Exhibit 99.2

| | Supplemental Operating

and Financial Data First Quarter 2014 |

Franklin Street Properties Corp. ● 401 Edgewater Place ● Wakefield, MA 01880 ● (781) 557-1300

www.franklinstreetproperties.com

| |  | Table of Contents |

| | Page | | | Page |

| | | | | |

| Company Overview | 3 | | Tenant Analysis and Leasing Activity | |

| | | | 20 Largest Tenants, Industry Profile | 18 |

| Key Financial Data | | | 20 Largest Tenants with Annualized Rent and Remaining Term | 19 |

| Financial Highlights | 4 | | Leasing Activity | 20 |

| Income Statements | 5 | | Lease Expirations by Square Feet | 21 |

| Balance Sheets | 6 | | Lease Expirations with Annualized Rent per Square Foot | 22 |

| Cash Flow Statements | 7 | | Capital Expenditures | 23 |

| Property Net Operating Income (NOI) | 8 | | | |

| | | | Transaction Activity | 24 |

| Reconciliation | | | | |

| FFO & AFFO | 9 | | Loan Portfolio of Secured Real Estate | 25 |

| EBITDA | 10 | | | |

| Property NOI | 11 | | Net Asset Value Components | 26 |

| | | | | |

| Debt Summary | 12 | | Appendix: Definitions of Non-GAAP Measures | |

| | | | FFO | 27 |

| Capital Analysis | 13 | | EBITDA and AFFO | 28 |

| | | | NOI | 29 |

| Owned and Managed Portfolio Overview | 14-17 | | | |

All financial information contained in this supplemental information package is unaudited. In addition, certain statements contained in this supplemental information package may be deemed to be forward-looking statements within the meaning of the federal securities laws. Although FSP believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Factors that could cause actual results to differ materially from FSP’s current expectations include general economic conditions, uncertainties relating to fiscal policy, changes in government regulations, regulatory uncertainty, geopolitical events, local real estate conditions, the performance of properties that FSP has acquired or may acquire, the timely lease-up of properties and other risks, detailed from time to time in FSP’s SEC reports. FSP assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

| |  | Company Overview |

Overview

Franklin Street Properties Corp. (“FSP”, “we”, “our” or the “Company”) (NYSE MKT: FSP) is investing in institutional-quality office properties in the U.S. FSP’s strategy is to invest in select urban infill and central business district (CBD) properties, with primary emphasis on our top five markets of Atlanta, Dallas, Denver, Houston, and Minneapolis. FSP seeks value-oriented investments with an eye towards long-term growth and appreciation, as well as current income. FSP is a Maryland corporation that operates in a manner intended to qualify as a real estate investment trust (REIT) for federal income tax purposes. FSP’s real estate operations include property acquisitions and dispositions, short-term financing, leasing, development and asset management. FSP’s subsidiary, FSP Investments LLC (member, FINRA and SIPC), is a real estate investment banking firm and registered broker/dealer that previously sponsored the organization of single-purpose entities that own real estate and the private placement of equity in those entities, which we refer to as “Sponsored REITs”.

Our Business

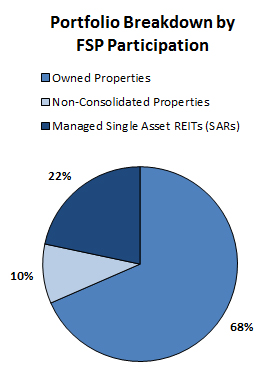

As of March 31, 2014, the Company owned and operated a portfolio of real estate consisting of 39 properties, managed 14 Sponsored REITs and held six promissory notes secured by mortgages on real estate owned by Sponsored REITs. From time-to-time, the Company may acquire real estate, make additional secured loans or acquire one of its Sponsored REITs. The Company may also pursue, on a selective basis, the sale of its properties in order to take advantage of the value creation and demand for its properties, or for geographic or property specific reasons.

| Management Team | | |

| | | |

| George J. Carter | | Scott H. Carter |

| President, Chief Executive Officer | | Executive Vice President, General |

| Chairman of the Board | | Counsel and Assistant Secretary |

| | | |

| Barbara J. Fournier | | Jeffrey B. Carter |

| Executive Vice President, Chief Operating Officer, | | Executive Vice President and |

| Treasurer, Secretary and Director | | Chief Investment Officer |

| | | |

| Janet Notopoulos | | John G. Demeritt |

| Executive Vice President and Director | | Executive Vice President and |

| | | Chief Financial Officer |

| Snapshot (as of March 31, 2014) | |

| Corporate Headquarters | Wakefield, MA |

| Fiscal Year-End | 31-Dec |

| Total Properties | 39 |

| Total Square Feet | 9.7 Million |

| Trading Symbol | FSP |

| Exchange | NYSE MKT |

| Common Shares Outstanding | 100,187,405 |

| Quarterly Dividend | $0.19 |

| Dividend Yield | 6.0% |

| Total Market Capitalization | $2.2 Billion |

| Insider Holdings | 10.2% |

| |  | Summary of Financial Highlights

(in thousands, except per share data) |

| (in thousands except per share amounts, SF & number of properties) | | For the Three Months Ended | |

| | | 31-Mar-14 | | | 31-Dec-13 | | | 30-Sep-13 | | | 30-Jun-13 | | | 31-Mar-13 | |

| Income Items: | | | | | | | | | | | | | | | | | | | | |

| Rental revenue | | $ | 61,597 | | | $ | 61,307 | | | $ | 56,760 | | | $ | 46,017 | | | $ | 42,842 | |

| Total revenue | | | 63,263 | | | | 63,024 | | | | 58,446 | | | | 47,671 | | | | 44,495 | |

| Adjusted EBITDA* | | | 35,186 | | | | 35,645 | | | | 31,862 | | | | 26,074 | | | | 24,712 | |

| Equity in earnings in non-consolidated REITs | | | (484 | ) | | | (543 | ) | | | (431 | ) | | | (196 | ) | | | (188 | ) |

| Net income | | | 3,573 | | | | 6,591 | | | | 4,094 | | | | 4,741 | | | | 4,401 | |

| FFO* | | | 28,779 | | | | 29,220 | | | | 27,566 | | | | 22,810 | | | | 21,237 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.04 | | | $ | 0.07 | | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.05 | |

| FFO* | | $ | 0.29 | | | $ | 0.29 | | | $ | 0.28 | | | $ | 0.25 | | | $ | 0.26 | |

| Weighted Average Shares (diluted) | | | 100,187 | | | | 100,187 | | | | 100,187 | | | | 91,847 | | | | 82,937 | |

| Closing share price | | $ | 12.60 | | | $ | 11.95 | | | $ | 12.74 | | | $ | 13.20 | | | $ | 14.62 | |

| Dividend | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | |

| Payout Ratio: | | | 66% | | | | 66% | | | | 69% | | | | 77% | | | | 74% | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Items: | | | | | | | | | | | | | | | | | | | | |

| Real estate, net | | $ | 1,558,136 | | | $ | 1,568,338 | | | $ | 1,575,690 | | | $ | 1,280,252 | | | $ | 1,128,398 | |

| Other assets, net | | | 467,539 | | | | 475,696 | | | | 500,939 | | | | 428,789 | | | | 383,244 | |

| Total assets, net | | | 2,025,675 | | | | 2,044,034 | | | | 2,076,629 | | | | 1,709,041 | | | | 1,511,642 | |

| Total liabilities, net | | | 993,273 | | | | 993,868 | | | | 1,017,480 | | | | 627,997 | | | | 657,809 | |

| Shareholders' equity | | | 1,032,402 | | | | 1,050,166 | | | | 1,059,149 | | | | 1,081,044 | | | | 853,833 | |

| | | | | | | | | | | | | | | | | | | | | |

| Market Capitalization and Debt: | | | | | | | | | | | | | | | | | | | | |

| Total Market Capitalization (a) | | $ | 2,198,861 | | | $ | 2,123,739 | | | $ | 2,227,888 | | | $ | 1,903,974 | | | $ | 1,834,295 | |

| Total debt outstanding | | | 936,500 | | | | 926,500 | | | | 951,500 | | | | 581,500 | | | | 621,750 | |

| Debt to Total Market Capitalization | | | 42.6% | | | | 43.6% | | | | 42.7% | | | | 30.5% | | | | 33.9% | |

| Debt to Adjusted EBITDA | | | 6.7 | | | | 6.5 | | | | 7.5 | | | | 5.6 | | | | 6.3 | |

| | | | | | | | | | | | | | | | | | | | | |

| Owned Portfolio Leasing Statistics: | | | | | | | | | | | | | | | | | | | | |

| Owned portfolio assets (includes asset held for sale before 12/31/13) | | | 39 | | | | 39 | | | | 40 | | | | 38 | | | | 37 | |

| Portfolio total SF | | | 9,686,055 | | | | 9,685,285 | | | | 9,807,339 | | | | 8,529,752 | | | | 7,856,859 | |

| Portfolio % leased | | | 94.5% | | | | 94.1% | | | | 93.8% | | | | 94.4% | | | | 94.4% | |

(a) Total Market Capitalization is the closing share price multilplied by the number of shares outstanding plus total debt outstanding on that date.

