MERUS LABS INTERNATIONAL INC.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED SEPTEMBER 30, 2011

December 29, 2011

TABLE OF CONTENTS

i

ANNUAL INFORMATION FORM

PART 1 EXPLANATORY NOTES AND CAUTIONARY STATEMENTS

1.1 Explanatory Notes

Merus Labs International Inc. (“Merus”, “we”, “us”, or “our”) was formed on December 19, 2011 by the amalgamation (the “Amalgamation”) of Merus Labs International Inc. (“Old Merus”) and Envoy Capital Group Inc. (“Envoy”). Merus has adopted Envoy’s year end of September 30, 2011. The Amalgamation occurred on December 19, 2011, which is after Envoy’s year end. Thus, Merus is required to file this Annual Information Form (“AIF”) for Envoy’s business activities prior to the closing of the Amalgamation. Although this AIF includes descriptions of the Amalgamation and the business of Merus after the closing of the Amalgamation, the financial statements and information included by reference hereto are only those of Envoy as of September 30, 2011.

All information contained in this AIF is as of September 30, 2011, unless otherwise indicated. Merus uses the Canadian dollar as its reporting currency. References to “$” refer to Canadian currency.

1.2 About Forward-Looking Information

This AIF and the documents incorporated by reference herein contain certain statements or disclosures that may constitute forward-looking information or statements (collectively, “forward-looking information”) under applicable securities laws. All statements and disclosures, other than those of historical fact, which address activities, events, outcomes, results or developments that management of Merus, anticipates or expects may or will occur in the future (in whole or in part) should be considered forward-looking information. In some cases, forward-looking information can be identified by terms such as “forecast”, “future”, “may”, “will”, “expect”, “anticipate”, “believe”, “could”, “potential”, “enable”, “plan, “continue”, “contemplate”, “pro forma” or other comparable terminology. Forward-looking information presented in such statements or disclosures may, among other things: sources of income; forecasts of capital expenditures, including general and administrative expenses, and the sources of the financing thereof; expectations regarding the ability to raise capital; movements in currency exchange rates; anticipated income taxes; Merus’ business outlook; plans and objectives of management for future operations; forecast business results; and anticipated financial performance.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Merus, including information obtained from third-party industry analysts and other third party sources. In some instances, material assumptions and factors are presented or discussed elsewhere in this AIF in connection with the statements or disclosure containing the forward-looking information. You are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to:

2

- no significant event occurring outside the ordinary course of business such as a natural disaster or other calamity.

The forward-looking information in statements or disclosures in this AIF is based (in whole or in part) upon factors which may cause actual results, performance or achievements of Merus to differ materially from those contemplated (whether expressly or by implication) in the forward-looking information. Those factors are based on information currently available to Merus, including information obtained from third-party industry analysts and other third party sources. Actual results or outcomes may differ materially from those predicted by such statements or disclosures. While Merus does not know what impact any of those differences may have, their business, results of operations, financial condition and credit stability may be materially adversely affected. Factors that could cause actual results or outcomes to differ materially from the results expressed or implied by forward-looking information include, among other things:

the acceptance of Merus’ products by hospital formularies and pharmacies, physicians and patients in the marketplace;

Merus’ ability to successfully market and sell its products;

delays or setbacks with respect to clinical trials, governmental approvals, or manufacturing or commercial activities;

the timing and unpredictability of regulatory actions;

the ability to develop and commercialize new products effectively;

unanticipated cash requirements to support current operations, to expand its business or for capital expenditures;

the inability to adequately protect its key intellectual property rights;

the loss of key management or scientific personnel;

the activities of its competitors;

regulatory, legal or other setbacks with respect to its operations or business;

market conditions in the capital markets and the biopharmaceutical industry that make raising capital or consummating acquisitions difficult, expensive or both;

enactment of new government laws, regulations, court decisions, regulatory interpretations or other initiatives that are adverse to Merus or its interests;

the risk that Merus is not able to arrange sufficient, cost-effective financing to repay maturing debt and to fund capital expenditures, future exploration activities and acquisitions, and other obligations; and

the risks associated with legislative and regulatory developments that may affect costs, revenues, the speed and degree of competition entering the market, global capital markets activity and general economic conditions in geographic areas where Merus operates.

3

Merus is not obligated to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable laws. Because of the risks, uncertainties and assumptions contained herein, securityholders should not place undue reliance on forward-looking statements or disclosures. The foregoing statements expressly qualify any forward-looking information contained herein.

The reader is further cautioned that the preparation of financial statements in accordance with Canadian GAAP or IFRS requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. These estimates may change, having either a negative or positive effect on net earnings as further information becomes available, and as the economic environment changes.

Merus cautions you that the above list of risk factors is not exhaustive. Other factors which could cause actual results, performance or achievements of Merus to differ materially from those contemplated (whether expressly or by implication) in the forward-looking statements or other forward-looking information are disclosed in Merus’ publicly filed disclosure documents, including those disclosed under “Risk Factors” in this AIF.

1.3 Documents Incorporated by Reference

The audited consolidated financial statements of Envoy for the year ended September 30, 2011 include its consolidated balance sheets as at September 30, 2011 and 2010 and the consolidated statements of operations and comprehensive loss, cash flows and shareholders’ equity of Envoy for the year ended September 31, 2011, 2010 and 2009, together with the notes thereon. They have been filed with Canadian securities regulatory authorities on SEDAR (available at www.sedar.com), and are incorporated by reference into this AIF. Also incorporated by reference into this AIF is Envoy’s Management’s Discussion and Analysis (“MD&A”) dated December 13, 2011, which has also been filed with Canadian securities regulatory authorities on SEDAR (available at www.sedar.com). All financial information in this AIF is prepared in accordance with Canadian generally accepted accounting principles.

PART 2 CORPORATE STRUCTURE

2.1 Name, Address and Incorporation

Envoy was incorporated under the laws of the Province of British Columbia, Canada as “Potential Mines Ltd.” in December 1973 and was continued under the laws of the Province of Ontario, Canada in December 1997. At Envoy’s annual general meeting held on March 30, 2007 the shareholders voted to amend Envoy’s articles of incorporation by changing its name to Envoy Capital Group Inc. On December 16, 2011, Envoy filed a continuation application with the British Columbia Corporate Registry and was continued under the laws of the Province of British Columbia.

Old Merus was incorporated under the laws of the Province of British Columbia on November 2, 2009 as a numbered company, 0865346 B.C. Ltd. On January 22, 2010, Old Merus changed its name to Merus Labs International Inc. in connection with a plan of arrangement with Range Gold Corp.

On December 19, 2011, pursuant to a plan of arrangement filed with the British Columbia Corporate Registry, Old Merus and Envoy amalgamated to form Merus.

4

As of December 28, 2011, Merus’ registered office is located at 800-885 West Georgia Street, Vancouver, BC V6C 3H1; its head office is located at Suite 2007. 1177 West Hastings Street, Vancouver, BC V6E 2K3; and its telephone number is 604-805-7783.

The common shares in the capital of Merus (the “Common Shares”) are publicly traded on the Toronto Stock Exchange (“TSX”) under the symbol “MSL” and on NASDAQ under the symbol “MSLI”.

