QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

U.S. Restaurant Properties, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

U.S. RESTAURANT PROPERTIES, INC.

12240 Inwood Road

Suite 300

Dallas, Texas 75244

(972) 387-1487

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 17, 2003

To the Stockholders of U.S. Restaurant Properties, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders (the "Meeting") of U.S. Restaurant Properties, Inc., a Maryland corporation (the "Company"), will be held at 12240 Inwood Road, Suite 300, Dallas, Texas, on Tuesday, June 17, 2003, at 10:00 a.m. local time, for the following purposes:

- 1.

- The election of eight directors to hold office for terms expiring at the next annual meeting of stockholders;

- 2.

- To ratify the appointment of Deloitte & Touche LLP as independent auditors for the fiscal year ending December 31, 2003; and

- 3.

- To transact such other business as may properly come before the Meeting.

It is desirable that as large a proportion as possible of the stockholders' interests be represented at the Meeting. Whether or not you plan to be present at the Meeting, you are requested to sign and return the enclosed proxy in the envelope provided so that your stock will be represented. The giving of such proxy will not affect your right to vote in person should you later decide to attend the Meeting. Please date and sign the enclosed proxy and return it promptly in the enclosed envelope.

Copies of the Proxy Statement relating to the Meeting and the Annual Report outlining the Company's operations for the year ended December 31, 2002 accompany this Notice of Annual Meeting of Stockholders.

Only holders of record of the Common Stock of the Company at the close of business on May 12, 2003 are entitled to notice of, and to vote at, the Meeting or any adjournment thereof, notwithstanding any transfer of the Common Stock on the books of the Company after such record date.

By Order of the Board of Directors,

/s/ David M. West

DAVID M. WEST

Chairman of the Board

Dallas, Texas

May 14, 2003

U.S. RESTAURANT PROPERTIES, INC.

12240 Inwood Road

Suite 300

Dallas, Texas 75244

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 17, 2003

This Proxy Statement and the accompanying proxy card, Notice of Annual Meeting of Stockholders and letter to stockholders are first being mailed to holders (the "Stockholders") of the common stock, par value $.001 per share (the "Common Stock"), of U.S. Restaurant Properties, Inc., a Maryland corporation (the "Company"), on or about May 14, 2003, in connection with the solicitation of proxies on behalf of the Board of Directors of the Company (the "Board of Directors" or the "Board") to be exercised at the Annual Meeting of Stockholders (the "Meeting") to be held at 12240 Inwood Road, Suite 300, Dallas, Texas, on Tuesday, June 17, 2003, at 10:00 a.m.

At the Meeting, the Stockholders will be asked to consider and vote on the following proposals (together, the "Proposals"):

- (1)

- The election of eight directors to hold office for one-year terms expiring at the 2004 annual meeting of stockholders;

- (2)

- To ratify the appointment of Deloitte and Touche LLP as independent auditors for the fiscal year ending December 31, 2003; and

- (3)

- Such other business as may properly come before the Meeting.

The Board of Directors does not know of any other matter that is to come before the Meeting. If any other matters are properly presented for consideration, however, the persons authorized by the enclosed proxy will have discretion to vote on such matters in accordance with their best judgment.

Only Stockholders of record as of the close of business on May 12, 2003 (the "Record Date") are entitled to notice of and to vote at the Meeting or any adjournments thereof. As of the close of business on the Record Date, there were 19,859,689 shares of Common Stock issued and outstanding and entitled to vote. The Common Stock constitutes the only class of capital stock of the Company issued and outstanding entitled to vote at the Meeting. Each Stockholder of record on the Record Date is entitled to one vote for each share of Common Stock held. A majority of the outstanding shares of Common Stock, represented in person or by proxy, will constitute a quorum at the Meeting; however, if a quorum is not present or represented at the Meeting, the Stockholders entitled to vote thereat, present in person or represented by proxy, have the power to adjourn the Meeting from time to time, without notice, other than by announcement at the Meeting, until a quorum is present or represented. At any such adjourned Meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the original Meeting.

