325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

James F. Laird, Jr., 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

Item 1. Reports to Stockholders.

Table of Contents

| Letter to Shareholders | 1 |

| | |

| Mission Statement, Pledge, and Fundamental Principles | 4 |

| | |

| Financial Statements | |

| | |

| Schedules of Investments | 7 |

| | |

| Tabular Presentation of Schedule of Investments | 19 |

| | |

| Statements of Assets & Liabilities | 21 |

| | |

| Statements of Operations | 23 |

| | |

| Statements of Changes in Net Assets | 24 |

| | |

| Schedule of Capital Share Transactions | 26 |

| | |

| Financial Highlights | 28 |

| | |

| Notes to Financial Statements | 35 |

| | |

| Other Items | 42 |

| | |

| Schedule of Shareholder Expenses | 44 |

| | |

| Management of the Trust | 45 |

| | |

| Notice of Privacy Policy | 46 |

CAUTIONARY STATEMENT

At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Please read the Prospectus carefully for a discussion of fees, expenses, and risks. Current performance may be lower or higher than that quoted herein. You may obtain a current copy of the Prospectus or more current performance information by calling 1-888-226-5595 or at Diamond Hill’s website (www.diamond-hill.com).

Letter to Shareholders

Dear fellow shareholder:

We are pleased to provide this 2009 mid-year update for the Diamond Hill Funds. Our focus remains on seeking out investment opportunities where the price-to-intrinsic value relationship provides an opportunity to earn an attractive rate of return while also providing a margin of safety.

Fund Performance and Markets

Following a dismal 2008, U.S. equity markets posted positive returns for the first six months of 2009 with the Russell 1000 and Russell 2000 Indices increasing 4.32% and 2.64%, respectively. The year began with a brief rally in January, as investors reacted positively to new policy initiatives and support for the ailing financial sector. However, the markets soon reflected pessimism that the policy changes would be insufficient and recognition that financial sector risk remained high. In addition, corporate earnings reports were not only worse than expected, but also the quality was low and guidance for 2009 earnings fell dramatically.

Initially driven by positive comments from financial giants Bank of America and JP Morgan Chase and from short covering, the market staged a second more significant rally in early March that continued into the second quarter of 2009. In general, the second quarter was a period of healing for financial markets around the globe. A transition from risk aversion to risk taking is a necessary precondition to a market recovery, and we had been monitoring the credit markets closely for signs that this shift was underway. The credit markets began to recover with the equity markets in early March and the progress continued unabated through the end of the second quarter. For the first half of the year, the Merrill Lynch US High Yield Master II Index returned 29.37% and the Merrill Lynch US Corporate Master Index returned 9.23%. As is typical, the market improvement began in anticipation of tangible signs of economic recovery, or at the very least, in the anticipation that the worst might be over. Following the recent rally, corporate profits will need to match forecasts to justify market valuations, and investors may continue to be wary of any signs of renewed crisis.

We were very pleased with the absolute and relative performance of our funds for periods ended June 30, 2009. Although the Diamond Hill Large Cap Fund lagged the Russell 1000 Index very slightly in the first six months of 2009, it remains solidly ahead of the Russell 1000 for longer time periods. All other Funds exceeded their respective benchmarks. We remain focused on long-term performance and committed to our investment philosophy, which is rooted in the belief that market price and intrinsic value tend to converge over a reasonable period of time.

Market Returns - 1970s and Today

As I have stated many times, I was very fortunate to get started in this business in 1982. The bull market, which began in August of that year and lasted until 2000, helped make it a wonderful period to be an equity investor. At the beginning of my career, I remember being surprised by the dismal equity returns of the previous periods. Equities were virtually flat for the 14 years ending in July of 1982, which is a very long period of time for so little progress to be made in the equity markets. This had several implications, but primarily an indifferent investor class and attractive valuations. Today’s investors seem more discouraged than indifferent, but I look back on that period for clues as to the opportunities available in the market today. On the surface, it might appear discouraging. If we are entering an extended period of flat market returns, equity opportunities would appear limited. However, the analogy I would like to draw is with the narrower time period of 1974-1982. While the 14 year period ending in 1982 was awful, the returns from the lows of 1974-75 were attractive. If March 2009 turns out to be the market low of this cycle, similar opportunities may be available today. If we were to apply the 1970s analogy, simple math indicates that investment opportunities could return to historical norms. To provide an example, let’s assume a 16 year period of a flat S&P 500. That sounds like an awful return but remember valuations were a lot higher in 2000. So if we assume the market does return to the peak levels of 2000 by the end of 2016, then the market appreciation from June 30, 2009 would be approximately 7% annually. Add in the dividend yield, and we would have a very normal return for the next 7 ½ years, in that scenario.

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 1 |

Of course, simply doing the calculation does not mean that the market will return to those levels or that the 1970s analogy is even valid. However, in my opinion, if you examine the levels of earnings and valuations in the market today, normal rates of growth off normalized earnings could get you close to the level of earnings in the market in 2006-2007. If you put a normal multiple on those earnings, you could justify the market valuations we first reached in 2000. My estimates may be off by a year or two, but I believe the opportunity remains approximately the same. The way I see it, normal, but not outstanding, investment opportunities appear to be available in the equity markets.

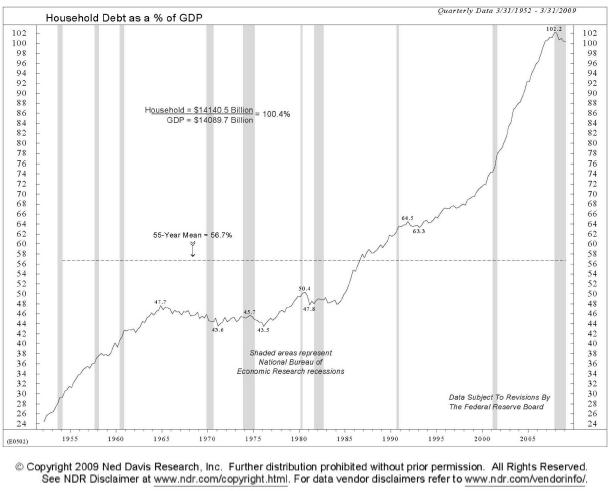

Consumer Debt

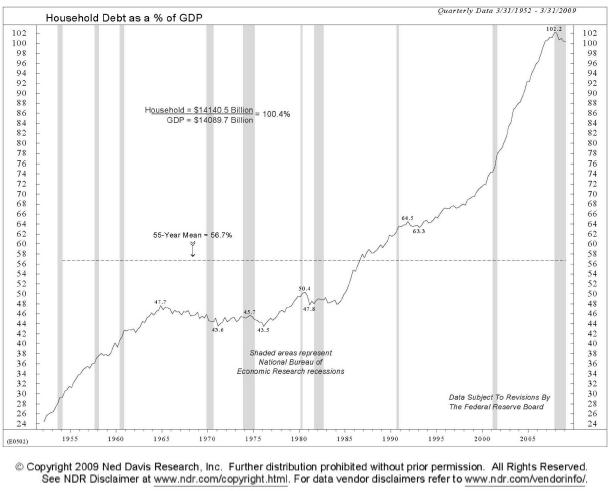

Within the equity markets, we remain concerned regarding the health of the American consumer and the effect the consumer will have on the economic recovery. This is an area of the U.S. economy that is facing serious secular issues. The past 25 years have been marked by occasional recessions and recoveries, driven by consumer spending. This consumer spending was driven, in large part, by increased borrowing against higher asset prices. Those assets are no longer appreciating, but the debt remains. Levels of consumer debt seem unsustainable, which is why I believe the market may be too optimistic regarding a U.S. recovery dependent on consumer spending. Below is a chart showing the rise in consumer debt relative to GDP. The increase in the last 30 years is amazing.

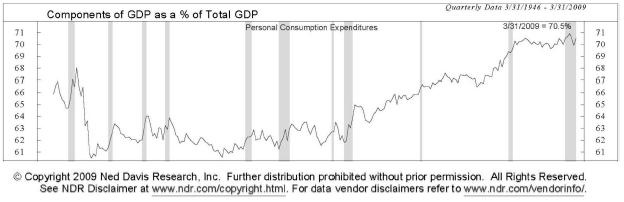

The next chart shows the growth of personal consumption expenditures as a percent of GDP. Note the steady rise over this period. Through much of the 1980s and early 1990s, this could be explained by the normal spending pattern of baby boomers, as they approached middle age. However, now the population is aging, and consumption should shrink from these high levels. While such a correction is normal, it will make it difficult for American consumers to drive future GDP growth.

| |

| Page 2 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

This letter is intended to provide an historic framework for our current environment, as well as a sober assessment of the opportunities. Market opportunities will be different in this environment, as the challenges facing the U.S. consumer are daunting. In my opinion, the good news is that valuations have adjusted, so going forward equity investors should have the opportunity for more normal returns for the next several years. As you would expect, that assessment is reflected in our portfolios.

