Published February 20, 2018 2018 – 2021 Exhibit 99.3

Forward-Looking Statements Forward-Looking Statements: This presentation includes forward-looking statements based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,” "project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the ability to experience growth in the Regulated Distribution and Regulated Transmission segments and the effectiveness of our strategy to transition to a fully regulated business profile; the accomplishment of our regulatory and operational goals in connection with our transmission and distribution investment plans, including, but not limited to, our planned transition to forward-looking formula rates; changes in assumptions regarding economic conditions within our territories, assessment of the reliability of our transmission system, or the availability of capital or other resources supporting identified transmission investment opportunities; the ability to accomplish or realize anticipated benefits from strategic and financial goals, including, but not limited to, the ability to continue to reduce costs and to successfully execute our financial plans designed to improve our credit metrics and strengthen our balance sheet; success of legislative and regulatory solutions for generation assets that recognize their environmental or energy security benefits; the risks and uncertainties associated with the lack of viable alternative strategies regarding the Competitive Energy Services (CES) segment, thereby causing FirstEnergy Solutions Corp. (FES) to restructure its substantial debt and other financial obligations with its creditors or seek protection under United States bankruptcy laws (which filing would include FirstEnergy Nuclear Operating Company (FENOC)) and the losses, liabilities and claims arising from such bankruptcy proceeding, including any obligations at FirstEnergy Corp.; the risks and uncertainties at the CES segment, including FES, its subsidiaries, and FENOC, related to wholesale energy and capacity markets, and the viability and/or success of strategic business alternatives, such as pending and potential CES generating unit asset sales or the potential need to deactivate additional generating units, which could result in further substantial write-downs and impairments of assets; the substantial uncertainty as to FES’ ability to continue as a going concern and substantial risk that it may be necessary for FES and FENOC to seek protection under United States bankruptcy laws; the risks and uncertainties associated with litigation, arbitration, mediation and like proceedings, including, but not limited to, any such proceedings related to vendor commitments, such as long-term fuel and transportation agreements; the uncertainties associated with the deactivation of older regulated and competitive units, including the impact on vendor commitments, such as long-term fuel and transportation agreements, and as it relates to the reliability of the transmission grid, the timing thereof; the impact of other future changes to the operational status or availability of our generating units and any capacity performance charges associated with unit unavailability; changing energy, capacity and commodity market prices including, but not limited to, coal, natural gas and oil prices, and their availability and impact on margins; costs being higher than anticipated and the success of our policies to control costs and to mitigate low energy, capacity and market prices; replacement power costs being higher than anticipated or not fully hedged; our ability to improve electric commodity margins and the impact of, among other factors, the increased cost of fuel and fuel transportation on such margins; the uncertainty of the timing and amounts of the capital expenditures that may arise in connection with any litigation, including New Source Review litigation, or potential regulatory initiatives or rulemakings (including that such initiatives or rulemakings could result in our decision to deactivate or idle certain generating units); changes in customers' demand for power, including, but not limited to, changes resulting from the implementation of state and federal energy efficiency and peak demand reduction mandates; economic or weather conditions affecting future sales, margins and operations such as a polar vortex or other significant weather events, and all associated regulatory events or actions; changes in national and regional economic conditions affecting us, our subsidiaries and/or our major industrial and commercial customers, and other counterparties with which we do business, including fuel suppliers; the impact of labor disruptions by our unionized workforce; the risks associated with cyber-attacks and other disruptions to our information technology system that may compromise our generation, transmission and/or distribution services and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information regarding our business, employees, shareholders, customers, suppliers, business partners and other individuals in our data centers and on our networks; the impact of the regulatory process and resulting outcomes on the matters at the federal level and in the various states in which we do business including, but not limited to, matters related to rates; the impact of the federal regulatory process on Federal Energy Regulatory Commission (FERC)-regulated entities and transactions, in particular FERC regulation of wholesale energy and capacity markets, including PJM Interconnection, L.L.C. (PJM) markets and FERC-jurisdictional wholesale transactions; FERC regulation of cost-of-service rates; and FERC’s compliance and enforcement activity, including compliance and enforcement activity related to North American Electric Reliability Corporation’s mandatory reliability standards; the uncertainties of various cost recovery and cost allocation issues resulting from American Transmission Systems, Incorporated's realignment into PJM; the ability to comply with applicable state and federal reliability standards and energy efficiency and peak demand reduction mandates; other legislative and regulatory changes, including the federal administration's required review and potential revision of environmental requirements, including, but not limited to, the effects of the United States Environmental Protection Agency’s Clean Power Plan, Coal Combustion Residuals regulations, Cross-State Air Pollution Rule and Mercury and Air Toxics Standards programs, including our estimated costs of compliance, Clean Water Act (CWA) waste water effluent limitations for power plants, and CWA 316(b) water intake regulation; adverse regulatory or legal decisions and outcomes with respect to our nuclear operations (including, but not limited to, the revocation or non-renewal of necessary licenses, approvals or operating permits by the Nuclear Regulatory Commission; issues arising from the indications of cracking in the shield building at Davis-Besse; changing market conditions that could affect the measurement of certain liabilities and the value of assets held in our Nuclear Decommissioning Trusts, pension trusts and other trust funds, and cause us and/or our subsidiaries to make additional contributions sooner, or in amounts that are larger than currently anticipated; the impact of changes to significant accounting policies; the impact of any changes in tax laws or regulations, including the Tax Cuts and Job Act, or adverse tax audit results or rulings; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us and our subsidiaries; further actions that may be taken by credit rating agencies that could negatively affect us and/or our subsidiaries’ access to financing, increase the costs thereof, increase requirements to post additional collateral to support, or accelerate payments under outstanding commodity positions, letters of credit and other financial guarantees, and the impact of these events on the financial condition and liquidity of FirstEnergy Corp. and/or its subsidiaries, specifically FES and its subsidiaries; issues concerning the stability of domestic and foreign financial institutions and counterparties with which we do business; and the risks and other factors discussed from time to time in our United States Securities and Exchange Commission (SEC) filings, and other similar factors. Dividends declared from time to time on FirstEnergy Corp.'s common stock and thereby on FirstEnergy Corp.'s preferred stock, during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.'s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read in conjunction with the other cautionary statements and risks that are included in our filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. These risks, unless otherwise indicated, are presented on a consolidated basis for FirstEnergy; if and to the extent a deconsolidation occurs with respect to certain FirstEnergy companies, the risks described herein may materially change. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. We expressly disclaim any obligation to update or revise, except as required by law, any forward-looking statements contained herein as a result of new information, future events or otherwise. 2Published February 20, 2018

Non-GAAP Financial Matters Published February 20, 2018 3 This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (losses). In addition, Basic Earnings (Loss) Per Share – Operating, calculated on a segment basis, and Regulated operating (non-GAAP) earnings per share are also non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). Operating earnings (losses) and Regulated operating (non-GAAP) earnings per share are not calculated in accordance with GAAP to the extent they exclude the impact of “special items” and, in the case of Regulated operating (non-GAAP) earnings per share, because it excludes the CES segment. Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. The Company’s management cannot estimate on a forward looking basis the impact of these items because these items, which could be significant, are difficult to predict and may be highly variable. Regulated Operating (non-GAAP) earnings per share are calculated based on the regulated distribution and regulated transmission segments, and including the corporate segment, divided by the basic weighted average shares outstanding for the period. Basic Earnings (Loss) Per Share - Operating for each segment is calculated by dividing segment Operating earnings (losses), which exclude special items as discussed above, by the basic weighted average shares outstanding for the period. Management uses non-GAAP financial measures such as Operating earnings (losses) and Regulated operating (non-GAAP earnings) per share to evaluate the company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Basic Earnings (Loss) Per Share - Operating by segment to further evaluate the company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (losses), Regulated operating (non-GAAP earnings) per share, and Basic Earnings (Loss) Per Share – Operating by segment provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the company against its peer group by presenting period-over- period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FirstEnergy has provided quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Refer to slides 26-27.

2018 – 2021 Financial Summary

2018-2021 Financial Plan ■ In January 2018, announced transformational $2.5B equity investment that supports the transition to a fully regulated utility company – Strengthens balance sheet and positions FE for sustained investment-grade credit metrics – Expected to satisfy equity needs through at least year-end 2021 (excluding ~$100M equity annually through the stock investment and employee benefit plans) ■ Created Restructuring Working Group to advise FE management regarding a potential restructuring of FES ■ Enhanced focus on substantial regulated growth investment opportunities – Energizing the Future transmission growth plan – Grid modernization in Ohio – Infrastructure improvement in New Jersey Published February 20, 2018 5 Reposition FirstEnergy as a premier, high-growth pure-play regulated utility