Each share of Common Stock may be voted to elect up to eight individuals (the number of directors to be elected) as directors of the Company. To be elected, each nominee for director must receive a plurality of the votes cast by the shares of Common Stock entitled to vote at a meeting at which a quorum is present. It is intended that, unless authorization to vote for one or more nominees for director is withheld, proxies will be voted FOR the election of all of the nominees named in this Proxy Statement.

The ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of the holders of a majority of the Common Stock represented at the Meeting and entitled to vote thereon to be approved.

Votes cast by proxy or in person will be counted by two persons appointed by the Company to act as inspectors for the Meeting. The election inspectors will treat shares represented by proxies that

reflect abstentions as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. For purposes of the Proposals to elect directors and to ratify the appointment of Deloitte & Touche LLP, abstentions will not be counted as votes cast and will have no effect on the result of the vote on such Proposals.

Broker non-votes occur where a broker holding stock in street name votes the shares on some matters but not others. Brokers are permitted to vote on routine, non-controversial proposals in instances where they have not received voting instructions from the beneficial owner of the stock but are not permitted to vote on non-routine matters. The missing votes on non-routine matters are deemed to be "broker non-votes." The election inspectors will treat broker non-votes as shares that are present and entitled to vote for the purpose of determining the presence of a quorum.

After reviewing the information contained in this Proxy Statement and in the Annual Report outlining the Company's operations for the fiscal year ended December 31, 2002 (included with this Proxy Statement), Stockholders are urged to sign the accompanying form of proxy, solicited on behalf of the Board of Directors, and return it immediately in the envelope provided for that purpose. Valid proxies will be voted at the Meeting and any adjournment or adjournments thereof in the manner specified therein. If no directions are given but proxies are executed in the manner set forth therein, such proxies will be voted FOR the election of the nominees for director set forth in this Proxy Statement. Any Stockholder returning the accompanying proxy may revoke such proxy at any time prior to its exercise by providing written notice to the Secretary of the Company of such revocation, voting in person at the Meeting or executing and delivering, to the Secretary of the Company, a later-dated proxy.

Each of the directors and executive officers of the Company has informed the Company that he or she will vote all of his or her shares of Common Stock in favor of the Proposals.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the number of directors of the Company shall be as set forth in the Company's Articles of Incorporation, as amended (the "Articles"), or as may be established by the Board of Directors but may not be fewer than the number required under the Maryland General Corporation Law nor more than 15 members. The current Board of Directors consists of eight members. At the Meeting, the eight current directors, David M. West, Len W. Allen, Jr., G. Steven Dawson, John C. Deterding, Robert Gidel, James H. Kropp, Robert J. Stetson and Gregory I. Strong, are to be elected, to hold office until the next annual meeting of Stockholders or until their successors are elected and qualify. Each of the nominees has consented to serve as a director if elected. If any of the nominees shall become unable or unwilling to stand for election as a director (an event not now anticipated by the Board of Directors), proxies will be voted for such substitute as shall be designated by the Board of Directors. The following table sets forth for each nominee for election as a director of the Company his age, principal occupation, position with the Company, if any, and certain other information. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES.

| Name | Age | Principal Occupation | Director Since | |||

|---|---|---|---|---|---|---|

| David M. West | 46 | Mr. West was elected Chairman of the Board, a Director and Interim Chief Executive Officer in March 2001 (he resigned as Interim Chief Executive Officer in June 2001 at the time Mr. Stetson was elected Chief Executive Officer) in connection with the closing of a significant common stock investment by Lone Star Fund III (U.S.), L.P. and its affiliates ("Lone Star Funds") in the Company. Lone Star Funds is one of the largest opportunity funds in the world, with over $8 billion of equity capital under management. Mr. West is the President of Lone Star U.S. Acquisitions, LLC and, in that capacity, directs all North American origination, underwriting and asset management efforts for Lone Star Funds. Prior to joining Lone Star Funds in 1998, Mr. West was a Senior Vice President with L.J. Melody & Company where he was responsible for originating real estate debt and equity transactions. His professional experience also includes 15 years with General Electric Capital Commercial Real Estate where, as Senior Vice President/Territory Manager, he led the real estate investment group for the Southwest United States. | March 2001 | |||

