2Q 2020 Strategic & Financial Highlights Charles E. Jones, CEO Steven E. Strah, President K. Jon Taylor, SVP and CFO July 24, 2020

Non-GAAP Financial Matters This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment are not calculated in accordance with GAAP to the extent they exclude the impact of “special items.” Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items also reflect the adjustment to include the full impact of share dilution from the $2.5 billion equity issuance in January 2018. Special items are not necessarily non-recurring. FirstEnergy Corp. (FE or the Company) management cannot estimate on a forward-looking basis the impact of these items in the context of Operating earnings (loss) per share growth projections because these items, which could be significant, are difficult to predict and may be highly variable. Consequently, the Company is unable to reconcile Operating earnings (loss) per share growth projections (i.e. CAGR) to a GAAP measure without unreasonable effort. Operating earnings (loss) per share and Operating earnings (loss) per share for each segment is calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented in 2019 by 539 million shares, 541 million shares for the first half of 2020, and 542 million shares in the second quarter and full year 2020, which reflects the full impact of share dilution from the equity issuance in January 2018. Management uses non-GAAP financial measures such as Operating earnings (loss) and Operating earnings (loss) per share to evaluate the company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating earnings (loss) per share by segment to further evaluate the company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FirstEnergy has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. 2 July 24, 2020

Business Updates Commentary on House Bill 6 Investigation COVID-19 Summary ■ Our business strategy remains resilient; well-positioned to continue managing through the COVID-19 crisis – Continue making our planned investments and deploying capital across our system – Have not experienced any significant disruptions to our supply chain or workforce ■ To protect the health and safety of our employees, their families, and our customers, we adjusted our work procedures early in the pandemic and have continued refining our practices – Our employees haven’t missed a beat; both those in the field and the 7,000 working from home ■ Safety is an unwavering core value, and we will continue to provide employees with a safe working environment as we do our part to stop the spread of this disease Diversity & Inclusion ■ The outcry over inequality and social injustice faced by people of color have also brought us together with a deeper sense of urgency and renewed focus on diversity and inclusion The FirstEnergy team is coming together to work smarter, more creatively and more efficiently than ever before; we will continue keeping safety our top priority 3 July 24, 2020

Financial Summary 2Q 2020 Results ■ Reported GAAP and Operating earnings of $0.57 per basic share – Results near the upper end of the operating earnings guidance ■ As expected, business model and rate structure provided a measure of stability during this period of pandemic and economic slowdown – While weather-adjusted load dropped by almost 4% vs. 2Q19, the increase in residential revenues more than offset the decreases in the C&I classes Guidance Updates ■ Affirming 2020 GAAP earnings forecast of $1,020M - $1,130M, or $1.88 - $2.08 per share – Includes the impact from the February 26th remeasurement of Pension/OPEB plans ■ Affirming 2020 Operating (non-GAAP) earnings guidance of $2.40 - $2.60 per share(1) ■ Affirming Operating (non-GAAP) EPS CAGR(2) projection of 6% - 8% from 2018 through 2021, and 5% - 7% extending through 2023 – Includes up to $600M of equity annually in 2022 and 2023, to fund growth initiatives ■ Introducing 3Q 2020 GAAP and Operating (non-GAAP) earnings guidance of $0.73 to $0.83 per share (1) Refer to the Earnings Supplement to the Financial Community section for reconciliations between GAAP and Operating (non-GAAP) earnings (2) Refer to slide 2 for information on Non-GAAP Financial Matters 4 July 24, 2020

Regulatory & Operational Updates COVID-19 Updates ■ Utility commissions in West Virginia and New Jersey have both authorized deferral mechanisms for incremental expenses as a result of COVID-19 and the Pennsylvania PUC authorized a deferral mechanism for uncollectible expenses – In April, Maryland was the first state in our territory to put such a mechanism in place ■ We have existing riders in Ohio and New Jersey for uncollectible expenses New Jersey Updates ■ Administrative Law Judge (ALJ) assigned for our distribution base rate case – Case was filed in February to recover increasing costs associated with providing safe and reliable electric service along with recovery of storm costs incurred over the last few years ■ In settlement discussions on our formula rate filing for JCP&L’s transmission assets – In December, FERC accepted our application to move these transmission assets onto forward-looking formula rates effective January 1, 2020, subject to refund – Supports our plan for ~$175M in customer-focused cap-ex on JCP&L’s transmission system in 2020 Capital Spend Update ■ Continue to execute on our plans for 2020 ■ Even with the significant precautions to keep our employees and customers safe, remain on track to make more than $3B in customer-focused investments 5 July 24, 2020

(GAAP) (Non-GAAP) 2Q20 vs. 2Q19 EPS Variance Basic EPS Operating EPS(1) Regulated Distribution ($0.01) ($0.02) 2Q 2020 Earnings Results Regulated Transmission ($0.01) ($0.01) (1) Quarter-over-Quarter: Basic EPS / Operating EPS Corporate / Other $0.01 ($0.01) FE Consolidated ($0.01) ($0.04) ■ Reconciliations and detailed information is available on our website – Strategic & Financial Highlights and Investor FactBook documents ■ Reported 2Q 2020 GAAP and Operating earnings of $0.57 per basic and diluted share – Results near top end of 2Q quarterly guidance range of $0.48 - $0.58 per share ■ Regulated Distribution ($0.01) / ($0.02) ■ Regulated Transmission: ($0.01) / ($0.01) – Results due to the absence of the Ohio DMR – Earnings growth from continued Energizing the and higher expenses due to COVID-19, mostly Future investments at MAIT and ATSI was offset by revenue increases as a result of higher more than offset by the reconciliation of the residential usage, incremental rider revenues, estimated vs. actual true-ups of our formula and weather rates revenues and higher interest expense Quarter-over-Quarter 2Q20 vs. 2Q19 ■ Corporate / Other: +$0.01 / ($0.01) Sales Comparisons Actual Weather-Adj Residential +17.1% +14.8% – Results due to higher expenses, partially offset Commercial(2) (14.4%) (14.5%) by discrete income tax benefits Industrial (11.7%) (11.7%) Increased residential volumes more than offset the decrease in C&I load; net benefit of +$0.04 per share Weather Comparison Vs. Normal Vs. 2Q19 Heating Degree Days +27% +58% Cooling Degree Days +2% +6% Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period assuming full impact of dilution from the $2.5 billion equity issuance in January 2018. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the second quarter of 2020 and 2019. (1) Refer to the Earnings Supplement to the Financial Community section for reconciliations between GAAP and Operating (non-GAAP) earnings (2) Commercial includes Other (Streetlight customers) 6 July 24, 2020

