This presentation may contain forward-looking statements based on current judgments and current knowledge of management, which are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements. Investors are cautioned that our forward-looking statements involve risks and uncertainty, including without limitation, economic conditions in the United States, disruptions in the debt markets, economic conditions in the markets in which we own properties, risks of a lessening of demand for the types of real estate owned by us, changes in government regulations and regulatory uncertainty, uncertainty about governmental fiscal policy, geopolitical events, expenditures that cannot be anticipated such as utility rate and usage increases, unanticipated repairs, additional staffing, insurance increases, real estate tax valuation reassessments and our failure to maintain our status as a real estate investment trust ("REIT") under the Internal Revenue Code of 1986, as amended. Readers are advised to refer to the “Risk Factors” section of our quarterly reports on Form 10-Q and our Annual Report on Form 10-K for additional information concerning these risks and uncertainties. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We do not undertake a duty to update or revise any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise.

Unless otherwise indicated, all information contained in this presentation is as of March 31, 2014. This presentation contains references to Funds from Operations (“FFO”), Adjusted FFO (“AFFO”) and Adjusted EBITDA ("Adj. EBITDA"). Such measurements are non-GAAP (Generally Accepted Accounting Principles) financial measures. Please refer to pages 35 through 37 for definitions and reconciliations of GAAP net income to FFO and Adj. EBITDA. Past financial performance is not a guarantee of future financial performance. Franklin Street Properties Corp. (“FSP”) assumes no obligation to update or revise the financial information contained in this presentation.

FSP is a Leading Owner and Operator of Institutional Quality Office Assets in Major U.S. Markets

| ¡ | FSP acquires high quality, Class A office properties in select urban infill and central business districts (CBD), with a primary emphasis on the top five markets of Atlanta, Dallas, Denver, Houston, and Minneapolis |

| ¡ | Portfolio of 39 office properties comprising 9.7 million square feet, all unencumbered |

| ¡ | 2 office properties comprising 1.4 million square feet are non-consolidated investments |

| ¡ | FSP manages an additional 12 properties comprising 3.1 million square feet |

| ¡ | Diverse and stable tenant base with over 450 tenants |

| ¡ | Portfolio 94.5% leased at 3/31/2014 |

| ¡ | Conservative capital structure with 4.9x fixed charge coverage |

| ¡ | FSP Partnership formed in 1997, converted to a REIT in 2002, and listed in 2005 |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

Modern, Broadly Appealing and Well Amenitized Office Space in Institutional High Growth Markets

| ¡ | Class A product catering to diverse tenant needs in growing industry verticals |

| ¡ | Proximity to significant in-place infrastructure, transportation and centers of trade / business |

| ¡ | Focus on sustainability to attract quality tenants, to enhance tenant satisfaction, and to boost operating efficiency |

| ¡ | 17 owned properties have earned ENERGY STAR labels and / or LEED designations. |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

(1) Year built / renovated for FSP’s owned portfolio, weighted by rentable square feet.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