Len W. Allen, Jr. | 38 | Mr. Allen is a Director of the Company and a member of the Executive Committee. Since August 2000, Mr. Allen has served as Executive Vice President of Lone Star U.S. Acquisitions LLC where he is responsible for originating investment opportunities in North America for the affiliated funds. From February 1997 until he joined Lone Star Funds, Mr. Allen was Executive Vice President of Hudson Advisors LLC, an affiliate, where he was responsible for managing portfolios of assets located in North America. Mr. Allen's previous experience also includes Lehndorff USA, a diversified real estate company with holdings throughout the United States. | March 2001 | |||

3

G. Steven Dawson | 45 | Mr. Dawson is a Director of the Company and a member of the Audit Committee. Since 1990, Mr. Dawson has served as Senior Vice President and Chief Financial Officer of Camden Property Trust (or its predecessors (NYSE: CPT), a public real estate company which specializes in the acquisition, development, and management of apartment communities throughout the United States, with major concentrations in Dallas, Houston, Las Vegas, Southern California, Denver and the Tampa/Orlando areas. Prior to 1990, Mr. Dawson served in various related capacities with companies involved in commercial real estate including land and office building development as well as the construction and management of industrial facilities located on airports throughout the country. He currently serves on the board of AmREIT, a publicly traded real estate investment trust ("REIT"). | June 2000 | |||

John C. Deterding | 71 | Mr. Deterding is a Director of the Company and the Chairman of the Compensation Committee. He has been the owner of Deterding Associates, a real estate consulting company, since June 1993. From 1975 until June 1993 he served as Senior Vice President and General Manager of the Commercial Real Estate division of General Electric Capital Corporation. From November 1989 to June 1993, Mr. Deterding served as Chairman of the General Electric Real Estate Investment Company, a privately held REIT. He served as Director of GECC Financial Corporation from 1986 to 1993. He currently serves as a director of Atrium Companies and a trustee of Fortress Registered Investment Trust. He was formerly a trustee for BAI and the Urban Land Institute and was a director of Patriot American. | June 2001 | |||

4

Robert Gidel | 51 | Mr. Gidel is a Director of the Company and a member of the Audit Committee. Since 1998, Mr. Gidel has been the Managing Director of Liberty Partners, L.P., a partnership which makes investments in real estate operating companies and partnerships. Since 1996, Mr. Gidel has been the independent member of the Independent Investment Committee of the Lone Star Funds. The investment committee approves, but does not generate, all investment made by the Lone Star Funds. Through April 1998 (when it merged with EastGroup Properties), Mr. Gidel was the President, Chief Executive Officer and a Director of Meridian Point Realty Trust VIII, a publicly traded REIT specializing in industrial properties. Through April 1997, Mr. Gidel served as President, COO and a Director of Paragon Group, Inc., a publicly traded REIT that owned multifamily apartments located in the southern states, and from 1995 through 1996, served as President of Paragon Group Property Services, a related subsidiary providing property management services. From 1995 until 1997, Mr. Gidel was a Partner and the COO of Brazos Principal GenPar, the general partner of the Brazos Fund, and served as President, COO and a Director of Brazos Asset Management, the general partner of Brazos Partners, from 1993 to 1995. Both Brazos entities were real estate opportunity funds sponsored by affiliates of Robert M. Bass and had assets in excess of $1 and $3 billion, respectively. Prior to 1993, Mr. Gidel served in several executive management positions with Alex. Brown Kleinwort Benson Realty Advisors and Heller Financial. Mr. Gidel is currently a member of the Board of Directors of two public REITs—Developers Diversified Realty Corporation (of which he is a member of the audit and compensation committees and he is the chairman of the compensation committee) and Pinnacle Holdings, Inc. and two investment companies—Fortress Registered Investment Trust and Fortress Investment Fund II LLC. | March 2001 | |||

