Exhibit 99.2

CORPORATE PARTICIPANTS

Lisa Miles MAXIM US - IR

David Walker MAXIMUS - CFO

Rich Montoni MAXIM US - CEO

Bruce Caswell MAXIM US - President and General Manager, Health Services

CONFERENCE CALL PARTICIPANTS

Charlie Strauzer CJS Securities - Analyst

Constantine Davides JMP Securities - Analyst

Brian Kinstlinger Sidoti & Company - Analyst

Frank Sparacino First Analysis - Analyst

PRESENTATION

Operator

Greetings and welcome to the MAXIMUS fiscal 2012 second quarter conference call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. (Operator Instructions)

As reminder, this conference is being recorded. It is now my pleasure to introduce your host, Lisa Miles, Vice President of Investor Relations forMAXIMUS.Thank you, Miss Miles, you may begin.

Lisa Miles - MAXIMUS - IR

Good morning. Thank you for joining us on today's conference call. I would like to point out that we have posted a presentation to our website under the investor relations page to assist you in following along with today's call.With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments we will open the call up for Q&A.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events and results may differ materially as a result of risks we face including those discussed in exhibit 99.1 of our SEC filings.We encourage you to review the summary of these risks in our most recent 10K filed with the SEC.The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I will turn the call over to Dave.

David Walker - MAXIMUS - CFO

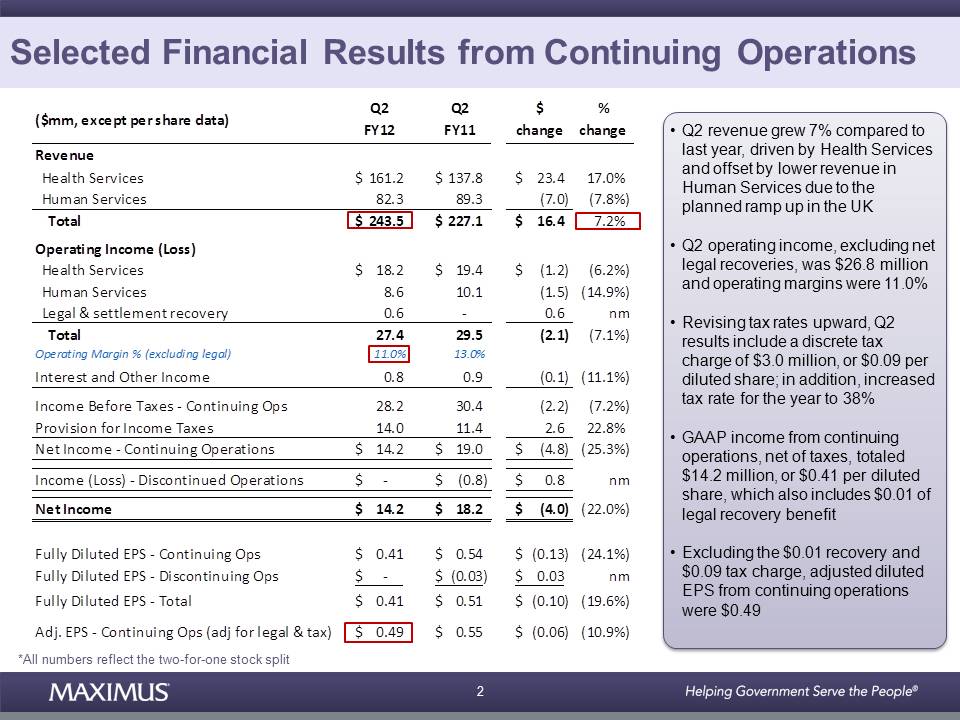

Thanks, Lisa. Good morning, everyone. Once again, MAXIMUS reported another solid quarter of financial results with revenue increasing 7% to $243.5 million compared to last year. Growth in the quarter was driven by the Health Services segment. This was offset by the anticipated lower revenue in the Human Services segment that resulted from the revenue ramp up on the Work Programme in the UK.

Operating income, excluding net legal recoveries, totaled $26.8 million in the second fiscal quarter with associated operating margins of 11%. As noted in this morning's press release we are revising our tax rate upward to account for a greater mix of business in higher tax rate jurisdictions. As part of this adjustment, second quarter results include a discrete tax charge of $3 million or $0.09 per diluted share related to higher state taxes incurred in prior periods. In addition to this tax true up, we increased our tax rate for the year to 38%.

2

As a result, second quarter GAAP income from continuing operations, net of taxes, totaled $14.2 million or $0.41 per diluted share. The $0.41 of earnings also includes a $0.01 benefit related to a legal insurance recovery. Excluding this $0.01 benefit and the $0.09 tax charge in the quarter, adjusted diluted earnings per share from continuing operations were $0.49. And as always, we've included a supplemental table in the PowerPoint presentation to help investors understand the quarter's highlights.The same table can also be found on the last page of this morning's press release.

Subsequent to quarter close, we completed the acquisition of PSI in an all cash transaction which Rich will cover in his prepared remarks.

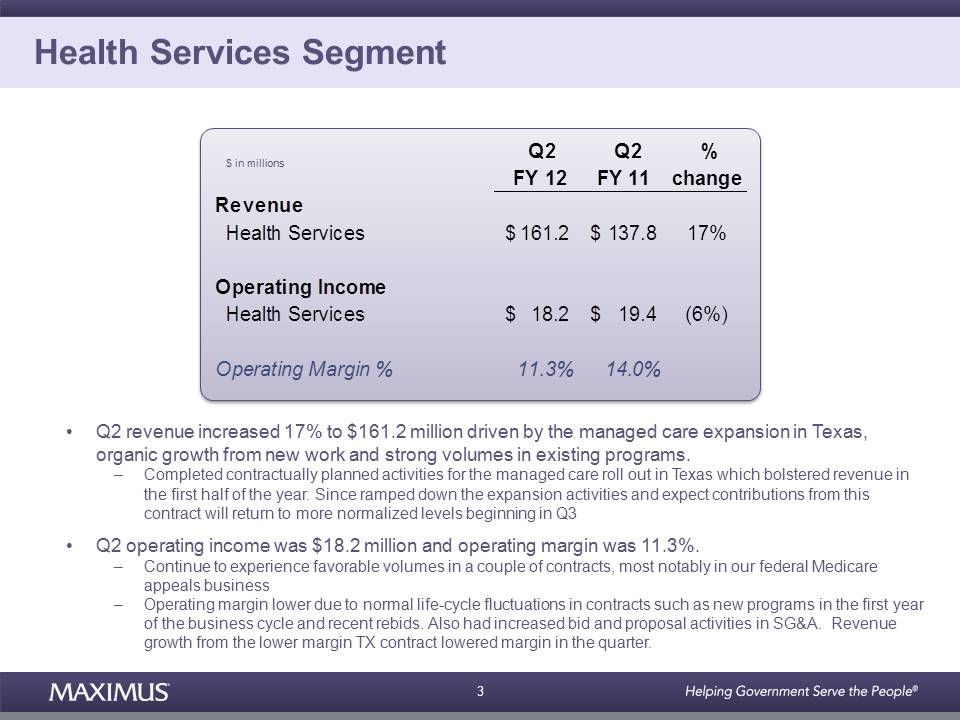

Let's turn our attention to results by segment.The Health Services segment delivered another good quarter with revenue growing 17% to $161.2 million compared to the same period last year driven by the managed care expansion in Texas.The segment also benefited from organic growth from new work and strong volumes in existing programs.

During the quarter we completed contractually planned activities for the managed care rollout in Texas which bolstered revenue in the first half of the year.We've since ramped down the managed care expansion activities and expect that contributions from this contract will return to more normalized levels beginning in the third quarter.

For the second quarter of fiscal 2012, operating income for the Health Services segments was $18.2 million with an operating margin of 11.3%.We continue to experience favorable volumes in a couple of contracts, most notably in our federal Medicare appeals business with increased volumes generated by the Recovery Audit Contractors, or RACs as they are more commonly known.

Operating margin was lower compared to the same period last year principally due to normal contract lifecycle.This would include new programs that are in the first year of the business cycle as well as some recently rebid contracts. During the quarter, we also had an increased amount of bid and proposal activities included in SG&A. And as we noted in the first fiscal quarter, the revenue expansion from the lower margin Texas contract dampened the operating margin in the quarter.

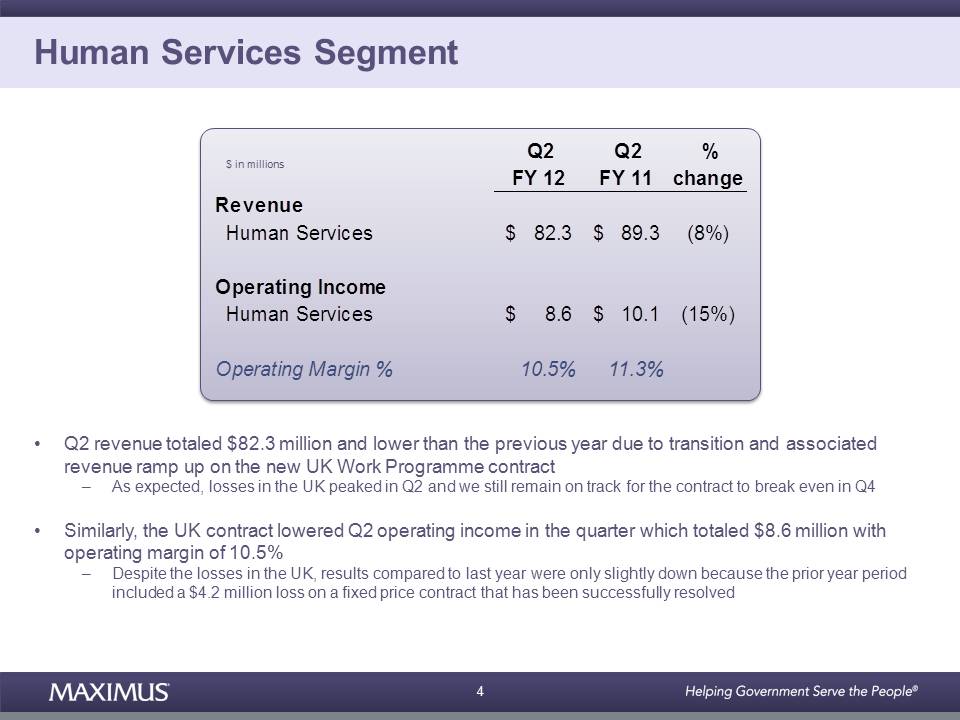

Turning to Human Services, the segment performed in line with our expectations. Second quarter revenue for the Human Services segment totaled $82.3 million and was lower compared to last year as we transitioned to the United Kingdom Work Programme contract. Similarly, the UK contract lowered operating income in the quarter which totaled $8.6 million with a margin of 10.5%. Despite the losses on the UK Work Programme in the current quarter, results were only slightly down compared to the same quarter last year. This is because last year's results included a loss of $4.2 million on a fixed price contract that has since been successfully resolved.

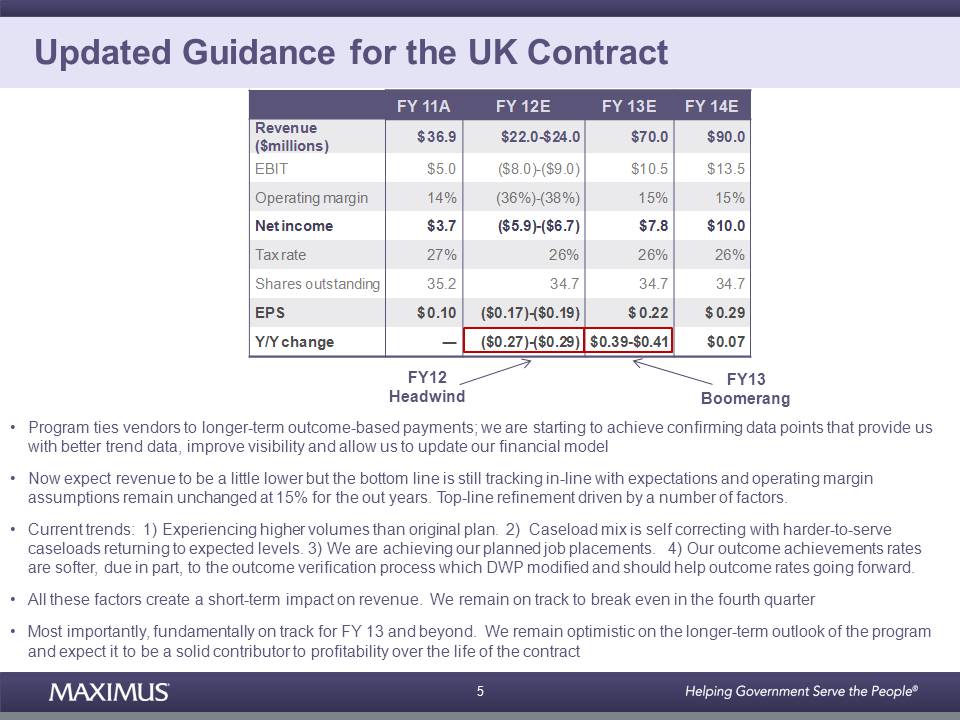

Consistent with our prior guidance, the losses in the UK peaked in the second fiscal quarter and we still remain on track for the contract to breakeven in the fourth quarter. As a reminder, the nature of the program ties vendors to longer term outcome based payments. As we've gained experience on the program, we've started to achieve confirming data points that provide us with better trend data, improve our overall visibility, and allow us to update our financial model.

Based on this data, we expect that revenues will be lower than our previous forecast, but the bottom line is still tracking in line with our original expectations.We now expect fiscal year '12 revenue from this contract to come in between $22 million and $24 million versus our prior estimate of $30 million.We are tweaking our fiscal year '13 and fiscal year '14 revenue down by only $5 million and now expect revenue of $70 million and $90 million respectively. Our operating margin assumptions remain unchanged at 15% for these out years.

The top line refinement is driven by a number of factors, so let me walk you through exactly what we're seeing. First, as we mentioned last quarter, overall volumes are coming in higher than our original expectations. In addition, we're starting to see the caseload mix self correct with volumes from the harder to serve cases picking up in the last few months and returning to levels that we anticipated in our original plan.

The number of placements we're achieving, or the number of people we actually find a job for, are tracking as planned. The achievement of outcomes, or those people that remain in the job for a specified period of time, typically 26 weeks or 13 weeks, are tracking a little softer than expected. Part of this softness is related to the outcome verification process which the Department of Work and Pensions modified at the end of March. This modification should help our outcome achievement rates going forward. So when you add it all up, these factors create a short term impact on revenue in fiscal '12 because of how revenue ramps over time.

3

We have also closely managed costs so we are now expecting a loss in the range of $8 million to $9 million and remain on track to breakeven in the fourth quarter. But most importantly, we still believe that we're fundamentally on target for fiscal year '13 and beyond and we remain optimistic on the longer term outlook of the program.We firmly believe that the economics remain sound and we still expect the program to be a solid contributor to profitability over the life of the contract.

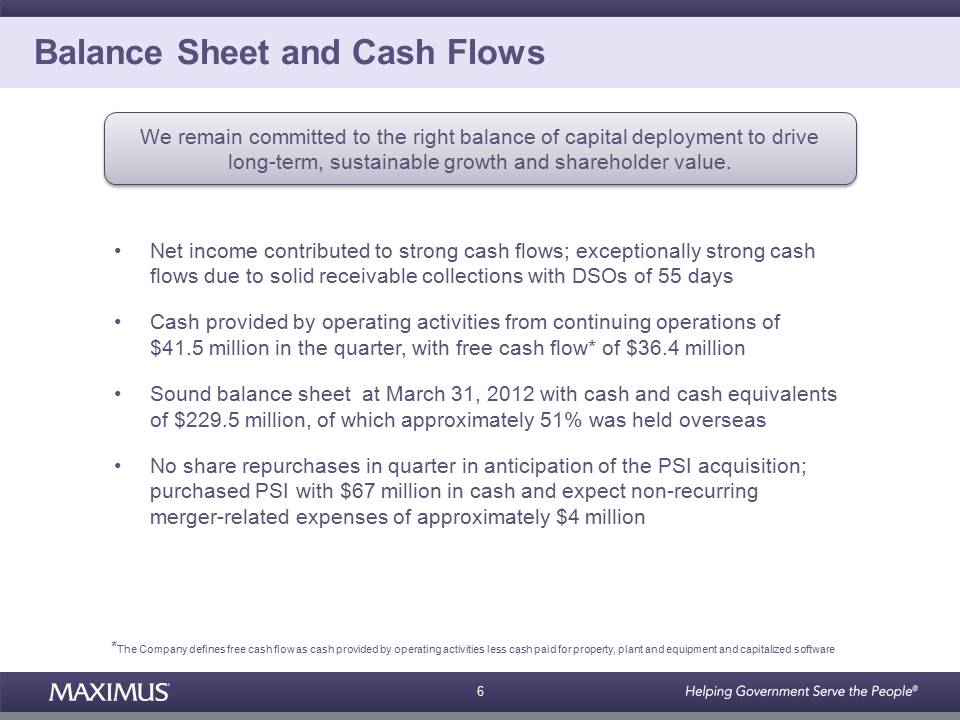

Moving onto cash flow and balance sheet items, net income in the quarter contributed to another quarter of strong cash flows. Cash flow in the fiscal second quarter was exceptional strong driven most notably by solid receivable collections and favorable DSOs of 55 days. Cash provided by operating activities from continuing operations totaled $41.5 million for the second quarter with free cash flow of $36.4 million. Our balance sheet remains sound and at March 31st we had $229.5 million in cash and cash equivalents of which approximately 51% was held overseas.

During the quarter we did not repurchase any shares in anticipation of the PSI acquisition.We purchased PSI with $67 million in cash and we also expect nonrecurring merger related expenses of approximately $4 million.

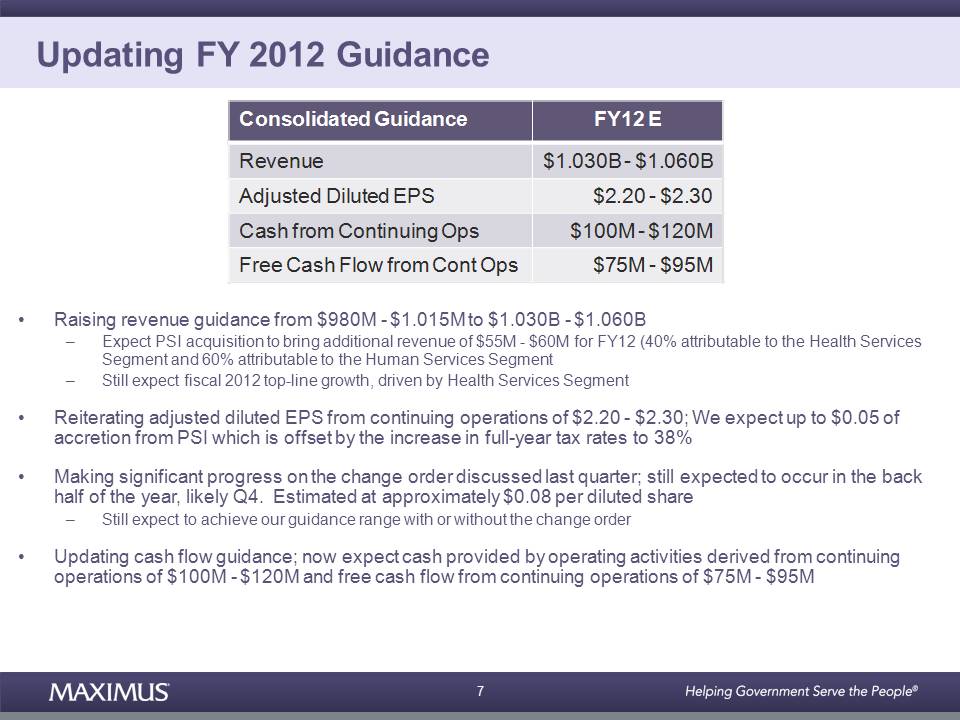

Before I hand the call over to Rich, I'll wrap up with guidance. For fiscal 2012 we are updating our guidance to include the acquisition of PSI for the five months from May 1st through September 30th. For fiscal 2012, we expect PSI to generate revenue in the range of $55 million to $60 million, of which approximately 40% will be attributable to the Health segment and the remaining 60% will be attributable to the Human Services segment. As a result, we now expect total company revenue to range between $1.03 billion and $1.06 billion, up from our prior estimate of $980 million to $1.015 billion.

We are maintaining our earnings estimates for fiscal 2012 and still expect adjusted diluted earnings per share from continuing operations to range between $2.20 and $2.30, which excludes nonrecurring acquisition related charges, legal recovery benefits and the discrete tax charge taken in second quarter.We expect that the acquisition of PSI will provide up to $0.05 of accretion which is offset by the increase in our full year tax rate to 38%.

We also wanted to update you on the status of the change order that we discussed on our last earnings call.We are making significant progress as we continue to work collaboratively with the client on the overall scope of the modification.We still expect the modification to be approximately $0.08 per share and to be completed in the back half of the year, and more specifically, in the fourth quarter. Furthermore, we still expect to achieve our guidance range with or without the change order. But depending on the nature, extent and amount of the change order, it could provide some upside to the top of our forecasted range.

We are also updating our cash flow guidance.We now expect cash provided by operating activities derived from continuing operations to be in the range of $100 million to $120 million. And we expect free cash flow from continuing operations to be in the range of $75 million to $95 million.

And with that, I will turn the call over to Rich.

Rich Montoni - MAXIMUS - CEO

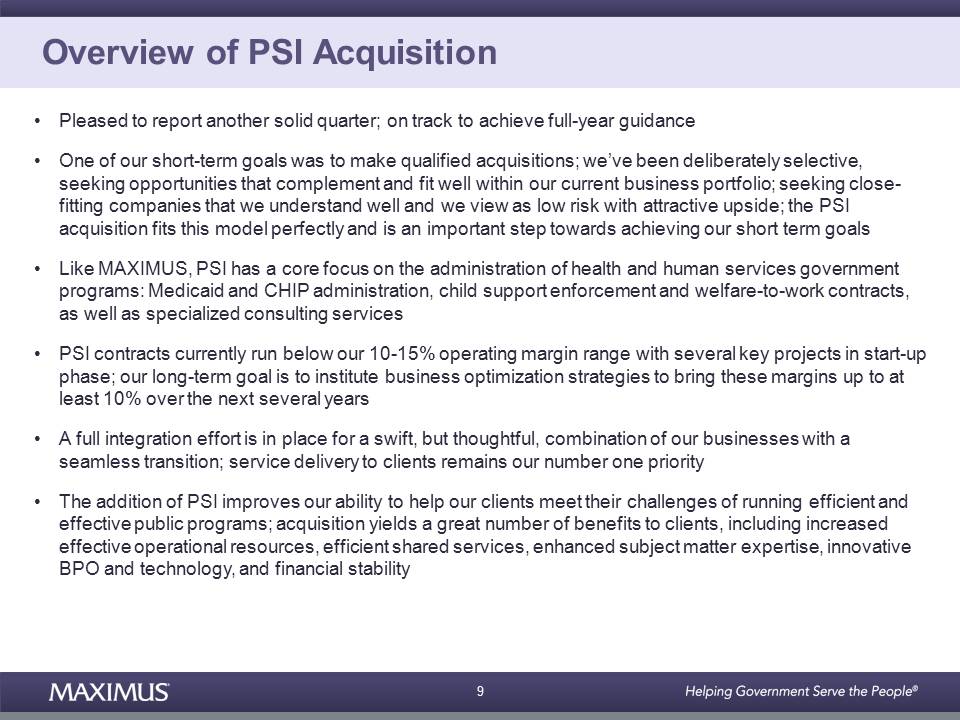

Thanks, David. Good morning everyone.We're pleased to report another solid quarter which keeps us on track to achieve our full year guidance.

On Tuesday, MAXIMUS completed the purchase of PSI, so I'd like to begin with the specifics surrounding the acquisition. One of the ways that MAXIMUS drives long term shareholder value is to use our excess cash in a variety of ways including strategic acquisitions. At the end of last fiscal year, we stated one of our short term goals was to make qualified acquisitions.We've been deliberatively selective with our acquisition activity, seeking opportunities that compliment and fit well within our current business portfolio.

We are seeking close fitting companies that we understand well and that we view as low risk with attractive upside. The completion of the PSI acquisition on April 30th fits this model perfectly and is an important step towards achieving our short term goals. Like MAXIMUS, PSI has a core focus on the administration of government health and human services programs. The PSI portfolio includes Medicaid and CHIP administration, child support enforcement, and welfare to work contracts, as well as specialized consulting services. Many of these contracts allow us to grow our market share and cultivate new client relationships.

4

As we blend the PSI contracts into our business, it's important to note that these contracts currently run below our 10% to 15% operating margin range. This is due in part to several key projects that are in startup phase. Our long term goal is to institute many of the same business optimization strategies that we put into place six years ago at MAXIMUS.We are confident that we can bring these margins up to at least 10% over the next several years.

A full integration effort is underway and our goal is to achieve a swift but thoughtful combination of our businesses.We expect a smooth and seamless integration and the MAXIMUS/PSI team is already implementing a detailed integration plan covering all business areas. Throughout the transition period, we are maintaining a laser sharp focus on service delivery for our clients. This remains our number one priority.

The strategy behind the acquisition centers on the services we provide to our government clients. The addition of PSI improves our ability to help our clients meet their challenges of running efficient and effective public programs.The combined organization yields a great number of benefits to the clients of both firms. These benefits include increased operational resources, efficient shared services, enhanced subject matter expertise, innovative BPO and technology, and financial stability.

A high degree of overlap exists between the operations of MAXIMUS and PSI, making this acquisition a natural fit.We are excited to blend the PSI contracts into our domestic Health and Human Services portfolio and I'd like to take a moment to walk you through the benefits of the acquisition by segment.We've included several slides in today's presentation that give you a high level overview of the enhanced portfolio and the market share landscape.

Starting with health services, PSI brings 7 Medicaid and CHIP contracts including those with marquee CHIP clients such as Georgia and Florida. With the addition of PSI's health portfolio, MAXIMUS serves an additional 2 million CHIP and Medicaid beneficiaries. MAXIMUS has a long term history of effectively serving many states. In particular, larger tier one states with complex programs in diverse beneficiary populations.With the addition of PSI, we gain several additional tier one clients including Georgia and Florida. In addition to longstanding and excellent client relationships, PSI has developed innovative approaches to meeting the unique policy and program requirements in the states they serve.

The combination of MAXIMUS and PSI offers a broad range of capabilities, both technical and operational, and additional economies of scale to meet the diverse needs of our clients better. As health reform continues to develop and states plan the rollout of their health insurance exchanges, MAXIMUS and PSI together offer additional options and long term stability for existing clients while bringing together two highly experienced and innovative firms to address the needs of state clients and the federal government.

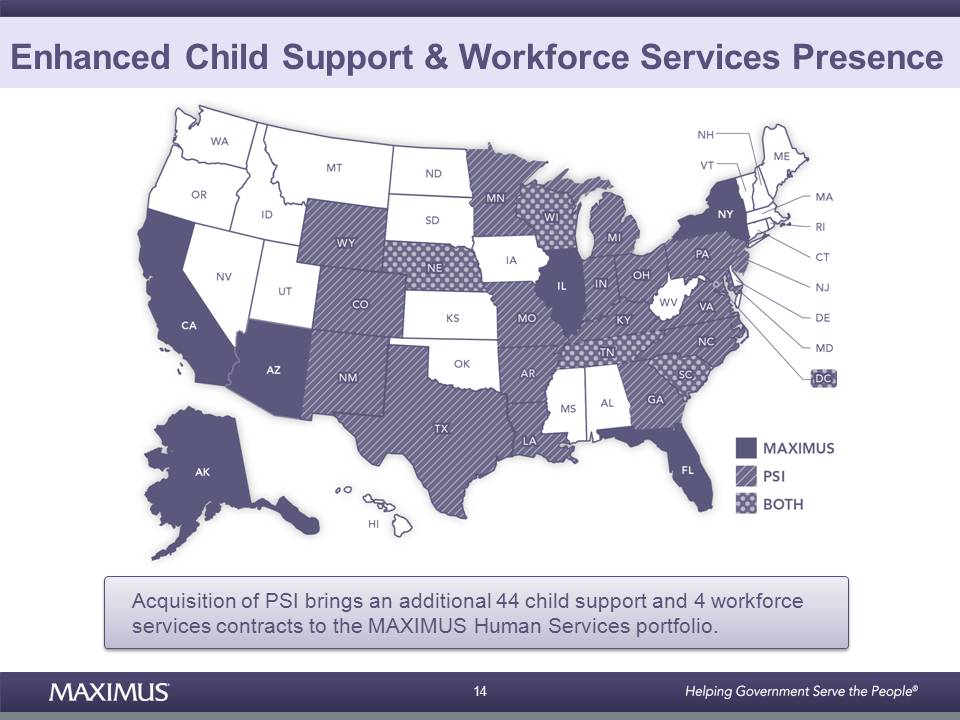

On the Human Services side, the acquisition adds new Welfare to Work and consulting contracts and meaningfully grows our market share in child support. PSI provides additional qualifications that now open up entirely new adjacent child support markets where MAXIMUS has historically not been a meaningful player. PSI brings a long history of success in the child support market with extensive experience and industry leading best practices.

PSI also offers more operational resources to tackle the increasing demand in filling gaps where we may have been resource constrained in the past. And as market demand for our services continues to increase, the acquisition brings more resources to bear as we grow the business and capitalize on new Health and Human Services opportunities both here in the US and abroad. We're really excited about the breadth and depth of experience and innovation that PSI employees bring to MAXIMUS. We share a common commitment of serving our government partners and ultimately improving the lives of citizens around the world. So we're pleased to wrap up the acquisition and welcome the PSI employees to the MAXIMUS team.

Now turning to healthcare reform in the US. The implementation of ACA continues to be a pressing concern for states of all sizes in the different phases of reform.We recognize that some states are waiting to see if the Supreme Court decision impacts the healthcare reform law. And while we can't speculate on this decision, we have completed a thorough analysis of our strategy under the various potential outcomes.

As we've mentioned before, one of the variations of health reform is a gradual ramp up of the establishment of exchanges on a state by state basis. An April 17th Reuters piece noted that some states are moving ahead with reform regardless of whether the Supreme Court overturns pieces of ACA or the entire law. To date, 16 states and the District of Columbia have legislation or executive orders directing the implementation of ACA. These states, along with other states that have the political support for the law's goals, will continue pursuing some level of reform. And many are looking at the viability and sustainability of different models in the event that ACA is overturned.

5

Regardless of the direction or speed of reform, the underlying fundamental social challenges won't go away just because the law is changed or modified. Individuals who aren't eligible for public programs or don't have access to employer sponsored coverage are simply more likely to turn to emergency rooms as their primary source of medical treatment. Underserved and uninsured populations still must be connected to coverage that best meets their individual needs.To accomplish this goal, states will need to retain cost effective solutions from partners who are independent and free from any conflict of interest.

In the meantime, the health insurance exchange procurement marketplace is rolling out just as we anticipated with the additional focus on technology bids designed for system integrators.While MAXIMUS is not a system integrator, we are selectively participating in these initial bids and that's in a subcontractor role. For us, these initial bids are more of a toe in the water opportunity.We view them as tactical presence to maintain an awareness as the HIX market continues to progress.

Once the technology is built out, the operational focus will shift to the BPO and healthcare consumer engagement and service.These administrative functions are right in the sweet spot for MAXIMUS and we look forward to applying our experience, independence and best practices for Medicaid and CHIP to help insurance exchanges.

Moving on to an update on our international activities in the UK, our Work Programme operations are up and running and that's at full speed and they remain fundamentally on track. As David noted, we still expect to break even in the fourth quarter of fiscal '12.The lower revenue forecast for the year is balanced by the recent process modifications implemented by the Department of Work and Pensions.These modifications are expected to improve the outcome verification process going forward. As we've talked about historically, we run these programs with a large portion of [varied] costs which allows us to efficiently and effectively manage resources to achieve our bottom line results.

Much like under the previous flexible new deal program, the UK government plans to publish performance outcomes for work program vendors. These results are expected in the fall, but the UK Employment Minister has stated he anticipates the results could lead to a shakeout in the supply chain of vendors.We believe our performance has been strong relative to the pack and we believe we are well on the way to making this a successful project.

We also have great news to share from Australia today.We recently signed a three-year, $450 million expansion to our job services Australia contract. As a result of our exceptional performance as publicized in the star rating, we picked up some additional work in Ipswich, South Brisbane, and Western Downs through the reallocation process.This new work increases our national caseload by approximately 3%.

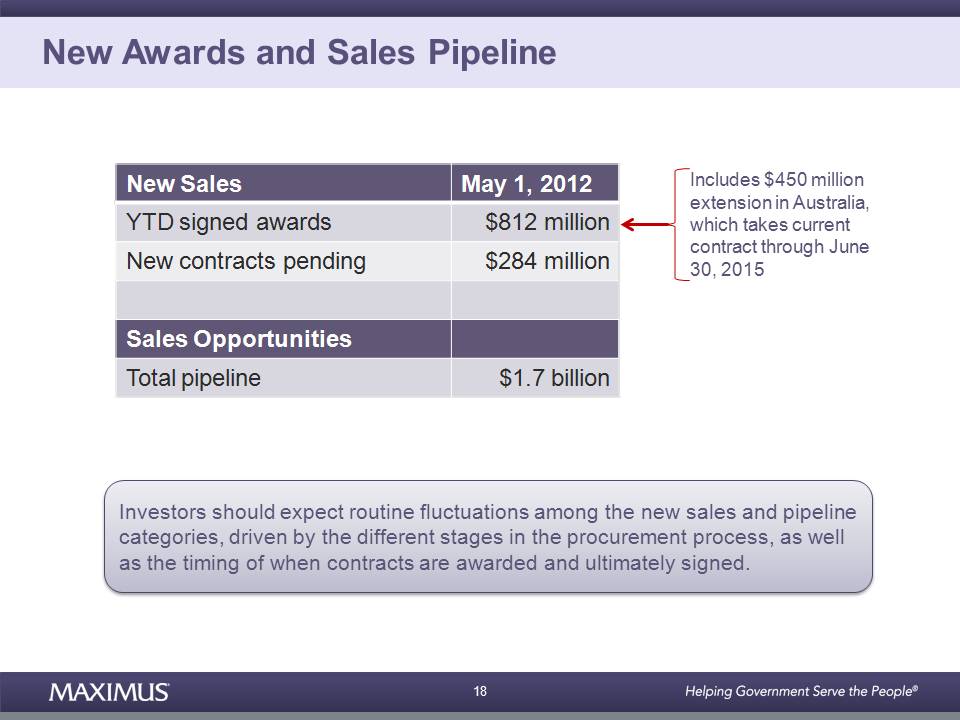

Moving onto new awards in the sales pipeline, as a reminder, fiscal '12 continues to be fairly light rebids compared to fiscal 'l1 which had several large rebid awards. At April 25th, our fiscal year to date signed contract wins totaled $812 million which includes the Australia contract extension. New contracts pending are those that are awarded but unsigned, totaled $284 million. Our pipeline of sales opportunities at April 25th remains strong at $1.7 billion. And as a reminder, investors should expect routine fluctuations between the pipeline and the new sales categories. These shifts are driven by the different stages in the procurement process as well as the timing of when contracts are awarded and ultimately signed.

In summary, we continue to make solid progress on our short term goals.We are successfully ramping up operations in the UK and remain on track to achieve breakeven status in the fourth quarter.We continue to move forward with our business development plans for winning our fair share of healthcare reform contracts.We have completed the strategic acquisition of PSI, a growth platform that will help us drive long term value for our shareholders.We view the acquisition as a prudent use of cash as we drive growth in our core markets.

Moving forward, we intend to employ the same fundamental principles of cash deployment which include investing in business development and growth prospects across all our markets including organic and through acquisition, continuing our quarterly cash dividend strategy, and finally, executing on our share buybacks in an opportunistic fashion. But most importantly, the team remains committed to growing the business and delivering long term shareholder value.

6

And with that, let's open it up for questions. Operator?

QUESTIONS AND ANSWERS

Operator

(Operator Instructions). Charlie Strauzer, CJS Securities.

Charlie Strauzer - CJS Securities - Analyst

Good morning. Rich, if you could, give us a little bit more color on the PSI acquisition and how you expect the year to kind of unfold with the addition of that from a revenue and earnings perspective?

Rich Montoni - MAXIMUS - CEO

Good morning, Charlie, I'd be pleased to do that. Let me take it this way. Let me put some data out there as it relates to PSI.We expect that this year it's going to contribute I think the midpoint is $57 million in revenue. And keep in mind that's for 5 months as the acquisition was completed on May 1st.

So when we take PSI and consider the fact that it has lower margins, it's about 60% into our Human Services segment, 40% into our health segment, the way we see the rest of the year unfolding is as follows. On a consolidated basis from a top line perspective, we expect that our Health Services segment, we expect the full year revenue growth will be driven principally in the entire corporation by Health Services plus PSI. And as we discussed I think last quarter, the Health Services, its organic revenue is expected to be stronger in the first half of the year and this is due to a spike that we're getting from the expansion in Texas. Organically for the Health Services segment, we expect that's going to come down in the back half of the year. But when you put PSI into the mix, that will bolster Q4 by an anticipated $8 million. So we see overall with PSI the Health segment being relatively consistent in Q3 with a bolster in Q4.That Q4 relates to the change order we anticipate to receive, that's order of magnitude $8 million. So that's the story with the Health Services segment with PSI.

As it relates to the Human Services side, organically, excluding PSI, that segment's revenue for fiscal '12 is expected to be relatively flat compared to '11 with quarterly revenue lower in the first half of the year. And that's really a result of the start up in the UK and we expect that that's going to ramp back up in the second half of the year.When we put PSI into the mix on the Human Services side, we see a significant increase in Q3 and Q4 for its revenue.

And again, to emphasize, that change order we expect in the fourth quarter, when we add all that together, we end up with our guidance range to be $2.20 to $2.30 which is the same as the prior EPS adjusted earnings per share.

Charlie Strauzer - CJS Securities - Analyst

Excellent, and just one quick follow up, Rich, if I could. Just when you talk about ACA and the Supreme Court is obviously reviewing that, remind us again if say ACA is repealed or done away with and has to kind of go back to the drawing board, I know there's a lot of states saying that the health exchanges are still going to move forward.What is the states' kind of thinking there? Why would they move forward with those if ACA is not in place? Just remind us again there.

7

Rich Montoni - MAXIMUS - CEO

Charlie, that's a great question. As you can imagine we are day in and day out very, very much involved in the details at the state level as it relates to it. I'm going to make a fundamental commentary and then I'm going to as Bruce Caswell who is in charge of this line of business for us and is very much involved in it. But fundamentally what I think is going on is the Supreme Court, they will go through their deliberations from a legal perspective, but it's very important to remind ourselves that what we're trying to deal with here is a very, very large social challenge. There are millions of people out there who otherwise don't have healthcare, need healthcare. And there's another interesting trend that's very much playing into it and that's the number of employers who -- the decreasing number of employers who are not offering -- I'm sorry, a decreasing number of employers offering healthcare to their employees. So there are more individuals, even employed individuals, who are not receiving healthcare from their employer.That adds an additional pressure to these government health plans. So we've got a very large social problem.The states have to tackle it regardless of the Supreme Court deliberations. And Bruce, why don't you talk a little bit about what you're seeing at the state level in the marketplace here?

Bruce Caswell - MAXIMUS - President and General Manager, Health Services

Sure. Thanks, Rich, and good morning. The -- as Rich mentioned, the dynamics have been in place for some time and really in a sense have not changed the underlying social drivers. And many states, as you're well aware, had started to address this issue even prior to the creation of the act by looking at their insurance markets, addressing potential reforms, and looking at ways to increase and broaden coverage for their populations. It's important to note that there are a total of 24 states that have either signed legislation, have a workaround in place through an executive order or similar, or have a live bill for exchanges. So that really is nearly 50% of the country where there is broad I'd call it legislative support in order to enact these types of reforms around an exchange concept. And the fundamental principle of a more transparent market and efficient market and consumer choice driven market is sustained. That's bolstered by the availability of federal money that is flowing into these states that they don't need to give back through the establishment grant process. So there's an infrastructure being built and there is some political weld in legislative progress that I think is sustainable going forward.

Rich Montoni - MAXIMUS - CEO

Next question, please?

Operator

Constantine Davides, JMP Securities.

Constantine Davides - JMP Securities - Analyst

Thanks. Good morning. I guess first, just on the UK, can you talk a little bit more about what the process modifications are there in terms of the outcomes verification? And why is this sort of a depressing effect on revenue but yet you call out that it's going to be a positive driver of outcomes going forward?

Rich Montoni - MAXIMUS - CEO

Good morning, Constantine. I'd be pleased to answer your question. And as we get into the UK discussion, I think it's important to understand the basis for the revision. And I'll get to your detail question in a moment, Constantine, but what's happening here is, for this relatively new program, every quarter we have more experience, we become more confident in our model.We've refined the model based on real experience to date, real data. I am pleased to say that the frontend drivers are proving out actually a bit more favorable.We talk about them being volumes, more favorable mix shift, I think last time we talked we were seeing a mix shift towards the easier population to serve.That seems to be righting itself and coming back to what we initially expected. Placements are on track. It's the outcomes that have been a bit softer and in part that has been a function of the verification process.

8

As we go through this, in order to be entitled to an outcome payment, we have to verify that we in fact placed that individual and that individual reached the outcome payment point, which depending upon the type of individual, might be 13 weeks or 26 weeks.

The process that the government has had in place basically hung up some of these individuals in the verification process. And it's a meaningful number.The government has since remedied that situation to facilitate clearing the backlog in the short term and then remedying the process on a go forward basis. In particular, the prior model had called for a government verification of the ongoing employment achieving the employment hurdle. They've modified that to allow -- and previously they also required us to verify it with the employee. Now they're allowing us to verify it with the employer which as you can imagine is easier to do than contacting the employee in some cases.

Constantine Davides - JMP Securities - Analyst

Okay, thanks, that's helpful. And maybe just piggybacking on the UK, the DWP posted some awards on the health assessment side and I'm wondering if -- I don't want to jump the gun here, but wondering if you can talk a little bit about the opportunity there because it looks like you guys picked up a few lots.

Bruce Caswell - MAXIMUS - President and General Manager, Health Services

Which specific -- this is Bruce Caswell.Which specific awards are you referencing?

Constantine Davides - JMP Securities - Analyst

The health and disability framework.

Bruce Caswell - MAXIMUS - President and General Manager, Health Services

Indeed. And again, like the Work Programme, this was just a framework award, so this gives you the ability to then compete for the specific regions in which you've earned that privilege. So we're excited about that having passed through that qualification process and we're evaluating that opportunity and potential to partner in that area going forward. So it's an important first step and I think it's a good validation of the capabilities of the firm in that adjacent market.

Rich Montoni - MAXIMUS - CEO

But to be clear, it's a framework award as opposed to a specific award or contract award, so there's really no revenue associated with it at this point in time.

Constantine Davides - JMP Securities - Analyst

Got it. And then lastly, just one for Dave. On the tax issue, can you just tell us when that came to your attention? And should we be modeling 38% as kind of the 3Q/4Q tax rate?

9

David Walker - MAXIMUS - CFO

Yes. This relates to state taxes and we recently this quarter completed our corporate tax return, so a normal part of the process is to review the prior year estimates related to taxes. So the largest portion of this $0.09 relates to fiscal '11 and it's a true up that' done when the tax return gets completed which, again, happened this quarter.We treat it as a discrete charge, and to accountants that means we're booking it so it doesn't confuse what is a normalized provision. So the normalized provision which shows the higher impact for fiscal '12 of the state rate is 38%. So the full year actually retroactive and going forward is 38% and this $0.09 is one-time charge which kind of takes the difference in expenses of this quarter. And if you kind of look, if you were modeling out past fiscal '12, it's important to point out that the UK which had a los this year and is a lower tax rate, actually hurts us because you have a loss so you get less tax benefit. So if you were thinking about it beyond '12, 37% is a more appropriate rate.

Rich Montoni - MAXIMUS - CEO

And Constantine, to answer your question, I think Dave may have answered it, but this came to our attention this quarter.

Constantine Davides - JMP Securities - Analyst

Okay, thanks.

Operator

Brian Kinstlinger, Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

The first question I have, and I joined late so sorry if you mentioned it, but I just heard the answer how the outcomes, basically some of them may have been missed between the verification. Are you able to recoup that once they realize and you're able to give them verification of when the payments were due?

Rich Montoni - MAXIMUS - CEO

Brian, indeed we are.We have a number that are in the queue subject to verification. Realistically, I think a good percentage of them will be deemed to be verified and naturally we would get the benefit of that.

Brian Kinstlinger - Sidoti & Company - Analyst

And then on the discussion on the UK shakeout of vendors, how do you -- in light of how the original competition went based on pricing, how do you think that the DWP weighs price versus market share going forward?

Rich Montoni - MAXIMUS - CEO

That's a great question. I think it's a question that many governments will be facing in the future, how do they balance the right point on curve in terms of the benefits and costs. And I think many are going to find that the benefit to the government is not maximized when they choose the lowest price.They will receive fewer placements, they will receive -- they will receive service that will not be as efficient, that will not be as effective as the government would like. So I think clearly I would expect that the UK government is taking a hard look at that and perhaps they will adjust their weightings as we go forward.

10

Brian Kinstlinger - Sidoti & Company - Analyst

And if I could ask one more question, seeing how the outcomes based contract has been working out and in light of the pipeline of several countries looking at changing their Welfare to Work programs that you've discussed in the past, are you prepared to take on more outcomes based pricing right now? And is that how you think the market is going to go forward on new contracts?

Rich Montoni - MAXIMUS - CEO

I think it's going to be a blend.We will entertain, on an opportunity by opportunity basis, new work. I expect there will be some that we will feel comfortable moving forward. I expect there will be some where we will not move forward. So we'll be selective. If we think it's an opportunity we feel comfortable we can deliver the results based upon the terms and conditions, we would move forward. But it's not a categorical yes to all opportunities. It would have to depend upon the facts and circumstances.

Brian Kinstlinger - Sidoti & Company - Analyst

Great, thanks.

Operator

Frank Sparacino, First Analysis.

Frank Sparacino - First Analysis - Analyst

Hi, guys. I just want to be clear on the UK, the revision for 2012. I understand the comments made around the outcome as being temporary, so there obviously had to be something from a permanent standpoint that forced a reduction. It's just not clear to me what that exactly is.

Rich Montoni - MAXIMUS - CEO

Good morning, Frank. Let me try to talk about this. Again, when we first estimated the revenue and costs and operating income, this program was yet to be launched. And as it launches, we go through and collect actual data. And when you study this program, you're going to find that the drivers to revenue and to ultimate operating income are the volumes that we receive, the mix of the cases that we receive, the percentage of those cases that we actually place, the percentage of those placements that actually get to the initial outcome payment, it's either 13 weeks or 26 weeks, and then the percentage of those individuals, once they're placed in a job, what percentage remain in that job by week for up to a number of months.

So the formula is fairly complex. It's based upon a number of interrelated variables. So every month as we've progressed and we learn actual experience, we've changed the model accordingly. So the primary answer is that we simply received direct data to modify the model. And as a result, when we study those individual variables, we have favorable variances on the volume side, on the mix side, on the placement side. It's the outcomes that we've modified, or we've taken down our assumption as it relates to what percentage of those individuals will actually hit the outcome phase. So it's a minor tweak.What that does, Frank, it actually just takes some revenue and pushes it to the right and it brings revenue a little bit down in each of the periods that we've been forecasting.

Frank Sparacino - First Analysis - Analyst

Okay, thank you. And then just a follow-up. Obviously there was quite a bit of news in the first quarter as it relates to the Work Programme and I'm curious if you've seen any impact or fallout in terms of closer scrutiny of the program or any potential hurdles or roadblocks as a result of that.

11

I think that there's been a fair amount of press in the United Kingdom and there's been one firm in particular that's received an awful lot of negative attention. I do think categorically that programs like this will always be under the watcheye. Government programs do get an incredible amount of scrutiny in part because we're spending public funds and also in part because oftentimes it's at the intersection of political differences.

So these programs do get a lot of attention and as a result it's very important for anybody operating in this space to pay attention to their billing integrity, to put forth really best efforts, best practices in terms of the integrity of the bills that are submitted to the government. And whenever a firm slips up, and it's inevitable there will be isolated instances, so it's a matter of having a good, solid billing integrity program, which MAXIMUS does, but those that don't are subject to criticism. And it's important that to the industry as a whole, that it's isolated and it doesn't become an industry problem. At that point it could jeopardize an entire program. But I don't think we're there. I think in this particular case the department is very comfortable with the performance of certain vendors including MAXIMUS and I think the department as well as MAXIMUS remains very, very much committed to the success of the program. It's really intended to address head on a very important social issue and fiscal issue that they're trying to deal with.

Frank Sparacino - First Analysis - Analyst

Great, thank you, guys.

Operator

(Operator Instructions). Constantine Davides, JMP Securities

Constantine Davides - JMP Securities - Analyst

Thanks. One quick one on PSI.You called out $4 million of I guess integration expenses. Is that contemplated in the $2.20 to $2.30 EPS guidance or is it excluded? And I guess is that a 3Q event or is it spread evenly across the next couple of quarters?

David Walker - MAXIMUS - CFO

It's excluded and it will largely be in Q3, a little bit coming into Q4.

Constantine Davides - JMP Securities - Analyst

Thanks, Dave.

Rich Montoni - MAXIMUS - CEO

Next question, please.

Operator

(Operator Instructions). Brian Kinstlinger, Sidoti & Company.

12

Brian Kinstlinger - Sidoti & Company - Analyst

Great, thanks. Just one question. In the first half of the year, we've seen the shift towards managed care with Texas helping your earnings and revenue. I'm curious, is there any particular state right now out there that is about to go through a similar process that will help drive incremental revenue and earnings to that -- maybe not to that degree given the stage of them, but are going through something that's going to temporarily spike your earnings?

Rich Montoni - MAXIMUS - CEO

Bruce Caswell, would you respond to that please?

Bruce Caswell - MAXIMUS - President and General Manager, Health Services

Happy to. Yes, we continue to see this trend in the marketplace as we have indicated, that we expect to continue really though 2013. States are moving populations that historically you might not have even considered eligible for managed care, into these programs.Without mentioning any specific states, there are activities really across the country including some states where MAXIMUS is not a current provider that are seeking to shift populations for example from primary care case management models into full capitated risk based managed care models. So we see it as creating strong market opportunity not just within our current client base, but beyond.

Operator

Frank Sparacino.

Frank Sparacino - First Analysis - Analyst

Hi, guys, just wanted to follow up on the Australia rebid. I'm curious as it relates to pricing on that contract relative to what you experienced the prior time around.Then also just from a competitive standpoint what that process was like.

Rich Montoni - MAXIMUS - CEO

I'm very, very pleased to answer that question because it's a very significant highlight to not only the quarter but to the year. This is our largest contract I believe and this one, Frank, the Australian government is very interesting in terms of how they go to market here. And it speaks to the earlier question about governments' bidding price and whether or not we would move forward. This particular government I think has a great model. They don't bid price. They simply say to the vendors, this is the price that we will pay. They have determined what's the optimal price for them to maximize their situation. So you don't bid price, you bid qualifications. And they hold your feet to the fire in terms of getting the results done.

This particular case was not a rebid. It basically went and extended the contract of current providers who were performing at a three-star or better rating.They have a four-star rating -- I'm sorry, a five-star rating process that rates the performance of the individual vendors. So they just automatically extended those who were three stars or better which is even better than a rebid situation. Next question?

Operator

It appears we have no further questions at this time. This concludes today's teleconference. You may now disconnect your lines at this time and thank you for your participation.

13

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2012,Thomson Reuters. All Rights Reserved.

14

Slide: 1 Title: David N. Walker Chief Financial Officer and Treasurer May 3, 2012 Fiscal 2012 Second Quarter Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Slide: 2 Title: Selected Financial Results from Continuing Operations *All numbers reflect the two-for-one stock splitQ2 revenue grew 7% compared to last year, driven by Health Services and offset by lower revenue in Human Services due to the planned ramp up in the UKQ2 operating income, excluding net legal recoveries, was $26.8 million and operating margins were 11.0% Revising tax rates upward, Q2 results include a discrete tax charge of $3.0 million, or $0.09 per diluted share; in addition, increased tax rate for the year to 38% GAAP income from continuing operations, net of taxes, totaled $14.2 million, or $0.41 per diluted share, which also includes $0.01 of legal recovery benefitExcluding the $0.01 recovery and $0.09 tax charge, adjusted diluted EPS from continuing operations were $0.49

Slide: 3 Title: Health Services Segment Q2 revenue increased 17% to $161.2 million driven by the managed care expansion in Texas, organic growth from new work and strong volumes in existing programs. Completed contractually planned activities for the managed care roll out in Texas which bolstered revenue in the first half of the year. Since ramped down the expansion activities and expect contributions from this contract will return to more normalized levels beginning in Q3Q2 operating income was $18.2 million and operating margin was 11.3%. Continue to experience favorable volumes in a couple of contracts, most notably in our federal Medicare appeals businessOperating margin lower due to normal life-cycle fluctuations in contracts such as new programs in the first year of the business cycle and recent rebids. Also had increased bid and proposal activities in SG&A. Revenue growth from the lower margin TX contract lowered margin in the quarter. $ in millions

Slide: 4 Title: Human Services Segment Q2 revenue totaled $82.3 million and lower than the previous year due to transition and associated revenue ramp up on the new UK Work Programme contract As expected, losses in the UK peaked in Q2 and we still remain on track for the contract to break even in Q4Similarly, the UK contract lowered Q2 operating income in the quarter which totaled $8.6 million with operating margin of 10.5%Despite the losses in the UK, results compared to last year were only slightly down because the prior year period included a $4.2 million loss on a fixed price contract that has been successfully resolved$ in millions

Slide: 5 Title: Updated Guidance for the UK Contract FY12 Headwind FY13 BoomerangProgram ties vendors to longer-term outcome-based payments; we are starting to achieve confirming data points that provide us with better trend data, improve visibility and allow us to update our financial modelNow expect revenue to be a little lower but the bottom line is still tracking in-line with expectations and operating margin assumptions remain unchanged at 15% for the out years. Top-line refinement driven by a number of factors. Current trends: 1) Experiencing higher volumes than original plan. 2) Caseload mix is self correcting with harder-to-serve caseloads returning to expected levels. 3) We are achieving our planned job placements. 4) Our outcome achievements rates are softer, due in part, to the outcome verification process which DWP modified and should help outcome rates going forward.All these factors create a short-term impact on revenue. We remain on track to break even in the fourth quarterMost importantly, fundamentally on track for FY 13 and beyond. We remain optimistic on the longer-term outlook of the program and expect it to be a solid contributor to profitability over the life of the contract

Slide: 6 Title: Balance Sheet and Cash Flows Other Placeholder: Net income contributed to strong cash flows; exceptionally strong cash flows due to solid receivable collections with DSOs of 55 daysCash provided by operating activities from continuing operations of $41.5 million in the quarter, with free cash flow* of $36.4 millionSound balance sheet at March 31, 2012 with cash and cash equivalents of $229.5 million, of which approximately 51% was held overseasNo share repurchases in quarter in anticipation of the PSI acquisition; purchased PSI with $67 million in cash and expect non-recurring merger-related expenses of approximately $4 million *The Company defines free cash flow as cash provided by operating activities less cash paid for property, plant and equipment and capitalized software We remain committed to the right balance of capital deployment to drive long-term, sustainable growth and shareholder value.

Slide: 7 Title: Updating FY 2012 Guidance Raising revenue guidance from $980M - $1.015M to $1.030B - $1.060BExpect PSI acquisition to bring additional revenue of $55M - $60M for FY12 (40% attributable to the Health Services Segment and 60% attributable to the Human Services SegmentStill expect fiscal 2012 top-line growth, driven by Health Services Segment Reiterating adjusted diluted EPS from continuing operations of $2.20 - $2.30; We expect up to $0.05 of accretion from PSI which is offset by the increase in full-year tax rates to 38%Making significant progress on the change order discussed last quarter; still expected to occur in the back half of the year, likely Q4. Estimated at approximately $0.08 per diluted shareStill expect to achieve our guidance range with or without the change orderUpdating cash flow guidance; now expect cash provided by operating activities derived from continuing operations of $100M - $120M and free cash flow from continuing operations of $75M - $95M

Slide: 8 Title: Richard A. Montoni President and Chief Executive Officer May 3, 2012 Fiscal 2012 Second Quarter Earnings

Slide: 9 Other Placeholder: Pleased to report another solid quarter; on track to achieve full-year guidanceOne of our short-term goals was to make qualified acquisitions; we’ve been deliberately selective, seeking opportunities that complement and fit well within our current business portfolio; seeking close-fitting companies that we understand well and we view as low risk with attractive upside; the PSI acquisition fits this model perfectly and is an important step towards achieving our short term goals Like MAXIMUS, PSI has a core focus on the administration of health and human services government programs: Medicaid and CHIP administration, child support enforcement and welfare-to-work contracts, as well as specialized consulting servicesPSI contracts currently run below our 10-15% operating margin range with several key projects in start-up phase; our long-term goal is to institute business optimization strategies to bring these margins up to at least 10% over the next several years A full integration effort is in place for a swift, but thoughtful, combination of our businesses with a seamless transition; service delivery to clients remains our number one priorityThe addition of PSI improves our ability to help our clients meet their challenges of running efficient and effective public programs; acquisition yields a great number of benefits to clients, including increased effective operational resources, efficient shared services, enhanced subject matter expertise, innovative BPO and technology, and financial stability Title:Overview of PSI Acquisition

Slide: 10 Title: PSI Acquisition: Health Services The acquisition of PSI brings seven new Medicaid and CHIP contracts, including marquee CHIP clients, such as Georgia and FloridaWith the addition of PSI’s health portfolio, MAXIMUS serves an additional two million CHIP and Medicaid beneficiariesPSI brings innovative approaches to meeting policy and program requirementsThe combination offers a broader range of technical and operational capabilities, and additional economies of scale to meet the diverse needs of our clients betterAs states plan for Health Insurance Exchanges, MAXIMUS and PSI together offer additional options and long-term stability for existing and potential clients

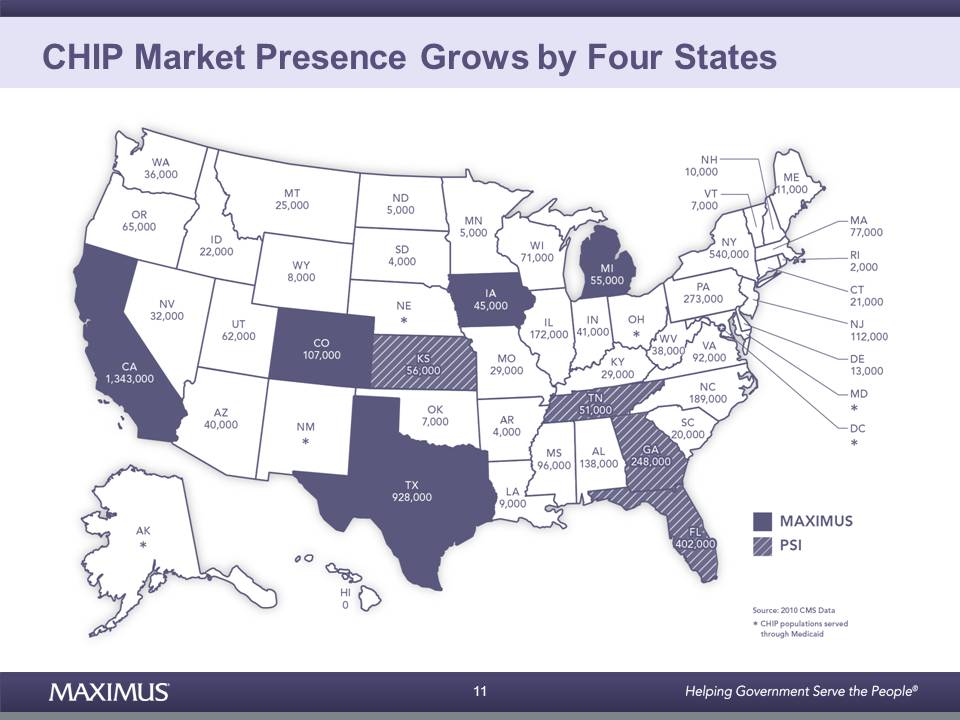

Slide: 11 Title: CHIP Market Presence Grows by Four States

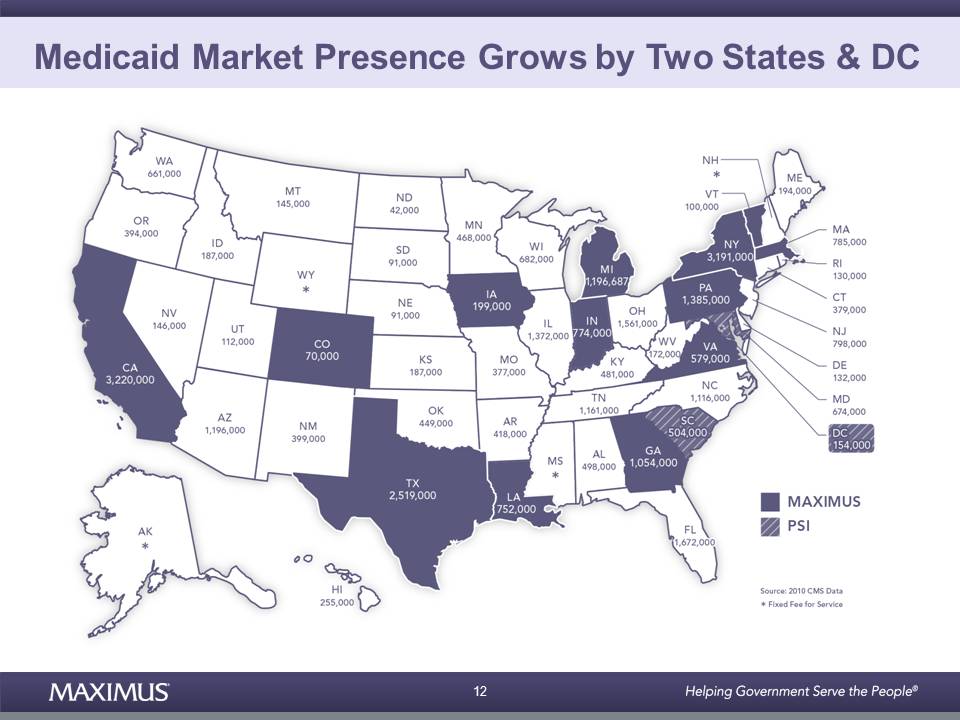

Slide: 12 Title: Medicaid Market Presence Grows by Two States & DC

Slide: 13 Title: PSI Acquisition: Human Services The acquisition of brings on new welfare-to-work and consulting contracts and meaningfully grows our market share in child supportPSI brings new qualifications that now open up entirely new adjacent child support markets where MAXIMUS has historically not been a meaningful playerPSI brings a long-history of success in the child support market with extensive experience and industry-leading best practices

Slide: 14 Title: Enhanced Child Support & Workforce Services Presence Acquisition of PSI brings an additional 44 child support and 4 workforce services contracts to the MAXIMUS Human Services portfolio.

Slide: 15 Other Placeholder: PSI offers additional operational resources to tackle the increasing demand and fill in gaps where we may have been resource constrained in the past As market demand for our services continues to increase, acquisition brings more resources to bear as we grow the business and capitalize on new opportunities, here in the U.S. and abroad Excited about the breadth and depth of experience and innovation PSI employees bring; we share a common commitment of serving our government partners, and ultimately improving the lives of citizens around the world Title:More Resources for Future Opportunities

Slide: 16 Title: U.S. Health Care Reform Update While we can’t speculate on the outcome of the ACA hearings, we have a completed a thorough analysis of our strategy under the various potential outcomesOne variation is a gradual ramp for the establishment of exchanges on a state-by-state basis; April 17 Reuters piece noted that some states are moving ahead with reform efforts regardless of Supreme Court direction; 16 states and the District of Columbia have legislation or executive orders for the implementation of ACAUnderlying fundamental social challenges don’t go away just because the law is changed or modified; underserved and uninsured populations more likely to use costly emergency services for routine medical problems and must be connected to coverage that best meets their individual needs. HIX procurements rolling out as anticipated, with initial focus on technology bids designed for system integrators; MMS is not a system integrator, so selectively participating on initial bids in a subcontractor role to gain tactical presence as HIX market continues to progressHIX isn’t just about technology; once the technology is built out, the operational focus will shift to the BPO and health care consumer engagement and service; these administrative functions are right in the sweet spot for MAXIMUS; look forward to applying our experience and best practices from Medicaid and CHIP to the Exchanges

Slide: 17 Title: Update on International Operations In the UK, Work Programme operations running at full speed; still expect to break even in Q4 of FY12; lower revenue forecast for the year balanced by the recent process modifications implemented by DWP are expected to improve the outcome verification going forward; we run these programs with a large portion of variable costs which allows us to efficiently and effectively manage resources to achieve our bottom-line results UK government plans to publish performance outcomes for Work Programme vendors; results are expected in the fall, but UK Employment Minister anticipates results could lead to a “shakeout” in the supply chain of vendors; we believe our performance has been strong relative to the pack and we are well on our way to making this a successful projectRecently signed the three-year, $450 million extension to our Job Services Australia contract; as a result of our exceptional performance, we picked up some new work in Ipswich, South Brisbane and Western Downs through reallocations; new work increases our national caseload by approximately 3%

Slide: 18 Title: New Awards and Sales Pipeline Investors should expect routine fluctuations among the new sales and pipeline categories, driven by the different stages in the procurement process, as well as the timing of when contracts are awarded and ultimately signed.Includes $450 million extension in Australia, which takes current contract through June 30, 2015

Slide: 19 Title: Conclusion Other Placeholder: Making solid progress on our short-term goals Successfully ramping up operations in the UK and remain on track to achieve breakeven status in the fourth quarter Continue to move forward with our business development plans for winning our fair share of health care reform contracts Completed the strategic acquisition of PSI, a growth platform that will help us drive long-term value for our shareholders. Acquisition is prudent use of cash as we drive growth in our core markets; moving forward, we intend to employ the same fundamental principles of cash deployment : Investing in business development and growth prospects across all our markets, including both organically and through acquisition Continuing our quarterly cash dividend strategyExecuting our share buybacks in an opportunistic fashion The team remains committed to growing the business and delivering long-term shareholder value