Exhibit 99.2

| | Supplemental Operating

and Financial Data Second Quarter 2012 |

Franklin Street Properties Corp. ● 401 Edgewater Place ● Wakefield, MA 01880 ● (781) 557-1300

www.franklinstreetproperties.com

| |  | Table of Contents |

| | | | | |

| | Page | | | Page |

| | | | | |

| Company Overview | 3-5 | | Tenant Analysis | |

| | | | 20 Largest Tenants with Annualized Rent and Remaining Term | 17 |

| Key Financial Data | | | 20 Largest Tenants, Industry Profile | 18 |

| Financial Highlights | 6 | | Lease Expirations by Square Feet | 19 |

| Income Statements | 7 | | Lease Expirations with Annualized Rent per Square Foot | 20 |

| Balance Sheets | 8 | | Percentage of Leased Space by Property | 21 |

| Cash Flow Statements | 9 | | | |

| Property Net Operating Income (NOI) | 10 | | Transactional Drivers | |

| Capital Analysis | 11 | | Capital Recycling | 22 |

| | | | | |

| Portfolio Overview | | | FFO Reconciliation | 23 |

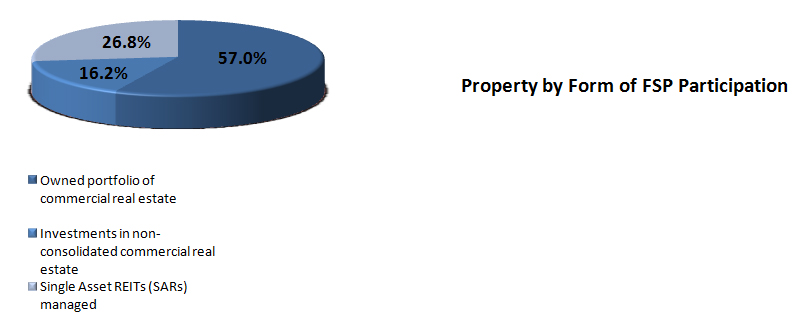

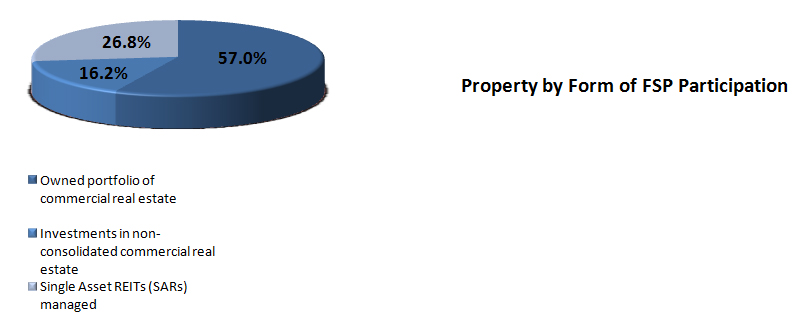

| Property by Form of FSP Participation | 12 | | FFO Definition | 24 |

| Regional Analysis and Map | 13 | | FAD Reconciliation and Definition | 25 |

| Owned Property List | 14 | | EBITDA Reconciliation and Definition | 26 |

| Properties with GAAP Rent per Square Foot | 15 | | NOI Reconciliation and Definition | 27 |

| Capital Expenditures | 16 | | | |

All financial information contained in this supplemental information package is unaudited. In addition, certain statements contained in this supplemental information package may be deemed to be forward-looking statements within the meaning of the federal securities laws. Although FSP believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Factors that could cause actual results to differ materially from FSP’s current expectations include general economic conditions, local real estate conditions, the performance of properties that FSP has acquired or may acquire, the timely lease-up of properties and other risks, detailed from time to time in FSP’s SEC reports. FSP assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

| |  | Company Overview |

Overview

Franklin Street Properties Corp. (“FSP”, “we”, “our” or the “Company”) (NYSE MKT: FSP) is an investment firm focused on achieving current income and long-term growth through investments in commercial properties. FSP’s portfolio of real estate assets consists primarily of suburban office buildings and includes select investments in central business district (CBD) properties. FSP’s real estate operations include property acquisitions and dispositions, short-term financing, leasing, development and asset management. FSP’s subsidiary, FSP Investments LLC (member, FINRA and SIPC), is a real estate investment banking firm and registered broker/dealer that previously sponsored the organization of single-purpose entities that own real estate and the private placement of equity in those entities, which we refer to as “Sponsored REITs”.

Our Business

As of June 30, 2012, the Company owned and operated a portfolio of real estate consisting of 36 properties, managed 16 Sponsored REITs and held eight promissory notes secured by mortgages on real estate owned by Sponsored REITs. From time-to-time, the Company may acquire real estate, make additional secured loans or acquire one of its Sponsored REITs. The Company may also pursue, on a selective basis, the sale of its properties in order to take advantage of the value creation and demand for its properties, or for geographic or property specific reasons.

Strategy

FSP’s investment strategy is to make direct investments in real estate assets. Our primary type of real estate asset is suburban office properties. The Company believes that real estate, in general, and suburban office real estate, in particular, is a cyclical asset class, and FSP tries to minimize the risk of investing in that cyclical asset class by maintaining a low to moderate level of debt at the corporate level and historically has not had secured debt at the property level. FSP believes that matching a low to moderate leverage ratio with investments in the cyclical suburban office asset class will allow it to take advantage of disposition opportunities during peaks in the cycles and protect its investments from foreclosure or refinancing risk during the lows of the cycles. In addition to maintaining modest leverage, FSP believes that it can lower investment risk while enhancing current income and long-term appreciation potential through geographical diversification by owning a portfolio of properties in varied markets that have sound long-term economic growth potential.

| | |

| Snapshot | |

| (as of Juns 30, 2012) | |

| Corporate Headquarters | Wakefield, MA |

| Fiscal Year-End | 31-Dec |

| Total Properties | 36 |

| Total Square Feet | 7.1 Million |

| Common Shares Outstanding | 82,937,405 |

| Quarterly Dividend | $0.19 |

| Dividend Yield | 7.2% |

| Total Market Capitalization | $1.4 Billion |

| Insider Holdings | 12.1% |

| | |

| |  | Company Overview |

FSP selects acquisitions based on market and/or property specific criteria, and actively manages the properties to maximize current income and long term appreciation in value. Attempting to invest more heavily in property near the perceived bottom of market cycles and likewise disposing of properties near the perceived top of the market cycles is a natural consequence of our flexible lower leverage model. Proceeds from property sales are redeployed into other specific real estate assets, used for other corporate purposes and/or paid out to shareholders as special dividends.

Structure of the Company

FSP has elected to be taxed as a real estate investment trust (REIT) under the Internal Revenue Code. To qualify as a REIT, we must meet a number of organizational and operational requirements, including a requirement to distribute at least 90% of our adjusted taxable income to our shareholders. Management intends to continue to adhere to these requirements and to maintain our REIT status. As a REIT we are entitled to a tax deduction for some or all of the dividends we pay to shareholders. Accordingly, we generally will not be subject to federal income taxes as long as we distribute an amount equal to or in excess of our taxable income to shareholders.

Dividend Philosophy

FSP has been able to offer shareholders high-quality, risk-adjusted returns. The ongoing and recurring rental revenue stream provides stability to our regular quarterly dividend. In addition, the possibility exists for the payment of annual special dividends resulting from the sale of properties in the portfolio.

| Board of Directors and Management | | | | |

| | | | | |

| George J. Carter | | Dennis J. McGillicuddy | | Scott H. Carter |

| President, Chief Executive Officer | | Director, Member, Audit Committee and | | Executive Vice President, General |

| Chairman of the Board | | Member, Compensation Committee | | Counsel and Assistant Secretary |

| | | | | |

| Barbara J. Fournier | | Georgia Murray | | Jeffrey B. Carter |

| Executive Vice President, Chief Operating Officer, | | Director, Chair, Compensation Committee and | | Executive Vice President and |

| Treasurer, Secretary and Director | | Member, Audit Committee | | Chief Investment Officer |

| | | | | |

| Janet Notopoulos | | Barry Silverstein | | John G. Demeritt |

| Executive Vice President and Director | | Director, Member, Audit Committee and | | Executive Vice President and |

| | | Member, Compensation Committee | | Chief Financial Officer |

| John N. Burke | | | | |

| Director, Chair, Audit Committee and | | | | |

| Member, Compensation Committee | | | | |

| |  | Company Overview |

| | | | | |

| Corporate Headquarters | | Trading Symbol | | Inquiries |

| 401 Edgewater Place, Suite 200 | | NYSE MKT | | Inquires should be directed to: |

| Wakefield, MA 01880 | | Symbol: FSP | | John Demeritt, CFO |

| (t) 781-557-1300 | | | | 877-686-9496 or InvestorRelations@ |

| (f) 781-246-2807 | | | | franklinstreetproperties.com |

| www.franklinstreetproperties.com | | | | |

| Common Stock Data (NYSE MKT: FSP) | | | | | | | | |

| | For the Three Months Ended |

| | 30-Jun-12 | 31-Mar-12 | 31-Dec-11 | 30-Sep-11 | 30-Jun-11 | 31-Mar-11 | 31-Dec-10 | 30-Sep-10 |

| High Price | $ 10.84 | $ 11.14 | $ 13.08 | $ 13.91 | $ 14.25 | $ 15.63 | $ 14.42 | $ 12.86 |

| Low Price | $ 9.57 | $ 9.43 | $ 9.90 | $ 10.49 | $ 12.00 | $ 13.52 | $ 12.20 | $ 10.99 |

| Closing Price, at the end of the quarter | $ 10.58 | $ 10.60 | $ 9.95 | $ 11.31 | $ 12.91 | $ 14.07 | $ 14.25 | $ 12.42 |

| Dividends paid per share – quarterly | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 | 0.19 |

| Closing dividend yield – annualized | 7.2% | 7.2% | 7.64% | 6.72% | 5.89% | 5.40% | 5.33% | 6.12% |

| Common shares outstanding (millions) | 82.94 | 82.94 | 82.94 | 82.94 | 81.44 | 81.44 | 81.44 | 79.84 |

| | | | | | | | | |

Quarterly and Annual results are expected to be announced during the week ending on these dates:

| First Quarter: | 3-May-13 | | Third Quarter: | 2-Nov-12 |

| Second Quarter: | 2-Aug-12 | | Fourth Quarter: | 1-Mar-13 |

| |  | Financial Highlights

(in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | For the Year | |

| | | For the Three Months Ended | | | For the Three Months Ended | | | Ended | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | 31-Dec-11 | |

