UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ![]()

Filed by a Party other than the Registrant ![]()

Check the appropriate box:

(as permitted by Rule 14a-6(e)(2)) | ||||||

GLOBECOMM SYSTEMS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

GLOBECOMM SYSTEMS INC.

45 Oser Avenue

Hauppauge, New York 11788

Notice of Annual Meeting of Stockholders

November 17, 2005

The Annual Meeting of Stockholders of Globecomm Systems Inc. (the "Company") will be held at the principal executive offices of the Company, 45 Oser Avenue, Hauppauge, New York 11788 on November 17, 2005, at 10:00 a.m. (eastern standard time) (the "Annual Meeting") for the following purposes:

| (1) | To elect eight directors to serve until the next annual meeting or until their respective successors shall have been elected and qualified; |

| (2) | To ratify the appointment of Ernst & Young LLP, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2006; and |

| (3) | To transact such other business as may properly come before the Annual Meeting. |

Only stockholders of record at the close of business on September 30, 2005 will be entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at the principal executive offices of the Company at the address above.

Whether or not you expect to attend the Annual Meeting, your proxy vote is important to the Company. To assure your representation at the meeting, please sign and date the enclosed proxy card and return it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States or Canada, or vote by telephone or over the Internet as described on the enclosed proxy card.

| By Order of the Board of Directors |

| Paul J. Johnson Secretary |

October 14, 2005

IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD

BE COMPLETED AND RETURNED PROMPTLY

GLOBECOMM SYSTEMS INC.

PROXY STATEMENT

October 14, 2005

This Proxy Statement is furnished to stockholders of record of Globecomm Systems Inc. (the "Company") as of September 30, 2005, in connection with the solicitation of proxies by the board of directors of the Company (the "Board of Directors" or "Board") for use at the Annual Meeting of Stockholders to be held at the principal executive offices of the Company at 45 Oser Avenue, Hauppauge, New York 11788 on November 17, 2005, at 10:00 a.m. (eastern standard time) (the "Annual Meeting").

Shares cannot be voted at the Annual Meeting unless the owner is present in person or by proxy. All properly executed and unrevoked proxies in the accompanying form that are received in time for the Annual Meeting will be voted at the meeting or any adjournment thereof in accordance with instructions thereon, or if no instructions are given, will be voted (1) "FOR" the election of the named nominees and (2) "FOR" the ratification of Ernst & Young LLP, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2006, and will be voted in accordance with the best judgment of the persons appointed as proxies with respect to other matters which properly come before the Annual Meeting. Any person giving a proxy may revoke it by written notice to the Company at any time prior to exercise of the proxy. In addition, although mere attendance at the Annual Meeting will not revoke the proxy, a stockholder who attends the Annual Meeting may withdraw his or her proxy by voting in person. The holders of the stock issued and outstanding and entitled to vote, present in person or by proxy, will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted in tabulations of the votes cast on each of the proposals presented at the Annual Meeting, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved.

The Annual Report of the Company (which does not form a part of the proxy solicitation material), with the consolidated financial statements of the Company for the fiscal year ended June 30, 2005, is being distributed concurrently herewith to stockholders.

The mailing address of the principal executive offices of the Company is 45 Oser Avenue, Hauppauge, New York 11788. This Proxy Statement and the accompanying form of proxy are being mailed to the stockholders of the Company on or about October 14, 2005.

VOTING SECURITIES

The Company has only one class of voting securities outstanding, its Common Stock, par value $.001 per share (the "Common Stock"). At the Annual Meeting, each stockholder of record at the close of business on September 30, 2005 will be entitled to one vote for each share of Common Stock owned by that stockholder on that date as to each matter presented at the Annual Meeting. On September 30, 2005, 14,958,343 shares of Common Stock were outstanding. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at the principal executive offices of the Company at the address specified above.

PROPOSAL 1

ELECTION OF DIRECTORS

Unless otherwise directed, the persons appointed in the accompanying form of proxy intend to vote at the Annual Meeting for the election of the eight nominees named below as directors of the Company

to serve until the next annual meeting of stockholders or until their successors have been elected and qualified. If any nominee is unable to be a candidate when the election takes place, the shares represented by valid proxies will be voted in favor of the remaining nominees. The authorized number of directors is presently nine. Each of the current directors has been nominated for and has elected to stand for re-election. The Board of Directors may fill the current or any future vacancy upon identification of a qualified candidate. The Board of Directors does not currently anticipate that any nominee will be unable to serve as a director.

Stockholder Approval

The affirmative vote of a plurality of the shares of the Company's outstanding Common Stock voted by stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect the directors. Proxies may not be voted for more than eight directors.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote "FOR" these nominees.

Information Regarding Nominees for Election as Directors

The following information with respect to the principal occupation or employment, other affiliations and business experience of each of the eight nominees has been furnished to the Company by such nominee. Except as indicated, each of the nominees has had the same principal occupation for the last five years.

Richard E. Caruso, 59, has been a director of the Company since February 2000. Since January 2004, Mr. Caruso has served as a Managing Director in the Communications Industry of BearingPoint, Inc., a provider of business consulting, systems integration and managed services. From 2001 to 2003, Mr. Caruso was a Senior Partner at TechLeaders Consulting, LLC, an information technology staffing and consulting company. From 1999 to 2001, Mr. Caruso served as President of Hosting Solutions and Storage Networking at Nortel Networks Corporation, a global supplier of networking solutions and services that support the Internet. From 1994 to 1999, Mr. Caruso served as Vice President and General Manager of Solutions for IBM Global Telecom and Media Industries. From 1983 to 1994, Mr. Caruso held various positions with Bellcore, including Corporate Vice President of Industry Markets. From May 1999 until January 2002, Mr. Caruso was a director of SL Industries. Mr. Caruso holds a B.S. in Industrial Engineering from Rutgers University and an M.S. in Industrial Engineering from the New Jersey Institute of Technology.

David E. Hershberg, 68, founded the Company in 1994 and has served as its Chief Executive Officer and Chairman of the Board of Directors since its inception. From 1976 to 1994, Mr. Hershberg was the President of Satellite Transmission Systems, Inc., or STS, a provider of satellite ground segment systems and networks, which he founded and which became a subsidiary of California Microwave, Inc., or CMI, and is currently a subsidiary of L3 Communications Corporation. From 1990 to 1994, Mr. Hershberg also served as Group President of the Satellite Communications Group of CMI, where he also had responsibility for EFData, Inc., a manufacturer of satellite communications modems, and for Viasat Technology Corp., a manufacturer of communications systems which specialized in portable and mobile satellite communications equipment. Mr. Hershberg is a director of Primus Telecommunications Group, Inc., a telecommunications company providing long distance services. Mr. Hershberg holds a B.S.E.E. from Rensselaer Polytechnic Institute, an M.S.E.E. from Columbia University and an M.S. in Management Science from Stevens Institute of Technology.

