UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☒ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

FirstEnergy Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

☐ | Fee paid previously with preliminary materials: |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No. |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

FirstEnergy Shareholder Outreach & Engagement Corporate Governance Spring 2020

We are a forward-thinking electric utility powered by a diverse team of employees committed to making customers’ lives brighter, the environment better and our

communities stronger. Diverse Team Customers Environment Communities Forward-Thinking Our Mission Corporate Governance Shareholder Outreach & Engagement Spring 2020 2 (Logo)

Cautionary Statement Forward-looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Unless the context requires otherwise, as used herein, references to “we”, “us”, “our”, and “FirstEnergy” refer to FirstEnergy Corp. Forward-looking statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the extent and duration of the novel coronavirus (known as COVID-19) and the impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories, volatile capital and credit markets, legislative and regulatory actions, the effectiveness of our pandemic and business continuity plans, the precautionary measures we are taking on behalf of our customers and employees, our customers’ ability to make their utility payment and the potential for supply-chain disruptions; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets risks associated with the decommissioning of TMI-2; the ability to accomplish or realize anticipated benefits from strategic and financial goals, including, but not limited to, executing our transmission and distribution investment plans, controlling costs, improving our credit metrics, strengthening our balance sheet and growing earnings; legislative and regulatory developments including, but not limited to, matters related to rates, compliance and enforcement activity; economic and weather conditions affecting future operating results, such as significant weather events and other natural disasters, and associated regulatory events or actions; changes in assumptions regarding economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, the impact of climate change or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions affecting us and/or our major industrial and commercial customers or others with which we do business; the risks associated with cyber-attacks and other disruptions to our information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts and other trust funds, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; the risks and uncertainties associated with litigation, arbitration, mediation and like proceedings; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, , or adverse tax audit results or rulings; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (SEC) filings. Dividends declared from time to time on our common stock during any period may in the aggregate vary from prior periods due to circumstances considered by our Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in our filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q together with any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein as a result of new information, future events or otherwise. Corporate Governance Shareholder Outreach & Engagement Spring 2020 3 (Logo)

Board and Corporate Governance Practices Corporate Governance Shareholder Outreach & Engagement Spring 2020 4(Logo)

Highly Skilled & Diverse Board We seek to maintain a well-rounded and diverse Board representing a wide breadth of experience and perspectives that balances the institutional knowledge of longer-tenured directors with the fresh perspectives brought by newer directors. Below are highlights regarding our 11 Directors. Board Tenure (Graph) 54% Of Directors joined the Board since the beginning of 2015 27% Female Directors 36% Diverse Directors (by female, race and ethnicity) Corporate Governance Shareholder Outreach & Engagement Spring 2020 5 (logo)

