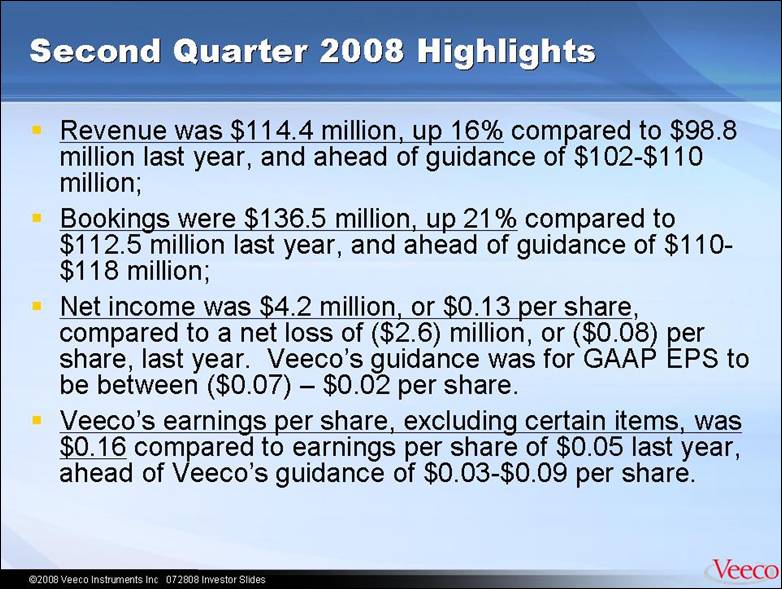

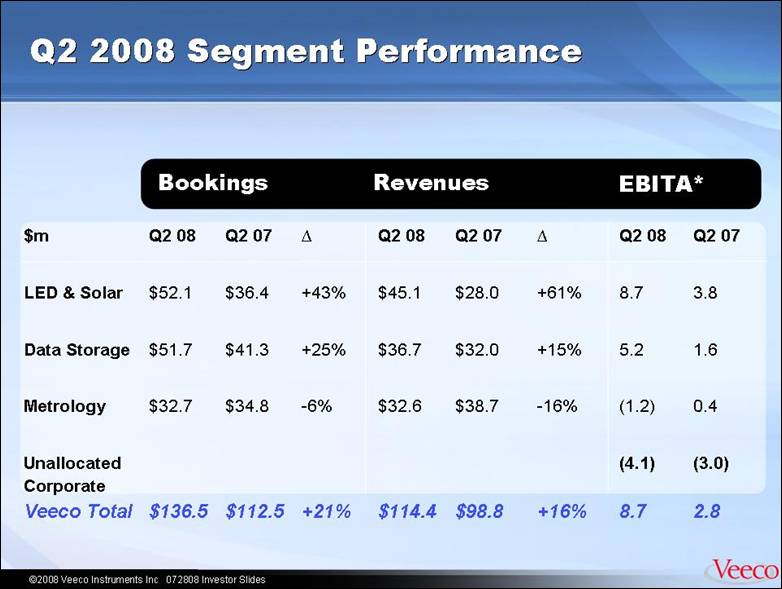

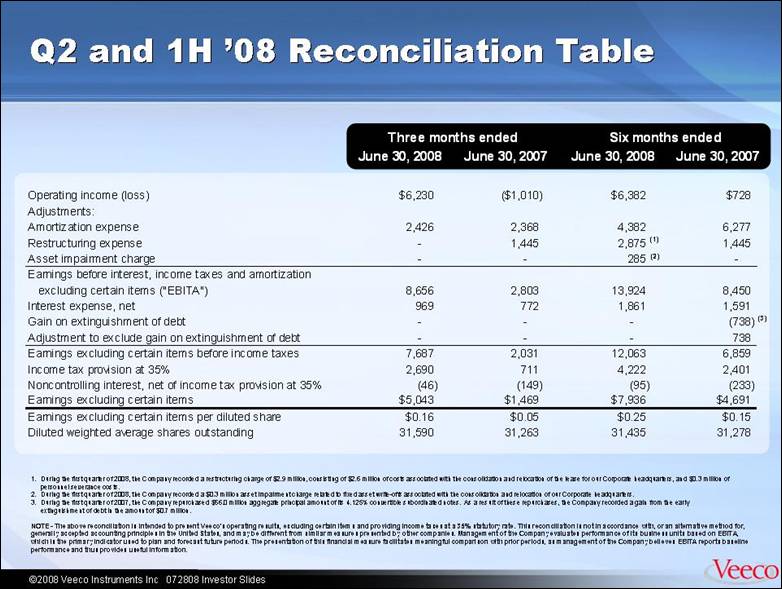

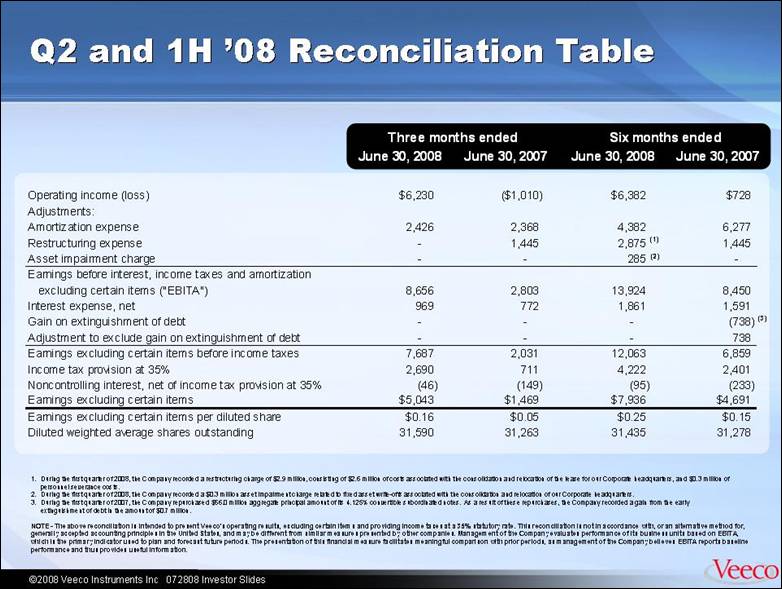

| ©2008 Veeco Instruments Inc 042808 Investor Slides 12 ©2008 Veeco Instruments Inc 072808 Investor Slides Q2 and 1H ’08 Reconciliation Table NOTE - The above reconciliation is intended to present Veeco's operating results, excluding certain items and providing income taxes at a 35% statutory rate. This reconciliation is not in accordance with, or an alternative method for, generally accepted accounting principles in the United States, and may be different from similar measures presented by other companies. Management of the Company evaluates performance of its business units based on EBITA, which is the primary indicator used to plan and forecast future periods. The presentation of this financial measure facilitates meaningful comparison with prior periods, as management of the Company believes EBITA reports baseline performance and thus provides useful information. 1. During the first quarter of 2008, the Company recorded a restructuring charge of $2.9 million, consisting of $2.6 million of costs associated with the consolidation and relocation of the lease for our Corporate headquarters, and $0.3 million of personnel severance costs. 