UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K/A

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2005

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-22009

NEOMAGIC CORPORATION

(Exact name of Registrant as specified in its charter)

| | |

| DELAWARE | | 77-0344424 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

3250 Jay Street Santa Clara, California | | 95054 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (408) 988-7020

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months ( or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2) Yes x No ¨

The aggregate market value of voting stock held by non-affiliates of the Registrant was approximately $47,153,835 as of July 30, 2004 based upon the closing price on the Nasdaq National Market reported for such date, the last business day of the Registrant’s most recently completed second fiscal quarter. This calculation does not reflect a determination that certain persons are affiliates of the Registrant for any other purposes.

The number of shares of the Registrant’s Common Stock, $.001 par value, outstanding at April 22, 2005 was 33,238,669.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

The registrant is filing this amendment (“Amendment No. 1”) to Form 10-K for the fiscal year ended January 31, 2005, which was originally filed with the Securities and Exchange Commission (“SEC”) on April 28, 2005. The original Form 10-K incorporated by reference to the registrant’s Proxy Statement for its 2005 Annual Meeting of Stockholders certain information required by Part III, Items 10 through 14 of Form 10-K. The registrant is filing herewith certain information required by Part III, Items 10 through 14 of Form 10-K, that was incorporated by reference to the registrant’s Proxy Statement for its 2005 Annual Meeting of Stockholders in the original Form 10-K, as the registrant will not be filing the Proxy Statement for its 2005 Annual Meeting of Stockholders with the SEC pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended January 31, 2005. In addition, in connection with the filing of this Amendment No. 1 and pursuant to Rules 12b-15 and 13a-14 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the registrant is including with this Amendment No. 1 certain currently-dated certifications. No other information included in the Annual Report on Form 10-K is amended by this Amendment No. 1 on Form 10-K/A.

FORM 10-K/A CROSS REFERENCE INDEX

PART III

Item 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

Directors

Set forth below is certain information regarding the directors of the Company:

| | | | |

Name

| | Age

| | Position

|

Douglas R. Young | | 60 | | President, Chief Executive Officer and Director |

Brian P. Dougherty (1)(2)(3) | | 48 | | Director |

Anil K. Gupta (1)(2)(3) | | 55 | | Director |

Carl Stork (1)(2)(3) | | 45 | | Director |

(1) | Member of the Audit Committee |

(2) | Member of the Compensation Committee |

(3) | Member of the Nominating and Governance Committee |

Douglas R. Young, has been President, Chief Executive Officer, and a Director of the Company since April 2005. Mr. Young joined the Company in February 2004 as Director of Sales and was promoted to Vice President of Worldwide Sales in January 2005. Mr. Young was Senior Vice President of Worldwide Sales at Planetweb, Inc., a provider of embedded multimedia application and browser software, from 1999 through 2003. He has over 25 years of experience working for IBM, Storage Technology Corporation, Unilease Computer Corporation, Data General and Hitachi Data Systems. He was President and CEO of a computer and satellite leasing company. Mr. Young holds a BA from Princeton University and an MBA from The Stern School of Business at New York University.

Brian P. Dougherty has served as a Director of the Company since January 1997. Mr. Dougherty has been the Chief Executive Officer of Airena, Inc., a mobile software company, since May 2003. Mr. Dougherty was founder, Chairman and Chief Technology Officer of Wink Communications, a developer of interactive television software, from 1995 through 2002, when Wink was acquired by Liberty Media. From its inception in 1983 through 1994, Mr. Dougherty served as Chief Executive Officer of Geoworks, an applications and operating system software developer. Mr. Dougherty is a member of the Board of Directors of THQ, an interactive entertainment software company. Mr. Dougherty holds a BS degree in Electrical Engineering from the University of California at Berkeley.

Dr. Anil K. Gupta has served as a Director of the Company since November 2000. Dr. Gupta is the Ralph J. Tyser Professor of Strategy at the Robert H. Smith School of Business, University of Maryland at College Park where he has served on the faculty since 1986. Dr. Gupta holds a B. Tech. degree from the Indian Institute of Technology, an M.B.A. from the Indian Institute of Management, and a Ph.D. in business strategy from the Harvard Business School.

Carl Stork has served as a Director of the Company since June 2002. Mr. Stork is President of Ciconia & Co., LLC, a private investment firm, and a partner in Wyndcrest Holdings, LLC. Mr. Stork was employed by Microsoft Corporation in a variety of management positions from 1981 through 2002, most recently as General Manager of Hardware Strategy and Business Development. At Microsoft, Mr. Stork managed marketing and partner relationships in the development and launch of multiple releases of the Microsoft Windows operating systems and served as general manager of the team that developed Windows 98. Mr. Stork holds a MBA from the University of Washington and a BA in Physics from Harvard University.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company believes that all of its executive officers, directors and greater than 10 percent beneficial owners complied with all filing requirements applicable to them with respect to reporting ownership and changes in ownership of NeoMagic Common Stock under Section 16(a) of the Securities Exchange Act of 1934, as amended, during the fiscal year ended January 31, 2005, with the exception of Mr. Sanjay Adkar who filed one Form 4 delinquently and Mr. Prakash Agarwal who filed his Form 13(d) delinquently.

