UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a–12 |

| SILVER BULL RESOURCES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and 0–11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

SILVER BULL RESOURCES, INC.

777 Dunsmuir Street, Suite 1610

Vancouver, British Columbia V7Y 1K4

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, APRIL 19, 2022

To the Shareholders of Silver Bull Resources, Inc.:

The Annual Meeting of Shareholders of Silver Bull Resources, Inc., a Nevada corporation (“Silver Bull” or the “Company”), will be held at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia V7Y 1K4, on Tuesday, April 19, 2022 at 10:00 a.m. local time for the purpose of considering and voting upon proposals to:

- Elect four (4) directors, each to serve until the next annual meeting of shareholders of the Company or until their successors are elected and qualified;

- Ratify and approve the appointment of Smythe LLP, Chartered Professional Accountants, as our independent registered public accounting firm for the fiscal year ending October 31, 2022;

- Approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers;

- Approve and adopt an amendment to the Company’s 2019 Stock Option and Stock Bonus Plan (the “2019 Plan”) to increase the number of shares of Silver Bull common stock issuable under the 2019 Plan;

- Approve the unallocated entitlements under the 2019 Plan, whether or not amended; and

- Transact such other business as may lawfully come before the meeting or any adjournment(s) or postponement(s) thereof.

The Board of Directors has fixed the close of business on February 22, 2022 as the record date for determination of the Company’s shareholders entitled to vote at the meeting and any adjournment(s) or postponement(s) thereof. This Notice of Annual Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about February 25, 2022.

Under the U.S. Securities and Exchange Commission and Canadian securities rules, we have elected to use the Internet for delivery of our annual meeting materials to our shareholders, enabling us to provide them with the information they need, while lowering the costs of delivery and reducing the environmental impact associated with our annual meeting. Our proxy materials are available at www.proxyvote.com. We also post our proxy materials on our website at www.silverbullresources.com/investors/agm.

We cordially invite you to attend the annual meeting. Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. Please refer to your proxy card or Notice Regarding the Availability of Proxy Materials for more information on how to vote your shares at the meeting and return your voting instructions as promptly as possible.

Thank you for your support.

| | BY ORDER OF THE BOARD OF DIRECTORS,

BRIAN D. EDGAR, CHAIRMAN |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON TUESDAY, APRIL 19, 2022 Our Notice of Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com. |

2022 PROXY STATEMENT

TABLE OF CONTENTS

| ABOUT THE ANNUAL MEETING | 1 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 7 |

| MANAGEMENT | 8 |

| EXECUTIVE COMPENSATION | 16 |

| SUMMARY COMPENSATION TABLE | 16 |

| COMPENSATION DISCUSSION AND ANALYSIS | 17 |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | 24 |

| GRANTS OF PLAN-BASED AWARDS | 24 |

| DIRECTOR COMPENSATION | 26 |

| INDEPENDENT PUBLIC ACCOUNTANTS | 26 |

| REPORT OF THE AUDIT COMMITTEE | 27 |

| REPORT OF THE COMPENSATION COMMITTEE | 28 |

| PROPOSAL 1: ELECTION OF DIRECTORS | 29 |

| PROPOSAL 2: RATIFICATION AND APPROVAL OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

| PROPOSAL 3: APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS | 31 |

| PROPOSAL 4: ApprovAL and adoptION OF AN AMENDMENT TO THE COMPANY’S 2019 Stock Option and Stock Bonus Plan | 32 |

| PROPOSAL 5: ApprovAL OF THE UNALLOCATED ENTITLEMENTS UNDER THE 2019 PLAN | 39 |

| ANNUAL REPORT TO SHAREHOLDERS | 39 |

| OTHER MATTERS | 39 |

| SHAREHOLDER PROPOSALS | 40 |

Silver Bull Resources, Inc.

777 Dunsmuir Street, Suite 1610

Vancouver, British Columbia V7Y 1K4

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TUESDAY, APRIL 19, 2022

ABOUT THE ANNUAL MEETING

This proxy statement (the “Proxy Statement”) is furnished to shareholders of Silver Bull Resources, Inc. (“Silver Bull,” the “Company,” “us,” or “we”) in connection with the solicitation of proxies by the Board of Directors of Silver Bull (the “Board”), on behalf of the Company, to be voted at the Annual Meeting of Shareholders (the “Meeting”). The Meeting will be held at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia V7Y 1K4, on Tuesday, April 19, 2022 at 10:00 a.m. local time, or at any adjournment or postponement thereof. The Meeting is being held for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The Meeting will be held observing all COVID-19 protocols, including mandatory wearing of masks and social distancing of at least two meters. No refreshments will be served and all attendees will disperse immediately after the meeting chair declares the Meeting adjourned.

We have elected to provide access to our proxy materials on the Internet under the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulators’ “notice and access” rules. Our proxy materials are available at www.proxyvote.com. We also post our proxy materials on our website at www.silverbullresources.com/investors/agm/. The Notice of Annual Meeting of Shareholders and related proxy materials are being made available to shareholders beginning on or about February 25, 2022.

All references to currency in this Proxy Statement are in U.S. dollars, unless otherwise indicated.

Notice of Internet Availability of Proxy Materials

On or about February 25, 2022, we will furnish a Notice of Internet Availability of Proxy Materials (“Notice”) to our shareholders containing instructions on how to access the proxy materials and vote online. In addition, instructions on how to request a printed copy of these materials may be found on the Notice. If you received a Notice by mail, you will not receive a paper copy of the proxy materials unless you request such materials by following the instructions contained on the Notice. Your vote is important regardless of the extent of your holdings.

Solicitation Costs

The cost of preparing and mailing the Notice, handling requests for proxy materials, and the cost of solicitation of proxies on behalf of the Board will be borne by the Company. Proxies may be solicited personally or via mail, telephone or facsimile by directors, officers and regular employees of the Company, none of whom will receive any additional compensation for such solicitations. The Company has no present plans for the third-party solicitation of proxies for the Meeting.

Dissenters Rights

The proposed corporate actions on which the Company’s shareholders are being asked to vote are not corporate actions for which shareholders of a Nevada corporation have the right to dissent under the Nevada Private Corporations Chapter of the Nevada Revised Statutes, Nev. Rev. Stat. 78.

What is the purpose of the Meeting?

At our Meeting, shareholders will vote on the following items of business:

- Elect four (4) directors, each to serve until the next annual meeting of shareholders of the Company or until their successors are elected and qualified;

- Ratify and approve the appointment of Smythe LLP, Chartered Professional Accountants (“Smythe”), as our independent registered public accounting firm for the fiscal year ending October 31, 2022;

- Approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement;

- Approve and adopt an amendment to the Company’s 2019 Stock Option and Stock Bonus Plan (the “2019 Plan”) to increase the number of shares of Silver Bull common stock issuable under the 2019 Plan; and

- Approve the unallocated entitlements under the 2019 Plan, whether or not amended.

You will also vote on such other matters as may properly come before the Meeting or any postponement(s) or adjournment(s) thereof.

What are the Board’s recommendations?

The Board recommends that you vote:

| 1. | “FOR” the election of the four (4) nominated directors; |

| 2. | “FOR” the ratification and approval of the appointment of Smythe as our independent registered public accounting firm for the fiscal year ending October 31, 2022; |

| 3. | “FOR” the approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers; |

| 4. | “FOR” the approval and adoption of an amendment to the 2019 Plan to increase the number of shares of Silver Bull common stock issuable under the 2019 Plan; and |

| 5. | “FOR” the approval of the unallocated entitlements under the 2019 Plan, whether or not amended. |

At this time, our management does not intend to present other items of business and knows of no items of business that are likely to be brought before the Meeting, except those described in this Proxy Statement. However, if any other matters should properly come before the Meeting, the persons named in the enclosed proxy will have discretionary authority to vote the shares represented by such proxy in accordance with their best judgment on the matters.

What shares are entitled to vote?