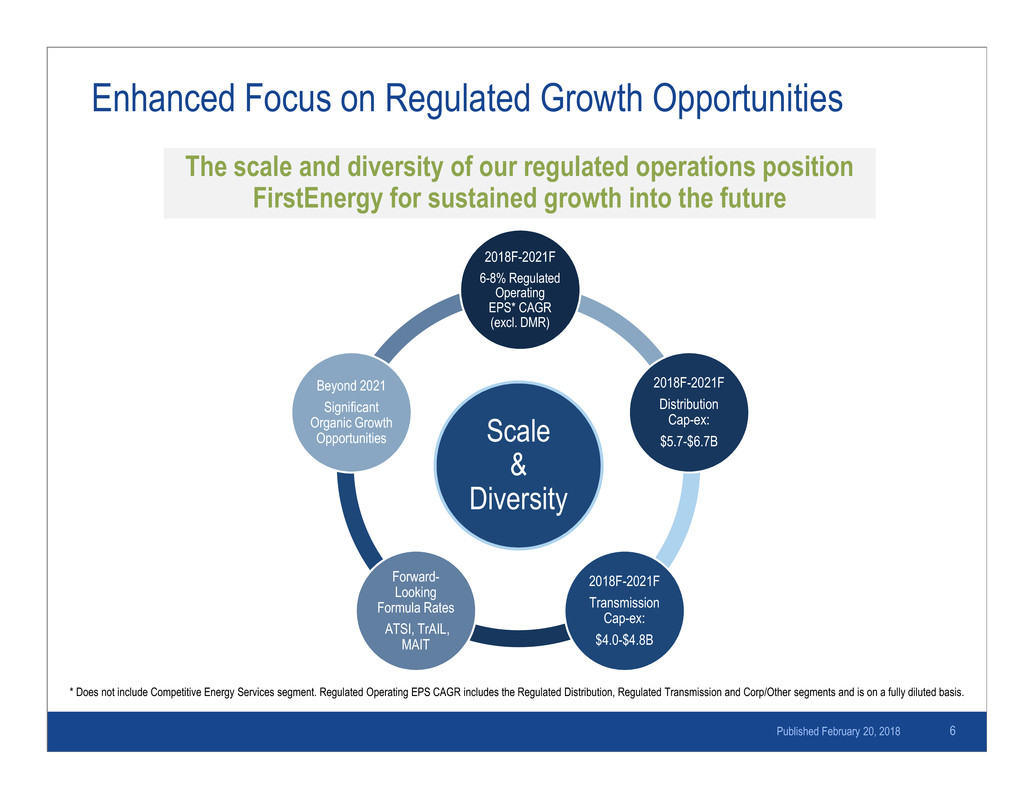

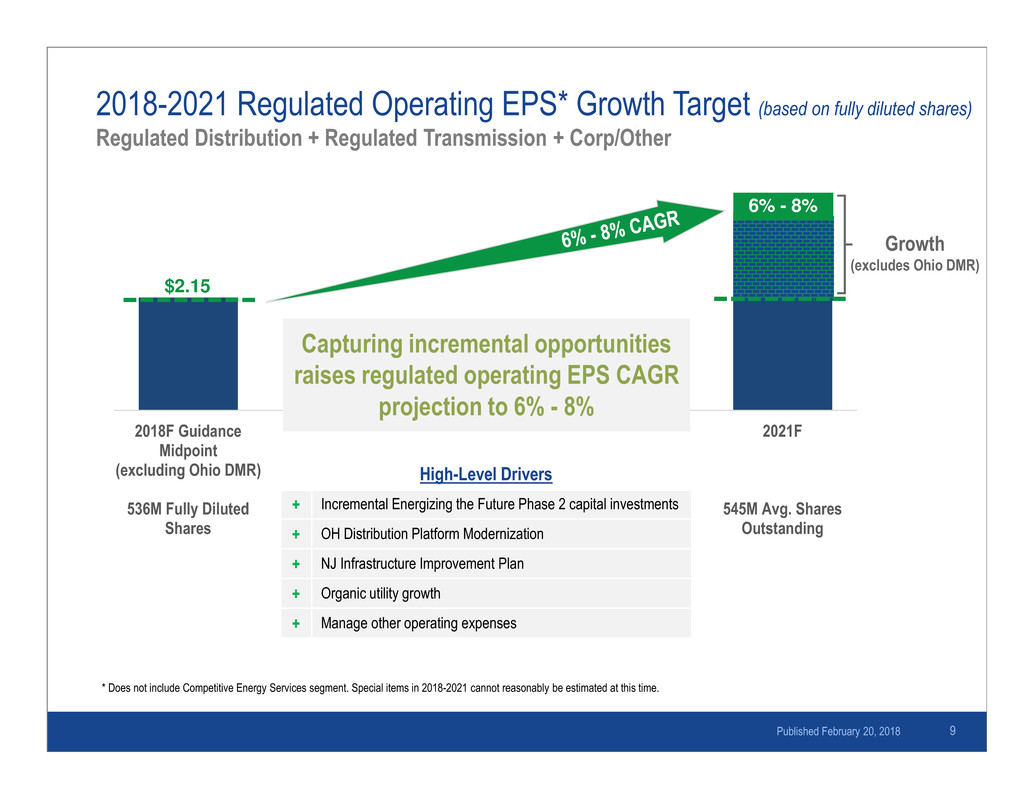

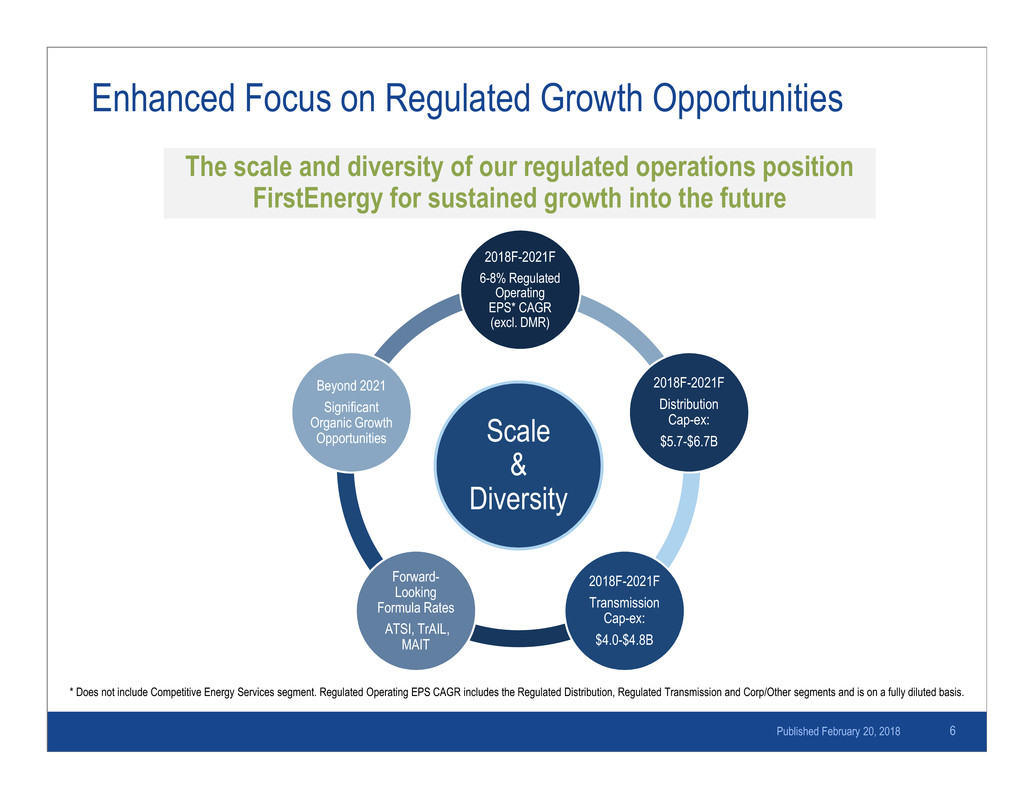

Enhanced Focus on Regulated Growth Opportunities Published February 20, 2018 6 The scale and diversity of our regulated operations position FirstEnergy for sustained growth into the future Scale & Diversity 2018F-2021F 6-8% Regulated Operating EPS* CAGR (excl. DMR) 2018F-2021F Distribution Cap-ex: $5.7-$6.7B 2018F-2021F Transmission Cap-ex: $4.0-$4.8B Forward- Looking Formula Rates ATSI, TrAIL, MAIT Beyond 2021 Significant Organic Growth Opportunities * Does not include Competitive Energy Services segment. Regulated Operating EPS CAGR includes the Regulated Distribution, Regulated Transmission and Corp/Other segments and is on a fully diluted basis.

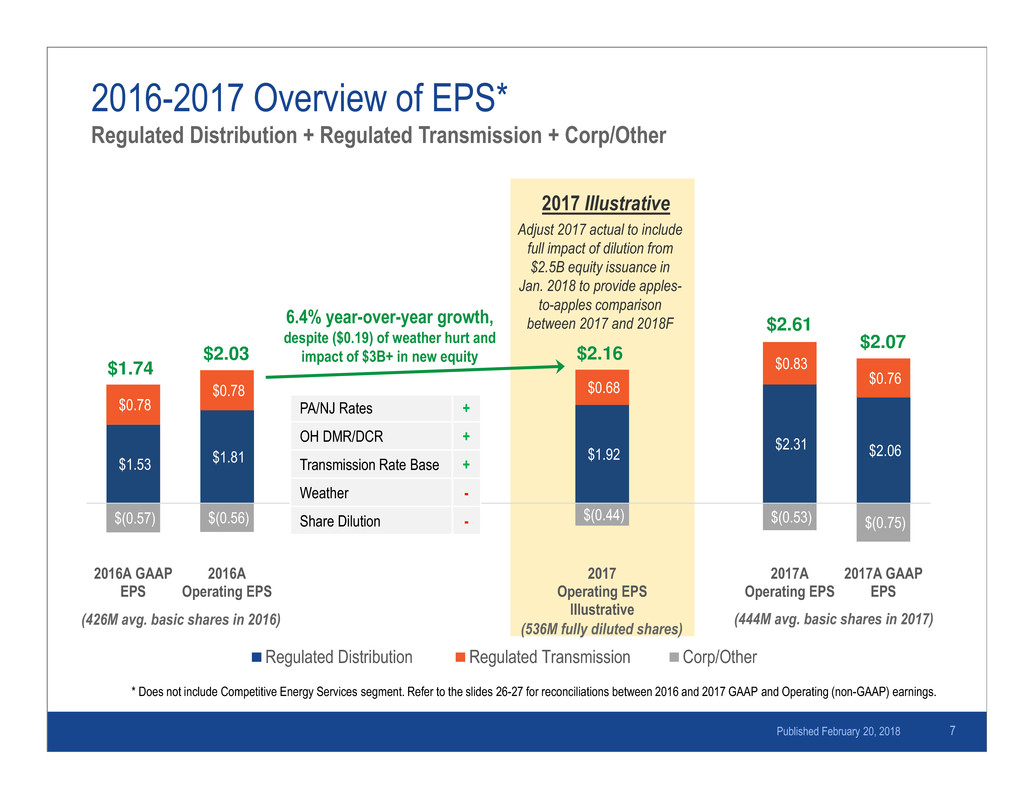

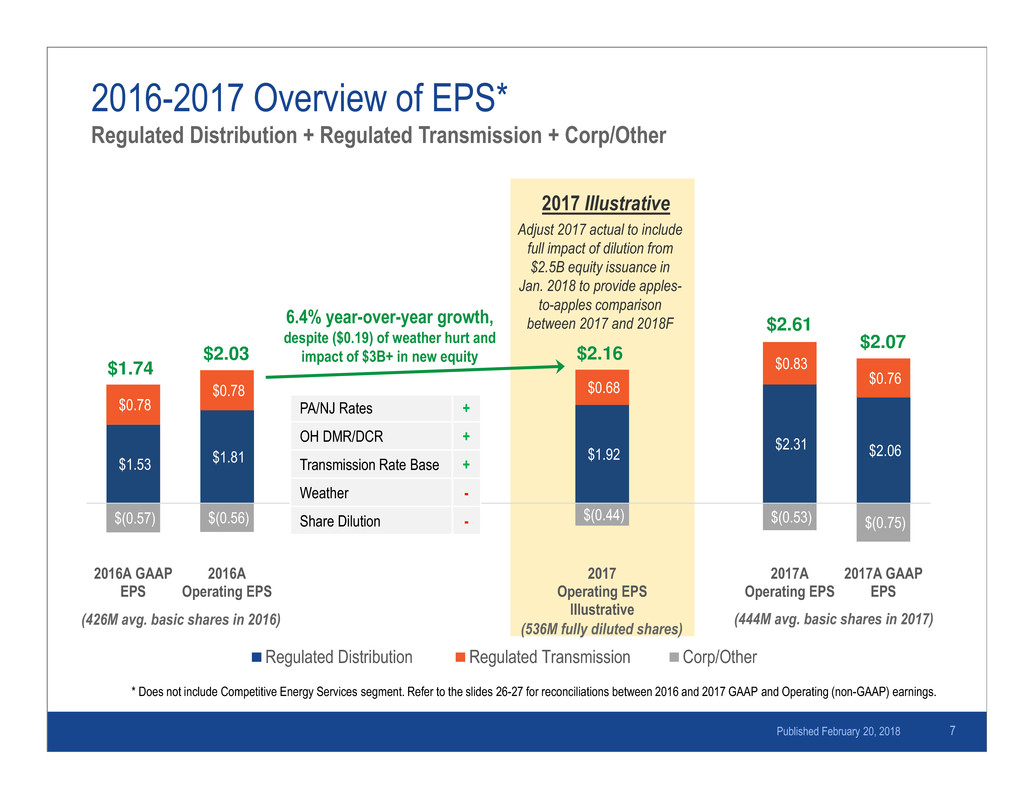

Adjust 2017 actual to include full impact of dilution from $2.5B equity issuance in Jan. 2018 to provide apples- to-apples comparison between 2017 and 2018F 2017 Illustrative 2016-2017 Overview of EPS* Regulated Distribution + Regulated Transmission + Corp/Other Published February 20, 2018 7 $1.53 $1.81 $1.92 $2.31 $2.06 $0.78 $0.78 $0.68 $0.83 $0.76 $(0.57) $(0.56) $(0.44) $(0.53) $(0.75) 2016A GAAP EPS 2016A Operating EPS 2017 Operating EPS Illustrative 2017A Operating EPS 2017A GAAP EPS Regulated Distribution Regulated Transmission Corp/Other $1.74 $2.03 $2.16 $2.61 $2.07 PA/NJ Rates + OH DMR/DCR + Transmission Rate Base + Weather - Share Dilution - 6.4% year-over-year growth, despite ($0.19) of weather hurt and impact of $3B+ in new equity (426M avg. basic shares in 2016) (444M avg. basic shares in 2017)(536M fully diluted shares) * Does not include Competitive Energy Services segment. Refer to the slides 26-27 for reconciliations between 2016 and 2017 GAAP and Operating (non-GAAP) earnings.