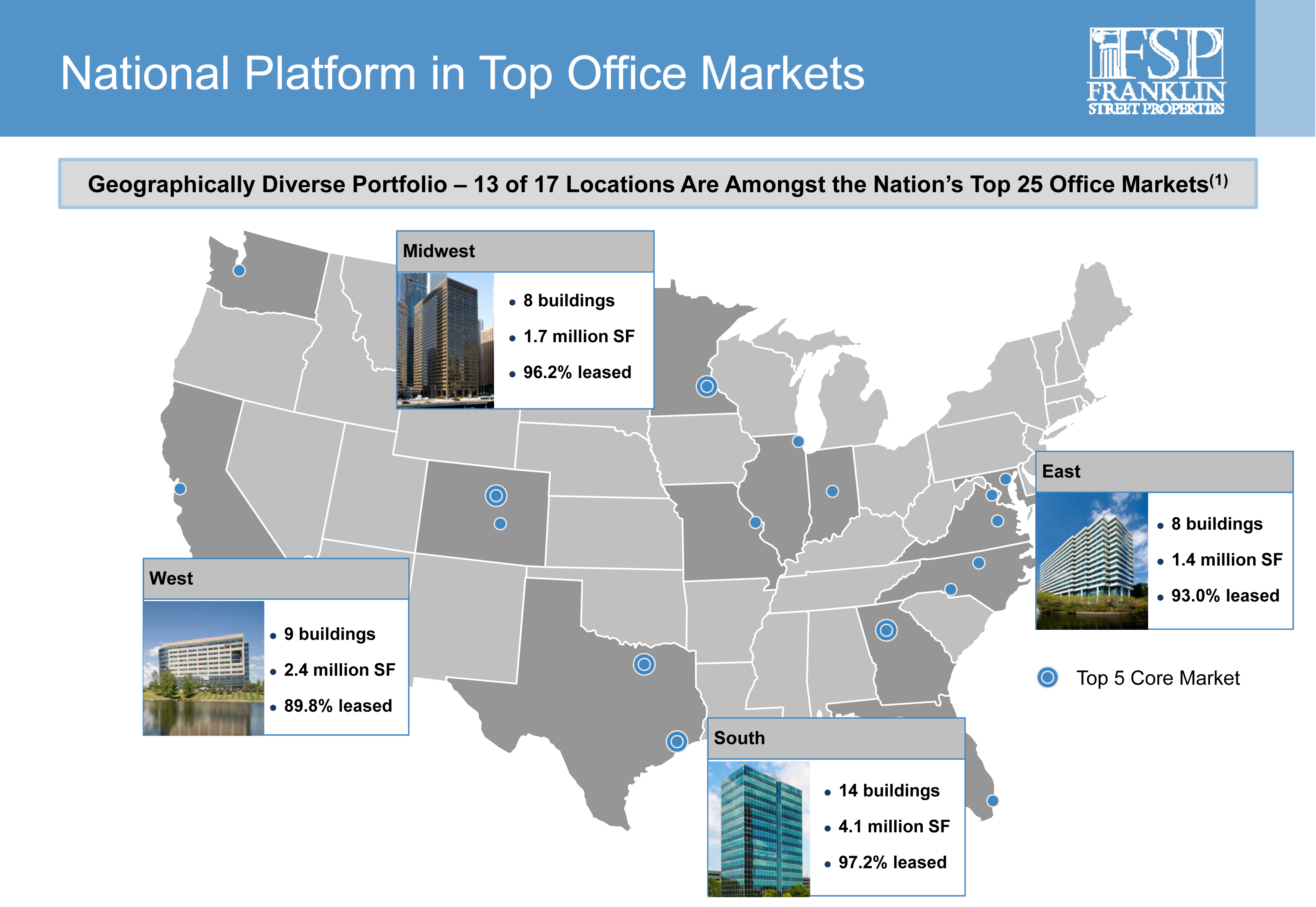

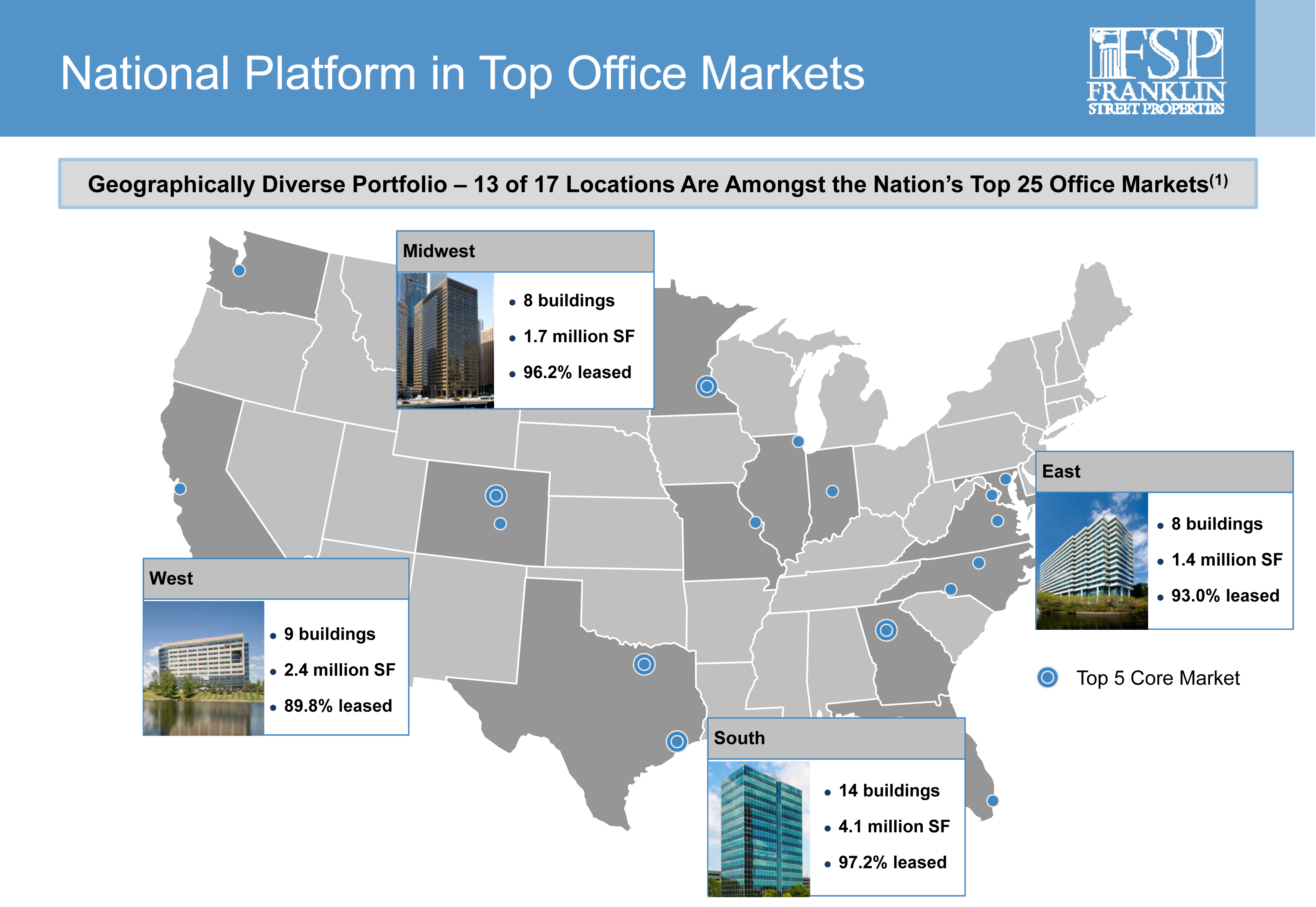

(1) Based on list of top Metropolitan Statistical Areas per the US Office of Management and Budget.

