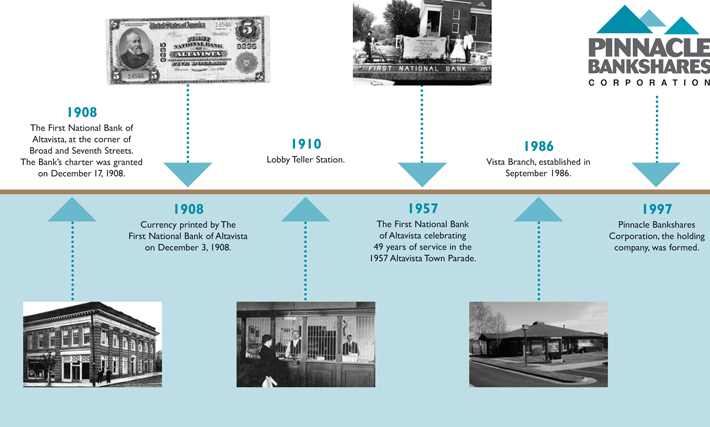

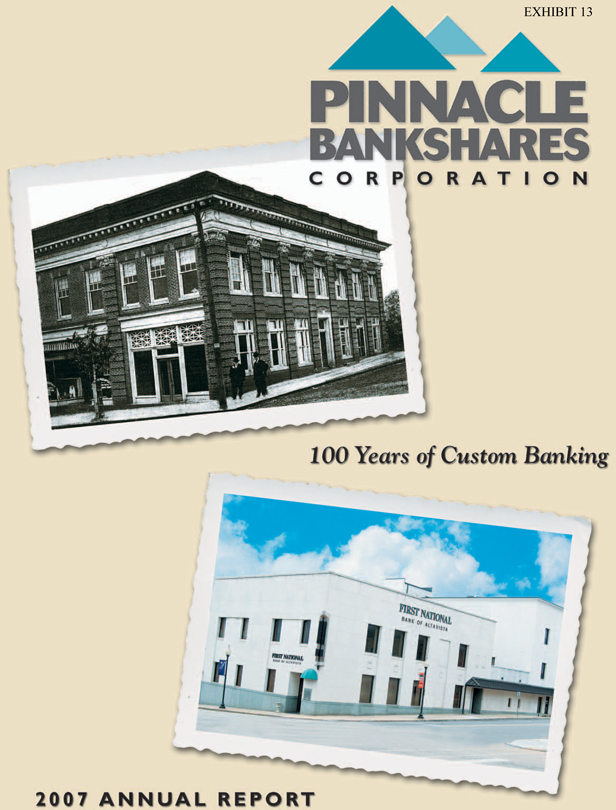

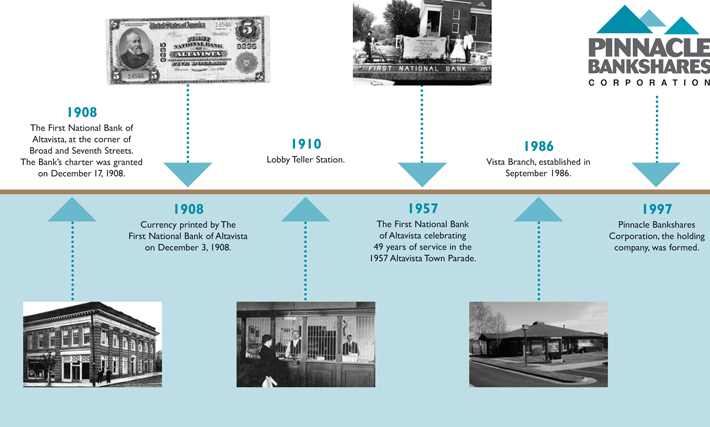

In the year 1908 when the Town of Altavista, Virginia was in its infancy, a group of local businessmen realized that the town, being located at the junction of two railroads, The Southern and the Virginian (soon to be completed) and the Staunton River, had prospects of great potential, but in order to grow and attract business, a bank was a necessity.

Mr. Henry L. Lane of the Lane Brothers Company, founders of the town, a local physician, Dr. W.O. Smith, and Mr. W. S. Frazier, a lumber mill owner and operator, proceeded with the organization of a bank and made application to the Treasury Department in Washington, D.C. for a charter which was granted on December 17, 1908 to “The First National Bank of Altavista,” Altavista, Virginia with a capitalization of $25,000. Mr. Lane was elected President, Dr. Smith, Vice President and Mr. E.T. Yeaman, Cashier, and banking was begun in a portion of a newly erected building of the Lane Brothers Company at the corner of Broad and Seventh Streets. Mr. Yeaman, the Cashier, operated the bank alone for some time and as business increased, the Board of Directors employed a bookkeeper, Miss Douglas Snow, in August, 1909.

In 1917, First National Bank purchased the building from Lane Brothers utilizing the same space in which it began and rented the space it did not use to several local businesses.

With the confidence and cooperation of its depositors, the bank continued to grow through the challenging years of the depression.

Through its one hundred years of business, The First National Bank of Altavista has operated under six presidents, Henry L. Lane, Dr. W.O. Smith, W.S. Frazier, Paul W. Tyree, S. Thomas Cox and Robert H. Gilliam, Jr. The bank is unique in that it has maintained the same name and has been headquartered on the same corner at Broad and Seventh in Altavista as when the bank opened in 1908.

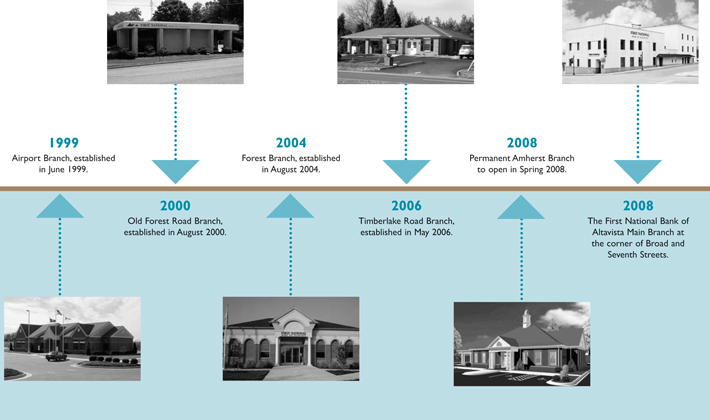

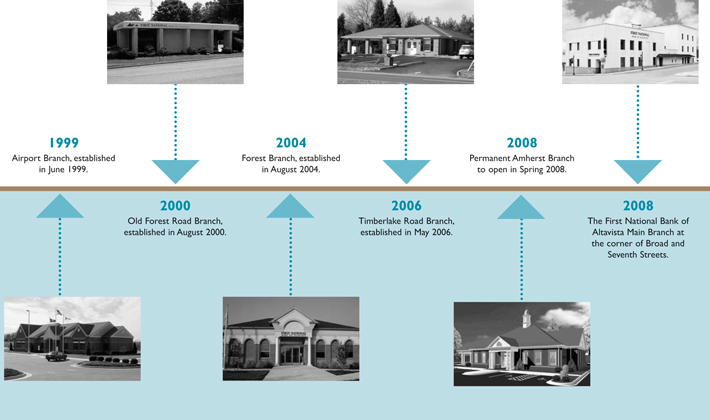

From humble beginnings in 1908, the bank has grown in assets to $279,913,000 as of December 31, 2007 with capital of $26,816,000. The First National Bank of Altavista currently maintains a total of eight offices. The Main Office and Vista Branch are located in the Town of Altavista, the Airport Branch and Timberlake Branch in Campbell County, the Old Forest Road Branch in the City of Lynchburg, the Forest Branch in Bedford County, the Amherst Branch in the Town of Amherst and a Loan Production Office in Franklin County at Smith Mountain Lake.

A total of one-hundred full and part-time staff members serve the bank’s customers.