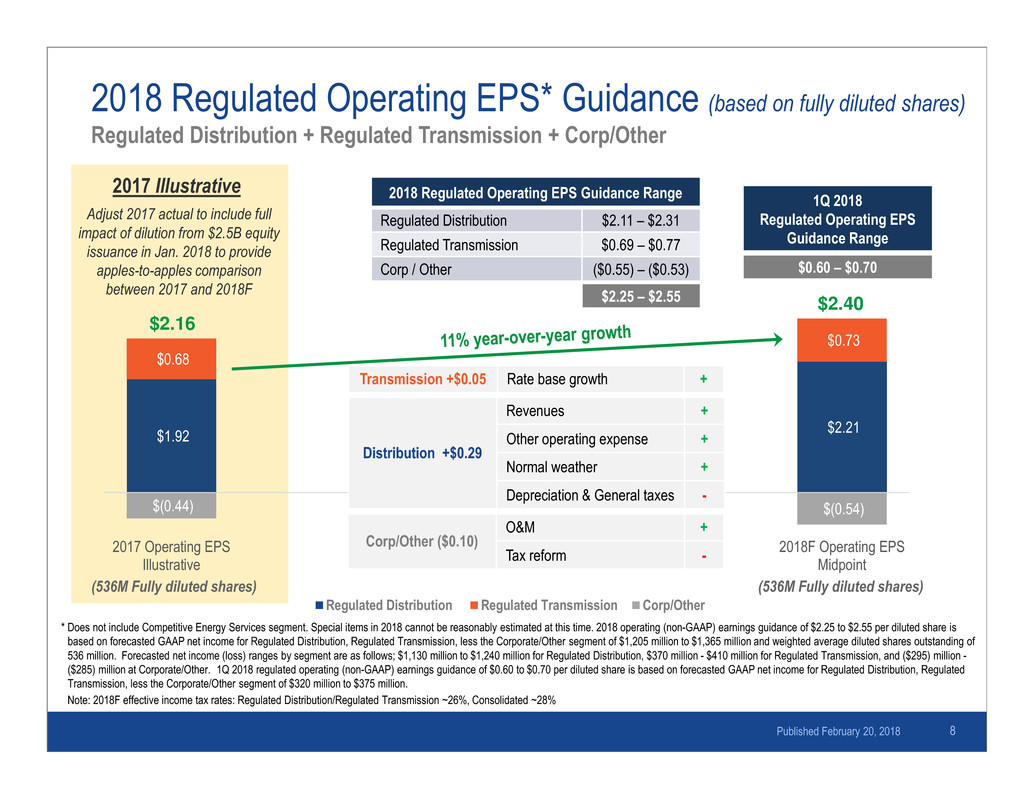

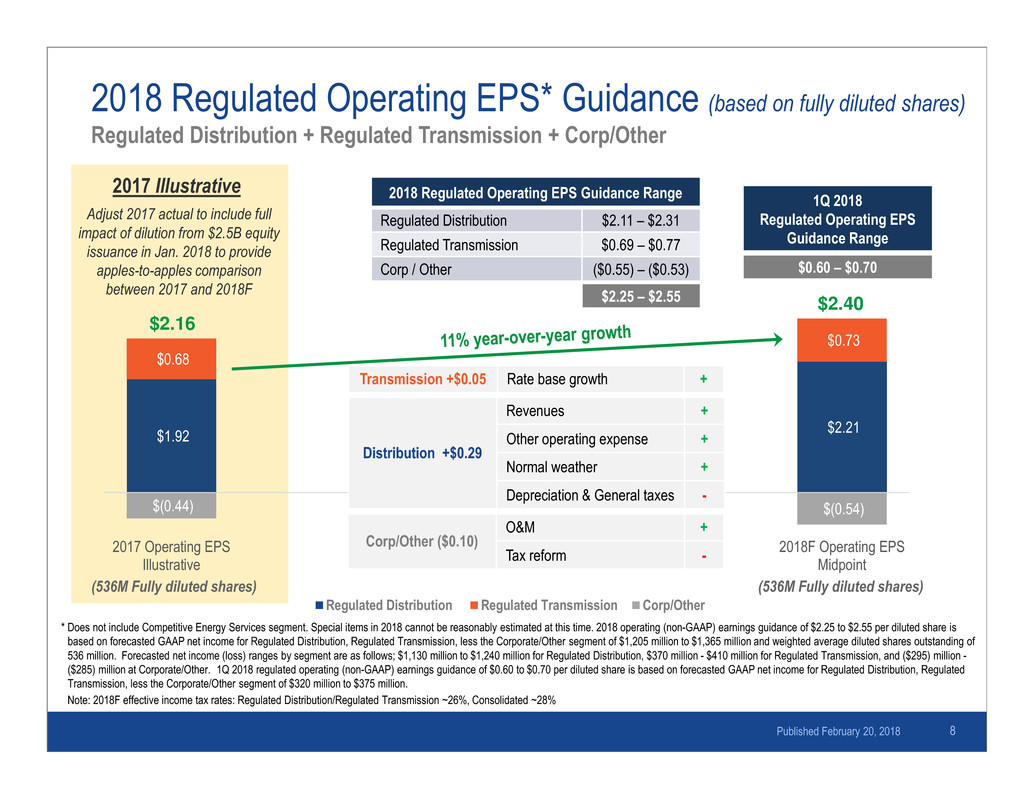

Adjust 2017 actual to include full impact of dilution from $2.5B equity issuance in Jan. 2018 to provide apples-to-apples comparison between 2017 and 2018F 2017 Illustrative 8 2018 Regulated Operating EPS* Guidance (based on fully diluted shares) Regulated Distribution + Regulated Transmission + Corp/Other Note: 2018F effective income tax rates: Regulated Distribution/Regulated Transmission ~26%, Consolidated ~28% 2018 Regulated Operating EPS Guidance Range Regulated Distribution $2.11 – $2.31 Regulated Transmission $0.69 – $0.77 Corp / Other ($0.55) – ($0.53) $2.25 – $2.55 $2.16 $2.40 (536M Fully diluted shares)(536M Fully diluted shares) $1.92 $2.21 $0.68 $0.73 $(0.44) $(0.54) 2017 Operating EPS Illustrative 2018F Operating EPS Midpoint Regulated Distribution Regulated Transmission Corp/Other Corp/Other ($0.10) O&M + Tax reform - 1Q 2018 Regulated Operating EPS Guidance Range $0.60 – $0.70 Distribution +$0.29 Revenues + Other operating expense + Normal weather + Depreciation & General taxes - Transmission +$0.05 Rate base growth + Published February 20, 2018 * Does not include Competitive Energy Services segment. Special items in 2018 cannot be reasonably estimated at this time. 2018 operating (non-GAAP) earnings guidance of $2.25 to $2.55 per diluted share is based on forecasted GAAP net income for Regulated Distribution, Regulated Transmission, less the Corporate/Other segment of $1,205 million to $1,365 million and weighted average diluted shares outstanding of 536 million. Forecasted net income (loss) ranges by segment are as follows; $1,130 million to $1,240 million for Regulated Distribution, $370 million - $410 million for Regulated Transmission, and ($295) million - ($285) million at Corporate/Other. 1Q 2018 regulated operating (non-GAAP) earnings guidance of $0.60 to $0.70 per diluted share is based on forecasted GAAP net income for Regulated Distribution, Regulated Transmission, less the Corporate/Other segment of $320 million to $375 million.

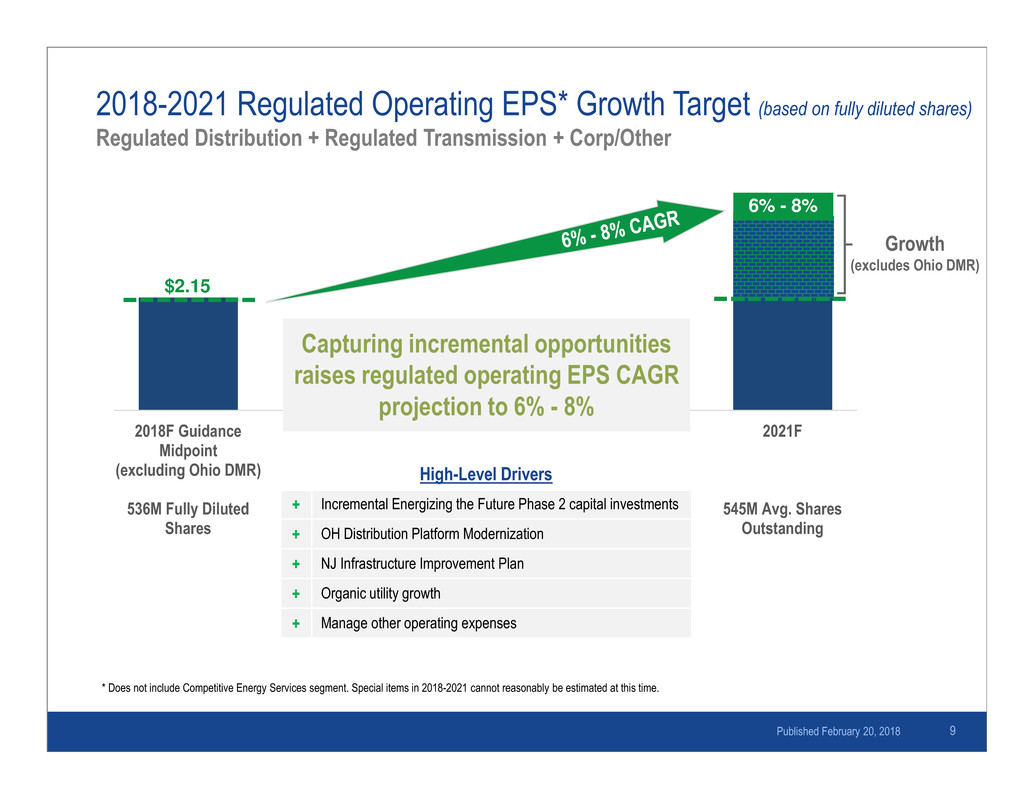

9 2018F Guidance Midpoint (excluding Ohio DMR) 536M Fully Diluted Shares 2021F 545M Avg. Shares Outstanding Growth (excludes Ohio DMR) 2018-2021 Regulated Operating EPS* Growth Target (based on fully diluted shares) Regulated Distribution + Regulated Transmission + Corp/Other * Does not include Competitive Energy Services segment. Special items in 2018-2021 cannot reasonably be estimated at this time. Capturing incremental opportunities raises regulated operating EPS CAGR projection to 6% - 8% 6% - 8% Published February 20, 2018 $2.15 High-Level Drivers + Incremental Energizing the Future Phase 2 capital investments + OH Distribution Platform Modernization + NJ Infrastructure Improvement Plan + Organic utility growth + Manage other operating expenses

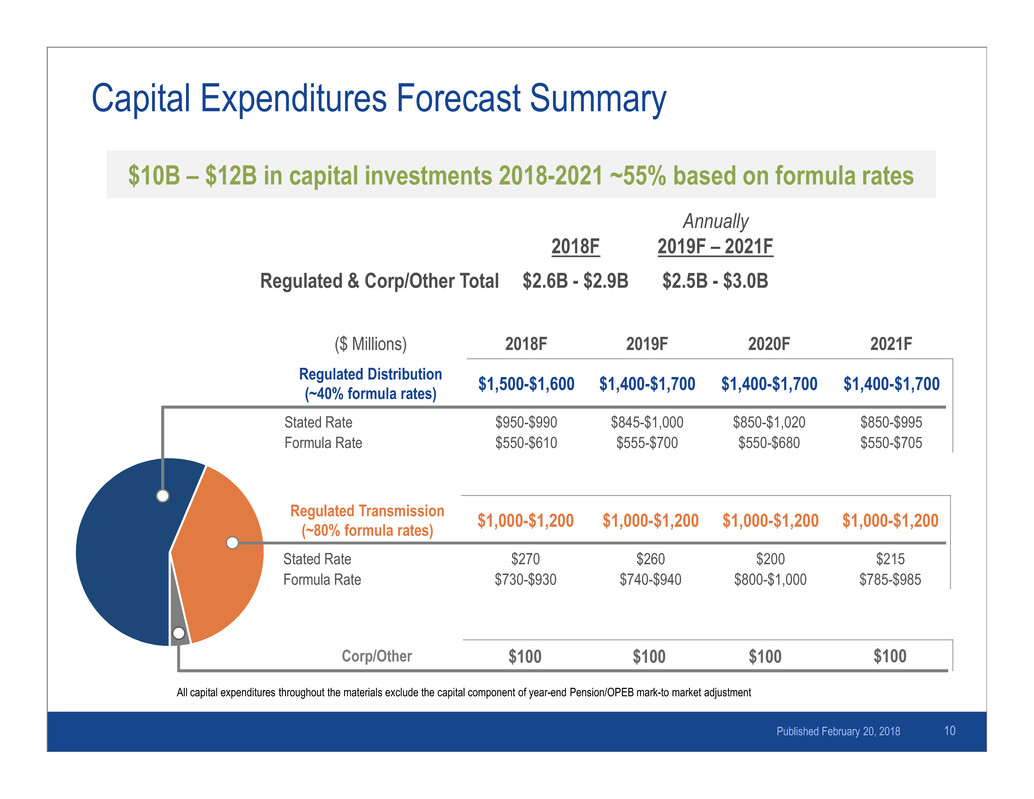

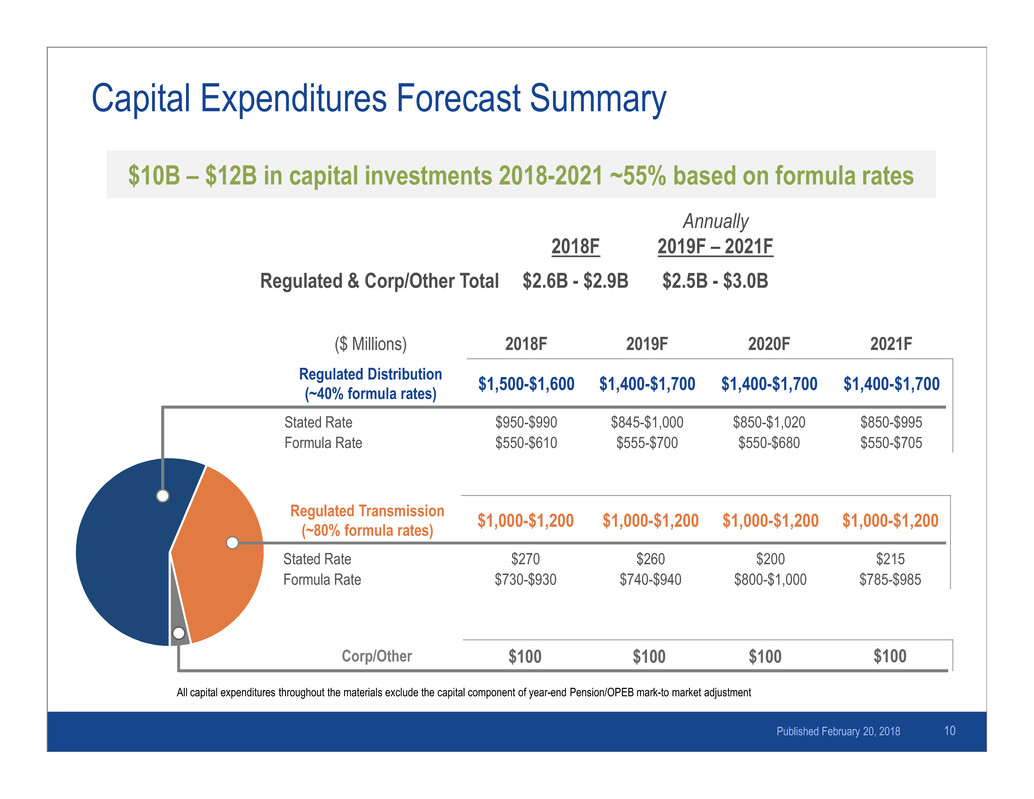

$10B – $12B in capital investments 2018-2021 ~55% based on formula rates Capital Expenditures Forecast Summary Published February 20, 2018 10 Regulated Transmission (~80% formula rates) $1,000-$1,200 $1,000-$1,200 $1,000-$1,200 $1,000-$1,200 Stated Rate $270 $260 $200 $215 Formula Rate $730-$930 $740-$940 $800-$1,000 $785-$985 2018F Annually 2019F – 2021F Regulated & Corp/Other Total $2.6B - $2.9B $2.5B - $3.0B All capital expenditures throughout the materials exclude the capital component of year-end Pension/OPEB mark-to market adjustment ($ Millions) 2018F 2019F 2020F 2021F Regulated Distribution (~40% formula rates) $1,500-$1,600 $1,400-$1,700 $1,400-$1,700 $1,400-$1,700 Stated Rate $950-$990 $845-$1,000 $850-$1,020 $850-$995 Formula Rate $550-$610 $555-$700 $550-$680 $550-$705 Corp/Other $100 $100 $100 $100

Financing Plan (2018-2021) Regulated Transmission Year Entity Amount Purpose 2018F MAIT $450M New IssuanceATSI $200M New Issuance 2019F MAIT $150M New Issuance 2020F MAIT $225M New Issuance FET $150M New Issuance ATSI $175M New Issuance 2021F FET $300M New Issuance MAIT $125M New Issuance ATSI $100M New Issuance FE Corp Year Entity Amount Purpose 2018 FE Corp $850M New Common Stock Issuance FE Corp $1,620M New Preferred Stock Issuance Committed to investment-grade credit ratings at all regulated entities and FE Corp 11 Regulated Distribution Year Entity Amount Purpose 2018F MP $74M PCRB Refinancing PP $50M New Issuance CEI $300M $300M at 8.875% maturing 11/15/18 2019F ME $450M $300M at 7.7% maturing 1/15/19 JCP&L $300M $300M at 7.35% maturing 2/1/19 PN $300M $125M at 6.625% maturing 4/1/19 WPP $200M New Issuance PE $100M New Issuance 2020F PN $250M $250M at 5.2% maturing 4/1/20TE $100M $50M at 7.25% maturing 5/1/20 2021F PE $100M New Issuance MP $200M New Issuance OE $185M New Issuance JCP&L $250M New Issuance WPP $100M New Issuance Published February 20, 2018