As of the close of business on February 22, 2022, the record date for the Meeting, we had 35,055,652 shares of Silver Bull common stock outstanding. Each share of Silver Bull common stock outstanding on the record date is entitled to one vote on all items being voted on at the Meeting. You can vote all of the shares that you owned on the record date. These shares include (i) shares held directly in your name as the shareholder of record and (ii) shares held for you as the beneficial owner through a broker, bank or other nominee.

What is required to approve each item and how will abstentions and “broker non-votes” be counted?

- For Proposal 1 (election of directors), four (4) candidates will be elected by a plurality vote, provided a quorum is present; however, pursuant to our Majority Voting Policy, any director who fails to receive a majority of the votes cast (in person or by proxy) “FOR” such candidate is required to tender his written resignation to the Board. See “Majority Voting Policy” below. “Broker non-votes” are not counted for determining the number of votes cast “FOR” or “WITHHELD” for such candidate and therefore have no effect on the outcome of the vote.

- For Proposal 2 (ratification and approval of appointment of independent registered public accounting firm), the affirmative vote of the majority of votes cast (in person or by proxy) at the Meeting is required for ratification and approval, provided a quorum is present. Abstentions and “broker non-votes” are not counted for determining the number of votes cast for or against this proposal and therefore have no effect on the outcome of the vote.

- For Proposal 3 (advisory vote on executive compensation), the affirmative vote of the majority of votes cast (in person or by proxy) at the Meeting is required for approval, provided a quorum is present. Abstentions and “broker non-votes” are not counted for determining the number of votes cast for or against this proposal and therefore have no effect on the outcome of the vote. Because your vote on this proposal is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation.

- For Proposal 4 (to approve and adopt an amendment to the 2019 Plan to increase the number of shares of Silver Bull common stock issuable under the 2019 Plan), the affirmative vote of the majority of votes cast (in person or by proxy) at the Meeting (excluding votes cast by insiders of the Company), provided a quorum is present. Abstentions and “broker non-votes” are not counted for determining the number of votes cast for or against this proposal and therefore have no effect on the outcome of the vote.

- For Proposal 5 (to approve the unallocated entitlements under the 2019 Plan, whether or not amended), the affirmative vote of the majority of votes cast (in person or by proxy) at the Meeting (excluding votes cast by insiders of the Company), provided a quorum is present. Abstentions and “broker non-votes” are not counted for determining the number of votes cast for or against this proposal and therefore have no effect on the outcome of the vote.

How do I vote my shares?

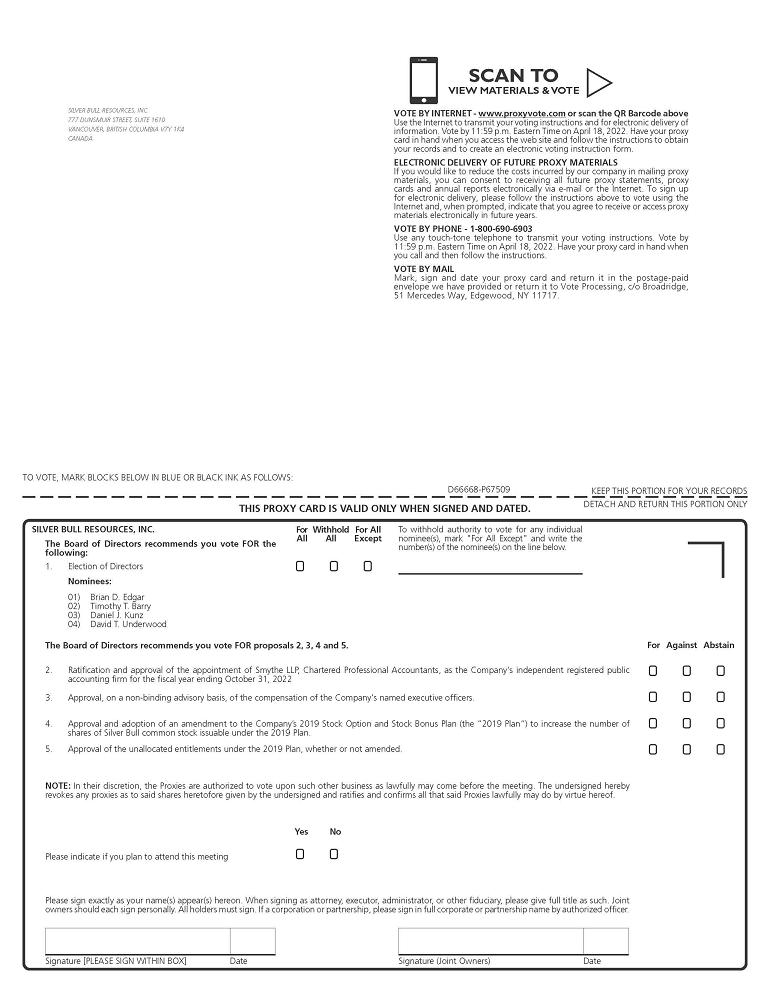

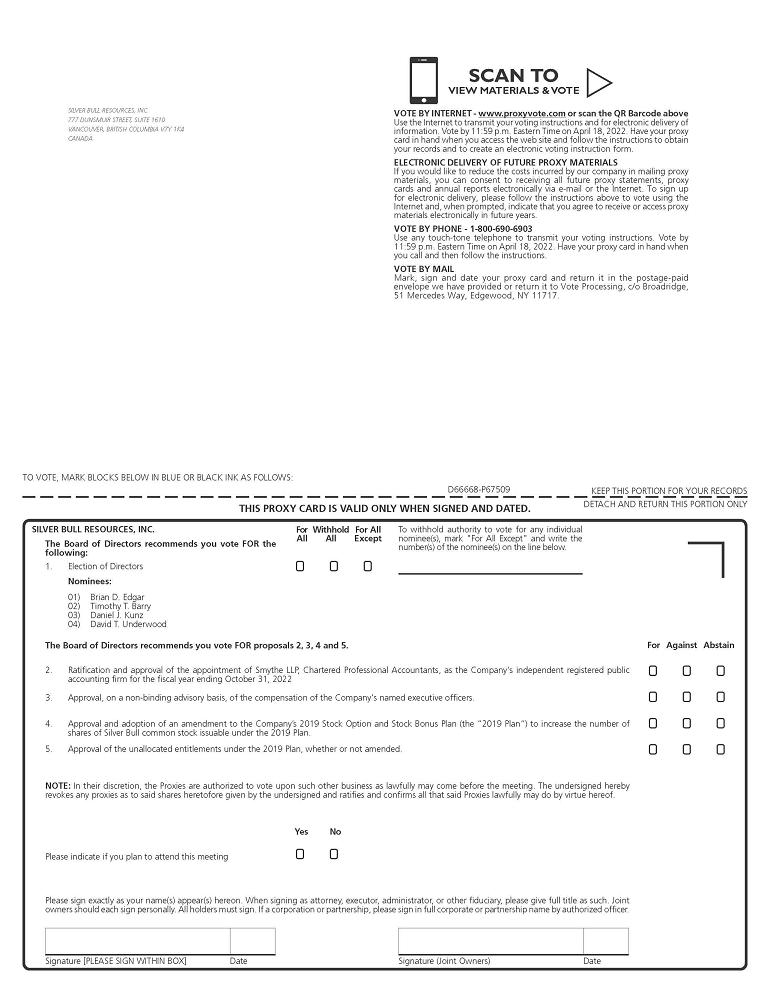

Each share of Silver Bull common stock that you own entitles you to one vote. Your Notice or proxy card shows the number of shares of Silver Bull common stock that you own. You may elect to vote in one of the following methods:

- By Mail – If you have requested a paper copy of the proxy materials, please date and sign the proxy card and return it promptly in the accompanying envelope.

- By Internet – If you received a Notice of Internet Availability of Proxy Materials, you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice.

- By Telephone – You may vote your shares by calling the telephone number specified on your proxy card. You will need to follow the instructions on your proxy card and the voice prompts.