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Table of Contents

| | |

| | | Page |

Board of Directors | | 2 |

| |

Office Locations | | 3 |

| |

President’s Letter | | 4 |

| |

Selected Consolidated Financial Information | | 6 |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operation | | 7 |

| |

Consolidated Balance Sheets | | 26 |

| |

Consolidated Statements of Income | | 27 |

| |

Consolidated Statements of Changes in Stockholders’ Equity and Comprehensive Income | | 28 |

| |

Consolidated Statements of Cash Flows | | 29 |

| |

Notes to Consolidated Financial Statements | | 31 |

| |

Management’s Report on Internal Control Over Financial Reporting | | 56 |

| |

Report of Independent Registered Public Accounting Firm | | 57 |

| |

Officers and Managers | | 58 |

| |

Robert H. Gilliam Jr.’s Election to the Federal Reserve Board of Directors | | 59 |

| |

Shareholder Information | | 60 and IBC |

| | |

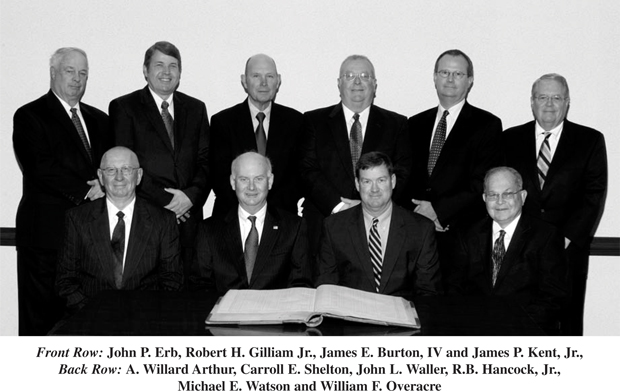

| B O A R D O F D I R E C T O R S |

| A. Willard Arthur | | James P. Kent, Jr. |

| Chairman and Secretary | | Partner |

| Marvin V. Templeton & Sons, Inc. | | Kent & Kent, P.C. |

| |

| James E. Burton, IV | | William F. Overacre |

| Vice President, Operations | | Broker/Owner |

| Marvin V. Templeton & Sons, Inc. | | RE/MAX 1st Olympic, REALTORS |

| |

| John P. Erb | | Carroll E. Shelton |

| Assistant Superintendent | | Senior Vice President |

| Campbell County Schools | | The First National Bank of Altavista |

| | Pinnacle Bankshares Corporation |

| |

| Robert H. Gilliam, Jr. | | |

| President & CEO | | John L. Waller |

| The First National Bank of Altavista | | Owner & Operator |

| Pinnacle Bankshares Corporation | | Waller Farms, Inc. |

| |

| R. B. Hancock, Jr. | | Michael E. Watson |

| President & Owner | | Controller |

| R.B.H., Inc. | | Flippin, Bruce & Porter, Inc. |

2

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

The First National Bank of Altavista Office Locations

ALTAVISTA

MAIN OFFICE

622 Broad Street

Altavista, Virginia 24517

Telephone: (434) 369-3000

VISTA OFFICE

1301 N. Main Street

Altavista, Virginia 24517

Telephone: (434) 369-3001

LYNCHBURG

AIRPORT OFFICE

14580 Wards Road

Lynchburg, Virginia 24502

Telephone: (434) 237-3788

TIMBERLAKE OFFICE

20865 Timberlake Road

Lynchburg, Virginia 24502

Telephone: (434) 237-7936

OLD FOREST ROAD OFFICE

3309 Old Forest Road

Lynchburg, Virginia 24501

Telephone: (434) 385-4432

FOREST

FOREST OFFICE

14417 Forest Road

Forest, Virginia 24551

Telephone: (434) 534-0451

AMHERST

AMHERST OFFICE

130 South Main Street

Amherst, Virginia 24521

Telephone: (434) 946-7814

SMITH MOUNTAIN LAKE

LOAN PRODUCTION OFFICE

74 Scruggs Road, Suite 102

Moneta, Virginia 24121

Telephone: (540) 719-0193

3

TO OUR SHAREHOLDERS, CUSTOMERS AND FRIENDS:

This is a special time for all of us as The First National Bank of Altavista, the banking subsidiary of Pinnacle Bankshares Corporation, celebrates its 100th Anniversary in 2008. Achievement of this milestone has resulted from a combination of strong and conservative leadership, a committed staff, loyal customers and supportive ownership that has exhibited pride in being part of a successful community banking organization.

The First National Bank of Altavista is truly a unique company in that relatively few businesses of any sort can claim to have operated on the same corner and under the same name for one hundred years. From humble beginnings in 1908 in a town chartered only one year earlier, the Bank prospered for over ninety years within the town limits. It was not until 1999 that the Bank expanded outside the Town of Altavista to embark on what has become an objective of being the premier community financial institution in Region 2000. Today First National Bank has a total of eight office locations with only two of these being in Altavista.

We are fortunate that our growth in recent years has resulted in enhanced financial performance. 2007 saw a continuation of this trend. Income and assets once again reached new highs.

Net income for 2007 was $2,600,000, a 7.79% increase over net income of $2,412,000 for 2006. Return on average assets for 2007 was 0.97%, down slightly from the 1.00% threshold for 2006. Return on average equity grew from 10.10% in 2006 to 10.17% for 2007. Higher loan volume in 2007 was the primary reason for growth in net income, as interest margins decreased slightly for the year.

Total assets rose by 9.16% in 2007, ending the year at $279,913,000 compared with $256,421,000 at year-end 2006. Deposits grew 9.12% to $251,866,000 in 2007 and net loans increased 11.97% to $232,752,000 in 2007. Growth in deposits of $21,049,000 in 2007 funded all but $3,842,000 of the growth in net loans of $24,891,000. The difference was funded by maturing securities.

Stockholders’ equity at year-end 2007 was $26,816,000, an increase of $2,324,000 over the previous year. Book value per share was $17.95 as of the end of 2007. Average equity to average assets for the year was 9.51% and the Company continues to be “well capitalized” by all regulatory standards. The cash dividend rate for 2007 increased 9.09% to $0.60 per share and the dividend payout ratio for the year was 34.12%. 2007 marked the 31st consecutive year of an increase in the cash dividend rate.

With the strong growth we have realized in our loan portfolio over recent years, we have recognized the need for enhancement in our loan administration and loan operations functions. Restructuring our loan administration area became one of our top priorities and we accomplished a great deal toward this goal in 2007. Senior Vice President Carroll Shelton has filled the role of Chief Credit Officer,

4

Vice President Todd Hall has become Chief Lending Officer and Vice President Pam Adams has become Loan Operations Manager. Tracie Robinson is now Vice President and Mortgage Production Manager and Edgar Tuck has recently joined the bank as Vice President and Smith Mountain Lake Market Manager. We expect these changes to result in continued strong loan production, enhanced credit risk management practices and improved efficiency in loan administration and operations. Congratulations to each of these key officers in their new responsibilities.

Progress was made in 2007 toward our goal of continued orderly expansion. Construction of a permanent facility is nearing completion in the Town of Amherst to replace the temporary branch we opened there in November 2006. We expect to be in business in this attractive location prior to the end of March. We contracted to acquire a branch site in Rustburg in 2007 which we feel will help solidify our presence in Campbell County. We have now closed on this property, located on Village Highway in the Rustburg Marketplace Shopping Center, and are currently developing site and building plans so that we might begin construction of a branch office there by mid-year 2008.

Based upon weakness in the economy and the Federal Reserve’s lowering of interest rates in an attempt to stimulate the economy, we anticipate that 2008 will be a challenging year for us from the standpoint of both asset quality and earnings. In the fourth quarter of 2007, we experienced a loss on a commercial real estate loan in Lynchburg that required a special loan loss provision to replenish our reserves. We are now seeing evidence of borrowers becoming strained in their ability to service loans which may result in impairment of other credits. Although our balance sheet today is less sensitive to fluctuations in interest rates than in previous years, our interest margins will decline in 2008 from the precipitous cuts in interest rates that have already occurred plus the expectation that rates will decline further. We will manage through this environment but may incur some set-backs along the way.

As for now, we are focused on celebrating successes of the past and our rich one hundred year heritage. We invite you to join us for our Annual Meeting of Shareholders to be held at 11:30 a.m., Tuesday, April 8, 2008 in the Fellowship Hall of Altavista Presbyterian Church, 707 Broad Street, Altavista, Virginia, and for Customer Appreciation Days on May 2, August 1 and December 3 during 2008 at all of our office locations.

Thank you for the unique role you play in this special Company and for your continued support.

| | |

| |

|

| | Robert H. Gilliam, Jr. |

| | President and Chief Executive Officer |

| |

| February 21, 2008 | | |

5

PINNACLE BANKSHARES CORPORATION

AND SUBSIDIARY

Selected Consolidated Financial Information

(In thousands, except ratios, share and per share data)

| | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Income Statement Data: | | | | | | | | | | | | | | | | |

Net interest income | | $ | 10,181 | | | 9,192 | | | 7,983 | | | 7,400 | | | 7,083 | |

Provision for loan losses | | | 462 | | | 339 | | | 230 | | | 223 | | | 470 | |

Noninterest income | | | 2,632 | | | 2,500 | | | 2,396 | | | 2,255 | | | 2,578 | |

Noninterest expenses | | | 8,524 | | | 7,825 | | | 7,166 | | | 6,901 | | | 6,738 | |

Income tax expense | | | 1,227 | | | 1,116 | | | 876 | | | 712 | | | 681 | |

Net income | | | 2,600 | | | 2,412 | | | 2,107 | | | 1,819 | | | 1,772 | |

Per Share Data: | | | | | | | | | | | | | | | | |

Basic net income | | $ | 1.76 | | | 1.65 | | | 1.44 | | | 1.25 | | | 1.22 | |

Diluted net income | | | 1.75 | | | 1.64 | | | 1.43 | | | 1.23 | | | 1.21 | |

Cash dividends | | | 0.60 | | | 0.55 | | | 0.49 | | | 0.45 | | | 0.44 | |

Book value | | | 17.95 | | | 16.66 | | | 15.91 | | | 15.24 | | | 14.71 | |

Weighted-Average Shares Outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 1,479,689 | | | 1,459,007 | | | 1,458,615 | | | 1,457,406 | | | 1,455,530 | |

Diluted | | | 1,489,377 | | | 1,471,806 | | | 1,476,288 | | | 1,473,442 | | | 1,469,739 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | |

Assets | | $ | 279,913 | | | 256,421 | | | 233,490 | | | 219,813 | | | 206,344 | |

Loans, net | | | 232,752 | | | 207,861 | | | 181,268 | | | 158,846 | | | 147,883 | |

Securities | | | 19,635 | | | 24,866 | | | 29,261 | | | 34,224 | | | 37,108 | |

Cash and cash equivalents | | | 18,344 | | | 14,586 | | | 13,814 | | | 17,336 | | | 13,766 | |

Deposits | | | 251,866 | | | 230,817 | | | 209,246 | | | 196,639 | | | 183,865 | |

Stockholders’ equity | | | 26,816 | | | 24,492 | | | 23,212 | | | 22,207 | | | 21,435 | |

Performance Ratios: | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.97 | % | | 1.00 | % | | 0.94 | % | | 0.86 | % | | 0.87 | % |

Return on average equity | | | 10.17 | % | | 10.10 | % | | 9.29 | % | | 8.33 | % | | 8.51 | % |

Dividend payout | | | 34.12 | % | | 33.25 | % | | 33.93 | % | | 36.06 | % | | 36.07 | % |

Asset Quality Ratios: | | | | | | | | | | | | | | | | |

Allowance for loan losses to total loans, net of unearned income and fees | | | 0.73 | % | | 0.84 | % | | 0.83 | % | | 0.94 | % | | 1.02 | % |

Net charge-offs to average loans, net of unearned income and fees | | | 0.23 | % | | 0.04 | % | | 0.13 | % | | 0.16 | % | | 0.16 | % |

Capital Ratios: | | | | | | | | | | | | | | | | |

Leverage | | | 9.54 | % | | 9.80 | % | | 9.88 | % | | 9.85 | % | | 9.79 | % |

Risk-based: | | | | | | | | | | | | | | | | |

Tier 1 capital | | | 10.55 | % | | 9.92 | % | | 10.54 | % | | 10.98 | % | | 11.57 | % |

Total capital | | | 11.24 | % | | 10.64 | % | | 11.23 | % | | 11.75 | % | | 12.45 | % |

Average equity to average assets | | | 9.51 | % | | 9.91 | % | | 10.07 | % | | 10.32 | % | | 10.20 | % |

6

Management’s Discussion and Analysis

of Financial Condition and Results of Operation

(in thousands, except ratios, share and per share data)

The following discussion is qualified in its entirety by the more detailed information and the consolidated financial statements and accompanying notes appearing elsewhere in this Annual Report. In addition to the historical information contained herein, this Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of management, are generally identifiable by use of words such as “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “may,” “will” or similar expressions. Although we believe our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these plans, intentions, or expectations will be achieved. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain, and actual results, performance or achievements could differ materially from those contemplated. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in: interest rates; general economic conditions; the legislative/regulatory climate; monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System; the quality or composition of the loan and/or investment portfolios; demand for loan products; deposit flows; competition; demand for financial services in our market area; and accounting principles, policies and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements contained herein. Bankshares bases its forward-looking statements on management’s beliefs and assumptions based on information available as of the date of this report. You should not place undue reliance on such statements, because the assumptions, beliefs, expectations and projections about future events on which they are based may, and often do, differ materially from actual results. We undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Company Overview

Pinnacle Bankshares Corporation, a Virginia corporation (Bankshares), was organized in 1997 and is registered as a bank holding company under the Bank Holding Company Act of 1956, as amended. Bankshares is headquartered in Altavista, Virginia. Bankshares conducts all of its business activities through the branch offices of its wholly owned subsidiary bank, The First National Bank of Altavista (the Bank). Bankshares exists primarily for the purpose of holding the stock of its subsidiary, the Bank, and of such other subsidiaries as it may acquire or establish.

The First National Bank of Altavista currently maintains a total of eight offices to serve its customers. The Main Office and Vista Branch are located in the Town of Altavista, the Airport Branch and Timberlake Branch in Campbell County, the Old Forest Road Branch in the City of Lynchburg, the Forest Branch in Bedford County, the Amherst Branch in the Town of Amherst and a Loan Production Office in Franklin County at Smith Mountain Lake. The Bank also maintains an administrative and training facility in the Wyndhurst section of the City of Lynchburg.

A total of one-hundred full and part-time staff members serve the Bank’s customers.

With an emphasis on personal service, the Bank today offers a broad range of commercial and retail banking products and services including checking, savings and time deposits, individual retirement accounts, merchant bankcard processing, residential and commercial mortgages, home equity loans, consumer installment loans, agricultural loans, investment loans, small business loans, commercial lines of credit and letters of credit. The Bank also offers a full range of investment, insurance and annuity products through its association with BI Investment Group, and Banker’s Insurance, LLC. The Bank has two wholly-owned subsidiaries: FNB Property Corp., which holds title to Bank premises real estate; and First Properties, Inc., which holds title to other real estate owned from foreclosures.

7

The following discussion supplements and provides information about the major components of the results of operations and financial condition, liquidity and capital resources of Bankshares and its subsidiary (collectively the Company). This discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and accompanying notes.

Executive Summary

The Company serves a trade area consisting primarily of Campbell County, northern Pittsylvania County, eastern Bedford County, northern Franklin County, Amherst County and the city of Lynchburg from facilities located in the town of Altavista and the city of Lynchburg, Virginia. In addition, in June 1999 the Company opened the Airport facility, located just outside the Lynchburg city limits. In August 2000, the Company opened the Old Forest Road facility, located on Old Forest Road in Lynchburg, and the Brookville Plaza facility, located on Timberlake Road in Lynchburg. The Company opened these offices to better serve the Lynchburg and northern Campbell County areas. To better service eastern Bedford County, the Company opened the Forest facility in August 2004 located at the intersection of Perrowville Road and Route 221. In July 2005, the Company opened the Smith Mountain Lake Loan Production Office located on Scruggs Road in Moneta. In May 2006, the Company moved the Brookville Plaza facility on Timberlake Road in Lynchburg to a new full service facility approximately 1.5 miles away on Timberlake Road in Campbell County now referred to as the Timberlake facility. This move was completed to better service our customers by providing drive-through teller lanes and an ATM, safe deposit boxes, night depository and the same good service given at the previous facility. In November 2006, the Company opened the Amherst Office at a temporary site located on Richmond Highway in Amherst to extend our services to Amherst County and further expand our footprint. The Bank is scheduled to open the permanent Amherst facility on South Main Street in Amherst in March 2008. In January of 2008, the Company acquired a branch site in Rustburg, Virginia located on Village Highway in the Rustburg Marketplace Shopping Center which will further increase our presence in Campbell County in the future. The Company is currently developing site and building plans in anticipation of beginning construction of a facility by mid-year 2008. The Company operates in a well-diversified industrial economic region that does not depend upon one or a few types of commerce.

The Company earns revenues on the interest margin between the interest it charges on loans it extends to customers and interest received on the Company’s securities portfolio net of the interest it pays on deposits to customers. The Company also earns revenues on service charges on deposit and loan products, gains on securities that are called or sold, fees from origination of mortgages, and other noninterest income items including but not limited to overdraft fees, commissions from investment, insurance and annuity sales, safe deposit box rentals, and automated teller machine surcharges. The Company’s revenue generating activities and related expenses are outlined in the consolidated statements of income and consolidated statements of changes in stockholders’ equity and comprehensive income and accompanying notes and in “Results of Operations” below.

The Company generates cash through its operating, investing and financing activities. The generation of cash flows is outlined more fully in the consolidated statements of cash flows and accompanying notes and in “Liquidity and Asset/Liability Management” below.

The Company’s balance sheet experienced strong growth in its loan and deposit portfolios and good growth overall in 2007 assisted by growth in the commercial loan portfolio, continued deposit and loan growth at the Forest facility and good initial growth at our new Amherst facility. The overall growth of the Company is outlined in the consolidated balance sheets and accompanying notes and the “Investment Portfolio,” “Loan Portfolio,” “Bank Premises and Equipment,” “Deposits” and “Capital Resources” discussions below.

The Company looks to continue growing in 2008 and plans to research further expansion opportunities. While growing, the Company is continually striving to leverage efficiencies from our reporting and imaging systems. The Company is also striving to make our customers’ lives more convenient by offering innovative products and services and providing many channels to bank with us including Internet banking, Internet bill pay, telephone banking, debit cards and real-time ATMs. The Company will continue to strive to identify and install convenient products and services in 2008 with the goal to better enhance the customer’s experience with the Company.

8

Overview of 2007 and 2006

Total assets at December 31, 2007 were $279,913, up 9.16% from $256,421 at December 31, 2006. The principal components of the Company’s assets at the end of the year were $18,344 in cash and cash equivalents, $19,635 in securities and $232,752 in net loans. During the year ended December 31, 2007, gross loans increased 11.83% or $24,818. The Company’s lending activities are a principal source of income.

