EXECUTION VERSION NYDOCS02/1142212.8 TRANSACTION AGREEMENT by and among STARTEK, INC., CSP ALPHA MIDCO PTE LTD and CSP ALPHA HOLDINGS PARENT PTE LTD Dated as of March 14, 2018

NYDOCS02/1142212.8 i TABLE OF CONTENTS ARTICLE I TRANSACTIONS ...................................................................................................... 2 1.1 Sale ...............................................................................................................................2 1.2 Issuance .........................................................................................................................2 1.3 Additional Cash Payment and Additional Shares .........................................................2 1.4 The Closing ...................................................................................................................2 1.5 Actions at the Closing ...................................................................................................3 1.6 Net Debt Adjustment ....................................................................................................3 1.7 Transaction Expenses ...................................................................................................6 ARTICLE II REPRESENTATIONS AND WARRANTIES OF THE STOCKHOLDER ............ 7 2.1 Organization, Standing .................................................................................................7 2.2 Authority, Power; No Conflict; Required Filings and Consents ..................................7 2.3 Ownership of Private Company Common Stock ..........................................................9 2.4 Lack of Ownership of Company Stock ........................................................................9 2.5 Litigation .......................................................................................................................9 2.6 Brokers ........................................................................................................................10 2.7 Purchase for Own Account; Sophistication ................................................................10 2.8 Restricted Securities; Legends ....................................................................................10 2.9 Accredited Investor .....................................................................................................11 2.10 Independent Investigation ...........................................................................................11 2.11 No Other Representations or Warranties; Non-Reliance ............................................11 ARTICLE III REPRESENTATIONS AND WARRANTIES OF PUBLIC COMPANY ........... 12 3.1 Organization, Standing and Power .............................................................................12 3.2 Capitalization ..............................................................................................................13 3.3 Subsidiaries .................................................................................................................15 3.4 Authority; No Conflict; Required Filings and Consents ............................................16 3.5 SEC Filings; Financial Statements; Information Provided .........................................18 3.6 No Undisclosed Liabilities .........................................................................................21 3.7 Absence of Certain Changes or Events ......................................................................21 3.8 Taxes ...........................................................................................................................21 3.9 Real Property ..............................................................................................................23 3.10 Intellectual Property; Data Privacy .............................................................................24

NYDOCS02/1142212.8 ii 3.11 Contracts .....................................................................................................................25 3.12 Litigation .....................................................................................................................26 3.13 Environmental Matters ...............................................................................................26 3.14 Employee Benefit Plans ..............................................................................................27 3.15 Compliance With Laws ..............................................................................................29 3.16 Anti-Corruption ..........................................................................................................29 3.17 Permits and Regulatory Matters .................................................................................30 3.18 Insurance .....................................................................................................................31 3.19 Labor Matters ..............................................................................................................31 3.20 Opinion of Financial Advisor .....................................................................................31 3.21 Section 203 of the DGCL ...........................................................................................32 3.22 Certain Business Relationships With Affiliates .........................................................32 3.23 Brokers ........................................................................................................................32 3.24 Independent Investigation ...........................................................................................32 3.25 No Appraisal Rights ...................................................................................................32 3.26 Customers and Suppliers ............................................................................................33 3.27 No Other Representations or Warranties; Non-Reliance ............................................33 ARTICLE IV REPRESENTATIONS AND WARRANTIES OF PRIVATE COMPANY ........ 33 4.1 Organization, Standing and Power .............................................................................34 4.2 Capitalization ..............................................................................................................35 4.3 Subsidiaries .................................................................................................................36 4.4 Authority; No Conflict; Required Filings and Consents ............................................37 4.5 Financial Statements; Information Provided ..............................................................38 4.6 No Undisclosed Liabilities .........................................................................................39 4.7 Absence of Certain Changes or Events ......................................................................39 4.8 Taxes ...........................................................................................................................39 4.9 Real Property ..............................................................................................................40 4.10 Intellectual Property ....................................................................................................41 4.11 Contracts .....................................................................................................................43 4.12 Litigation .....................................................................................................................44 4.13 Environmental Matters ...............................................................................................44 4.14 Employee Benefit Plans ..............................................................................................44 4.15 Compliance With Laws ..............................................................................................45

NYDOCS02/1142212.8 iii 4.16 Anti-Corruption ..........................................................................................................46 4.17 Permits and Regulatory Matters .................................................................................47 4.18 Insurance .....................................................................................................................47 4.19 Labor Matters ..............................................................................................................47 4.20 Ownership of Public Company Common Stock .........................................................48 4.21 Certain Business Relationships With Affiliates .........................................................48 4.22 Brokers ........................................................................................................................48 4.23 Controls and Procedures, Certifications and Other Matters .......................................48 4.24 Independent Investigation ...........................................................................................49 4.25 Customers and Suppliers ............................................................................................49 4.26 Teleperformance SPA .................................................................................................49 4.27 No Other Representations or Warranties; Non-Reliance ............................................49 ARTICLE V CONDUCT OF BUSINESS ................................................................................... 50 5.1 Covenants of Public Company ...................................................................................50 5.2 Covenants of Private Company ..................................................................................53 ARTICLE VI ADDITIONAL AGREEMENTS ........................................................................... 56 6.1 No Solicitation ............................................................................................................56 6.2 Proxy Statement ..........................................................................................................60 6.3 Stockholder Approval .................................................................................................61 6.4 NYSE Listing..............................................................................................................62 6.5 Confidentiality; Access to Information ......................................................................62 6.6 Reasonable Best Efforts ..............................................................................................63 6.7 Public Disclosure ........................................................................................................65 6.8 Director and Officer Indemnification .........................................................................66 6.9 Notification of Certain Matters ...................................................................................66 6.10 Employee Benefits Matters .........................................................................................67 6.11 Officers and Directors .................................................................................................67 6.12 State Takeover Laws ...................................................................................................67 6.13 Security Holder Litigation ..........................................................................................67 6.14 Integration Planning ....................................................................................................68 6.15 Resignations ................................................................................................................68 6.16 Agreement to Vote ......................................................................................................68 6.17 Release and Waiver ....................................................................................................68

