UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

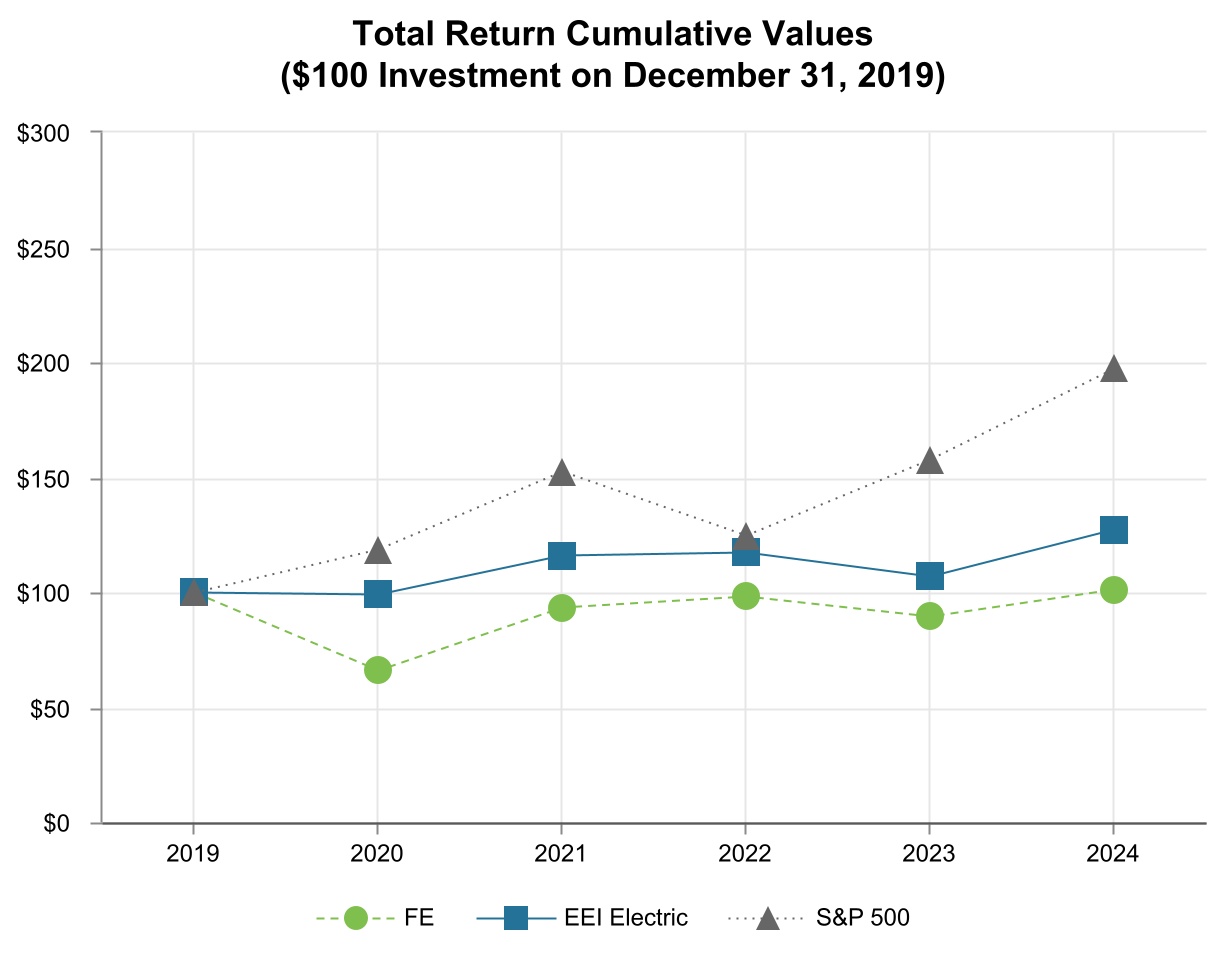

For the FISCAL YEAR ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________________ to ___________________

| | | | | | | | | | | | | | | | | | | | | | | |

| Commission | | Registrant; State of Incorporation; | | I.R.S. Employer |

| File Number | | Address; and Telephone Number | | Identification No. |

| | | | | | | | |

| 333-21011 | | FIRSTENERGY CORP | | 34-1843785 |

| | | (An | Ohio | Corporation) | | |

| | | 76 South Main Street | | |

| | | Akron | OH | 44308 | | |

| | | Telephone | (800) | 736-3402 | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, $0.10 par value per share | | FE | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | |

| Large Accelerated Filer | ☑ |

| |

| Accelerated Filer | ☐ |

| |

| Non-accelerated Filer | ☐ |

| |

| Smaller Reporting Company | ☐ |

| |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

$22,003,636,801 as of June 30, 2024

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

| | | | | | | | |

| | |

| CLASS | | AS OF JANUARY 31, 2025 |

| Common Stock, $0.10 par value | | 576,697,425 | |

Documents Incorporated By Reference

| | | | | | | | |

| | | PART OF FORM 10-K INTO WHICH |

| DOCUMENT | | DOCUMENT IS INCORPORATED |

| Portions of the Definitive Proxy Statement for the 2025 Annual Meeting of Shareholders of FirstEnergy Corp. to be held May 21, 2025. | | Part III |

TABLE OF CONTENTS

| | | | | |

| | Page |

| |

| Glossary of Terms | |

| |

| Part I | |

| |

| Item 1. Business | |

| |

| The Companies | |

| Capital Requirements | |

| Supply Plan | |

| System Demand | |

| |

| Regional Reliability | |

| Competition | |

| Seasonality | |

| Human Capital | |

| |

| Information About Our Executive Officers | |

| FirstEnergy Website and Other Social Media Sites and Applications | |

| |

| Item 1A. Risk Factors | |

| |

| Item 1B. Unresolved Staff Comments | |

| |

| Item 1C. Cybersecurity | |

| |

| Item 2. Properties | |

| |

| Item 3. Legal Proceedings | |

| |

| Item 4. Mine Safety Disclosures | |

| |

| Part II | |

| |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| |

| Item 6. [Reserved] | |

| |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | |

| |

| Item 8. Financial Statements and Supplementary Data | |

| Report of Independent Registered Public Accounting Firm | |

| |

| Financial Statements | |

| Consolidated Statements of Income | |

| Consolidated Statements of Comprehensive Income | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Stockholders' Equity | |

| Consolidated Statements of Cash Flows | |

| |

| Notes to Consolidated Financial Statements | |

| |

| Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | |

| |

| Item 9A. Controls and Procedures | |

| |

| Item 9B. Other Information | |

| |

| | | | | |

| Item 9C. Disclosure Regarding Foreign Jurisdictions That Prevent Inspections | |

| |

| Part III | |

| |

| Item 10. Directors, Executive Officers and Corporate Governance | |

| |

| Item 11. Executive Compensation | |

| |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | |

| |

| Item 14. Principal Accountant Fees and Services | |

| |

| Part IV | |

| |

| Item 15. Exhibit and Financial Statement Schedules | |

| |

| Item 16. Form 10-K Summary | |

GLOSSARY OF TERMS

The following abbreviations and acronyms are used in this report to identify FirstEnergy Corp. and its current and former subsidiaries:

| | | | | |

| AE Supply | Allegheny Energy Supply Company, LLC, an unregulated generation subsidiary of FE |

| AGC | Allegheny Generating Company, a generation subsidiary of MP |

| ATSI | American Transmission Systems, Incorporated, a transmission subsidiary of FET |

| CEI | The Cleveland Electric Illuminating Company, an Ohio electric utility subsidiary of FE |

| Electric Companies | OE, CEI, TE, JCP&L, MP, PE and FE PA (as successor-in-interest to Penn, ME, PN and WP) |

| FE | FirstEnergy Corp., a public utility holding company |

| FENOC | Energy Harbor Nuclear Corp. (formerly known as FirstEnergy Nuclear Operating Company), a subsidiary of EH, which operates EH’s nuclear generating facilities |

| FE PA | FirstEnergy Pennsylvania Electric Company, a Pennsylvania electric utility subsidiary of FirstEnergy Pennsylvania Holding Company LLC, a wholly owned subsidiary of FE |