Total liabilities at December 31, 2007 were $253,097, up 9.13% from $231,929 at December 31, 2006, with the increase reflective of an increase in total deposits of $21,049 or 9.12%. Noninterest-bearing demand deposits increased $3,613 or 15.29% and represented 10.82% of total deposits at December 31, 2007, compared to 10.24% at December 31, 2006. Savings and NOW accounts increased $5,072 or 7.27% and represented 29.73% of total deposits at December 31, 2007, compared to 30.24% at December 31, 2006. Time deposits increased $12,364 or 9.00% at December 31, 2007 and represented 59.45% of total deposits at December 31, 2007, compared to 59.52% at December 31, 2006. The Company’s deposits are provided by individuals and businesses located within the communities served.

Total stockholders’ equity at December 31, 2007 was $26,816 compared to $24,492 at December 31, 2006.

The Company had net income of $2,600 for the year ended December 31, 2007, compared to net income of $2,412 for the year ended December 31, 2006, an increase of 7.79%.

Profitability as measured by the Company’s return on average assets (ROA) was 0.97% in 2007, compared to 1.00% in 2006. Another key indicator of performance, the return on average equity (ROE), was 10.17% for 2007, compared to 10.10% for 2006.

Overview of 2006 and 2005

Total assets at December 31, 2006 were $256,421, up 9.82% from $233,490 at December 31, 2005. The principal components of the Company’s assets at the end of 2006 were $14,586 in cash and cash equivalents, $24,866 in securities and $207,861 in net loans. During the year ended December 31, 2006, gross loans increased 14.71% or $26,907.

Total liabilities at December 31, 2006 were $231,929, up 10.30% from $210,278 at December 31, 2005, with the increase reflective of an increase in total deposits of $21,571 or 10.31%. Noninterest-bearing demand deposits increased $1,717 or 7.84% and represented 10.24% of total deposits at December 31, 2006, compared to 10.47% at December 31, 2005. Savings and NOW accounts increased $5,137 or 7.94% and represented 30.24% of total deposits at December 31, 2006, compared to 30.90% at December 31, 2005. Time deposits increased $14,717 or 12.00% at December 31, 2006 and represented 59.52% of total deposits at December 31, 2006, compared to 58.63% at December 31, 2005.

Total stockholders’ equity at December 31, 2006 was $24,492 compared to $23,212 at December 31, 2005.

The Company had net income of $2,412 for the year ended December 31, 2006, compared to net income of $2,107 for the year ended December 31, 2005, an increase of 14.48%.

Profitability as measured by the Company’s return on average assets (ROA) was 1.00% in 2006, compared to 0.94% in 2005. Another key indicator of performance, the return on average equity (ROE), was 10.10% for 2006, compared to 9.29% for 2005.

9

Results of Operations

Net Interest Income. Net interest income represents the principal source of earnings for the Company. Net interest income is the amount by which interest and fees generated from loans, securities and other interest-earning assets exceed the interest expense associated with funding those assets. Changes in the amounts and mix of interest-earning assets and interest-bearing liabilities, as well as their respective yields and rates, have a significant impact on the level of net interest income. Changes in the interest rate environment and the Company’s cost of funds also affect net interest income.

The net interest spread decreased to 3.44% for the year ended December 31, 2007 from 3.56% for the year ended December 31, 2006. Net interest income was $10,181 ($10,345 on a tax-equivalent basis) for the year ended December 31, 2007, compared to $9,192 ($9,334 on a tax-equivalent basis) for the year ended December 31, 2006, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2007, our loans repriced at higher rates less rapidly than did our deposits, causing our interest rate spread to decrease. The Bank’s yield on interest-earning assets for the year ended December 31, 2007 was 0.34% higher than the year ended December 31, 2006 due to lower yielding assets being replaced by higher yielding ones in 2007. The Bank’s cost of funds rate on interest-bearing liabilities in 2007 was 0.46% higher compared to 2006.

The net interest spread increased to 3.56% for the year ended December 31, 2006 from 3.43% for the year ended December 31, 2005. Net interest income was $9,192 ($9,334 on a tax-equivalent basis) for the year ended December 31, 2006, compared to $7,983 ($8,156 on a tax-equivalent basis) for the year ended December 31, 2005, and is attributable to interest income from loans, federal funds sold and securities exceeding the cost associated with interest paid on deposits and other borrowings. In 2006, our loans repriced at higher rates more rapidly than did our deposits, causing our interest rate spread to increase. The Bank’s yield on interest-earning assets for the year ended December 31, 2006 was 0.84% higher than the year ended December 31, 2005 due to lower yielding assets being replaced by higher yielding ones in 2006. The Bank’s cost of funds rate on interest-bearing liabilities in 2006 was 0.71% higher compared to 2005.

The Company’s net interest margin decreased in 2007 from 2006 levels. The Company attempts to increase net interest margin by product pricing strategies. Many economic forecasts of interest rates for 2008 predict that interest rates may decrease if the overall economy shows signs of sluggishness. The Company expects its net interest margin to decline in 2008 from the precipitous cuts in interest rates that have occurred in January of 2008 plus the expectation that rates will decline further. While there is no guarantee of how rates may change in 2008, the Company will strive to price products that are competitive in the market, allow for growth and strive to maintain the net interest margin as much as possible. The Company also continues to strive to find new sources of noninterest income to combat the effects of volatility in the interest rate environment.

The following table presents the major categories of interest-earning assets, interest-earning liabilities and stockholders’ equity with corresponding average balances, related interest income or interest expense and resulting yield and rates for the periods indicated.

10

ANALYSIS OF NET INTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans (2)(3) | | $ | 222,412 | | | 16,748 | | 7.53 | % | | 194,819 | | | 13,979 | | 7.18 | % | | 171,388 | | | 10,847 | | 6.33 | % |

Investment securities: | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxable | | | 17,178 | | | 831 | | 4.84 | % | | 20,111 | | | 988 | | 4.91 | % | | 23,540 | | | 1,150 | | 4.89 | % |

Tax-exempt (4) | | | 5,910 | | | 386 | | 6.53 | % | | 6,555 | | | 419 | | 6.39 | % | | 8,501 | | | 577 | | 6.79 | % |

Interest-earning deposits | | | 87 | | | 4 | | 4.60 | % | | 91 | | | 5 | | 5.49 | % | | 205 | | | 6 | | 2.93 | % |

Federal funds sold | | | 11,496 | | | 554 | | 4.82 | % | | 7,695 | | | 368 | | 4.78 | % | | 9,227 | | | 263 | | 2.85 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-earning assets | | | 257,083 | | | 18,523 | | 7.21 | % | | 229,271 | | | 15,759 | | 6.87 | % | | 212,861 | | | 12,843 | | 6.03 | % |

Other assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses | | | (1,802 | ) | | | | | | | (1,638 | ) | | | | | | | (1,556 | ) | | | | | |

Cash and due from banks | | | 5,132 | | | | | | | | 4,929 | | | | | | | | 6,115 | | | | | | |

Other assets, net | | | 7,792 | | | | | | | | 8,367 | | | | | | | | 7,691 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 268,205 | | | | | | | | 240,929 | | | | | | | | 225,111 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Years ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | | | Average

balance(1) | | | Interest

income/

expense | | Rate

earned/

paid | |

Liabilities and Stockholders’ equity | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings and NOW | | $ | 73,171 | | | 1,403 | | 1.92 | % | | 66,666 | | | 1,048 | | 1.57 | % | | 63,374 | | | 549 | | 0.87 | % |

Time | | | 143,769 | | | 6,771 | | 4.71 | % | | 127,185 | | | 5,367 | | 4.22 | % | | 116,895 | | | 4,119 | | 3.52 | % |

Other borrowings | | | 60 | | | 4 | | 6.67 | % | | 158 | | | 10 | | 6.33 | % | | 260 | | | 16 | | 6.15 | % |

Federal funds purchased | | | — | | | — | | | | | — | | | — | | — | | | 75 | | | 3 | | 4.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 217,000 | | | 8,178 | | 3.77 | % | | 194,009 | | | 6,425 | | 3.31 | % | | 180,604 | | | 4,687 | | 2.60 | % |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | | 24,631 | | | | | | | | 22,008 | | | | | | | | 21,169 | | | | | | |

Other liabilities | | | 1,240 | | | | | | | | 1,054 | | | | | | | | 662 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 242,871 | | | | | | | | 217,071 | | | | | | | | 202,435 | | | | | | |

Stockholders’ equity | | | 25,334 | | | | | | | | 23,858 | | | | | | | | 22,676 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 268,205 | | | | | | | | 240,929 | | | | | | | | 225,111 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | | | | 10,345 | | | | | | | | 9,334 | | | | | | | | 8,156 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin (5) | | | | | | | | 4.02 | % | | | | | | | 4.05 | % | | | | | | | 3.83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest spread (6) | | | | | | | | 3.44 | % | | | | | | | 3.56 | % | | | | | | | 3.43 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Averages are daily averages. |

| (2) | Loan interest income includes amortization of loan fees of $23 in 2007, amortization of loan fees of $53 in 2006 and accretion of loan fees of $45 in 2005. |

11

| (3) | For the purpose of these computations, non-accrual loans are included in average loans. |

| (4) | Tax-exempt income from investment securities is presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate for 2007, 2006 and 2005. |

| (5) | The net interest margin is calculated by dividing net interest income by average total interest-earning assets. |

| (6) | The net interest spread is calculated by subtracting the interest rate paid on interest-bearing liabilities from the interest rate earned on interest-earning assets. |

As discussed above, the Company’s net interest income is affected by the change in the amounts and mix of interest-earning assets and interest-bearing liabilities, referred to as “volume change,” as well as by changes in yields earned on interest-earning assets and rates paid on deposits and other borrowed funds, referred to as “rate change.” The following table presents, for the periods indicated, a summary of changes in interest income and interest expense for the major categories of interest-earning assets and interest-bearing liabilities and the amounts of change attributable to variations in volumes and rates.