2

Harry L. Hutcherson, Jr., 63, has been a director of the Company since November 2003. Since 1992, Mr. Hutcherson has been affiliated with Navigant Consulting, Inc. (formerly, Peterson Consulting) that provides financial and business analysis on litigation support projects, and other business consulting, as an independent contract consultant. During 2004, Mr. Hutcherson also provided certain consulting services to The World Bank. From 1977 through 1992, Mr. Hutcherson was an audit partner of Arthur Andersen LLP. Mr. Hutcherson currently is teaching a Master of Accountancy course at George Washington University. Mr. Hutcherson is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants, the Greater Washington Society of Certified Public Accountants and the Virginia State Society of Certified Public Accountants. Mr. Hutcherson holds a B.S. in Accounting from the University of Richmond.

Brian T. Maloney, 51, has been a director of the Company since April 2002. Mr. Maloney currently serves as an independent consultant in the telecommunications industry. From 2002 to September 2004, Mr. Maloney served as Chief Operating Officer for Perot Systems Corporation. From 1978 to 2002, Mr. Maloney held various positions with AT&T, most recently as Senior Vice President of AT&T, and President and Chief Executive Officer of AT&T Solutions. Mr. Maloney received a B.S. in English from Hunter College and an M.A. in English from Columbia University.

Kenneth A. Miller, 60, has served as President and a director since joining the Company in October 1994. From 1978 to 1994, he held various positions with STS, and succeeded Mr. Hershberg as President of STS in 1994. Prior to his employment at STS, Mr. Miller was Manager of Satellite Systems at Comtech Telecommunications Corp., and a Satellite Communications Staff Officer with the United States Army. Mr. Miller holds a B.S.E.E. from the University of Michigan and an M.B.A. from Hofstra University.

Jack A. Shaw, 66, has been a director of the Company since June 2004. From 1998 to December 2003, Mr. Shaw held various positions at Hughes Electronics Corporation, or Hughes, most recently as its President and Chief Executive Officer and as a member of its board of directors. From 1998 to 2001, Mr. Shaw served as Senior Executive Vice President of Hughes. Mr. Shaw is currently a director of XM Satellite Radio Holdings Inc. and Guidant Corporation and is a senior member of the Institute of Electrical and Electronics Engineers. Mr. Shaw holds a B.S. in Electrical Engineering from Purdue University.

A. Robert Towbin, 70, has been a director of the Company since November 1997. Mr. Towbin has been the Managing Director of Stephens Inc. since December 2001. From 2000 to 2001, he was Co-Chairman of C.E. Unterberg, Towbin and from 1995 to 1999 was Senior Managing Director of C.E. Unterberg, Towbin. From 1994 to 1995, Mr. Towbin was President and Chief Executive Officer of the Russian-American Enterprise Fund, a U.S. government-owned investment fund, and later, Vice Chairman of its successor fund, the U.S. Russia Investment Fund. Mr. Towbin was a Managing Director of Lehman Brothers and its Co-Head of High Technology Investment Banking from 1987 until 1994. From 1959 to 1987 Mr. Towbin was Vice Chairman and a Director of L.F. Rothschild, Unterberg, Towbin Holdings Inc. and its predecessor companies. Mr. Towbin serves on the board of directors of Gerber Scientific, Inc. and North Fork Bancorporation, Inc. Mr. Towbin holds a B.A. from Dartmouth College.

C. J. Waylan, 64, has been a director of the Company since January 1997. Dr. Waylan acts as an advisor to telecommunication and satellite companies. Since 1997 he has been President and Chief Executive Officer of CCI International, NV, a start-up mobile satellite communications company. From 1996 to 1997, he served as Executive Vice President of NextWave Telecom, Inc., a start-up provider of wireless communications. Prior to retiring in 1996, Dr. Waylan was an executive with GTE Corporation, where he served as Executive Vice President for GTE Mobilnet and President of GTE Spacenet Corporation. Dr. Waylan is the chairman of the board of directors of Radyne Corporation and a director

3

of CCI International, NV. Dr. Waylan holds a B.S. from the University of Kansas and an M.S.E.E. and a Ph. D. from the Naval Postgraduate School.

Committees of the Board

The Board of Directors currently has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each member of the Audit, Compensation and Nominating and Corporate Governance Committees is an independent director as defined in Rule 4200(a)(15) of the Marketplace Rules of the National Association of Securities Dealers, Inc.

Audit Committee. The Audit Committee of the Board of Directors currently consists of Mr. Hutcherson (Chairperson), Mr. Caruso, Mr. Maloney and Dr. Waylan, and reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company's independent registered public accounting firm, the scope of the annual audits, fees to be paid to the independent registered public accounting firm, the performance of the Company's independent registered public accounting firm and the accounting practices of the Company. The Audit Committee also serves as the Board of Directors Qualified Legal Compliance Committee within the meaning of Section 307 of the Sarbanes-Oxley Act of 2002. The Board of Directors has determined that Mr. Hutcherson is qualified as an "audit committee financial expert" as defined in Item 401(h) of Regulation S-K.

Compensation Committee. The Compensation Committee of the Board of Directors currently consists of Mr. Caruso (Chairperson), Mr. Maloney, Mr. Shaw and Dr. Waylan, and determines the salaries and incentive compensation of the executive officers and directors of the Company. The Compensation Committee also administers various incentive compensation, stock and benefit plans, including awards to directors.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee, which currently consists of Mr. Maloney (Chairperson), Mr. Caruso, Mr. Shaw and Dr. Waylan, is responsible for searching for and recommending to the Board of Directors potential nominees for director positions, making recommendations to the Board of Directors regarding the size and composition of the Board of Directors and its committees, monitoring the Board's effectiveness and developing and implementing the Company's corporate governance procedures and policies.

In selecting candidates for the Board of Directors, the Nominating and Corporate Governance Committee begins by determining whether the incumbent directors whose terms expire at the annual meeting of stockholders desire and are qualified to continue their service on the Board of Directors. The Board of Directors is of the view that the continuing service of qualified incumbents promotes stability and continuity in the boardroom, giving the Company the benefit of the familiarity and insight into the Company's affairs that its directors have accumulated during their tenure, while contributing to the Board of Director's ability to work as a collective body. Accordingly, it is the policy of the Nominating and Corporate Governance Committee, absent special circumstances, to nominate qualified incumbent directors who continue to satisfy the Nominating and Corporate Governance Committee's criteria for membership on the Board of Directors, whom the Nominating and Corporate Governance Committee believes will continue to make important contributions to the Board of Directors and who consent to stand for re-election and, if re-elected, to continue their service on the Board of Directors.