* See pages 9 & 10 for reconciliations of Net Income to FFO and Adjusted EBITDA, respectively, and the Appendix for Defintions of these Non-GAAP Measures beginning on page 27.

| |  | Condensed Consolidated Income Statements

($ in thousands, except per share amounts) |

| | | Three | | | | | | | | | | | | | | | For the | |

| | | Months Ended | | | For the Three Months Ended | | | Year Ended | |

| | | 31-Mar-14 | | | 31-Mar-13 | | | 30-Jun-13 | | | 30-Sep-13 | | | 31-Dec-13 | | | 31-Dec-13 | |

| | | | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

| Rental | | $ | 61,597 | | | $ | 42,842 | | | $ | 46,017 | | | $ | 56,760 | | | $ | 61,307 | | | $ | 206,926 | |

| Related party revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

| Management fees and interest income from loans | | | 1,643 | | | | 1,622 | | | | 1,642 | | | | 1,665 | | | | 1,717 | | | | 6,646 | |

| Other | | | 23 | | | | 31 | | | | 12 | | | | 21 | | | | — | | | | 64 | |

| Total revenue | | | 63,263 | | | | 44,495 | | | | 47,671 | | | | 58,446 | | | | 63,024 | | | | 213,636 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Real estate operating expenses | | | 15,071 | | | | 10,770 | | | | 11,116 | | | | 13,991 | | | | 15,223 | | | | 51,100 | |

| Real estate taxes and insurance | | | 9,251 | | | | 6,595 | | | | 7,308 | | | | 8,801 | | | | 8,912 | | | | 31,616 | |

| Depreciation and amortization | | | 24,300 | | | | 15,781 | | | | 16,919 | | | | 22,163 | | | | 23,976 | | | | 78,839 | |

| Selling, general and administrative | | | 3,272 | | | | 2,532 | | | | 3,204 | | | | 3,477 | | | | 2,698 | | | | 11,911 | |

| Interest | | | 7,176 | | | | 4,208 | | | | 4,174 | | | | 5,474 | | | | 7,198 | | | | 21,054 | |

| Total expenses | | | 59,070 | | | | 39,886 | | | | 42,721 | | | | 53,906 | | | | 58,007 | | | | 194,520 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before interest income, equity in earnings of non-consolidated REITs and taxes | | | 4,193 | | | | 4,609 | | | | 4,950 | | | | 4,540 | | | | 5,017 | | | | 19,116 | |

| Interest income | | | 1 | | | | 1 | | | | 4 | | | | 5 | | | | 6 | | | | 16 | |

| Equity in losses of non-consolidated REITs | | | (484 | ) | | | (188 | ) | | | (196 | ) | | | (431 | ) | | | (543 | ) | | | (1,358 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income before taxes on income | | | 3,710 | | | | 4,422 | | | | 4,758 | | | | 4,114 | | | | 4,480 | | | | 17,774 | |

| Income tax expense | | | 137 | | | | 119 | | | | 115 | | | | 118 | | | | 128 | | | | 480 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 3,573 | | | | 4,303 | | | | 4,643 | | | | 3,996 | | | | 4,352 | | | | 17,294 | |

| Income from discontinued operations | | | — | | | | 98 | | | | 98 | | | | 98 | | | | 81 | | | | 375 | |

| Gain (loss) on sale, less applicable income tax | | | — | | | | — | | | | — | | | | — | | | | 2,158 | | | | 2,158 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 3,573 | | | $ | 4,401 | | | $ | 4,741 | | | $ | 4,094 | | | $ | 6,591 | | | $ | 19,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding,basic and diluted | | | 100,187 | | | | 82,937 | | | | 91,847 | | | | 100,187 | | | | 100,187 | | | | 93,855 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings per share, basic and diluted, attributable to: | | | | | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.04 | | | $ | 0.18 | |

| Discontinued operations | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Gain (loss) on sale, less applicable income tax | | | — | | | | — | | | | — | | | | — | | | | 0.03 | | | | 0.03 | |

| Net income per share, basic and diluted | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.07 | | | $ | 0.21 | |

| |  | Condensed Consolidated Balance Sheets

(in thousands) |

| | | March 31, | | | March 31, | | | June 30, | | | September 30, | | | December 31, | |

| | | 2014 | | | 2013 | | | 2013 | | | 2013 | | | 2013 | |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| Real estate assets: | | | | | | | | | | | | | | | | | | | | |

| Land | | $ | 185,479 | | | $ | 141,545 | | | $ | 157,879 | | | $ | 185,479 | | | $ | 185,479 | |

| Buildings and improvements | | | 1,605,808 | | | | 1,175,743 | | | | 1,320,703 | | | | 1,599,519 | | | | 1,603,941 | |

| Fixtures and equipment | | | 1,296 | | | | 904 | | | | 960 | | | | 985 | | | | 1,170 | |

| | | | 1,792,583 | | | | 1,318,192 | | | | 1,479,542 | | | | 1,785,983 | | | | 1,790,590 | |

| Less accumulated depreciation | | | 234,447 | | | | 189,794 | | | | 199,290 | | | | 210,293 | | | | 222,252 | |

| Real estate assets, net | | | 1,558,136 | | | | 1,128,398 | | | | 1,280,252 | | | | 1,575,690 | | | | 1,568,338 | |

| | | | | | | | | | | | | | | | | | | | | |

| Acquired real estate leases, net | | | 172,262 | | | | 102,274 | | | | 129,226 | | | | 194,893 | | | | 183,454 | |

| Investment in non-consolidated REITs | | | 79,983 | | | | 81,746 | | | | 81,523 | | | | 81,065 | | | | 80,494 | |

| Assets held for sale | | | — | | | | 10,431 | | | | 10,286 | | | | 10,143 | | | | — | |

| Cash and cash equivalents | | | 20,031 | | | | 17,282 | | | | 24,962 | | | | 25,539 | | | | 19,623 | |

| Restricted cash | | | 688 | | | | 583 | | | | 602 | | | | 623 | | | | 643 | |

| Tenant rent receivables, net | | | 6,035 | | | | 2,357 | | | | 2,331 | | | | 6,029 | | | | 5,102 | |

| Straight-line rent receivable, net | | | 44,392 | | | | 36,210 | | | | 37,865 | | | | 40,086 | | | | 42,261 | |

| Prepaid expenses and other assets | | | 9,954 | | | | 10,545 | | | | 12,532 | | | | 11,846 | | | | 11,215 | |

| Related party mortgage loan receivable | | | 101,916 | | | | 96,896 | | | | 97,846 | | | | 98,846 | | | | 99,746 | |

| Other assets: derivative asset | | | 4,801 | | | | — | | | | 6,739 | | | | 4,365 | | | | 5,321 | |

| Deferred leasing commissions, net | | | 27,477 | | | | 24,920 | | | | 24,877 | | | | 27,504 | | | | 27,837 | |

| Total assets | | $ | 2,025,675 | | | $ | 1,511,642 | | | $ | 1,709,041 | | | $ | 2,076,629 | | | $ | 2,044,034 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Bank note payable | | $ | 316,500 | | | $ | 221,750 | | | $ | 181,500 | | | $ | 331,500 | | | $ | 306,500 | |

| Term loan payable | | | 620,000 | | | | 400,000 | | | | 400,000 | | | | 620,000 | | | | 620,000 | |

| Accounts payable and accrued expenses | | | 34,390 | | | | 25,493 | | | | 29,971 | | | | 39,907 | | | | 44,137 | |

| Accrued compensation | | | 1,027 | | | | 540 | | | | 1,677 | | | | 2,432 | | | | 2,985 | |

| Tenant security deposits | | | 4,258 | | | | 2,474 | | | | 3,074 | | | | 3,891 | | | | 4,027 | |

| Other liabilities: derivative termination value | | | 3,825 | | | | 778 | | | | — | | | | 4,579 | | | | 2,044 | |

| Acquired unfavorable real estate leases, net | | | 13,273 | | | | 6,774 | | | | 11,775 | | | | 15,171 | | | | 14,175 | |

| Total liabilities | | | 993,273 | | | | 657,809 | | | | 627,997 | | | | 1,017,480 | | | | 993,868 | |

| | | | | | | | | | | | | | | | | | | | | |

| Commitments and contingencies | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | |

| Preferred stock | | | — | | | | — | | | | — | | | | — | | | | — | |

| Common stock | | | 10 | | | | 8 | | | | 10 | | | | 10 | | | | 10 | |

| Additional paid-in capital | | | 1,273,556 | | | | 1,042,876 | | | | 1,273,585 | | | | 1,273,585 | | | | 1,273,556 | |

| Accumulated other comprehensive income (loss) | | | 976 | | | | (778 | ) | | | 6,739 | | | | (214 | ) | | | 3,277 | |