2.2 Intercorporate Relationships

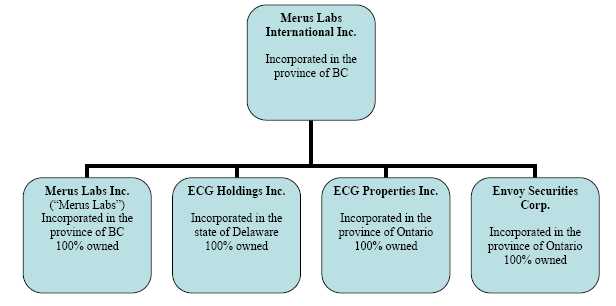

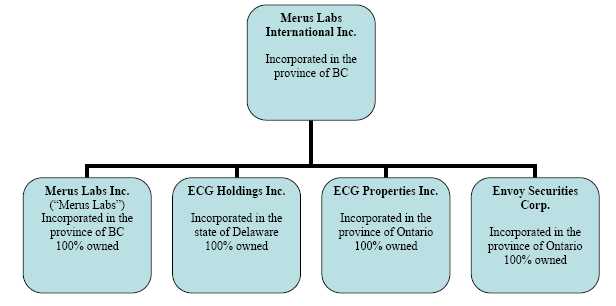

As of December 28, 2011, Merus has four subsidiaries:

PART 3 GENERAL DEVELOPMENT OF THE BUSINESS

3.1 Three Year History

Envoy’s business was to provide marketing, communications and consumer and retail branding services for promoting clients’ products, services and business messages utilizing such media as print, broadcast and the Internet. Effective upon the Amalgamation, Envoy ceased this line of business and the business of Old Merus will be the business of Merus going forward.

Merus is focused on the acquisition and licensing of prescription pharmaceutical products in the mature stage of the product life cycle. Legacy products are those products that are no longer promoted, most likely generecised (i.e. the trademark has becomes generic), considered time-trusted medicines with known risk profiles and are at the steady state cash flow stage of their life cycle.

On June 23, 2010, Merus Labs entered into a binding letter of intent with Methapharm for the licensing, registration, and distribution of specific pharmaceutical products and medical devices in Canada, on an exclusive basis.

On July 5, 2010, Merus Labs entered into a formal agreement with Methapharm for the licensing, registration, and distribution of specific pharmaceutical products and medical devices in Canada, on an exclusive basis. The deal includes a portfolio of advanced wound care products including Hydrogel, ulcer wound, and composite multi-layered dressings, as well as, antimicrobial silver Hydrogel dressings. The portfolio also includes anti-fungal creams.

5

On September 17, 2010, Merus Labs entered into a definitive agreement with Innocoll Pharmaceuticals Limited (“Innocoll”) to license in, on an exclusive basis, 3 advanced wound care products for the Canadian market. Furthermore, Innocoll agrees to grant to Merus Labs a right of first refusal for all current pipeline advanced wound care products for the Canadian Market.

On May 13, 2011, Merus Labs acquired all right, title and interest in and to the pharmaceutical product Vancocin® (vancomycin hydrochloride) capsules (“Vancocin®”), including the right to manufacture, market and sell Vancocin® in Canada, from Iroko. Merus Lab acquired Vancocin® for total consideration in line with an acquisition of a pharmaceutical brand, which is typically divested at a price ranging from a multiple of 2.5 to 3.5 times the net annual sales of the product.

Vancocin® capsules are indicated for the treatment of:

On May 26, 2011, Old Merus announced that Health Canada has approved its advanced wound care product Collacare®.

On July 5, 2011, Old Merus announced it has entered into a support services agreement (the “Methapharm Agreement”) with Methapharm. Under the terms of the Methapharm Agreement, Methapharm has agreed to provide Merus with $500,000 in working capital in consideration for:

being appointed the exclusive provider of certain distribution services of Merus’ products in Canada; and

payment of certain fees based on net sales of Merus’ products, and service fees in line with market rates customary to such services.

The Methapharm Agreement is for a term of five years with automatic renewal terms of two years until terminated.

3.2 Significant Acquisitions

Please see sections 3.1 and Part 4 of this annual information form.

PART 4 DESCRIPTION OF THE BUSINESS

4.1 General

Merus operates a specialty pharmaceutical business specializing in acquisition of mature prescription and over-the-counter pharmaceutical products and licensing in of novel hospital products.

6

Merus plans to specialize in the management and acquisition of products that achieved market exclusivity as a result of technological, manufacturing or economic barriers to competitive entry, or otherwise maintain stable demand. Merus expects to work with a variety of diversified products without limiting itself to a specific class of drug as these mature products typically do not require a sales force or a significant amount of marketing resources.

Merus also plans to license in novel hospital products, on an exclusive basis, where products have been approved in one major market or about to be approved in one major market, hence lowering the risk of its portfolio. These products tend to have patent protection over long periods of time and serve unmet medical needs.

Superior Business Model for Acquisition of Diversified Legacy Products

Merus believes that it has a unique strategy in seeking to acquire legacy products primarily for the purpose of generating a stream of stable revenues and cash flow. This strategy shall provide Merus with the flexibility to consider a broad range of acquisition targets from a variety of therapeutic areas. Therefore, the potential number of product acquisition candidates may be much larger for Merus than for its competitors. Management believes that Merus’ approach to product acquisition and its return objectives provide Merus with a competitive advantage in acquiring products as it can often purchase diversified bundles of products from a single vendor. In contrast, Merus’ competitors, such as niche pharmaceutical companies, are more likely to focus on individual product acquisition within the same therapeutic area. As a result, certain vendors may view Merus as a preferred purchasing candidate.

Predictable Cost Structure

Merus plans to establish a predictable cost structure by relying on a small employee base and outsourcing more of the operational functions associated with its business, including warehousing, distribution, customer service, invoicing, collections, regulatory affairs, medical and drug information, human resources and informational technology. Wherever possible, Merus will achieve cost controls by entering into contractual supply and/or service agreements that dictate fixed or percentage fixed costs with annual adjustments for inflation. In the case of its manufacturing supply agreements, Merus’ cost of goods will be based on a fixed, per unit cost with annual inflationary adjustments. Management believes the predictability, flexibility and efficiency gained by contracting with established, experienced service organizations will assist Merus in maintaining its margins and maximizing distributable cash.

Partnership with Leading Service Providers

Related to the above, Merus will enter into outsourcing relationships with leading providers of pharmaceutical contract services for many of the operational functions associated with its business and intends to pursue this strategy in the future.

Competitors of Merus

Competitors in the pharmaceutical market range from large multinational pharmaceutical development corporations to small, single product companies that may limit their activities to a particular therapeutic area or region or territory. Competition also comes from generic companies, which develop and commercialize formulations that are identical to marketed brands. Merus expects to compete with a variety of drug companies. However, the Initial Portfolio is comprised of established brands with no generic competition.

7

With respect to its acquisition strategy, Merus expects to compete principally with other pharmaceutical companies who seek to acquire mature pharmaceutical products as part of their growth strategy. These companies, however, typically focus on under-promoted products in specific therapeutic niches that offer growth potential through synergistic sales and marketing efforts. To Merus’ knowledge, few, if any, companies are currently seeking to acquire legacy products solely for the purpose of generating a stream of consistent cash flow. In addition, since Merus is not focused on specific therapeutic classes, it will have the ability to purchase diversified products and product bundles.