| FES | Energy Harbor LLC (formerly known as FirstEnergy Solutions Corp.), a subsidiary of EH, which provides energy-related products and services |

| FESC | FirstEnergy Service Company, which provides legal, financial, and other corporate support services |

| FES Debtors | FENOC, FES, and FES’ subsidiaries as of March 31, 2018 |

| FET | FirstEnergy Transmission, LLC a consolidated VIE of FE, and the parent company of ATSI, MAIT and TrAIL, and having a joint venture in PATH |

| FEV | FirstEnergy Ventures Corp., which invests in certain unregulated enterprises and business ventures |

| FirstEnergy | FirstEnergy Corp., together with its consolidated subsidiaries |

| Global Holding | Global Mining Holding Company, LLC, a joint venture between FEV, WMB Marketing Ventures, LLC and Pinesdale LLC |

| JCP&L | Jersey Central Power & Light Company, a New Jersey electric utility subsidiary of FE |

| KATCo | Keystone Appalachian Transmission Company, a transmission subsidiary of FE |

| MAIT | Mid-Atlantic Interstate Transmission, LLC, a transmission subsidiary of FET |

| ME | Metropolitan Edison Company, a former Pennsylvania electric utility subsidiary of FE, which merged with and into FE PA on January 1, 2024 |

| MP | Monongahela Power Company, a West Virginia electric utility subsidiary of FE |

| OE | Ohio Edison Company, an Ohio electric utility subsidiary of FE |

| Ohio Companies | CEI, OE and TE |

| PATH | Potomac-Appalachian Transmission Highline, LLC, a joint venture between FE and a subsidiary of AEP |

| PATH-Allegheny | PATH Allegheny Transmission Company, LLC |

| PATH-WV | PATH West Virginia Transmission Company, LLC |

| PE | The Potomac Edison Company, a Maryland and West Virginia electric utility subsidiary of FE |

| Penn | Pennsylvania Power Company, a former Pennsylvania electric utility subsidiary of OE, which merged with and into FE PA on January 1, 2024 |

| Pennsylvania Companies | ME, PN, Penn and WP, each of which merged with and into FE PA on January 1, 2024 |

| PN | Pennsylvania Electric Company, a former Pennsylvania electric utility subsidiary of FE, which merged with and into FE PA on January 1, 2024 |

| Signal Peak | Signal Peak Energy, LLC, an indirect subsidiary of Global Holding that owns mining operations near Roundup, Montana |

| TE | The Toledo Edison Company, an Ohio electric utility subsidiary of FE |

| TrAIL | Trans-Allegheny Interstate Line Company, a transmission subsidiary of FET |

| Transmission Companies | ATSI, KATCo, MAIT and TrAIL |

| WP | West Penn Power Company, a former Pennsylvania electric utility subsidiary of FE, which merged with and into FE PA on January 1, 2024 |

| |

| | | | | |

| The following abbreviations and acronyms are used to identify frequently used terms in this report: |

| |

| 2021 Credit Facilities | Collectively, the six separate senior unsecured five-year syndicated revolving credit facilities entered into by FE, the Electric Companies and the Transmission Companies, on October 18, 2021, as amended through October 24, 2024 |

| 2023 Credit Facilities | Collectively, the FET Revolving Facility and KATCo Revolving Facility |

| 2026 Convertible Notes | FE's 4.00% convertible senior notes, due 2026 |

| 2031 Notes | FE’s 7.375% Notes, Series C, due 2031 |

A&R FET LLC

Agreement | Fourth Amended and Restated Limited Liability Company Operating Agreement of FET |

| ACE | Affordable Clean Energy |

| AEP | American Electric Power Company, Inc. |

| AFS | Available-for-sale |

| AFSI | Adjusted Financial Statement Income |

| AFUDC | Allowance for Funds Used During Construction |

| AMI | Advanced Metering Infrastructure |

| AMT | Alternative Minimum Tax |

| AOCI | Accumulated Other Comprehensive Income (Loss) |

| ARO | Asset Retirement Obligation |

| ARP | Alternative Revenue Program |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| Bankruptcy Court | U.S. Bankruptcy Court in the Northern District of Ohio in Akron |

| BGS | Basic Generation Service |

| Brookfield | North American Transmission Company II L.P., a controlled investment vehicle entity of Brookfield Infrastructure Partners |

| Brookfield Guarantors | Brookfield Super-Core Infrastructure Partners L.P., Brookfield Super-Core Infrastructure Partners (NUS) L.P., and Brookfield Super-Core Infrastructure Partners (ER) SCSp |

| CAA | Clean Air Act |

| CCR | Coal Combustion Residual |

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act of 1980 |

| CFIUS | Committee on Foreign Investments in the United States |

| CFR | Code of Federal Regulations |

| CISO | Chief Information Security Officer |

CO2 | Carbon Dioxide |

| CODM | Chief Operating Decision Maker |

| COVID-19 | Coronavirus disease |

| CPP | EPA's Clean Power Plan |

| CSAPR | Cross-State Air Pollution Rule |

| D.C. Circuit | United States Court of Appeals for the District of Columbia Circuit |

| DCPD | FE Deferred Compensation Plan for Outside Directors |

| DCR | Delivery Capital Recovery |

| DMR | Distribution Modernization Rider |

| DOE | U.S. Department of Energy |

| DPA | Deferred Prosecution Agreement entered into on July 21, 2021 between FE and the U.S. Attorney’s Office for the S.D. Ohio |

| DSIC | Distribution System Improvement Charge |

| EBRG | Employee Business Resource Group |

| EDC | Electric Distribution Company |

| EDCP | FE Amended and Restated Executive Deferred Compensation Plan |

| EE&C | Energy Efficiency and Conservation |

| EEI | The Edison Electric Institute |

| | | | | |

| EGS | Electric Generation Supplier |

| EGU | Electric Generation Unit |

| EH | Energy Harbor Corp. |

| ELG | Effluent Limitation Guidelines |

| EmPOWER Maryland | EmPOWER Maryland Energy Efficiency Act |

| ENEC | Expanded Net Energy Cost |

| Energize365 | FirstEnergy's Transmission and Distribution Infrastructure Investment Program. |

| EnergizeNJ | JCP&L's second Infrastructure Investment Program |

| EPA | United States Environmental Protection Agency |

| EPS | Earnings per Share |

| ESP | Electric Security Plan |

| Exchange Act | Securities and Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| FE Board | FE Board of Directors |

| FE Revolving Facility | FE and the Electric Companies’ former five-year syndicated revolving credit facility, as amended, and replaced by the 2021 Credit Facilities on October 18, 2021 |

| FERC | Federal Energy Regulatory Commission |

| FET Board | FET Board of Directors |

| FET Equity Interest Sale | Sale of an additional 30% membership interest of FET, such that Brookfield will own 49.9% of FET |

| FET LLC Agreement | Third Amended and Restated Limited Liability Company Operating Agreement of FET |

| FET P&SA I | Purchase and Sale Agreement entered into on November 6, 2021, by and between FE, FET, Brookfield and the Brookfield Guarantors |

| FET P&SA II | Purchase and Sale Agreement entered into on February 2, 2023, by and between FE, FET, Brookfield, and the Brookfield Guarantors |

| FET Revolving Facility | FET’s five-year syndicated revolving credit facility, dated as of October 20, 2023, as amended through October 24, 2024 |

| FIP | Federal Implementation Plan |

| Fitch | Fitch Ratings Service |

| FMB | First Mortgage Bond |

| FTR | Financial Transmission Right |

| GAAP | Generally Accepted Accounting Principles in the United States of America |

| GHG | Greenhouse Gas |

| HB 6 | House Bill 6, as passed by Ohio's 133rd General Assembly |

| IBEW | International Brotherhood of Electrical Workers |

| ICP 2015 | FirstEnergy Corp. 2015 Incentive Compensation Plan |

| ICP 2020 | FirstEnergy Corp. 2020 Incentive Compensation Plan |

| IRA of 2022 | Inflation Reduction Act of 2022 |

| IRS | Internal Revenue Service |

| KATCo Revolving Facility | KATCo’s four-year syndicated revolving credit facility, dated as of October 20, 2023, as amended through October 24, 2024 |