| Accumulated distributions in excess of accumulated earnings | | | (242,140 | ) | | | (188,273 | ) | | | (199,290 | ) | | | (214,232 | ) | | | (226,677 | ) |

| Total stockholders’ equity | | | 1,032,402 | | | | 853,833 | | | | 1,081,044 | | | | 1,059,149 | | | | 1,050,166 | |

| Total liabilities and stockholders’ equity | | $ | 2,025,675 | | | $ | 1,511,642 | | | $ | 1,709,041 | | | $ | 2,076,629 | | | $ | 2,044,034 | |

| |  | Condensed Consolidated Statements of Cash Flows

(in thousands) |

| | | Three Months ended

March 31, | | | Twelve Months ended

December 31 | |

| | | 2014 | | | 2013 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | |

| Cash flows from operating activities: | | | | | | | | | | | | | | | | |

| Net income | | $ | 3,573 | | | $ | 4,401 | | | $ | 19,827 | | | $ | 7,633 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | |

| Depreciation and amortization expense | | | 24,797 | | | | 16,415 | | | | 81,267 | | | | 57,500 | |

| Amortization of above market lease | | | (11 | ) | | | (3 | ) | | | (365 | ) | | | 71 | |

| Gain (loss) on sale, less applicable income tax | | | — | | | | — | | | | (2,158 | ) | | | 14,826 | |

| Equity in earnings (losses) from non-consolidated REITs | | | 484 | | | | 188 | | | | 1,358 | | | | (2,033 | ) |

| Distributions from non-consolidated REITs | | | — | | | | — | | | | — | | | | 705 | |

| Increase in bad debt reserve | | | — | | | | (1,190 | ) | | | (1,250 | ) | | | 65 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | |

| Restricted cash | | | (45 | ) | | | (8 | ) | | | (68 | ) | | | (82 | ) |

| Tenant rent receivables | | | (933 | ) | | | 582 | | | | (2,103 | ) | | | (354 | ) |

| Straight-line rents | | | (1,784 | ) | | | (657 | ) | | | (5,782 | ) | | | (4,464 | ) |

| Lease acquisition costs | | | (347 | ) | | | (189 | ) | | | (1,146 | ) | | | (2,520 | ) |

| Prepaid expenses and other assets | | | 800 | | | | 70 | | | | (1,547 | ) | | | (328 | ) |

| Accounts payable and accrued expenses | | | (7,257 | ) | | | (5,011 | ) | | | 11,137 | | | | 3,717 | |

| Accrued compensation | | | (1,958 | ) | | | (2,000 | ) | | | 445 | | | | 318 | |

| Tenant security deposits | | | 231 | | | | (15 | ) | | | 1,538 | | | | 481 | |

| Payment of deferred leasing commissions | | | (1,113 | ) | | | (2,624 | ) | | | (9,125 | ) | | | (5,179 | ) |

| | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 16,437 | | | | 9,959 | | | | 92,028 | | | | 70,356 | |

| | | | | | | | | | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | | | | | | | | | |

| Purchase of real estate assets, office computers and furniture, capitalized merger costs and acquired real estate leases | | | (4,850 | ) | | | (3,465 | ) | | | (574,065 | ) | | | (221,170 | ) |

| Investment in non-consolidated REITs | | | — | | | | 4,752 | | | | 4,858 | | | | (1 | ) |

| Distributions in excess of earnings from non-consolidated REITs | | | 27 | | | | 27 | | | | 108 | | | | 2,105 | |

| Investment in related party mortgage loan receivable | | | (2,170 | ) | | | (3,000 | ) | | | (8,200 | ) | | | (74,580 | ) |

| Repayment of related party mortgage loan receivable | | | — | | | | | | | | 2,350 | | | | 121,200 | |

| Changes in deposits on real estate assets | | | — | | | | (1,500 | ) | | | — | | | | — | |

| Proceeds received on sales of real estate assets | | | — | | | | — | | | | 12,301 | | | | 157 | |

| | | | | | | | | | | | | | | | | |

| Net cash used in investing activities | | | (6,993 | ) | | | (3,186 | ) | | | (562,648 | ) | | | (172,289 | ) |

| | | | | | | | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | | | | | | |

| Distributions to stockholders | | | (19,036 | ) | | | (15,758 | ) | | | (69,588 | ) | | | (63,032 | ) |

| Proceeds (costs) from equity offering, net | | | — | | | | — | | | | 230,682 | | | | — | |

| Borrowings under Revolver | | | 10,000 | | | | 5,000 | | | | 160,000 | | | | 294,750 | |

| Repayments under Revolver | | | — | | | | — | | | | (70,250 | ) | | | (527,000 | ) |

| Borrowing (repayment) of term loan payable, net | | | — | | | | — | | | | 220,000 | | | | 400,000 | |

| Deferred Financing Costs | | | — | | | | — | | | | (1,868 | ) | | | (5,331 | ) |

| | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) financing activities | | | (9,036 | ) | | | (10,758 | ) | | | 468,976 | | | | 99,387 | |

| | | | | | | | | | | | | | | | | |

| Net decreases in cash and cash equivalents | | | 408 | | | | (3,985 | ) | | | (1,644 | ) | | | (2,546 | ) |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 19,623 | | | | 21,267 | | | | 21,267 | | | | 23,813 | |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 20,031 | | | $ | 17,282 | | | $ | 19,623 | | | $ | 21,267 | |

| |  | Property Net Operating Income (NOI)*

with Same Store comparison

(in thousands) |

| (in thousands) | | | | | | | | | | | | | | | |

| | | Rentable | | | | | | | | | | | | | |

| | | Square Feet | | | Three Months Ended | | | Inc | | | % | |

| Region | | or RSF | | | 31-Mar-14 | | | 31-Mar-13 | | | (Dec) | | | Change | |

| East | | | 1,442 | | | $ | 4,727 | | | $ | 4,756 | | | $ | (29 | ) | | | -0.6% | |

| MidWest | | | 1,682 | | | | 5,107 | | | | 4,839 | | | | 268 | | | | 5.5% | |

| South | | | 3,523 | | | | 14,135 | | | | 13,227 | | | | 908 | | | | 6.9% | |

| West | | | 1,088 | | | | 2,567 | | | | 2,350 | | | | 217 | | | | 9.2% | |

| Same Store | | | 7,735 | | | | 26,536 | | | | 25,172 | | | | 1,364 | | | | 5.4% | |

| | | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | | 1,951 | | | | 10,037 | | | | — | | | | 10,037 | | | | 39.9% | |

| Property NOI from the continuing portfolio | | | 9,686 | | | | 36,573 | | | | 25,172 | | | | 11,401 | | | | 45.3% | |

| Dispositions and asset held for sale | | | | | | | — | | | | 252 | | | | (252 | ) | | | -1.4% | |

| Property NOI | | | | | | $ | 36,573 | | | $ | 25,424 | | | $ | 11,149 | | | | 43.9% | |

| | | | | | | | | | | | | | | | | | | | | |

| Same Store | | | | | | $ | 26,536 | | | $ | 25,172 | | | $ | 1,364 | | | | 5.4% | |

| | | | | | | | | | | | | | | | | | | | | |

| Nonrecurring Items in NOI (a) | | | | | | | 707 | | | | 63 | | | | 644 | | | | -2.6% | |

| | | | | | | | | | | | | | | | | | | | | |

| Comparative Same Store | | | | | | $ | 25,829 | | | $ | 25,109 | | | $ | 720 | | | | 2.9% | |

| (a) | Nonrecurring Items in NOI include proceeds from bankruptcies, lease termination fees or other significant nonrecurring income or expenses, which may affect comparability. |

| * | See page 11 for a reconciliation of Net Income to Property NOI and the Appendix for Definitions of Non-GAAP Measures beginning on page 27. Property NOI Excludes NOI from investments in and interest income from secured loans to non-consolidated REITs. |

| |  | FFO & AFFO Reconciliation

(in thousands, except per share amounts) |

| | | Three | | | | | | | | | | | | | | | For the | |

| | | Months Ended | | | For the Three Months Ended: | | | Year Ended | |

| | | 31-Mar-14 | | | 31-Mar-13 | | | 30-Jun-13 | | | 30-Sep-13 | | | 31-Dec-13 | | | 31-Dec-13 | |

| | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 3,573 | | | $ | 4,401 | | | $ | 4,741 | | | $ | 4,094 | | | $ | 6,591 | | | $ | 19,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain (loss) on sale, less applicable income tax | | | — | | | | — | | | | — | | | | — | | | | (2,158 | ) | | | (2,158 | ) |

| GAAP income from non-consolidated REITs | | | 484 | | | | 188 | | | | 196 | | | | 431 | | | | 543 | | | | 1,358 | |

| FFO from non-consolidated REITs | | | 419 | | | | 647 | | | | 696 | | | | 459 | | | | 346 | | | | 2,148 | |

