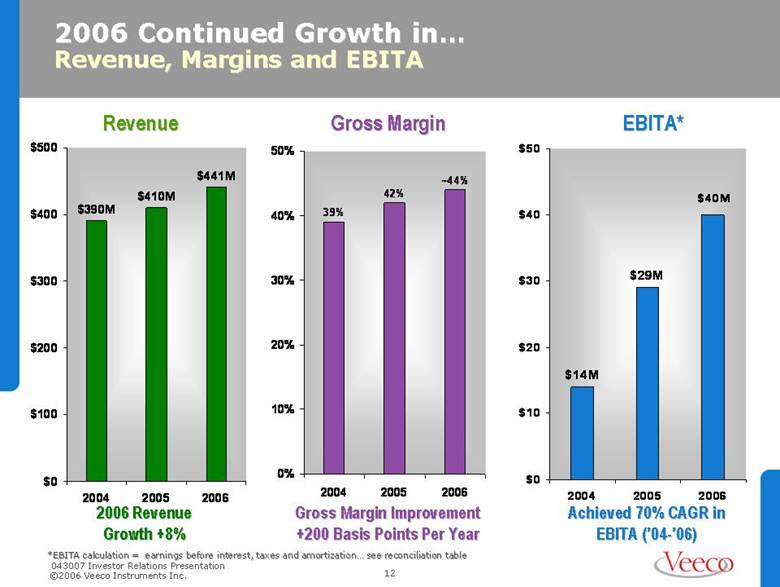

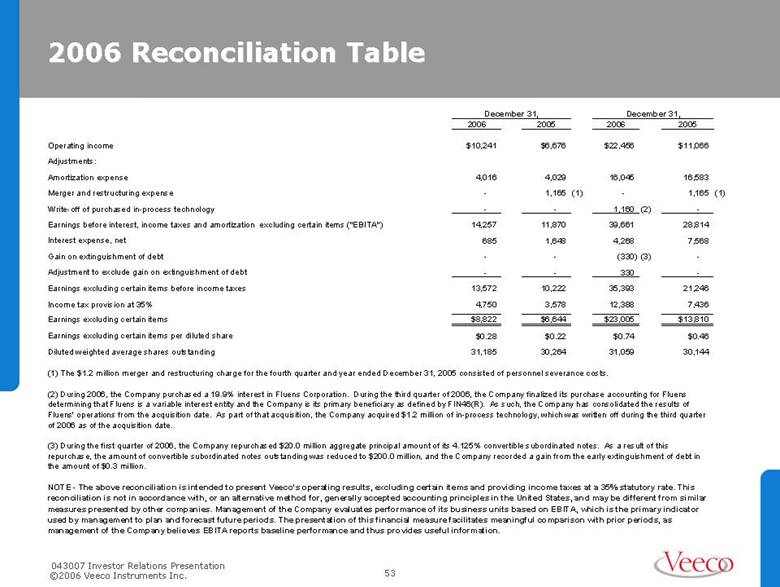

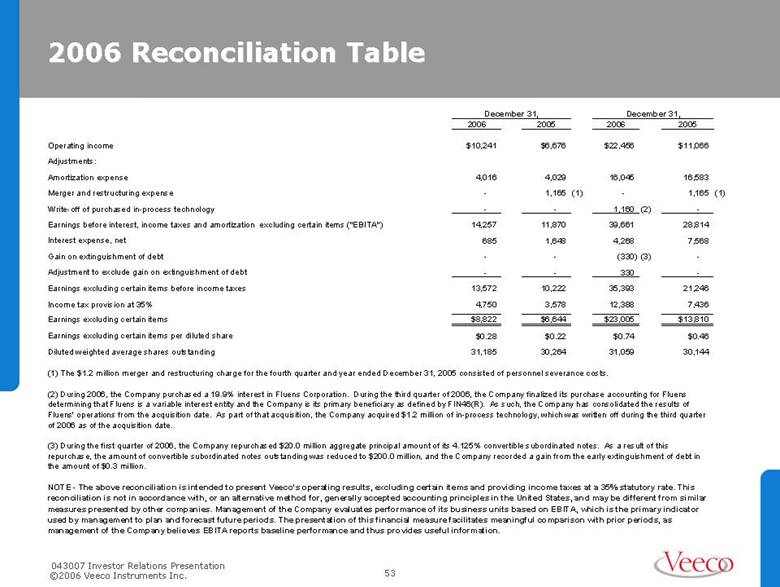

| 043007 Investor Relations Presentation 2006 Veeco Instruments Inc. 2006 Reconciliation Table 2006 2005 2006 2005 Operating income $10,241 $6,676 $22,456 $11,066 Adjustments: Amortization expense 4,016 4,029 16,045 16,583 Merger and restructuring expense - 1,165 (1) - 1,165 (1) Write-off of purchased in-process technology - - 1,160 (2) - Earnings before interest, income taxes and amortization excluding certain items ("EBITA") 14,257 11,870 39,661 28,814 Interest expense, net 685 1,648 4,268 7,568 Gain on extinguishment of debt - - (330) (3) - Adjustment to exclude gain on extinguishment of debt - - 330 - Earnings excluding certain items before income taxes 13,572 10,222 35,393 21,246 Income tax provision at 35% 4,750 3,578 12,388 7,436 Earnings excluding certain items $8,822 $6,644 $23,005 $13,810 Earnings excluding certain items per diluted share $0.28 $0.22 $0.74 $0.46 Diluted weighted average shares outstanding 31,185 30,264 31,059 30,144 NOTE - The above reconciliation is intended to present Veeco's operating results, excluding certain items and providing income taxes at a 35% statutory rate. This reconciliation is not in accordance with, or an alternative method for, generally accepted accounting principles in the United States, and may be different from similar measures presented by other companies. Management of the Company evaluates performance of its business units based on EBITA, which is the primary indicator used by management to plan and forecast future periods. The presentation of this financial measure facilitates meaningful comparison with prior periods, as management of the Company believes EBITA reports baseline performance and thus provides useful information. December 31, (1) The $1.2 million merger and restructuring charge for the fourth quarter and year ended December 31, 2005 consisted of personnel severance costs. (2) During 2006, the Company purchased a 19.9% interest in Fluens Corporation. During the third quarter of 2006, the Company finalized its purchase accounting for Fluens determining that Fluens is a variable interest entity and the Company is its primary beneficiary as defined by FIN46(R). As such, the Company has consolidated the results of Fluens' operations from the acquisition date. As part of that acquisition, the Company acquired $1.2 million of in-process technology, which was written off during the third quarter of 2006 as of the acquisition date. (3) During the first quarter of 2006, the Company repurchased $20.0 million aggregate principal amount of its 4.125% convertible subordinated notes. As a result of this repurchase, the amount of convertible subordinated notes outstanding was reduced to $200.0 million, and the Company recorded a gain from the early extinguishment of debt in the amount of $0.3 million. December 31, |