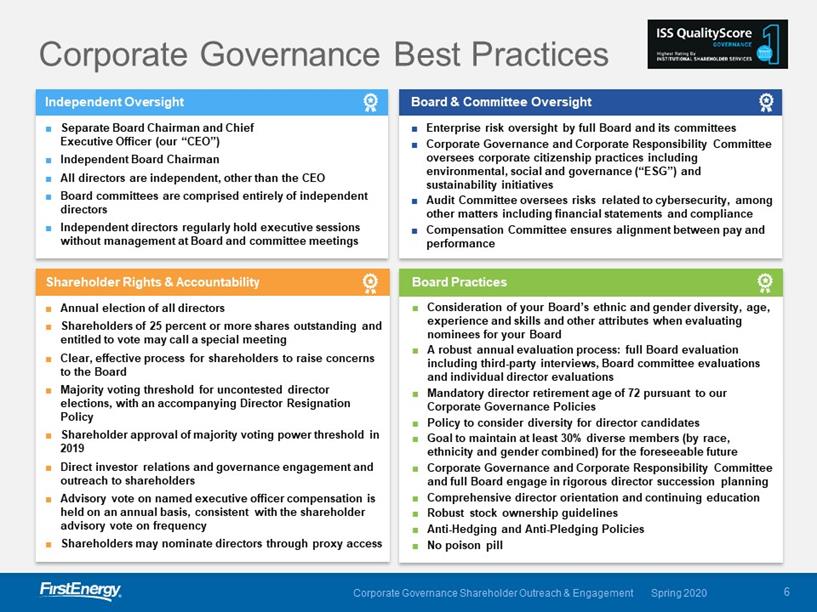

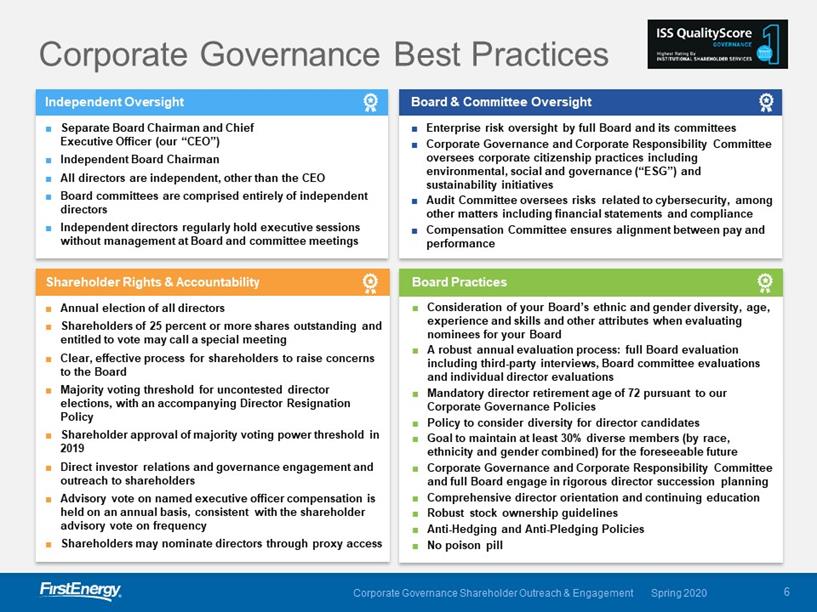

Corporate Governance Best Practices (Logo) Independent Oversight Separate Board Chairman and Chief Executive Officer (our “CEO”) Independent Board Chairman All directors are independent, other than the CEO Board committees are comprised entirely of independent directors Independent directors regularly hold executive sessions without management at Board and committee meetings Shareholder Rights & Accountability Annual election of all directors Shareholders of 25 percent or more shares outstanding and entitled to vote may call a special meeting Clear, effective process for shareholders to raise concerns to the Board Majority voting threshold for uncontested director elections, with an accompanying Director Resignation Policy Shareholder approval of majority voting power threshold in 2019 Direct investor relations and governance engagement and outreach to shareholders Advisory vote on named executive officer compensation is held on an annual basis, consistent with the shareholder advisory vote on frequency Shareholders may nominate directors through proxy access Board & Committee Oversight Enterprise risk oversight by full Board and its committees Corporate Governance and Corporate Responsibility Committee oversees corporate citizenship practices including environmental, social and governance (“ESG”) and sustainability initiatives Audit Committee oversees risks related to cybersecurity, among other matters including financial statements and compliance Compensation Committee ensures alignment between pay and performance Board Practices Consideration of your Board’s ethnic and gender diversity, age, experience and skills and other attributes when evaluating nominees for your Board A robust annual evaluation process: full Board evaluation including third-party interviews, Board committee evaluations and individual director evaluations Mandatory director retirement age of 72 pursuant to our Corporate Governance Policies Policy to consider diversity for director candidates Goal to maintain at least 30% diverse members (by race, ethnicity and gender combined) for the foreseeable future Corporate Governance and Corporate Responsibility Committee and full Board engage in rigorous director succession planning Comprehensive director orientation and continuing education Robust stock ownership guidelines Anti-Hedging and Anti-Pledging Policies No poison pill (logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 6

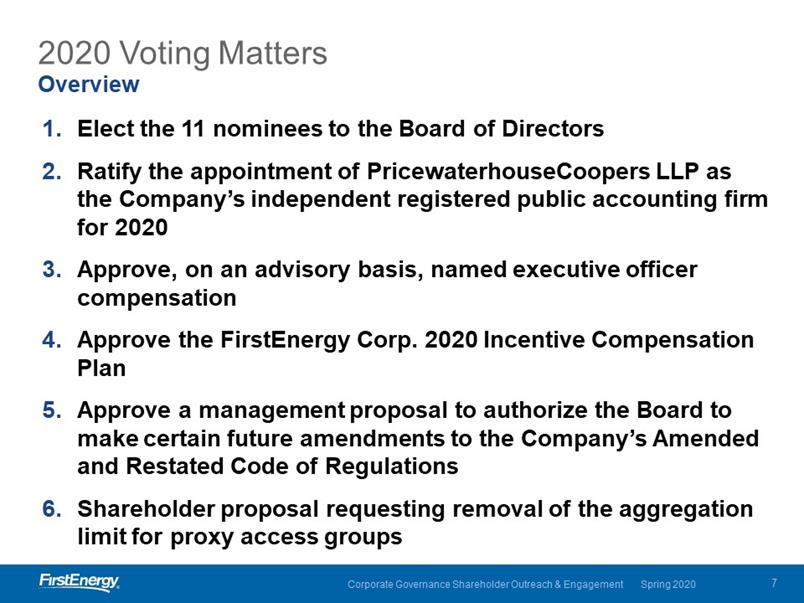

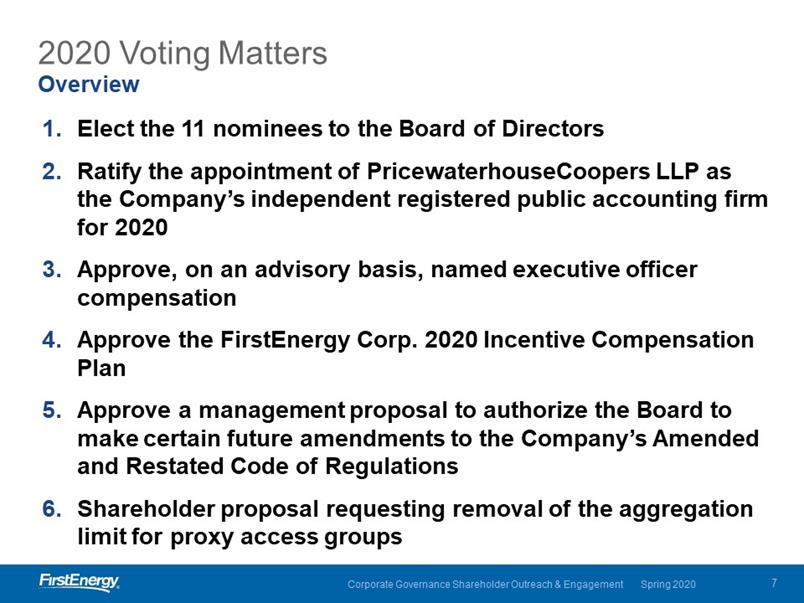

2020 Voting Matters Overview Elect the 11 nominees to the Board of Directors Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2020 Approve, on an advisory basis, named executive officer compensation Approve the FirstEnergy Corp. 2020 Incentive Compensation Plan Approve a management proposal to authorize the Board to make certain future amendments to the Company’s Amended and Restated Code of Regulations Shareholder proposal requesting removal of the aggregation limit for proxy access groups (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 7

Interactive Proxy Statement / Web Hosting www.FirstEnergyCorp.com/AnnualMeeting Interactive Proxy Statement uick Links (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 8

Corporate Responsibility (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 9

CORPORATE RESPONSIBILITY A FORWARD-THINKING ELECTRIC UTILITY Committed to making our customers’ lives brighter, the environment better and our communities stronger. Seek to inform and engage our stakeholders, while at the same time setting and achieving goals. Led by a dedicated team, along with Executive and Board Oversight on Corporate Responsibility and ESG strategy. Environmental 90% CO2 Emissions Reduction Goal By 2045 Social $ 54M FE Foundation awarded to non-profits over past decade Governance 1 ISS Governance Score ENERGY FOR A BRIGHTER FUTURE (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 10