| Income Items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rental | | $ | 36,668 | | | $ | 35,830 | | | $ | 31,099 | | | $ | 33,606 | | | $ | 33,672 | | | $ | 37,014 | | | $ | 135,391 | |

| Related party revenue | | | 2,616 | | | | 3,045 | | | | 808 | | | | 1,150 | | | | 1,037 | | | | 1,051 | | | | 4,046 | |

| Other | | | 34 | | | | 39 | | | | 7 | | | | 6 | | | | 7 | | | | 29 | | | | 49 | |

| Total revenue | | | 39,318 | | | | 38,914 | | | | 31,914 | | | | 34,762 | | | | 34,716 | | | | 38,094 | | | | 139,486 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total expenses | | | 33,900 | | | | 33,901 | | | | 28,288 | | | | 31,201 | | | | 31,772 | | | | 33,685 | | | | 124,946 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before interest income, equity in earnings in

non-consolidated REITs and taxes | | | 5,418 | | | | 5,013 | | | | 3,626 | | | | 3,561 | | | | 2,944 | | | | 4,409 | | | | 14,540 | |

| Interest income | | | 8 | | | | 4 | | | | 11 | | | | 5 | | | | 3 | | | | 3 | | | | 22 | |

| Equity in earnings in non-consolidated REITs | | | 391 | | | | 494 | | | | 968 | | | | 1,166 | | | | 573 | | | | 978 | | | | 3,685 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before taxes | | | 5,817 | | | | 5,511 | | | | 4,605 | | | | 4,732 | | | | 3,520 | | | | 5,390 | | | | 18,247 | |

| Income tax expense | | | 79 | | | | 77 | | | | 50 | | | | 68 | | | | 67 | | | | 82 | | | | 267 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 5,738 | | | | 5,434 | | | | 4,555 | | | | 4,664 | | | | 3,453 | | | | 5,308 | | | | 17,980 | |

| Income from discontinued operations | | | - | | | | - | | | | 620 | | | | 3,370 | | | | (139 | ) | | | (246 | ) | | | 3,605 | |

| Gain on sale of assets | | | - | | | | - | | | | 19,592 | | | | 2,347 | | | | - | | | | - | | | | 21,939 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,738 | | | $ | 5,434 | | | $ | 24,767 | | | $ | 10,381 | | | $ | 3,314 | | | $ | 5,062 | | | $ | 43,524 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FFO* | | $ | 19,571 | | | $ | 19,041 | | | $ | 16,250 | | | $ | 20,140 | | | $ | 16,362 | | | $ | 18,457 | | | $ | 71,209 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.30 | | | $ | 0.13 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.53 | |

| FFO* | | | 0.24 | | | | 0.23 | | | | 0.20 | | | | 0.25 | | | | 0.20 | | | | 0.22 | | | | 0.87 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Shares (diluted) | | | 82,937 | | | | 82,937 | | | | 81,437 | | | | 81,437 | | | | 81,600 | | | | 82,937 | | | | 81,857 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Real estate, net | | $ | 1,001,863 | | | $ | 997,345 | | | $ | 979,560 | | | $ | 976,131 | | | $ | 997,258 | | | $ | 1,006,221 | | | $ | 867,608 | |

| Other assets, net | | | 436,665 | | | | 433,018 | | | | 387,342 | | | | 327,633 | | | | 348,526 | | | | 402,440 | | | | 402,440 | |

| Total assets, net | | | 1,438,528 | | | | 1,430,363 | | | | 1,366,902 | | | | 1,303,764 | | | | 1,345,784 | | | | 1,408,661 | | | | 1,238,735 | |

| Total liabilities, net | | | 527,181 | | | | 529,340 | | | | 435,801 | | | | 377,374 | | | | 413,784 | | | | 487,294 | | | | 487,294 | |

| Shareholders' equity | | | 911,347 | | | | 901,023 | | | | 931,101 | | | | 926,390 | | | | 932,000 | | | | 921,367 | | | | 921,367 | |

* See page 23 for a reconciliation of Net Income to FFO and page 24 for a definition of FFO

| |  | Condensed Consolidated Income Statements

($ in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | | | For the | |

| | | For the Three Months Ended | | | For the Three Months Ended | | | Year Ended | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | 31-Dec-11 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Rental | | $ | 36,668 | | | $ | 35,830 | | | $ | 31,099 | | | $ | 33,606 | | | $ | 33,672 | | | $ | 37,014 | | | $ | 135,391 | |

| Related party revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Management fees and interest income from loans | | | 2,616 | | | | 3,045 | | | | 808 | | | | 1,150 | | | | 1,037 | | | | 1,051 | | | | 4,046 | |

| Other | | | 34 | | | | 39 | | | | 7 | | | | 6 | | | | 7 | | | | 29 | | | | 49 | |

| Total revenue | | | 39,318 | | | | 38,914 | | | | 31,914 | | | | 34,762 | | | | 34,716 | | | | 38,094 | | | | 139,486 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Real estate operating expenses | | | 9,077 | | | | 8,828 | | | | 8,730 | | | | 8,765 | | | | 9,328 | | | | 9,862 | | | | 36,685 | |

| Real estate taxes and insurance | | | 5,813 | | | | 5,576 | | | | 4,759 | | | | 5,228 | | | | 5,020 | | | | 5,426 | | | | 20,433 | |

| Depreciation and amortization | | | 13,256 | | | | 13,224 | | | | 10,745 | | | | 12,029 | | | | 12,351 | | | | 13,124 | | | | 48,249 | |

| Selling, general and administrative | | | 2,077 | | | | 2,236 | | | | 1,645 | | | | 1,602 | | | | 1,654 | | | | 2,012 | | | | 6,913 | |

| Interest | | | 3,677 | | | | 4,037 | | | | 2,408 | | | | 3,578 | | | | 3,419 | | | | 3,261 | | | | 12,666 | |

| Total expenses | | | 33,900 | | | | 33,901 | | | | 28,287 | | | | 31,202 | | | | 31,772 | | | | 33,685 | | | | 124,946 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before interest income, equity in earnings of non-consolidated REITs and taxes | | | 5,418 | | | | 5,013 | | | | 3,627 | | | | 3,560 | | | | 2,944 | | | | 4,409 | | | | 14,540 | |

| Interest income | | | 8 | | | | 4 | | | | 11 | | | | 5 | | | | 3 | | | | 3 | | | | 22 | |

| Equity in earnings of non-consolidated REITs | | | 391 | | | | 494 | | | | 968 | | | | 1,166 | | | | 573 | | | | 978 | | | | 3,685 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before taxes on income | | | 5,817 | | | | 5,511 | | | | 4,606 | | | | 4,731 | | | | 3,520 | | | | 5,390 | | | | 18,247 | |

| Income tax expense | | | 79 | | | | 77 | | | | 50 | | | | 68 | | | | 67 | | | | 82 | | | | 267 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 5,738 | | | | 5,434 | | | | 4,556 | | | | 4,663 | | | | 3,453 | | | | 5,308 | | | | 17,980 | |

| Income from discontinued operations | | | - | | | | - | | | | 620 | | | | 3,370 | | | | (139 | ) | | | (246 | ) | | | 3,605 | |

| Gain on sale of assets | | | - | | | | - | | | | 19,592 | | | | 2,347 | | | | - | | | | - | | | | 21,939 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,738 | | | $ | 5,434 | | | $ | 24,768 | | | $ | 10,380 | | | $ | 3,314 | | | $ | 5,062 | | | $ | 43,524 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding,basic and diluted | | | 82,937 | | | | 82,937 | | | | 81,437 | | | | 81,437 | | | | 81,600 | | | | 82,937 | | | | 81,857 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings per share, basic and diluted, attributable to:Continuing operations | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.06 | | | $ | 0.06 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.22 | |

| Discontinued operations | | | - | | | | - | | | | 0.01 | | | | - | | | | (0.00 | ) | | | (0.00 | ) | | | 0.04 | |

| Gains on sales of assets | | | - | | | | - | | | | 0.24 | | | | 0.03 | | | | - | | | | - | | | | 0.27 | |

| Net income per share, basic and diluted | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.30 | | | $ | 0.13 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |  | Condensed Consolidated Balance Sheets

(in thousands) |

| | | March 31, | | | June 30, | | | March 31, | | | June 30, | | | September 30, | | | December 31, | |

| | | 2012 | | | 2012 | | | 2011 | | | 2011 | | | 2011 | | | 2011 | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Real estate assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Land | | $ | 137,503 | | | $ | 137,503 | | | $ | 129,800 | | | $ | 129,800 | | | $ | 134,711 | | | $ | 137,503 | |

| Buildings and improvements | | | 1,023,905 | | | | 1,027,321 | | | | 978,876 | | | | 982,821 | | | | 1,006,814 | | | | 1,020,449 | |

| Fixtures and equipment | | | 885 | | | | 896 | | | | 600 | | | | 726 | | | | 761 | | | | 856 | |

| | | | 1,162,293 | | | | 1,165,720 | | | | 1,109,276 | | | | 1,113,347 | | | | 1,142,286 | | | | 1,158,808 | |

| Less accumulated depreciation | | | 160,430 | | | | 168,375 | | | | 129,716 | | | | 137,216 | | | | 145,028 | | | | 152,587 | |

| Real estate assets, net | | | 1,001,863 | | | | 997,345 | | | | 979,560 | | | | 976,131 | | | | 997,258 | | | | 1,006,221 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquired real estate leases, net | | | 87,073 | | | | 82,769 | | | | 85,290 | | | | 81,455 | | | | 91,585 | | | | 91,613 | |

| Investment in non-consolidated REITs | | | 87,061 | | | | 86,658 | | | | 88,652 | | | | 88,654 | | | | 88,225 | | | | 87,598 | |

| Assets held for syndication, net | | | - | | | | - | | | | 47,630 | | | | 11,206 | | | | 4,720 | | | | - | |

| Assets held for sale | | | - | | | | - | | | | 5,108 | | | | - | | | | - | | | | - | |

| Cash and cash equivalents | | | 29,283 | | | | 22,620 | | | | 49,488 | | | | 28,881 | | | | 44,047 | | | | 23,813 | |

| Restricted cash | | | 511 | | | | 533 | | | | 440 | | | | 459 | | | | 477 | | | | 493 | |

| Tenant rent receivables, net | | | 1,090 | | | | 1,403 | | | | 1,688 | | | | 1,846 | | | | 1,418 | | | | 1,460 | |

| Straight-line rent receivable, net | | | 31,932 | | | | 33,142 | | | | 20,838 | | | | 23,745 | | | | 26,067 | | | | 28,545 | |

