- FE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

-

Institutional

- Shorts

-

PRE 14A Filing

FirstEnergy (FE) PRE 14APreliminary proxy

Filed: 7 Mar 23, 5:02pm

| Filed by the Registrant ☒ | ||||

| Filed by a Party other than the Registrant ☐ | ||||

| Check the appropriate box: | ||||

| ☒ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☐ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

FirstEnergy Corp. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check all boxes that apply): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

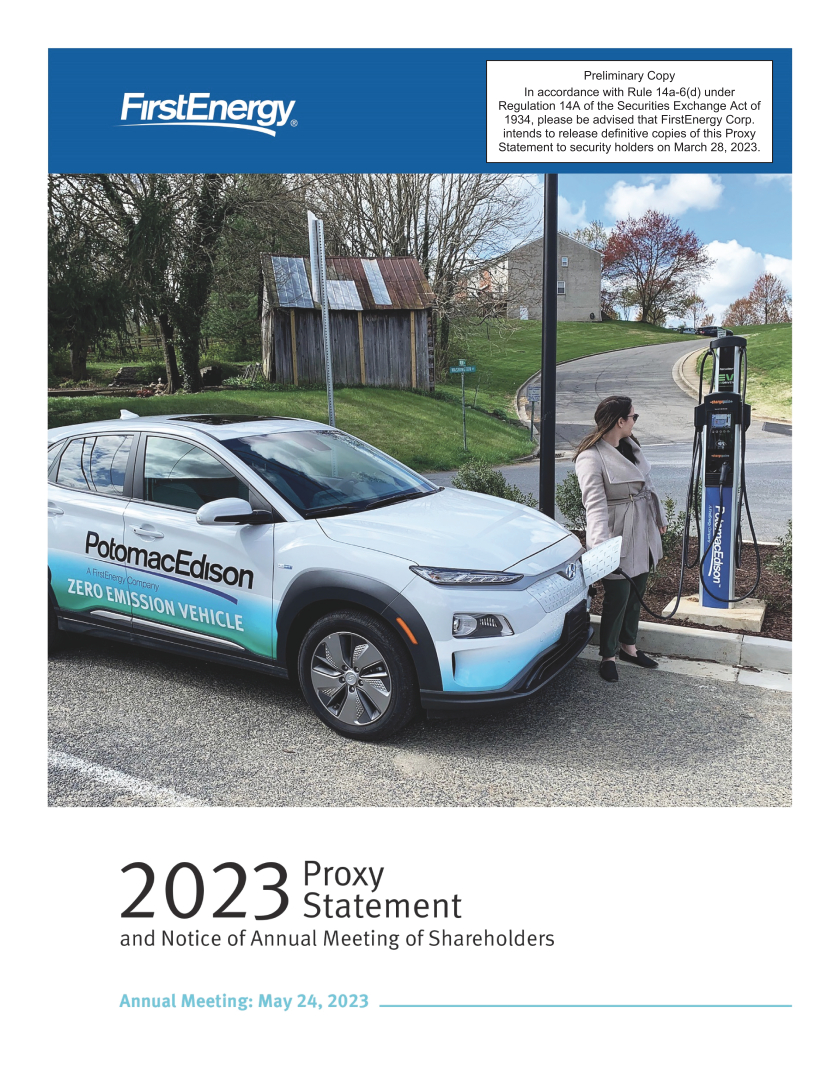

On the Cover: The Potomac Edison Company’s (a subsidiary of FirstEnergy Corp.) EV Driven program is a five-year initiative designed to benefit the state’s environment by reducing auto emissions and supporting Maryland’s goal to reach 300,000 zero-emission vehicles on the road by 2025. Potomac Edison is installing 59 charging stations – including 20 fast-charging stations – across its seven-county Maryland territory over the course of the program, which runs through 2023.

Letter from |

March [28], 2023

Letter from Our Chair and Interim President & CEO

|

|

John W. Somerhalder, II Chair of the Board and Interim President & CEO

| ||||||

Dear FirstEnergy Shareholders:

Thank you for your confidence in FirstEnergy. On behalf of your Board of Directors and management team, we welcome your attendance at our 2023 Annual Meeting of Shareholders on May 24, 2023. A schedule of business to be conducted at the meeting is available in the attached Notice of the 2023 Annual Meeting of Shareholders, and the accompanying Proxy Statement includes information about your Board, FirstEnergy’s employee, environmental, social and governance (EESG) practices and our executive compensation programs.

The meeting will be conducted online. To attend the virtual event, please follow the registration instructions listed on your proxy card. Additional registration information is available in the Questions and Answers section of the accompanying Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.”

Becoming a Premier Utility

I’m proud of FirstEnergy’s progress to become a premier, forward-thinking electric company that is well positioned to deliver value to stakeholders. We’re harnessing our strengths while enhancing nearly every aspect of the organization, emerging as a more resilient, innovative and efficient company.

Recent highlights include executing transformative equity investments to enhance our financial position and fuel our growth; modernizing our work practices and processes to optimize our performance, drive efficiencies and deliver a superior customer experience; and continued progress

fostering a culture rooted in our core values and focused on ethics, integrity and accountability.

We intend to build on this momentum and solidify our position as an industry leader as we drive our long-term strategy focused on strengthening our foundation, building a customer-centered focus and enabling the clean energy transition.

Expanding our corporate responsibility focus

Our strategy supports — and is supported by — our approach to corporate responsibility. Last year, we enhanced our corporate responsibility framework to include employee along with environmental, social and governance priorities. Recognizing employees as a distinct and essential pillar of our corporate responsibility approach pays tribute to their role in our success, as well as our commitment to cultivating a rewarding work environment where they can thrive.

To learn more about our EESG priorities and how they’re making us a more innovative, diverse, sustainable and industry-leading company, I encourage you to review the “Commitments to EESG” section of the accompanying Proxy Statement as well as our refreshed corporate responsibility website at www.fecorporateresponsibility.com.

The website also includes an updated Climate Report aligned with guidance from the Task Force on Climate-related Financial Disclosures. The new report demonstrates FirstEnergy’s continued commitment to addressing the realities of climate change, while meeting stakeholder expectations for transparency and oversight.

| FIRSTENERGY CORP. | ||||

|

Upholding high standards of governance

Strong corporate governance is foundational to our business and important to advancing the interests of our shareholders. Your highly independent and diverse Board oversees and guides FirstEnergy’s business strategy, including your Company’s progress building a strong, centralized compliance program, ensuring a culture of ethics and integrity and advancing EESG matters.

We believe our shareholder engagement programs and investor communication efforts are vital to FirstEnergy’s success, and we value the opportunity to further strengthen our engagement with our shareholders. With support from the full Board, our executive management team and integrated shareholder outreach team — consisting of members of Corporate Responsibility, Corporate Secretary department, Legal, Finance, Human Resources and Investor Relations, hold regular conversations with a broad base of investors throughout the year. The feedback and suggestions gathered from these engagements guide the Board as we help FirstEnergy execute its business strategy and fulfill its mission to make customers’ lives brighter, the environment better and our communities stronger.

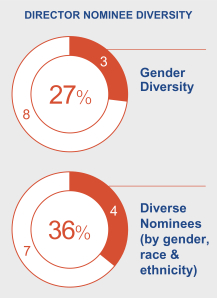

We are focused on creating a more diverse, equitable and inclusive company, including at the senior leadership and Board levels. Our Board nominees demonstrate diversity in the form of gender, ethnicity, age, tenure, thought, background and experience and support our goal of maintaining at least 30% diverse members by race, ethnicity and gender for the foreseeable future.

We also believe it is important to periodically refresh our Board with new members who bring fresh perspectives to the boardroom. Eight of our 11 director nominees have joined the Board since 2021.

Lighting the Way

It’s an exciting time for FirstEnergy, as we’re poised to leverage our many strengths: from our diverse assets, to the transformation that has taken place since 2020, to the talented employees who are making the company stronger with their drive, passion and ingenuity.

Together with these engaged and motivated employees, your Board and management team are deeply committed to serving our customers, meeting our commitments to stakeholders and strengthening our company for the future.