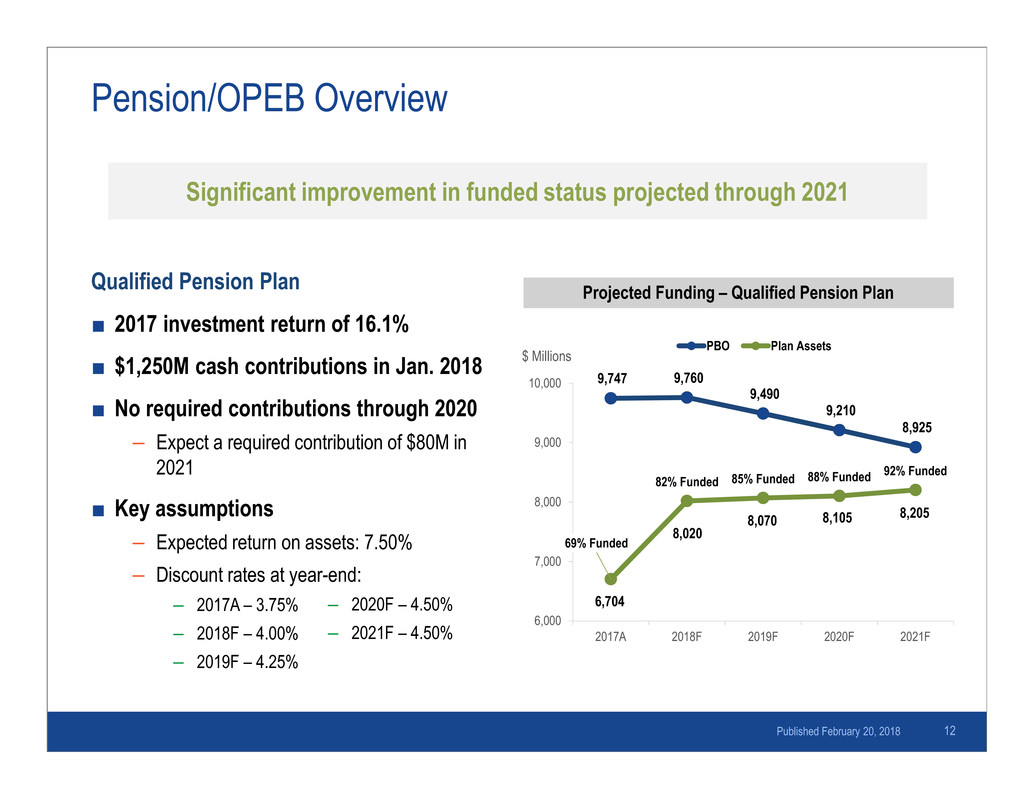

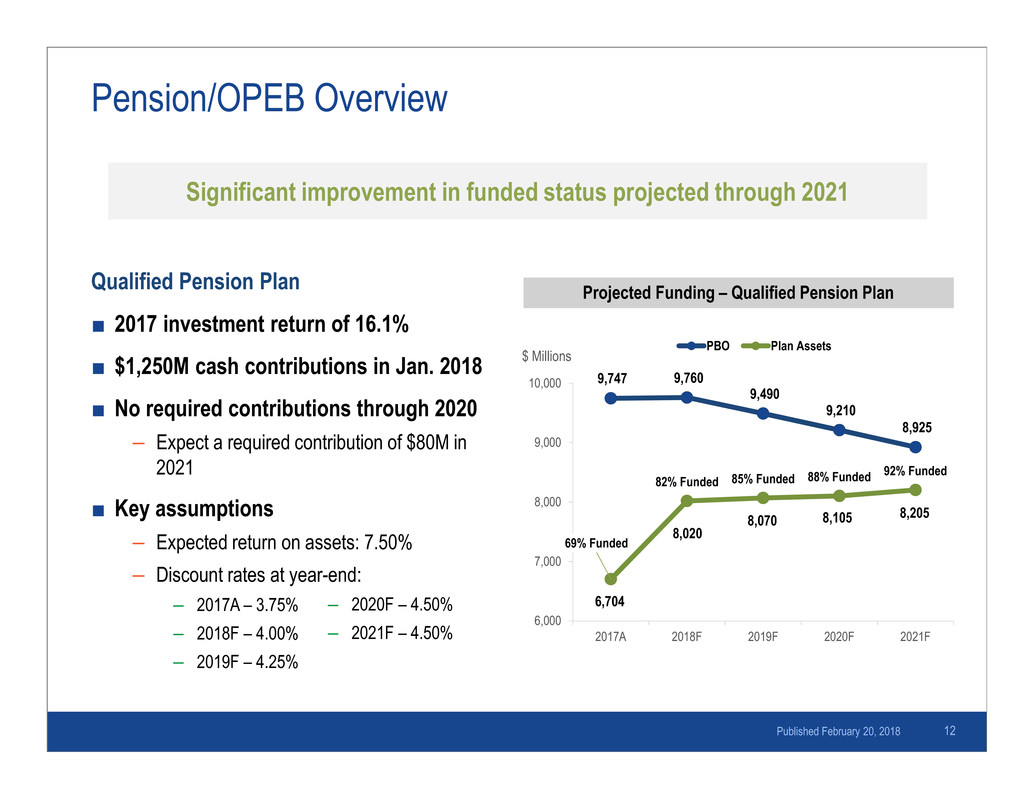

Pension/OPEB Overview Qualified Pension Plan ■ 2017 investment return of 16.1% ■ $1,250M cash contributions in Jan. 2018 ■ No required contributions through 2020 – Expect a required contribution of $80M in 2021 ■ Key assumptions – Expected return on assets: 7.50% – Discount rates at year-end: – 2017A – 3.75% – 2018F – 4.00% – 2019F – 4.25% Published February 20, 2018 12 Projected Funding – Qualified Pension Plan 9,747 9,760 9,490 9,210 8,925 69% Funded 82% Funded 85% Funded 88% Funded 92% Funded 6,000 7,000 8,000 9,000 10,000 2017A 2018F 2019F 2020F 2021F PBO Plan Assets$ Millions – 2020F – 4.50% – 2021F – 4.50% 6,704 8,020 8,070 8,105 8,205 Significant improvement in funded status projected through 2021

Regulated Distribution Support

2018 Regulated Distribution Guidance Sensitivities Published February 20, 2018 14 Estimated Impact of Annual Retail Sales Volumes + / - 1% Change in Residential Deliveries ~$0.02/share + / - 1% Change in Commercial Deliveries ~$0.01/share + / - 1% Change in Industrial Deliveries ~$0.004/share Weather Impact on Residential/Commercial Sales Volumes + / - 96 HDD vs. normal (Dec-Mar) ~$0.01/share + / - 31 CDD vs. normal (June-Sept) ~$0.01/share

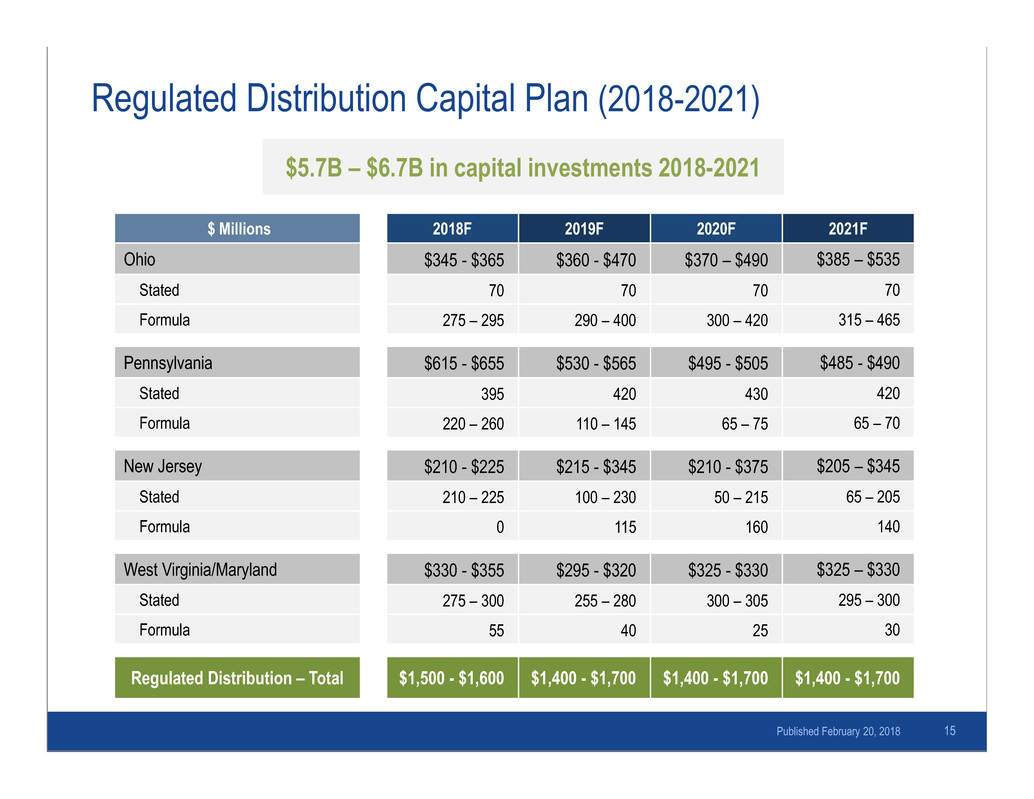

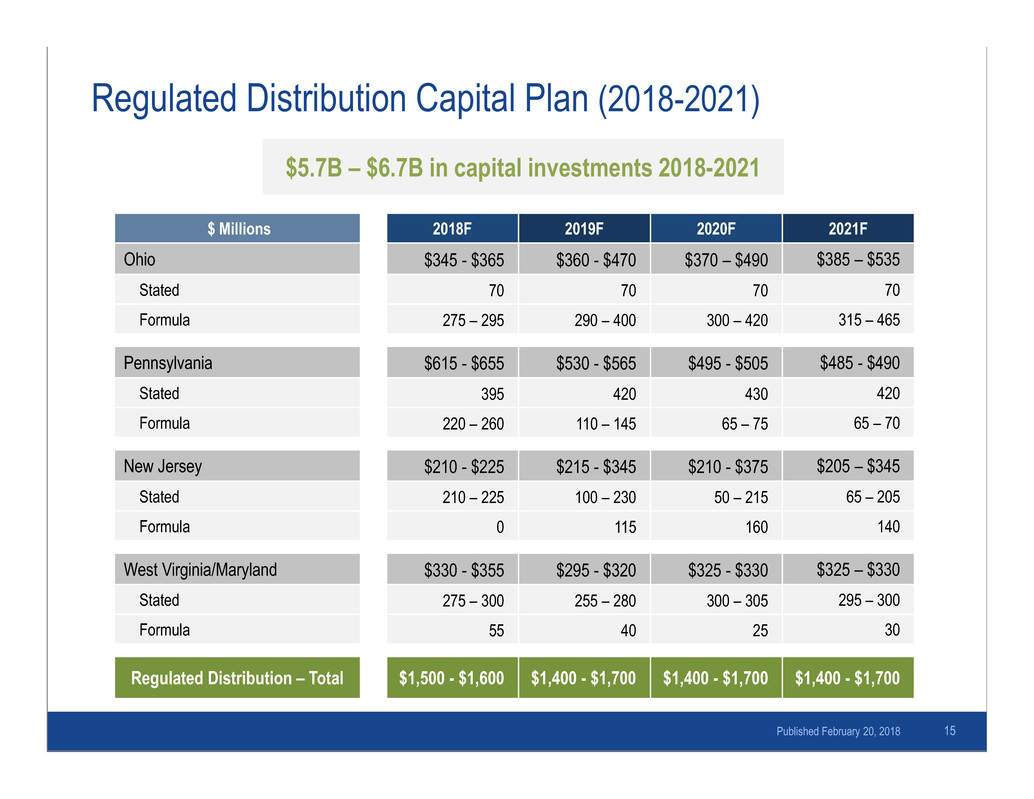

Regulated Distribution Capital Plan (2018-2021) $ Millions 2018F 2019F 2020F 2021F Ohio $345 - $365 $360 - $470 $370 – $490 $385 – $535 Stated 70 70 70 70 Formula 275 – 295 290 – 400 300 – 420 315 – 465 Pennsylvania $615 - $655 $530 - $565 $495 - $505 $485 - $490 Stated 395 420 430 420 Formula 220 – 260 110 – 145 65 – 75 65 – 70 New Jersey $210 - $225 $215 - $345 $210 - $375 $205 – $345 Stated 210 – 225 100 – 230 50 – 215 65 – 205 Formula 0 115 160 140 West Virginia/Maryland $330 - $355 $295 - $320 $325 - $330 $325 – $330 Stated 275 – 300 255 – 280 300 – 305 295 – 300 Formula 55 40 25 30 Regulated Distribution – Total $1,500 - $1,600 $1,400 - $1,700 $1,400 - $1,700 $1,400 - $1,700 15 $5.7B – $6.7B in capital investments 2018-2021 Published February 20, 2018

