Exhibit 99.1

MERUS LABS INTERNATIONAL INC.

BUSINESS ACQUISITION REPORT

FORM 51-102F4

Item 1. Identity of Company

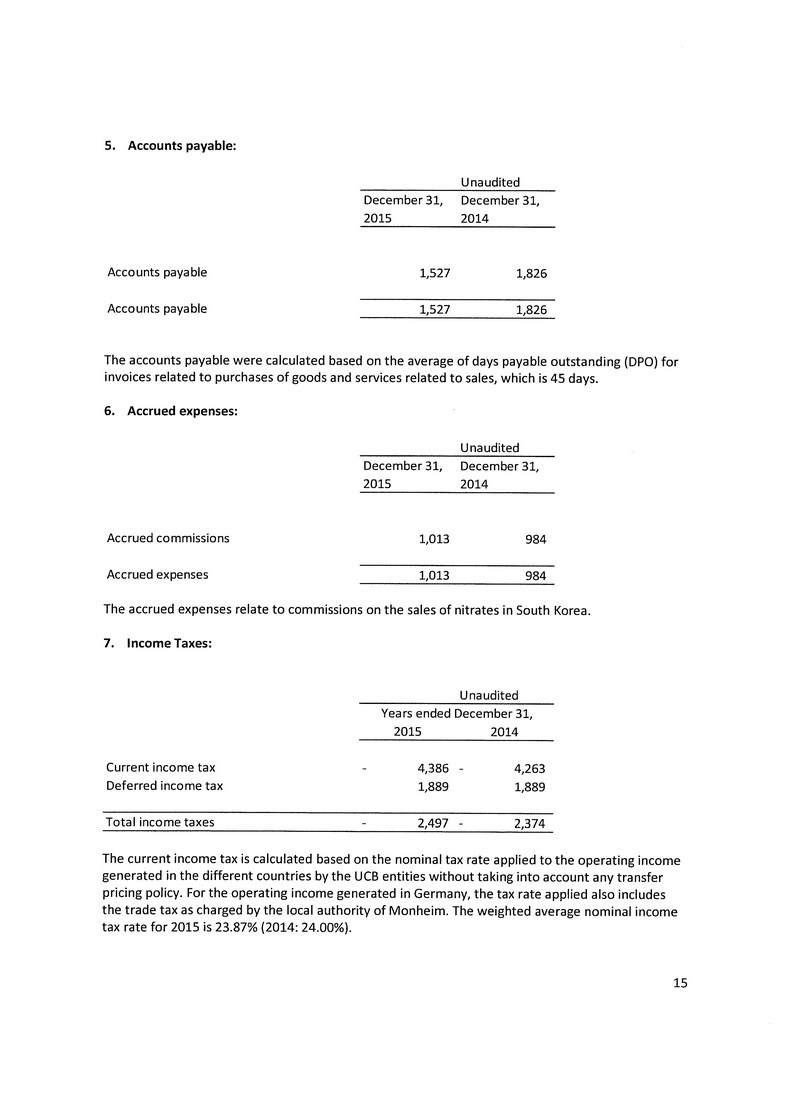

| 1.1 | Name and Address of Company |

Merus Labs International Inc. (the “Company” or “Merus”)

100 Wellington Street West

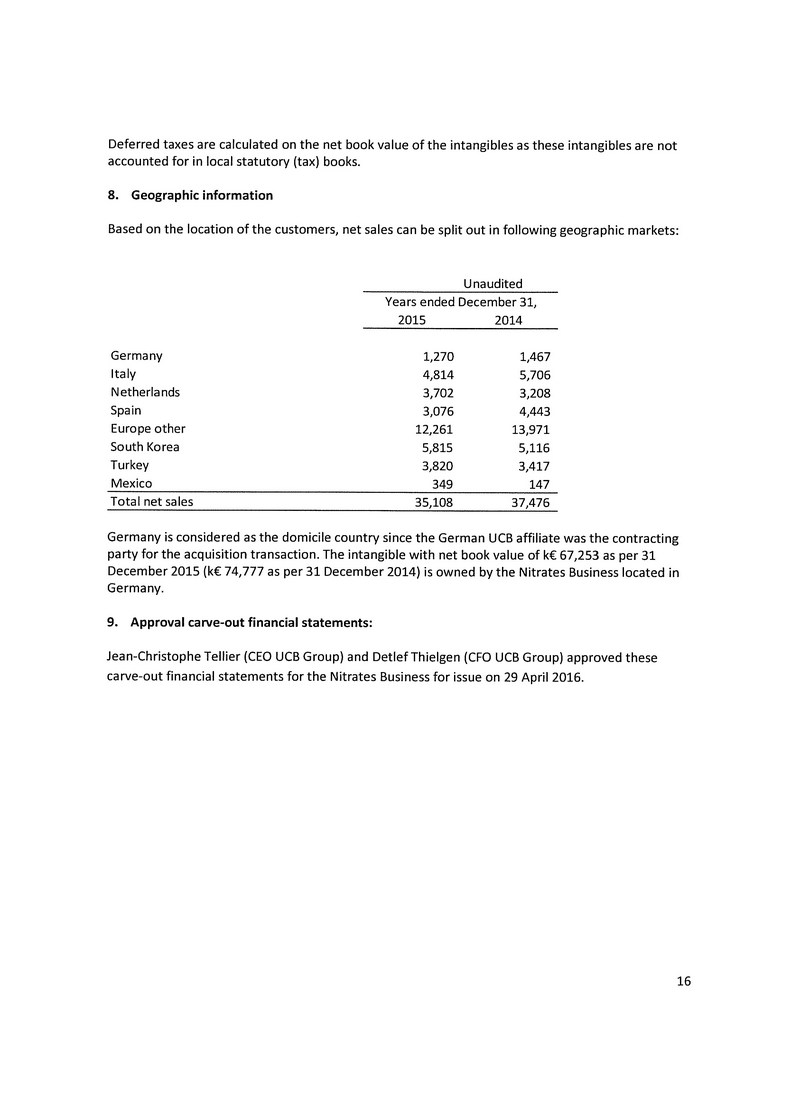

Suite 2110, PO Box 151

Toronto, Ontario, M5K 1H1

The following executive officer of the Company is knowledgeable about the significant acquisition and this business acquisition report:

| Executive Officer: | Andrew Patient, Chief Financial Officer |

| Telephone: | 416-593-3725 |

Item 2. Details of Acquisition

| 2.1 | Nature of Business Acquired |

UCB Purchase Agreement and Acquisition of the UCB Products

On February 4, 2016, the Company completed the acquisition from UCB Pharma GmbH (“UCB”) of the nitrates business of UCB comprised of the rights to the Elantan®, Isoket® and Deponit® pharmaceutical products (together, the “UCB Products”) in Europe and select other markets (the “UCB Product Acquisition”). The UCB Products were purchased pursuant to a purchase agreement entered into among the Company, one of its indirectly wholly owned subsidiaries and UCB on February 1, 2016 (the “UCB Purchase Agreement”).

The UCB Products acquired include the UCB Products in a variety of formats, including tablet, spray, patch and injectable presentations. The UCB Products belong to a category of pharmaceuticals called nitrates, and are used to treat both acute and chronic coronary artery disease.

The UCB Products include exclusive rights to manufacture, market and sell the UCB Products in twenty European countries, Mexico, Turkey and South Korea (the “Territories”). The European countries in the Territory include France, Germany, Italy, Spain and the United Kingdom. Approximately 80% of revenues from the UCB Products are derived from countries where the Company’s existing products are currently sold.

The rights acquired in connection with the UCB Products include exclusive know-how, business contracts, purchase orders, marketing authorizations, intellectual property and existing inventory relating to the UCB Products. UCB has agreed to transfer to the Company the benefit of each marketing authorization which it holds in relation to the UCB Products, subject to the terms and conditions of a transitional services agreement (the “TSA”) and as more particularly provided in the UCB Purchase Agreement.

Under the TSA:

| · | the Company’s subsidiary will apply for the approval of the transfers of the marketing authorizations for the UCB Products in the relevant Territories, and UCB will provide regulatory transitional services, subject to reimbursement of its costs and expenses, pending the approval and completion of the transfers of the marketing authorizations under an agreed upon regulatory transition plan; |

| · | pending the transfers of the marketing authorizations in the relevant jurisdictions, the Company’s subsidiary will deliver existing stock purchased from UCB in order to enable UCB to complete sales under the TSA, and will order any additional required inventory from UCB’s designated supplier; |

| · | pending the transfers of the marketing authorizations, UCB will sell the UCB Products in the relevant Territories for the account of the Company’s subsidiary and UCB will pay to the Company’s subsidiary the profit derived from sales of the products in the relevant Territories based upon an agreed form of profit calculation; and |

| · | following completion of the marketing authorizations in a jurisdiction, the Company’s subsidiary will sell UCB Products directly without involvement from UCB. |

Amended and Restated Credit Agreement

In connection with the completion of the UCB Product Acquisition, the Company, together with its indirectly wholly owned subsidiary, also entered into an amended and restated credit agreement dated February 1, 2016 (the “Amended and Restated Credit Agreement”) between the Company, as borrower, the Bank of Montreal, as co-lead arranger, sole bookrunner and administrative agent, Canadian Imperial Bank of Commerce, as co-lead arranger and syndication agent, and certain credit parties and lenders thereto (the “Lenders”). The Amended and Restated Credit Agreement amends and restates the credit agreement dated September 8, 2014 entered into between the Company, as borrower, the Bank of Montreal, as agent, and certain credit parties and lenders thereto (the “Original Credit Agreement”).