Your Board and management team will continue to engage with you regularly and keep you updated on your Company’s progress. I invite you to read more about your Board, company strategies and EESG practices, and executive compensation programs in the accompanying Proxy Statement.

We appreciate your support and thank you in advance for voting promptly.

| Sincerely, | ||

| John W. Somerhalder, II Chair of your Board and Interim President & CEO |

| 2023 PROXY STATEMENT |

Notice of Annual Meeting of Shareholders |

Notice of Annual Meeting of Shareholders

Please carefully review this Notice, the Company’s Annual Report to Shareholders for the year ended December 31, 2022 (the “2022 Annual Report”), and the accompanying Proxy Statement and vote your shares by following the instructions on your proxy card/voting instruction form or Notice of Internet Availability of Proxy Materials to ensure your vote is cast at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”).

DATE AND TIME

Wednesday, May 24, 2023 8:00 a.m. EDT

RECORD DATE

March 27, 2023 | LOCATION

The Annual Meeting will be a virtual meeting of shareholders, conducted via live webcast, and will take place at: www.cesonlineservices.com/fe23_vm. Online access will begin at 7:30 a.m. EDT on May 24, 2023. There will be no physical location for in-person attendance at the Annual Meeting.

Shareholders must register in advance to attend, ask questions or vote at the virtual Annual Meeting. Registration instructions are available in the “Questions and Answers about the Annual Meeting” section of the accompanying Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.” Only shareholders of record as of the close of business on March 27, 2023, or their proxy holders, may vote at the Annual Meeting. | |

AGENDA

On behalf of the Board of Directors,

| Mary M. Swann Corporate Secretary and Associate General Counsel Akron, Ohio |

This Notice and accompanying Proxy Statement are being mailed or made available to shareholders on or about March [28], 2023.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 24, 2023. The accompanying Proxy Statement and the 2022 Annual Report are available at www.FirstEnergyCorp.com/AnnualMeeting.

|

| FIRSTENERGY CORP. | ||||

Table of |

Table of Contents

2023 PROXY STATEMENT |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

OUR VALUES

Integrity We always act ethically with honesty, humility and accountability. |

Safety We keep ourselves and others safe. |

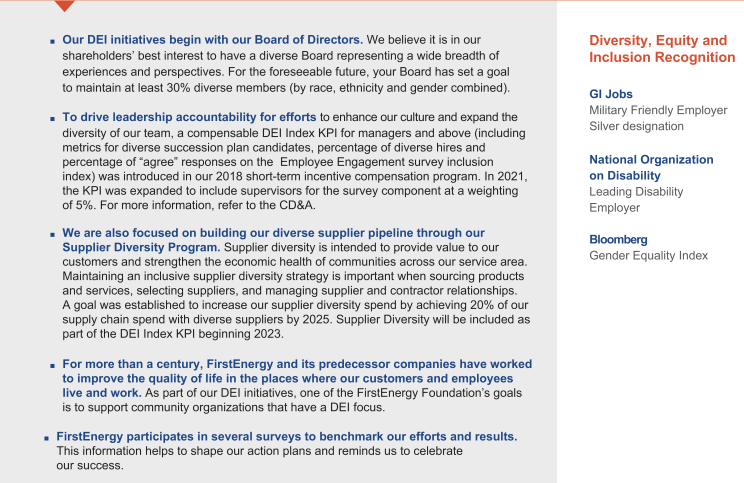

Diversity, Equity & Inclusion We embrace differences, ensure every employee is treated fairly and create a culture where everyone feels they belong. |

Performance Excellence We pursue excellence and seek opportunities for growth, innovation and continuous improvement. |

Stewardship We positively impact our customers, communities and other stakeholders, and strive to protect the environment. |

| 1 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

CODE OF CONDUCT

FirstEnergy’s Code of Conduct, The Power of Integrity, lays the foundation for what we expect from the Board and all employees. It reflects our collective commitment to keep integrity at the forefront of everything we do — a pledge underscored by the inclusion of integrity in our mission, core values and company strategy.

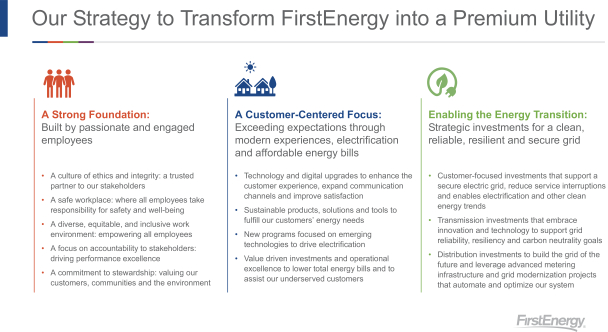

COMPANY STRATEGY

FirstEnergy is embracing pivotal changes within our operations and culture that are energizing the company as we further our transformation into a forward-thinking, premium utility. Three pillars of strategy represent the focus of our efforts and investments and are backed by tangible goals.

| ◾ | A Strong Foundation: built by passionate and engaged employees. |

| ◾ | A Customer-Centered Focus: exceeding expectations through modern experiences, electrification and affordable energy bills. |

| ◾ | Enabling the Energy Transition: strategic investments for a clean, reliable, resilient and secure electric grid. |

| 2023 PROXY STATEMENT | 2 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

EESG FOCUS

The pillars of our company strategy are supported by our employee, environmental, social and governance (EESG) priorities and aligned with our commitment to corporate responsibility. Because of this strategic integration, improving our EESG performance also advances our strategy and helps us become a more innovative, diverse, sustainable and industry-leading company.

EESG Priorities: | ||||||

| EMPLOYEE: Support the development of an inclusive, equitable, rewarding and safe work culture while empowering our diverse and innovative team to make our customers’ lives brighter and our communities stronger | |||||

| ENVIRONMENTAL: Protect the environment by minimizing our impact, improving the sustainability of our operations, executing our Climate Strategy and finding opportunities to enhance the ecosystems we interact with | |||||

| SOCIAL: Invest in the communities we serve, promote public safety and economic development, and advance equitable and inclusive business practices to enable positive change while delivering superior customer service | |||||

| GOVERNANCE: Maintain oversight of significant company issues and strengthen risk management; build a strong, centralized corporate compliance program and culture of ethics and integrity; continue stakeholder engagement efforts and provide consistent, transparent disclosures on EESG topics

| |||||

COMPANY CULTURE

Transforming our company culture is foundational to achieving our company’s strategy. Our core values are the foundation of our transformation, our strategy and ultimately FirstEnergy’s long-term success. Integrity, Safety, Diversity, Equity and Inclusion (DEI), Performance Excellence, and Stewardship are the bedrock from which we operate, behave and interact every day. We are committed to a strong cultural foundation of ethics and integrity where employees feel safe to be themselves, speak up and bring their best to work every day. Creating a work environment that allows for greater diversity, equity and inclusion and prioritizes employees’ safety, health and well-being is also key to that cultural transformation. As part of our transformation we strive to prioritize, operationalize and live these values in everything we do, internally and externally. They guide our behavior, our decisions and ultimately the actions that create our performance and success.

HUMAN CAPITAL MANAGEMENT

FirstEnergy’s workforce is essential in our ability to continue moving our company forward by keeping each other safe, delivering value to our stakeholders, and transforming our culture in alignment with our core values. While 2022 continued to present unprecedented challenges, our commitment to our employees and their health and safety has not wavered. Integrity is critical to our path to a stronger, more sustainable FirstEnergy, and reflects our collective commitment to ensuring that we conduct business ethically. We expect all employees do the right thing, and we treat our coworkers and communities with the respect we all deserve. Further details of our focus on keeping our core values and behaviors at the center of everything we do, and our desire to help our employees to do their best each day is included in the “Our Commitment to EESG” section of this Proxy Statement.

| 3 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

CLIMATE STRATEGY

Enabling the Energy Transition

Our commitment to climate is a significant component of our company’s overarching strategy, especially our desire to enable the transition to a clean energy future. Executing our Climate Strategy and advancing the transition to clean energy requires addressing, among other things: emerging federal and state decarbonization goals; physical risks of climate change; industry trends and technology advancements; and customer expectations for cleaner energy, increased usage control, and more sustainable alternatives in transportation, manufacturing and industrial processes. Through our investment plan, we aim to enhance the resiliency, reliability and security of the electric system and support the integration of renewables, electric vehicles, grid modernization improvements and other emerging technologies.