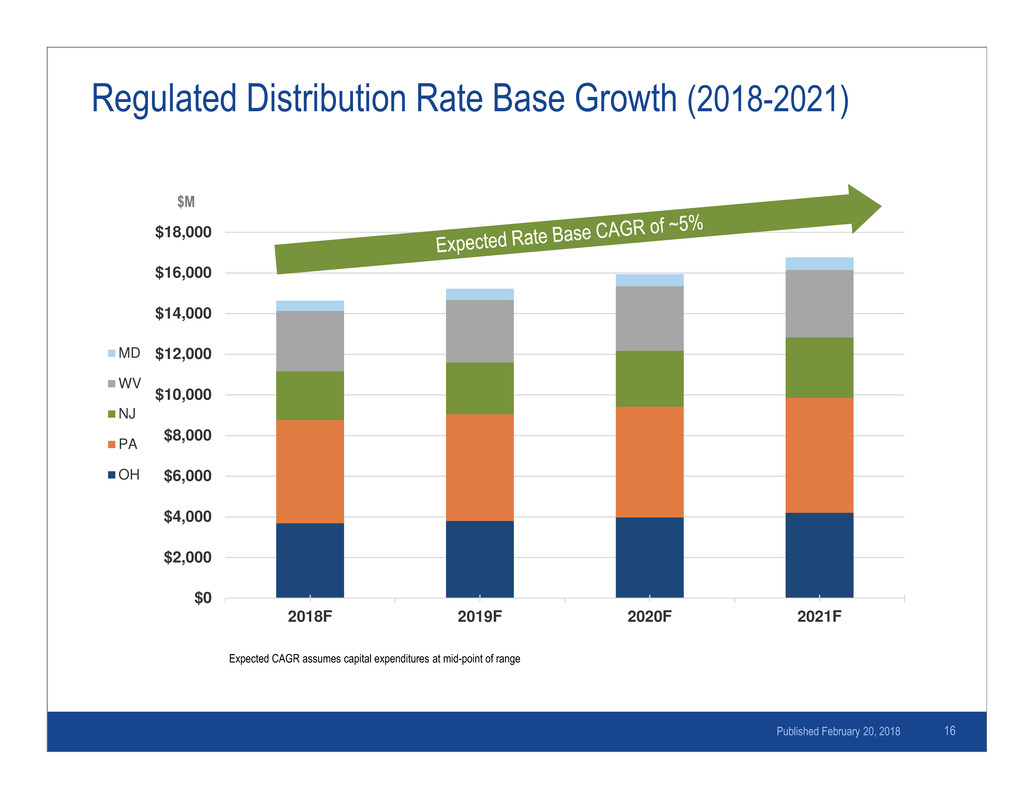

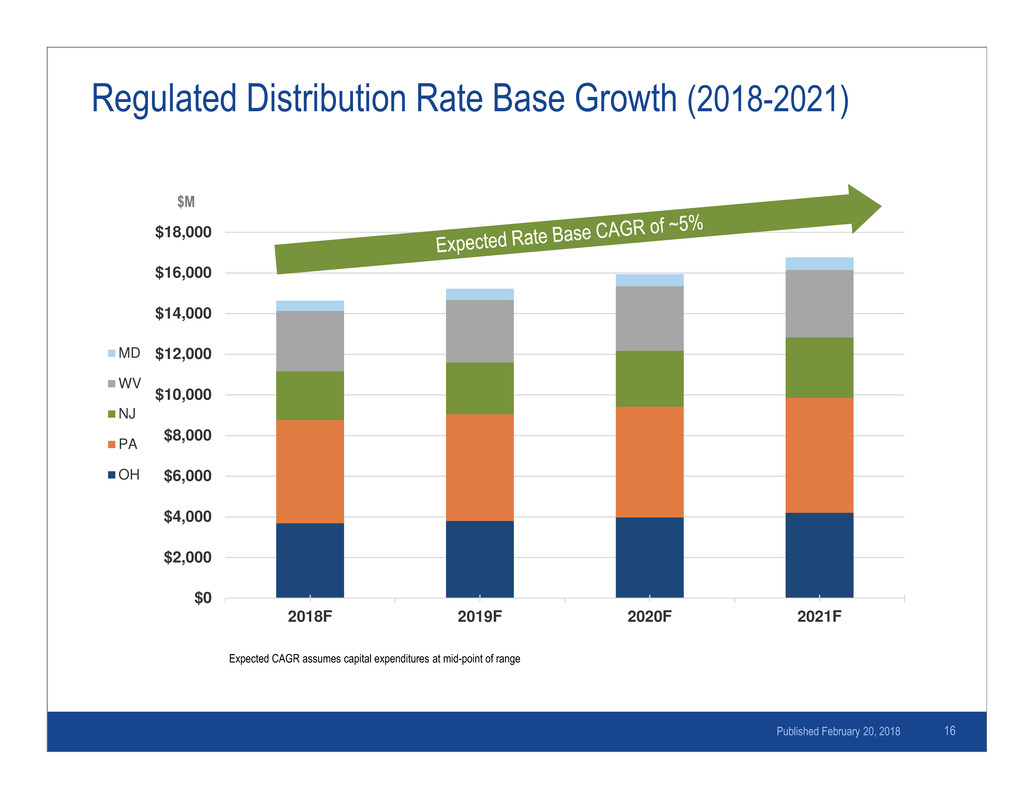

Regulated Distribution Rate Base Growth (2018-2021) $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 2018F 2019F 2020F 2021F MD WV NJ PA OH $M 16Published February 20, 2018 Expected CAGR assumes capital expenditures at mid-point of range

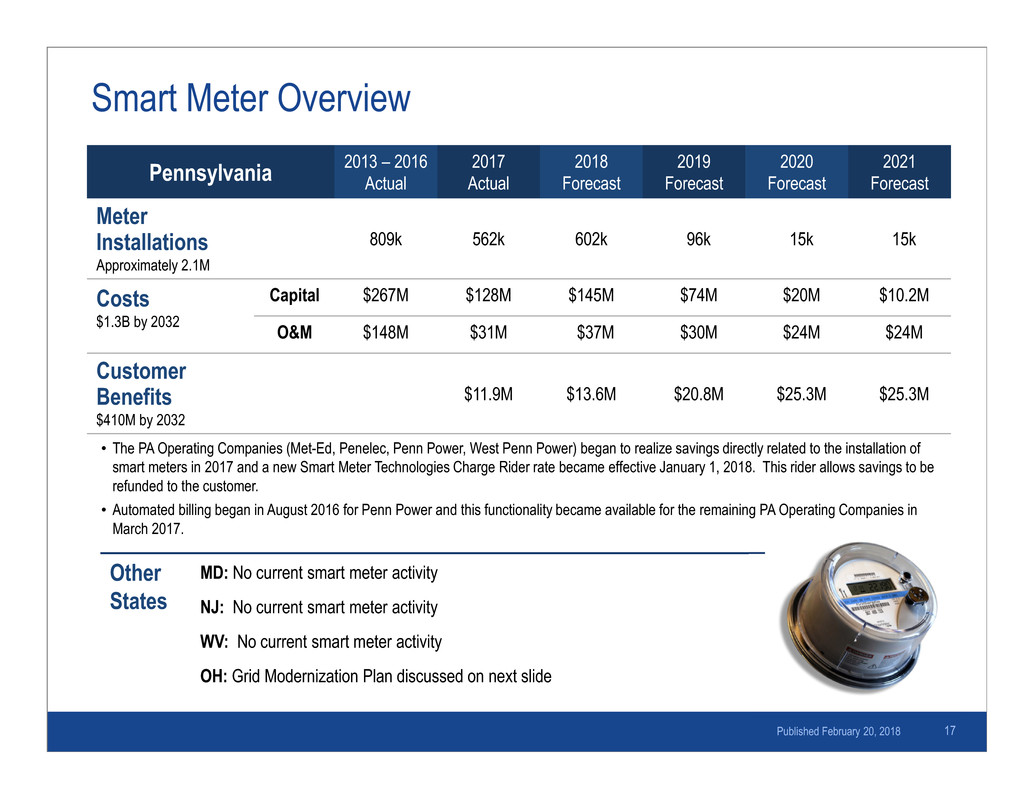

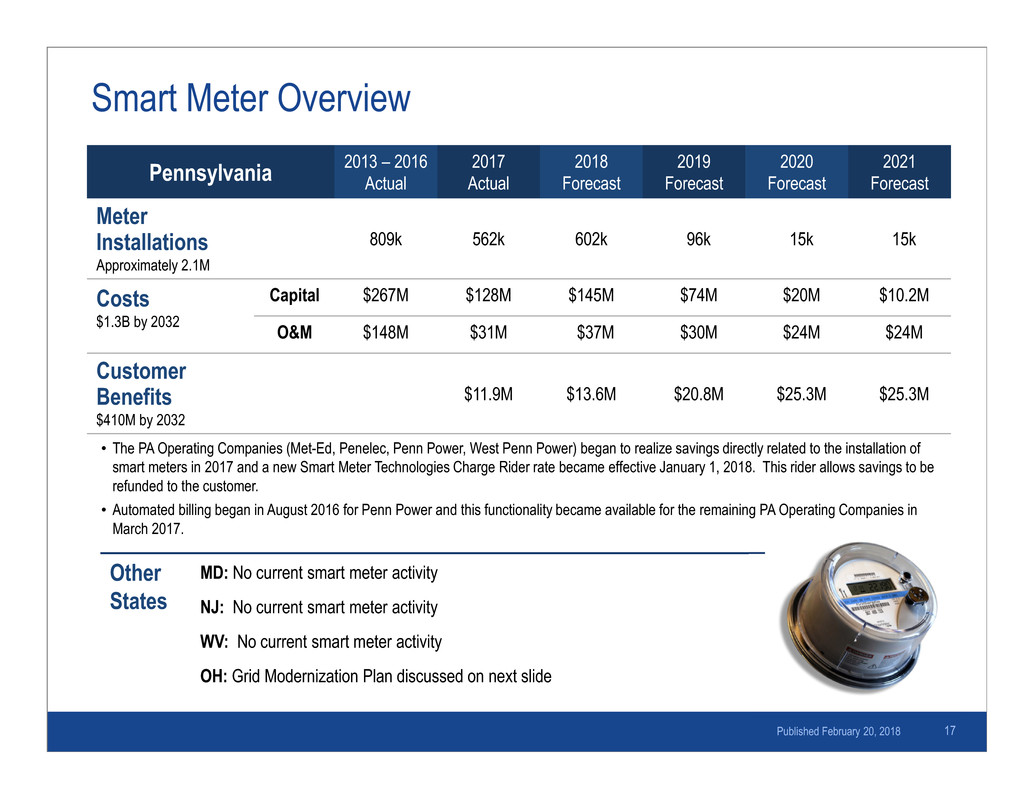

Smart Meter Overview Other States MD: No current smart meter activity NJ: No current smart meter activity WV: No current smart meter activity OH: Grid Modernization Plan discussed on next slide 17 Pennsylvania 2013 – 2016Actual 2017 Actual 2018 Forecast 2019 Forecast 2020 Forecast 2021 Forecast Meter Installations Approximately 2.1M 809k 562k 602k 96k 15k 15k Costs $1.3B by 2032 Capital $267M $128M $145M $74M $20M $10.2M O&M $148M $31M $37M $30M $24M $24M Customer Benefits $410M by 2032 $11.9M $13.6M $20.8M $25.3M $25.3M • The PA Operating Companies (Met-Ed, Penelec, Penn Power, West Penn Power) began to realize savings directly related to the installation of smart meters in 2017 and a new Smart Meter Technologies Charge Rider rate became effective January 1, 2018. This rider allows savings to be refunded to the customer. • Automated billing began in August 2016 for Penn Power and this functionality became available for the remaining PA Operating Companies in March 2017. Published February 20, 2018

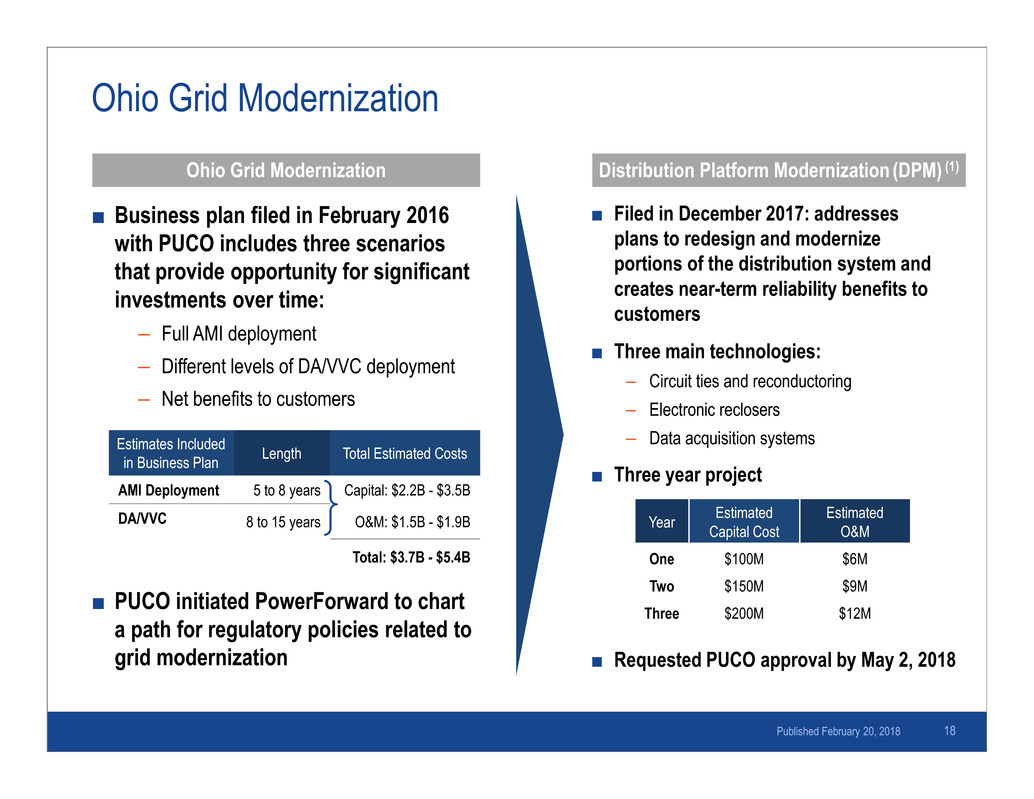

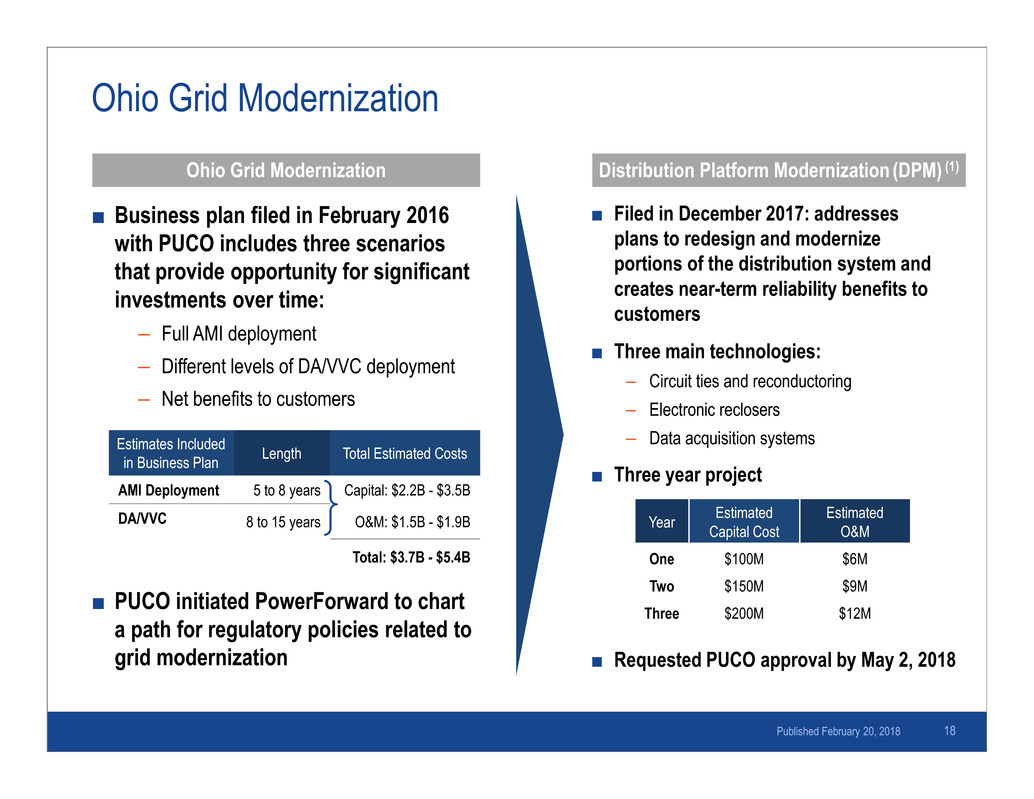

Ohio Grid Modernization ■ Business plan filed in February 2016 with PUCO includes three scenarios that provide opportunity for significant investments over time: – Full AMI deployment – Different levels of DA/VVC deployment – Net benefits to customers ■ Filed in December 2017: addresses plans to redesign and modernize portions of the distribution system and creates near-term reliability benefits to customers ■ Three main technologies: – Circuit ties and reconductoring – Electronic reclosers – Data acquisition systems ■ Three year project Published February 20, 2018 18 Estimates Included in Business Plan Length Total Estimated Costs AMI Deployment 5 to 8 years Capital: $2.2B - $3.5B DA/VVC 8 to 15 years O&M: $1.5B - $1.9B Total: $3.7B - $5.4B ■ PUCO initiated PowerForward to chart a path for regulatory policies related to grid modernization ■ Requested PUCO approval by May 2, 2018 Year Estimated Capital Cost Estimated O&M One $100M $6M Two $150M $9M Three $200M $12M Ohio Grid Modernization Distribution Platform Modernization (DPM) (1)