| Depreciation & amortization | | | 24,289 | | | | 15,984 | | | | 17,044 | | | | 22,176 | | | | 23,886 | | | | 79,090 | |

| NAREIT FFO* | | | 28,765 | | | | 21,220 | | | | 22,677 | | | | 27,160 | | | | 29,208 | | | | 100,265 | |

| Acquisition costs | | | 14 | | | | 17 | | | | 133 | | | | 406 | | | | 12 | | | | 568 | |

| Funds From Operations (FFO)* | | $ | 28,779 | | | $ | 21,237 | | | $ | 22,810 | | | $ | 27,566 | | | $ | 29,220 | | | $ | 100,833 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Funds From Operations (AFFO)* | | | | | | | | | | | | | | | | | | | | | | | | |

| Funds From Operations (FFO)* | | | 28,779 | | | | 21,237 | | | | 22,810 | | | | 27,566 | | | | 29,220 | | | | 100,833 | |

| Reverse FFO from non-consolidated REITs | | | (419 | ) | | | (647 | ) | | | (696 | ) | | | (459 | ) | | | (346 | ) | | | (2,148 | ) |

| Distributions from non-consolidated REITs | | | 27 | | | | 27 | | | | 27 | | | | 27 | | | | 26 | | | | 107 | |

| Amortization of deferred financing costs | | | 499 | | | | 429 | | | | 429 | | | | 456 | | | | 499 | | | | 1,813 | |

| Straight-line rent | | | (1,783 | ) | | | (657 | ) | | | (1,186 | ) | | | (2,078 | ) | | | (1,862 | ) | | | (5,783 | ) |

| Building improvements | | | (1,119 | ) | | | (1,118 | ) | | | (1,622 | ) | | | (1,552 | ) | | | (1,479 | ) | | | (5,771 | ) |

| Tenant improvements | | | (1,133 | ) | | | (1,729 | ) | | | (5,754 | ) | | | (4,596 | ) | | | (2,992 | ) | | | (15,071 | ) |

| Leasing commissions | | | (1,112 | ) | | | (2,813 | ) | | | (1,087 | ) | | | (3,821 | ) | | | (1,536 | ) | | | (9,257 | ) |

| Adjusted Funds From Operations (AFFO)* | | $ | 23,739 | | | $ | 14,729 | | | $ | 12,921 | | | $ | 15,543 | | | $ | 21,530 | | | $ | 64,723 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.07 | | | $ | 0.21 | |

| FFO* | | | 0.29 | | | | 0.26 | | | | 0.25 | | | | 0.28 | | | | 0.29 | | | | 1.07 | |

| AFFO* | | | 0.24 | | | | 0.18 | | | | 0.14 | | | | 0.16 | | | | 0.21 | | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Shares (basic and diluted) | | | 100,187 | | | | 82,937 | | | | 91,847 | | | | 100,187 | | | | 100,187 | | | | 93,855 | |

* See the Appendix for Definitions of these Non-GAAP Measures beginning on page 27.

| |  | EBITDA Reconciliation

(in thousands, except ratio amounts) |

| | | Three | | | | | | | | | | | | | | | | |

| | | Months Ended | | | For the Three Months Ended | | | Year Ended | |

| | | 31-Mar-14 | | | 31-Mar-13 | | | 30-Jun-13 | | | 30-Sep-13 | | | 31-Dec-13 | | | 31-Dec-13 | |

| | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 3,573 | | | $ | 4,401 | | | $ | 4,741 | | | $ | 4,094 | | | $ | 6,591 | | | $ | 19,827 | |

| Interest expense | | | 7,176 | | | | 4,208 | | | | 4,174 | | | | 5,474 | | | | 7,198 | | | | 21,054 | |

| Depreciation and amortization | | | 24,300 | | | | 15,984 | | | | 17,044 | | | | 22,176 | | | | 23,886 | | | | 79,090 | |

| Income taxes | | | 137 | | | | 119 | | | | 115 | | | | 118 | | | | 128 | | | | 480 | |

| EBITDA | | | 35,186 | | | | 24,712 | | | | 26,074 | | | | 31,862 | | | | 37,803 | | | | 120,451 | |

| Excluding (gain) loss on sale, less applicable income tax | | | — | | | | — | | | | — | | | | — | | | | (2,158 | ) | | | (2,158 | ) |

| Adjusted EBITDA | | $ | 35,186 | | | $ | 24,712 | | | $ | 26,074 | | | $ | 31,862 | | | $ | 35,645 | | | $ | 118,293 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | $ | 7,176 | | | $ | 4,208 | | | $ | 4,174 | | | $ | 5,474 | | | $ | 7,198 | | | $ | 21,054 | |

| Scheduled principal payments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Interest and scheduled principal payments | | $ | 7,176 | | | $ | 4,208 | | | $ | 4,174 | | | $ | 5,474 | | | $ | 7,198 | | | $ | 21,054 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest coverage ratio | | | 4.90 | | | | 5.87 | | | | 6.25 | | | | 5.82 | | | | 4.95 | | | | 5.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt service coverage ratio | | | 4.90 | | | | 5.87 | | | | 6.25 | | | | 5.82 | | | | 4.95 | | | | 5.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt | | $ | 936,500 | | | $ | 621,750 | | | $ | 581,500 | | | $ | 951,500 | | | $ | 926,500 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | 35,186 | | | | 24,712 | | | | 26,074 | | | | 31,862 | | | | 35,645 | | | | | |

| Annualized | | | 140,744 | | | | 98,848 | | | | 104,296 | | | | 127,448 | | | | 142,580 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt-to-EBITDA | | | 6.7 | | | | 6.3 | | | | 5.6 | | | | 7.5 | | | | 6.5 | | | | | |

* See the Appendix for Definitions of these Non-GAAP Measures beginning on page 27. Amounts in the EBITDA reconciliation do not reflect our proportionate share of interest expense, depreciation, amortization , income taxes, gains or losses on sales and debt from our investments in non-consolidated REITs , which are accounted for under the equity method.

| |  | Reconciliation of Net Income to Property NOI*

(in thousands) |

| Reconciliation to Net income | | Three Months | |

| | | Ended | |

| | | 31-Mar-14 | | | 31-Mar-13 | |

| Net Income | | $ | 3,573 | | | $ | 4,401 | |

| Add (deduct): | | | | | | | | |

| Discontinued operations | | | — | | | | (98 | ) |

| Management fee income | | | (646 | ) | | | (559 | ) |

| Depreciation and amortization | | | 24,300 | | | | 15,784 | |

| Amortization of above/below market leases | | | (11 | ) | | | 48 | |

| Selling, general and administrative | | | 3,272 | | | | 2,532 | |

| Interest expense | | | 7,176 | | | | 4,208 | |

| Interest income | | | (1,410 | ) | | | (1,353 | ) |

| Equity in earnings of | | | | | | | | |

| nonconsolidated REITs | | | 484 | | | | 187 | |

| Non-property specific items, net | | | (165 | ) | | | 22 | |

| | | | | | | | | |

| Property NOI from the continuing portfolio | | $ | 36,573 | | | $ | 25,172 | |

| | | | | | | | | |

| Dispositions and asset held for sale | | | — | | | | 252 | |

| Property NOI | | $ | 36,573 | | | $ | 25,424 | |

* See the Appendix for Definition of Non-GAAP Measures beginning on page 27.

| |  | Debt Summary |

| | | | | | | | | | | (a) | | |

| (dollars in thousands) | | | | Maximum | | Amount | | Interest | | Interest | | |

| | | Maturity | | Amount | | Drawn at | | Rate | | Rate at | | Facility |

| | | Date | | of Loan | | 31-Mar-14 | | Components | | 31-Mar-14 | | Fee |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 2012 Revolver | | 27-Sep-16 | | $ 500,000 | | $ 316,500 | | L+1.45% | | 1.60% | | 0.30% |

| 2012 Term Loan | | 27-Sep-17 | | 400,000 | | 400,000 | | 0.75% + 1.45% | | 2.20% | | 0.30% |

| 2013 Term Loan | | 26-Aug-20 | | 220,000 | | 220,000 | | 2.32% + 1.65% | | 3.97% | | |

| | | | | | | | | | | | | |

| | | | | $ 1,120,000 | | $ 936,500 | | | | 2.41% | | |

(a) Interest rate excludes amortization of deferred financing costs and facility fees, see notes below

On August 26, 2013, we entered into a term loan we call the 2013 Term Loan and borrowed $220 million. On September 27, 2012, we entered into a new bank facility we call the 2012 Credit Facility for a total of $900 million, which is comprised of a line of credit that we can borrow up to $500 million on, which we call the 2012 Revolver and a term loan for $400 million that we call the 2012 Term Loan. Additional information about these loans are in the footnotes to our financial statements. Pricing is leverage based over LIBOR for the 2013 Term Loan and the 2012 Credit Facility. Each of these facilities also has the option to use the respective bank’s base rate.