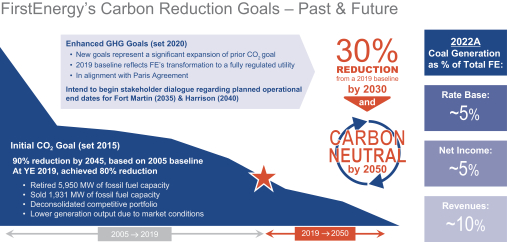

Reducing Greenhouse Gas Emissions

As part of our Climate Strategy, we are also committed to reducing greenhouse gas (GHG) emissions. We’ve pledged to achieve carbon neutrality by 2050, with an interim 30% reduction in greenhouse gases within our direct operational control (Scope 1) by 2030 based on 2019 levels. This Scope 1 GHG goal encompasses companywide emissions across our transmission, distribution and regulated generation operations.

Key steps in working toward carbon neutrality by 2050 include:

| ◾ | Reducing Sulfur Hexafluoride (SF6) Emissions: We’re working to repair or replace, as appropriate, transmission breakers that leak SF6, which is a gas commonly used by energy companies as an electrical insulating material and arc extinguisher in high-voltage circuit breakers and switchgear. If escaped to the atmosphere, it acts as a potent greenhouse gas with a global warming potential significantly greater than CO2. |

| ◾ | Electrifying our Vehicle Fleet: We’re targeting 30% electrification of our light-duty and aerial truck fleet by 2030 and 100% electrification by 2050. To reach our electrification goal, we’re striving for 100% electric or hybrid vehicle purchases for our light-duty and aerial truck fleet moving forward, beginning with the first hybrid electric vehicle additions to the fleet in 2021. |

| ◾ | Transitioning Away from Coal Generation: We’ve committed to moving beyond our two coal-fired generating plants no later than 2050. Our commitment is consistent with the depreciation rates filing we submitted to the Public Service Commission of West Virginia (the “WVPSC”), in which we proposed end-of-life dates for the Fort Martin (2035) and Harrison (2040) plants. We intend to engage in a broad stakeholder dialogue and work closely with the WVPSC as we develop and seek approval for that future transition plan. |

To read more about our decarbonization strategy, including near-term actions to achieve our interim 30% GHG reduction target by 2030, please visit our Climate Report (www.firstenergycorp.com/climatereport). Information on our website does not constitute part of (and shall not be deemed incorporated by reference into) this Proxy Statement or any other document we file with the Securities and Exchange Commission (the “SEC”).

| 2023 PROXY STATEMENT | 4 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Proxy Statement Summary

2023 Annual Meeting of Shareholders (the “Annual Meeting” or the “Meeting”)

| ◾ | Time and Date: 8:00 a.m. EDT on Wednesday, May 24, 2023 |

| ◾ | Location: The Annual Meeting will be a virtual meeting of shareholders, conducted via live webcast, and will take place at: www.cesonlineservices.com/fe23_vm. Online access will begin at 7:30 a.m. EDT on May 24, 2023. |

| ◾ | Record Date: March 27, 2023 |

| ◾ | Voting: Shareholders of FirstEnergy Corp. (“FirstEnergy”, the “Company”, “we”, “us” or “our”) common stock as of the Record Date are entitled to receive the Notice of Annual Meeting of Shareholders and they or their proxy holders may vote their shares at the Annual Meeting. |

| ◾ | Admission: If you plan to attend the Annual Meeting, you must register in advance. Registration instructions are available in the “Questions and Answers about the Annual Meeting” section of the accompanying Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.” Shareholders may only participate online and must pre-register to vote and ask questions at the virtual Annual Meeting. |

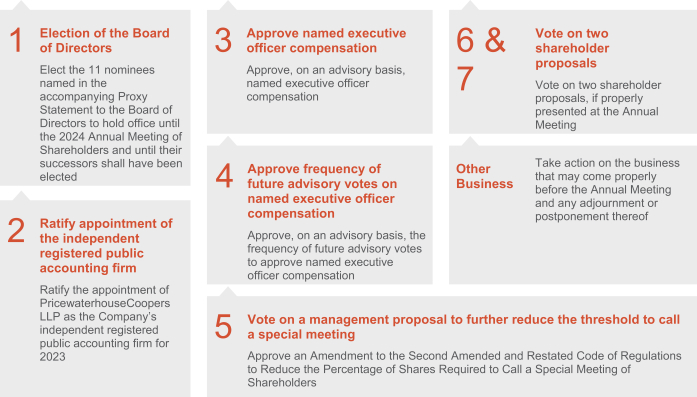

VOTING MATTERS

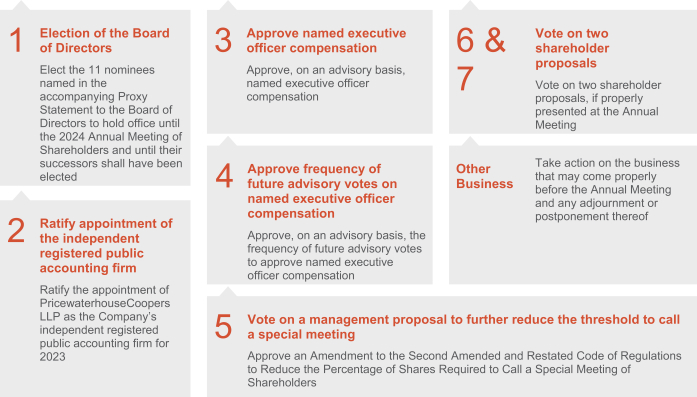

Item 1 |

Elect the 11 nominees named in this Proxy Statement to the Board of Directors (“Board”). Refer to page 35 for more detail. | Item 4 |

Approve, on an advisory basis, the frequency of future advisory votes to approve named executive officer compensation. Refer to page 38 for more detail. | |||||||

✓ | Your Board recommends you vote FOR the election of all the nominees listed in this Proxy Statement. | ✓ | Your Board recommends you vote for a frequency of EVERY YEAR under this item. | |||||||

Item 2 |

Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2023. Refer to page 36 for more detail. | Item 5 |

Approve an Amendment to the Second Amended and Restated Code of Regulations to Reduce the Percentage of Shares Required to Call a Special Meeting of Shareholders. Refer to page 39 for more detail. | |||||||

✓ | Your Board recommends you vote FOR this item. | ✓ | Your Board recommends you vote FOR this item. | |||||||

Item 3 |

Approve on an advisory basis named executive officer compensation. Refer to page 37 for more detail. | Items 6 & 7 |

Shareholder proposals. Refer to pages 40-45 for more detail. | |||||||

| ✓ | Your Board recommends you vote FOR this item. | X | Your Board recommends you vote AGAINST these items. | |||||||

| 5 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

HOW TO CAST YOUR VOTE

Your vote is important! Even if you plan to attend our Annual Meeting virtually, please cast your vote as soon as possible by:

Do you hold shares directly with FirstEnergy or in the FirstEnergy Corp. Savings Plan?

| ||||||||||||

|

INTERNET |  |

| |||||||||

| Use the internet at www.cesvote.com | Mail by returning your proxy card/voting instruction form(1) | |||||||||||

|

TELEPHONE |  |

DURING THE MEETING | |||||||||

| Call toll-free at 1-888-693-8683 | This year’s meeting will be virtual. For details on voting your shares during the meeting, see “Questions and Answers about the Annual Meeting.” | |||||||||||

| | ||||||||||||

(1) If your pre-addressed envelope is misplaced, send your proxy card to Corporate Election Services, Inc., the Company’s independent proxy tabulator and Inspector of Election. The address is FirstEnergy Corp., c/o Corporate Election Services, P.O. Box 1150, Pittsburgh, PA 15230.

| ||||||||||||

| Do you hold shares through a bank, broker or other institution (beneficial ownership)?(2) | ||||

| Use the internet at www.proxyvote.com | Call toll-free at 1-800-454-8683 | Mail by returning your proxy card/voting instruction form | ||

(2) Not all beneficial owners may be able vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions.

| ||||

Please follow the instructions provided on your proxy card/voting instruction form (the “proxy card”), Notice of Internet Availability of Proxy Materials, or electronic or other communications included with your proxy materials. Shareholders as of the March 27, 2023 Record Date may attend the virtual Annual Meeting and vote if registered in advance by following the Advance Registration Instructions below. Refer to the “Questions and Answers about the Annual Meeting” section below for more details, including the Advance Registration Instructions and questions 2, 13 and 15.