3

Code of Ethics and Business Conduct

The Company has adopted a code of ethics and business conduct that applies to all directors, officers and employees. A copy of the Company’s code of ethics is available, free of charge, on our website at www.neomagic.com.

Board Meetings and Committees

The Board of Directors held 11 meetings during the fiscal year ended January 31, 2005. No Director attended less than 75% of the aggregate number of meetings of the Board of Directors and all applicable committee meetings.

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. Each of the committees operates under a written charter adopted by the Board. All of the committee charters are available on NeoMagic Corporation’s website at http://www.neomagic.com/about/corporate_governance.asp. Membership on these committees is limited to non-employee directors. The Board has determined that, except Douglas Young, who is an executive officer of the Company, each of the current directors has no material relationship with NeoMagic Corporation (either directly or as a partner, shareholder or officer of an organization that has a material relationship with NeoMagic Corporation) and is independent within the meaning of the NASDAQ Stock Market, Inc. (“NASDAQ”) director independence standards.

The current members of the Audit Committee are, Mr. Dougherty, Dr. Gupta and Mr. Stork. Mr. James Lally previously served as committee chairman until his resignation from the Board on February 4, 2005. While each member of the Audit Committee is NASDAQ “independent” as described above, NeoMagic does not currently have an “audit committee financial expert,” as defined in Rule 401(h) of Regulation S-K, serving on its Audit Committee. NeoMagic is actively engaged in the process of evaluating potential candidates for its Board of Directors who may, among other things, fill the “audit committee financial expert” role. The functions of the Audit Committee include reviewing NeoMagic’s auditing, accounting, financial reporting and system of internal controls, overseeing the work of the independent registered public accounting firm, and approving audit and non-audit services provided by the independent registered public accounting firm. In addition, the Audit Committee has discussed with the independent registered public accounting firm the auditor’s independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of non-audit services with the auditors’ independence. During the fiscal year ended January 31, 2005, the Audit Committee met 5 times.

The current members of the Compensation Committee are Mr. Dougherty, Dr. Gupta and Mr. Stork. Mr. Lally served on the committee until his resignation from the Board on February 4, 2005 and Mr. Richman served on the committee until his resignation from the Board on December 15, 2004. The functions of the Compensation Committee include approving and evaluating the executive officer compensation plans, policies, and programs of the Company. During the last fiscal year, the Compensation Committee met 1 time.

The current members of the Nominating and Governance Committee are, Mr. Dougherty, Dr. Gupta, and Mr. Stork. Mr. Paul Richman served as the committee chairman until his resignation from the Board on December 15, 2004. The functions of the Nominating and Governance Committee include assisting the Board by identifying prospective director nominees and recommending to the Board the director nominees for the next annual meeting of shareholders, developing and recommending to the Board the governance principles applicable to the Company, overseeing the evaluation of the Board and management, and recommending to the Board director nominees for each committee. During the last fiscal year, the Nominating and Governance Committee met three times.

4

Item 11. EXECUTIVE COMPENSATION

Director Compensation

Directors of the Company who are not also employees of the Company receive a quarterly retainer of $4,000. Directors of the Company who are not also employees of the Company and serve on the audit committee receive a quarterly retainer of $2,000. In addition, each non-employee director receives $1,000 for each Board of Directors meeting attended in person and $500 per meeting attended telephonically. The Company also reimburses the directors for their out-of-pocket expenses.

The non-employee directors are entitled to stock option grants under the provisions of the Company’s 2003 Stock Option Plan and its predecessor the 1993 Stock Option Plan. A non-employee director joining the Board for the first time receives an option grant for 100,000 shares as of the first date of service, which vests over a four-year period. The exercise price for nonstatutory options granted to non-employee directors shall be at the fair market value of a share on the date of grant or the initial commencement date. In addition, stock option grants ranging from 30,000 to 100,000 are annually awarded to non-employee directors. During fiscal year 2005, each non-employee director received 60,000 option shares that vest at the rate of 1/24th monthly for two years. During fiscal year 2006, each non-employee director has been granted 80,000 option shares that will vest at the rate of 1/24th monthly for two years. The terms of the options granted may not exceed ten years. All options granted will vest according to their individual vesting period subject to such member’s continued service as a director of the Company.

Compensation Committee Interlocks

Mr. Dougherty, Dr. Gupta, and Mr. Stork are the current members of the Compensation Committee. No interlocking relationship exists between the Company’s Board of Directors or Compensation Committee and the board of directors or compensation committee of any other Company, nor has any such interlocking relationship existed in the past.

Executive Compensation

The following table sets forth information concerning the compensation paid by the Company during the last three fiscal years to the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers (collectively, the “Named Officers”).