Charles S. Bath, CFA

Managing Director - Investments

The views expressed are those of the portfolio manager as of June 30, 2009, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 90% of the U.S. market.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

Investors should consider the investment objectives, risks, and charges and expenses of the Diamond Hill Funds carefully before investing. This and other information about the Funds is in the prospectus, which can be obtained at www.diamond-hill.com or by calling 888-226-5595. Read the prospectus carefully before you invest. Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. The Diamond Hill Funds are distributed by BHIL Distributors, Inc. (Member FINRA), an affiliated company. Like all mutual funds, Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 3 |

Mission Statement, Pledge

and Fundamental Principles

| Mission | The mission of Diamond Hill is to serve our clients through a disciplined intrinsic value-based approach to investing, while maintaining a long-term perspective, and aligning our interests with those of our clients. |

| | To successfully pursue our mission, we are: |

| | |

| | COMMITTED to the Graham-Buffett investment philosophy, with goals (over 5-year rolling periods) to outperform benchmarks and our peers, and achieve absolute returns sufficient for risk of asset class. DRIVEN by our conviction to create lasting value for clients and shareholders. MOTIVATED through ownership of Diamond Hill funds and company stock. |

| | |

Investment Philosophy | At Diamond Hill, the investment philosophy, which is rooted in the teachings of Benjamin Graham and the methods of Warren Buffett, drives the investment process — not the opposite. |

| | |

| | Most simply, we invest in a company when its market price is at a discount to our appraisal of the intrinsic value of the business (or at a premium for short positions). There are four guiding principles to our investment philosophy: |

| | ♦ | Treat every investment as a partial ownership interest in that company |

| | ♦ | Always invest with a margin of safety to ensure the protection of capital as well as return on capital |

| | ♦ | Possess a long-term investment temperament |

| | | |

| | ♦ | Recognize that market price and intrinsic value tend to converge over a reasonable period of time |

“Investment is most intelligent when it is most businesslike.”

| Pledge | Consistent with our mission & investment philosophy, we pledge the following to all of our clients: |

| | Our investment discipline is to assess the economics of the underlying business, its management, and the price that must be paid to own a piece of it. We seek to concentrate our investments in businesses that are available at prices below intrinsic value (above intrinsic value for short positions) and are managed or controlled by trustworthy and capable people. Benjamin Graham pioneered this discipline during the 1930s and many others have practiced it with great success ever since, most notably Warren Buffett. |

| | We will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust. |

| | Our investment team will be comprised of people with integrity, sound experience and education, in combination with a strong work ethic and independence of thought. Especially important is that each possesses the highest level of character, business ethics and professionalism. |

| |

| Page 4 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

| | Our employees will enjoy a working environment that supports professional and personal growth, thereby enhancing employee satisfaction, the productivity of the firm and the experience of our clients. |

| | “Invest With Us” means we will invest the capital you entrust to us with the same care that we invest our own capital. To this end, Diamond Hill employees and affiliates are significant investors in the same portfolios in which our clients invest and are collectively the largest shareholders in the Diamond Hill Funds. In addition, all Diamond Hill employees are subject to a Code of Ethics, which states that all personal investments must be made in a Diamond Hill fund, unless approved by our Chief Compliance Officer. |

| | |

Our fundamental investment principles | Valuation |

| | Every share of stock has an intrinsic value that is independent of its current stock market price. |

| | At any point in time, the stock market price may be either significantly higher or lower than intrinsic value. |

| | Over short periods of time, as evidenced by extreme stock market volatility, the stock market price is heavily influenced by the emotions of market participants, which are far more difficult to predict than intrinsic value. While stock market prices may experience extreme fluctuations on a particular day, we believe intrinsic value is far less volatile. |

| | Over sufficiently long periods of time, five years and longer, the stock market price tends to converge with intrinsic value. |

| | Calculating Intrinsic Value Estimate |

| | We believe that we can determine a reasonable approximation of that intrinsic value in some cases. |

| | That value can be determined if we have a reasonable basis for projecting the future cash flows of a business and use an appropriate discount rate. |

| | In estimating intrinsic value, we use an interdisciplinary approach. Not only do we perform financial modeling including discounted cash flow, private market value, and leveraged buyout analyses, we draw from other areas we believe are relevant to our investment decision-making. These include economics, statistics and probability theory, politics, psychology, and consumer behavior. |

| | In short, we do not want to exclude from our thinking anything that can help us forecast future cash flows, our most important as well as most difficult job. |

| | The Diamond Hill investment process continually compares market price to our estimate of intrinsic value, which is updated over time as new information arises. |

| | We only invest in a business when the stock market price is lower than our conservative assessment of per share intrinsic value (or higher than our assessment of per share intrinsic value for short positions). |

| | We concentrate our investments in businesses whose per share intrinsic value is likely to grow. |

| | To achieve this, we assess the underlying economics of the businesses in which we invest and the industries and markets in which they participate. We seek to invest in businesses that possess a competitive advantage and significant growth prospects as well as outstanding managers and employees. |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 5 |

| | Every business in which we invest is “handicapped” by its price. While we would prefer to own only great businesses with superior managers, there are very few businesses that satisfy those criteria and additionally are available at attractive prices. As a result, we may invest in less attractive businesses at more than attractive prices. Depending on the price that we pay, our returns from less than ideal businesses may be even better than our returns from ideal businesses. |

| | We intend to achieve our return from both the closing of the gap between our purchase price and intrinsic value and the growth in per share intrinsic value. For short positions, a growing intrinsic value may shorten the holding period. |

| | We do not define risk by price volatility. We define risk as the possibility that we are unable to obtain the return of the capital that we invest as well as a reasonable return on that capital when you need the capital for other purposes. If your time horizon is less than five years, then you should not invest that capital in the stock market. |

| | |

Our fundamental strategic income principles | Our Yield Our primary goal is to generate a yield greater than the current rate of inflation without bearing undue credit or interest rate risk. However, we cannot guarantee any specific yield. |

| | A flexible approach allows us to invest in both investment grade and non-investment grade corporate bonds as well as in preferred securities, real estate investment trusts, master limited partnerships, and closed end funds. |

| | We can also invest in securities issued by the U.S. government and its agencies when conditions warrant. |

| | We balance our income objective with a focus on total return. Over the next five years, our objective is to earn equity-like returns in the income markets with lower year-to-year volatility and more importantly, a much lower risk of permanent loss of capital. |

“You simply have to behave according to what is rational than

according to what is fashionable.”

— WARREN BUFFETT

| |

| Page 6 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Small Cap Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | | |

| | | | | | Market | |

| | | Shares | | | Value | |

| Preferred Stock — 1.1% | | | | | | |

| Financial — 1.1% | | | | | | |

| Mid-America Apartment | | | | | | |

Communities, Inc. - REIT◊ | | | 125,069 | | | $ | 4,591,283 | |

| | | | | | | | | |

| Common Stocks — 79.7% | | | | | | | | |

| Consumer Discretionary — 10.3% | | | | | | | | |

Aaron Rents, Inc. ◊ | | | 58,980 | | | | 1,758,784 | |

| Black & Decker Corp., The | | | 132,295 | | | | 3,791,575 | |

| Brink's Home Security Holdings, Inc.* | | | 114,340 | | | | 3,236,965 | |

Callaway Golf Co. ◊ | | | 631,916 | | | | 3,203,814 | |

Charming Shoppes, Inc.* ◊ | | | 691,690 | | | | 2,573,087 | |

Hanesbrands, Inc.* ◊ | | | 355,100 | | | | 5,330,051 | |

| JAKKS Pacific, Inc.* | | | 231,212 | | | | 2,966,450 | |

K-Swiss, Inc. ◊ | | | 457,100 | | | | 3,885,350 | |

Priceline.com, Inc.* ◊ | | | 19,205 | | | | 2,142,318 | |

Steiner Leisure Ltd.* ◊ | | | 495,310 | | | | 15,121,814 | |

| | | | | | | | 44,010,208 | |

| | | | | | | | | |

| Consumer Staples — 7.3% | | | | | | | | |

Chattem, Inc.* ◊ | | | 132,710 | | | | 9,037,551 | |

| Del Monte Foods Co. | | | 590,160 | | | | 5,535,701 | |

Flowers Foods, Inc. ◊ | | | 303,350 | | | | 6,625,164 | |

| Lance, Inc. | | | 155,682 | | | | 3,600,925 | |

Ruddick Corp. ◊ | | | 275,945 | | | | 6,465,391 | |

| | | | | | | | 31,264,732 | |

| | | | | | | | | |

| Energy — 13.2% | | | | | | | | |

Berry Petroleum Co. ◊ | | | 179,460 | | | | 3,336,161 | |

Cimarex Energy Co. ◊ | | | 404,530 | | | | 11,464,380 | |

| Encore Acquisition Co.* | | | 415,108 | | | | 12,806,081 | |

Helmerich & Payne, Inc. ◊ | | | 175,695 | | | | 5,423,705 | |

| Hornbeck Offshore Services, Inc.* | | | 271,525 | | | | 5,807,920 | |

| Lufkin Industries, Inc. | | | 112,750 | | | | 4,741,138 | |

| Southwestern Energy Co.* | | | 178,230 | | | | 6,924,236 | |

Whiting Petroleum Corp.* ◊ | | | 170,055 | | | | 5,979,134 | |

| | | | | | | | 56,482,755 | |

| | | | | | | | | |

| Financial — 16.7% | | | | | | | | |

Alleghany Corp.* ◊ | | | 8,571 | | | | 2,322,741 | |

| Assurant, Inc. | | | 399,980 | | | | 9,635,517 | |

Assured Guaranty Ltd. ◊ | | | 841,492 | | | | 10,417,670 | |

City National Corp. ◊ | | | 158,685 | | | | 5,844,369 | |

First State Bancorp*◊ | | | 617,950 | | | | 1,192,644 | |

| Hanover Insurance Group | | | 178,565 | | | | 6,805,112 | |

Huntington Bancshares, Inc. ◊ | | | 1,305,798 | | | | 5,458,236 | |

LaSalle Hotel Properties - REIT◊ | | | 214,720 | | | | 2,649,645 | |

Leucadia National Corp.* ◊ | | | 286,645 | | | | 6,045,343 | |

Old Republic International Corp. ◊ | | | 671,690 | | | | 6,616,147 | |

| Redwood Trust, Inc. | | | 246,720 | | | | 3,641,587 | |

Taylor Capital Group, Inc◊ | | | 111,249 | | | | 762,056 | |

| United Fire & Casualty Co. | | | 156,509 | | | | 2,684,129 | |

| XL Capital, Class A | | | 672,025 | | | | 7,701,407 | |

| | | | | | | | 71,776,603 | |

| | | | | | | | | |

| Health Care — 8.3% | | | | | | | | |

| Analogic Corp. | | | 84,069 | | | | 3,106,350 | |

| InVentiv Health, Inc.* | | | 383,780 | | | | 5,192,543 | |

| LifePoint Hospitals, Inc.* | | | 275,325 | | | | 7,227,281 | |

| Res-Care, Inc.* | | | 500,695 | | | | 7,159,939 | |

STERIS Corp. ◊ | | | 184,640 | | | | 4,815,411 | |

| Waters Corp.* | | | 152,120 | | | | 7,829,616 | |

| | | | | | | | 35,331,140 | |

| | | | | | | | | |

| Industrial — 11.5% | | | | | | | | |

AirTran Holdings, Inc.* ◊ | | | 1,036,405 | | | | 6,415,347 | |

Apogee Enterprises, Inc. ◊ | | | 499,250 | | | | 6,140,775 | |

BE Aerospace, Inc.* ◊ | | | 563,240 | | | | 8,088,126 | |

| Brink's Co., The | | | 182,175 | | | | 5,288,540 | |

| Hub Group, Inc. - Class A* | | | 261,430 | | | | 5,395,915 | |

Kaydon Corp. ◊ | | | 161,270 | | | | 5,250,951 | |

Toro Co., The◊ | | | 313,670 | | | | 9,378,734 | |

Trinity Industries, Inc. ◊ | | | 246,170 | | | | 3,352,835 | |

| | | | | | | | 49,311,223 | |

| | | | | | | | | |

| Information Technology — 7.6% | | | | | | | | |

Alliance Data Systems Corp.* ◊ | | | 178,685 | | | | 7,360,035 | |

| CSG Systems International, Inc.* | | | 399,322 | | | | 5,287,023 | |

| KLA-Tencor Corp. | | | 262,130 | | | | 6,618,783 | |

Orbitz Worldwide, Inc.* ◊ | | | 739,940 | | | | 1,405,886 | |

| Verigy Ltd.* | | | 987,055 | | | | 12,012,459 | |

| | | | | | | | 32,684,186 | |

| | | | | | | | | |

| Utilities — 4.8% | | | | | | | | |

Cleco Corp. ◊ | | | 318,925 | | | | 7,150,299 | |

| UGI Corp. | | | 243,200 | | | | 6,199,168 | |

WGL Holdings, Inc. ◊ | | | 228,319 | | | | 7,310,774 | |

| | | | | | | | 20,660,241 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 341,521,088 | |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 7 |

Diamond Hill Small Cap Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | | | Market | |

| | | | Shares | | | | Value | |

| Registered Investment Companies — 37.5% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 81,112,935 | | | $ | 81,112,935 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 79,314,831 | | | | 79,314,831 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 160,427,766 | |

| | | | | | | | | |

| Total Investment Securities — 118.3% | | | | | | | | |

| (Cost $545,619,101)** | | | | | | $ | 506,540,137 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (18.3)% | | | | | | | (78,389,208 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 428,150,929 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $73,195,869. |

| †† | A portion of this security represents collateral for securities loaned. The total value of the collateral, as of June 30, 2009, was $75,811,300. |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements.

Diamond Hill Small-Mid Cap Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 86.6% | | | | | | |

| Consumer Discretionary — 9.3% | | | | | | |

| Black & Decker Corp., The | | | 13,882 | | | $ | 397,858 | |

| Brink's Home Security Holdings, Inc.* | | | 9,345 | | | | 264,557 | |

Callaway Golf Co. ◊ | | | 73,080 | | | | 370,516 | |

Charming Shoppes, Inc.* ◊ | | | 74,760 | | | | 278,107 | |

| Hanesbrands, Inc.* | | | 11,845 | | | | 177,793 | |

Harley - Davidson, Inc. ◊ | | | 9,080 | | | | 147,187 | |

K-Swiss, Inc. ◊ | | | 33,945 | | | | 288,533 | |

Steiner Leisure Ltd.* ◊ | | | 20,975 | | | | 640,366 | |

| | | | | | | | 2,564,917 | |

| | | | | | | | | |

| Consumer Staples — 9.8% | | | | | | | | |

Chattem, Inc.* ◊ | | | 9,955 | | | | 677,936 | |

| ConAgra Foods, Inc. | | | 39,840 | | | | 759,350 | |

| Del Monte Foods Co. | | | 57,105 | | | | 535,645 | |

Flowers Foods, Inc. ◊ | | | 23,980 | | | | 523,723 | |

| Lance, Inc. | | | 9,345 | | | | 216,150 | |

| | | | | | | | 2,712,804 | |

| | | | | | | | | |

| Energy — 15.4% | | | | | | | | |

Berry Petroleum Co. ◊ | | | 6,570 | | | | 122,136 | |

Cimarex Energy Co. ◊ | | | 29,740 | | | | 842,831 | |

| Encore Acquisition Co.* | | | 27,170 | | | | 838,195 | |

| Helmerich & Payne, Inc. | | | 11,950 | | | | 368,897 | |

Hornbeck Offshore Services, Inc.* ◊ | | | 11,010 | | | | 235,504 | |

| Noble Energy, Inc. | | | 18,150 | | | | 1,070,305 | |

| Southwestern Energy Co.* | | | 15,885 | | | | 617,132 | |

| Whiting Petroleum Corp.* | | | 4,410 | | | | 155,056 | |

| | | | | | | | 4,250,056 | |

| | | | | | | | | |

| Financial — 17.0% | | | | | | | | |

| Allstate Corp. | | | 16,595 | | | | 404,918 | |

| Assurant, Inc. | | | 25,565 | | | | 615,860 | |

Assured Guaranty Ltd. ◊ | | | 36,675 | | | | 454,037 | |

| City National Corp. | | | 6,640 | | | | 244,551 | |

Fifth Third Bancorp◊ | | | 38,590 | | | | 273,989 | |

| Hanover Insurance Group, Inc. | | | 11,745 | | | | 447,602 | |

| Huntington Bancshares, Inc. | | | 89,884 | | | | 375,715 | |

| Marsh & McLennan Co's., Inc. | | | 19,365 | | | | 389,817 | |

Old Republic International Corp. ◊ | | | 35,170 | | | | 346,425 | |

| Prudential Financial, Inc. | | | 4,290 | | | | 159,674 | |

| SunTrust Banks, Inc. | | | 28,155 | | | | 463,149 | |

United Fire & Casualty Co. ◊ | | | 9,024 | | | | 154,762 | |

| XL Capital Ltd. - Class A | | | 30,861 | | | | 353,667 | |

| | | | | | | | 4,684,166 | |

| |

| Page 8 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Small-Mid Cap Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Health Care — 4.6% | | | | | | |

| Analogic Corp. | | | 5,302 | | | $ | 195,909 | |

| LifePoint Hospitals, Inc.* | | | 12,865 | | | | 337,706 | |

Steris Corp. ◊ | | | 12,105 | | | | 315,698 | |

| Waters Corp.* | | | 8,120 | | | | 417,937 | |

| | | | | | | | 1,267,250 | |

| | | | | | | | | |

| Industrial — 15.6% | | | | | | | | |

AirTran Holdings, Inc.* ◊ | | | 54,605 | | | | 338,005 | |

| Avery Dennison Corp. | | | 11,310 | | | | 290,441 | |

BE Aerospace, Inc.* ◊ | | | 24,350 | | | | 349,666 | |

| Brink's Co., The | | | 10,135 | | | | 294,219 | |

| Dover Corp. | | | 28,040 | | | | 927,843 | |

| Fluor Corp. | | | 8,890 | | | | 455,968 | |

| Hub Group, Inc. - Class A* | | | 21,310 | | | | 439,838 | |

Southwest Airlines Co. ◊ | | | 47,250 | | | | 317,993 | |

Toro Co., The◊ | | | 17,795 | | | | 532,071 | |

Trinity Industries, Inc. ◊ | | | 25,840 | | | | 351,941 | |

| | | | | | | | 4,297,985 | |

| | | | | | | | | |

| Information Technology — 8.0% | | | | | | | | |

Alliance Data Systems Corp.* ◊ | | | 13,355 | | | | 550,092 | |

| KLA-Tencor Corp. | | | 24,010 | | | | 606,253 | |

Orbitz Worldwide, Inc.* ◊ | | | 56,880 | | | | 108,072 | |

| Paychex, Inc. | | | 7,515 | | | | 189,378 | |

| Verigy Ltd.* | | | 62,680 | | | | 762,816 | |

| | | | | | | | 2,216,611 | |

| | | | | | | | | |

| Utilities — 6.9% | | | | | | | | |

| Cleco Corp. | | | 16,315 | | | | 365,782 | |

| Energen Corp. | | | 17,760 | | | | 708,624 | |

| UGI Corp. | | | 18,305 | | | | 466,594 | |

| WGL Holdings, Inc. | | | 11,525 | | | | 369,031 | |

| | | | | | | | 1,910,031 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 23,903,820 | |

| | | | | | | | | |

| Registered Investment Companies — 31.6% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 7,466,154 | | | $ | 7,466,154 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 1,275,779 | | | | 1,275,779 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 8,741,933 | |

| | | | | | | | | |

| Total Investment Securities — 118.2% | | | | | | | | |

| (Cost $33,270,271)** | | | | | | $ | 32,645,753 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (18.2)% | | | | | | | (5,022,981 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 27,622,772 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $4,412,453. |

| †† | A portion of this security represents collateral for securities loaned. The total value of the collateral, as of June 30, 2009, was $4,565,353. |

See accompanying Notes to Financial Statements.