RATE/VOLUME ANALYSIS

| | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2007 compared to 2006

Increase (decrease) | | | 2006 compared to 2005

Increase (decrease) | |

| | | Volume | | | Rate | | | Net | | | Volume | | | Rate | | | Net | |

Interest earned on interest-earning assets: | | | | | | | | | | | | | | | | | | | |

Loans (1) | | $ | 1,986 | | | 783 | | | 2,769 | | | 1,601 | | | 1,531 | | | 3,132 | |

Investment securities: | | | | | | | | | | | | | | | | | | | |

Taxable | | | (177 | ) | | 20 | | | (157 | ) | | (129 | ) | | (32 | ) | | (161 | ) |

Tax-exempt (2) | | | (50 | ) | | 17 | | | (33 | ) | | (126 | ) | | (32 | ) | | (158 | ) |

Interest-earning deposits | | | — | | | (1 | ) | | (1 | ) | | 2 | | | (3 | ) | | (1 | ) |

Federal funds sold | | | 182 | | | 4 | | | 186 | | | (34 | ) | | 138 | | | 104 | |

| | | | | | | | | | | | | | | | | | | |

Total interest earned on interest-earning assets | | | 1,941 | | | 823 | | | 2,764 | | | 1,314 | | | 1,602 | | | 2,916 | |

| | | | | | | | | | | | | | | | | | | |

Interest paid on interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Savings and NOW | | | 70 | | | 285 | | | 355 | | | 30 | | | 469 | | | 499 | |

Time | | | 679 | | | 725 | | | 1,404 | | | 383 | | | 865 | | | 1,248 | |

Federal funds purchased | | | — | | | — | | | — | | | (3 | ) | | — | | | (3 | ) |

Other borrowings | | | (7 | ) | | 1 | | | (6 | ) | | (6 | ) | | — | | | (6 | ) |

| | | | | | | | | | | | | | | | | | | |

Total interest paid on interest-bearing liabilities | | | 742 | | | 1,011 | | | 1,753 | | | 404 | | | 1,334 | | | 1,738 | |

| | | | | | | | | | | | | | | | | | | |

Change in net interest income | | $ | 1,199 | | | (188 | ) | | 1,011 | | | 910 | | | 268 | | | 1,178 | |

| | | | | | | | | | | | | | | | | | | |

| (1) | Non-accrual loans are included in the average loan totals used in the calculation of this table. |

| (2) | Tax-exempt income from investment securities is presented on a tax equivalent basis assuming a 34% U.S. Federal tax rate. |

Provision for Loan Losses. The provision for loan losses is based upon the Company’s evaluation of the quality of the loan portfolio, total outstanding and committed loans, previous loan losses and current and anticipated economic conditions. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charges against the allowance for loan losses.

The Company’s allowance for loan losses is typically maintained at a level deemed adequate to provide for known and inherent losses in the loan portfolio. No assurance can be given that unforeseen adverse economic conditions or other circumstances will not result in increased provisions in the future. Additionally, regulatory examiners may require the Company to recognize additions to the allowance based upon their judgment about information available to them at the time of their examinations.

The provisions for loan losses for the years ended December 31, 2007, 2006 and 2005 were $462, $339 and $230, respectively. See “Allowance for Loan Losses” for further discussion.

12

Noninterest Income.Total noninterest income for the year ended December 31, 2007 increased $132, or 5.28% to $2,632 from $2,500 in 2006. The Company’s principal source of noninterest income is service charges and fees on deposit accounts, particularly transaction accounts, fees on sales of mortgage loans, and commissions and fees from investment, insurance, annuity and other bank products. The increase in 2007 is primarily attributable to an increase in service charges on deposits accounts and commissions on products sales. Service charges on deposit accounts increased $55 and commissions on investment product sales increased $39 for the year ended December 31, 2007, compared to 2006.

Total noninterest income for the year ended December 31, 2006 increased $104, or 4.34% to $2,500 from $2,396 in 2005. The increase in 2006 is primarily attributable to an increase in service charges on deposits accounts and commissions on products sales. Service charges on deposit accounts increased $64 and commissions on investment product sales increased $46 for the year ended December 31, 2006, compared to 2005.

Noninterest Expense.Total noninterest expense for the year ended December 31, 2007 increased $699 or 8.93% to $8,524 from $7,825 in 2006. The increase in noninterest expense is attributable to the effect of overall growth of the Company on personnel expenses and fixed asset costs. The Company has added seven new branches and a loan production facility to its operations since June 1999. The $276 increase in other expense is primarily due to an $83 loss on the Company’s investment in Bankers Investments Group, LLC. In December 2007, Bankers Investments Group, LLC, in which the Bank is a member, entered into merger agreement with Infinex Financial Group. The merger is expected to be completed in March 2008. Based upon the approved terms of the merger, the Bank recognized a permanent impairment loss of $83 in its investment in Bankers Investments Group, LLC in December 2007. Other expenses that contributed to the increase in other expense was a $48 expense associated with the sale of a charged-off property in December 2007, a $22 increase in telephone expense, a $13 increase in legal fees and a $22 increase in indirect loan chargebacks.

Total noninterest expense for the year ended December 31, 2006 increased $659 or 9.20% to $7,825 from $7,166 in 2005. The increase in noninterest expense is attributable to the effect of overall growth of the Company on personnel expenses and fixed asset costs. The $108 increase in other expense is primarily due to a $48 increase in consultant expenses, a $7 increase in costs associated with our overdraft privilege program, an $8 increase in legal fees, a $9 increase in fees paid to directors, and a $35 increase in indirect loan chargebacks.

Income Tax Expense. Applicable income taxes on 2007 earnings amounted to $1,227, resulting in an effective tax rate of 32.06% compared to $1,116, or 31.63% in 2006. The effective tax rate for 2007 is higher primarily because the level of tax-exempt interest income for 2007 was lower compared to 2006.

Applicable income taxes on 2006 earnings amounted to $1,116, resulting in an effective tax rate of 31.63% compared to $876, or 29.37% in 2005. The effective tax rate for 2006 is higher primarily because the level of tax-exempt interest income for 2006 was lower compared to 2005.

Liquidity and Asset/Liability Management

Effective asset/liability management includes maintaining adequate liquidity and minimizing the impact of future interest rate changes on net interest income. The responsibility for monitoring the Company’s liquidity and the sensitivity of its interest-earning assets and interest-bearing liabilities lies with the Asset Liability Committee of the Bank which meets at least quarterly to review liquidity and the adequacy of funding sources.

Cash Flows. The Company derives cash flows from its operating, investing and financing activities. Cash flows of the Company are primarily used to fund loans and securities and are provided by the deposits and borrowings of the Company.

The Company’s operating activities for the year ended December 31, 2007 resulted in net cash provided of $3,773, compared to net cash provided from operating activities of $3,218 in 2006. The increase is primarily attributable to the Company’s cash received from net interest income of $10,184, which was $1,020 higher than the net interest received in 2006 as a result of an increase in loan

13

volume and yield received of $2,210. Cash paid for noninterest expenses of $7,747 was $188 lower than 2006 primarily due to a lower pension contribution in 2007. Partially offsetting this was cash received from noninterest income in 2007 that was $71 lower than the noninterest income amount received in 2006. Also, the Company’s cash paid for income taxes totaled $1,019 in 2007 compared to $900 in 2006. Management expects any changes in the Company’s cash provided by operating activities to be partially offset through continued expansion of the Company’s loan origination programs, changes in deposit pricing strategies and continued focus on improving the efficiency of the Company’s operations.

The Company’s cash flows from investing activities for the year ended December 31, 2007 resulted in net cash used of $20,332, compared to net cash used in investing activities of $23,135 in 2006. The decrease is primarily attributable to a $2,012 decrease in cash used to make loans to customers as the Company increased its gross loans by 11.83% from 2006 to 2007 as compared to 14.71% from 2005 to 2006. The Company expects to continue to increase its loan portfolio in 2008. The Company also experienced fewer paydowns and maturities of available-for-sale mortgage-backed securities. The Company expects a slightly lower volume of paydowns in available-for-sale mortgage-backed securities in 2008 due to fewer mortgage-backed securities in the investment portfolio.

Net cash provided by financing activities for the year ended December 31, 2007 resulted in net cash provided of $20,317, compared to net cash provided by financing activities of $20,689 in 2006. The decrease in net cash provided is primarily attributable to the lower net increase in deposits from 2006 to 2007 compared to 2005 to 2006. The Company had success in attracting all different types of deposits to fund the growth in the loan portfolio although the cost of the deposits increased in 2007.