On November 3, 2011, Optimer Pharmaceuticals, Inc. (“Optimer”) announced that Health Canada awarded Optimer priority review for its product: DIFICID®. DIFICID® is another method for the treatment of Clostridium difficile infection. Optimer asserts that DIFICID® has a slightly lower recurrence rate than Vancocin®. The recent Infectious Diseases Society of America guidelines (the “IDSA Guidelines”) indicate that a tapered and pulsed regimen with Vancocin® is effective in reducing recurrence. The IDSA Guidelines also recommend that Vancocin® be used as a first-line therapy in the treatment of Clostridium difficile. If Optimer is able to demonstrate that DIFICID® is preferable to Vancocin®, the business of Merus could be adversely affected.

Description of Products and Services

Anti-infective Franchise

The global market for anti-infective drugs, which mainly includes antibacterials, antivirals, antifungals, and vaccines, is projected to exceed $103 billion by the year 2015, according to a newly published report. Antibacterials represent the largest segment of the anti-infectives market globally. The global anti-infective market is forecast to expand at a compound annual growth rate of 5.7% between 2008 and 2013. The ten leading companies in the anti-infectives market accounted for 53.8% (or $37.3 billion) of total revenues in 2007. The competitive landscape remains highly fragmented, with market leaders Merck and GSK controlling a combined market share of only 21.4% . Anti-bacterials accrued sales of $36.3 billion in 2007, accounting for 52.3% of total market revenues.

Vancocin

Vancomycin was first isolated by Eli Lilly. The original indication for vancomycin was for the treatment of penicillin-resistant staphylococcus aureus. One advantage that was quickly apparent is that staphylococci did not develop significant resistance despite serial passage in culture media containing vancomycin. The rapid development of penicillin resistance by staphylococci led to the compounds being fast-tracked for approval by the US Food and Drug Administration (“FDA”). Eli Lilly first marketed vancomycin hydrochloride under the trade name Vancocin. Vancocin is a powerful antibiotic used to treat a life-threatening disease resulting from the infection of Clostridium Difficile (“C. Difficile”).

C. Difficile is on the increase with higher mortality and severity. Due to the nature of the disease, intravenous (systemic) solutions are regarded as ineffective. To be effective against C. Difficile, drugs must act locally on the flora of the gastro intestinal track. Intravenous solutions by definition do not act locally.

Recent Clinical Practice Guidelines (Clinical Practice Guidelines for Clostridium difficile Infection in Adults: 2010 Update by the Society for Healthcare Epidemiology of America (SHEA) and the Infectious Diseases Society of America (IDSA)) state that oral Vancocin should be used as first line therapy in severe cases of C. Difficile. The guidelines state that vancomycin is the drug of choice for an initial episode of severe C. Difficile. The dosage is 125 mg orally four times per day for 10–14 days. Vancomycin administered orally (and per rectum, if ileus is present) is the regimen of choice for the treatment of severe, complicated C. Difficile.

8

Barriers to Entry

There are a number of important barriers to entry with regards to Vancocin, which includes the following.

Quality of Vancomycin HCI Non-Sterile, USP:

Vancomycin HCI Non-Sterile, USP (“API”) is a result of a complex fermentation process, which requires significant know how and experience. The source of API is a critical factor. As well, the impurity profile of the API has a direct impact on efficacy. In vitro antibacterial effects, protein binding and pharmacokinetic properties were similar between the generic vancomycin preparations and VAN-Lilly (or Vancocin). However, in a staphylococcus aureus neutropenic mouse thigh infection model, the antibacterial activity of the generic vancomycin preparations marketed between 2002 and November 2004, when Eli Lilly sold its brand name and production secrets to several manufacturers worldwide, proved to be significantly inferior to that of VAN-Lilly (or Vancocin). One generic could not even achieve bacteriostasis, and others showed a pronounced Eagle effect, with paradoxical bacterial growth at high antibiotic concentrations; VAN-Lilly (or Vancocin) exhibited bactericidal activity over a broad concentration range. What they came to learn is that vancomycin, specifically factor B, is really the active product, and Eli Lilly was the one that originally had 92% purity in their production line, with less than 4% of impurities, specifically crystalline degradation products. It turns out that many of the generics vancomycin, especially less expensive ones, have higher rates of impurities and lower amounts of factor B.

Narrow Therapeutic Index:

Most antibiotics, such as the β-lactams, macrolides and quinolones, have a wide therapeutic index and therefore, do not require therapeutic drug monitoring. Some, such as the aminoglycosides and vancomycin, have a narrow therapeutic index. Vancocin is considered a Narrow Therapeutic Range drug (“NTR drug”), which means the usual bioequivalence studies used by generic companies will not apply. To be considered as “interchangeable” the generic product must show invivo therapeutic equivalency. This can be achieved via human clinical studies that are costly.

Although there are a number of barriers to entry, the future of Vancocin may be affected by the following:

Lobbying by Generic Manufacturers:

Health Canada may give into lobbying by generic manufacturers and change its NTR drug requirement thus no longer requiring human studies to establish bio-equivalency.

New Therapies:

New therapies such as Fidaxomicin, a macrocyclic antibiotic, may replace the use of Vancocin. Fidaxomicin was found to be non-inferior to vancomycin against C. Difficile in a phase III non-inferiority study reported in the February 3, 2011 issue of the New England Journal of Medicine. However, Fidaxomicin sells at approximately ten times the price of Oral Vancocin.

9

Wound Care Franchise

The worldwide advanced wound care market is estimated to be approximately $5.5 billion in 2010. This market is expected to grow by approximately 5.7% to 6% to 2013.

There is tremendous amount of innovation in this market place. Most of Merus’ product offerings in this segment will be medical devices. The regulatory pathway for medical devices is much less complex and less expensive, leading to much shorter time to revenues and commercialization. Given Merus’ reach with major hospitals in Canada, wound care is a natural fit with its hospital specialty business.

As of the date of this Information Circular, Merus has not launched any of its wound care products. Merus’ entrance into this market is focused on advanced woundcare devices. These are devices that are implantable and contain collagen as the active ingredient. Collagen has a long history of safe medical use and is a biodegradable substance. It has several other positive attributes that make it an excellent biomaterial; these include its positive influence on wound healing, its intrinsically low antigenicity and ability to be sterilized.

With Merus’ current portfolio of Collacare and Collexa, Merus offers solutions in the following markets:

- Diabetic foot ulcer;

- Chronic leg ulcer;

- Pressure ulcers;

- Moderate and severe burns; and

- Dehisced surgical wounds.

Collacare

Collacare is an advanced wound care device comprising a white to off-white collagen matrix containing 2.8 mg/cm2 of renatured bovine collagen. Collacare is used in the management of wounds and is highly conformable for a variety of anatomical sites.

Collexa

Collexa is an advanced bilayer wound care device comprising a layer of white collagen matrix containing 2.8 mg/cm2 of renatured bovine collagen with a backing layer of off-white/cream absorbent polyurethane foam. The collagen matrix layer aids in the wound management while the polyurethane foam layer acts as a reservoir absorbing wound fluids. Collexa can absorb greater than ten times its own weight in wound fluids. Collexa is highly conformable for a variety of anatomical sites.