Top Office Markets(1)

| Market | RSF | % Portfolio |

| 1. Denver | 2,007,195 | 21% |

| 2. Dallas - Fort Worth | 1,345,247 | 14% |

| 3. Atlanta | 1,395,816 | 14% |

| 4. Houston | 1,191,630 | 12% |

| 5. Minneapolis | 628,019 | 6% |

| 6. St. Louis | 476,741 | 5% |

| 7. Washington, D.C. | 386,664 | 4% |

| 8. Chicago | 372,093 | 4% |

| 9. Baltimore | 325,445 | 3% |

| 10. Richmond | 298,456 | 3% |

| Top 10 Markets | 8,427,306 | 87% |

| Other | 1,258,749 | 13% |

| Total Portfolio | 9,686,055 | 100% |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

(1) Percentages based on RSF.

No Single Tenant Represents More Than 4% of FSP’s Annualized Rent

| | | | | | | | | | | Remaining |

| | | | | | | | Annualized | | % of | Lease Term |

| | Top Tenants | | Industry | Tenant Use | Rating | | Rent | | Total | (Months)(1) |

| 1. |  | | Biotechnology R&D | Corporate Headquarters | Ba3 | | $8,821,181 | | 3.9% | 60 |

| 2. |  | | Energy Services | General Office Use | Ba1 / BBB- | | 7,699,991 | | 3.4% | 95 |

| 3. |  | | Energy Services | U.S. Corporate Headquarters | B1 / B | | 7,558,782 | | 3.4% | 95 |

| 4. |  | | Legal Services | Legal Offices | -- | | 7,410,774 | | 3.3% | 73 |

| 5. |  | | Gov't / Public Administration | Various U.S. Agencies | Aaa / AAA | | 7,207,773 | | 3.2% | 4, 5, 9, 17, 50, 78 |

| 6. |  | | Publishing Industry | Regional Offices | -- | | 5,957,254 | | 2.6% | 36 |

| 7. |  | | Energy Services | U.S. Corporate Headquarters | Baa1 | | 4,969,982 | | 2.2% | 68 |

| 8. |  | | Food & Agriculture | Corporate Headquarters | B2 | | 4,792,432 | | 2.1% | 54 |

| 9. |  | | Energy Services | Subleased to Conoco | Baa3 / BBB | | 4,439,625 | | 2.0% | 37 |

| 10. |  | | Insurance | Corporate Headquarters | Baa1 / A- | | 4,304,802 | | 1.9% | 9 |

| 11. |  | | Transportation / Logistics | Corporate Headquarters Campus | -- | | 4,221,068 | | 1.9% | 87 |

| 12. |  | | Banks & Credit Services | Corporate Headquarters | -- | | 3,700,702 | | 1.6% | 113 |

| 13. |  | | Banks & Credit Services | General Office Operations | Baa2 / A- | | 3,689,049 | | 1.6% | 33 |

| 14. |  | | Banks & Credit Services | Offices & Small Retail Bank | Baa1 / BBB | | 3,679,500 | | 1.6% | 31, 90 |

| 15. |  | | Radio Telephone Comm. | Subleased | Baa1 | | 3,532,064 | | 1.6% | 59 |

| Total | | | | | | | $81,984,979 | | 36.3% | |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

(1) Remaining months of lease term as of March 31, 2014.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

| ¡ | Well laddered lease maturity schedule adds operational flexibility |

| ¡ | Proactively working with tenants on renewals |

| ¡ | Opportunity for growth through mark-to-market of rents on expiring leases |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

Note: Graph shows lease maturities as a percentage of total square feet.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

Note: Includes owned portfolio.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

__________

Source: SNL Financial as of May 16, 2014. Metrics represent total portfolio owned.

(1) MSA ranked by total population determined by the U.S. Census Bureau as of May 3, 2013.

(2) Peer average includes BDN, CLI, CUZ, HIW, LPT, PDM and PKY.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

Note: $ in millions

FSP’s strategy is to invest in select urban / suburban infill and CBD office properties that offer long-term appreciation potential, as well as current income. FSP has identifiedfive core markets of focus that we believe have distinct drivers for long-term growth. These five markets are Atlanta, Dallas, Denver, Houston, and Minneapolis. Additionally, FSP has been and will continue to be a cyclical investor within diverse metropolitan areas across the US, including San Diego, South Florida, Silicon Valley / San Francisco, Greater Boston, Raleigh-Durham, several Midwestern markets, and Greater Washington, DC. FSP will continue to monitor these markets, as well as others, for selective opportunistic investments.