2. During the first quarter of 2008, the Company recorded a $0.3 million asset impairment charge related to fixed asset write-offs associated with the consolidation and relocation of our Corporate headquarters. 3. During the first quarter of 2007, the Company repurchased $56.0 million aggregate principal amount of its 4.125% convertible subordinated notes. As a result of these repurchases, the Company recorded a gain from the early extinguishment of debt in the amount of $0.7 million. (1) (2) (3) June 30, 2008 June 30, 2007 June 30, 2008 June 30, 2007 Operating income (loss) $6,230 ($1,010) $6,382 $728 Adjustments: Amortization expense 2,426 2,368 4,382 6,277 Restructuring expense - 1,445 2,875 1,445 Asset impairment charge - - 285 - Earnings before interest, income taxes and amortization excluding certain items ("EBITA") 8,656 2,803 13,924 8,450 Interest expense, net 969 772 1,861 1,591 Gain on extinguishment of debt - - - (738) Adjustment to exclude gain on extinguishment of debt - - - 738 Earnings excluding certain items before income taxes 7,687 2,031 12,063 6,859 Income tax provision at 35% 2,690 711 4,222 2,401 Noncontrolling interest, net of income tax provision at 35% (46) (149) (95) (233) Earnings excluding certain items $5,043 $1,469 $7,936 $4,691 Earnings excluding certain items per diluted share $0.16 $0.05 $0.25 $0.15 Diluted weighted average shares outstanding 31,590 31,263 31,435 31,278 Three months ended Six months ended |