If there are positions on the Board of Directors for which the Nominating and Corporate Governance Committee will not be re-nominating an incumbent director, or if there is a vacancy on the Board of Directors, the Nominating and Corporate Governance Committee will solicit recommendations for nominees from persons whom the Nominating and Corporate Governance Committee believes are

4

likely to be familiar with qualified candidates, including members of the Board of Directors and senior management of the Company. The Nominating and Corporate Governance Committee may also engage a search firm to assist in the identification of qualified candidates.

The Nominating and Corporate Governance Committee will review and evaluate each candidate whom it believes merits serious consideration, taking into account all available information concerning the candidate, the existing composition and mix of talent and expertise on the Board of Directors and other factors that it deems relevant. In conducting its review and evaluation, the Nominating and Corporate Governance Committee may solicit the views of management and other members of the Board of Directors and may, if deemed helpful, conduct interviews of proposed candidates. The Nominating and Corporate Governance Committee requires that all candidates for the Board of Directors be of the highest personal and professional integrity and have demonstrated exceptional ability and judgment. The Nominating and Corporate Governance Committee will consider whether such candidate will be effective, in conjunction with the other members of the Board of Directors, in collectively serving the long-term interests of the Company's stockholders. In addition, the Nominating and Corporate Governance Committee requires that all candidates have no interests that materially conflict with those of the Company and its stockholders, have meaningful management, advisory or policy making experience, have a general appreciation of the major business issues facing the Company and have adequate time to devote to service on the Board of Directors. The Company also requires that a majority of its directors be independent; at least three of the directors have the financial literacy necessary for service on the Audit Committee and at least one of these directors qualifies as a financial expert in accordance with Nasdaq rules.

The Nominating and Corporate Governance Committee will consider stockholder recommendations for candidates for the Board of Directors if such recommendations are received in writing by the Nominating and Corporate Governance Committee by the due date for stockholder proposals as indicated in the Company's proxy statement for the previous fiscal year. Such candidates will be considered using the same criteria as for other candidates, except that the Nominating and Corporate Governance Committee may consider, as one of the factors in its evaluation of stockholder recommended candidates, the size and duration of the interest of the recommending stockholder or stockholder group in the equity of the Company. A stockholder seeking to recommend a prospective nominee for the Nominating and Corporate Governance Committee's consideration should submit the candidate's name and qualifications in writing to the Nominating and Corporate Governance Committee at the following address: Globecomm Systems Inc., 45 Oser Avenue, Hauppauge, NY 11788, Attention: Nominating and Corporate Governance Committee.

Committee Charters

The Company's Board of Directors adopted charters for the Audit, Compensation and Nominating and Corporate Governance Committees (the "Charters"). Their respective committees review the Charters for adequacy on an annual basis. These Charters are available on the Company's website at www.globecommsystems.com. under Corporate Governance. To access, choose the Investor tab, then select Governance from the drop down list under General Information.

Compensation Committee Interlocks and Insider Participation

The Company's Compensation Committee consists of Mr. Caruso (Chairperson), Mr. Maloney, Mr. Shaw and Dr. Waylan. None of these individuals has ever been an officer or employee of the Company nor did they have any relationship with the Company that requires disclosure in this Proxy Statement.

5

Communications with the Board of Directors

Stockholders and other interested parties may communicate with the Board, the non-management directors as a group, any committee of the Board or any individual member of the Board, including the Chairperson of the Nominating and Corporate Governance Committee, by either writing the Company's Corporate Secretary at 45 Oser Avenue, Hauppauge, New York 11788 or electronically mailing the Company's Corporate Secretary at pjohnson@globecommsystems.com. All communications will be reviewed by the Company's Corporate Secretary, who will then forward such communications or a summary thereof to the appropriate directors. Any communication related to accounting, internal controls or auditing matters will be brought promptly to the attention of the Chairperson of the Audit Committee.

Attendance at Board and Committee Meetings

During fiscal 2005, the Board of Directors held four regular meetings. There were twelve meetings of the Audit Committee, four meetings of the Compensation Committee, three meetings of the Nominating and Corporate Governance Committee and one meeting of the non-employee directors during fiscal 2005. Directors are expected to attend all scheduled Board and Committee meetings and in no event less than 75% of such meetings annually. All directors attended 75% or more of the (i) meetings of the Board of Directors and (ii) meetings of the Committees of the Board on which they served, except Mr. Shaw missed one meeting of the Nominating and Corporate Governance Committee. The non-employee directors are required to have at least one regularly scheduled meeting a year without management present. All of the then current directors attended the Company's 2004 Annual Meeting of Stockholders, except for Mr. Towbin.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct, which applies to all employees of the Company, including its principal executive officer, principal financial officer and controller. A copy of the Code of Ethics and Business Conduct is available on the Company's website at www.globecommsystems.com under Corporate Governance. To access, choose the Investor tab, then select Governance from the drop down list under General Information.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, the Company's directors, executive officers, and any persons holding more than ten percent of the Common Stock are required to report their ownership of the Common Stock and any changes in that ownership to the Securities and Exchange Commission (the "Commission"), and the Nasdaq National Market Surveillance Department. Specific due dates for these reports have been established by the Commission and the Company is required to report in this Proxy Statement any failure to file by these dates during the fiscal year ended June 30, 2005. The Company believes that during the fiscal year ended June 30, 2005, all filing requirements under Section 16(a) applicable to its officers, directors and greater than ten percent beneficial owners were complied with on a timely basis.

Compensation of Directors

All non-employee directors of the Company receive an annual fee of $20,000 for their service on the Board of Directors, and $1,500 annually per committee on which they serve. Each member of the Audit Committee receives an additional $5,000 annually for service on the Audit Committee, except that the

6

Chairperson of the Audit Committee receives an additional $10,000 annually. These directors are also reimbursed for certain expenses incurred in connection with attendance at Board meetings. Directors who are also employees of the Company do not receive any cash compensation for their service as directors.

During fiscal 2005, Mr. Caruso, Mr. Hutcherson, Mr. Maloney, Mr. Shaw, Mr. Towbin and Dr. Waylan were each granted an option to purchase 5,000 shares of Common Stock for their service on the Board pursuant to the Automatic Option Grant Program of the Company's Amended and Restated 1997 Stock Incentive Plan (the "1997 Plan").

