| | | | EXHIBIT 1 |

| | | |  |

| | | | | |

| | | | | Michael R. Murphy 1 312 265 9605 mmurphy@thediscoverygroup.com |

October 8, 2012

Board of Directors

Globecomm Systems, Inc.

c/o Corporate Secretary

45 Oser Avenue

Hauppauge, NY

11788-3816

Dear Directors:

Discovery Group manages investment funds that own approximately 6.9% of the outstanding shares of Globecomm Systems, Inc. We have followed Globecomm closely for years and since our initial investment in the Company in 2011 we have held numerous conversations and visits with the executive management team. Recently, as explained below, we have come to believe that the Board is not representing the best interests of shareholders in failing to pursue the immediate sale of Globecomm. Therefore, as one of the company’s largest owners, Discovery respectfully requests that the Board engage an investment bank to solicit offers from the multiple parties interested in acquiring Globecomm.

Globecomm Suffers from Public Market Undervaluation

Discovery has a long history of research and investment in the defense, electronics, and communications industry. We invested in Globecomm because of the Company’s excellent competitive position and the ability of the management and employees to deliver high quality solutions in a profitable manner. Globecomm is a valuable business, but the public market prices the Company at a discount to its true inherent value. This is common among micro-cap companies when small float, limited trading volume, and the resulting lack of research leads to persistent undervaluation. However, the issue is particularly acute for Globecomm as the current mix of government and commercial businesses may lead to only modest cash flow growth in the near term – not an exciting proposition for most equity investors.

| · | As evidence of the market’s lack of interest, consider the fact that Globecomm’s EBITDA was $10.9 million in fiscal 2008, a period when the stock traded in a range of $10 to $14. In fiscal year 2012, Globecomm generated $42.6 million in EBITDA - an increase of nearly 4x - yet today’s stock price is under $11. |

The Board is Obstructing Value

Any Board facing this predicament should, we believe, seek to unlock the true value of a firm by pursuing all strategic alternatives available to increase shareholder value, including a potential sale of the company. Sadly, this does not appear to be the case in the Globecomm boardroom. Discovery is concerned that the Board is not only complacent, but may be failing to pursue opportunities to sell the Company.

191 N. Wacker Drive, Suite 1685, Chicago, IL 60606

Board of Directors

October 8, 2012

Page 17

Based on media reports which we deem to be credible, our experience in the M&A market, and discussions with potential acquirers, we believe that Globecomm has been approached by several well qualified strategic and financial suitors. This is not surprising, given the consolidation that has occurred in the industry, the high quality of Globecomm’s operations, the company’s profitability, and its undervaluation in the public market. What is surprising is the fact that the Globecomm Board has failed to translate this high level of strategic interest into a favorable outcome for shareholders.

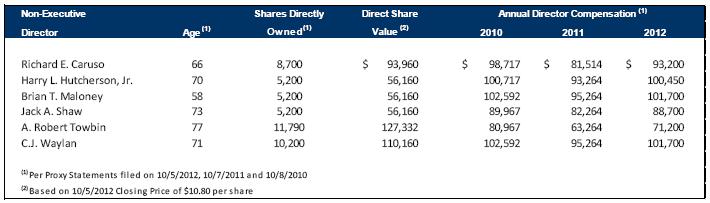

Directors not Aligned with Shareholders

Discovery believes that the Globecomm Board suffers from a severe case of incentive misalignment. The non-executive Directors of Globecomm have an inconsequential direct investment in Company stock while enjoying significant director fees. The table below shows the direct ownership of shares (excluding options and restricted stock grants) by each of the non-executive directors. At less than 12,000 shares each, the value of each director’s direct investment in Globecomm is, in most cases, less than the $60,000 to $100,000 of annual fees paid to each of them. Unfortunately, we believe that the six directors’ comfortable total annual payment of over $500,000 may be discouraging them from thinking and acting in the best interest of all shareholders.