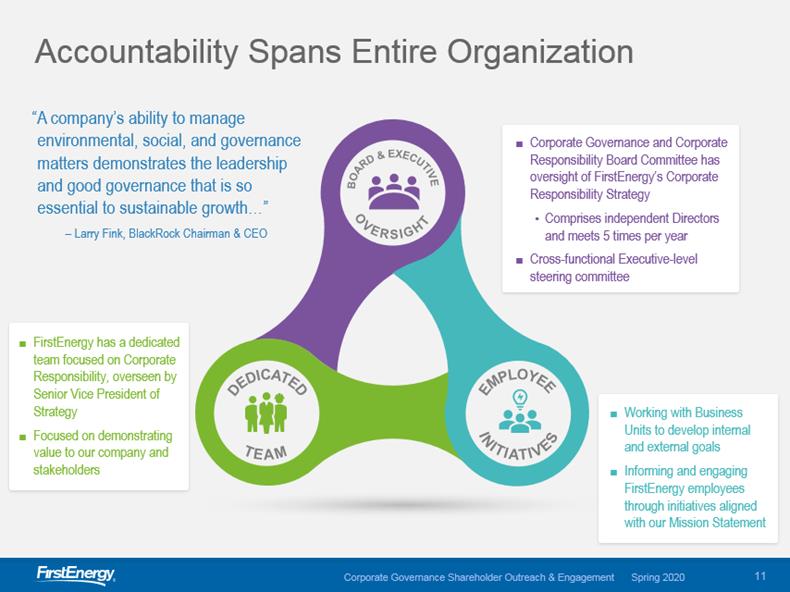

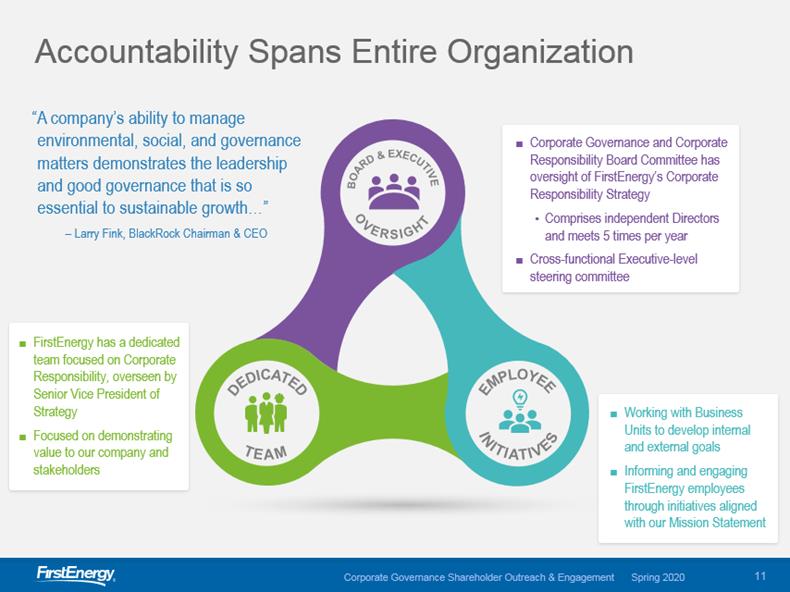

Accountability Spans Entire Organization “A company’s ability to manage environmental, social, and governance matters demonstrates the leadership and good governance that is so essential to sustainable growth…” – Larry Fink, BlackRock Chairman & CEO FirstEnergy has a dedicated team focused on Corporate Responsibility, overseen by Senior Vice President of Strategy Focused on demonstrating value to our company and stakeholders Corporate Governance and Corporate Responsibility Board Committee has oversight of FirstEnergy’s Corporate Responsibility Strategy Comprises independent Directors and meets 5 times per year Cross-functional Executive-level steering committee Working with Business Units to develop internal and external goals Informing and engaging FirstEnergy employees through initiatives aligned with our Mission Statement (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 11