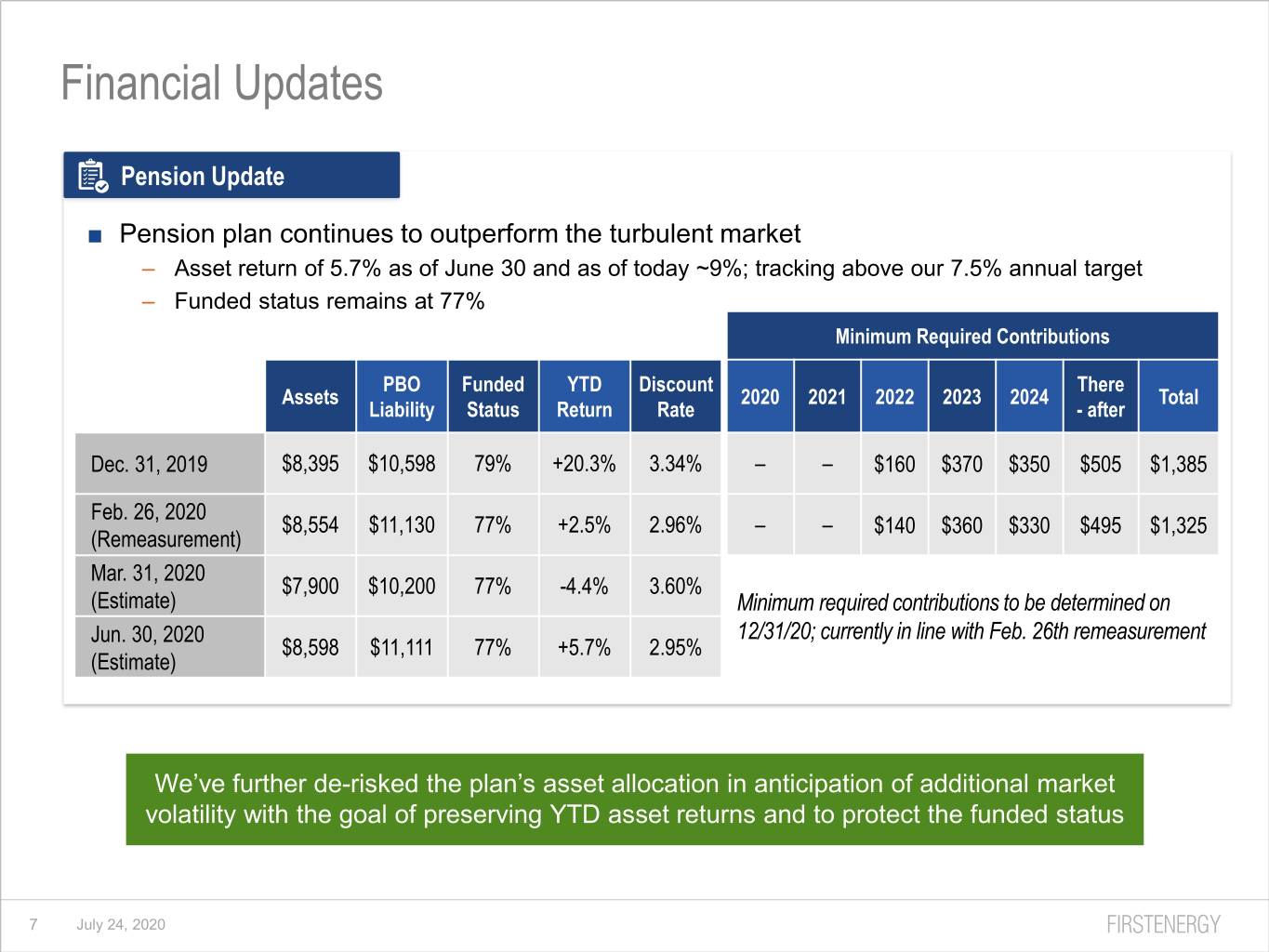

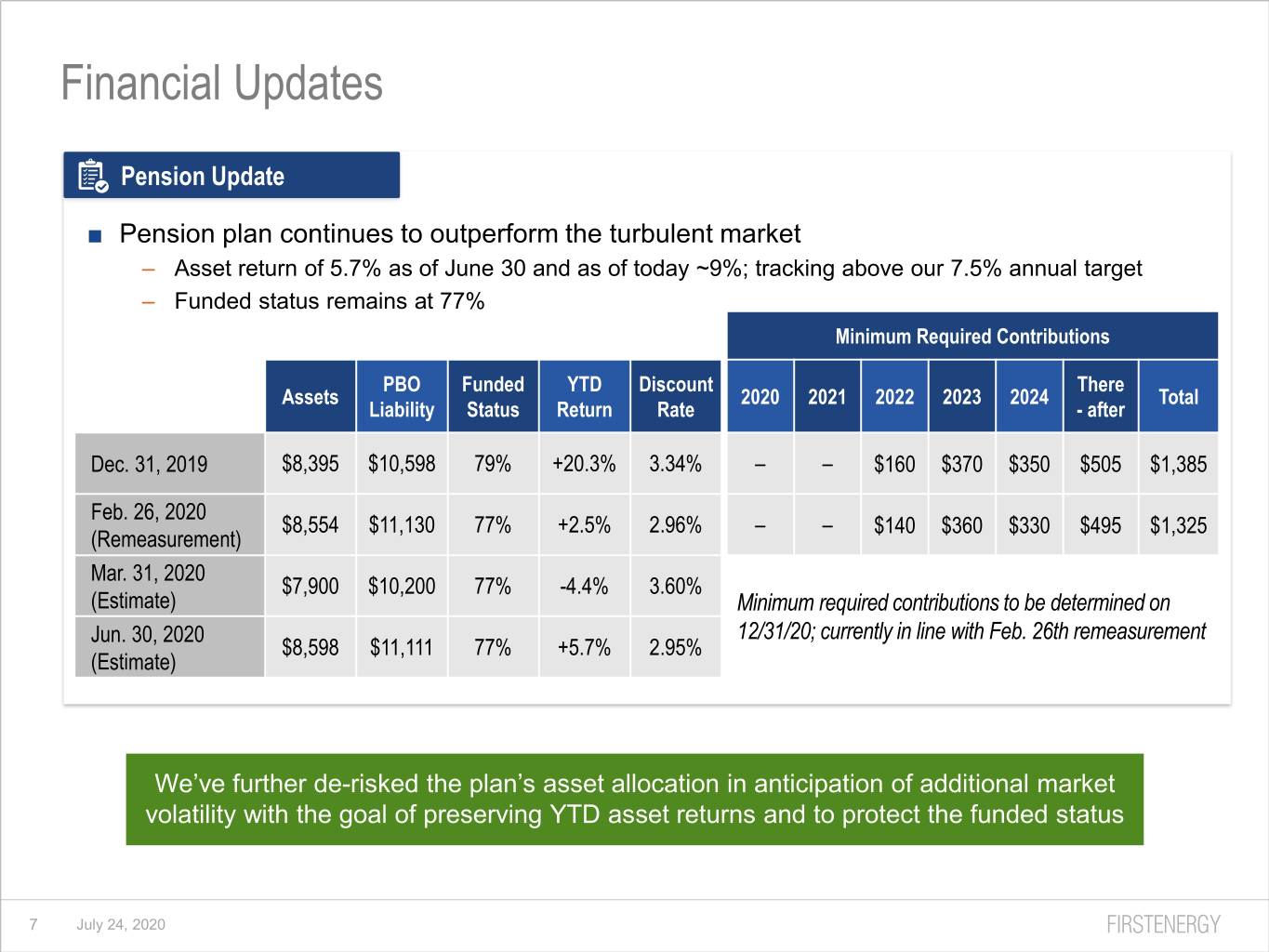

Financial Updates Pension Update ■ Pension plan continues to outperform the turbulent market – Asset return of 5.7% as of June 30 and as of today ~9%; tracking above our 7.5% annual target – Funded status remains at 77% Minimum Required Contributions PBO Funded YTD Discount There Assets 2020 2021 2022 2023 2024 Total Liability Status Return Rate - after Dec. 31, 2019 $8,395 $10,598 79% +20.3% 3.34% – – $160 $370 $350 $505 $1,385 Feb. 26, 2020 $8,554 $11,130 77% +2.5% 2.96% – – $140 $360 $330 $495 $1,325 (Remeasurement) Mar. 31, 2020 $7,900 $10,200 77% -4.4% 3.60% (Estimate) Minimum required contributions to be determined on Jun. 30, 2020 12/31/20; currently in line with Feb. 26th remeasurement $8,598 $11,111 77% +5.7% 2.95% (Estimate) We’ve further de-risked the plan’s asset allocation in anticipation of additional market volatility with the goal of preserving YTD asset returns and to protect the funded status 7 July 24, 2020

Financial Updates (Continued) Financing Updates ■ In June, completed the refinancing of $750M in FE Corp. debt at a blended rate of 2% ■ In June, also completed a $175M debt financing at Potomac Edison; and in July, completed a $250M debt financing at CEI ■ Our liquidity remains strong at $3.5B – Credit facilities in place through December 2022 – Compliant with all covenants and can make the necessary representations and warranties as required under our credit facilities to borrow money ■ In regards to our financing plan, our debt maturities are minimal – No other debt maturing in 2020; only $74M expiring in 2021 – New money requirements are very manageable; $250M in 2020 and $575M in 2021 8 July 24, 2020

Earnings Supplement to the Financial Community TABLE OF CONTENTS (Slide) 10. 2Q Earnings Summary and Reconciliation 11. YTD Earnings Summary and Reconciliation 12. 2Q Earnings Drivers by Segment 13. Special Items Descriptions 14. 2Q 2020 Earnings Results 15. 2Q 2019 Earnings Results 16. Quarter-over-Quarter Earnings Comparison 17. YTD 2020 Earnings Results 18. YTD 2019 Earnings Results 19. Year-over-Year Earnings Comparison 20. Condensed Consolidated Balance Sheets (GAAP) 21. Condensed Consolidated Statements of Cash Flows (GAAP) 22. 2020F GAAP to Operating (Non-GAAP) Earnings Reconciliation 23. Forward-Looking Statements Irene M. Prezelj, Vice President Gina E. Caskey, Senior Advisor Jake M. Mackin, Consultant prezelji@firstenergycorp.com caskeyg@firstenergycorp.com mackinj@firstenergycorp.com 330.384.3859 330.761.4185 330.384.4829 9 July 24, 2020

Quarterly Summary 2Q 2020 2Q 2019 Change GAAP Earnings (Loss) Per Basic Share $0.57 $0.58 $(0.01) Special Items $— $0.03 $(0.03) Operating (Non-GAAP) Earnings Per Share $0.57 $0.61 $(0.04) Quarterly Reconciliation FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2Q 2019 Net Income (Loss) attributable to Common Stockholders (GAAP) $258 $116 $(66) $308 2Q 2019 Basic Earnings (Loss) Per Share (avg. shares outstanding 532M) $0.48 $0.22 $(0.12) $0.58 Special Items - 2019 Impact of full dilution (0.01) — 0.01 — Exit of competitive generation 0.02 — 0.01 0.03 Total Special Items - 2Q 2019 0.01 — 0.02 0.03 2Q 2019 Operating Earnings (Loss) Per Share - Non-GAAP (539M fully diluted shares) $0.49 $0.22 $(0.10) $0.61 Distribution Revenues 0.10 — — 0.10 Absence of Ohio DMR (0.06) — — (0.06) Transmission Margin — 0.02 — 0.02 Net Operating and Miscellaneous Expenses (0.03) — (0.03) (0.06) Depreciation (0.02) — — (0.02) General Taxes (0.02) — — (0.02) Net Financing Costs — (0.01) — (0.01) 2019 Rate True-Ups — (0.01) — (0.01) Effective Tax Rate — — 0.02 0.02 Other 0.01 (0.01) — — 2Q 2020 Operating Earnings (Loss) Per Share - Non-GAAP (542M fully diluted shares) $0.47 $0.21 $(0.11) $0.57 Special Items - 2020 Total Special Items - 2Q 2020 — — — — 2Q 2020 Basic Earnings (Loss) Per Share (avg. shares outstanding 542M) $0.47 $0.21 $(0.11) $0.57 2Q 2020 Net Income (Loss) attributable to Common Stockholders (GAAP) $251 $114 $(56) $309 Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period assuming full impact of dilution from the $2.5 billion equity issuance in January 2018. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the second quarter of 2020 and 2019. Note: Refer to slide 2 for information on Non-GAAP Financial Matters. 10 July 24, 2020

