Exhibit 10.44

StarTek

Lease Summary

Regina, Saskatchewan

Project: |

| Cornwall Centre |

|

|

|

Landlord: |

| Cornwall Centre Limited, c/o The Cadillac Fairview Corporation Limited, 20 Queen Street West, Toronto, Ontario M5H 3R4 |

|

|

|

Tenant: |

| StarTek Canada Services, Ltd. |

|

|

|

Premises: |

| 3r Floor, 61,988 SF |

|

|

|

Term: |

| 10 years commencing 8/1/03, ending 7/31/2013 |

|

|

|

Rent: |

| 8/03 - 7/31/08: $69,736.50/mo. * |

|

| 8/08 - 7/31/13: $74,902.I7/mo. * |

|

| Tenant shall not pay rent from occupancy through 7/31/03 |

|

|

|

Operating Expenses: |

| 8/03 - 10/04: $.70/sf* with CPI adjustments thereafter. Tenant to reimburse Landlord for costs to maintain chillers, roof top units, boilers and elevator |

|

|

|

Taxes: |

| Tenant shall not pay property taxes for years 1-5 |

|

|

|

Utilities/Janitorial |

| Paid direct by Tenant |

|

|

|

Security Deposit: |

| $69,624* against first month’s rent |

|

|

|

Landlord Services: |

| HVAC, elevator, electrical, gas, water service |

|

|

|

Tenant Services: |

| Maintain lobby vestibule of elevator, janitorial service |

|

|

|

Alterations: |

| Landlord approval not required if less than $20,000, however, Tenant shall notify Landlord. No overhead to be charged for work using Landlord contractor |

|

|

|

Restoration: |

| None |

|

|

|

Sublease/Assignment: |

| No Landlord approval for sublease/consent to an affiliate, but notice required. Landlord shall have the right to recapture. Profits, net of costs, split evenly with Landlord |

|

|

|

Holdover: |

| 125% for first three (3) months, 150% thereafter |

|

|

|

Parking: |

| 225 covered spaces, free for term |

Competition: |

| Landlord shall not lease space to a Competitor as long as Tenant occupies 80% of Premises |

|

|

|

Option to Renew: |

| Two (2), three (3) year options at market with twelve (12) month notice |

|

|

|

Tenant Improvement |

| $14.00/sf* paid upon occupancy |

Allowance: |

|

|

|

|

|

Building Sign: |

| Canopy identification over 11th Avenue entry |

|

|

|

Tenant Base Building |

| Tenant to contribute $150,000* toward cost of chillers |

Contribution: |

|

|

|

|

|

Indemnification: |

| StarTek, Inc. guarantees Lease |

* Canadian Dollars

|

CORNWALL CENTRE

Regina, Saskatchewan

OFFICE LEASE

CORNWALL CENTRE LIMITED

(Landlord)

and

STARTEK CANADA SERVICES LTD.

(Tenant)

CORNWALL CENTRE

OFFICE LEASE

TABLE OF CONTENTS

|

Section 2.05 Payment of Estimated Taxes |

|

|

|

|

|

|

i

| |

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

SCHEDULE “A” -LEGAL DESCRIPTION OF LANDS |

|

|

|

| |

|

|

| |

|

|

| |

|

|

|

ii

THIS LEASE is dated is dated the 14th day of February, 2003, and is made

BETWEEN:

CORNWALL CENTRE LIMITED

(the “Landlord”)

OF THE FIRST PART

- and -

STARTEK CANADA SERVICES LTD.

(the “Tenant”)

OF THE SECOND PART

ARTICLE I - PREMISES, TERM AND USE

Section 1.01 Grant and Premises

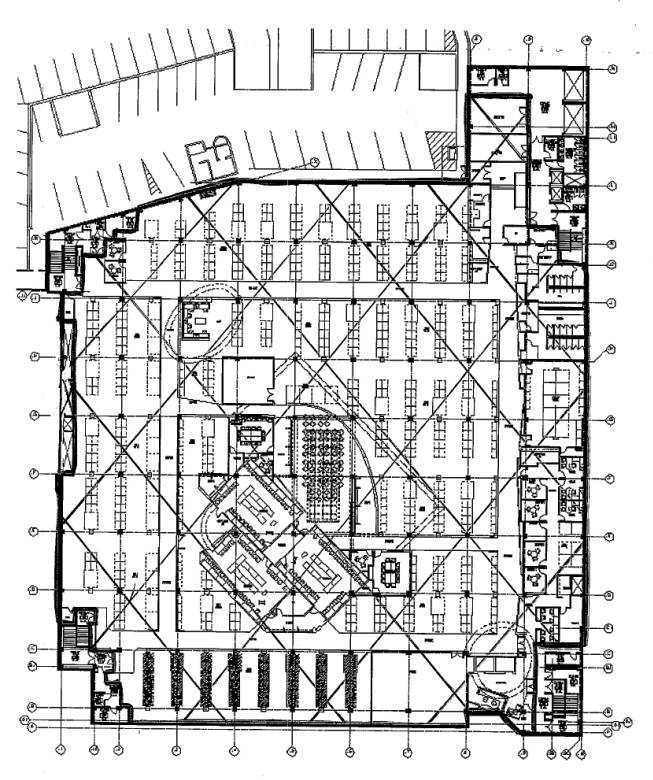

In consideration of the performance by the Tenant of its obligations under this Lease, the Landlord leases the Premises to the Tenant for the Term. The Premises are located on the third (3rd) floor of the Building and are shown cross hatched in red on the floor plan attached as Schedule “B”. The Rentable Area of the Premises is approximately sixty one thousand nine hundred and eighty-eight (61,988) square feet (5,758.68 square metres).

The Term of this Lease is ten (10) years, from the 1st day of August, 2003 to 31st day of July, 2013.

Section 1.03 Construction of Premises

The Tenant shall abide by the provisions of the tenant leasehold improvement manual supplied by the Landlord for any construction it proposes to do prior to or upon occupancy of the Premises, and any renovations to the Premises after it takes occupancy.

Section 1.04 Use and Conduct of Business

The Premises shall be used only for general office use for the purposes of a call center and for no other purpose. The Tenant shall conduct its business in the Premises in a reputable and first class manner.

(a) Except as may be provided in Section 2.02, the Tenant shall pay Rent from the Commencement Date without prior demand and without any deduction, abatement, setoff or compensation. If the Commencement Date is not on the first day of a calendar month, or the period of time from the Commencement Date to the end of the first Fiscal Year during the Term is less than 12 calendar months, or the period of time from the last Fiscal Year end during the Term to the end of the Term is less than 12 calendar months, then Rent for such month and such periods shall be pro-rated on a per diem basis, based upon a period of 365 days.

(b) Upon the occurrence of an Event of Default the Tenant will immediately deliver to the Landlord on each Fiscal Year end thereafter and throughout the Term, a series of monthly post- dated cheques for the next ensuing twelve month period, for the total of the monthly payments of Net Rent and any Additional Rent estimated by the Landlord in advance.

The Tenant shall pay Net Rent as follows:

(i) during the period from and including the 1st day of August, 2003 to and including the 31st day of July, 2008, the annual sum of EIGHT HUNDRED THIRTY SIX THOUSAND EIGHT HUNDRED AND THIRTY-EIGHT DOLLARS ($836,838.00) payable in equal consecutive monthly installments of SIXTY NINE THOUSAND SEVEN HUNDRED THIRTY-SIX DOLLARS AND FIFTY CENTS ($69,736.50) each in advance on the first day of each calendar month during the aforesaid period, based upon an annual rate of THIRTEEN DOLLARS AND FIFTY CENTS ($13.50) per square foot ($145.32 per square metre) of the Rentable Area of the Premises; and,

(ii) during the period from and including the 1st day of August, 2008 to and including the 31st day of July, 2013, the annual sum of EIGHT HUNDRED NINETY EIGHT THOUSAND EIGHT HUNDRED AND TWENTY-SIX DOLLARS ($898,826.00) payable in equal consecutive

1

monthly instalments of SEVENTY FOUR THOUSAND NINE HUNDRED TWO DOLLARS AND SEVENTEEN CENTS ($74,902.17) each in advance on the first day of each calendar month during the aforesaid period, based upon an annual rate of FOURTEEN DOLLARS AND FIFTY CENTS ($14.50) per square foot ($156.08 per square meter) of the Rentable Area of the Premises.