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 9 |

Diamond Hill Large Cap FundSchedule of Investments

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 90.9% | | | | | | |

| Consumer Discretionary — 3.4% | | | | | | |

Black & Decker Corp., The◊ | | | 96,576 | | | $ | 2,767,868 | |

Hanesbrands, Inc.* ◊ | | | 205,113 | | | | 3,078,746 | |

| McDonald’s Corp. | | | 169,780 | | | | 9,760,652 | |

| | | | | | | | 15,607,266 | |

| | | | | | | | | |

| Consumer Staples — 12.6% | | | | | | | | |

ConAgra Foods, Inc. ◊ | | | 479,440 | | | | 9,138,126 | |

General Mills, Inc. ◊ | | | 175,770 | | | | 9,846,635 | |

| Kimberly-Clark Corp. | | | 160,585 | | | | 8,419,472 | |

| PepsiCo, Inc. | | | 178,730 | | | | 9,823,001 | |

Procter & Gamble Co., The◊ | | | 268,950 | | | | 13,743,346 | |

Sysco Corp. ◊ | | | 340,180 | | | | 7,647,246 | |

| | | | | | | | 58,617,826 | |

| | | | | | | | | |

| Energy — 20.4% | | | | | | | | |

Anadarko Petroleum Corp. ◊ | | | 420,450 | | | | 19,084,226 | |

| Apache Corp. | | | 295,070 | | | | 21,289,301 | |

| Devon Energy Corp. | | | 317,340 | | | | 17,295,030 | |

Occidental Petroleum Corp. ◊ | | | 275,427 | | | | 18,125,851 | |

Southwestern Energy Co.* ◊ | | | 107,505 | | | | 4,176,569 | |

| Transocean, Ltd.* | | | 48,990 | | | | 3,639,467 | |

| XTO Energy, Inc. | | | 305,497 | | | | 11,651,656 | |

| | | | | | | | 95,262,100 | |

| | | | | | | | | |

| Financial — 10.1% | | | | | | | | |

| Allstate Corp. | | | 81,145 | | | | 1,979,938 | |

American Express Co. ◊ | | | 275,980 | | | | 6,413,775 | |

Bank of New York Mellon Corp. ◊ | | | 184,861 | | | | 5,418,276 | |

| Marsh & McLennan Co's., Inc. | | | 322,665 | | | | 6,495,246 | |

SunTrust Banks, Inc. ◊ | | | 466,270 | | | | 7,670,142 | |

Travelers Companies, Inc., The◊ | | | 229,415 | | | | 9,415,191 | |

| U.S. Bancorp | | | 195,010 | | | | 3,494,579 | |

Wells Fargo & Co. ◊ | | | 247,875 | | | | 6,013,448 | |

| | | | | | | | 46,900,595 | |

| | | | | | | | | |

| Health Care — 18.4% | | | | | | | | |

Abbott Laboratories◊ | | | 317,275 | | | | 14,924,616 | |

| Baxter International, Inc. | | | 146,990 | | | | 7,784,590 | |

| Cardinal Health, Inc. | | | 249,370 | | | | 7,618,254 | |

Johnson & Johnson◊ | | | 190,350 | | | | 10,811,880 | |

Medtronic, Inc. ◊ | | | 509,987 | | | | 17,793,446 | |

Pfizer, Inc. ◊ | | | 564,160 | | | | 8,462,400 | |

| Schering-Plough Corp. | | | 344,140 | | | | 8,644,797 | |

UnitedHealth Group, Inc. ◊ | | | 388,690 | | | | 9,709,476 | |

| | | | | | | | 85,749,459 | |

| | | | | | | | | |

| Industrial — 12.4% | | | | | | | | |

Avery Dennison Corp. ◊ | | | 191,960 | | | | 4,929,533 | |

Dover Corp. ◊ | | | 272,765 | | | | 9,025,794 | |

Fluor Corp. ◊ | | | 106,550 | | | | 5,464,950 | |

Illinois Tool Works, Inc. ◊ | | | 250,745 | | | | 9,362,818 | |

Parker Hannifin Corp. ◊ | | | 220,345 | | | | 9,466,021 | |

| Southwest Airlines Co. | | | 750,370 | | | | 5,049,990 | |

United Technologies Corp. ◊ | | | 279,770 | | | | 14,536,849 | |

| | | | | | | | 57,835,955 | |

| | | | | | | | | |

| Information Technology — 11.1% | | | | | | | | |

Alliance Data Systems Corp.* ◊ | | | 148,545 | | | | 6,118,569 | |

| Cisco Systems* | | | 490,675 | | | | 9,146,182 | |

Dell, Inc.* ◊ | | | 543,900 | | | | 7,467,747 | |

KLA-Tencor Corp. ◊ | | | 303,040 | | | | 7,651,760 | |

Microsoft Corp. ◊ | | | 534,945 | | | | 12,715,642 | |

Texas Instruments, Inc. ◊ | | | 408,850 | | | | 8,708,505 | |

| | | | | | | | 51,808,405 | |

| | | | | | | | | |

| Utilities — 2.5% | | | | | | | | |

| Dominion Resources, Inc. | | | 344,260 | | | | 11,505,169 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 423,286,775 | |

| Registered Investment Companies — 35.6% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 123,537,669 | | | $ | 123,537,669 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 42,069,971 | | | | 42,069,971 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 165,607,640 | |

| | | | | | | | | |

| Total Investment Securities — 126.5% | | | | | | | | |

| (Cost $636,369,242)** | | | | | | $ | 588,894,415 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (26.5)% | | | | | | | (123,328,339 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 465,566,076 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $119,634,757. |

| †† | The entire security represents collateral for securities loaned as of June 30, 2009. |

See accompanying Notes to Financial Statements.

| |

| Page 10 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Large Cap FundSchedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | | | Market | |

| | | | Shares | | | | Value | |

| Total Investment Securities — 126.5% | | | | | | | | |

| (Cost $636,369,242)** | | | | | | $ | 588,894,415 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (26.5)% | | | | | | | (123,328,339 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 465,566,076 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $119,634,757. |

| †† | The entire security represents collateral for securities loaned as of June 30, 2009. |

See accompanying Notes to Financial Statements.

Diamond Hill Select Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 89.4% | | | | | | |

| Consumer Discretionary — 3.8% | | | | | | |

Hanesbrands, Inc.* ◊ | | | 18,161 | | | $ | 272,597 | |

| McDonald’s Corp. | | | 6,155 | | | | 353,851 | |

| | | | | | | | 626,448 | |

| | | | | | | | | |

| Consumer Staples — 13.1% | | | | | | | | |

| ConAgra Foods, Inc. | | | 28,643 | | | | 545,935 | |

| General Mills, Inc. | | | 6,250 | | | | 350,125 | |

| PepsiCo, Inc. | | | 5,090 | | | | 279,746 | |

| Procter & Gamble Co., The | | | 9,765 | | | | 498,992 | |

| Sysco Corp. | | | 21,235 | | | | 477,363 | |

| | | | | | | | 2,152,161 | |

| | | | | | | | | |

| Energy — 15.2% | | | | | | | | |

| Anadarko Petroleum Corp. | | | 10,210 | | | | 463,432 | |

| Apache Corp. | | | 8,185 | | | | 590,548 | |

Cimarex Energy Co. ◊ | | | 5,725 | | | | 162,247 | |

| Devon Energy Corp. | | | 11,035 | | | | 601,407 | |

| Occidental Petroleum Corp. | | | 7,915 | | | | 520,886 | |

| Southwestern Energy Co.* | | | 4,115 | | | | 159,868 | |

| | | | | | | | 2,498,388 | |

| | | | | | | | | |

| Financial — 9.8% | | | | | | | | |

| American Express Co. | | | 9,645 | | | | 224,150 | |

| SunTrust Banks, Inc. | | | 17,650 | | | | 290,343 | |

| Travelers Companies, Inc., The | | | 11,105 | | | | 455,749 | |

| U.S. Bancorp | | | 16,550 | | | | 296,576 | |

| Wells Fargo & Co. | | | 14,040 | | | | 340,610 | |

| | | | | | | | 1,607,428 | |

| | | | | | | | | |

| Health Care — 20.0% | | | | | | | | |

| Abbott Laboratories | | | 11,230 | | | | 528,259 | |

| Baxter International, Inc. | | | 7,235 | | | | 383,166 | |

| Cardinal Health, Inc. | | | 13,800 | | | | 421,590 | |

| Johnson & Johnson | | | 6,120 | | | | 347,616 | |

| Medtronic, Inc. | | | 14,806 | | | | 516,581 | |

| Pfizer, Inc. | | | 23,545 | | | | 353,175 | |

| Schering-Plough Corp. | | | 14,360 | | | | 360,723 | |

| UnitedHealth Group, Inc. | | | 14,682 | | | | 366,756 | |

| | | | | | | | 3,277,866 | |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 11 |

Diamond Hill Select Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Industrial — 13.4% | | | | | | |

AirTran Holdings, Inc.* ◊ | | | 10,600 | | | $ | 65,614 | |

Dover Corp. ◊ | | | 15,430 | | | | 510,579 | |

| Illinois Tool Works, Inc. | | | 15,073 | | | | 562,826 | |

Parker Hannifin Corp. ◊ | | | 5,550 | | | | 238,428 | |

Trinity Industries, Inc. ◊ | | | 10,795 | | | | 147,028 | |

| United Technologies Corp. | | | 13,055 | | | | 678,337 | |

| | | | | | | | 2,202,812 | |

| | | | | | | | | |

| Information Technology — 11.4% | | | | | | | | |

Alliance Data Systems Corp.* ◊ | | | 6,040 | | | | 248,788 | |

| Cisco Systems* | | | 22,190 | | | | 413,622 | |

| KLA-Tencor Corp. | | | 12,340 | | | | 311,585 | |

| Microsoft Corp. | | | 25,985 | | | | 617,663 | |

| Verigy Ltd.* | | | 22,955 | | | | 279,362 | |

| | | | | | | | 1,871,020 | |

| | | | | | | | | |

| Utilities — 2.7% | | | | | | | | |

| Dominion Resources, Inc. | | | 13,100 | | | | 437,802 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 14,673,925 | |

| Registered Investment Companies — 17.3% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 1,097,946 | | | $ | 1,097,946 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 1,733,984 | | | | 1,733,984 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 2,831,930 | |

| | | | | | | | | |

| Total Investment Securities — 106.7% | | | | | | | | |

| (Cost $17,252,502)** | | | | | | $ | 17,505,855 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (6.7)% | | | | | | | (1,105,860 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 16,399,995 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $1,059,187. |

| †† | The entire security represents collateral for securities loaned as of June 30, 2009. |

See accompanying Notes to Financial Statements.

