The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting and is supplemental to, and expressly made a part of, this Notice of Meeting.

The Company’s Board of Directors has fixed February 25, 2014 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof. Each registered shareholder at the close of business on that date is entitled to such notice and to vote at the Meeting in the circumstances set out in the accompanying Information Circular.

If you are a registered shareholder of the Company and unable to attend the Meeting in person, please complete, date and sign the accompanying form of proxy and deposit it with the Company’s transfer agent, Olympia Trust Company, Suite 1003, 750 West Pender Street Vancouver, British Columbia, V6C 2T8, at least 48 hours (excluding Saturdays, Sundays and holidays recognized in the Province of British Columbia) before the time and date of the Meeting or any adjournment or postponement thereof.

If you are a non-registered shareholder of the Company and received this Notice of Meeting and accompanying materials through a broker, a financial institution, a participant, a trustee or administrator of a self-administered retirement savings plan, retirement income fund, education savings plan or other similar self-administered savings or investment plan registered under theIncome Tax Act (Canada), or a nominee of any of the foregoing that holds your securities on your behalf (the “Intermediary”), please complete and return the materials in accordance with the instructions provided to you by your Intermediary.

DATED at Toronto, Ontario, this 25th day of February, 2014.

This Information Circular accompanies the Notice of Annual General and Special Meeting (the “Notice”) and is furnished to shareholders (the “Shareholders”) holding common shares (the “Common Shares”) in the capital of Merus Labs International Inc. (the ”Company”) in connection with the solicitation by the management of the Company of proxies to be voted at the annual general and special meeting (the “Meeting”) of the Shareholders to be held at 10:00 a.m. (Toronto time) on Thursday, March 27, 2014 at 100 Wellington Street West, Suite 2110, Toronto, Ontario M5K 1H1 or at any adjournment or postponement thereof.

The date of this Information Circular is February 25, 2014. Unless otherwise stated, all amounts herein are in Canadian dollars.

The solicitation of proxies by management of the Company will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation by the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred in obtaining from their principals authorization to execute forms of proxy, except that the Company has requested brokers and nominees who hold stock in their respective names to furnish this proxy material to their customers, and the Company will reimburse such brokers and nominees for their related out of pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company.

No person has been authorized to give any information or to make any representation other than as contained in this Information Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Information Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Information Circular. This Information Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

Registered Shareholders are entitled to vote at the Meeting. A Shareholder is entitled to one vote for each Common Share that such Shareholder holds on the record date (the “Record Date”) of February 25, 2014 on the resolutions to be voted upon at the Meeting, and any other matter to come before the Meeting.

In order to be voted, the completed form of proxy must be received by the Company’s registrar and transfer agent, Olympia Trust Company (the “Transfer Agent”) at their offices located at Suite 1003, 750 West Pender Street Vancouver, British Columbia, V6C 2T8 by mail or fax, at least 48 hours (excluding Saturdays, Sundays and holidays recognized in the Province of British Columbia) prior to the scheduled time of the Meeting, or any adjournment or postponement thereof.

A proxy may not be valid unless it is dated and signed by the Shareholder who is giving it or by that Shareholder’s attorney-in-fact duly authorized by that Shareholder in writing or, in the case of a corporation, dated and executed by a duly authorized officer or attorney-in-fact for the corporation. If a form of proxy is executed by an attorney-in-fact for an individual Shareholder or joint Shareholders, or by an officer or attorney-in-fact for a corporate Shareholder, the instrument so empowering the officer or attorney-in-fact, as the case may be, or a notarially certified copy thereof, must accompany the form of proxy.

A Shareholder who has given a proxy may revoke it at any time before it is exercised by an instrument in writing: (a) executed by that Shareholder or by that Shareholder’s attorney-in-fact, authorized in writing, or, where the Shareholder is a corporation, by a duly authorized officer of, or attorney-in-fact for, the corporation; and (b) delivered either: (i) to the Company at the address set forth above, at any time up to and including the last business day preceding the day of the Meeting or, if adjourned or postponed, any reconvening thereof, or (ii) to the Chairman of the Meeting prior to the vote on matters covered by the proxy on the day of the Meeting or, if adjourned or postponed, any reconvening thereof, or (iii) in any other manner provided by law.

Also, a proxy will automatically be revoked by either: (i) attendance at the Meeting and participation in a poll (ballot) by a Shareholder, or (ii) submission of a subsequent proxy in accordance with the foregoing procedures. A revocation of a proxy does not affect any matter on which a vote has been taken prior to any such revocation.

A Shareholder may indicate the manner in which the Designated Persons are to vote with respect to a matter to be voted upon at the Meeting by marking the appropriate space. If the instructions as to voting indicated in the proxy are certain, the Common Shares represented by the proxy will be voted or withheld from voting in accordance with the instructions given in the proxy.The Common Shares represented by a proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for. If the Shareholder specifies a choice with respect to any matter to be acted upon, then the Common Shares represented will be voted or withheld from voting on that matter accordingly.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to other matters which may properly come before the Meeting, including any amendments or variations to any matters identified in the Notice, and with respect to other matters which may properly come before the Meeting. At the date of this Information Circular, management of the Company is not aware of any such amendments, variations or other matters to come before the Meeting.

In the case of abstentions from, or withholding of, the voting of the Common Shares on any matter, the Common Shares that are the subject of the abstention or withholding will be counted for determination of a quorum, but will not be counted as affirmative or negative on the matter to be voted upon.

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders are “non-registered” Shareholders because the Common Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. More particularly, a person is not a registered Shareholder in respect of Common Shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators or self-administered RRSP’s, RRIF’s, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depositary Services Inc. (“CDS”)) of which the Intermediary is a participant. In accordance with the requirements as set out in National Instrument 54-101 of the Canadian Securities Administrators (“NI 54-101”), the Company has distributed copies of the Notice of Meeting, this Information Circular and the form of Proxy (collectively, the ”Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

In either case, the purpose of this procedure is to permit a Non-Registered Holder to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the management proxyholders named in the form and insert the Non-Registered Holder’s name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered. Typically, the Intermediary will require the Non-Registered Holder to submit their proxy authorization form before the Company’s proxy deadline to allow the Intermediary time to submit their proxy to the Company.

There are two kinds of beneficial owners – those who object to their names being made known to the issuers of securities which they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called NOBOs for Non-Objecting Beneficial Owners). Pursuant to NI 54-101, issuers can obtain a list of their NOBOs from Intermediaries for distribution of proxy-related materials directly to NOBOs.

All references to Shareholders in this Information Circular are to registered Shareholders, unless specifically stated otherwise.

Except as disclosed elsewhere in this Information Circular, no director or executive officer of the Company who was a director or executive officer since the beginning of the Company’s last financial year, no proposed nominee for election as a director of the Company, or any associate or affiliates of any such directors, officers or nominees, has any material interest, direct or indirect, by way of beneficial ownership of Common Shares or other securities in the Company or otherwise, in any matter to be acted upon at the Meeting other than the election of directors.

The Company is authorized to issue an unlimited number of Common Shares without par value and an unlimited number of preferred shares without par value. As of the Record Date, a total of 38,391,512 Common Shares were issued and outstanding and no preferred shares were issued and outstanding. Each Common Share carries the right to one vote at the Meeting.