As soon as reasonably possible after completion of construction of the Premises, the Landlord shall engage an architect or space planner of its choice to measure the Net Rentable Area of the Premises and shall calculate the Rentable Area of the Premises and Rent shall be adjusted accordingly. It is confirmed that the standard of measurement shall be the current BOMA. The Tenant shall be entitled, at its sole cost to review the final measurement calculation.

Section 2.03 Payment of Operating Costs

Notwithstanding anything to contrary contained in this Lease, the Tenant’s Share of the costs of operating, maintaining, repairing, replacing and administering the Lands and Building (excluding the Premises and the systems and elevators provided solely for the Premises) from the Commencement Date to October 31, 2004, shall be an amount equal to the product of the Rentable Area of the Premises multiplied by Seventy Cents ($0.70). After the Fiscal Year ending October 31, 2004, the Tenant’s Share shall be increased at the beginning of each Fiscal Year and shall be equal to the amount payable by the Tenant for the preceding Fiscal Year increased by the percentage increase, if any, in the C.P.I. between the first month of the preceding Fiscal Year and the first month of the Fiscal Year for which the calculation is being done. In addition, the Tenant shall reimburse the Landlord, in accordance with Section 2.05, for all maintenance, operation, repairs and replacements to the chillers, roof top units, boilers and elevator serving only the Premises (the “Premises Maintenance Costs”). Notwithstanding the foregoing, the Tenant will not be required to replace an entire chiller, roof top unit, boiler or elevator if such replacement is required during the last year of the Term.

(a) The Tenant shall pay when due all Business Tax. If the Tenant’s Business Tax is payable by the Landlord to the relevant taxing authority, the Tenant shall pay the amount thereof to the Landlord or as it directs. If no separate tax bills for Business Tax are issued with respect to the Tenant or the Premises, the Landlord may allocate Business Tax charged, assessed or levied against the Building or the Lands to the Tenant on the basis of the Tenant’s Proportionate Share. The parties acknowledge that If Business Taxe are have been eliminated by the Province of Saskatchewan orand the City of Regina, and the foregoing shall only apply upon the re- introduction of Business Taxes. Taxes are increased the Tenant will pay an equitable share of Taxes attributable to the premises to the extent, (and only to the extent) that Taxes attributable to the Premises are increased as a consequence of the elimination of Business Taxes.

(b) The Landlord shall allocate Taxes between the Total Rentable Area of the Building and other components of the Development on such bases as the Landlord, acting equitably, determines from time to time. The Tenant shall not be required to pay any Taxes which are abated as a result of the Tenant’s occupancy of the Premises.

With respect to any Taxes which are not abated, the Tenant shall pay from the Commencement Date to the expiration of the Term for all Taxes imposed in respect of the Premises and the Lands attributable to the Premises as calculated by the Landlord in accordance with the following paragraphs.

For the purposes of establishing the amount of Taxes payable by the Tenant pursuant to this Section 2.04(b), the parties recognize and acknowledge that it is necessary to establish the assessments upon which such Taxes are based.

The Landlord, with the assistance of the Tenant, shall use its best efforts to obtain the separate assessment upon which such Taxes are based with respect to the Premises and the Land attributable to the Premises. If such cannot be obtained, the Landlord shall use its best efforts to obtain, with the assistance of the Tenant, sufficient official information to determine the methodology utilized by the assessing authority with respect to the determination of the assessment for Taxes of the Premises and the Lands attributable to the Premises. Upon the determination of the methodology of assessment, similar methodology shall be utilized by the Landlord to allocate the Taxes payable by the Tenant pursuant to this Section 2.04(b) with respect to the Premises and the Land attributable to the Premises. The parties acknowledge that as at the date of this Lease a separate notice of assessment is not provided by the assessing authority for the Premises, but that an assessment can be determined for the Premises and the land assessment attributable to the Development based on the assessment authority’s working papers. The land assessment so determined for the Development shall be further allocated to the Premises based on a proportionate share being the proportion that the Rentable Area of the Premises bears to the total Rentable Area of the Building and shopping centre (excluding the parkade) located on Block B-1 of the Development. In the event that such official information is not available, the Landlord shall allocate the total assessment of the Development in a manner which is equitable and consistent, having regard to the primary

2

method of assessment which the assessing authorities are required to employ so as to arrive at a separate assessment upon which such Taxes are based in accordance with the applicable assessment legislation.

If other taxes are imposed against the Development on a basis other than an assessor’s valuation, the tenant will pay a share, equitably allocated to the Premises and Lands attributable to the Premises based on the methodology used by the taxing authority. Where the methodology of the taxing authority is not available, the Tenant will pay its proportionate share being the proportion that the Rentable Area of the Premises bears to the total Rentable Area of the Development.

c) (The Tenant shall pay to the Landlord its Proportional Sshare of the Taxes allocated by the landlord to the Premises and the Lands attributable to the Premises as set out in Section 2.04 (b) above. Total Rentable area of the Building by the Landlord. After deducting from those Taxes amounts paid in respect of those Taxes by Major Tenants.

(d) If the Landlord obtains a written statement from the assessment or taxing authorities indicating that as a result of any construction or installation of improvements in the Premises, or any act or election of the Tenant, the Taxes payable by the Tenant under subsection 2.05(b) do not accurately reflect the Tenant’s proper share of Taxes, the Landlord may require the Tenant to pay such greater or lesser amount as is determined by the Landlord, acting reasonably.

(e) The Landlord may: contest any Taxes and appeal any assessments with respect thereto; withdraw any such contest or appeal; and agree with the taxing authorities on any settlement or compromise with respect to Taxes. The Tenant will co-operate with the Landlord in respect of any such contest or appeal and will provide the Landlord with all relevant information, documents and consents required by the Landlord in connection with any such contest or appeal. The Tenant will not contest any Taxes or appeal any assessments related thereto without the Landlord’s prior written consent.

(f) The Tenant shall promptly deliver to the Landlord on request, copies of assessment notices, tax bills and other documents received by the Tenant relating to Taxes and Business Tax and receipts for payment of Taxes and Business Tax payable by the Tenant.

(g) The Tenant shall on demand, pay to the Landlord or to the appropriate taxing authority if required by the Landlord, all goods and services taxes, sales taxes, value added taxes, business transfer taxes, or any other taxes imposed on the Landlord with respect to Rent or in respect of the rental of space under this Lease, whether characterized as a goods and services tax, sales tax, value added tax, business transfer tax or otherwise. The Landlord shall have the same remedies and rights with respect to the payment or recovery of such taxes as it has for the payment or recovery of Rent under this Lease.

Section 2.05 Payment of Estimated Taxes and Operating Costs and Premises Maintenance Costs

(a) The amount of Taxes and Premises Maintenance Costs and Operating Costs may be estimated by the Landlord for such period (not to exceed twelve months) as the LandLord determines from time to time, and the Tenant agrees to pay to the Landlord the amounts so estimated in equal instalments, in advance, on the first day of each month during such period. Such estimates shall be reasonable and upon request of the Tenant the Landlord shall provide its rationale for such estimate. Notwithstanding the foregoing, when bills for all or any portion of the amounts so estimated are received, the Landlord may bill the Tenant for the Tenant’s Proportionate S share thereof (or the amount determined under Section 2.04(d)) after crediting against such amounts any monthly payments of estimated Taxes and Operating Costs and Premises Maintenance Costs previously made by the Tenant and the Tenant shall pay the Landlord the amounts so billed. Taxes will be pro-rated for any partial tax year in the Term.

(b) Within a reasonable time after the end of the period for which such estimated payments have been made, the Landlord shall submit to the Tenant a statement showing the calculation of the Tenant’s share of Taxes and Operating Costs together with a report from the Landlord’s auditor as to the total amount of Operating Costs. If: (i) the amount the Tenant has paid is less than the amounts due, the Tenant shall pay such deficiency to the Landlord; or (it) the amount paid by the Tenant is greater than the amounts due, the Landlord shall pay such excess to the Tenant.