| Prepaid expenses | | | 1,164 | | | | 2,605 | | | | 1,400 | | | | 1,255 | | | | 2,553 | | | | 1,223 | |

| Related party mortgage loan receivable | | | 172,286 | | | | 177,536 | | | | 60,116 | | | | 61,916 | | | | 61,916 | | | | 140,516 | |

| Other assets | | | 4,006 | | | | 3,640 | | | | 6,339 | | | | 6,237 | | | | 5,219 | | | | 4,538 | |

| Deferred leasing commissions, net | | | 22,259 | | | | 22,112 | | | | 20,353 | | | | 21,979 | | | | 22,299 | | | | 22,641 | |

| Total assets | | $ | 1,438,528 | | | $ | 1,430,363 | | | $ | 1,366,902 | | | $ | 1,303,764 | | | $ | 1,345,784 | | | $ | 1,408,661 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank note payable | | $ | 494,000 | | | $ | 494,000 | | | $ | 404,000 | | | $ | 345,000 | | | $ | 375,000 | | | | 449,000 | |

| Term loan payable | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Accounts payable and accrued expenses | | | 23,311 | | | | 25,408 | | | | 20,562 | | | | 21,431 | | | | 28,258 | | | | 26,446 | |

| Accrued compensation | | | 446 | | | | 944 | | | | 603 | | | | 1,070 | | | | 1,383 | | | | 2,222 | |

| Tenant security deposits | | | 2,181 | | | | 2,113 | | | | 2,533 | | | | 2,476 | | | | 2,453 | | | | 2,008 | |

| Other liabilities: derivative termination value | | | - | | | | - | | | | 828 | | | | 447 | | | | 63 | | | | - | |

| Acquired unfavorable real estate leases, net | | | 7,243 | | | | 6,875 | | | | 7,275 | | | | 6,950 | | | | 6,627 | | | | 7,618 | |

| Total liabilities | | | 527,181 | | | | 529,340 | | | | 435,801 | | | | 377,374 | | | | 413,784 | | | | 487,294 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Commitments and contingencies | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Common stock | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | |

| Additional paid-in capital | | | 1,042,876 | | | | 1,042,876 | | | | 1,025,491 | | | | 1,025,491 | | | | 1,042,876 | | | | 1,042,876 | |

| Accumulated other comprehensive loss | | | - | | | | - | | | | (828 | ) | | | (447 | ) | | | (63 | ) | | | - | |

| Accumulated distributions in excess of accumulated earnings | | | (131,537 | ) | | | (141,861 | ) | | | (93,570 | ) | | | (98,662 | ) | | | (110,821 | ) | | | (121,517 | ) |

| Total stockholders’ equity | | | 911,347 | | | | 901,023 | | | | 931,101 | | | | 926,390 | | | | 932,000 | | | | 921,367 | |

| Total liabilities and stockholders’ equity | | $ | 1,438,528 | | | $ | 1,430,363 | | | $ | 1,366,902 | | | $ | 1,303,764 | | | $ | 1,345,784 | | | $ | 1,408,661 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| |  | Condensed Consolidated Statements of Cash Flows

(in thousands) |

| | | Six Months Ended June 30, | | | Twelve Months Ended December 31 | |

| | | 2012 | | | 2011 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | | | | |

| Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 11,172 | | | $ | 35,148 | | | $ | 43,524 | | | $ | 22,093 | | | $ | 27,872 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | |

| Gains on assets sold | | | - | | | | (21,939 | ) | | | (21,939 | ) | | | - | | | | (424 | ) |

| Depreciation and amortization expense | | | 27,495 | | | | 23,670 | | | | 50,261 | | | | 39,627 | | | | 36,561 | |

| Amortization of above market lease | | | 20 | | | | (62 | ) | | | (47 | ) | | | 1,362 | | | | 3,359 | |

| Equity in earnings (losses) from non-consolidated REITs | | | (885 | ) | | | (2,844 | ) | | | (3,086 | ) | | | (1,183 | ) | | | (2,012 | ) |

| Distributions from non-consolidated REITs | | | 993 | | | | 2,318 | | | | 3,474 | | | | 1,633 | | | | 2,283 | |

| Increase in bad debt reserve | | | 65 | | | | (365 | ) | | | (365 | ) | | | 980 | | | | 111 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | |

| Restricted cash | | | (40 | ) | | | (39 | ) | | | (73 | ) | | | (86 | ) | | | 2 | |

| Tenant rent receivables | | | (8 | ) | | | 441 | | | | 827 | | | | (1,120 | ) | | | (564 | ) |

| Straight-line rents | | | (2,571 | ) | | | (5,176 | ) | | | (9,878 | ) | | | (4,249 | ) | | | (1,879 | ) |

| Lease Acquisition Costs | | | (2,026 | ) | | | (55 | ) | | | (153 | ) | | | (4,246 | ) | | | (59 | ) |

| Prepaid expenses and other assets | | | (1,512 | ) | | | 914 | | | | 1,611 | | | | 865 | | | | 907 | |

| Accounts payable and accrued expenses | | | (1,395 | ) | | | (726 | ) | | | 4,213 | | | | (351 | ) | | | 2,760 | |

| Accrued compensation | | | (1,278 | ) | | | (733 | ) | | | 419 | | | | 387 | | | | (238 | ) |

| Tenant security deposits | | | 105 | | | | 546 | | | | 78 | | | | 122 | | | | (66 | ) |

| Payment of deferred leasing commissions | | | (1,513 | ) | | | (5,386 | ) | | | (8,058 | ) | | | (10,515 | ) | | | (2,659 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 28,622 | | | | 25,712 | | | | 60,808 | | | | 45,319 | | | | 65,954 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | | |

| Purchase of real estate assets, office computers and furniture, capitalized merger costs and acquired real estate leases | | | (7,112 | ) | | | (173,031 | ) | | | (236,097 | ) | | | (50,098 | ) | | | (132,264 | ) |

| Investment in non-consolidated REITs | | | (1 | ) | | | (10 | ) | | | (10 | ) | | | (11 | ) | | | (13,218 | ) |

| Distributions in excess of earnings from non-consolidated REITs | | | 834 | | | | 664 | | | | 1,582 | | | | 3,537 | | | | 3,345 | |

| Investment in related party mortgage loan receivable | | | (37,020 | ) | | | (4,232 | ) | | | (82,832 | ) | | | (21,149 | ) | | | (35,410 | ) |

| Changes in deposits on real estate assets | | | - | | | | 200 | | | | 200 | | | | (200 | ) | | | - | |

| Investment in assets held for syndication, net | | | - | | | | (8,200 | ) | | | 2,230 | | | | 1,319 | | | | 8,159 | |

| Proceeds received on sales of real estate assets | | | - | | | | 96,790 | | | | 96,790 | | | | - | | | | 672 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net cash used in investing activities | | | (43,299 | ) | | | (87,819 | ) | | | (218,137 | ) | | | (66,602 | ) | | | (168,716 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | | |

| Distributions to stockholders | | | (31,516 | ) | | | (30,946 | ) | | | (62,177 | ) | | | (60,586 | ) | | | (55,313 | ) |

| Proceeds (costs) from equity offering, net | | | - | | | | (90 | ) | | | 17,295 | | | | 21,868 | | | | 114,695 | |

| Borrowings under New Revolver, net | | | 45,000 | | | | 345,000 | | | | 449,000 | | | | - | | | | - | |

| Borrowings (repayments) under Revolver | | | - | | | | (209,968 | ) | | | (209,968 | ) | | | 100,960 | | | | 41,540 | |

| Borrowing (repayment) of term loan payable, net | | | - | | | | (74,850 | ) | | | (74,850 | ) | | | (150 | ) | | | - | |

| Deferred Financing Costs | | | - | | | | (5,389 | ) | | | (5,388 | ) | | | - | | | | - | |

| Swap termination payment | | | - | | | | (982 | ) | | | (983 | ) | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) financing activities | | | 13,484 | | | | 22,775 | | | | 112,929 | | | | 62,092 | | | | 100,922 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net decreases in cash and cash equivalents | | | (1,193 | ) | | | (39,332 | ) | | | (44,400 | ) | | | 40,809 | | | | (1,840 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 23,813 | | | | 68,213 | | | | 68,213 | | | | 27,404 | | | | 29,244 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 22,620 | | | $ | 28,881 | | | $ | 23,813 | | | $ | 68,213 | | | $ | 27,404 | |

| |  | Property Net Operating Income (NOI):

with Same Store comparison

(in thousands) |

| | | Net Operating Income (NOI)* | |

| (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Rentable | | | | | | | | | Six Months | | | | | | | | | Six Months | | | | | | | |

| | Square Feet | | | Three Months Ended: | | | Ended | | | Three Months Ended: | | | Ended | | | Inc | | | % | |

| Region | | or RSF | | | 31-Mar-12 | | | 30-Jun-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Jun-11 | | | (Dec) | | | Change | |

| East | | | 1,181 | | | $ | 3,479 | | | $ | 3,094 | | | $ | 6,573 | | | $ | 3,019 | | | $ | 2,735 | | | $ | 5,754 | | | $ | 819 | | | | 14.2% | |

| MidWest | | | 1,699 | | | | 4,034 | | | | 3,983 | | | | 8,017 | | | | 4,438 | | | | 4,012 | | | | 8,450 | | | | (433 | ) | | | -5.1% | |

| South | | | 2,089 | | | | 6,901 | | | | 6,725 | | | | 13,626 | | | | 5,886 | | | | 6,756 | | | | 12,642 | | | | 984 | | | | 7.8% | |

| West | | | 1,089 | | | | 2,278 | | | | 2,443 | | | | 4,721 | | | | 1,718 | | | | 2,293 | | | | 4,011 | | | | 710 | | | | 17.7% | |

| Same Store | | | 6,058 | | | | 16,692 | | | | 16,245 | | | | 32,937 | | | | 15,061 | | | | 15,796 | | | | 30,857 | | | | 2,080 | | | | 6.7% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | | 994 | | | | 4,901 | | | | 4,868 | | | | 9,769 | | | | 807 | | | | 3,513 | | | | 4,320 | | | | 5,449 | | | | | |

| Dispositions | | | - | | | | - | | | | - | | | | - | | | | 495 | | | | 133 | | | | 628 | | | | (628 | ) | | | | |