Diamond Hill Long-Short Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 86.0% | | | | | | |

| Consumer Discretionary — 4.2% | | | | | | |

Acco Brands Corp.* נ | | | 862,449 | | | $ | 2,432,106 | |

Black & Decker Corp., Theנ | | | 523,045 | | | | 14,990,470 | |

Hanesbrands, Inc.* נ | | | 1,029,786 | | | | 15,457,088 | |

McDonald’s Corp. † | | | 688,369 | | | | 39,574,334 | |

| | | | | | | | 72,453,998 | |

| | | | | | | | | |

| Consumer Staples — 11.3% | | | | | | | | |

ConAgra Foods, Inc. † | | | 1,978,570 | | | | 37,711,544 | |

General Mills, Inc. † | | | 712,656 | | | | 39,922,989 | |

PepsiCo, Inc. ◊ | | | 738,140 | | | | 40,568,174 | |

| Procter & Gamble Co., The | | | 1,003,195 | | | | 51,263,266 | |

Sysco Corp. † | | | 1,183,457 | | | | 26,604,113 | |

| | | | | | | | 196,070,086 | |

| | | | | | | | | |

| Energy — 18.9% | | | | | | | | |

Anadarko Petroleum Corp. † | | | 1,367,135 | | | | 62,054,258 | |

Apache Corp. † | | | 918,431 | | | | 66,264,796 | |

Cimarex Energy Co. ◊ | | | 589,480 | | | | 16,705,863 | |

Devon Energy Corp. נ | | | 968,315 | | | | 52,773,168 | |

Occidental Petroleum Corp. † | | | 1,156,785 | | | | 76,128,020 | |

| Transocean, Ltd.* | | | 203,766 | | | | 15,137,776 | |

XTO Energy, Inc. † | | | 956,857 | | | | 36,494,526 | |

| | | | | | | | 325,558,407 | |

| | | | | | | | | |

| Financial — 8.0% | | | | | | | | |

| American Express Co. | | | 1,058,050 | | | | 24,589,082 | |

SunTrust Banks, Inc. ◊ | | | 1,787,655 | | | | 29,406,925 | |

Travelers Companies, Inc., The◊ | | | 855,830 | | | | 35,123,263 | |

U.S. Bancorpנ | | | 817,137 | | | | 14,643,095 | |

Wells Fargo & Co. ◊ | | | 762,760 | | | | 18,504,558 | |

| XL Capital, Class A | | | 1,362,892 | | | | 15,618,742 | |

| | | | | | | | 137,885,665 | |

| | | | | | | | | |

| Health Care — 18.0% | | | | | | | | |

Abbott Laboratories† | | | 1,183,475 | | | | 55,670,664 | |

| Baxter International, Inc. | | | 572,255 | | | | 30,306,625 | |

Cardinal Health, Inc. † | | | 835,510 | | | | 25,524,831 | |

Johnson & Johnsonנ | | | 612,185 | | | | 34,772,108 | |

Medtronic, Inc. † | | | 1,590,052 | | | | 55,476,914 | |

| Pfizer, Inc. | | | 2,249,135 | | | | 33,737,025 | |

Schering-Plough Corp. † | | | 1,366,025 | | | | 34,314,548 | |

UnitedHealth Group, Inc. † | | | 1,632,145 | | | | 40,770,982 | |

| | | | | | | | 310,573,697 | |

| |

| Page 12 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Long-Short Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Industrial — 12.2% | | | | | | | | |

AirTran Holdings, Inc.* † | | | 531,471 | | | | 3,289,805 | |

Avery Dennison Corp. ◊ | | | 732,754 | | | | 18,817,123 | |

Dover Corp. † | | | 1,056,055 | | | | 34,944,860 | |

Fluor Corp. נ | | | 420,275 | | | | 21,555,905 | |

Illinois Tool Works, Inc. † | | | 895,960 | | | | 33,455,146 | |

Parker Hannifin Corp. ◊ | | | 717,775 | | | | 30,835,614 | |

Trinity Industries, Inc. נ | | | 862,194 | | | | 11,743,082 | |

United Technologies Corp. † | | | 1,085,615 | | | | 56,408,556 | |

| | | | | | | | 211,050,091 | |

| | | | | | | | | |

| Information Technology — 10.8% | | | | | | | | |

Alliance Data Systems Corp.* ◊ | | | 549,585 | | | | 22,637,406 | |

| Cisco Systems, Inc.* | | | 1,895,325 | | | | 35,328,858 | |

| Dell, Inc.* | | | 2,092,290 | | | | 28,727,142 | |

KLA-Tencor Corp. ◊ | | | 1,209,845 | | | | 30,548,586 | |

Microsoft Corp. נ | | | 1,843,935 | | | | 43,830,335 | |

Texas Instruments, Inc. ◊ | | | 1,230,730 | | | | 26,214,549 | |

| | | | | | | | 187,286,876 | |

| | | | | | | | | |

| Utilities — 2.6% | | | | | | | | |

Dominion Resources, Inc. ◊ | | | 1,353,830 | | | | 45,244,999 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 1,486,123,819 | |

| | | | | | | | | |

| Registered Investment Companies — 22.6% | | | | | | | | |

| JPMorgan 100% U.S. Treasury | | | | | | | | |

| Securities Money Market Fund | | | 89,460,300 | | | $ | 89,460,300 | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 139,782,977 | | | | 139,782,977 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 161,448,536 | | | | 161,448,536 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 390,691,813 | |

| | | | | | | | | |

| Total Investment Securities — 108.6% | | | | | | | | |

| (Cost $2,026,356,751)** | | | | | | $ | 1,876,815,632 | |

| | | | | | | | | |

| Segregated Cash | | | | | | | | |

| With Brokers — 36.0% | | | | | | | 622,583,231 | |

| | | | | | | | | |

| Securities Sold Short—(36.2)% | | | | | | | | |

| (Proceeds $644,711,506) | | | | | | | (625,234,072 | ) |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (8.4)% | | | | | | | (145,585,607 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,728,579,184 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009 was $135,820,774. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short aggregating a total market value of $646,658,299. |

| †† | The entire security represents collateral for securities loaned as of June 30, 2009. |

See accompanying Notes to Financial Statements.