5

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Long-Term Compensation

| | | |

| | | | | Annual Compensation

| | | Awards

| | Payouts

| | | |

Name and Principal Position

| | Fiscal

Year

| | Salary

($)

| | | Bonus ($) (1)

| | | Restricted

Stock

Award(s)

($) (8)

| | Securities Underlying Options/ SARs (#)

| | LTIP

Payouts

($)

| | All Other

Compensation

($) (2)

| |

Douglas R. Young (12) President and CEO | | 2005 | | 154,494 | | | 35,000 | (13) | | n/a | | 190,000 | | n/a | | 11,878 | |

| | | | | | | |

Prakash C. Agarwal (7) President and CEO | | 2005

2004

2003 | | 340,442

274,486

317,554 | (3)

(3)

(3) | | n/a

n/a

200,000 |

(4) | | 280,287

164,997

n/a | | 540,000

1,160,000

600,000 | | n/a

n/a

n/a | | 13,027

31,918

12,162 |

|

| | | | | | | |

Mark Singer (9) Vice President, Marketing | | 2005

2004

2003 | | 195,144

170,395

183,546 | (3)

(3)

| | n/a

n/a

n/a |

| | 80,082

47,142

n/a | | 100,000

267,500

43,333 | | n/a

n/a

n/a | | 12,460

11,371

14,146 |

|

| | | | | | | |

Scott Sullinger, Vice President, Finance and Chief Financial Officer | | 2005 | | 184,800 | | | 25,000 | (13) | | n/a | | 300,000 | | n/a | | 9,404 | (14) |

| | | | | | | |

Sanjay Adkar (10) Vice President, Corporate Engineering | | 2005

2004

2003 | | 247,937

209,800

230,148 |

| | n/a

100,000

1,200,000 |

(5) | | 102,336

60,242

n/a | | n/a

200,000

190,000 | | n/a

n/a

n/a | | 12,768

12,562

15,063 |

|

| | | | | | | |

Ernest Lin (11) Vice President, Global Sales | | 2005

2004

2003 | | 157,255

151,516

170,774 | (3)

(3)

| | 11,700

n/a

125,000 |

(6) | | 71,184

41,904

n/a | | n/a

180,000

n/a | | n/a

n/a

n/a | | 11,222

11,226

12,725 |

|

(1) | Includes annual incentive compensation as well as discretionary bonus. |

(2) | Includes premiums paid for health and life insurance, ESPP W-2 income and employee gym subsidies. |

(3) | Includes vacation payout. |

(4) | Represents the forgiveness of an employee note receivable. |

(5) | Represents the payment of a guaranteed gain pursuant to an employment agreement. See Certain Relationships and Related Transactions section of this document for details. |

(6) | Represents the payment of a performance bonus pursuant to the Asset Purchase Agreement with LinkUp Systems Corporation dated December 18, 2001. |

(7) | Mr. Agarwal resigned as our President, Chief Executive Officer, and member of the Board of Directors on April 19, 2005. |

(8) | The value of the restricted stock awards on the release date of March 1, 2004, was $280,287, $80,082, $102,336, and $71,184 for Messrs. Agarwal, Singer, Adkar, and Lin, respectively. Such value is calculated by multiplying the closing market price on March 1, 2004 by the number of restricted shares held by the respective individuals on that date. The value of the restricted stock awards at the end of the fiscal year 2004 was $279,090, $79,740, $101,899, and $70,880 for Messrs. Agarwal, Singer, Adkar, and Lin, respectively. Such value is calculated by multiplying the closing market price for the stock on the last trading day of the Company’s fiscal year, by the number of restricted shares held by each individual on that date. The number of the restricted stock awards held by P. Agarwal, M. Singer, S. Adkar, and E. Lin at March 1, 2004 and at the end of the fiscal year 2004 was 63,000, 18,000, 23,002, and 16,000, respectively. Restrictions lapsed on March 1, 2004. |

(9) | Mr. Singer resigned as our Vice President of Marketing on April 20, 2005. |

(10) | Mr. Adkar resigned as our Vice President of Corporate Engineering on December 4, 2004. |

(11) | Mr. Lin resigned as our Vice President of Global Sales on December 19, 2004. |

(12) | Mr. Young was promoted to President, Chief Executive Officer and a member of the Board of Directors on April 19, 2005. Prior to that time he held the positions of Vice President, Worldwide Sales from January 2005 and Director of Sales from February 2004 until January 2005. |

(13) | Includes the payment of a one time hiring bonus of $25,000 for Mr. Young and Mr. Sullinger, and a commission of $10,000 for Mr. Young. |

(14) | Includes relocation income of $4,363. |

6

Stock Options

The following tables provide information concerning grants of options to purchase the Company’s Common Stock made to each of the Named Officers during the fiscal year ended January 31, 2005. All options granted during the fiscal year were granted under the Stock Plans. Each option becomes exercisable according to a vesting schedule, subject to the employee’s continued employment with the Company.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1)

|

| | | Number of

Securities

Underlying

Options

Granted (#)

| | | % of Total

Options

Granted to

Employees

| | | Exercise Price Per Share

| | | Expiration

Date

| | 5%

| | 10%

|

Douglas R. Young | | 80,000

30,000

80,000 | (5)

(6)

(6) | | 2.61

.98

2.61 | %

%

% | | $

$

$ | 4.30

0.27

0.93 | (2)

(3)

(2) | | 02/02/14

09/30/14

01/26/15 | | $

$

$ | 216,340

43,210

46,790 | | $

$

$ | 548,247

73,603

118,574 |

Prakash Agarwal | | 540,000 | (6) | | 17.6 | % | | $ | 1.02 | (2) | | 12/08/14 | | $ | 346,395 | | $ | 877,833 |