| kV | Kilovolt |

| kWh | Kilowatt-hour |

| LOC | Letter of Credit |

| LTIIP | Long-Term Infrastructure Improvement Plan |

| MDPSC | Maryland Public Service Commission |

| MGP | Manufactured Gas Plants |

| Moody’s | Moody’s Investors Service, Inc. |

| MW | Megawatt |

| MWh | Megawatt-hour |

| N.D. Ohio | Federal District Court, Northern District of Ohio |

| NAV | Net Asset Value |

| | | | | |

| NCI | Noncontrolling Interest |

| NERC | North American Electric Reliability Corporation |

| NJBPU | New Jersey Board of Public Utilities |

| NOL | Net Operating Loss |

| NOx | Nitrogen Oxide |

| NSR | New Source Review |

| NUG | Non-Utility Generation |

| NYPSC | New York State Public Service Commission |

| OAG | Ohio Attorney General |

| OCC | Ohio Consumers' Counsel |

| ODSA | Ohio Development Service Agency |

| Ohio Stipulation | Stipulation and Recommendation, dated November 1, 2021, entered into by and among the Ohio Companies, the OCC, PUCO staff, and several other signatories |

| OOCIC | Ohio Organized Crime Investigations Commission, which is composed of members of the Ohio law enforcement community and is chaired by the OAG |

| OPEB | Other Postemployment Benefits |

| OPEIU | Office and Professional Employees International Union |

| OPIC | Other paid-in capital |

| OSMRE | United States Department of the Interior, Office of Surface Mining Reclamation and Enforcement |

| OVEC | Ohio Valley Electric Corporation |

| PA Consolidation | Consolidation of the Pennsylvania Companies |

| PEER | FirstEnergy's Program for Enhanced Employee Retirement, as announced in 2023 |

| PJM | PJM Interconnection, LLC, an RTO |

| PJM Region | The territory that PJM coordinates the movement of electricity through, including all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. |

| PJM Tariff | PJM Open Access Transmission Tariff |

| POLR | Provider of Last Resort |

| PPA | Purchase Power Agreement |

| PPUC | Pennsylvania Public Utility Commission |

| PUCO | Public Utilities Commission of Ohio |

| Regulation FD | Regulation Fair Disclosure promulgated by the SEC |

| RFC | ReliabilityFirst Corporation |

| ROE | Return on Equity |

| RTO | Regional Transmission Organization |

| S&P | Standard & Poor’s Ratings Service |

| S&P 500 | Standard & Poor’s 500 index |

| S.D. Ohio | Federal District Court, Southern District of Ohio |

| SEC | United States Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| SEET | Significantly Excessive Earnings Test |

| SIP | State Implementation Plan(s) under the CAA |

| SLC | Special Litigation Committee of the FE Board |

SO2 | Sulfur Dioxide |

| SOFR | Secured Overnight Financing Rate |

| SOS | Standard Offer Service |

| SPE | Special Purpose Entity |

| SSO | Standard Service Offer |

| Tax Act | Tax Cuts and Jobs Act adopted December 22, 2017 |

| UWUA | Utility Workers Union of America |

| Valley Link | Valley Link Transmission Company, LLC, a holding company formed by FET, Dominion High Voltage MidAtlantic, Inc., and Transource Energy, LLC, on November 24, 2024 |

| | | | | |

| VEPCO | Virginia Electric and Power Company, a subsidiary of Dominion Energy, Inc. |

| VIE | Variable Interest Entity |

| VSCC | Virginia State Corporation Commission |

| WVPSC | Public Service Commission of West Virginia |

PART I

ITEM 1. BUSINESS

The Companies

FE and its subsidiaries are principally involved in the transmission, distribution, and generation of electricity. FirstEnergy’s electric operating companies comprise one of the nation’s largest investor-owned electric systems, serving over six million customers in the Midwest and Mid-Atlantic regions. FirstEnergy’s transmission operations include more than 24,000 miles of transmission lines and two regional transmission operation centers. As of December 31, 2024, MP and AGC control 3,604 MWs of total capacity.

Regulated Electric Company Operating Subsidiaries

The Electric Companies’ combined service areas encompass approximately 65,000 square miles in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York, providing distribution services for over six million customers in an area with a population of approximately 14 million and include more than 9,900 miles of transmission lines. Total rate base was approximately $20.6 billion as of December 31, 2024.

OE owns property and does business as an electric public utility in Ohio, providing distribution services to approximately 1.1 million customers in central and northeastern Ohio, with a rate base of $2.1 billion as of December 31, 2024. OE has 1,061 employees and serves an area that has a population of approximately 2.4 million.

CEI owns property and does business as an electric public utility in Ohio, providing distribution services to approximately 0.8 million customers in northeastern Ohio, with a rate base of $1.7 billion as of December 31, 2024. CEI has 819 employees and serves an area that has a population of approximately 1.7 million.

TE owns property and does business as an electric public utility in Ohio, providing distribution services to approximately 0.3 million customers in northwestern Ohio, with a rate base of $0.6 billion as of December 31, 2024. TE has 324 employees and serves an area that has a population of approximately 0.7 million.

FE PA owns property and does business as an electric public utility in Pennsylvania and New York, providing distribution services to approximately 2.1 million customers in Pennsylvania and four thousand customers in Waverly, New York, with a rate base of $6.6 billion as of December 31, 2024. FE PA has 2,083 employees and serves an area that has a population of approximately 4.5 million. On January 1, 2024, FirstEnergy consolidated the Pennsylvania Companies into FE PA, rendering FE PA a new, single operating entity and the successor-in-interest to all assets and liabilities of the Pennsylvania Companies. As of January 1, 2024, FE PA is FE’s only regulated distribution power company in Pennsylvania encompassing the operations previously conducted individually by the Pennsylvania Companies.

JCP&L owns property and does business as an electric public utility in New Jersey, providing distribution services to approximately 1.2 million customers, as well as transmission services in northern, western, and east central New Jersey, with a combined rate base of $4.7 billion as of December 31, 2024. JCP&L has 1,296 employees and serves an area that has a population of approximately 2.8 million.

PE owns property and does business as an electric public utility in Maryland, Virginia, and West Virginia, providing distribution services to approximately 0.5 million customers in Maryland and West Virginia and provides transmission services in Maryland, West Virginia and Virginia. PE had a combined rate base of approximately $1.6 billion as of December 31, 2024. PE has 505 employees and serves an area that has a population of approximately 1.0 million.

MP owns property and does business as an electric public utility in West Virginia, providing distribution services to approximately 0.4 million customers, as well as generation and transmission services in northern West Virginia, with a combined rate base of $3.3 billion as of December 31, 2024. MP has 1,040 employees and serves an area with a population of approximately 0.8 million. MP is contractually obligated to provide power to PE to meet its load obligations in West Virginia. MP owns or contractually controls 3,604 MWs of net maximum generation capacity that is supplied to its electric utility business, including 24 MWs of Solar generation and 487 MWs of pumped-storage hydroelectric generation from its 16.25% undivided interest in the Bath County facility in Virginia through its wholly-owned subsidiary AGC.

Regulated Transmission Company Operating Subsidiaries

FET, a holding company and parent of ATSI, MAIT, TrAIL, and PATH, is a VIE of FE, which holds 50.1% of its issued and outstanding membership interests. Brookfield owns the remaining 49.9% of the issued and outstanding membership interests of FET. Through its subsidiaries, FET owns and operates high-voltage transmission facilities in the PJM Region and has a rate base of $8.5 billion. FET's subsidiaries are subject to regulation by FERC and applicable state regulatory authorities. FET and its subsidiaries have no direct employees. Each of these companies, however, relies on employees of their affiliates, including FESC, for the performance of necessary services. On January 1, 2024, PN and ME contributed their respective Class B equity interests of MAIT to FE, which were ultimately contributed to FET in exchange for a special purpose membership interest in FET.

So long as FE holds the FET special purpose membership interests, it will receive 100% of any Class B distributions made by MAIT.