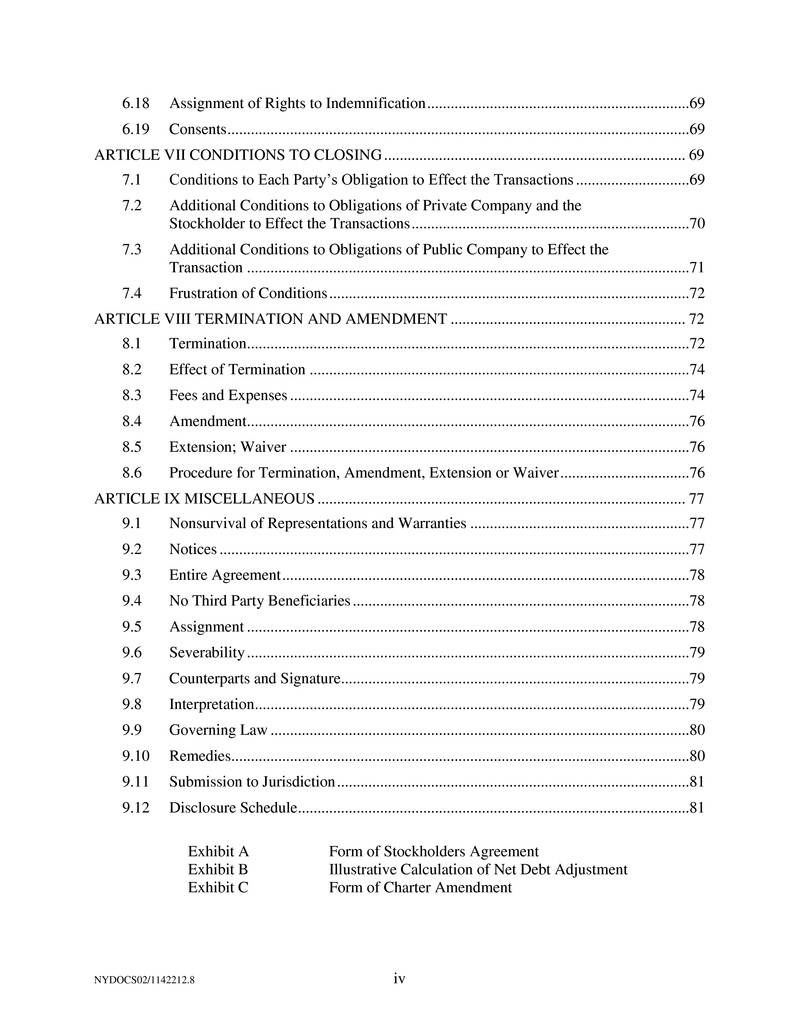

NYDOCS02/1142212.8 iv 6.18 Assignment of Rights to Indemnification ...................................................................69 6.19 Consents ......................................................................................................................69 ARTICLE VII CONDITIONS TO CLOSING ............................................................................. 69 7.1 Conditions to Each Party’s Obligation to Effect the Transactions .............................69 7.2 Additional Conditions to Obligations of Private Company and the Stockholder to Effect the Transactions .......................................................................70 7.3 Additional Conditions to Obligations of Public Company to Effect the Transaction .................................................................................................................71 7.4 Frustration of Conditions ............................................................................................72 ARTICLE VIII TERMINATION AND AMENDMENT ............................................................ 72 8.1 Termination .................................................................................................................72 8.2 Effect of Termination .................................................................................................74 8.3 Fees and Expenses ......................................................................................................74 8.4 Amendment .................................................................................................................76 8.5 Extension; Waiver ......................................................................................................76 8.6 Procedure for Termination, Amendment, Extension or Waiver .................................76 ARTICLE IX MISCELLANEOUS .............................................................................................. 77 9.1 Nonsurvival of Representations and Warranties ........................................................77 9.2 Notices ........................................................................................................................77 9.3 Entire Agreement ........................................................................................................78 9.4 No Third Party Beneficiaries ......................................................................................78 9.5 Assignment .................................................................................................................78 9.6 Severability .................................................................................................................79 9.7 Counterparts and Signature.........................................................................................79 9.8 Interpretation ...............................................................................................................79 9.9 Governing Law ...........................................................................................................80 9.10 Remedies .....................................................................................................................80 9.11 Submission to Jurisdiction ..........................................................................................81 9.12 Disclosure Schedule ....................................................................................................81 Exhibit A Form of Stockholders Agreement Exhibit B Illustrative Calculation of Net Debt Adjustment Exhibit C Form of Charter Amendment

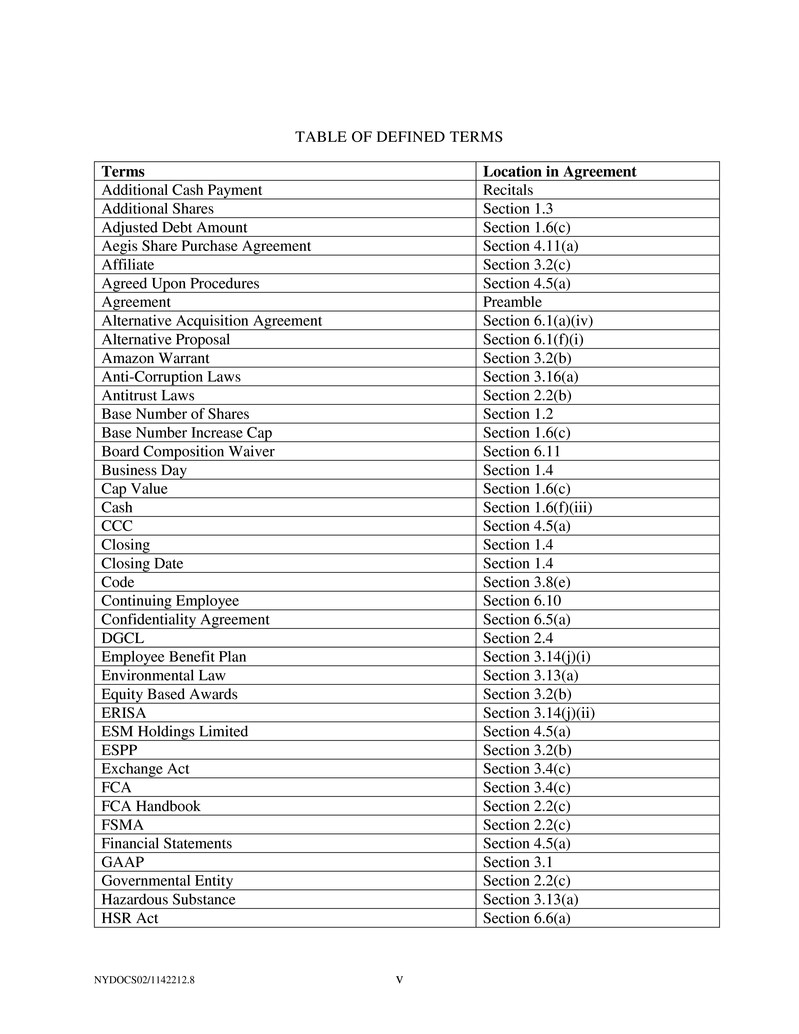

NYDOCS02/1142212.8 v TABLE OF DEFINED TERMS Terms Location in Agreement Additional Cash Payment Recitals Additional Shares Section 1.3 Adjusted Debt Amount Section 1.6(c) Aegis Share Purchase Agreement Section 4.11(a) Affiliate Section 3.2(c) Agreed Upon Procedures Section 4.5(a) Agreement Preamble Alternative Acquisition Agreement Section 6.1(a)(iv) Alternative Proposal Section 6.1(f)(i) Amazon Warrant Section 3.2(b) Anti-Corruption Laws Section 3.16(a) Antitrust Laws Section 2.2(b) Base Number of Shares Section 1.2 Base Number Increase Cap Section 1.6(c) Board Composition Waiver Section 6.11 Business Day Section 1.4 Cap Value Section 1.6(c) Cash Section 1.6(f)(iii) CCC Section 4.5(a) Closing Section 1.4 Closing Date Section 1.4 Code Section 3.8(e) Continuing Employee Section 6.10 Confidentiality Agreement Section 6.5(a) DGCL Section 2.4 Employee Benefit Plan Section 3.14(j)(i) Environmental Law Section 3.13(a) Equity Based Awards Section 3.2(b) ERISA Section 3.14(j)(ii) ESM Holdings Limited Section 4.5(a) ESPP Section 3.2(b) Exchange Act Section 3.4(c) FCA Section 3.4(c) FCA Handbook Section 2.2(c) FSMA Section 2.2(c) Financial Statements Section 4.5(a) GAAP Section 3.1 Governmental Entity Section 2.2(c) Hazardous Substance Section 3.13(a) HSR Act Section 6.6(a)