Scott Sullinger | | 200,000

100,000 | (7)

(6) | | 6.52

3.26 | %

% | | $

$ | 4.45

1.02 | (4)

(2) | | 03/22/14

12/08/14 | | $

$ | 631,388

64,147 | | $

$ | 1,532,555

162,562 |

Mark Singer | | 100,000 | (6) | | 3.26 | % | | $ | 1.02 | (2) | | 12/08/14 | | $ | 64,147 | | $ | 162,562 |

Sanjay Adkar | | — | | | — | % | | | — | | | — | | | — | | | — |

Ernest Lin | | — | | | — | % | | | — | | | — | | | — | | | — |

(1) | Potential gains are net of the exercise price but before taxes associated with the exercise. The 5% and 10% assumed annual rates of compounded stock appreciation based upon the deemed fair market value are mandated by the rules of the Securities and Exchange Commission and do not represent the Company’s estimate or projection of the future common stock price. Actual gains, if any, on stock option exercises are dependent on the future financial performance of the Company, overall market conditions and the option holders’ continued employment through the vesting period, or individual agreement. This table does not take into account any appreciation in the deemed fair market value of the Common Stock from the date of grant to the date of this Proxy Statement, other than the columns reflecting assumed rates of appreciation of 5% and 10%. |

(2) | Options were granted at an exercise price equal to the fair market value based on the closing market value of Common Stock on the Nasdaq National Market on the date of grant. |

(3) | Options were granted at an exercise price equal to 25.7% of the fair market value based on the closing market value of Common Stock on the Nasdaq National Market on the date of grant. |

(4) | Options were granted at an exercise price equal to the fair market value based on the closing market value of Common Stock on the Nasdaq National Market on the date Mr. Sullinger began with the Company. |

(5) | Vesting of this option commenced on February 2, 2005. One-forty-eighth of the shares vest ratably each month thereafter. |

(6) | Vesting of this option commenced on January 31, 2005. One-twenty-fourth of the shares vest ratably each month thereafter. |

(7) | Vesting of this option commenced on March 22, 2005. One-forty-eighth of the shares vest ratably each month thereafter. |

7

Option Exercises and Holdings

The following table sets forth for each of the Named Officers certain information concerning the number of shares subject to both exercisable and nonexercisable stock options at January 31, 2005. Also reported are values for “in-the-money” options that represent the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company’s Common Stock as of January 31, 2005.

Aggregated Option Exercises in Fiscal 2005 and Fiscal 2005 Values

| | | | | | | | | | | | | | | |

| | | | | | | Number of Securities

Underlying Unexercised

Options at January 31, 2005(1)

| | Value of Unexercised In-the-Money Options at January 31, 2005(1)(2)

|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized ($)

| | Exercisable

| | Nonexercisable

| | Exercisable

| | Nonexercisable

|

Sanjay Adkar | | — | | $ | — | | 340,000 | | 300,000 | | $ | — | | $ | — |

Prakash C. Agarwal | | — | | $ | — | | 1,950,000 | | 1,350,000 | | $ | — | | $ | — |

Ernest Lin | | — | | $ | — | | — | | — | | $ | — | | $ | — |

Mark Singer | | — | | $ | — | | 402,500 | | 250,000 | | $ | — | | $ | — |

Scott Sullinger | | — | | $ | — | | — | | 300,000 | | $ | — | | $ | — |

Douglas Young | | — | | $ | — | | — | | 190,000 | | $ | — | | $ | 18,600 |

(1) | Certain of the options granted under the Stock Plan may be exercised immediately upon grant and prior to full vesting, subject to the optionee’s entering a restricted stock purchase agreement with the Company with respect to any unvested shares. Other options granted under the Stock Plan are exercisable during their term in accordance with the Vesting Schedule set out in the Notice of Grant. |

(2) | Market value of securities underlying in-the-money options at fiscal year ended (based on $0.89 per share, the closing price of the Common Stock on the Nasdaq National Market on January 28, 2005), minus the exercise price. |

Information as of January 31, 2005 regarding equity compensation plans approved and not approved by stockholders is summarized in the following table:

| | | | | | | | |

Plan Category

| | (A) Number of Shares to be

Issued Upon Exercise of

Outstanding Options

| | (B)

Weighted Average

Exercise Price of

Outstanding Options

| | (C) Number of Shares

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding Shares

Reflected in Column A)

| |

Equity compensation plans approved by shareholders | | 6,307,519 | | $ | 2.60 | | 1,512,858 | (1) |

Equity compensation plans not approved by shareholders | | 5,981,931 | | $ | 2.00 | | 1,034,001 | (2) |

| | |

| |

|

| |

|

|

Total | | 12,289,450 | | $ | 2.31 | | 2,546,859 | |

(1) | Includes 1,053,039 shares available for future issuance under our 2003 Stock Plan, as amended, generally used for grants to officers and directors. Any shares that would otherwise return to the 1993 Stock Plan as the result of termination of options or the repurchase of shares will become available for issuance under the 2003 Stock Plan. Also includes 459,819 shares available under our 1997 Employee Stock Purchase Plan. |

(2) | Shares available under our 1998 Nonstatutory Stock Option Plan, used for grants to employees other than officers and directors except as provided within the plan. Prior to fiscal year 2004, this plan was not required to be approved by shareholders. Beginning with fiscal year 2004, as a result of regulatory changes, all material changes to the plan require shareholder approval. |

8

REPORT OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

The Company’s compensation programs and policies applicable to its executive officers are administered by either the Compensation Committee of the Board of Directors or the Board of Directors. During the fiscal year ended January 31, 2005, the Board of Directors administered the Company’s compensation programs and policies. The Board did not modify or reject any action or recommendation by the Compensation Committee. The Compensation Committee is made up entirely of non-employee directors. The programs and policies are designed to provide competitive compensation and to enhance stockholder value by aligning the financial interests of the executive officers of the Company with those of its stockholders.