- In Person – You may attend the Meeting and vote in person. We will give you a ballot when you arrive. If your stock is held in the name of your broker, bank or another nominee (a “Nominee”), then you must present a proxy from that Nominee in order to verify that the Nominee has not already voted your shares on your behalf.

If your shares are held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice or proxy materials, as applicable, are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Meeting.

Your Voting Instruction Form from Broadridge Financial Solutions, Inc. (“Broadridge”) or your Notice provides information on how to vote your shares. Additionally, Silver Bull may utilize the Broadridge Quickvote service to assist eligible beneficial owners with voting their shares.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, the organization that holds your shares may generally vote on “routine” matters such as Proposal 2 (ratification and approval of appointment of independent registered public accounting firm), but cannot vote on “non-routine” matters such as Proposal 1 (election of directors), Proposal 3 (advisory vote on executive compensation), Proposal 4 (approval and adoption of amendment to the 2019 Plan) or Proposal 5 (approval of the unallocated entitlements under the 2019 Plan, whether or not amended). Thus, if the organization that holds your shares does not receive instructions from you on how to vote your shares on a “non-routine” matter, that organization will inform the inspector of election that it does not have the authority to vote on such matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Proxies submitted properly by one of the methods discussed above will be voted in accordance with the instructions contained therein. If the proxy is submitted but voting directions are not provided, the proxy will be voted “FOR” each of the four (4) director nominees, “FOR” the ratification and approval of the appointment of Smythe as our independent registered public accounting firm for the fiscal year ending October 31, 2022, “FOR” the approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, “FOR” the proposal to approve and adopt an amendment to the 2019 Plan to increase the number of shares of Silver Bull common stock issuable under the 2019 Plan, and “FOR” the proposal to approve the unallocated entitlements under the 2019 Plan, whether or not amended, and in such manner as the proxy holders named on the proxy, in their discretion, determine upon such other business as may properly come before the Meeting or any adjournment or postponement thereof.

Who may attend the Meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the Meeting. If you are not a shareholder of record but hold shares through a broker or bank (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement as of February 22, 2022, a copy of the voting instruction card provided by your broker, bank or other holder of record, or other similar evidence of ownership. Cameras, recording devices and other electronic devices will not be permitted at the Meeting.

How may I vote my shares in person at the Meeting?

Shares held in your name as the shareholder of record may be voted in person at the Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, bank or other holder of record that holds your shares giving you the right to vote the shares. Even if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions prior to the Meeting as described below so that your vote will be counted if you later decide not to attend the Meeting.

May I change my vote or revoke my proxy after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change the votes you cast or revoke your proxy at any time before the votes are cast at the Meeting (i) by delivering a written notice of your revocation to our principal executive office, if sent by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, P.O. Box 10427, Vancouver, British Columbia, V7Y 1K4, Canada, or, if sent other than by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada; or (ii) by executing and delivering a later-dated proxy. In addition, the powers of the proxy holders will be suspended if you attend the Meeting in person and so request, although attendance at the Meeting will not by itself revoke a previously granted proxy. Notwithstanding the foregoing, no proxy will be counted unless it is received by the Company prior to the commencement of the Meeting.

What constitutes a quorum?

The presence, in person or by proxy, of one-third of the shares of Silver Bull common stock outstanding as of the record date constitutes a quorum for the transaction of business at the Meeting. In the event there are not sufficient votes for a quorum or to approve any proposals at the time of the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies. The inspector of election will treat shares of Silver Bull common stock represented by a properly signed and returned proxy as present at the Meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining. Abstentions and “broker non-votes” as to particular matters are counted for purposes of determining whether a quorum is present at the Meeting. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions to do so from the beneficial owner.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or brokerage account. You should sign and return all proxies for each proxy card that you receive in order to ensure that all of your shares are voted.

How may I vote on each of the proposals?

For the election of directors pursuant to Proposal 1, you may vote “FOR” any nominee, or you may indicate that you wish to withhold authority to vote for one or more of the nominees being proposed.

For each of Proposals 2, 3, 4 and 5 you may vote “FOR” or “AGAINST” the proposal, or you may indicate that you wish to “ABSTAIN” from voting on the proposal.

Who will count the proxy votes?

We currently expect that Broadridge will tabulate the votes and that the Company’s Chief Financial Officer, Christopher Richards, will serve as inspector of election for the Meeting.

How will voting on any other business be conducted?

We do not expect any matters to be presented for a vote at the Meeting other than the matters described in this Proxy Statement. If you grant a proxy, either of the officers named as proxy holder, Timothy Barry or Christopher Richards, will have the discretion to vote your shares on any additional matters that are properly presented for a vote at the Meeting.

Why is the Company seeking approval of an amendment to the 2019 Plan?

Currently, the 2019 Plan limits the number of shares of Silver Bull common stock issuable under the 2019 Plan to the lower of (i) 3,750,000 shares or (ii) 10% of the issued and outstanding shares at any point in time. Since the 2019 Plan was adopted in April 2019, the number of authorized shares of Silver Bull common stock was increased from 37,500,000 to 150,000,000 in April 2021. The proposed amendment would remove the 3,750,000 share ceiling, and increase, to the extent the number of issued and outstanding shares of common stock increase over time, the number of shares of Silver Bull common stock issuable under the 2019 Plan from the lower of (i) 3,750,000 shares or (ii) 10% of the issued and outstanding shares at any point in time to 10% of the issued and outstanding shares at any point in time. The proposed amendment also makes a corresponding change to the number of shares that may be issued pursuant to stock options that are incentive stock options, increasing that total from from 2,948,352 shares (as adjusted for the one-for-eight reverse stock split completed on September 18, 2020) to 15,000,000 shares (i.e., 10% of the authorized share capital of Silver Bull), subject to the overall limitation on the number of shares that may be reserved for issuance under the 2019 Plan. By removing the “lower of” threshold, over time the amended 2019 Plan would allow for the grant of additional stock options or stock bonuses as part of compensation to new employees, officers and directors as part of a competitive overall compensation package, the lack of which may impair the Company’s ability to incent or retain key employees.

Why is the Company seeking approval of the unallocated entitlements under the 2019 Plan?

Pursuant to Toronto Stock Exchange (“TSX”) policies, all unallocated options, rights or entitlements under a security-based compensation arrangement which does not have a fixed maximum number of securities issuable must be approved by the listed issuer’s security holders every three years after the institution of the arrangement. Accordingly, at the Meeting, shareholders will be asked to pass an ordinary resolution to approve the unallocated options and common stock issuable pursuant to the 2019 Plan, whether or not the 2019 Plan is amended, until April 19, 2025.

If shareholders do not approve Proposal 5, whether or not the 2019 Plan is amended, the Company will cease being able to grant options under the 2019 Plan (whether or not amended), or to issue common stock under the 2019 Plan (whether or not amended), after the Meeting, and all previously granted options will no longer be available for reallocation if they are cancelled or expire unexercised. All outstanding options will continue unaffected.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Management

The number of shares of Silver Bull common stock outstanding as of February 18, 2022 was 35,055,652. The following table sets forth the number of shares of Silver Bull common stock beneficially owned by each of the Company’s directors, nominees and named executive officers and the number of shares beneficially owned by all of the directors, nominees, and named executive officers as a group:

| Name and Address of Beneficial Owner (1) | | Position | | Amount and Nature of Beneficial Ownership (2)(12) | | | Percent of Common Stock | |

| Brian D. Edgar | | Chairman and Director | | | 1,334,537 | (3) | | | 3.78% | |

| Timothy T. Barry | | Chief Executive Officer | | | 788,888 | (4) | | | 2.23% | |

| Darren E. Klinck | | President | | | 609,063 | (5) | | | 1.73% | |

| Christopher Richards | | Chief Financial Officer | | | 340,146 | (6) | | | *% | |

| Daniel J. Kunz | | Director | | | 322,096 | (7) | | | *% | |

| John A. McClintock | | Director (8) | | | 102,971 | (9) | | | *% | |

| David T. Underwood | | Director Nominee (10) | | | 21,500 | (11) | | | *% | |

| All directors, nominees, and executive officers as a group (7 persons) | | | | | 3,519,201 | | | | 9.72% | |