The obligations contained in this subsection shall survive the expiration or earlier termination of the Term. Failure of the Landlord to render any statement of Taxes and Operating Costs shall not prejudice the Landlord’s right to render such statement thereafter or with respect to any other period. The rendering of any such statement shall also not affect the Landlord’s right to subsequently render an amended or corrected statement.

Except as otherwise provided in this Lease, all Additional Rent shall be payable by the Tenant to the Landlord within 15 business days after demand.

3

All Rent past due shall bear interest from the date on which the same became due until the date of payment at 3% per annum in excess of the prime interest rate for Canadian Dollar demand loans announced from time to time by any Canadian chartered bank designated by the Landlord.

Section 2.08 Utilities and Janitorial Services

(a) The Tenant shall pay to the Landlord, or as the Landlord directs, all gas, electricity, water, steam and other utility charges applicable to the Premises directly to the utility supplier where direct billing is available and-shall otherwise pay the Landlord as the Landlord directs on the basis of sub-meters the Rentable Area of the Premises. Charges for utilities which are payable to the Landlord shall be payable in advance on the first day of each month at a basic rate determined by the Landlord’s engineers. The Landlord shall be entitled to allocate to the Premises an additional charge, as determined by the Landlord’s engineer, for any supply of utilities to the Premises in excess of those covered by such basic charge. If any utility rates or related taxes or charges are increased or decreased during the Term, such charges shall be equitably adjusted and the decision of the Landlord, acting reasonably, shall be final and binding with respect to any such adjustment.

(b) The LandlordTenant shall at its sole cost have the exclusive right to replace bulbs, tubes and ballasts in the lighting system in the Premises, on either an individual or a group basis. The tenant shall pay the cost of such replacement on the first day of each month or at the option of the Landlord upon demand.

(c) The Tenant Landlord shall pay the cost of installing, inspecting, verifying, maintaining and repairing any meters or metering system installed at the request of the Landlord or the Tenant to measure the usage of utilities in the Premises. Where a base building metering system has been installed in the Building, the Landlord will provide, at the Tenant’s expense, all necessary components and programming to connect the Premises to the Landlord’s metering system.

(d) The Tenant shall, at its cost, provide cleaning services in the Premises which shall be to a standard as determined by the Landlord, acting reasonably and which is suitable to the Building and Development and the mix of uses therein.

Section 2.09 Adjustment of Areas - Intentionally Deleted

Section 2.10 Net Lease

This Lease is a completely net lease to the Landlord, except as expressly herein set out. The Landlord is not responsible for any expenses or outlays of any nature arising from or relating to the Premises, or the use or occupancy thereof, or the contents thereof or the business carried on therein. Except as otherwise provided in this Lease, the Tenant shall pay all charges, impositions and outlays of every nature and kind relating to the Premises except as expressly herein set out.

Section 2.11 Deposit

Upon execution and return of this Lease, the Tenant covenants and agrees to provide the Landlord with a deposit cheque in the amount of $69,624.00 to be applied without interest against the first months Rent due under this Lease.

Section 2.12 Electronic Funds Transfer

At the Landlord’s request, the Tenant will participate in an electronic funds transfer (“EFT”) system or similar system whereby the Tenant will authorize its bank, trust company, credit union or other financial institution to credit the Landlord’s bank account each month in an amount equal to the Net Rent and Additional Rent payable on a monthly basis pursuant to the provisions of this Lease.

ARTICLE III - CONTROL OF BUILDING

Section 3.01 Landlord’s Services

(a) The Landlord shall provide climate control, at Tenant’s expense, to the Premises during the operating hours of the Tenant Normal Business Hours to maintain a temperature adequate for normal occupancy, except during the making of repairs, alterations or improvements, provided that the Landlord shall have no liability for failure to supply climate control service when stopped as aforesaid or when prevented from doing so by repairs, or causes beyond the Landlord’s reasonable control. Any rebalancing of the climate control system in the Premises necessitated by the installation of partitions, equipment or fixtures by the Tenant or by any use of the Premises not in accordance with the design standards of such system will be performed by the Landlord at the Tenant’s expense. Notwithstanding the foregoing, the Landlord agrees to use reasonable efforts to schedule repairs and maintenance of the mechanical systems outside of the Tenant’s operating hours and to expedite to the extent possible any repairs which affect the use of the Premises by the Tenant.

4

(b) Subject to the Rules and Regulations, the Landlord shall provide elevator service during Normal Business Hours the operating hours of the Tenant, as determined by the Tenant in its discretion, for use by the Tenant in common with others, except when prevented by repairs.

(c) The landlord will Provide cleaning services in the Building consistent with the standards of a first class office building.

(d) Subject to Section 2.08, and in accordance with Section 11.25, the Landlord shall make available to the Premises electricity for normal lighting and miscellaneous power requirements and, in normal quantities gas, water, and other public utilities generally made available to other tenants of the Building by the Landlord.

Section 3.02 Alterations by Landlord

The Landlord may: (a) alter, add to, subtract from, construct improvements to, rearrange, build additional storeys on and construct additional facilities adjoining or near the Development; (b relocate the facilities and improvements comprising the Building or erected on the Lands, or relocate, alter or rearrange the Premises, provided that the premises as relocated, altered, or rearranged shall be in all material aspects comparable to the Premises as herein defined;

(c) do such things on, or in the Lands or Development as are required to comply with any laws, by-laws, regulations, orders or directives affecting the Lands or any part of the Development; and (d) do such other things on or in the Lands or Development as the Landlord, in the use of good business judgment determines to be advisable; provided that notwithstanding anything contained in this Section, access to the Premises shall at all times be available from the elevator lobby of the Building and from the adjacent parkade.

The Landlord shall not be in breach of its covenant for quiet enjoyment or liable for any loss, costs or damages, whether direct or indirect, incurred by the Tenant due to any of the foregoing provided the foregoing does not increase the Tenant’s operating costs nor materially adversely affect the Tenant’s ability to carry on business in the Premises.

Section 3.03 Riser Telephone Rooms

The parties understand that the Building contains one or more rooms where the fibre optic and telephone equipment for the Building is situated (hereinafter referred to as the "Riser Telephone Rooms”) and the Tenant agrees that all Riser Telephone Rooms shall be for the sole and exclusive use of the Landlord. The Tenant shall not use the equipment contained in the Rider Telephone Rooms, install, or instruct the installation of any additional equipment, whether telephone equipment, fibre optic equipment or otherwise, without first obtaining the Landlord’s written consent to same, which consent shall not may be unreasonably withheld or but which may be granted upon the imposition of any terms which the Landlord deems fit, acting reasonably excluding the payment of an additional fee, the amount of which shall be established at the sole discretion of the Landlord.

Section 3.04 Telecommunication Service Providers

The Tenant may utilize a telecommunication service provider of its choice with the Landlord’s prior written consent which the Landlord may withhold in its discretion acting reasonably, subject to the provisions of this Lease including but not limited to the following:

(a) the service provider shall execute and deliver the Landlord’s standard form of license agreement which shall include a provision for the Landlord to received compensation for the use of the space for the service provider’s equipment and materials:

(b) the Landlord shall incur no expense or liability whatsoever with respect to any aspect of the provision of telecommunication services, including without limitation, the cost of installation, service, materials, repairs, maintenance, interruption or loss of telecommunication service;

(c) if such services are being added after the initial construction of the Premises, the Landlord must first reasonably determine that there is sufficient space in the risers of the Building for the installation of the service provider’s equipment and materials;

(d) the Tenant shall indemnify and hold harmless the Landlord for all losses, claims, demands, expenses and judgements against the Landlord caused by or arising out of, either directly or indirectly, any acts or omissions by the service provider or the Tenant or those for whom they are responsible at law.

(e) the Tenant shall incorporate in its agreement with its service provider a provision granting the Tenant the right to terminate the service provider agreement if required to do so by the Landlord and the Landlord shall have the right at any time from time to time during the Term to require the Tenant at its expense to exercise the termination right and to contract for telecommunication service with a different service provider.