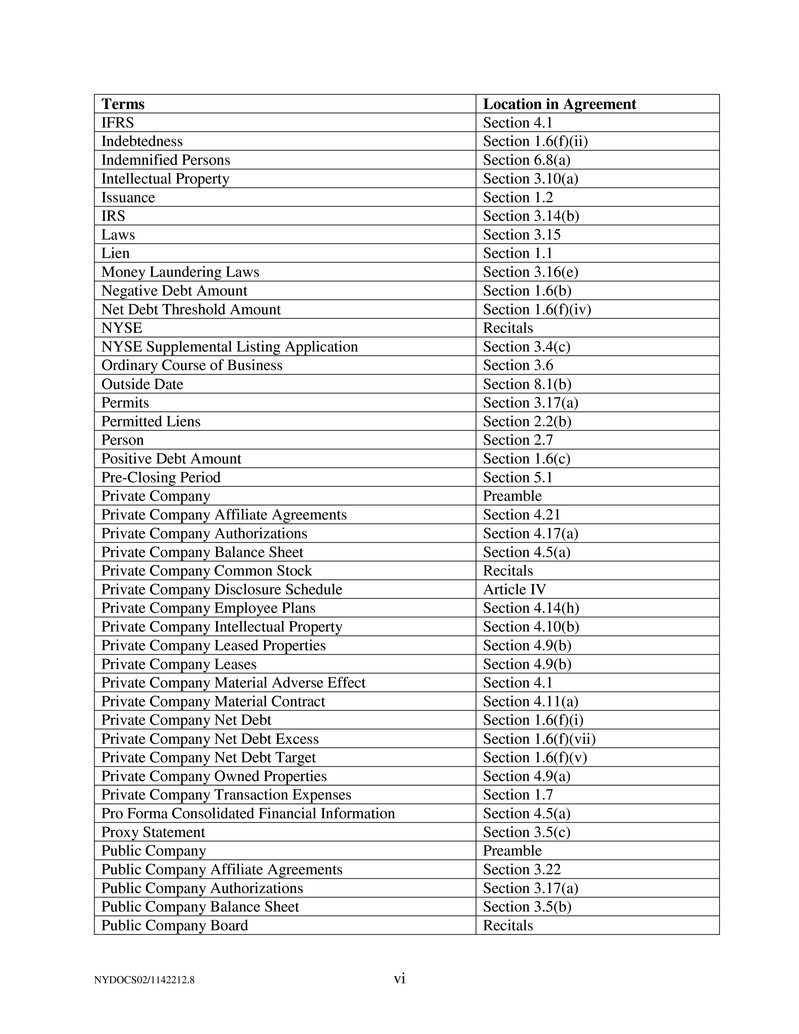

NYDOCS02/1142212.8 vi Terms Location in Agreement IFRS Section 4.1 Indebtedness Section 1.6(f)(ii) Indemnified Persons Section 6.8(a) Intellectual Property Section 3.10(a) Issuance Section 1.2 IRS Section 3.14(b) Laws Section 3.15 Lien Section 1.1 Money Laundering Laws Section 3.16(e) Negative Debt Amount Section 1.6(b) Net Debt Threshold Amount Section 1.6(f)(iv) NYSE Recitals NYSE Supplemental Listing Application Section 3.4(c) Ordinary Course of Business Section 3.6 Outside Date Section 8.1(b) Permits Section 3.17(a) Permitted Liens Section 2.2(b) Person Section 2.7 Positive Debt Amount Section 1.6(c) Pre-Closing Period Section 5.1 Private Company Preamble Private Company Affiliate Agreements Section 4.21 Private Company Authorizations Section 4.17(a) Private Company Balance Sheet Section 4.5(a) Private Company Common Stock Recitals Private Company Disclosure Schedule Article IV Private Company Employee Plans Section 4.14(h) Private Company Intellectual Property Section 4.10(b) Private Company Leased Properties Section 4.9(b) Private Company Leases Section 4.9(b) Private Company Material Adverse Effect Section 4.1 Private Company Material Contract Section 4.11(a) Private Company Net Debt Section 1.6(f)(i) Private Company Net Debt Excess Section 1.6(f)(vii) Private Company Net Debt Target Section 1.6(f)(v) Private Company Owned Properties Section 4.9(a) Private Company Transaction Expenses Section 1.7 Pro Forma Consolidated Financial Information Section 4.5(a) Proxy Statement Section 3.5(c) Public Company Preamble Public Company Affiliate Agreements Section 3.22 Public Company Authorizations Section 3.17(a) Public Company Balance Sheet Section 3.5(b) Public Company Board Recitals

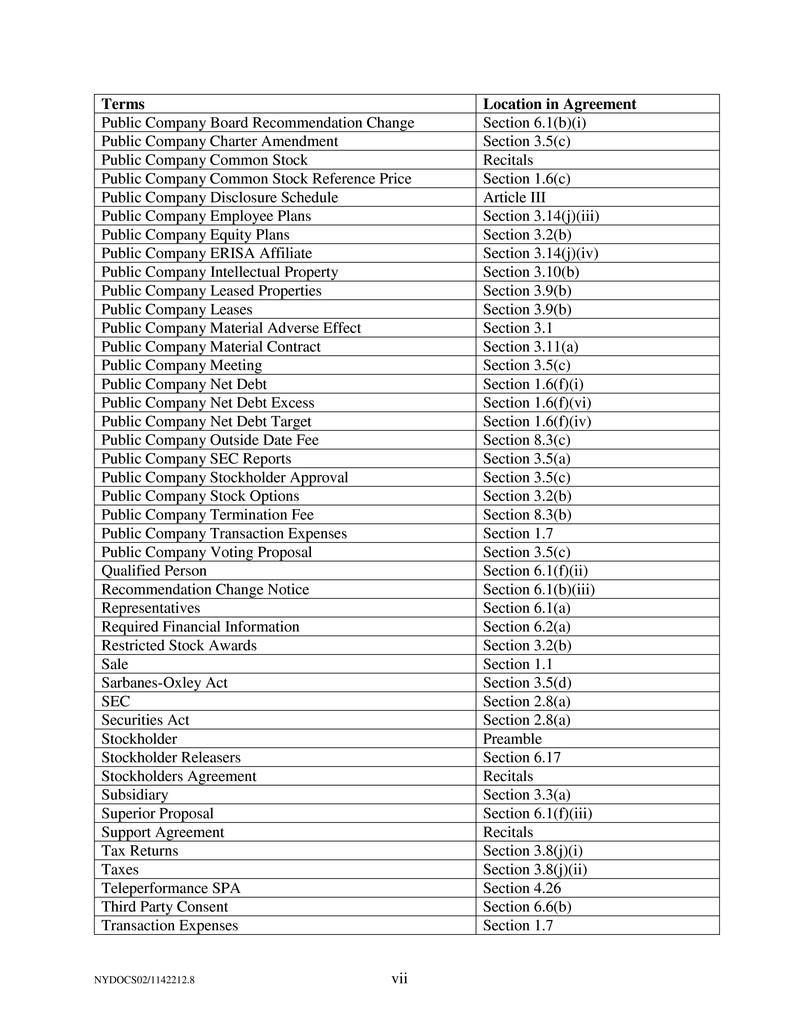

NYDOCS02/1142212.8 vii Terms Location in Agreement Public Company Board Recommendation Change Section 6.1(b)(i) Public Company Charter Amendment Section 3.5(c) Public Company Common Stock Recitals Public Company Common Stock Reference Price Section 1.6(c) Public Company Disclosure Schedule Article III Public Company Employee Plans Section 3.14(j)(iii) Public Company Equity Plans Section 3.2(b) Public Company ERISA Affiliate Section 3.14(j)(iv) Public Company Intellectual Property Section 3.10(b) Public Company Leased Properties Section 3.9(b) Public Company Leases Section 3.9(b) Public Company Material Adverse Effect Section 3.1 Public Company Material Contract Section 3.11(a) Public Company Meeting Section 3.5(c) Public Company Net Debt Section 1.6(f)(i) Public Company Net Debt Excess Section 1.6(f)(vi) Public Company Net Debt Target Section 1.6(f)(iv) Public Company Outside Date Fee Section 8.3(c) Public Company SEC Reports Section 3.5(a) Public Company Stockholder Approval Section 3.5(c) Public Company Stock Options Section 3.2(b) Public Company Termination Fee Section 8.3(b) Public Company Transaction Expenses Section 1.7 Public Company Voting Proposal Section 3.5(c) Qualified Person Section 6.1(f)(ii) Recommendation Change Notice Section 6.1(b)(iii) Representatives Section 6.1(a) Required Financial Information Section 6.2(a) Restricted Stock Awards Section 3.2(b) Sale Section 1.1 Sarbanes-Oxley Act Section 3.5(d) SEC Section 2.8(a) Securities Act Section 2.8(a) Stockholder Preamble Stockholder Releasers Section 6.17 Stockholders Agreement Recitals Subsidiary Section 3.3(a) Superior Proposal Section 6.1(f)(iii) Support Agreement Recitals Tax Returns Section 3.8(j)(i) Taxes Section 3.8(j)(ii) Teleperformance SPA Section 4.26 Third Party Consent Section 6.6(b) Transaction Expenses Section 1.7

NYDOCS02/1142212.8 viii Terms Location in Agreement Transactions Recitals

NYDOCS02/1142212.8 1 TRANSACTION AGREEMENT This TRANSACTION AGREEMENT (this “Agreement”), dated as of March 14, 2018, is entered into by and among StarTek, Inc., a Delaware corporation (“Public Company”), CSP Alpha Midco Pte Ltd, a Singapore private limited company (“Private Company”) and CSP Alpha Holdings Parent Pte Ltd, a Singapore private limited company (the “Stockholder”). WHEREAS, the Stockholder owns all of the issued and outstanding shares of the common stock of Private Company (the “Private Company Common Stock”); WHEREAS, the parties hereto desire to enter into this Agreement pursuant to which, among other things: (i) the Stockholder shall sell to Public Company, and Public Company shall purchase from the Stockholder, all of the shares of Private Company Common Stock; (ii) in consideration of such sale and purchase, Public Company shall issue and deliver to the Stockholder or its designee twenty million six hundred thousand (20,600,000) shares of the common stock of Public Company, par value $0.01 per share (the “Public Company Common Stock”), as may be adjusted pursuant to Section 1.6 and further adjusted for stock splits, consolidation and other similar corporate events; (iii) in order to effect such issuance and the other transactions contemplated hereby, Public Company shall effectuate the Public Company Charter Amendment (as defined herein); and (iv) in addition to the Sale (as defined herein) and Issuance (as defined herein), the Stockholder shall purchase, for ten million US dollars (US$10,000,000) (as may be adjusted pursuant to Section 1.6(c) and further adjusted for stock splits, consolidation and other similar corporate events, the “Additional Cash Payment”), additional shares of Public Company Common Stock at a price of $12.00 per share of Public Company Common Stock; in each case, on the terms and subject to the conditions contained herein (collectively, along with all other transactions contemplated by this Agreement, the “Transactions”); WHEREAS, the Board of Directors of Public Company (together with any duly authorized committee thereof, the “Public Company Board”) has unanimously (i) approved the execution, delivery and performance of this Agreement, (ii) determined that the Public Company Charter Amendment is advisable in connection with the Transactions in accordance with the provisions of the DGCL (as defined herein), and (iii) resolved to recommend the Public Company Stockholder Approval, upon the terms and subject to the conditions set forth in this Agreement and in accordance with the provisions of the DGCL and the rules and regulations of the New York Stock Exchange (“NYSE”), as applicable; WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to Private Company’s and the Stockholder’s willingness to enter into this Agreement, the stockholders of Public Company listed in Section A of the Public Company Disclosure Schedule have entered into support agreements, each dated as of the date of this