The Company’s operating activities for the year ended December 31, 2006 resulted in net cash provided of $3,218, compared to net cash provided from operating activities of $2,711 in 2005. The increase is primarily attributable to the Company’s cash received from net interest income of $9,164, which was $1,116 higher than the net interest received in 2005 as a result of an increase in loan volume and yield received of $2,423. Partially offsetting this was cash received from noninterest income in 2006 that was $34 lower than the noninterest income amount received in 2005 and cash paid for noninterest expenses of $7,935 that was $1,299 higher than 2005 primarily due to the Company’s increased personnel and fixed asset expenses associated with its continued growth. Also, the Company’s cash paid for income taxes totaled $900 in 2006 compared to $688 in 2005.

The Company’s cash flows from investing activities for the year ended December 31, 2006 resulted in net cash used of $23,135, compared to net cash used in investing activities of $18,044 in 2005. The increase is primarily attributable to a $4,788 increase in cash used to make loans to customers as the Company increased its gross loans by 14.71%. The Company also experienced fewer paydowns and maturities of available-for-sale mortgage-backed securities due to a rising interest rate environment in 2006.

Net cash provided by financing activities for the year ended December 31, 2006 resulted in net cash provided of $20,689, compared to net cash provided by financing activities of $11,811 in 2005. The increase in net cash provided is primarily attributable to the net increase in deposits. The Company had success in attracting all different types of deposits to fund the growth in the loan portfolio although the cost of the deposits increased in 2006.

Liquidity. Liquidity measures the ability of the Company to meet its maturing obligations and existing commitments, to withstand fluctuations in deposit levels, to fund its operations, and to provide for customers’ credit needs. Liquidity represents an institution’s ability to meet present and future financial obligations through either the sale or maturity of existing assets or the acquisition of additional funds from alternative funding sources.

The Company’s liquidity is provided by cash and due from banks, federal funds sold, investments available-for-sale, managing investment maturities, interest-earning deposits in other financial institutions and loan repayments. The Company’s ratio of liquid

14

assets to deposits and short-term borrowings was 13.66% as of December 31, 2007 as compared to 14.89% as of December 31, 2006. The Company sells excess funds as overnight federal funds sold to provide an immediate source of liquidity. Federal funds sold for the year ended December 31, 2007 was $11,562 as compared to $8,638 for the year ended December 31, 2006. The increase in federal funds sold in 2007 was primarily related to the net increase in deposits and paydowns and maturities of securities in 2007. Cash and due from banks of $6,782 as of December 31, 2007 was $834 higher when compared to December 31, 2006.

The level of deposits may fluctuate significantly due to seasonal business cycles of depository customers. Levels of deposits are also affected by convenience of branch locations and ATMs to the customer, the rates offered on interest-bearing deposits and the attractiveness of noninterest-bearing deposit offerings compared with the competition. Similarly, the level of demand for loans may vary significantly and at any given time may increase or decrease substantially. However, unlike the level of deposits, management has more direct control over lending activities and maintains the level of those activities according to the amounts of available funds. Loan demand may be affected by the overall health of the local economy, loan rates compared with the competition and other loan features offered by the Company.

As a result of the Company’s management of liquid assets and its ability to generate liquidity through alternative funding sources, management believes that the Company maintains overall liquidity that is sufficient to satisfy its depositors’ requirements and to meet customers’ credit needs. Additional sources of liquidity available to the Company include its capacity to borrow funds through correspondent banks and the Federal Home Loan Bank.

The Company obtains sources of funds through growth in deposits, scheduled payments and prepayments from the loan and investment portfolio, retained earnings growth, and may purchase or borrow funds through the Federal Reserve’s discount window. The Company also has sources of liquidity through three correspondent banking relationships. The Company uses its funds to fund loan and investment growth. Excess funds are sold daily to other institutions. The Company had one borrowing with the Federal Home Loan Bank during 2007 with an interest rate of 6.13%. The final principal payment of the borrowing was made in December 2007.

Interest Rates

While no single measure can completely identify the impact of changes in interest rates on net interest income, one gauge of interest rate sensitivity is to measure, over a variety of time periods, the differences in the amounts of the Company’s rate-sensitive assets and rate-sensitive liabilities. These differences or “gaps” provide an indication of the extent to which net interest income may be affected by future changes in interest rates. A “positive gap” exists when rate-sensitive assets exceed rate-sensitive liabilities and indicates that a greater volume of assets than liabilities will reprice during a given period. This mismatch may enhance earnings in a rising interest rate environment and may inhibit earnings in a declining interest rate environment. Conversely, when rate-sensitive liabilities exceed rate-sensitive assets, referred to as a “negative gap,” it indicates that a greater volume of liabilities than assets will reprice during the period. In this case, a rising interest rate environment may inhibit earnings and a declining interest rate environment may enhance earnings. The cumulative one-year gap as of December 31, 2007 was $(15,340), representing 5.48% of total assets. This negative gap falls within the parameters set by the Company.

The following table illustrates the Company’s interest rate sensitivity gap position at December 31, 2007.

| | | | | | | | | | | |

| | | 1 year | | | 1-3 years | | | 3-5 years | | 5-15 years |

ASSET/(LIABILITY): | | | | | | | | | | | |

Cumulative interest rate sensitivity gap | | $ | (15,340 | ) | | (21,220 | ) | | 16,263 | | 38,781 |

15

As of December 31, 2007, the Company was liability-sensitive in periods from one to three years and was asset-sensitive beyond three years. The foregoing table does not necessarily indicate the impact of general interest rate movements on the Company’s net interest yield, because the repricing of various categories of assets and liabilities is discretionary and is subject to competition and other pressures. As a result, various assets and liabilities indicated as repricing within the same period may in fact price at different times and at different rate levels. Management attempts to mitigate the impact of changing interest rates in several ways, one of which is to manage its interest rate-sensitivity gap. In addition to managing its asset/liability position, the Company has taken steps to mitigate the impact of changing interest rates by generating noninterest income through service charges, and offering products that are not interest rate-sensitive.

Effects of Inflation

The effect of changing prices on financial institutions is typically different from other industries as the Company’s assets and liabilities are monetary in nature. Interest rates are significantly impacted by inflation, but neither the timing nor the magnitude of the changes is directly related to price level indices. Impacts of inflation on interest rates, loan demand and deposits are not reflected in the consolidated financial statements.

Investment Portfolio

The Company’s investment portfolio is used primarily for investment income and secondarily for liquidity purposes. The Company invests funds not used for capital expenditures or lending purposes in securities of the U.S. Government and its agencies, mortgage-backed securities, and taxable and tax-exempt municipal bonds, corporate securities or certificates of deposit. Obligations of the U.S. Government and its agencies include treasury notes and callable or noncallable agency bonds. The mortgage-backed securities include mortgage-backed security pools that are diverse as to interest rates and guarantors. The Company has not invested in derivatives or other high-risk type securities.

Investment securities available-for-sale as of December 31, 2007 were $15,460, a decrease of $3,761 or 19.57% from $19,221 as of December 31, 2006. Investment securities held-to-maturity decreased to $4,175 as of December 31, 2007 from $5,645 as of December 31, 2006, a decrease of $1,470 or 26.04%.

The following table presents the composition of the Company’s investment portfolios as of the dates indicated.

| | | | | | | | | | | | | |

| | | December 31, |

| | | 2007 | | 2006 | | 2005 |

| | | Amortized

costs | | Fair

values | | Amortized

costs | | Fair

values | | Amortized

costs | | Fair

values |

Available-for-Sale | | | | | | | | | | | | | |

U.S. Treasury securities and obligations of U.S. Government corporations and agencies | | $ | 2,647 | | 2,657 | | 4,889 | | 4,843 | | 3,985 | | 3,921 |

Obligations of states and political subdivisions | | | 6,142 | | 6,178 | | 6,033 | | 6,025 | | 6,922 | | 6,934 |

Corporate securities | | | 2,498 | | 2,474 | | 3,502 | | 3,451 | | 6,055 | | 5,985 |

Mortgage-backed securities – government | | | 4,132 | | 4,101 | | 4,908 | | 4,852 | | 5,494 | | 5,461 |

Other securities | | | 50 | | 50 | | 50 | | 50 | | 50 | | 50 |

| | | | | | | | | | | | | |

Total available-for-sale | | $ | 15,469 | | 15,460 | | 19,382 | | 19,221 | | 22,506 | | 22,351 |

| | | | | | | | | | | | | |

| |

| | | December 31, |

| | | 2007 | | 2006 | | 2005 |

| | | Amortized

costs | | Fair

values | | Amortized

costs | | Fair

values | | Amortized

costs | | Fair

values |

Held-to-Maturity | | | | | | | | | | | | | |

Obligations of states and political subdivisions | | $ | 4,175 | | 4,213 | | 5,645 | | 5,673 | | 6,910 | | 6,982 |

| | | | | | | | | | | | | |

Total held-to-maturity | | $ | 4,175 | | 4,213 | | 5,645 | | 5,673 | | 6,910 | | 6,982 |

| | | | | | | | | | | | | |

16

The following table presents the maturity distribution based on fair values and amortized costs of the investment portfolios as of the dates indicated.