You may have multiple accounts and therefore receive more than one proxy card or voting instruction form and related materials. Please vote each proxy card and voting instruction form that you receive.

| 2023 PROXY STATEMENT | 6 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Your Board Nominees

The following provides summary information about each nominee standing for election to your Board. Each member stands for election annually.

Your Board nominees are highly qualified individuals and represent a diversity of gender, ethnicity, age, tenure, thought, background and experiences. Your Board is periodically refreshed with the addition of candidates whom we believe bring new ideas and fresh perspectives into the boardroom.

Jana T. Croom, 46

Independent Director Chief financial officer of Kimball Electronics, Inc. |

Steven J. Demetriou, 64

Independent Director Executive board chair of | Other public boards 3 | |||

Sean T. Klimczak, 46

Independent Director Senior managing director and | Other public boards 1 |

Jesse A. Lynn, 52

Independent Director General counsel of Icahn Enterprises LP | Other public boards 3 | |||

Andrew Teno, 38

Independent Director Portfolio manager of Icahn Capital LP | Other public boards 2 |

Leslie M. Turner, 65

Independent Director Retired senior vice president, | |||

| 7 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

| | ||||

Lisa Winston Hicks, 56

Independent Director Lead Independent Director |

Paul Kaleta, 67

Independent Director Retired executive vice president and | |||

James F. O’Neil III, 64

Independent Director Chief executive officer and vice chairman | Other public boards 1 |

John W. Somerhalder II, 67

Director Interim President, Chief Executive Officer and | Other public boards 1 | |||

Melvin D. Williams, 59

Independent Director Retired president of Nicor Gas and | ||||

OUR COLLECTIVE DIRECTOR NOMINEE SKILLS

| ||

| 2023 PROXY STATEMENT | 8 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Key Board Corporate Governance Features

Your Board is committed to strong corporate governance, which we believe is important to the success of our business and in advancing shareholder interests. Highlights include:

| Independent Oversight | ◾ All directors are independent, other than our Board Chair

◾ The positions of Board Chair and Lead Independent Director are held by separate individuals

◾ Board’s three primary standing committees are comprised entirely of independent directors

◾ Independent directors regularly hold executive sessions without management at Board and committee meetings

| |||

| Board & Committee Oversight | ◾ Your Board and Committees review material risks facing your Company and oversees your Company’s risk management practices

◾ Corporate Governance, Corporate Responsibility and Political Oversight Committee oversees corporate citizenship practices, including the political and lobbying action policy and EESG and sustainability initiatives

◾ Audit Committee provides oversight of, and makes recommendations for implementation of, compliance program enhancements and oversees risks related to financial statements, compliance and cybersecurity regulatory compliance

◾ Compensation Committee oversees the Company’s compensation philosophy, practices and human capital initiatives and focuses on alignment between pay and performance

◾ Safety and Operations Oversight Committee oversees operational strategy including reliability, safety, cybersecurity risks and audits, as well as environmental practices and policies

◾ Prior to its dissolution on December 13, 2022, the Compliance Oversight Sub-Committee of the Audit Committee, comprised of all independent directors and supported by independent counsel, oversaw ethics and compliance program enhancements ; these responsibilities have been assumed by the Audit Committee

| |||

Shareholder Rights & Accountability | ◾ Annual election of all directors

◾ Clear, effective process for shareholders to raise concerns to your Board

◾ Majority voting standard for uncontested director elections, with an accompanying Director Resignation Policy

◾ General majority voting threshold

◾ Direct investor relations and governance engagement and outreach to shareholders

◾ Advisory vote to approve named executive officer compensation is held on an annual basis, consistent with the shareholder advisory vote on frequency

◾ Shareholders may nominate directors through proxy access

◾ Shareholders of 25 percent or more shares outstanding and entitled to vote may call a special meeting. Based on your Board’s ongoing review we are seeking shareholder approval at the Annual Meeting to further reduce this threshold to at least 20 percent of the shares of common stock outstanding.

◾ No poison pill

| |||

| Board Practices | ◾ Goal to maintain at least 30% diverse members (by gender, race and ethnicity combined) for the foreseeable future

◾ Actively seek to include in the director nominee pool with candidates of diverse backgrounds, skills and experience, including highly qualified women and people of color

◾ A robust annual evaluation process, including full Board evaluation, Board committee evaluations and individual director evaluations

◾ Policy requiring directors who reach the age of 72 to tender their resignations to your Board to be effective upon acceptance by the Board.

◾ Corporate Governance, Corporate Responsibility and Political Oversight Committee and full Board engage in rigorous director succession planning

◾ Extensive director orientation and continuing education

◾ Robust stock ownership guidelines

◾ Anti-Hedging and Anti-Pledging Policies

| |||

Our corporate governance practices are described in greater detail in the “Corporate Governance and Board of Directors Information” section beginning on page 12.

| 9 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

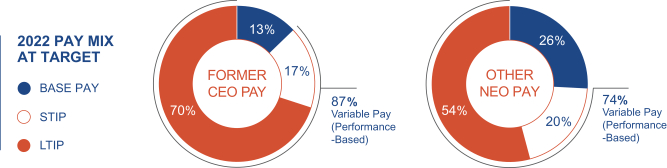

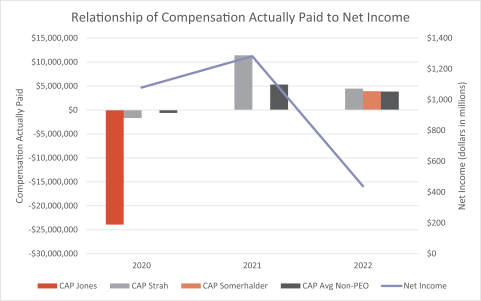

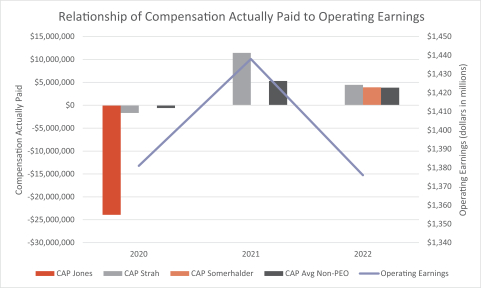

Executive Compensation Highlights

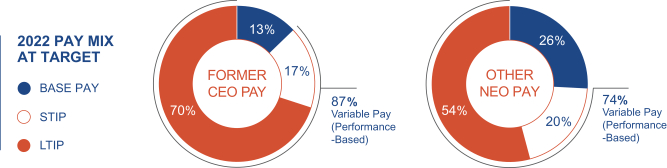

Under our compensation design, the percentage of pay that is based on performance increases as the responsibilities of a Named Executive Officer (“NEO”) increase. The charts below illustrate the mix of annual base salary rate and 2022 short-term incentive program (“STIP”) and long-term incentive program (“LTIP”) awards for our NEOs. Approximately 87% of the Former President and CEO’s total target pay and 74% of our other NEOs’ (excluding Mr. Somerhalder) average target pay is variable and could be reduced to zero if performance metrics are not met at a minimum threshold level. For the continuing NEOs, the values shown are effective as of December 31, 2022. During his role as Vice Chair and Executive Director (March 2021 to May 2022), Mr. Somerhalder’s pay mix for 2022 was made up of approximately 19% for his base salary, 19% for his target STIP award, 31% for his performance-based restricted stock units (“RSUs”) and 31% for his time-based restricted stock. Although Mr. Somerhalder’s compensation package in his role as Vice Chair and Executive Director did not match that of the other NEOs, the performance goals aligned with those of other executives at FirstEnergy. During his role as Interim President and CEO, Mr. Somerhalder’s pay mix for 2022 is made up of approximately 12% for his base salary, 16% for his target STIP award, and 72% for his time-based restricted stock. Mr. Somerhalder’s pay mix in his current role is less variable than that of the other NEOs due to the interim status of his role. The charts below do not include Mr. Somerhalder due to the interim status of both of his roles in 2022.