The Tenant shall be responsible for the costs associated with the supply and installation of telephone, computer and other communication equipment and systems and related wiring within the Premises to the boundary of the Premises for hook up or other integration with telephone and other communication equipment and systems of a telephone or other communication service provider, which equipment and

5

systems of the service provider are located or are to be located in the Building pursuant to the Landlord’s standard form of license agreement.

The Landlord shall supply space in risers in the Building and space on floor(s) of the Building in which the Premises are located, the location of which shall be designated by the Landlord in its discretion, to telecommunication service providers who have entered into the Landlord’s standard form of license agreement for the purpose, without any cost or expense to Landlord therefor, of permitting installation in such risers and on such floor(s) of telephone and other communication services and systems (including data cable patch panels) to the Premises at a point designated by the Landlord.

The Landlord shall have the right to assume control of cables and other telecommunication equipment in the Building and may designate them as part of the common areas.

Section 4.01 Right of Examination

The Landlord shall be entitled at all reasonable times (and at any time in case of emergency) to enter the Premises to examine them; to make such repairs, alterations or improvements in the Premises as the Landlord considers necessary or desirable; to have access to underfloor ducts and access panels to mechanical shafts; to check, calibrate, adjust and balance controls and other parts of the heating systems; and for any other purpose necessary to enable the Landlord to perform its obligations or exercise its rights under this Lease. The Tenant shall not obstruct any pipes, conduits or mechanical or electrical equipment so as to prevent reasonable access thereto. The Landlord shall exercise its rights under this Section, to the extent possible in the circumstances, in such manner so as to minimize interference with the Tenant’s use and enjoyment of the Premises. The Landlord shall provide prior verbal or written notice to the Tenant if it requires access for any reason other than routine maintenance or emergency.

Section 4.02 Right to Show Premises

The Landlord and its agents shall have the right to enter the Premises at all reasonable times during Normal Business Hours upon prior verbal or written notice to, show them to prospective purchasers, or Mortgagees or prospective Mortgagees, and, during the last six months of the Term (or the last six months of any renewal term if this Lease is renewed), to prospective tenants.

Section 4.03 Entry not Forfeiture

No entry into the Premises or anything done therein by the Landlord pursuant to a right granted by this Lease shall constitute a breach of any covenant for quiet enjoyment, or (except where expressed by the Landlord in writing) shall constitute a re-entry or forfeiture, or an actual or constructive eviction. The Tenant shall have no claim for injury, damages or loss suffered as a result of any such entry or thing, except in the case of willful misconduct or gross negligence by the Landlord in the course of such entry but the Landlord shall in no event be responsible for the acts or negligence of any Persons providing cleaning services in the Building.

ARTICLE V - MAINTENANCE, REPAIRS AND ALTERATIONS

Section 5.01 Maintenance By Landlord

(a) The Landlord covenants to keep the following in good repair as a prudent owner: (i) the structure of the Building including exterior walls and roofs; (ii) the mechanical, electrical and other base building systems; and (iii) the entrance, lobbies (except the lobby for the elevator serving only the Premises which shall be the Tenant’s responsibility), plazas, stairways, corridors, parking areas and other facilities from time to time provided for use in common by the Tenant and other tenants of the Building. If such maintenance or repairs are required by law due to the business carried on by the Tenant, then the full cost of such maintenance and repairs plus a sum equal to 10% of such cost representing the Landlord’s overhead, shall be paid by the Tenant to the Landlord.

(b) The Landlord shall not be responsible for any damages caused to the Tenant by reason of failure of any equipment or facilities serving the Building or delays in the performance of any work for which the Landlord is responsible under this Lease. The Landlord shall have the right to step, interrupt or reduce any services, systems or utilities provided to, or serving the Building or Premises to perform repairs, alterations or maintenance or to comply with laws or regulations, or binding requirements of its insurers, or for causes beyond the Landlord’s reasonable control or as a result of the Landlord exercising its rights under Section 3.02. The Landlord shall not be in breach of its covenant for quiet enjoyment or liable for any loss, costs or damages, whether direct or indirect, incurred by the Tenant due to any of the foregoing, but the Landlord shall make reasonable efforts to restore the services, utilities or systems so stopped, interrupted or reduced.

(c) If within 5 days of receipt of written notice from the Landlord detailing the work required to be done, the Tenant fails to carry out any maintenance, repairs or work required to be carded out by it under this Lease to the reasonable satisfaction of the Landlord, the Landlord may at its option carry out such maintenance or repairs without any liability for any resulting damage to the Tenant’s property or business unless arising from Landlord’s gross negligence or willful

6

misconduct. The cost of such work, plus a sum equal to 10% of such cost representing the Landlord’s overhead, shall be paid by the Tenant to the Landlord.

Section 5.02 Maintenance by Tenant; Compliance with Laws

(a) The Tenant shall at its sole cost repair and maintain the Premises exclusive of base building mechanical and electrical systems, all to a standard consistent with a first class office building similar to the Building located in a similar Development with a similar mix of uses as determined by the Landlord, acting reasonably, with the exception only of those repairs which are the obligation of the Landlord under this Lease, subject to Article VII. The Landlord may enter the Premises at all reasonable times to view their condition and the Tenant shall maintain and keep the Premises in good and substantial repair according to notice in writing. At the expiration or earlier termination of the Term, the Tenant shall surrender the Premises to the Landlord in as good condition and repair as the Tenant is required to maintain the Premises throughout the Term

(b) The Tenant shall at its cost maintain the washrooms located on the 3rd floor, such maintenance to include, but not be limited to, the daily cleaning of the washrooms and the replenishment of all necessary supplies.

(c) The Tenant shall at its cost clean on a daily basis and maintain the elevator lobby area at the street level of the Building.

(d) The Tenant shall, at its own expense, promptly comply with all laws, by-laws, government orders and with all reasonable requirements or directives of the Landlord’s insurers affecting the Premises or their use, repair or alteration. The Landlord shall perform the Landlord’s Work in accordance with all laws, by-laws and codes.

Section 5.03 Approval of Tenant’s Alterations

(a) No Alterations, which exceed $20,000, shall be made to the Premises without the Landlord’s written approval which shall not be unreasonably withheld, conditioned or delayed. Any Alterations which do not exceed $20,000 shall be made only upon prior written notice to the Landlord. The Tenant shall submit to the Landlord details of the proposed work including drawings and specifications prepared by qualified architects or engineers conforming to good engineering practice. All such Alterations shall be performed: (i) at the sole cost of the Tenant; (ii) by contractors and workmen approved by the Landlord; (iii) in a good and workmanlike manner; (iv) in accordance with drawings and specifications approved by the Landlord; (v) in accordance with all applicable legal and insurance requirements; (vi) subject to the reasonable regulations, supervision, control and inspection of the Landlord; and (vii) subject to such indemnification against liens and expenses as the Landlord reasonably requires. The Landlord’s reasonable cost of supervising all such work shall be paid by the Tenant unless the Tenant uses one of the Landlord’s approved contractors.

(b) If the Alterations would affect the structure of the Building or any of the electrical, plumbing, mechanical, heating, ventilating or air conditioning systems or other base building systems, such work shall at the option of the Landlord be performed by the Landlord at the Tenant’s cost. On completion of such work, the cost of the work plus a sum equal to 10% of said cost representing the Landlord’s overhead shall be paid to the Landlord.

(c) If, after the installation of the initial improvements, the Tenant installs Leasehold Improvements, or makes Alterations which depart from the Building standard and which restrict access by the Landlord to any Building system, or which restrict the installation of the leasehold improvements of any other tenant in the Building, then the Tenant shall be responsible for all costs incurred by the Landlord in obtaining access to such Building system, or in installing such other tenant’s leasehold improvements.

Section 5.04 Repair Where Tenant at Fault

Notwithstanding any other provisions of this Lease, but subject to Section 6.07, if the Building is damaged or destroyed or requires repair, replacement or alteration as a result of the act or omission of the Tenant, its employees, agents, invitees, licensees, contractors or others for whom it is in law responsible, the cost of the resulting repairs, replacements or alterations plus a sum equal to 10% of such cost representing the Landlord’s overhead, shall be paid by the Tenant to the Landlord.