_________________________

| * | The percentage of Silver Bull common stock beneficially owned is less than one percent (1%). |

| (1) | The address of these persons is c/o Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia V7Y 1K4. |

| (2) | Unless otherwise indicated, each person listed has the sole power to vote and dispose of the shares listed. Pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), beneficial ownership includes shares as to which the individual or entity has or shares voting power or investment power, and any shares that the individual or entity has the right to acquire within 60 days of February 18, 2022, including through the exercise of any option, warrant, or right. For each individual or entity that holds options, warrants or rights to acquire shares, the shares of Silver Bull common stock underlying those securities are treated as owned by that holder and as outstanding shares when that holder’s percentage ownership of Silver Bull common stock is calculated. That Silver Bull common stock is not treated as outstanding when the percentage ownership of any other holder is calculated. |

| (3) | Consists of (i) 845,102 shares of Silver Bull common stock held directly, (ii) warrants to purchase 106,500 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, (iii) stock options to purchase 133,333 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, and (iv) 249,602 shares of Silver Bull common stock owned by Tortuga Investments Corp., a company wholly owned by Mr. Edgar. Excludes (a) 425,000 shares of Silver Bull common stock and (b) warrants to purchase 212,500 shares of Silver Bull common stock, in each case that are owned by 0893306 B.C. Ltd., a company wholly owned by Mr. Edgar’s spouse, and of which Mr. Edgar disclaims beneficial ownership. |

| (4) | Consists of (i) 538,888 shares of Silver Bull common stock held directly and (ii) stock options to purchase 250,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days. Excludes (a) 319,000 shares of Silver Bull common stock and (b) warrants to purchase 159,500 shares of Silver Bull common stock, in each case that are owned by Mr. Barry’s spouse, and of which Mr. Barry disclaims beneficial ownership. |

| (5) | Consists of (i) 20,000 shares of Silver Bull common stock held directly, (ii) 39,063 shares of Silver Bull common stock held indirectly in Westcott Management Ltd., (iii) stock options to purchase 250,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, and (iv) 300,000 shares of Silver Bull common stock for which voting and investment power is shared with his spouse. |

| (6) | Consists of (i) 148,813 shares of Silver Bull common stock held directly, (ii) warrants to purchase 8,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, and (iii) stock options to purchase 183,333 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, |

| (7) | Consists of (i) 192,096 shares of Silver Bull common stock held directly and (ii) warrants to purchase 80,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, (iii) stock options to purchase 50,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days. |

| (8) | Mr. McClintock is not standing for re-election at the Meeting. |

| (9) | Consists of (i) 44,971 shares of Silver Bull common stock held directly, (ii) warrants to purchase 8,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days, and (iii) stock options to purchase 50,000 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days. |

| (10) | Mr. Underwood is nominated as a director of Silver Bull and is intended to replace Mr. McClintock, who is not standing for re-election at the Meeting. |

| (11) | Consists of warrants to purchase 21,500 shares of Silver Bull common stock that are exercisable or will be exercisable within 60 days. |

(12) Stock options exercisable or that will be exercisable within 60 days were granted to certain officers and directors of Silver Bull on February 17, 2022. A total of 3,150,000 options were issued with an exercise of price of CDN$0.32 (US$0.252). Such options vest as follows: one-third immediately upon grant, one-third on the first anniversary of the grant and one-third on the second anniversary of the grant. Options granted on February 17, 2022 are the only options outstanding under the 2019 Plan at the date of this Proxy Statement.

Security Ownership of Certain Beneficial Owners

There is no person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding voting shares of Silver Bull common stock.

Security Ownership of Certain Beneficial Owners

There is no person or entity known to the Company to be the beneficial owner of more than 5% of the outstanding voting shares of Silver Bull common stock.

MANAGEMENT

Identification of Directors and Executive Officers

The table below sets forth the names, titles, and ages of each of the nominees standing for election to the Board and the Company’s executive officers as of the record date. There are no family relationships among any of the directors, executive officers and/or director/nominees of the Company.

Except as described herein, there was no agreement or understanding between the Company and any director or executive officer pursuant to which he was selected as an officer or director, although certain of the Company’s executive officers have entered into employment agreements with the Company.

| Name | | Current Position | | Age | | | Year Initially Appointed as Officer or Director | |

| Brian D. Edgar | | Chairman and Director | | | 71 | | | | 2010 | |

| Timothy T. Barry | | Chief Executive Officer and Director | | | 46 | | | | 2010 | |

| Daniel J. Kunz | | Director | | | 69 | | | | 2011 | |

| David T. Underwood | | Director Nominee | | | 57 | | | | — | |

| Christopher Richards | | Chief Financial Officer | | | 44 | | | | 2020 | |

| Darren E. Klinck | | President | | | 45 | | | | 2021 | |

Brian D. Edgar. Mr. Edgar was appointed Chairman of the Board in April 2010. Mr. Edgar has broad experience working in junior and mid-size natural resource companies. He served as Dome’s President and Chief Executive Officer from February 2005 to April 2010, when Dome was acquired by Silver Bull. Further, Mr. Edgar served as a director of Dome (1998–2010), Lucara Diamond Corp. (2007–May 2020), BlackPearl Resources Inc. (2006–December 2018), and ShaMaran Petroleum Corp. (2007–June 2019). He has served as a director of Denison Mines Corp. since 2005 and of Arras Minerals Corp. (“Arras”) since its inception on February 5, 2021 and of numerous other public resource companies over the last 30 years. Mr. Edgar practiced corporate/securities law in Vancouver, British Columbia, Canada for 16 years.

Timothy T. Barry. Mr. Barry was appointed as Vice President – Exploration of Silver Bull in August 2010. He then served as President of Silver Bull from March 2011 to October 1, 2021, and has served as the Chief Executive Officer and a director of Silver Bull since March 2011. In addition, Mr. Barry served as President of Arras from February 5, 2021 to October 1, 2021 and has served as the Chief Executive Officer and a director of Arras since February 5, 2021. Between 2006 and August 2010, Mr. Barry spent five years working as Chief Geologist in West and Central Africa for Dome. During this time, he managed all aspects of Dome’s exploration programs and oversaw corporate compliance for Dome’s various subsidiaries. Mr. Barry also served on Dome’s board of directors. In 2005, he worked as a project geologist in Mongolia for Entree Gold, a company that has a significant stake in the Oyu Tolgoi mine in Mongolia. Between 1998 and 2005, Mr. Barry worked as an exploration geologist for Ross River Minerals Inc. on its El Pulpo copper/gold project in Sinaloa, Mexico, for Canabrava Diamonds Corporation on its exploration programs in the James Bay lowlands in Ontario, Canada, and for Homestake Mining Company on its Plutonic Gold Mine in Western Australia. He has also worked as a mapping geologist for the Geological Survey of Canada in the Coast Mountains, and as a research assistant at the University of British Columbia, where he examined the potential of CO2sequestration in Canada using ultramafic rocks. Mr. Barry received a Bachelor of Science degree from the University of Otago in Dundein, New Zealand and is a Chartered Professional Geologist (CPAusIMM).