10

Collexa may be used for the management of wounds including:

- Diabetic ulcers;

- Venous ulcers;

- Pressure ulcers;

- Ulcers caused by mixed vascular etiologies;

- Full thickness and partial thickness wounds;

- Abrasions;

- Traumatic wounds;

- 1st and 2nd degree burns;

- Dehisced surgical wounds; and

- Exuding wounds.

On September 12, 2011, Merus announced that Health Canada has approved Collexa for sale in Canada.

Customers

Management expects that Merus will generally sell between 80% and 90% of its products directly to three major wholesalers in Canada and United States: AmerisourceBergen, McKesson Corporation and Matrix, which does business as Shoppers Drug Mart. Management believes that it is common practice in Canada and the United States for pharmacies to have multiple wholesale sources. Other direct buyers include additional smaller wholesalers and distributors, in addition to certain pharmacy chains and food stores that warehouse the products internally. Additional key customer groups include the following:

Physicians and allied health professionals including nurses, physician assistants andpharmacists: While physicians and allied health professionals are not themselves direct buyers of Merus’ products, they are the key decision-makers in terms of recommending or prescribing Merus’ products to patients. These healthcare providers make prescribing decisions based on personal experience, influence of peers, medical/educational meetings/events, medical journals, and information obtained through various pharmaceutical-sponsored educational and promotional programs and sales representatives.

Patients and their families/caregivers: In the United States, patients have to bear a greater share of the cost of healthcare. Therefore, the industry has increasingly turned to promotional and educational initiatives that directly target patients and their families. Merus will generally not engage in activities that directly target patients, except for the provision of various product and disease-specific patient education materials that may be passed along to patients by physicians.

Third-party payors such as managed care organizations and group purchasingorganizations: Third party payors, like certain insurance companies and employers, make purchasing and reimbursement decisions based on a number of health outcomes and economic variables. Merus will not attempt to influence the historical level of reimbursement for its products.

State and federal government health agencies: Certain federal government agencies like the Department of Veteran Affairs, the Department of Defence, prison systems and Indian Health Services may purchase pharmaceutical products directly from Merus or provide third-party reimbursement to those that do purchase Merus’ products. In addition, Medicaid programs at the individual state level may also reimburse patients in the purchase of Merus’ products. The historical utilization/reimbursement activity of Merus’ products for these government agencies has been low and Merus anticipates this to continue. However, the 2006 adoption of Part D prescription drug coverage for patients aged 65 and over may expand the potential market for certain legacy products.

11

4.2Risk Factors

In addition to the risk factors listed below, businesses are often subject to risks not foreseen or fully appreciated by management. In addition to reviewing the risk factors below, Shareholders should also consider the “Risks and Uncertainties” from Envoy’s management discussion and analysis as of December 13, 2011, which has been filed with the securities commissions or similar authorities in Canada on SEDAR, and which is specifically incorporated by reference into, and forms an integral part of, the Information Circular.

Risk Factors Associated with the Business of Merus

Merus may not be able to secure additional financing.

There can be no assurance that Merus will be able to raise the additional funding that it needs to carry out its business objectives. The development of Merus’ business depends upon prevailing capital market conditions, Merus’ business performance and its ability to obtain financing through joint ventures, debt financing, equity financing or other means. There is no assurance that Merus will be successful in obtaining required financing as and when needed or at all. If additional financing is raised by the issuance of shares from treasury, control of Merus may change and shareholders may suffer additional dilution.

Merus may not be ability to implement its business strategy.

The growth and expansion of Merus’ business will be heavily dependent upon the successful implementation of its business strategy. There can be no assurance that Merus will be successful in the implementation of its business strategy.

Merus will rely on third parties to manufacture its products.

Merus will not have the internal capability to manufacture pharmaceutical products and will rely on third parties to manufacture its products. Merus cannot be certain that manufacturing sources will continue to be available or that it will be able to continue to outsource the manufacturing of its products on reasonable or acceptable terms. In addition, outsourcing manufacturing will expose Merus to a number of risks which are outside its control, including: its suppliers may fail to comply with government mandated current good manufacturing practices which include quality control and quality assurance requirements, as well as the corresponding maintenance of records and documentation and manufacture of products according to the specifications contained in the applicable regulatory file resulting in mandated production halts or limitations; or its suppliers may experience manufacturing quality, control or yield issues which would require the supplier to halt or limit production of its products.

If Merus encounters delays or difficulties with contract manufacturers, packagers or distributors, sales of Merus’ products could be delayed. If Merus changes the source or location of supply or modifies the manufacturing process, regulatory authorities will require it to demonstrate that the product produced by the new source or from the modified process is equivalent to the product used in any clinical trials that were conducted. If Merus is unable to demonstrate this equivalence, it will be unable to manufacture products from the new source or location of supply, or use the modified process. Merus may incur substantial expenses in order to ensure equivalence. This may negatively affect its business, financial condition and operating results.

12

If its supply of finished products is interrupted, Merus’ ability to maintain inventory levels could suffer and future revenues could be delayed.

Supply interruptions may occur and Merus’ inventory of finished products may not always be adequate to satisfy demand. Numerous factors could cause interruptions in the supply of Merus’ finished products, including failure to have a third party supply chain validated in a timely manner, shortages in raw material and packaging components required by its manufacturers, changes in its sources for manufacturing or packaging, its failure to timely locate and obtain replacement manufacturers as needed and conditions affecting the cost and availability of raw materials. There can be no assurances that Merus’ other products will not be interrupted in the future. This may have an adverse effect on its business, financial results and operations.

Merus will rely on third parties to perform distribution, logistics, regulatory and sales services for its products.

Merus will rely on third parties to provide distribution, logistics, regulatory and sales services including warehousing of finished product, accounts receivable management, billing, collection and record keeping. If the third parties cease to be able to provide Merus with these services, or do not provide these services in a timely or professional manner Merus may not be able to successfully manage the product revenues or integrate new products into its business, which may result in decreases in sales. Additionally, any delay or interruption in the process or in payment could result in a delay delivering product to its customers, which could have a material effect on Merus’ business, financial condition and operating results.

Core patent protection for Merus’ initial portfolio has expired or will soon expire, which could result in significant competition from generic products resulting in a significant reduction in sales.

The core patents protecting its products have expired or will soon expire, which could result in significant competition from generic products and could result in a significant reduction in sales. In order to continue to obtain commercial benefits from Merus’ products, it will rely on product manufacturing trade secrets, know-how and related non-patent intellectual property. The effect of this patent expiration depends, among other things, upon the nature of the market and the position of Merus’ products in the market from time to time, the growth of the market, the complexities and economics of manufacture of a competitive product and regulatory approval requirements of generic drug laws. In the event that competition develops from generic products, this competition could have a material adverse effect on its business, financial condition and operating results.

The pharmaceutical industry is highly competitive and is subject to rapid and significant technological change, which could render technologies and products obsolete or uncompetitive.

Merus’ products will face competition from new pharmaceutical and biotech products that treat some of the same diseases and conditions as Merus’ products. Many of Merus’ competitors have greater financial resources and selling and marketing capabilities. Merus will face further competition from drug development companies that focus their efforts on developing and marketing products that are similar in nature to its products, but that in some instances offer improvements over Merus’ products, such as less frequent dosing, more pleasant taste, new dosage formats and other novel approaches to improve existing products. Merus’ competitors may succeed in developing technologies and products that are more effective or less expensive to use than any that Merus may license or acquire. These developments could render Merus’ products obsolete or uncompetitive, which would have a material adverse effect on Merus’ business, financial condition and operating results.

