fourth quarter was $9.6 million. □ Cash used in investing activities for the fourth quarter was $0.6 million. □ Cash used in financing activities for fourth quarter was $0.4 million due to shares buyback. Cash Flow Analysis 23

5 Company Outlook 24

25 □ The Company believes it is nearing the end of its transition and transformation. □ The Company expects total revenues in the first quarter of 2015 to be in the range of $25 million to $30 million and anticipates double - digit growth in non - GAAP revenue for the full year. □ New higher quality and higher margin products are still in early stages of their product life cycle and given a relative decline in carrier capital expenditures last year, including with our core customers, the uptake of these higher - end products has shifted from 2014 into the second half of 2015. □ Will continue to work to mitigate the pressure on gross margin due to the headwinds from the depreciation of the Japanese yen against the U.S. dollar. □ The Company will maintain a tight focus on financial controls. □ The Company expects to deliver incremental improvements in non - GAAP operating income compared to 2014. Company Outlook

Investor Relations Contacts UTStarcom, Investor Relations □ Jiang Ning Tel: +852 - 3951 - 9757 Email: njiang@utstar.com FTI Consulting, Inc. □ Joanna Jiang (Beijing) Tel: +86 - 10 - 8591 - 1958 Email: Joanna.Jiang@fticonsulting.com □ Sean Pattwell (Hong Kong) Tel: +852 - 3768 - 4543 Email: Sean.Pattwell@fticonsulting.com 26