Five (5) Core Investment Principles:

| ☑ | Invest in Geographic / Economic Diversification –Spread geographic and economic concentrations of properties / tenancy across regions and industries |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –Market understanding and history combined with deep local contacts contributes to best performance |

| ☑ | Invest in “Hub” Markets –Seek to invest in markets / properties that possess strong transportation and communications infrastructure that aids in facilitating the flow of goods, services, and people |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Expanding infrastructure investments into transportation (rail), housing, education, medical research / patient services, and cultural attractions signals positive prospects |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Markets / Cities with dynamic and globally significant industry clusters can offer the potential of long-term above average growth rates |

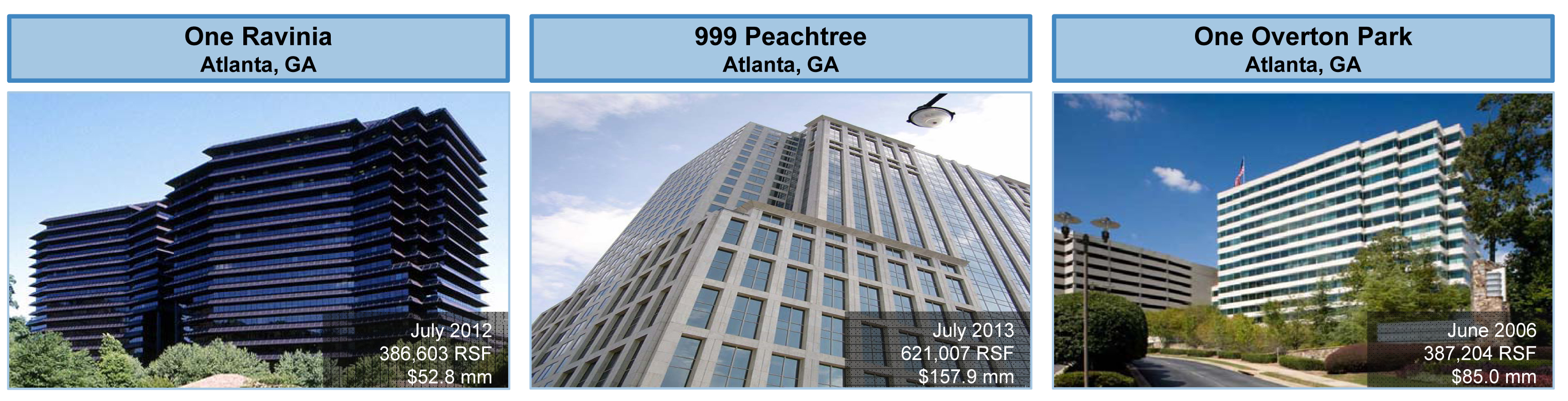

With Housing as a Strong Economic Driver, Atlanta is Regarded as the Economic Capital of the SE US

| ☑ | Invest in Geographic / Economic Diversification –Atlantapossesses adiverse economy that is well-positioned within the high growth US sunbelt |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –FSP and / or its affiliates first began investing in Atlanta inJanuary 2003 |

| ☑ | Invest in “Hub” Markets –Atlanta is a major transportation (Hartsfield International Airport and highway system) and cultural center for SE US. Emory University and Georgia Tech supply deeply talented labor force |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Atlanta has seen committed “densification” investment in MARTA Light Rail, highway expansion, and infill housing |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Traditional local housing, as well as from the manufacturing of building materials and home furnishings for broader US consumption, have the potential to generate meaningful demand drivers to spur growth above the national average |

Diversified Economy that is Strong in Professional Services, Transportation, Technology, and Energy. Dallas is Home to Many Corporate Headquarters.

| ☑ | Invest in Geographic / Economic Diversification –Dallaspossesses ahighly diversified economy that is well-positioned within the fast growing Sunbelt State of Texas |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –FSP and / or its affiliates first began investing in Dallas inDecember 2000 |

| ☑ | Invest in “Hub” Markets –Dallas is a major transportation and distribution center hub (DFW Airport and highway system – Cross-Roads for NAFTA Trade) and a cultural center for the supply a deeply talented labor force. Baylor University, Southern Methodist University, and Texas Tech |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Dallas has seen committed “densification” investment in DART Light Rail, highway expansion (LBJ), and infill housing |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Dallas has robust industry drivers in financial services, transportation, technology, and energy, that have the potential to generate meaningful demand drivers to spur growth above the national average |

Diversified Economy that is Strong in US Domestic Energy & Natural Resources, Transportation, and Technology. Highly Educated Workforce and Strong Population Growth.

| ☑ | Invest in Geographic / Economic Diversification –Denverpossesses ahighly diversified economy that is well-positioned within the fast growing western US. |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –FSP and / or its affiliates first began investing in Colorado (Colorado Springs) inSeptember 2000 |

| ☑ | Invest in “Hub” Markets –Denver is a major transportation (DIA Airport and highway system) and cultural center for the US. Deep and talented labor force. University of Colorado, Colorado State University, University of Denver, and Colorado School of Mines |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Denver has seen committed “densification” investment in its Light Rail system and nationally acclaimed downtown Union Station redevelopment, as well as significant investments into infill housing |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Denver has robust drivers in diverse industries, with surging domestic energy and natural resources specifically having the potential to generate meaningful growth above the national average |