The material terms of the Amended and Restated Credit Agreement are summarized as follows:

| · | Pursuant to the terms of the Amended and Restated Credit Agreement, the Lenders agreed to provide senior secured credit facilities in the aggregate amount of $180 million, including a senior secured revolving credit facility in the principal amount of $10 million and senior secured term facilities in the aggregate principal amount of $170 million. |

| · | The applicable interest rates of loans advanced under the credit facilities are determined by reference of the ratio of the Company’s senior funded debt to its EBIDTA, as determined in accordance with the terms of the Amended and Restated Credit Agreement. |

| · | Advances under the senior secured term facilities are repayable over a five year term, with equal quarterly repayments of the principal advanced. |

| · | All of the Company’s obligations under the Amended and Restated Credit Agreement are guaranteed by all material subsidiaries of the Company and are secured by the assets of the Company and the assets of and equity interests in its material subsidiaries. |

The Company has converted the outstanding debt owing under the original credit agreement entered into in September 2014 in connection with its acquisition of Sintrom® into a Euro-denominated five year term debt facility under the Amended and Restated Credit Agreement.

Additional Information

Further information about the UCB Product Acquisition can be found in the UCB Purchase Agreement and in the Amended and Restated Credit Agreement, copies of which have been filed under the Company’s profile on SEDAR atwww.sedar.com.

The Company completed the UCB Product Acquisition on February 4, 2016.

The UCB Product Acquisition was structured as an all cash transaction pursuant to which the Company’s wholly owned subsidiary paid a purchase price of €92 million on closing for the UCB Products. In addition, existing UCB Product inventory has been purchased subsequent to the closing date. The aggregate purchase price paid, including inventory, was €96.6 million. Merus funded the acquisition with a combination of cash-on-hand and proceeds from a new Euro-denominated five year term debt facility (matching where the majority of the product revenue will occur) at a rate of 4.5%, decreasing as the Company de-leverages in accordance with the terms of the Amended and Restated Credit Facility.

| 2.4 | Effect on Financial Position |

Upon the completion of the Arrangement, the Company added the UCB Products to its portfolio of pharmaceutical products. The Company plans to continue sales of the UCB Products in the Territories, initially under the TSA, and then using its own distribution network following the transition period under the TSA.

Except as disclosed in this Business Acquisition Report, the Company does not have any current plans or proposals for material changes in its business affairs or the affairs of the UCB Products which may have a significant effect on the results of operations and financial position of the Company.

Not applicable.

| 2.6 | Parties to the Transaction |

The UCB Product Acquisition was not with an informed person, associate or affiliate of Merus as defined in Section 1.1 of National Instrument 51-102Continuous Disclosure Obligations.

May 3, 2016.

Item 3. Financial Statements

The following financial statements are attached to this Business Acquisition Report:

| Schedule | | Financial Statements |

| | | |

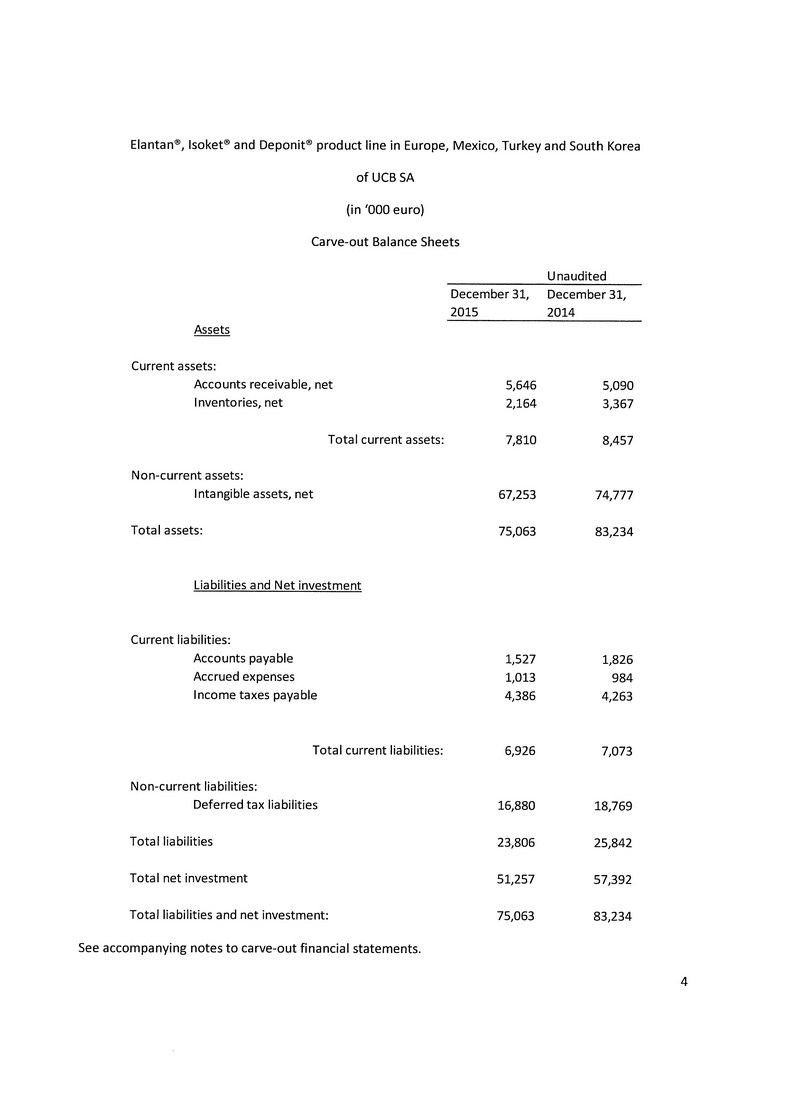

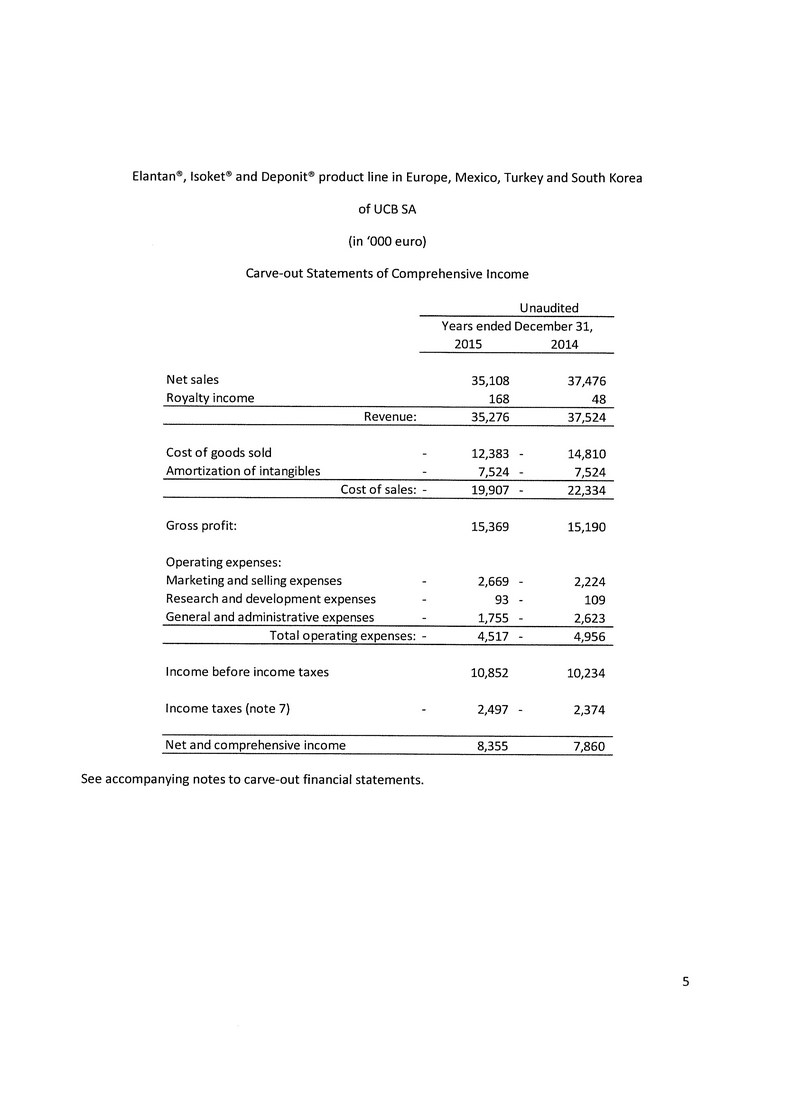

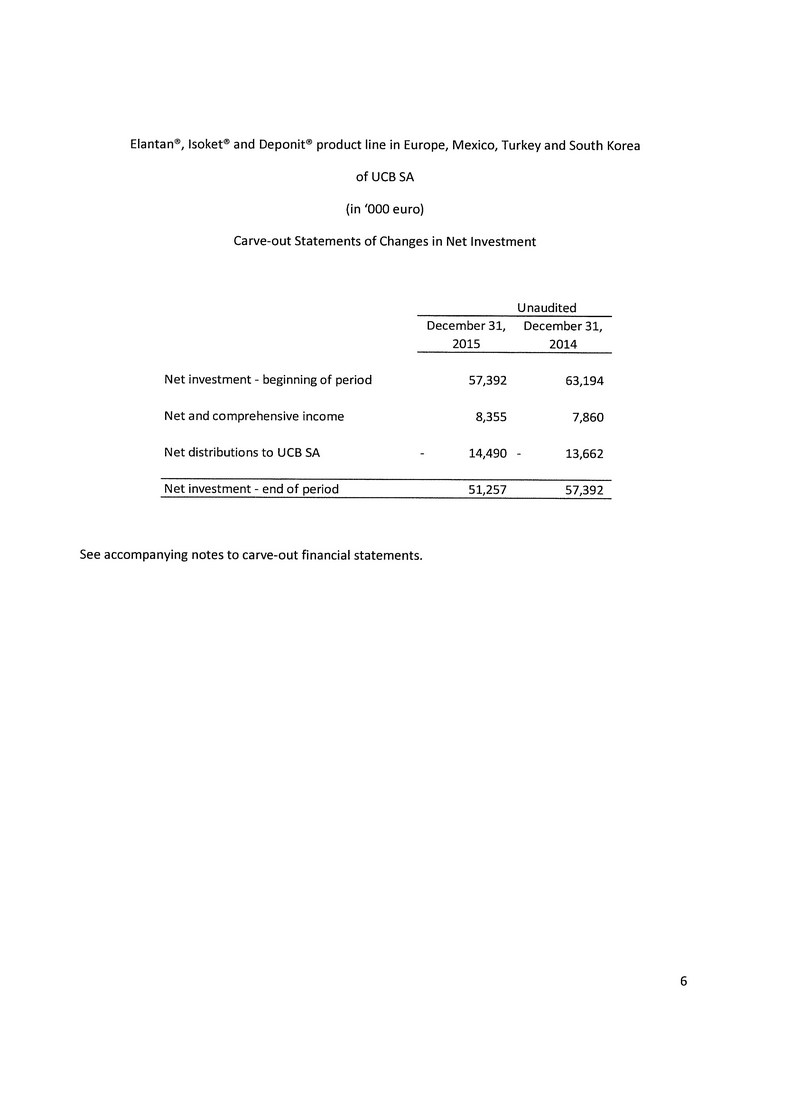

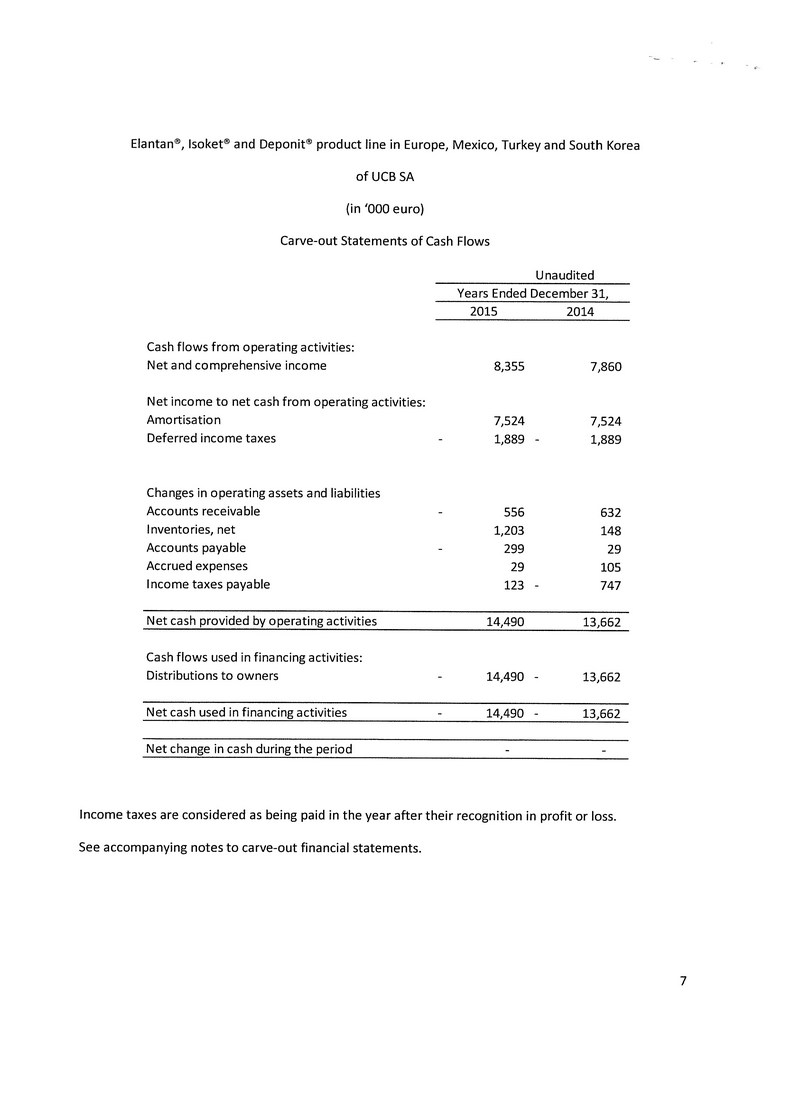

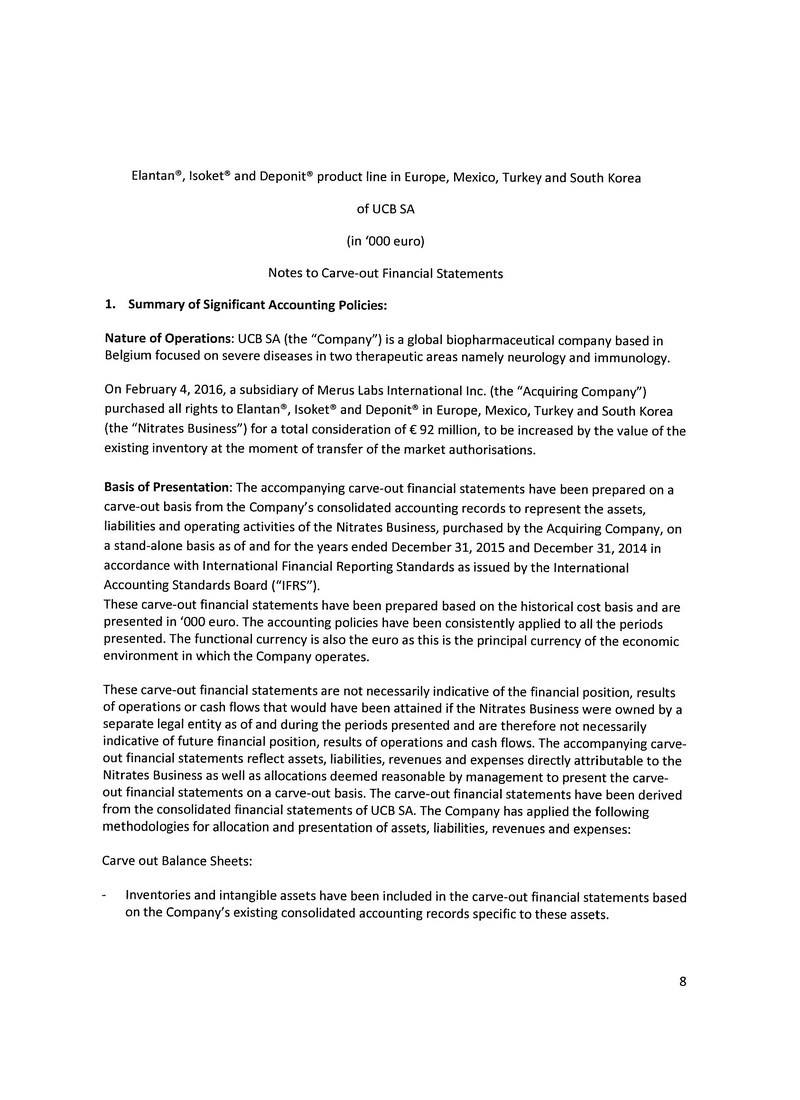

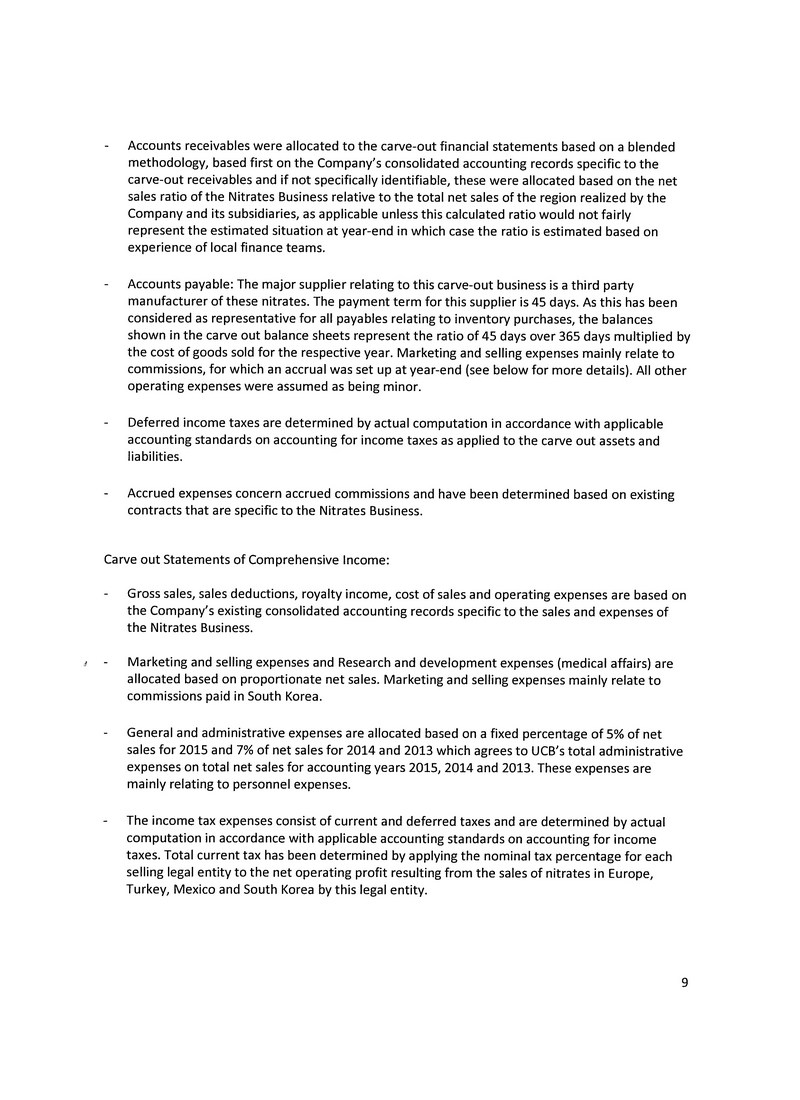

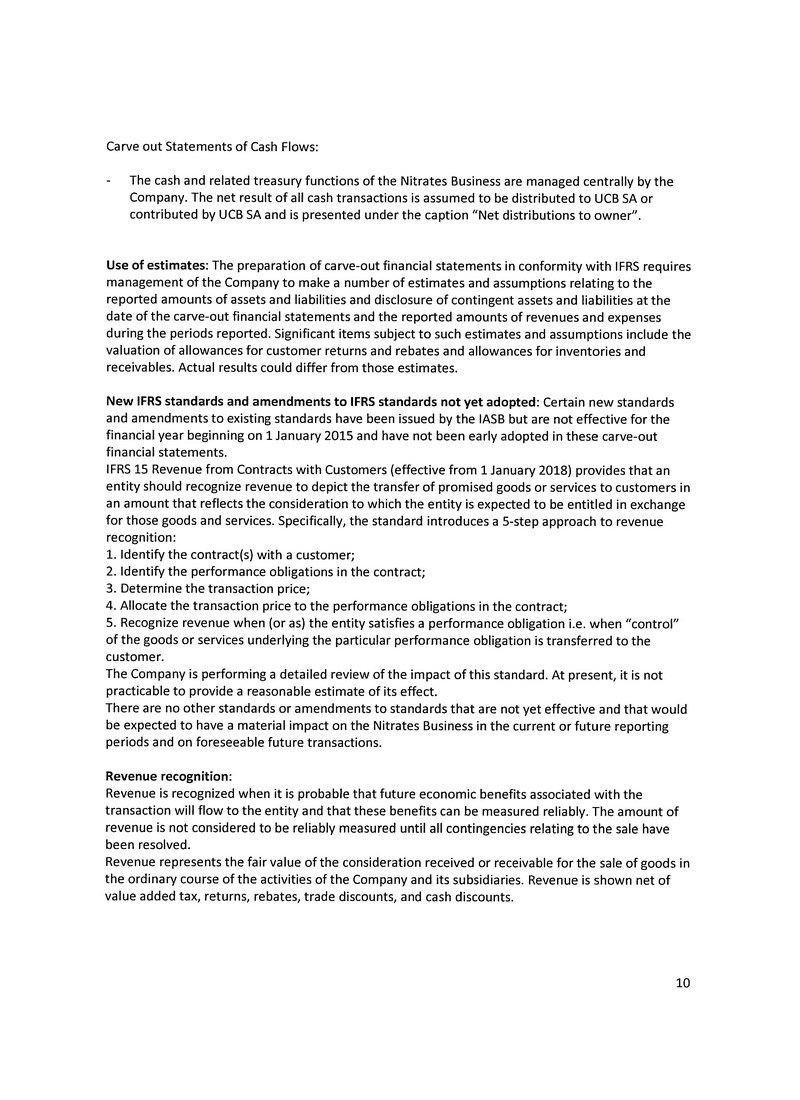

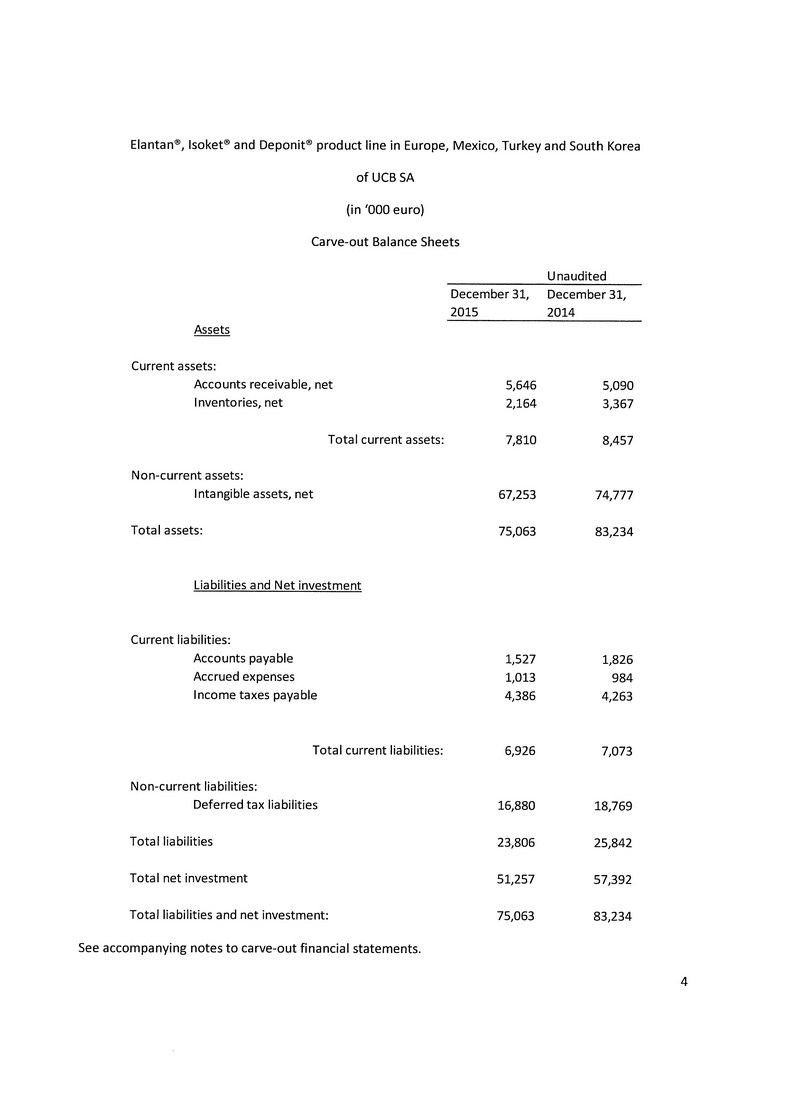

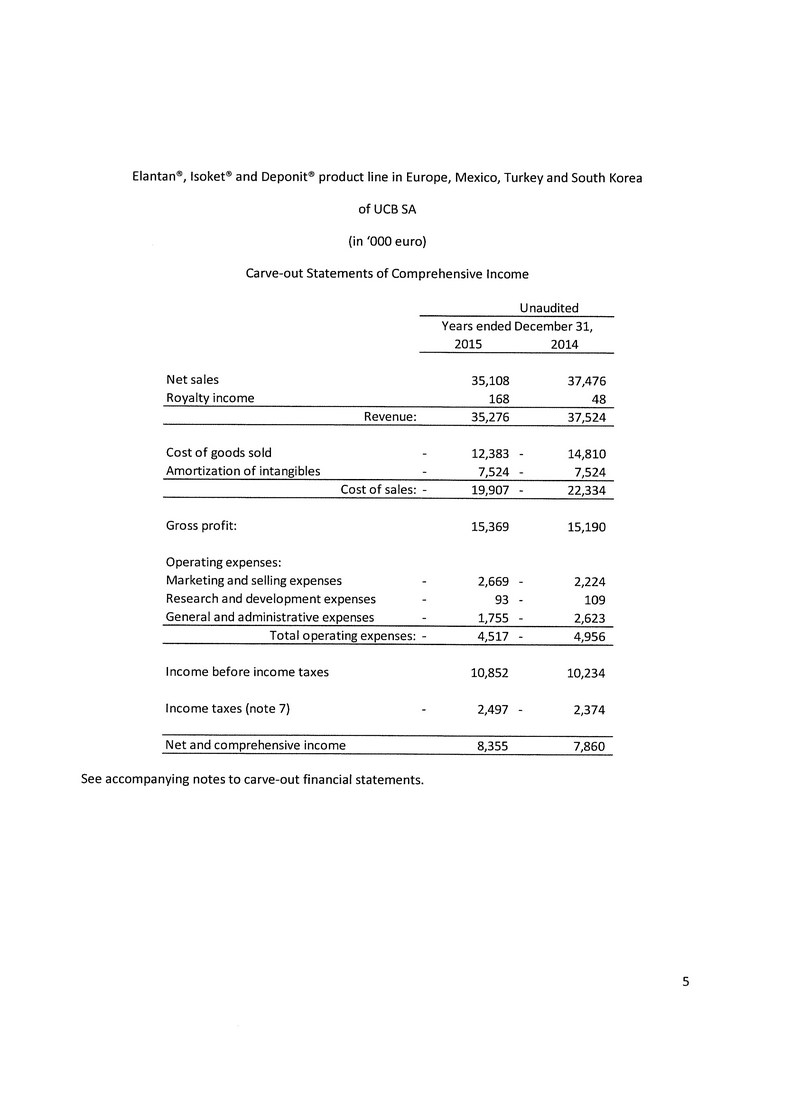

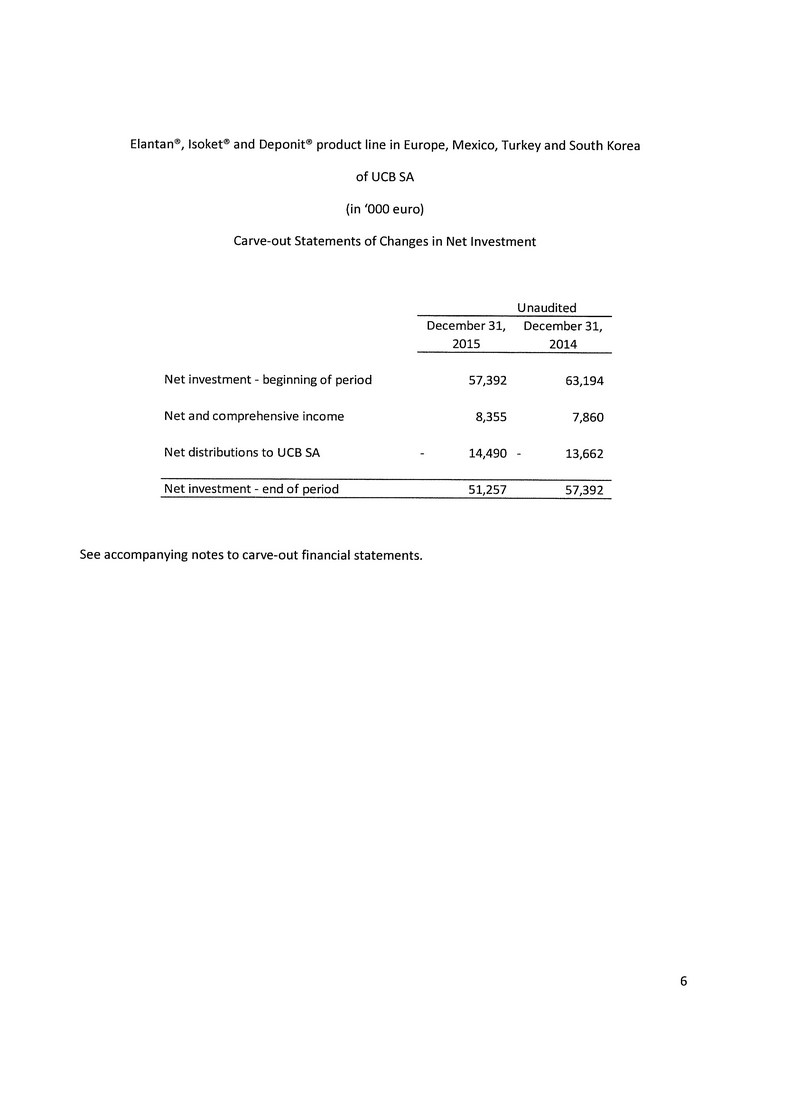

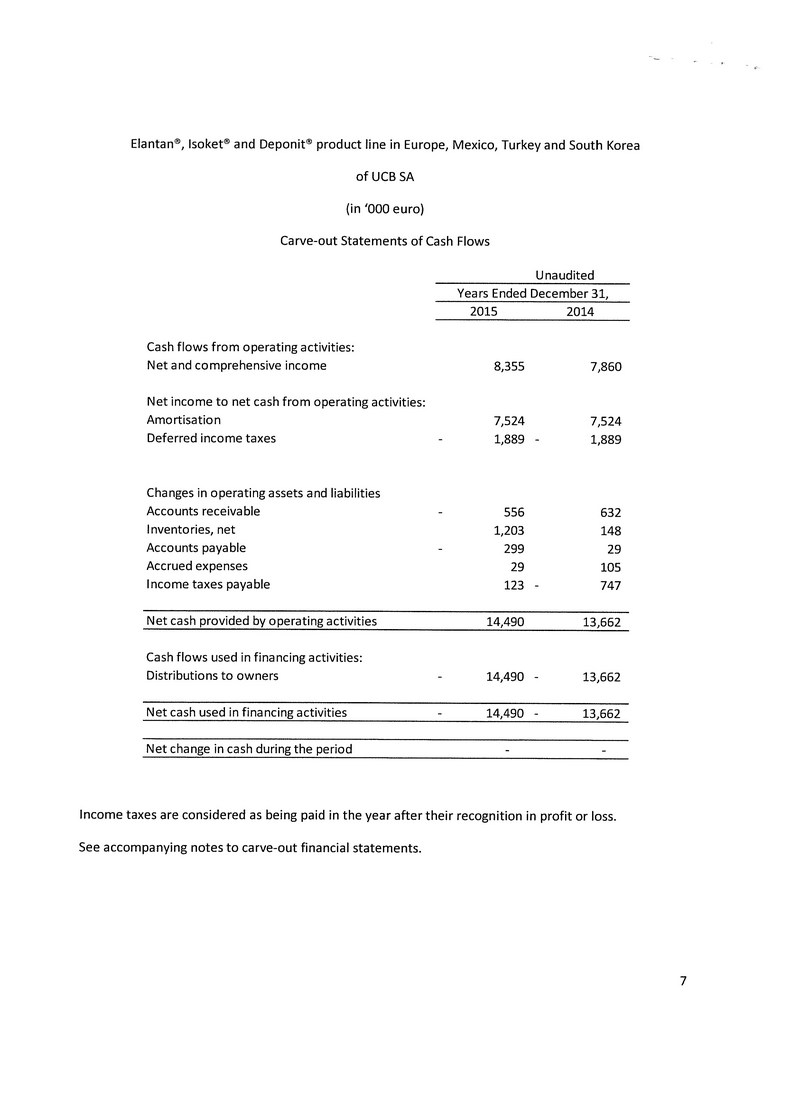

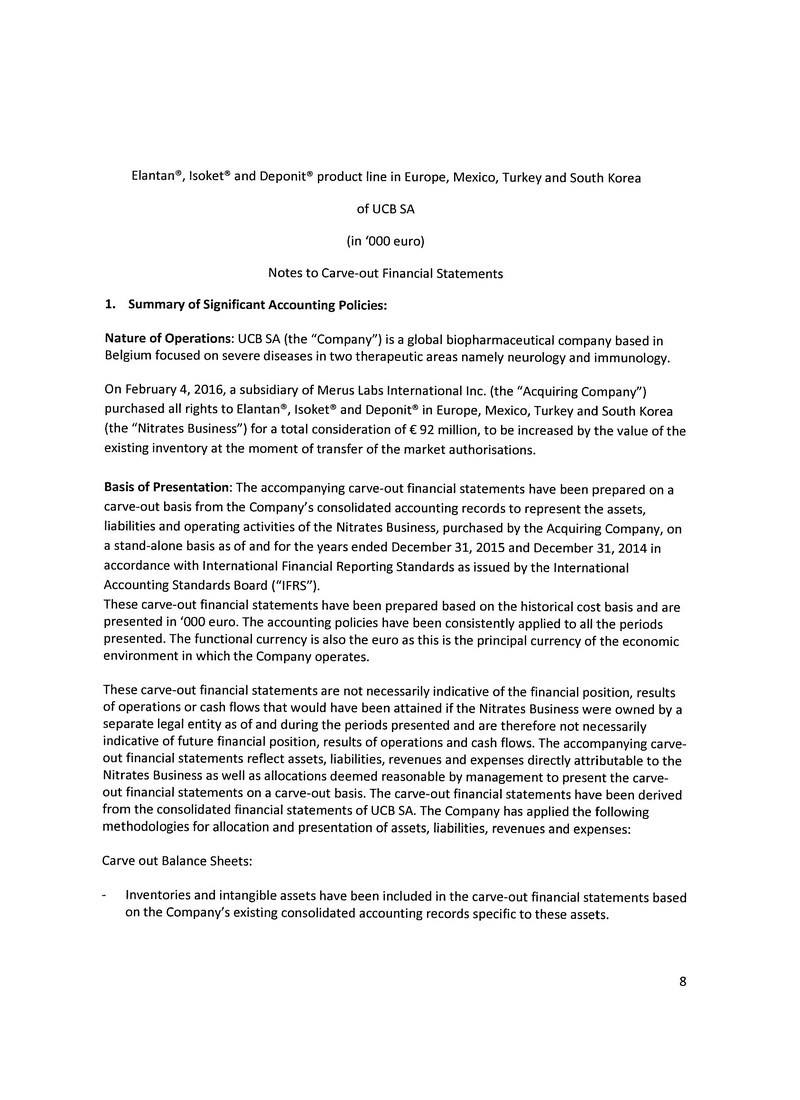

| A | | Carve out financial statements for the Nitrates Business of UCB SA comprised of: · Independent Auditors’ Report · Carve-out Balance Sheets as at December 31, 2015 (audited) and December 31, 2014 (unaudited) · Carve-out Statements of Comprehensive Income for the years ended December 31, 2015 (audited) and December 31, 2014 (unaudited) · Carve-out Statements of Changes in Net Investment for the years ended December 31, 2015 (audited) and December 31, 2014 (unaudited) · Carve-out Statements of Cash Flows for the years ended December 31, 2015 (audited) and December 31, 2014 (unaudited) · Notes to Carve-out Financial Statements |

| | | |

| B | | Unaudited Pro Forma Consolidated Financial Statements for the year ended September 30, 2015 and the three months ended December 31, 2015 including: · Unaudited Pro Forma Consolidated Statement of Financial Position as at December 31, 2015 · Unaudited Pro Forma Consolidated Statement of Operations the the three months ended December 31, 2015 · Unaudited Pro Forma Condensed Consolidated Statement of Operations the year ended September 30, 2015 · Notes to Pro Forma Consolidated Financial Statements |

SCHEDULE A

Carve-out Financial Statements for the UCB Products for the years ended December 31, 2015 (audited) and 2014 (unaudited)