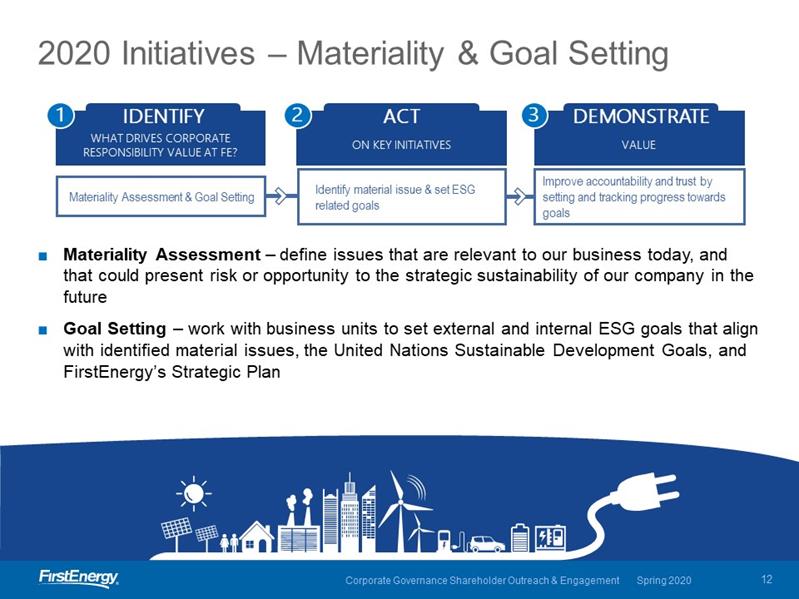

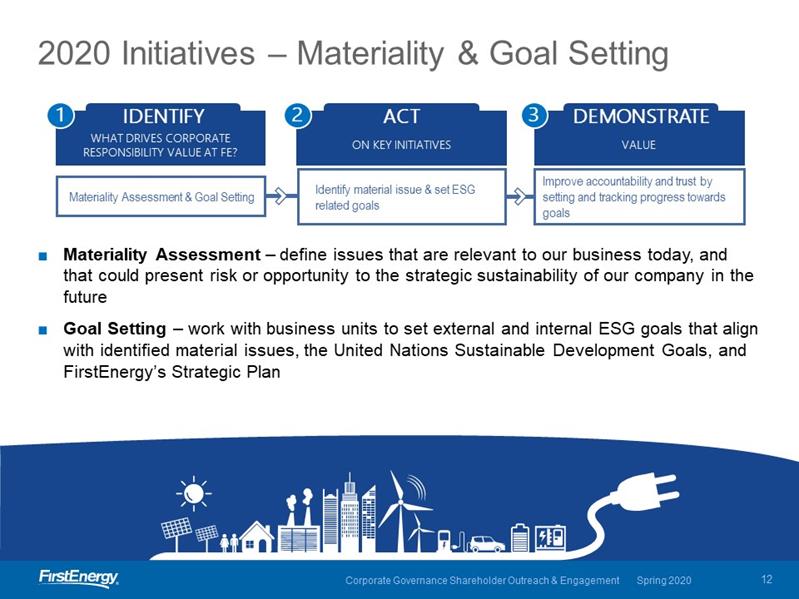

2020 Initiatives – Materiality & Goal Setting IDENTIFY WHAT DRIVES CORPORATE RESPONSIBILITY VALUE AT FE? Materiality Assessment & Goal Setting ACT ON KEY INITIATIVES Identify material issue & set ESG related goals DEMONSTRATE VALUE Improve accountability and trust by setting and tracking progress towards goals Materiality Assessment – define issues that are relevant to our business today, and that could present risk or opportunity to the strategic sustainability of our company in the future Goal Setting – work with business units to set external and internal ESG goals that align with identified material issues, the United Nations Sustainable Development Goals, and FirstEnergy’s Strategic Plan (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 12

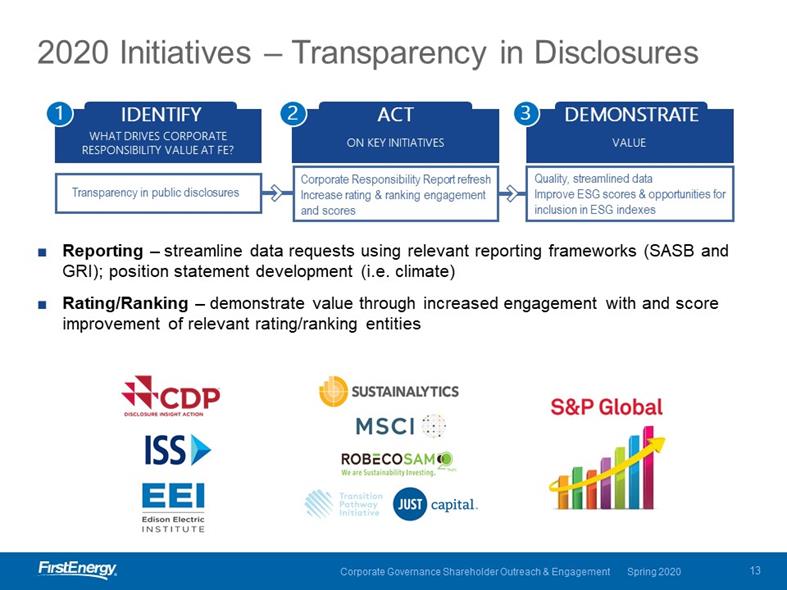

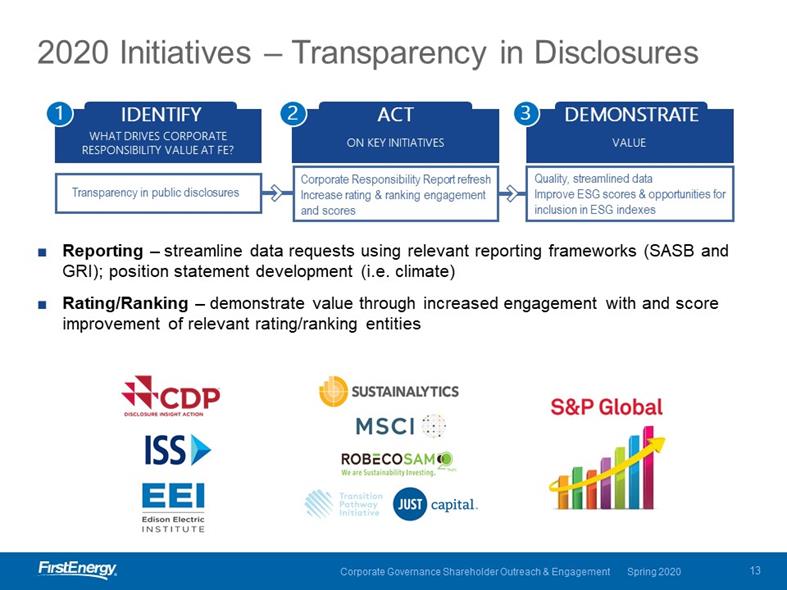

2020 Initiatives – Transparency in Disclosures WHAT DRIVES CORPORATE IDENTIFY RESPONSIBILITY VALUE AT FE? Transparency in public disclosures ACT ON KEY INITIATIVES Corporate Responsibility Report refresh Increase rating & ranking engagement and scores DEMONSTRATE VALUE Quality, streamlined data Improve ESG scores & opportunities for inclusion in ESG indexes Reporting – streamline data requests using relevant reporting frameworks (SASB and GRI); position statement development (i.e. climate) Rating/Ranking – demonstrate value through increased engagement with and score improvement of relevant rating/ranking entities