Only registered Shareholders as of the record date are entitled to receive notice of, and to attend and vote at, the Meeting or any adjournment or postponement of the Meeting.

To the knowledge of the directors and senior officers of the Company, as of the Record Date, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying more than 10% of the voting rights attached to the outstanding Common Shares.

At the Meeting, Shareholders will be asked to pass an ordinary resolution to set the number of directors of the Company for the ensuing year at five. The number of directors will be approved if the affirmative vote of the majority of Shares present or represented by proxy at the Meeting and entitled to vote are voted in favour of setting the number of directors at five.

The Board currently consists of five directors, all of whom are elected annually and hold office until the next annual general meeting of the Shareholders or until their successors are elected. The management of the Company proposes to nominate the persons listed below for election as directors of the Company to serve until their successors are elected or appointed. All of the five nominees for election at the Meeting are currently directors of the Company and have agreed to stand for election.

In the absence of instructions to the contrary, Proxies given pursuant to the solicitation by the management of the Company will be voted for the nominees listed in this Information Circular.

Management has no reason to believe that any of such nominees will be unable to serve as directors; however, if, for any reason one or more of the proposed nominees do not stand for election or are unable to serve as directors, the management designees named in the Proxy intend to vote for another nominee or nominees, as the case may be, in their discretion, unless the Shareholder has specified in his or her Proxy that his or her Common Shares are to be withheld from voting in the election of directors.

| Notes: |

| (1) | This information has been obtained from public insider filings and from the directors themselves. No individual director, either alone or together with such director’s associates or affiliates, owns or controls 10% of more of the voting securities of the Company. |

| (2) | Appointed a director of Envoy on February 10, 2011. On December 19, 2011, Old Merus amalgamated with Envoy continuing under the name “Merus Labs International Inc.” On October 1, 2012, the Company amalgamated with its wholly-owned subsidiary, Merus Labs Inc. and continued under the name “Merus Labs International Inc.” |

| (3) | Does not include 400,000 stock options exercisable into Common Shares. |

| (4) | Member of the Audit Committee. |

| (5) | Independent director. |

| (6) | Member of the Compensation Committee. |

| (7) | Includes 62,500 Common Shares controlled or directed by Deborah Guebert and 146,667 Common Shares held directly but does not include 150,000 stock options exercisable into Common Shares. |

| (8) | Includes 464,875 Common Shares controlled or directed by Michelle Pollock and 3,002,223 Common Shares held directly but does not include 150,000 stock options and 375,000 warrants exercisable into Common Shares. |

| (9) | Does not include 150,000 stock options exercisable into Common Shares. |

| (10) | Includes 100,000 Common Shares controlled or directed by Anne Sorensen and 788,500 Common Shares held directly but does not include 150,000 stock options and 25,750 warrants exercisable into Common Shares. |

7

Principal Occupation, Business or Employment of Nominees

Elie Farah – President, Chief Executive Officer and Director

Mr. Farah was appointed as the Company’s President in January 2012 and Chief Executive Officer in July 2012. Mr. Farah previously headed the global mergers and acquisitions initiative with Boehringer Ingelheim GmbH, an international pharmaceutical company based in Germany from October 1999 to March 2003. Mr. Farah executed and oversaw strategic transactions across Europe and the Americas while working at the North American holding company in Canada and subsequently at the global headquarters in Germany. Mr. Farah was the President and CFO of Transition Therapeutics Inc. from July 2008 to December 2011 and the Vice-President of Corporate Development of Transition Therapeutics from May 2005 to June 2008. During his time at Transition Therapeutics, Mr. Farah played an instrumental role in the company listing on NASDAQ, completing equity financings, managing and executing multiple company acquisitions as well as licensing agreements with large pharmaceutical companies. He holds an MBA and an MAcc in addition to the following designations; Chartered Financial Analyst (CFA) and Chartered Accountant (CA).

Robert S. Pollock — Director

Mr. Pollock is a Director and Chief Executive Officer of Primary Capital Inc., an exempt market dealer. Mr. Pollock was President of Primary Corp. (TSX: PYC), a natural resources lending company from August 2008 to June 2012. He was formerly Vice President-Investment Banking at Dundee Securities Corporation and has 15 years of experience in the Canadian capital markets with specific experience in merchant banking, institutional sales and investment banking. Mr. Pollock holds an MBA from St. Mary’s University (1993) and a BA from Queen’s University (1991).

Mr. Pollock’s principal occupations during the five preceding years are as follows: since July 2008 he has been Director and Chief Executive Officer of Primary Capital Inc.; from August 2008 to June 2012, he was a Director and Chief Executive Officer of Primary Corp.; from February 10, 2011 to January 12, 2012, he was the interim Chief Executive Officer of Envoy and our company.

David D. Guebert — Director

Mr. Guebert is a chartered accountant and certified public accountant with over 30 years of experience in finance and accounting, 20 of which were served as chief financial officer of public and private companies in the resource and technology sectors. He is currently the Chief Financial Officer of Marret Resource Corp., a company focused on natural resource lending. He is also is the Chief Financial Officer of Times Three Wireless Inc., a wireless location technology company. Mr. Guebert holds a B.Comm. from the University of Saskatchewan (1979).

Mr. Guebert’s principal occupations during the five preceding years are as follows: Since 2008 he has been Chief Financial Officer of Marret Resource Corp. and since 2004 has been Chief Financial Officer of Times Three Wireless Inc. From 2010 to 2013 he was a director of Advitech Inc., a biotech company.

8

Timothy G. Sorensen — Director

Mr. Sorensen is a Director and the President of Primary Capital Inc., an exempt market dealer. He joined Primary Capital from Macquarie Capital Markets Canada where he served as Divisional Director Head of Institutional Sales. Mr. Sorensen has over 14 years of capital markets experience in institutional sales and equity analysis. He has a CFA designation and holds an MBA (1996) and B.Comm (1995) both from the University of Windsor.

Mr. Sorensen’s principal occupation during the five preceding years is as follows: he has been President of Primary Capital Inc. since November 2010; from January 2008 until September 2010, he was the Divisional Director Head of Institutional Sales of Macquarie Capital Markets Canada; and he was an institutional sales person from 2004 to 2008 with Orion Financial Inc., which became Macquarie Group in 2007.

Michael Cloutier — Director

Mr. Michael Cloutier was appointed Director of Merus Labs International Inc. on July 8, 2013. He is currently the President and General Manager of InterMune Inc., a biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and orphan fibrotic diseases. Prior to his appointment at Merus, Mr. Cloutier was the CEO of the Canadian Diabetes Association from 2010 to 2013 and was the CEO of Critical Outcomes Technology Inc., an early stage biotech company based in London, Ontario with proprietary technology uniquely positioned to accelerate and advance pre-clinical research and drug development activities, from 2008 to 2010. From 2003 to 2008, Mr. Cloutier held several roles with AstraZeneca including the CEO of the Canadian operations and VP, HR, Global Marketing at the corporate headquarters in London, England. Other leadership roles include President of Pharmacia Canada from 2000 to 2003 and President of Searle Canada from 1998 to 2000.

Selection of Directors and Officers

There are no arrangements or understandings between any director or executive officer of the Company with major shareholders, customers or others, pursuant to which he or she was selected as such.