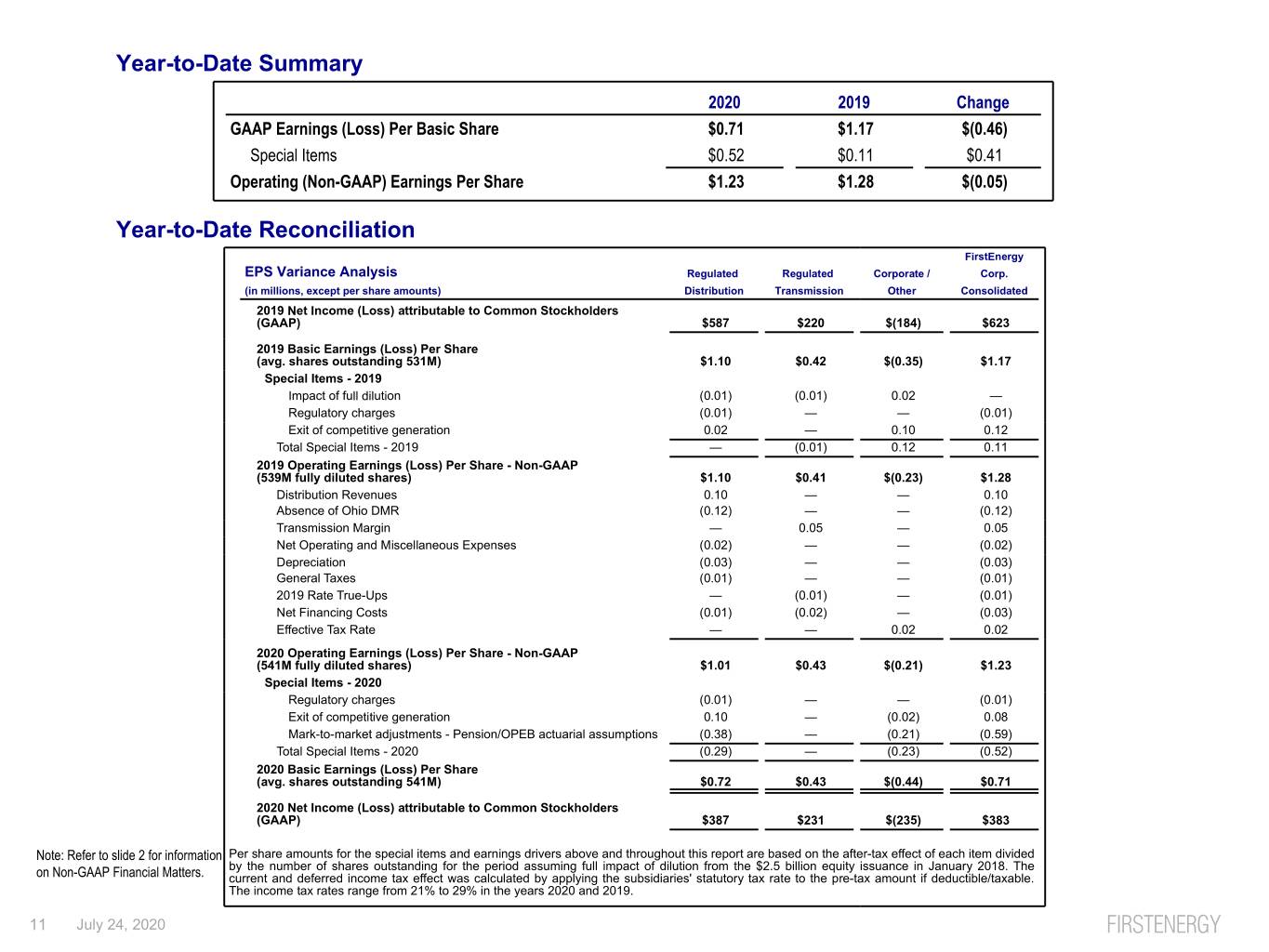

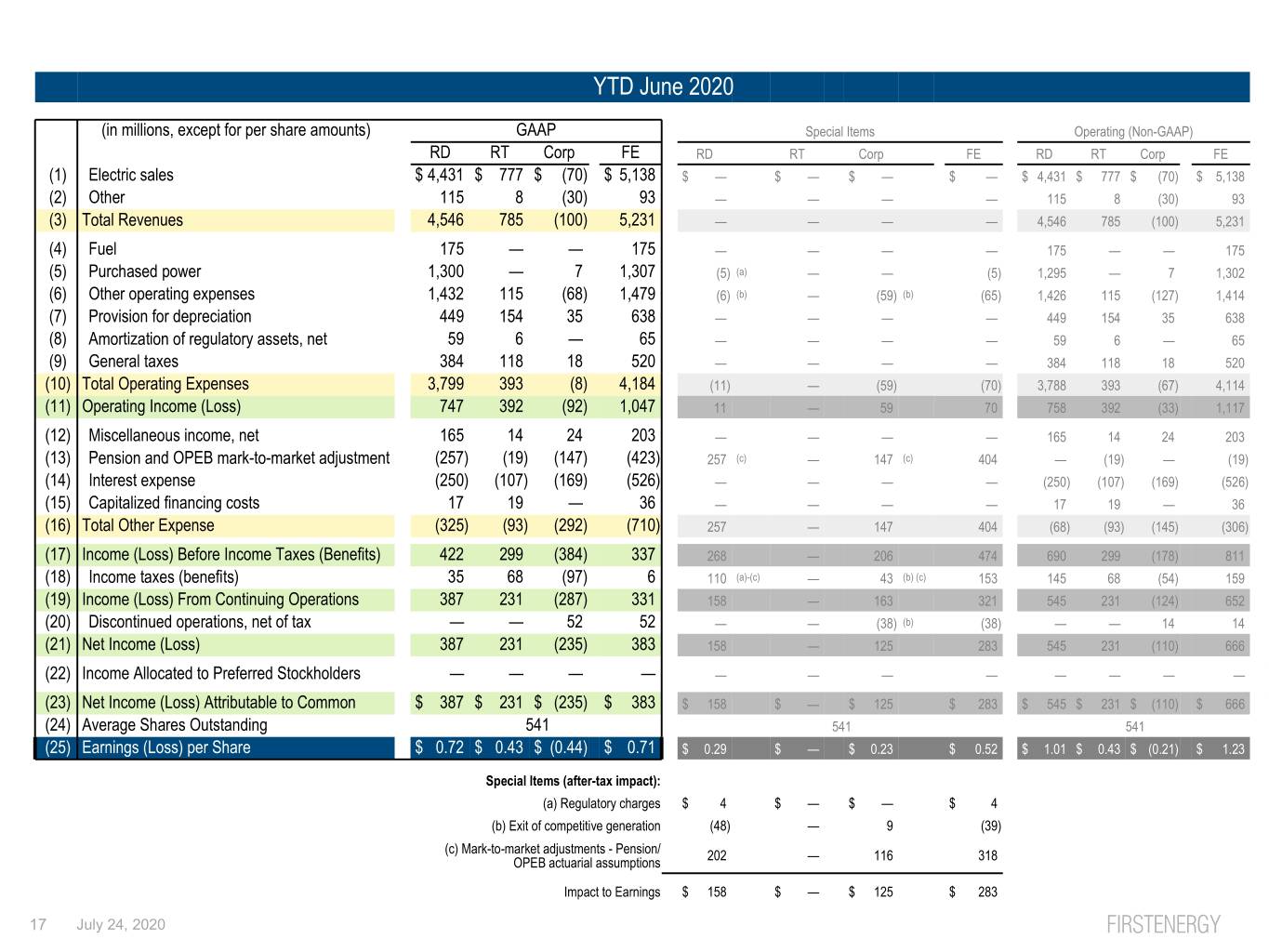

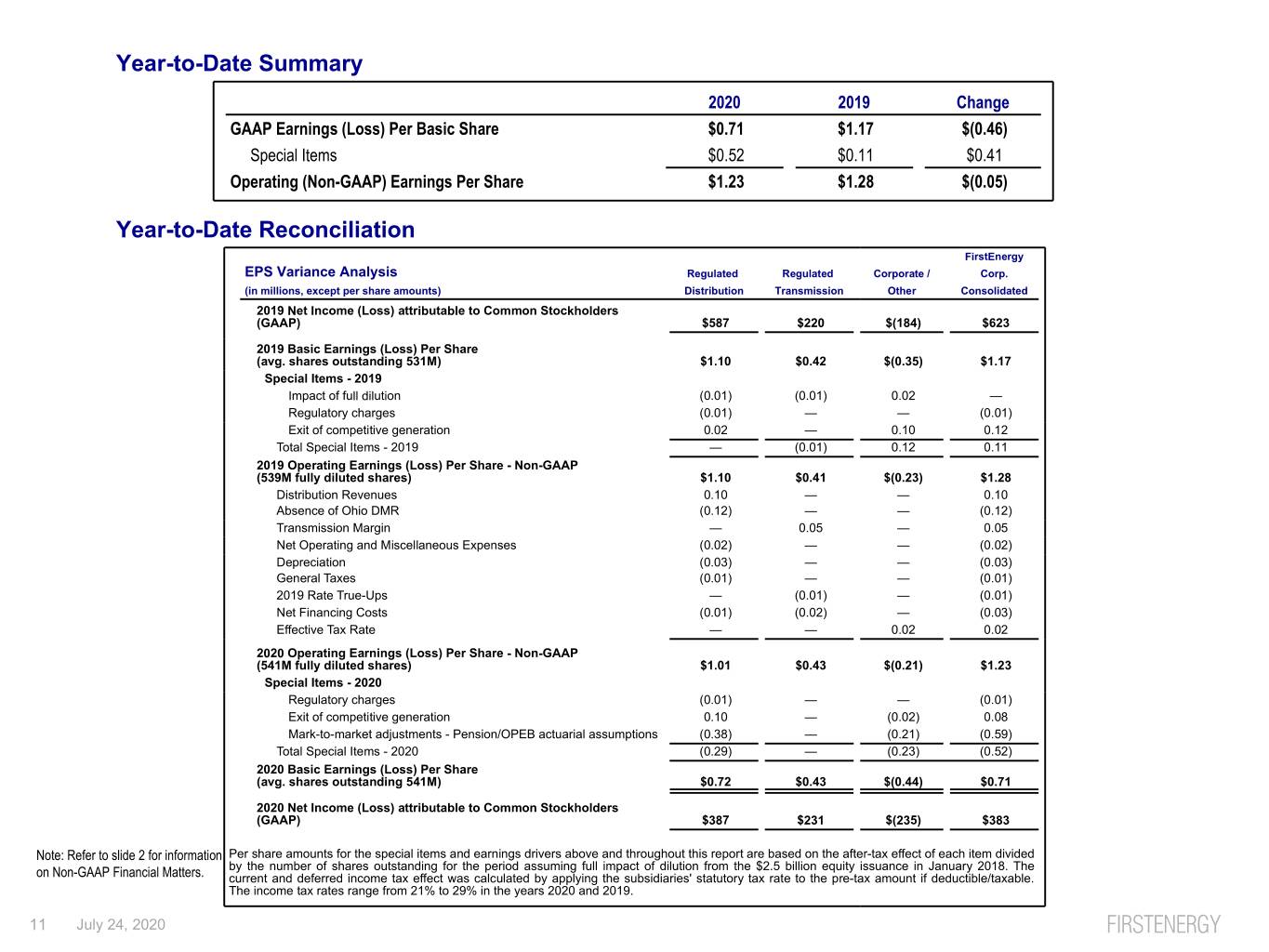

Year-to-Date Summary 2020 2019 Change GAAP Earnings (Loss) Per Basic Share $0.71 $1.17 $(0.46) Special Items $0.52 $0.11 $0.41 Operating (Non-GAAP) Earnings Per Share $1.23 $1.28 $(0.05) Year-to-Date Reconciliation FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2019 Net Income (Loss) attributable to Common Stockholders (GAAP) $587 $220 $(184) $623 2019 Basic Earnings (Loss) Per Share (avg. shares outstanding 531M) $1.10 $0.42 $(0.35) $1.17 Special Items - 2019 Impact of full dilution (0.01) (0.01) 0.02 — Regulatory charges (0.01) — — (0.01) Exit of competitive generation 0.02 — 0.10 0.12 Total Special Items - 2019 — (0.01) 0.12 0.11 2019 Operating Earnings (Loss) Per Share - Non-GAAP (539M fully diluted shares) $1.10 $0.41 $(0.23) $1.28 Distribution Revenues 0.10 — — 0.10 Absence of Ohio DMR (0.12) — — (0.12) Transmission Margin — 0.05 — 0.05 Net Operating and Miscellaneous Expenses (0.02) — — (0.02) Depreciation (0.03) — — (0.03) General Taxes (0.01) — — (0.01) 2019 Rate True-Ups — (0.01) — (0.01) Net Financing Costs (0.01) (0.02) — (0.03) Effective Tax Rate — — 0.02 0.02 2020 Operating Earnings (Loss) Per Share - Non-GAAP (541M fully diluted shares) $1.01 $0.43 $(0.21) $1.23 Special Items - 2020 Regulatory charges (0.01) — — (0.01) Exit of competitive generation 0.10 — (0.02) 0.08 Mark-to-market adjustments - Pension/OPEB actuarial assumptions (0.38) — (0.21) (0.59) Total Special Items - 2020 (0.29) — (0.23) (0.52) 2020 Basic Earnings (Loss) Per Share (avg. shares outstanding 541M) $0.72 $0.43 $(0.44) $0.71 2020 Net Income (Loss) attributable to Common Stockholders (GAAP) $387 $231 $(235) $383 Note: Refer to slide 2 for information Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period assuming full impact of dilution from the $2.5 billion equity issuance in January 2018. The on Non-GAAP Financial Matters. current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the years 2020 and 2019. 11 July 24, 2020