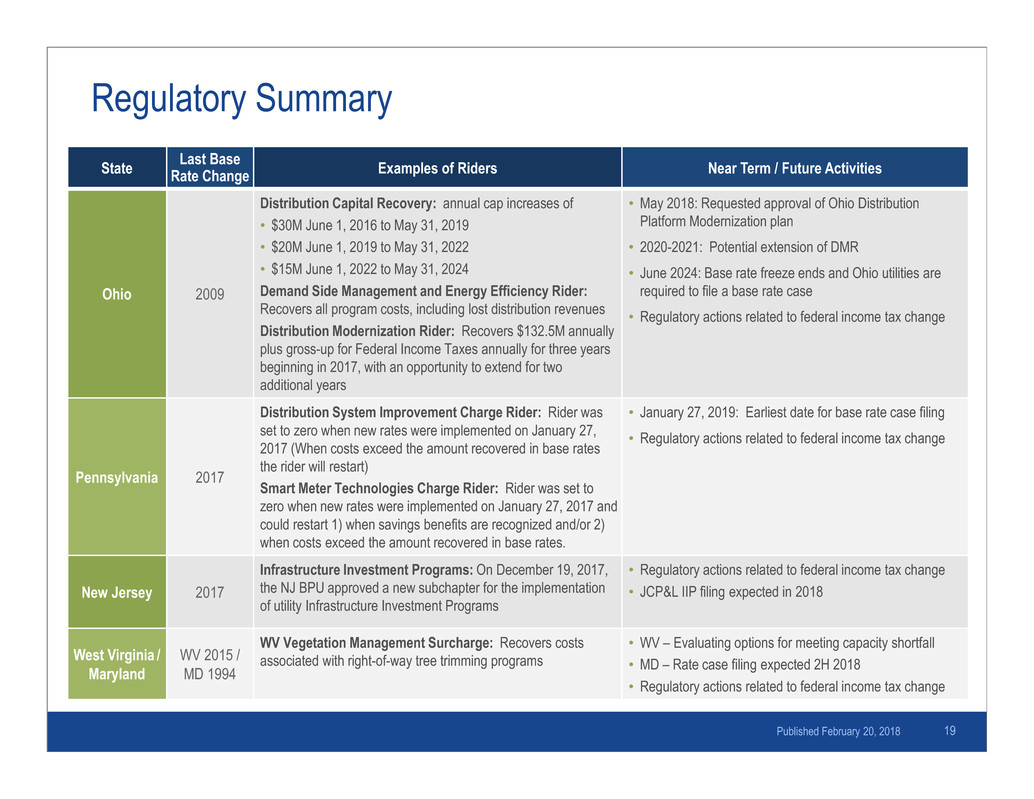

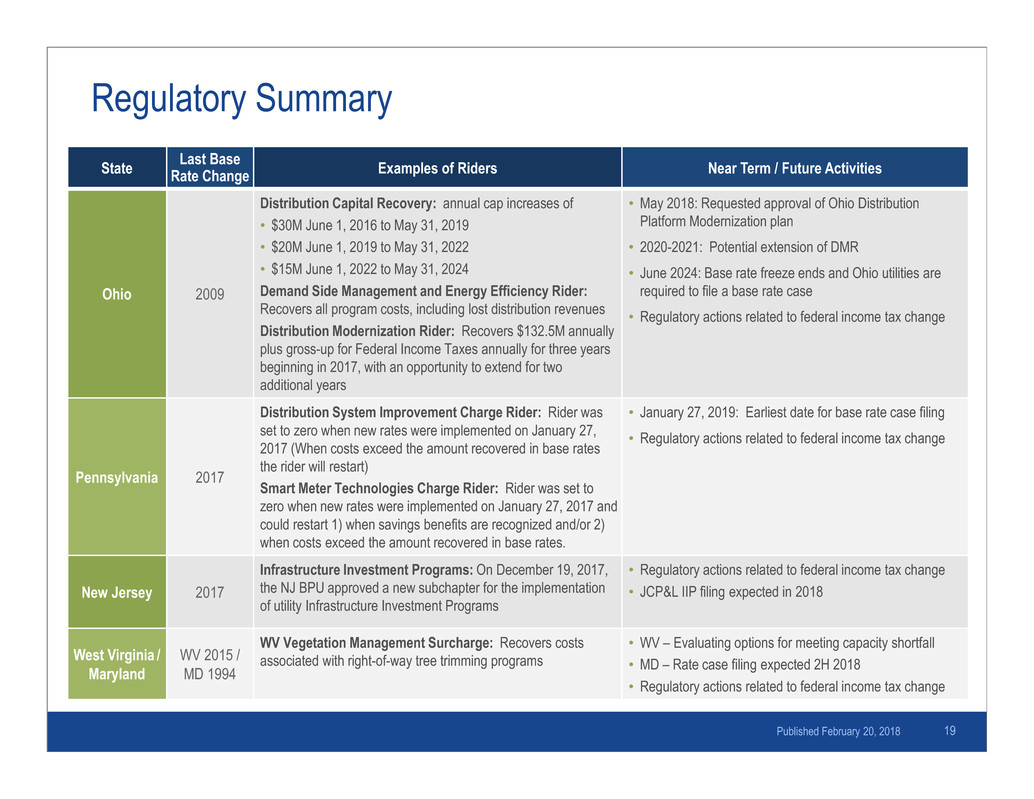

Regulatory Summary State Last Base Rate Change Examples of Riders Near Term / Future Activities Ohio 2009 Distribution Capital Recovery: annual cap increases of • $30M June 1, 2016 to May 31, 2019 • $20M June 1, 2019 to May 31, 2022 • $15M June 1, 2022 to May 31, 2024 Demand Side Management and Energy Efficiency Rider: Recovers all program costs, including lost distribution revenues Distribution Modernization Rider: Recovers $132.5M annually plus gross-up for Federal Income Taxes annually for three years beginning in 2017, with an opportunity to extend for two additional years • May 2018: Requested approval of Ohio Distribution Platform Modernization plan • 2020-2021: Potential extension of DMR • June 2024: Base rate freeze ends and Ohio utilities are required to file a base rate case • Regulatory actions related to federal income tax change Pennsylvania 2017 Distribution System Improvement Charge Rider: Rider was set to zero when new rates were implemented on January 27, 2017 (When costs exceed the amount recovered in base rates the rider will restart) Smart Meter Technologies Charge Rider: Rider was set to zero when new rates were implemented on January 27, 2017 and could restart 1) when savings benefits are recognized and/or 2) when costs exceed the amount recovered in base rates. • January 27, 2019: Earliest date for base rate case filing • Regulatory actions related to federal income tax change New Jersey 2017 Infrastructure Investment Programs: On December 19, 2017, the NJ BPU approved a new subchapter for the implementation of utility Infrastructure Investment Programs • Regulatory actions related to federal income tax change • JCP&L IIP filing expected in 2018 West Virginia / Maryland WV 2015 / MD 1994 WV Vegetation Management Surcharge: Recovers costs associated with right-of-way tree trimming programs • WV – Evaluating options for meeting capacity shortfall • MD – Rate case filing expected 2H 2018 • Regulatory actions related to federal income tax change 19Published February 20, 2018

Weather-Adjusted Distribution Deliveries Commercial Industrial M MWH 2018F 2019F 2020F 2021F 2018F-2021F CAGR % Sub-Total 43.0 42.9 42.7 42.4 -0.5% OH 15.3 15.3 15.3 15.2 -0.2% PA 12.8 12.8 12.7 12.6 -0.5% WV 3.8 3.8 3.8 3.8 0.0% NJ 9.0 8.9 8.8 8.7 -1.1% MD 2.1 2.1 2.1 2.1 0.0% M MWH 2018F 2019F 2020F 2021F 2018F-2021F CAGR % Sub-Total 52.2 52.9 53.6 54.6 1.5% OH 20.4 20.6 20.6 20.8 0.6% PA 21.1 21.2 21.1 21.2 0.2% WV 6.8 7.3 8.1 9.0 9.8% NJ 2.1 2.0 2.0 1.9 -3.3% MD 1.8 1.8 1.8 1.7 -1.9% M MWH 2018F 2019F 2020F 2021F 2018F-2021F CAGR % Sub-Total 53.3 52.8 52.1 51.8 -0.9% OH 17.0 16.8 16.5 16.4 -1.2% PA 18.2 18.0 17.7 17.6 -1.1% WV 5.6 5.6 5.6 5.6 0.0% NJ 9.3 9.2 9.1 9.0 -1.1% MD 3.2 3.2 3.2 3.2 0.0% M MWH 2018F 2019F 2020F 2021F 2018F-2021F CAGR % Total 148.5 148.6 148.4 148.8 0.1% OH 52.7 52.7 52.4 52.4 -0.2% PA 52.1 52.0 51.5 51.4 -0.4% WV 16.2 16.7 17.5 18.4 4.3% NJ 20.4 20.1 19.9 19.6 -1.3% MD 7.1 7.1 7.1 7.0 -0.5% Total Deliveries Residential Projected total load growth CAGR of 0.1% through 2021F Projected WV load growth CAGR of ~4% through 2021F, primarily from ~10% growth in the Industrial class 20Published February 20, 2018