13

Recently, Optimer announced that Health Canada awarded Optimer priority review for its product: DIFICID®. DIFICID® is another method for the treatment of Clostridium difficile infection. Optimer asserts that DIFICID® has a slightly lower recurrence rate than Vancocin®. If Optimer is able to demonstrate that DIFICID® is preferable to Vancocin®, the business of Merus could be adversely affected.

Uncertainty can arise regarding the applicability of Merus’ proprietary information.

Merus will rely on trade secrets, know-how and other proprietary information as well as requiring employees, suppliers and other third-party service providers to sign confidentiality agreements. However, these confidentiality agreements may be breached, and Merus may not have adequate remedies for such breaches. Others may independently develop substantially equivalent proprietary information without infringing upon any proprietary technology. Third parties may otherwise gain access to Merus’ proprietary information and adopt it in a competitive manner. If a third party obtains Merus’ proprietary information and adopts it in a competitive manner, it may have a material effect on Merus’ business, financial condition and operating results.

The publication of negative results of studies or clinical trials may adversely impact Merus’ products.

From time-to-time, studies or clinical trials on various aspects of pharmaceutical products are conducted by academics or others, including government agencies. The results of these studies or trials, when published, may have a dramatic effect on the market for the pharmaceutical product that is the subject of the study. The publication of negative results of studies or clinical trials related to Merus’ products or the therapeutic areas in which Merus’ products compete could adversely affect Merus’ sales, the prescription trends for Merus’ products and the reputation of Merus’ products. In the event of the publication of negative results of studies or clinical trials related to Merus’ products or the therapeutic areas in which Merus’ products compete, Merus’ business, financial condition, and operating results could be materially adversely affected.

Merus will face competition for future acquisitions of legacy products.

Merus’ growth strategy will be partially predicated on its ability to acquire additional legacy products at prices that are accretive to cash flow. Merus will compete to acquire legacy products with other participants in the pharmaceutical industry. In particular, many companies have adopted business strategies that entail acquiring legacy products with a view to increasing sales through focused marketing efforts and some of these companies may have greater resources than Merus. In addition, although Merus is currently unaware of any other entities that are focused on acquiring legacy products primarily for the purpose of generating a stream of stable revenues and cash flow, there can be no assurances that other entities will not adopt this strategy in the future. If Merus is unable to acquire additional legacy products at prices that are accretive to cash flow, Merus’ ability to expand its business and to increase or maintain distributions may be adversely affected.

14

Merus must successfully integrate any products that it has acquired or will acquire in the future.

Merus will pursue additional products that could complement or expand its business. However, there can be no assurance that Merus will be able to identify appropriate acquisition candidates in the future. If an acquisition candidate is identified, there can be no assurance that Merus will be able to successfully negotiate the terms of any such acquisition, finance such acquisition or integrate such acquired product or business into its existing products and business. Furthermore, the negotiation of potential acquisitions and integration of acquired product lines could divert management’s time and resources, and require significant resources to consummate. If Merus consummate one or more significant acquisitions through the issuance of shares, Merus’ shareholders could suffer significant dilution of their ownership interests.

Merus will depend on key managerial personnel for its success.

Merus will be highly dependent upon qualified managerial personnel. Its anticipated growth will require additional expertise and the addition of new qualified personnel. There is intense competition for qualified personnel in the pharmaceutical field. Therefore, Merus may not be able to attract and retain the qualified personnel necessary for the development of its business. The loss of the services of existing personnel, as well as the failure to recruit additional key managerial personnel in a timely manner, would harm its business development programs, and its ability to manage day-to-day operations, attract collaboration partners, attract and retain other employees and generate revenues. Merus will not maintain key person life insurance on any of its employees.

Increases in sales may attract generic competition.

Merus expects its initial portfolio to continue to enjoy market exclusivity due to a number of factors, including economic barriers to competition. If sales of its initial portfolio were to increase substantially, competitors may be more likely to develop generic formulations that compete directly with Merus’ products. Increased generic competition would have a material adverse effect on its business and financial results.

Merus’ business will be subject to limitations imposed by government regulations.

In both, domestic and foreign markets, the formulation, manufacturing, packaging, labelling, handling, distribution, importation, exportation, licensing, sale and storage of its products are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints which are beyond Merus’ control. Such laws, regulations and other constraints may exist at all levels of government. There can be no assurance that Merus will be in compliance with all of these laws, regulations and other constraints. Failure to comply with these laws, regulations and other constraints or new laws, regulations or constraints could lead to the imposition of significant penalties or claims and could negatively impact Merus’ business. In addition, the adoption of new laws, regulations or other constraints or changes in the interpretations of such requirements may result in significant compliance costs or lead Merus to discontinue product sales and may have an adverse effect on the marketing of Merus’ products, resulting in significant loss of sales.

In the United States, the FDA perceives any written or verbal statement used to promote or sell a product that associates an unapproved nutrient with a disease (whether written by Merus, the content of a testimonial endorsement or contained within a scientific publication) to be evidence of intent to sell an unapproved new drug. If any such evidence is found with respect to Merus’ products, the FDA may take adverse action against Merus, ranging from a warning letter necessitating cessation of use of the statement to injunctions against product sale, seizures of products promoted with the statements, and civil and criminal prosecution of Merus’ executives. Such actions could have a detrimental effect on sales.

15

Merus may be subject to product liability claims, which can be expensive, difficult to defend and may result in large judgments or settlements.

The administration of drugs to humans, whether in clinical trials or after marketing clearance is obtained, can result in product liability claims. Product liability claims can be expensive, difficult to defend and may result in large judgments or settlements against Merus. In addition, third party collaborators and licensees may not protect Merus from product liability claims.

Merus will maintain product liability insurance in connection with the marketing of its products. Merus may not be able to obtain or maintain adequate protection against potential liabilities arising from product sales. If Merus is unable to obtain sufficient levels of insurance at acceptable cost or otherwise protect against potential product liability claims Merus will be exposed to product liability claims. A successful product liability claim in excess of its insurance coverage could harm its financial condition, results of operations and prevent or interfere with its product commercialization efforts. In addition, any successful claim may prevent Merus from obtaining adequate product liability insurance in the future on commercially desirable terms. Even if a claim is not successful, defending such a claim may be time-consuming and expensive.

Merus may be subject to the risks of foreign exchange rate fluctuation.

Merus will be exposed to fluctuations of the Canadian dollar against certain other currencies because it publishes its financial statements in Canadian dollars, while a minor portion of its assets, liabilities, revenues and costs are or will be denominated in other currencies, such as the euro and the U.S. dollar. Exchange rates for currencies of the countries in which Merus operates may fluctuate in relation to the Canadian dollar, and such fluctuations, especially as between the Canadian dollar and the euro, may have a material adverse effect on its earnings or assets when translating foreign currency into Canadian dollars. In order to mitigate the risk, Merus uses forward contracts and other derivative instruments to reduce its exposure to foreign currency risk. Dependent on the nature, amount and timing of foreign currency receipts and payments, Merus may from time to time enter into foreign currency contracts. Accordingly, Merus may experience economic loss and a negative impact on earnings solely as a result of foreign exchange rate fluctuations, which include foreign currency devaluations against the Canadian dollar. Merus does not typically carry currency convertibility risk insurance.

