UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the registrant ☒

Filed by a party other than the registrant ☐

Check the appropriate box:

| | | | | | | | | | | |

☐ | | | Preliminary proxy statement |

☐ | | | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive proxy statement |

☐ | | | Definitive additional materials |

☐ | | | Soliciting material pursuant to section 240.14a-12 |

| | |

| Maximus, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| | |

| Registrant |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of filing fee (Check all boxes that apply):

| | | | | | | | | | | | | | | | | | | | |

| ☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 26(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

January 22, 2025

Dear Fellow Shareholders,

On behalf of the Board of Directors, I am pleased to share another year of strong financial and operational performance for Maximus, which delivered company record setting adjusted earnings per share and over 8% revenue growth for the full year. Our recently expanded leadership team continued to guide the Maximus Forward strategy to new heights and efficiencies, allowing our business as a whole to secure numerous task orders and contract wins in 2024.

Our Business Resiliency

As a leading partner to federal, state and local governments, our team has supported millions of Americans in fiscal 2024. Our business resilience is unmatched as we consistently achieve outcomes for the government, at scale. We will continue to partner closely with our government clients to support their efforts helping people respond to the complex technology, health and social challenges facing the world today.

Continued Commitment to Shareholder Engagement

The Board has continued our long-standing practice of annual shareholder engagement, engaging our top 20 investors to discuss our strategy, Board composition, compensation program and evolving governance expectations. We are pleased to share that in response to feedback we heard, we have enhanced this year’s proxy disclosures to include a number of changes to increase transparency, including bolstering disclosures on our continuing director education program, Board assessment and evaluation processes and specific topics of risk oversight, such as how we responsibly and ethically leverage and oversee new possibilities offered by artificial intelligence.

Independent Freedom of Association Audit

In 2024, the Board approved and oversaw an independent, third-party audit that assessed and validated our compliance with employees’ freedom of association rights. We respect and support our workers’ rights and are committed to upholding a work environment and culture centered on open communication. The Board actively oversees the company’s talent strategy to ensure employees at Maximus have a career, not just a job, and is pleased with the progress made to the talent development programs in fiscal 2024, including significant enhancements to the strategic talent planning designed to prepare Maximus and our talent for future market demands.

The Maximus Board thanks you for your continued support of and investment in Maximus. We kindly request your voting support in the voting recommendations contained in this proxy statement.

We look forward to delivering another year of strong performance for all of our shareholders and further expanding our long-standing practice of maintaining open dialogue with our investors in order to continuously improve our strategic execution and shareholder value creation.

Sincerely,

John J. Haley

Chair of the Board

January 22, 2025

Dear Maximus Shareholders,

In fiscal year 2024, the talented and dedicated Maximus team further demonstrated our value as an efficient and accountable partner to government in delivering essential citizen services. Our team achieved a year of transformative growth and record financial results, exceeding our forecasts and demonstrating healthy business operations, partnering with new government agencies and expanding our service offerings.

Highlights included achieving outstanding full year growth in revenue, operating margin and adjusted EBITDA margin. We finished the year with a strong pipeline of opportunities and contract award positioning, with signed new contract awards valued at $2.2 billion and a total pipeline of sales opportunities of over $54 billion.

The success of our teams and operations are a reflection of the resiliency of Maximus’ strategic growth pillars, which prioritize long term demand characteristics that are shaping the role of government in supporting its citizens.

Delivering Customer Services, Digitally Enabled

Maximus’ long-standing practice of bringing together people, process, and advanced technology in the

solutions we deliver on behalf of our customers was further demonstrated in 2024. With greater integration of digital platforms in our offerings, we meet the evolving expectations of citizens seeking a streamlined and efficient interaction with government programs. In doing so, we achieve higher levels of satisfaction, performance accuracy and accountability for our government customers. At Maximus, we take pride in our history of implementing complex public policy with efficient technology-based solutions. In fiscal year 2024, we rolled out Total Experience Management, or TXM. This Contact Center as a Service (or CCaaS) capability is an added differentiator for Maximus as governments seek single providers to deliver secure, scalable, cloud-based solutions to serve employees and citizens.

Focused on the Future of Health

We advanced our ambition to help state and federal government agencies meet rising demands for health services this year, with rebid wins including our California Independent Medical Review (IMR) Project. Since 2013, we have supported the Department of Industrial Relations Division of Workers' Compensation by providing IMR services, underscoring how long-term customer relationships are a key feature of our business. We are also excited to continue supporting our nation's veterans through the Medical Disability Exams ("MDE") contracts with the Veterans Benefits Administration (VBA). We are honored to have gained the trust of the VBA as a reliable and value-driven partner, while continuously investing in operational improvements to enhance the Veteran experience. In fiscal year 2024 we also successfully launched the new Functional Assessment Services (FAS) contract in the United Kingdom. This $1B award provides the foundation for the UK’s progressive efforts to consolidate and streamline multiple assessment programs.

Advancing Technological Modernization

We continued to progress our technology modernization efforts for civilian, defense and health agencies, enabling Maximus to support customers in the rapidly evolving and increasingly complex cybersecurity and geopolitical landscape. As a technology leader, we view progress on this strategic imperative and expanding federal footprint as critical to ensuring government programs are resilient, dynamic, integrated and equitable. Our $171M fiscal year 2024 win of the Transportation Security Administration's OPTIMA program further evidences our growing position as a trusted partner to Federal agencies delivering critical mission services.

Moving Our Talent Forward

As we advance our Maximus Forward strategy, we are also prioritizing initiatives that move our Maximus people forward. Our transformative, organization wide initiative, Moving Our Talent Forward, was established to promote more efficient operations and reinvestment in the business to accelerate talent development, including reskilling, upskilling and leveling-up, as we prepare our teams for the future. Our people are our most valuable asset and top priority, which is why we strive for all of our employees to have a career at Maximus, not just a job.

As a testament to the success of our talent strategy, in our 2024 Global Employee Engagement survey, we had a 76% overall response rate, with a resounding +31 employee net promoter score. An improvement of 11 points from 2023.

We are proud of the financial results, delivery excellence, and contract victories achieved in 2024, made possible by our more than 40,000 employees in whose skills and capabilities we continue to invest. We look forward to delivering another year of strong and focused execution in FY2025, and we are grateful for your engagement and support.

Sincerely,

Bruce L. Caswell

Chief Executive Officer and President

Notice of Annual Meeting

of Shareholders

The 2025 Annual Meeting of Shareholders (the “Annual Meeting”) of Maximus, Inc. (“Maximus” or the “Company”) will be conducted online through a live webcast.

Meeting Details

| | | | | | | | | | | | | | | | | | | | | | | |

| Date March 11, 2025 | | | Time 11:00 a.m. ET | | | Location www.virtualshareholdermeeting.com/MMS2025 |

| | | | | | | |

Voting Matters

| | | | | |

| 1 | The election of eight Directors nominated by the Board of Directors of the Company to serve until the 2026 Annual Meeting of Shareholders. |

| 2 | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our 2025 fiscal year. |

| 3 | An advisory vote to approve the compensation of the named executive officers. |

The meeting will also include the transaction of any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

Record Date

Shareholders of record at the close of business on January 13, 2025, will be entitled to vote at the Annual Meeting or at any adjournment or postponement of the Annual Meeting.

Attendance

All shareholders are invited to attend the virtual meeting. In order to attend the virtual Annual Meeting, go to virtualshareholdermeeting.com/MMS2025 and enter the control number found on your proxy card, voting instruction form, or notice you previously received. If you are not eligible to participate in the meeting, you may listen to a webcast of the meeting by visiting virtualshareholdermeeting.com/MMS2025 and logging on as a guest. Guests will not be able to ask questions or vote at the meeting.

The Board of Directors of Maximus (“Board of Directors” or “Board”) is making this proxy statement, our Annual Report on Form 10-K for fiscal year 2024, and a form of proxy available to you in connection with the solicitation of proxies by the Board for use at the Annual Meeting and at any adjournments or postponements of the Annual Meeting.

Under Securities and Exchange Commission (“SEC”) rules, we have elected to furnish our proxy materials to shareholders over the Internet. We believe this will allow us to provide shareholders with the information they need while at the same time conserving natural resources and lowering the cost of printing and delivery. On or about January 22, 2025, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our 2025 proxy statement and 2024 annual report. The Notice also provides instructions on how to vote online and includes instructions on how to receive a paper copy of the proxy materials by mail.

By Order of the Board of Directors

John T. Martinez

Chief Legal Officer and Secretary

This proxy statement is dated January 22, 2025 and is first being furnished to shareholders on or about January 22, 2025.

Table of Contents

| | | | | |

| |

| Fiscal Year 2024 Company Highlights | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proxy Summary

The information provided in this Proxy Summary is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement.

Meeting Details

| | | | | | | | | | | | | | | | | | | | | | | |

| Date March 11th, 2025 | | | Time 11:00 A.M. EDT | | | Location www.virtualshareholdermeeting.com/MMS2025 |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Ways to Vote Your vote is important. Whether or not you plan to attend, we encourage you to vote promptly. There are several ways that you can cast your ballot: | | | Via the Internet Go to proxyvote.com | | | Virtually Attend the virtual Annual Meeting |

| | | | | |

| | By Telephone (+1) 800-586-1548 (toll-free) (+1) 303-562-9288 (international) | | | By Mail Sign, date, and return your proxy card in the enclosed envelope |

| | | | | | |

Voting Recommendations

| | | | | | | | | | | |

| Proposal | Board's Voting Recommendation | Page Reference |

| |

| 1 | The election of eight Directors nominated by the Board of Directors of the Company to serve until the 2026 Annual Meeting of Shareholders. | FOR each nominee | |

| 2 | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our 2025 fiscal year. | FOR | |

| 3 | An advisory vote to approve the compensation of the named executive officers. | FOR | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 1 |

Fiscal Year 2024 Company Highlights

| | | | | | | | |

| | |

| | |

| $5.3B | |

| FY24 Revenue | |

| | |

| | |

| | |

| 41,100+ | |

| Employees worldwide | |

| | |

| | |

| | |

| 100M+ | |

| American citizens supported by programs we administer | |

| | |

| | |

| | |

| McLean | |

| Headquarters are located in McLean, Virginia | |

| | |

| | | | | | | | |

| | |

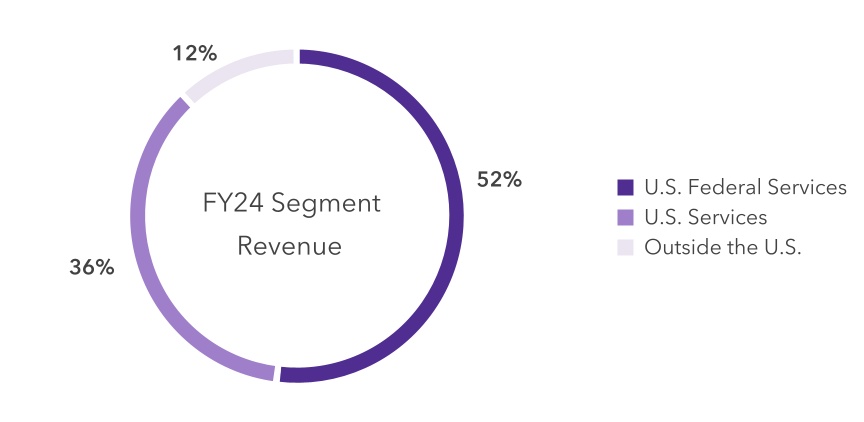

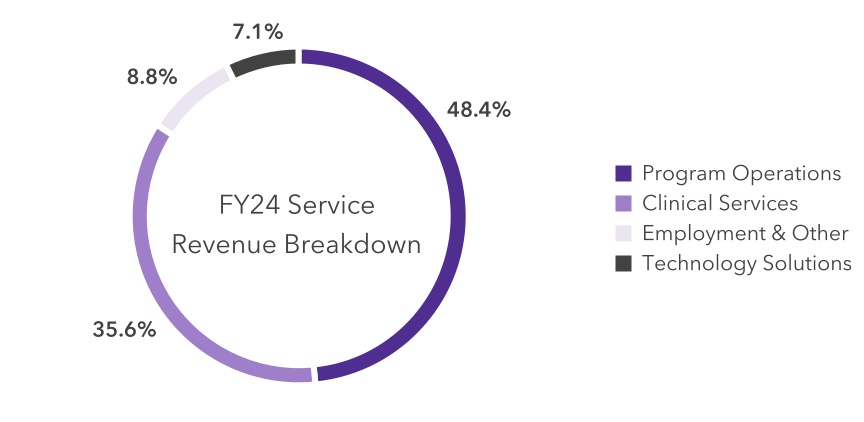

8.2% | | 11.6% |

| Increase in revenue from $4.9B in fiscal year 2023 | | Adjusted EBITDA margin1 |

| | |

| | |

| $6.11 | | $401M |

Adjusted diluted earnings per share1 | | Free cash flow1 |

| | |

1.Adjusted earnings metrics and free cash flow are non-GAAP terms. A summary of our use of non-GAAP numbers as well as a description of how we calculate them, may be found in Item 7 of our Annual Report on Form 10-K for the year ended September 30, 2024, and filed with the SEC on November 21, 2024.

| | | | | | | | |

| 2 | MAXIMUS 2025 PROXY STATEMENT | |

Moving our Talent Forward

At Maximus, we want our employees to have a career, not just a job. This means it will take all of us, through tools, processes, technology, and a shared vision, to enable our talent to both redeploy internally and level-up for future skills. We are committed to Moving Our Talent Forward. Embarking on an organization-wide initiative of the same name, we are focused on planning and meeting our organization’s current and future strategic talent goals by empowering our most important success factor–our employees.

| | | | | | | | |

| | |

| Mobilizing our talent internally as the business needs | | Helping employees level-up for future skill needs |

| | |

| To support mobilizing our talent internally, we created a Strategic Workforce Planning (SWP) function to ensure we are taking an employee-centric approach to streamlining the redeployment of our workforce. They are dedicated to ensuring we have the right people with the right skills at the right time to meet the demands of our government clients to effectively serve and support the citizens in our own communities. This team partnered with the business to implement the “Beach,” which is a virtual status that bridges the gap between assignments, providing income and benefit continuity, proactively nurturing our employees during times of change, providing them with stability, and enabling employees to move more seamlessly to new projects. Since its implementation, we have matched 2,100 employees ending a project with open positions. preventing potential reductions in force (RIFs). These efforts created value by avoiding severance, recruitment, and rehiring expenses, and created an atmosphere of increased employee security by ensuring their careers could continue. | | To support our employees' journey to level-up for future skills, we are committed to and value ongoing development and continuous learning for all Maximus employees. Maximus offers a variety of instructor-led and self-paced learning programs for diverse audiences ranging from individual contributors to frontline supervisors and executive leadership. Our project training teams manage customized programs supporting contract requirements, customer service, local leadership development, and employee engagement. We also provide many employees with online role-based and skill-based learning tools. Starting in 2023, to support our transition to a Skills-Based Organization, we invested in internal cross-functional resources and into an innovative AI Total Talent Management System, Eightfold. Officially launched on October 1, 2024, Eightfold will ultimately enable us to address talent needs and gaps more effectively as it is a career hub that gives Maximus more data and insight into the skillsets of our employees, recommends internal roles based on skillsets and career aspirations, and connects employees to skill development opportunities. |

| | |

Our Values

We continue to build a culture that embodies our values of accountability, collaboration, compassion, customer focus, innovation, and respect. To support this, we look for ways to continuously embed these values into our organizational DNA, guiding our conduct and decision-making and reflecting our collective beliefs and ambitions. At Maximus, we share an authentic desire to do something meaningful to help others succeed. This is the Maximus culture and the bedrock of our brand identity and values. It’s who we are.

| | | | | | | | | | | | | | | | | |

| Respect | | Compassion | | Innovation |

| | | | | |

| Accountability | | Collaboration | | Customer Focus |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 3 |

Strategy for Growth

Today’s rapidly changing world demands that governments have the capacity and flexibility to respond to the growing expectations of the people they serve. Maximus makes it easier for people to access public services more easily and equitably. As a leader in the ability to translate health and human services public policy into outcomes-based operating models, we provide transformative technology services, digitally enabled customer experiences, and clinical health services that change lives.

The three pillars of our strategy are supported by significant and growing demand, the capabilities we bring to our mission of “moving people forward,” and our ability to deliver on customer priorities with differentiation and sustainable competitive advantage. With the relentless pace of technology, what was considered cutting edge two years ago is becoming table stakes. As the competitive landscape moves, we are investing in anticipation of evolving customer needs.

| | | | | | | | | | | | | | |

| | | | |

Technology

Modernization | | Future

of Health | | Customer Services,

Digitally Enabled |

| | | | |

•Modernizing programs and legacy technology systems to be agile enough to meet the needs of a rapidly changing world can be hard. We make that easier by offering more options for modernizing programs – aligning solutions around the unique circumstances of each program. | | •We use innovative techniques and proven technologies and analytics to meet individuals on their own terms. •We automate complex processes and empower health professionals with timely, actionable data – enabling them to focus on individuals while responding to community needs at scale. | | •Our solutions provide streamlined and equitable access to critical benefits. •We apply advances in business intelligence, predictive analytics, and emerging technologies to unlock the full potential of an agency’s mission. We proactively detect and resolve barriers to reach target populations. |

| | | | | | | | |

| 4 | MAXIMUS 2025 PROXY STATEMENT | |

Board of Directors

The Nominating and Governance Committee (N&G) works directly with the Chairman to lead the Board in an annual self-evaluation process that assesses the performance of the Board as a whole, the committees of the Board, and the contributions of the individual directors. In fiscal year 2024, the N&G Committee recommended retaining the committee structure that was implemented on January 1, 2024.

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Audit | Nominating & Governance | Compensation & Human Resources | Technology Committee |

| | | | | | |

| Anne K. Altman | 65 | 2016 | | | l | |

| Bruce L. Caswell | 59 | 2018 | | | | |

| John J. Haley | 75 | 2020 | | l | | |

| Jan D. Madsen | 61 | 2020 | | | | l |

| Richard A. Montoni | 73 | 2006 | | | | |

| Gayathri Rajan | 57 | 2016 | | l | | l |

| Raymond B. Ruddy | 81 | 2004 | l | l | | |

| Michael J. Warren | 57 | 2019 | l | | l | l |

| | | | | | | | | | | | | | |

| Committee Chair | | l | Committee Member |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 5 |

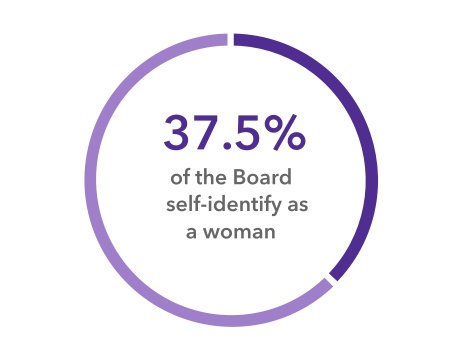

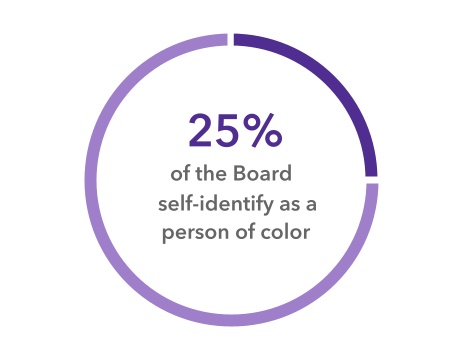

Board Composition

The N&G Committee has worked to ensure that Maximus' Board reflects that of a strategic asset board that is richly defined by a variety of skills that will benefit the long-term strategy of the organization while at the same time representing the needs of our shareholders. As a global company, with a wide array of stakeholders, whose employees, customers, and stakeholders represent a wide variety of backgrounds, ethnicities, genders, etc, we are proud of our board composition and feel that it represents us well.

Current Board Composition:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Tenure | | | Director Age |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| l | l | l | l | l | l | l | l | | | l | l | l | l | l | l | l | l | | | l | l | l | l | l | l | l | l |

| 5 - 9 years | | | 50's | | | 60's |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| l | l | l | l | l | l | l | l | | | l | l | l | l | l | l | l | l | | | l | l | l | l | l | l | l | l |

| 10+ years | | | 70's | | | 80's |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| 6 | MAXIMUS 2025 PROXY STATEMENT | |

Our Leadership

Our executive officers and their respective ages and positions as of the date of this proxy statement are as follows:

| | | | | | | | |

| Name | Age | Position |

| | |

| Bruce L. Caswell | 59 | Chief Executive Officer, President and Director |

| David W. Mutryn | 43 | Chief Financial Officer and Treasurer |

| Ilene R. Baylinson | 68 | General Manager, U.S. Services |

| Michelle F. Link | 50 | Chief Human Resources Officer |

| John T. Martinez | 52 | Chief Legal Officer and Corporate Secretary |

The following information sets forth biographical information for the past five years of the executive officers. Such information with respect to Bruce L. Caswell, our Chief Executive Officer and President, is set forth below in the “Proposal 1 - Election of Directors” section.

David W. Mutryn assumed the role of Chief Financial Officer in 2021. Mr. Mutryn joined Maximus in 2016 as Corporate Controller and transitioned to Senior Vice President of Finance in 2020. Prior to Maximus, Mr. Mutryn was Vice President of Finance at CSRA, Inc. and held numerous financial leadership positions at SRA International, Inc.

Ilene R. Baylinson has served as the General Manager of our U.S. Services Segment since 2020. She previously served as the General Manager of the U.S. Health Segment from 2015 to 2020. Ms. Baylinson joined Maximus in 1991.

Michelle F. Link joined Maximus in March 2020 as Chief Human Resources Officer. From 2018 to 2020 she served as the Executive Vice President of Human Resources for ADS, Inc. Before that she served as Chief Human Resources Officer for PRA Group from 2011 to 2018. She has also held senior Human Resources roles at BlueCross Blue Shield of Tennessee, AMERIGROUP (now Elevance Health), CIGNA, and Corning.

John T. Martinez joined Maximus in September 2023 as Chief Legal Officer and Corporate Secretary. Mr. Martinez previously served as Vice President and General Counsel of GE Aerospace from August 2021 to September 2023 where he was responsible for developing and executing GE Aerospace's legal strategy across the commercial aviation and defense sectors and led GE Aerospace's global legal, contracts, compliance, and government relations organizations. In the ten years prior, Mr. Martinez served in roles including senior leadership positions at Raytheon Intelligence & Space, the Director of National Intelligence, and the Central Intelligence Agency.

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 7 |

Corporate Governance

Board’s Role in Risk Oversight

The Board of Directors as a whole oversees the risk management of the Company. Senior members of the Company’s management team regularly report to the Board on operational and financial risks relating to the Company’s projects, and about compliance with the Company’s policies and procedures and code of ethics.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board of Directors | |

| | | | | | | | | |

| | | | | | | | | |

| Audit Committee | | Nominating and

Governance Committee | | | Compensation and Human Resources Committee | | Technology Committee | |

| | | | | | | | | |

| Oversees management of business and operational risks that could have a financial impact, such as those relating to internal controls and liquidity. | | Manages the risks associated with compliance matters, including receiving regular reports from the Company’s CCO governance issues, such as the independence and performance of the Board, and environmental and social issues. | | | Responsible for managing the risks relating to the Company’s executive compensation and succession plans and policies. | | Assists the Board with oversight of the Company’s information technology risks, strategic technology investments, and the quality and effectiveness of the Company’s cybersecurity policies and practices, including the company's use of artificial intelligence. | |

| | | | | | | | | |

| | | | | | | | | |

| Enterprise Risk Management | |

| | |

Annually, the Company surveys key leaders of the Company to identify significant risks facing the Company. Those risks are ranked based on likelihood of occurrence as well as potential impact and assigned a risk manager. Management engages risk managers to regularly update performance metrics and mitigation plans for risks identified in the assessment process. The Risk Governance Committee, a management committee made up of key leaders of the Company, oversees performance and mitigations, and determines action necessary based on the Company's tolerance for risk. The outcome of the Risk Governance Committee's process is reported to the Board. This process also informs the Company's disclosure and discussion of risks in its SEC filings.

| | | | | | | | |

| 8 | MAXIMUS 2025 PROXY STATEMENT | |

Corporate Governance Guidelines

The Board of Directors has adopted Guidelines for Corporate Governance that set forth the practices of the Board with respect to the function of the Board, management oversight, Board composition, selection of directors, operation of the Board and meetings, committees of the Board, director responsibilities, and tenure and evaluation of the Board and committees. The Guidelines for Corporate Governance are available on our Corporate Governance web page at investor.maximus.com/governance. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC.

Director Independence

Under our Guidelines for Corporate Governance and New York Stock Exchange (“NYSE”) rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries. Our Guidelines for Corporate Governance define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies.

Our Guidelines for Corporate Governance require the Board to review the independence of all directors at least annually. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, the Board will determine, considering all relevant facts and circumstances, whether such relationship is material.

The Board of Directors in its business judgment has determined that the following directors are independent as defined by NYSE listing standards: Anne K. Altman, John J. Haley, Jan D. Madsen, Richard A. Montoni, Gayathri Rajan, Raymond B. Ruddy, and Michael J. Warren.

How We Are Elected

The Board of Directors currently consists of eight directors. All directors are elected annually for one-year terms, and the Board has nominated the eight director nominees for election at the Annual Meeting. If you sign and return your proxy card, the persons named as proxies in the proxy card will vote to elect those eight nominees unless you mark your proxy card otherwise. You may not vote for a greater number of nominees than eight. Each nominee has consented to being named in this proxy statement and to serve if elected. If for any reason a nominee should become unavailable for election prior to the Annual Meeting, the proxy holders may vote for the election of a substitute. We do not presently expect that any of the nominees will be unavailable.

Vote Required for the Election of Directors

The Company’s bylaws provide for majority voting in director elections. The Board of Directors also has adopted a Director Resignation Policy. Under that policy, each director nominee has submitted a written contingent resignation which will become effective only if (i) the director fails to receive the required number of votes for re-election as set forth in the Company’s bylaws and (ii) the Board of Directors accepts the resignation. The affirmative vote of a majority of the total number of votes cast with respect to that director’s election is required to re-elect each nominee to our Board. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the outcome of this matter.

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 9 |

Director Nomination Process

Under the process we use for selecting new Board candidates, the Chief Executive Officer, the Nominating and Governance Committee, or other Board members identify the need to add a new Board member with specific qualifications or to fill a vacancy on the Board. The Chair of the Nominating and Governance Committee will initiate a search, working with staff support and seeking input from Board members and senior management, hiring a search firm, if necessary, and considering any candidates recommended by shareholders. The Chief Executive Officer and members of the Nominating and Governance Committee interview prospective candidates. The Nominating and Governance Committee recommends final candidates for approval by the full Board of Directors.

Shareholder Recommendations and Nominations of Director Candidates

The Nominating and Governance Committee will consider qualified shareholder recommendations for candidates to serve on the Board of Directors and would evaluate any such candidate in the same manner described above. A shareholder may submit candidates for consideration by the Nominating and Governance Committee if such shareholder gives timely written notice, in proper form, for each such recommended director nominee. To be timely for the 2026 Annual Meeting of Shareholders, the notice must be received within the time frame set forth in “Shareholder Proposals and Directors For Our 2026 Annual Meeting of Shareholders” below. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and such other information as required under our bylaws. These requirements are more fully described in Article I, Section 6, of our bylaws.

Insider Trading Policy

We have adopted our Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities by our directors, officers, employees and other covered persons that we believe is reasonably designed to promote compliance with insider trading laws, rules and regulations, and the exchange listing standards applicable to us. A copy of our Insider Trading Policy is filed as Exhibit 19.1 to our Annual Report on Form 10-K for the year ended September 30, 2024.

Code of Ethics

We have adopted a code of ethics that applies to all employees, including our principal executive officer, principal financial officer and principal accounting officer or controller, or persons performing similar functions. That code, our Standards of Business Conduct and Ethics, can be found posted on our Corporate Governance web page at investor.maximus.com/governance. The Board regularly reviews our code of ethics, and any amendment or waiver of our code of ethics required to be disclosed under the Securities Exchange Act of 1934 (the “Exchange Act”) will be reflected on our Corporate Governance web page.

| | | | | | | | |

| 10 | MAXIMUS 2025 PROXY STATEMENT | |

Director Attendance

Our Board expects that its members will prepare for, attend, and participate in all Board and applicable committee meetings. Our Board of Directors held 10 meetings during fiscal year 2024. During our 2024 fiscal year, all of our directors attended at least 75% of the aggregate Board and applicable committee meetings.

We encourage members of the Board of Directors to attend our annual meetings. All of our directors attended our annual meeting in 2024.

Executive Sessions

Executive sessions where non-management directors meet on an informal basis are scheduled either at the beginning or at the end of each regularly scheduled Board meeting. John J. Haley, the independent, non-executive Chair of the Board, presides over the executive sessions.

Board Evaluations

As part of the Board’s ongoing commitment to continuous improvement, the Nominating and Governance Committee leads the Board in an annual self-evaluation process that assesses the performance of the Board as a whole, the committees of the Board, and the individual directors. Based on results of the annual assessments, the Chair of the Board provides feedback to each respective Board member. In addition, an outside expert is engaged every five years to perform an in-depth, independent assessment. The most recent external assessment was completed in fiscal year 2022. Board members received feedback on their strengths and contributions, as well as opportunities for improvement. Feedback is also considered when designing education and certification road maps for each director.

As a result of the Board evaluation process, the Board made several changes and enhancements to the Committee composition, overall Board focus, processes, information and resources as well as amplification of our positive Board culture. In fiscal year 2024, the Board adjusted Committee assignments in accordance with Director skills and experiences, further aligned to company strategy and growth plans which have enhanced Board risk assessment, governance and oversight.

Stemming from the annual self-evaluation process, the Board initiated a two-day Board and senior management off-site which examined the company's existing strategy, assessed historical implementation of, and performance against, our strategic metrics as well as reviewed changes to the future strategic direction of the company based on company capabilities, customer demand signals, and overall competitive landscape. The Directors also assessed allocation of Board meeting time, cadence, and presentation materials. Process improvements were implemented, including providing Directors with background reference materials for in-depth understanding of the presentation materials which have been streamlined highlighting important information while maintaining a thoroughness that allows Directors to better assess risk and perform their governance and oversight responsibilities. As a result of these changes, it has allowed greater time for discussion, debate, and detailed reviews of key risk areas and opportunities, focus on strategic trends for the company, and the Board's engagement and interaction with senior management as well as emerging talent within the organization.

Lastly, consistent with our company core values, the overall changes and enhancements made in fiscal year 2024 further facilitated the Board's thoughtful discussion and debate in a collegial and collaborative environment that drives strategic priorities and facilitates stronger governance and oversight.

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 11 |

Director Education

The Board acknowledges the significance of continuous director education and is in regular pursuit of continuous learning to enhance governance and oversight responsibilities. The Board facilitates both internal and external speakers and presentations on relevant topics and encourages Directors to pursue their own independent education and continuous learning, including through external director education programs, presentations and professional articles. The Board also leverages formal Board and Committee meetings to access regular presentations by subject-matter experts in a variety of areas relevant to the company's strategic priorities and that facilitates stronger oversight and governance of the company. In fiscal year 2024 alone, the Board received numerous internal and external presentations by experts on topics including: enterprise risk management, ethics and compliance, microeconomic and political trends related to government contractors, the macroeconomic and geopolitical landscape, emerging technology such as generative artificial intelligence, machine learning, quantum computing and cybersecurity risks, trends and best practices, human capital management, talent and succession planning as well as brand and reputational management, among others.

Independent Board Chair

Maximus has maintained separate Chief Executive Officer and Chair of the Board positions since before the Company’s initial public offering in 1997. John J. Haley currently serves as our independent, non-executive Chair of the Board. Under our Guidelines for Corporate Governance, the Board will periodically evaluate the separation of the CEO and Chair positions in light of the Company’s governance objectives and relevant circumstances. We believe that the separation of these roles at this time is appropriate and represents good corporate governance that promotes Board and director independence from the management team.

Mr. Haley brings experience to the Company from his prior roles as both board chair and CEO of a public company. Mr. Haley, together with Anne Altman in her capacity as Chair of the Nominating and Governance Committee and Vice Chair, represents the Company in meetings with shareholders and leads the Board in consideration of input from shareholders and other stakeholders.

| | | | | | | | |

| 12 | MAXIMUS 2025 PROXY STATEMENT | |

Committees of the Board

The standing committees of the Board of Directors are the Audit Committee, the Nominating and Governance Committee, the Compensation and Human Resources Committee, and the Technology Committee. Each Committee operates under a written charter adopted by the Board. Committee charters, as amended and currently in effect, are available on our Corporate Governance web page at investor.maximus.com/governance/governance-documents.

| | | | | | | | | | | | | | |

| | | | |

| Audit Committee Jan D. Madsen (Chair) Raymond B. Ruddy Michael J. Warren Meetings in fiscal 2024: 5 | | | The Audit Committee assists the Board of Directors in fulfilling its responsibility to oversee management’s conduct of our financial reporting processes and audits of our financial statements. The Audit Committee specifically reviews the financial reports and other financial information provided by the Company, our disclosure controls and procedures, internal accounting and financial controls, the internal audit function, the legal compliance and ethics programs, and the annual independent audit process. Each member of the Audit Committee is independent as defined by applicable NYSE listing standards and SEC regulations governing the qualifications of audit committee members. The Board of Directors has determined that all of the committee members are financially literate as defined by the NYSE listing standards and that Ms. Madsen, Mr. Ruddy, and Mr. Warren qualify as audit committee financial experts as defined by regulations of the SEC. For additional information regarding the Audit Committee, see “Report of the Audit Committee” below. |

| | | | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 13 |

| | | | | | | | | | | | | | |

| | | | |

| Nominating & Governance Committee Anne K. Altman (Chair) John J. Haley Gayathri Rajan Raymond B. Ruddy Meetings in fiscal 2024: 4 | | | The purpose of the Nominating and Governance Committee is to oversee the lifecycle of the Board to include identifying, evaluating, and recommending candidates for membership on the Board of Directors, to establish and assure the effectiveness of the governance principles of the Board and the Company, and to establish the ongoing training and assessments/evaluations of our directors. The Nominating and Governance Committee is responsible for assessing the appropriate mix of skills, qualifications, and characteristics for the effective functioning of the Board in light of the needs of the Company. The committee considers, at a minimum, the following qualifications in recommending to the Board potential new directors, or the continued service of existing directors: •personal characteristics, such as the highest personal and professional ethics, integrity and values, an inquiring and independent mind, with a respect for the views of others, ability to work well with others, and practical wisdom and mature judgment •broad, policy-making level experience in business, government, academia, or science to understand business problems and evaluate and formulate solutions •experience and expertise that is useful to the Company and complementary to the background and experience of other directors •willingness and ability to devote the time necessary to carry out duties and responsibilities of directors and to be an active, objective, and constructive participant at meetings of the Board and its committees •commitment to serve on the Board over a period of several years to develop knowledge about the Company’s principal operations •willingness to represent the best interests of all shareholders and objectively evaluate management performance •diversity of experiences, skills and backgrounds The Nominating and Governance Committee has oversight of the Company’s ESG initiatives. The Committee also oversees and receives reports at least quarterly on (1) compliance with applicable laws and Company policies pertaining to political contributions, (2) political activities and contributions of the Maximus Political Action Committee, (3) significant lobbying priorities and related expenditures in the U.S. and (4) expenditures relating to the Company's principal U.S. trade associations. |

| | | | |

| | | | | | | | |

| 14 | MAXIMUS 2025 PROXY STATEMENT | |

| | | | | | | | | | | | | | |

| | | | |

| Compensation & Human Resources Committee John J. Haley (Chair) Anne K. Altman Michael J. Warren Meetings in fiscal 2024: 6 | | | The Compensation and Human Resources Committee is responsible for reviewing, approving, and overseeing our compensation and executive benefit programs, evaluating their effectiveness in supporting our overall business objectives and ensuring an appropriate structure and process for management succession. The committee also reviews, in conjunction with the CEO and the Chief Human Resources Officer (CHRO), activities impacting human resources such as inclusion initiatives, the Global Employee Engagement Survey, and labor relations. Specifically, the committee is responsible for: •evaluating the performance and setting the compensation of the Chief Executive Officer and approving the CEO’s recommendations for other members of senior management •reviewing the Company’s compensation policies and practices •reviewing executive succession plans •reviewing the risks associated with our incentive compensation programs To assist in its efforts to meet the objectives outlined above, the Compensation and Human Resources Committee also retains an independent consulting firm to advise it on executive compensation programs. For additional information regarding the committee, see “Compensation and Human Resources Committee Report” below. |

| | | | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 15 |

| | | | | | | | | | | | | | |

| | | | |

| Technology Committee Fiscal 2023 Members: Richard A. Montoni (Chair) Jan D. Madsen Gayathri Rajan Michael J. Warren Meetings in fiscal 2024: 5 | | | The Technology Committee assists the Board of Directors in fulfilling its responsibility to oversee the Company's strategic information technology investments and its risk management efforts pertaining to cybersecurity, artificial intelligence, and the protection of data assets. The Technology Committee meets regularly with our Chief Digital & Information Officer and our Chief Information Security Officer. Strategic technology investments include investments that are considered material expenditures and are important for the ongoing success of the business. These also include evaluation of merger and acquisition strategy intended to supplement or supplant the Company’s technology portfolio. Risk management includes protecting the Company’s intellectual property and other data assets – in particular customer data – from theft or other compromise. This includes protection from external bad actors, as well as from unauthorized access on the part of employees, partners and customers. It also includes oversight of the Company's use of artificial intelligence (AI) to sort, organize, analyze, and generate data for business purposes, including the use of machine learning, generative AI, and other standard techniques. The comprehensive lifecycle utilization of AI, whether implemented directly by us or in collaboration with third parties, necessitates ongoing investment in governance and security resources to help ensure its responsible use of AI and to safeguard against potential risks and vulnerabilities. With oversight from the Technology Committee of the Board of Directors, our AI Guiding Principles ensure that our approach to AI is grounded in: •Human Oversight and Accountability •Ethical and Inclusive Design •Iterative Development These guiding principles help ensure we continue to operate in compliance with applicable laws and regulations, align with industry standards and best practices, and take societal and environmental well-being into consideration. |

| | | | |

| | | | | | | | |

| 16 | MAXIMUS 2025 PROXY STATEMENT | |

Shareholder Engagement and Responsiveness

Maximus is committed to engaging directly with our shareholders to understand their views on governance matters. Maximus, including members of our Board of Directors as appropriate, regularly meets with major shareholders on a wide range of topics including strategy, financial performance, capital allocation, corporate governance, and executive compensation. In addition, the full Board receives and reviews reports on investor feedback and emerging governance issues, allowing our directors to better understand shareholder priorities and perspectives.

We actively consider shareholder feedback and, as warranted, take action. During the last year, Maximus engaged with investors regarding, among other topics: the financial impact of the restart to Medicaid redeterminations, continued volume ramp of Veterans Affairs Medical Disability Exams (VA MDE) contracts, the performance of the Outside the US segment, capital allocation strategy, executive compensation, sustainability initiatives and priorities, cybersecurity, human capital management and employee engagement, as well as Board refreshment and governance.

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 17 |

Director Compensation Table

The table below summarizes the compensation paid to our non-employee directors in fiscal year 2024.

| | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) | |

| | | | |

Anne K. Altman(2) | 150,000 | | 210,000 | | 360,000 | | |

John J. Haley(3) | — | | 500,000 | | 500,000 | | |

Jan D. Madsen(4) | 75,000 | | 255,000 | | 330,000 | | |

Richard A. Montoni(5) | 320,000 | | — | | 320,000 | | |

Gayathri Rajan(6) | 150,000 | | 150,000 | | 300,000 | | |

Raymond B. Ruddy(7) | 335,000 | | — | | 335,000 | | |

Michael J. Warren(8) | 150,000 | | 150,000 | | 300,000 | | |

1.The amounts in this column reflect the aggregate grant date fair values, computed in accordance with FASB ASC Topic 718, of RSU awards made on March 12, 2024, under our 2021 Omnibus Incentive Plan. For each of the RSU awards, the grant date fair value is calculated using the closing price of our common stock on the grant date as if these awards were vested and issued on the grant date. The amounts shown disregard estimated forfeitures. For additional information regarding the assumptions used in determining the fair value of an award, please refer to Note 12 to the consolidated financial statements contained in our Annual Report on Form 10-K for the year ended September 30, 2024.

2.As of September 30, 2024, Ms. Altman held 2,489 RSUs.

3.As of September 30, 2024, Mr. Haley held 5,925 RSUs and an additional 16,582 deferred shares.

4.As of September 30, 2024, Ms. Madsen held 3,021 RSUs and an additional 14,086 deferred shares.

5.As of September 30, 2024, Mr. Montoni held 0 RSUs.

6.As of September 30, 2024, Ms. Rajan held 1,778 RSUs.

7.As of September 30, 2024, Mr. Ruddy held 198,067 deferred shares.

8.As of September 30, 2024, Mr. Warren held 1,778 RSUs and an additional 7,209 deferred shares.

Fees Payable to Non-Employee Directors

The director compensation for fiscal year 2024 as shown in the chart above was comprised of the below elements. The Compensation & Human Resources Committee, with the assistance of FW Cook, the committee’s compensation consultant, regularly reviews our non-employee director compensation and evaluates the competitiveness and reasonableness of the compensation program in light of general trends and practices. Based on its review, in fiscal year 2024 the Compensation & Human Resources Committee recommended, and the Board determined to increase the following annual cash retainers to better reflect market competitiveness: (i) increase the Nominating and Governance Committee Chair’s annual cash retainer from $15,000 to $20,000, (ii) increase the Vice Chair of the Board’s annual cash retainer from $35,000 to $40,000, (iii) increase the Board Chair’s annual cash retainer from $150,000 to $180,000, (iv) increase the Compensation and Human Resources Committee Chair and Technology Committee Chair annual cash retainer from $18,000 to $20,000 and (v) increase the Audit Committee Chair’s annual cash retainer from $25,000 to $30,000.

| | | | | | | | |

| 18 | MAXIMUS 2025 PROXY STATEMENT | |

Directors who are also Maximus employees do not receive additional compensation for their services as directors.

•An annual retainer of $300,000 payable in restricted stock units (“RSUs”) or cash, with a minimum amount of $150,000 in RSUs unless a director holds more than seven times the annual retainer in Company equity.

•Ms. Altman received an additional $20,000 retainer for her services as the Chair of the Nominating and Governance Committee, and an additional $40,000 as Vice Chair of the Board.

•Mr. Haley received an additional $180,000 retainer for his services as Chair of the Board and a $20,000 retainer for his services as the Chair of the Compensation and Human Resources Committee.

•Ms. Madsen received an additional $30,000 retainer for her services as the Chair of the Audit Committee.

•Mr. Montoni received an additional $20,000 retainer for his services as Chair of the Technology Committee.

•Mr. Ruddy received an additional $35,000 retainer, which is a continuation of the additional retainer he previously received for his services as Vice Chair of the Board, which reflects his leadership role on the Board and recognizes the additional time that he continues to spend on Company matters over and above his normal director duties.

•RSU awards granted to our non-employee directors vest after one year; directors may elect to defer receipt of shares for their RSUs for a longer period up to termination of service on the Board of Directors.

We also permit our directors to participate in the medical and dental plans that we offer to our employees, although each director who elects to participate must pay the full cost of his or her own premiums in the plan. During fiscal year 2024, Mr. Montoni and Mr. Ruddy participated in portions of those plans.

Director Equity Ownership Requirements

Directors have been required to hold equity in the Company equal to at least five times their annual cash retainer. For these purposes, “equity” consists of shares owned directly by the director, and any shares that would have been distributed to the director but for the director’s election to defer receipt of the shares for tax purposes. All of our directors met the ownership requirement as of the end of fiscal year 2024.

How To Communicate with Us

Our Board of Directors values input from a wide array of sources to inform its deliberations and decision-making. Since shareholders have a financial stake in the success of the Company and represent independent sources of information, the Board especially values shareholder questions and insights. The Board has therefore created a number of ways to obtain shareholder input including via participation at the annual meeting, use of the Company’s various reporting mechanisms including its hotline and audit functions, requests for individual director engagements, and use of the official communications mechanism described here.

Shareholders and other interested parties wishing to communicate with the Board of Directors, the non-employee directors, or any individual director (including any committee chair) may do so by sending a communication to the Board of Directors and/or a particular member of the Board of Directors, care of the Company Secretary at Maximus, 1600 Tysons Boulevard, McLean, Virginia 22102. Depending upon the nature of the communication and to whom it is directed, the Company Secretary will, as appropriate: (a) forward the communication to the appropriate director or directors; (b) forward the communication to the relevant department within the Company; or (c) attempt to handle the matter directly (for example, a communication dealing with a share ownership matter).

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 19 |

PROPOSAL 1

Election of Directors

The Maximus Board of Directors takes seriously the opportunity that you, our shareholders, have to cast votes to elect or re-elect us each year.

When seeking to identify candidates to be considered for potential Board membership, our Board strives for a candidate pool with a wide variety of perspectives and backgrounds, including age, length of service, expertise, gender, orientation, and race/ethnicity. The Board and the Nominating and Governance Committee assess the appropriate mix of skills, qualifications, and characteristics when looking for new directors and nominating current directors in conjunction with the needs of the Company as it continues to evolve.

In 2022, our Board of Directors spent a significant amount of time ensuring they are a strategic asset board – a board that has the critical skills, knowledge, and expertise to advise the Company on subjects specific to our operations and proactively contribute to the Company's successful execution of strategic objectives. We revisited our traditional skills matrix and assessed which skills are needed most, both for today and for the upcoming three to five years.

The following skills are highlighted within the biographies of our current Board members, but are not all-inclusive of the experience and knowledge on which we rely on each individual:

•Additional Public Company Board, CEO/CFO or NEO

•Federal Government Contracting

•Business Process Services

•Technology Modernization

•Government Citizen Services

•Financial Acumen

•Mergers & Acquisitions

•Cybersecurity & Data Privacy

•Human Resource Management

•Environment, Social, and Governance

We also developed, in conjunction with the Nominating and Governance Committee, a competency matrix with appropriate proficiency assessments for Directors to better assess their skills relative to what would most benefit the company. This activity has been important to the Board and Nominating and Governance Committee in their work to refresh the Board. The progression of a strategic asset board is anticipated to be a multi-year process as we carry out our strategic priorities.

We continue to believe that these skills and our Board’s representation of these skills and experiences position us for future success by aligning with our strategic direction.

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 21 |

Biographical Information of Director Nominees

The following presents biographical information about the eight directors nominated by the Board for election at the Annual Meeting. As part of the information below, we have included a brief description of the experience, qualifications, attributes, and skills that led to the conclusion that each director should serve on the Board. Information about the number of shares of common stock beneficially owned by each director, directly or indirectly, as of January 13, 2025, appears below under “Security Ownership - Security Ownership of Management.”

Nominees for Director (terms expiring in 2026)

| | | | | | | | |

| | The Board of Directors recommends that the shareholders vote “FOR” the eight nominees set forth below. |

| | | | | | | | |

| 22 | MAXIMUS 2025 PROXY STATEMENT | |

| | | | | | | | |

| | Career Snapshot: Ms. Altman retired from IBM in 2016 having served since 2013 as the company’s General Manager for U.S. Federal and Government Industries. Previously she served as General Manager for IBM's Global Public Sector with responsibilities for global government—national, regional, and local—as well as education, healthcare, and life sciences. Ms. Altman joined IBM in 1981 as a systems engineer and held a number of roles with increasing responsibility in areas pertaining to government and technology. Why she is valuable to Maximus: Ms. Altman’s qualifications and skills include her experience with public sector clients and the information technology industry including security, analytics, cognitive, digital, commerce, and cloud capabilities. She provides expertise around ESG and responsible stewardship. •Federal Government Contracting – at IBM, held positions of General Manager, U.S. Federal and Government Industries ($4B business) and General Manager, Global Public Sector ($20B business). Responsible for strategy, solution development, and services for U.S. Federal Government and global public sectors, as well as compliance with federal and international regulations. •Technology Modernization, Government Citizen Services, Cybersecurity & Data Privacy – proven experience in the IT industry, where she dealt with security, analytics, cognitive, digital, commerce, and cloud capabilities. Started career in 1981 as a system engineer, involved in various government-facing projects requiring innovation and problem-solving, as well as maintenance and security of data. Led IBM’s Smarter Cities initiative helping organizations, states and countries focus on transforming infrastructure, citizen-based services, healthcare, and education all directed at improving economic vitality. •Financial Acumen, Mergers & Acquisitions – at IBM, track record of successful management of global P&L’s of more than $5B. Led and/or contributed to various acquisitions ranging from $200M - $2.6B, ~ $5B in total. Participated in programmatic M&A by identifying needed capabilities and working with M&A team to identify appropriate targets. M&A work consisted of acquisitions in the healthcare industry, Watson analytics, and the IBM Mainframe. As a Director for SPX Flow, Inc., participated in the process to take the company private in 2021. •Environment, Social, Governance Expertise – •E: As Chair of the Nominating and Governance Committee of SPX Flow, Inc., oversaw and contributed to efforts to reduce carbon footprint of a manufacturing company. •S: Led IBM’s women’s group from 2013 to 2016. Co-Founder of Everyone Matters, Inc, a social impact enterprise with a focus on ensuring everyone has equal access to health, education, and government services. •G: Chair or member of Nominating and Governance Committees, focused on discipline and finding best practices and processes for companies to implement. |

| |

Anne K. Altman Age: 65 Director Since: 2016 Vice Chair Since: 2021 Committees: Nominating and Governance (Chair), Compensation and Human Resources Education: B.S., George Mason University More: Co-Founder & CEO, Everyone Matters, Inc. Chairman of the Board, Siemens Government Technologies, Inc. Board Member, TechFlow, Inc. Board Member, Gunnison Consulting Group, Inc. Board Member, National Symphony Orchestra | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 23 |

| | | | | | | | |

| | Career Snapshot: Mr. Caswell was appointed Chief Executive Officer of Maximus effective April 1, 2018. He was named President of Maximus in 2014, and prior to that served as the President of our Health Services Segment from 2007 through 2014. Before that, he was President of Operations from 2005 to 2007 and President of our Human Services Group from 2004 to 2005. Previously, he worked at IBM Corporation for nine years, serving most recently as Vice President, State and Local Government & Education Industries for IBM Business Consulting Services. Why he is valuable to Maximus: Mr. Caswell provides subject matter expertise in government policy and health and human services programs together with his detailed knowledge of the Company's operations gained through his service as our Chief Executive Officer, President, and other senior leadership positions at the Company. The Board of Directors believes that it is important to have the Company’s chief executive serve as a director. •Business Process Services, Technology Modernization, Government Citizen Services – at Price Waterhouse contributed to nationwide transformation in the delivery of public assistance benefits leveraging financial services infrastructure. At IBM managed emerging technology team in Pervasive Computing division, lead Federal technology modernization bids, and ultimately P&L responsibility for state, local, and education technology solutions delivery. As President & General Manager of multiple Maximus business segments from 2004 - 2014, and subsequently company President, oversaw business process outsourcing and technology modernization projects that carried out critical Federal and state programs. •Financial Acumen, Mergers & Acquisitions – as CEO and President of Maximus, has track record of successful management of global P&L’s of more than $4B. Oversees programmatic M&A team, whose objective is to work with business leaders to identify needed capabilities and appropriate targets to strengthen longer-term organic growth. •Federal Government Contracting – began career in Federal consulting with Price Waterhouse. Served as capture lead on complex systems-integration bids and subsequently led Federal Sales for IBM Business Consulting Services for three years, requiring deep understanding of Federal procurement processes and regulations related to pricing, bidding, and contracting.

|

| |

Bruce L. Caswell Age: 59 Director Since: 2018 Education: Masters, Public Policy, John F. Kennedy School of Government at Harvard University B.A., Economics, Haverford College More: Chairman of the Board, Northern Virginia Technology Council Board of Directors, Wolf Trap Foundation for the Performing Arts, a nonprofit organization Board of Directors, Professional Services Council (PSC) Board of Directors, Greater Washington Partnerships | |

| | | | | | | | |

| 24 | MAXIMUS 2025 PROXY STATEMENT | |

| | | | | | | | |

| | Career Snapshot: John J. Haley served as one of our directors from 2002 to January 2019 and then rejoined the Board in March 2020. In 2021, he was elected to serve as Chair of the Board. From 2016 until his retirement at the end of 2021, Mr. Haley served as the Chief Executive Officer of Willis Towers Watson, an insurance broker and human resources and employee benefits consulting firm formed through the merger of Willis Group Holdings Public Limited Company and Towers Watson & Co. From 2010 until 2016, Mr. Haley served as the Chief Executive Officer and Chair of the Board of Towers Watson & Co. Previously he served as President and Chief Executive Officer of Watson Wyatt Worldwide, Inc. from 1999 until its merger with Towers Perrin, Forster & Crosby, Inc. in 2010. Mr. Haley joined Watson Wyatt in 1977. Mr. Haley is a Fellow of the Society of Actuaries and is a co-author of Fundamentals of Private Pensions (University of Pennsylvania Press). Why he is valuable to Maximus: Mr. Haley’s qualifications and skills include his experience as the Chief Executive Officer and Chair of a large, global publicly-traded consulting firm together with his knowledge of finance and human resources matters as well as his public company directorship experience. Mr. Haley has been instrumental in listening to feedback from Maximus shareholders and embracing a forward-looking view on ESG matters. He has been a champion of the board refreshment strategy and provides valuable compensation and benefits expertise. •Additional CEO/CFO, Public Board, NEO Experience – CEO of Willis Towers Watson for 23 years. Chairman of the Board for Hudson Highland, a publicly traded company. •Financial Acumen – as CEO of Willis Towers Watson, has demonstrated expertise of overseeing $10B P&L, oversaw CFO and signed quarterly SEC certifications. •Mergers & Acquisitions – Responsible for several integral acquisitions which ultimately formed present-day Willis Towers Watson, including acquisitions of large firms in Germany and the Netherlands. •Human Resource Management - As CEO of Willis Towers Watson, led a world-wide organization of experts in the area of workforce management, employee experience, benefits administration, compensation strategy, and executive compensation. •Environment, Social, Governance: •E: Contributor to World Economic Forum with focus on climate resilient infrastructure. At Willis Towers Watson, spearheaded the Coalition for Climate Resilient Investment, which represents 34 companies with more than $5T in assets. Oversaw establishment of key ESG metrics. •S: Presented to United Nations on “Employment: The Autism Advantage” in 2021, working with organizations to recruit and train persons with autism. •G: Leverages experience from Willis Towers Watson to enhance governance programs, particularly with respect to Board and NEO compensation structures, driving focus on shareholder return and best practices. |

| |

John J. Haley Age: 75 Chair Since: 2021 Director Since: 2020 Committees: Compensation and Human Resources (Chair), Nominating and Governance, Technology Prior Tenure on Board of Directors: 2002 – 2019 Education: A.B., Rutgers University More: Director, Willis Towers Watson (until 2021) | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 25 |

| | | | | | | | |

| | Career Snapshot: Ms. Madsen is a Certified Public Accountant with over fifteen years of experience in global public company senior finance and operations roles, most recently as the Chief Financial Officer of West Corporation. West, rebranded Intrado, operates in 28 countries, serving Fortune 100 and other business clients with technology-based services, focused on communications, safety and health, and wellness. Ms. Madsen was responsible for global financial operations, including internal audit, public reporting, and treasury, managing over $4 billion in debt. She was also instrumental in significant strategic initiatives, including a secondary equity offering, debt, and tax restructuring, and taking the company private in a sale to Apollo in 2017. Prior to West, Ms. Madsen held various finance and operating roles at First Data Corporation, including segment chief financial officer and senior vice president of six sigma quality, earning her certifications in six sigma process improvement methodologies. Prior to First Data, she was a manager at an international public accounting firm. Ms. Madsen currently serves as the Executive Vice President of Creighton University, overseeing operations including finance, information technology, enterprise risk management ("ERM"), human resources, communications and marketing, facilities, internal audit, and continuous improvement. Why she is valuable to Maximus: Ms. Madsen brings finance, accounting, mergers and acquisitions, and operations expertise gained through her current and prior positions in higher education and international, publicly traded, technology-based, business services organizations. •Financial Acumen – Certified Public Accountant with over fifteen years of experience in global public company senior finance and operations roles, including CFO of West Corporation, segment CFO of First Data, and currently EVP of Creighton University. •Additional CEO/CFO, Public Board, NEO Experience – CFO of West Corporation (2014 – 2018, $3B revenue; $5B market cap). Executive Vice President of Creighton University. •Technology Modernization – At First Data, a company focused on selling technology platforms to financial institutions, gained experience in product development, innovation, and software development. Developed and led six sigma process improvement program for 5 years. At West Corporation, provided technology-enabled services to Fortune 500 customers for communications, marketing, and customer care services, and safety and security services (i.e.: 911 support) to state and local government customers. •Mergers & Acquisitions – In previous roles, led and contributed to multiple acquisitions, working directly with investment bankers. Most recently, at West Corporation completed $335M acquisition of Nasdaq’s digital media businesses in 2018 and took West Corporation private in 2017, a $5B transaction. Took First Data private in 2007, a $29B transaction. •Cybersecurity & Data Privacy – Holds NACD certification on Cyber-Risk Oversight. •Environmental, Social, Governance: In addition to completing NACD training on ESG Oversight: •E: At Creighton University, working with their Sustainability Committee to measure and reduce emissions of the University. Collaborating with fund managers to understand ESG ratings of University Endowment’s portfolio. •S: As EVP of Creighton University, where Inclusion is a strategic pillar, participates in or contributes to initiatives. |

| |

Jan D. Madsen Age: 61 Director Since: 2020 Committees: Audit (Chair), Technology Education: B.S.B.A., University of Nebraska – Lincoln More: Certified Public Accountant | |

| | | | | | | | |

| 26 | MAXIMUS 2025 PROXY STATEMENT | |

| | | | | | | | |

| | Career Snapshot: Mr. Montoni served as Senior Advisor to the Chief Executive Officer of Maximus from April 1, 2018 to September 30, 2019. He was the Company's Chief Executive Officer from 2006 to April 1, 2018. He also served as President from 2006 through 2014. Previously, Mr. Montoni served as our Chief Financial Officer and Treasurer from 2002 to 2006. Before his employment with Maximus, Mr. Montoni served as Chief Financial Officer and Executive Vice President for Managed Storage International, Inc. from 2000 to 2001. From 1996 to 2000, he was Chief Financial Officer and Executive Vice President for CIBER, Inc. where he also served as a director until 2002. Before joining CIBER, he was an audit partner with KPMG LLP, where he worked for nearly 20 years. Why he is valuable to Maximus: Mr. Montoni brings to Maximus audit and financial experience together with the detailed knowledge of the operations of the Company gained through his prior service as our Chief Executive Officer and other senior leadership positions at the Company. •Additional CEO/CFO, Public Board, NEO Experience – CFO of Managed Storage International (2000 – 2001), CFO of CIBER (1996 – 2000). •Financial Acumen – Various CFO roles at Managed Storage International, CIBER, and Maximus (2002-2006), and KPMG LLP audit partner. •Mergers & Acquisitions – As CEO of Maximus, led growth strategy into UK, Canada and Australia, largely executed through mergers and acquisitions. Oversaw Corporate Development team responsible for targeting acquisitions, due diligence, and working with bankers to execute. •Government Citizen Services, Business Process Services – As CFO and CEO of Maximus, oversaw divisions responsible for various business process outsourcing projects that carried out critical programs on behalf of Health and Human Services government agencies. |

| |

Richard A. Montoni Age: 73 Director Since: 2006 Vice Chair Since: 2018 Committees: Technology (Chair) Education: Masters, Accounting, Northeastern University B.S., Economics, Boston University | |

| | | | | | | | |

| MAXIMUS 2025 PROXY STATEMENT | 27 |

| | | | | | | | |

| | Career Snapshot: Ms. Rajan is the Senior Vice President of Data and AI Products at Adyen, a financial technology platform. Previously, Ms. Rajan was the Chief Product Officer at DriveWealth. Mas. Rajan spent more than 16 years at Google as Product VP and GM for Google Maps Platform, and in roles leading product development for Good Payments, Android, and Advertising. Prior to that, Ms. Rajan held engineering and product management roles at Air Products & Chemicals, The Vanguard Group, and Unilever. Why she is valuable to Maximus: Ms. Rajan brings to Maximus cutting-edge information technology expertise that has been used to build secure, scalable financial platforms and innovative consumer-centric products. •Technology Modernization – VP and General Manager of Google Maps Platform (2016-2022), including management of Enterprise P&L. As SVP of Product at Adyen, and previously Chief Product Officer at DriveWealth, oversees product development and go-to-market strategies. •Cybersecurity & Data Privacy – Product development roles include consideration for cyber risks and contribution to overall cybersecurity strategy. As a seasoned technology professional, stays relevant on cybersecurity topics and has the technical background to speak the cyber language effectively. •Additional CEO/CFO, Public Board, NEO Experience – Chief Product Officer, DriveWealth. •Mergers & Acquisitions – As VP and General Manager of Google Maps Platform, contributed to programmatic M&A process, with particular focus on due diligence.

|

| |

Gayathri Rajan Age: 57 Director Since: 2016 Committees: Technology, Nominating and Governance Education: MBA Stanford University, MSc Computer Science, University of Pennsylvania B.A. and M. Eng, Chemical Engineering, Cambridge University More: Commonwealth Scholar Arjay Miller Scholar at Stanford GSB Board Member, Shape Therapeutics, Inc. | |

| | | | | | | | |

| 28 | MAXIMUS 2025 PROXY STATEMENT | |

| | | | | | | | |