5

James H. Kropp | 54 | Mr. Kropp is a Director of the Company and a member of the Compensation Committee. He has been a Managing Director of Christopher Weil & Company, Inc. ("CWC"), a securities broker-dealer and registered investment advisor, since April 1995. During Mr. Kropp's tenure, CWC has participated in multiple transactions with the Company, including the acquisition of the QSR and Divall portfolios, managing a portfolio of publicly-traded restaurant bonds and the investment in the Company's Common Stock by Lone Star Funds. From July 1994 to November 1994, he was Executive Vice President and Chief Financial Officer of Hospitality Investment Trust, a REIT. From 1989 to July 1994, he was Managing Director of MECA Associates USA, a real estate advisory and asset management company serving institutional property owners. He currently serves as a Director of PS Business Parks and Madison Park Real Estate Investment Trust, a non-public REIT. | June 2001 | |||

Robert J. Stetson | 52 | Mr. Stetson is a Director of the Company and has been Chief Executive Officer of the Company since June 2001. He served as the Chief Executive Officer and President of the Company from its formation in January 1997 until October 1999. From May 1994 until December 2000, Mr. Stetson has also served as President and a Director of QSV Restaurant Properties, Inc. ("QSV"), the former general partner of U.S. Restaurant Properties Master L. P. ("USRP"), the predecessor to the Company, and, until October 1999, was also Chief Executive Officer of QSV. From 1987 until 1992, Mr. Stetson served as the Chief Financial Officer and later President-Retail Division of Burger King Corporation and Chief Financial Officer and later Chief Executive Officer of Pearle Vision. As Chief Financial Officer of Burger King Corporation, Mr. Stetson was responsible for managing more than 950 restaurants that Burger King Corporation leased to tenants. Prior to 1987, Mr. Stetson served in several positions with PepsiCo Inc. and its subsidiaries, including Chief Financial Officer of Pizza Hut, Inc. | January 1997 | |||

Gregory I.Strong | 46 | Mr. Strong is a Director of the Company and a member of the Audit Committee. Mr. Strong serves as Executive Vice President of Hudson Advisors LLC, an affiliate of the Lone Star Funds, where he currently oversees the management of portfolios in North America. Mr. Strong began his career at Brazos Asset Management (the predecessor to Hudson Advisors LLC) in 1993 as an asset manager and underwriter of real estate portfolios. In 1995, he was promo to Director of Underwriting where he served until his next promotion to Portfolio Manager of the European assets under management. Prior to 1993, Mr. Strong worked for other diversified real estate companies including American Real Estate Group, American Residential Properties and the FDIC/FADA. | March 2001 |

6

Meetings and Committees of the Board of Directors

During the fiscal year ended December 31, 2002, the Board of Directors held four regular meetings and one special meeting. Each of the directors attended at least 75% of all meetings held by the Board of Directors and all meetings of each committee of the Board of Directors on which such director served during the fiscal year ended December 31, 2002. The Board of Directors has an Audit Committee, a Compensation Committee, an Executive Committee and, as needed, establishes a Special Committee to address related party and other issues.

The Audit Committee is an advisory committee whose members through December 17, 2002, were Mr. Dawson, Mr. Gidel and Mr. Strong. On December 17, 2002, Mr. Strong resigned from the Audit Committee as a result of the determination by the Board of Directors that he would not qualify as an "independent director" as defined by Section 301 of the Sarbanes-Oxley Act of 2002. Mr. Strong was replaced by Mr. Deterding. The Audit Committee met five times during the fiscal year ended December 31, 2002. The function of the Audit Committee is to make recommendations concerning the engagement of independent public accountants, review with the independent public accountants the plans and results of the audit engagement, approve professional services provided by the independent public accountants, review the independence of the independent public accountants, consider the range of audit and no audit fees and review the adequacy of the Company's internal accounting controls. The Audit Committee has a written charter adopted by the Board of Directors. All of the members of the Audit Committee are independent as independence is currently defined in the New York Stock Exchange listing standards.

The Compensation Committee currently consists of Mr. Deterding, Mr. Kropp and Mr. West. The Compensation Committee recommends compensation for the Company's executive officers to the Board of Directors and administers the Company's Flexible Incentive Plan. The Compensation Committee met two times during the fiscal year ended December 31, 2002.