INVESTMENT PORTFOLIO – MATURITY DISTRIBUTION

| | | | | | | | |

| | | December 31, 2007 | |

| | | Amortized

Costs | | Fair

Values | | Yield | |

Available-for-Sale | | | | | | | | |

U.S. Treasury securities and obligations of U.S. Government corporations: | | | | | | | | |

Within one year | | $ | 1,000 | | 999 | | 3.99 | % |

After one but within five years | | | 1,647 | | 1,658 | | 4.55 | % |

Obligations of states and political subdivisions (1): | | | | | | | | |

Within one year | | | 1,130 | | 1,130 | | 4.41 | % |

After one but within five years | | | 3,502 | | 3,523 | | 4.65 | % |

After five years through ten years | | | 1,010 | | 1,026 | | 4.44 | % |

After ten years | | | 500 | | 499 | | 3.40 | % |

Corporate securities: | | | | | | | | |

Within one year | | | 1,500 | | 1,496 | | 4.39 | % |

After one but within five years | | | 998 | | 978 | | 4.23 | % |

Mortgage-backed securities – government | | | 4,132 | | 4,101 | | 5.12 | % |

Other securities (2) | | | 50 | | 50 | | — | |

| | | | | | | | |

Total available-for-sale | | $ | 15,469 | | 15,460 | | | |

| | | | | | | | |

Held-to-Maturity | | | | | | | | |

Obligations of states and political subdivisions (1): | | | | | | | | |

Within one year | | | 1,670 | | 1,670 | | 4.18 | % |

After one but within five years | | | 2,204 | | 2,245 | | 4.77 | % |

After five years through ten years | | | 301 | | 298 | | 3.45 | % |

| | | | | | | | |

Total held-to-maturity | | $ | 4,175 | | 4,213 | | | |

| | | | | | | | |

| (1) | Obligations of states and political subdivisions include yields of tax–exempt securities presented on a tax-equivalent basis assuming a 34% U.S. Federal tax rate. |

| (2) | Equity securities are assumed to have a life greater than ten years. |

Loan Portfolio

The Company’s net loans were $232,752 as of December 31, 2007, an increase of $24,891 or 11.97% from $207,861 as of December 31, 2006. This increase resulted primarily from increased volume of commercial loan originations during 2007 and loan volume from our loan production facility. The Company’s ratio of net loans to total deposits was 92.41% as of December 31, 2007 compared to 90.05% as of December 31, 2006.

Typically, the Company maintains a ratio of loans to deposits of between 70% and 90%. The loan portfolio primarily consists of commercial, real estate (including real estate term loans, construction loans and other loans secured by real estate), and loans to individuals for household, family and other consumer expenditures. However, the Company adjusts its mix of lending and the terms of its loan programs according to market conditions and other factors. The Company’s loans are typically made to businesses and individuals located within the Company’s market area, most of whom have account relationships with the Bank. There is no concentration of loans exceeding 10% of total loans that is not disclosed in the categories presented below. The Company has not made any loans to any foreign entities including governments, banks, businesses or individuals. Commercial and construction loans in the Company’s portfolio are primarily variable rate loans and have little interest rate risk.

17

The following table presents the composition of the Company’s loan portfolio as of the dates indicated.

LOAN PORTFOLIO

| | | | | | | | | | | | | | | | |

| | | December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Real estate loans: | | | | | | | | | | | | | | | | |

Residential | | $ | 75,579 | | | 68,540 | | | 55,936 | | | 52,470 | | | 52,264 | |

Other | | | 92,102 | | | 72,797 | | | 53,039 | | | 43,877 | | | 34,697 | |

Loans to individuals for household, family and other consumer expenditures | | | 46,834 | | | 46,360 | | | 44,369 | | | 41,449 | | | 44,367 | |

Commercial and industrial loans | | | 19,909 | | | 21,694 | | | 28,659 | | | 21,680 | | | 17,635 | |

All other loans | | | 240 | | | 454 | | | 935 | | | 992 | | | 533 | |

| | | | | | | | | | | | | | | | |

Total loans, gross | | | 234,664 | | | 209,845 | | | 182,938 | | | 160,468 | | | 149,496 | |

Less unearned income and fees | | | (192 | ) | | (214 | ) | | (162 | ) | | (120 | ) | | (85 | ) |

| | | | | | | | | | | | | | | | |

Loans, net of unearned income and fees | | | 234,472 | | | 209,631 | | | 182,776 | | | 160,348 | | | 149,411 | |

Less allowance for loan losses | | | (1,720 | ) | | (1,770 | ) | | (1,508 | ) | | (1,502 | ) | | (1,528 | ) |

| | | | | | | | | | | | | | | | |

Loans, net | | $ | 232,752 | | | 207,861 | | | 181,268 | | | 158,846 | | | 147,883 | |

| | | | | | | | | | | | | | | | |

Commercial Loans. Commercial and industrial loans accounted for 8.48% of the Company’s loan portfolio as of December 31, 2007 compared to 15.62% as of December 31, 2006. Such loans are generally made to provide operating lines of credit, to finance the purchase of inventory or equipment, and for other business purposes. Commercial loans are primarily made at rates that adjust with changes in the prevailing prime interest rate, are generally made for a maximum term of five years (unless they are term loans), and generally require interest payments to be made monthly. The creditworthiness of these borrowers is reviewed, analyzed and evaluated on a periodic basis. Most commercial loans are collateralized with business assets such as accounts receivable, inventory and equipment. Even with substantial collateralization such as all of the assets of the business and personal guarantees, commercial lending involves considerable risk of loss in the event of a business downturn or failure of the business. Commercial loan volume has fallen from 2006 to 2007 as the Company has focused on commercial real estate and construction lending in 2008.

Real Estate Loans.Real estate loans accounted for 71.46% of the Company’s loan portfolio as of December 31, 2007 compared to 62.08% as of December 31, 2006. The Company makes commercial and industrial real estate term loans that are typically secured by a first deed of trust. As of December 31, 2007, 42.33% of the real estate loans were secured by 1-4 family residential properties compared to 50.52% at December 31, 2006. As of December 31, 2007, 26.47% of total real estate loans were construction loans compared to 14.22% at December 31, 2006. Real estate lending involves risk elements when there is lack of timely payment and/or a decline in the value of the collateral. The current local market in 2007 remained strong with real estate values maintaining value although many areas of the nation experienced decreasing real estate values in 2007. The Company is now seeing evidence of borrowers becoming strained in ability to service loans which may result in impairment of other credits. The Company will continue to monitor the real estate market in 2008 for signs of weakness in the local market.

Installment Loans. Installment loans are represented by loans to individuals for household, family and other consumer expenditures. Installment loans accounted for 19.96% of the Company’s loan portfolio as of December 31, 2007 compared to 22.09% as of December 31, 2006.

Loan Maturity and Interest Rate Sensitivity. The following table presents loan portfolio information related to maturity distribution of commercial and industrial loans and real estate construction loans based on scheduled repayments at December 31, 2007.

18

LOAN MATURITY

| | | | | | | | | |

| | | Due within

one year | | Due one to

five years | | Due after

five years | | Total |

Commercial and industrial loans | | $ | 13,892 | | 5,106 | | 911 | | 19,909 |

Real estate – construction | | | 33,755 | | 8,927 | | 1,706 | | 44,388 |

The following table presents the interest rate sensitivity of commercial and industrial loans and real estate construction loans maturing after one year or longer as of December 31, 2007.

INTEREST RATE SENSITIVITY

| | | |

Fixed interest rates | | $ | 5,503 |

Variable interest rates | | | 514 |

| | | |

Total maturing after one year | | $ | 6,017 |

| | | |

Restructured Loans.The Company had no restructured loans during the years ended December 31, 2007 and 2006.

Nonperforming Assets. Interest on loans is normally accrued from the date a disbursement is made and recognized as income as it is accrued. Generally, the Company reviews any loan on which payment has not been made for 90 days for potential non-accrual. The loan is examined and the collateral is reviewed to determine loss potential. If the loan is placed on non-accrual status, any prior accrued interest that remains unpaid is reversed. Loans on non-accrual status amounted to $634, $255 and $421 as of December 31, 2007, 2006 and 2005, respectively. Interest income that would have been earned on non-accrual loans if they had been current in accordance with their original terms and the recorded interest that was included in income on these loans was not significant for 2007, 2006 or 2005. There were no commitments to lend additional funds to customers whose loans were on non-accrual status at December 31, 2007. No foreclosed property was on hand as of December 31, 2007 and 2006. Foreclosed property as of December 31, 2005 consisted of one property totaling $150.

The following table presents information with respect to the Company’s nonperforming assets and nonaccruing loans 90 days or more past due by type as of the dates indicated.

NONPERFORMING ASSETS

| | | | | | | |

| | | December 31, |

| | | 2007 | | 2006 | | 2005 |

Nonaccrual loans | | $ | 634 | | 255 | | 421 |

Foreclosed properties | | | — | | — | | 150 |

| | | | | | | |

Total nonperforming assets | | $ | 634 | | 255 | | 571 |

| | | | | | | |

Nonperforming assets totaled $634 or 0.27% of total gross loans as of December 31, 2007, compared to $255 or 0.12% as of December 31, 2006 and $571 or 0.31% as of December 31, 2005. The following table presents the balance of accruing loans 90 days or more past due by type as of the dates indicated.