Section 5.05 Removal of Improvements and Fixtures

All Leasehold Improvements (other than Trade Fixtures) shall immediately upon their placement become the Landlord’s property without compensation to the Tenant. Except as otherwise agreed by the Landlord in writing, no Leasehold Improvements shall be removed from the Premises by the Tenant either during or at the expiry or sooner termination of the Term except that: (a) the Tenant may, during the Term, in the usual course of its business, remove its Trade Fixtures, provided that the Tenant is not in default under this Lease; and (b) the Tenant shall, at the expiration or earlier termination of the Term, at its sole cost, remove its Trade Fixtures (and may, at its sole option, remove the generator, server equipment and stand alone supplemental air units) from the Premises, failing which, at the option of the Landlord, the Trade Fixtures shall become the property of the Landlord and may be removed from the Premises and sold or disposed of by the Landlord in such manner as it deems advisable; and (c) subject to the last

7

paragraph of this Section 5.05, the Tenant shall, at the expiration or earlier termination of the Term, at its sole cost, either remove such of the Leasehold Improvements in the Premises as the Landlord shall require to be removed, and restore the Premises to the Landlord’s then current base Building standard to the extent required by the Landlord, or at the Landlord’s option, pay to the Landlord the estimated cost of such removal and restoration as determined by the Architect, acting reasonably. If the Landlord requires the Tenant to perform the required work, then: (i) the Tenant shall submit detailed demolition drawings to the Landlord for its prior approval, and such work shall be completed under the supervision of the Landlord; (ii) the Tenant shall, at its expense, repair any damage caused to the Building by such removal; and (iii) if the Tenant fails to complete such work within 30 days following the expiry or earlier termination of the Term, the Tenant shall pay compensation to the Landlord for each day following such 30th day until the completion of such work, at a rate equal to the per diem Rent payable during the last month preceding the expiry or earlier termination of the Term, which sum is agreed by the parties to be a reasonable estimate of the damages suffered by the Landlord for the loss of use of the Premises.

Notwithstanding the foregoing, the Landlord acknowledges and agrees that provided all Leasehold Improvements have been approved by the Landlord, the Tenant will not be required to remove its Leasehold Improvements from the Premises upon the expiration or earlier termination of the Lease,

The Tenant shall promptly pay for all materials supplied and work done in respect of the Premises at the Tenant’s request so as to ensure that no lien is registered against any portion of the Lands or Building or against the Landlord’s or Tenant’s interest therein. If a lien is registered or filed, the Tenant shall discharge it at its expense forthwith (which discharge may be obtained by payment into court), failing which the Landlord may at its option discharge the lien by paying the amount claimed to be due into court or directly to the lien claimant and the amount so paid and all expenses of the Landlord including legal fees (on a solicitor and client basis) shall be paid by the Tenant to the Landlord.

The Tenant shall notify the Landlord of any accident, defect, damage or deficiency in any part of the Premises or, if a person in a management position has actual knowledge of it, the Building which comes to the attention of the Tenant, or its employees or contractors notwithstanding that the Landlord may have no obligation in respect thereof.

ARTICLE VI - INSURANCE AND INDEMNITY

Section 6.01 Tenant’s Insurance

(a) The Tenant shall maintain the following insurance throughout the Term at its sole cost:

(i) “All Risks” (including flood and earthquake) property insurance with deductibles not exceeding 3% of the amount insured, naming the Landlord, the owners of the Lands and Development and the Mortgagee as insured parties, as their interests may appear, containing a waiver of any subrogation rights which the Tenant’s insurers may have against the Landlord and against those for whom the Landlord is in law responsible, and (except with respect to the Tenant’s chattels) incorporating the Mortgagee’s standard mortgage clause. Such insurance shall insure: (1) property of every kind owned by the Tenant or for which the Tenant is legally liable located on or in the Development including, without limitation, Leasehold Improvements, in an amount equal to not less than 90% of the full replacement cost thereof, subject to a stated amount co-insurance clause; and (2) extra expense insurance in such amount as will reimburse the Tenant for loss attributable to all perils referred to in this paragraph 6.01(a)(i) or resulting from prevention of access to the Premises. However, so long as the Tenant is STARTEK CANADA SERVICES LTD. and is itself in occupation of and conducting business in the whole of the Premises, the Tenant shall be entitled to self-insure in respect of flood and earthquake insurance, but shall be deemed for the purposes of this Lease to have satisfactorily taken out such insurance and to have received all insurance proceeds payable thereunder.

(ii) Commercial general liability insurance which includes the following coverages: coverage for construction of improvements owners protective personal injury; occurrence property damage; and employers and blanket contractual liability. Such policies shall contain inclusive limits of not less than $5,000,000 per occurrence for bodily injury for any one or more Persons, or property damage, provide for cross liability, and name the Landlord as an insured.

(iii) Tenant’s “all risks” legal liability insurance for the replacement cost cash value of the Premises not exceeding $300,000;

(iv) Automobile liability insurance on a non-owned form including contractual liability, and on an owner’s form covering all licensed vehicles operated by or on behalf of the Tenant, which insurance shall have inclusive limits of not less than $1,000,000; and

8

(v) Any other form of insurance which the Tenant or the Landlord, acting reasonably, or the Mortgagee requires from time to time in form, in amounts and for risks against which a prudent tenant would insure.

(b) All policies referred to in this Section 6.01 shall: (i) be taken out with insurers reasonably acceptable to the Landlord; (ii) be in a form reasonably satisfactory to the Landlord; (iii) be non- contributing with, and shall apply only as primary and not as excess to any other insurance available to the Landlord; (iv) not be invalidated as respects the interests of the Landlord or the Mortgagee by reason of any breach of or violation of any warranty, representation, declaration or condition; and (v) contain an undertaking by the insurers to notify the Landlord by registered mail not less than 30 days prior to any material change, cancellation or termination. Certificates of insurance on the Landlord’s standard a form acceptable to the Landlord, acting reasonably, or, if required by the Landlord, certified copies of such insurance policies, shall be delivered to the Landlord forthwith upon request. If the Tenant fails to take out or to keep in force any insurance referred to in this Section 6.01 or should any such insurance not be approved by either the Landlord or the Mortgagee and should the Tenant not commence to diligently rectify (and thereafter proceed to diligently rectify) the situation within 48 hours after written notice by the Landlord to the Tenant (stating, if the Landlord or the Mortgagee, from time to time, does not approve of such insurance, the reasons therefor) the Landlord has the right without assuming any obligation in connection therewith, to effect such insurance at the sole cost of the Tenant and all outlays by the Landlord shall be paid by the Tenant to the Landlord without prejudice to any other rights or remedies of the Landlord under this Lease.

Section 6.02 Increase in Insurance Premiums

The Tenant shall not keep or use in the Premises any article which may be prohibited by any fire insurance policy in force from time to time covering the Premises or the Development. If: (a) the conduct of business in, or use or manner of use of the Premises; (b) or any acts or omissions of the Tenant in the Development or any part thereof; cause or result in any increase in premiums for any insurance carried by the Landlord with respect to the Development, the Tenant shall pay any such increase in premiums. In determining whether increased premiums are caused by or result from the use or occupancy of the Premises, a schedule issued by the organization computing the insurance rate on the Development showing the various components of such rate, shall be conclusive evidence of the items and charges which make up such rate.

Section 6.03 Cancellation of Insurance

If any insurer under any insurance policy covering any part of the Development or any occupant thereof cancels or threatens to cancel its insurance policy or reduces or threatens to reduce coverage under such policy by reason of the use of the Premises by the Tenant or by any Transferee, or by anyone permitted by the Tenant to be upon the Premises, the Tenant shall remedy such condition within 48 hours after notice thereof by the Landlord.