SCHEDULE B

Unaudited Pro Forma Consolidated Financial Statements for the year ended September 30, 2015 and the three months ended December 31, 2015

| Merus Labs International Inc. |

| Unaudited Pro Forma Consolidated Statement of Financial Position |

| As at December 31, 2015 |

| (Expressed in Canadian dollars) |

| | | | | | | | | | | | | | | Merus Labs | |

| | | Merus Labs | | | UCB Nitrates | | | Pro Forma | | | | | | International Inc. | |

| | | International Inc. | | | Portfolio | | | Adjustments | | | Reference | | | Consolidated | |

| | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 43,599,373 | | | $ | - | | | $ | (35,820,993 | ) | | | 3 | (c) | | $ | 7,778,380 | |

| Short-term investments | | | 3,350 | | | | - | | | | - | | | | | | | | 3,350 | |

| Trade and other receivables | | | 12,102,058 | | | | 8,485,372 | | | | (8,485,372 | ) | | | 3 | (b) | | | 12,102,058 | |

| Inventories | | | 6,716,515 | | | | 3,252,276 | | | | (3,252,276 | ) | | | 3 | (b) | | | 6,716,515 | |

| Prepaid expenses | | | 492,162 | | | | - | | | | | | | | | | | | 492,162 | |

| | | | 62,913,458 | | | | 11,737,648 | | | | (47,558,641 | ) | | | | | | | 27,092,465 | |

| Non-current assets | | | | | | | | | | | | | | | | | | | | |

| Property and equipment | | | 115,932 | | | | - | | | | - | | | | | | | | 115,932 | |

| Intangible assets | | | 195,291,844 | | | | 101,074,534 | | | | 37,192,266 | | | | 3 | (a) | | | 333,558,644 | |

| Total assets | | $ | 258,321,234 | | | $ | 112,812,182 | | | $ | (10,366,375 | ) | | | | | | $ | 360,767,041 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Equity | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | | | | | | | | | |

| Operating line | | $ | - | | | $ | - | | | $ | 6,575,609 | | | | 3 | (c) | | $ | 6,575,609 | |

| Accounts payable and accrued liabilities | | | 5,165,146 | | | | 3,817,366 | | | | (3,817,366 | ) | | | 3 | (b) | | | 5,165,146 | |

| Income taxes payable | | | 1,288,950 | | | | 6,591,719 | | | | (6,591,719 | ) | | | 3 | (b) | | | 1,288,950 | |

| Derivative liabilities | | | 578,479 | | | | - | | | | - | | | | | | | | 578,479 | |

| Long term debt due within one year | | | 15,494,049 | | | | - | | | | 7,280,709 | | | | 3 | (c) | | | 22,774,758 | |

| | | | 22,526,624 | | | | 10,409,085 | | | | 3,447,233 | | | | | | | | 36,382,942 | |

| Non-current liabilities | | | | | | | | | | | | | | | | | | | | |

| Provisions | | | 163,206 | | | | - | | | | - | | | | | | | | 163,206 | |

| Long term debt | | | 43,363,060 | | | | - | | | | 90,139,458 | | | | 3 | (c) | | | 133,502,518 | |

| Preferred shares | | | 9,947,730 | | | | - | | | | - | | | | | | | | 9,947,730 | |

| Deferred income taxes | | | - | | | | 25,368,952 | | | | (25,368,952 | ) | | | 3 | (b) | | | - | |

| Total liabilities | | | 76,000,620 | | | | 35,778,037 | | | | 68,217,739 | | | | | | | | 179,996,396 | |

| | | | | | | | | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | | | | | | | | |

| Share capital | | | 185,070,086 | | | | - | | | | - | | | | | | | | 185,070,086 | |

| Equity reserve | | | 37,772,419 | | | | 77,034,145 | | | | (77,034,145 | ) | | | 3 | (a) | | | 37,772,419 | |

| Accumulated deficit | | | (62,186,634 | ) | | | - | | | | (1,549,968 | ) | | | 3 | (d) | | | (63,736,602 | ) |

| | | | | | | | | | | | - | | | | 3 | (d) | | | | |

| Accumulated other comprehensive income | | | 21,664,743 | | | | - | | | | - | | | | | | | | 21,664,743 | |

| Total equity | | | 182,320,614 | | | | 77,034,145 | | | | (78,584,113 | ) | | | | | | | 180,770,646 | |

| Total liabilities and equity | | $ | 258,321,234 | | | $ | 112,812,182 | | | $ | (10,366,375 | ) | | | | | | $ | 360,767,041 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

Merus Labs International Inc. |

| Unaudited Pro Forma Consolidated Statement of Operations |

| For the Three Months Ended December 31, 2015 |

| (Expressed in Canadian dollars) |

| | | | | | | | | | | | | | | Merus Labs | |

| | | Merus Labs | | | UCB Nitrates | | | Pro Forma | | | | | | International Inc. | |

| | | International Inc. | | | Portfolio | | | Adjustments | | | Reference | | | Consolidated | |

| | | | | | | | | | | | | | | | |

| Revenues | | $ | 15,925,851 | | | $ | 12,883,677 | | | $ | - | | | | | | | $ | 28,809,528 | |

| Cost of goods sold | | | 4,484,811 | | | | 4,522,946 | | | | - | | | | | | | | 9,007,757 | |

| Gross margin | | | 11,441,040 | | | | 8,360,731 | | | | - | | | | | | | | 19,801,771 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing | | | 1,392,556 | | | | 974,420 | | | | - | | | | | | | | 2,366,976 | |

| General and administrative | | | 1,513,209 | | | | 674,936 | | | | - | | | | | | | | 2,188,145 | |

| Share-based compensation | | | 1,092,173 | | | | - | | | | - | | | | | | | | 1,092,173 | |

| Acquisition costs | | | 352,319 | | | | - | | | | - | | | | 3 | (d) | | | 352,319 | |

| Amortization of intangible assets | | | 7,356,701 | | | | 2,747,953 | | | | (2,747,953 | ) | | | 3 | (e) | | | 9,661,148 | |

| | | | | | | | | | | | 2,304,447 | | | | 3 | (e) | | | | |

| Depreciation | | | 3,854 | | | | - | | | | - | | | | | | | | 3,854 | |

| Foreign exchange gains | | | (570,697 | ) | | | - | | | | - | | | | | | | | (570,697 | ) |

| | | | 11,140,115 | | | | 4,397,309 | | | | (443,506 | ) | | | | | | | 15,093,918 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 300,925 | | | | 3,963,422 | | | | 443,506 | | | | | | | | 4,707,853 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense, net | | | 947,629 | | | | - | | | | 1,340,925 | | | | 3 | (f) | | | 2,288,554 | |

| Derivative losses | | | 136,872 | | | | - | | | | - | | | | | | | | 136,872 | |

| Investment income | | | (117 | ) | | | - | | | | - | | | | | | | | (117 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before income taxes | | | (783,459 | ) | | | 3,963,422 | | | | (897,419 | ) | | | | | | | 2,282,544 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income tax expense | | | 131,561 | | | | 1,248,500 | | | | (1,043,542 | ) | | | 3 | (g) | | | 336,519 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss (income) for the period | | $ | (915,020 | ) | | $ | 2,714,922 | | | $ | 146,123 | | | | | | | $ | 1,946,024 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | | | | $ | 0.02 | |

| Diluted | | | | | | | | | | | | | | | | | | $ | 0.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding - basic | | | | | | | | | | | | | | | | | | | 102,372,965 | |

| Weighted average number of common shares outstanding - diluted | | | | | | | | | | | | | | | | | | | 102,372,965 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

Merus Labs International Inc. |

| Unaudited Pro Forma Condensed Consolidated Statement of Operations |

| For the Year Ended September 30, 2015 |

| (Expressed in Canadian dollars) |

| | | Merus Labs | | | UCB Nitrates | | | | | | | | | | |

| | | International Inc. | | | Portfolio | | | | | | | | | Merus Labs | |

| | | October 1, 2014 - | | | January 1 - | | | Pro Forma | | | | | | International Inc. | |

| | | September 30, 2015 | | | December 31, 2015 | | | Adjustments | | | Reference | | | Consolidated | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 48,958,425 | | | $ | 50,039,006 | | | $ | - | | | | | | | $ | 98,997,431 | |

| Cost of goods sold | | | 7,535,124 | | | | 17,565,286 | | | | - | | | | | | | | 25,100,410 | |

| Gross margin | | | 41,423,301 | | | | 32,473,721 | | | | - | | | | | | | | 73,897,022 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Sales and marketing | | | 2,384,833 | | | | 3,785,977 | | | | - | | | | | | | | 6,170,810 | |

| General and administrative | | | 8,937,014 | | | | 2,621,388 | | | | - | | | | | | | | 11,558,402 | |

| Acquisition costs | | | - | | | | - | | | | 407,078 | | | | 3 | (d) | | | 407,078 | |

| Amortization of intangible assets | | | 25,184,970 | | | | 10,672,794 | | | | (10,672,794 | ) | | | 3 | (e) | | | 34,402,757 | |

| | | | | | | | | | | | 9,217,787 | | | | 3 | (e) | | | | |

| Depreciation | | | 15,591 | | | | - | | | | - | | | | | | | | 15,591 | |

| Foreign exchange gains | | | (1,294,980 | ) | | | - | | | | - | | | | | | | | (1,294,980 | ) |

| | | | 35,227,428 | | | | 17,080,159 | | | | (1,047,929 | ) | | | | | | | 51,259,657 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 6,195,873 | | | | 15,393,562 | | | | 1,047,929 | | | | | | | | 22,637,364 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense, net | | | 5,975,357 | | | | - | | | | 2,905,666 | | | | 3 | (f) | | | 10,023,913 | |

| | | | | | | | | | | | 1,142,890 | | | | 3 | (d) | | | | |

| Derivative losses | | | 1,535,920 | | | | - | | | | - | | | | | | | | 1,535,920 | |

| Investment expense | | | 1,769 | | | | - | | | | - | | | | | | | | 1,769 | |

| | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before income taxes | | | (1,317,173 | ) | | | 15,393,562 | | | | (3,000,627 | ) | | | | | | | 11,075,762 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income tax expense (recovery) - current | | | 62,824 | | | | 4,994,000 | | | | (4,089,148 | ) | | | 3 | (g) | | | 967,676 | |

| - deferred | | | (1,142,118 | ) | | | - | | | | - | | | | | | | | (1,142,118 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income for the year | | $ | (237,879 | ) | | $ | 10,399,562 | | | $ | 1,088,521 | | | | | | | $ | 11,250,204 | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | | | | $ | 0.12 | |

| Diluted | | | | | | | | | | | | | | | | | | $ | 0.12 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding - basic | | | | | | | | | | | | | | | | | | | 90,060,403 | |

| Weighted average number of common shares outstanding - diluted | | | | | | | | | | | | | | | | | | | 90,060,403 | |

The accompanying notes are an integral part of these unaudited pro forma condensed consolidated financial statements

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

| 1. | Acquisition of Elantan®, Isoket® and Deponit® |

| | Merus Labs International Inc., incorporated under the Business Corporations Act (British Columbia), and its subsidiaries ("Merus" or the “Company”), operate in Canada and Europe. The Company is a specialty pharmaceutical company engaged in the acquisition and licensing of branded prescription pharmaceutical products. |

| | On February 4, 2016, the Company entered into an agreement with UCB to acquire rights to Elantan®, Isoket® and Deponit® (the "UCB Nitrates Portfolio") in Europe and select other markets (the "Acquisition"). These products belong to a category of pharmaceuticals called nitrates, and are used to treat both acute and chronic coronary artery disease. |

The rights were acquired for a one-time cash payment of €92 million (approx. $138 million) at the date of the transaction closing. The acquisition was funded with cash-on-hand and a new Euro-denominated five year term debt facility.