The Executive Committee consists of Mr. West, Mr. Allen, Mr. Stetson and Mr. Strong. The Executive Committee's functions include reviewing, evaluating and recommending to the full Board such matters as: (i) growth strategies, (ii) material proposed transactions, (iii) financial implications of matters involving financial policies, plans and procedures, (iv) financial implication of proposed company actions and (v) material leases. The Executive Committee did not meet during the year ended December 31, 2002.

The Board of Directors also established a Special Committee for the purpose of overseeing and reviewing related party and other special transactions between the Company and Shoney's Inc., of which the Lone Star Funds own a 92.5% equity interest and the Company owns a 7.5% equity interest. The Special Committee is comprised of Messrs. Kropp, Dawson and Deterding. The Special Committee met six times during the year ended December 31, 2002.

Compensation of Directors

Directors who are not employees of the Company are paid a $14,000 annual retainer and each committee chairman receives an additional $6,000 per annum. Directors who are employees of the Company, as well as Mr. West, Mr. Allen and Mr. Strong, are not paid any director's fees. Directors also receive $1,000 for each board or committee meeting physically attended and $250 for telephonic attendance. The Company may reimburse all directors for their travel expenses incurred in connection with attending meetings and their activities on behalf of the Company.

EXECUTIVE OFFICERS AND DIRECTORS

The executive officers of the Company serve at the discretion of the Board of Directors and are chosen annually by the Board of Directors at its first meeting following the annual meeting of

7

Stockholders. The following table sets forth the names and ages of the executive officers and directors of the Company and the positions held with the Company by each individual.

| Name | Age | Title | |||

|---|---|---|---|---|---|

| Executive Officers | |||||

| Robert J. Stetson | 52 | Chief Executive Officer, Director | |||

| Harry O. Davis | 46 | Chief Operating Officer | |||

| Stacy M. Riffe | 37 | Chief Financial Officer | |||

Outside Directors | |||||

| Len W. Allen, Jr. | 38 | Director | |||

| G. Steven Dawson | 45 | Director | |||

| John C. Deterding | 71 | Director | |||

| Robert Gidel | 51 | Director | |||

| James H. Kropp | 54 | Director | |||

| Gregory I. Strong | 46 | Director | |||

| David M. West | 46 | Director | |||

Executive Officers

For a description of the business experience of Mr. Stetson, see "Election of Directors" above.

Harry O. Davis. Mr. Davis joined the Company in July 1998 and has run the Asset Management Department since May 1999. In June 2001, he was named Senior Vice President and in October 2002 he was named Chief Operating Officer. Mr. Davis is a twenty-year commercial real estate industry veteran. From 1990 to 1994, he served as Vice President-Real Estate for BEG Enterprises, a Michigan-based commercial property owner. From 1994 until joining the Company, Mr. Davis served as President of Davis Commercial Realty and Director of Asset Management for Kim Martin Company, full service commercial real estate firms.

Stacy M. Riffe. Ms. Riffe joined the Company in October 2002 as Chief Financial Officer. From November 1999 until joining the Company, Ms. Riffe served as Chief Financial Officer of Mail Box Capital Corporation d/b/a The Mail Box, a printing and mailing company. From April 1998 until November 1999, Ms. Riffe served as Chief Financial Officer of Pinnacle Restaurant Group, LLC, which was the owner/operator of Harrigan's Grill and Bar restaurants. From January 1996 until November 1997, Ms. Riffe was Chief Financial Officer of Casa Olé Restaurants, Inc. (currently Mexican Restaurants, Inc.). From 1991 until 1996, Ms. Riffe held various positions, including Controller, with Spaghetti Warehouse, Inc. Prior to 1991, Ms. Riffe was an auditor for the Dallas office of KPMG Peat Marwick.

Outside Directors

For a description of the business experience of Messrs. Allen, Dawson, Deterding, Gidel, Kropp, Strong and West, see "Election of Directors" above.