Earnings Drivers: 2Q 2020 vs. 2Q 2019 Regulated Distribution (RD) ▪ Distribution Revenues: Distribution revenues increased earnings $0.10 per share, due to $0.05 per share from incremental rider revenues in Ohio and Pennsylvania, $0.04 per share benefit from a favorable mix of weather-adjusted sales (higher residential volumes, partially offset by lower commercial and industrial volumes), and $0.01 per share from higher weather-related usage. Q-o-Q Weather-Adjusted Distribution Deliveries Q-o-Q Actual Distribution Deliveries 14.8% 17.1% (3.8)% (3.1)% (14.5)% (11.7)% (14.4)% (11.7)% Residential Commercial* Industrial Total Residential Commercial* Industrial Total ▪ Absence of Ohio DMR: Absence of earnings contribution from the Ohio Distribution Modernization Rider (DMR), which ended on July 2, 2019, decreased earnings $0.06 per share. ▪ Net Operating and Miscellaneous Expenses: Higher expenses decreased earnings $0.03 per share. ▪ Depreciation: Higher depreciation expense decreased earnings $0.02 per share, primarily due to a higher asset base. ▪ General Taxes: Higher general taxes decreased earnings $0.02 per share. ▪ Other: Other/Segment Rounding increased earnings $0.01 per share. Regulated Transmission (RT) ▪ Transmission Margin: Higher transmission margin increased earnings $0.02 per share, primarily due to higher rate base at Mid-Atlantic Interstate Transmission, LLC (MAIT) and American Transmission Systems, Incorporated (ATSI). ▪ Net Financing Costs: Higher interest expense decreased earnings $0.01 per share. ▪ 2019 Rate True-Ups: True-ups associated with Actual Transmission Revenue Requirement (ATRR) filings at MAIT and ATSI decreased earnings $0.01 per share. ▪ Other: Other/Segment Rounding decreased earnings $0.01 per share. Corporate / Other (Corp) ▪ Net Operating and Miscellaneous Expenses: Higher expenses decreased results $0.03 per share. ▪ Effective Tax Rate: Discrete income tax benefits increased results $0.02 per share. *Commercial includes Other (Streetlight customers) 12 July 24, 2020

Special Items Descriptions ▪ Regulatory charges: Primarily reflects the impact of regulatory agreements or orders requiring certain commitments and/or disallowing the recoverability of costs, net of related credits. ▪ Exit of competitive generation: Primarily reflects charges or credits resulting from the exit of competitive operations and impairments of certain non-core assets, including the impact of deconsolidating FES, its subsidiaries and FENOC, following their voluntary petitions for bankruptcy protection on March 31, 2018. ▪ Mark-to-market adjustments - Pension/OPEB actuarial assumptions: Reflects the change in fair value of plan assets and net actuarial gains and losses associated with the company's pension and other post-employment benefit plans. ▪ Impact of full dilution: Represents the dilutive impact of increasing weighted average shares outstanding to reflect the full impact of share dilution from the $2.5 billion equity issuance in January 2018, including preferred dividends and conversion of preferred stock to common shares. Note: Special items represent charges incurred or benefits realized, including share dilution, that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. 13 July 24, 2020