On July 26, 2024, FE, VEPCO and Transource Energy, LLC, a subsidiary of AEP, entered into a joint proposal agreement in connection with PJM’s 2024 Regional Transmission Expansion Plan Open Window 1 process. Pursuant to such joint proposal agreement, FET, VEPCO and Transource Energy, LLC jointly proposed certain regional electric transmission projects for PJM's consideration during the Open Window process. On November 25, 2024, FET, Dominion High Voltage MidAtlantic, Inc., as affiliate of VEPCO, and Transource Energy, LLC, formed Valley Link, which is the holding company responsible for managing and executing any projects awarded by PJM, and entered into a limited liability agreement. On February 26, 2025, PJM selected certain of the joint proposed projects, which included approximately $3 billion in investments for Valley Link to both build new and upgrade existing transmission infrastructure.

ATSI owns high-voltage transmission facilities in PJM, which consist of 7,964 circuit miles of transmission lines with nominal voltages of 345 kV, 138 kV and 69 kV in Ohio and Pennsylvania and has a rate base of $4.3 billion as of December 31, 2024.

MAIT owns high-voltage transmission facilities in PJM, which consist of 4,287 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, 115 kV, 69 kV and 46 kV in Pennsylvania, and has a rate base of $2.8 billion as of December 31, 2024.

TrAIL owns high-voltage transmission facilities in PJM, which consists of 269 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, including a 500 kV transmission line extending approximately 150 miles from southwestern Pennsylvania through West Virginia to a point of interconnection with VEPCO in northern Virginia, and has a rate base of $1.4 billion as of December 31, 2024.

PATH was a proposed transmission line from West Virginia through Virginia into Maryland which PJM cancelled in 2012. In March 2024, PATH completed the process of terminating all of its FERC-jurisdictional rates and facilities, with the result that PATH no longer is a “public utility” and no longer is subject to FERC jurisdiction. FET and its non-affiliated joint venture partner are completing the process of terminating the PATH corporate entities.

KATCo owns high-voltage transmission facilities formerly owned by WP in PJM, which consist of 1,696 circuit miles of transmission lines with nominal voltages of 500 kV, 345 kV, 230 kV, 138 kV, and 115 kV in Pennsylvania, and has a rate base of $0.5 billion as of December 31, 2024. On January 1, 2024, WP transferred certain of its Pennsylvania-based transmission assets to KATCo. See Note 1, "Organization and Basis of Presentation," for more information.

Service Company

FESC has 5,166 employees and provides corporate support and other services, including executive administration, accounting and finance, risk management, human resources, corporate affairs, communications, information technology, legal services and other similar services at cost, in accordance with its cost allocation manual, to affiliated FirstEnergy companies under FESC agreements.

Segments Overview

During the first quarter of 2024, FirstEnergy’s segment reporting structure was modified to increase transparency for leadership and investors, simplify the presentation to corresponding legal entities, and align FirstEnergy’s earnings, cash flows and balance sheets at the business unit level. FirstEnergy’s reportable segments are as follows, and FirstEnergy continues to evaluate segment performance based on earnings attributable to FE from continuing operations:

•Distribution Segment, which consists of the Ohio Companies and FE PA;

•Integrated Segment, which consists of MP, PE and JCP&L; and

•Stand-Alone Transmission Segment, which consists of FE's ownership in FET and KATCo.

FE and its subsidiaries are principally involved in the transmission, distribution and generation of electricity through its reportable segments: Distribution, Integrated and Stand-Alone Transmission.

The Distribution segment, which consists of the Ohio Companies and FE PA, representing $11 billion in rate base as of December 31, 2024, distributes electricity through FirstEnergy’s electric operating companies in Ohio and Pennsylvania. The Distribution segment serves approximately 4.3 million customers in Ohio and Pennsylvania across its distribution footprint and purchases power for its provider of last resort, SOS, standard service offer and default service requirements. The segment’s results reflect the costs of securing and delivering electric generation to customers, including the deferral and amortization of certain costs.

The Integrated segment includes the distribution and transmission operations under JCP&L, MP and PE, as well as MP’s regulated generation operations, representing $9.6 billion in rate base as of December 31, 2024. The Integrated segment distributes electricity to approximately 2 million customers in New Jersey, West Virginia and Maryland across its distribution footprint; provides transmission infrastructure in New Jersey, West Virginia, Maryland and Virginia to transmit electricity and

operates 3,604 MWs of regulated net maximum generation capacity located primarily in West Virginia and Virginia. The segment will also include MP and PE’s 50 MWs of solar generation at five sites in West Virginia once complete. The first two solar generation sites were completed and placed in service in January and September 2024, representing 24 MWs of net maximum generating capacity. The remaining three sites, once completed, are expected to provide 26 MWs of additional net maximum generation capacity.

The Stand-Alone Transmission segment, which consists of FE's ownership in FET and KATCo, representing $5.3 billion in rate base as of December 31, 2024, includes transmission infrastructure owned and operated by the Transmission Companies and used to transmit electricity. The segment’s revenues are primarily derived from forward-looking formula rates, pursuant to which the revenue requirement is updated annually based on a projected rate base and projected costs, which is subject to an annual true-up based on actual rate base and costs. The segment’s results also reflect the net transmission expenses related to the delivery of electricity on FirstEnergy’s transmission facilities. KATCo, which was a subsidiary of FET, became a wholly owned subsidiary of FE prior to the closing of the FET P&SA I and remains in the Stand-Alone Transmission segment. On January 1, 2024, WP transferred certain of its Pennsylvania-based transmission assets to KATCo and prior year results in the Stand-Alone Transmission segment reflect the earnings and results of those WP transmission assets.

Corporate/Other reflects corporate support and other costs not charged or attributable to the Electric Companies or Transmission Companies, including FE’s retained pension and OPEB assets and liabilities of former subsidiaries, interest expense on FE’s holding company debt and other investments or businesses that do not constitute an operating segment, including FEV’s investment of 33-1/3% equity ownership in Global Holding. Also included in Corporate/Other for segment reporting is 67 MWs of net maximum generation capacity, representing AE Supply’s OVEC capacity entitlement. As of December 31, 2024, Corporate/Other had approximately $6.1 billion of external FE holding company debt.

Regulatory Accounting

FirstEnergy accounts for the effects of regulation through the application of regulatory accounting to the Electric Companies and the Transmission Companies as their rates are established by third-party regulators with the authority to set binding rates that are cost-based and can be charged to and collected from customers.

The Electric Companies and the Transmission Companies recognize, as regulatory assets and regulatory liabilities, costs that FERC and the various state utility commissions, as applicable, have authorized for recovery from or return to customers in future periods or for which authorization is probable. Without the probability of such authorization, costs currently recorded as regulatory assets and regulatory liabilities would have been charged or credited to income as incurred. All regulatory assets and liabilities are expected to be recovered from or returned to customers. Based on current ratemaking procedures, the Electric Companies and the Transmission Companies continue to collect cost-based rates for their distribution and transmission services; accordingly, it is appropriate that the Electric Companies and the Transmission Companies continue the application of regulatory accounting to those operations. Regulatory accounting is applied only to the parts of the business that meet the above criteria. If a portion of the business applying regulatory accounting no longer meets those requirements, previously recorded regulatory assets and liabilities are removed from the balance sheet in accordance with GAAP.

State Regulation and Federal Regulation

The following table summarizes the allowed ROE and the aggregate actual ROE of the Electric Companies and Transmission Companies as determined for regulatory purposes as of and for the year ended December 31, 2024:

| | | | | | | | | | | | | | | | | |

| Segment | Entity/State | | Allowed ROE | | Actual ROE |

| Stand-Alone Transmission | FET | | 9.88%(1) - 12.7% | | 10.4%(2) |

| KATCo | | 9.6% | | 10.45% |

| Integrated | Maryland | | 9.5% - Distribution

10.45% - Transmission | | 8.3% |

| New Jersey | | 9.6% - Distribution

10.2% - Transmission | | 9.3% |

| West Virginia | | 9.8% | | 8.4% |

| Distribution | Ohio | | 10.8%(3) | | 4.7%(3) |

| Pennsylvania | | Settled(4) | | 9.0% |

(1) Reflects a 0.5% reduction to ATSI's 10.38% approved ROE due to the January 2025 Sixth Circuit ruling eliminating the 50 basis point adder associated with RTO membership (see Transmission ROE Incentive: OCC v. ATSI, et al. below)

(2) FET ROE is a weighted average allowed ROE of ATSI, MAIT and TrAIL

(3) As filed on July 31, 2024, in pending base rate case before revenue adjustment

(4) Commission-approved settlement agreement did not disclose ROE

See "Outlook - State Regulation" in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information and discussion.