A Sale Must Be Pursued

The best way to rectify this governance crisis and allow shareholders to achieve full value for their investment is to sell the Company. In certain circumstances a sophisticated and well-meaning Board can explore strategic alternatives in a private, confidential manner over time. However, given the dubious incentives of this Board, the widespread belief that strategic buyers have an interest in acquiring the Company, and the growing discontent of your shareholder base, the best solution at this juncture is an explicit and public sale process. Business disruption and executive management distractions can be minimized by engaging an experienced and well qualified investment bank familiar with the various qualified suitors and willing to orchestrate an orderly but expeditious auction process.

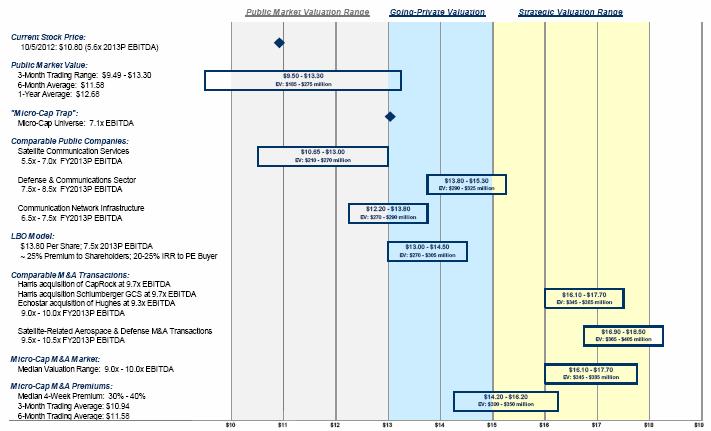

Timing is of the essence given the potential shareholder value that is at stake. Discovery’s detailed valuation analysis, as summarized below, shows that Globecomm’s takeover value in the M&A market is significantly higher than today’s publicly traded share price.

Board of Directors

October 8, 2012

Page 18

| | · | Globecomm’s value to a buyer should be 30% to 50% higher than the public market valuation |

Discovery realizes that the final result of a competitive sale process could produce a price higher or lower than the value range suggested by our analysis. Regardless, we feel strongly that it will certainly provide an outcome that is superior to the Globecomm’s existing status as a small public company governed by a board with questionable motives and is ignored by most large institutional investors

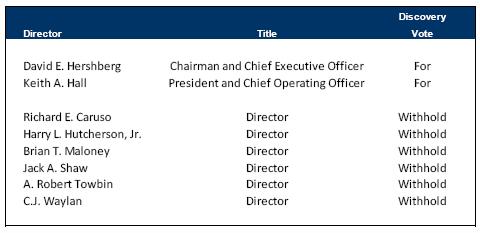

Directors Must Listen to Owners

Discovery feels strongly that a full and competitive auction to sell the Company is the best course of action for all Globecomm shareholders. Until we are convinced that the Directors are genuinely pursuing a sale process, we can not support the re-election of the non-executive directors. We will continue to support the directors that are members of the management team as they continue to profitably manage the Company and seek organic revenue growth.

Board of Directors

October 8, 2012

Page 19

Therefore, Discovery plans to submit the following votes at the November 15, 2012 Annual Meeting of Stockholders:

Withholding our votes is meant to send a clear signal to the incumbent non-executive directors of our dissatisfaction with their current stewardship of Globecomm.

We realize our withholding of votes cannot stop the re-election of the directors. Globecomm’s shareholder-unfriendly governance provisions such as a plurality voting standard, the lack of a majority voting requirement, and the absence of alternative nominees means that the Globecomm Board can continue in its current composition after this year’s meeting. However, a substantial withhold vote by shareholders should be taken very seriously. We strongly urge the Board to listen to all shareholders and act on their cumulative desires. Otherwise, it seems to us likely that your shareholder base will take additional measures to improve governance and implement necessary changes at Globecomm.

Sincerely,

Michael R. Murphy

Managing Partner