We believe that our executive compensation philosophy and practices align with the long-term interests of our shareholders and with commonly viewed best practices in the market.

WHAT WE

|

◾ LTIP(1) is 100% at risk, with no solely time-based vesting requirements ◾ STIP is 100% at risk

◾ Threshold financial performance hurdle for Operating Earnings must be achieved before any STIP award is paid ◾ Individual STIP awards capped at 200% (consistent with our peer companies) ◾ Individual LTIP awards capped at 200% (consistent with our peer companies) and capped at 100% if absolute Total Shareholder Return (“TSR”) over the performance period is negative

|

| ||

WHAT WE

|

|

| ||

(1) Excludes Mr. Somerhalder due to the interim status of his roles. For more details see the “Performance-based and Time-based Equity Award for Mr. Somerhalder” section.

Our executive compensation practices are described in greater detail in the “Executive Compensation” section beginning on page 56.

| 2023 PROXY STATEMENT | 10 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Note About Forward-Looking Statements |

Forward-Looking Statements: This Proxy Statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cybersecurity, and climate change; the risks associated with cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, greenhouse gas reduction goals, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet, and satisfying the conditions necessary to close the sale of additional membership interests of FirstEnergy Transmission, LLC; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changes in customers’ demand for power, including, but not limited to, economic conditions, the impact of climate change, or energy efficiency and peak demand reduction mandates; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by the FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. Forward-looking and other statements in this Proxy Statement regarding our Climate Strategy, including our greenhouse gas emission reduction goals, are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking statements regarding climate matters, including greenhouse gas emissions, may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve and assumptions that are subject to change in the future. |

| 11 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Corporate Governance and Board of Directors Information

Board Leadership Structure

The positions of Board Chair and Lead Independent Director are held by separate individuals. Our Second Amended and Restated Code of Regulations and Corporate Governance Policies do not require that the CEO and Board Chair positions be separate, and your Board has not adopted a specific policy or philosophy on whether such roles should remain separate. However, having separate roles has historically allowed your CEO to focus more time on our day-to-day operations.

It is the Board’s further policy that, in circumstances where the Board Chair is not independent, it is appropriate to designate a Lead Independent Director. When a Lead Independent Director is appointed, their responsibilities shall include, but not be limited to, the following:

| ◾ | serving as principal liaison between the independent directors and management and, if any, the non-executive Board Chair, when needed. |

| ◾ | presiding at executive sessions of the independent directors. |

| ◾ | convening meetings of the Board, as appropriate. |

| ◾ | overseeing Board meeting schedules, agendas, and materials and provide input to Committee Chairs on Committee schedules, agendas, and materials. |

| ◾ | in coordination with the Corporate Governance, Corporate Responsibility and Political Oversight Committee Chair, participate in the process for annual review and evaluation of Board and director performance. |

| ◾ | in coordination with the Compensation Committee Chair, participate in the annual evaluation of the performance and compensation of the CEO and, if any, other executive members of the Board. |

| ◾ | if requested, be available for consultation and direct communication with the Company’s major shareholders. |

| ◾ | assume the duties of the Board Chair when the Board Chair is not available to perform his or her duties and otherwise assist the Board Chair in his or her duties as requested. |

In May 2022, the Board, based on a recommendation from the Corporate Governance, Corporate Responsibility and Political Oversight Committee, elected Mr. Somerhalder and Ms. Hicks as its respective Board Chair and Lead Independent Director, each to serve until the first regular Board meeting following the Company’s 2023 annual meeting of shareholders. In September 2022, following the retirement of Mr. Steven Strah, Mr. Somerhalder was appointed by the Board to serve as Interim President and Chief Executive Officer for the duration of our ongoing search for a new CEO.

Your Board will continue to consider whether an alternate Board leadership structure is appropriate if changing circumstances dictate. Your Board schedules regular executive sessions for your independent directors to meet without management participation. Because an independent director is required to preside over each such executive session of independent directors, we believe it is efficient and appropriate to have your independent Lead Independent Director preside over such meetings.

Board Composition and Refreshment

Your Board is comprised of individuals who are highly qualified, diverse, and independent (other than Mr. Somerhalder who is not considered independent because of his employment with the Company). Your Board’s succession planning takes into account the importance of Board refreshment and having an appropriate balance of experience and perspectives on your Board. As further

| 2023 PROXY STATEMENT | 12 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

discussed in the “Board Qualifications” section of this Proxy Statement, your Board and the Corporate Governance, Corporate Responsibility and Political Oversight Committee recognize that the racial, ethnic and gender diversity of your Board, as well as diversity of thought, background and experiences, are an important part of their analysis as to whether your Board possesses a variety of complementary skills and experiences. Accordingly, your Board has set a goal that, for the foreseeable future, at least 30% of your Board will be composed of diverse (by gender, race and ethnicity combined) individuals.

The Corporate Governance, Corporate Responsibility and Political Oversight Committee reviews Board succession planning on an ongoing basis. In performing this function, the Committee recruits and recommends nominees for election as directors to your Board. Accordingly, we have regularly added directors who we believe infuse diversity, new ideas and fresh perspectives into the boardroom. All 11 nominees have joined the Board since the beginning of 2017 and the result is an average tenure for our directors of 2.82 years. During this time, your Board also added four of the current directors that increased its diversity profile.

The Corporate Governance, Corporate Responsibility and Political Oversight Committee has sole authority to retain and engage a third-party search firm to identify a candidate or candidates for the Board.

Board Oversight

Board Response to Government Investigations

Your Company has been cooperating fully with requests related to recent government investigations relating to Ohio House Bill 6. We’ve pledged full and continuing cooperation with the government investigations.

Your Board has formed various special Board oversight committees since July 2020. Effective July 1, 2021, a Special Litigation Committee was created to take all actions with respect to pending derivative litigation and demands. See “Board Committees – Special Board Oversight Committees” section below. The Independent Review Committee and the Demand Review Committee, both special Board oversight committees, which were previously established were dissolved in July 2021. Effective December 13, 2022, the Compliance Oversight Sub-committee of the Audit Committee was also dissolved and the Audit Committee will directly oversee the Company’s Office of Ethics and Compliance as provided in the Audit Committee Charter.

Legal Proceedings

Beginning in July 2020, stockholders of the Company filed shareholder derivative lawsuits in the federal courts for the Northern and Southern Districts of Ohio and in the Court of Common Pleas of Summit County, Ohio, asserting claims on behalf of the Company against various former and current officers and directors of the Company arising out of the circumstances at issue in the investigations and proceedings relating to Ohio House Bill 6. The lawsuits, Gendrich v. Anderson, et al. and Sloan v. Anderson, et al. (Common Pleas Court, Summit County, OH, all actions have been consolidated) and Miller v. Anderson, et al. (Federal District Court, N.D. Ohio); Bloom, et al. v. Anderson, et al.; Employees Retirement System of the City of St. Louis v. Jones, et al.; Electrical Workers Pension Fund, Local 103, I.B.E.W. v. Anderson et al.; Massachusetts Laborers Pension Fund v. Anderson et al.; The City of Philadelphia Board of Pensions and Retirement v. Anderson et al.; Atherton v. Dowling et al.; Behar v. Anderson, et al. (Federal District Court, S.D. Ohio, all actions have been consolidated), assert claims for breach of fiduciary duty and for violation of Section 14(a) of the Securities Exchange Act of 1934, (the “Exchange Act”), among other claims.