Compensation Philosophy

The Board of Directors has adopted a management compensation program based on the following compensation principles:

| | • | | The Company provides the level of total compensation necessary to attract and retain the best executives in its industry. |

| | • | | Compensation is linked to performance and to the creation of stockholder value. |

| | • | | Compensation balances rewards for short-term versus long-term results. |

| | • | | Compensation programs include features that encourage executives to make long-term career commitment to the Company and its stockholders. |

| | • | | Plans include measurements based on continuous growth and performance relative to peer companies. |

Compensation Methodology

The Company strives to provide a comprehensive executive compensation program that is both innovative and competitive, in order to attract and retain superior, executive talent.

Each year the Compensation Committee of the Board of Directors or the Board of Directors reviews market data and assesses the Company’s competitive position in each component of executive compensation, including base salary, annual incentive compensation and long-term incentives.

The descriptions below of the components of compensation contain additional detail regarding compensation methodology. Compensation decisions regarding individual executives may also be based on factors such as individual performance, level of responsibility or unique skills of the executives.

Components of Compensation

The Company’s compensation package for executive officers consists of three basic elements: (i) base salary; (ii) annual incentive compensation; and (iii) long-term incentives in the form of stock options granted pursuant to the Company’s stock plans. Other elements of compensation include a defined contribution 401(k) plan and medical and life insurance benefits available to employees, generally.

Each element of compensation has a different purpose. Salary and incentive payments are mainly designed to reward current and past performance. Stock options are primarily designed to provide a strong incentive for superior long-term future performance and are directly linked to stockholders’ interest because the value of the awards will increase or decrease based upon the future price of the Company’s Common Stock.

Base Salary

Base salaries for fiscal 2005, reported herein, were determined by the Board of Directors. The Board of Directors reviews salaries recommended by the Chief Executive Officer for executive officers other than the Chief Executive Officer. In conducting its review, the Board of Directors takes into consideration the overall performance of the Company, the Chief Executive Officer’s evaluation of individual executive officer performance, the level of expertise, responsibility and experience of executives and independent compensation surveys such as the Radford Survey for High Technology Companies. Final decisions on base salary adjustments for executives other than the Chief Executive Officer are made in conjunction with the Chief Executive Officer. The Board of Directors independently

9

determines the base salary for the Chief Executive Officer by: (i) examining the Company’s performance against its preset goals, (ii) examining the Company’s performance within the semiconductor industry, (iii) evaluating the overall performance of the Chief Executive Officer, and (iv) comparing the base salary of the Chief Executive Officer to that of other chief executive officers in the semiconductor industry. As a part of a Company wide program to reduce costs in fiscal year 2004, the former Chief Executive Officer’s base salary was reduced by 20% from $315,000 to $252,000 in March 2003. Sixty-three thousand restricted shares of the Company’s common stock were awarded to him in return for his salary reduction. The restriction on the common stock expired and his base salary of $315,000 was reinstated on March 1, 2004.

Annual Incentive Compensation

The annual incentive compensation is a cash-based incentive bonus program. The plan establishes a fixed percentage of the executive officer’s annual salary as their target annual incentive opportunity. The annual incentive compensation provides for payment of cash bonuses to executive officers that are directly related to the profitability and gross revenues of the Company, as well as accomplishing specific milestone achievements, such as production related events and achieving strategic design wins. In addition, the Board of Directors from time to time may authorize the Company to pay individuals a discretionary bonus based on the individual employee’s overall performance.

The Committee approved no incentive compensation for the executive officers for fiscal year 2005 and fiscal year 2004. The bonus column of the Summary Compensation Table contains the annual incentive payment as well as discretionary bonuses for fiscal 2005 for each of the Company’s most highly compensated executive officers.

Stock Options

Long-term incentives are provided through stock option grants to employees, including the Named Officers. The number of shares subject to each stock option grant is based on the employee’s current and anticipated future performance and ability to affect achievement of strategic goals and objectives. The Company grants options in order to directly link a significant portion of each employee’s total compensation to the long-term interests of stockholders. Since options are generally granted at the fair market value of the Company’s Common Stock and vest over a multi-year period, employees will only receive value from the options to the extent that they remain employed by the Company and the Company’s Common Stock price increases during the term of the options, thus generating returns for both stockholders and executives. In the fiscal year ended January 31, 2005, the Company granted stock options to employees at the fair market value on the dates of the grants as well as stock options at an option price less than fair market value on the dates of the grants. The Board believes these option grants were essential to enable it to retain and attract its workforce.