8

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to annual and long-term compensation for the period ended December 31, 2002, paid, or accrued with respect to, each of the Company's executive officers (the "Executive Officers").

| | | | | | Long-Term Compensation Awards Securities Underlying Options | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation | All Other Compensation | |||||||||

| Robert J. Stetson Chief Executive Officer, Director | 2002 2001 2000 | $ $ | 245,192 135,417 — | $ $ | 100,000 50,000 — | — — — | — 200,000 — | — — — | ||||||

| Harry O. Davis Chief Operating Officer | 2002 2001 2000 | $ $ | 107,610 89,440 — | $ $ | 30,000 41,475 — | — — — | 15,000 15,000 — | — — — | ||||||

| Stacy M. Riffe(1) Chief Financial Officer | 2002 | $ | 25,962 | 10,000 | — | 20,000 | — | |||||||

- (1)

- Ms. Riffe was appointed as Chief Financial Officer in October 2002 following the resignation of H.G. Carrington, Jr., the Company's former Chief Operating Officer and Chief Financial Officer.

Option Grants

The following table sets forth certain information with respect to the issuance of options granted to Executive Officers during the fiscal year ended December 31, 2002, including options granted under the Company's Flexible Incentive Plan that the Stockholders approved in 1997 and amended in 1998:

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees | Exercise Price Per Share | Expiration Date | 0% | 5% | 10% | |||||||||||

| Robert J. Stetson | — | — | — | — | — | — | — | |||||||||||

Harry O. Davis(1) | 15,000 | 43 | % | $ | 13.00 | 5/21/09 | $ | 14.22 | $ | 105,835 | $ | 220,661 | ||||||

Stacy M. Riffe(2) | 20,000 | 57 | % | $ | 14.25 | 12/17/09 | — | $ | 116,000 | $ | 270,384 | |||||||

- (1)

- The options were granted effective May 21, 2002, and vest in equal increments on each of the first and second anniversaries of their date of grant.

- (2)

- The options were granted effective December 17, 2002, and vest in equal increments on each of the first and second anniversaries of their date of grant.

- (3)

- "Potential Realizable Value" is disclosed in response to Securities and Exchange Commission rules, which require such disclosure for illustrative purposes only, and is based on the difference between the potential market value of shares issuable (based upon assumed appreciation rates) upon exercise of such Options and the exercise price of such Options. The values disclosed are not

9

intended to be, and should not be interpreted by investors as, representations or projections of future value of the Company's stock or of the stock price.

Option Exercises and Year-End Option Values

The following table sets forth certain information concerning option exercises during the 2002 fiscal year and the value of the unexercised options as of December 31, 2002 held by the Executive Officers.

10

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

| | | | Number of Securities Underlying Unexercised Option/SARs at Fiscal Year-End | Value of Unexercised in-the-Money Options/SARs at Fiscal Year-End | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired on Exercise (#) | | |||||||||||||

| Name | Value Received ($) | ||||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Robert J. Stetson | 62,000 | $ | 149,300 | 116,000 | — | $ | 357,280 | — | |||||||

| Harry O. Davis | 7,000 | $ | 24,750 | 8,000 | 15,000 | $ | 24,640 | $ | 16,200 | ||||||

| Stacy M. Riffe | — | — | — | 20,000 | — | — | |||||||||

- (1)

- The fair market value on December 31, 2002 of the Common Stock underlying the options was $14.08 per share.

Employment Agreements

There are no employment agreements with any of the Executive Officers of the Company.

REPORT OF THE COMPENSATION COMMITTEE ON

EXECUTIVE OFFICER COMPENSATION

The following report of the Compensation Committee of the Company's Board of Directors (the "Compensation Committee") and the performance graph that appears immediately after such report should not be deemed to be soliciting material or filed with the Securities and Exchange Commission (the "SEC") under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any document so filed.