See "Outlook - FERC Regulatory Matters" in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information and discussion.

Environmental Matters

See "Outlook - Environmental Matters" in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information and discussion.

Capital Requirements

FirstEnergy’s business is capital intensive, requiring significant resources to fund operating expenses, construction and other investment expenditures, scheduled debt maturities and interest payments, dividend payments and potential contributions to its pension plan. See "Capital Resources and Liquidity" in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information and discussion.

Supply Plan

Supply Chain

Economic conditions have stabilized across numerous material categories, but not all lead times have returned to pre-pandemic levels. Several key suppliers have seen improvements with capacity, but FirstEnergy continues to monitor the situation as demand increases across the industry, including due to data center usage. Inflationary pressures have moderated, which has improved the cost of materials, but certain categories have remained elevated. FirstEnergy continues to implement mitigation strategies to address supply constraints and does not expect any corresponding service disruptions or any material impact on its capital investment plan. However, the situation remains fluid and a prolonged continuation or further increase in demand, or the continuation of uncertain or adverse macroeconomic conditions, including inflationary pressures and new or increased existing tariffs, could lead to an increase in supply chain disruptions that could, in turn, have an adverse effect on FirstEnergy’s results of operations, cash flow and financial condition.

In February 2025, the new U.S. presidential administration announced the imposition of widespread and substantial tariffs on imports, with plans for additional tariffs to potentially be adopted in the future. Although certain of these tariffs were subsequently temporarily stayed, the situation is dynamic and subject to rapid change. The imposition of these or any other new or increased tariffs or resultant trade wars could have an adverse effect on FirstEnergy's results of operations, cash flow and financial condition.

Default Service

Certain of the Electric Companies have default service obligations to provide power to non-shopping customers who have elected to continue to receive service under regulated retail tariffs. These default service plans vary by state and service territory, and volume of sales can vary depending on the level of shopping that occurs. JCP&L’s default service, or BGS supply, is secured through a statewide competitive procurement process approved by the NJBPU. Default service for the Ohio Companies, FE PA and PE's Maryland jurisdiction are provided through a competitive procurement process approved by the PUCO (under the current ESP), PPUC (under the Default Service Plan) and MDPSC (under the SOS), respectively. If any supplier fails to deliver power to any one of those Electric Companies’ service areas, the Utility serving that area may need to procure the required power in the market in their role as the default load serving entity. West Virginia electric generation continues to be regulated by the WVPSC.

Fuel Supply

MP has coal contracts with various terms to purchase approximately 3 million tons of coal for the year 2025, which, along with its 2024 year-end inventory levels, accounts for approximately 80% of its forecasted 2025 coal requirements. MP has the ability to acquire additional tonnage through options available in its current contracts, as well as purchases through the spot market. The contracts expire at various times through 2027. This contracted coal is produced primarily from mines located in Pennsylvania and West Virginia. In order to meet emission requirements, MP holds contracts for a variety of reagents expiring at various times through 2026, as well as the ability to purchase additional reagents through the spot market. Additionally, MP is granted emission allowances by the EPA and purchases additional allowances as needed to meet emission requirements. See "Outlook - Environmental Matters" in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information pertaining to the impact of increased environmental regulations on fuel supply.

System Demand

The maximum hourly demand in 2024, 2023 and 2022 for each of the Electric Companies was:

| | | | | | | | | | | | | | | | | | | | |

| | For the Years Ended December 31, |

| System Demand | | 2024 | | 2023 | | 2022 |

| | (In MWs) |

| CEI | | 3,971 | | | 3,868 | | | 4,266 | |

FE PA1 | | 10,404 | | | 10,058 | | | 10,255 | |

| JCP&L | | 6,184 | | | 5,731 | | | 6,122 | |

| MP | | 2,096 | | | 2,051 | | | 2,124 | |

| OE | | 5,582 | | | 5,192 | | | 5,652 | |

| PE | | 3,860 | | | 3,103 | | | 3,514 | |

| TE | | 2,074 | | | 2,220 | | | 2,277 | |

(1) On January 1, 2024, FirstEnergy consolidated the Pennsylvania Companies into FE PA, making it a new, single operating entity.

Regional Reliability

All of FirstEnergy's facilities are located within the PJM Region and operate under the reliability oversight of a regional entity known as RFC. This regional entity operates under the oversight of NERC in accordance with a delegation agreement approved by FERC.

Competition

Within FirstEnergy’s Electric Companies' distribution business, there generally is no competition for electric distribution service in the Electric Companies’ respective service territories in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey and New York. Additionally, pursuant to FERC’s Order No. 1000 and subject to state and local siting and permitting approvals, non-incumbent developers can compete for certain PJM transmission projects in the service territories of certain of FirstEnergy’s Electric Companies' providing transmission services and the Transmission Companies. This has resulted in additional competition to build transmission facilities in the respective service territories while also allowing the opportunity to seek to build facilities in non-incumbent service territories.

Seasonality

The sale of electric power is generally a seasonal business, and weather patterns can have, and have in the past had, a material impact on FirstEnergy’s Electric Companies' operating results. Demand for electricity in our service territories historically peaks during the summer and winter months. Accordingly, FirstEnergy’s annual results of operations and liquidity position may depend disproportionately on its operating performance during the summer and winter. Mild weather conditions may result in lower power sales, and consequently, lower revenue, earnings and cash flow.

Human Capital

FirstEnergy focuses on a number of human capital resources, measures and objectives in managing its business, including through striving to achieve its core values.

FirstEnergy believes that creating a sense of belonging among our employees positions the company to deliver better service to customers, strengthen operational performance, and help create a work environment where employees feel valued and respected. FirstEnergy remains focused advancing a culture of belonging for employees.

During 2024, FirstEnergy continued to promote these values by:

•Sponsoring a council of select senior management and other leaders and influential employees across the company, who work together to promote our core values throughout the workforce;

•Sharing the results of our most recent employee engagement survey designed to capture our employees’ perspectives on their work experience and progress toward embracing a more welcoming culture; and

•Supporting multiple employee business resource groups, known as "EBRGs," to further support our values through networking, mentoring, coaching, recruiting, development and community outreach. There are currently 9 EBRGs across 21 chapters, which are open to all employees.

Safety

Safety is an unwavering core value of FirstEnergy. FirstEnergy employees have the power and responsibility to keep each other safe and eliminate life-changing events, which are injuries that have life-changing impacts or fatal results. Safety metrics, such as injuries that result in days away or restricted time and life-changing events, are regularly monitored, internally reported, and included in FirstEnergy’s annual incentive compensation program to reinforce that a safe work environment is crucial to FirstEnergy’s success.

FirstEnergy continues to focus on mitigating life-changing event exposure to strengthen FirstEnergy’s safety-first culture and drive safer decisions from an engaged workforce who puts safety first. FirstEnergy continues to embed its "Leading with Safety" learnings where leaders and employees receive safety training and reinforcement of exposure control concepts that are designed to improve job site exposure identification, communication and mitigation to ultimately prevent life changing events.

Employee Development

FirstEnergy’s employees are empowered to take ownership of their careers with increased transparency into FirstEnergy’s internal and external hiring process and availability of tools and processes that support career management, talent reviews, succession planning and leadership selection. FirstEnergy is committed to preparing its high-performing workforce for the future and helping employees reach their full potential, which includes developing employee skills and competencies and preparing aspiring, emerging and experienced leaders for future leadership responsibilities.