Diversified Economy that is the Global Leader in Energy. Strong in Trade and Exports due to Gulf Coast Location. Highly Educated Workforce and Strong Population Growth.

| ☑ | Invest in Geographic / Economic Diversification –Houstonpossesses a robust Gulf Coast economy that is well-positioned within the fast growing Sunbelt of the US |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –FSP and / or its affiliates / predecessors first began investing in Houston with Apartments inJune 1993 and in Office Properties in June 2002 |

| ☑ | Invest in “Hub” Markets –Houston is a major transportation (Houston Ship Channel and the George Bush Intercontinental Airport) and cultural center for the US. Deep and talented labor force. Rice University, University of Texas, and the University of Houston |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Houston has seen committed “densification” investment into core locations downtown with Light Rail, and with major infill urban housing investments in key locations across the metro area |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Houston has the unique distinction of being the Global Energy Capital to the World. Such clustering of energy companies provides the potential to generate meaningful growth above the national average |

Diversified Economy in US Food-Belt that Possesses a Highly Educated Workforce and Strong Spirit of Innovation

| ☑ | Invest in Geographic / Economic Diversification –Minneapolispossesses a highly diversified economy and highly educated/talented workforce. Financial services, food, retail, medical, industrial, and technology industries all well-represented |

| ☑ | Invest in Markets Where FSP Has Long-Term Knowledge / Experience –FSP and / or its affiliates/predecessors first began investing in Minneapolis inOctober 2004 |

| ☑ | Invest in “Hub” Markets –Minneapolis is a major transportation (Mississippi River and the Minneapolis Saint-Paul International Airport) and cultural center for the US. Deep and talented labor force. University of Minnesota |

| ☑ | Invest in Cities / Markets with a Track-Record of Committed Investment into Infill and CBD Infrastructure Improvements –Minneapolis has seen committed “densification” investment into core locations downtown with Light Rail expansion, Sporting Venues, and with major infill urban housing investments |

| ☑ | Invest in Markets / Cities where Macro / Global Long-Term Drivers are Identified that can Potentially Increase Employment Growth Over and Above Broader US Averages –Minneapolis is a highly diverse economy that counts food as a major economic driver. Additionally, Minneapolis is strong in financial services, technology, retail, and the medical industries |

__________

(1) Asset managed by FSP.

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

__________

Source: Public Company filings and disclosures as of March 31, 2014.

Note: $ in millions.

__________

Source: Public Company filings and disclosures as of March 31, 2014.

| (1) | Different REITs may calculate Adjusted EBITDA in different ways. Please refer to page 37 for FSP’s definition of Adjusted EBITDA and for a reconciliation of GAAP net income to Adjusted EDITDA. Adjusted EBITDA is a non-GAAP financial measure on which undue reliance should not be placed. |

| (2) | The metric of Net Debt is defined as total debt less cash and cash equivalents, which is divided by annualized Q1 2014 Adjusted EBITDA. |

| (3) | Metric calculated using most recent quarterly data. |

| (4) | HIW does not include principal amortization. |

| (5) | Peer average includes BDN, CLI, CUZ, HIW, LPT, PDM and PKY. |

__________

Source: SNL Financial as of May 16,2014.

(1) Peer average includes BDN, CLI, CUZ, HIW, LPT, PDM and PKY.

| ¡ | Preserve and advance portfolio quality by acquiring high quality assets in high quality markets and maintaining existing assets with sufficient capex |

| ¡ | Continue our simple business model |

| ¡ | Recycle assets where value is fully realized |

| ¡ | Pursue external growth opportunities in our target markets at the right price |

| ¡ | Maintain conservative leverage to minimize risk and allow full financial flexibility |