| • | The 2013 Term Loan fixed LIBOR at 2.32% for seven years. The current leverage spread over LIBOR is 1.65%, so our interest rate is 3.97% as of March 31, 2014. |

| • | The 2012 Credit Facility has the 2012 Term Loan with LIBOR fixed at 0.75% for five years and the 2012 Revolver is at the LIBOR rate. The current leverage spread for the 2012 Credit Facility is 1.45%, so our interest rate is 2.20% as of March 31, 2014. |

| • | The total amount available under the 2012 Credit Facility is $900 million and is subject to a facility fee on the entire amount based on the leverage ratio. As of March 31, 2014 the facility fee was 30 bps based on our leverage ratio, or approximately $2.7 million per year. |

| • | We incurred financing costs to close the 2013 Term Loan, 2012 Credit Facility and the 2011 Revolver that preceded the 2012 Credit Facility. These costs are deferred and amortized into interest expense during the terms of the loans. The annual run rate for amortization to interest expense from deferred financing costs is approximately $2.0 million. |

| • | The 2012 Revolver can be extended for 1 year at the Company’s option upon payment of fees and includes an accordion feature that allows for up to $250 million of additional borrowing capacity. The 2013 Term Loan includes an accordion feature that allows for up to $50 million of additional borrowing capacity. The accordion features are subject to receipt of lender commitments and satisfaction of certain customary conditions. |

| |  | Capital Analysis

(in thousands, except per share amounts) |

| | | 31-Mar-14 | | | 31-Mar-13 | | | 30-Jun-13 | | | 30-Sep-13 | | | 31-Dec-13 | |

| Market Data: | | | | | | | | | | | | | | | |

| Shares Outstanding | | | 100,187 | | | | 82,937 | | | | 100,187 | | | | 100,187 | | | | 100,187 | |

| Closing market price per share | | $ | 12.60 | | | $ | 14.62 | | | $ | 13.20 | | | $ | 12.74 | | | $ | 11.95 | |

| Market capitalization | | $ | 1,262,361 | | | $ | 1,212,545 | | | $ | 1,322,474 | | | $ | 1,276,388 | | | $ | 1,197,239 | |

| Total Debt | | | 936,500 | | | | 621,750 | | | | 581,500 | | | | 951,500 | | | | 926,500 | |

| Total Market Capitalization | | $ | 2,198,861 | | | $ | 1,834,295 | | | $ | 1,903,974 | | | $ | 2,227,888 | | | $ | 2,123,739 | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividend Data: | | | | | | | | | | | | | | | | | | | | |

| Total dividends paid | | $ | 19,036 | | | $ | 15,758 | | | $ | 15,758 | | | $ | 19,036 | | | $ | 19,036 | |

| Common dividend per share | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.19 | |

| Quarterly dividend as a % of FFO* | | | 65.5% | | | | 73.1% | | | | 76.0% | | | | 67.9% | | | | 65.5% | |

| | | | | | | | | | | | | | | | | | | | | |

| Liquidity: | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 20,031 | | | $ | 17,282 | | | $ | 24,962 | | | $ | 25,539 | | | $ | 19,623 | |

| Revolving credit facilities: | | | | | | | | | | | | | | | | | | | | |

| Gross potential available under the 2012 Credit Facility | | | 900,000 | | | | 900,000 | | | | 900,000 | | | | 900,000 | | | | 900,000 | |

| Less: | | | | | | | | | | | | | | | | | | | | |

| Outstanding balance | | | (716,500 | ) | | | (621,750 | ) | | | (581,500 | ) | | | (731,500 | ) | | | (706,500 | ) |

| Total Liquidity | | $ | 203,531 | | | $ | 295,532 | | | $ | 343,462 | | | $ | 194,039 | | | $ | 213,123 | |

*See page 9 for a reconciliation of Net Income to FFO and the Appendix for Definitions of Non-GAAP Measures beginning on page 27.

| |  | Portfolio Overview |

| | For the Three Months Ended |

| | 31-Mar-14 | 31-Dec-13 | 30-Sep-13 | 30-Jun-13 | 31-Mar-13 |

| Owned portfolio of commercial real estate: | | | | | |

| Number of properties (a) | 39 | 39 | 40 | 38 | 37 |

| Square feet | 9,686,055 | 9,685,285 | 9,807,339 | 8,529,752 | 7,856,859 |

| Leased percentage | 94.5% | 94.1% | 93.8% | 94.4% | 94.4% |

| | | | | | |

| Investments in non-consolidated | | | | | |

| commercial real estate: | | | | | |

| Number of properties (a) | 2 | 2 | 2 | 2 | 2 |

| Square feet | 1,395,500 | 1,395,500 | 1,395,500 | 1,395,500 | 1,392,316 |

| Leased percentage | 64.0% | 64.1% | 61.5% | 67.6% | 66.1% |

| | | | | | |

| Single Asset REITs (SARs) managed: | | | | | |

| Number of properties | 12 | 12 | 13 | 13 | 13 |

| Square feet | 3,067,199 | 3,067,199 | 3,323,198 | 3,323,566 | 3,323,566 |

| Leased percentage | 87.4% | 87.4% | 86.6% | 83.9% | 87.8% |

| | | | | | |

| Total owned (a) , investments | | | | | |

| and managed properties: | | | | | |

| Number of properties | 53 | 53 | 55 | 53 | 52 |

| Square feet | 14,148,754 | 14,147,984 | 14,526,037 | 13,248,818 | 12,572,741 |

| Leased percentage | 90.0% | 89.7% | 89.1% | 89.0% | 89.5% |

| | | | | | |

| (a) Includes asset held for periods prior to 31-Dec-2013 | | | | |

| |  | Owned Portfolio Overview |

| | | | Square | Percent | Wtd Ave (a) | GAAP (b) |

| MSA / Property Name | City | State | Feet | Leased | Occupied | Rent |

| | | | | | | |

| East Region | | | | | | |

| | | | | | | |

| Baltimore | | | | | | |

| East Baltimore | Baltimore | MD | 325,445 | 77.8% | 77.8% | $ 23.95 |

| | | | | | | |

| Washington, D.C. | | | | | | |

| Meadow Point | Chantilly | VA | 138,537 | 92.6% | 92.6% | $ 27.25 |

| Stonecroft | Chantilly | VA | 111,469 | 100.0% | 100.0% | $ 39.07 |

| Loudoun Tech Center | Dulles | VA | 136,658 | 100.0% | 100.0% | $ 15.52 |

| | | | | | | |

| Richmond | | | | | | |

| Innsbrook | Glen Allen | VA | 298,456 | 99.9% | 99.9% | $ 18.61 |

| | | | | | | |

| Charlotte | | | | | | |

| Park Seneca | Charlotte | NC | 109,674 | 83.6% | 81.6% | $ 15.09 |

| Forest Park | Charlotte | NC | 62,212 | 100.0% | 100.0% | $ 13.75 |

| | | | | | | |

| Raleigh-Durham | | | | | | |

| Emperor Boulevard | Durham | NC | 259,531 | 100.0% | 100.0% | $ 35.57 |

| | | | | | | |

| East Region Total | | | 1,441,982 | 93.0% | 92.9% | $ 24.66 |

| | | | | | | |

| Midwest Region | | | | | | |

| | | | | | | |

| Chicago | | | | | | |

| Northwest Point | Elk Grove Village | IL | 176,848 | 100.0% | 100.0% | $ 19.67 |

| 909 Davis Street | Evanston | IL | 195,245 | 97.9% | 97.9% | $ 36.04 |

| | | | | | | |

| Indianapolis | | | | | | |

| River Crossing | Indianapolis | IN | 205,059 | 99.1% | 99.1% | $ 23.48 |

| | | | | | | |

| St. Louis | | | | | | |

| Timberlake | Chesterfield | MO | 232,766 | 98.3% | 98.3% | $ 22.75 |

| Timberlake East | Chesterfield | MO | 116,197 | 91.0% | 91.0% | $ 23.92 |

| Lakeside Crossing | Maryland Heights | MO | 127,778 | 100.0% | 100.0% | $ 26.86 |