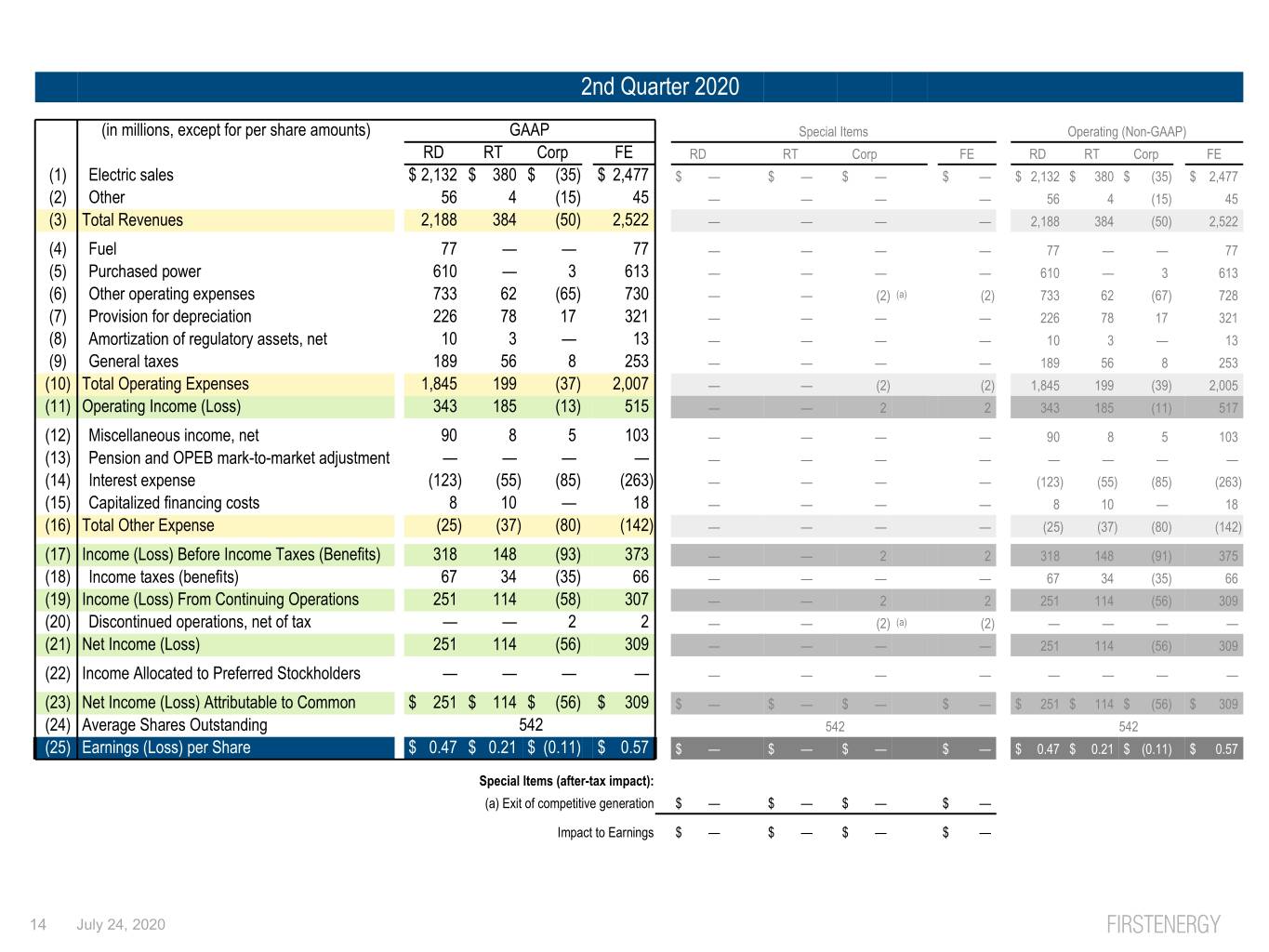

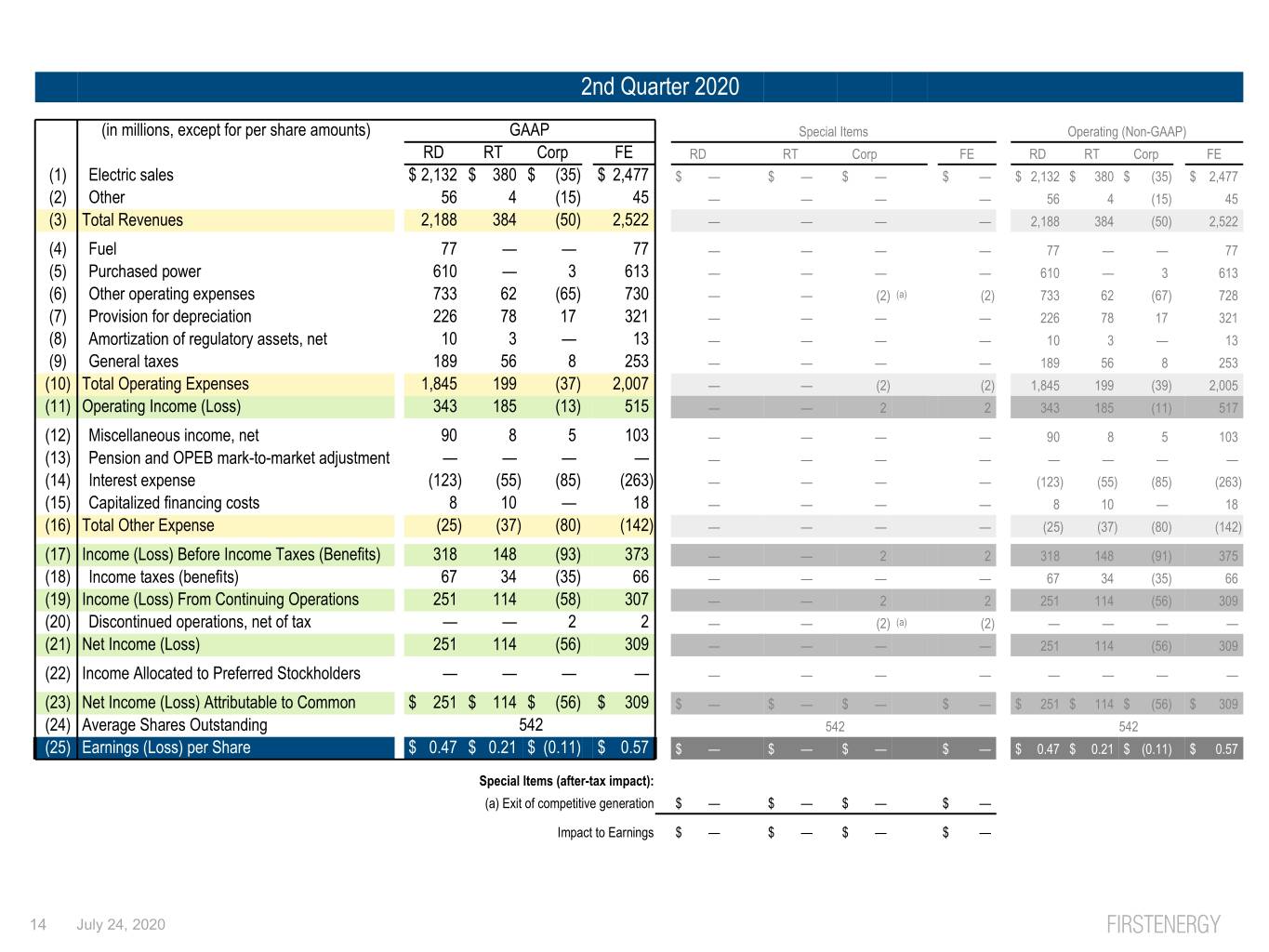

2nd Quarter 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,132 $ 380 $ (35) $ 2,477 $ — $ — $ — $ — $ 2,132 $ 380 $ (35) $ 2,477 (2) Other 56 4 (15) 45 — — — — 56 4 (15) 45 (3) Total Revenues 2,188 384 (50) 2,522 — — — — 2,188 384 (50) 2,522 (4) Fuel 77 — — 77 — — — — 77 — — 77 (5) Purchased power 610 — 3 613 — — — — 610 — 3 613 (6) Other operating expenses 733 62 (65) 730 — — (2) (a) (2) 733 62 (67) 728 (7) Provision for depreciation 226 78 17 321 — — — — 226 78 17 321 (8) Amortization of regulatory assets, net 10 3 — 13 — — — — 10 3 — 13 (9) General taxes 189 56 8 253 — — — — 189 56 8 253 (10) Total Operating Expenses 1,845 199 (37) 2,007 — — (2) (2) 1,845 199 (39) 2,005 (11) Operating Income (Loss) 343 185 (13) 515 — — 2 2 343 185 (11) 517 (12) Miscellaneous income, net 90 8 5 103 — — — — 90 8 5 103 (13) Pension and OPEB mark-to-market adjustment — — — — — — — — — — — — (14) Interest expense (123) (55) (85) (263) — — — — (123) (55) (85) (263) (15) Capitalized financing costs 8 10 — 18 — — — — 8 10 — 18 (16) Total Other Expense (25) (37) (80) (142) — — — — (25) (37) (80) (142) (17) Income (Loss) Before Income Taxes (Benefits) 318 148 (93) 373 — — 2 2 318 148 (91) 375 (18) Income taxes (benefits) 67 34 (35) 66 — — — — 67 34 (35) 66 (19) Income (Loss) From Continuing Operations 251 114 (58) 307 — — 2 2 251 114 (56) 309 (20) Discontinued operations, net of tax — — 2 2 — — (2) (a) (2) — — — — (21) Net Income (Loss) 251 114 (56) 309 — — — — 251 114 (56) 309 (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 251 $ 114 $ (56) $ 309 $ — $ — $ — $ — $ 251 $ 114 $ (56) $ 309 (24) Average Shares Outstanding 542 542 542 (25) Earnings (Loss) per Share $ 0.47 $ 0.21 $ (0.11) $ 0.57 $ — $ — $ — $ — $ 0.47 $ 0.21 $ (0.11) $ 0.57 Special Items (after-tax impact): (a) Exit of competitive generation $ — $ — $ — $ — Impact to Earnings $ — $ — $ — $ — 14 July 24, 2020