Daniel J. Kunz. Mr. Kunz has more than 35 years of experience in international mining, energy, engineering and construction, including in executive, business development, management, accounting, finance and operations roles. In June 2020, he was appointed President and Chief Executive Officer of Prime Mining Corp., a mine development company. Since 2014, he has been the managing member of Daniel Kunz & Associates, LLC, an advisory and engineering services company focused on the natural resources sector. From 2013 to 2018, he was the Chairman and Chief Executive Officer of Gold Torrent, Inc., a mine development company. In addition, Mr. Kunz is the founder, and from 2003 until he retired in April 2013 was the President and Chief Executive Officer and a director, of U.S. Geothermal, Inc., a renewable energy company that owns and operates geothermal power plants in Idaho, Oregon, and Nevada and was sold to Ormat Technologies, Inc. in 2018. Mr. Kunz was Senior Vice President and Chief Operating Officer of Ivanhoe Mines Ltd. from 1997 to October 2000, and served as its President and Chief Executive Officer and as a director from November 2000 to March 2003. He was part of the team that discovered Oyu Tolgoi, one of the world’s largest copper-gold deposits. From March 2003 to March 2004, Mr. Kunz served as President and Chief Executive Officer of China Gold International Resources Corp. Ltd. and served as a director from March 2003 to October 2009. Mr. Kunz was a founder of MK Resources LLC, formerly known as the NASDAQ-listed company MK Gold Company, and directed the company’s 1993 initial public offering as the President and Chief Executive Officer and a director. For 17 years, he held executive positions with NYSE-listed Morrison Knudsen Corporation (including Vice President and Controller). Mr. Kunz holds a Masters of Business Administration and a Bachelor of Science in Engineering Science. He is currently a director of Raindrop Ventures Inc., Prime Mining Corp., Greenbriar Capital Corp., and Arras.

David T. Underwood. Mr. Underwood has 30 years of broad exploration experience in Africa and other parts of the world acting in executive and senior technical roles for major and junior exploration and mining companies. Since January 2017, he has been the Vice President of Exploration of Osino Resources Corp. in Namibia. Mr. Underwood is also a co-founder of, and since June 2020 has been a technical advisor for, Lotus Gold in Egypt. He was a co-founder, and from 2014 to 2015 served as the Vice President of Exploration, of BHK Mining Corp. operating in Gabon. Mr. Underwood worked in business development for Newmont Mining Corporation in Africa from January 2010 to December 2013 and as a lead gold consultant to AngloGold Ashanti Limited from 2008 to 2010. During this period, he also consulted to numerous companies, including Roxgold Inc. and Silver Bull, and prior to 2008 held several key management positions, including Managing Director of Anglo American in Kenya and Managing Director of Desert Minerals in Namibia. Mr. Underwood has a BSc (Hons) degree, is a Fellow of the Society of Economic Geology, and is a Registered Professional Scientist with the South African Council for Natural Scientific Professions.

Christopher Richards. Mr. Richards was appointed as the Company’s Chief Financial Officer effective as of September 28, 2020. Since February 2021, he has also served as the Chief Financial Officer of Arras. Mr. Richards previously served as the Vice President of Finance for Great Panther Mining Limited, a U.S. and Canadian dual-listed gold and silver producer, from June 2018 to February 2020. From January 2017 to May 2018, he was self-employed as a senior financial consultant, advising public and private companies in the mining and natural resources industries. Prior to that, Mr. Richards served as the Vice President of Finance and Corporate Secretary (December 2013–December 2016) and Group Controller (April 2009–November 2013) of Kyzyl Gold Ltd., a wholly owned subsidiary of London Stock Exchange-listed Polymetal International plc, engaged in the development of the Kyzyl Gold Mine located in Kazakhstan. From July 2015 to October 2016, he served as the Chief Financial Officer of TSX Venture Exchange-listed True North Gems Inc. Earlier in his career, Mr. Richards served as the Corporate Controller of U.S. and Canadian dual-listed NovaGold Resources Inc. and as a Senior Manager of Audit for KPMG LLP. He is a CPA (Chartered Professional Accountant, British Columbia), CA, and received a Bachelor of Business Administration degree from Simon Fraser University in 2000 and a certificate in mining studies from the University of British Columbia in 2014.

Darren E. Klinck. Mr. Klinck was appointed as the Company’s President effective September 28, 2021. Mr. Klinck most recently served as President (August 2017–April 2021) and Chief Executive Officer (August 2017–January 2020) of Bluestone Resources Inc. From April 2007 to June 2017, he served in numerous roles at OceanaGold Corporation, including Executive Vice President and Head of Corporate Development, Head of Business Development, and Vice President of Corporate and Investor Relations. Mr. Klinck has served as a director of ValOre Metals Corp. since June 1, 2021, as a director of Gold Basin Resources Corp. since September 9, 2021, and as the President and a director of Arras since October 1, 2021. In addition, he served as a director of Bluestone Resources Inc. from August 2017 to April 2021. Mr. Klinck has a Bachelor of Commerce degree from the Haskayne School of Business at the University of Calgary.

Relationship of Silver Bull Resources, Inc. with Arras Minerals Corp.

As previously disclosed, on February 5, 2021, Arras was incorporated in British Columbia, Canada, as a wholly-owned subsidiary of Silver Bull. On March 19, 2021, pursuant to an asset purchase agreement with Arras, Silver Bull transferred its right, title and interest in and to the Beskauga option agreement relating to a project in Kazakhstan, among other things, to Arras. On September 24, 2021, Silver Bull distributed to its shareholders one Arras common share for each Silver Bull share held by such shareholders (the “Distribution”). Upon completion of the Distribution, Silver Bull retained approximately 4% of the outstanding Arras common shares as a strategic investment, and Arras became a stand-alone company.

Board Composition

Majority Voting Policy

The Board has adopted a Majority Voting Policy stipulating that shareholders shall be entitled to vote in favor of, or withhold from voting for, each individual director nominee at a meeting of shareholders. If the number of shares “withheld” for any nominee exceeds the number of shares voted “FOR” such nominee, then, notwithstanding that such director was duly elected as a matter of corporate law, he or she shall tender his or her written resignation to the chair of the Board. The Corporate Governance and Nominating Committee of the Board (the “Corporate Governance and Nominating Committee”) will consider such offer of resignation and will make a recommendation to the Board concerning the acceptance or rejection of the resignation after considering, among other things, the stated reasons, if any, why certain shareholders “withheld” votes for the director, the qualifications of the director and whether the director’s resignation from the Board would be in the best interests of the Company. The Board must take formal action on the Corporate Governance and Nominating Committee’s recommendation within 90 days and announce its decision by a press release.

According to the Majority Voting Policy, the affected director cannot participate in the deliberations of the Corporate Governance and Nominating Committee or the Board as to whether to consider his or her resignation. The Majority Voting Policy applies only in circumstances involving an uncontested election of directors, meaning an election in which the number of nominees is equal to the number of directors to be elected.

The Board seeks to ensure that it is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight obligations effectively. The Company’s Corporate Governance and Nominating Committee is charged with identifying, screening and/or appointing persons to serve on the Board. The Corporate Governance and Nominating Committee evaluates nominees recommended by the shareholders using the same criteria it uses for other nominees. In identifying Board candidates, it is the Company’s goal to identify persons who it believes have appropriate expertise and experience to contribute to the oversight of a company of the Company’s nature while also reviewing other appropriate factors. The Board believes that the process in place to identify candidates and elect directors allows the most qualified candidates to be appointed independently.

The Company believes that each of the persons standing for election to the Board at the Meeting has the experience, qualifications, attributes and skills that, when taken as a whole, will enable the Board to satisfy its oversight responsibilities effectively. With regard to the Board nominees, the following factors were among those considered that led to the Board’s conclusion that each would make valuable contributions to the Board:

| · | Brian D. Edgar: The Board believes that Mr. Edgar is qualified to serve as a director of the Company because of his extensive experience working with junior and mid-size natural resource companies, as well as his experience with and general knowledge of the capital markets. |

| · | Timothy T. Barry: The Board believes that Mr. Barry is qualified to serve as a director of the Company because of his geological education and background, and his significant experience with junior and mid-size natural resources companies, particularly early-stage natural resource companies. |

| · | Daniel J. Kunz: The Board believes that Mr. Kunz is qualified to serve as a director of the Company because of his significant experience in international mining, engineering and construction projects, and his many years of senior management and director experience. |

| · | David T. Underwood: The Board believes that Mr. Underwood is qualified to serve as a director of the Company because of his significant experience in all facets of the mineral exploration business, which includes managing large exploration organizations, as well as his education and general knowledge of the exploration industry. |

Involvement in Certain Legal Proceedings

During the past ten years, none of the director nominees or persons currently serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to be disclosed pursuant to Item 401(f) of SEC Regulation S-K, including (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the U.S. Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; or (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

Transactions with Related Persons

Pursuant to its charter, the Audit Committee of the Board (the “Audit Committee”) reviews and approves all related party transactions on an ongoing basis.