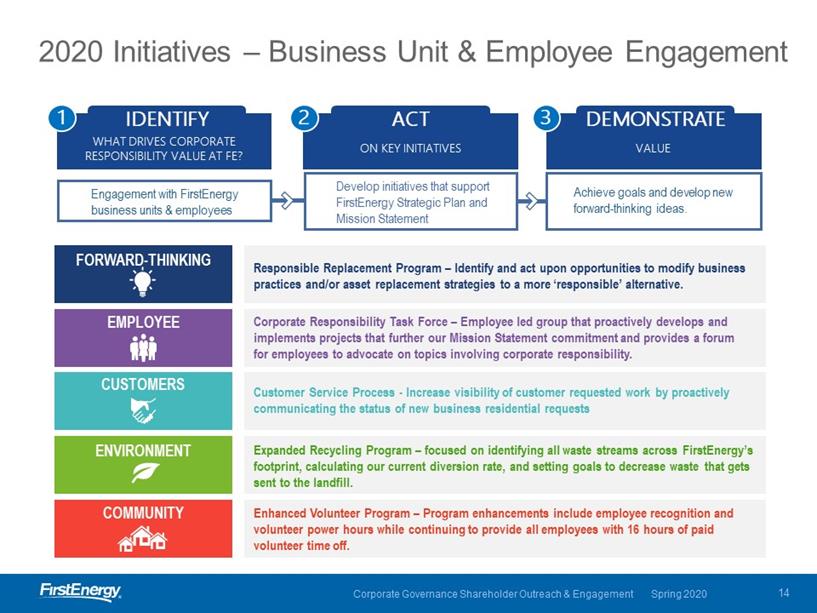

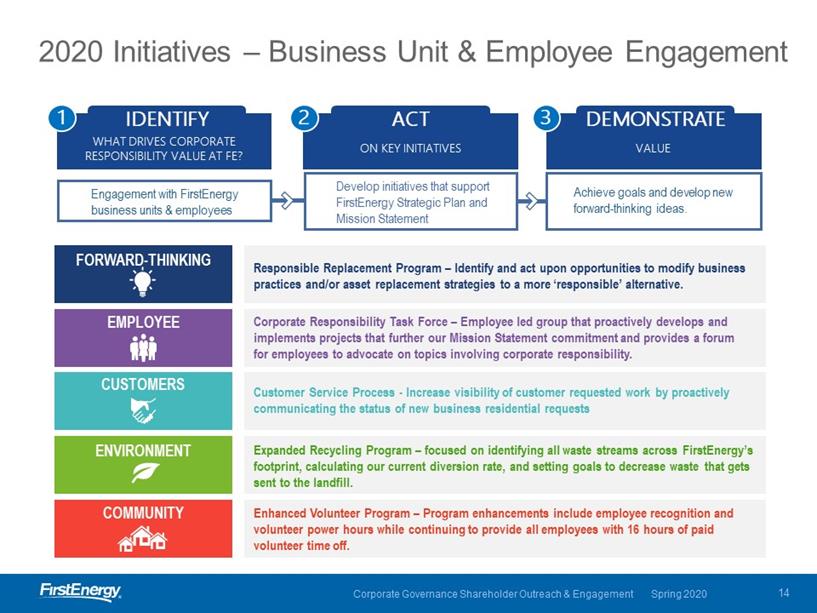

2020 Initiatives – Business Unit & Employee Engagement IDENTIFY WHAT DRIVES CORPORATE RESPONSIBILITY VALUE AT FE? Engagement with FirstEnergy business units & employees ACT ON KEY INITIATIVES Develop initiatives that support FirstEnergy Strategic Plan and

Mission DEMONSTRATE VALUE Achieve goals and develop new forward-thinking ideas. FORWARD-THINKING EMPLOYEE CUSTOMERS ENVIRONMENT COMMUNITY Responsible Replacement Program – Identify and act upon opportunities to modify business practices and/or asset replacement strategies to a more ‘responsible’ alternative. Corporate Responsibility Task Force – Employee led group that proactively develops and implements projects that further our Mission Statement commitment and provides a forum for employees to advocate on topics involving corporate responsibility. Customer Service Process - Increase visibility of customer requested work by proactively communicating the status of new business residential requests Expanded Recycling Program – focused on identifying all waste streams across FirstEnergy’s footprint, calculating our current diversion rate, and setting goals to decrease waste that gets sent to the landfill. Enhanced Volunteer Program – Program enhancements include employee recognition and volunteer power hours while continuing to provide all employees with 16 hours of paid volunteer time off. (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 2