As previously disclosed on March 11, 2022, the plaintiffs and defendants in the lawsuits, and the Special Litigation Committee acting on behalf of the Company, entered into a settlement agreement to resolve all of the shareholder derivative lawsuits. The settlement includes a series of corporate governance enhancements, that resulted in the following actions in connection with or following the Company’s 2022 annual meeting of shareholder (the “2022 Annual Meeting”):

| ◾ | Six former members of the Board did not stand for re-election at the 2022 Annual Meeting; |

| ◾ | A special Board committee of at least three recently appointed independent directors was formed on June 15, 2022, within 30 days of the 2022 Annual Meeting, to initiate a review process of the current senior executive team. The Board appointed Ms. Lisa Winston Hicks and Messrs. Paul Kaleta, Sean T. Klimczak, Jesse A. Lynn, Andrew Teno, and Melvin D. Williams to serve on that special committee. On September 5, 2022, the special committee completed its work and discussed its review with the Board; |

| 13 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

| ◾ | The Board oversees the Company’s lobbying and political activities, including periodically reviewing and approving political and lobbying action plan prepared by management (the “Political and Lobbying Action Plan”); |

| ◾ | The Corporate Governance, Corporate Responsibility and Political Oversight Committee was reconstituted on May 17, 2022, to consist of a majority of independent directors who joined the Board in 2019 or later to oversee the implementation and third-party audits of the Board-approved Political and Lobbying Action Plan; |

| ◾ | The Company has implemented enhanced disclosure to shareholders of political and lobbying activities, including in its annual proxy statement as provided in the “Other Important Matters” – “Transparency in Corporate Contributions” section below; and |

| ◾ | The Company has further aligned financial incentives of senior executives to proactive compliance with legal and ethical obligations. On May 17, 2022, the Company reconstituted the Compensation Committee to meet the settlement requirements. |

The settlement also includes a payment to FirstEnergy of $180 million, to be paid by insurance, less the court-ordered attorney’s fees awarded to plaintiffs. On August 23, 2022, the Southern District of Ohio granted final approval of the parties’ Settlement Agreement, fully releasing all claims covered by the Settlement Stipulation, and dismissing the Southern District Action with prejudice. On September 20, 2022, a FirstEnergy shareholder filed a motion for reconsideration of the court’s Order of Final Settlement Approval. That motion is fully briefed and under consideration by the court. In addition, the Court of Common Pleas of Summit County, Ohio, dismissed the shareholder derivative lawsuit with prejudice, while the lawsuit filed in the Northern District of Ohio remains pending.

While your Board cannot predict the outcome of the continuing government investigations and related matters, as your stewards, we are fully committed to providing thorough and complete oversight and will, as a Board, take any necessary actions to address these matters. Your Board will not tolerate any actions or behaviors demonstrating anything less than a commitment to high standards of ethics and compliance for your Company and is committed to continuing improvement of the compliance policies and culture at FirstEnergy.

Risk Management

The Company recognizes that it must take certain risks in the ordinary course of business to ensure overall success of the Company as it pursues its strategic objectives. The Company has implemented an Enterprise Risk Management process to identify, prioritize, report, monitor, manage, and mitigate its significant risks, including strategic, financial, operational, compliance and litigation, and reputational risks. An Enterprise Risk Management Committee, chaired by the head of the risk management group and consisting of senior executive officers, provides oversight and monitoring to ensure that appropriate risk policies are established and carried out and management processes are executed in accordance with selected limits. The Enterprise Risk Management Committee also vets risk prioritization and mitigation to help ensure that risks – including climate-related ones (for additional information on climate-related risks, see the Company’s report at http://www.firstenergycorp.com/climatereport) – are managed in accordance with the Company’s expectations. In addition, other management committees are focused on addressing topical risk issues to support the various Board committee risk oversight, as shown in the chart below. Timely reports on significant risk issues are provided as appropriate to employees, management, senior executive officers, respective Board committees, and the full Board. The leadership of our risk management group provides oversight of day-to-day risk management efforts and prepares enterprise-wide risk management reports for presentation to the Audit Committee and your Board. As of March [27], 2023, the Chief Risk Officer role was vacant pending an ongoing candidate search.

Your Board administers its risk oversight function through the full Board, as well as through the various Board committees, and views risk management as an integral part of the Company’s strategic planning process. Specifically, your Board considers risks applicable to the Company at each meeting in connection with its consideration of significant business and financial developments of the Company. Also, the Audit Committee charter requires the Audit Committee to oversee, assess, discuss, and generally review the Company’s policies with respect to the assessment and management of risks, including risks related to the financial statements, payment processes, and financial reporting process and controls of the Company. The Audit Committee also reviews and discusses with management the steps taken to monitor, control, and mitigate such exposures.

In addition to the Audit Committee’s role in risk oversight, our other Board committees also play a role in risk oversight within each of their areas of responsibility. Specifically, the Compensation Committee reviews, discusses, and assesses risks related to

| 2023 PROXY STATEMENT | 14 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

executive compensation programs, including incentive compensation and equity-based plans, as well as human capital and the relationship between our risk management policies and practices and compensation. See also, “Risk Assessment of Compensation Programs” found in the CD&A section in this Proxy Statement. The Corporate Governance, Corporate Responsibility and Political Oversight Committee considers risks related to corporate governance, including Board and committee membership, Board effectiveness, related person transactions, and the Company’s corporate citizenship practices, the Political and Lobbying Action Plan and EESG strategies and initiatives. The Finance Committee evaluates risks relating to financial resources and strategies, including capital structure policies, financial forecasts, budgets and financial transactions, commitments, expenditures, long and short-term debt levels, dividend policy, acquisition and divestitures, issuance of securities, exposure to fluctuation in interest rates, share repurchase programs and other financial matters deemed appropriate by your Board. The Operations and Safety Oversight Committee considers risks associated with safety, reliability, cybersecurity, customer service, environmental strategy, climate change, environmental protection and sustainability, and the Company’s electric distribution, transmission, and generation facilities.

Through this oversight process, your Board obtains an understanding of significant risk issues on a timely basis, including the risks inherent in the Company’s strategy. In addition, while the Company’s risk management group administratively reports to your Senior Vice President, Chief Financial Officer & Strategy, the group’s leadership also has full access to the Audit Committee and is scheduled to attend and report during other Board committee meetings as appropriate.

Board Committee Reporting for Top Risks

| ||||||||||||

| Audit

| Compensation

| Corp. Gov., Corp. Resp. & Political Oversight

| Finance

| Operations & Safety

| Full Board *

| |||||||

Enterprise Risks | ||||||||||||

Climate | · | |||||||||||

| Compliance | · | · | ||||||||||

| Culture | · | |||||||||||

| Customer Affordability | · | · | ||||||||||

| Cybersecurity | · | · | ||||||||||

| Financial | · | |||||||||||

| Regulatory Changes | · | · | ||||||||||

| Reliability | · | |||||||||||

| Reputation with Stakeholders | · | |||||||||||

| Safety | · | |||||||||||

| Strategy and Execution | · | |||||||||||

| Supply Chain | · | |||||||||||

| Talent Management | · | |||||||||||

· Enterprise Risk(s) assessed, discussed, and monitored by each respective Committee. * Full board reporting at least annually on enterprise-wide risk profile. | ||||||||||||

| 15 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Evaluating Board Effectiveness

Your Board is committed to a rigorous evaluation process as further described below. Annually, Board, committee and individual director evaluations are performed and coordinated by the Corporate Governance, Corporate Responsibility and Political Oversight Committee. In 2022, the Corporate Governance, Corporate Responsibility and Political Oversight Committee engaged an independent third party, experienced in corporate governance matters, to assess the effectiveness of the Board, committees and individual directors.