Understanding FirstEnergy’s rapidly changing industry and strategy is key to its employees’ ability to support FirstEnergy’s mission and meet its customers’ evolving needs. Key FirstEnergy development programs include:

•Talent management, which includes a commitment to transparency in career management and development opportunities, consistent with FirstEnergy’s core values;

•A mentoring program that gives employees the opportunity to select a mentor from within the organization to promote enhanced learning, teamwork and collaboration;

•Leadership development opportunities that include training for new supervisors and managers, experienced leader programming and coaching, aspiring leader programs that build leadership capabilities for employees who are ready near-term leadership roles; and external partnership with the Center for Creative Leadership® and BeingFirst® for senior and executive leadership development;

•Educational opportunities through FirstEnergy’s "Educate to Elevate" program, which provides access to post-secondary education and a path to both associate’s and bachelor’s degrees for employees; and

•Workforce development programs that include an apprentice line worker program designed to attract technical entry-level talent to FirstEnergy.

Compensation and Benefits

FirstEnergy’s total rewards program is designed to attract, motivate, retain and reward employees for their role in the success of FirstEnergy. The base pay program is designed to balance an employee’s value to FirstEnergy in a manner that is commensurate with comparable jobs at peer companies. FirstEnergy aims to ensure that its internal policies and processes support pay equity.

The annual incentive compensation program is designed to align compensation with the achievement of near-term corporate and business unit objectives, as well as outstanding individual performance. Additionally, FirstEnergy’s long-term incentive compensation program is designed to reward eligible leaders for FirstEnergy’s achievement of longer-term goals intended to drive shareholder value and growth. In addition to base pay and incentive compensation plans, FirstEnergy offers a comprehensive benefits program, including healthcare, dental, prescription, vision, a 401(k) savings plan and a defined benefit pension plan to eligible employees.

Employees and Collective Bargaining Agreements

As of December 31, 2024, FirstEnergy had 12,294 employees, all of whom were located in the United States as follows:

| | | | | | | | | | | |

| Total

Employees | | Bargaining

Unit

Employees |

| FESC | 5,166 | | | 521 | |

| CEI | 819 | | | 570 | |

| FE PA | 2,083 | | | 1,536 | |

| JCP&L | 1,296 | | | 992 | |

| MP | 1,040 | | | 396 | |

| OE | 1,061 | | | 666 | |

| PE | 505 | | | 246 | |

| TE | 324 | | | 249 | |

| Total | 12,294 | | | 5,176 | |

As of December 31, 2024, the IBEW, the UWUA and the OPEIU unions collectively represented approximately 40% of FirstEnergy’s employees. There are currently 15 collective bargaining agreements between FirstEnergy’s subsidiaries and its unions, which have multi-year contracts. In 2024, FirstEnergy’s subsidiaries reached new collective bargaining agreements with IBEW Local 1289, IBEW Local 459 and OPEIU 792. One collective bargaining agreement was set to expire in 2025, with a settlement reached in January 2025, representing approximately 3% of FirstEnergy’s employees.

Information About Our Executive Officers (as of February 27, 2025)

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions Held During Past Five Years | | Dates |

| Brian X. Tierney | | 57 | | Chair, President and Chief Executive Officer (A) | | 2024-Present |

| | | | President and Chief Executive Officer (A) | | 2023-2024 |

| | | | President and Chief Executive Officer (B) | | 2023-Present |

| | | | Blackstone Infrastructure Partners, Senior Managing Director | | 2021-2023 |

| | | | AEP, Executive Vice President - Strategy | | 2021 |

| | | | AEP, Executive Vice President and Chief Financial Officer | | *-2020 |

| | | | | | |

| Hyun Park | | 63 | | Senior Vice President and Chief Legal Officer (A) (B) | | 2021-Present |

| | | | Senior Vice President and General Counsel (C) (D) | | 2021-2022 |

| | | | LimNexus, Partner and General Counsel | | *-2021 |

| | | | | | |

| Jason J. Lisowski | | 43 | | Vice President, Controller and Chief Accounting Officer (A) (B) | | *-Present |

| | | | Vice President and Controller (C) (E) | | *-Present |

| | | | | | |

| K. Jon Taylor | | 51 | | Senior Vice President, Chief Financial Officer and Strategy (A) (B) | | 2021-Present |

| | | | Senior Vice President and Chief Financial Officer (C) (E) | | 2020-2024 |

| | | | Senior Vice President and Chief Financial Officer (A) (B) | | 2020-2021 |

| | | | Vice President, Utility Operations (B) | | *-2020 |

| | | | President (D) | | *-2020 |

| | | | | | |

| Toby L. Thomas | | 53 | | Chief Operating Officer (A) (B) | | 2023-Present |

| | | | AEP, Senior Vice President | | 2021-2023 |

| | | | Indiana Michigan Power, President and Chief Operating Officer | | *-2021 |

| | | | | | |

| A. Wade Smith | | 60 | | President, FirstEnergy Utilities (A) (B) | | 2023-Present |

| | | | Puget Sound Energy, Inc., Executive Vice President and Chief Operating Officer | | 2022-2023 |

| | | | Pacific Gas & Electric, Senior Vice President | | 2021-2022 |

| | | | AEP, Senior Vice President | | *-2021 |

| | |

| * Indicates position held at least since January 1, 2020 |

| (A) Denotes position held at FE |

| (B) Denotes position held at FESC |

(C) Denotes position held at the Ohio Companies, the Pennsylvania Companies(1), MP, PE, FET, ATSI, MAIT, TrAIL and KATCo. |

| (D) Denotes position held at AGC |

(E) Denotes position held at FE PA(1) |

(1) On January 1, 2024, FirstEnergy consolidated the Pennsylvania Companies into FE PA, making it a new, single operating entity. Upon consolidation, executive officers of the Pennsylvania Companies were named as executive officers of FE PA.

FirstEnergy Website and Other Social Media Sites and Applications

FirstEnergy's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, amendments to those reports, and all other documents filed with or furnished to the SEC pursuant to Section 13(a) of the Exchange Act are made available free of charge on FirstEnergy’s website at investors.firstenergycorp.com. These documents are also available to the public from commercial document retrieval services and the website maintained by the SEC at www.sec.gov.

FirstEnergy has adopted, and posted on its website at www.firstenergycorp.com/responsibility, a Code of Conduct, The Power of Integrity, which applies to all employees, including FirstEnergy’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The Code of Conduct is available, without charge, upon written request to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890. Within the time period required by the SEC, FirstEnergy will post on its website any substantive amendment to the Code of Conduct and any waiver applicable to an FE director or FE executive officer.

These SEC filings are posted on the website as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Additionally, FirstEnergy routinely posts additional important information, including press releases, investor presentations, investor factbooks and notices of upcoming events under the "Investors" section of FirstEnergy’s website and recognizes FirstEnergy’s website as a channel of distribution to reach public investors and as a means of disclosing (including initially or exclusively) material non-public information for complying with disclosure obligations under Regulation FD. Investors may be notified of postings to the website by signing up for email alerts and Rich Site Summary feeds on the “Investors” page of FirstEnergy’s website. FirstEnergy also uses X (the social networking site formerly known as Twitter®), LinkedIn®, YouTube® and Facebook® as additional channels of distribution to reach public investors and as a supplemental means of disclosing material non-public information for complying with its disclosure obligations under Regulation FD. Information contained on FirstEnergy’s website, X (the social networking site formerly known as Twitter®) handle, LinkedIn® profile, YouTube® channel or Facebook® page, and any corresponding applications of those sites, shall not be deemed incorporated into, or to be part of, this report.

ITEM 1A. RISK FACTORS

We operate in a business environment that involves significant risks, many of which are beyond our control. Management regularly evaluates the most significant risks of its businesses and reviews those risks with the FE Board and appropriate Committees of the FE Board. The following risk factors and all other information contained in this report should be considered carefully when evaluating FirstEnergy. These risk factors could affect our financial results and cause such results to differ materially from those expressed in any forward-looking statements made by or on behalf of us. Below, we have identified risks we consider material. The risks that we face are not limited to those in this section. There may be additional risks and uncertainties (either currently unknown or not currently believed to be material) that could adversely affect our business, financial condition, results of operations, liquidity or cash flows. Although the risks are organized by headings, and each risk is discussed separately, many are interrelated. These risk factors should be read in conjunction with Item 1, "Business,” Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in other sections of this Form 10-K that include forward-looking and other statements involving risks and uncertainties that could impact our business, financial condition, results of operations, liquidity or cash flows.