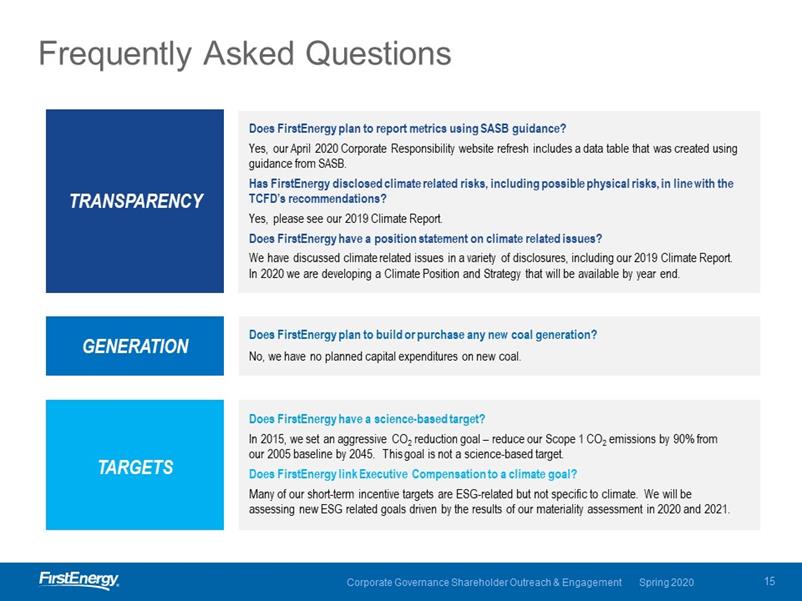

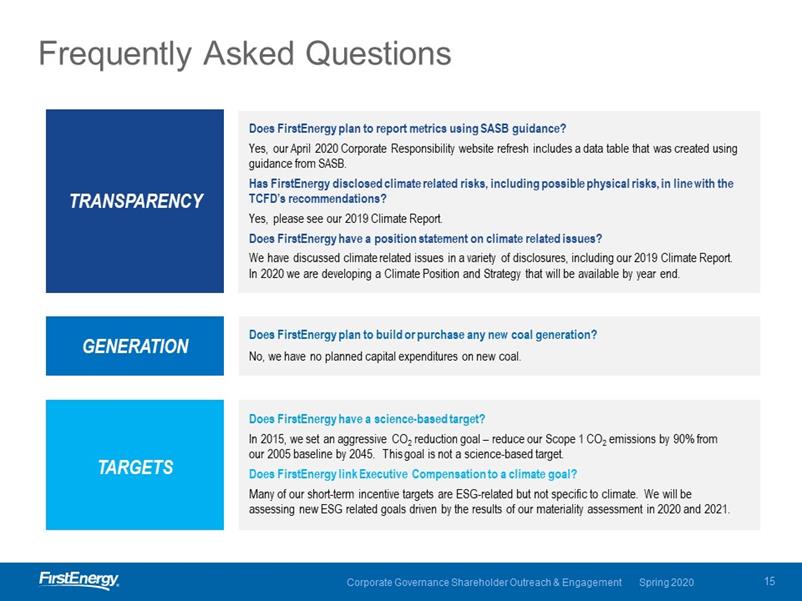

Frequently Asked Questions TRANSPARENCY GENERATION TARGETS Does FirstEnergy plan to report metrics using SASB guidance? Yes, our April 2020 Corporate Responsibility website refresh includes a data table that was created using guidance from SASB. Has FirstEnergy disclosed climate related risks, including possible physical risks, in line with the TCFD’s recommendations? Yes, please see our 2019 Climate Report. Does FirstEnergy have a position statement on climate related issues? We have discussed climate related issues in a variety of disclosures, including our 2019 Climate Report. In 2020 we are developing a Climate Position and Strategy that will be available by year end. Does FirstEnergy plan to build or purchase any new coal generation? No, we have no planned capital expenditures on new coal. Does FirstEnergy have a science-based target? In 2015, we set an aggressive CO2 reduction goal – reduce our Scope 1 CO2 emissions by 90% from our 2005 baseline by 2045. This goal is not a science-based target. Does FirstEnergy link Executive Compensation to a climate goal? Many of our short-term incentive targets are ESG-related but not specific to climate. We will be assessing new ESG related goals driven by the results of our materiality assessment in 2020 and 2021. (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 15