| | | | | | | |

| Minneapolis | | | | | | |

| Eden Bluff | Eden Prairie | MN | 153,028 | 100.0% | 100.0% | $ 29.11 |

| 121 South 8th Street | Minneapolis | MN | 474,991 | 90.7% | 89.8% | $ 13.68 |

| | | | | | | |

| Midwest Region Total | | | 1,681,912 | 96.2% | 95.9% | $ 22.69 |

(a) Weighted Occupied Percentage for the quarter ended March 31, 2014

(b) Weighted Average GAAP Rent per Occupied Square Foot

| |  | Owned Portfolio Overview |

| | | | | Percent | Wtd Ave (a) | GAAP (b) |

| MSA / Property Name | City | State | Square Feet | Leased | Occupied | Rent |

| | | | | | | |

| South Region | | | | | | |

| | | | | | | |

| Dallas-Fort Worth | | | | | | |

| Willow Bend Office Center | Plano | TX | 117,050 | 100.0% | 94.9% | $ 20.52 |

| Legacy Tennyson Center | Plano | TX | 202,600 | 100.0% | 100.0% | $ 17.59 |

| One Legacy Circle | Plano | TX | 214,110 | 100.0% | 100.0% | $ 32.97 |

| Addison Circle | Addison | TX | 293,787 | 94.3% | 94.3% | $ 24.40 |

| Collins Crossing | Richardson | TX | 298,766 | 99.5% | 99.5% | $ 24.37 |

| Liberty Plaza | Addison | TX | 218,934 | 96.0% | 89.7% | $ 20.67 |

| | | | | | | |

| Houston | | | | | | |

| Park Ten | Houston | TX | 157,460 | 100.0% | 99.1% | $ 24.11 |

| Eldridge Green | Houston | TX | 248,399 | 100.0% | 100.0% | $ 29.20 |

| Park Ten Phase II | Houston | TX | 156,746 | 100.0% | 100.0% | $ 30.06 |

| Westchase I & II | Houston | TX | 629,025 | 97.1% | 97.1% | $ 31.71 |

| | | | | | | |

| Miami-Ft. Lauderdale-West Palm Beach | | | | | | |

| Blue Lagoon Drive | Miami | FL | 212,619 | 100.0% | 100.0% | $ 20.72 |

| | | | | | | |

| Atlanta | | | | | | |

| One Overton Place | Atlanta | GA | 387,267 | 98.9% | 98.9% | $ 22.18 |

| One Ravinia | Atlanta | GA | 386,603 | 93.6% | 90.4% | $ 21.79 |

| 999 Peachtree | Houston | TX | 621,946 | 93.0% | 93.9% | $ 30.02 |

| South Region Total | | | 4,145,312 | 97.2% | 96.5% | $ 26.05 |

| | | | | | | |

| West Region | | | | | | |

| | | | | | | |

| Seattle | | | | | | |

| Federal Way | Federal Way | WA | 117,010 | 54.4% | 54.4% | $ 17.35 |

| | | | | | | |

| San Francisco-San Jose-Oakland | | | | | | |

| Hillview Center | Milpitas | CA | 36,288 | 100.0% | 100.0% | $ 16.13 |

| Montague Business Center | San Jose | CA | 145,951 | 100.0% | 100.0% | $ 15.71 |

| | | | | | | |

| Denver | | | | | | |

| 380 Interlocken | Broomfield | CO | 240,184 | 95.2% | 84.8% | $ 29.53 |

| 1999 Broadway | Denver | CO | 673,839 | 95.6% | 95.1% | $ 31.09 |

| Greenwood Plaza | Englewood | CO | 196,236 | 100.0% | 100.0% | $ 23.81 |

| 390 Interlocken | Broomfield | CO | 241,516 | 69.4% | 69.4% | $ 26.40 |

| 1001 17th Street | Denver | CO | 655,420 | 88.5% | 88.5% | $ 33.74 |

| | | | | | | |

| Colorado Springs | | | | | | |

| Centennial Technology Center | Colorado Springs | CO | 110,405 | 97.3% | 85.4% | $ 16.15 |

| | | | | | | |

| West Region Total | | | 2,416,849 | 89.8% | 88.1% | $ 28.24 |

| | | | | | | |

| | | | | | | |

| Total Owned | | | 9,686,055 | 94.5% | 93.7% | $ 25.76 |

(a) Weighted Occupied Percentage for the quarter ended March 31, 2014

(b) Weighted Average GAAP Rent per Occupied Square Foot

| |  | Managed Portfolio Overview |

| MSA / Property Name | City | State | Square Feet |

| | | | |

| Southeast Region | | | |

| | | | |

| Columbia | | | |

| 1441 Main Street | Columbia | SC | 264,857 |

| | | | |

| Atlanta | | | |

| Satellite Place | Duluth | GA | 134,785 |

| | | | |

| Southeast Region Total | | | 399,642 |

| | | | |

| Southwest Region | | | |

| | | | |

| Dallas-Fort Worth | | | |

| 5601 Executive Drive | Irving | TX | 152,121 |

| Galleria North | Dallas | TX | 379,518 |

| | | | |

| Houston | | | |

| Energy Tower I | Houston | TX | 325,797 |

| | | | |

| Denver | | | |

| Highland Place | Centennial | CO | 139,142 |

| 385 Interlocken | Broomfield | CO | 296,868 |

| | | | |

| Southwest Region Total | | | 1,293,446 |

| | | | |

| Midwest Region | | | |

| | | | |

| Chicago | | | |

| East Wacker (a) | Chicago | IL | 860,429 |

| | | | |

| Indianapolis | | | |

| Monument Circle | Indianapolis | IN | 213,609 |

| | | | |

| St. Louis | | | |

| Lakeside Crossing II | Maryland Heights | MO | 116,000 |

| | | | |

| Minneapolis | | | |

| 50 South Tenth Street | Minneapolis | MN | 498,768 |

| | | | |

| Kansas City | | | |

| Grand Boulevard (b) | Kansas City | MO | 535,071 |

| | | | |

| Cincinnati | | | |

| Centre Pointe V | West Chester | OH | 135,936 |

| Union Centre | West Chester | OH | 409,798 |

| | | | |

| Midwest Region Total | | | 2,769,611 |

| | | | |

| Total Managed | | | 4,462,699 |

| | | | |

| Total Owned & Managed | | | 14,148,754 |

| (a) | FSP has a Preferred Share Interest of 43.7% in the entity that owns this property. |

| (b) | FSP has a Preferred Share Interest of 27.0% in the entity that owns this property. |

| |  | Tenants By Industry |

| |  | 20 Largest Tenants with Annualized Rent and

Remaining Term (Owned Portfolio) |

| | | | Remaining | Aggregate | % of Aggregate | Annualized | % of Aggregate |

| | Tenant | Number of | Lease Term | Leased | Leased | Rent | Leased |

| | Name | Leases | in Months | Square Feet | Square Feet | (in 000's) | Annualized Rent |

| | | | | | | | |

| 1 | TCF National Bank | 2 | 21 | 263,111 | 2.7% | $ 2,896,157 | 1.3% |

| 2 | Quintiles Transnational Corp | 1 | 60 | 259,531 | 2.7% | 8,821,181 | 3.9% |

| 3 | CITGO Petroleum Corporation | 1 | 95 | 248,399 | 2.6% | 7,558,782 | 3.4% |

| 4 | Sutherland Asbill Brennan LLP | 1 | 73 | 243,839 | 2.5% | 7,410,774 | 3.3% |

| 5 | Newfield Exploration Company | 1 | 95 | 234,495 | 2.4% | 7,699,991 | 3.4% |

| 6 | US Government (a) | 6 | 4,5,9,17,50,78 | 229,752 | 2.4% | 7,207,773 | 3.2% |

| 7 | Burger King Corporation | 1 | 54 | 212,619 | 2.2% | 4,792,432 | 2.1% |

| 8 | Denbury Onshore, LLC | 2 | 64 | 202,600 | 2.1% | 3,510,042 | 1.6% |

| 9 | RGA Reinsurance Company | 2 | 9 | 197,354 | 2.0% | 4,304,802 | 1.9% |

| 10 | SunTrust Bank (b) | 2 | 31, 90 | 182,888 | 1.9% | 3,679,500 | 1.6% |

| 11 | Citicorp Credit Services, Inc | 1 | 33 | 176,848 | 1.8% | 3,689,049 | 1.6% |

| 12 | C.H. Robinson Worldwide, Inc | 1 | 87 | 153,028 | 1.6% | 4,221,068 | 1.9% |

| 13 | T-Mobile South, LLC dba T-Mobile | 1 | 59 | 151,792 | 1.6% | 3,532,064 | 1.6% |

| 14 | Houghton Mifflin Harcourt Publishing Company | 1 | 36 | 150,050 | 1.5% | 5,957,254 | 2.6% |

| 15 | Petrobras America, Inc. | 1 | 68 | 144,813 | 1.5% | 4,969,982 | 2.2% |

| 16 | Murphy Exploration & Production Company | 1 | 37 | 144,677 | 1.5% | 4,439,625 | 2.0% |

| 17 | Argo Data Resource Corporation | 1 | 113 | 138,540 | 1.4% | 3,700,702 | 1.6% |

| 18 | Monsanto Company | 1 | 70 | 127,778 | 1.3% | 3,282,617 | 1.5% |

| 19 | Federal National Mortgage Association | 1 | 30 | 123,144 | 1.3% | 2,886,188 | 1.3% |

| 20 | Vail Corp. | 1 | 108 | 122,232 | 1.3% | 3,369,399 | 1.5% |

| | | | | | | | |

| | | | Total | 3,707,490 | 38.3% | $ 97,929,382 | 43.5% |

(a) Includes 180,444 and 37,813 square feet which expire in 2018 & 2014, respectively. The remaining 11,495 square feet expire between 2015 - 2020.