NYDOCS02/1142212.8 2 Agreement, in the form agreed to by the Stockholder (each, a “Support Agreement” and collectively the “Support Agreements”), pursuant to which such stockholders have, among other things, agreed to vote all of their shares of capital stock in favor of the Transactions and against any competing proposals; and WHEREAS, concurrently with the Closing, and as a condition and inducement to the parties’ willingness to enter into this Agreement, Public Company and the Stockholder shall enter into a Stockholders Agreement, dated as of the Closing Date, substantially in the form attached hereto as Exhibit A (the “Stockholders Agreement”). NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth below, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Public Company, Private Company and the Stockholder agree as follows: ARTICLE I TRANSACTIONS 1.1 Sale. Upon the terms and subject to the conditions set forth in this Agreement, at the Closing, Public Company shall purchase from Stockholder, and Stockholder shall sell, convey, assign, transfer and deliver to Public Company, all of the outstanding shares of Private Company Common Stock, free and clear of all Liens (the “Sale”). “Lien” means any mortgage, pledge, lien, encumbrance, charge or other security interest or ownership interest or claim of any kind in respect of any asset or Person. 1.2 Issuance. Upon the terms and subject to the conditions set forth in this Agreement, at the Closing and in consideration of the Sale, Public Company shall issue and deliver to Stockholder or its designee, twenty million six hundred thousand (20,600,000) shares of Public Company Common Stock, free and clear of all Liens (as may be adjusted pursuant to Section 1.6 and further adjusted for stock splits, consolidation and other similar corporate events, the “Base Number of Shares”) (the “Issuance”). 1.3 Additional Cash Payment and Additional Shares. In addition to the Sale and Issuance, at the Closing, the Stockholder shall purchase from Public Company for the Additional Cash Payment, and the Public Company shall issue and deliver to the Stockholder or its designee, eight hundred and thirty-three thousand, three hundred and thirty-three (833,333) shares of Public Company Common Stock (as may be adjusted pursuant to Section 1.6(c) and further adjusted for stock splits, consolidation and other similar corporate events, the “Additional Shares”). 1.4 The Closing. Subject to the satisfaction or waiver (to the extent permitted by applicable Law) of the conditions set forth in Article VII, the closing of the Transactions (the “Closing”) will take place on a date to be specified by Public Company and Private Company, which shall not be later than the fifth (5th) Business Day following the day on which the last of the conditions set forth in Article VII (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions) to be

NYDOCS02/1142212.8 3 satisfied or waived has been satisfied or waived in accordance with this Agreement, at the offices of Jenner & Block LLP, 353 N. Clark St., Chicago, Illinois 60654, unless another date, place or time is agreed to in writing by Public Company and Private Company. For the avoidance of doubt, in the event the number of shares to be issued to the Stockholder or its designee in respect of a Positive Debt Amount would exceed the Base Number Increase Cap, the Closing Date shall occur two (2) Business Days after the expected Closing Date pursuant to Section 1.6(a) to accommodate the time period to seek consent or waiver as set forth in Section 1.6(c). For the purposes of this Agreement, the term “Business Day” shall mean any day other than a Saturday, Sunday or other day on which commercial banking institutions in New York, New York or Singapore are authorized or permitted by applicable Law to be closed, and the term “Closing Date” shall mean the date on which the Closing actually occurs. 1.5 Actions at the Closing. At the Closing: (a) Private Company and the Stockholder shall deliver to Public Company the various certificates, instruments and documents referred to in Section 7.3; (b) Public Company shall deliver to the Stockholder the various certificates, instruments and documents referred to in Section 7.2; (c) Public Company shall deliver to the Stockholder certificates representing the number of shares of Public Company Common Stock payable pursuant to Section 1.2 and Section 1.3; (d) the Stockholder shall deliver to Public Company by wire transfer of immediately available funds an amount in cash equal to the Additional Cash Payment pursuant to Section 1.3; and (e) the Stockholder shall deliver or procure to be delivered to Public Company stock certificates representing all of the shares of Private Company Common Stock owned by the Stockholder, duly endorsed in blank for transfer or accompanied by duly executed stock powers assigning all of the outstanding shares of Private Company Common Stock in blank, and any other documents necessary to transfer to Public Company good and valid title to such shares free and clear of all Liens. 1.6 Net Debt Adjustment. (a) On the third (3rd) Business Day prior to the Closing Date, (i) Public Company shall deliver to the Stockholder a statement prepared in good faith setting forth the Public Company Net Debt as determined as of 11:59 PM (Eastern Time) on the Business Day immediately prior to such date, including a separate line item for each component set forth in such definition and reasonable supporting documentation used in the preparation of such statement; and (ii) Private Company shall deliver to the Stockholder a statement prepared in good faith setting forth the Private Company Net Debt as determined as of 11:59 PM (Eastern Time) on the Business Day immediately prior to such date, including a separate line item for each component set forth in such definition and reasonable supporting documentation used in the preparation of such statement. Each of the Public Company, on the one hand, and the Private Company or the Stockholder, on the other hand, shall have the right to review and comment on

NYDOCS02/1142212.8 4 the Private Company Net Debt or Public Company Net Debt, as the case may be, and the other party or parties hereto will consider in good faith any comments or adjustments to the calculation of Private Company Net Debt or Public Company Net Debt, as the case may be, and make appropriate changes in light of any such comments or proposed adjustments. (b) If the Public Company Net Debt Excess is equal to the Private Company Net Debt Excess, there shall be no adjustment in the number of shares in the Issuance, which shall remain as the Base Number of Shares, and, for the avoidance of doubt, no adjustment to the Additional Cash Payment. (c) If the Public Company Net Debt Excess less the Private Company Net Debt Excess is a positive number (the “Positive Debt Amount”), the Base Number of Shares shall be increased by a number of shares (rounded up or down to the nearest whole share) equal to the Positive Debt Amount divided by the Public Company Common Stock Reference Price; provided that if, as a result of such adjustment, the Base Number of Shares would be increased by more than 200,000 shares (as may be adjusted for stock splits, consolidation and other similar corporate events) (the “Base Number Increase Cap”), then the parties hereto shall proceed in the following order: (i) Public Company shall use its reasonable best efforts to obtain any waiver or consent of any relevant third party to allow, without requiring any material amendment to any existing agreement with any such relevant third party, an increase in the Base Number Increase Cap to permit the full adjustment and increase to the Base Number of Shares, in which case, the adjustment to the Base Number of Shares in this Section 1.6(c) shall be made without the limitation of the Base Number Increase Cap; (ii) Public Company may, in its sole discretion, waive the application of the Base Number Increase Cap and issue a number of additional shares of Public Company Common Stock in respect of all or part of the Positive Debt Amount, with each share of Public Company Common Stock being valued at the Public Company Common Stock Reference Price (provided that such waiver shall not conflict with, or result in any violation or breach of, constitute a default, or give rise to the vesting of any right by any third party or the acceleration of any material benefit for any third party, pursuant to any of the terms, conditions or provisions of any contract or other agreement, instrument or obligation of Public Company); and (iii) if such consent or waiver referenced in sub-clause (i) is not obtained on or prior to the extended Closing Date contemplated by Section 1.4 and the waiver contemplated by sub-clause (ii), if made, does not result in the issuance of an additional number of shares of Public Company Common Stock equal to the Positive Debt Amount divided by the Public Company Common Stock Reference Price, then (x) the Additional Cash Payment shall be reduced to an amount (but not less than zero) equal to ten million US dollars (US$10,000,000) minus the difference between the Positive Debt Amount and the Cap Value, and the number of Additional Shares shall equal the Additional Cash Payment as so reduced divided by the Public Company Common Stock Reference Price, and (y) the Base Number of Shares shall be adjusted to equal 20,800,000 (as may be adjusted for stock splits, consolidation and other similar corporate events) plus the number of shares obtained by dividing the Adjusted Debt Amount by the Public Company Common Stock Reference Price (with any fractional shares rounded up or down to the nearest whole share); provided, however, that, for the avoidance of doubt, the total number of shares of Public Company Common Stock to be issued to the Stockholder or its designee at Closing shall not exceed 21,633,333 (as may be adjusted for stock splits, consolidation and other similar corporate events). “Public Company Common Stock Reference Price” shall mean $12.00 per share of Public Company Common Stock, as may be adjusted for