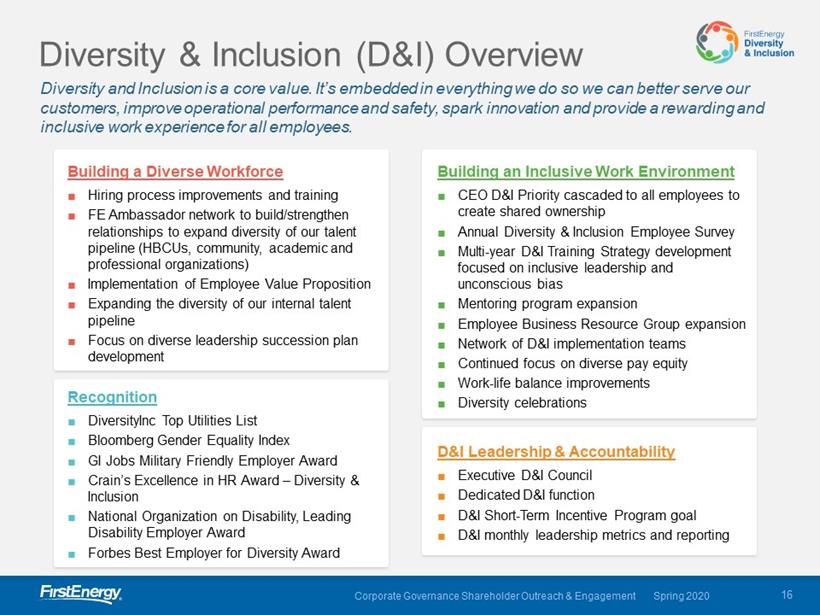

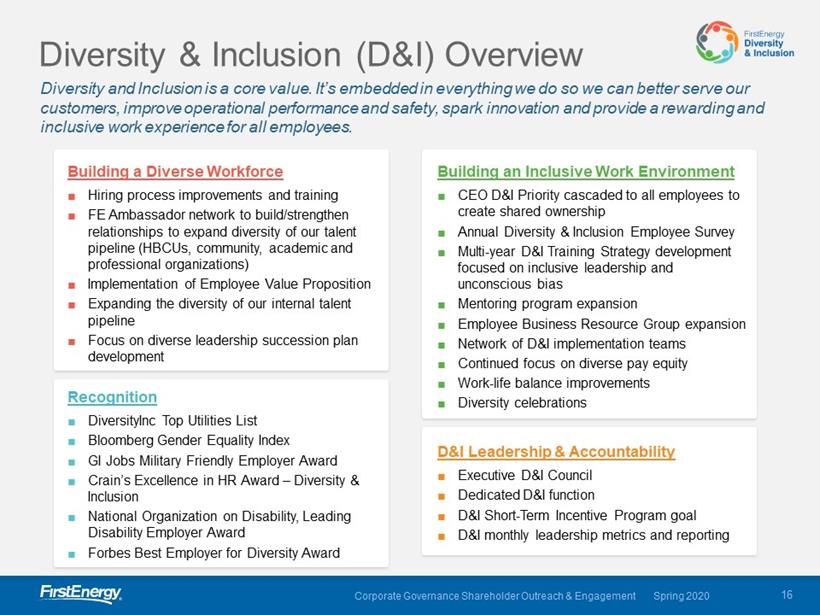

Diversity & Inclusion (D&I) Overview Diversity and Inclusion is a core value. It’s embedded in everything we do so we can better serve our customers, improve operational performance and safety, spark innovation and provide a rewarding and inclusive work experience for all employees. Building a Diverse Workforce Hiring process improvements and training FE Ambassador network to build/strengthen relationships to expand diversity of our talent pipeline (HBCUs, community, academic and professional organizations) Implementation of Employee Value Proposition Expanding the diversity of our internal talent pipeline Focus on diverse leadership succession plan development Recognition DiversityInc Top Utilities List Bloomberg Gender Equality Index GI Jobs Military Friendly Employer Award Crain’s Excellence in HR Award – Diversity & Inclusion National Organization on Disability, Leading Disability Employer Award Forbes Best Employer for Diversity Award Building an Inclusive Work Environment CEO D&I Priority cascaded to all employees to create shared ownership Annual Diversity & Inclusion Employee Survey Multi-year D&I Training Strategy development focused on inclusive leadership and unconscious bias Mentoring program expansion Employee Business Resource Group expansion Network of D&I implementation teams Continued focus on diverse pay equity Work-life balance improvements Diversity celebrations D&I Leadership & Accountability Executive D&I Council Dedicated D&I function D&I Short-Term Incentive Program goal D&I monthly leadership metrics and reporting (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 16

Executive Compensation (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 17

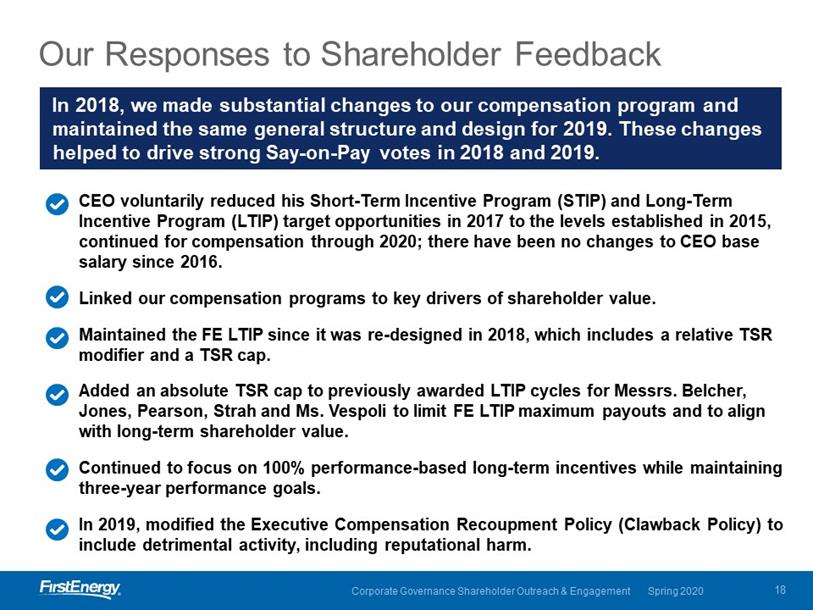

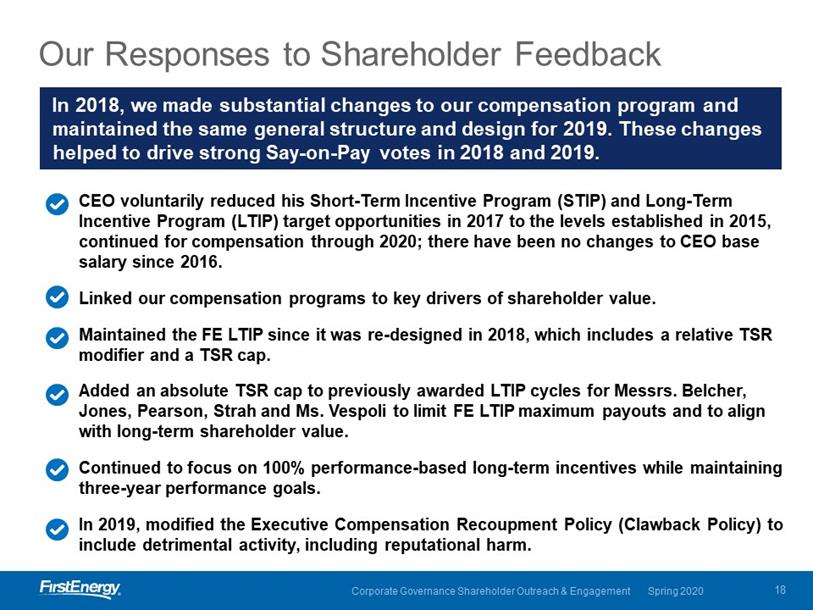

Our Responses to Shareholder Feedback In 2018, we made substantial changes to our compensation program and maintained the same general structure and design for 2019. These changes helped to drive strong Say-on-Pay votes in 2018 and 2019. CEO voluntarily reduced his Short-Term Incentive Program (STIP) and Long-Term Incentive Program (LTIP) target opportunities in 2017 to the levels established in 2015, continued for compensation through 2020; there have been no changes to CEO base salary since 2016. Linked our compensation programs to key drivers of shareholder value. Maintained the FE LTIP since it was re-designed in 2018, which includes a relative TSR modifier and a TSR cap. Added an absolute TSR cap to previously awarded LTIP cycles for Messrs. Belcher, Jones, Pearson, Strah and Ms. Vespoli to limit FE LTIP maximum payouts and to align with long-term shareholder value. Continued to focus on 100% performance-based long-term incentives while maintaining three-year performance goals. In 2019, modified the Executive Compensation Recoupment Policy (Clawback Policy) to include detrimental activity, including reputational harm. (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 18