General

The Compensation Committee recommends to the Board of Directors the compensation of the executive officers of the Company and administers the Plan and any other employment benefit plans established by the Company. The Compensation Committee reviews the overall compensation program of the Company to assure that it is reasonable and, in consideration of all the facts including practices of comparably sized REITs, adequately recognizes performance tied to creating stockholder value and meets overall Company compensation and business objectives. The Compensation Committee's philosophy for compensating executive offices is that an incentive-based compensation system tied to the Company's financial performance and stockholder return will best align the interests of its executive officers with the objectives of the Company and its stockholders. The Compensation Committee attempts to promote financial and operational success by attracting, motivating and assisting in the retention of key employees who demonstrate the highest levels of ability and talent. The Compensation Committee has determined that the Company's compensation program should reward performance measured by the creation of value for stockholders. In accordance with this philosophy, the Compensation Committee oversees the implementation of the compensation system designed to meet the Company's financial objectives by making a significant portion of an executive officer's compensation dependent upon the Company's and such executive's performance. The Company's executive compensation program consists of the following elements:

(1) A base salary, which results from an assessment of each executive's level of responsibility and experience, individual performance and contributions to the Company;

(2) Annual incentives that are directly related to the performance of the executive's department and the financial performance of the Company as a whole; and

11

(3) Subject to the provisions of the Plan previously approved by the stockholders, grants of stock options designed to motivate individuals to enhance long-term profitability of the Company and the value of the Common Stock.

The Compensation Committee does not allocate a fixed percentage to each of these elements, but works with management to design compensation structures that best serve its goals.

Base Salary

The base salary of Mr. Stetson, the Company's Chief Executive Officer, was recommended by the Compensation Committee. Recommendations for compensation of executive officers, other than Mr. Stetson, are provided by the Chief Executive Officer after annual evaluations of individual contributions to the business of the Company are held with each such executive officer. Factors considered by the Compensation Committee in recommending base salaries include the performance of the Company, measured by both financial and non-financial objectives, individual accomplishments, any planned change of responsibilities for the forthcoming year, salaries paid for similar positions within the real estate and REIT industry as published in industry statistical surveys and proposed base salary relative to that of other executive officers. The predominating factor is the performance of the Company. The application of the remaining factors is subjective, with no factor being given more weight than the other.

Annual Incentive

Executives are also eligible for annual incentive awards which awards are designed to place a significant part of an executive's annual compensation at risk. The Executive Officers will participate in the bonus incentive program under which the individual executives are eligible for annual cash bonuses. Bonuses were paid by the Company to each of the Executive Officers for the year ended December 31, 2002. The Compensation Committee anticipates that future bonuses will be determined on the basis of a comparison of actual performance against pre-established performance goals for the Company and will be, in part, based on the discretion of the Compensation Committee.

Long-term Incentives

In keeping with the Compensation Committee's philosophy to provide long-term incentives to executive officers and other key employees, stock options are anticipated to be granted to executive officers and other key officers on a periodic basis. The Compensation Committee establishes the number of options granted based upon REIT industry data and upon each individual's base salary.

CEO Performance Evaluation

The Compensation Committee recommends to the Board of Directors for its approval the compensation of all executives, including the Chief Executive Officer. Mr. Stetson's salary for 2003, as established by the Compensation Committee, is set at $250,000. In 2002, the Company paid Mr. Stetson $245,192 in base compensation. Also, he was awarded a bonus of $100,000 for achieving performance goals pre-established by the Compensation Committee.

Tax Consideration

The Compensation Committee is aware of the tax law which makes certain (non-performance based) compensation to certain executive offices in excess of $1,000,000 non-deductible to the Company. While none of the Executive Officers currently receives performance-based compensation at or near the $1,000,000 maximum, the Compensation Committee has carefully considered the impact of these tax provisions and has taken steps which are designed to minimize their future effect, if any.

12

THE COMPENSATION COMMITTEE

John C. Deterding

David M. West

James H. Kropp

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of members of the Board of Directors who are neither former or current officers or employees of the Company or any of its subsidiaries. No executive officer of the Company serves as an officer, director or member of any entity, an executive officer or director of which is a member of the Compensation Committee.