Appendix

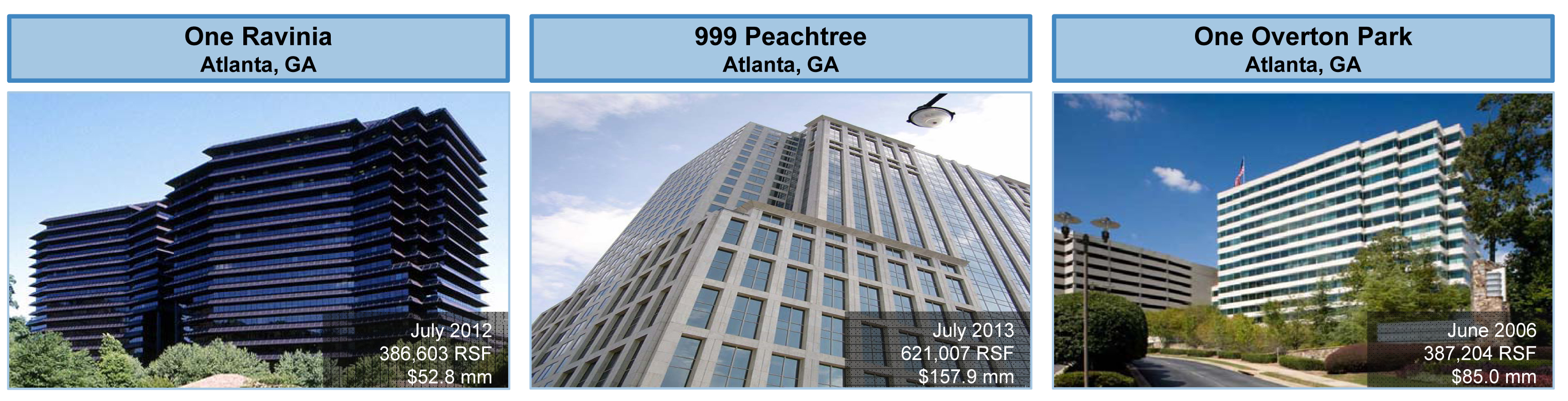

999 Peachtree – Midtown Atlanta, GA

| ¡ | Acquisition of Class A, office property for $157.9 million or $254 per rentable SF |

| ¡ | Attractive purchase price at significant discount to replacement cost |

| ¡ | 28 story, multi-tenant office building totaling 621,007 rentable SF |

| ¡ | ~ 95% leased to diversified tenant base including legal professionals, financial services |

Value-Add Potential

| ¡ | Lease-up vacant space (33,000 SF) (an entire midrise floor) |

| ¡ | Push rents higher by marking-to-market below market rents |

| ¡ | Explore retail expansion (footprint) |

| ¡ | Major push in the local market for more retail |

| High Quality

Asset | ¡ 9 story parking garage with covered walkway ¡ Conference center and fitness center ¡ LEED Silver Certified |

High Visibility

Location | ¡ 10th & Peachtree is one of Atlanta’s most prized intersections ¡ Across from the Federal Reserve and the midtown MARTA light rail station |

City /

Submarket Momentum | ¡ Atlanta office market has experienced 8 consecutive quarters of positive absorption ¡ Strong growth and demand for luxury residential |

Vibrant Urban

Center | ¡ 24/7 urban infill, pedestrian friendly environment ¡ Well-served by public transportation & MARTA Rail ¡ Cultural attractions – High Museum Art, Atlanta Symphony & Piedmont Park |

Retail /

Hospitality

Amenities | ¡ Located within planned “Midtown Mile” of mixed-use pedestrian friendly shopping district ¡ PremierEmpire State South restaurant on location ¡ Hyatt Midtown Atlanta opened in 2013 next door |

1999 Broadway – Downtown Denver, CO

| ¡ | Acquisition of Class A, office property for $183.0 million or $269 per rentable SF |

| ¡ | Attractive purchase price at significant discount to replacement cost |

| ¡ | 43 story, multi-tenant office building totaling 680,277 rentable SF |

| ¡ | ~96% leased to diversified tenant base including financial services, energy services |

Value-Add Potential

| ¡ | Lease-up vacant space (23,000 SF) (Including entire top Floor) |

| ¡ | Push rents higher by marking-to-market below market rents |

| ¡ | Best views in city available for lease on top floor of property |

| High Quality

Asset | ¡ Includes underground parking as well as a freestanding 9 story parking garage ¡ Fitness center and conference rooms ¡ LEED Silver Certified |

High Visibility

Location | ¡ Most accessible downtown tower ¡ Only CBD tower served by a two-directional FasTracks stop/station at front door |

City /

Submarket

Momentum | ¡ Denver office market has experienced 5 consecutive quarters of positive absorption ¡ Strong growth and demand for luxury residential |

Vibrant Urban

Center | ¡ 24/7 urban, pedestrian friendly environment ¡ Well-served by public transportation ¡ Cultural capital of the city – numerous performing arts centers, museums and sports venues |

Retail /

Hospitality Amenities | ¡ 16th Street Mall, the Denver Pavilions and LoDo shopping attractions in close proximity to property ¡ Stop planned on Downtown Denver Circulator bus ¡ Five-Star Brown Palace hotel within two blocks |

TCF Tower & Bank Building – Downtown Minneapolis, MN

| ¡ | Acquisition of Class B, office tower and ancillary low-rise bank building for $40.5 million or ~$85 per rentable SF |

| ¡ | Attractive purchase price atsignificant discount to replacement cost |

| ¡ | 17 story, multi-tenant office building totaling ~300,000 rentable SF |

| ¡ | 4 story low-rise building totaling ~170,000 rentable SF |

| ¡ | Intended to be long-term development play with strong initial coupon |

| ¡ | Closed June 29, 2010 - ~90% leased at purchase |

Value-Add Potential

| ¡ | Low-rise building represents one of downtown’s best remaining development sites – adjacent to and connected to the Landmark Foshay Tower (a W Hotel) and caddy-corner to the IDS Center |

| ¡ | Site could potentially support a 600,000 to 700,000 SF tower development according to an initial architectural review by Pikard-Chilton conducted by Seller (Ryan Properties). |

| ¡ | FSP priced-in up front at purchase the anticipated departure of TCF Bank at end of December of 2015, which would open up exploring development opportunities to further add value to the site |

| ¡ | Strengthening Minneapolis economy and office market |

| Quality Asset | ¡ Includes an integrated 5 story parking ramp ¡ Finishing complete elevator modernization ¡ Finishing full skyway level amenity makeover |

High Visibility

Class “A”