The Landlord shall not be liable for any death or injury arising from or out of any occurrence in, upon, at, or relating to the Lands or Development or damage to property of the Tenant or of others located on the Premises or elsewhere in the Development, nor shall it be responsible for any loss of or damage to any property of the Tenant or others from any cause, whether or net any such death, injury, loss or damage results from the negligence of the Landlord, its agents, employees, contractors, or others for whom it may, in law, be responsible. Without limiting the generality of the foregoing, the Landlord shall not be liable for any injury or damage to Persons or property resulting from fire, explosion, falling plaster, falling ceiling tile, falling fixtures, steam, gas, electricity, water, rain, flood, snow or leaks from any part of the Premises or from the pipes, sprinklers, appliances, plumbing works, roof, windows or subsurface of any floor or ceiling of the Development or from the street or any other place or by dampness or by any other cause whatsoever. The Landlord shall not be liable for any such damage caused by other tenants or Persons on the Lands or in the Development or by occupants of adjacent property thereto, or the public, or caused by construction or by any private, public or quasi-public work. All property of the Tenant kept or stored on the Premises shall be so kept or stored at the risk of the Tenant only and the Tenant releases and agrees to indemnify the Landlord and save it harmless from any claims arising out of any damage to the same including, without limitation, any subrogation claims by the Tenant’s insurers.

Section 6.05 Landlord’s Insurance

The Landlord shall throughout the Term carry: (a) all risks insurance on the Development (excluding the foundations and excavations) and the machinery, boilers and equipment in or servicing the Development and owned by the Landlord or the owners of the Development (excluding any property which the Tenant and other tenants are obliged to insure under Section 6.01 or similar sections of their respective leases) containing a waiver of subrogation rights with respect to the Premises which the Landlord’s insurer may have against the Tenant and against those for whom the Tenant is in law responsible against damage by fire and extended perils coverage; (b) public liability and property damage insurance with respect to the Landlord’s operations in the Development; and (c) such other form or forms of insurance as the Landlord or the Mortgagee reasonably considers advisable. Such insurance shall be in such reasonable amounts and with such reasonable deductibles as would be carried by a prudent owner of a reasonably similar building, having regard to size, age and location. Notwithstanding the Landlord’s covenant in this Section and notwithstanding any contribution by the Tenant to the cost of the Landlord’s insurance premiums, the Tenant acknowledges and agrees that: (i) the Tenant is not relieved of any

9

liability arising from or contributed to by its negligence or its willful act or omissions; (ii) no insurable interest is conferred upon the Tenant under any insurance policies carried by the Landlord; and (iii) the Tenant has no right to receive any proceeds of any insurance policies carried by the Landlord.

Section 6.06 Indemnification of the Landlord

Notwithstanding any other provision of this Lease, the Tenant shall indemnify the Landlord and save it harmless from all loss (including loss of Net Rent and Additional Rent) claims, actions, damages, liability and expense in connection with loss of life, personal injury, damage to property or any other loss or injury whatsoever arising out of this Lease, or any occurrence in, upon or at the Premises, or the occupancy or use by the Tenant of the Premises or any part thereof, or occasioned wholly or in part by any act or omission of the Tenant or by anyone permitted to be on the Premises by the Tenant. If the Landlord shall, without fault on its part, be made a party to any litigation commenced by or against the Tenant, then the Tenant shall protect, indemnify and hold the Landlord harmless in connection with such litigation. The Landlord may, at its option, participate in or assume carriage of any litigation or settlement discussions relating to the foregoing, or any other matter for which the Tenant is required to indemnify the Landlord under this Lease. Alternatively, the Landlord may require the Tenant to assume carriage of and responsibility for all or any part of such litigation or discussions

Section 6.07 Release by the Landlord

Despite any other section or clause of this Lease (except the last sentence of this Section 6.07), the Tenant is not responsible for any part, in excess of $5,000,000.00, or the amount of liability insurance coverage available to the Tenant, whichever is the greater, of any loss or damage to property of the Landlord that is located in, or is part of the Building and Lands caused by any of the perils for which the Landlord is required under Section 6.05 to maintain insurance. This release applies whether or not the loss or damage arises from the negligence of the Tenant. This release does not apply, however to damage arising from the willful or grossly negligent acts of the Tenant.

ARTICLE VII - DAMAGE AND DESTRUCTION

If the Premises or Building are damaged or destroyed in whole or in part by fire or any other occurrence, this Lease shall continue in full force and effect and there shall be no abatement of Rent except as provided in this Article VII.

Section 7.02 Damage to Premises

If the Premises are at any time destroyed or damaged as a result of fire or any other casualty required to be insured against by the Landlord under this Lease or otherwise insured against by the Landlord and not caused or contributed to by the Tenant, then the following provisions shall apply:

(a) if the Premises are rendered untenantable-unfit for use by the Tenant only in part, the Landlord shall diligently repair the Premises to the extent only of its obligations under Section 5.01 and Net Rent shall abate proportionately to the portion of the Premises rendered untenantable unfit for use by the Tenant from the date of destruction or damage until the Landlord’s repairs have been completed;

(b) if the Premises are rendered wholly untenantable unfit for use by the Tenant, the Landlord shall diligently repair the Premises to the extent only of its obligations pursuant to Section 5.01 and Net Rent shall abate entirely from the date of destruction or damage until the Landlord’s repairs have been completed;

(c) if the Premises are not rendered untenantable unfit for use by the Tenant in whole or in part, the Landlord shall diligently perform such repairs to the Premises to the extent only of its obligations under Section 5.01, but in such circumstances Net Rent shall not terminate or abate;

(d) upon being notified by the Landlord that the Landlord’s repairs have been substantially completed, the Tenant shall diligently perform all repairs to the Premises which are the Tenant’s responsibility under Section 5.02, and all other work required to fully restore the Premises for use in the Tenant’s business, in every case at the Tenant’s cost and without any contribution to such cost by the Landlord, whether or not the Landlord has at any time made any contribution to the cost of supply, installation or construction of Leasehold Improvements in the Premises;

(e) nothing in this Section shall require the Landlord to rebuild the Premises in the condition which existed before any such damage or destruction so long as the Premises as rebuilt will have reasonably similar facilities to those in the Premises prior to such damage or destruction, having regard, however, to the age of the Building at such time; and

(f) nothing in this Section shall require the Landlord to undertake any repairs having a cost in excess of the insurance proceeds actually received by the Landlord with respect to such damage or destruction.

10

Section 7.03 Right of Termination

(a) Notwithstanding Section 7.02, if the damage or destruction which has occurred in the Premises is such that in the reasonable opinion of the Landlord the Premises cannot be rebuilt or made fit for the purposes of the Tenant within 90 days of the happening of the damage or destruction, the Landlord may, at its option, terminate this Lease on notice to the Tenant given within 30 days after such damage or destruction. If such notice of termination is given, Rent shall be apportioned and paid to the date of such damage or destruction and the Tenant shall immediately deliver vacant possession of the Premises in accordance with the terms of this Lease.

(b) Notwithstanding Section 7.02, if the damage and destruction which has occurred in the Premises is such that in the reasonably opinion of the Architect, the Premises cannot be rebuilt or be made fit for the purposes of the Tenant within 180 days of the happening of the damage or destruction, then the Landlord will, subject to Section 7.03(a), provide the Tenant with other premises comparable to the Premises having regard to size, age and location within the downtown core of Regina on a temporary basis until such time as the Premises have been rebuilt as contemplated, failing which the Tenant may, at its option, elect to terminate this Lease by giving to the Landlord notice of termination and thereupon Rent shall be apportioned and paid to the date of such termination and the Tenant shall immediately deliver vacant possession of the Premises in accordance with the terms of this Lease.

Section 7.04 Destruction of Building or the Development

(a) Notwithstanding anything contained in this Lease and specifically notwithstanding the provisions of Section 7.03, if

(i) thirty-five percent (35%) or more of the total Rentable Area of the Development; or

(ii) fifty percent (50%) or more of the total Rentable Area of the Building;

is damaged or destroyed by any cause whatsoever (irrespective of whether the Premises are damaged or destroyed) and if, in the opinion of the Landlord reasonably arrived at, the total Rentable Area of the Development or the total Rentable Area of the Building, as the case may be, so damaged or destroyed cannot be rebuilt or made fit for the purposes of the respective tenants of such space within one hundred and eighty (180) days of the happening of the damage or destruction; then and so often as any of such events occur, the Landlord may at its option (to be exercised by written notice to the Tenant within sixty (60) days following any such occurrence), elect to terminate this lease. In the case of such election, the Term and the tenancy hereby created shall expire upon the thirtieth (30th) day after such notice is given, without indemnity or penalty payable by, or any other recourse against the Landlord, and the Tenant shall, within such thirty (30) day period, vacate the Premises and surrender them to the Landlord with the Landlord having the right to re-enter and repossess the Premises discharged of this lease and to expel all Persons and remove all property therefrom. Net Rent and Additional Rent shall be due and payable without reduction or abatement subsequent to the destruction or damage and until the date of termination, unless the Premises shall have been destroyed or damaged as well, in which event Section 7.03 shall apply.