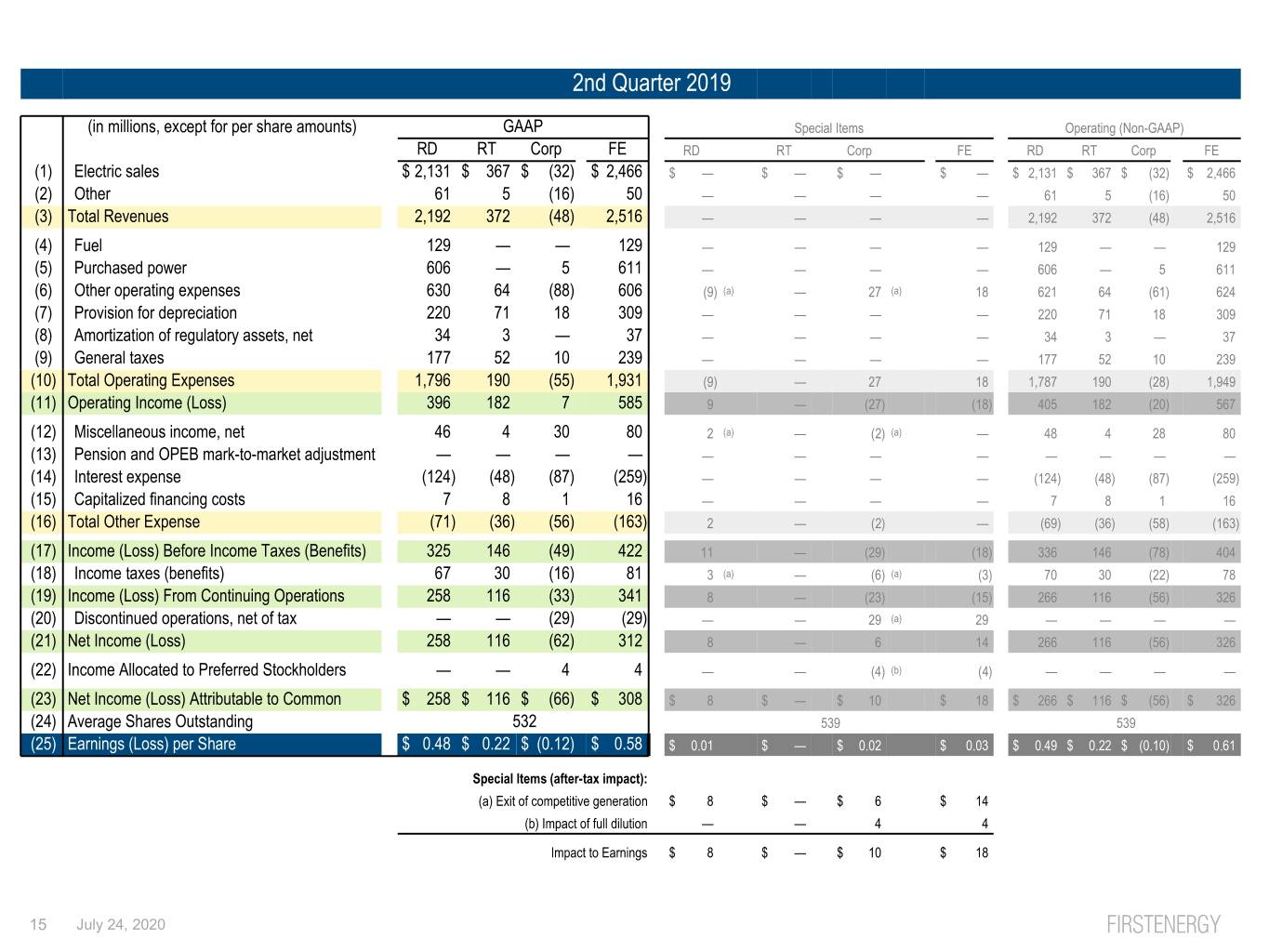

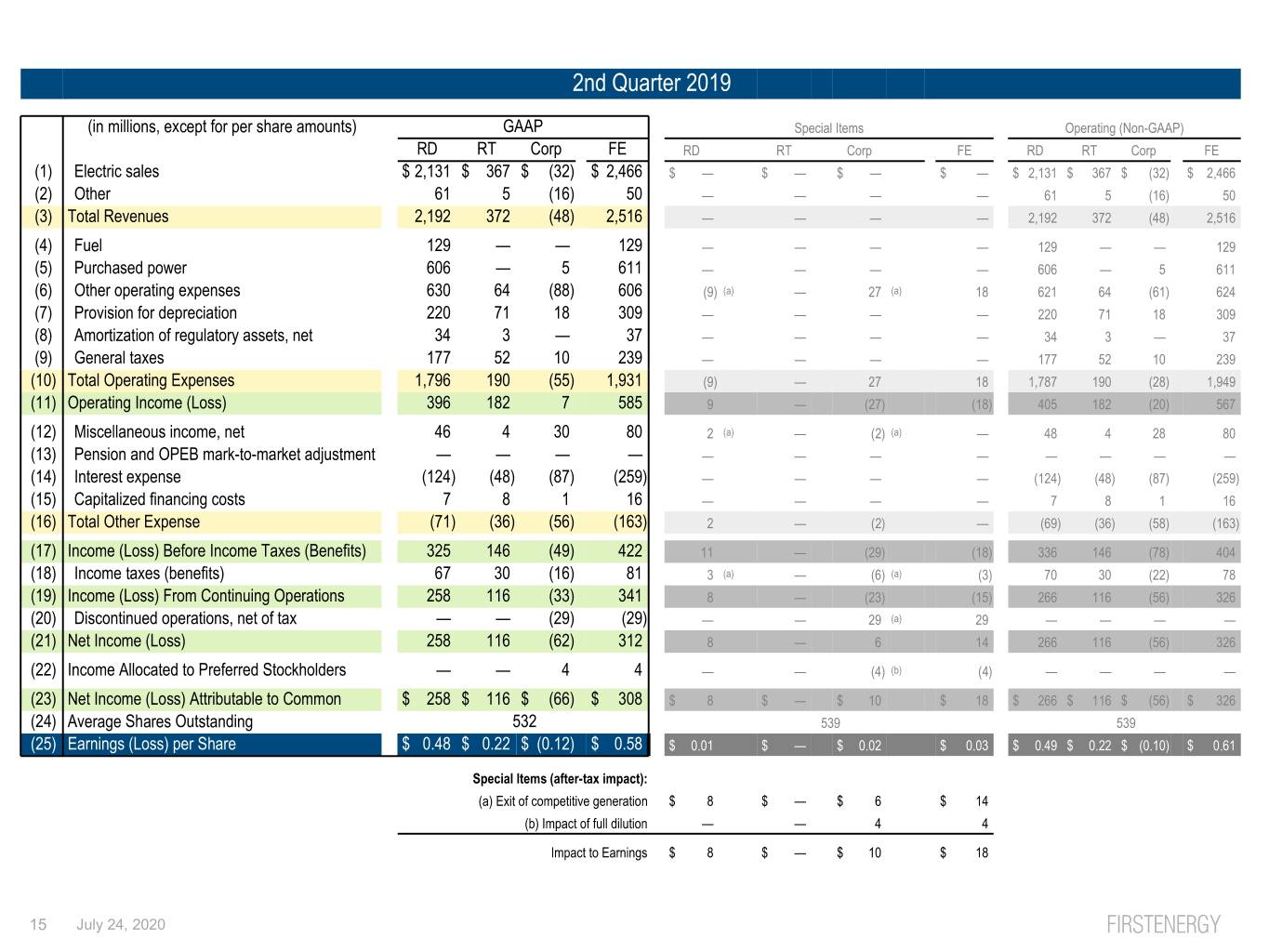

2nd Quarter 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,131 $ 367 $ (32) $ 2,466 $ — $ — $ — $ — $ 2,131 $ 367 $ (32) $ 2,466 (2) Other 61 5 (16) 50 — — — — 61 5 (16) 50 (3) Total Revenues 2,192 372 (48) 2,516 — — — — 2,192 372 (48) 2,516 (4) Fuel 129 — — 129 — — — — 129 — — 129 (5) Purchased power 606 — 5 611 — — — — 606 — 5 611 (6) Other operating expenses 630 64 (88) 606 (9) (a) — 27 (a) 18 621 64 (61) 624 (7) Provision for depreciation 220 71 18 309 — — — — 220 71 18 309 (8) Amortization of regulatory assets, net 34 3 — 37 — — — — 34 3 — 37 (9) General taxes 177 52 10 239 — — — — 177 52 10 239 (10) Total Operating Expenses 1,796 190 (55) 1,931 (9) — 27 18 1,787 190 (28) 1,949 (11) Operating Income (Loss) 396 182 7 585 9 — (27) (18) 405 182 (20) 567 (12) Miscellaneous income, net 46 4 30 80 2 (a) — (2) (a) — 48 4 28 80 (13) Pension and OPEB mark-to-market adjustment — — — — — — — — — — — — (14) Interest expense (124) (48) (87) (259) — — — — (124) (48) (87) (259) (15) Capitalized financing costs 7 8 1 16 — — — — 7 8 1 16 (16) Total Other Expense (71) (36) (56) (163) 2 — (2) — (69) (36) (58) (163) (17) Income (Loss) Before Income Taxes (Benefits) 325 146 (49) 422 11 — (29) (18) 336 146 (78) 404 (18) Income taxes (benefits) 67 30 (16) 81 3 (a) — (6) (a) (3) 70 30 (22) 78 (19) Income (Loss) From Continuing Operations 258 116 (33) 341 8 — (23) (15) 266 116 (56) 326 (20) Discontinued operations, net of tax — — (29) (29) — — 29 (a) 29 — — — — (21) Net Income (Loss) 258 116 (62) 312 8 — 6 14 266 116 (56) 326 (22) Income Allocated to Preferred Stockholders — — 4 4 — — (4) (b) (4) — — — — (23) Net Income (Loss) Attributable to Common $ 258 $ 116 $ (66) $ 308 $ 8 $ — $ 10 $ 18 $ 266 $ 116 $ (56) $ 326 (24) Average Shares Outstanding 532 539 539 (25) Earnings (Loss) per Share $ 0.48 $ 0.22 $ (0.12) $ 0.58 $ 0.01 $ — $ 0.02 $ 0.03 $ 0.49 $ 0.22 $ (0.10) $ 0.61 Special Items (after-tax impact): (a) Exit of competitive generation $ 8 $ — $ 6 $ 14 (b) Impact of full dilution — — 4 4 Impact to Earnings $ 8 $ — $ 10 $ 18 15 July 24, 2020