Family Relationship

There are no family relationships between any of the persons named above.

Cease Trade Orders

To the best of management’s knowledge, no proposed director of the Company is, or within the ten (10) years before the date of this Information Circular has been, a director, chief executive officer or chief financial officer of any company that:

| | (a) | was subject to (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| | | |

| | (b) | was subject to (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

9

Bankruptcies

To the best of management’s knowledge, no proposed director of the Company is, or within ten (10) years before the date of this Information Circular has been, a director or an executive officer of any company that, while the person was acting in that capacity, or within a year of that person ceasing to act in the capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets or made a proposal under any legislation relating to bankruptcies or insolvency.

To the best of management’s knowledge, no proposed director of the Company has, within 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Penalties or Sanctions

To the best of management’s knowledge, no proposed director of the Company has been subject to:

| | (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | | |

| | (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. |

EXECUTIVE COMPENSATION

General

For the purpose of this Information Circular:

“CEO” means an individual who acted as chief executive officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

“CFO” means an individual who acted as chief financial officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

“NEO” or “Named Executive Officer” means each of the following individuals:

10

| | (c) | each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000, as determined in accordance with subsection 1.3(6) of Form 51-102F6Statement of Executive Compensation, for that financial year; and |

| | | |

| | (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year; |

Compensation Discussion and Analysis

The Company’s executive compensation program has been developed with the objective of aligning executive compensation with the Company’s business plans, strategies and goals, while taking into account various factors and criteria, including competitive factors and the Company’s performance. The specific objectives of the Company’s compensation strategy are to:

| | (a) | provide an appropriate overall compensation package that enables the Company to attract and retain highly qualified and experienced senior executives and which is competitive with that offered for comparable positions in other pharmaceutical companies of a similar size and overall stage of business development; |

| | | |

| | (b) | encourage superior performance by executives, to motivate executives to achieve important corporate and personal performance objectives and then to award compensation based on corporate and individual results; and |

| | | |

| | (d) | align the interests of executive officers with the long-term interests of shareholders through participation in the Company’s incentive stock option plan. |

The Compensation Committee is responsible for recommending the compensation of the Company’s executive officers to the Board.

The Company’s executive compensation package consists of the following components:

| | (a) | base salary; |

| | | |

| | (b) | discretionary annual incentive cash bonuses, and |

| | | |

| | (c) | long-term incentives in the form of share options franted under the Company’s 2011 Plan (as defined below). |

The Compensation Committee did not rely on any specific objectives or measures to measure individual performance, other than by measuring the achievement of specific objectives that were related to concrete, measurable elements, including net income and earnings per share.

Salary

The NEOs are paid a salary in order to ensure that the compensation package offered by the Company is in line with that offered by other comparable companies in the pharmaceutical industry, and as an immediate means of rewarding the NEO's for efforts expended on behalf of the Company. Base salary levels are based on responsibility, experience, knowledge and on internal equity criteria and external pay practices, as well as by reference to the competitive marketplace for management talent at other pharmaceutical companies of similar stage of development, market capitalization and size.

11

The Compensation Committee completes an annual performance review of each NEO following the end of each fiscal year at which it considers, among other things, individual performance assessments, the Company’s performance, the alignment with and balance between short and longer-term performance goals, the value of incentive awards paid to similar positions in comparable companies and previous incentive awards. This annual performance review is used to determine any adjustments to the NEO’s base salary and any bonuses to be awarded to the NEO in respect of the completed fiscal year.

The Compensation Committee did not rely on any comparator groups to determine salaries for the Company’s most recent financial year. Actual salaries take into consideration the individual’s position and responsibilities with the Company and their contribution to the Company’s performance.

Annual Incentive Cash Bonuses

Our NEOs are entitled to be considered for a discretionary annual incentive cash bonus at the end of each year. The Company has not established any defined performance measures on which these bonuses are based. In general, the Compensation Committee will evaluate the granting of the discretionary bonus following the end of year based on the Company’s overall financial performance, together with the performance of the NEO. The Compensation Committee will consider our sales and revenue growth and overall financial performance, among other factors, in deciding whether to grant discretionary bonuses. The Company’s objectives in granting annual incentive cash bonuses generally include:

| | (i) | attracting and retaining talented, qualified and effective executives, |

| | | |

| | (ii) | motivating the short and long-term performance of these executives, and |

| | | |

| | (iii) | better aligning their interests with those of the Company’s shareholders. |

Cash bonuses are discretionary and may be awarded during 2014.

Long Term Incentives – Share Options

The 2011 Plan is intended to provide long term rewards linked directly to the market value of the Common Shares. The Company regards the strategic use of incentive stock options as a key component of the Company’s compensation plan. The Company is committed to long-term incentive programs that promote the continuity of an excellent management team and, therefore, the long-term success of the Company. The Company established a formal plan under which stock options may be granted to directors, officers, employees and consultants as an incentive to serve the Company in attaining its goal of improved shareholder value. It applies to personnel at all levels and continues to be one of the Company’s primary tools for attracting, motivating and retaining qualified personnel which is critical to the Company’s success. The Compensation Committee is responsible for administering the Company’s stock option plan and determining the type and amount of compensation to be paid to directors, officers, employees and consultants of the Company including the awards of any stock options under a stock option plan. Stock options are typically part of the overall compensation package for executive officers.

Stock options are granted to reward individuals for current performance, expected future performance and to align the long term interest of NEOs with shareholders. All grants of stock options to the NEOs are reviewed and approved by the Compensation Committee. In evaluating option grants to an NEO, the Compensation Committee evaluates a number of factors including, but not limited to: (i) the number of options already held by such NEO; (ii) a fair balance between the number of options held by the NEO concerned and the other executives of the Company, in light of their responsibilities and objectives; and (iii) the value of the options (generally determined using a Black-Scholes analysis) as a component in the NEO’s overall compensation package.

12

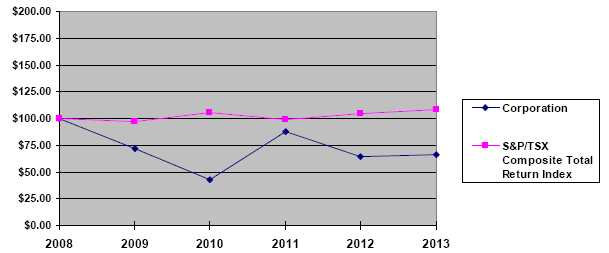

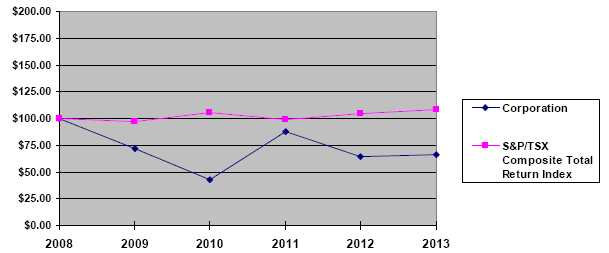

Performance Graph

Comparison of Cumulative Total Return Between Common Shares and

S&P/TSX Composite Total Return Index 2008 through 2013

The following graph compares the Company’s cumulative total shareholder return (assuming an investment of $100 on October 1, 2008) on the Common Shares during the period October 1, 2008 to October 1, 2013 with the cumulative total return of the S&P/TSX Composite Total Return Index during the same period. The Common Share price performance as set out in the graph does not necessarily indicate future price performance.

| | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| The Company | $100.00 | $72.04 | $42.65 | $87.68 | $64.93 | $66.35 |

S&P/TSX Composite

Total Return Index | $100.00

| $96.95

| $105.24

| $98.90

| $104.81

| $108.80

|

Hedging Policy

Although the Company has not adopted a policy disallowing insiders from purchasing financial instruments designed to hedge or offset any decrease in market value of Common Shares or any other securities of the Company, the Company is not aware of any insiders having adopted such practice.