NYDOCS02/1142212.8 5 stock splits, consolidation and other similar corporate events. “Cap Value” shall be an amount equal to two million four hundred thousand US dollars (US$2,400,000), which, for the avoidance of doubt, shall equal the product of the Base Number Increase Cap and the Public Company Common Stock Reference Price (not accounting for stock splits, consolidation and other similar corporate events); provided, however, that if Public Company waives the application of the Base Number Increase Cap pursuant to sub-clause (ii), the Cap Value shall be increased to equal the Public Company Common Stock Reference Price multiplied by the number of shares of Public Company Common Stock to be issued pursuant to sub-clause (ii). “Adjusted Debt Amount” means an amount equal to the Positive Debt Amount minus the Cap Value; provided, however, that if the amount so calculated exceeds ten million US dollars (US$10,000,000), then the Adjusted Debt Amount shall be deemed to equal ten million US dollars (US$10,000,000). (d) If the Public Company Net Debt Excess less the Private Company Net Debt Excess is a negative number (the “Negative Debt Amount”), the Base Number of Shares shall be decreased by a number of shares (rounded up or down to the nearest whole share) equal to the absolute value of the Negative Debt Amount divided by the Public Company Common Stock Reference Price, and, for the avoidance of doubt, there shall be no adjustment to the Additional Cash Payment. (e) An illustrative calculation of the adjustments pursuant to this Section 1.6 is set forth in Exhibit B attached hereto. (f) (i) “Public Company Net Debt” shall mean an amount equal to Indebtedness minus Cash with respect to Public Company and its Subsidiaries on a consolidated basis, as determined as of 11:59 PM (Eastern Time) on the Business Day immediately prior to the applicable date, and “Private Company Net Debt” shall mean an amount equal to Indebtedness minus Cash with respect to Private Company and its Subsidiaries on a consolidated basis, as determined as of 11:59 PM (Eastern Time) on the Business Day immediately prior to the applicable date. (ii) “Indebtedness” shall mean, without duplication, (A) all liabilities for borrowed money, whether current, short-term, long-term, secured or unsecured, all obligations evidenced by bonds, debentures, notes or similar instruments, and all liabilities in respect of mandatorily redeemable or purchasable capital stock or securities convertible into capital stock; (B) all liabilities for the principal amount of the deferred and unpaid purchase price of real property and equipment that have been delivered; or (C) all liabilities in respect of any lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which liabilities are required to be classified and accounted for under GAAP, with respect to Public Company, and IFRS, with respect to Private Company, as capital leases; and (D) all liabilities as guarantor of obligations of any other Person of a type described in clauses (A), (B), or (C) above, to the extent of the obligation guaranteed; provided, however, for the avoidance of doubt, “Indebtedness” shall not include (w) any Indebtedness (1) between Public Company and any of its Subsidiaries (or between any of Public Company’s Subsidiaries); and (2) between Private Company and any of its Subsidiaries (or between any of Public Company’s Subsidiaries), (x) any liabilities in respect of any agreement or arrangement with respect to any swap, cap, collar, forward, future or derivative transaction or option or similar agreement, whether exchange traded, “over-the-counter” or otherwise, involving, or settled by

NYDOCS02/1142212.8 6 reference to, one or more rates, currencies, commodities, equity or debt instruments or securities, or economic, financial or pricing indices or measures of economic, financial or pricing risk or value or any similar transaction or any combination of these transactions; (y) any guarantees by Public Company or Private Company (or the Stockholder), or its respective Subsidiaries, as applicable, of the performance of the obligations of another Person (other than obligations in respect of Indebtedness for borrowed money), or (z) any liabilities for the reimbursement of any obligor on any undrawn letter of credit, banker’s acceptance or similar credit transaction securing obligations of any other Person of a type described in clauses (A), (B), or (C) above. (iii) “Cash” shall mean, with respect to any Person and without duplication, all cash, bank accounts, certificates of deposit, commercial paper, treasury bills and notes, marketable securities and other cash equivalents of such Person and the Subsidiaries of such Person, including the amounts of any received but uncleared checks, drafts and wires issued prior to such time, less the amounts of any outstanding checks or transfers at such time, determined in accordance with GAAP, with respect to Public Company, and IFRS, with respect to Private Company, but in each case, for the avoidance of doubt, without giving effect to the Transactions. (iv) “Public Company Net Debt Target” shall mean an amount equal to twenty-eight million US dollars (US$28,000,000) plus the Net Debt Threshold Amount. “Net Debt Threshold Amount” shall mean three million US dollars (US$3,000,000). (v) “Private Company Net Debt Target” shall mean an amount equal to one hundred and fifty million US dollars (US$150,000,000) plus the Net Debt Threshold Amount. (vi) “Public Company Net Debt Excess” shall mean (i) the excess, if any, of the Public Company Net Debt over the Public Company Net Debt Target; or (ii) zero (0) if the Public Company Net Debt Target is equal to or greater than the Public Company Net Debt. (vii) “Private Company Net Debt Excess” shall mean (i) the excess, if any, of the Private Company Net Debt over the Private Company Net Debt Target; or (ii) zero (0) if the Private Company Net Debt Target is equal to or greater than the Private Company Net Debt. 1.7 Transaction Expenses. After the Closing, Public Company shall pay (when due and payable) or promptly reimburse, as applicable, on behalf of the Stockholder, Public Company, and Private Company, all Public Company Transaction Expenses and Private Company Transaction Expenses. “Public Company Transaction Expenses” means the Transaction Expenses incurred or otherwise payable by or on behalf of Public Company, and “Private Company Transaction Expenses” means the Transaction Expenses incurred or otherwise payable by or on behalf of the Stockholder or Private Company, which shall not include any Transaction Expenses incurred or otherwise payable to Stockholder or any of its Affiliates. “Transaction Expenses” means the aggregate amount of all fees and expenses, incurred by or on behalf of, or to be paid by, Public Company, the Stockholder or Private Company, as applicable, in connection with the consummation of the Transactions, or otherwise relating to the negotiation, preparation or execution of this Agreement or any documents or agreements

NYDOCS02/1142212.8 7 contemplated hereby or the performance or consummation of the transaction contemplated hereby or thereby, including (i) any fees and expenses payable to legal or financial advisors and accountants; (ii) any termination payments to any terminated employees in connection with the Transactions; (iii) any transfer Taxes, stamp duty or similar Taxes payable in connection with the Transactions; and (iv) any transaction bonus, discretionary bonus, retention, “stay put” or other similar compensatory payments (including pursuant to any plans or agreements providing for change of control or severance payments to which Public Company or Private Company, as applicable, or one of its respective Subsidiaries is a party or participates), to be made to any current or former employee, board member or consultant of the Public Company or Private Company, as applicable, or one of its respective Subsidiaries on or after the Closing Date as a result of (A) the execution of this Agreement or the consummation of the transactions contemplated hereby or thereby; or (B) any change of control of Public Company or Private Company, as applicable, or one of its respective Subsidiaries resulting from the transactions contemplated hereby; in each case, estimates of which (as of the date hereof) are set forth on Section 1.7 of the Public Company Disclosure Schedule or Private Company Disclosure Schedule, as applicable. ARTICLE II REPRESENTATIONS AND WARRANTIES OF THE STOCKHOLDER The Stockholder represents and warrants to Public Company that the statements contained in this Article II are true and correct. For purposes hereof, the phrase “to the knowledge of the Stockholder” and similar expressions mean the actual knowledge as of the date hereof (without any duty to inquire or investigate) of the individuals identified in Section 2.0 of the Private Company Disclosure Schedule. 2.1 Organization, Standing. The Stockholder (a) is a private limited company duly organized, validly existing and in good standing under the laws of Singapore and (b) has all requisite power and authority to carry on the businesses in which it is engaged and to own and use the properties owned and used by it. 2.2 Authority, Power; No Conflict; Required Filings and Consents. (a) The Stockholder has all necessary power and authority to execute, deliver and perform its obligations under this Agreement and the other documents contemplated hereby to be executed and delivered by the Stockholder and to consummate the Transactions. The execution, delivery and performance of this Agreement and the other documents contemplated hereby to be executed and delivered by the Stockholder and the consummation by the Stockholder of the transactions contemplated hereby and thereby have been duly and validly authorized by all necessary corporate and other action on the part of the Stockholder. This Agreement has been, and all other documents contemplated hereby to be executed or delivered by the Stockholder will be, duly and validly executed and delivered by the Stockholder and, assuming the due authorization, execution and delivery by Public Company, Private Company and any other party thereto, constitute or will constitute valid and binding obligations of the Stockholder, enforceable against the Stockholder in accordance with their terms, except as the enforceability hereof may be limited by applicable bankruptcy, insolvency, reorganization,