It is the Company’s policy generally to qualify compensation paid to executive officers for deductibility under Section 162(m) of the Internal Revenue Code. Section 162(m) generally prohibits the Company from deducting the compensation of executive officers that exceeds $1,000,000 unless that compensation is based on the satisfaction of objective performance goals. The Company’s 2003 Stock Plan and the executive bonus programs are generally structured to qualify awards under such plans as performance-based compensation and to maximize the tax deductibility of such awards. However, the Company reserves the discretion to pay compensation to its executive officers that may not be deductible.

Employee Stock Purchase Plan

The Company maintains a qualified employee stock purchase plan subject to provisions of the Internal Revenue Code, which is generally available to all employees, and pursuant to which employees can purchase Company stock through payroll deductions of up to 10% of their base salary. This plan allows participants to buy Company stock at a discount from the market price.

The foregoing report has been furnished by the Compensation Committee of the Board of Directors of NeoMagic Corporation:

Brian P. Dougherty

Anil K. Gupta

Carl Stork

10

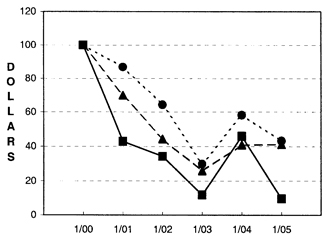

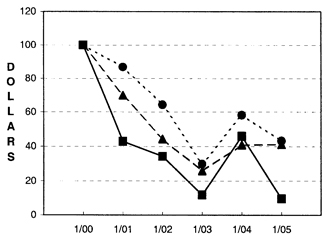

Stock Price Performance Graph

The following graph compares the cumulative total stockholder return of the Company’s Common Stock with The Nasdaq Stock Market Index (U.S.) and The Nasdaq Electronic Components Stock Index. The comparison assumes the investment of $100 on January 31, 2000. The comparisons in the graph are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of possible future performance of the Company’s Common Stock.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG NEOMAGIC CORPORATION, THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ ELECTRONIC COMPONENTS INDEX

11

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information as of April 15, 2005, as to shares of the Company’s Common Stock beneficially owned by: (i) each of the Named Officers listed in the Summary Compensation Table provided below, (ii) each of the Company’s directors, (iii) all directors and executive officers of the Company as a group, and (iv) each person who is known by the Company to be the beneficial owner of more than 5% of the Company’s Common Stock.

| | | | | | |

| | | Amount and Nature of Beneficial Ownership

| | |

Name and Address of Beneficial Owner

| | Currently Owner

| | Acquirable Within 60

days

| | Percent

Of Class*

|

Holders of Greater Than 5% | | | | | | |

None | | — | | — | | % |

Directors, Nominees and Named Executive Officers | | | | | | |

Sanjay Adkar (1) | | 140,582 | | 98,333 | | ** |

Prakash C. Agarwal (2) | | 3,198,557 | | 2,175,000 | | 9.6% |

Brian Dougherty | | 225,333 | | 175,333 | | ** |

Anil Gupta (3) | | 139,458 | | 126,958 | | % |

James Lally (4) | | 183,256 | | 86,000 | | ** |

Ernest Lin (5) | | 57,047 | | — | | ** |

Paul Richman (6) | | 277,500 | | — | | ** |

Vinit Sethi (7) | | — | | — | | ** |

Mark Singer (8) | | 496,013 | | 444,166 | | 1.5% |

Carl Stork | | 127,783 | | 99,583 | | ** |

Scott Sullinger | | 79,167 | | 79,167 | | ** |

Douglas Young | | 49,584 | | 49,584 | | ** |

| | | |

All directors and officers as a group (11 persons) | | 4,974,280 | | 3,334,124 | | 15.0% |

* | Percent ownership is based on 33,238,669 shares of Common Stock outstanding as of April 15, 2005. Unless otherwise indicated, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. The number of shares beneficially owned is determined under the rules of the Securities and Exchange Commission and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares of Common Stock that such persons or entities have the right to acquire within 60 days of April 15, 2005. |

(1) | Mr. Adkar resigned as our Vice President of Corporate Engineering on December 4, 2004. |

(2) | Mr. Agarwal resigned as our President, Chief Executive Officer and member of the Board of Directors on April 19, 2005. |

(3) | Includes 2,500 shares held by Dr. Gupta’s son. |

(4) | Mr. Lally resigned from our Board of Directors on February 4, 2005. |

(5) | Mr. Lin resigned as our Vice President of Global Sales on December 19, 2004. |

(6) | Mr. Richman resigned from our Board of Directors on December 15, 2004. Includes 252,500 shares held by Mr. Richman’s spouse. |

(7) | Mr. Sethi resigned from our Board of Directors on July 8, 2004. |

(8) | Mr. Singer resigned as our Vice President of Marketing on April 20, 2005. |

Item 13. CERTAIN RELAIONSHIPS AND RELATED TRANSACTIONS

Paul Richman served as a member of the NeoMagic Board of Directors from April 2002 through December 2004. During this time, Mr. Richman also served as CEO of The Consortium for Technology Licensing, Ltd. (“The Consortium”). In April 2002, The Consortium began performing services for NeoMagic as its exclusive patent licensing agent. In conjunction with these services, Mr. Richman was reimbursed for the expense he incurred and paid

12

approximately $9 thousand, $4 thousand and $16 thousand in this regard during fiscal years 2005, 2004 and 2003, respectively. Mr. Richman no longer serves as a Board member of the Company; however, NeoMagic continues to work with The Consortium as the Company’s exclusive patent licensing agent and completed a patent sale with The Consortium in April 2005 that is described in Note 15 to the Consolidated Financial Statements of the Company’s Annual Report.