Compensation Governance

The Company does not have a formal written policy with respect to the remuneration of its NEOs and directors. Under the Company’s executive compensation program, the Board has delegated to the Compensation Committee the responsibility of determining for each NEO the amounts of the three main components of the Company’s executive compensation. The Compensation Committee also determines the compensation paid to the directors of the Corporation.

13

Role of the Compensation Committee

When considering the appropriate compensation to be paid to the executive officers, the Compensation Committee has regard to a number of factors including:

recruiting and retaining executives critical to the success of the Company and the enhancement of shareholder value;

providing fair and competitive compensation;

aligning the interests of management and shareholders;

rewarding performance, both on an individual basis and with respect to operations generally; and

available financial resources.

In addition, the Compensation Committee receives performance reviews and compensation recommendations from the President and Chief Executive Officer in respect of other executive officers. The Committee reviews these recommendations made to it and has discretion to modify any of the recommendations before making its recommendation to the Board.

Composition of the Compensation Committee

The Compensation Committee is comprised of only independent members within the meaning of NI 52-110Audit Committees (“NI 52-110”) and while the Board determines its members, the CEO is not involved in the selection process for this committee. The current members of the Compensation Committee are Tim Sorensen (Chair), Rob Pollock and David Guebert.

Each member has experience in executive compensation by virtue of his experience as current or former director or officer of a public corporation (see above under “Election of Directors – Principal Occupation, Business or Employment of Nominees”). The Board believes the Compensation Committee collectively has the knowledge, experience and background required to fulfill its mandate.

No compensation consultant or advisor was retained by the Corporation during the fiscal year ended September 30, 2013.

Compensation Risk Management

The Compensation Committee, during its annual review, evaluates the risks, if any, associated with the Company’s compensation policies and practices. Implicit in the Compensation Committee’s mandate is that the Company’s policies and practices respecting compensation, including those applicable to the Company’s NEOs, be designed in a manner which is in the best interests of the Company and its Shareholders. Risk evaluation is one of the considerations for this review.

A portion of the Company’s executive compensation consists of options granted under the 2011 Plan. Such compensation is both “long term” and “at risk” and, accordingly, is directly linked to the achievement of long term value creation. Since the benefits of such compensation, if any, are generally not realized by the NEO until a significant period of time has passed, the possibility of NEOs taking inappropriate or excessive risks with regard to their compensation that are financially beneficial to them at the expense of the Company and its Shareholders is extremely limited. In addition, all major transactions require approval by the Board.

14

The other element of compensation, salary, is capped, thereby reducing risks associated with unexpectedly high levels of pay. In addition, the Compensation Committee believes it is unlikely that NEOs would take inappropriate or excessive risks at the expense of the Company and its Shareholders that would be beneficial to them with regard to their short term compensation when their longer term compensation might be put at risk from their actions.

Management bonuses are not directly tied to financial performance but are discretionary based on the achievement of personal and company objectives. Bonuses are also capped at a percentage of salary, minimizing risks associated with unexpectedly high amounts.

Due to the size of the Company, and the current level of the Company’s activity, the Compensation Committee is able to closely monitor and consider any risks which may be associated with the Company’s compensation policies and practices. Risks, if any, may be identified and mitigated through regular Board meetings during which, financial and other information of the Company are reviewed, and which includes executive compensation. No risks have been identified arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

Summary Compensation Table

The following table sets forth, in Canadian dollars, all compensation for the fiscal years ended September 30, 2013, 2012, and 2011 paid to the principal executive officer of the Company, the principal financial officer of our company and the three other most highly compensated officers who served as NEOs.

| | | | | | Non-equity | | | |

| | | | | | Incentive Plan | | | |

| | | | | | Compensation(1) | | | |

| | | | | | | ($) | | | |

| | | | Share- | Option- | | Long- | | All Other | Total |

| | | | based | based | Annual | term | Pension | Compens- | Compens- |

| Name and Principal | | Salary | Awards(2) | Awards(3) | Incentive | Incentive | Value | ation | ation |

| Position | Year | ($) | ($) | ($) | Plans | Plans | ($) | ($) | ($) |

| Elie Farah, | 2013 | $270,000 | nil | nil | $75,000 | nil | nil | nil | $345,000 |

| President and CEO | 2012 | $187,977 | nil | $521,282 | nil | nil | nil | nil | $709,259 |

| | 2011 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Andrew Patient, | 2013 | $210,000 | nil | $38,507 | $31,500 | nil | nil | nil | $280,007 |

| Chief Financial Officer | 2012 | $217,248 | nil | $256,827 | nil | nil | nil | nil | $474,075 |

| | 2011 | $290,000 | nil | nil | nil | nil | nil | $6,000 | $296,000 |

| Ahmad Doroudian, | 2013 | $270,000 | nil | nil | nil | nil | nil | nil | $270,000 |

| Executive Vice Chairman | 2012 | $191,864 | nil | $821,846 | nil | nil | nil | nil | $1,013,710 |

| | 2011 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Ulrich Schoeberl(4), | 2013 | $259,436 | nil | nil | $50,292 | nil | nil | nil | $309,728 |

| Managing Director | 2012 | $39,398 | nil | $94,850 | nil | nil | nil | nil | $134,248 |

| European Operations | 2011 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

15

| | | | | | Non-equity | | | |

| | | | | | Incentive Plan | | | |

| | | | | | Compensation(1) | | | |

| | | | | | | ($) | | | |

| | | | Share- | Option- | | Long- | | All Other | Total |

| | | | based | based | Annual | term | Pension | Compens- | Compens- |

| Name and Principal | | Salary | Awards(2) | Awards(3) | Incentive | Incentive | Value | ation | ation |

| Position | Year | ($) | ($) | ($) | Plans | Plans | ($) | ($) | ($) |

| Ali Moghaddam | 2013 | $158,400 | nil | nil | nil | nil | nil | $7,200 | $165,600 |

| Vice President Business | 2012 | $123,600 | nil | $260,641 | nil | nil | nil | $5,400 | $389,641 |

| Development | 2011 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Notes: |

| (1) | “Non-equity Incentive Plan Compensation” includes all compensation under an incentive plan or portion of an incentive plan that is not an equity incentive plan. |

| (2) | “Share-based Awards” means an award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty, Common Shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock. |

| (3) | “Option-based Awards” means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar instruments that have option-like features. The value of these options in 2013 is estimated using the Black-Scholes option pricing model with the following assumptions: Share price of $1.19, risk free interest rate of 2%, expected stock price volatility of 80%, expected dividend yield of nil and expected term of 5 years. |

| (4) | Compensation for Mr. Shoeberl is paid in Euros. Canadian dollar equivalent amounts are calculated at the rates in effect when the expense is incurred. |