| Property NOI | | | 7,052 | | | $ | 21,593 | | | $ | 21,113 | | | $ | 42,706 | | | $ | 16,363 | | | $ | 19,442 | | | $ | 35,805 | | | $ | 6,901 | | | | 6.7% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store | | | | | | $ | 16,692 | | | $ | 16,245 | | | $ | 32,937 | | | $ | 15,061 | | | $ | 15,796 | | | $ | 30,857 | | | $ | 2,080 | | | | 6.7% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nonrecurring | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Items in NOI (a) | | | | | | | 599 | | | | 20 | | | | 619 | | | | 1 | | | | - | | | | 1 | | | | 618 | | | | 2.0% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comparative | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store | | | | | | $ | 16,093 | | | $ | 16,225 | | | $ | 32,318 | | | $ | 15,060 | | | $ | 15,796 | | | $ | 30,856 | | | $ | 1,462 | | | | 4.7% | |

| | | | | | | | | | | |

| (a) Nonrecurring Items in NOI include proceeds from bankruptcies, termination fees or other significant nonrecurring |

| income or expenses, which may affect comparability. | | | | | | |

| | | | | | | | | | | |

| *Excludes NOI from investments in and interest income from secured loans to non-consolidated REITs. | | |

| See page 27 for a reconciliation and definition of Net Income to Property NOI GAAP. | | | |

| |  | Capital Analysis

(in thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | | | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | |

| Market Data: | | | | | | | | | | | | | | | | | | |

| Shares Outstanding | | | 82,937 | | | | 82,937 | | | | 81,437 | | | | 81,437 | | | | 82,937 | | | | 82,937 | |

| Closing market price per share | | $ | 10.60 | | | $ | 10.58 | | | $ | 14.07 | | | $ | 12.91 | | | $ | 11.31 | | | $ | 9.95 | |

| Market capitalization | | $ | 879,136 | | | $ | 877,478 | | | $ | 1,145,824 | | | $ | 1,051,357 | | | $ | 938,022 | | | $ | 825,227 | |

| Total Debt | | | 494,000 | | | | 494,000 | | | | 404,000 | | | | 345,000 | | | | 375,000 | | | | 449,000 | |

| Total Market Capitalization | | $ | 1,373,136 | | | $ | 1,371,478 | | | $ | 1,549,824 | | | $ | 1,396,357 | | | $ | 1,313,022 | | | $ | 1,274,227 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total dividends paid | | $ | 15,758 | | | $ | 15,758 | | | $ | 15,473 | | | $ | 15,473 | | | $ | 15,473 | | | $ | 15,758 | |

| Common dividend per share | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | |

| Quarterly dividend as a % of FFO* | | | 80.5% | | | | 82.6% | | | | 95% | | | | 76% | | | | 95% | | | | 86% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liquidity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 29,283 | | | $ | 22,620 | | | $ | 49,488 | | | $ | 28,881 | | | $ | 44,047 | | | $ | 23,813 | |

| Revolving credit facilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross potential available under current credit facilities | | | 600,000 | | | | 600,000 | | | | 500,000 | | | | 600,000 | | | | 600,000 | | | | 600,000 | |

| Less: | | | | | | | | | | | | | | | | | | | | | | | | |

| Outstanding balance | | | (494,000 | ) | | | (494,000 | ) | | | (404,000 | ) | | | (345,000 | ) | | | (375,000 | ) | | | (449,000 | ) |

| Total Liquidity | | $ | 135,283 | | | $ | 128,620 | | | $ | 145,488 | | | $ | 283,881 | | | $ | 269,047 | | | $ | 174,813 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| *See page 23 for a reconciliation of Net Income to FFO and page 24 for a definition of FFO |

| |  | Portfolio Overview |

| | 30-Jun-12 | 31-Mar-12 | 31-Dec-11 | 30-Sep-11 | 30-Jun-11 |

| Owned portfolio of commercial real estate: | | | | | |

| Number of properties | 36 | 36 | 36 | 35 | 34 |

| Square feet | 7,052,592 | 7,052,068 | 7,052,068 | 6,929,891 | 6,747,815 |

| Leased percentage | 90% | 89% | 89% | 88% | 87% |

| | | | | | |

| Investments in non-consolidated commercial real estate: | | | | | |

| Number of properties | 3 | 3 | 3 | 3 | 3 |

| Square feet | 2,003,968 | 2,004,953 | 2,001,542 | 1,998,575 | 1,996,457 |

| Leased percentage | 89% | 90% | 87% | 83% | 82% |

| | | | | | |

| Single Asset REITs (SARs) managed: | | | | | |

| Number of properties | 13 | 13 | 13 | 13 | 13 |

| Square feet | 3,322,589 | 3,322,570 | 3,322,639 | 3,322,638 | 3,322,569 |

| Leased percentage | 85% | 84% | 80% | 80% | 79% |

| | | | | | |

| Total owned, investments and managed properties: | | | | | |

| Number of properties | 52 | 52 | 52 | 51 | 50 |

| Square feet | 12,379,149 | 12,379,591 | 12,376,249 | 12,251,104 | 12,066,841 |

| Leased percentage | 89% | 88% | 86% | 85% | 84% |

| |  | Regional Analysis and Map |

| Owned: | | | | |

| Name | City | State | Region | Square Feet |

| Park Seneca | Charlotte | NC | East | 109,550 |

| Forest Park | Charlotte | NC | East | 62,212 |

| Emperor Boulevard | Durham | NC | East | 259,531 |

| Meadow Point | Chantilly | VA | East | 138,537 |

| Stonecroft | Chantilly | VA | East | 111,469 |

| Innsbrook | Glen Allen | VA | East | 298,456 |

| East Baltimore | Baltimore | MD | East | 325,445 |

| Loudoun Tech Center | Dulles | VA | East | 135,888 |

| Southfield Centre | Southfield | MI | MidWest | 214,697 |

| Northwest Point | Elk Grove Village | IL | MidWest | 176,848 |

| 909 Davis | Evanston | IL | MidWest | 195,245 |

| River Crossing | Indianapolis | IN | MidWest | 205,059 |

| Timberlake | Chesterfield | MO | MidWest | 232,766 |

| Timberlake East | Chesterfield | MO | MidWest | 116,197 |

| Lakeside Crossing | Maryland Heights | MO | MidWest | 127,778 |

| Eden Bluff | Eden Prairie | MN | MidWest | 153,028 |

| 121 South 8th Street | Minneapolis | MN | MidWest | 472,712 |

| Blue Lagoon Drive | Miami | FL | South | 212,619 |

| One Overton Place | Atlanta | GA | South | 387,267 |

| Willow Bend Office Center | Plano | TX | South | 117,050 |

| Legacy Tennyson Center | Plano | TX | South | 202,600 |

| One Legacy Circle | Plano | TX | South | 214,110 |

| Park Ten | Houston | TX | South | 155,715 |

| Addison Circle | Addison | TX | South | 293,787 |

| Collins Crossing | Richardson | TX | South | 298,766 |

| East Renner Road | Richardson | TX | South | 122,300 |

| Eldridge Green | Houston | TX | South | 248,399 |

| Park Ten Phase II | Houston | TX | South | 156,746 |

| Liberty Plaza | Addison | TX | South | 218,934 |

| Centennial Technology Center | Colorado Springs | CO | West | 110,405 |

| 380 Interlocken | Broomfield | CO | West | 240,184 |

| Greenwood Plaza | Englewood | CO | West | 197,527 |

| 390 Interlocken | Broomfield | CO | West | 241,516 |

| Hillview Center | Milpitas | CA | West | 36,288 |

| Federal Way | Federal Way | WA | West | 117,010 |

| Montague Business Center | San Jose | CA | West | 145,951 |

| Total | | | | 7,052,592 |

| |

| Managed: | | | | |

| Name | City | State | Region | Square Feet |

| 1441 Main Street | Columbia | SC | East | 264,857 |

| 303 East Wacker Drive | Chicago | IL | MidWest | 844,953 |

| Monument Circle | Indianapolis | IN | MidWest | 213,609 |

| 505 Waterford | Plymouth | MN | MidWest | 256,367 |

| 50 South Tenth Street | Minneapolis | MN | MidWest | 498,768 |

| Grand Boulevard | Kansas City | MO | MidWest | 535,071 |

| Lakeside Crossing II | Maryland Heights | MO | MidWest | 116,000 |

| Centre Pointe V | West Chester | OH | MidWest | 135,936 |

| Union Centre | West Chester | OH | MidWest | 409,798 |

| Satellite Place | Duluth | GA | South | 134,785 |

| 5601 Executive Drive | Irving | TX | South | 152,121 |

| Galleria North | Dallas | TX | South | 379,518 |

| Energy Tower I | Houston | TX | South | 325,797 |

| Phoenix Tower | Houston | TX | South | 623,944 |

| Highland Place I | Centennial | CO | West | 139,142 |

| 385 Interlocken | Broomfield | CO | West | 295,891 |

| Total | | | | 5,326,557 |

| Properties by Division/Region |

| ($ in thousands) |

| | | | | | | | | | | | | | | | NBV (a) | | | | % Leased | |

| | | | # of Properties | | | | Square Feet | | | | % of Portfolio | | | | 30-Jun-12 | | | | 30-Jun-12 | |

| | | | | | | | | | | | | | | | | | | | | |

| Mideast Division | | | 8 | | | | 1,441,088 | | | | 20.4% | | | $ | 222,692 | | | | 88.8% | |

| East Region Total | | | 8 | | | | 1,441,088 | | | | 20.4% | | | | 222,692 | | | | 88.8% | |

| East North Central Division | | | 4 | | | | 791,849 | | | | 11.2% | | | | 99,828 | | | | 81.3% | |

| West North Central | | | 5 | | | | 1,102,481 | | | | 15.6% | | | | 105,764 | | | | 96.3% | |

| Midwest Region Total | | | 9 | | | | 1,894,330 | | | | 26.8% | | | | 205,592 | | | | 90.0% | |

| Southeast | | | 2 | | | | 599,886 | | | | 8.5% | | | | 117,176 | | | | 95.2% | |

| Southwest | | | 10 | | | | 2,028,407 | | | | 28.8% | | | | 291,915 | | | | 94.3% | |

| South Region Total | | | 12 | | | | 2,628,293 | | | | 37.3% | | | | 409,091 | | | | 94.5% | |

| Mountain | | | 4 | | | | 789,632 | | | | 11.2% | | | | 124,153 | | | | 81.1% | |

| Pacific | | | 3 | | | | 299,249 | | | | 4.3% | | | | 35,817 | | | | 79.3% | |

| West Region Total | | | 7 | | | | 1,088,881 | | | | 15.5% | | | | 159,970 | | | | 80.6% | |

| | | | | | | | | | | | | | | | | | | | | |

| Grand Total | | | 36 | | | | 7,052,592 | | | | 100.0% | | | $ | 997,345 | | | | 90.0% | |