2022 Board Evaluations: A Multi-Step Process

1 | Annual Process is Initiated

Your Board’s Corporate Governance, Corporate Responsibility and Political Oversight Committee initiated the annual Board, committee and individual director evaluation process and presented the proposed approach to your Board for comment. | |

| ||

2 | Board & Committee Assessment, Individual Director Evaluations

Each independent director’s opinion was solicited regarding your Board’s and its committees’ effectiveness relating to topics such as ethics and accountability, Board composition and culture, succession planning, and shareholder and stakeholder involvement. In addition, input is obtained from each director as to the performance of the other Board members. | |

| ||

| ||

3 | Director Self-Assessments

Prior to accepting a re-nomination, each director conducted a self-assessment as to whether he or she satisfies the criteria set forth in the Company’s Corporate Governance Policies and the Corporate Governance, Corporate Responsibility and Political Oversight Committee Charter. | |

| ||

4 | Presentation of Findings

The annual Board, committee and individual director assessments were discussed with your Board, the committees and directors. These discussions focused on certain key themes and priority areas for the Board, including management development, cultural transformation, and continuous improvement. | |

| ||

5 | Feedback Incorporated

Your Board, committees and directors are committed to continuous improvement and what they learn from this evaluation process is expected to be incorporated in their ongoing work for the Company. | |

Shareholder Outreach and Engagement Program

Commitment to Shareholder Outreach and Engagement

FirstEnergy has a long history of meaningful, robust engagement with our shareholders. We believe consistent, transparent dialogue is essential in order to understand investor feedback on a broad range of issues and provides valuable insights for our Board, its committees, and our management team into investor perspectives and priorities.

| 2023 PROXY STATEMENT | 16 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

In connection with our shareholder outreach that focused on EESG and executive compensation matters, we recently reached out to our top shareholders representing over 46% of shares outstanding. In addition to our proactive shareholder engagement throughout the year focused on EESG and executive compensation matters, our management team participates in numerous investor conferences, and in both one-on-one and group meetings.

In 2022 and early 2023, members of our Board and management met with institutional shareholders, including our then-interim CEO and members of the management team from Corporate Responsibility, Corporate Secretary department, Finance, Legal, Human Resources and Investor Relations. These conversations covered a variety of topics, including:

| ◾ | Our strategic vision |

| ◾ | Board oversight of corporate governance, and our ethics and compliance program |

| ◾ | Federal and state regulatory matters spanning our five-state service territory |

| ◾ | Financial and operational performance |

| ◾ | Executive compensation |

| ◾ | Company culture |

| ◾ | Our political, lobbying and public policy practices, generally, and their alignment with our climate goals |

| ◾ | Our climate goals, clean energy transition and sustainable investments |

As part of our commitment to shareholder engagement and understanding our investors’ perspectives, we welcome the opportunity for future dialogue on matters of mutual interest and to obtain insights and feedback.

Other Governance Practices and Policies

Code of Conduct

FirstEnergy’s Code of Conduct, The Power of Integrity, lays the foundation for what we expect from all FirstEnergy employees, officers and directors, including our CEO, CFO, Chief Accounting Officer and other executives. It reflects our collective commitment to keep integrity at the forefront of everything we do — a pledge underscored by the inclusion of integrity in our mission and core values. By adhering to the expectations of compliance and ethics in this Code, always acting with uncompromising integrity, and speaking up when something doesn’t seem right, we are paving the way for a strong future for FirstEnergy.

Any substantive amendments to, or waivers of, the provisions of this document will be disclosed and made available on our website, as permitted by the SEC and as disclosed in our most recent Annual Report. The Code is available, without charge, upon written request to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890 or is accessible on our website at www.firstenergycorp.com/responsibility.

Corporate Governance Policies and Standing Committee Charters

Your Board believes that the Company’s policies and practices should enhance your Board’s ability to represent your interests as shareholders. Your Board established Corporate Governance Policies which, together with Board committee charters, which are reviewed at least annually and serve as a framework for meeting your Board’s duties and responsibilities with respect to the governance of the Company. Our Corporate Governance Policies and Board committee charters can be viewed by visiting our website at www.firstenergycorp.com/charters. Any amendments to these documents will be made available on our website.

Director Orientation and Continuing Education

Your Board recognizes the importance of its members to keep current on Company, industry and governance issues and their responsibilities as directors. All new directors participate in orientation soon after being elected to your Board. Also, your Board makes available and encourages continuing education programs for Board members, which include internal strategy meetings and presentations and engagement with relevant third-party experts, third-party presentations and external programs.

| 17 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Attendance at Board Meetings, Committee Meetings and the Annual Meeting of Shareholders

Our Corporate Governance Policies provide that directors are expected to attend all scheduled Board and applicable committee meetings and the Company’s annual meetings of shareholders. Your Board held 18 meetings in 2022. The overall attendance percentage for our directors was approximately 96% in 2022, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2022. Also, all of our directors who were members of the Board at the time of the 2022 Annual Meeting attended the 2022 Annual Meeting.

Non-management directors met, as annually required, as a group in executive session without the CEO or any other non-independent director or member of management at each of the seven regularly scheduled 2022 Board meetings. Our Lead Independent Director presided over all executive sessions.

Other Public Company Board Membership and Related Time Commitments

Our Corporate Governance Policies provide that directors will not, without your Board’s approval, serve on a total of more than four public company board of directors (including FirstEnergy). Further, without your Board’s approval, no director who serves as an executive officer of any public company may serve on a total of more than two public company boards of directors, including FirstEnergy. Furthermore, when a director has a major change in their responsibilities, including principal employment or directorships, but excluding changes resulting from a normal retirement as well as commitments with non-profit organizations, the Corporate Governance, Corporate Responsibility and Political Oversight Committee considers such change and makes any appropriate recommendation to your Board.

As further described in the “Biographical Information and Qualifications of Nominees for Election as Directors” section below, in addition to being a director of the Company, Mr. Demetriou recently stepped down as chief executive officer of Jacobs Solutions Inc. (formerly Jacobs Engineering Group Inc.) and, effective January 24, 2023, continues to serve as Executive Chair at Jacobs Solutions Inc. Mr. Demetriou also serves as a director of Arcosa, Inc. and as a director and non-executive board chair of C5 Acquisition Corp, a special acquisition company without significant operations. As described more fully on page 25, the Board has evaluated Mr. Demetriou’s current responsibilities and approved his current directorships, due in part to his significantly reduced future commitment expectations as well as the valuable experience and attributes he brings to your Board.

Communications with your Board of Directors

Your Board provides a process for shareholders and interested parties to send communications to your Board and non-management directors, including our Chair of the Board. As set forth in the Company’s Corporate Governance Policies, shareholders and interested parties may send written communications to your Board or a specified individual director, including our Chair of the Board, by mailing any such communications to the FirstEnergy Board of Directors at the Company’s principal executive office, c/o Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, OH 44308-1890. Our Corporate Governance Policies can be viewed by visiting our website at www.firstenergycorp.com/charters.

The Corporate Secretary or a member of her staff reviews all such communications promptly and relay them directly to a member of your Board; provided that such communications (i) bear relevance to the Company and the interests of the shareholder, (ii) are capable of being implemented by your Board, (iii) do not contain any obscene or offensive remarks, (iv) are of a reasonable length, and (v) are not from a shareholder who has already sent two such communications to your Board in the last year. Your Board may modify procedures for sorting shareholders communications or adopt any additional procedures, provided that they are approved by a majority of independent Directors.

Your Audit Committee also receives, reviews, and acts on complaints and concerns regarding accounting, internal accounting controls or auditing matters, including complaints regarding material ethical or criminal misconduct on the part of the Board of Directors, the Chief Executive Officer, any officer reporting directly to the Chief Executive Officer, the Controller & Chief Accounting Officer, and complaints regarding matters that could lead to significant reputational damage to the Company. Complaints or concerns specifically related to such matters may be made directly to your Audit Committee. Correspondence to the Audit Committee should be addressed to the attention of the Audit Committee Chair (c/o Corporate Secretary), FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890.

| 2023 PROXY STATEMENT | 18 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Board Qualifications

The Corporate Governance, Corporate Responsibility and Political Oversight Committee recommends Board candidates by identifying qualified individuals in a manner that is consistent with criteria approved by your Board. In consultation with the CEO, the Corporate Governance, Corporate Responsibility and Political Oversight Committee, as led by the Board Chair and Lead Independent Director, searches for, recruits, screens, interviews and recommends prospective directors to provide your Board with an appropriate balance of knowledge, experience, diversity attributes and capability on your Board. Suggestions for potential Board candidates come to the Corporate Governance, Corporate Responsibility and Political Oversight Committee from a number of sources, including a third-party search firm, incumbent directors, officers and others. In connection with the Board’s active director succession planning, the Corporate Governance, Corporate Responsibility and Political Oversight Committee regularly evaluates the addition of a director or directors with particular attributes with an appropriate mix of long-, medium-, and short-term tenured directors in its succession planning.