Employment Agreements

Elie Farah – Chief Executive Officer

Effective January 6, 2012, the Company entered into an employment agreement with Elie Farah, whereby Elie Farah agreed to provide services to the Company in consideration for, among other things, an annual base salary of $210,000 starting January 6, 2012 and upon the date of executing the next definitive agreement related to the next acquisition transaction of the Company subsequent to January 6, 2012, an annual base salary of $270,000. In addition, four weeks of paid vacation per annum shall be provided to Elie Farah and shall be taken at such time or times as is mutually determined. Elie Farah is also eligible to receive an annual bonus of up to 30% of his annual base salary in recognition of personal and employer milestones. The decision to pay a bonus, if any is to be paid, is at the discretion of the Compensation Committee and the Board. Elie Farah is entitled to options to acquire additional Common Shares as the compensation and Board shall determine, from time to time. In connection with his employment agreement, Elie Farah was granted 400,000 options to purchase Common Shares priced at market price at the time of grant, which options are subject to vesting. Elie Farah is entitled to receive health and dental benefits according to the Company’s benefit plan as well as long term disability and life insurance coverage. Mr. Farah’s base salary is reviewed by the Compensation Committee and, if deemed appropriate by the Compensation Committee, adjusted on an annual basis.

Andrew Patient – Chief Financial Officer

Effective January 1, 2012, the Company entered into an employment agreement with Andrew Patient, whereby Andrew Patient agreed to provide services to the Company in consideration for, among other things, an annual base salary of $180,000. In addition, four weeks of paid vacation per annum shall be provided to Andrew Patient and shall be taken at such time or times as is mutually determined. Andrew Patient is also eligible to receive an annual bonus of up to 15% of his annual base salary in recognition of personal and employer milestones. The decision to pay a bonus, if any is to be paid, is at the discretion of the Compensation Committee and the Board. Andrew Patient is entitled to options to acquire additional Common Shares as the Compensation Committee and Board shall determine, from time to time. In connection with his employment, Andrew Patient was granted 200,000 options to purchase Common Shares of the Company priced at market price at the time of grant, subject to vesting. Andrew Patient is entitled to receive health and dental benefits according to the Company’s benefit plan as well as long term disability and life insurance coverage. Mr. Patient’s base salary is reviewed by the Compensation Committee and, if deemed appropriate by the Compensation Committee, adjusted on an annual basis.

16

Termination and Change of Control Provisions

Each of the employment agreements for Mr. Farah and Mr. Patient provides that their employment agreement may be terminated without cause by the Company upon payment to the NEO, in lieu of all notice requirements or other payments due under the employment agreement, of an amount equal to the aggregate of (i) an amount equal to all accrued but unpaid base salary and vacation pay, and (ii) an amount equal to 100% of the NEO’s base salary for the current year.

Each of the employment agreements for Mr. Farah and Mr. Patient also provides that their employment agreement may be terminated by the NEO within three months of the date of a “change of control”, as defined in the NEO’s employment agreement, at the election of the NEO. Upon termination by the NEO following a “change of control”, the Company will pay to the NEO an amount equal to the aggregate of (i) an amount equal to all accrued but unpaid base salary and vacation pay, and (ii) an amount equal to 100% of the NEO’s annual base salary for the current year.

The table below provides estimates of the incremental amounts that would have been payable to the following NEOs assuming (i) termination by the Company without cause, or (ii) termination in the event of a Change of Control event occurred on September 30, 2013.

Name |

Termination Without Cause

($) | Termination and

Change in Control

($) |

| Elie Farah | $300,000 | $300,000 |

| Andrew Patient | $220,000 | $220,000 |

Incentive Plan Awards

Outstanding Share-based awards and option-based awards

The following table sets forth all option and share-based awards granted to NEOs that were outstanding as of September 30, 2013.

| | Option-based Awards | Share-based Awards |

| | | | | | Number of | Market or |

| | Number of | | | Value of | shares or | payout value |

| | securities | | | unexercised | units of | of share- |

| | underlying | Option | | in-the- | shares that | based awards |

| | unexercised | exercise | Option | money | have not | that have not |

| | options | price | expiration | options | vested | vested |

| Name | (#) | ($) | date | ($)(1) | (#) | ($) |

| Elie Farah | 400,000 | $2.05 | January 5, 2017 | nil | nil | nil |

17

| | Option-based Awards | Share-based Awards |

| | | | | | Number of | Market or |

| | Number of | | | Value of | shares or | payout value |

| | securities | | | unexercised | units of | of share- |

| | underlying | Option | | in-the- | shares that | based awards |

| | unexercised | exercise | Option | money | have not | that have not |

| | options | price | expiration | options | vested | vested |

| Name | (#) | ($) | date | ($)(1) | (#) | ($) |

| Andrew Patient | 200,000 | $2.02 | January 18, 2017 | nil | nil | nil |

| | 50,000 | $1.19 | January 6, 2018 | $10,500 | nil | nil |

| Ahmad Doroudian | 640,000 | $2.02 | January 18, 2017 | nil | nil | nil |

| Ulrich Schoeberl | 100,000 | $1.52 | September 11, 2017 | nil | nil | nil |

| Ali Moghaddam | 200,000 | $2.05 | January 5, 2017 | nil | nil | nil |

| Notes: |

| (1) | The closing price of Common Shares on September 30, 2013 was $1.40. |

Incentive Plan Awards – Value vested or earned during the year

The following table sets forth details of the value vested or earned for all incentive plan awards during the year ended September 30, 2013 by NEOs.

Name |

Option-based awards – Value

vested during the year

($) |

Share-based awards – Value

vested during the year

($) | Non-equity incentive plan

compensation – Value earned

during the year

($) |

| Elie Farah | nil | nil | nil |

| Andrew Patient | nil | nil | nil |

| Ahmad Doroudian | nil | nil | nil |

| Ulrich Schoeberl | nil | nil | nil |

| Ali Moghaddam | nil | nil | nil |

Narrative Discussion

Refer to the section titled “Compensation Discussion and Analysis”, beginning on page 10, and “2011 Stock Option Plan”, beginning on page 20, for a description of all plan based awards and their significant terms. There was no re-pricing of stock options under the stock option plan or otherwise during the Company’s most recently completed financial year ended September 30, 2013.

In January 2013, the Company granted 50,000 options to an officer of the Company as incentive compensation. The options have a five year term and were granted with an exercise price of $1.19 per share, with all options vesting on the first anniversary date of the grant.

The estimated fair value of the options granted during the twelve months of fiscal 2013, using the Black-Scholes option pricing model, was $132,080. A total of $332,175 was expensed in the financial statements during the twelve months ending September 30, 2013 relating to current and prior period grants. The remaining expense will be recognized over the balance of the vesting periods.

Pension Plan Benefits

The Company has no pension, defined benefit, defined contribution or deferred compensation plans in place.