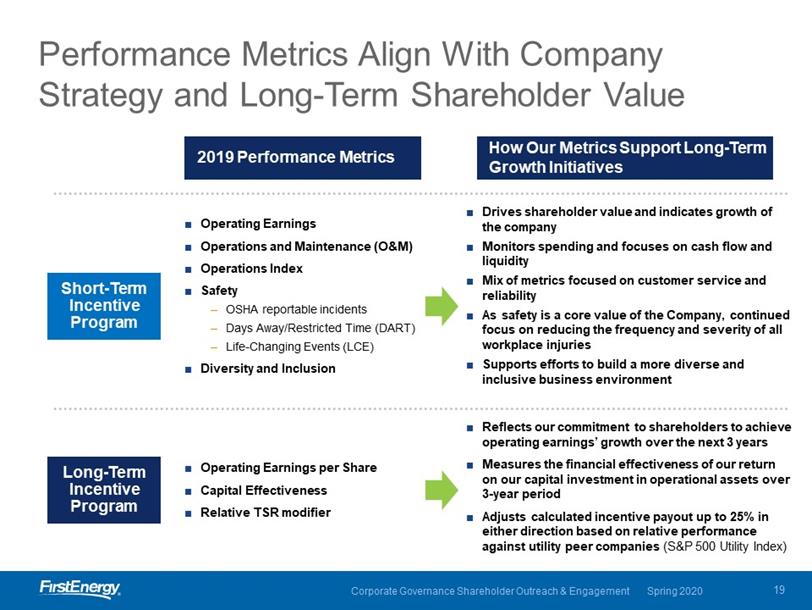

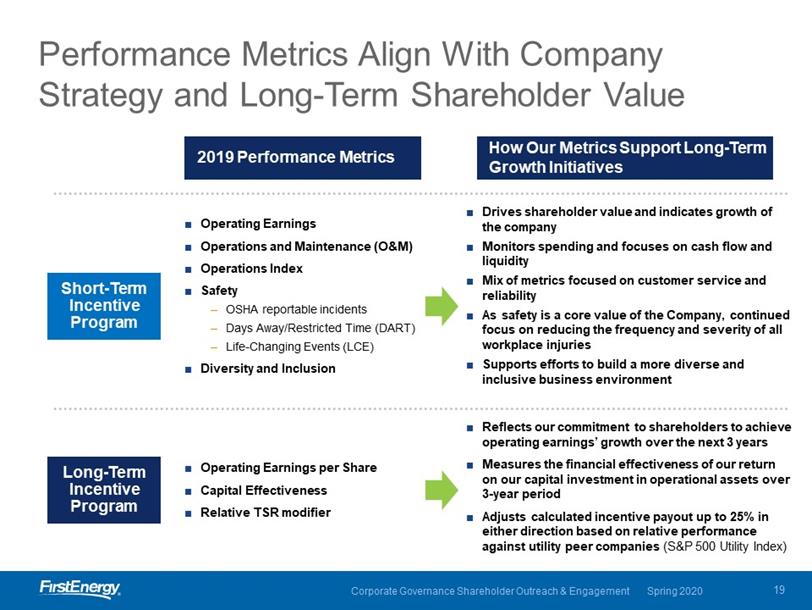

Performance Metrics Align With Company Strategy and Long-Term Shareholder Value 2019 Performance Metrics Operating Earnings Operations and Maintenance (O&M) Operations Index Safety OSHA reportable incidents Days Away/Restricted Time (DART) Life-Changing Events (LCE) Diversity and Inclusion Short-Term Incentive Program Long-Term Incentive Program Operating Earnings per Share Capital Effectiveness Relative TSR modifier How Our Metrics Support Long-Term Growth Initiatives Drives shareholder value and indicates growth of the company Monitors spending and focuses on cash flow and liquidity Mix of metrics focused on customer service and reliability As safety is a core value of the Company, continued focus on reducing the frequency and severity of all workplace injuries Supports efforts to build a more diverse and inclusive business environment Reflects our commitment to shareholders to achieve operating earnings’ growth over the next 3 years Measures the financial effectiveness of our return on our capital investment in operational assets over 3-year period Adjusts calculated incentive payout up to 25% in either direction based on relative performance against utility peer companies (S&P 500 Utility Index) (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 19

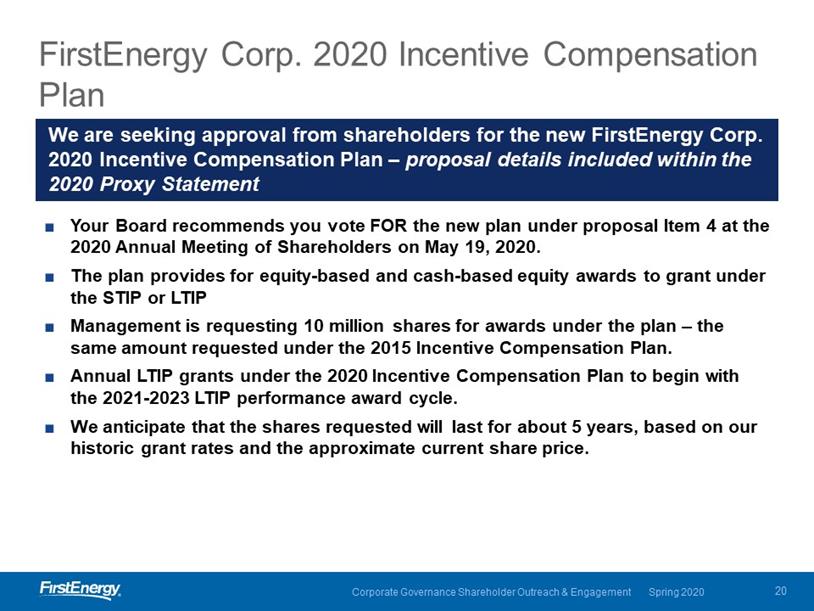

FirstEnergy Corp. 2020 Incentive Compensation Plan We are seeking approval from shareholders for the new FirstEnergy Corp. 2020 Incentive Compensation Plan – proposal details included within the 2020 Proxy Statement Your Board recommends you vote FOR the new plan under proposal Item 4 at the 2020 Annual Meeting of Shareholders on May 19, 2020. The plan provides for equity-based and cash-based equity awards to grant under the STIP or LTIP Management is requesting 10 million shares for awards under the plan – the same amount requested under the 2015 Incentive Compensation Plan. Annual LTIP grants under the 2020 Incentive Compensation Plan to begin with the 2021-2023 LTIP performance award cycle. We anticipate that the shares requested will last for about 5 years, based on our historic grant rates and the approximate current share price. (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 20

Thank You (Logo) Corporate Governance Shareholder Outreach & Engagement Spring 2020 21