Stock Option Grant. Under the Automatic Option Grant Program of the 1997 Plan, each individual who becomes a non-employee Board member on or after August 7, 1997 will be granted an option to purchase 15,000 shares of Common Stock on the date such individual joins the Board, provided that such individual has not been in the prior employ of the Company. The initial 5,000 share portion of this grant vests immediately, with the remaining two thirds of the grant vesting one-third on the first anniversary of the date of grant and one-third of the second anniversary of the grant. Annually each non-employee Board member receives a fully-vested automatic annual grant of options to purchase 5,000 shares of Common Stock under the Automatic Option Grant Program of the 1997 Plan, and non-employee Board members can be granted options to purchase shares of Common Stock under the Discretionary Option Grant Program of the 1997 Plan at the discretion of the 1997 Plan's plan administrator, which is currently the Compensation Committee.

7

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

The executive officers of the Company are the following:

| Name | Age | Position | ||||||||

| David E. Hershberg | 68 | Chief Executive Officer and Chairman of the Board of Directors | ||||||||

| Kenneth A. Miller | 60 | President and Director | ||||||||

| Stephen C. Yablonski | 58 | Senior Vice President Sales, Marketing and Product Development | ||||||||

| Andrew C. Melfi | 52 | Vice President, Chief Financial Officer and Treasurer | ||||||||

| Paul J. Johnson | 50 | Senior Vice President, Customer Relations and Contracts and Corporate Secretary | ||||||||

| Paul Eterno | 50 | Vice President of Human Resources | ||||||||

Information Concerning Executive Officers Who are Not Directors or are Not Nominees for Election as Directors

Stephen C. Yablonski, 58, has served as Vice President since joining the Company in June 1995. Mr. Yablonski served as a director from June 1995 to November 2004, at which time he decided not to stand for re-election. In January 2003, he was promoted to the position of Senior Vice President Sales, Marketing and Product Development. From November 1999 to December 2002 he held the position of General Manager. From 1988 to 1995, he was employed by STS, most recently as Vice President of the Commercial Systems and Networks Division. Prior to his employment at STS, he was Vice President of Engineering at Argo Communications, a telecommunications services provider. Mr. Yablonski holds a B.S.E.E. from Brown University and an M.S.E.E. from the University of Pennsylvania.

Andrew C. Melfi, 52, has served as Vice President and Treasurer since September 1997 and as Chief Financial Officer since joining the Company in January 1996. From 1982 to 1995, he was the Controller of STS. Mr. Melfi holds an M.B.A. and a B.B.A. in Accounting from Dowling College.

Paul J. Johnson, 50, has served as Vice President of Contracts since joining the Company in October 1996 and as Corporate Secretary since 1998. In November 2004, he was promoted to Senior Vice President, Customer Relations and Contracts. From 1991 to 1996, he was Director of Contracts for STS. Mr. Johnson holds a B.B.A. from St. Bonaventure University.

Paul Eterno, 50, has served as Vice President of Human Resources of the Company since November 1999 and he served as Senior Director of Human Resources from 1998 to 1999. From 1997 to 1998, Mr. Eterno served as a consultant to the Company. From 1995 to 1997, he served as Senior Vice President of Human Resources for US Computer Group, a turnkey provider of computer service maintenance and products. Prior to that, he served most recently as Senior Director of Human Resources at STS, where he was employed from 1983 to 1995. Mr. Eterno holds a B.S. in Management from the New York Institute of Technology and an M.B.A. in Executive Management from St. John's University.

8

Summary Compensation Table

The following table sets forth information concerning the compensation paid by the Company for services rendered during the fiscal years ended June 30, 2005, 2004 and 2003 to: (i) the Company's Chief Executive Officer and (ii) the four other most highly paid executive officers of the Company, each of whose compensation during fiscal 2005 was at least $100,000 (together with the Chief Executive Officer, the "Named Executive Officers").

| Annual Compensation | Long-Term Compensation | All Other Compensation(2) | ||||||||||||||||||||

| Name and Principal Position | Year | Salary(1) | Bonus | Securities Underlying Options | ||||||||||||||||||

| David E. Hershberg, Chairman and Chief Executive Officer | 2005 | $ | 338,462 | $ | 43,750 | 12,500 | — | |||||||||||||||

| 2004 | 320,000 | 25,000 | 20,000 | — | ||||||||||||||||||

| 2003 | 308,462 | 60,000 | 40,000 | $ | 16,000 | |||||||||||||||||

| Kenneth A. Miller, President | 2005 | 270,559 | 33,875 | 10,000 | — | |||||||||||||||||

| 2004 | 249,000 | 20,000 | 15,000 | — | ||||||||||||||||||

| 2003 | 230,193 | 50,000 | 30,000 | 15,060 | ||||||||||||||||||

| Andrew C. Melfi, Vice President, Chief Financial Officer and Treasurer | 2005 | 195,266 | 30,000 | 27,500 | — | |||||||||||||||||

| 2004 | 175,000 | 17,000 | 15,000 | — | ||||||||||||||||||

| 2003 | 155,962 | 20,000 | 20,000 | 7,250 | ||||||||||||||||||

| Stephen C. Yablonski, Senior Vice President Sales, Marketing and Product Development | 2005 | 194,923 | 24,750 | 5,000 | — | |||||||||||||||||

| 2004 | 190,000 | 12,000 | 15,000 | — | ||||||||||||||||||

| 2003 | 175,000 | 40,000 | 20,000 | 3,400 | ||||||||||||||||||

| Paul J. Johnson, Senior Vice President, Customer Relations and Contracts and Corporate Secretary | 2005 | 159,539 | 26,250 | 5,000 | — | |||||||||||||||||

| 2004 | 140,185 | 17,000 | 10,000 | — | ||||||||||||||||||

| 2003 | 129,481 | 70,000 | 15,000 | 2,765 | ||||||||||||||||||

| (1) | Other compensation in the form of perquisites and other personal benefits has been omitted as the aggregate amount of such perquisites and other personal benefits constituted the lesser of $50,000 or 10% of the total annual salary and bonus of the Named Executive Officer for such year. |

| (2) | Includes annual Company contributions to the Company's 401(k) plan. |

9

Option Grants in Last Fiscal Year

The following table sets forth information regarding option grants made pursuant to the 1997 Plan during fiscal 2005 to each of the Named Executive Officers. The Company has never granted any stock appreciation rights.