In September 2001, the Company provided a loan to Mr. Stephen Lanza, Senior Vice President Operations and Business Development and Chief Financial Officer, in the principal amount of $100,000 at an annual interest rate of 4.82% pursuant to a promissory note secured by a pledge of 240,000 shares of Common Stock. In the first quarter of fiscal year 2005, the balance of the promissory note and accrued interest of $9,521 was paid in full. Mr. Lanza resigned from the Company March 2, 2004.

In June 2000, the Company entered into an employment agreement with Mr. Sanjay Adkar, the Company’s Vice President of Corporate Engineering, pursuant to which the Company granted to Mr. Adkar options to purchase 400,000 shares of the Company’s common stock with a guaranteed gain of $8.00 per share for the first 150,000 shares vested. In July 2000 and July 2001, in accordance with the terms of the employment agreement, the Company provided loans to Mr. Adkar in the aggregate principal amount of $1,200,000, pursuant to two promissory notes at annual interest rates of 5.59% and 5.02%, respectively, secured by pledges of the $8.00 per share guaranteed gain on an aggregate of 150,000 shares of Common Stock. The largest aggregate amounts of indebtedness outstanding during the fiscal year 2003 on the first and second promissory notes were $636,335 and $632,630, respectively (including interest payable). In the first quarter of fiscal year 2004, the promissory notes and accrued interest were paid in full.

In January 2003, the Company and Mr. Adkar entered into an agreement to cancel a portion of Mr. Adkar’s option (described above) with respect to the first 150,000 shares of Common Stock that had vested under such option agreement, including the related $8.00 per share guaranteed gain. As consideration for the partial termination of the option and the termination of the guarantee, the Company paid Mr. Adkar $1,200,000 in the first quarter of fiscal year 2004.

Item 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Fees Billed to the Company by Ernst & Young LLP during fiscal year 2005 and 2004

Audit Fees:

Fees for professional services provided by Ernst & Young LLP, our independent registered public accounting firm, in each of the last two fiscal years are:

| | | | | | |

(in thousands) | | 2005

| | 2004

|

Audit Fees(1) | | $ | 954 | | $ | 423 |

Tax Services (2) | | | 36 | | | 111 |

| | |

|

| |

|

|

Total | | $ | 990 | | | 534 |

(1) | Fees for audit services include fees associated with the annual audit, the reviews of the Company’s quarterly financial statements, statutory audits required for the international subsidiaries, accounting consultations and review of regulatory filings. |

(2) | Tax fees include fees associated with domestic and international tax compliance, tax advice and tax planning. |

Audit Committee Pre-Approval of Non-Audit Services:

Beginning in August 2002, all non-audit related services to be performed by Ernst & Young LLP and all audit, review or attest engagements required under applicable securities laws were pre-approved by the Audit Committee. The Audit Committee has determined that the other professional services provided by Ernst & Young LLP are compatible with maintaining the independence of Ernst & Young LLP.

13

PART IV

Item 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) | The following documents are filed as part of this report: |

1. Exhibits

The exhibits listed in the accompanying Exhibit Index are filed or incorporated by reference as a part of this report.

14

EXHIBIT INDEX

The following exhibits are filed as part of, or incorporated by reference into, this report:

| | |

Number

| | Description

|

| |

3.1(1) | | Amended and Restated Certificate of Incorporation. |

| |

3.2(1) | | Bylaws. |

| |

4.1(10) | | Preferred Stock Rights Agreement dated December 19, 2002, between the Company and EquiServe Trust Company, N.A. |

| |

4.2(13) | | Amendment to Rights Agreement, dated as of August 20, 2004, between the Company and EquiServe Trust Company, N.A. |

| |

4.3(12) | | Series A Warrant to Satellite Strategic Finance Associates, LLC, dated August 20, 2004. |

| |

4.4(12) | | Series B Warrant to Satellite Strategic Finance Associates, LLC, dated August 20, 2004. |

| |

4.5(12) | | Registration Rights Agreement dated August 19, 2004 by and between the Company and Satellite Strategic Finance Associates, LLC. |

| |

4.6(9) | | Certificate of Designation of Rights, Preferences and Privileges of Series A Participating Preferred Stock. |

| |

4.7(12) | | Certificate of Designations, Preferences and Rights of the Series B Convertible Preferred Stock dated August 20, 2004 |

| |

10.1(1) | | Form of Indemnification Agreement entered into by the Company with each of its directors and executive officers. |

| |

10.2(2) | | Lease Agreement, dated as of October 9, 1997, between the Company and A&P Family Investments, as landlord for the leased premises located at 3250 Jay Street. |

| |

10.3(1) | | Amended and Restated 1993 Stock Plan and related agreements. |

| |

10.4(2) | | Amendment No. 1, dated as of October 15, 1997, between the Company and A&P Family Investments, as landlord for the leased premises located at 3260 Jay Street. |