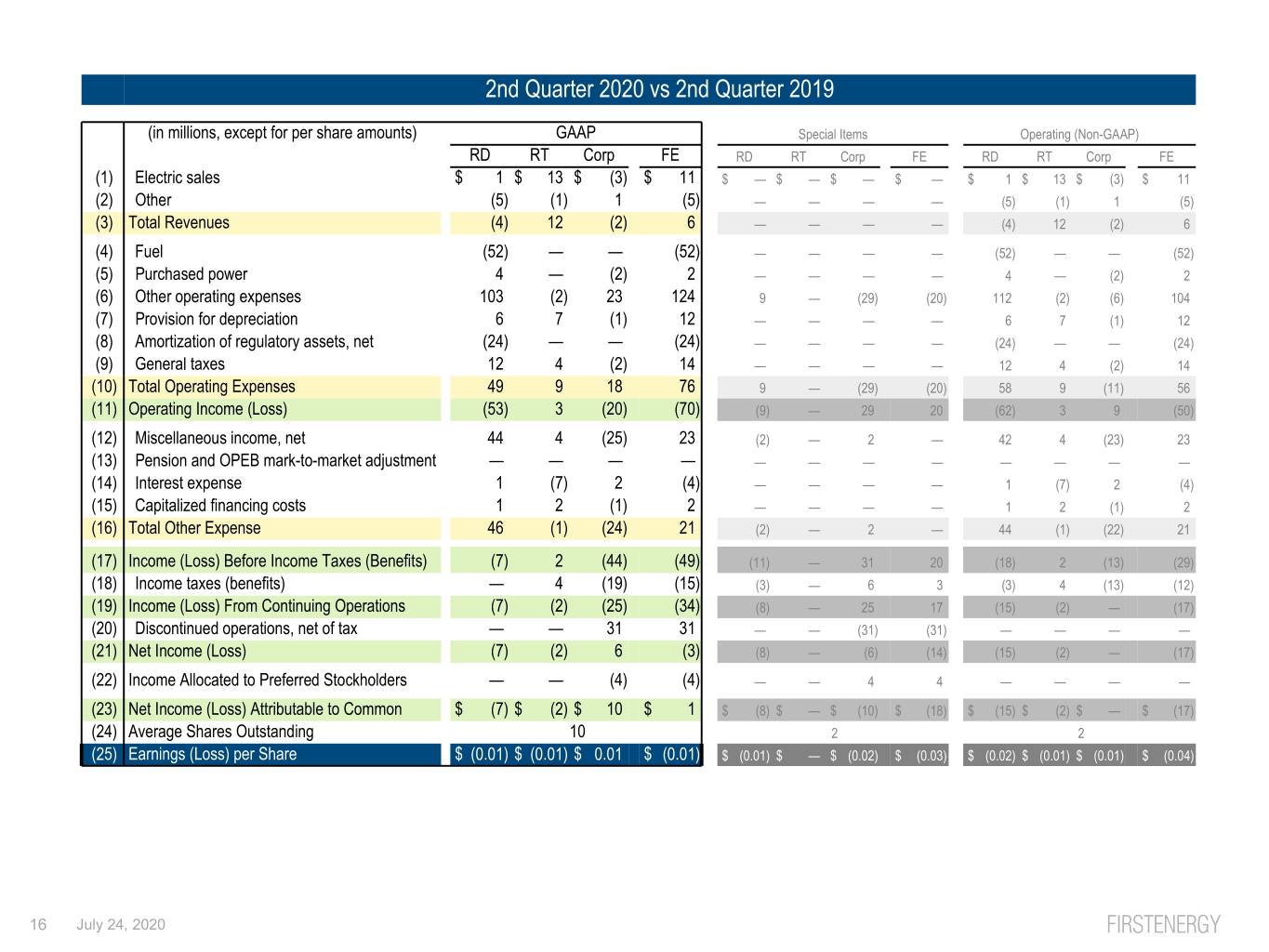

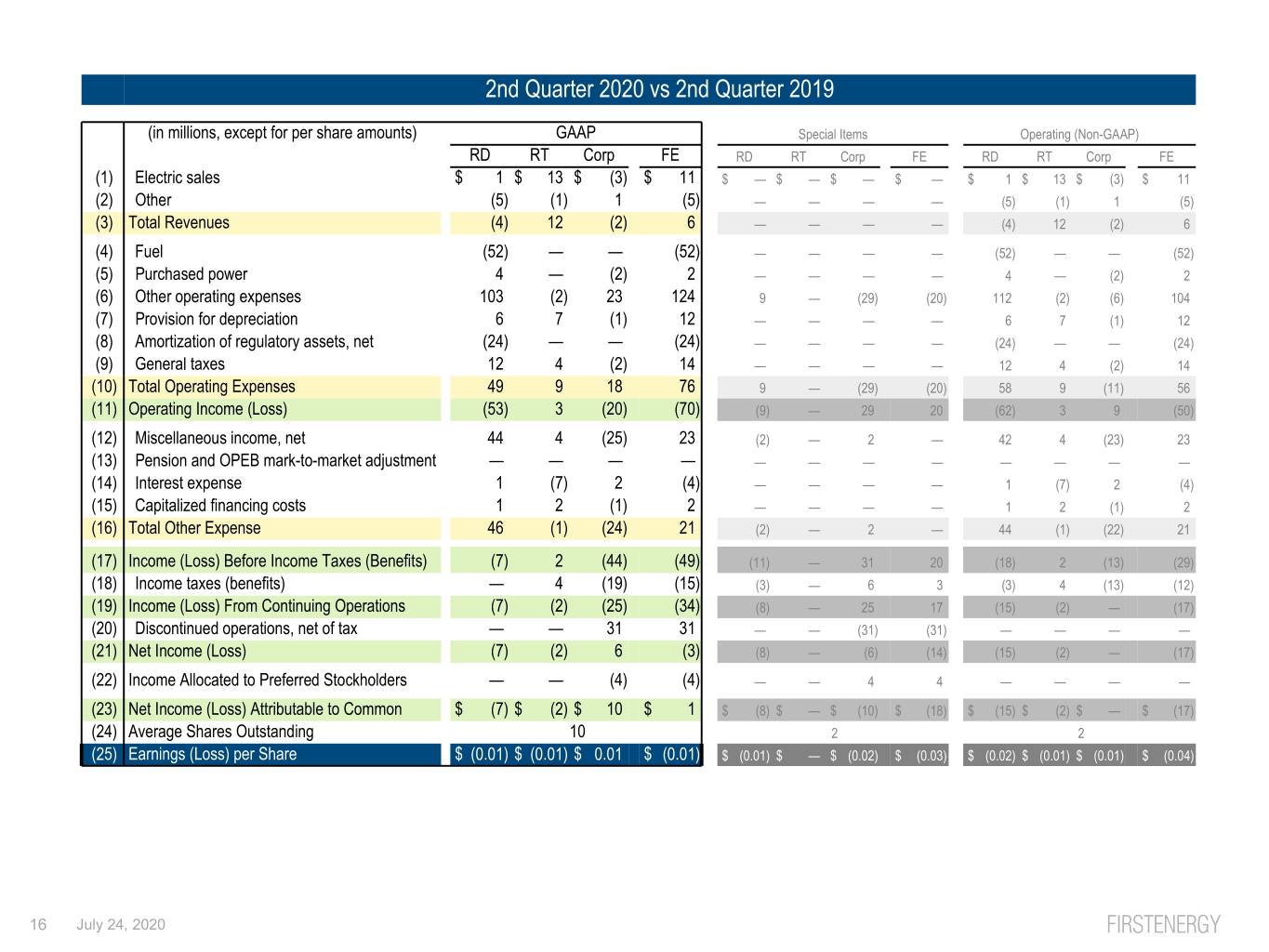

2nd Quarter 2020 vs 2nd Quarter 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 1 $ 13 $ (3) $ 11 $ — $ — $ — $ — $ 1 $ 13 $ (3) $ 11 (2) Other (5) (1) 1 (5) — — — — (5) (1) 1 (5) (3) Total Revenues (4) 12 (2) 6 — — — — (4) 12 (2) 6 (4) Fuel (52) — — (52) — — — — (52) — — (52) (5) Purchased power 4 — (2) 2 — — — — 4 — (2) 2 (6) Other operating expenses 103 (2) 23 124 9 — (29) (20) 112 (2) (6) 104 (7) Provision for depreciation 6 7 (1) 12 — — — — 6 7 (1) 12 (8) Amortization of regulatory assets, net (24) — — (24) — — — — (24) — — (24) (9) General taxes 12 4 (2) 14 — — — — 12 4 (2) 14 (10) Total Operating Expenses 49 9 18 76 9 — (29) (20) 58 9 (11) 56 (11) Operating Income (Loss) (53) 3 (20) (70) (9) — 29 20 (62) 3 9 (50) (12) Miscellaneous income, net 44 4 (25) 23 (2) — 2 — 42 4 (23) 23 (13) Pension and OPEB mark-to-market adjustment — — — — — — — — — — — — (14) Interest expense 1 (7) 2 (4) — — — — 1 (7) 2 (4) (15) Capitalized financing costs 1 2 (1) 2 — — — — 1 2 (1) 2 (16) Total Other Expense 46 (1) (24) 21 (2) — 2 — 44 (1) (22) 21 (17) Income (Loss) Before Income Taxes (Benefits) (7) 2 (44) (49) (11) — 31 20 (18) 2 (13) (29) (18) Income taxes (benefits) — 4 (19) (15) (3) — 6 3 (3) 4 (13) (12) (19) Income (Loss) From Continuing Operations (7) (2) (25) (34) (8) — 25 17 (15) (2) — (17) (20) Discontinued operations, net of tax — — 31 31 — — (31) (31) — — — — (21) Net Income (Loss) (7) (2) 6 (3) (8) — (6) (14) (15) (2) — (17) (22) Income Allocated to Preferred Stockholders — — (4) (4) — — 4 4 — — — — (23) Net Income (Loss) Attributable to Common $ (7) $ (2) $ 10 $ 1 $ (8) $ — $ (10) $ (18) $ (15) $ (2) $ — $ (17) (24) Average Shares Outstanding 10 2 2 (25) Earnings (Loss) per Share $ (0.01) $ (0.01) $ 0.01 $ (0.01) $ (0.01) $ — $ (0.02) $ (0.03) $ (0.02) $ (0.01) $ (0.01) $ (0.04) 16 July 24, 2020

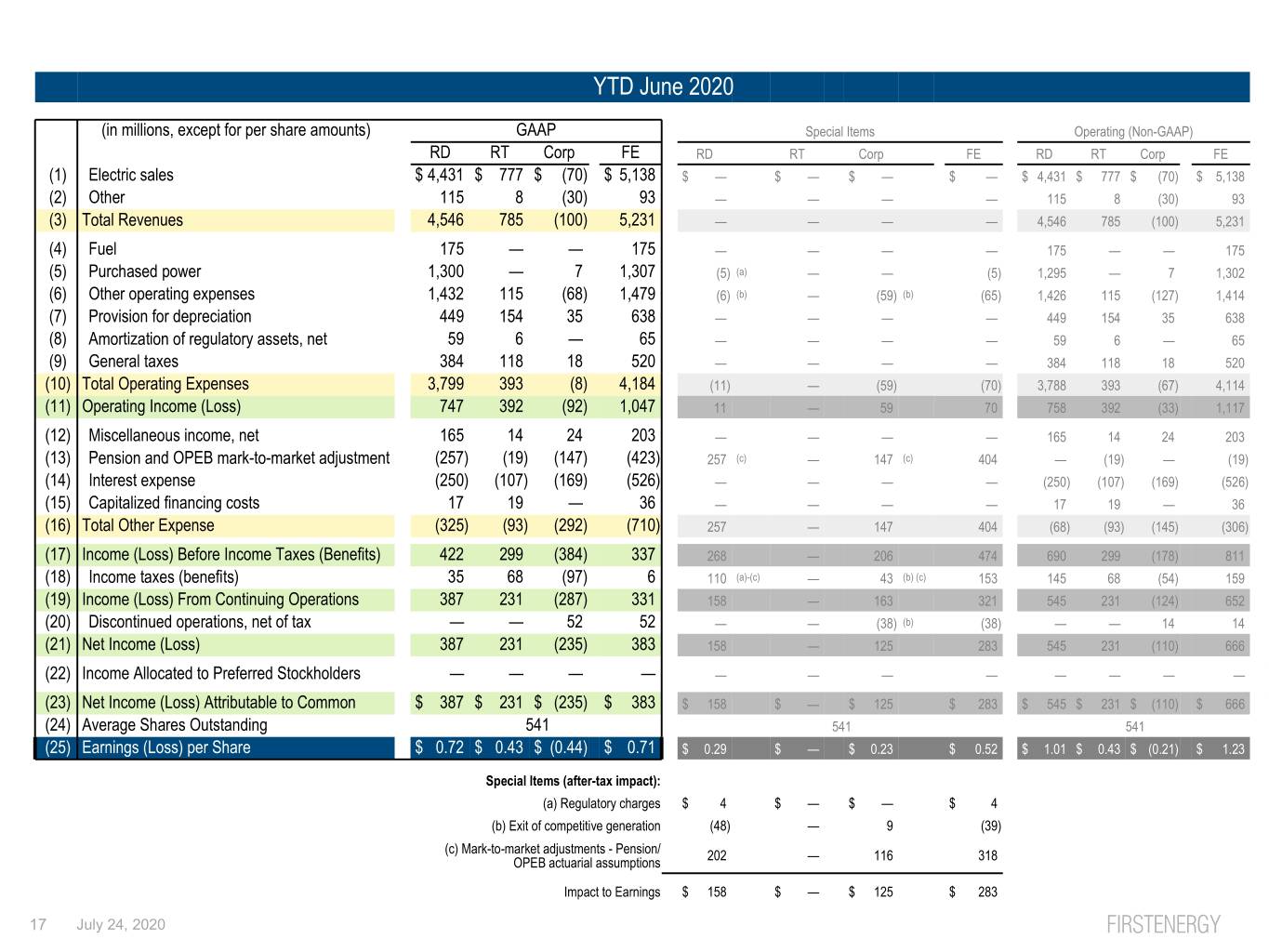

YTD June 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 4,431 $ 777 $ (70) $ 5,138 $ — $ — $ — $ — $ 4,431 $ 777 $ (70) $ 5,138 (2) Other 115 8 (30) 93 — — — — 115 8 (30) 93 (3) Total Revenues 4,546 785 (100) 5,231 — — — — 4,546 785 (100) 5,231 (4) Fuel 175 — — 175 — — — — 175 — — 175 (5) Purchased power 1,300 — 7 1,307 (5) (a) — — (5) 1,295 — 7 1,302 (6) Other operating expenses 1,432 115 (68) 1,479 (6) (b) — (59) (b) (65) 1,426 115 (127) 1,414 (7) Provision for depreciation 449 154 35 638 — — — — 449 154 35 638 (8) Amortization of regulatory assets, net 59 6 — 65 — — — — 59 6 — 65 (9) General taxes 384 118 18 520 — — — — 384 118 18 520 (10) Total Operating Expenses 3,799 393 (8) 4,184 (11) — (59) (70) 3,788 393 (67) 4,114 (11) Operating Income (Loss) 747 392 (92) 1,047 11 — 59 70 758 392 (33) 1,117 (12) Miscellaneous income, net 165 14 24 203 — — — — 165 14 24 203 (13) Pension and OPEB mark-to-market adjustment (257) (19) (147) (423) 257 (c) — 147 (c) 404 — (19) — (19) (14) Interest expense (250) (107) (169) (526) — — — — (250) (107) (169) (526) (15) Capitalized financing costs 17 19 — 36 — — — — 17 19 — 36 (16) Total Other Expense (325) (93) (292) (710) 257 — 147 404 (68) (93) (145) (306) (17) Income (Loss) Before Income Taxes (Benefits) 422 299 (384) 337 268 — 206 474 690 299 (178) 811 (18) Income taxes (benefits) 35 68 (97) 6 110 (a)-(c) — 43 (b) (c) 153 145 68 (54) 159 (19) Income (Loss) From Continuing Operations 387 231 (287) 331 158 — 163 321 545 231 (124) 652 (20) Discontinued operations, net of tax — — 52 52 — — (38) (b) (38) — — 14 14 (21) Net Income (Loss) 387 231 (235) 383 158 — 125 283 545 231 (110) 666 (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 387 $ 231 $ (235) $ 383 $ 158 $ — $ 125 $ 283 $ 545 $ 231 $ (110) $ 666 (24) Average Shares Outstanding 541 541 541 (25) Earnings (Loss) per Share $ 0.72 $ 0.43 $ (0.44) $ 0.71 $ 0.29 $ — $ 0.23 $ 0.52 $ 1.01 $ 0.43 $ (0.21) $ 1.23 Special Items (after-tax impact): (a) Regulatory charges $ 4 $ — $ — $ 4 (b) Exit of competitive generation (48) — 9 (39) (c) Mark-to-market adjustments - Pension/ 202 — 116 318 OPEB actuarial assumptions Impact to Earnings $ 158 $ — $ 125 $ 283 17 July 24, 2020