Market rate fluctuations could adversely affect Merus’ results of operations.

Merus will be subject to market risk through the risk of loss of value in Merus’ portfolios resulting from changes in interest rates, foreign exchange rates, credit spreads, and equity prices. Merus will be required to mark to market its held-for-trading investments at the end of each reporting period. This process could result in significant write-downs of Merus’ investments over one or more reporting periods, particularly during periods of overall market instability, which would have a significant unfavourable effect on Merus’ financial position.

16

Merus may be unsuccessful in evaluating material risks involved in completed and future investments.

Merus will regularly review investment opportunities and as part of the review, conduct business, legal and financial due diligence with the goal of identifying and evaluating material risks involved in any particular transaction. Despite Merus’ efforts, it may be unsuccessful in ascertaining or evaluating all such risks. As a result, it might not realize the intended advantages of any given investment and may not identify all of the risks relating to the investment. If Merus fails to realize the expected benefits from one or more investments, or does not identify all of the risks associated with a particular investment, Merus’ business, results of operations and financial condition could be adversely affected.

Merus may be subject to certain regulations that could restrict Merus’ activities.

From time to time, governments, government agencies and industry self- regulatory bodies in Canada, the United States, the European Union and other countries in which Merus will operate have adopted statutes, regulations and rulings that directly or indirectly affect the activities of Merus and its future clients.

PART 5 DIVIDENDS AND DISTRIBUTIONS

Merus has not paid any dividends since its incorporation. Any determination to pay any future dividends will remain at the discretion of Merus’ Board of Directors (the “Board”) and will be made based on Merus’ financial condition and other factors deemed relevant by the Board. There are no restrictions on the ability of Merus to pay dividends except as set out under its governing statute and constating documents.

PART 6 DESCRIPTION OF CAPITAL STRUCTURE

6.1 Authorized

As of September 30, 2011, Envoy was authorized to issue an unlimited number of common shares of Envoy, of which, there were 8,028,377 common shares were issued and outstanding.

As of December 28, 2011, Merus is authorized to issue an unlimited number of Common Shares without par value and an unlimited number of preferred shares without par value (each, a “Preferred Share”). As of December 28, 2011, there were 24,207,073 Common Shares issued and outstanding and no Preferred Shares.

6.2 Common Shares

Each Common Share shall entitle the holder thereof to one vote per Common Share in all shareholder meetings of Merus. The holders of Common Shares are entitled to dividends that are set and declared by the Board of Directors. In the event of the liquidation, dissolution or winding up of Merus, whether voluntary or involuntary, the shareholders of Merus shall be entitled to share in the remaining property of Merus, subject to the order of priority set out in the share capital of Merus.

17

6.3 Preferred Shares

The holders of Preferred Shares shall be entitled, on the liquidation or dissolution of Merus, or on any other distribution of its assets among its shareholders for the purpose of winding up its affairs, to receive, before any distribution is made to the holders of Common Shares or any other shares of Merus ranking junior to the Preferred Shares with respect to the repayment of capital on the liquidation or dissolution of Merus, or on any other distribution of its assets among its shareholders for the purpose of winding up its affairs, the amount paid up with respect to each Preferred Share held by them, together with the fixed premium (if any) thereon, all accrued and unpaid cumulative dividends (if any and if preferential) thereon, and all declared and unpaid noncumulative dividends thereon. After payment to the holders of the Preferred Shares of the amounts so payable to them, they shall not, as such, be entitled to share in any further distribution of the property or assets of Merus, except as specifically provided in the special rights and restrictions attached to any particular series. All assets remaining after payment to the holders of Preferred Shares as aforesaid shall be distributed rateably among the holders of the Common Shares.

Except for such rights relating to the election of directors on a default in payment of dividends as may be attached to any series of the Preferred Shares by the directors, holders of Preferred Shares shall not be entitled, as such, to receive notice of, or to attend or vote at, any general meeting of shareholders of Merus.

PART 7 MARKET FOR SECURITIES

7.1 Trading Price and Volume

The Common Shares are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “MSL” and NASDAQ under the symbol “MSLI” as of December 22, 2011. Envoy’s common shares were listed on the TSX under the symbol “ECG” and NASDAQ under the symbol “ECGI”.

The table below sets forth the high and low closing prices and the volumes for the Envoy common shares traded through the TSX on a monthly basis for the year ended September 30, 2011, as stated in Canadian dollars.

| Month Ended | High | Low | Volume |

| October 2010 | $0.96 | $0.87 | 37,504 |

| November 2010 | $0.95 | $0.81 | 41,694 |

| December 2010 | $1.05 | $0.76 | 502,471 |

| January 2011 | $1.29 | $0.86 | 199,180 |

| February 2011 | $1.89 | $1.03 | 1,983,818 |

| March 2011 | $1.78 | $1.51 | 348,253 |

| April 2011 | $1.66 | $1.50 | 20,797 |

| May 2011 | $1.80 | $1.46 | 21,801 |

| June 2011 | $2.05 | $1.50 | 243,385 |

| July 2011 | $2.10 | $1.65 | 136,063 |

18

| Month Ended | High | Low | Volume |

| August 2011 | $1.86 | $1.54 | 6,740 |

| September 2011 | $1.85 | $1.63 | 74,609 |

PART 8 ESCROW SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTIONS ON TRANSFER

8.1 Escrowed Securities and Securities Subject to Contractual Restriction on Transfer

As at September 30, 2011, there were no common shares of Envoy held that were in escrow or subject to contractual restrictions.

PART 9 DIRECTORS AND OFFICERS

9.1 Name, Occupation and Security Holding

As of September 30, 2011, the directors of Envoy were as follows:

Name Province/State Country of

Residence and Position(s)

with Envoy | Periods during which

Individual has Served

as a Director or Officer |

Robert Pollock

Ontario, Canada

President and CEO and Director | February 10, 2011 –

December 19, 2011

|

Andrew Patient

Ontario, Canada

Chief Financial Officer | October 1, 2008(1) –

December 19, 2011

|

Priscilla Cheung

Ontario, Canada

Secretary | September 1, 2011 –

December 19, 2011

|

John Campbell

Ontario, Canada

Director | February 10, 2011 –

December 19, 2011

|

Dave Guebert

Alberta, Canada

Director | February 10, 2011 –

December 19, 2011

|

Tim Sorensen

Ontario, Canada

Director | February 10, 2011 –

December 19, 2011

|

| (1) | On October 1, 2008, Mr. Patient was appointed as Chief Financial Officer of Envoy. Mr. Patient was appointed President of Envoy on December 31, 2009, a position he held until February 10, 2011, when he was reappointed Chief Financial Officer. |

19

The current directors and officer of Merus are as follows:

Name Province/State Country of

Residence and Position(s)

with Merus(1) | Periods during which

Individual has Served

as a Director or Officer |

Ahmad Doroudian

Vancouver, BC Canada

President, Chief Executive Officer and

Director | December 19, 2011 –

Present

|

Andrew Patient

Ontario, Canada

Chief Financial Officer | December 19, 2011 –

Present

|

Moira Ong

British Columbia, Canada

Vice President, Finance and Secretary | December 19, 2011 –

Present

|

Ali Moghaddam

Quebec, Canada

Vice President Business Development &

Commercial Operations |

December 19, 2011 –

Present

|

David Guebert(2)(3)

