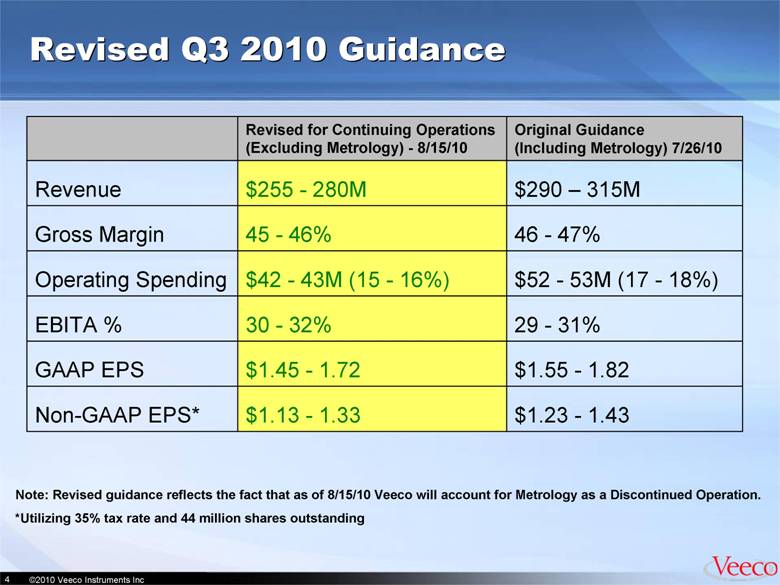

| Revised Q3 Guidance Reconciliation for Continuing Ops (Excluding Metrology) NOTE - The above reconciliation is intended to present Veeco's operating results from continuing operations, excluding certain items and providing income taxes at a 35% statutory rate. This reconciliation is not in accordance with, or an alternative method for, generally accepted accounting principles in the United States, and may be different from similar measures presented by other companies. Management of the Company evaluates performance of its business units based on earnings before interest, income taxes and amortization excluding certain items ("EBITA"), which is the primary indicator used to plan and forecast future periods. The presentation of this financial measure facilitates meaningful comparison with prior periods, as management of the Company believes EBITA reports baseline performance and thus provides useful information. (1) Adjustment to exclude non-cash interest expense on convertible subordinated notes. 44,000 44,000 Diluted weighted average shares outstanding $ 1.33 $ 1.13 Earnings per diluted share excluding certain items $ 58,410 $ 49,587 Earnings excluding certain items 31,452 26,700 Income tax provision at 35% 89,862 76,287 Earnings excluding certain items before income taxes (1) (769) (1) (769) Adjustment to add back non-cash portion of interest expense 1,678 1,678 Interest expense, net 90,771 77,196 excluding certain items ("EBITA") Earnings before interest, income taxes and amortization 2,601 2,601 Equity-based compensation 1,237 1,237 Amortization Adjustments: $ 86,933 $ 73,358 Operating income from continuing operations HIGH LOW months ending September 30, 2010 Guidance for the three (Unaudited) (In thousands, except per share data) Reconciliation of operating income from continuing operations to earnings excluding certain items Veeco Instruments Inc. and Subsidiaries |