Regulated Transmission Support

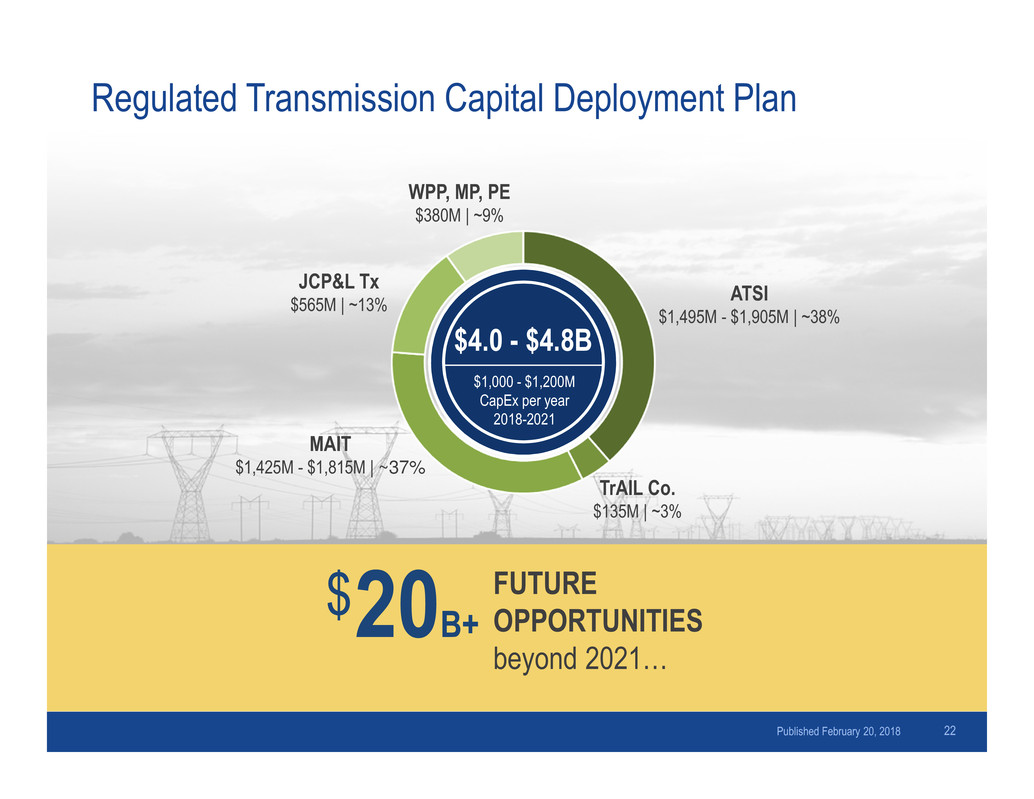

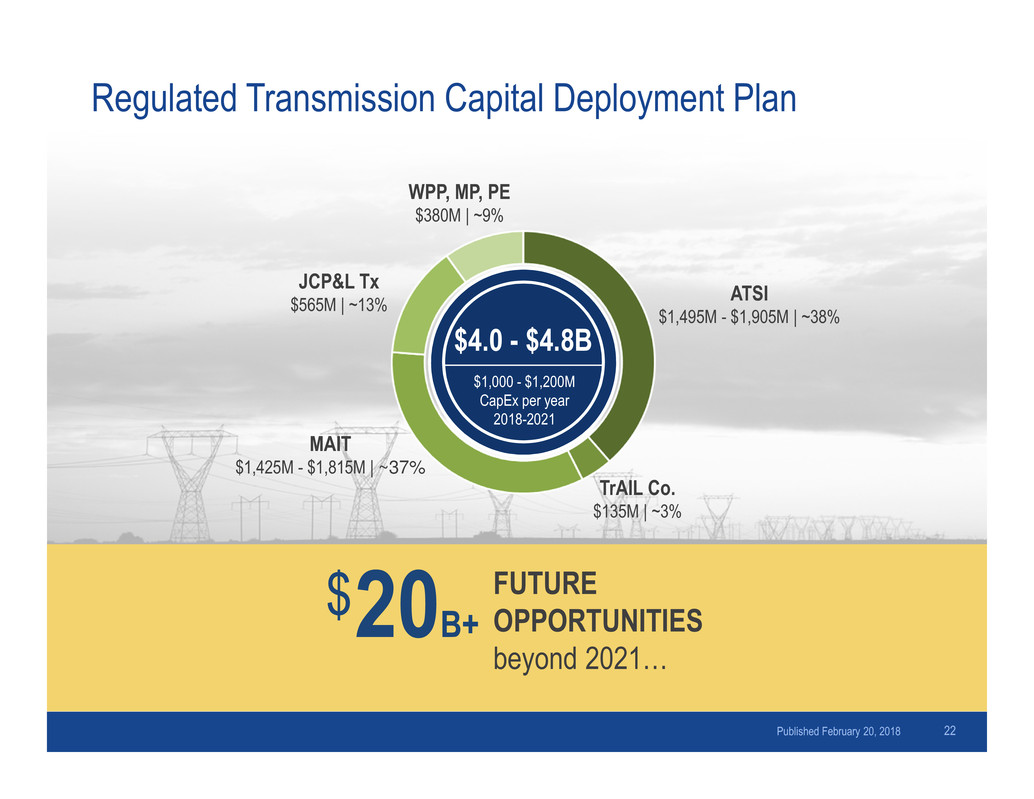

ATSI $1,495M - $1,905M | ~38% JCP&L Tx $565M | ~13% MAIT $1,425M - $1,815M | ~37% WPP, MP, PE $380M | ~9% TrAIL Co. $135M | ~3% 20B+ FUTURE OPPORTUNITIES beyond 2021… $ $4.0 - $4.8B $1,000 - $1,200M CapEx per year 2018-2021 Regulated Transmission Capital Deployment Plan 22Published February 20, 2018

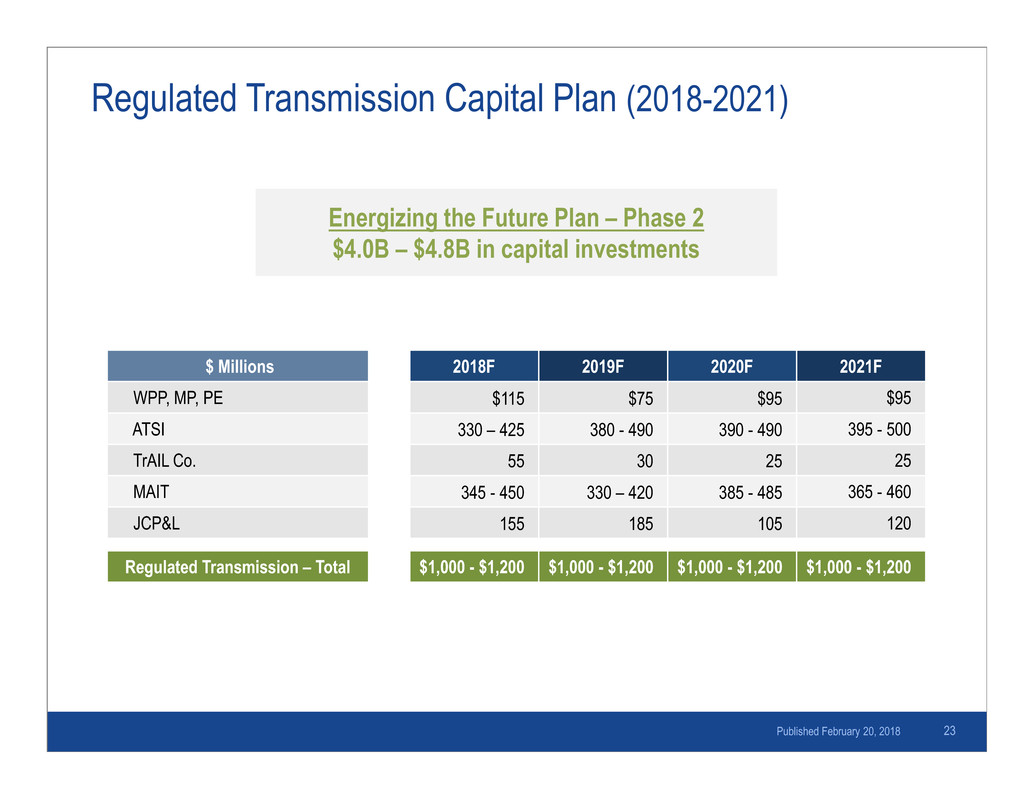

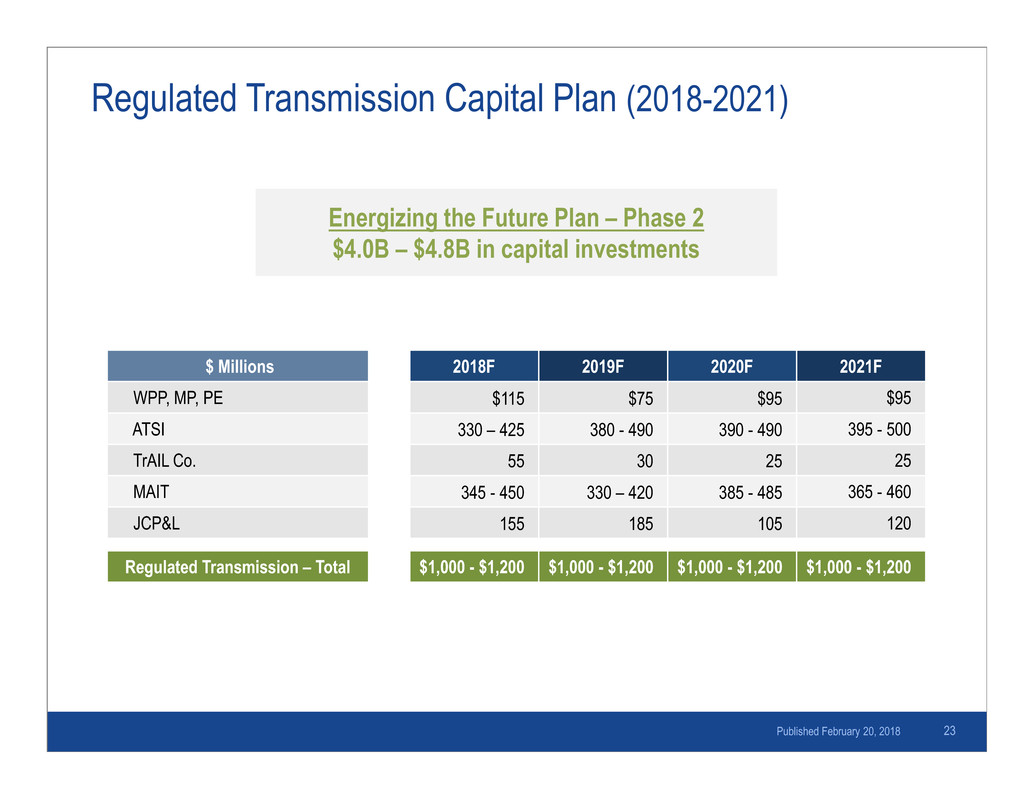

Regulated Transmission Capital Plan (2018-2021) $ Millions 2018F 2019F 2020F 2021F WPP, MP, PE $115 $75 $95 $95 ATSI 330 – 425 380 - 490 390 - 490 395 - 500 TrAIL Co. 55 30 25 25 MAIT 345 - 450 330 – 420 385 - 485 365 - 460 JCP&L 155 185 105 120 Regulated Transmission – Total $1,000 - $1,200 $1,000 - $1,200 $1,000 - $1,200 $1,000 - $1,200 23 Energizing the Future Plan – Phase 2 $4.0B – $4.8B in capital investments Published February 20, 2018

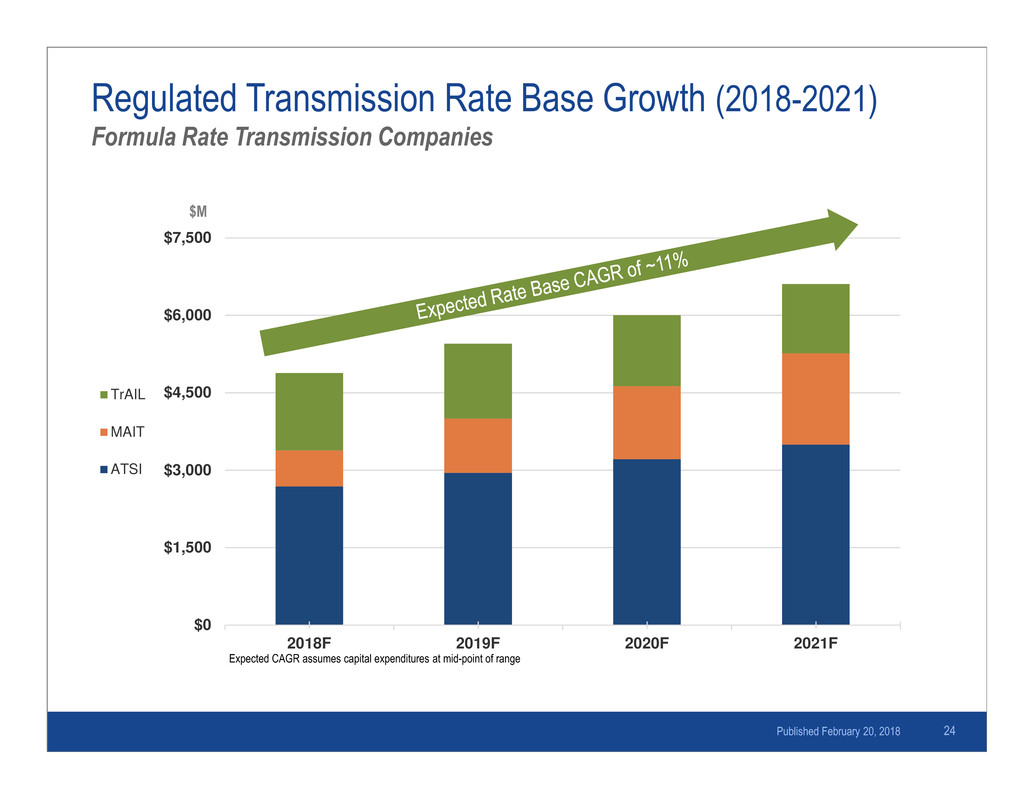

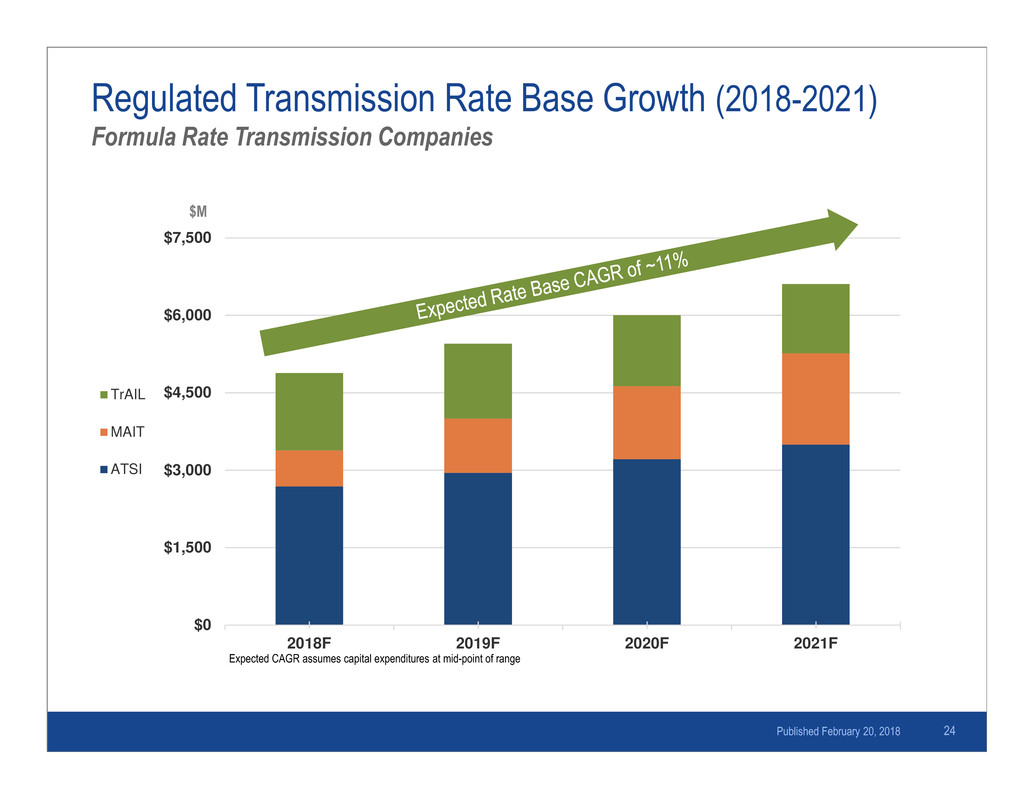

Regulated Transmission Rate Base Growth (2018-2021) Formula Rate Transmission Companies $0 $1,500 $3,000 $4,500 $6,000 $7,500 2018F 2019F 2020F 2021F TrAIL MAIT ATSI $M 24Published February 20, 2018 Expected CAGR assumes capital expenditures at mid-point of range