YTD June 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 4,643 $ 719 $ (63) $ 5,299 $ — $ — $ — $ — $ 4,643 $ 719 $ (63) $ 5,299 (2) Other 122 9 (31) 100 — — — — 122 9 (31) 100 (3) Total Revenues 4,765 728 (94) 5,399 — — — — 4,765 728 (94) 5,399 (4) Fuel 260 — — 260 — — — — 260 — — 260 (5) Purchased power 1,383 — 9 1,392 — — — — 1,383 — 9 1,392 (6) Other operating expenses 1,401 130 (146) 1,385 (15) (a) (b) — 23 (b) 8 1,386 130 (123) 1,393 (7) Provision for depreciation 429 140 37 606 — — — — 429 140 37 606 (8) Amortization of regulatory assets, net 37 5 — 42 8 (a) — — 8 45 5 — 50 (9) General taxes 375 103 22 500 — — (2) (b) (2) 375 103 20 498 (10) Total Operating Expenses 3,885 378 (78) 4,185 (7) — 21 14 3,878 378 (57) 4,199 (11) Operating Income (Loss) 880 350 (16) 1,214 7 — (21) (14) 887 350 (37) 1,200 (12) Miscellaneous income, net 92 8 34 134 2 (b) — 2 (b) 4 94 8 36 138 (13) Pension and OPEB mark-to-market adjustment — — — — — — — — — — — — (14) Interest expense (246) (93) (173) (512) — — — — (246) (93) (173) (512) (15) Capitalized financing costs 17 16 1 34 — — — — 17 16 1 34 (16) Total Other Expense (137) (69) (138) (344) 2 — 2 4 (135) (69) (136) (340) (17) Income (Loss) Before Income Taxes (Benefits) 743 281 (154) 870 9 — (19) (10) 752 281 (173) 860 (18) Income taxes (benefits) 156 61 (43) 174 3 (a) (b) — (4) (b) (1) 159 61 (47) 173 (19) Income (Loss) From Continuing Operations 587 220 (111) 696 6 — (15) (9) 593 220 (126) 687 (20) Discontinued operations, net of tax — — (64) (64) — — 64 (b) 64 — — — — (21) Net Income (Loss) 587 220 (175) 632 6 — 49 55 593 220 (126) 687 (22) Income Allocated to Preferred Stockholders — — 9 9 — — (9) (c) (9) — — — — (23) Net Income (Loss) Attributable to Common $ 587 $ 220 $ (184) $ 623 $ 6 $ — $ 58 $ 64 $ 593 $ 220 $ (126) $ 687 (24) Average Shares Outstanding 531 539 539 (25) Earnings (Loss) per Share $ 1.10 $ 0.42 $ (0.35) $ 1.17 $ — $ (0.01) $ 0.12 $ 0.11 $ 1.10 $ 0.41 $ (0.23) $ 1.28 Special Items (after-tax impact): (a) Regulatory charges $ (6) $ — $ — $ (6) (b) Exit of competitive generation 12 — 49 61 (c) Impact of full dilution — — 9 9 Impact to Earnings $ 6 $ — $ 58 $ 64 18 July 24, 2020

YTD June 2020 vs YTD June 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ (212) $ 58 $ (7) $ (161) $ — $ — $ — $ — $ (212) $ 58 $ (7) $ (161) (2) Other (7) (1) 1 (7) — — — — (7) (1) 1 (7) (3) Total Revenues (219) 57 (6) (168) — — — — (219) 57 (6) (168) (4) Fuel (85) — — (85) — — — — (85) — — (85) (5) Purchased power (83) — (2) (85) (5) — — (5) (88) — (2) (90) (6) Other operating expenses 31 (15) 78 94 9 — (82) (73) 40 (15) (4) 21 (7) Provision for depreciation 20 14 (2) 32 — — — — 20 14 (2) 32 (8) Amortization of regulatory assets, net 22 1 — 23 (8) — — (8) 14 1 — 15 (9) General taxes 9 15 (4) 20 — — 2 2 9 15 (2) 22 (10) Total Operating Expenses (86) 15 70 (1) (4) — (80) (84) (90) 15 (10) (85) (11) Operating Income (Loss) (133) 42 (76) (167) 4 — 80 84 (129) 42 4 (83) (12) Miscellaneous income, net 73 6 (10) 69 (2) — (2) (4) 71 6 (12) 65 (13) Pension and OPEB mark-to-market adjustment (257) (19) (147) (423) 257 — 147 404 — (19) — (19) (14) Interest expense (4) (14) 4 (14) — — — — (4) (14) 4 (14) (15) Capitalized financing costs — 3 (1) 2 — — — — — 3 (1) 2 (16) Total Other Expense (188) (24) (154) (366) 255 — 145 400 67 (24) (9) 34 (17) Income (Loss) Before Income Taxes (Benefits) (321) 18 (230) (533) 259 — 225 484 (62) 18 (5) (49) (18) Income taxes (benefits) (121) 7 (54) (168) 107 — 47 154 (14) 7 (7) (14) (19) Income (Loss) From Continuing Operations (200) 11 (176) (365) 152 — 178 330 (48) 11 2 (35) (20) Discontinued operations, net of tax — — 116 116 — — (102) (102) — — 14 14 (21) Net Income (Loss) (200) 11 (60) (249) 152 — 76 228 (48) 11 16 (21) (22) Income Allocated to Preferred Stockholders — — (9) (9) — — 9 9 — — — — (23) Net Income (Loss) Attributable to Common $ (200) $ 11 $ (51) $ (240) $ 152 $ — $ 67 $ 219 $ (48) $ 11 $ 16 $ (21) (24) Average Shares Outstanding 10 2 2 (25) Earnings (Loss) per Share $ (0.38) $ 0.01 $ (0.09) $ (0.46) $ 0.29 $ 0.01 $ 0.11 $ 0.41 $ (0.09) $ 0.02 $ 0.02 $ (0.05) 19 July 24, 2020

Condensed Consolidated Balance Sheets (GAAP) (in millions) June 30, December 31, Assets 2020 2019 Current Assets: Cash, cash equivalents and restricted cash $ 165 $ 679 Receivables 1,232 1,294 Other 589 438 Current assets - discontinued operations — 33 Total Current Assets 1,986 2,444 Property plant and equipment 32,408 31,650 Investments 575 569 Deferred charges and other assets 6,508 6,756 Assets held for sale 926 882 Total Assets $ 42,403 $ 42,301 Liabilities and Capitalization Current Liabilities: Currently payable long-term debt $ 81 $ 380 Short-term borrowings 115 1,000 Accounts payable 882 1,005 Other 1,466 2,477 Total Current Liabilities 2,544 4,862 Capitalization: Total equity 7,143 6,975 Long-term debt and other long-term obligations 21,980 19,618 Total Capitalization 29,123 26,593 Noncurrent Liabilities 10,027 10,155 Liabilities held for sale 709 691 20 July 24, 2020 Total Liabilities and Capitalization $ 42,403 $ 42,301

Condensed Consolidated Statements of Cash Flows (GAAP) (in millions ) For the Six Months Ended June 30, 2020 2019 Cash Flow from Operating Activities: Net Income $ 383 $ 632 Adjustments to reconcile net income to net cash from operating activities: Loss (gain) on disposal, net of tax (52) 39 Depreciation and amortization, including regulatory assets, net, and deferred debt-related costs 602 702 Deferred income taxes and investment tax credits, net 3 162 Retirement benefits, net of payments (144) (53) Pension trust contributions — (500) Pension and OPEB mark-to-market adjustment 423 — Settlement agreement and tax sharing payments to the FES Debtors (978) — Changes in working capital and other (87) (357) Net cash provided from operating activities 150 625 Net cash provided from financing activities 742 756 Net cash used for investing activities (1,406) (1,336) Net change in cash, cash equivalents, and restricted cash $ (514) $ 45 21 July 24, 2020

2020F GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation 2020 Forecast 3Q20 Forecast (In $M, except per share amounts) RD RT Corp FE FE 2020F Net Income (Loss) attributable to Common Stockholders (GAAP) $1,000 - $1,075 $460 - $485 ($440) - ($430) $1,020 - $1,130 $395 - $450 2020F Earnings (Loss) Per Share $1.84 - $1.98 $0.85 - $0.89 ($0.81) - ($0.79) $1.88 - $2.08 $0.73 - $0.83 Excluding Special Items: Mark-to-market adjustments - Pension/OPEB actuarial assumptions (2) 0.38 — 0.21 0.59 — Regulatory charges 0.01 — — 0.01 — Exit of competitive generation (0.10) — 0.02 (0.08) — Total Special Items $0.29 $— $0.23 $0.52 $— 2020F Operating Earnings (Loss) Per Share - Non-GAAP (542M fully diluted shares) $2.13 - $2.27 $0.85 - $0.89 ($0.58) - ($0.56) $2.40 - $2.60 $0.73 - $0.83 (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. (2) Upon the emergence of FES from bankruptcy, FirstEnergy performed a remeasurement of the pension and OPEB plans as of February 26, 2020. Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period (542M). The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29%. 22 July 24, 2020

Forward-Looking Statements Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: The extent and duration of COVID-19 and the impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories, volatile capital and credit markets, legislative and regulatory actions, the effectiveness of our pandemic and business continuity plans, the precautionary measures we are taking on behalf of our customers and employees, our customers’ ability to make their utility payment and the potential for supply-chain disruptions; risks and uncertainties associated with the ongoing government investigation regarding Ohio House Bill 6 and related matters; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets, including, but not limited to, risks associated with the decommissioning of TMI-2; the ability to accomplish or realize anticipated benefits from strategic and financial goals, including, but not limited to, executing our transmission and distribution investment plans, controlling costs, improving our credit metrics, strengthening our balance sheet and growing earnings; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity; economic and weather conditions affecting future operating results, such as significant weather events and other natural disasters, and associated regulatory events or actions; changes in assumptions regarding economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, the impact of climate change or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions affecting us and/or our major industrial and commercial customers or others with which we do business; the risks associated with cyber-attacks and other disruptions to our information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts and other trust funds, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; the risks and uncertainties associated with litigation, arbitration, mediation and like proceedings; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; the risks and other factors discussed from time to time in our SEC filings. Dividends declared from time to time on our common stock during any period may in the aggregate vary from prior periods due to circumstances considered by our Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy’s filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. 23 July 24, 2020