| | | | | | | | | | | | | | | | | | | | | |

| (a) NBV is for real estate assets, excluding intangibles | | | | | | |

| |  | Owned Property List

(in thousands) |

| | | | | | | NBV (1) | % Leased |

| Region | Division | Name | City | State | S.F. | 30-Jun-12 | 30-Jun-12 |

| | | | | | | | |

| West | Pacific | Hillview Center | Milpitas | CA | 36 | $ 4,065 | 100.0% |

| West | Pacific | Montague | San Jose | CA | 146 | 17,650 | 100.0% |

| West | Mountain | 380 Interlocken | Broomfield | CO | 240 | 41,135 | 89.5% |

| West | Mountain | 390 Interlocken | Broomfield | CO | 242 | 41,260 | 97.2% |

| West | Mountain | Centennial Technology Center | Colorado Springs | CO | 110 | 11,417 | 85.4% |

| West | Mountain | Greenwood Plaza | Englewood | CO | 197 | 30,342 | 48.9% |

| South | Southeast | Blue Lagoon Drive | Miami | FL | 213 | 46,244 | 100.0% |

| South | Southeast | One Overton Place | Atlanta | GA | 387 | 70,932 | 92.6% |

| MidWest | East North Central | Northwest Point | Elk Grove Village | IL | 177 | 27,494 | 100.0% |

| MidWest | East North Central | 909 Davis | Evanston | IL | 195 | 22,790 | 94.8% |

| MidWest | East North Central | River Crossing | Indianapolis | IN | 205 | 34,886 | 96.1% |

| East | Mideast | East Baltimore | Baltimore | MD | 325 | 53,776 | 58.2% |

| MidWest | East North Central | Southfield Centre | Southfield | MI | 215 | 14,659 | 39.6% |

| MidWest | West North Central | Eden Bluff | Eden Prairie | MN | 153 | 14,001 | 100.0% |

| MidWest | West North Central | 121 South 8th Street | Minneapolis | MN | 473 | 24,813 | 95.6% |

| MidWest | West North Central | Timberlake | Chesterfield | MO | 233 | 33,402 | 93.2% |

| MidWest | West North Central | Timberlake East | Chesterfield | MO | 116 | 16,941 | 97.0% |

| MidWest | West North Central | Lakeside Crossing | Maryland Heights | MO | 128 | 16,606 | 100.0% |

| East | Mideast | Park Seneca | Charlotte | NC | 110 | 7,240 | 81.5% |

| East | Mideast | Forest Park | Charlotte | NC | 62 | 5,968 | 100.0% |

| East | Mideast | Emperor Boulevard | Durham | NC | 259 | 54,626 | 100.0% |

| South | Southwest | Addison Circle | Addison | TX | 294 | 45,464 | 95.8% |

| South | Southwest | Liberty Plaza | Addison | TX | 219 | 23,826 | 84.1% |

| South | Southwest | Park Ten | Houston | TX | 156 | 18,794 | 96.1% |

| South | Southwest | Eldridge Green | Houston | TX | 248 | 41,744 | 100.0% |

| South | Southwest | Park Ten Phase II | Houston | TX | 157 | 29,882 | 100.0% |

| South | Southwest | Willow Bend Office Center | Plano | TX | 117 | 18,343 | 77.8% |

| South | Southwest | Legacy Tennyson Center | Plano | TX | 203 | 24,377 | 100.0% |

| South | Southwest | One Legacy Circle | Plano | TX | 214 | 38,842 | 100.0% |

| South | Southwest | Collins Crossing | Richardson | TX | 299 | 42,736 | 87.8% |

| South | Southwest | East Renner Road | Richardson | TX | 122 | 7,907 | 100.0% |

| East | Mideast | Meadow Point | Chantilly | VA | 139 | 22,340 | 100.0% |

| East | Mideast | Stonecroft | Chantilly | VA | 111 | 18,719 | 100.0% |

| East | Mideast | Loudoun Tech Center | Dulles | VA | 136 | 16,906 | 100.0% |

| East | Mideast | Innsbrook | Glen Allen | VA | 298 | 43,116 | 98.3% |

| West | Pacific | Federal Way | Federal Way | WA | 117 | 14,102 | 47.0% |

| | | | | | 7,053 | $ 997,345 | 90.0% |

| | | (1) NBV is for real estate assets, excluding intangibles | | | | |

| |  | Properties with GAAP Rent per Square Foot |

| | | | | | | | | | | | | Weighted | | |

| | | | | | | | | | | | | Occupied | | Weighted |

| | | | | | | Year Built | | | | Weighted | | Percentage as of | | Average GAAP |

| | | | | | | or | | Net Rentable | | Occupied | | December 31, | | Rent per Occupied |

| Property Name | | City | | State | | Renovated | | Square Feet | | Sq. Ft. | | 2011 (a) | | Square Feet (b) |

| | | | | | | | | | | | | | | |

| Park Seneca | | Charlotte | | NC | | 1969 | | 109,550 | | 87,300 | | 79.7% | | $ 15.58 |

| Forest Park | | Charlotte | | NC | | 1999 | | 62,212 | | 48,239 | | 77.5% | | 15.53 |

| Meadow Point | | Chantilly | | VA | | 1999 | | 138,537 | | 137,817 | | 99.5% | | 26.23 |

| Innsbrook | | Glen Allen | | VA | | 1999 | | 298,456 | | 149,944 | | 50.2% | | 20.82 |

| East Baltimore | | Baltimore | | MD | | 1989 | | 325,445 | | 204,445 | | 62.8% | | 27.43 |

| Loudoun Tech Center | | Dulles | | VA | | 1999 | | 135,888 | | 135,888 | | 100.0% | | 15.58 |

| Stonecroft | | Chantilly | | VA | | 2008 | | 111,469 | | 111,469 | | 100.0% | | 37.40 |

| Emperor Boulevard | | Durham | | NC | | 2009 | | 259,531 | | 259,531 | | 100.0% | | 34.58 |

| East total | | | | | | | | 1,441,088 | | 1,134,633 | | 78.7% | | 26.19 |

| Southfield Centre | | Southfield | | MI | | 1977 | | 214,697 | | 97,215 | | 45.3% | | 11.83 |

| Northwest Point | | Elk Grove Village | | IL | | 1999 | | 176,848 | | 176,848 | | 100.0% | | 19.38 |

| 909 Davis Street | | Evanston | | IL | | 2002 | | 195,245 | | 185,131 | | 94.8% | | 33.84 |

| River Crossing | | Indianapolis | | IN | | 1998 | | 205,059 | | 191,833 | | 93.6% | | 23.75 |

| Timberlake | | Chesterfield | | MO | | 1999 | | 232,766 | | 227,296 | | 97.7% | | 21.33 |

| Timberlake East | | Chesterfield | | MO | | 2000 | | 116,197 | | 109,365 | | 94.1% | | 23.74 |

| Lakeside Crossing | | St. Louis | | MO | | 2008 | | 127,778 | | 127,778 | | 100.0% | | 23.68 |

| Eden Bluff | | Eden Praire | | MN | | 2006 | | 153,028 | | 153,028 | | 100.0% | | 27.21 |

| 121 South 8th Street | | Minneapolis | | MN | | 1974 | | 472,616 | | 419,021 | | 88.7% | | 15.64 |

| Midwest total | | | | | | | | 1,894,234 | | 1,687,515 | | 89.1% | | 21.68 |

| Blue Lagoon Drive | | Miami | | FL | | 2002 | | 212,619 | | 212,619 | | 100.0% | | 22.03 |

| One Overton Place | | Atlanta | | GA | | 2002 | | 387,267 | | 352,916 | | 91.1% | | 21.19 |

| Willow Bend Office Center | | Plano | | TX | | 1999 | | 116,622 | | 74,801 | | 64.1% | | 20.23 |

| Park Ten | | Houston | | TX | | 1999 | | 155,715 | | 108,533 | | 69.7% | | 28.67 |

| Addison Circle | | Addison | | TX | | 1999 | | 293,787 | | 281,507 | | 95.8% | | 25.16 |

| Collins Crossing | | Richardson | | TX | | 1999 | | 298,766 | | 217,830 | | 72.9% | | 24.37 |

| Eldridge Green | | Houston | | TX | | 1999 | | 248,399 | | 248,399 | | 100.0% | | 27.20 |

| Park Ten Phase II | | Houston | | TX | | 2006 | | 156,746 | | 156,746 | | 100.0% | | 28.75 |

| Liberty Plaza | | Addison | | TX | | 1985 | | 218,934 | | 156,516 | | 71.5% | | 20.91 |

| Denbury Park | | Plano | | TX | | 1999/2008 | | 202,600 | | 202,600 | | 100.0% | | 17.03 |

| One Legacy Circle | | Plano | | TX | | 2008 | | 214,110 | | 198,608 | | 92.8% | | 33.10 |

| East Renner Road | | Richardson | | TX | | 1999 | | 122,300 | | 122,300 | | 100.0% | | 10.00 |

| South Total | | | | | | | | 2,627,865 | | 2,333,376 | | 88.8% | | 23.56 |

| Centennial Technology Center | | Colorado Springs | | CO | | 1999 | | 110,405 | | 73,817 | | 66.9% | | 16.39 |

| 380 Interlocken | | Broomfield | | CO | | 2000 | | 240,184 | | 204,349 | | 85.1% | | 27.64 |

| Greenwood Plaza | | Englewood | | CO | | 2000 | | 197,527 | | 92,383 | | 46.8% | | 18.68 |

| 390 Interlocken | | Broomfield | | CO | | 2002 | | 241,516 | | 215,456 | | 89.2% | | 29.24 |

| Hillview Center | | Milpitas | | CA | | 1984 | | 36,288 | | 36,288 | | 100.0% | | 14.19 |

| Federal Way | | Federal Way | | WA | | 1982 | | 117,010 | | 43,773 | | 37.4% | | 18.94 |

| Montague Business Center | | San Jose | | CA | | 1982 | | 145,951 | | 145,951 | | 100.0% | | 15.45 |

| West Total | | | | | | | | 1,088,881 | | 812,018 | | 74.6% | | 22.76 |

| | | | | | | | | | | | | | | |

| Grand Total | | | | | | | | 7,052,068 | | 5,967,542 | | 84.6% | | $ 23.42 |

| | | | | | | | | | | | | | | |

| (a) Based on weighted occupied square feet for the year ended December 31, 2011, including month-to-month tenants, divided by the Property's net rentable square footage |