NYDOCS02/1142212.8 8 moratorium or other similar Laws affecting the enforcement of creditors’ rights generally or applicable equitable principles (whether considered in a proceeding at law or in equity). (b) The execution and delivery of this Agreement and the other documents contemplated hereby to be executed or delivered by the Stockholder do not, and the consummation by the Stockholder of the transactions contemplated hereby and thereby will not, (i) conflict with, or result in any violation or breach of, any provision of the articles of association or bylaws (or similar organizational documents) of the Stockholder, (ii) conflict with, or result in any violation or breach of, or constitute (with or without notice or lapse of time, or both) a default (or give rise to a right of termination, cancellation or acceleration of any obligation or loss of any material benefit) under, require a consent or waiver under, require the payment of a penalty under or result in the imposition of any Lien (other than a Permitted Lien) on the assets of the Stockholder pursuant to, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, lease, license, contract or other agreement, instrument or obligation to which the Stockholder is a party or by which it or any of its properties or assets (whether owned or leased) may be bound, or (iii) subject to compliance with any applicable requirements of the HSR Act and any other Laws analogous to the HSR Act existing in foreign jurisdictions (together with the HSR Act, “Antitrust Laws”), conflict with or violate any permit, concession, franchise, license, judgment, injunction, order, decree, statute, law, ordinance, rule or regulation applicable to the Stockholder or any of the properties or assets owned or leased by such Stockholder, except in the case of clauses (ii) and (iii) of this Section 2.2(b), for any such conflicts, violations, breaches, defaults, notices, filings, terminations, cancellations, accelerations, losses, penalties or Liens, and for any consents, approvals, authorizations or waivers not obtained, that, individually or in the aggregate, would not reasonably be expected to prohibit or materially delay the ability of the Stockholder to consummate the Transactions or any other document contemplated hereby to be executed or delivered by the Stockholder or to perform its obligations hereunder or thereunder. Section 2.2(b) of the Private Company Disclosure Schedule lists all consents, waivers and approvals (if any) under any of the Stockholder’s agreements, licenses or leases required to be obtained in connection with the consummation of the Transactions, which, if individually or in the aggregate were not obtained, would reasonably be expected to prohibit or materially delay the ability of such Stockholder to consummate the Transactions or any other document contemplated hereby to be executed or delivered by such Stockholder or to perform such Stockholder’s obligations hereunder or thereunder. “Permitted Liens” means any (a) Liens for Taxes not yet due and payable, (b) statutory Liens of landlords, (c) Liens of carriers, warehousemen, mechanics, materialmen and repairmen incurred in the Ordinary Course of Business and not yet due and payable, (d) in the case of leased real property, zoning, building, or other restrictions, variances, covenants, rights of way, encumbrances, easements and other minor irregularities in title that are not violated by the current use or occupancy of such leased real property or the operation of the business conducted thereon, (e) the title of a lessor under an operating lease or capitalized lease or of any licensor under a license, and (f) imperfections of title and Liens that do not, individually or in the aggregate, (i) interfere with the present use of or occupancy of the affected leased real property, (ii) have more than a de minimis effect on the value thereof or its use, or (iii) impair the ability of such parcel to be sold, leased or subleased for its present use. (c) Except for filings, permits, authorizations, consents, approvals and other applicable requirements as may be required under the Securities Act, the Exchange Act, state

NYDOCS02/1142212.8 9 securities or blue sky laws, Antitrust Laws, the UK Financial Services and Markets Act 2000 (“FSMA”), or the UK Financial Conduct Authority’s Handbook (“FCA Handbook”), no consent, approval, license, permit, order or authorization of, or registration, declaration, notice or filing with, any United States or non-United States (including supranational) court, arbitrational tribunal, administrative agency or commission or other governmental, regulatory or self- regulatory authority, agency or instrumentality (a “Governmental Entity”) is required by or with respect to the Stockholder in connection with the execution and delivery by the Stockholder of this Agreement or any other document contemplated hereby to be executed or delivered by the Stockholder or the consummation by the Stockholder of the Transactions or any other document contemplated hereby to be executed or delivered by the Stockholder, except for such consents, approvals, licenses, permits, orders, authorizations, registrations, declarations, notices and filings that, individually or in the aggregate, if not obtained or made, would not reasonably be expected to prohibit or materially delay the ability of the Stockholder to consummate the Transactions or any other document contemplated hereby to be executed or delivered by such Stockholder or to perform its obligations hereunder or thereunder. 2.3 Ownership of Private Company Common Stock. Except as set forth on Section 2.3 of the Private Company Disclosure Schedule, the Stockholder holds legally, beneficially and of record all of the shares of Private Company Common Stock, free and clear of any Liens. The Stockholder is not a party to any voting trust, proxy, or other agreement or understanding with respect to the voting or transfer of any shares of Private Company Common Stock. Upon consummation of the Sale, Public Company will acquire from the Stockholder good and marketable title to all shares of Private Company Common Stock, free and clear of all Liens. 2.4 Lack of Ownership of Company Stock. Neither the Stockholder nor any of its Subsidiaries (a) beneficially owns, directly or indirectly, any shares of Public Company Common Stock or other securities convertible into, exchangeable into or exercisable for shares of Public Company Common Stock, or (b) is a party to any voting trusts or other agreements or understandings with respect to the voting of the capital stock or other equity interests of Public Company or any of its Subsidiaries, in each case except in accordance with this Agreement, including, for the avoidance of doubt, entry into the Support Agreements. Neither the Stockholder nor any of its Subsidiaries is, nor at any time during the last three years has been, an “interested stockholder” of Public Company as defined in Section 203 of the General Corporation Law of the State of Delaware (the “DGCL”). 2.5 Litigation. There is no action, suit, proceeding, claim, arbitration or investigation before any Governmental Entity or before any arbitrator that is pending or, to the knowledge of the Stockholder, has been threatened in writing against the Stockholder that questions the validity of this Agreement or any other document contemplated hereby to be executed or delivered by the Stockholder or any action taken or to be taken by the Stockholder in connection herewith or therewith or that would reasonably be expected to prohibit or materially delay the Stockholder’s ability to consummate the Transactions or any other document contemplated hereby to be executed or delivered by such Stockholder. As of the date hereof, the Stockholder does not have any claim of any kind against Private Company.

NYDOCS02/1142212.8 10 2.6 Brokers. No agent, broker, investment banker, financial advisor or other firm or Person is or shall be entitled, as a result of any action or agreement of the Stockholder or any of its Affiliates, to any broker’s, finder’s, financial advisor’s or other similar fee or commission in connection with any of the Transactions. 2.7 Purchase for Own Account; Sophistication. The Stockholder acknowledges and agrees that shares of Public Company Common Stock to be acquired by the Stockholder pursuant to this Agreement will be acquired for investment for the Stockholder’s or its Affiliate’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof in violation of any applicable securities Laws, and that the Stockholder has no present intention of selling, granting any participation in, or otherwise distributing the same. The Stockholder acknowledges and agrees that the Stockholder does not presently have any contract, undertaking, agreement or arrangement with any individual, corporation, partnership, limited liability company, joint venture, association, trust, Governmental Entity, unincorporated organization or other entity (each, a “Person”) to sell, transfer or grant participations to such Person or to any other Person, with respect to any of the shares of Public Company Common Stock to be received by it pursuant to this Agreement. The Stockholder represents and warrants that the Stockholder has such knowledge and experience in financial and business matters that the Stockholder is capable of evaluating the merits and risks of owning the shares of Public Company Common Stock to be received by the Stockholder pursuant to this Agreement. 2.8 Restricted Securities; Legends. (a) The Stockholder understands that the shares of Public Company Common Stock to be received by the Stockholder in connection with the Transactions have not been, and as of the Closing will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Stockholder’s representations and warranties as expressed herein. The Stockholder understands that such shares of Public Company Common Stock will be “restricted securities” under applicable securities Laws and that, pursuant to these Laws, the Stockholder must hold such shares indefinitely unless they are registered with the Securities and Exchange Commission (the “SEC”) and qualified by state authorities, or an exemption from such registration and qualification requirements is available. (b) The Stockholder understands that the shares of Public Company Common Stock to be received by the Stockholder in connection with the Transactions may be notated with one or more of the following legends: (i) “THE SHARES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH TRANSFER MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.”