Debt Refinancing

On February 1, 2016, in conjunction with above noted acquisition the Company refinanced its existing senior secured debt facility with a new Euro-denominated facility (“Debt Facility”). The Debt Facility was advanced under an amendment and restatement to the Company's existing credit agreement. Pursuant to the terms of the amended credit agreement, the lenders agreed to provide senior secured credit facilities in the aggregate amount of $180 million, comprising of a senior secured revolving credit facility in the principal amount of $10 million and senior secured term facilities in the aggregate principal amount of $170 million. The Debt Facility has a five year term at an initial coupon rate of 4.5% per annum, decreasing as the Company de-leverages, and principal repayments of approximately $8.5 million per quarter and monthly interest payments.

All of the Company's obligations under the amended facility are guaranteed by all material subsidiaries of the Company and are secured by the material assets of the Company and the assets of, and all equity interests in its material subsidiaries. The Company converted the outstanding debt owing under the original credit agreement entered into in September 2014 into the Debt Facility at February 1, 2016.

The unaudited pro forma consolidated financial statements of the Company have been prepared by management. In the opinion of management, the pro forma consolidated financial statements include all adjustments necessary for fair presentation of the transactions as described above.

The unaudited pro forma consolidated financial statements of the Company have been compiled from the following financial information:

| · | Audited financial statements of Merus for the year ended September 30, 2015; |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

| · | Unaudited financial statements of Merus as of and for the three months ended December 31, 2015; |

| · | Unaudited carve out financial information for Elantan®, Isoket® and Deponit® for the period October 1, 2015 to December 31, 2015; |

| · | Audited carve out financial statements of Elantan®, Isoket® and Deponit® for the year ended December 31, 2015. |

The unaudited pro forma consolidated balance sheet has been prepared as if the acquisition of Elantan®, Isoket® and Deponit® and the associated financing for the acquisition occurred on December 31, 2015. The unaudited pro forma consolidated income statements have been prepared as if the transactions described in Note 1, and the associated financing, had occurred on October 1, 2014. The unaudited pro forma consolidated financial statements are not intended to reflect the financial position or performance of the Company that would have actually resulted had the proposed transactions described in Note 1 and other pro forma adjustments occurred as assumed. Further, these unaudited pro forma consolidated financial statements are not necessarily indicative of the financial position or performance that may be attained in the future. The unaudited pro forma consolidated financial statements should be read in conjunction with the financial information referred to above.

| 3. | Pro Forma Consolidated Adjustments |

The unaudited pro forma consolidated financial statements incorporate the following assumptions:

(a) The Acquisition is considered to be a business combination under IFRS 3 with the Merus as the acquirer and the acquired rights to Elantan®, Isoket® and Deponit® in Europe and select other markets as the acquiree. Accordingly, the purchase price calculations and the purchase price allocations are dependent upon fair value estimates and assumptions as at the Acquisition date.

The preliminary purchase price allocation to the following identifiable assets is based on their estimated fair values:

Net Assets Acquired:

| Product rights | | $ | 138,266,800 | |

| | | | | |

| Total | | $ | 138,266,800 | |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

Consideration Comprised of:

| Cash | | $ | 138,266,800 | |

| | | | | |

| Total | | $ | 138,266,800 | |

The purchase consideration was measured using a EUR/CA$ rate of 1.5029, which reflects the rate as of December 31, 2015.

The above allocation of the purchase price is preliminary. The Company is continuing to assess and review the fair value of net assets acquired pursuant to the acquisition and finalize the associated purchase price accounting. As a result, the final allocation of the purchase price could vary significantly from the amounts used in the unaudited pro forma consolidated financial statements. As part of the above allocation of the purchase price, the balance in the net equity section of the Elantan®, Isoket® and Deponit® audited carve out balance sheet as at December 31, 2015 of $77,034,145 has been eliminated.

(b) The unaudited pro forma consolidated balance sheet has been adjusted to eliminate the historical cost of assets and liabilities recorded by UCB. As described in Note (a), the Company is continuing to finalize the valuation of assets acquired pursuant to the Elantan®, Isoket® and Deponit® acquisition. The following table details the assets and liabilities not acquired as part of the Acquisition:

Net assets not acquired

| Accounts receivable | | $ | 8,485,373 | |

| Inventory | | | 3,252,276 | |

| Accounts payable and accrued liabilities | | | (3,817,366 | ) |

| Income taxes payable | | | (6,591,719 | ) |

| Deferred income taxes | | | (25,368,952 | ) |

| | | | | |

| Total net assets not acquired | | $ | (24,040,388 | ) |

(c) The acquisition of Elantan®, Isoket® and Deponit® from UCB was financed using a mixture of bank facilities and cash on hand. The following table details the sources and uses of the funds:

Sources of funds

| Amended and Restated Credit Facility (revolving and term facilities) | | $ | 166,575,609 | |

| Cash on hand | | | 35,820,993 | |

| | | | | |

| Total | | $ | 202,396,602 | |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

Uses of funds

| Purchase consideration for Elantan®, Isoket® and Deponit® | | $ | 138,266,800 | |

| Retirement of existing Senior Secured Facility | | | 60,000,000 | |

| Debt issuance costs | | | 3,722,724 | |

| Acquisition costs | | | 407,078 | |

| | | | | |

| Total | | $ | 202,396,602 | |

The sources of funds has been measured using an exchange rate of 1.5029 EUR/CA$, which reflects rates as of December 31, 2015.

(d) The Company will treat the financing described above as an extinguishment of the Company’s existing Senior Secured Facility in accordance with IAS 39 and will expense the remaining unamortized financing costs described below. As at December 31, 2015 the Senior Secured Facility had a face value of $60,000,000 and a carrying value of $58,857,109 in the financial statements of the Company. The difference of $1,142,891 between the face value of the debt and the carrying value of the debt represents the unamortized portion of transaction costs incurred upon issuance of the credit facilities. Transaction costs associated with the Senior Secured Facility have been included as a reduction to the carrying amount of the liability and are amortized through interest and accretion expense using the effective interest rate method in the financial statements of the Company. The unaudited pro forma balance sheet includes adjustments to: (i) eliminate the carrying amount of the Senior Secured Facility of $58,857,109; (ii) recognize a write-off of unamortized carrying costs of $1,142,891 to retained earnings; (iii) reflect the issuance of a new Amended and Restated Credit Facility, net of estimated debt issuance costs as detailed in the table below; and (iv) recognize an expense of $407,078 to retained earnings to account for the portion of the financing that was used to pay for acquisition related costs.

The following table details the carrying value of debt included as an adjustment to the unaudited pro forma consolidated balance sheet:

Carrying value of long-term debt

| Bank facilities | | $ | 166,575,609 | |

| Less: debt issuance costs | | | (3,722,724 | ) |

| | | | | |

| Total | | $ | 162,852,885 | |

(e) The unaudited pro forma consolidated income statement for the three months ended December 31, 2015 and for the year ended September 30, 2015 include adjustments to decrease amortization expense by $2,747,953 and $10,672,794, respectively, representing the amortization of intangible assets recorded by UCB. The statements also include adjustments to increase amortization expense by $2,304,447 and $9,217,787. These adjustments represents the amortization that Merus would have recognized in each period assuming that the acquired product rights detailed in Note 3(a) of $138,266,800 were amortized over a period of 15 years. As discussed in note (a) above, the Company is continuing to assess and review the fair value of net assets acquired pursuant to the Acquisition and finalize the associated purchase price accounting including the valuation of intangible assets acquired. As part of the valuation the Company will also determine the useful life of each of the products acquired. As a result, the actual amortization expense recognized by the Company could vary significantly from the amounts used in the unaudited pro forma consolidated financial statements.

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

(f) The unaudited pro forma consolidated income statements for the three months ended December 31, 2015 and for the year ended September 30, 2015 include adjustments to increase interest and accretion expense to reflect the impact of the Amended and Restated Credit Facility referred to in note 3(c) above. For the purposes of the unaudited pro forma consolidated income statements it is assumed that Amended and Restated Credit Facility became effective on October 1, 2014.

(g) The unaudited pro forma consolidated income statement for the three months ended December 31, 2015 and the year ended September 30, 2015 include adjustments to decrease income taxes by $1,043,542 and $4,089,148, respectively. These adjustments reflect the assumption that: (i) the products acquired from UCB would have been subject to Merus’ effective tax rate; and (ii) the net pro forma adjustments would reduce taxable income in Merus.