The Company entered into an independent contractor agreement, effective as of October 1, 2020, with Nicholas Edgar, the son of Brian Edgar, the Company’s Chairman, pursuant to which agreement Nicholas Edgar will provide certain consulting services for the Company’s exploration projects for CDN$400 per day. On November 10, 2020, the Audit Committee approved the independent contractor agreement with Nicholas Edgar.

On October 27, 2020 and November 9, 2020, the Company entered into a series of substantially similar subscription agreements pursuant to which the Company issued and sold to certain investors, in a private placement, units (the “Units”) of the Company at a price of US$0.47 per Unit (the “Private Placement”). Each Unit consisted of one share of Silver Bull common stock and one-half of one common stock purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one share of Silver Bull common stock and one common share of Arras pursuant to the terms of the Separation and Distribution Agreement, dated as of August 31. 2021, between Silver Bull and Arras. The Private Placement included subscriptions from three members of the Board, the Company’s Chief Financial Officer, and an entity affiliated with the spouse of the Chairman of the Board for an aggregate 830,000 Units (US$390,100). On October 14, 2020, the Audit Committee approved the Private Placement.

Independence of the Board

The Board currently consists of Timothy Barry, Brian Edgar, Daniel Kunz and John McClintock. Messrs. Barry, Edgar and Kunz are being nominated by the Company for re-election at the Meeting. Mr. McClintock, who is currently an independent director of Silver Bull, is not standing for re-election at the Meeting and instead, David Underwood is being nominated by the Company for election at the Meeting. Messrs. Kunz and Underwood are considered “independent” as that term is defined in Section 311 of the TSX Company Manual.

Board Leadership Structure

The Board does not have an express policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Brian Edgar has been the Company’s Chairman of the Board since April 2010, while Timothy Barry has served as the Company’s Chief Executive Officer since February 2011. The Board believes that this leadership structure is appropriate, as Mr. Edgar and Mr. Barry bring complementary skills to the Company’s business operations and strategic plans and generally are focused on somewhat different aspects of the Company’s operations. Mr. Barry, with his geological background and experience, has a greater depth of knowledge regarding the Company’s exploration activities, while Mr. Edgar has a significant amount of experience with mid-sized and junior level exploration and mining companies and with the capital markets.

Although Mr. Edgar does not work full-time for the Company, he has previously devoted a significant portion of his time to the day-to-day affairs of, and has played a key policy-making role for, the Company. For this reason, the Company has previously viewed Mr. Edgar as one of its executive officers. On a go-forward basis, Mr. Edgar’s role is expected to be less full time and therefore, Mr. Edgar is no longer considered an executive officer.

Also, the Board does not have a formal policy with respect to the consideration of diversity when assessing directors and directorial candidates but considers diversity as part of its overall assessment of the Board’s functioning and needs.

Board’s Role in Risk Oversight

Company management is charged with the day-to-day management of risks the Company faces. However, the Board, directly and through its committees, is actively involved in the oversight of the Company’s risk management policies. The Audit Committee is charged with overseeing enterprise risk management generally and with reviewing and discussing with management the Company’s major risk exposures (whether financial, operating or otherwise) and the steps that management takes to monitor, control and manage these exposures, including the Company’s risk assessment and risk management guidelines and policies. The Audit Committee reports to the Board regarding the foregoing matters, and the Board ultimately approves any changes in corporate policies, including those pertaining to risk management. Additionally, the Compensation Committee of the Board (the “Compensation Committee”) oversees the Company’s compensation policies generally, in part to determine whether they create risks that are reasonably likely to have a material adverse effect on the Company. The Audit Committee and the Compensation Committee correspond with, and report to, management and the Board.

Meetings of the Board and Committees

Board of Directors

The Board held fourteen meetings during the fiscal year ended October 31, 2021, and has held two meetings during the current fiscal year. Such meetings consisted of both actions taken by the unanimous written consent of the directors and live meetings at which the directors were present in person or by telephone. All of the Company’s directors attended at least 75% of the Board meetings conducted during the fiscal year ended October 31, 2021. The Company does not have a formal policy with regard to Board members’ attendance at annual meetings but encourages them to attend meetings of shareholders. Mr. Edgar and Mr. Barry attended last year’s annual meeting of shareholders.

Audit Committee

The Company has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The following persons currently serve on the Company’s Audit Committee: Daniel Kunz and John McClintock. Messrs. Kunz and McClintock are considered “independent” under Rule 10A-3 of the Exchange Act. Mr. Kunz is the “financial expert” for the Audit Committee.

The Audit Committee held six meetings during the fiscal year ended October 31, 2021, and has held two meetings during the current fiscal year. Such meetings consisted of both actions taken by the unanimous written consent of the Audit Committee members and live meetings at which the members were present in person or by telephone. Messrs. Kunz and McClintock attended all of the meetings in person or by telephone. On May 1, 2006, the Board adopted a written charter for the Audit Committee, which was amended on February 14, 2012 and February 22, 2017. The Audit Committee charter is available on our website at www.silverbullresources.com. The composition of the Audit Committee following the Meeting will be determined by the Board after the Meeting, but it is anticipated that Mr. Kunz will continue to serve on the Audit Committee and Mr. Underwood will be appointed to the Audit Committee.

Compensation Committee

The Company’s Compensation Committee currently consists of John McClintock and Daniel Kunz, each of whom is considered “independent” under Section 311 of the TSX Company Manual. The Compensation Committee held two meetings during the fiscal year ended October 31, 2021, and has held three meetings during the current fiscal year. Such meetings consisted of both actions taken by the unanimous written consent of the Compensation Committee members and live meetings at which the members were present in person or by telephone. The composition of the Compensation Committee following the Meeting will be determined by the Board after the Meeting, but it is anticipated that Mr. Kunz will continue to serve on the Compensation Committee and that Mr. Underwood will be appointed to the Compensation Committee.

Duties of the Compensation Committee include reviewing and making recommendations regarding compensation of executive officers and determining the need for and the appropriateness of employment agreements for senior executives. This includes the responsibility (i) to determine, review and approve on an annual basis the corporate goals and objectives with respect to compensation for the senior executives; and (ii) to evaluate at least once a year the performance of the senior executives in light of the established goals and objectives and, based upon these evaluations, to determine the annual compensation for each, including salary, bonus, incentive and equity compensation. The Compensation Committee has authority to retain such compensation consultants, outside counsel and other advisors as the Compensation Committee in its sole discretion deems appropriate. The Compensation Committee may also invite the executive officers and other members of management to participate in its deliberations, or to provide information to the Compensation Committee for its consideration with respect to such deliberations, except that the Chief Executive Officer may not be present for the deliberation of or the voting on compensation for the Chief Executive Officer. The Chief Executive Officer may, however, be present for the deliberation of or the voting on compensation for any other officer.

The Compensation Committee also has the authority and responsibility (i) to review the fees paid to independent directors for service on the Board and its committees, and make recommendations to the Board with respect thereto (however, disinterested members of the Board ultimately determine the fees paid to the independent directors); and (ii) to review the Company’s incentive compensation and other stock-based plans and recommend changes in such plans to the Board as needed.