ACCRUING LOANS 90 DAYS OR MORE

PAST DUE BY TYPE

| | | | | | | |

| | | December 31, |

| | | 2007 | | 2006 | | 2005 |

Loans 90 days or more past due by type: | | | | | | | |

Real estate loans | | $ | 149 | | — | | 17 |

Loans to individuals | | | 7 | | 15 | | — |

Commercial loans | | | — | | — | | 51 |

| | | | | | | |

Total accruing loans 90 days or more past due | | $ | 156 | | 15 | | 68 |

| | | | | | | |

19

Allowance for Loan Losses. The Company maintains an allowance for loan losses, which it considers adequate to cover the risk of losses in the loan portfolio. The allowance is based upon management’s ongoing evaluation of the quality of the loan portfolio, total outstanding and committed loans, previous charges against the allowance and current and anticipated economic conditions. The allowance is also subject to regulatory examinations and determinations as to adequacy, which may take into account such factors as the methodology used to calculate the allowance. The Company’s management believes that as of December 31, 2007, 2006 and 2005, the allowance was adequate. The amount of the provision for loan losses is a charge against earnings. Actual loan losses are charged against the allowance for loan losses.

Management evaluates the reasonableness of the allowance for loan losses on a quarterly basis and adjusts the provision as deemed necessary. As of December 31, 2007, the allowance for loan losses totaled $1,720 or 0.73% of total loans, net of unearned income and fees compared to $1,770 or 0.84% of total loans, net of unearned income and fees as of December 31, 2006. The provision for loan losses for the years ended December 31, 2007 and 2006 was $462 and $339, respectively. Net charge-offs for the Company were $512 and $77 for the years ended December 31, 2007 and 2006, respectively. The ratio of net loan charge-offs during the period to average loans outstanding for the period was 0.23% and 0.04% for the years ended December 31, 2007 and 2006, respectively.

As of December 31, 2006, the allowance for loan losses totaled $1,770 or 0.84% of total loans, net of unearned income and fees compared to $1,508 or 0.83% of total loans, net of unearned income and fees as of December 31, 2005. The provision for loan losses for the years ended December 31, 2006 and 2005 was $339 and $230, respectively. Net charge-offs for the Company were $77 and $224 for the years ended December 31, 2006 and 2005, respectively. The ratio of net loan charge-offs during the period to average loans outstanding for the period was 0.04% and 0.13% for the years ended December 31, 2006 and 2005, respectively.

The following table presents charged off loans, provisions for loan losses, recoveries on loans previously charged off, allowance adjustments and the amount of the allowance for the years indicated.

ANALYSIS OF ALLOWANCE FOR LOAN LOSSES

| | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Balance at beginning of year | | $ | 1,770 | | | 1,508 | | | 1,502 | | | 1,528 | | | 1,298 | |

Loan charge-offs: | | | | | | | | | | | | | | | | |

Real estate loans – other | | | — | | | — | | | — | | | — | | | — | |

Real estate loans – commercial | | | (223 | ) | | — | | | — | | | (24 | ) | | — | |

Commercial and industrial loans | | | (137 | ) | | — | | | (66 | ) | | (98 | ) | | — | |

Loans to individuals for household, family and other consumer expenditures | | | (286 | ) | | (206 | ) | | (314 | ) | | (229 | ) | | (367 | ) |

| | | | | | | | | | | | | | | | |

Total loan charge-offs | | | (646 | ) | | (206 | ) | | (380 | ) | | (351 | ) | | (367 | ) |

| | | | | | | | | | | | | | | | |

Loan recoveries: | | | | | | | | | | | | | | | | |

Loans to individuals for household, family and other consumer expenditures | | | 134 | | | 129 | | | 156 | | | 102 | | | 127 | |

| | | | | | | | | | | | | | | | |

Net loan charge-offs | | | (512 | ) | | (77 | ) | | (224 | ) | | (249 | ) | | (240 | ) |

Provisions for loan losses | | | 462 | | | 339 | | | 230 | | | 223 | | | 470 | |

| | | | | | | | | | | | | | | | |

Balance at end of year | | $ | 1,720 | | | 1,770 | | | 1,508 | | | 1,502 | | | 1,528 | |

| | | | | | | | | | | | | | | | |

The primary risk elements considered by management with respect to each installment and conventional real estate loan are lack of timely payment and the value of the collateral. The primary risk elements with respect to real estate construction loans are fluctuations in real estate values in the Company’s market areas, inaccurate estimates of construction costs, fluctuations in interest

20

rates, the availability of conventional financing, the demand for housing in the Company’s market area and general economic conditions. The primary risk elements with respect to commercial loans are the financial condition of the borrower, general economic conditions in the Company’s market area, the sufficiency of collateral, the timeliness of payment and, with respect to adjustable rate loans, interest rate fluctuations. Management has a policy of requesting and reviewing annual financial statements from its commercial loan customers and periodically reviews the existence of collateral and its value. Management also has a reporting system that monitors all past due loans and has adopted policies to pursue its creditor’s rights in order to preserve the Company’s position.

Loans are charged against the allowance when, in management’s opinion, they are deemed uncollectible, although the Bank continues to aggressively pursue collection. The Company considers a number of factors to determine the need for and timing of charge-offs including the following: whenever any commercial loan becomes past due for 120 days for any scheduled principal or interest payment and there is no recommendation to place the loan in non-accrual status; whenever foreclosure on real estate collateral or liquidation of other collateral does not result in full payment of the obligation and the deficiency or some portion thereof is deemed uncollectible, the uncollectible portion shall be charged-off; whenever any installment loan becomes past due for 120 days and has not been placed in non-accrual status; whenever any repossessed vehicle remains unsold for 60 days after repossession; whenever a bankruptcy notice is received on any installment loan and review of the facts results in an assessment that all or most of the balance will not be collected, the loan will be placed in non-accrual status; whenever a bankruptcy notice is received on a small, unsecured, revolving installment account; and whenever any other small, unsecured, revolving installment account becomes past due for 180 days.

Although management believes that the allowance for loan losses is adequate to absorb losses as they arise, there can be no assurance that (i) the Company will not sustain losses in any given period which could be substantial in relation to the size of the allowance for loan losses, (ii) the Company’s level of nonperforming loans will not increase, (iii) the Company will not be required to make significant additional provisions to its allowance for loan losses, or (iv) the level of net charge-offs will not increase and possibly exceed applicable reserves.

The following table presents the allocation of the allowance for loan losses as of the dates indicated. Notwithstanding these allocations, the entire allowance for loan losses is available to absorb charge-offs in any category of loans.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2007 | | | December 31, 2006 | | | December 31, 2005 | | | December 31, 2004 | | | December 31, 2003 | |

| | | Allowance

for loan

losses | | Percent of

loans in each

category to

total loans | | | Allowance

for loan

losses | | Percent of

loans in each

category to

total loans | | | Allowance

for loan

losses | | Percent of

loans in each

category to

total loans | | | Allowance

for loan

losses | | Percent of

loans in each

category to

total loans | | | Allowance

for loan

losses | | Percent of

loans in each

category to

total loans | |

Real estate loans: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential | | $ | 57 | | 32.21 | % | | 17 | | 24.72 | % | | 75 | | 30.58 | % | | 20 | | 32.69 | % | | 71 | | 34.96 | % |

Other | | | 970 | | 39.25 | % | | 282 | | 36.75 | % | | 173 | | 28.99 | % | | 107 | | 27.34 | % | | 366 | | 23.21 | % |

Loans to individuals for households, family and other consumer expenditures | | | 416 | | 19.96 | % | | 502 | | 22.09 | % | | 417 | | 24.25 | % | | 333 | | 25.84 | % | | 333 | | 29.68 | % |

Commercial and industrial loans | | | 226 | | 8.48 | % | | 509 | | 16.22 | % | | 730 | | 15.66 | % | | 951 | | 13.52 | % | | 727 | | 11.79 | % |

All other loans | | | — | | 0.10 | % | | — | | 0.22 | % | | — | | 0.52 | % | | 43 | | 0.61 | % | | — | | 0.36 | % |

Unallocated | | | 51 | | — | | | 460 | | — | | | 113 | | — | | | 48 | | — | | | 31 | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 1,720 | | 100.00 | % | | 1,770 | | 100.00 | % | | 1,508 | | 100.00 | % | | 1,502 | | 100.00 | % | | 1,528 | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

21

While consumer related charge-offs represent a majority of total charge-offs over the last three years, they are of a low dollar amount on an individual loan basis. Commercial loans on the other hand, though few in terms of the number of charge-offs over the past two years, have the potential to greatly impact the allowance if a particular loan defaults. The Bank’s loan review team uses the principles of Statement of Financial Accounting Standard (SFAS) No. 5,Accounting for Contingencies and SFAS No. 114,Accounting by Creditors for Impairment of a Loan, an amendment of FASB Statements No. 5 and 15, when determining the allowance for loan losses between loan categories. The determination of a loan category’s allowance is based on the probability of a loan’s default and the probability of loss in the event of a default.

Credit Risk Management