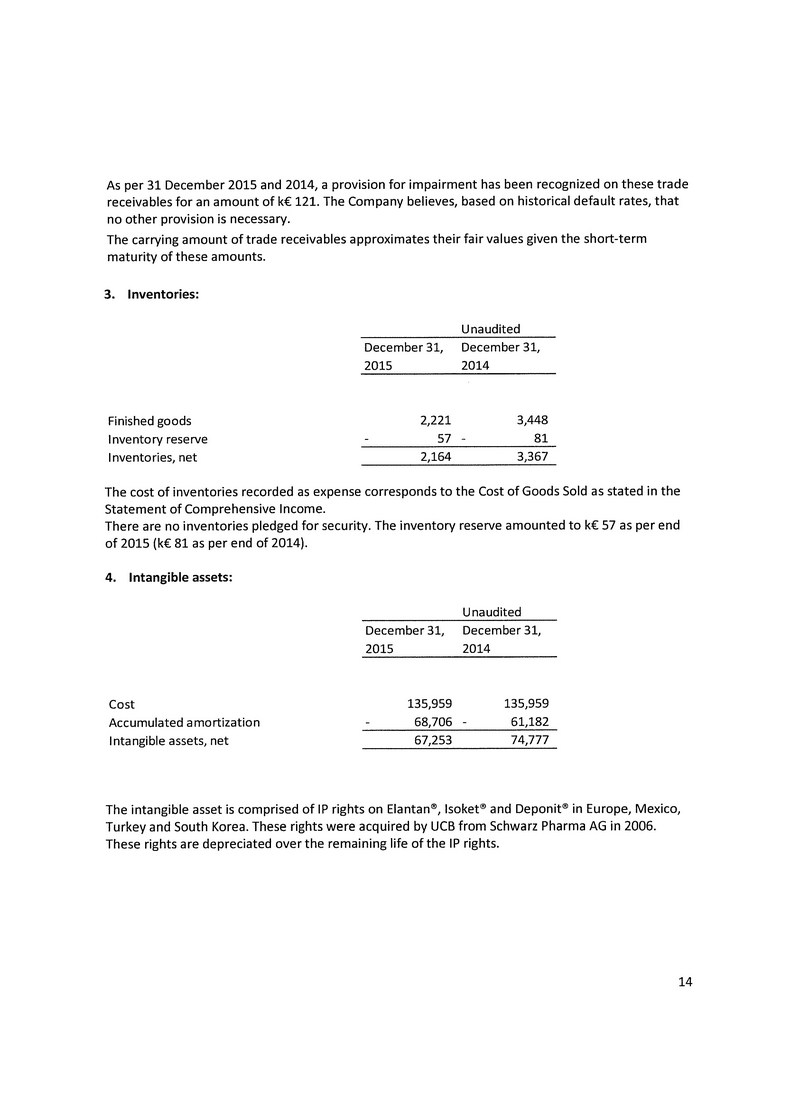

The following table details the impact of the assumptions noted:

| | | Three

months

ended

December

31, 2015 | | | Year ended

September

30, 2015 | |

| | | | | | | |

| Elantan®, Isoket® and Deponit® income before recovery of income taxes | | $ | 3,963,422 | | | $ | 15,393,562 | |

| Impact to net income before tax of pro forma adjustments | | | (897,419 | ) | | | (1,857,737 | ) |

| Net impact of acquisition to net income before tax | | | 3,066,003 | | | | 13,535,825 | |

| Income tax expense at the Merus' effective tax rate (6.7%) | | | 204,958 | | | | 904,852 | |

| Reversal of reported income tax expense | | | (1,248,500 | ) | | | (4,994,000 | ) |

| Total tax adjustments | | $ | (1,043,542 | ) | | $ | (4,089,148 | ) |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

| 4. | Presentation and Translation of UCB Nitrates Portfolio Income Statements |

Certain reclassifications were recorded to adjust the presentation of the UCB Nitrates Portfolio’s statements of income to align with the manner in which the Company presents its consolidated statement of operations.

The following table presents a reconciliation of the UCB Nitrates Portfolio statement of income for the three months ended December 31, 2015 and translates this statement from Euros to Canadian dollars at an average exchange rate of 1.4609:

| | | UCB Nitrates | | | UCB Nitrates | | | UCB Nitrates | | | UCB Nitrates | |

| | | Portfolio | | | Portfolio | | | Portfolio | | | Portfolio | |

| | | as presented | | | reallocations | | | reclassified | | | translated to CAD | |

| Revenues | | € | 8,819,000 | | | € | - | | | € | 8,819,000 | | | $ | 12,883,677 | |

| Cost of goods sold | | | 4,977,000 | | | | (1,881,000 | ) | | | 3,096,000 | | | | 4,522,946 | |

| Gross margin | | | 3,842,000 | | | | 1,881,000 | | | | 5,723,000 | | | | 8,360,731 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Sales and marketing | | | 667,000 | | | | - | | | | 667,000 | | | | 974,420 | |

| General and administrative | | | 439,000 | | | | 23,000 | | | | 462,000 | | | | 674,936 | |

| Amortization of intangible assets | | | - | | | | 1,881,000 | | | | 1,881,000 | | | | 2,747,953 | |

| Depreciation | | | - | | | | - | | | | - | | | | - | |

| Research and development expenses | | | 23,000 | | | | (23,000 | ) | | | - | | | | - | |

| Foreign exchange gains | | | - | | | | - | | | | - | | | | - | |

| | | | 1,129,000 | | | | 1,881,000 | | | | 3,010,000 | | | | 4,397,309 | |

| | | | | | | | | | | | | | | | | |

| Operating income | | | 2,713,000 | | | | - | | | | 2,713,000 | | | | 3,963,422 | |

| | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 2,713,000 | | | | - | | | | 2,713,000 | | | | 3,963,422 | |

| | | | | | | | | | | | | | | | | |

| Income tax expense (recovery) - current | | | 624,250 | | | | - | | | | 624,250 | | | | 1,248,500 | |

| - deferred | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Net income for the year | | € | 2,088,750 | | | € | - | | | € | 2,088,750 | | | $ | 2,714,922 | |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

The following table presents a reconciliation of the UCB Nitrates Portfolio statement of income for the year ended December 31, 2015 and translates this statement from Euros to Canadian dollars at an average exchange rate of 1.4185:

| | | UCB Nitrates | | | UCB Nitrates | | | UCB Nitrates | | | UCB Nitrates | |

| | | Portfolio | | | Portfolio | | | Portfolio | | | Portfolio | |

| | | as presented | | | reallocations | | | reclassified | | | translated to CAD | |

| Revenues | | € | 35,276,000 | | | € | - | | | € | 35,276,000 | | | $ | 50,039,006 | |

| Cost of goods sold | | | 19,907,000 | | | | (7,524,000 | ) | | | 12,383,000 | | | | 17,565,286 | |

| Gross margin | | | 15,369,000 | | | | 7,524,000 | | | | 22,893,000 | | | | 32,473,721 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Sales and marketing | | | 2,669,000 | | | | - | | | | 2,669,000 | | | | 3,785,977 | |

| General and administrative | | | 1,755,000 | | | | 93,000 | | | | 1,848,000 | | | | 2,621,388 | |

| Amortization of intangible assets | | | - | | | | 7,524,000 | | | | 7,524,000 | | | | 10,672,794 | |

| Depreciation | | | - | | | | - | | | | - | | | | - | |

| Research and development expenses | | | 93,000 | | | | (93,000 | ) | | | - | | | | - | |

| Foreign exchange gains | | | - | | | | - | | | | - | | | | - | |

| | | | 4,517,000 | | | | 7,524,000 | | | | 12,041,000 | | | | 17,080,159 | |

| | | | | | | | | | | | | | | | | |

| Operating income | | | 10,852,000 | | | | - | | | | 10,852,000 | | | | 15,393,562 | |

| | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 10,852,000 | | | | - | | | | 10,852,000 | | | | 15,393,562 | |

| | | | | | | | | | | | | | | | | |

| Income tax expense (recovery) - current | | | 2,497,000 | | | | - | | | | 2,497,000 | | | | 4,994,000 | |

| - deferred | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Net income for the year | | € | 8,355,000 | | | € | - | | | € | 8,355,000 | | | $ | 10,399,562 | |

| Merus Labs International Inc. |

| Notes to Pro Forma Consolidated Financial Statements |

| (Unaudited) |

| (Expressed in Canadian dollars) |

| 5. | Translation of UCB Nitrates Portfolio Balance Sheet |

The following table presents a reconciliation of the UCB Nitrates Portfolio balance sheet at December 31, 2015 and translates these statements from Euros to Canadian dollars at an exchange rate of 1.5029:

| | | UCB Nitrates | | | UCB Nitrates | |

| | | Portfolio | | | Portfolio | |

| | | as presented | | | translated to CAD | |

| Assets | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | € | - | | | $ | - | |

| Short-term investments | | | - | | | | - | |

| Trade and other receivables | | | 5,646,000 | | | | 8,485,372 | |

| Inventories | | | 2,164,000 | | | | 3,252,276 | |

| Prepaid expenses | | | - | | | | - | |

| | | | 7,810,000 | | | | 11,737,648 | |

| Non-current assets | | | | | | | | |

| Property and equipment | | | - | | | | - | |

| Intangible assets | | | 67,253,000 | | | | 101,074,534 | |

| | | | | | | | | |

| Total assets | | € | 75,063,000 | | | $ | 112,812,182 | |

| | | | | | | | | |

| Liabilities and Equity | | | | | | | | |

| | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued liabilities | | | 2,540,000 | | | | 3,817,366 | |

| Income taxes payable | | | 4,386,000 | | | | 6,591,719 | |

| Derivative liabilities | | | - | | | | - | |

| Long term debt due within one year | | | - | | | | - | |

| | | | 6,926,000 | | | | 10,409,085 | |

| Non-current liabilities | | | | | | | | |

| Provisions | | | - | | | | - | |

| Long term debt | | | - | | | | - | |

| Preferred shares | | | - | | | | - | |

| Deferred income taxes | | | 16,880,000 | | | | 25,368,952 | |

| Total liabilities | | | 23,806,000 | | | | 35,778,037 | |

| | | | | | | | | |

| Equity | | | | | | | | |

| Share capital | | | - | | | | - | |

| Equity reserve | | | 51,257,000 | | | | 77,034,145 | |

| Accumulated deficit | | | - | | | | - | |

| Accumulated other comprehensive income | | | - | | | | - | |

| Total equity | | | 51,257,000 | | | | 77,034,145 | |

| Total liabilities and equity | | € | 75,063,000 | | | $ | 112,812,182 | |