The Corporate Governance, Corporate Responsibility and Political Oversight Committee considers suggestions for candidates for membership on your Board, including candidates recommended by shareholders for your Board. Provided that shareholders suggesting director candidates have complied with the procedural requirements set forth in the Corporate Governance, Corporate Responsibility and Political Oversight Committee Charter and Second Amended and Restated Code of Regulations, the Corporate Governance, Corporate Responsibility and Political Oversight Committee applies the same criteria and employs substantially similar procedures for evaluating candidates suggested by shareholders for your Board as it would for evaluating any other Board candidate. The Corporate Governance, Corporate Responsibility and Political Oversight Committee will also give due consideration to all recommended candidates that are submitted in writing to the Corporate Governance, Corporate Responsibility and Political Oversight Committee, in care of the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890, received at least 120 days before the publication of the Company’s annual Proxy Statement from a shareholder or group of shareholders owning one half of one percent (0.5 percent) or more of the Company’s voting stock for at least one year, and accompanied by a description of the proposed nominee’s qualifications and other relevant biographical information, together with the written consent of the proposed nominee to be named in the Proxy Statement and to serve on your Board. Also refer to the “Proposals and Business by Shareholders” section of the “Questions and Answers about the Annual Meeting” below for information regarding nominations under the Company’s Second Amended and Restated Code of Regulations.

Director Nomination Related Agreements

On March 16, 2021, your Company entered into a Director Appointment and Nomination Agreement (the “Icahn Director Nomination Agreement”) with Carl C. Icahn, Andrew Teno, Jesse A. Lynn, Icahn Partners LP, Icahn Partners Master Fund LP, Icahn Enterprises G.P. Inc., Icahn Enterprises Holdings L.P., IPH GP LLC, Icahn Capital LP, Icahn Onshore LP, Icahn Offshore LP and Beckton Corp. (collectively, the “Icahn Group”). Pursuant to the Icahn Director Nomination Agreement, effective as of March 18, 2021, your Board, among other matters agreed to appoint Mr. Jesse A. Lynn and Mr. Andrew Teno (the “Icahn Designees”) to serve as directors of the Company to fill such vacancies, each with a term expiring at the 2021 Annual Meeting. Messrs. Lynn and Teno were elected to your Board by shareholders at the 2022 Annual Meeting and your Board has again nominated each of them to stand for reelection as a director at the 2023 Annual Meeting to continue to serve for a term expiring at the Company’s annual meeting of shareholders in 2024 (the “2024 Annual Meeting”).

On November 6, 2021, your Company entered into a Common Stock Purchase Agreement (the “Blackstone SPA”) with BIP Securities II-B L.P., an affiliate of Blackstone Infrastructure Partners L.P. (“Blackstone”), for the private placement of 25,588,535 shares of the Company’s common stock. Pursuant to the Blackstone SPA, your Board, among other matters, agreed to appoint Mr. Sean T. Klimczak to stand for election as a director at the 2022 Annual Meeting. Shareholders elected Mr. Klimczak as a director at the 2022 Annual Meeting, and your Board has nominated him to stand for reelection as a director at the 2023 Annual Meeting to continue to serve for a term expiring at the 2024 Annual Meeting.

Summaries of the terms of the Icahn Director Nomination Agreement and the Blackstone SPA are provided in the “Certain Relationships and Related Person Transactions” section below.

| 19 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

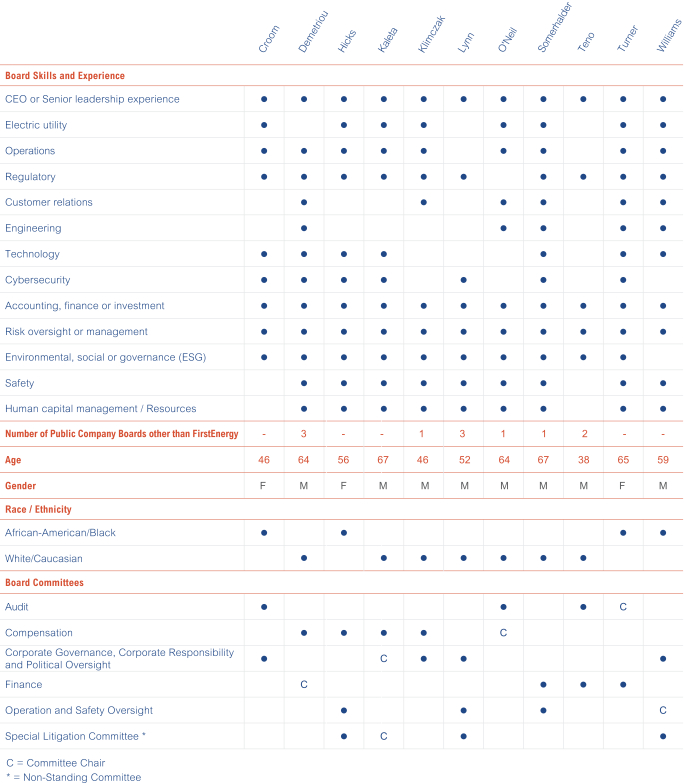

Attributes, Experience, Qualifications and Skills of your Board

In recruiting and selecting Board candidates, the Corporate Governance, Corporate Responsibility and Political Oversight Committee takes into account the size of your Board and considers a “skills matrix” to determine whether those skills and/or other attributes qualify candidates for service on your Board. The attributes, experiences, qualifications and skills considered in accordance with Corporate Governance Policies and the Corporate Governance, Corporate Responsibility and Political Oversight Committee charter for each director nominee led your Board to conclude that the nominee is qualified to serve on your Board.

The high-level overview below depicts some of the attributes, experiences, qualifications and skills of our director nominees the committee takes into account. It is not intended to be an exhaustive list of each director nominee’s skills or contributions to your Board. Also, additional biographical information and qualifications for each nominee is provided in the “Biographical Information and Qualifications of Nominees for Election as Directors” section below and contains information regarding the person’s service as a director, principal occupation, business experience along with key attributes, experience and skills. Each of the nominees brings a strong and unique background and skill set to your Board, giving your Board, as a whole, competence and experience in a wide variety of areas necessary to oversee the operations of the Company.

| 2023 PROXY STATEMENT | 20 |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

Board Nominees Skills, Diversity & Committee Memberships

| 21 | FIRSTENERGY CORP. |

Proxy | Corporate | Items to Be | Commitments to EESG | Executive & Director Compensation | Other Important Matters / Q&A |

The above takes into account a level of knowledge that could include direct experience, subject matter expertise, directly managing one or more members of management engaged in such activities or exposure as a board or board committee member, including on your Board and Board committees.

Board’s Focus on Diversity

The Company and your Board is committed to a policy of inclusiveness and believes that well assembled boards consist of a diverse group of individuals who possess a variety of complementary skills and experiences. Accordingly, your Board has set a goal that, for the foreseeable future, at least 30% of your Board will be composed of diverse (by gender, race and ethnicity combined) individuals. The Corporate Governance, Corporate Responsibility and Political Oversight Committee regularly assesses the size and composition of your Board in light of the current operating requirements of the Company and the current needs of your Board, and is also committed to actively seeking out highly qualified candidates of diverse backgrounds – including gender, race, skills, and professional experience and other attributes that contribute in the aggregate to the optimal functioning of your Board – to include in the pool from which future Board nominees are chosen. The Company’s Corporate Governance Policies also provide further opportunity for board refreshment by requiring directors who reach the age of 72 to tender their resignations to the Board to be effective upon acceptance by your Board.

Director Independence

Your Board annually reviews the independence of each of its members to make the affirmative determination of independence that is called for by our Corporate Governance Policies and required by the Securities Exchange Commission (“SEC”) and New York Stock Exchange (“NYSE”) listing standards, including certain independence requirements of Board members serving on the Audit Committee, the Compensation Committee and the Corporate Governance, Corporate Responsibility and Political Oversight Committee. The definition used by your Board to determine independence is included in our Corporate Governance Policies and can be viewed by visiting our website at www.firstenergycorp.com/charters.