Ontario, Canada

Director | December 19, 2011 –

Present

|

Robert Pollock

Ontario, Canada

Director | December 19, 2011 –

Present

|

Joseph Rus(2)(3)

Ontario, Canada

Director | December 19, 2011 –

Present

|

Timothy Sorensen(2)(3)

Ontario, Canada

Director | December 19, 2011 –

Present

|

| (1) | Information has been furnished by the respective individuals. |

| (2) | Denotes a member of the Audit Committee of Merus. |

| (3) | Denotes an independent director. |

Ahmad Doroudian — President, Chief Executive Officer, and Director

Dr. Doroudian was appointed as the President, Chief Executive Officer and director of Merus on March 15, 2010. Since May 2009, Dr. Doroudian has been the President, Chief Executive Officer and a director of Merus’ subsidiary, Merus Labs Inc. He is also a director of Neurokine Pharmaceuticals Inc., a private pharmaceutical company that develops new uses for existing drugs, since April of 2007. He was the Chief Executive Officer of Neurokine Pharmaceuticals Inc. from May 2009 to September 2011. He was the President of Rayan Pharma Inc., an exporter of pharmaceuticals to Eastern Europe, from March 2003 to April 2007. From November 2003 to March 2004, Dr. Doroudian was the Vice Chairman of the board of PanGeo Pharma Inc., a TSX listed company (now PendoPharm, a division of Pharmascience Inc.) and he served as Chief Executive Officer, Chairman and Director of PanGeo from April 1996 to November 2003. Dr. Doroudian has been involved with early stage financing and management of private and publicly listed companies since 1996. Dr. Doroudian holds a Bachelors Degree in Biochemistry and a Masters Degree and Ph.D. in Biopharmaceutics from the University of British Columbia. Dr. Doroudian is 49 years old and is a Canadian citizen resident in Vancouver, British Columbia.

20

Andrew Patient — Chief Financial Officer

Mr. Patient began serving as the Company’s Chief Financial Officer in 2008. Mr. Patient joined Envoy in 2001, initially serving as controller at Envoy’s former wholly-owned subsidiary, Watt International Inc. In February 2006, Mr. Patient moved to the corporate head office in the role of Director of Finance, responsible for all aspects of Envoy’s financial reporting. Prior to joining Envoy, Mr. Patient spent six years at BDO Dunwoody LLP in Canada and five years in financial roles at early stage technology companies in San Diego, California. Mr. Patient was appointed President and Chief Executive Officer of Envoy on December 22, 2009. Mr. Patient ceased to serve as President and Chief Executive Officer of Envoy on February 10, 2011 and was reappointed as Envoy’s Chief Financial Officer. Mr. Patient holds a Bachelor of Accounting degree from Brock University and obtained his CA designation in 1995.

Moira Ong — Vice President, Finance

Ms. Ong was appointed as Merus’ Chief Financial Officer on March 30, 2010. Ms. Ong has more than 10 years experience in public accounting and audit reporting. From 2005 until 2010, Ms. Ong was the senior manager at Grant Thornton LLP in charge of completion of financial statements for Canadian publicly listed companies in addition to serving as financial consultant for Strategic Income Security Services from 2003 to 2005. Ms. Ong was an audit manager in the Banking and Securities group at Deloitte & Touche LLP in New York from 2000 to 2003 and served as the senior accountant for Grant Thornton LLP from 1996 to 2000. Ms. Ong obtained her CA designation in 1999 and her CFA designation in 2003.

Ali Moghaddam — Vice President Business Development & Commercial Operations

Mr. Moghaddam was appointed as Vice President of Merus on March 1, 2011, he was appointed Merus’ director on March 15, 2010. Since May 21 2009 he has been a director of Merus Labs. Mr. Moghaddam was a general manager of Corporation Bioheel Inc. (Canada)/Nuvovie Inc. (U.S.A.), a North American specialty healthcare company focused on health and nutrition, which he joined in 2008. He was the President, Chief Executive Officer and founder of Arura Pharma Inc., an integrated specialty healthcare company from 2005 to January 2008. Mr. Moghaddam acted as the President and Chief Executive Officer of Chaichem Pharmaceutical Inc., focusing on commercialization of the company’s products in the area of Oncology API, from 2002 to 2004. Before being appointed to these positions, he acted as a senior director of corporate business development of E-Z-EM Inc., a major manufacturer of contrast agents for gastrointestinal radiology, subsequently acquired by Bracco Diagnostics, Inc. Mr. Moghaddam holds a Bachelor of Commerce with Major in Finance & Marketing from Concordia University. He also has a CMA designation of McGill University.

Robert S. Pollock — Director

Mr. Pollock is Director, President and Chief Executive Officer of Primary Corp. (TSX: PYC), a natural resources lending company, and Director and Chief Executive Officer of Primary Capital Inc., an exempt market dealer. He served as Senior Vice President of Quest Capital Corp. from September 2003 to October 2006. He was formerly Vice President – Investment Banking at Dundee Securities Corporation and has 15 years of experience in the Canadian capital markets with specific experience in merchant banking, institutional sales and investment banking. Mr. Pollock holds an MBA from St. Mary’s University (1993) and a BA from Queen’s University (1991).

21

Mr. Pollock’s principal occupations during the five preceding years are as follows: since February 10, 2011, he has been the Chief Executive Officer and a Director of Envoy. Since August 2008, he has been the Director and Chief Executive Officer of Primary Corp. and since July 2008 he has been Director and Chief Executive Officer of Primary Capital Inc. From September 2003 to October 2006 he served as Senior Vice President of Quest Capital Corp.

David D. Guebert — Director

Mr. Guebert is a chartered accountant and certified public accountant with over 30 years of experience in finance and accounting, 20 of which were served as chief financial officer of public and private companies in the resource and technology sectors. He is currently the Chief Financial Officer of Primary Corp., a merchant banking company. He is also is the Chief Financial Officer of Cell-Loc Location Technologies Inc., a wireless location technology company. Mr. Guebert holds a B.Comm. from the University of Saskatchewan (1979).

Mr. Guebert’s principal occupations during the five preceding years are as follows: Since 2007 he has been Chief Financial Officer of Primary Corp. and since 2004 has been Chief Financial Officer of Cell-Loc Location Technologies Inc. Since 2010 he has also been a director of Advitech Inc., a biotech company.

Timothy G. Sorensen — Director

Mr. Sorensen is a Director and the President of Primary Capital Inc., an exempt market dealer. He recently joined Primary Capital from Macquarie Capital Markets Canada where he served as Divisional 7 Director Head of Institutional Sales. Mr. Sorensen has over 14 years of capital markets experience in institutional sales and equity analysis. He has a CFA designation and holds an MBA (1996) and B.Comm (1995) both from the University of Windsor.

Mr. Sorensen’s principal occupation during the five preceding years is as follows: he has been President of Primary Capital Inc. since November 2010. From January 2008 until September 2010, he was the Divisional Director Head of Institutional Sales of Macquarie Capital Markets Canada and prior to that, he was an institutional sales person from 2004 to 2008 with Orion Financial Inc., which became Macquarie Group in 2007.