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 13 |

Diamond Hill Long-Short Fund

Schedule of Securities Sold Short

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 87.8% | | | | | | |

| Consumer Discretionary — 40.3% | | | | | | |

| Amazon.com, Inc.* | | | 162,070 | | | $ | 13,558,776 | |

| Career Education Corp.* | | | 1,753,620 | | | | 43,647,602 | |

| CarMax, Inc.* | | | 527,598 | | | | 7,755,691 | |

| Chipotle Mexican Grill, Inc.* | | | 84,240 | | | | 6,739,200 | |

| Corinthian Colleges, Inc.* | | | 627,705 | | | | 10,627,046 | |

| Gap, Inc., The | | | 444,035 | | | | 7,282,174 | |

| Gymboree Corp., The* | | | 484,185 | | | | 17,178,884 | |

| J.C. Penny Company, Inc. | | | 243,990 | | | | 7,004,953 | |

| Macy's, Inc. | | | 617,210 | | | | 7,258,390 | |

| Marvel Entertainment, Inc.* | | | 833,650 | | | | 29,669,603 | |

| MGM MIRAGE* | | | 2,800,810 | | | | 17,897,176 | |

| NetFlix, Inc.* | | | 143,265 | | | | 5,922,574 | |

| Nordstrom, Inc. | | | 330,275 | | | | 6,569,169 | |

| Regal Entertainment Group | | | 1,544,276 | | | | 20,523,428 | |

| Royal Caribbean Cruises, Ltd. | | | 1,179,190 | | | | 15,966,233 | |

| Sally Beauty Holdings, Inc.* | | | 1,521,610 | | | | 9,677,440 | |

| Tractor Supply Co.* | | | 598,128 | | | | 24,714,649 | |

| | | | | | | | 251,992,988 | |

| | | | | | | | | |

| Consumer Staples — 12.9% | | | | | | | | |

| BJ's Wholesale Club, Inc.* | | | 220,587 | | | | 7,109,519 | |

| Colgate-Palmolive Co. | | | 395,646 | | | | 27,987,998 | |

| Dean Foods Co.* | | | 923,048 | | | | 17,713,292 | |

| Kraft Foods, Inc. | | | 1,088,860 | | | | 27,591,712 | |

| | | | | | | | 80,402,521 | |

| | | | | | | | | |

| Financial — 1.3% | | | | | | | | |

| Prosperity Bancshares, Inc. | | | 287,385 | | | | 8,572,694 | |

| | | | | | | | | |

| Health Care — 17.0% | | | | | | | | |

| Covance* | | | 342,575 | | | | 16,854,690 | |

| Laboratory Corp. of | | | | | | | | |

| America Holdings* | | | 598,488 | | | | 40,571,502 | |

| Omnicare, Inc. | | | 1,258,521 | | | | 32,419,501 | |

| Quest Diagnostics, Inc. | | | 289,850 | | | | 16,356,235 | |

| | | | | | | | 106,201,928 | |

| | | | | | | | | |

| Industrial — 4.1% | | | | | | | | |

| Boeing Co., The | | | 417,160 | | | | 17,729,300 | |

| Old Dominion Freight Line, Inc.* | | | 233,115 | | | | 7,825,671 | |

| | | | | | | | 25,554,971 | |

| | | | | | | | | |

| Information Technology — 2.5% | | | | | | | | |

| Akamai Technologies, Inc.* | | | 627,195 | | | $ | 12,029,600 | |

| Salesforce.com, Inc.* | | | 94,930 | | | | 3,623,477 | |

| | | | | | | | 15,653,077 | |

| | | | | | | | | |

| Materials — 7.5% | | | | | | | | |

| Dow Chemical Co. | | | 2,904,235 | | | | 46,874,353 | |

| | | | | | | | | |

| | | | | | | | | |

| Utilities — 2.2% | | | | | | | | |

| Sprint Nextel Corp.* | | | 2,798,055 | | | | 13,458,645 | |

| | | | | | | | | |

| Total Common Stocks Sold Short | | | | | | $ | 548,711,177 | |

| | | | | | | | | |

| Exchange Traded Funds — 12.2% | | | | | | | | |

| iShares Russell 2000 Index Fund | | | 793,250 | | | | 40,424,020 | |

| SPDR S&P Retail ETF | | | 1,296,655 | | | | 36,098,875 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Exchange Traded | | | | | | | | |

| Funds Sold Short | | | | | | $ | 76,522,895 | |

| | | | | | | | | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $644,711,506) | | | | | | $ | 625,234,072 | |

| * | Non-dividend expense producing security. |

See accompanying Notes to Financial Statements.

| | |

| Page 14 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Financial Long-Short Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Preferred Stocks — 16.1% | | | | | | |

| Financial — 12.4% | | | | | | |

| Citizens Funding Trust I, 7.50% | | | 6,340 | | | $ | 69,740 | |

Countrywide Capital V, 7.00%† | | | 19,550 | | | | 333,523 | |

Huntington Bancshares, 8.50%◊ | | | 423 | | | | 317,250 | |

National City Capital Trust IV, 8.00%◊ | | | 15,310 | | | | 339,882 | |

| Regions Financing Trust III, 8.88% | | | 2,411 | | | | 47,931 | |

| | | | | | | | 1,108,326 | |

| | | | | | | | | |

| Real Estate Investment Trust — 3.7% | | | | | | | | |

| iStar Financial, Inc., Series F | | | 1,359 | | | | 9,662 | |

| LaSalle Hotel Properties, Series B | | | 203 | | | | 3,999 | |

| LaSalle Hotel Properties, Series E | | | 1,557 | | | | 27,345 | |

| Mid-America Apartment | | | | | | | | |

Communities, Inc.† | | | 2,926 | | | | 107,413 | |

| Wachovia Preferred Funding | | | 10,375 | | | | 187,373 | |

| | | | | | | | 335,792 | |

| | | | | | | | | |

| Total Preferred Stocks | | | | | | $ | 1,444,118 | |

| | | | | | | | | |

| Common Stocks — 75.5% | | | | | | | | |

| Finance - Banks & Thrifts — 37.2% | | | | | | | | |

Bank of New York Mellon Corp. † | | | 9,429 | | | | 276,364 | |

City National Corp. † | | | 3,295 | | | | 121,355 | |

Comerica, Inc. † | | | 4,440 | | | | 93,906 | |

| Fifth Third Bancorp | | | 19,185 | | | | 136,214 | |

First State Bancorp† | | | 13,280 | | | | 25,630 | |

Huntington Bancshares, Inc. נ | | | 29,825 | | | | 124,669 | |

| JPMorgan Chase & Co. | | | 16,765 | | | | 571,853 | |

PNC Financial Services Group, Inc. † | | | 6,935 | | | | 269,147 | |

| Prudential Financial, Inc. | | | 5,975 | | | | 222,390 | |

| South Financial Group, Inc., The | | | 77,100 | | | | 91,749 | |

| SunTrust Banks, Inc. | | | 23,740 | | | | 390,523 | |

Synovus Financial Corp. † | | | 10,922 | | | | 32,657 | |

Taylor Capital Group, Incנ | | | 1,220 | | | | 8,357 | |

U.S. Bancorp† | | | 21,125 | | | | 378,560 | |

Wells Fargo & Co. † | | | 23,960 | | | | 581,269 | |

| | | | | | | | 3,324,643 | |

| | | | | | | | | |

| Finance - Broker Dealer — 4.2% | | | | | | | | |

Affiliated Managers Group, Inc.* ◊ | | | 2,930 | | | $ | 170,497 | |

Morgan Stanley† | | | 3,935 | | | | 112,187 | |

| State Street Corp. | | | 2,040 | | | | 96,288 | |

| | | | | | | | 378,972 | |

| | | | | | | | | |

| Financial - Diversified — 3.8% | | | | | | | | |

| Leucadia National Corp.* | | | 3,155 | | | | 66,539 | |

| Marsh & McLennan Co's., Inc. | | | 9,875 | | | | 198,784 | |

Paychex, Inc. ◊ | | | 3,145 | | | | 79,254 | |

| | | | | | | | 344,577 | |

| | | | | | | | | |

| Financial Specialties — 4.8% | | | | | | | | |

| American Express Co. | | | 12,060 | | | | 280,274 | |

Discover Financial Services† | | | 15,000 | | | | 154,050 | |

| | | | | | | | 434,324 | |

| | | | | | | | | |

| Insurance — 23.0% | | | | | | | | |

Allstate Corp. † | | | 12,500 | | | | 305,000 | |

Assurant, Inc. † | | | 12,135 | | | | 292,332 | |

Assured Guaranty Ltd. ◊ | | | 24,580 | | | | 304,300 | |

Hanover Insurance Group, Inc. נ | | | 5,375 | | | | 204,841 | |

| Hartford Financial | | | | | | | | |

Services Group, Inc., The◊ | | | 4,600 | | | | 54,602 | |

Old Republic International Corp. ◊ | | | 23,650 | | | | 232,953 | |

| Travelers Companies, Inc., The | | | 9,195 | | | | 377,363 | |

United Fire & Casualty Co. † | | | 3,987 | | | | 68,377 | |

| XL Capital Ltd. - Class A | | | 19,028 | | | | 218,061 | |

| | | | | | | | 2,057,829 | |

| | | | | | | | | |

| Real Estate Investment Trust — 2.5% | | | | | | | | |

Redwood Trust, Inc. ◊ | | | 15,070 | | | | 222,433 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Common Stocks | | | | | | $ | 6,762,778 | |

| | | | | | | | | |

| Registered Investment Companies — 22.3% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 1,757,257 | | | $ | 1,757,257 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 239,845 | | | | 239,845 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 1,997,102 | |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 15 |

Diamond Hill Financial Long-Short Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | | | | | | Market | |

| | | | Par Value | | | | Value | |

| Corporate Bonds — 2.2% | | | | | | | | |

| Financial — 2.2% | | | | | | | | |

| First Horizon National, | | | | | | | | |

| 4.50%, 5/15/13 | | | 250,000 | | | $ | 199,313 | |

| | | | | | | | | |

| Total Investment Securities — 116.1% | | | | | | | | |

| (Cost $10,403,836)** | | | | | | $ | 10,403,311 | |

| | | | | | | | | |

| Segregated Cash With Brokers — 7.2% | | | | | | | 647,746 | |

| | | | | | | | | |

| Securities Sold Short—(7.9)% | | | | | | | | |

| (Proceeds $844,076) | | | | | | | (708,278 | ) |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (15.4)% | | | | | | | (1,378,036 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 8,964,743 | |

| * | Non-income producing security. |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $1,325,184. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short aggregating a total market value of $2,610,568. |

| †† | A portion of this security represents collateral for securities loaned. The total value of the collateral, as of June 30, 2009, was $1,356,515. |

See accompanying Notes to Financial Statements.