18

Compensation of Directors

Director Compensation Table

The total compensation paid to directors, who are not NEOs, during the financial year ended on September 30, 2013, is set out in the following table:

Name |

Fees

earned

($) | Share-

based

awards

($) | Option-

based

awards

($) | Non-equity

incentive plan

compensation

($) |

Pension

value

($) |

All other

compensation

($) |

Total

($) |

| David D. Guebert | $36,750 | nil | nil | nil | nil | nil | $36,750 |

| Robert S. Pollock | $30,250 | nil | nil | nil | nil | nil | $30,250 |

| Joseph Rus | $30,250 | nil | nil | nil | nil | nil | $30,250 |

| Timothy G. Sorensen | $34,250 | nil | nil | nil | nil | nil | $34,250 |

| Michael Cloutier | $6,500 | nil | $89,876 | nil | nil | nil | $96,376 |

Narrative Discussion

All directors of the Company or any of its affiliates are compensated for their services as directors and members of a committee through the payment of monthly fees. In addition, Directors are entitled to participate in the Company’s Stock Option Plan. Directors earn an annual fee of $20,000, plus an an additional fee for their role as Chairman ($10,000) or subcommittee Chair ($5,000), as well as meeting fees of $1,000 per meeting attended. Directors may also be reimbursed reasonable travel expenses incurred in connection with attendance at meetings.

Directors’ and Officers’ Liability Insurance

The Company maintains liability insurance for the benefit of the directors and officers of the Company and its subsidiaries against liability incurred by them in their respective capacities. The current annual policy limit is $10,000,000. Under the policy, individual directors and officers are reimbursed for losses incurred in their capacities as such, subject to a deductible of $50,000 for securities or employment practices claims and no deductible for all other claims. The deductible is the responsibility of the Company. The annual premium of $102,600 was paid by the Company.

Outstanding Share-Based Awards and Option-Based Awards for Directors

The following table sets forth all option and share-based awards granted to the Company’s directors, other than the NEOs, that were outstanding as of September 30, 2013.

| | Option-based Awards | Share-based Awards |

Name |

Number of

securities

underlying

unexercised

options

(#) |

Option exercise

price

($) |

Option

expiration date |

Value of

unexercised

in-the-

money

options(1)

($) | Number of

shares or

units of

shares that

have not

vested

(#) |

Market or

payout value of

share-based

awards that

have not vested

($) |

| David D. Guebert | 150,000 | $2.00 | July 25, 2017 | nil | nil | nil |

19

| | Option-based Awards | Share-based Awards |

Name |

Number of

securities

underlying

unexercised

options

(#) |

Option exercise

price

($) |

Option

expiration date |

Value of

unexercised

in-the-

money

options(1)

($) | Number of

shares or

units of

shares that

have not

vested

(#) |

Market or

payout value of

share-based

awards that

have not vested

($) |

| Robert S. Pollock | 150,000 | $2.00 | July 25, 2017 | nil | nil | nil |

| Timothy G. Sorensen | 150,000 | $2.00 | July 25, 2017 | nil | nil | nil |

| Michael Cloutier | 150,000 | $0.91 | July 7, 2018 | $73,500 | nil | nil |

| Notes: |

| (1) | The closing price of Common Shares on September 30, 2013 was $1.40. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth details of the value vested or earned for all incentive plan awards during the year ended September 30, 2013 by directors.

Name | Option-based awards –

Value vested during the

year

($) | Share-based awards –

Value vested during the

year

($) | Non-equity incentive plan

compensation – Value

earned during the year

($) |

| David D. Guebert | nil | nil | nil |

| Robert S. Pollock | nil | nil | nil |

| Joseph Rus | nil | nil | nil |

| Timothy G. Sorensen | nil | nil | nil |

| Michael Cloutier | nil | nil | nil |

Narrative Discussion

Refer to the section titled “Compensation Discussion and Analysis”, beginning on page 10, and “2011 Stock Option Plan”, beginning on page 20, for a description of all plan based awards and their significant terms. There was no re-pricing of stock options under the stock option plan or otherwise during the Company’s most recently completed financial year ended September 30, 2013.

In July 2013, the Company granted 150,000 options to a new director. The options have a term of five years, vesting immediately, with an exercise price of $0.91 per share.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out, as at September 30, 2013, the share-based compensation plans of the Company pursuant to which Common Shares can be issued from treasury. The information has been consolidated by category of share-based compensation plan, namely, the plans providing for the issuance of Shares previously approved by the Shareholders and those not having been approved by the Shareholders. There is no plan which has not been approved by the Shareholders. The number of Shares which appears at the line “Share-based compensation plan” refers to the 2011 Plan.

20

Plan

Category |

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a) |

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b) | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in

column (a))(1)

(c) |

| Equity compensation plans approved by securityholders | 2,465,000 | $1.90 | 1,374,151 |

| Equity compensation plans not approved by securityholders | Nil | N/A | Nil |

| Notes: |

| (1) | The Company’s stock option plan allows it to grant options to acquire up to 3,839,151 Common Shares. |

2011 Stock Option Plan

The Company’s stock option plan (the “2011 Plan”) was adopted in connection with the Amalgamation on December 19, 2011, which was updated by the Board on January 18, 2012 and February 25, 2013.

The following summary of the 2011 Plan is intended to be a brief description of the 2011 Plan and is qualified in its entirety by the full text of the 2011 Plan which is attached hereto as Schedule “A”.

The purpose of the 2011 Plan is intended to: (i) provide an incentive to Eligible Persons (as defined in the 2011 Plan) to further the development, growth and profitability of the Company; (ii) contribute in providing such Eligible Persons with a total compensation and rewards package; (iii) assist the Company in retaining and attracting employees and consultants with experience and ability; and (iv) encourage share ownership and provide Eligible Persons with proprietary interests in, and a greater concern for, the welfare of, and an incentive to continued service with, the Company. Eligible persons include (i) employees, (ii) directors, (iii) executive officers, and (iv) any person or company engaged to provide ongoing management or consulting services to the Company.

The 2011 Plan is administered by the Compensation Committee, which has full and final authority with respect to granting of all options thereunder subject to the requirements of the TSX and other requirements of law.

The 2011 Plan authorizes the Compensation Committee to grant options to purchase Common Shares on the following terms and conditions:

the aggregate number of Common Shares which may be issued pursuant to options granted under the 2011 Plan will not exceed that number which is equal to ten percent of the issued and outstanding Common Shares from time to time;

any increase in the issued and outstanding Common Shares will result in an increase in the available number of Common Shares issuable under the 2011 Plan, and any exercises of options will make new grants available under the 2011 Plan effectively resulting in a re-loading of the number of options available to grant under the 2011 Plan;