(b) If the Landlord is entitled to, but does not elect to terminate this Lease under Section 7.04(a), the Landlord shall, following such damage or destruction, diligently repair if necessary that part of the Building damaged or destroyed, but only to the extent of the Landlord’s obligations under the terms of the various leases for premises in the Building and exclusive of any tenant’s responsibilities with respect to such repair. If the Landlord elects to repair the Building, the Landlord may do so in accordance with plans and specifications other than those used in the original construction of the Building.

Section 7.05 Architect’s Certificate

The certificate of the Architect shall bind the parties as to: (a) the percentage of the total Rentable Area of the Building and/or Development damaged or destroyed; (b) whether or not the Premises are rendered untenantable unfit for use by the Tenant and the percentage of the Premises rendered untenantable unfit for use by the Tenant; (c) the date upon which either the Landlord’s or Tenant’s work of reconstruction or repair is completed or substantially completed and the date when the Premises are rendered tenantable; and (d) the state of completion of any work of the Landlord or the Tenant.

ARTICLE VIII - ASSIGNMENT, SUBLETTING AND TRANSFERS

Section 8.01 Assignments, Subleases and Transfers

The Tenant shall not enter into, consent to, or permit any Transfer without the prior written consent of the Landlord in each instance, which consent shall not be unreasonably withheld but shall be subject to the Landlord’s rights under Section 8.02. Notwithstanding any statutory provision to the contrary, it shall not be considered unreasonable for the Landlord to take into account the following factors in deciding whether to grant or withhold its consent: (a) whether such Transfer is in violation or in breach of any covenants or restrictions made or granted by the Landlord to other tenants or occupants or prospective tenants or occupants with whom the Landlord is having active negotiations, of the Building

11

Development; (b) whether in the Landlord’s opinion, the financial background, business history and capability of the proposed Transferee is satisfactory; and (c) if the Transfer is to an existing tenant of the Landlord. Consent by the Landlord to any Transfer if granted shall not constitute a waiver of the necessity for such consent to any subsequent Transfer. This prohibition against Transfer shall include a prohibition against any Transfer by operation of law and no Transfer shall take place by reason of the failure of the Landlord to give notice to the Tenant within 30 days as required by Section 8.02.

Section 8.01A Related Corporation

However, notwithstanding anything to the contrary contained in Section 8.01, so long as the Tenant is and is itself in occupation of the whole of the Premises, and has not failed or neglected to remedy or commenced to remedy any default or breach of its obligations as set out in this Lease after notice and within the times as set forth in this Lease, the Tenant shall have the right without the consent of the Landlord, but upon prior written notice to the Landlord, to assign this Lease or sublet the whole of the Premises to a corporation which is an affiliate of (within the meaning of the Canada Business Corporations Act), but only so long as:

(A) such affiliate remains an affiliate of ;

(B) such assignee or sublessee shall be bound by the permitted use set out in Section [Use and Conduct of Business] of this Lease;

(C) all of the provisions of Section 8.03 shall apply in respect of the Transfer; and

(D) The Tenant shall remain liable under this Lease and shall not be released from per[orming any of the terms of this Lease.

In the event of any further proposed Transfer, the terms of this Lease shall prevail as if this

Section 8.01A had not formed part of this Lease.

Section 8.02 Landlord’s Right to Terminate

If the Tenant intends to effect a Transfer, the Tenant shall give prior notice to the Landlord of such intent specifying the identity of the Transferee, the type of Transfer contemplated, the portion of the Premises affected thereby, and the financial and other terms of the Transfer, and shall provide such financial, business or other information relating to the proposed Transferee and its principals as the Landlord or any Mortgagee requires, together with copies of any documents which record the particulars of the proposed Transfer. The Landlord shall, within 30 days after having received such notice and all requested information, notify the Tenant either that:

(a) it consents or does not consent to the Transfer in accordance with the provisions and qualifications of this Article VIII; or

(b) it elects to cancel this Lease as to the whole or the relevant part, as the case may be, of the Premises affected by the proposed Transfer, in preference to giving such consent.

If the Landlord elects to terminate this Lease it shall stipulate in its notice the termination date of this Lease, which date shall be no less than 30 days nor more than 90 days following the giving of such notice of termination. If the Landlord elects to terminate this Lease, the Tenant shall notify the Landlord within 10 days thereafter of the Tenant’s intention either to refrain from such Transfer or to accept termination of this Lease or the portion thereof in respect of which the Landlord has exercised its rights. If the Tenant fails to deliver such notice within such 10 days or notifies the Landlord that it accepts the Landlord’s termination, this Lease will as to the whole or affected relevant part of the Premises, as the case may be, be terminated on the date of termination stipulated by the Landlord in its notice of termination. If the Tenant notifies the Landlord within 10 days that it intends to refrain from such Transfer, then the Landlord’s election to terminate this Lease shall become void.

Section 8.03 Conditions of Transfer

The following terms and conditions apply in respect of a Transfer:

(a) If there is a permitted Transfer, the Landlord may collect rent from the Transferee and apply the net amount collected to the Rent payable under this Lease but no acceptance by the Landlord of any payments by a Transferee shall be deemed a waiver of the Tenant’s covenants or any acceptance of the Transferee as tenant or a release from the Tenant from the further performance by the Tenant of its obligations under this Lease. Any consent by the Landlord shall be subject to the Tenant and Transferee executing an agreement with the Landlord agreeing:

(i) that the Transferee will be bound by all of the terms of this Lease and, except in the case of a sublease, that the Transferee will be so bound as if it had originally executed this Lease as tenant; and

(ii) to amend the Lease to incorporate such terms, covenants and conditions as are necessary so that the Lease will be in accordance with the Landlord’s standard form of office lease in use for the Building at the time of the Transfer, and so as to incorporate any conditions imposed by the Landlord in its consent or required by this Section 8.03

12

(b) The Tenant making such Transfer shall remain liable under this Lease and shall not be released from performing any of the terms of this Lease.

(c) If the Landlord has space which would be suitable for the Transferee elsevwhere in the Development, the net and additional rent payable by the Transferee shall not be less than the Rent payable by the Tenant under this Lease as at the effective date of the Transfer, (including any increases provided for in this Lease), and if the net and additional rent to be paid by the Transferee under such Transfer exceeds the Rent payable under this Lease, the Tenant shall be entitled to deduct from such excess (the “Excess”) the Tenant’s out of pocket costs, if any, for brokerage fees, legal fees, financial inducements paid by the Tenant to the Transferee and the Tenant’s cost of constructing Leasehold Improvements on behalf of the Transferee as follows: The costs shall be amortized monthly on a straight line basis over zero over the term of the sublease or the assignment, as the case may be (the “Amortized Amount”); and fifty percent (50%} of the Excess less the Amortized Amount - shal] be paid by the Tenant to the Landlord on the first day of each month of the term of the sublease of assignment. The Tenant shall provide the Landlord with proof of the payment of such third party costs in the form of paid invoices. If the Tenant receives from any Transferee, either directly or indirectly, any consideration other than rent or additional rent for such Transfer, either in the form of cash, goods or services (other than the proceeds of any financing as the result of a Transfer involving a mortgage, charge or similar security interest in this Lease) the Tenant shall forthwith pay to the Landlord an amount equivalent to such consideration. The Tenant and the Transferee shall execute any agreement required by the Landlord to give effect to the foregoing terms.

(d) If the Transfer is a sublease, the Transferee will agree to waive any statutory right to retain the unexpired portion of the term of the sublease or the Term of this Lease or to enter into a lease directly with the Landlord, in the event this Lease is terminated, surrendered, disclaimed or otherwise disposed of or dealt with.

(e) Notwithstanding the effective date of any permitted Transfer as between the Tenant and the Transferee, all Rent for the month in which such effective date occurs shall be paid in advance by the Tenant so that the Landlord will not be required to accept partial payments of Rent for such month from either the Tenant or Transferee.