Diamond Hill Financial Long-Short Fund

Schedule of Securities Sold Short

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 100.0% | | | | | | |

| Finance - Banks & Thrifts — 90.3% | | | | | | |

| First Financial Bankshares, Inc. | | | 2,825 | | | $ | 142,267 | |

| Glacier Bancorp, Inc. | | | 7,875 | | | | 116,314 | |

| Home Bancshares, Inc. | | | 6,410 | | | | 122,046 | |

| Peoples Bancorp, Inc. | | | 5,130 | | | | 87,466 | |

| Prosperity Bancshares, Inc. | | | 2,745 | | | | 81,884 | |

| WesBanco, Inc. | | | 6,150 | | | | 89,421 | |

| | | | | | | | 639,398 | |

| | | | | | | | | |

| Finance - Broker Dealer — 9.7% | | | | | | | | |

| KBW, Inc.* | | | 2,395 | | | | 68,880 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $844,076) | | | | | | $ | 708,278 | |

| * | Non-dividend expense producing security |

See accompanying Notes to Financial Statements.

| |

| Page 16 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Strategic Income Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | Shares/ | | | Market | |

| | | Par Value | | | Value | |

| Common Stocks — 0.3% | | | | | | |

| Real Estate Investment Trust — 0.3% | | | | | | |

iStar Financial, Inc. ◊ | | | 94,500 | | | $ | 268,380 | |

| | | | | | | | | |

| Collateralized Debt Obligations — 0.5% | | | | | | | | |

Alesco Preferred Funding III† | | | 724,100 | | | | 83,800 | |

Alesco Preferred Funding IV† | | | 337 | | | | 4,014 | |

Alesco Preferred Funding V† | | | 80 | | | | 1,002 | |

Alesco Preferred Funding VI† | | | 621,631 | | | | 114,100 | |

| Alesco Preferred Funding VI | | | | | | | | |

Series E† | | | 336,608 | | | | 61,475 | |

Fort Sheridan, Ltd.† | | | 489,231 | | | | 95,292 | |

Taberna Preferred Funding, Ltd. † | | | 1,008,118 | | | | 176,351 | |

| Total Collateralized | | | | | | | | |

| Debt Obligations | | | | | | $ | 536,034 | |

| | | | | | | | | |

| Preferred Stocks — 8.5% | | | | | | | | |

| Countrywide Capital V, 7.00% | | | 114,600 | | | | 1,955,076 | |

| Eagle Hospitality Properties | | | | | | | | |

| Trust, Inc., 8.25%, Series A - REIT | | | 21,007 | | | | 3,151 | |

| Innkeepers USA Trust | | | 93,250 | | | | 46,625 | |

| iStar Financial, 7.80%, Series F | | | 138,500 | | | | 984,735 | |

National City Capital IV, 8.00%◊ | | | 70,300 | | | | 1,560,660 | |

| Wachovia Preferred Funding - REIT | | | 153,815 | | | | 2,777,899 | |

| XL Capital Ltd., 10.75% | | | 88,000 | | | | 1,716,000 | |

| Total Preferred Stocks | | | | | | $ | 9,044,146 | |

| Registered Investment Companies — 4.6% | | | | | | | | |

| JPMorgan Prime Money | | | | | | | | |

Market Fund†† | | | 3,261,549 | | | | 3,261,549 | |

| JPMorgan U.S. Government | | | | | | | | |

| Money Market Fund | | | 1,636,053 | | | | 1,636,053 | |

| Total Registered | | | | | | | | |

| Investment Companies | | | | | | $ | 4,897,602 | |

| | | | | | Market | |

| | | Par Value | | | Value | |

| Corporate Bonds — 86.5% | | | | | | |

| Consumer Discretionary — 11.4% | | | | | | |

| Expedia, Inc., 8.50%, 7/1/16^ | | $ | 4,500,000 | | | $ | 4,320,000 | |

Fortune Brands, 4.875%, 12/1/13◊ | | | 3,475,000 | | | | 3,382,979 | |

| Hansebrands, Inc., | | | | | | | | |

4.59%, 12/15/14∆ | | | 3,505,000 | | | | 2,821,525 | |

| Historic Time Warner, Inc., | | | | | | | | |

| 8.05%, 1/15/16 | | | 1,600,000 | | | | 1,609,494 | |

| | | | | | | | 12,133,998 | |

| | | | | | | | | |

| Energy — 10.1% | | | | | | | | |

| Centerpoint Energy, Inc., | | | | | | | | |

| 5.95%, 2/1/17 | | | 2,525,000 | | | | 2,206,360 | |

| Cimarex Energy, 7.125%, 5/1/17 | | | 1,650,000 | | | | 1,452,000 | |

| Energy Transfer Partners, | | | | | | | | |

| 5.95%, 2/1/15 | | | 1,700,000 | | | | 1,712,786 | |

| Enterprise Products | | | | | | | | |

| Operation, 9.75%, 1/31/14 | | | 1,450,000 | | | | 1,666,788 | |

| Kaneb Pipeline, 7.75%, 2/15/12 | | | 1,700,000 | | | | 1,694,781 | |

| Pacific Energy Partners, | | | | | | | | |

| 7.125%, 6/15/14 | | | 2,000,000 | | | | 2,047,872 | |

| | | | | | | | 10,780,587 | |

| | | | | | | | | |

| Finance — 41.2% | | | | | | | | |

| American Express, | | | | | | | | |

| 7.00%, 3/19/18 | | | 2,000,000 | | | | 1,942,076 | |

| AmSouth Bank NA, | | | | | | | | |

| 5.20%, 4/1/15 | | | 2,000,000 | | | | 1,604,994 | |

| CNA Financial Corp., | | | | | | | | |

| 6.50%, 8/15/16 | | | 1,465,000 | | | | 1,187,117 | |

| Fifth Third Bank, 4.75%, 2/1/15 | | | 2,473,000 | | | | 2,088,624 | |

| First Horizon National | | | | | | | | |

| Corp., 4.50%, 05/15/13 | | | 1,400,000 | | | | 1,116,149 | |

| First Tennessee Bank, | | | | | | | | |

| 4.63%, 5/15/13 | | | 1,795,000 | | | | 1,447,628 | |

| First Tennessee Bank, | | | | | | | | |

| 5.05%, 1/15/15 | | | 1,150,000 | | | | 890,611 | |

| First Tennessee Bank, | | | | | | | | |

| 5.65%, 4/1/16 | | | 400,000 | | | | 299,734 | |

| Goldman Sachs Group, Inc., | | | | | | | | |

6.60%, 1/15/12◊ | | | 1,300,000 | | | | 1,384,143 | |

| Hartford Financial Services | | | | | | | | |

| Group, 6.30%, 3/15/18 | | | 4,900,000 | | | | 3,984,549 | |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 17 |

Diamond Hill Strategic Income Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | | | | Market | |

| | | Par Value | | | Value | |

| | | | | | | |

| Finance — 41.2% continued | | | | | | |

| Huntington National Bank, | | | | | | |

| 6.60%, 6/15/18 | | | 4,525,000 | | | $ | 3,262,398 | |

Key Bank, 5.80%, 7/1/14◊ | | | 2,000,000 | | | | 1,855,896 | |

| Key Bank, 7.413%, 5/6/15 | | | 1,125,000 | | | | 1,008,471 | |

| Marsh & McLennan Co.'s, Inc., | | | | | | | | |

5.75%, 9/15/15◊ | | | 3,000,000 | | | | 2,858,187 | |

| National City Bank of | | | | | | | | |

| Kentucky, 6.30%, 2/15/11 | | | 3,267,000 | | | | 3,306,246 | |

| National City Bank, | | | | | | | | |

| 6.20%, 12/15/11 | | | 773,000 | | | | 794,413 | |

| Nuveen Investments, Inc., | | | | | | | | |

| 10.50%, 11/15/15^ | | | 3,000,000 | | | | 2,070,000 | |

| OneBeacon U.S. Holdings, | | | | | | | | |

| 5.88%, 5/15/13 | | | 2,800,000 | | | | 2,637,566 | |

| Prudential Financial, Inc., | | | | | | | | |

| 5.10%, 9/20/14 | | | 2,720,000 | | | | 2,569,913 | |

| Prudential Financial, Inc., | | | | | | | | |

| 6.10%, 6/15/17 | | | 2,000,000 | | | | 1,902,700 | |

| Transatlantic Holdings, | | | | | | | | |

| 5.75%, 12/14/15 | | | 3,800,000 | | | | 3,139,849 | |

| Wachovia Corp., 5.75%, 6/15/17 | | | 1,635,000 | | | | 1,613,024 | |

| Wilmington Trust Corp., | | | | | | | | |

| 8.50%, 4/2/18 | | | 1,000,000 | | | | 942,960 | |

| | | | | | | | 43,907,248 | |

| | | | | | | | | |

| Industrial — 23.8% | | | | | | | | |

BE Aerospace, Inc., 8.50%, 7/1/18◊ | | | 3,300,000 | | | | 3,110,250 | |

| Fisher Scientific | | | | | | | | |

| International, Inc., 6.75%, 8/15/14 | | | 3,350,000 | | | | 3,442,882 | |

| Freeport McMoRan Copper | | | | | | | | |

| & Gold, Inc., 8.25%, 4/1/15 | | | 5,050,000 | | | | 5,100,500 | |

| KLA Instruments Corp., | | | | | | | | |

| 6.90%, 5/1/18 | | | 4,425,000 | | | | 3,978,402 | |

| Martin Marietta Materials, | | | | | | | | |

| 6.60%, 4/15/18 | | | 2,500,000 | | | | 2,376,840 | |

| National Semiconductor, | | | | | | | | |

| 6.60%, 6/15/17 | | | 4,475,000 | | | | 3,913,974 | |

| Trinity Industries, Inc., | | | | | | | | |

| 6.50%, 3/15/14 | | | 3,870,000 | | | | 3,366,900 | |

| | | | | | | | 25,289,748 | |

| | | | | | | | | |

| Utilities — 0.0% | | | | | | | | |

| International Telephone, | | | | | | | | |

| 7.50%, 7/1/11 | | | 40,000 | | | $ | 40,094 | |

| Total Corporate Bonds | | | | | | $ | 92,151,675 | |

| | | | | | | | | |

| Total Investment Securities — 100.4% | | | | | | | | |

| (Cost $116,197,547)** | | | | | | $ | 106,897,837 | |

| | | | | | | | | |

| Liabilities In Excess | | | | | | | | |

| Of Other Assets — (0.4)% | | | | | | | (473,058 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 106,424,779 | |

| ** | Represents cost for financial reporting purposes. |

| ◊ | All or a portion of the security is on loan. The total market value of the securities on loan, as of June 30, 2009, was $2,743,971. |