| |

10.5(1) | | Lease Agreement, dated as of February 5, 1996, between the Company and A&P Family Investments, as landlord. |

| |

10.6(1) | | 1997 Employee Stock Purchase Plan, with exhibit. |

| |

10.7(4) | | 1998 Nonstatutory Stock Option Plan. |

| |

10.8(4) | | Wafer Supply Agreement, dated as of March 15, 1999, between NeoMagic International Corporation and Siemens Aktiengesellschaft Semiconductor Group, now Infineon Technologies AG. |

| |

10.9(5) | | General Amendment to the Wafer Supply Agreement with Product Sourcing Agreement, dated January 9, 2001, between NeoMagic International Corporation and Infineon Technologies AG. |

| |

10.10(6) | | Employment Offer Letter dated May 10, 2000, between the Company and Sanjay Adkar. |

| |

10.11(6) | | Employee Loan Agreement dated May 10, 2000, between the Company and Sanjay Adkar. |

| |

10.12(6) | | Security Agreement dated September 1, 2001, between the Company and Stephen Lanza. |

| |

10.13(6) | | Promissory Note dated September 1, 2001, between the Company and Stephen Lanza. |

15

| | |

Number

| | Description

|

| |

10.14(7) | | Full and Final Release dated September 9, 2002, from the Wafer Supply Agreement and the Product Sourcing Agreement between NeoMagic International Corporation and Infineon Technologies AG. |

| |

10.15(8) | | Amendment No. 1, dated as of February 26, 2002, between the Company and A&P Family Investments, as landlord for the leased premises located at 3250 Jay Street. |

| |

10.16(8) | | Amendment No. 2, dated as of April 7, 2000, between the Company and A&P Family Investments, as landlord for the leased premises located at 3260 Jay Street. |

| |

10.17(8) | | Amendment No. 3, dated as of February 26, 2002, between the Company and A&P Family Investments, as landlord for the leased premises located at 3260 Jay Street. |

| |

10.18(11) | | Amendment No. 4, dated as of January 31, 2003, between the Company and A&P Family Investments, as landlord for the leased premises located at 3260 Jay Street. |

| |

10.19(12) | | Securities Purchase Agreement dated August 19, 2004 by and between the company and Satellite Strategic Finance Associates, LLC. |

| |

21.1(14) | | NeoMagic Subsidiaries. |

| |

23.1(14) | | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm. |

| |

31.1 | | Certification of the Chief Executive Officer pursuant to Securities Exchange Act Rules 13a-14 and 15d-14 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

31.2 | | Certification of the Chief Financial Officer pursuant to Securities Exchange Act Rules 13a-14 and 15d-14 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

32.1 | | Certification by the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

32.2 | | Certification by the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

(1) | Incorporated by reference to the Company’s registration statement on Form S-1, registration no. 333-20031. |

(2) | Incorporated by reference to the Company’s Form 10-Q for the period ended October 31, 1997. |

(3) | Incorporated by reference to the Company’s Form 10-K for the year ended January 31, 1998. |

(4) | Incorporated by reference to the Company’s Form 10-K for the year ended January 31, 1999. |

(5) | Incorporated by reference to the Company’s Form 10-K for the year ended January 31, 2001. |

(6) | Incorporated by reference to the Company’s Form 10-K for the year ended January 31, 2002. |

(7) | Incorporated by reference to the Company’s Form 10-Q for the quarter ended July 31, 2002. |

(8) | Incorporated by reference to the Company’s Form 10-Q for the quarter ended October 31, 2002. |

(9) | Incorporated by reference to the Company’s Form 8-A filed December 23, 2002. |

(10) | Incorporated by reference to the Company’s Form 8-K filed December 23, 2002. |

(11) | Incorporated by reference to the Company’s Form 10-K for the year ended January 31, 2003. |

(12) | Incorporated by reference to the Company’s Form 8-K filed August 20, 2004. |

(13) | Incorporated by reference to the Company’s Form 8-A/A filed August 23, 2004. |

(14) | Filed with the Company’s Form 10-K filed with the SEC on April 28, 2005. |

16

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized, on May 27, 2005.

| | |

NEOMAGIC CORPORATION |

| |

By: | | /s/ SCOTT SULLINGER

|

| | | SCOTT SULLINGER Vice President Finance and Chief Financial Officer (Principal Financial Officer) |

Pursuant to the requirements of the Securities and Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacity and on the date indicated:

| | | | |

Name

| | Title

| | Date

|

/s/ DOUGLAS R. YOUNG

Douglas R. Young | | President, Chief Executive Officer and Director (Principal Executive Officer) | | May 27, 2005 |

| | |

/s/ SCOTT SULLINGER

Scott Sullinger | | Vice President Finance and Chief Financial Officer (Principal Financial Officer) | | May 27, 2005 |

| | |

/s/ BRIAN P. DOUGHERTY

Brian P. Dougherty | | Director | | May 27, 2005 |

| | |

/s/ ANIL GUPTA

Anil Gupta | | Director | | May 27, 2005 |

| | |

/s/ CARL STORK

Carl Stork | | Director | | May 27, 2005 |

17