Location | ¡ Highly accessible downtown tower ¡ Full Skyway connectivity to Nicollet Mall and IDS Crystal Court amenities ¡ Best of Class location in downtown |

City /

Submarket

Momentum | ¡ Downtown Minneapolis office market has experienced 2 consecutive quarters of positive absorption ¡ Strong growth and demand for downtown residential and retail |

Vibrant Urban

Center | ¡ 24/7 urban, pedestrian friendly environment ¡ Well-served by public transportation ¡ Cultural area with numerous performing arts centers, museums and sports venues |

Retail /

Hospitality

Amenities | ¡ Nicollet Mall contains numerous shopping attractions in close proximity to property ¡ Pedestrian friendly environment with Skyway ¡ Connected to W Hotel |

Proven track record of selling assets when value has been deemed to be maximized and reinvesting proceeds into new high potential assets

| ¡ | Historically monetized assets for the following reasons: |

| ¡ | Exit heated markets when achievable prices reflect value maximization for shareholders |

| ¡ | Size / age / efficiency of operation considerations |

| ¡ | Realize / maximize return on investment life cycle relative to time horizon of invested capital |

Fairview – Falls Church, VA Case Study

| ¡ | FSP sold asset in January 2011 |

| ¡ | Net sales proceeds of $89.4 million |

| ¡ | Realized a $19.6 million gain on sale |

Goldentop Technology Center – San Diego, CA Case Study

| ¡ | FSP exited Goldentop Technology Center in June 2007 |

| ¡ | Net sales proceeds of $36.2 million |

| ¡ | Realized a $14.7 million gain on sale |

Recognized a net gain on sale of ~$123 million on ~$491 million of non-core disposition proceeds since 2005

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

100% of office space leased through 2021 with two full-building tenants

| ¡ | FSP’s leasing strategy focuses on long-term value creation |

| ¡ | Successfully leased 100% of office space to high quality tenants with long term leases |

| ¡ | FSP acquisition team targeted Greenwood Plaza due to planned development of light rail station close to property |

| ¡ | At acquisition, 100% leased to a single tenant (Sybase) |

| ¡ | Sybase subleased ~75% to various other subtenants |

| ¡ | April 2010: Sybase lease expires and FSP retains ~25% of existing subtenants for balance of 2010 |

| ¡ | January 2011: FSP signs DirecTV to a 130 month lease for all of Building I ‘s office space (66,226 rentable SF) |

| ¡ | November 2012: FSP signs Kaiser Permanente to a 130 month lease for all of Building II’s office space (120,979 rentable SF) |

| ¡ | Lack of new construction and strong Denver office market led to a competitive leasing environment |

__________

Source: Public Company filings and disclosures as of March 31, 2014, Bloomberg and FSP Management as of May 16, 2014.

| | | Three | | | | | | | | | | For the | | For the |

| | | Months Ended | | For the Three Months Ended: | | Year Ended | | Year Ended |

| | | 31-Mar-14 | | 31-Mar-13 | | 30-Jun-13 | | 30-Sep-13 | | 31-Dec-13 | | 31-Dec-13 | | 31-Dec-12 |

| | | | | | | | | | | | | | | |

| Net income | | $ | 3,573 | | | $ | 4,401 | | | $ | 4,741 | | | $ | 4,094 | | | $ | 6,591 | | | $ | 19,827 | | | $ | 7,633 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain (loss) on sale, less applicable income tax | | | — | | | | — | | | | — | | | | — | | | | (2,158 | ) | | | (2,158 | ) | | | 14,826 | |

| GAAP income from non-consolidated REITs | | | 484 | | | | 188 | | | | 196 | | | | 431 | | | | 543 | | | | 1,358 | | | | (2,033 | ) |

| FFO from non-consolidated REITs | | | 419 | | | | 647 | | | | 696 | | | | 459 | | | | 346 | | | | 2,148 | | | | 4,124 | |

| Depreciation & amortization | | | 24,289 | | | | 15,984 | | | | 17,044 | | | | 22,176 | | | | 23,886 | | | | 79,090 | | | | 55,518 | |

| NAREIT FFO* | | | 28,765 | | | | 21,220 | | | | 22,677 | | | | 27,160 | | | | 29,208 | | | | 100,265 | | | | 80,068 | |

| Acquisition costs | | | 14 | | | | 17 | | | | 133 | | | | 406 | | | | 12 | | | | 568 | | | | 287 | |

| Funds From Operations (FFO)* | | $ | 28,779 | | | $ | 21,237 | | | $ | 22,810 | | | $ | 27,566 | | | $ | 29,220 | | | $ | 100,833 | | | $ | 80,355 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Funds From Operations (AFFO)* | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Funds From Operations (FFO)* | | | 28,779 | | | | 21,237 | | | | 22,810 | | | | 27,566 | | | | 29,220 | | | | 100,833 | | | | 80,355 | |

| Reverse FFO from non-consolidated REITs | | | (419 | ) | | | (647 | ) | | | (696 | ) | | | (459 | ) | | | (346 | ) | | | (2,148 | ) | | | (4,124 | ) |