Risks Associated with Damage to Our Reputation and HB 6 Related Litigation and Investigations

HB 6-related investigations and litigation could have a material adverse effect on our reputation, business, financial condition, results of operations, our ability to access capital, liquidity or cash flows.

On July 21, 2021, we entered into a three-year DPA with the U.S. Attorney’s Office that, subject to court proceedings, resolves the previously disclosed U.S. Attorney’s Office investigation into us relating to our lobbying and governmental affairs activities concerning HB 6. Under the DPA, we paid a $230 million monetary penalty in 2021 and agreed to the filing of a criminal information charging FirstEnergy with one count of conspiracy to commit honest services wire fraud.

As of July 22, 2024, we successfully completed the obligations required within the three-year term of the DPA. Under the DPA, and until the conclusion of any related investigation, criminal prosecution and civil proceeding brought by the U.S. Attorney’s Office, we have an obligation to continue (i) publishing quarterly a list of all payments to 501(c)(4) entities and all payments to entities known by us to be operating for the benefit of a public official, either directly or indirectly; (ii) not making any statements that contradict the DPA; (iii) notifying the U.S. Attorney’s Office for the S.D. Ohio of any changes in FirstEnergy’s corporate form; and (iv) cooperating with the U.S. Attorney’s Office for the S.D. Ohio. In accordance with the DPA, these obligations will continue until the completion of any related investigation, criminal prosecution, and civil proceeding brought by the U.S. Attorney’s Office related to the conduct set forth in the DPA’s statement of facts, including the January 17, 2025 indictment against two former FirstEnergy senior officers, described below in “Outlook—Other Legal Proceeding – United States v. Larry Householder, et al.” Within 30 days of those matters concluding, and FirstEnergy’s successful completion of its remaining obligations, the U. S. Attorney’s Office will dismiss the criminal information.

If we are found to have breached the terms of the DPA, the U.S. Attorney’s Office may elect to prosecute, or bring a civil action against, us for conduct alleged in the DPA or known to the government, which could result in fines or penalties and could have a material adverse impact on our reputation or relationships with regulatory and legislative authorities, customers and other stakeholders, as well as our consolidated financial statements. Failure to comply with the DPA, including alleged failures to comply with anti-corruption and anti-bribery laws, may also result in a breach of certain covenants contained in our credit agreements and could result in an event of default under such agreements, and we would not be able to access our credit facilities for additional borrowings and letters of credit during the existence of any such default.

Following the announcement by the U.S. Attorney’s Office for the S.D. Ohio of the investigation surrounding HB 6 in July 2020, certain of our stockholders and customers filed several lawsuits against us and certain current and former directors, officers and other employees, including the federal securities class action litigation In re FirstEnergy Corp. Securities Litigation (Federal District Court, S.D. Ohio). We believe that it is probable that FE will incur a loss in connection with the resolution of In re FirstEnergy Corp. Securities Litigation. Given the ongoing nature and complexity of such litigation, we cannot yet reasonably estimate a loss or range of loss that may arise from its resolution. However, if it is resolved against us substantial monetary damages could result and our reputation, business, financial condition, results of operations, liquidity or cash flows may be materially adversely affected.

The litigation related to HB 6 could divert management’s focus and have resulted in, and could continue to result in, substantial expenses, and the commitment of substantial corporate resources. The outcome, duration, scope, result or related costs of the in securities class action litigation In re: FirstEnergy Corp. Securities Litigation discussed above, are inherently uncertain. Therefore, any of these risks could impact us significantly beyond expectations. See Note 15, "Commitments, Guarantees and Contingencies" of the Notes to Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates.”

These matters are likely to continue to have an adverse impact on the trading prices of our securities, which could be material. See Note 15, “Commitments, Guarantees and Contingencies,” of the Notes to Consolidated Financial Statements, for additional details on the government investigations and subsequent litigation surrounding HB 6.

The HB 6 related state regulatory investigations could have a material adverse effect on our reputation, business, financial condition, results of operations, liquidity or cash flows.

There are several ongoing HB 6 related state regulatory matters including, but not limited to, the below HB 6-related matters, each of which was stayed for a third time by the PUCO on August 23, 2023, at the request of the U.S. Attorney for the Southern District of Ohio, for a period of an additional six months. The stay on the following matters was lifted on February 26, 2024:

•On September 8, 2020, the OCC filed motions in the Ohio Companies’ corporate separation audit and DMR audit dockets, requesting the PUCO to open an investigation and management audit, hire an independent auditor, and require FirstEnergy to show it did not improperly use money collected from consumers or violate any utility regulatory laws, rules or orders in its activities regarding HB 6. On February 26, 2024, this proceeding was consolidated with the expanded DCR rider audit proceeding described below and on November 22, 2024, the administrative law judge ordered that the bifurcated portion of the corporate separation audit, discussed further below, be consolidated with the already-consolidated DMR audit and expanded DCR rider audit proceeding. Evidentiary hearings are scheduled to begin May 13, 2025;

•On September 15, 2020, the PUCO opened a new proceeding to review the political and charitable spending by the Ohio Companies in support of HB 6 and the subsequent referendum effort. On September 30, 2024, the third-party auditor’s report was filed. See ”Outlook - State Regulation - Ohio” below for additional information regarding the auditor’s findings. Comments have been filed on the audit report and remain pending with the PUCO;

•On December 30, 2020, the PUCO directed PUCO staff to solicit a third-party auditor and conduct a full review of the DMR to ensure funds collected from customers through the DMR were only used for the purposes established in ESP IV. The auditor’s report was filed on January 14, 2022, and the parties submitted final comments and responses in the second quarter 2022. See ”Outlook - State Regulation - Ohio” below for additional information regarding the auditor’s findings. On February 26, 2024, this proceeding was consolidated with the expanded DCR rider audit proceeding described below and on November 22, 2024, the administrative law judge ordered that the bifurcated portion of the corporate separation audit, discussed further below, be consolidated with the already-consolidated DMR audit and expanded DCR rider audit proceeding. Evidentiary hearings are scheduled to begin May 13, 2025; and

•On March 10, 2021, the PUCO expanded the scope of an ongoing annual audit of the Ohio Companies’ Rider DCR for 2020 to include a review of certain transactions that were either improperly classified, misallocated, or lacked supporting documentation, and to determine whether funds collected from customers were used to pay the vendors, and if so, whether or not the funds associated with those payments should be returned to customers through Rider DCR or through an alternative proceeding. On February 26, 2024, this proceeding was consolidated with the Rider DMR audit proceeding described above, and further lifted the stay of the portion of the investigation relating to an apparent nondisclosure of a side agreement. On November 22, 2024, the administrative law judge ordered that the bifurcated portion of the corporate separation audit be consolidated with the already-consolidated DMR audit and the expanded DCR rider audit proceeding. Evidentiary hearings are scheduled to begin May 13, 2025.

See Note 14, "Regulatory Matters" of the Notes to Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates” for additional details on the state regulatory investigations surrounding HB 6.

While FirstEnergy is committed to pursuing an open dialogue with stakeholders in an appropriate manner with respect to the numerous regulatory proceedings currently underway, FirstEnergy shareholders in particular are at risk of being adversely impacted because the rates our Electric Companies and Transmission Companies are allowed to charge may be decreased as a result of actions taken by a regulator to which our Electric Companies and Transmission Companies are subject to jurisdiction, whether as a result of the DPA, any failure to have complied with anti-corruption laws, or otherwise.

We are unable to predict the adverse impacts of such regulatory matters, including with respect to rates, and, therefore, any of these risks could impact us significantly beyond expectations. Moreover, we are unable to predict the potential for any additional regulatory actions, any of which could exacerbate these risks or expose us to adverse outcomes in pending or future rate cases, and could have a material adverse effect on our reputation, business, financial condition, results of operations, liquidity or cash flows.

Damage to our reputation may arise from numerous sources making us vulnerable to negative customer perception, adverse regulatory outcomes, or other consequences, which could materially adversely affect our business, results of operations and financial condition.