| (b) Represents GAAP rental revenue for year ended December 2011 per weighted occupied square foot. |

| |  | Owned Property Capital Expenditures

(in thousands) |

| | | | | | | | | Six Months | | | | | | | |

| | | For the Three Months Ended: | | | Ended | | | | | | | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 30-Jun-12 | | | | | | | |

| Tenant improvements | | $ | 3,014 | | | $ | 2,705 | | | $ | 5,719 | | | | | | | | | |

| Deferred leasing costs | | | 2,196 | | | | 1,343 | | | | 3,539 | | | | | | | | | |

| Building improvements | | | 746 | | | | 1,003 | | | | 1,749 | | | | | | | | | |

| Total | | $ | 5,956 | | | $ | 5,051 | | | $ | 11,007 | | | | | | | | | |

| | | | | | | | | | | | | | | Year | |

| | | | | | For the Three Months Ended | | | | | | Ended | |

| | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | 31-Dec-11 | |

| Tenant improvements | | $ | 2,506 | | | $ | 3,215 | | | $ | 5,092 | | | $ | 8,219 | | | $ | 19,032 | |

| Deferred leasing costs | | | 2,819 | | | | 2,567 | | | | 1,324 | | | | 1,348 | | | | 8,058 | |

| Building improvements | | | 449 | | | | 876 | | | | 754 | | | | 747 | | | | 2,826 | |

| Total | | $ | 5,774 | | | $ | 6,658 | | | $ | 7,170 | | | $ | 10,314 | | | $ | 29,916 | |

| | | | | | | | | | | | | | | Year | |

| | | | | | For the Three Months Ended | | | | | | Ended | |

| | | 31-Mar-10 | | | 30-Jun-10 | | | 29-Sep-10 | | | 31-Dec-10 | | | 31-Dec-10 | |

| Tenant improvements | | $ | 1,305 | | | $ | 935 | | | $ | 3,634 | | | $ | 1,126 | | | $ | 7,000 | |

| Deferred leasing costs | | | 5,566 | | | | 1,519 | | | | 808 | | | | 2,622 | | | | 10,515 | |

| Building improvements | | | 380 | | | | 498 | | | | 671 | | | | 1,053 | | | | 2,602 | |

| Total | | $ | 7,251 | | | $ | 2,952 | | | $ | 5,113 | | | $ | 4,801 | | | $ | 20,117 | |

| | | | | | | | | | | | | | | Year | |

| | | | | | For the Three Months Ended | | | | | | Ended | |

| | | 31-Mar-09 | | | 30-Jun-09 | | | 30-Sep-09 | | | 31-Dec-09 | | | 31-Dec-09 | |

| Tenant improvements | | $ | 1,373 | | | $ | 912 | | | $ | 931 | | | $ | 1,528 | | | $ | 4,744 | |

| Deferred leasing costs | | | 162 | | | | 1,395 | | | | 645 | | | | 457 | | | | 2,659 | |

| Building improvements | | | 466 | | | | 116 | | | | 265 | | | | 619 | | | | 1,466 | |

| Total | | $ | 2,001 | | | $ | 2,423 | | | $ | 1,841 | | | $ | 2,604 | | | $ | 8,869 | |

| |  | 20 Largest Tenants with Annualized Rent and

Remaining Term at June 30, 2012 |

| | | | Remaining | Aggregate | % of Aggregate | Annualized | % of Aggregate |

| | Tenant | Number of | Lease Term | Leased | Leased | Rent | Leased |

| | Name | Leases | in Months | Square Feet | Square Feet | (in 000's) | Annualized Rent |

| | | | | | | | |

| 1 | TCF National Bank (a) | 1 | 6, 42 | 268,984 | 3.81% | $ 2,903,475 | 2.12% |

| 2 | Quintiles Transnational Corp. | 1 | 81 | 259,531 | 3.68% | 8,279,077 | 6.04% |

| 3 | CITGO Petroleum Corporation | 1 | 116 | 248,399 | 3.52% | 7,363,001 | 5.37% |

| 4 | Burger King Corporation | 1 | 75 | 212,619 | 3.01% | 4,465,755 | 3.26% |

| 5 | Denbury Onshore, LLC | 1 | 49 | 202,600 | 2.87% | 3,510,042 | 2.56% |

| 6 | RGA Reinsurance Company | 1 | 30 | 185,501 | 2.63% | 3,803,069 | 2.77% |

| 7 | SunTrust Bank | 2 | 52, 111 | 182,888 | 2.59% | 2,856,446 | 2.08% |

| 8 | Citicorp Credit Services, Inc | 1 | 54 | 176,848 | 2.51% | 3,511,335 | 2.56% |

| 9 | C.H. Robinson Worldwide, Inc | 1 | 108 | 153,028 | 2.17% | 4,064,622 | 2.96% |

| 10 | Houghton Mifflin Harcourt Publishing Company | 1 | 57 | 150,050 | 2.13% | 5,696,915 | 4.15% |

| 11 | Murphy Exploration & Production Company | 1 | 58 | 144,677 | 2.05% | 4,017,514 | 2.93% |

| 12 | Giesecke & Devrient America, Inc. | 1 | 32 | 135,888 | 1.93% | 1,842,083 | 1.34% |

| 13 | Monsanto Company | 1 | 31 | 127,778 | 1.81% | 3,308,333 | 2.41% |

| 14 | AT&T Services, Inc. | 1 | 72 | 122,300 | 1.73% | 958,812 | 0.70% |

| 15 | Vail Holdings, Inc. | 2 | 81, 129 | 122,232 | 1.73% | 3,366,724 | 2.45% |

| 16 | Northrop Grumman Systems Corporation | 1 | 70 | 111,469 | 1.58% | 4,260,211 | 3.11% |

| 17 | Argo Data Resource Corporation | 1 | 71 | 109,990 | 1.56% | 2,690,829 | 1.96% |

| 18 | Alliance Data Systems | 1 | 95, 108 | 96,749 | 1.37% | 2,890,424 | 2.11% |

| 19 | Federal National Mortgage Association | 1 | 14 | 92,358 | 1.31% | 1,863,613 | 1.36% |

| 20 | County of Santa Clara | 1 | 102 | 90,467 | 1.28% | 1,399,304 | 1.02% |

| | | | | | | | |

| | | | Total | 3,194,356 | 45.29% | $ 73,051,584 | 53.25% |

| | | | | | | | |

| | | | | | | | |

| (a) Tenant to contract by 5,141 sf of December 31, 2012. |

| |  | Tenant Analysis – 20 Largest Tenants Industry Profile

(as a % of square feet at June 30, 2012) |

| |  | Lease Expirations by Square Feet |

| Year | | Total

Square Feet | | % of Square

Feet

Commercial |

| | | | | |

| 2012 | | 155,148 | | 2.2% |

| 2013 | | 450,290 | | 6.4% |

| 2014 | | 415,284 | | 5.9% |

| 2015 | | 812,702 | | 11.5% |

| 2016 | | 921,681 | | 13.1% |

| 2017 | | 756,940 | | 10.7% |

| 2018 | | 721,612 | | 10.2% |

| 2019 | | 720,848 | | 10.2% |

| 2020 | | 181,879 | | 2.6% |

| 2021 | | 590,748 | | 8.4% |

| 2022 | | 475,730 | | 6.7% |

| 2023 | | 144,640 | | 2.1% |

| Vacant | | 705,090 | | 10.0% |

| | | | | |

| Total | | 7,052,592 | | 100.0% |

| |  | Lease Expirations

with Annualized Rent per Square Foot |

| | | | Rentable | | | | Annualized | | Percentage |

| | Number of | | Square | | | | Rent | | of Total Final |

| Year of | Leases | | Footage | | Annualized | | Per Square | | Annualized |

| Lease | Expiring | | Subject to | | Rent Under | | Foot Under | | Rent Under |

| Expiration | Within the | | Expiring | | Expiring | | Expiring | | Expiring |

| June 30, | Year | | Leases | | Leases (a) | | Leases | | Leases |

| 2012 | 80 | (b) | | 155,148 | | $ 2,954,911 | | $ 19.05 | | 2.2% |

| 2013 | 53 | | | 450,290 | | 10,148,904 | | 22.54 | | 7.4% |

| 2014 | 45 | | | 415,284 | | 7,649,361 | | 18.42 | | 5.6% |

| 2015 | 44 | | | 812,702 | | 17,027,468 | | 20.95 | | 12.4% |

| 2016 | 40 | | | 921,681 | | 17,817,791 | | 19.33 | | 13.0% |

| 2017 | 32 | | | 756,940 | | 18,977,692 | | 25.07 | | 13.8% |

| 2018 | 17 | | | 721,612 | | 15,731,269 | | 21.80 | | 11.5% |

| 2019 | 15 | | | 720,848 | | 17,006,355 | | 23.59 | | 12.4% |

| 2020 | 9 | | | 181,879 | | 4,291,352 | | 23.59 | | 3.1% |

| 2021 and thereafter | 45 | | | 1,211,118 | | 25,574,060 | | 21.12 | | 18.6% |

| | 380 | | | 6,347,502 | | $ 137,179,163 | | $ 21.61 | | 100.0% |

| Vacancies as of 6/30/12 | | | 705,090 | | | | | | |

| Total Portfolio Square Footage | | | 7,052,592 | | | | | | |

(a) Annualized rent represents the monthly rent, including tenant reimbursements, for each lease in effect at June 30, 2012 mulitplied by 12. Tenant reimbursements generally include payment of real estate taxes, operating expenses and common area maintenance and utility charges.