The Compensation Committee is authorized to delegate any of its responsibilities to a subcommittee as the Compensation Committee deems appropriate. The Compensation Committee’s charter was adopted by the Board on May 1, 2006 and amended on December 5, 2006, February 22, 2013, and February 22, 2017. The charter is available on our website at www.silverbullresources.com.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee served as an employee of the Company during the fiscal year ended October 31, 2021 (or subsequently). No current member of our Compensation Committee formerly served as an officer of the Company, and none of the current members of the Compensation Committee has entered into a transaction with the Company in which he had a direct or indirect interest that is required to be disclosed pursuant to Item 404(a) of SEC Regulation S-K. During the past year, no executive officer of the Company served as a director or on the compensation committee of another entity whose executive officer also served on the Company’s Board or Compensation Committee.

Corporate Governance and Nominating Committee

The Company’s Corporate Governance and Nominating Committee currently consists of Daniel Kunz and John McClintock, each of whom is considered “independent” under Section 311 of the TSX Company Manual. The future composition of the Corporate Governance and Nominating Committee will be determined after the Meeting, but it is anticipated that Mr. Kunz will continue to serve on the Corporate Governance and Nominating Committee and that Mr. Underwood will be appointed to the Corporate Governance and Nominating Committee. Duties of the Corporate Governance and Nominating Committee include oversight of the process by which individuals may be nominated to the Board. The Corporate Governance and Nominating Committee’s charter was adopted by the Board on May 1, 2006 and amended on July 7, 2006, February 22, 2013, and February 22, 2017 and is available on our website at www.silverbullresources.com.

The functions performed by the Corporate Governance and Nominating Committee include identifying potential directors and making recommendations as to the size, functions and composition of the Board and its committees. In making nominations, our Corporate Governance and Nominating Committee is required to submit candidates who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who shall be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the Company’s shareholders. The Nominating Committee does not have a formal policy with respect to the consideration of diversity when identifying nominees for director but considers diversity as part of its overall assessment of the Board’s needs.

The Corporate Governance and Nominating Committee will consider nominees proposed by our shareholders. To recommend a prospective nominee for the Corporate Governance and Nominating Committee’s consideration, you may submit the candidate’s name by delivering notice in writing, if sent by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, P.O. Box 10427, Vancouver, British Columbia, V7Y 1K4, Canada, Attention: Corporate Governance and Nominating Committee, or, if sent other than by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada, Attention: Corporate Governance and Nominating Committee.

A shareholder nomination submitted to the Corporate Governance and Nominating Committee must include at least the following information (and can include such other information the person submitting the recommendation desires to include), and must be submitted to the Company by the date mentioned in the proxy statement for the Company’s most recent annual meeting under the heading “Shareholder Proposals,” as such date may be amended in cases where the annual meeting has been changed as contemplated in SEC Rule 14a-8(e), Question 5:

| (i) | The name, address, telephone number, fax number and e-mail address of the person submitting the recommendation. |

| (ii) | The number of shares and description of the Company voting securities held by the person submitting the nomination and whether such person is holding the shares through a brokerage account (and if so, the name of the broker-dealer) or directly. |

| (iii) | The name, address, telephone number, fax number and e-mail address of the person being recommended to the Corporate Governance and Nominating Committee to stand for election at the next annual meeting (the “proposed nominee”) together with information regarding such person’s education (including degrees obtained and dates), business experience during the past ten years, professional affiliations during the past ten years and other relevant information. |

| (iv) | Information regarding any family relationships of the proposed nominee as required by Item 401(d) of SEC Regulation S-K. |

| (v) | Information whether the proposed nominee or the person submitting the recommendation has (within the ten years prior to the recommendation) been involved in legal proceedings of the type described in Item 401(f) of SEC Regulation S-K (and if so, provide the information regarding those legal proceedings required by Item 401(f) of SEC Regulation S-K). |

| (vi) | Information regarding the share ownership of the proposed nominee required by Item 403 of SEC Regulation S-K. |

| (vii) | Information regarding certain relationships and related party transactions of the proposed nominee as required by Item 404 of SEC Regulation S-K. |

| (viii) | The signed consent of the proposed nominee in which he or she (1) consents to being nominated as a director of the Company if selected by the Corporate Governance and Nominating Committee; (2) states his or her willingness to serve as a director if elected for compensation not greater than that described in the most recent proxy statement; (3) states whether the proposed nominee is “independent” as defined by applicable laws; and (4) attests to the accuracy of the information submitted pursuant to paragraphs (i) through (vii) above. |

Although the information may be submitted by fax, e-mail, mail or courier, the Corporate Governance and Nominating Committee must receive the proposed nominee’s signed consent, in original form, within ten days of the nomination having been made.

When the information required above has been received, the Corporate Governance and Nominating Committee will evaluate the proposed nominee based on the criteria described below, with the principal criteria being the needs of the Company and the qualifications of such proposed nominee to fulfill those needs. No shareholder nominations were received in connection with the Meeting.

The process for evaluating a director nominee is the same whether a nominee is recommended by a shareholder or by an existing officer or director. The Corporate Governance and Nominating Committee will:

| (1) | Establish criteria for selection of potential directors, taking into consideration the following attributes that are desirable for a member of the Board: leadership, independence, interpersonal skills, financial acumen, business experiences, industry knowledge and diversity of viewpoints. The Corporate Governance and Nominating Committee will periodically assess the criteria to ensure that they are consistent with best practices and the goals of the Company; |

| (2) | Identify individuals who satisfy the criteria for selection to the Board and, after consultation with the Chairman of the Board, make recommendations to the Board on new candidates for Board membership; and |

| (3) | Receive and evaluate nominations for Board membership that are recommended by existing directors, corporate officers or shareholders in accordance with policies set by the Corporate Governance and Nominating Committee and applicable laws. |

The Corporate Governance and Nominating Committee held one meeting during the fiscal year ended October 31, 2021 and has held one meeting during the current fiscal year. The Corporate Governance and Nominating Committee has nominated Brian Edgar, Timothy Barry and Daniel Kunz to stand for re-election at the Meeting and has nominated David Underwood to stand for election for the first time at the Meeting. The Company has not engaged the services of or paid a fee to any third party or parties to identify or evaluate or assist in identifying or evaluating potential nominees.

Shareholder Communication with the Board

The Company values the views of its shareholders (current and future shareholders, employees and others). Accordingly, the Board established a system through its Audit Committee to receive, track and respond to communications from shareholders addressed to the Board or to the Company’s non-management directors. Any shareholder who wishes to communicate with the Board or the Company’s non-management directors may write, if sent by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, P.O. Box 10427, Vancouver, British Columbia, V7Y 1K4, Canada, Attention: Audit Committee Chair, or, if sent other than by regular mail, to Silver Bull Resources, Inc., 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, V7Y 1K4, Canada, Attention: Audit Committee Chair.

The chair of the Audit Committee is the Board Communications Designee. He will review all communications and report on the communications to the chair of the Corporate Governance and Nominating Committee, the full Board or the Company’s non-management directors as appropriate. The Board Communications Designee will take additional action or respond to letters in accordance with instructions from the relevant Board source.