| Distributions from non-consolidated REITs | | | 27 | | | | 27 | | | | 27 | | | | 27 | | | | 26 | | | | 107 | | | | 2,810 | |

| Amortization of deferred financing costs | | | 499 | | | | 429 | | | | 429 | | | | 456 | | | | 499 | | | | 1,813 | | | | 2,052 | |

| Straight-line rent | | | (1,783 | ) | | | (657 | ) | | | (1,186 | ) | | | (2,078 | ) | | | (1,862 | ) | | | (5,783 | ) | | | (4,463 | ) |

| Building improvements | | | (1,119 | ) | | | (1,118 | ) | | | (1,622 | ) | | | (1,552 | ) | | | (1,479 | ) | | | (5,771 | ) | | | (3,712 | ) |

| Tenant improvements | | | (1,133 | ) | | | (1,729 | ) | | | (5,754 | ) | | | (4,596 | ) | | | (2,992 | ) | | | (15,071 | ) | | | (13,037 | ) |

| Leasing commissions | | | (1,112 | ) | | | (2,813 | ) | | | (1,087 | ) | | | (3,821 | ) | | | (1,536 | ) | | | (9,257 | ) | | | (7,427 | ) |

| Adjusted Funds From Operations (AFFO)* | | $ | 23,739 | | | $ | 14,729 | | | $ | 12,921 | | | $ | 15,543 | | | $ | 21,530 | | | $ | 64,723 | | | $ | 52,454 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EPS | | $ | 0.04 | | | $ | 0.05 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.07 | | | $ | 0.21 | | | $ | 0.09 | |

| FFO* | | | 0.29 | | | | 0.26 | | | | 0.25 | | | | 0.28 | | | | 0.29 | | | | 1.07 | | | | 0.97 | |

| AFFO* | | | 0.24 | | | | 0.18 | | | | 0.14 | | | | 0.16 | | | | 0.21 | | | | 0.69 | | | | 0.63 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Shares (basic and diluted) | | | 100,187 | | | | 82,937 | | | | 91,847 | | | | 100,187 | | | | 100,187 | | | | 93,855 | | | | 82,937 | |

*See page 36 for definitions of these Non-GAAP measures.

Definition of Funds From Operations (FFO)

The Company evaluates performance based on Funds From Operations, which we refer to as FFO, as management believes that FFO represents the most accurate measure of activity and is the basis for distributions paid to equity holders. The Company defines FFO as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and acquisition costs of newly acquired properties that are not capitalized, plus depreciation and amortization, including amortization of acquired above and below market lease intangibles and impairment charges on properties or investments in non-consolidated REITs, and after adjustments to exclude equity in income or losses from, and, to include the proportionate share of FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income (determined in accordance with GAAP), nor as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs.

Other real estate companies and the National Association of Real Estate Investment Trusts, or NAREIT, may define this term in a different manner. We have included the NAREIT FFO definition in our table and note that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of the results of the Company, FFO should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

Definition of Adjusted FFO (AFFO)

The Company defines AFFO as the sum of (1) FFO; (2) less the effect of straight-line rent; (3) plus deferred financing costs, (4) less recurring capital expenditures that are generally for (a) maintenance of properties or are second generation capital expenditures or what we call non-investment capex, (b) tenant improvements, (c) leasing commissions; and (4) plus non-cash compensation expenses, if any. AFFO should not be considered as an alternative to net income (determined in accordance with GAAP), as an indicator of the Company’s financial performance, nor as an alternative to cash flows from operating activities (determined in accordance with GAAP), nor as a measure of the Company’s liquidity, nor is it necessarily indicative of sufficient cash flow to fund all of the Company’s needs. Other real estate companies may define this term in a different manner. We believe that in order to facilitate a clear understanding of the results of the Company, AFFO should be examined in connection with net income and cash flows from operating, investing and financing activities in the consolidated financial statements.

EBITDA is defined as net income plus interest expense, income tax expense and depreciation and amortization expense. Adjusted EBITDA is defined as EBITDA excluding gains and losses on sales of properties or shares of equity investments or provisions for losses on assets held for sale. EBITDA and Adjusted EBITDA are not intended to represent cash flow for the period, are not presented as an alternative to operating income as an indicator of operating performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP and are not indicative of operating income or cash provided by operating activities as determined under GAAP. EBITDA and Adjusted EBITDA are presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA or Adjusted EBITDA the same way, this presentation may not be comparable to similarly titled measures of other companies. The Company believes that net income is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to EBITDA and Adjusted EBITDA.

| Adjusted EBITDA Reconciliation |

| | | Three Months

Ended | | | Three Months

Ended | |

| | | 31-Mar-14 | | | 31-Mar-13 | |

| Net Income | | $ | 3,573 | | | $ | 4,401 | |

| Interest Expense | | | 7,176 | | | | 4,208 | |

| Depreciation & amortization | | | 24,300 | | | | 15,984 | |

| Income Taxes | | | 137 | | | | 119 | |

| EBITDA | | | 35,186 | | | | 24,712 | |

| Excluding (gain) loss on sale, less applicable income tax | | | — | | | | — | |

| Adjusted EBITDA | | $ | 35,186 | | | $ | 24,712 | |

__________

Note: $ in millions.