| Number of Shares Underlying Options Granted (1) | Percentage of Total Options Granted (2) | Exercise Price (3) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4) | ||||||||||||||||||||||

| Name | 5% | 10% | ||||||||||||||||||||||||

| David E. Hershberg | 12,500 | 6.07 | % | $ | 6.5100 | 01/04/15 | $ | 51,176 | $ | 129,691 | ||||||||||||||||

| Kenneth A. Miller | 10,000 | 4.85 | 6.5100 | 01/04/15 | 40,941 | 103,753 | ||||||||||||||||||||

| Andrew C. Melfi | 20,000 | 9.71 | 5.1600 | 07/20/14 | 64,902 | 164,474 | ||||||||||||||||||||

| Andrew C. Melfi | 7,500 | 3.64 | 6.5100 | 01/04/15 | 30,706 | 77,814 | ||||||||||||||||||||

| Stephen C. Yablonski | 5,000 | 2.43 | 6.5100 | 01/04/15 | 20,471 | 51,876 | ||||||||||||||||||||

| Paul J. Johnson | 5,000 | 2.43 | 6.5100 | 01/04/15 | 20,471 | 51,876 | ||||||||||||||||||||

| (1) | When granted each option grant became exercisable in four equal annual installments commencing one year after the date of the option grant. On May 11, 2005, in response to Financial Accounting Standards Board Statement No. 123, "Share-Based Payment (revised 2004)" ("FAS 123R"), the Board of Directors of the Company, upon recommendation of the Compensation Committee, approved an acceleration of all unvested options granted to employees and directors under the Company's 1997 Plan. In order to prevent unintended personal benefit to directors and executive officers, the Board of Directors, upon recommendation of the Compensation Committee, imposed restrictions on any shares received through the exercise of accelerated options held by those individuals. These restrictions prevent their sale of stock obtained through exercise of an accelerated option prior to the earlier of the original vesting date or the individual's termination of employment or service on the Board of Directors. |

| (2) | Based on options to purchase an aggregate of 206,050 shares of Common Stock granted to employees in fiscal 2005, including options granted to the Named Executive Officers. |

| (3) | The exercise price may be paid in one or more of the following forms: (i) cash or check made payable to the Company, (ii) shares of Common Stock held for the requisite period necessary to avoid a charge to the Company's earnings for financial reporting purposes and valued at fair market value on the date of exercise or (iii) through a special sale and remittance procedure through a broker. |

| (4) | Amounts represent hypothetical gains that could be achieved for the respective options at the end of the ten-year option term. The assumed 5% and 10% rates of stock appreciation are mandated by rules of the Commission and do not represent the Company's estimate of the future market price of the Common Stock. |

10

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

The following table sets forth, for each of the Named Executive Officers, certain information concerning option exercises and the value of unexercised options at the end of fiscal 2005.

| Shares Acquired on Exercise | Value Realized | Number of Unexercised Shares Underlying Options | Net Values of Unexercised In-the-Money Options(1) | |||||||||||||||||||||||

| Name | Exercisable | Unexercisable (2) | Exercisable | Unexercisable (2) | ||||||||||||||||||||||

| David E. Hershberg | — | — | 175,266 | — | $ | 193,700 | — | |||||||||||||||||||

| Kenneth A. Miller | 3,000 | $ | 8,640 | 231,468 | — | 265,395 | — | |||||||||||||||||||

| Andrew C. Melfi | 3,000 | 3,960 | 213,128 | — | 178,177 | — | ||||||||||||||||||||

| Stephen C. Yablonski | 61,600 | 91,698 | 135,250 | — | 162,866 | — | ||||||||||||||||||||

| Paul J. Johnson | 35,000 | 58,257 | 89,125 | — | 47,400 | — | ||||||||||||||||||||

| (1) | Value is defined as the fair market price of the Company's Common Stock at June 30, 2005, less the exercise price. On June 30, 2005, the closing selling price of a share of the Company's Common Stock was $6.01. |

| (2) | On May 11, 2005, in response to FAS 123R, the Board of Directors of the Company, upon recommendation of the Compensation Committee, approved an acceleration of all unvested options granted to employees and directors under the Company's 1997 Plan. In order to prevent unintended personal benefit to directors and executive officers, the Board of Directors, upon recommendation of the Compensation Committee, imposed restrictions on any shares received through the exercise of accelerated options held by those individuals. These restrictions prevent their sale of stock obtained through exercise of an accelerated option prior to the earlier of the original vesting date or the individual's termination of employment or service on the Board of Directors. |

Employment Contracts and Change of Control Arrangements

In October 2001, the Company entered into employment agreements (the "Executive Agreements") with each of Messrs. Hershberg, Miller, Melfi, Yablonski and Johnson (each, an "Executive"). The Executive Agreements continue from year to year, unless terminated earlier by either party by written notice of termination given to the other party. Each Executive Agreement entitles the Executive to all employee benefits generally made available to executive officers.

Under the Executive Agreements between the Company and each of Messrs. Hershberg, Miller, Melfi, Yablonski and Johnson, the Company is currently required to compensate Messrs. Hershberg, Miller, Melfi, Yablonski and Johnson an annual base salary of $350,000, $271,000, $200,000, $198,000 and $170,000, respectively (which amounts are reviewed annually by the Board of Directors and subject to increase at the Board's discretion). The Executives may also receive discretionary bonuses. Messrs. Hershberg, Miller, Melfi, Yablonski and Johnson are required to devote their full-time efforts to the Company as Chairman of the Board and Chief Executive Officer, President, Vice President and Chief Financial Officer, Senior Vice President Sales, Marketing and Product Development and Senior Vice President, Customer Relations and Contracts, respectively. If the Company terminates any of the Executive Agreements, other than for disability or cause, or if any Executive terminates his employment with the Company for Good Reason (as defined in each Executive Agreement), the Company will have the following obligations: (i) to continue to pay the Executive his then applicable annual base salary for a two-year period commencing upon the effective date of the termination (the "Severance Period"); provided, however, that the Severance Period for Messrs. Hershberg and Miller shall be a three-year

11

period commencing on the effective date of the termination; (ii) to pay for continued health benefits during the Severance Period; and (iii) to pay the cash value of certain other benefits during the Severance Period.