NYDOCS02/1142212.8 11 (ii) Any legend required by applicable securities Laws to the extent such Laws are applicable to the shares represented by the certificate, instrument, or book entry so legended. 2.9 Accredited Investor. The Stockholder is an “accredited investor” (as defined in Regulation D promulgated under the Securities Act). 2.10 Independent Investigation. The Stockholder acknowledges that it has conducted to its satisfaction its own independent investigation and analysis of the business, operations, assets, liabilities, results of operations, condition (financial or otherwise) and prospects of Public Company and Public Company’s Subsidiaries and that the Stockholder and its Representatives have received access to such books and records, facilities, equipment, contracts and other assets of Public Company and Public Company’s Subsidiaries that it and its Representatives have desired or requested to review for such purpose, and that it and its Representatives have had a full opportunity to meet with the management of Public Company and Public Company’s Subsidiaries and to discuss the business, operations, assets, liabilities, results of operations, condition (financial or otherwise) and prospects of Public Company and Public Company’s Subsidiaries. 2.11 No Other Representations or Warranties; Non-Reliance. The Stockholder acknowledges that, except for the representations and warranties contained in Article III of this Agreement, none of Public Company or any of its Affiliates or Representatives or any other Person makes (and the Stockholder is not relying on) any representation or warranty, express or implied, to the Stockholder in connection with the Transactions. In connection with the due diligence investigation of Public Company by the Stockholder and its Affiliates and Representatives, the Stockholder and its Affiliates and Representatives have received and may continue to receive after the date hereof from Public Company and its Affiliates and Representatives certain estimates, projections, forecasts and other forward-looking information, as well as certain business plan information, regarding Public Company, its Subsidiaries, and their respective businesses and operations. The Stockholder hereby acknowledges and agrees that (i) there are uncertainties inherent in attempting to make such estimates, projections, forecasts and other forward-looking statements, as well as in such business plans, with which the Stockholder is familiar, and no assurance can be given that such estimates, projections, forecasts and other forward-looking statements will be realized, and (ii) except for the specific representations and warranties of Public Company contained in this Agreement (including any that are subject to the Public Company Disclosure Schedule and the Public Company SEC Reports), the Stockholder acknowledges that Public Company has not made any representation, with respect to the accuracy or completeness of any representation or warranty, either express or implied, with respect to Public Company or any of its Affiliates or their business, operations, technology, assets, liabilities, results of operations, financial condition, prospects, projections, budgets, estimates or operational metrics, or as to the accuracy or completeness of any of the information provided to the Stockholder, or any of its Affiliates or any of their respective Representatives by Public Company, its Affiliates or any of its or their respective Representatives.

NYDOCS02/1142212.8 12 ARTICLE III REPRESENTATIONS AND WARRANTIES OF PUBLIC COMPANY Public Company represents and warrants to Private Company that the statements contained in this Article III are true and correct, except (a) as disclosed in the Public Company SEC Reports filed or furnished prior to the date of this Agreement (excluding any risk factor disclosures and any forward-looking statements or other statements that are predictive or forward-looking in nature) or (b) as set forth herein or in the disclosure schedule delivered by Public Company to Private Company on the date of this Agreement (the “Public Company Disclosure Schedule”). For purposes hereof, the phrase “to the knowledge of Public Company” and similar expressions mean the actual knowledge as of the date hereof (without any duty to inquire or investigate) of the individuals identified in Section 3.0 of the Public Company Disclosure Schedule. 3.1 Organization, Standing and Power. Public Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware, has all requisite corporate power and authority to own, lease and operate its properties and assets (either owned or leased) and to carry on its business as now being conducted, and is duly qualified to do business and, where applicable as a legal concept, is in good standing as a foreign corporation in each jurisdiction in which the character of the properties it owns, operates or leases or the nature of its activities makes such qualification legally required, except for such failures to be so organized, qualified or in good standing that, individually or in the aggregate, would not reasonably be expected to have a Public Company Material Adverse Effect. For purposes of this Agreement, the term “Public Company Material Adverse Effect” means any effect, fact, circumstance, occurrence, event, development, change or condition, either individually or together with one or more other contemporaneously existing effects, facts, circumstances, occurrences, events, developments, changes or conditions that is, or would reasonably be expected to be, materially adverse to the business or financial condition of Public Company and its Subsidiaries, taken as a whole; provided, however, that no effect, fact, circumstance, occurrence, event, development, change or condition (by itself or when aggregated or taken together with any and all other effects, facts, circumstances, occurrences, events, developments, changes or conditions) directly or indirectly resulting from, arising out of, attributable to, or related to any of the following shall be deemed to be or constitute a “Public Company Material Adverse Effect,” and no effect, fact, circumstance, occurrence, event, development, change or condition (by itself or when aggregated or taken together with any and all other such effects, facts, circumstances, occurrences, events, developments, changes or conditions) directly or indirectly resulting from, arising out of, attributable to, or related to any of the following shall be taken into account when determining whether a “Public Company Material Adverse Effect” has occurred or may, would or could occur: (i) general economic conditions (or changes in such conditions) in any country or region in the world, or conditions in the global economy generally; (ii) conditions (or changes in such conditions) in the securities markets, credit markets, currency markets or other financial markets in any country or region in the world, including (A) changes in interest rates in any country or region in the world and changes in exchange rates for the currencies of any countries and (B) any suspension of trading in securities (whether equity, debt, derivative or hybrid securities) generally on any securities exchange or over-the-counter market operating in any country or region in the world; (iii) conditions (or changes in such conditions) in

NYDOCS02/1142212.8 13 the industries in which Public Company and its Subsidiaries conduct business; (iv) political conditions (or changes in such conditions) in any country or region in the world or acts of war (whether or not declared), sabotage or terrorism (including any escalation or general worsening of any such acts of war, sabotage or terrorism) in the United States or any other country or region in the world; (v) earthquakes, hurricanes, tsunamis, tornadoes, floods, mudslides, wild fires or other natural disasters, weather conditions and other force majeure events in any country or region in the world; (vi) the announcement or pendency of this Agreement or the anticipated consummation of the Transactions, including the identity of Private Company (including, to the extent resulting from the foregoing, any effect on any of Public Company’s or any of its Subsidiaries’ relationships with their respective customers, suppliers or employees); (vii) any actions taken or any failure to take action, in each case, which Private Company has approved, consented to or requested; or compliance with the terms of, or the taking of any action required or contemplated by, this Agreement; or the failure to take any action prohibited by this Agreement; (viii) changes in law or other legal or regulatory conditions, or the interpretation thereof, or changes in United States generally accepted accounting principles (“GAAP”) or other accounting standards (or the interpretation thereof), or effects that result from any action taken for the purpose of complying with any of the foregoing; (ix) any fees or expenses incurred in connection with the Transactions; (x) changes in Public Company’s stock price or the trading volume of Public Company’s stock, or any failure by Public Company to meet any public estimates or expectations of Public Company’s revenue, earnings or other financial performance or results of operations for any period, or any failure by Public Company or any of its Subsidiaries to meet any internal budgets, plans or forecasts of its revenues, earnings or other financial performance or results of operations (but not, in each case, the underlying cause of such changes or failures, unless such changes or failures would otherwise be excepted from this definition); (xi) any legal proceedings made or brought by any of the current or former stockholders of Public Company (on their own behalf or on behalf of Public Company) against Public Company arising out of the Transactions; (xii) any events resulting from or arising out of any actions taken by Public Company or any of its Subsidiaries, on the one hand, and Private Company or any of its Subsidiaries, on the other hand, as required by this Agreement; or (xiii) any action or omission explicitly required under this Agreement or any action taken or omitted to be taken at the specific request of Private Company or any omission caused by the failure of Private Company to provide a consent under Section 5.1 (other than any such consent with respect to which Private Company has reasonably withheld such consent pursuant to and consistent with Section 5.1); except to the extent such effects directly or indirectly resulting from, arising out of, attributable to or related to the matters described in the foregoing clauses (i) through (v) and (viii) disproportionately adversely affect in a material respect Public Company and its Subsidiaries, taken as a whole, as compared to other companies that conduct business in the countries and regions in the world and in the industries in which Public Company and its Subsidiaries conduct business (in which case, such adverse effects (if any) shall be taken into account when determining whether a “Public Company Material Adverse Effect” has occurred or may, would or could occur solely to the extent they are disproportionate in a material respect). 3.2 Capitalization. (a) The authorized capital stock of Public Company as of the date of this Agreement consists of 32,000,000 shares of Public Company Common Stock. As of the close of