Joseph Rus — Director

Mr. Joseph Rus was appointed Director of Envoy on October 31, 2011. Prior to his appointment, Mr. Rus joined Shire Pharmaceuticals in 1999, following 25 years of experience with two major Pharmaceutical Companies (Warner Lambert & Hoffmann-la Roche) in both Canadian and Global assignments. In 2002, Mr. Rus returned to the U.K. as head of Shire’s International Operations (all countries except the USA). Since that time Mr. Rus also served on Shire’s Executive Committee as well as the Portfolio Review Committee. In 2006, Mr. Rus was charged with the responsibility of establishing affiliates in the increasingly important emerging markets, and by 2009 affiliates were open in Brazil, Mexico, Argentina, Russia, Australia and Japan.

22

Mr. Rus is a Canadian citizen who received his education in Romania and is a graduate of the Executive Marketing Program at the University of Western Ontario in London, Ontario, as well as the International Program at the Institute of Management and Development of the University of Lausanne in Switzerland.

9.2 Corporate Cease Trade Orders

Other than as set out below, to the best of management’s knowledge, no director or executive officer of Merus is or has been within 10 years before the date of this AIF, a director, chief executive officer (“CEO”) or chief financial officer (“CFO”) of any company that: (i) while that person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied that person or company access to any exemption under securities legislation for a period of more than 30 consecutive days, or (ii) was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the director or executive officer ceased to be a director, CEO or CFO and which resulted from an event that occurred while that person was acting in the capacity of director, CEO or CFO.

John K. Campbell was a director of American Natural Energy Corp. (“American”) from April 2000 to November 2010. In June 2003, each of the l’Autorite des marches financiers (“AMF”), the British Columbia Securities Commission (“BCSC”) and the Manitoba Securities Commission issued cease trade orders against American for failure to file its financial statements within the prescribed times. The cease trade orders were rescinded in August and September 2003. Subsequently, during the period between May 2007 and March 2008, each of the BCSC, the Ontario Securities Commission, the Alberta Securities Commission and the AMF issued cease trade orders against American for failure to file its financial statements within the prescribed times. The cease trade orders were rescinded in October 2008.

PanGeo Pharma Inc. (“PanGeo”) failed to file its annual financial statements for the period ended January 31, 2003 by the deadline. As a result, cease trade orders were issued against PanGeo by the Ontario Securities Commission on June 24, 2003, by the Quebec Securities Commission on June 23, 2003, by the Manitoba Securities Commission on June 25, 2003, and by the British Columbia Securities Commission on July 10, 2003. On July 10, 2003, PanGeo filed for protection under theCompanies Creditors Arrangement Act. These cease trade orders were not revoked.

Following this event, PanGeo’s shares did not trade again. Ahmad Doroudian was chief executive officer of PanGeo

9.3 Penalties and Sanctions

To the best of management’s knowledge, other than as disclosed below, no proposed director of Merus has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

On January 12, 2010, Mr. Rus filed an insider report for the purchase of 100,000 securities of Bellus Sante Inc. that occurred on June 29, 2009. Mr. Rus was assessed and paid a fine of $5,000 by the AMF.

23

9.4 Bankruptcies

To the best of management’s knowledge, no director, executive officer of shareholder holding a sufficient number of shares to materially affect control of Merus: (i) is or has been within the 10 years before the date of this AIF, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has, within the 10 years before the date of this AIF, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or became subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets.

9.5 Conflicts of Interest

In the event conflicts arise at a meeting of the Board, a director who has such a conflict will declare the conflict and abstain from voting. In appropriate cases, Merus may establish a special committee of independent non-executive directors (who must at all times be “independent” within the meaning of NI 52-110) to review a matter in which one or more directors or management may have a conflict.

To the best of Merus’ knowledge there are no known existing or potential conflicts of interest between Merus and any director or officer of Merus, except that certain of the directors of Merus serve as directors and officers of other companies and it is therefore possible that a conflict may arise between their duties as a director or officer of Merus and their duties as a director or officer of such other companies. Where such conflicts arise, they will be addressed as indicated above.

9.6 Promoters

Envoy has not had any promoters during the two most recently completed financial years.

PART 10 LEGAL PROCEEDINGS AND REGULATORY ACTIONS

10.1 Legal Proceedings

There are no legal proceedings to which Merus is or was a party to, or that any of Merus’ property is or was the subject of, during the most recently completed financial year, that were or are material to Merus, and there are no such material legal proceedings that Merus is currently aware of that are contemplated.

10.2 Regulatory Action

To the knowledge of Merus, there are no: (a) penalties or sanctions imposed against Merus by a court relating to securities legislation or by a securities regulatory authority during the September 30, 2011 financial year; (b) any other penalties or sanctions imposed by a court or regulatory body against Merus that would likely be considered important to a reasonable investor in making an investment decision; and (c) settlement agreements that Merus has entered into before a court relating to securities legislation or with a securities regulatory authority during the September 30, 2011 financial year.

24

PART 11 INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no: (a) director, nominee for director, or executive officer of Merus; (b) person or company who beneficially owns, or controls or directs, directly or indirectly, common shares of Merus, or a combination of both carrying more than 10% of the voting rights attached to the common shares outstanding (any of these being an Insider); (c) director or executive officer of an Insider; or (d) associate or affiliate of any Insider, has had any material interest, direct or indirect, in any transaction since the commencement of either Merus’ most recently completed financial year or in any proposed transaction which has materially affected or would materially affect Merus or any of its subsidiaries, except with an interest arising from the ownership of common shares where such person or company will receive no extra or special benefit or advantage not shared on a pro rata basis by all holders of the common shares.

PART 12 TRANSFER AGENTS AND REGISTRARS

12.1 Transfer Agents and Registrars

As of December 28, 2011, the transfer agent and registrar for the Common Shares is Olympia Trust Company located at 1003-750 West Pender Street, Vancouver, BC V6C 2T8.

PART 13 MATERIAL CONTRACTS

13.1 Material Contracts

With the exception of agreements entered into in the normal course of business, the only agreements of any significance with regard to Merus that have been entered into by Merus within the two years prior to the date of this Application, or that must be signed by the Company at the latest by the close of this Offering, are the following:

An Exclusive License and Distribution Agreement between Merus Labs and Innocoll Pharmaceuticals Limited dated September 17, 2010.

A Master Support Services Agreement between Merus and Methapharm Inc. dated July 1, 2011.

An Asset Purchase Agreement between Merus Labs and Iroko International LP dated May 13, 2011.

An Arrangement Agreement between Old Merus and Envoy dated November 10, 2011.

PART 14 EXPERTS

14.1 Names of Experts

Not applicable.

25

PART 15 ADDITIONAL INFORMATION

15.1 Additional Information

Additional information relating to Merus may be found on SEDAR at www.sedar.com. Additional information including directors’ and officers’ remuneration and indebtedness, principal holders of Merus’ securities and securities authorized for issuance under equity compensation plans are contained in the management information circular prepared in connection with Envoy’s 2011 annual general and special meeting of shareholders which was held on December 9, 201l. The management information circular is available on SEDAR at www.sedar.com. Additional financial information is provided in Envoy’s audited financial statements and MD&A for the financial year ended September 30, 2011, which are incorporated by reference herein and may be found on SEDAR at www.sedar.com.

26