If the Executive does not provide the Company notice of resignation and remains employed by the Company through the one-year anniversary of a Change in Control, as defined in the 1997 Plan, the Executive shall be paid a one-time bonus payment equal to 300%, in the cases of Messrs. Hershberg and Miller, and 200%, in the cases of Messrs. Melfi, Yablonski and Johnson, of his then applicable annual base salary (the "Retention Bonus"); provided that the Executive must execute and deliver to the Company a general release as a condition of receiving the Retention Bonus. If an Executive gives notice of his resignation for Good Reason within one year after a Change in Control, and the Company requests that the Executive continue his employment until a date no later than the first anniversary of the Change in Control, then the Executive shall receive the severance payments and benefits described above only if he continues his employment until that date.

The 1997 Plan provides for the accelerated vesting of the shares of Common Stock subject to outstanding options held by any executive officer or the shares of Common Stock subject to direct issuances held by any such individual, in connection with certain changes in control of the Company or the subsequent termination of the executive officer's employment following the change in control.

12

COMPENSATION COMMITTEE REPORT

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Securities and Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

The Compensation Committee of the Board of Directors is responsible for establishing the base salary and incentive cash bonus programs for the Company's executive officers and directors and administering certain other compensation programs for such individuals, subject in each instance to review by the full Board of Directors. The Compensation Committee also is responsible for the administration of the 1997 Plan under which grants may be made to executive officers and directors. The Board of Directors has reviewed the report of the Compensation Committee, and is in accord with the compensation paid to executive officers in fiscal 2005.

General Compensation Policy. The fundamental policy of the Compensation Committee is to provide the Company's executive officers with competitive compensation opportunities based upon their contribution to the development and financial success of the Company and their personal performance. It is the Compensation Committee's objective to have a portion of each executive officer's compensation contingent upon the Company's performance, as well as upon his own level of performance. Accordingly, the compensation package for each executive officer is comprised of two elements: (i) base salary and bonus which reflects individual performance and is designed primarily to be competitive with salary levels in the industry and (ii) long-term stock-based incentive awards which strengthen the mutuality of interests between the executive officers and the Company's stockholders.

Factors. The principal factors that the Compensation Committee considered in ratifying the components of each executive officer's compensation package for fiscal 2005 are summarized below. The Compensation Committee may, however, in its discretion apply entirely different factors in setting executive compensation for future years.

| • | Base Salary. Any increase in base salary for each executive officer beyond that provided in his respective Executive Agreement is determined on the basis of the following factors: experience; personal performance; the salary levels in effect for comparable positions within and outside the industry; and internal base salary comparability considerations. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate. |

| • | Bonus. The Compensation Committee may authorize cash bonuses if such bonuses are deemed to be in the best interest of the Company. For fiscal 2005, the Committee established a Management Incentive Plan (the "Plan") under which bonuses would be awarded to executive officers upon the Company achieving certain predetermined goals. The bonus awards were made to executive officers based upon the recommendations of the Chief Executive Officer of the Company, while the Compensation Committee determined the level of the Chief Executive Officer's bonus under the Plan. |

| • | Long-Term Incentive Compensation. In fiscal 2005, long-term incentives were provided through stock option grants. The grants were designed to align the interests of each executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company. Each grant allowed the individual to acquire shares of the Company's Common Stock at a fixed price per share over a specified period of time (up to 10 years). For fiscal 2006 and thereafter, the Company is reconsidering granting stock options as long-term incentive compensation in light of FAS 123R. |

13

The number of shares subject to each option grant has been set at a level intended to create a meaningful opportunity for stock ownership based on the officer's current position with the Company, the base salary associated with that position, the size of comparable awards made to individuals in similar positions within the industry, the individual's potential for increased responsibility and promotion over the option term and the individual's performance in recent periods. However, the Compensation Committee has not adhered to any specific guidelines as to the relative option holdings of the Company's executive officers. There were stock options granted to executive officers in fiscal 2005 to purchase an aggregate of 65,000 shares of Common Stock. On May 11, 2005, in response to FAS 123R, the Board of Directors, upon recommendation of the Compensation Committee, approved an acceleration of all unvested options granted to employees and directors under the Company's 1997 Plan. In order to prevent unintended personal benefit to directors and executive officers, the Board of Directors, upon recommendation of the Compensation Committee, imposed restrictions on any shares received through the exercise of accelerated options held by those individuals. These restrictions prevent their sale of stock obtained through exercise of an accelerated option prior to the earlier of the original vesting date or the individual's termination of employment or service on the Board of Directors.

CEO Compensation. In setting the compensation payable to the Company's Chief Executive Officer, the Compensation Committee seeks to achieve two objectives: (i) establish a level of base salary, within the parameters of his Executive Agreement, competitive with that paid by companies within the industry which are of comparable size to the Company and by companies outside of the industry with which the Company competes for executive talent, and (ii) make a significant percentage of the total compensation package contingent upon the Company's performance and stock price appreciation, pursuant to the terms of Mr. Hershberg's Executive Agreement. In fiscal 2005, as part of his compensation, Mr. Hershberg received a $43,750 bonus, pursuant to the Company's Management Incentive Plan, and an option to purchase 12,500 shares of Common Stock under the 1997 plan as a long-term stock-based incentive award at an exercise price of $6.51 per share.

Director Compensation. The Compensation Committee reviewed the current level of compensation for non-employee members of the Board and considered it to be consistent with that provided to non-employee directors of technology-related companies of similar size.

Director Option Grant Policy. As plan administrator of the 1997 Plan, the Compensation Committee may, in its discretion, grant options from time to time to non-employee members of the Board under the Discretionary Option Grant component of the 1997 Plan, in addition to the automatic option grants provided in the 1997 Plan. The basis for such grants is the Compensation Committee's assessment of each Board member's specific contributions to the Company during the course of the year. The circumstances and amounts of such grants may vary based on the Compensation Committee's assessment. During fiscal 2005, no discretionary options were granted to non-employee directors.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to publicly held companies for compensation exceeding $1.0 million paid to certain of the corporation's executive officers. The limitation applies only to compensation, which is not considered to be performance-based. The non-performance based compensation paid to the Company's executive officers for the 2005 fiscal year did not exceed the $1.0 million limit per officer, nor is it expected that the non-performance based compensation to be paid to the Company's executive officers for fiscal 2006 will exceed that limit. The 1997 Plan is structured so that any compensation deemed paid to an executive officer in connection with the exercise of option grants made under that plan with an exercise price equal to the fair market value of the option shares on the grant date will qualify as performance-based compensation which will not be subject to the $1.0 million limitation. Because it is very unlikely that the cash compensation payable to any of the Company's executive officers

14

in the foreseeable future will approach the $1.0 million limit, the Compensation Committee has decided at this time not to take any other action to limit or restructure the elements of cash compensation payable to the Company's executive officers. The Compensation Committee will reconsider this decision should the individual compensation of any executive officer ever approach the $1.0 million level.