(f) Any document evidencing any Transfer permitted by the Landlord, or setting out any terms applicable to such Transfer or the rights and obligations of the Tenant or Transferee thereunder, shall be prepared by the Landlord or its solicitors and all associated legal costs shall be paid by the Tenant.

Section 8.04 Change of Control

If the Tenant is at ahy time a corporation or partnership, any actual or proposed Change of Control in such corporation or partnership shall be deemed to be a Transfer and subject to all of the provisions of this Article VIII. The Tenant shall make available to the Landlord or its representatives all of its corporate or partnership records, as the case may be, for inspection at all reasonable times, in order to ascertain whether any Change of Control has occurred.

The Tenant shall not advertise that the whole or any part of the Premises are available for a Transfer a~d shall not permit any broker or other Person to do so unless the text and format of such advertisement is approved in writing by the Landlord. No such advertisement shall contain any reference to the rental rate of the Premises.

Section 8.06 Assignment By Landlord

The Landlord shall have the unrestricted right to sell, lease, convey or otherwise dispose of all or any part of the Building or Lands or this Lease or any interest of the Landlord in this Lease. To the extent that the purchaser or assignee from the Landlord assumes the obligations of the Landlord under this Lease, the Landlord shall thereupon and without further agreement be released from all liability under this Lease.

Section 9.01 Default and Remedies

If and whenever an Event of Default occurs, then without prejudice to any other rights which it has pursuant to this Lease or at law, the Landlord shall have the following rights and remedies, which are cumulative and not alternative:

(a) to terminate this Lease by notice to the Tenant;

(b) to enter the Premises as agent of the Tenant and to relet the Premises for whatever term, and on such terms as the Landlord in its discretion may determine and to receive the rent therefor and as agent of the Tenant to take possession of any property of the Tenant on the Premises, to store such property at the expense and risk of the Tenant or to sell or otherwise dispose of such

13

property in such manner as the Landlord may see fit without notice to the Tenant; to make alterations to the Premises to facilitate their reletting; and to apply the proceeds of any such sale or reletting first, to the payment of any expenses incurred by the Landlord with respect to any such reletting or sale; second, to the payment of any indebtedness of the Tenant to the Landlord other than rent; and third, to the payment of Rent in arrears; with the residue to be held by the Landlord and applied in payment of future Rent as it becomes due and payable. The Tenant shall remain liable for any deficiency to the Landlord;

(c) to remedy or attempt to remedy any default of the Tenant under this Lease for the account of the Tenant and to enter upon the Premises for such purposes. No notice of the Landlord’s intention to perform such covenants need be given the Tenant unless expressly required by this Lease. The Landlord shall not be liable to the Tenant for any loss, injury or damage caused by acts of the Landlord in remedying or attempting to remedy such default and the Tenant shall pay to the Landlord all expenses incurred by the Landlord in connection with remedying or attempting to remedy such default;

(d) to recover from the Tenant all damages, and expenses incurred by the Landlord as a result of any breach by the Tenant including, if the Landlord terminates this Lease, any deficiency between those amounts which would have been payable by the Tenant for the portion of the Term following such termination and the net amounts actually received by the Landlord during such period of time with respect to the Premises;

(e) to recover from the Tenant the full amount of the current month’s Rent together with the next 3 months’ instalments of Rent, all of which shall accrue on a day-to-day basis and shall immediately become due and payable as accelerated rent (it is agreed that upon the Tenant paying such 3 months accelerated rent the Landlord shall not be entitled to take its remedies for a failure to pay rent during the 3 months for which such accelerated rent was paid); and

(f) if the Lease has been terminated in accordance with Section 9.01(a), to recover from the Tenant the unamortized portion of any leasehold improvement allowance or inducement paid by the Landlord under the terms of this Lease, calculated from the date which is the later of the date of payment by the Landlord or the Commencement Date, on the basis of an assumed rate of depreciation on a straight line basis to zero over the initial Term of this Lease.

Notwithstanding any provision of this Lease or any provision of applicable legislation, none of the goods and chattels of the Tenant on the Premises at any time during the Term shall be exempt from levy by distress for Rent in arrears, and the Tenant waives any such exemption. If the Landlord makes any claim against the goods and chattels of the Tenant by way of distress, this provision may be pleaded as an estoppel against the Tenant in any action brought to test the right of the Landlord to levy such distress.

Section 9.03 Costs

The prevailing party shall pay to the other party all damages and costs (including,,without limitation, all legal fees on a solicitor and his client basis) incurred by the prevailing party in enforcing the terms of this Lease, or with respect to any matter or thing which is the obligation of the Landlord or Tenant under this Lease, or in respect of which either party has agreed to insure, or to indemnify the other.

Section 9.04 Allocation of Payments

The Landlord may at its option apply sums received from the Tenant against any amounts due and payable by the Tenant under this Lease in such manner as the Landlord sees fit.

Section 9.05 Survival of Obligations

If the Tenant has failed to fulfil its obligations under this Lease with respect to the maintenance, repair and alteration of the Premises and removal of improvements and fixtures from the Premises during or at the end of the Term, such obligations and the Landlord’s rights in respect thereto shall remain in full force and effect notwithstanding the expiration or sooner termination of the Term.

ARTICLE X - STATUS STATEMENT, ATTORNMENT AND SUBORDINATION

Section 10.01 Status Statement

Within 15 days after written request by the Landlord, the Tenant shall deliver in a form supplied by the Landlord a statement or estoppel certificate to the Landlord as to the status of this Lease, including as to whether this Lease is unmodified and in full force and effect (or, if there have been modifications that this Lease is in full force and effect as modified and identifying the modification agreements); the amount of Net Rent and Additional Rent then being paid and the dates to which same have been paid; whether or not there is any existing or alleged default by either party with respect to which a notice of default has been served and if there is any such default, specifying the nature and extent thereof; and any other matters pertaining to this Lease as to which the Landlord shall request such statement or certificate.

14

This Lease and all rights of the Tenant shall, subject to any Mortgagee agreeing to execute and deliver to the Tenant a non-disturbance agreement on terms and conditions satisfactory to the Tenant, acting reasonably, be subject and subordinate to any and all Mortgages and any ground, operating, overriding or underlying leases, from time to time in existence against the Lands and Building. On request, the Tenant shall subordinate this Lease and its rights under this Lease to any and all such Mortgages and leases and to all advances made under such Mortgages. The form of such subordination shall be as required by the Landlord or any Mortgagee or the lessee under any such lease.

The Tenant shall promptly, on request, attorn to any Mortgagee, or to the owners of the Building and Lands, or the lessor under any ground, operating, overriding, underlying or similar lease of all or substantially all of the Building made by the Landlord or otherwise affecting the Building and Lands, or the purchaser on any foreclosure or sale proceedings taken under any Mortgage, and shall recognize such Mortgagee owner, lessor or purchaser as the Landlord under this Lease.

Section 10.04 Execution of Documents

The Tenant irrevocably constitutes the Landlord the agent and attorney of the Tenant for the purpose of executing any agreement, certificate, attornment or subordination required by this Lease and for registering postponements in favour of any Mortgagee if the Tenant fails to execute such documents within 5 days of the second notice from the Landlord after the Tenant has failed to respond to an initial 10 day notice request by the Landlord

ARTICLE Xl - GENERAL PROVISIONS

Section 11.01 Rules and Regulations

The Tenant shall comply with all Rules and Regulations, and amendments thereto, adopted by the Landlord from time to time including those set out in Schedule “D”. Such Rules and Regulations may differentiate between different types of businesses in the Building, and the Landlord shall have no obligation to enforce any Rule or Regulation or the provisions of any other lease against any other tenant, and the Landlord shall have no liability to the Tenant with respect thereto.

Section 11.02 Delay

Except as expressly provided in this Lease, whenever the Landlord or Tenant is delayed in the fulfilment of any obligation under this Lease (other than the payment of Rent and surrender of the Premises on termination) by an unavoidable occurrence which is not the fault of the party delayed in performing such obligation, then the time for fulfilment of such obligation shall be extended during the period in which such circumstances operate to delay the fulfilment of such obligation.