Filed Pursuant to Rule 424(b)(5)

Registration No. 333-220257

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 9, 2018

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated January 2, 2018)

$ Floating Rate Notes due 2019

$ Floating Rate Notes due 2021

$ % Notes due 2020

$ % Notes due 2023

$ % Notes due 2028

$ % Notes due 2038

$ % Notes due 2048

We are offering $ aggregate principal amount of our Floating Rate Notes due 2019 (the “2019 floating rate notes”), $ aggregate principal amount of our Floating Rate Notes due 2021 (the “2021 floating rate notes”), $ aggregate principal amount of our % Notes due 2020 (the “2020 notes”), $ aggregate principal amount of our % Notes due 2023 (the “2023 notes”), $ aggregate principal amount of our % Notes due 2028 (the “2028 notes”), $ aggregate principal amount of our % Notes due 2038 (the “2038 notes”) and $ aggregate principal amount of our % Notes due 2048 (the “2048 notes”). We sometimes refer to the 2019 floating rate notes and the 2021 floating rate notes as the “floating rate notes.” We sometimes refer to the 2020 notes, the 2023 notes, the 2028 notes, the 2038 notes and the 2048 notes as the “fixed rate notes.” We sometimes refer to the floating rate notes and the fixed rate notes as the “notes.”

The 2019 floating rate notes will bear interest at a per annum rate equal to the 3 Month LIBOR Rate (as defined herein), which rate will be reset quarterly as described in this prospectus supplement, plus basis points, and will mature on , 2019. The 2021 floating rate notes will bear interest at a per annum rate equal to the 3 Month LIBOR Rate, which rate will be reset quarterly as described in this prospectus supplement, plus basis points, and will mature on , 2021. Interest on the floating rate notes will accrue from , 2018 and will be payable quarterly in arrears on , , and of each year, beginning on , 2018, and at their respective maturity dates, subject to possible adjustment of such interest payment dates as described herein.

The 2020 notes will bear interest at the rate of % per year and mature on , 2020. The 2023 notes will bear interest at the rate of % per year and mature on , 2023. The 2028 notes will bear interest at the rate of % per year and mature on , 2028. The 2038 notes will bear interest at the rate of % per year and mature on , 2038. The 2048 notes will bear interest at the rate of % per year and mature on , 2048. Interest on the fixed rate notes will accrue from , 2018 and will be payable semi-annually in arrears on and of each year, beginning on , 2018.

The 2019 floating rate notes will not be subject to redemption at our option. At our option, we may redeem some or all of the 2021 floating rate notes at any time on or after , 2019 at the applicable redemption price described in this prospectus supplement. At our option, we may redeem some or all of the fixed rate notes of each series at any time at the applicable redemption price for such series of fixed rate notes described in this prospectus supplement.

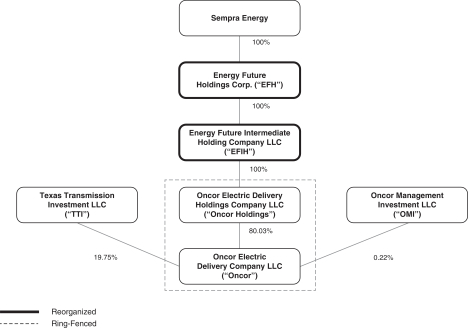

We intend to use the net proceeds from this offering to finance a portion of the cost of our proposed merger (the “Merger”) with Energy Future Holdings Corp., as described herein under the heading “Summary Information—Recent Developments—Proposed Acquisition of Energy Future Holdings Corp.” and to pay related fees and expenses. However, the completion of this offering is not contingent upon the completion of the Merger. If we do not consummate the Merger on or prior to December 1, 2018, or if, on or prior to such date, the Merger Agreement (as defined herein) is terminated, we will be required to redeem all of the outstanding notes (other than the 2028 notes)on the Special Mandatory Redemption Date (as defined herein) at a redemption price equal to 101% of the principal amount of the notes we are required to redeem plus accrued and unpaid interest, if any, to, but excluding, the Special Mandatory Redemption Date as described under the caption “Description of the Notes—Special Mandatory Redemption.” The 2028 notes are not subject to special mandatory redemption. If we are required to redeem notes because the Merger is not consummated or the Merger Agreement is terminated, we may use all or a portion of the net proceeds from the sale of the notes to pay all or a portion of the redemption price of the notes we are required to redeem and we intend to use any remaining net proceeds for general corporate purposes, which may include, in our sole discretion, voluntary redemption of our Mandatory Convertible Preferred Stock (as defined herein), if issued, repayment of other debt, including repayment of commercial paper, capital expenditures, investments and possibly, repurchases of our common stock at the discretion of our board of directors. See “Summary Information” and “Use of Proceeds.”

The notes will be our unsecured and unsubordinated obligations and will rank on a parity in right of payment with all of our other unsecured and unsubordinated indebtedness and guarantees.

Investing in the notes involves risks. See the “Risk Factors” section on pageS-27 of this prospectus supplement.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per 2019

Floating Rate

Note | | | Per 2021

Floating Rate

Note | | | Per 2020

Note | | | Per 2023

Note | | | Per 2028

Note | | | Per 2038

Note | | | Per 2048

Note | | | Total | |

Public Offering Price(1) | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | $ | | |

Underwriting Discount | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | $ | | |

Proceeds to Sempra Energy (before expenses)(1) | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | |

| (1) | Plus accrued interest from , 2018, if settlement occurs after that date. |

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the notes in book-entry form through the facilities of The Depository Trust Company for the accounts of its participants, including Clearstream Banking S.A. and Euroclear Bank SA/NV, as operator of the Euroclear System, against payment in New York, New York on or about , 2018.

Joint Book-Running Managers

| | | | |

RBC Capital Markets (All notes) | | Morgan Stanley (All notes) | | Barclays (All notes) |

| | | | | | |

BBVA (2028 notes) | | HSBC (2048 notes) | | Santander (2023 notes) | | SOCIETE GENERALE (2038 notes) |

Co-Managers

| | | | | | |

BBVA (2019 floating rate notes, 2021 floating rate notes, 2020 notes, 2023 notes, 2038 notes, 2048 notes) | | HSBC (2019 floating rate notes, 2021 floating rate notes, 2020 notes, 2023 notes, 2028 notes, 2038 notes) | | Santander (2019 floating rate notes, 2021 floating rate notes, 2020 notes, 2028 notes, 2038 notes, 2048 notes) | | SOCIETE GENERALE (2019 floating rate notes, 2021 floating rate notes, 2020 notes, 2023 notes, 2028 notes, 2048 notes) |

, 2018