THE COMPENSATION COMMITTEE

Richard E. Caruso (Chairperson)

Brian T. Maloney

Jack A. Shaw

C. J. Waylan

15

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Securities and Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

The following is the report of the Audit Committee with respect to the Company's audited consolidated financial statements for the fiscal year ended June 30, 2005, included in the Company's Annual Report on Form 10-K for that year and the independent registered public accounting firm's opinion of management's assessment of the effectiveness of internal controls over financial reporting.

The Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company for the fiscal year ended June 30, 2005 with the Company's management. The Audit Committee has discussed with Ernst & Young LLP, the Company's independent registered public accounting firm, matters required to be discussed by Statement on Auditing Standards No. 61 ("Communication with Audit Committees"), as amended, which includes, among other things, matters related to the conduct of the audit of the Company's consolidated financial statements.

The Audit Committee discussed with Ernst & Young LLP its opinion regarding the effectiveness of the Company's internal controls over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. This was the first year in which the Company was required to comply with Section 404. The independent registered public accounting firm was able to issue their audit opinion on management's assessment based on its understanding and evaluation of management's assessment process and its conclusion that management's assessment was sufficient for the purpose of fulfilling management's responsibilities under Section 404.

The Audit Committee has received the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1, "Independence Discussion with Audit Committees", as amended, and the Audit Committee has discussed with Ernst & Young LLP its independence from the Company.

Based on the Audit Committee's review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2005 for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

Harry L. Hutcherson, Jr. (Chairperson)

Richard E Caruso

Brian T. Maloney

C. J. Waylan

16

PERFORMANCE GRAPH

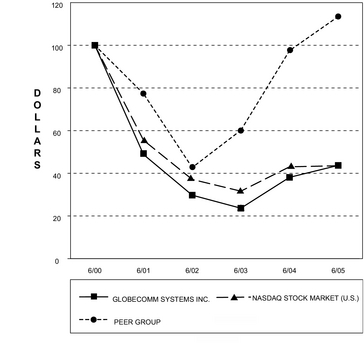

Set forth below is a graph comparing the cumulative total stockholder return, assuming dividend reinvestment of $100 invested in the Company's Common Stock on June 30, 2000 through June 30, 2005 with the cumulative total return, assuming dividend reinvestment of $100 invested in the Nasdaq Stock Market (U.S.) Index and a Self-Constructed Peer Group Index. The peer group consists of the following companies: Comtech Telecommunications Corp., EMS Technologies, Inc., Radyne Corporation and ViaSat, Inc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG GLOBECOMM SYSTEMS INC.

THE NASDAQ STOCK MARKET (U.S.) INDEX

AND A PEER GROUP

17

PROPOSAL 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon the recommendation of the Audit Committee, the Board of Directors appointed Ernst & Young LLP, independent registered public accounting firm of the Company since November 27, 1996, as the independent registered public accounting firm of the Company to serve for the fiscal year ending June 30, 2006, subject to the ratification of such appointment by the stockholders at the Annual Meeting. A representative of Ernst & Young LLP will attend the Annual Meeting with the opportunity to make a statement if he or she so desires and will also be available to answer inquiries.

Stockholder Approval

The affirmative vote of a majority of the Company's outstanding Common Stock represented and voting at the Annual Meeting is required to ratify the appointment of Ernst & Young LLP as independent registered public accounting firm of the Company to serve for the fiscal year ending June 30, 2006.

Principal Accountant Fees and Services

The following is a summary of the fees billed to the Company for audit, audit related and non-audit services provided by Ernst & Young LLP provided to the Company for the fiscal years ended June 30, 2005 and June 30, 2004:

| Fee Category | Fiscal 2005 | Fiscal 2004 | ||||||||

| Audit Fees | $ | 376,200 | $ | 187,500 | ||||||

| Audit-Related Fee | 15,000 | 20,000 | ||||||||

| Tax Fees | 54,300 | 43,500 | ||||||||

| All Other Fees | — | — | ||||||||

| Total Fees | $ | 445,500 | $ | 251,000 | ||||||

Audit Fees: Consists of the aggregate fees billed for professional services rendered for the audit of the Company's annual financial statements and review of the interim financial statements included in the Company's quarterly reports on Form 10-Q and services that are normally provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements. In 2005, audit fees also included $180,000 of fees for professional services rendered for the audits of (i) management's assessment of the effectiveness of internal control over financial reporting and (ii) the effectiveness of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act.

Audit-Related Fees: Consists of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company's financial statements and are not reported under "Audit Fees." These services include the audit of an employee benefit plan and consultations concerning financial accounting and reporting standards and transactions.

Tax Fees: Consists of the aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning.

All Other Fees: Consists of the aggregate fees billed for products and services other than the services reported above.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by Ernst & Young LLP. These services may include audit services, audit-related services, tax services and

18

other services. Pre-approval is generally provided for audit services a year in advance and any pre-approval for permissible non-audit services is detailed as to the particular service or category of services. Ernst & Young LLP and the Company's management are required to periodically report to the Audit Committee regarding the extent of services provided by Ernst & Young LLP in accordance with this pre-approval and the fees for the services performed.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholders vote "FOR" the proposal to ratify the appointment of Ernst & Young LLP.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of September 30, 2005, certain information with respect to the beneficial ownership of shares of the Company's Common Stock of: (i) all stockholders known by the Company to be the beneficial owners of more than 5% of its outstanding Common Stock, (ii) each director, nominee for director and Named Executive Officer of the Company and (iii) all current directors and executive officers of the Company as a group. Beneficial ownership is determined in accordance with the rules of the Commission and includes voting and investment power with respect to shares of Common Stock.