GAAP to Operating (Non-GAAP) Reconciliations and IR Contacts

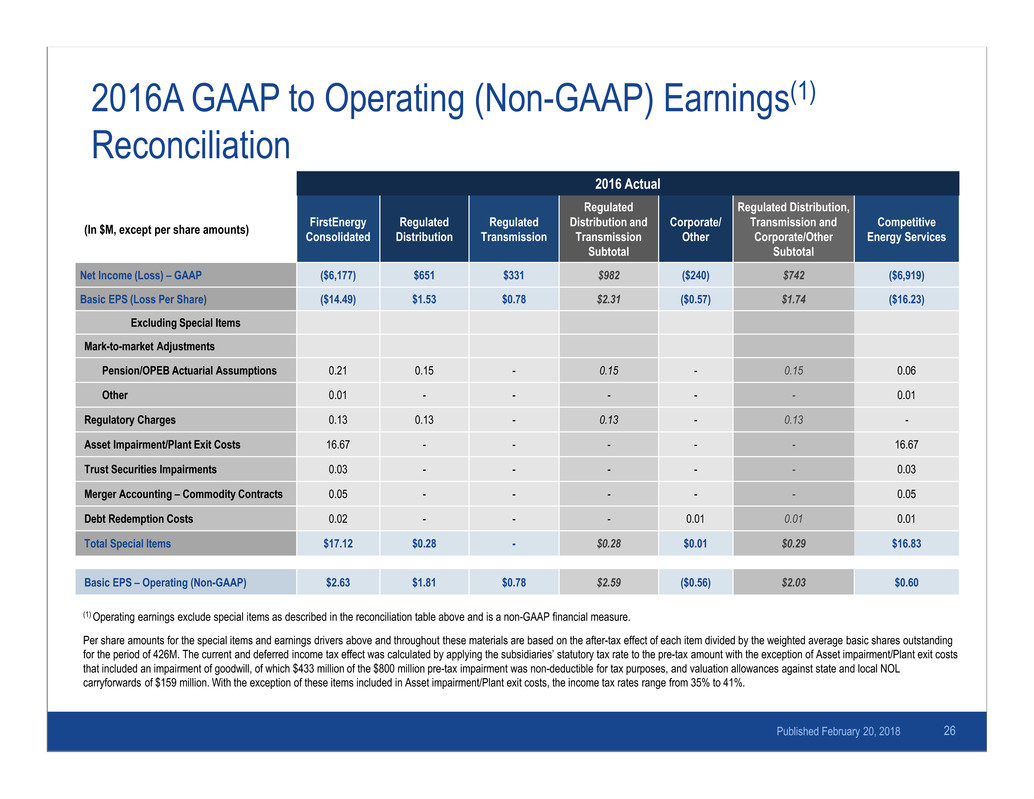

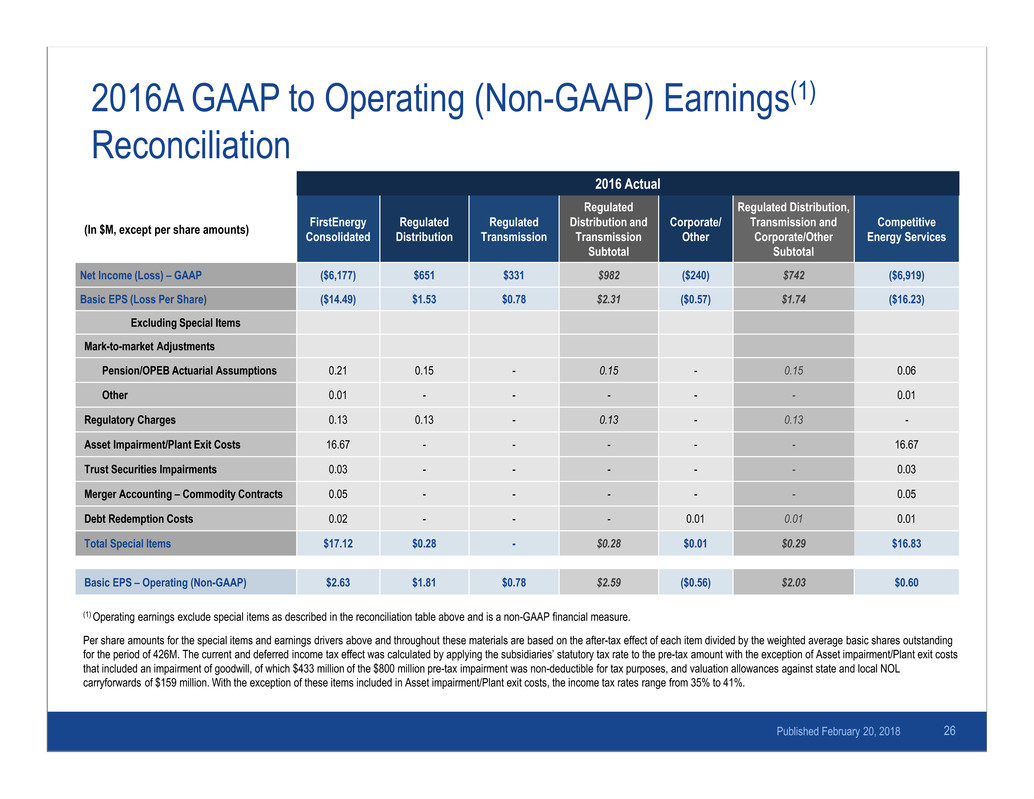

2016A GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation Published February 20, 2018 26 2016 Actual (In $M, except per share amounts) FirstEnergy Consolidated Regulated Distribution Regulated Transmission Regulated Distribution and Transmission Subtotal Corporate/ Other Regulated Distribution, Transmission and Corporate/Other Subtotal Competitive Energy Services Net Income (Loss) – GAAP ($6,177) $651 $331 $982 ($240) $742 ($6,919) Basic EPS (Loss Per Share) ($14.49) $1.53 $0.78 $2.31 ($0.57) $1.74 ($16.23) Excluding Special Items Mark-to-market Adjustments Pension/OPEB Actuarial Assumptions 0.21 0.15 - 0.15 - 0.15 0.06 Other 0.01 - - - - - 0.01 Regulatory Charges 0.13 0.13 - 0.13 - 0.13 - Asset Impairment/Plant Exit Costs 16.67 - - - - - 16.67 Trust Securities Impairments 0.03 - - - - - 0.03 Merger Accounting – Commodity Contracts 0.05 - - - - - 0.05 Debt Redemption Costs 0.02 - - - 0.01 0.01 0.01 Total Special Items $17.12 $0.28 - $0.28 $0.01 $0.29 $16.83 Basic EPS – Operating (Non-GAAP) $2.63 $1.81 $0.78 $2.59 ($0.56) $2.03 $0.60 (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. Per share amounts for the special items and earnings drivers above and throughout these materials are based on the after-tax effect of each item divided by the weighted average basic shares outstanding for the period of 426M. The current and deferred income tax effect was calculated by applying the subsidiaries’ statutory tax rate to the pre-tax amount with the exception of Asset impairment/Plant exit costs that included an impairment of goodwill, of which $433 million of the $800 million pre-tax impairment was non-deductible for tax purposes, and valuation allowances against state and local NOL carryforwards of $159 million. With the exception of these items included in Asset impairment/Plant exit costs, the income tax rates range from 35% to 41%.

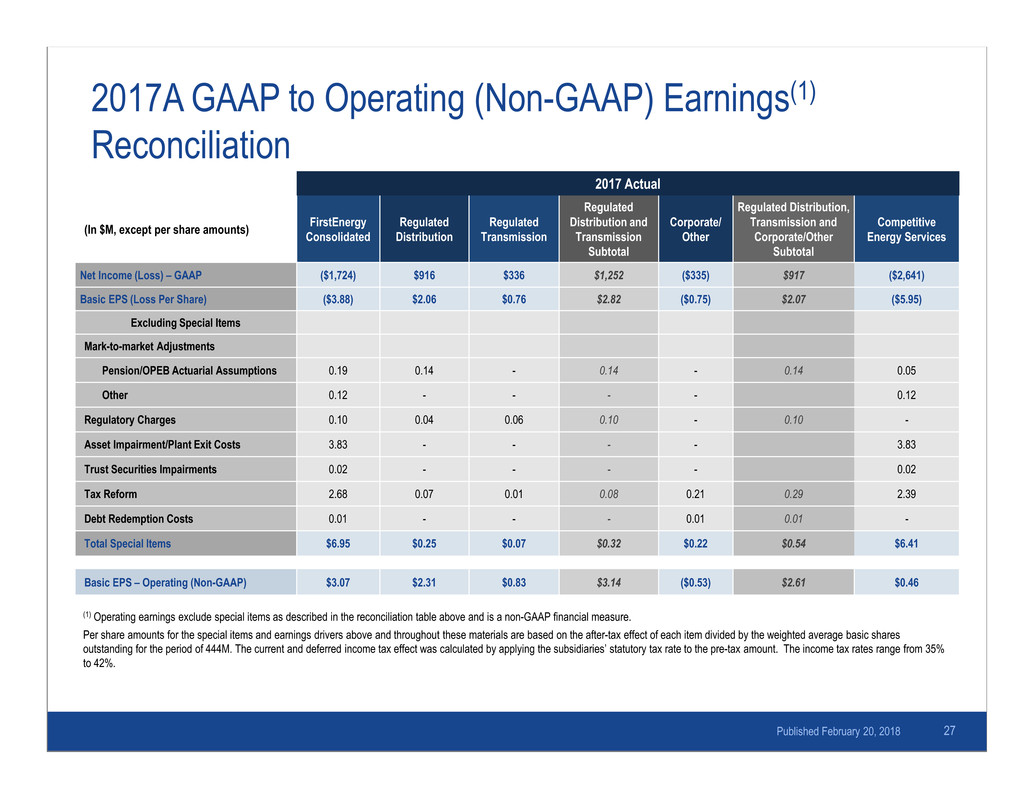

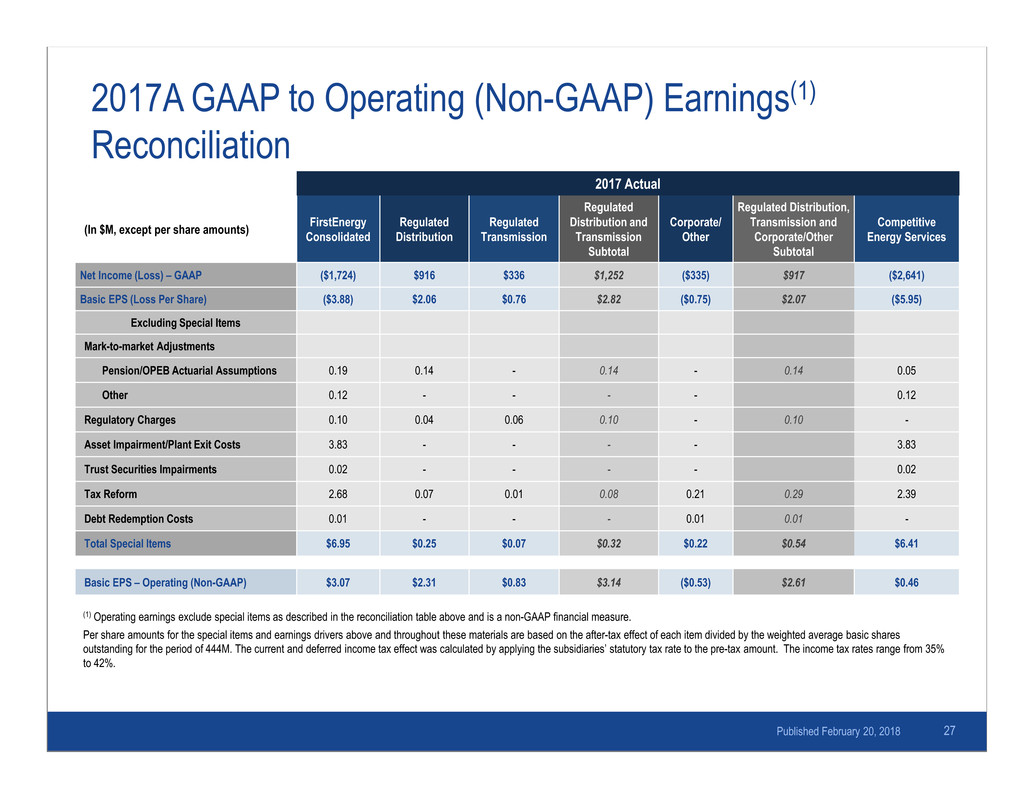

2017 Actual (In $M, except per share amounts) FirstEnergy Consolidated Regulated Distribution Regulated Transmission Regulated Distribution and Transmission Subtotal Corporate/ Other Regulated Distribution, Transmission and Corporate/Other Subtotal Competitive Energy Services Net Income (Loss) – GAAP ($1,724) $916 $336 $1,252 ($335) $917 ($2,641) Basic EPS (Loss Per Share) ($3.88) $2.06 $0.76 $2.82 ($0.75) $2.07 ($5.95) Excluding Special Items Mark-to-market Adjustments Pension/OPEB Actuarial Assumptions 0.19 0.14 - 0.14 - 0.14 0.05 Other 0.12 - - - - 0.12 Regulatory Charges 0.10 0.04 0.06 0.10 - 0.10 - Asset Impairment/Plant Exit Costs 3.83 - - - - 3.83 Trust Securities Impairments 0.02 - - - - 0.02 Tax Reform 2.68 0.07 0.01 0.08 0.21 0.29 2.39 Debt Redemption Costs 0.01 - - - 0.01 0.01 - Total Special Items $6.95 $0.25 $0.07 $0.32 $0.22 $0.54 $6.41 Basic EPS – Operating (Non-GAAP) $3.07 $2.31 $0.83 $3.14 ($0.53) $2.61 $0.46 2017A GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation Published February 20, 2018 27 (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. Per share amounts for the special items and earnings drivers above and throughout these materials are based on the after-tax effect of each item divided by the weighted average basic shares outstanding for the period of 444M. The current and deferred income tax effect was calculated by applying the subsidiaries’ statutory tax rate to the pre-tax amount. The income tax rates range from 35% to 42%.

FirstEnergy Investor Relations Contacts For our e-mail distribution list, please contact: Linda M. Nemeth, Executive Assistant to Vice President nemethl@FirstEnergyCorp.com 330-384-2509 Shareholder Inquiries: Irene M. Prezelj, Vice President prezelji@FirstEnergyCorp.com 330-384-3859 Shareholder Services (American Stock Transfer and Trust Company, LLC) firstenergy@amstock.com 1-800-736-3402 Meghan G. Beringer, Director mberinger@FirstEnergyCorp.com 330-384-5832 Jake Mackin, Manager mackinj@FirstEnergyCorp.com 330-384-4829 28Published February 20, 2018