| ∆ | Variable notes earn interest at a coupon rate which fluctuates at specified intervals, usually daily, monthly or semi-annually. The rates shown in the Schedule of Investments are the coupon rates in effect at June 30, 2009. |

| † | Restricted and illiquid securities valued at fair value and not registered under the Securities Act of 1933: |

| | Acquisition Date | | Current Cost | | | Value | | | Value as a % of Net Assets |

| Alesco Preferred Funding III | March-05 | | $ | 724,100 | | | $ | 83,800 | | | | 0.1 | % |

| Alesco Preferred Funding IV | May-04 | | | 337,338 | | | | 4,014 | | | | 0.0 | % |

| Alesco Preferred Funding V | October-04 | | | 80,180 | | | | 1,002 | | | | 0.0 | % |

| Alesco Preferred Funding VI | December-04 | | | 621,631 | | | | 114,100 | | | | 0.1 | % |

| Alesco Preferred Funding VI Series E | March-05 | | | 336,608 | | | | 61,475 | | | | 0.0 | % |

| Fort Sheridan, LTD | March-05 | | | 489,065 | | | | 95,292 | | | | 0.1 | % |

| Taberna Preferred Funding, LTD | March-05 | | | 1,010,811 | | | | 176,351 | | | | 0.2 | % |

| | | | $ | 3,599,733 | | | $ | 536,034 | | | | 0.5 | % |

| †† | The entire security represents collateral for securities loaned as of June 30, 2009. |

| ^ | Restricted securities not registered under the Securities Act of 1933. Acquisition date and current cost: Nuveen Investments, Inc., 10.50%, 11/15/15 – 1/08, $2,915,000 and Expedia, Inc., 8.50%, 7/1/16, $2,814,375. At June 30, 2009, these securities had a market value of $2,070,000 and $4,320,000, respectively, representing 1.9% and 4.1% of net assets, respectively. |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements.

| |

| Page 18 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Funds

Tabular Presentation of Schedule of Investments

June 30, 2009 (Unaudited)

The illustrations below provide each Fund's sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund's investments.

| Small Cap Fund | | | |

| | | % of | |

| Sector Allocation | | Net Assets | |

| Common Stock: | | | |

| Consumer Discretionary | | | 10 | % |

| Consumer Staples | | | 7 | % |

| Energy | | | 13 | % |

| Financial | | | 17 | % |

| Health Care | | | 8 | % |

| Industrial | | | 12 | % |

| Information Technology | | | 8 | % |

| Utilities | | | 5 | % |

| Preferred Stock | | | 1 | % |

| Cash and Cash Equivalents | | | 19 | % |

| | | | 100 | % |

| Small-Mid Cap Fund | | | |

| | | % of | |

| Sector Allocation | | Net Assets | |

| Consumer Discretionary | | | 9 | % |

| Consumer Staples | | | 10 | % |

| Energy | | | 15 | % |

| Financial | | | 17 | % |

| Health Care | | | 5 | % |

| Industrial | | | 16 | % |

| Information Technology | | | 8 | % |

| Utilities | | | 7 | % |

| Cash and Cash Equivalents | | | 13 | % |

| | | | 100 | % |

| Large Cap Fund | | | |

| | | % of | |

| Sector Allocation | | Net Assets | |

| Consumer Discretionary | | | 3 | % |

| Consumer Staples | | | 13 | % |

| Energy | | | 20 | % |

| Financial | | | 10 | % |

| Health Care | | | 18 | % |

| Industrial | | | 12 | % |

| Information Technology | | | 11 | % |

| Utilities | | | 3 | % |

| Cash and Cash Equivalents | | | 10 | % |

| | | | 100 | % |

| Select Fund | | | |

| | | % of | |

| Sector Allocation | | Net Assets | |

| Consumer Discretionary | | | 4 | % |

| Consumer Staples | | | 13 | % |

| Energy | | | 15 | % |

| Financial | | | 10 | % |

| Health Care | | | 20 | % |

| Industrial | | | 13 | % |

| Information Technology | | | 11 | % |

| Utilities | | | 3 | % |

| Cash and Cash Equivalents | | | 11 | % |

| | | | 100 | % |

| Long-Short Fund | | | | | | |

| | | % of Long | | | % of Net | |

| Sector Allocation | | Portfolio | | | Assets | |

| Long Portfolio | | | | | | |

| Consumer Discretionary | | | 4 | % | | | 4 | % |

| Consumer Staples | | | 11 | % | | | 11 | % |

| Energy | | | 17 | % | | | 19 | % |

| Financial | | | 7 | % | | | 8 | % |

| Health Care | | | 17 | % | | | 18 | % |

| Industrial | | | 11 | % | | | 12 | % |

| Information Technology | | | 10 | % | | | 11 | % |

| Utilities | | | 2 | % | | | 3 | % |

| Cash & Cash Equivalents | | | 21 | % | | | 14 | % |

| | | | 100 | % | | | | |

| | | | | | | | | |

| | | % of Short | | | % of Net | |

| Sector Allocation | | Portfolio | | | Assets | |

| Short Portfolio | | | | | | | | |

| Consumer Discretionary | | | 40 | % | | | -15 | % |

| Consumer Staples | | | 13 | % | | | -5 | % |

| Finance | | | 1 | % | | | 0 | % |

| Health Care | | | 17 | % | | | -6 | % |

| Industrial | | | 4 | % | | | -1 | % |

| Information Technology | | | 3 | % | | | -1 | % |

| Materials | | | 8 | % | | | -3 | % |

| Utilities | | | 2 | % | | | -1 | % |

| Exchange Traded Funds | | | 12 | % | | | -4 | % |

| | | | 100 | % | | | | |

| Other | | | | | | | | |

| Segregated Cash with Brokers | | | | | | | 36 | % |

| | | | | | | | 100 | % |

| |

| Diamond Hill Funds Semi-Annual Report June 30, 2009 | Page 19 |

Diamond Hill Funds

Tabular Presentation of Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| Financial Long-Short Fund | | | | | | |

| | | | | | | |

| | | % of Long | | | % of Net | |

| Sector Allocation | | Portfolio | | | Assets | |

| Long Portfolio | | | | | | |

| Common Stocks: | | | | | | |

| Finance - Banks & Thrifts | | | 32 | % | | | 37 | % |

| Finance - Broker Dealer | | | 4 | % | | | 4 | % |

| Finance - Diversified | | | 3 | % | | | 4 | % |

| Finance - Specialties | | | 4 | % | | | 5 | % |

| Insurance | | | 20 | % | | | 23 | % |

| REIT | | | 2 | % | | | 3 | % |

| Cash & Cash Equivalents | | | 19 | % | | | 7 | % |

| Preferred Stocks: | | | | | | | | |

| Finance | | | 11 | % | | | 12 | % |

| Real Estate Investment Trust | | | 3 | % | | | 4 | % |

| Corporate Bonds | | | 2 | % | | | 2 | % |

| | | | 100 | % | | | | |

| | | | | | | | | |

| | | % of Short | | | % of Net | |

| Sector Allocation | | Portfolio | | | Assets | |

| Short Portfolio | | | | | | | | |

| Commons Stocks: | | | | | | | | |

| Finance - Banks & Thrifts | | | 90 | % | | | -7 | % |

| Finance - Broker Dealer | | | 10 | % | | | -1 | % |

| | | | 100 | % | | | | |

| Other | | | | | | | | |

| Segregated Cash with Brokers | | | | | | | 7 | % |

| | | | | | | | 100 | % |

| | | | | | | | | |

| Strategic Income Fund | | | |

| | | | |

| | % of | |

| Sector Allocation | | Net Assets | |

| REIT Common Stock | | | 0 | % |

| Trust Preferred Stock | | | 9 | % |

| Collateralized Debt Obligations | | | 1 | % |

| Corporate Bonds - Maturing > 2 Years | | | 83 | % |

| Corporate Bonds - Maturing or | | | | |

| Likely to Be Called < 2 Years | | | 3 | % |

| Cash and Cash Equivalents | | | 4 | % |

| | | | 100 | % |

| |

| Page 20 | Diamond Hill Funds Semi-Annual Report June 30, 2009 |

Diamond Hill Funds

Statements of Assets & Liabilities

June 30, 2009 (Unaudited)

| | | | | | Small-Mid | | | | | | | |

| | | Small Cap | | | Cap | | | Large Cap | | | Select | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

| Assets | | | | | | | | | | | | |

| Investment securities, at cost | | $ | 545,619,101 | | | $ | 33,270,271 | | | $ | 636,369,242 | | | $ | 17,252,502 | |

| Investment securities, at market value - including $73,195,869; $4,412,453; $119,634,757; and $1,059,187 of securities loaned for the Small Cap Fund, the Small-Mid Cap Fund, the Large Cap Fund and the Select Fund, respectively. | | $ | 506,540,137 | | | $ | 32,645,753 | | | $ | 588,894,415 | | | $ | 17,505,855 | |

| Receivable for fund shares issued | | | 678,227 | | | | 11,004 | | | | 726,698 | | | | - | |

| Receivable for dividends and interest | | | 303,340 | | | | 18,151 | | | | 566,292 | | | | 19,074 | |

| Total Assets | | | 507,521,704 | | | | 32,674,908 | | | | 590,187,405 | | | | 17,524,929 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Return of collateral for securities on loan | | | 75,811,300 | | | | 4,565,353 | | | | 123,537,669 | | | | 1,097,946 | |

| Payable for securities purchased | | | 2,165,060 | | | | - | | | | - | | | | - | |

| Payable for fund shares redeemed | | | 753,197 | | | | 452,808 | | | | 541,970 | | | | 5,000 | |