(b) 51 leases are Month to Month

| |  | Percentage of Leased Space by Property |

| | | | | | | Second | | Third | | Fourth | | First | | Second |

| | | | | | % Leased (1) | Quarter | % Leased (1) | Quarter | % Leased (1) | Quarter | % Leased (1) | Quarter | % Leased (1) | Quarter |

| | | | | Square | as of | Average % | as of | Average % | as of | Average % | as of | Average % | as of | Average % |

| | | Property Name | Location | Feet | 30-Jun-11 | Leased (2) | 30-Sep-11 | Leased (2) | 31-Dec-11 | Leased (2) | 31-Mar-12 | Leased (2) | 30-Jun-12 | Leased (2) |

| | | | | | | | | | | | | | | |

| 1 | | PARK SENECA | Charlotte, NC | 109,550 | 80.1% | 79.1% | 80.9% | 80.5% | 80.6% | 80.6% | 80.5% | 79.9% | 81.5% | 80.9% |

| 2 | | HILLVIEW CENTER | Milpitas, CA | 36,288 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 3 | | SOUTHFIELD | Southfield, MI | 214,697 | 39.2% | 41.7% | 39.2% | 39.2% | 39.2% | 39.2% | 39.2% | 39.2% | 39.6% | 38.5% |

| 4 | | FOREST PARK | Charlotte, NC | 62,212 | 100.0% | 85.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 5 | | CENTENNIAL | Colorado Springs, CO | 110,405 | 66.9% | 66.9% | 66.9% | 66.9% | 85.4% | 73.0% | 85.4% | 85.4% | 85.4% | 85.4% |

| 6 | | MEADOW POINT | Chantilly, VA | 138,537 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 7 | | TIMBERLAKE | Chesterfield, MO | 232,766 | 97.7% | 97.7% | 97.7% | 97.7% | 97.7% | 97.7% | 97.7% | 97.7% | 93.2% | 96.2% |

| 8 | | FEDERAL WAY | Federal Way, WA | 117,010 | 42.0% | 42.0% | 42.0% | 42.0% | 47.0% | 44.3% | 47.0% | 47.0% | 47.0% | 47.0% |

| 9 | | NORTHWEST POINT | Elk Grove Village, IL | 176,848 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 10 | | TIMBERLAKE EAST | Chesterfield, MO | 116,197 | 100.0% | 100.0% | 85.9% | 90.6% | 85.9% | 85.9% | 85.9% | 85.9% | 97.0% | 89.6% |

| 11 | | PARK TEN | Houston, TX | 155,715 | 98.8% | 98.8% | 98.8% | 98.8% | 81.2% | 81.2% | 81.2% | 81.2% | 96.1% | 91.1% |

| 12 | | MONTAGUE | San Jose, CA | 145,951 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 13 | | ADDISON | Addison, TX | 293,787 | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% | 95.8% |

| 14 | | COLLINS CROSSING | Richardson, TX | 298,766 | 79.7% | 79.3% | 88.4% | 88.4% | 88.4% | 88.4% | 87.8% | 87.8% | 87.8% | 87.8% |

| 15 | | GREENWOOD PLAZA | Englewood, CO | 197,527 | 54.3% | 58.2% | 54.3% | 54.3% | 48.9% | 48.4% | 48.9% | 48.9% | 48.9% | 48.9% |

| 16 | | RIVER CROSSING | Indianapolis, IN | 205,059 | 93.5% | 93.4% | 93.5% | 93.5% | 93.5% | 93.5% | 93.9% | 93.1% | 96.1% | 94.6% |

| 17 | | LIBERTY PLAZA | Addison, TX | 218,934 | 75.6% | 75.6% | 68.6% | 68.0% | 77.9% | 74.8% | 76.4% | 77.4% | 84.1% | 78.9% |

| 18 | | INNSBROOK | Glen Allen, VA | 298,456 | 63.7% | 67.3% | 86.8% | 78.8% | 98.3% | 90.7% | 98.3% | 98.3% | 98.3% | 98.3% |

| 19 | | 380 INTERLOCKEN | Broomfield, CO | 240,184 | 85.1% | 85.1% | 85.1% | 85.1% | 85.1% | 85.1% | 89.5% | 86.5% | 89.5% | 89.5% |

| 20 | | BLUE LAGOON | Miami, FLA | 212,619 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 21 | | ELDRIDGE GREEN | Houston, TX | 248,399 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 22 | | WILLOW BEND | Plano, TX | 117,050 | 83.1% | 76.8% | 83.1% | 83.1% | 83.1% | 83.1% | 77.4% | 77.4% | 77.8% | 77.8% |

| 23 | | ONE OVERTON PARK | Atlanta, GA | 387,267 | 91.1% | 91.5% | 90.4% | 90.6% | 89.3% | 90.0% | 91.7% | 90.9% | 92.6% | 92.3% |

| 24 | | 390 INTERLOCKEN | Broomfield, CO | 241,516 | 95.9% | 95.9% | 96.6% | 96.9% | 93.4% | 94.3% | 96.4% | 94.6% | 97.2% | 96.9% |

| 25 | | EAST BALTIMORE | Baltimore, MD | 325,445 | 55.7% | 55.5% | 55.7% | 55.7% | 55.7% | 55.7% | 56.2% | 55.9% | 58.2% | 57.5% |

| 26 | | PARK TEN PHASE II | Houston, TX | 156,746 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 27 | | LAKESIDE CROSSING I | Maryland Heights, MO | 127,778 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 28 | | LOUDOUN TECH | Dulles, VA | 135,888 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 29 | | 4807 STONECROFT | Chantilly, VA | 111,469 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 30 | | EDEN BLUFF | Eden Prairie, MN | 153,028 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 31 | | 121 SOUTH EIGHTH ST | Minneapolis, MN | 472,712 | 92.5% | 92.1% | 93.6% | 93.1% | 93.6% | 93.6% | 93.8% | 93.8% | 95.6% | 94.4% |

| 32 | | EMPEROR BOULEVARD | Durham, NC | 259,531 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 33 | | LEGACY TENNYSON CTR | Plano, TX | 202,600 | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 34 | | ONE LEGACY | Plano, TX | 214,110 | 100.0% | 94.6% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| 35 | | 909 DAVIS | Evanston, IL | 195,245 | n/a | n/a | 94.8% | 94.8% | 94.8% | 94.8% | 94.8% | 94.8% | 94.8% | 94.8% |

| 36 | | 1410 EAST RENNER | Richardson, TX | 122,300 | n/a | n/a | n/a | n/a | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| | | | | | | | | | | | | | | |

| | | TOTAL WEIGHTED AVERAGE (3) | 7,052,592 | 86.9% | 86.9% | 88.1% | 87.7% | 88.7% | 88.1% | 89.0% | 88.8% | 90.0% | 89.5% |

(1) % Leased as of month's end includes all leases that expire on the last day of the quarter.

(2) Average quarterly percentage is the average of the end of the month leased percentage for each of the 3 months during the quarter.

(3) 2011 Second Quarter Totals include Bollman Place (98,745 sf) located Maryland, which sold in June 2011.

| |  | Capital Recycling

($ in thousands) |

| Recent Acquisitions: | | | | | | | | | | | | |

| | | State/Region | | Property Type | | Square Feet | | Date Acquired | | Purchase Price | | |

| | | | | | | | | | | | | |

| 2011 | | | | | | | | | | | | |

| Emperor Boulevard | | NC/East | | Office | | 259,531 | | 3/4/11 | | $ 75,800 | | |

| Legacy Tennyson Center | | TX/South | | Office | | 202,600 | | 3/10/11 | | 37,000 | | |

| One Legacy Circle | | TX/South | | Office | | 214,110 | | 3/24/11 | | 52,983 | | |

| 909 Davis | | IL/Midwest | | Office | | 195,245 | | 9/30/11 | | 37,062 | | |

| East Renner Road | | TX/South | | Office | | 122,300 | | 10/6/11 | | 11,282 | | |

| | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | |

| 121 South 8th Street | | MN/Midwest | | Office | | 474,646 | | 6/29/10 | | 39,405 | | |

| | | | | | | | | | | | | |

| 2009 | | | | | | | | | | | | |

| Stonecroft-Chantilly | | VA/East | | Office | | 111,469 | | 6/26/09 | | 29,000 | | |

| Eden Bluff - Eden Prairie | | MN/Midwest | | Office | | 153,028 | | 6/30/09 | | 22,784 | | |

| Fairview | | VA/East | | Office | | 252,613 | | 9/30/09 | | 73,000 | | |

| | | | | | | | | | | | | |

| 2008 | | | | | | | | | | | | |

| Park Ten Phase II | | TX/South | | Office | | 156,746 | | 5/15/08 | | 35,079 | | |

| Lakeside Crossing | | MO/Midwest | | Office | | 127,778 | | 12/11/08 | | 20,003 | | |

| Loudoun Tech Center | | VA/East | | Office | | 135,888 | | 12/23/08 | | 18,628 | | |

| | | | | | | | | | | | | |

| 2007 | | | | | | | | | | | | |

| East Baltimore | | MD/East | | Office | | 325,298 | | 6/13/07 | | 63,592 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Recent Dispositions: | | | | | | | | | | | | |

| | | | | | | | | | | Net Sales | | Gain (Loss) |

| | | State/Region | | Property Type | | Square Feet | | Date Sold | | Proceeds | | on Sale |

| 2011 | | | | | | | | | | | | |

| Fairview | | VA/East | | Office | | 252,613 | | 1/21/11 | | $ 89,382 | | $ 19,592 |

| Bollman | | MD/East | | Industrial | | 98,745 | | 6/24/11 | | 7,408 | | 2,346 |

| | | | | | | | | | | | | |

| 2007 | | | | | | | | | | | | |

| Piedmont Center | | SC/East | | Office | | 144,029 | | 1/31/07 | | 5,830 | | (4,849) |

| Royal Ridge | | GA/South | | Office | | 161,366 | | 6/21/07 | | 32,535 | | 6,601 |

| Goldentop Technology Center | | CA/West | | Office | | 141,405 | | 6/27/07 | | 36,199 | | 14,741 |

| Lyberty Way | | MA/East | | Office | | 104,711 | | 7/16/07 | | 10,861 | | 1,942 |

| Austin N.W. (Canyon Hills) | | TX/South | | Office | | 68,533 | | 12/20/07 | | 10,429 | | 257 |

| |  | FFO Reconciliation

(in thousands, except per share amounts) |

| | | For the Three Months Ended: | | | For the Year Ended: | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,738 | | | $ | 5,434 | | | $ | 24,767 | | | $ | 10,381 | | | $ | 3,314 | | | $ | 5,062 | | | $ | 43,524 | | | $ | 22,093 | | | $ | 27,872 | | | $ | 24,572 | |

| Less gain on sale of assets | | | — | | | | — | | | | (19,593 | ) | | | (2,346 | ) | | | — | | | | — | | | | (21,939 | ) | | | — | | | | (424 | ) | | | — | |

| GAAP income from non-consolidated REITs | | | (391 | ) | | | (494 | ) | | | (1,773 | ) | | | (1,166 | ) | | | (573 | ) | | | (978 | ) | | | (4,490 | ) | | | (1,190 | ) | | | (2,012 | ) | | | (1,953 | ) |

| Distributions from non-consolidated REITs | | | 929 | | | | 898 | | | | 1,767 | | | | 1,215 | | | | 1,104 | | | | 970 | | | | 5,056 | | | | 5,170 | | | | 5,628 | | | | 4,802 | |

| Depreciation & amortization | | | 13,295 | | | | 13,203 | | | | 10,812 | | | | 12,047 | | | | 12,332 | | | | 13,248 | | | | 48,439 | | | | 40,724 | | | | 39,652 | | | | 26,146 | |

| NAREIT FFO | | | 19,571 | | | | 19,041 | | | | 15,980 | | | | 20,131 | | | | 16,177 | | | | 18,302 | | | | 70,590 | | | | 66,797 | | | | 70,716 | | | | 53,567 | |

| Acquisition costs | | | — | | | | — | | | | 269 | | | | 9 | | | | 185 | | | | 157 | | | | 620 | | | | 125 | | | | 643 | | | | — | |

| Funds From Operations (FFO) | | $ | 19,571 | | | $ | 19,041 | | | $ | 16,249 | | | $ | 20,140 | | | $ | 16,362 | | | $ | 18,459 | | | $ | 71,210 | | | $ | 66,922 | | | $ | 71,359 | | | $ | 53,567 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.30 | | | $ | 0.13 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.55 | | | $ | 0.28 | | | $ | 0.38 | | | $ | 0.35 | |

| FFO | | | 0.24 | | | | 0.23 | | | | 0.20 | | | | 0.25 | | | | 0.20 | | | | 0.23 | | | | 0.89 | | | | 0.84 | | | | 0.98 | | | | 0.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Shares (basic and diluted) | | | 82,937 | | | | 82,937 | | | | 81,437 | | | | 81,437 | | | | 81,600 | | | | 81,600 | | | | 79,826 | | | | 79,826 | | | | 73,001 | | | | 70,481 | |

| |  | FFO Definition |

Definition of Funds From Operations (“FFO”)