| Name and Address of Beneficial Owner(1) | Number of Shares of Common Stock Beneficially Owned(2) | Percentage of Shares Outstanding | ||||||||

| Brown Advisory, Inc. 901 South Bond St., Suite 400 Baltimore, MD 21231-3340 | 1,521,759 | 10.17 | % | |||||||

| Royce & Associates, LLC 1414 Avenue of the Americas, 9th Floor, New York, New York 10019-2578 | 1,459,500 | 9.76 | % | |||||||

| Wachovia Securities, Inc. 901 East Byrd St. Richmond, VA 23219-4047. | 1,132,107 | 7.57 | % | |||||||

| David E. Hershberg | 892,266 | (3) | 5.90 | % | ||||||

| Kenneth A. Miller | 271,625 | (4) | 1.79 | % | ||||||

| Andrew C. Melfi | 204,278 | (5) | 1.35 | % | ||||||

| Stephen C. Yablonski | 132,223 | (6) | * | |||||||

| Paul J. Johnson | 91,375 | (7) | * | |||||||

| C. J. Waylan | 92,750 | (8) | * | |||||||

| Richard E. Caruso | 45,000 | (9) | * | |||||||

| A. Robert Towbin | 36,590 | (10) | * | |||||||

| Brian T. Maloney | 32,045 | (11) | * | |||||||

| Harry L. Hutcherson, Jr. | 20,000 | (12) | * | |||||||

| Jack A. Shaw | 20,000 | (12) | * | |||||||

| All current directors and executive officers as a group (12 persons) | 1,968,099 | (13) | 12.19 | % | ||||||

| * | Represents less than 1%. |

19

| (1) | Except as otherwise indicated, (i) the stockholders named in the table have sole voting and investment power with respect to all shares beneficially owned by them and (ii) the address of all stockholders listed in the table is: c/o Globecomm Systems Inc., 45 Oser Avenue, Hauppauge, New York 11788. |

| (2) | The number of shares of Common Stock outstanding as of September 30, 2005 was 14,958,343. Amounts shown for each stockholder include (i) all shares of Common Stock owned by each stockholder and (ii) shares of Common Stock underlying options and warrants exercisable within 60 days of September 30, 2005, with the exception of Brown Advisory, Inc., which is based on the latest information publicly available as of August 31, 2005, and Royce & Associates, LLC and Wachovia Securities, Inc., which is based on the latest information publicly available as of June 30, 2005. |

| (3) | Includes 171,000 shares of Common Stock held by Deerhill Associates, a family partnership of which Mr. Hershberg is General Managing Partner. Mr. Hershberg disclaims beneficial ownership of the shares held by Deerhill Associates except to the extent of his proportionate pecuniary interest therein. Includes 175,266 shares of Common Stock issuable upon the exercise of stock options. |

| (4) | Includes 228,281 shares of Common Stock issuable upon the exercise of stock options and warrants. |

| (5) | Includes 204,128 shares of Common Stock issuable upon the exercise of stock options. |

| (6) | Consists of 1,485 shares of Common Stock held by certain members of Mr. Yablonski's family of which Mr. Yablonski disclaims beneficial ownership and 129,138 shares of Common Stock issuable upon the exercise of stock options and warrants. |

| (7) | Includes 91,375 shares of Common Stock issuable upon the exercise of stock options and warrants. |

| (8) | Includes 87,750 shares of Common Stock issuable upon the exercise of stock options. |

| (9) | Includes 45,000 shares of Common Stock issuable upon the exercise of stock options. |

| (10) | Includes 30,000 shares of Common Stock issuable upon the exercise of stock options. |

| (11) | Includes 32,045 shares of Common Stock issuable upon the exercise of stock options. |

| (12) | Includes 20,000 shares of Common Stock issuable upon the exercise of stock options. |

| (13) | See Notes (3) through (12) above. |

20

CERTAIN TRANSACTIONS

From July 1, 2004 through September 30, 2005, the Company granted executive officers and non-employee directors of the Company and employees, some of whom are immediate family members of the Company's executive officers, options to purchase 206,050 shares of the Company's Common Stock with exercise prices ranging from $5.16 to $6.88 per share.

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING OF STOCKHOLDERS

Stockholders of the Company may submit proposals on matters appropriate for stockholder action at meetings of the Company's stockholders in accordance with Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended. For such proposals to be included in the Company's proxy materials relating to its 2006 Annual Meeting of Stockholders, all applicable requirements of Rule 14a-8 must be satisfied and such proposals must be received by the Company no later than June 16, 2006. Such proposals should be delivered to the Company in writing to the following address: Globecomm Systems Inc., Attn: Corporate Secretary, 45 Oser Avenue, Hauppauge, New York 11788.

OTHER MATTERS

The Board knows of no matters that are to be presented for action at the Annual Meeting other than those set forth above. If any other matters properly come before the Annual Meeting, the persons named in the enclosed form of proxy will vote the shares represented by proxies in accordance with their best judgment on such matters.

Proxies will be solicited by mail and may also be solicited in person or by telephone by some regular employees of the Company. The Company may also consider the engagement of a proxy solicitation firm. Costs of the solicitation will be borne by the Company.

| By Order of the Board of Directors |

| Paul J. Johnson Secretary |

Hauppauge, New York

October 14, 2005

21

(Form of Proxy)

GLOBECOMM SYSTEMS INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS – November 17, 2005

(This Proxy is solicited by the Board of Directors of the Company)

The undersigned stockholder of Globecomm Systems Inc. hereby appoints David E. Hershberg and Kenneth A. Miller, and each of them, with full power of substitution, proxies to vote the shares of common stock which the undersigned could vote if personally present at the Annual Meeting of Stockholders of Globecomm Systems Inc. to be held at the principal executive offices of Globecomm Systems Inc., 45 Oser Avenue, Hauppauge, New York 11788, on November 17, 2005, at 10:00 a.m. (eastern standard time), or any adjournment thereof.

VOTE BY INTERNET-www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER COMMUNICATIONS

If you would like to reduce the costs incurred by Globecomm Systems Inc. in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via email or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years.

VOTE BY PHONE-1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Globecomm Systems Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

| 1. | ELECTION OF DIRECTORS (for terms as described in the Proxy Statement) |

Richard E. Caruso, David E. Hershberg, Harry L. Hutcherson, Jr., Brian T. Maloney, Kenneth A. Miller, Jack A. Shaw, A. Robert Towbin and C. J. Waylan

![]() For All

For All ![]() Withhold All

Withhold All ![]() For All Except

For All Except

To withhold authority to vote for an individual nominee, mark "For All Except" and write the nominee's name on the line below.

| 2. | RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

![]() FOR

FOR ![]() AGAINST

AGAINST ![]() ABSTAIN

ABSTAIN

proposal to ratify the appointment of Ernst & Young LLP, as independent registered public accounting firm of the Company as described in the Proxy Statement.

To transact such other business as may properly come before the annual meeting.

UNLESS OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE PERSONS NOMINATED BY THE BOARD OF DIRECTORS AS DIRECTORS AND FOR PROPOSAL 2.

Please date and sign exactly as your name appears on the envelope in which this material was mailed. If shares are held jointly, each stockholder should sign. Executors, administrators, trustees, etc. should use full title and, if more than one, all should sign. If the stockholder is a corporation, please sign full corporate name by an authorized officer.

| Signature of Stockholder | ||||||

| Print name | ||||||

Dated: