As filed with the Securities and Exchange Commission on March 6, 2019

File Nos. 333-22075 and 811-8061

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

|

| | |

| THE SECURITIES ACT OF 1933 | | |

| Pre-Effective Amendment No. | | ¬ |

| Post-Effective Amendment No. | | ¬ |

Diamond Hill Funds

(Exact Name of Registrant as Specified in Charter)

325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (888) 226-5595

Gary R. Young, Diamond Hill Funds

325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215

(Name and Address of Agent for Service)

With copy to:

Michael V. Wible, Esq.

Thompson Hine LLP

41 South High Street, Suite 1700

Columbus, Ohio 43215-6101

Title of securities being registered: Shares of Research Opportunities Fund, a series of the Registrant

No filing fee is required because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares.

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing become effective on 30 days after filing date pursuant to Rule 488 under the Securities Act of 1933, as amended.

Diamond Hill Funds

325 John H. McConnell Boulevard, Suite 200

Columbus, Ohio 43215

For shareholders of:

Diamond Hill Financial Long-Short Fund

Dear Shareholder:

We wanted to inform you, as a shareholder of Diamond Hill Financial Long-Short Fund, that Diamond Hill Capital Management, Inc. (the “Adviser”) recommended, and the Board of Trustees of your Fund approved, the Adviser’s proposal (“Proposal”) to reorganize your Fund into Diamond Hill Research Opportunities Fund (together with Diamond Hill Financial Long-Short Fund, the “Funds”), effective on or about June 7, 2019. The Adviser’s recommendation to reorganize the two Funds was based largely on your Fund’s ability to attract assets and reach scale and its history of net redemption activity. This reorganization is subject to approval by shareholders of Diamond Hill Financial Long-Short Fund. If the reorganization is approved and other closing conditions are satisfied or waived, you will receive the same class of shares of Diamond Hill Research Opportunities Fund that you hold in Diamond Hill Financial Long-Short Fund as of the reorganization date. Both Funds have identical investment objectives. In addition, while the Funds’ principal investment strategies and investment policies are similar in many respects, there are critical differences between the two. The Diamond Hill Financial Long-Short Fund’s portfolio is “concentrated” in the financial services industry, meaning that it has adopted a fundamental policy to invest 25% or more of its total assets in that industry. The Diamond Hill Research Opportunities Fund’s portfolio is not concentrated, and it invests across all market sectors and industries. In addition, per the Funds’ Prospectuses, the Diamond Hill Financial Long-Short Fund will sell securities short as part of its principal strategy, whereas the Diamond Hill Research Opportunities Fund may engage in short sales as part of its principal strategy. Currently, in practice, each Fund sells securities short as part of its principal strategy.

The Adviser believes the proposed reorganization offers a number of benefits to shareholders of the Diamond Hill Financial Long-Short Fund, including being shareholders of a Fund with greater asset size that creates greater opportunity to benefit from long-term economies of scale and potentially lower total expenses. Each share class of the Diamond Hill Research Opportunities Fund is expected to have lower total expenses than the corresponding class of the Diamond Hill Financial Long-Short Fund, because the Acquiring Fund currently has lower dividend expenses and fees on securities sold short. The reorganization is designed to qualify as a tax-free reorganization, so you should generally not realize a tax gain or loss as a direct result of the reorganization.

If the proposed reorganization to is not approved by shareholders, the Adviser intends to recommend that the Board of Trustees vote to liquidate the Diamond Hill Financial Long-Short Fund. Shareholders would receive a liquidating distribution on the liquidation date equal to the value of the shares owned. The liquidating distribution would result in a taxable transaction.

The Proposal will be presented to shareholders at a special meeting of shareholders to be held on May 30, 2019 (the “Meeting”). Additional details about the proposed reorganization are described in the enclosed Q&A/Synopsis and Proxy statement/Prospectus, which you should read carefully.

Your Fund’s Board of Trustees believes the proposed reorganization is in the best interest of the Fund and unanimously recommends that shareholders vote FOR the Proposal.

Please read the enclosed Proxy Statement/Prospectus carefully and submit your voting instructions. If you have any questions about the Proposal, please call 614-255-3333.

Thank you for your consideration of the Proposal, which is important and warrants your consideration. We value your investment and look forward to our continued relationship.

Sincerely,

Gary R. Young

President

Diamond Hill Funds

Diamond Hill Funds

325 John H. McConnell Boulevard, Suite 200

Columbus, Ohio 43215

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held May 30, 2019

Notice is hereby given that the Board of Trustees of Diamond Hill Funds (the “Trust”) has called a Special Meeting of Shareholders of Diamond Hill Financial Long-Short Fund (the “Target Fund”), a series of the Trust, to be held at 325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215, on May 30, 2019, at 10:00 a.m. Eastern Time (together with any adjournments or postponements thereof, the “Meeting”). At the Meeting, shareholders of the Target Fund will be asked to vote on the Proposal set forth below, and to transact such other business, if any, as may properly come before the Meeting.

| |

| Proposal: | Approve an Agreement and Plan of Reorganization, which provides for the transfer of all or substantially all of the assets of the Diamond Hill Financial Long-Short Fund to Diamond Hill Research Opportunities Fund in exchange for shares of beneficial interest of Diamond Hill Research Opportunities Fund and the assumption by Diamond Hill Research Opportunities Fund of all of the liabilities of Diamond Hill Financial Long-Short Fund. |

Only shareholders of record of the Target Fund as of the close of business on March 22, 2019 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement and accompanying form of proxy will first be mailed to shareholders on or about April __, 2019.

The Board of Trustees of the Trust unanimously recommends that shareholders of the Target Fund vote FOR the Proposal.

By Order of the Board of Trustees,

Gary Young, President

YOUR VOTE IS IMPORTANT

To assure your representation at the Meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You also may vote by telephone or via the Internet by following the instructions on the enclosed proxy card. Whether or not you plan to attend the Meeting in person, please vote your shares; if you attend the Meeting, you may revoke your proxy and vote your shares in person. For more information or assistance with voting, please call 614-255-3333.

DIAMOND HILL FINANCIAL LONG-SHORT FUND

PROXY STATEMENT/PROSPECTUS APRIL __, 2019

Relating to the acquisition of the assets of

DIAMOND HILL FINANCIAL LONG-SHORT FUND

by and in exchange for shares of beneficial interest of

DIAMOND HILL RESEARCH OPPORTUNITIES FUND

each a series of DIAMOND HILL FUNDS

325 John H. McConnell Blvd., Suite 200

Columbus, Ohio 43215

614-255-3333

INTRODUCTION

This proxy statement/prospectus (the “Proxy Statement/Prospectus”) is being furnished to shareholders of Diamond Hill Financial Long-Short Fund (the “Target Fund”), a series of Diamond Hill Funds (the “Trust”), in connection with a special meeting of the shareholders of the Target Fund to be held at 325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215 on May 30, 2019 at 10:00 a.m. Eastern Time (together with any adjournments or postponements thereof, the “Meeting”). The Board of Trustees of the Trust (the “Board of Trustees” or the “Trustees”) is soliciting proxies from shareholders of the Target Fund for the Meeting.

At the Meeting, shareholders will be asked to vote on the Proposal set forth below, and to transact such other business, if any, as may properly come before the Meeting.

| |

| Proposal: | Approve an Agreement and Plan of Reorganization, which provides for the transfer of all or substantially all of the assets of the Diamond Hill Financial Long-Short Fund to Diamond Hill Research Opportunities Fund in exchange for shares of beneficial interest of Diamond Hill Research Opportunities Fund and the assumption by Diamond Hill Research Opportunities Fund of all of the liabilities of Diamond Hill Financial Long-Short Fund. |

We refer to Diamond Hill Research Opportunities Fund as the “Acquiring Fund.” We refer to the Target Fund and the Acquiring Fund collectively as the “Funds.” The Agreement and Plan of Reorganization for this proposed transaction is referred to herein as the “Plan,” and the transaction contemplated by the Plan is referred to herein as the “Reorganization.”

As a result of the proposed Reorganization, each shareholder of the Target Fund will receive a number of full and fractional shares of the Acquiring Fund equal in value to their holdings in the Target Fund as of the close of regular trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. The number of shares you will receive in the Reorganization will be determined by the relative net asset value (“NAV”) of each class of shares of the Target Fund and the corresponding class of shares of the Acquiring Fund. Diamond Hill Capital Management, Inc. (the “Adviser”) is the investment adviser for both the Acquiring Fund and the Target Fund and will remain the investment adviser of the Acquiring Fund following the completion of the Reorganization. After the Reorganization is completed, the Target Fund will be dissolved. The closing of the Reorganization is contingent upon approval of the Plan by shareholders of the Target Fund. A form of the Plan is attached as Appendix A. If shareholders approve the Plan, the Reorganization is expected to occur on or about June 7, 2019, or as soon as practicable thereafter (the “Closing Date”).

This Proxy Statement/Prospectus, Notice of Special Meeting, and the proxy card(s) are first being mailed to shareholders of the Target Fund on or about April __, 2019. Shareholders of record of the Target Fund as of the close of business on March 22, 2019 (the “Record Date”) are entitled to notice of and to vote at the Meeting.

The Board of Trustees unanimously recommends that shareholders of the Target Fund vote FOR the Proposal.

This Proxy Statement/Prospectus, which you should read carefully and retain for future reference, sets forth the information that you should know about the Target Fund, the Acquiring Fund, the proposed Reorganization, and the Proposal, before voting on

the Proposal. Both Funds have identical investment objectives. In addition, while the Funds’ principal investment strategies and investment policies are similar in many respects, there are critical differences between the two. The Target Fund’s portfolio is “concentrated” in the financial services industry, meaning that it has adopted a fundamental policy to invest 25% or more of its total assets in that industry. The Acquiring Fund’s portfolio is not concentrated, and it invests across all market sectors. In addition, per the Funds’ Prospectuses, the Diamond Hill Target Fund will sell securities short as part of its principal strategy, whereas the Acquiring Fund may engage in short sales as part of its principal strategy. Currently, in practice, each Fund sells securities short as part of its principal strategy. The Board of Trustees has approved the Proposal. The Adviser believes that shareholders of the Target Fund may benefit by being shareholders of a Fund with greater asset size that creates greater opportunity to benefit from long-term economies of scale and potentially lower total expenses. Each share class of the Target Fund is expected to have lower total expenses in their corresponding share class of the Acquiring Fund after the Reorganization, because the Acquiring Fund currently has lower dividend expenses and fees on securities sold short. The Proxy Statement/Prospectus serves as a prospectus of the Acquiring Fund in connection with the issuance of the Acquiring Fund common shares in the Reorganization. No person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Shares of the Acquiring Fund have not been approved or disapproved by the U.S. Securities and Exchange Commission (“SEC”) nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense. The shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, any financial institution or the U.S. Government, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency, and involve risk, including the possible loss of the principal amount invested.

Incorporation by Reference

For more information about the investment objective, strategies, restrictions, and risks of the Funds, see:

| |

| • | Each Fund’s Prospectus and Statement of Additional Information filed in Post-Effective Amendment No. 70 to Diamond Hill Funds’ registration statement on Form N-1A (File Nos. 811-08061 and 333-22075), dated February 28, 2019, filed on February 28, 2019; |

| |

| • | Each Fund’s Annual Report, filed on Form N-CSR (File No. 811-08061), for the fiscal year ended December 31, 2018, filed on February 21, 2019; and |

| |

| • | Proxy Statement, filed on Form DEF 14A (File No. 811-08061), dated February 4, 2019, filed on February 4, 2019. |

The above documents (the "Disclosure Documents") have been filed with the SEC and are incorporated by reference herein as appropriate. The Prospectus of each class of each Fund and its most recent shareholder report have previously been delivered to such Fund’s shareholders.

Important Notice Regarding Internet Availability of Proxy Materials

This Proxy Statement/Prospectus, the Disclosure Documents and copies of the Trust’s most recent annual and semi-annual reports to shareholders are available at www.diamond-hill.com. The Trust’s annual and semi-annual reports are available at no charge by calling 888-226-5595. The reports are also available, without charge, at diamond-hill.com, or by sending a written request to the Secretary of the Trust at 325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215.

A Statement of Additional Information dated April __, 2019 relating to the Reorganization has been filed with the SEC and is incorporated by reference into this Proxy Statement/Prospectus. You can obtain a free copy of that document by contacting your plan sponsor, broker-dealer, or financial intermediary or by contacting Diamond Hill at 855-255-8955 or info@diamond-hill.com.

Each Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and, in accordance therewith, files reports, proxy materials, and other information with the SEC. You may also obtain reports and other information about the Funds from the Electronic Data Gathering Analysis and Retrieval (EDGAR) Database on the SEC’s website at http://www.sec.gov.

The following chart outlines the impacted share classes and their respective ticker symbols:

|

| |

| Fund/Class | Ticker |

| Target Fund: | |

| Diamond Hill Financial Long-Short Fund | |

| Class A | BANCX |

| Class C | BSCCX |

| Class I | DHFSX |

| | |

| Acquiring Fund: | |

| Diamond Hill Research Opportunities Fund | |

| Class A | DHROX |

| Class C | DROCX |

| Class I | DROIX |

PROXY STATEMENT/PROSPECTUS

APRIL __, 2019

TABLE OF CONTENTS

|

| |

| Table of Contents | |

| | |

| QUESTIONS AND ANSWERS | |

| | |

| PROPOSAL-THE REORGANIZATION OF THE DIAMOND HILL FINANCIAL LONG-SHORT FUND INTO DIAMOND HILL RESEARCH OPPORTUNTIES FUND | |

| SUMMARY | |

| Comparison of Management Fees | |

| Current Fees and Expenses | |

| Fund Turnover | |

| Investment Objectives and Principal Investment Strategies | |

| Principal Investment Risks | |

| Comparison of Fund Performance | |

| Management of the Funds | |

| Tax Information | |

| Payments to Broker Dealers, Insurers and Other Financial Intermediaries | |

| | |

| THE REORGANIZATION | |

| The Plan | |

| Reasons for Reorganization | |

| U.S. Federal Income Tax Consequences | |

| Securities to be Issued, Key Differences in Shareholder Rights | |

| Capitalization | |

| | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| Additional Investment Strategies and General Fund Policies | |

| Fundamental Investment Policies and Restrictions | |

| Additional Risks of the Funds | |

| Other Comparative Information About the Funds | |

| Financial Highlights | |

| Conflicts of Interest | |

| Pricing of Fund Shares | |

| Purchase of Fund Shares | |

| Redemption of Fund Shares | |

| Dividends and Distributions | |

| Frequent Purchases and Redemptions | |

| Tax Consequences | |

| Distribution Arrangements | |

| Trustees and Officers | |

| Independent Registered Public Accounting Firm | |

| | |

| ADDITIONAL INFORMATION | |

| Quorum and Voting | |

| Share Ownership | |

| Solicitation of Proxies | |

| Shareholder Proposals for Subsequent Meetings | |

| Shareholder Communications | |

| Reports to Shareholders and Financial Statements | |

| Delivery of Voting Instructions | |

| | |

| APPENDIX A - FORM OF AGREEMENT AND PLAN OF REORGANIZATION | |

QUESTIONS AND ANSWERS

The following is a brief overview of the Proposal to be voted on at the Meeting relating to the proposed Reorganization. The Proxy Statement/Prospectus contains more detailed information about the Proposal and proposed Reorganization, and we encourage you to read it in its entirety before voting. This synopsis qualified in its entirety by the remainder of this Proxy Statement/Prospectus. The description of the Plan is qualified by reference to the full text of the form of the Plan, which is attached as Appendix A to this Proxy Statement/Prospectus.

| |

| Q. | What is being proposed? |

| |

| A. | The Board of Trustees recommends that shareholders of the Target Fund approve a Plan that authorizes the Reorganization of the Target Fund into the Acquiring Fund. Each Fund is a series of the Trust and is managed by the Adviser. You are receiving this Proxy Statement/Prospectus because, as a shareholder of the Target Fund, you have the right to vote on the Plan. |

If approved by shareholders of the Target Fund, as of the close of regular trading on the NYSE on the Closing Date of the Reorganization, Target Fund shareholders will receive a number of full and fractional shares of the Acquiring Fund equal in value to their holdings in the Target Fund. Specifically, all or substantially all of the assets of the Target Fund will be transferred to the Acquiring Fund in exchange for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all of the liabilities of the Target Fund. The shares of the Acquiring Fund received by the Target Fund will be distributed pro rata to Target Fund shareholders of record, determined as of the close of business on the Closing Date. After the Reorganization is completed, the Target Fund will be dissolved. The Reorganization is designed to qualify as a tax-free reorganization, so you should generally not realize a tax gain or loss as a direct result of the Reorganization.

| |

| Q. | Why am I am being asked to approve a reorganization of my Fund into Diamond Hill Research Opportunities Fund? |

| |

| A. | The Adviser is seeking to streamline its products and create more viable and scalable investment options. These Funds have identical investment objectives and similar investment policies and strategies, as described below. The Adviser believes the proposed Reorganization offers a number of benefits to shareholders of the Target Fund, including being shareholders of a Fund with greater asset size that creates greater opportunity to benefit from long-term economies of scale and potentially lower total expenses. Each share class of the Target Fund is expected to have lower total expenses in the corresponding share class of the Acquiring Fund after the Reorganization, because the Acquiring Fund currently has lower dividend expenses and fees on securities sold short. |

| |

| Q. | If the Reorganization occurs, how will the Acquiring Fund be managed? |

| |

| A. | If the Reorganization is consummated, the following will occur: |

| |

| • | The Target Fund will be reorganized into the Acquiring Fund. |

| |

| • | The Acquiring Fund will be managed by its current investment team at the Adviser. |

| |

| • | The investment objective of the Acquiring Fund, which is identical to that of the Target Fund, will not change. |

| |

| • | The investment policies, principal strategy and risks of the Acquiring Fund, which are similar to those of the Target Fund (except for the key differences outlined below), will not change. |

| |

| • | The Acquiring Fund will continue to have the Russell 3000 Index as its primary benchmark index. |

| |

| • | The Acquiring Fund will retain its current fee and expense structure, including an investment advisory fee at an annual rate of 0.95% of the Fund’s average daily net assets, calculated daily and paid monthly, which is the same as the Target Fund’s annual investment advisory fee rate of 0.95%; and including Other Expenses of the Acquiring Fund which will remain at the current levels, which are the same as the Target Fund, with the exception of dividend expenses and fees on short sales, which are currently lower. |

| |

| Q. | What is the recommendation of the Board of Trustees on the Reorganization? |

| |

| A. | At a meeting held on February 14, 2019, the Board of Trustees determined that the Reorganization is in the best interests of the Funds. In reaching this determination, the Trustees reviewed and analyzed various factors it deemed relevant, including the following factors, among others: |

| |

| • | Similarities and differences between the Funds’ investment objectives, policies and strategies; |

| |

| • | Whether the Reorganization would allow shareholders to continue their investment in the Diamond Hill Funds; |

| |

| • | Whether the larger asset base of the Acquiring Fund would create the opportunity to benefit from long-term economies of scale and potentially lower total expenses; |

| |

| • | The historical performance record of the Acquiring Fund, on an absolute basis and relative to the Target Fund; |

| |

| • | Whether the Reorganization, for each Fund and its shareholders, is expected to be tax-free in nature; |

| |

| • | That the Acquiring Fund may not be able to utilize certain tax loss carry forwards, if any, that would otherwise be available; |

| |

| • | The costs of the Reorganization, other than costs incurred to reposition a Fund in connection with the Reorganization (including whether the Adviser would bear such costs) |

| |

| • | The anticipated amount of repositioning costs, if any; |

| |

| • | The terms of the Reorganization and whether the Reorganization would dilute the interests of the shareholders of the Funds; |

| |

| • | The alternatives to the Reorganization, including the liquidation of the Target Fund; and |

| |

| • | The potential benefits of the Reorganization to the Adviser, including, among other things, the potential for greater operational efficiencies to be achieved by managing a single mutual fund, rather than separate funds with separate investment strategies. |

The Board of Trustees unanimously recommends that shareholders of the Target Fund vote FOR the approval of the Plan.

| |

| Q. | Will I own the same number of shares of the Acquiring Fund as I currently own of the Target Fund? |

| |

| A. | No. You will receive the same class of shares of the Acquiring Fund with equivalent dollar value as the class of shares of Target Fund you own as of the time the Reorganization closes. However, the number of shares you receive will depend on the relative NAVs of the shares of the Target Fund and the corresponding class of shares of the Acquiring Fund as of the close of trading on the New York Stock Exchange (“NYSE”) on the business day of the closing of the Reorganization. |

| |

| Q. | How do the Funds’ investment objectives, principal investment strategies, and investment policies compare? |

| |

| A. | The following summarizes the primary similarities and differences in the Funds’ investment objectives and principal investment strategies. |

Similarities:

Investment Objective: Both Funds seek to provide long-term capital appreciation.

Principal Investment Strategies:

| |

| • | Both Funds seek exposure to equity securities. |

| |

| • | Both Funds seek exposure to foreign securities, which may include investments in emerging markets. The Target Fund may invest up to 20% of net assets in foreign securities and the Acquiring Fund may invest up to 40% of net assets in foreign securities. |

Diversification: Each Fund is classified as “diversified” under the 1940 Act, meaning that each Fund may not, with respect to 75% of its total assets, invest more than 5% of its total assets in any issuer and may not own more than 10% of the outstanding voting securities of an issuer.

Differences:

Investment Personnel: Each Fund has a different investment team. The Acquiring Fund’s investment personnel will continue to manage the Acquiring Fund after the Reorganization. Each portfolio manager of the Target Fund is also a member of the team of research analysts that co-manage the Acquiring Fund.

Principal Investment Strategies:

| |

| • | Target Fund. The Target Fund seeks to achieve its investment objective by investing at least 80% of its net assets in U.S. equity securities of banks, thrifts, specialty lending institutions, insurance companies, real estate investment trusts and other financial services companies that the Adviser believes are undervalued. The Fund, under normal market conditions, will invest at least 80% of its net assets in equity securities of banks, thrifts, specialty lending institutions, insurance companies, real estate investment trusts and other financial services companies that the Adviser believes are undervalued. The Fund may also invest up to 20% of its net assets in foreign equity securities, including equity securities in emerging market countries. Equity securities consist of common and preferred stocks. As of December 31, 2018, the Target Fund has approximately 6% of its net assets allocated to non-US investments. |

| |

| • | Acquiring Fund. The Acquiring Fund invests its assets primarily in U.S. equity securities of any size that the Adviser believes are undervalued. The fund may also invest up to 40% of its net assets in foreign equity securities, including equity securities in emerging market countries. Equity securities consist of common and preferred stocks. As of December 31, 2018, the Acquiring Fund has approximately 15.3% of its net assets allocated to non-US investments. |

Short Selling: Per the Funds’ Prospectuses, the Target Fund will sell securities short as part of its principal strategy, whereas the Acquiring Fund may engage in short sales as part of its principal strategy. Currently, in practice, each Fund sells securities short as part of its principal strategy.

Benchmark: The Target Fund’s primary benchmark is the Russell 3000 Financials Index, is a subset of the Russell 3000 Index that measures the performance of the securities classified in the financial services sector of the U.S. equity market. The Russell 3000 Index is a market-capitalization weighted index measuring performance of the 3,000 largest U.S. companies based on total market capitalization. The Acquiring Fund's primary benchmark is the Russell 3000 Index.

Investment Policies: The Target Fund’s portfolio is “concentrated” in the financial services industry, meaning that it has adopted a fundamental policy to invest 25% or more of its total assets in that industry. The Acquiring Fund’s portfolio is not concentrated, and it invests across all market sectors.

Further information comparing the Funds’ investment objectives, strategies, restrictions, and risks is included below under “Summary of the Funds”. In addition, the Acquiring Fund’s Prospectus, as supplemented, are enclosed for your reference.

| |

| Q. | How do the Funds compare in size? |

| |

| A. | As of December 31, 2018, the Target Fund’s net assets were approximately $24 million, and the Acquiring Fund’s net assets were approximately $55 million. If the Reorganization were completed as of December 31, 2018, the combined net assets of the Acquiring Fund would be $79 million. The asset size of each Fund fluctuates on a daily basis, and the asset size of the Acquiring Fund after the Reorganization may be larger or smaller than the combined assets of the Funds as of December 31, 2018. More current total net asset information is available at diamond-hill.com. |

| |

| Q. | How do the fee and expense structures of the Funds compare? |

| |

| A. | Each Fund is subject to a the same fee and expense structure with payment of an annual investment advisory fee and administration fee paid to the Adviser and distribution fees paid to Foreside Financial Services, LLC. |

| |

| Q. | Will the Reorganization result in higher investment advisory fees for Target Fund shareholders? |

| |

| A. | As noted above, the Acquiring Fund will retain the same investment advisory fee schedule after the Reorganization, which is an annual rate of 0.95% of average daily net assets. The Target Fund pays a direct investment advisory fee at the annual rate of 0.95% of average daily net assets. |

| |

| Q. | Will the Reorganization result in higher total operating expenses? |

| |

| A. | No. The total gross and net expense ratios of each share class of the Acquiring Fund after the Reorganization is completed are expected to be less than the total gross and net expense ratios that would be paid by the corresponding share class of Target Fund’s |

shareholders if the Reorganization did not occur, because the Acquiring Fund currently has lower dividend expenses and fees on securities sold short.

| |

| Q. | What are the U.S. federal income tax consequences of the Reorganization? |

| |

| A. | The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes (under section 368(a) of the Internal Revenue Code of 1986, as amended) (the “Code”) and will not take place unless counsel provides an opinion to that effect. Assuming the Reorganization so qualifies, shareholders should not recognize any capital gain or loss as a direct result of the Reorganization. Prior to the Closing Date, you will likely receive an additional taxable distribution of ordinary income or capital gains that Target Fund has accumulated as of the date of the distribution. |

As always, if you choose to redeem or exchange your shares (whether before or after the Reorganization), you may realize a taxable gain or loss depending on the performance of such shares since you acquired them. Shareholders should consult a tax adviser with respect to the tax consequences of the Reorganization and any exchange or redemption.

| |

| Q. | Will my cost basis for U.S. federal income tax purposes change as a result of the Reorganization? |

| |

| A. | Your total cost basis for U.S. federal income tax purposes is not expected to change as a result of the Reorganization. However, since the number of shares you hold after the Reorganization is expected to be different than the number of shares you held prior to the Reorganization, your average cost basis per share may change. |

| |

| Q. | Will the shareholder service providers to my Fund change? |

| |

| A. | No. The current service providers to the Funds will continue to provide the same services to the Acquiring Fund following the Reorganization. |

Diamond Hill Capital Management, Inc. currently serves as investment adviser to both Funds and will continue as the investment adviser to the Acquiring Fund following the Reorganization. The administrator, custodian, transfer agent, auditor, and distributor are the same for the Funds and will not change as a result of the Reorganization. Accordingly, the Funds will continue to receive the same level of services with no increase in related fees.

| |

| Q. | Will there be any sales load, commission or other transactional fee in connection with the Reorganization? |

| |

| A. | No. There will be no sales load, commission or other transactional fee in connection with the Reorganization. The full and fractional value of shares of the Target Fund will be exchanged for full and fractional corresponding shares of the Acquiring Fund having equal value, without any sales load, commission or other transactional fee being imposed. |

| |

| Q. | Can I still add to my existing Target Fund account until the Reorganization? |

| |

| A. | Yes. Current Target Fund shareholders may continue to make additional investments until the Closing Date (anticipated to be on or about June 7, 2019), unless the Board of Trustees determines to limit future investments to ensure a smooth transition of shareholder accounts or for any other reason. If the Reorganization is approved and other closing conditions are satisfied or waived, an account in the Acquiring Fund will be set up in your name, and you will receive shares of the corresponding class of shares of the Acquiring Fund. You will receive confirmation of this transaction following the completion of the Reorganization. |

| |

| Q. | Will either Fund pay fees or expenses associated with the Reorganization? |

| |

| A. | No. The Adviser will pay the direct fees and expenses associated with the Reorganization, including preparation of the Proxy Statement/Prospectus, printing and mailing costs, solicitation costs, and legal and auditor fees, which are estimated to be approximately $50,000. However, the Funds will bear any brokerage commissions, transaction costs and similar expenses in connection with any purchases or sales of securities related to Fund repositioning in connection with the Reorganization, which are expected to be minimal. |

| |

| Q. | If shareholders approve the Reorganization, when will the Reorganization take place? |

| |

| A. | If Target Fund shareholders approve the Reorganization and other conditions are satisfied or waived, the Reorganization is expected to occur on or about June 7, 2019, or as soon as reasonably practicable after shareholder approval is obtained. After completion of the Reorganization, your financial intermediary or plan sponsor is responsible for sending you a confirmation statement reflecting your new Fund account number and number of shares owned. |

| |

| Q. | What happens if the Reorganization is not completed? |

| |

| A. | If the proposed Reorganization to is not approved by shareholders, the Adviser intends to recommend that the Board of Trustees vote to liquidate the Diamond Hill Financial Long-Short Fund. Shareholders would receive a liquidating distribution on the liquidation date equal to the value of the shares owned. The liquidating distribution would result in a taxable transaction. |

| |

| Q. | How many votes am I entitled to cast? |

| |

| A. | You are entitled to one vote for each whole dollar value and a proportionate fractional vote for each fractional dollar value of the NAV of Target Fund shares held in your name on the Record Date (defined below). |

Miscellaneous Matters

| |

| Q. | Who is eligible to vote? |

| |

| A. | Shareholders who owned shares of the Target Fund at the close of business on March 22, 2019 (the “Record Date”) will receive notice of the Meeting and be entitled to be present and vote at the Meeting. Those shareholders are entitled to one vote for each whole dollar (and a proportionate fractional vote for each fractional dollar) of net asset value owned on all matters presented at the Meeting. |

| |

| Q. | What is the required vote to approve the Proposal? |

| |

| A. | Approval of the Plan requires the affirmative vote of a “majority of the outstanding voting securities” as defined under the 1940 Act (such a majority referred to herein as a “1940 Act Majority”) of the Target Fund. A 1940 Act Majority means the lesser of the vote of (i) 67% or more of the shares of the Target Fund entitled to vote thereon present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Target Fund entitled to vote thereon. |

A quorum of the Target Fund’s shareholders is required to take action at the Meeting. The presence in person or by proxy of the holders of record of one-third of the Target Fund’s shares outstanding and entitled to vote at the Meeting constitutes a quorum.

| |

| Q. | How can I vote my shares? |

| |

| A. | You can vote or provide instructions in any one of four ways: |

| |

| • | By Internet through the website listed in the proxy voting instructions; |

| |

| • | By telephone by calling the toll-free number listed on your proxy card(s) and following the recorded instructions; |

| |

| • | By mail, by sending the enclosed proxy card(s) (signed and dated) in the enclosed envelope; or |

| |

| • | In person at the Meeting on May 30, 2019. |

Whichever method you choose, please take the time to read the full text of this Proxy Statement/Prospectus before you vote.

It is important that Target Fund shareholders respond to ensure that there is a quorum for the Meeting. If a quorum is not present or sufficient votes to approve the Proposal are not received by the date of the Meeting, the chairperson of the Meeting may adjourn the Meeting to a later date so that we can continue to seek additional votes.

| |

| Q. | If I vote my proxy now as requested, can I change my vote later? |

| |

| A. | Yes. You may revoke your proxy vote at any time before it is voted at the Meeting by (1) delivering a written revocation to the Secretary of the Target Fund; (2) submitting a subsequently executed proxy vote; or (3) attending the Meeting and voting in person. Even if you plan to attend the Meeting, we ask that you return the enclosed proxy card or vote by telephone or the internet. This will help us to ensure that an adequate number of shares are present at the Meeting for consideration of the Proposal. Target Fund shareholders should send notices of revocation to Diamond Hill Funds at 325 John H. McConnell Blvd., Suite 200, Columbus, Ohio 43215, Attn: Secretary. |

PROPOSAL – THE REORGANIZATON OF DIAMOND HILL FINANCIAL LONG-SHORT FUND

INTO DIAMOND HILL RESEARCH OPPORTUNITIES FUND

SUMMARY

This section provides a summary of certain information with respect to the Reorganization, the Target Fund, and the Acquiring Fund, including but not limited to comparative information regarding each Fund’s investment objective, fees and expenses, principal investment strategies and risks, historical performance, and other information. Please note that this is only a brief discussion and is qualified in its entirety by reference to the complete information contained herein, including the Funds’ prospectuses which are incorporated by reference.

There is no assurance that a Fund will achieve its stated objective. Each Fund is designed for investors seeking long term capital appreciation.

Comparison of Management Fees

Both the Target Fund and the Acquiring Fund pay the Adviser an investment advisory fee at an annual rate of 0.95% of the respective Fund’s average daily net assets, calculated daily and paid monthly. After the Reorganization, the Acquiring Fund will continue to pay this same fee rate to the Adviser.

Current Fees and Expenses

The following tables compare the fees and expenses you may bear as an investor in the Target Fund or Acquiring Fund. Fees and expenses shown for the Target Fund and the Acquiring Fund were determined based on each Fund’s average daily net assets for the annual period ended December 31, 2018. The fees and expenses of the Acquiring Fund shown below are not anticipated to change following the Reorganization.

More current total net asset information is available for the Funds at diamond-hill.com. It is important for you to know that dividend expenses and fees on short sales, market volatility or other factors, could cause the Fund’s expense ratio to be higher than the fees and expenses shown, which means you could pay more if you buy or hold shares of the Funds.

Annual Fund Operating Expenses

|

| | | |

| | Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | Target Fund | Acquiring Fund |

| Class A Shares | Management fee | 0.95 | 0.95 |

| | Other expenses: | | |

| | Distribution (12b-1) fees | 0.25 | 0.25 |

| | Administration fees | 0.21 | 0.21 |

| | Dividend expenses and fees on short sales | 0.44 | 0.39 |

| | Total other expenses | 0.65 | 0.60 |

| | Total annual fund operating expense | 1.85 | 1.80 |

| | | | |

| Class C Shares | Management fee | 0.95 | 0.95 |

| | Other expenses: | | |

| | Distribution (12b-1) fees | 1.00 | 1.00 |

| | Administration fees | 0.21 | 0.21 |

| | Dividend expenses and fees on short sales | 0.44 | 0.39 |

| | Total other expenses | 0.65 | 0.60 |

| | Total annual fund operating expense | 2.60 | 2.55 |

| | | | |

| Class C Shares | Management fee | 0.95 | 0.95 |

| | Other expenses: | | |

| | Administration fees | 0.17 | 0.17 |

| | Dividend expenses and fees on short sales | 0.44 | 0.39 |

| | Total other expenses | 0.61 | 0.56 |

| | Total annual fund operating expense | 1.56 | 1.51 |

Annual Fund Operating Expenses are paid out of a Fund’s assets and include fees for Fund management, administration and administrative services, including recordkeeping, accounting or sub-accounting, and other shareholder services. You do not pay these fees directly, but as the examples in the tables below show, these costs are borne indirectly by all shareholders.

Examples

The Examples are intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. The Examples assume that you invest $10,000 in the Funds for the time periods indicated and then redeem all of your shares at the end of those periods. The Examples also assume that your investment has a 5% return each year and that the Funds’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | |

| | Share Status | 1 year | 3 years | 5 years | 10 years |

| Target Fund (Class A) | Sold or Held | $679 | $1,053 | $1,451 | $2,561 |

| Acquiring Fund (Class A) | Sold or Held | $674 | $1,038 | $1,426 | $2,510 |

|

| | | | | |

| Target Fund (Class C) | Sold

Held

| $363

$263

| $808

$808 | $1,380

$1,380 | $2,934

$2,934

|

| Acquiring Fund (Class C) | Sold

Held | $358

$258 | $793

$793 | $1,355

$1,355 | $2,885

$2,885 |

|

| | | | | |

| Target Fund (Class I) | Sold or Held | $159 | $493 | $850 | $1,856 |

| Acquiring Fund (Class I) | Sold or Held | $154 | $477 | $824 | $1,802 |

Fund Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Examples, affect each Fund’s performance. During the most recent fiscal year, the Target Fund’s Fund turnover rate was 45% of the average value of its portfolio and the Acquiring Fund’s Fund turnover rate was 88% of the average value of its portfolio.

Investment Objectives

Both the Target Fund and the Acquiring Fund seek to provide long-term capital appreciation.

Principal Investment Strategies

Both Funds have identical investment objectives. In addition, while the Funds’ principal investment strategies and investment policies are similar in many respects, there are critical differences between the two. The Target Fund’s portfolio is “concentrated” in the financial services industry, meaning that it has adopted a fundamental policy to invest 25% or more of its total assets in that industry. The Acquiring Fund’s portfolio is not concentrated, and it invests across all market sectors. In addition, per the Funds’ Prospectuses, the Diamond Hill Target Fund will sell securities short as part of its principal strategy, whereas the Acquiring Fund may engage in short sales as part of its principal strategy. Currently, in practice, each Fund sells securities short as part of its principal strategy.

The following is intended to show the primary similarities and differences between the Funds’ principal investment strategies. The Acquiring Fund will continue to have the same investment strategies shown below following the Reorganization. This information is qualified in its entirety by the prospectuses of each Fund, which are incorporated by reference.

|

| |

| Target Fund | Acquiring Fund |

| Principal Investment Strategy |

| The Fund, under normal market conditions, invests at least 80% of its net assets in U.S. equity securities of banks, thrifts, specialty lending institutions, insurance companies, real estate investment trusts and other financial services companies that the Adviser believes are undervalued. The Fund, under normal market conditions, will invest at least 80% of its net assets in equity securities of banks, thrifts, specialty lending institutions, insurance companies, real estate investment trusts and other financial services companies that the Adviser believes are undervalued. The Fund may also invest up to 20% of its net assets in foreign equity securities, including equity securities in emerging market countries. Equity securities consist of common and preferred stocks. | The Fund, under normal market conditions, invests its assets primarily in U.S. equity securities of any size that the Adviser believes are undervalued. The Fund may also invest up to 40% of its net assets in foreign equity securities, including equity securities in emerging market countries. Equity securities consist of common and preferred stocks. The Fund is managed by a team of research analysts of the Adviser, each of whom is a co-manager of the Fund. Research analysts are organized into sector teams. Within the sector teams, each analyst is assigned assets and is responsible for an industry-specific portion of the portfolio (the “Sleeve”). Each co-manager is directly responsible for selecting securities and determining security weights within their respective Sleeve. |

|

| |

| Target Fund | Acquiring Fund |

| Investment Approach |

| The Adviser focuses on estimating a company’s value independent of its current stock price. To estimate a company’s value, the Adviser concentrates on the fundamental economic drivers of the business. The primary focus is on “bottom-up” analysis, which takes into consideration earnings, revenue growth, operating margins and other economic factors. The Adviser also considers the level of industry competition, regulatory factors, the threat of technological obsolescence, and a variety of other industry factors. If the Adviser’s estimate of a company’s value differs sufficiently from the current market price, the company may be an attractive investment opportunity. In constructing a portfolio of securities, the Adviser is not constrained by the sector or industry weights in the benchmark. The Adviser relies on individual stock selection and discipline in the investment process to add value. The highest portfolio security weights are assigned to companies where the Adviser has the highest level of conviction. | The Adviser focuses on estimating a company’s value independent of its current stock price. To estimate a company’s value, the Adviser concentrates on the fundamental economic drivers of the business. The primary focus is on “bottom-up” analysis, which takes into consideration earnings, revenue growth, operating margins and other economic factors. The Adviser also considers the level of industry competition, regulatory factors, the threat of technological obsolescence, and a variety of other industry factors. If the Adviser’s estimate of a company’s value differs sufficiently from the current market price, the company may be an attractive investment opportunity. In constructing a portfolio of securities, the Adviser is not constrained by the sector or industry weights in the benchmark. The Adviser relies on individual stock selection and discipline in the investment process to add value. The highest portfolio security weights are assigned to companies where the Adviser has the highest level of conviction.

|

| Short Selling |

| The Fund also will sell securities short. Short sales are effected when it is believed that the price of a particular security will decline, and involves the sale of a security which the Fund does not own in hopes of purchasing the same security at a later date at a lower price. To make delivery to the buyer, the Fund must borrow the security, and the Fund is obligated to return the security to the lender, which is accomplished by a later purchase of the security by the Fund. The frequency of short sales will vary substantially in different periods, and it is not intended that any specified portion of the Fund’s assets will as a matter of practice be invested in short sales. The Fund will not make a short sale if, immediately before the transaction, the market value of all securities sold short exceeds 40% of the value of the Fund’s net assets. | The Fund may sell securities short. Short sales are effected when it is believed that the price of a particular security will decline, and involves the sale of a security which the fund does not own in hopes of purchasing the same security at a later date at a lower price. To make delivery to the buyer, the Fund must borrow the security, and the fund is obligated to return the security to the lender, which is accomplished by a later purchase of the security by the Fund. The frequency of short sales will vary substantially in different periods, and it is not intended that any specified portion of the Fund’s assets will as a matter of practice be invested in short sales. The Fund will not make a short sale if, immediately before the transaction, the market value of all securities sold short exceeds 70% of the value of the Fund’s net assets. |

| Portfolio Maintenance |

| Once a stock is purchased or sold short, the Adviser continues to monitor the company’s strategies, financial performance and competitive environment. The Adviser may sell a security (or repurchase a security sold short) as it reaches the Adviser’s estimate of the company’s value; if it believes that the company’s earnings, revenue growth, operating margin or other economic factors are deteriorating (or improving in the case of a short sale) or if it identifies a stock that it believes offers a better investment opportunity. | Once a stock is purchased or sold short, the Adviser continues to monitor the company’s strategies, financial performance and competitive environment. The Adviser may sell a security (or repurchase a security sold short) as it reaches the Adviser’s estimate of the company’s value; if it believes that the company’s earnings, revenue growth, operating margin or other economic factors are deteriorating (or improving in the case of a short sale); or, if it identifies a stock that it believes offers a better investment opportunity. |

| Benchmarks |

Primary Russell 3000 Financials Index | Primary Russell 3000 Index |

Secondary 80% Russell 3000 Financials Index/20% ICE BofA Merrill Lynch US T-Bill 0-3 Month Index | Secondary 75% Russell 3000 Index/25% ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index |

| Morningstar Category |

| Financial | Long-Short Equity |

For additional information on the Funds’ principal investment strategies and related risks, please refer to the “Additional Information About the Funds” section of this Proxy Statement/Prospectus.

Principal Investment Risks

A Fund’s returns and yields will vary, and you could lose money. Each Fund is designed for long-term investors seeking long-term capital appreciation. The following is a summary of the principal risks associated with an investment in each Fund. Because the Funds have similar investment objectives and policies, and because both seek exposure to a mix of equity securities, many of the principal risks are similar for each Fund. Differences and similarities in risks between the Funds are noted below. Additional information about these risks is included

below and described in greater detail later in this Proxy Statement/Prospectus under “Additional Information About the Funds—Additional Risks of the Funds.” As with any security, an investment in either Fund involves certain risks, including loss of principal. The fact that a particular risk is not identified does not mean that a Fund, as part of its overall investment strategy, does not invest or is precluded from investing in securities that give rise to that risk. This information is qualified in its entirety by the prospectuses of each Fund, which are incorporated by reference.

|

| | |

| Target Fund | Acquiring Fund | How They Compare |

Financial Sector Risk. Because the Fund’s portfolio is concentrated in the financial services industry, it is subject to risks in addition to those that apply to the general equity market. Economic, legislative or regulatory developments may occur which significantly affect the entire sector. This may cause the Fund’s net asset value to fluctuate more than that of a fund that does not concentrate in a particular sector.

| Not applicable | A principal risk of the Target Fund’s strategy is financial sector risk, but that risk does not apply to the Acquiring Fund’s strategy. |

Equity Market Risk. Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value. | Equity Market Risk. Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value.

| The risks are the same. |

Foreign and Emerging Markets Risk. The Fund may invest in non-U.S. securities and U.S. securities of companies domiciled in foreign (non-U.S.) countries that may experience more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies. These companies may be subject to additional risks, including political and economic risks, civil conflicts and war, greater volatility, expropriation and nationalization risks, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investments, and less stringent investor protection and disclosure standards of foreign markets. The potential departure of one or more other countries from the European Union may have significant political and financial consequences for global markets. These risks are magnified in emerging markets as events and evolving conditions in certain economies or markets may alter the risks associated with investments tied to countries or regions that historically were perceived as comparatively stable becoming riskier and more volatile.

| Foreign and Emerging Markets Risk. The Fund may invest in non-U.S. securities and U.S. securities of companies domiciled in foreign (non-U.S.) countries that may experience more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies. These companies may be subject to additional risks, including political and economic risks, civil conflicts and war, greater volatility, expropriation and nationalization risks, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investments, and less stringent investor protection and disclosure standards of foreign markets. The potential departure of one or more other countries from the European Union may have significant political and financial consequences for global markets. These risks are magnified in emerging markets as events and evolving conditions in certain economies or markets may alter the risks associated with investments tied to countries or regions that historically were perceived as comparatively stable becoming riskier and more volatile. | The risks are the same. |

|

| | |

| Target Fund | Acquiring Fund | How They Compare |

Management Risk. The Adviser’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which the Fund invests may prove to be incorrect and there is no guarantee that individual companies will perform as anticipated. The value of an individual company can be more volatile than the market as a whole, and the Adviser’s intrinsic value-oriented approach may fail to produce the intended results. In addition, there is no guarantee that the use of long and short positions will succeed in limiting the Fund’s exposure to stock market movements, sector-swings or other risk factors. The strategy used by the Fund involves complex securities transactions that involve risks different than direct equity investments. In addition, some of the Fund’s Portfolio Managers have no experience managing a mutual fund.

| Management Risk. The Adviser’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which the Fund invests may prove to be incorrect and there is no guarantee that individual companies will perform as anticipated. The value of an individual company can be more volatile than the market as a whole, and the Adviser’s intrinsic value-oriented approach may fail to produce the intended results. In addition, there is no guarantee that the use of long and short positions will succeed in limiting the Fund’s exposure to stock market movements, sector-swings or other risk factors. The strategy used by the Fund involves complex securities transactions that involve risks different than direct equity investments. In addition, some of the Fund’s Portfolio Managers have no experience managing a mutual fund. | The risks are the same.

|

Short Sale Risk. The Fund will incur a loss as a result of a short sale if the price of the security sold short increases in value between the date of the short sale and the date on which the Fund purchases the security to replace the borrowed security. In addition, a lender may request, or market conditions may dictate, that securities sold short be returned to the lender on short notice, and the Fund may have to buy the securities sold short at an unfavorable price. If this occurs, any anticipated gain to the Fund may be reduced or eliminated or the short sale may result in a loss. The Fund’s losses are potentially unlimited in a short sale transaction. Short sales are speculative transactions and involve special risks, including greater reliance on the Adviser’s ability to accurately anticipate the future value of a security.

| Short Sale Risk. The Fund will incur a loss as a result of a short sale if the price of the security sold short increases in value between the date of the short sale and the date on which the Fund purchases the security to replace the borrowed security. In addition, a lender may request, or market conditions may dictate, that securities sold short be returned to the lender on short notice, and the Fund may have to buy the securities sold short at an unfavorable price. If this occurs, any anticipated gain to the Fund may be reduced or eliminated or the short sale may result in a loss. The Fund’s losses are potentially unlimited in a short sale transaction. Short sales are speculative transactions and involve special risks, including greater reliance on the Adviser’s ability to accurately anticipate the future value of a security. | The risks are the same. |

Small Cap and Mid Cap Company Risk. Investments in small cap and mid cap companies may be riskier than investments in larger, more established companies. The securities of these companies may trade less frequently and in smaller volumes than securities of larger companies. In addition, small cap and mid cap companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Because smaller companies may have limited product lines, markets or financial resources or may depend on a few key employees, they may be more susceptible to particular economic events or competitive factors than large capitalization companies. | Small Cap and Mid Cap Company Risk. Investments in small cap and mid cap companies may be riskier than investments in larger, more established companies. The securities of these companies may trade less frequently and in smaller volumes than securities of larger companies. In addition, small cap and mid cap companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Because smaller companies may have limited product lines, markets or financial resources or may depend on a few key employees, they may be more susceptible to particular economic events or competitive factors than large capitalization companies. | The risks are the same. |

Comparison of Fund Performance

The following information provides some indication of the risks of investing in each Fund by showing how each Fund’s performance has varied over time.

Acquiring Fund:

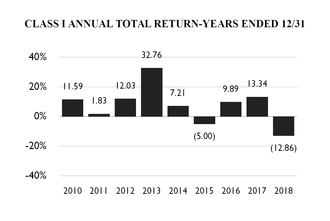

The following bar chart and table show two aspects of the fund: volatility and performance. The bar chart shows the volatility — or variability — of the fund’s annual total returns over time, and shows that fund performance can change from year to year. Prior to calendar year 2012, the bar chart and table reflect the past performance of Diamond Hill Research Partners, L.P. (the “Research Partnership”), a private fund managed with full investment authority by the fund’s Adviser, and provide some indication of the risks of investing in the fund by showing changes in the fund’s performance from year to year over the periods indicated and by showing how the fund’s average annual total returns for the periods indicated compared to a relevant market index. The fund is managed in all material respects in a manner equivalent to the management of the predecessor unregistered fund. The fund’s objectives, policies, guidelines and restrictions are in all material respects equivalent to the predecessor, and the fund was created for reasons entirely unrelated to the establishment of a performance record. The assets of the Research Partnership were converted, based on their value on December 30, 2011, into assets of the fund prior to commencement of operations of the fund. The performance of the Research Partnership has been restated to reflect the net expenses and maximum applicable sales charge of the fund for its initial years of investment operations. The Research Partnership was not registered under the Investment Company Act of 1940 (the “1940 Act”) and therefore was not subject to certain investment restrictions imposed by the 1940 Act. If the Research Partnership had been registered under the 1940 Act, its performance may have been adversely affected. Performance of the fund prior to calendar year 2012 is measured from March 31, 2009, the inception of the Research Partnership, and is not the performance of the fund. The fund’s and the Research Partnership’s past performance is not necessarily an indication of how the fund will perform in the future either before or after taxes. Updated performance information is available at no cost by visiting www.diamond-hill.com or by calling 888-226-5595.

Average Annual Total Returns As of 12/31/2018

The average annual total returns for the fund’s Class A and C shares below are reduced to reflect the maximum applicable sales charges for each class of shares and assume Class C shareholders redeem all of their shares at the end of the period indicated and pay the contingent deferred sales charge then applicable. After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold fund shares in tax-deferred accounts or to shares held by non-taxable entities. The one year and five year after-tax returns are shown for Class I shares only and will vary from the after-tax returns for the other share classes. After-tax returns are not provided prior to five years because the Research Partnership’s tax treatment was different than that of a registered investment company.

|

| | | | | | | |

| | Inception

Date of Class | One Year | Five

Year | Since Inception 3/31/09 |

Class I Before Taxes | 12/30/11 | (12.86 | )% | 2.02 | % | 10.46 | % |

| After Taxes on Distributions | | (13.68 | ) | 0.86 |

| N/A |

|

| After Taxes on Distributions and Sale of Fund Shares | | (6.96 | ) | 1.50 |

| N/A |

|

Class A Before Taxes | 12/30/11 | (17.41 | ) | 0.72 |

| 9.58 |

|

Class C Before Taxes | 12/30/11 | (14.57 | ) | 0.98 |

| 9.34 |

|

| Russell 3000 Index | | (5.24 | ) | 7.91 |

| 14.88 |

|

| 75% Russell 3000 Index/25% ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index | | (3.31 | ) | 6.16 |

| 11.25 |

|

The fund's primary benchmark, the Russell 3000 Index, is a market-capitalization weighted index measuring performance of the 3,000 largest U.S. companies based on total market capitalization.

The fund’s secondary benchmark, the 75% Russell 3000 Index/25% ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index, is a blended index representing a 75% weighting of the Russell 3000 index as described above, and a 25% weighting of the ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index. The ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

You cannot invest directly in an index. Unlike mutual funds, an index does not incur expenses. If expenses were deducted, the actual returns of an index would be lower.

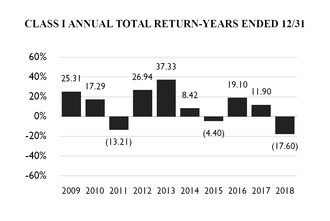

Target Fund:

The following bar chart and table show two aspects of the fund: volatility and performance. The bar chart shows the volatility — or variability — of the fund’s annual total returns over time, and shows that fund performance can change from year to year. The table shows the fund’s average annual total returns for certain time periods compared to the returns of a broad-based securities index. The bar chart and table provide some indication of the risks of investing in the fund. Of course, the fund’s past performance is not necessarily an indication of its future performance. Updated performance information is available at no cost by visiting www.diamond-hill.com or by calling 888-226-5595.

Average Annual Total Returns As of 12/31/2018

The average annual total returns for the fund’s Class A and C shares below are reduced to reflect the maximum applicable sales charges for each class of shares and assume Class C shareholders redeem all of their shares at the end of the period indicated and pay the contingent deferred sales charge then applicable. After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns are shown for Class I shares only and will vary from the after-tax returns for the other share classes.

|

| | | | | | | |

| | Inception

Date of Class | One Year | Five Year | Ten Year |

Class I Before Taxes | 12/31/06 | (17.60 | )% | 2.62 | % | 9.73 | % |

| After Taxes on Distributions | | (17.78 | ) | 2.53 |

| 9.62 |

|

| After Taxes on Distributions and Sale of Fund Shares | | (10.29 | ) | 2.02 |

| 8.03 |

|

Class A Before Taxes | 8/1/97 | (21.97 | ) | 1.29 |

| 8.83 |

|

Class C Before Taxes | 6/3/99 | (19.25 | ) | 1.58 |

| 8.58 |

|

| Russell 3000 Financials Index | | (8.35 | ) | 8.29 |

| 11.45 |

|

| 80% Russell 3000 Financials Index/20% ICE BofA Merrill Lynch US T-Bill 0-3 Month Index | | (6.24 | ) | 6.84 |

| 9.47 |

|

The fund's primary benchmark, the Russell 3000 Financials Index, is a subset of the Russell 3000 Index that measures the performance of the securities classified in the financial services sector of the U.S. equity market. The Russell 3000 Index is a market-capitalization weighted index measuring performance of the 3,000 largest U.S. companies based on total market capitalization.

The fund’s secondary benchmark, the 80% Russell 3000 Financials Index/20% ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index, is a blended index representing a 80% weighting of the Russell 3000 Financials Index as described above, and a 20% weighting of the ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index. The ICE BofA Merrill Lynch U.S. T-Bill 0-3 Month Index tracks the performance of the U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

You cannot invest directly in an index. Unlike mutual funds, an index does not incur expenses. If expenses were deducted, the actual returns of an index would be lower.

Management of the Funds

Investment Adviser:

Diamond Hill Capital Management, Inc. is the investment adviser for the Acquiring Fund and the Target Fund and will remain the investment adviser of the Acquiring Fund after the Reorganization.

Fund Management:

The Acquiring Fund’s investment personnel will continue to manage the Acquiring Fund after the Reorganization. For more information about each Fund’s investment personnel, please refer to “Other Comparative Information about the Funds.”

Tax Information

Both Funds intend to qualify each year as a regulated investment company under the Internal Revenue Code. As a regulated investment company, each Fund generally pays no federal income tax on the income and gains distributed to you. The Acquiring Fund, like the Target Fund, intends to declare and distribute its net investment income, if any, to shareholders annually, and such distributions may be taxed as ordinary income or capital gains. These tax characteristics of the Acquiring Fund will not change as a result of the Reorganization.

Payments to Broker-Dealers, Insurers, and Other Financial Intermediaries

If you purchase shares through a broker-dealer or other financial intermediary (such as a bank), a Fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s web site for more information.

THE REORGANIZATION

The Plan

Shareholders of the Target Fund are being asked to approve the Plan, which sets forth the terms and conditions under which the Reorganization will be implemented. Significant provisions of the Plan are summarized below; however, this summary is qualified in its entirety by reference to the Plan, a form of which is attached hereto as Appendix A to this Proxy Statement/Prospectus.

The Plan contemplates: (i) the Acquiring Fund’s acquisition of all or substantially all of the assets of the Target Fund in exchange solely for shares of the Acquiring Fund having an aggregate NAV equal to the aggregate NAV of the shares of the Target Fund and the assumption by the Acquiring Fund of all of the Target Fund’s liabilities, if any; (ii) the distribution of those shares of the Acquiring Fund to the shareholders of the Target Fund; and (iii) the complete termination and liquidation of the Target Fund.

The value of the Target Fund’s assets to be acquired, the amount of its liabilities to be assumed by the Acquiring Fund, and the NAV of a share of the Target Fund will be determined as of the close of regular trading on the NYSE on the Closing Date (the “Valuation Time”), after the declaration by the Target Fund of distributions, if any, on the Closing Date, and will be determined in accordance with the valuation methodologies described in the Funds’ currently effective prospectuses and Statement of Additional Information (“SAI”). The Plan provides that the Adviser will bear the fees and costs related to the Reorganization, including the costs and expenses incurred in the preparation and mailing of this Proxy Statement/Prospectus. Each Fund (and indirectly each Fund’s shareholders) will bear brokerage commissions or other transaction costs, if any, related to the Reorganization. The Closing Date is expected to be on or about June 7, 2019, or as soon as practicable thereafter.

The Target Fund will distribute pro rata to its shareholders of record the shares of the Acquiring Fund it receives in the Reorganization, so that each shareholder of the Target Fund will receive a number of full and fractional corresponding shares of the Acquiring Fund equal in value to his or her holdings in the Target Fund, and the Target Fund will be liquidated. The number of shares to be issued will be determined at the relative NAV of each class of shares of the Target Fund and the corresponding class of shares of the Acquiring Fund.

Such distribution will be accomplished by opening accounts on the books of the Acquiring Fund in the names of the Target Fund’s shareholders and by transferring to those accounts the shares of the Acquiring Fund previously credited to the account of the Target Fund. Each shareholder account shall be credited with the pro rata number of the Acquiring Fund’s shares due to that shareholder. All issued and outstanding shares of the Target Fund will simultaneously be canceled on the books of the Trust. Accordingly, immediately after the Reorganization, each former shareholder of the Target Fund will own shares of the Acquiring Fund that will be equal to the value of that shareholder’s shares of the Target Fund as of the Closing Date for the Reorganization.