The Company evaluates performance based on Funds From Operations, which we refer to as FFO, as management believes that FFO represents the most accurate measure of activity and is the basis for distributions paid to equity holders. The Company defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and acquisition costs of newly acquired properties that are not capitalized, plus depreciation and amortization, including amortization of acquired above and below market lease intangibles and impairment charges, and after adjustments to exclude non-cash income (or losses) from non-consolidated or Sponsored REITs, plus distributions received from non-consolidated or Sponsored REITs.

FFO should not be considered as an alternative to net income (determined in accordance with GAAP), nor as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs.

Other real estate companies and the National Association of Real Estate Investment Trusts, or NAREIT, may define this term in a different manner. We have included the NAREIT FFO definition in our table and note that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of the results of the Company, FFO should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

| |  | Funds Available for Distribution (FAD)

Reconciliation and Definition

(in thousands, except per share amounts) |

| | | For the Three Months Ended: | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | 31-Mar-10 | | | 30-Jun-10 | | | 30-Sep-10 | | | 31-Dec-10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,738 | | | $ | 5,434 | | | $ | 24,767 | | | $ | 10,381 | | | $ | 3,314 | | | $ | 5,062 | | | $ | 5,562 | | | $ | 5,954 | | | $ | 4,757 | | | $ | 5,820 | |

| (Gain) Loss on sale of assets | | | — | | | | — | | | | (19,593 | ) | | | (2,346 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| GAAP income from non-consolidated REITs | | | (391 | ) | | | (494 | ) | | | (1,773 | ) | | | (1,166 | ) | | | (573 | ) | | | (978 | ) | | | (253 | ) | | | (380 | ) | | | (404 | ) | | | (153 | ) |

| Distributions from non-consolidated REITs | | | 929 | | | | 898 | | | | 1,767 | | | | 1,215 | | | | 1,104 | | | | 970 | | | | 1,407 | | | | 1,324 | | | | 1,192 | | | | 1,247 | |

| Acquisition costs | | | — | | | | — | | | | 269 | | | | 9 | | | | 185 | | | | 157 | | | | — | | | | 129 | | | | (4 | ) | | | — | |

| Depreciation & amortization | | | 13,295 | | | | 13,203 | | | | 10,812 | | | | 12,047 | | | | 12,332 | | | | 13,248 | | | | 9,934 | | | | 9,675 | | | | 10,510 | | | | 10,605 | |

| Funds From Operations (FFO) | | $ | 19,571 | | | $ | 19,041 | | | $ | 16,249 | | | $ | 20,140 | | | $ | 16,362 | | | $ | 18,459 | | | $ | 16,650 | | | $ | 16,702 | | | $ | 16,051 | | | $ | 17,519 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Funds Available for Distribution: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Funds From Operations (FFO) | | | 19,571 | | | | 19,041 | | | | 16,249 | | | | 20,140 | | | | 16,362 | | | | 18,459 | | | | 16,650 | | | | 16,702 | | | | 16,051 | | | | 17,519 | |

| Straight-line rent | | | (1,516 | ) | | | (1,054 | ) | | | (2,303 | ) | | | (2,873 | ) | | | (2,228 | ) | | | (2,474 | ) | | | (1,018 | ) | | | (740 | ) | | | (1,203 | ) | | | (1,288 | ) |

| Capital expenditures | | | (746 | ) | | | (1,003 | ) | | | (449 | ) | | | (876 | ) | | | (754 | ) | | | (747 | ) | | | (380 | ) | | | (498 | ) | | | (671 | ) | | | (1,053 | ) |

| Funds Available for Distribution (FAD) | | $ | 17,309 | | | $ | 16,984 | | | $ | 13,497 | | | $ | 16,391 | | | $ | 13,380 | | | $ | 15,238 | | | $ | 15,252 | | | $ | 15,464 | | | $ | 14,177 | | | $ | 15,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.30 | | | $ | 0.13 | | | $ | 0.04 | | | $ | 0.06 | | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.06 | | | $ | 0.07 | |

| FFO | | | 0.24 | | | | 0.23 | | | | 0.20 | | | | 0.25 | | | | 0.20 | | | | 0.22 | | | | 0.21 | | | | 0.21 | | | | 0.20 | | | | 0.22 | |

| FAD | | | 0.21 | | | | 0.20 | | | | 0.17 | | | | 0.20 | | | | 0.16 | | | | 0.18 | | | | 0.19 | | | | 0.19 | | | | 0.18 | | | | 0.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Shares (basic and diluted) | | | 82,937 | | | | 82,937 | | | | 81,437 | | | | 81,437 | | | | 81,600 | | | | 82,937 | | | | 79,681 | | | | 79,681 | | | | 79,751 | | | | 80,187 | |

The Company defines FAD as the sum of (1) FFO, (2) less the effect of straight-line rent, (3) less recurring capital expenditures that are generally for maintenance of properties and are not recovered through rental income from tenants, and (4) plus non-cash compensation expenses, if any. FAD should not be considered as an alternative to net income (determined in accordance with GAAP), as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs. Other real estate companies may define this term in a different manner. We believe that in order to facilitate a clear understanding of the results of the Company, FAD should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

| |  | EBITDA Reconciliation and Definition

(in thousands, except ratio amounts) |

| | | For the three | | | | | | | | | | | | | | | Year Ended | | | | | | | | | | | | | | | Year Ended | |

| | | months ended: | | | For the three months ended: | | | 31-Dec-11 | | | For the three months ended: | | | 31-Dec-10 | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 31-Mar-11 | | | 30-Jun-11 | | | 30-Sep-11 | | | 31-Dec-11 | | | | | | 31-Mar-10 | | | 30-Jun-10 | | | 30-Sep-10 | | | 31-Dec-10 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 5,738 | | | $ | 5,434 | | | $ | 24,767 | | | $ | 10,381 | | | $ | 3,314 | | | $ | 5,062 | | | $ | 43,524 | | | $ | 5,562 | | | $ | 5,954 | | | $ | 4,757 | | | $ | 5,820 | | | $ | 22,093 | |

| Interest expense | | | 3,677 | | | | 4,037 | | | | 2,408 | | | | 3,578 | | | | 3,419 | | | | 3,261 | | | | 12,666 | | | | 1,652 | | | | 1,735 | | | | 1,892 | | | | 2,004 | | | | 7,283 | |

| Depreciation and amortization | | | 13,295 | | | | 13,203 | | | | 10,812 | | | | 12,047 | | | | 12,332 | | | | 13,248 | | | | 48,439 | | | | 9,934 | | | | 9,675 | | | | 10,510 | | | | 10,605 | | | | 40,724 | |

| Income taxes | | | 79 | | | | 77 | | | | 50 | | | | 68 | | | | 67 | | | | 82 | | | | 267 | | | | (68 | ) | | | 5 | | | | (37 | ) | | | 317 | | | | 217 | |

| EBITDA | | | 22,789 | | | | 22,751 | | | | 38,037 | | | | 26,074 | | | | 19,132 | | | | 21,653 | | | | 104,896 | | | | 17,080 | | | | 17,369 | | | | 17,122 | | | | 18,746 | | | | 70,317 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | $ | 3,677 | | | $ | 4,037 | | | $ | 2,408 | | | $ | 3,578 | | | $ | 3,419 | | | $ | 3,261 | | | $ | 12,666 | | | $ | 1,652 | | | $ | 1,735 | | | $ | 1,892 | | | $ | 2,004 | | | $ | 7,283 | |

| Scheduled principal payments (1) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 150 | | | | 150 | |

| Interest and scheduled principal payments | | $ | 3,677 | | | $ | 4,037 | | | $ | 2,408 | | | $ | 3,578 | | | $ | 3,419 | | | $ | 3,261 | | | $ | 12,666 | | | $ | 1,652 | | | $ | 1,735 | | | $ | 1,892 | | | $ | 2,154 | | | $ | 7,433 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest coverage ratio | | | 6.20 | | | | 5.64 | | | | 15.80 | | | | 7.29 | | | | 5.60 | | | | 6.64 | | | | 8.28 | | | | 10.34 | | | | 10.01 | | | | 9.05 | | | | 9.35 | | | | 9.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt service coverage ratio | | | 6.20 | | | | 5.64 | | | | 15.80 | | | | 7.29 | | | | 5.60 | | | | 6.64 | | | | 8.28 | | | | 10.34 | | | | 10.01 | | | | 9.05 | | | | 8.70 | | | | 9.46 | |

EBITDA, a non-GAAP financial measure, is defined as net income, plus interest expense, income tax expense and depreciation and amortization expense. EBITDA is not intended to represent cash flow for the period, is not presented as an alternative to operating income as an indicator of operating performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP and is not indicative of operating income or cash provided by operating activities as determined under GAAP. EBITDA is presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA the same way, this presentation of EBITDA may not be comparable to similarly titled measures of other companies. The Company believes that net income is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to EBITDA.

| |  | Reconciliation of Net Income to Property NOI

and Definition

(in thousands) |

| | | Three Months Ended | | | Three Months Ended | | | 2011 | | | Three Months Ended | | | 2010 | |