Our reputation is important. Damage to our reputation could materially adversely affect our business, results of operations and financial condition. Such damage may arise from numerous sources further discussed generally within these risk factors. Any damage to our reputation, either generally or as a result of the foregoing, may lead to negative customer perception, which may make it difficult for us to compete successfully for new opportunities, or could adversely impact our ability to launch new sophisticated technology-driven solutions to meet our customer expectations. A damaged reputation could further result in FERC, the state public utility commissions, and other regulatory and legislative authorities being less likely to view us in a favorable light and could negatively impact the rates we charge customers or otherwise cause us to be susceptible to unfavorable legislative and regulatory outcomes, as well as increased regulatory oversight and more stringent legislative or regulatory requirements.

Risks Associated with the Execution of Our Strategic Initiatives

If our cost saving initiatives do not achieve the expected benefits, there could be negative impacts to FirstEnergy's business, results of operations and financial condition.

FirstEnergy is engaged in an ongoing effort to create a culture of continuous improvement to strategically reduce our operating expenditures and continually reinvest in a more diverse capital program in support of our long-term strategy. FirstEnergy leverages opportunities to reduce costs – such as filling only critical positions, implementing our facility optimization plans, and exploring other additional, sustainable opportunities, such as reducing contractor spend. There can be no assurance that implementation of our continuous improvement culture will allow us to realize the anticipated benefits to our business, results of operations and financial condition in a timely manner, if at all.

Our ability to achieve the continued benefits from our cost saving initiatives is subject to many estimates and assumptions as well as our ability to hire, recruit and retain an appropriately qualified workforce and implement a culture of continuous improvement. FirstEnergy could experience unexpected delays and business disruptions resulting from supporting these initiatives, decreased productivity, and higher than anticipated costs, any of which may impair our ability to reduce operating expenditures and to achieve anticipated results or otherwise harm FirstEnergy's business, results of operations and financial condition.

Risks Associated with Regulation of Our Distribution and Transmission Businesses

Our ability to grow our distribution and transmission businesses is subject to numerous risks and events, many of which are outside of our control.

Our ability to capitalize on investment opportunities available to our transmission business depends, in part, on successful recovery of our transmission investments. Factors that may affect rate recovery of our transmission investments include: (1) FERC’s timely approval of rates to recover such investments; (2) whether the investments are included in PJM's Regional Transmission Expansion Plan; (3) FERC's evolving policies with respect to incentive rates for transmission assets; (4) FERC's evolving policies with respect to the calculation of the base ROE component of transmission rates; (5) consideration and potential impact of the objections of those who oppose such investments and their recovery; and (6) timely development, construction, and operation of the new facilities.

Our ability to capitalize on investment opportunities available to our distribution business depends, in part, on any future distribution rate cases or other filings seeking cost recovery for distribution system enhancements in the states where our Electric Companies operate, including maintaining the affordability of the rates charged to customers. Any denial of, or delay in, the approval of any future distribution or transmission rate requests could restrict us from fully recovering our cost of service, may impose risks on the distribution and transmission operations, and could have a material adverse effect on our regulatory strategy, results of operations and financial condition.

State rate regulation may delay or deny full recovery of costs and impose risks on our operations. Any denial of or delay in cost recovery could have an adverse effect on our business, results of operations, liquidity, cash flows and financial condition.

The retail rates for each of the Electric Companies are set by each of its respective regulatory agency for utilities in the state in which it operates - in Maryland by the MDPSC, in New Jersey by the NJBPU, in Ohio by the PUCO, in Pennsylvania by the PPUC, in West Virginia by the WVPSC and in New York by the NYPSC – through traditional, cost-based regulated utility ratemaking. As a result, any of the Electric Companies may not be permitted to recover its costs and, even if it is able to do so, there may be a significant delay between the time it incurs such costs and the time it is allowed to recover them. Factors that may affect outcomes in the distribution rate cases include, but are not limited to: (i) the value of plant in service; (ii) authorized rate of return; (iii) capital structure (including hypothetical capital structures); (iv) depreciation rates; (v) the allocation of shared costs, including consolidated deferred income taxes and income taxes payable across the Electric Companies; (vi) regulatory approval of rate recovery mechanisms for capital investment spending programs; and (vii) the accuracy of forecasts used for ratemaking purposes in "future test year" cases.

FirstEnergy can provide no assurance that any base rate request filed by any of the Electric Companies will be granted in whole or in part. Any denial of, or delay in, any base rate request could restrict the applicable utility from fully recovering its costs of service, may impose risks on its operations, and may negatively impact such Electric Company’s results of operations, cash flows and financial condition. In addition, to the extent that any of the Electric Companies seek an increase in rates, third-party pressure may be exerted on the applicable legislators and regulators to take steps to control rate increases, including through some form of rate increase moderation, reduction or freeze. Any related public discourse and debate, including with respect to the HB 6 litigation, can increase uncertainty associated with the regulatory process, the level of rates and revenues that are ultimately obtained, and the ability of the Electric Company to recover costs. Such uncertainty may restrict operational flexibility and resources, reduce liquidity and increase financing costs.

Federal rate regulation may delay or deny full recovery of costs and impose risks on our operations. Any denial or reduction of, or delay in cost recovery could have an adverse effect on our business, results of operations, cash flows and financial condition.

FERC policy currently permits recovery of prudently incurred costs associated with cost-of-service-based wholesale power rates and the expansion and updating of transmission infrastructure within its jurisdiction. FERC’s policies on recovery of transmission costs continue to evolve, evidenced by ongoing proceedings to determine an appropriate ROE methodology to determine transmission ROEs, and to determine whether FERC’s existing policies on transmission rate incentives should be revised. If FERC were to adopt a different policy regarding recovery of transmission costs or if there is any resulting delay in cost recovery, our strategy of investing in transmission could be adversely affected. If FERC were to lower the rate of return it has authorized for FirstEnergy's cost-based wholesale power rates or transmission investments and facilities, it could reduce future earnings and cash flows, and adversely impact our financial condition.

Complex and changing federal, state and local government regulations and actions, including those associated with rates, could have a negative impact on our business, financial condition, results of operations and cash flows.

We are subject to comprehensive regulation by various federal, state and local regulatory agencies that significantly influence our operating environment. Changes in, or reinterpretations of, existing laws or regulations, or the imposition of new laws or regulations, by federal executive orders or otherwise, have in the past and could in the future require us to incur additional costs, which could be substantial, or change the way we conduct our business, and therefore could have a material adverse impact on our results of operations and financial condition.

We could be subject to higher costs and/or penalties related to mandatory reliability standards set by NERC/FERC or changes in the rules of organized markets, which could have an adverse effect on our financial condition.

Owners, operators, and users of the bulk electric system are subject to mandatory reliability standards promulgated by NERC and approved by FERC. The standards are based on the functions that need to be performed to ensure that the bulk electric system operates reliably. NERC, RFC and FERC can be expected to continue to refine existing reliability standards as well as develop and adopt new reliability standards. Compliance with modified or new reliability standards may subject us to higher operating costs and/or increased investments. If we were found not to be in compliance with the mandatory reliability standards, we could be subject to sanctions, including substantial monetary penalties. FERC has authority to impose penalties up to and including $1.5 million per day for failure to comply with these mandatory electric reliability standards.

In addition, PJM may direct our transmission-owning affiliates to build new transmission facilities to meet PJM's reliability requirements or to provide new or expanded transmission service under the PJM Tariff.

We may be allocated a portion of the cost of transmission facilities built by others due to changes in RTO transmission rate design. We may be required to expand our transmission system according to decisions made by an RTO rather than our own internal planning processes. Various proposals and proceedings before FERC may cause transmission rates to change from time to time. In addition, RTOs have been developing rules associated with the allocation and methodology of assigning costs associated with improved transmission reliability, reduced transmission congestion and firm transmission rights that may have a financial impact on us.

As a member of PJM, which is an RTO, we are subject to certain additional risks, including those associated with the allocation among members of losses caused by unreimbursed defaults of other participants in PJM’s market, as well as those associated with complaint cases filed against PJM that may seek refunds of revenues previously earned by its members.

Risks Related to our Business Operations