21

no single participant in the 2011 Plan and his, her or its associates may be granted options which could result in the issuance of Common Shares exceeding five percent of the issued and outstanding Common Shares, within a one year period, to such participant and his, her or its associates, in the aggregate;

the number of Common Shares issuable to any single participant in the 2011 Plan pursuant to options, shall not exceed five percent of the issued and outstanding Common Shares;

the number of Common Shares issuable to Insiders (as defined in the TSX Company Manual), at any time, under all share compensation arrangements, shall not exceed ten percent of the issued and outstanding Common Shares and the number of Common Shares issued to Insiders, within any one year period, under all share compensation arrangements, shall not exceed ten percent of the issued and outstanding Common Shares;

the exercise price of an option shall not be less than the closing price on the day prior the date of grant of the option, subject to any extension in the event of a blackout period;

vesting of options granted under the 2011 Plan shall be at the discretion of the Board;

options granted under the 2011 Plan will be granted for a term not to exceed ten years from the date of grant;

in the event of the termination of a participant’s employment with the Company for cause or as a result of the participant’s voluntary resignation prior to normal retirement, such participant’s options will terminate three months from the date of such termination, and in the event of the retirement, death, physical or mental disability or termination (other than for cause) by the Company, the participant’s options will terminate 12 months from the date employment by the Company ceased, provided in each case that no options will be extended past their term except as provided below;

the Board or Compensation Committee is entitled to extend the time during which a participant that is not an Insider may exercise their options at its discretion provided that such extension does not extend past the maximum ten year term;

the expiry date of an option can be extended by the Compensation Committee without shareholder approval where such expiry date occurs within a blackout period or within ten days of the end of a blackout period and the new expiry date shall be the tenth day following the end of the relevant blackout period;

during a participant’s lifetime, an option may not be assigned or transferred except to a participant’s trust;

upon the announcement or contemplation of any event, including a reorganization, acquisition, amalgamation or merger (or a plan of arrangement in connection with any of the foregoing), other than solely involving the Company and one or more of its affiliates (as such term is defined in theSecurities Act(Ontario)), with respect to which all or substantially all of the persons who were the beneficial owners of the Common Shares immediately prior to such reorganization, amalgamation, merger or plan of arrangement do not, following such reorganization, amalgamation, merger or plan of arrangement, beneficially own, directly or indirectly more than 50% of the resulting voting shares on a fully-diluted basis (for greater certainty, this shall not include a public offering or private placement out of treasury) or the sale to a person other than an affiliate of the Company of all or substantially all of the Company’s assets, the Company shall have the discretion, without the need for the agreement of any participant, to accelerate the expiry dates and/or any applicable vesting provisions of all options, as it shall see fit. The Company may accelerate one or more participant’s expiry dates and/or vesting requirements without accelerating the expiry dates and/or vesting requirements of all options and may accelerate the expiry date and/or vesting requirements of only a portion of a participant’s options;

22

the following amendments to the 2011 Plan may be made by the Board without the approval of shareholders: (i) any amendments necessary to ensure that the 2011 Plan is in compliance with the rules of the Exchange and any other applicable regulatory authority; (ii) amendments that are of an administrative or general housekeeping nature; (iii) amendments to the definitions of “Eligible Persons” under the 2011 Plan; (iv) amendments to the manner in which the 2011 Plan is administered; (v) amendments to the maximum term of options granted pursuant to the 2011 Plan, provided that (A) such extension does not extend past the maximum ten year term, and (B) the participant is not an Insider as the Compensation Committee is not entitled to extend the time during which an Insider may exercise Options held by the Insider; (vi) amendments to the vesting provisions and the termination provisions set out in the 2011 Plan; and (vii) amendments to the anti-dilution provisions set out in the 2011 Plan; and

the following amendments to the 2011 Plan will require Shareholder approval: (i) amendments to the maximum number of Common Shares that may be issued as a result of the grant of options pursuant to the 2011 Plan; (ii) amendments to the maximum number of securities or options that may be granted to Insiders; (iii) amendments to the manner in which the exercise price of options is determined; (iv) any amendment to the term of options granted to Insiders; and (v) amendments to the amending provisions of the 2011 Plan.

Indebtedness of Directors and Executive Officers

No person who is, or who was within the 30 days prior to the date of the Information Circular, a director, executive officer, employee or any former director, executive officer or employee of the Company or a subsidiary thereof, and furthermore, no person who is a nominee for election as a director of the Company, and no associate of such persons is, or was as of the date of this Information Circular, indebted to the Company or a subsidiary of the Company or indebted to any other entity where such indebtedness is subject to a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or a subsidiary of the Company.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no: (a) director or executive officer of the Company; (b) person or company who beneficially owns, directly or indirectly, Common Shares or who exercises control or direction of Common Shares, or a combination of both carrying more than ten percent of the voting rights attached to the Common Shares outstanding (an “Insider”); (c) director or executive officer of an Insider; or (d) associate or affiliate of any of the directors, executive officers or Insiders, has had any material interest, direct or indirect, in any transaction since the commencement of the Company’s most recently completed financial year or in any proposed transaction which has materially affected or would materially affect the Company, except with an interest arising from the ownership of Common Shares where such person or company will receive no extra or special benefit or advantage not shared on a pro rata basis by all holders of the same class of Common Shares.

23

APPOINTMENT OF AUDITOR

Deloitte & Touche LLP, Chartered Accountants (“Deloitte”), will be nominated at the Meeting for reappointment as auditors of the Company until the next annual general meeting of the Shareholders or until their successors are duly elected or appointed, at remuneration to be fixed by the Board. Deloitte have been the auditors of the Company since April 3, 2012.

At the Meeting, Shareholders will be asked to vote for the appointment of Deloitte to serve as auditors of the Company to hold office until the next annual meeting of the Shareholders or until such firm is removed from office or resigns as provided by law, and to authorize the Board to fix the remuneration to be paid to the auditors.

Management recommends Shareholders vote for the appointment of Deloitte as the Company’s auditors for the Company’s fiscal year ending September 30, 2014 at remuneration to be fixed by the Board.

AUDIT COMMITTEE DISCLOSURE

Among other things, the Audit Committee is responsible for reviewing the Company’s annual and quarterly consolidated financial statements and reporting to the Board in connection therewith. On February 25, 2013, the Audit Committee adopted a new Audit Committee Charter, which specifies the auditor’s accountability to the Board and the authority and responsibilities of the Audit Committee in compliance with National Instrument 52-110Audit Committees (“NI 52-110”).

Charter

The text of the Audit Committee Charter is attached hereto as Schedule “B” to this Information Circular.

Composition

The Audit Committee is comprised of three directors, David Guebert (Chair), Tim Sorensen and Michael Cloutier. All three members of the Audit Committee are “independent” (as defined by NI 52-110) directors of the Company and “financially literate” (as defined by NI 52-110).

Relevant Education and Experience

The following describes the relevant education and experience of each member of the Audit Committee that shows their (a) understanding of the accounting principles used by the Company to prepare its financial statements, (b) ability to assess the general application of such accounting principles, (c) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to those that can reasonably be expected to be raised by the Company’s financial statements or experience actively supervising one or more persons engaged in such activities and (d) understanding of internal controls and procedures for financial reporting.

David D. Guebert — Director

Mr. Guebert is a chartered accountant and certified public accountant with over 30 years of experience in finance and accounting, 20 of which were served as chief financial officer of public and private companies in the resource and technology sectors. He is currently the Chief Financial Officer of Marret Resource Corp., a merchant banking company. He is also is the Chief Financial Officer of Times Three Wireless Inc., a wireless location technology company. Mr. Guebert holds a B.Comm. from the University of Saskatchewan (1979).

24

Timothy G. Sorensen — Director

Mr. Sorensen is a Director and the President of Primary Capital Inc., an exempt market dealer. He recently joined Primary Capital from Macquarie Capital Markets Canada where he served as Divisional 7 Director Head of Institutional Sales. Mr. Sorensen has over 14 years of capital markets experience in institutional sales and equity analysis. He has a CFA designation and holds an MBA (1996) and B.Comm (1995) both from the University of Windsor.