(b) Includes 55,388 square feet which expires October 31, 2016.

| |  | Leasing Activity

(Owned Portfolio) |

| | | Three | | | | |

| | | Months | | Year | | Year |

| | | Ended | | Ended | | Ended |

| Leasing Activity | | 31-Mar-14 | | 31-Dec-13 | | 31-Dec-12 |

| (in Square Feet - SF) | | | | | | |

| New leasing | | 15,000 | | 267,000 | | 315,740 |

| Renewals including expansions | | 165,000 | | 645,000 | | 700,838 |

| | | 180,000 | | 912,000 | | 1,016,578 |

| | | | | | | |

| Other information per SF | | | | | | |

| (Activity on a year-to-date basis) | | | | | | |

| GAAP Rents on leasing | | $ 23.95 | | $ 23.33 | | $ 22.41 |

| Weighted average lease term | | 6.75 Years | | 7.2 Years | | 5.1 Years |

| | | | | | | |

| Increase over ave GAAP rents in prior year | | 11.9% | | 8.0% | | 1.5% |

| | | | | | | |

| Average free rent | | 3 Months | | 3 Months | | 3 Months |

| Tenant Improvements | | $ 13.61 | | $ 18.25 | | $ 12.26 |

| Leasing Costs | | $ 8.30 | | $ 8.48 | | $ 5.40 |

| |  | Lease Expirations by Square Feet

(Owned Portfolio) |

| Year | | Total

Square Feet | | % of

Square Feet Commercial |

| | | | | |

| 2014 | | 463,849 | | 4.8% |

| 2015 | | 918,042 | | 9.5% |

| 2016 | | 944,181 | | 9.8% |

| 2017 | | 1,078,987 | | 11.1% |

| 2018 | | 902,727 | | 9.3% |

| 2019 | | 1,620,839 | | 16.7% |

| 2020 | | 645,945 | | 6.7% |

| 2021 | | 882,926 | | 9.1% |

| 2022 | | 870,127 | | 9.0% |

| 2023 | | 350,789 | | 3.6% |

| 2024 | | 256,329 | | 2.6% |

| 2025 | | 135,598 | | 1.4% |

| 2026 | | 86,128 | | 0.9% |

| Vacant | | 529,588 | | 5.5% |

| | | | | |

| Total | | 9,686,055 | | 100.0% |

| |  | Lease Expirations

with Annualized Rent per Square Foot

(Owned Portfolio) |

| | | | Rentable | | | | Annualized | | Percentage | | |

| | Number of | | Square | | | | Rent | | of Total Final | | |

| Year of | Leases | | Footage | | Annualized | | Per Square | | Annualized | | |

| Lease | Expiring | | Subject to | | Rent Under | | Foot Under | | Rent Under | | |

| Expiration | Within the | | Expiring | | Expiring | | Expiring | | Expiring | | Cumulative |

| December 31, | Year | | Leases | | Leases (a) | | Leases | | Leases | | Total |

| 2014 | 78 | (b) | | 463,849 | | | 11,469,933 | | 24.73 | | 5.10% | | 5.10% |

| 2015 | 88 | | | 918,042 | | | 22,580,976 | | 24.60 | | 10.05% | | 15.15% |

| 2016 | 68 | | | 944,181 | | | 19,454,342 | | 20.60 | | 8.66% | | 23.81% |

| 2017 | 67 | | | 1,078,987 | | | 29,425,363 | | 27.27 | | 13.10% | | 36.91% |

| 2018 | 56 | | | 902,727 | | | 25,056,595 | | 27.76 | | 11.15% | | 48.06% |

| 2019 | 48 | | | 1,620,839 | | | 41,472,907 | | 25.59 | | 18.46% | | 66.52% |

| 2020 | 19 | | | 645,945 | | | 18,043,628 | | 27.93 | | 8.03% | | 74.55% |

| 2021 | 16 | | | 882,926 | | | 19,120,410 | | 21.66 | | 8.51% | | 83.05% |

| 2022 and thereafter | 36 | | | 1,698,971 | (c) | | 38,076,492 | | 22.41 | | 16.95% | | 100.00% |

| | 476 | | | 9,156,467 | | | 224,700,646 | | 24.54 | | 100.00% | | |

| Vacancies as of 3/31/14 | | | | 529,588 | | | | | | | | | |

| Total Portfolio Square Footage | | | | 9,686,055 | | | | | | | | | |

| (a) | Annualized rent represents the monthly rent, including tenant reimbursements, for each lease in effect at March 31, 2014 mulitplied by 12. Tenant reimbursements generally include payment of real estate taxes, operating expenses and common area maintenance and utility charges. |

(b) Includes 21 leases that are month-to-month.

(c) Includes 51,776 square feet that are non-revenue producing building amenities.

| |  | Capital Expenditures

(in thousands) |

| Capital Expenditures | | | | | | | | | | | | | | | |

| Owned Portfolio | | Three Months | | | | | | | | | | | | | |

| (in thousands) | | Ended | | | | | | | | | | | | | |

| | | 31-Mar-14 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Tenant improvements | | $ | 1,133 | | | | | | | | | | | | | | | | | |

| Deferred leasing costs | | | 1,112 | | | | | | | | | | | | | | | | | |

| Non-investment capex | | | 1,119 | | | | | | | | | | | | | | | | | |

| | | $ | 3,364 | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended: | | | Year ended | |

| | | 31-Mar-13 | | | 30-Jun-13 | | | 30-Sep-13 | | | 31-Dec-13 | | | 31-Dec-13 | |

| | | | | | | | | | | | | | | | |

| Tenant improvements | | $ | 1,729 | | | $ | 5,754 | | | $ | 4,596 | | | $ | 2,992 | | | $ | 15,071 | |

| Deferred leasing costs | | | 2,813 | | | | 1,087 | | | | 3,821 | | | | 1,536 | | | | 9,257 | |

| Non-investment capex | | | 1,118 | | | | 1,622 | | | | 1,552 | | | | 1,479 | | | | 5,771 | |

| | | $ | 5,660 | | | $ | 8,463 | | | $ | 9,969 | | | $ | 6,007 | | | $ | 30,099 | |

| | | For the Three Months Ended: | | | Year ended | |

| | | 31-Mar-12 | | | 30-Jun-12 | | | 30-Sep-12 | | | 31-Dec-12 | | | 31-Dec-12 | |

| | | | | | | | | | | | | | | | |

| Tenant improvements | | $ | 3,014 | | | $ | 2,705 | | | $ | 2,854 | | | $ | 4,464 | | | $ | 13,037 | |

| Deferred leasing costs | | | 2,196 | | | | 1,343 | | | | 1,104 | | | | 2,784 | | | | 7,427 | |

| Non-investment capex | | | 746 | | | | 1,003 | | | | 711 | | | | 1,252 | | | | 3,712 | |

| | | $ | 5,956 | | | $ | 5,051 | | | $ | 4,669 | | | $ | 8,500 | | | $ | 24,176 | |

| |  | Transaction Activity |

| Recent Acquisitions: | | | | | | | Purchase Price | | |

| | City | State | Square Feet | | Date Acquired | | (in thousands) | | |

| 2013 | | | | | | | | | |

| 1999 Broadway | Denver | CO | 673,793 | | 5/22/13 | | $ 183,000 | | |

| 999 Peachtree | Atlanta | GA | 621,946 | | 7/1/13 | | 157,900 | | |

| 1001 17th Street | Denver | CO | 655,420 | | 8/28/13 | | 217,000 | | |

| | | | | | | | | | |

| 2012 | | | | | | | | | |

| One Ravinia | Atlanta | GA | 386,603 | | 7/31/12 | | $ 52,750 | | |

| Westchase | Houston | TX | 629,025 | | 11/1/12 | | 154,750 | | |

| | | | | | | | | | |

| 2011 | | | | | | | | | |

| Emperor Boulevard | Durham | NC | 259,531 | | 3/4/11 | | $ 75,800 | | |

| Legacy Tennyson Center | Plano | TX | 202,600 | | 3/10/11 | | 37,000 | | |

| One Legacy Circle | Plano | TX | 214,110 | | 3/24/11 | | 52,983 | | |

| 909 Davis | Evanston | IL | 195,245 | | 9/30/11 | | 37,062 | | |

| East Renner Road | Richardson | TX | 122,300 | | 10/6/11 | | 11,282 | | |

| | | | | | | | | | |

| Recent Dispositions: | | | | | | | | | |

| | | | | | | | Net Sales | | Gain (Loss) |

| | City | State | Square Feet | | Date Sold | | Proceeds | | on Sale |

| | | | | | | | (in thousands) |

| 2013 | | | | | | | | | |

| East Renner Road | Richardson | TX | 122,300 | | 10/29/13 | | $ 12,300 | | $ 2,169 |