NYDOCS02/1142212.8 14 business on March 9, 2018, 16,199,122 shares of Public Company Common Stock were issued and outstanding. (b) At the close of business on March 9, 2018, (A) 2,303,288 shares of Public Company Common Stock were issuable upon the exercise of outstanding stock options to purchase shares of Public Company Common Stock granted pursuant to any stock incentive or equity-related plans of Public Company (other than pursuant to the StarTek, Inc. Employee Stock Purchase Plan (“ESPP”)) (“Public Company Stock Options”), (B) 579,806 shares of Public Company Common Stock were issued as restricted stock in respect of shares of Public Company Common Stock granted pursuant to any stock incentive or equity-related plans of Public Company (“Restricted Stock Awards”), (C) 54,707 shares of Public Company Common Stock were subject to outstanding deferred stock awards granted pursuant to any stock incentive or equity-related plans of Public Company, (D) 215,572 shares of Public Company Common Stock were reserved for future awards under the stock incentive or equity-related plans of Public Company (collectively, including the ESPP, the “Public Company Equity Plans”) (other than pursuant to the ESPP), (E) 60,187 shares of Public Company Common Stock were reserved for future issuance under the ESPP, (F) 4,000,000 shares of Public Company Common Stock were issuable upon the exercise of an outstanding warrant issued to Amazon.com NV Investment Holdings LLC (the “Amazon Warrant”) and (G) no other shares of capital stock or other voting securities of Public Company were issued, reserved for issuance or outstanding. All outstanding shares of Public Company Common Stock are, and shares of Public Company Common Stock reserved for issuance with respect to Equity Based Awards and the ESPP, when issued in accordance with the respective terms thereof, will be, duly authorized and validly issued and are, or will be when issued in accordance with the respective terms thereof, fully paid, nonassessable and free of preemptive rights, purchase option, call or right of first refusal or similar rights. Included in Section 3.2(b) of the Public Company Disclosure Schedule is a true, correct and complete list, as of March 9, 2018, of all outstanding Public Company Stock Options or other rights to purchase or receive shares of Public Company Common Stock granted under the Public Company Equity Plans or otherwise (in each case, other than the ESPP), including any restricted stock units, restricted shares, performance units, performance shares, stock appreciation rights, “phantom” equity or similar securities or rights that are derivative of, or provide economic benefits based directly or indirectly on the value or price of any capital stock of, or other voting securities of, or ownership interest in Public Company or any Subsidiary (in each case, other than the ESPP) (collectively, the “Equity Based Awards”) and, including for each such Equity Based Award, the number of shares of Public Company Common Stock subject thereto, the name of the holder, date of grant, term, and, where applicable, exercise price and vesting schedule. Since March 9, 2018, Public Company has not issued any shares of its capital stock, voting securities or equity interests, or any securities convertible into or exchangeable or exercisable for any shares of its capital stock, voting securities or equity interests, other than pursuant to the outstanding Equity Based Awards referred to above in this Section 3.2(b). (c) Except (i) as set forth on Section 3.2(c) of the Public Company Disclosure Schedule, (ii) as set forth in this Section 3.2 and (iii) as reserved for future grants under Public Company Equity Plans as of the date of this Agreement, (A) there are no equity securities of any class of Public Company, or any security exchangeable into or exercisable for such equity securities, issued, reserved for issuance or outstanding and (B) there are no options, warrants, equity securities, calls, rights or agreements to which Public Company or any of its Subsidiaries

NYDOCS02/1142212.8 15 is a party or by which Public Company or any of its Subsidiaries is bound obligating Public Company or any of its Subsidiaries to issue, exchange, transfer, deliver or sell, or cause to be issued, exchanged, transferred, delivered or sold, additional shares of capital stock or other equity interests of Public Company or any security or rights convertible into or exchangeable or exercisable for any such shares or other equity interests, or obligating Public Company or any of its Subsidiaries to grant, extend, accelerate the vesting of, otherwise modify or amend or enter into any such option, warrant, equity security, call, right or agreement. Except as set forth on Section 3.2(c) of the Public Company Disclosure Schedule, Public Company does not have any outstanding stock appreciation rights, phantom stock, performance based rights or similar rights or obligations. Except as set forth on Section 3.2(c) of the Public Company Disclosure Schedule, neither Public Company nor any of its Affiliates is a party to or is bound by any agreement with respect to the voting (including proxies), sale, transfer, delivery or redemption of any shares of capital stock or other equity interests of, or other ownership interests in, Public Company, including any voting and support, stockholder, subscription, warrant, standstill and other similar agreements or commitment. Except as contemplated by this Agreement or described in this Section 3.2, and except to the extent arising pursuant to applicable state takeover or similar Laws, there are no registration rights, and there is no rights agreement, “poison pill” anti- takeover plan or other similar agreement to which Public Company or any of its Subsidiaries is a party or by which it or they are bound with respect to any equity security of any class of Public Company. For purposes of this Agreement, “Affiliate” when used with respect to any Person, means any other Person who is an “affiliate” of that first Person within the meaning of Rule 405 promulgated under the Securities Act. (d) All outstanding shares of Public Company Common Stock are, and all shares of Public Company Common Stock (i) to be issued in connection with the Issuance or in consideration of the Additional Cash Payment or (ii) that are subject to issuance as specified in Section 3.2(b) above, upon issuance on the terms and conditions specified in the instruments pursuant to which they are issuable, will in each case be, duly authorized, validly issued, fully paid and nonassessable, free and clear of all Liens and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the DGCL, Public Company’s certificate of incorporation or bylaws or any agreement to which Public Company is a party or is otherwise bound. (e) There are no obligations, contingent or otherwise, of Public Company or any of its Subsidiaries to repurchase, redeem or otherwise acquire any shares of Public Company Common Stock or the capital stock of Public Company or any of its Subsidiaries. 3.3 Subsidiaries. (a) All Subsidiaries of Public Company are listed on Section 3.3(a) of the Public Company Disclosure Schedule. For purposes of this Agreement, the term “Subsidiary” means, with respect to any Person, another Person (x) of which such first Person owns or controls, directly or indirectly, securities or other ownership interests representing (1) more than 50% of the voting power of all outstanding stock or ownership interests of such second Person or (2) the right to receive more than 50% of the net assets available for distribution to the holders of outstanding stock or ownership interests upon a liquidation or dissolution, or (y) of which such first Person is a general partner, manager, managing member or similar position.

NYDOCS02/1142212.8 16 (b) Each Subsidiary of Public Company is an entity duly organized, validly existing and in good standing (to the extent such concepts are applicable) under the laws of the jurisdiction of its organization, has all requisite corporate (or similar, in the case of a non- corporate entity) power and authority to own, lease and operate its properties and assets and to carry on its business as now being conducted, and is duly qualified to do business and is in good standing as a foreign entity (to the extent such concepts are applicable) in each jurisdiction where the character of its properties owned, operated or leased or the nature of its activities makes such qualification necessary, except for such failures to be so organized, qualified or in good standing that, individually or in the aggregate, would not reasonably be expected to have a Public Company Material Adverse Effect. All of the outstanding shares of capital stock and other equity securities or interests of each Subsidiary of Public Company are duly authorized, validly issued, fully paid, nonassessable and free of preemptive rights and all such shares (other than directors’ qualifying shares in the case of non-U.S. Subsidiaries, all of which Public Company has the power to cause to be transferred for no or nominal consideration to Public Company or Public Company’s designee) are owned, of record and beneficially, by Public Company or another of its Subsidiaries free and clear of any Lien (other than a Permitted Lien). There are no outstanding or authorized options, warrants, rights, agreements or commitments to which Public Company or any of its Subsidiaries is a party or which are binding on any of them providing for the issuance, disposition or acquisition of any capital stock of any Subsidiary of Public Company. There are no outstanding stock appreciation, phantom stock or similar rights with respect to any Subsidiary of Public Company. There are no voting trusts, proxies or other agreements or understandings with respect to the voting of any capital stock of any Subsidiary of Public Company. (c) Public Company has made available to Private Company complete and accurate copies of the charter and bylaws (or equivalent organizational documents) of each material Subsidiary of Public Company. (d) Except as set forth on Section 3.3(d) of the Public Company Disclosure Schedule, Public Company does not control, directly or indirectly, any capital stock or other equity interests of, or other ownership interests in, any Person that is not a Subsidiary of Public Company. 3.4 Authority; No Conflict; Required Filings and Consents. (a) Public Company has all necessary power and authority to execute, deliver and perform its obligations under this Agreement and the other documents contemplated hereby to be executed or delivered by Public Company and, subject only to the Public Company Stockholder Approval, to consummate the Transactions. The execution, delivery and performance of this Agreement and the other documents contemplated hereby to be executed and delivered by Public Company and the consummation by Public Company of the transactions contemplated hereby and thereby have been duly and validly authorized by all necessary corporate and other action on the part of Public Company, subject only to the receipt of the Public Company Stockholder Approval. This Agreement has been, and all other documents contemplated hereby and thereby to be executed or delivered by Public Company will be, duly and validly executed and delivered by Public Company and, assuming the due authorization, execution and delivery by Private Company, the Stockholder and any other party thereto,