EXECUTIVE COMPENSATION

Compensation and Other Benefits of Named Executive Officers

The following table sets out the compensation received for the fiscal years ended October 31, 2021, 2020, and 2019 in respect to each of named executive officers.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | | Fiscal Year | | | Salary ($) (1) | | | Non-Equity Incentive Plan Compensation ($)(7) | | | Stock Awards ($) | | | Option Awards ($) (2) | | | All Other Compensation ($) | | | Total ($) | |

| Current Named Executive Officers | | | | | | | | | | | | | | | | | | | | |

| Timothy T. Barry (3) | | 2021 | | | | 230,640 | | | | 64,783 | | | | — | | | | 223,049 | | | | — | | | | 518,471 | |

| Chief Executive Officer | | 2020 | | | | 206,487 | | | | 26,280 | | | | — | | | | — | | | | — | | | | 232,767 | |

| and Director | | 2019 | | | | 208,967 | | | | 25,963 | | | | — | | | | — | | | | — | | | | 234,930 | |

| Christopher Richards (4) | | 2021 | | | | 181,013 | | | | 56,127 | | | | — | | | | 111,524 | | | | — | | | | 348,664 | |

| Chief Financial Officer | | 2020 | | | | 14,932 | | | | 5,631 | | | | — | | | | — | | | | — | | | | 20,563 | |

| | | 2019 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Darren E. Klinck (5)

| | 2021 | | | | 23,552 | | | | 10,094 | | | | — | | | | 176,439 | | | | — | | | | 210,370 | |

| President | | 2020 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | 2019 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Brian D. Edgar (6)

| | 2021 | | | | 83,609 | | | | — | | | | — | | | | 178,439 | | | | — | | | | 262,048 | |

| Chairman and Director | | 2020 | | | | 67,578 | | | | — | | | | — | | | | — | | | | — | | | | 67,578 | |

| | | 2019 | | | | 68,389 | | | | — | | | | — | | | | — | | | | — | | | | 68,389 | |

| (1) | All 2019, 2020, and 2021 CDN$ amounts have been converted to US$ using the CDN$/US$ exchange rate as of October 31, 2019, 2020, and 2021, respectively. |

| (2) | Amounts represent the calculated fair value of stock options granted to the named executive officers based on provisions of the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 718-10, Stock Compensation. See Note 11 to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2021 for a discussion regarding assumptions used to calculate fair value under the Black–Scholes valuation model. All options were awarded by Arras. |

| (3) | Mr. Barry was appointed as Vice President – Exploration in August 2010. He then served as President of Silver Bull from March 2011 to October 1, 2021, and has served as Chief Executive Officer and a director of the Company since March 2011. Effective on February 15, 2021, Mr. Barry’s base compensation increased from CDN$275,000 to CDN$290,000. Also, Mr. Barry is eligible to receive an annual bonus at the discretion of the Board. During the year ended October 31, 2021. US$116,834 (CDN$144,687) of base compensation was allocated and billed to Arras for the period from February 1, 2021 to October 31, 2021 as Mr. Barry also holds the position of Chief Executive Officer of Arras. |

| (4) | Mr. Richards was appointed as the Company’s Chief Financial Officer effective as of September 28, 2020. On September 23, 2020, the Company entered into an employment agreement with Mr. Richards that provides for an annual base salary of CDN$210,000, and he is eligible to receive an annual bonus at the discretion of the Board. Effective on February 15, 2021, Mr. Richards’ base compensation increased to CDN$230,000. During the year ended October 31, 2021, US$92,525 (CDN$114,583) of base compensation was allocated and billed to Arras, where Mr. Richards also holds the position of Chief Financial Officer, for the period from February 1, 2021 to October 31, 2021. |

| (5) | Mr. Klinck was appointed as President of Silver Bull effective October 1, 2021. On September 28, 2021, Silver Bull entered into a consulting agreement with Westcott Management Ltd, Mr. Klinck’s personal service corporation, that provides for an annual base salary of CDN$50,000, and he is eligible to receive an annual bonus at the discretion of the Board. |

| (6) | Mr. Edgar was paid CDN$90,000 per year. During the year ended October 31, 2021, US$36,337 (CDN$45,000) of his director compensation was allocated and billed to Arras, where Mr. Edgar also holds the position of director and Chairman of the Board, for the period from March 1, 2021 to October 31, 2021. |

| (7) | During the year ended October 31, 2021, Mr. Barry received a CDN$41,667 annual bonus from Silver Bull and a CDN$32,727 bonus from Arras. Mr. Richards received a $CDN35,416 annual bonus from Silver Bull and a CDN$26,591 bonus from Arras and Mr. Klinck received a CDN$12,500 annual bonus from Arras. |

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis describes the material elements of compensation for the executive officers identified in the Summary Compensation Table contained above (collectively, the “named executive officers”).

The Compensation Committee reviews and approves the total direct compensation packages for each of our executive officers. Notably, the salary and other benefits payable to those persons who served as our named executive officers during the fiscal year ended October 31, 2021 are set forth in employment agreements which are discussed below. Stock option grants, as applicable to the named executive officers, are reviewed by the Compensation Committee and approved by the Board. The Compensation Committee has not engaged the services of or paid a fee to any compensation consultant or other third party to evaluate or assist with the evaluation of the Company’s compensation arrangements.

The principle objectives that guide the Compensation Committee in its deliberations regarding executive compensation matters include:

| · | attracting and retaining highly qualified executives who share our Company values and commitment; |

| · | providing executives a compensation package that is fair and competitive, with contractual terms that offer them reasonable security; and |

| · | motivating executives to provide excellent leadership and achieve Company goals by linking short-term and long-term incentives to the achievement of business objectives, thereby aligning the interests of executives and shareholders. |

The primary elements of compensation to our named executive officers are cash compensation and equity compensation in the form of stock option grants, each of which is further described below.

In April 2011, our shareholders recommended, in a non-binding vote, that shareholder advisory votes on the compensation of our executive officers, commonly referred to as a “say-on-pay” vote, be held every three years. Approximately 57% of the votes cast were voted in favor of a three-year frequency. Accordingly, the Board adopted the shareholders’ recommendation to hold the say-on-pay vote every three years. In April 2014, we held a shareholder advisory vote on the compensation of our named executive officers, and our shareholders overwhelmingly approved the compensation of our named executive officers, with over 95% of shareholder votes cast in favor of our say-on-pay resolution. In April 2017, our shareholders recommended, in a non-binding say-on-pay frequency vote, that shareholder advisory votes on the compensation of our executive officers be held every year. Approximately 50% of the votes cast were voted in favor of a one-year frequency. Accordingly, the Board adopted the shareholders’ recommendation to hold the say-on-pay vote every year. In each of April 2018, April 2019, and April 2020, we held a shareholder say-on-pay advisory vote in which our shareholders approved the compensation of our named executive officers, with approximately 93%, 93%, and 63%, respectively, of shareholder votes cast in favor of our say-on-pay resolution.

As we evaluated our compensation practices for the calendar years 2021 and 2022, we were mindful of the strong support our shareholders expressed for our philosophy of linking compensation to our operating objectives and the enhancement of shareholder value. As a result, our Compensation Committee decided to retain our general approach to executive compensation, with an emphasis on short- and long-term incentive compensation that rewards our executives when they deliver value for our shareholders during 2022. We are submitting the compensation of our named executive officers to an advisory vote this year as described more fully below under Proposal 3.

The Compensation Committee evaluates executive performance and makes salary adjustments, discretionary bonus determinations and equity awards. In February 2022, the Compensation Committee approved bonus targets for our named executive officers.

For fiscal 2021, Mr. Barry received a CDN$41,667 annual bonus from Silver Bull and a CDN$32,727 from Arras. Additionally, a bonus of CDN$35,000 previously approved by the Board for Mr. Barry’s calendar 2020 performance, remains unpaid and Mr. Barry has agreed to accept shares of Silver Bull common stock as settlement of this bonus. In February 2022, the Board approved payment of a 2021 performance bonus to Mr. Barry in the amount of CDN$50,000, which has been settled in shares of Silver Bull common stock. The Compensation Committee approved a 2022 bonus target for Mr. Barry of 50% of base salary. The amount of 2022 bonus to be awarded to Mr. Barry will be determined by the Compensation Committee in December 2022 or early 2023 based on certain criteria for 2022 recommended by the Compensation Committee and approved by the Board.

For fiscal year 2021, Mr. Richards received a CDN$35,416 annual bonus from Silver Bull and a CDN$26,591 annual bonus from Arras. In February 2022, the Board approved payment of a 2021 performance bonus to Mr. Richards in the amount of CDN$42,500, which has been settled in shares of Silver Bull common stock. The Compensation Committee approved a 2022 bonus target for Mr. Richards of 50% of base salary. The amount of 2022 bonus to be awarded to Mr. Richards will be determined by the Compensation Committee in December 2022 or early 2023 based on certain performance criteria for 2022 recommended by the Compensation Committee and approved by the Board.