| | | | | | | | | | |

| 2012 | | | | | | | | | |

| Southfield | Southfield | MI | 252,613 | | 12/21/12 | | $ 293 | | $ (14,826) |

| | | | | | | | | | |

| 2011 | | | | | | | | | |

| Fairview | Falls Church | VA | 252,613 | | 1/21/11 | | $ 89,382 | | $ 19,592 |

| Bollman (a) | Savage | MD | 98,745 | | 6/24/11 | | 7,408 | | 2,346 |

(a) Industrial property. All other acquisitions and dispositions are office properties

| |  | Loan Portfolio of Secured Real Estate |

| (dollars in thousands) | | | Maximum | Amount | | | Interest |

| | | Maturity | Amount | Drawn at | Interest | Draw | Rate at |

| Sponsored REIT | Location | Date | of Loan | 31-Mar-14 | Rate (1) | Fee (2) | 31-Mar-14 |

| | | | | | | | |

| Secured revolving lines of credit | | | | | | | |

| FSP Highland Place I Corp. | Centennial, CO | 31-Dec-14 | $ 5,500 | $ 2,995 | L+4.4% | 0.5% | 4.56% |

| FSP Satellite Place Corp. | Duluth, GA | 31-Mar-15 | 5,500 | 5,500 | L+4.4% | 0.5% | 4.56% |

| FSP 1441 Main Street Corp. | Columbia, SC | 31-Mar-15 | 10,800 | 9,000 | L+4.4% | 0.5% | 4.56% |

| FSP Galleria North Corp. | Dallas, TX | 30-Jan-15 | 15,000 | 13,880 | L+5.0% | 0.5% | 5.16% |

| | | | | | | | |

| Secured construction loan | | | | | | | |

| FSP 385 Interlocken | | | | | | | |

| Development Corp. | Broomfield, CO | 30-Apr-14 | 42,000 | 37,541 | L+4.4% | n/a | 4.56% |

| | | | | | | | |

| Mortgage loan secured by property | | | | | | | |

| FSP Energy Tower I Corp. (3) | Houston, TX | 5-Jul-14 | 33,000 | 33,000 | 6.41% | n/a | 6.41% |

| | | | | | | | |

| | | | $ 111,800 | $ 101,916 | | | |

(1) The interest rate is 30-day LIBOR rate plus the additional rate indicated, otherwise a fixed rate.

(2) The draw fee is a percentage of each new advance, and is paid at the time of each new draw.

(3) The loan has a secured fixed mortgage amount of $33,000,000. A loan fee of $300,630 was paid at the time of closing and funding of the loan on July 5, 2012. The borrower is required to pay the Company an exit fee in the amount of 0.982% of the principal repayment amount.

| |  | Net Asset Value Components |

(in thousands except per share data)

| | As of |

| | 31-Mar-14 |

| Total Market Capitalization Values | |

| Shares outstanding | 100,187.4 |

| Closing price, December 31st | $ 12.60 |

| Market capitalization | $ 1,262,361 |

| Debt | 936,500 |

| Total Market Capitalization | $ 2,198,861 |

| | |

| | |

| | 3 Months |

| | Ended |

| NOI Components | 31-Mar-14 |

| | |

| Same Store NOI (1) | $ 26,536 |

| Acquisitions (1) (2) | 10,037 |

| Property NOI (1) | 36,573 |

| Full quarter adjustment (3) | - |

| Stabilized portfolio | $ 36,573 |

| | |

| | |

| Financial Statement Reconciliation: | |

| Rental Revenue | $ 61,597 |

| Rental operating expenses | (15,071) |

| Real estate taxes and insurance | (9,251) |

| Taxes (4) | (137) |

| Management fees & other (5) | (565) |

| Property NOI (1) | $ 36,573 |

| Assets: | |

| Loans outstanding on secured RE | $ 101,916 |

| Investments in SARs (book basis) | 79,983 |

| Straight-line rent receivable | 44,392 |

| Asset held for sale | - |

| Cash and cash equivalents | 20,031 |

| Restricted cash | 688 |

| Tenant rent receivables | 6,035 |

| Prepaid expenses | 1,353 |

| Office computers and furniture | 746 |

| Other assets: | |

| Deferred financing costs, net | 6,669 |

| Other assets: Derivative Market Value | 4,801 |

| Phoenix Tower Liquidating Trust (6) | 4 |

| Other assets | 1,182 |

| | $ 267,800 |

| | - |

| Liabilities: | |

| Debt | $ 936,500 |

| Accounts payable & accrued expenses | 35,417 |

| Tenant security deposits | 4,258 |

| Other liabilities: derivative liability | 3,825 |

| | $ 980,000 |

Other information:

| Leased SF to be FFO producing | |

| During 2014 | 67 |

| | |

| Straight-line rental revenue Q4 | $ 1,783 |

| | |

| Management fee income first quarter 2014 | $ 234 |

| Interest income from secured loans | 1,409 |

| Management fees and interest income from loans | $ 1,643 |

| | |

| FFO from non-consolidated REITs - Q4 2013 (7): | |

| East Wacker | $ 245 |

| Grand Boulevard | 101 |

| Total | $ 346 |

Footnotes to the components

| (1) | See pages 11 & 29 for definitions and reconciliations |

| (2) | Includes NOI from 3 acquisitions 2013 |

| (3) | Adjustment to reflect property NOI for a full quarter in the quarter acquired, if necessary |

| (4) | HB3 Tax in Texas is classified as an income tax, though we treat it as a real estate tax in Property NOI |

| (5) | Management & other fees are eliminated in consolidation but included on Property NOI |

| (6) | Expected liquidating distribution from sale of equity interest(Collection within 2 years, subject to some expenses) |

| (7) | We report FFO from non-consolidated REITs for the previous quarter as their financial statements are not yet complete for the current quarter. |

| |  | Appendix: Non-GAAP Financial Measure Definitions |

Definition of Funds From Operations (“FFO”)

The Company evaluates performance based on Funds From Operations, which we refer to as FFO, as management believes that FFO represents the most accurate measure of activity and is the basis for distributions paid to equity holders. The Company defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and acquisition costs of newly acquired properties that are not capitalized, plus depreciation and amortization, including amortization of acquired above and below market lease intangibles and impairment charges on properties or investments in non-consolidated REITs, and after adjustments to exclude equity in income or losses from, and, to include the proportionate share of FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income (determined in accordance with GAAP), nor as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs.

Other real estate companies and the National Association of Real Estate Investment Trusts, or NAREIT, may define this term in a different manner. We have included the NAREIT FFO definition in our table and note that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of the results of the Company, FFO should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

| |  | Appendix: Non-GAAP Financial Measure Definitions |

Definition of Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA

EBITDA is defined as net income plus interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA excluding gains and losses on sales of properties or shares of equity investments or provisions for losses on assets held for sale. EBITDA and Adjusted EBITDA are not intended to represent cash flow for the period, are not presented as an alternative to operating income as an indicator of operating performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP and are not indicative of operating income or cash provided by operating activities as determined under GAAP. EBITDA and Adjusted EBITDA are presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA or Adjusted EBITDA the same way, this presentation may not be comparable to similarly titled measures of other companies. The Company believes that net income is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to EBITDA and Adjusted EBITDA.

Definition of Adjusted Funds From Operations (AFFO)

The Company defines AFFO as the sum of (1) FFO; (2) less the effect of straight-line rent; (3) plus deferred financing costs, (4) less recurring capital expenditures that are generally for (a) maintenance of properties or are second generation capital expenditures or what we call non-investment capex, (b) tenant improvements, (c) leasing commissions; and (4) plus non-cash compensation expenses, if any. AFFO should not be considered as an alternative to net income (determined in accordance with GAAP), as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs. Other real estate companies may define this term in a different manner. We believe that in order to facilitate a clear understanding of the results of the Company, AFFO should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

| |  | Appendix: Non-GAAP Financial Measure Definitions |

Definition of Property Net Operating Income (Property NOI)

The Company provides property performance based on Net Operating Income, which we refer to as NOI. Management believes that investors are interested in this information. NOI is a non-GAAP financial measure that the Company defines as net income (the most directly comparable GAAP financial measure) plus selling, general and administrative expenses, depreciation and amortization, including amortization of acquired above and below market lease intangibles and impairment charges, interest expense, less equity in earnings of nonconsolidated REITs, interest income, management fee income, gains or losses on the sale of assets and excludes non-property specific income and expenses. The information presented includes footnotes and the data is shown by region with properties owned in both periods, which we call Same Store. The Comparative Same Store results include properties held for the periods presented and exclude significant nonrecurring income such as bankruptcy settlements and lease termination fees. NOI, as defined by the Company, may not be comparable to NOI reported by other REITs that define NOI differently. NOI should not be considered an alternative to net income as an indication of our performance or to cash flows as a measure of the Company's liquidity or its ability to make distributions.

| | Investor Relations Contact (877) 686-9496 InvestorRelations@franklinstreetproperties.com |

Franklin Street Properties Corp. ● 401 Edgewater Place ● Wakefield, MA 01880 ● (781) 557-1300

www.franklinstreetproperties.com