Michael Cloutier — Director

Mr. Michael Cloutier was appointed Director of Merus Labs International Inc. on July 8, 2013. He is currently the President and General Manager of InterMune Inc., a biotechnology company focused on the research, development and commercialization of innovative therapies in pulmonology and orphan fibrotic diseases. Prior to his appointment at Merus, Mr. Cloutier was the CEO of the Canadian Diabetes Association from 2010 to 2013 and was the CEO of Critical Outcomes Technology Inc., an early stage biotech company based in London, Ontario with proprietary technology uniquely positioned to accelerate and advance pre-clinical research and drug development activities, from 2008 to 2010. From 2003 to 2008, Mr. Cloutier held several roles with AstraZeneca including the CEO of the Canadian operations and VP, HR, Global Marketing at the corporate headquarters in London, England. Other leadership roles include President of Pharmacia Canada from 2000 to 2003 and President of Searle Canada from 1998 to 2000.

Reliance on Certain Exemptions

During the financial year ended September 30, 2013, the Company has not relied on any exemption contained in NI 52 110.

Audit Committee Oversight

Since the commencement of the Company’s most recently completed financial year, the Board has not failed to adopt a recommendation of the Audit Committee to nominate or compensate an external auditor.

Pre-Approval Policies and Procedures

The Audit Committee has not adopted specific policies and procedures for the engagement of non-audit services. Subject to the requirements of NI 52-110, the engagement of non-audit services is considered by the Audit Committee on a case-by-case basis.

External Auditor Fees

In the following table, “audit fees” are fees billed by the Company’s external auditor for services provided in auditing the Company’s annual financial statements for the subject year. “Audit-related fees” are fees not included in audit fees that are billed by the auditor for assurance and related services that are reasonably related to the performance of the audit review of the Company’s financial statements. “Tax fees” are fees billed by the auditor for professional services rendered for tax compliance, tax advice and tax planning. “All other fees” are fees billed by the auditor for products and services not included in the foregoing categories.

25

The aggregate fees billed by Deloitte & Touche LLP related to the fiscal years ending September 30, 2013 and 2012 by category, are as follows:

Financial

Year Ending |

Audit Fees | Audit

Related Fees |

Tax Fees |

All Other Fees |

| September 30, 2013 | $205,000 | $143,000 | $45,325 | $nil |

| September 30, 2012 | $170,000 | $145,000 | $69,000 | $nil |

The aggregate fees billed by PricewaterhouseCooper LLP related to the fiscal years ending September 30, 2013 and 2012 by category, are as follows:

Financial

Year Ending |

Audit Fees | Audit

Related Fees |

Tax Fees |

All Other Fees |

| September 30, 2013 | nil | nil | nil | nil |

| September 30, 2012 | nil | $8,000 | nil | $3,000 |

The aggregate fees billed by Saturna Group Charted Accountants LLP related to the fiscal years ending September 30, 2013 and 2012 by category, are as follows:

Financial

Year Ending |

Audit Fees | Audit

Related Fees |

Tax Fees |

All Other Fees |

| September 30, 2013 | nil | nil | nil | nil |

| September 30, 2012 | nil | nil | nil | $12,000 |

The aggregate fees billed by MNP LLP related to the fiscal years ending September 30, 2013 and 2012 by category, are as follows:

Financial

Year Ending |

Audit Fees | Audit

Related Fees |

Tax Fees |

All Other Fees |

| September 30, 2013 | nil | nil | nil | nil |

| September 30, 2012 | nil | $22,000 | nil | $35,000 |

MANAGEMENT CONTRACTS

There are no management functions of the Company which were to any substantial degree performed by a person other than a director or executive officer of the Company or its subsidiaries during the Company’s most recently completed financial year.

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES

Board of Directors

The Board is responsible for determining whether or not each director is independent. In making this determination, the Board has adopted the definition of “independence” as set forth in National Instrument 58-101 Disclosure of Corporate Governance Standards. The Board has not adopted the director independence standards contained in Rule 5605 of the NASDAQ Listing Rules. The Company has determined that it has a majority of independent directors.

As of the date of this Information Circular, the Company considers that Robert Pollock, David Guebert, Michael Cloutier, and Timothy Sorensen are independent directors. The Company does not consider Elie Farah to be independent as he is also an officer of the Company and a member of management.

26

Other Directorships

The directors who are presently a director of other reporting issuers, and the names of the issuers, are as follows:

| Name | Name of Reporting Issuer |

| Robert S. Pollock | INV Metals Inc. |

| David D. Guebert | Nil |

| Michael Cloutier | Nil |

| Elie Farah | Ginguro Exploration Corp. |

| Timothy Sorensen | Nil |

The Company does not hold regularly scheduled meetings at which non-independent directors are not in attendance. However, the Company’s independent directors do communicate outside of formal meetings of the Board. Further, the independent directors have very strong governance backgrounds. As a result, they are acutely aware of the important roles independent directors have.

Mr. David Guebert currently serves as Chairman of the Board. The Board provides leadership for its independent directors by giving the independent directors unrestricted access to the Company’s auditors and external legal counsel.

All directors attended all meetings of the Board during the year ended September 30, 2013.

Board Mandate

The Board has adopted a Board Mandate pursuant to which the Board has the responsibility for the overall stewardship of the Company, establishing the overall policies and standards for the Company in the operation of its businesses, and reviewing and approving the Company’s strategic plans. In addition, the Board monitors and assesses overall performance and progress in meeting the Company’s goals. Day to day management is the responsibility of the Chief Executive Officer and senior management.

Position Descriptions

The Board has not developed written position descriptions for the chair and the chair of each committee of the Board. The Board delineates the role and responsibilities of each such position by discussing the role of the chair and by adopting written charters for each committee which delineate the role and responsibilities for the chair of each such committee.

The Board and CEO have not developed a written position description for the CEO. The Board delineates the role and responsibilities of the CEO by discussing the role of the CEO at meetings of the Board.

Orientation and Continuing Education

New directors are given the opportunity to individually meet with members of senior management to improve their understanding of the Company’s business. All directors have regular access to senior management to discuss Board presentations and other matters of interest.

The Company also gives directors a reference manual, which contains information about the Company’s history and current status, corporate governance materials, its investments and its Shareholders. This reference manual is updated regularly. It includes the Company’s Code of Business Conduct, which also applies to the directors, as well as governance and responsibilities of the Board and its committees, and a description of the duties and obligations of directors. As part of its mandate, the Nominating and Corporate Governance Committee is also responsible for providing orientation and continuing education for all members of the Board, including reimbursing costs of attending certain outside director education programs. During their regular scheduled Board meetings, directors are given presentations on various aspects of the Company’s business.

27

Ethical Business Conduct

The Board has adopted a Code of Business Conduct (the “Code”). All of the Company’s employees, directors and officers must follow the Code, which provides guidelines for ethical behaviour.

The Code sets out in detail the principles and general business tenets and ethics and compliance policies applicable to the Company’s business and activities. The Code addresses topics such as honest and ethical conduct and conflicts of interest; compliance with applicable laws and Company policies and procedures; business integrity and fair dealing; public disclosure; use of corporate property and opportunities; confidentiality; compliance with insider trading and other legal requirements; and records and document retention.