13

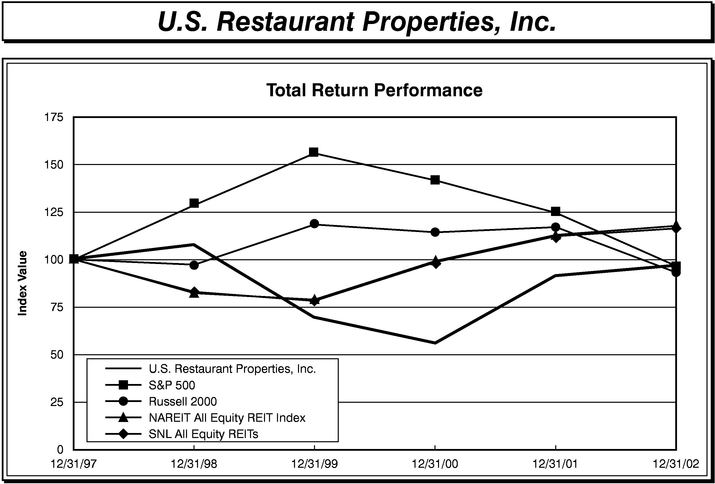

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on the Common Stock (and the common units of beneficial interest of U.S. Restaurant Properties Master L.P., the Company's predecessor, see "Certain Relationship and Related Transactions"), with the cumulative total return of the S&P 500 Index and the National Association of Real Estate Investment Trusts ("NAREIT") All Equity REIT Index, assuming the investment of $100 on December 31, 1997 and the reinvestment of dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG THE COMPANY, S&P 500 INDEX

AND NAREIT EQUITY REIT INDEX

| | Period Ending | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Index | ||||||||||||

| 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | |||||||

| U.S. Restaurant Properties, Inc. | 100.00 | 107.92 | 69.75 | 55.56 | 91.37 | 96.93 | ||||||

| S&P 500 | 100.00 | 128.55 | 155.60 | 141.42 | 124.63 | 96.95 | ||||||

| Russell 2000 | 100.00 | 97.45 | 118.17 | 114.60 | 117.45 | 93.39 | ||||||

| NAREIT All Equity REIT Index | 100.00 | 82.50 | 78.69 | 99.44 | 113.29 | 118.08 | ||||||

| SNL All Equity REITs | 100.00 | 82.74 | 78.25 | 98.50 | 112.10 | 116.53 | ||||||

14

The Audit Committee has reviewed and discussed with management the audited financial statements of the Company for the year ended December 31, 2002. Management has the primary responsibility for the financial statements and the reporting process. The Company's independent auditors, Deloitte & Touche LLP, are responsible for expressing an opinion on the conformity of our audited financial statements to accounting principles generally accepted in the United States of America.

We have discussed with Deloitte & Touche LLP the matters required by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. The Audit Committee has also received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1, and we have discussed with the firm its independence from the Company. We have also discussed with management of the Company and the auditing firm such other matters and received assurances from them that we deemed appropriate.

Based on the foregoing review and discussions and relying thereon, we have recommended to the Company's Board of Directors that the audited financial statement for the year ended December 31, 2002 be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

G. Steven Dawson

Robert Gidel

John C. Deterding

PROPOSAL TWO

RATIFICATION OF INDEPENDENT AUDITORS

The audit committee has appointed Deloitte & Touche LLP as independent auditors for the 2003 fiscal year, and presents this selection to the stockholders for ratification. Deloitte & Touche, or its predecessors, has served as our independent auditors for more than 15 years and is familiar with our affairs and financial procedures. Deloitte & Touche will audit our consolidated financial statements for fiscal 2003 and perform other services.

Principal Accounting Firm Fees

Aggregate fees billed to the Company for the year ended December 31, 2002 by the Company's principal accounting firm, Deloitte & Touche LLP were as follows:

| Audit Fees | $ | 197,000 | ||||

| Audit Related Fees | 45,000 | |||||

| All Other Fees | 13,600 | |||||

| Total Fees | $ | 255,600 | ||||

The Audit Committee has determined that the provision of the services included within "Audited Related Fees" and "All Other Fees" to be compatible with maintaining the principal accountant's independence.

Representatives of Deloitte & Touche will be present at the Meeting and will have an opportunity to make a statement, if they desire to do so, and to respond to appropriate questions from stockholders.

15

The Board of Directors unanimously recommends that you voteFOR the ratification of independent auditors as set forth in Proposal Two. Proxies solicited by the Board will be so voted unless you specify otherwise in your proxy.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In March 2000, the Company advanced $400,000 to Mr. Stetson for the purchase of Common Stock of the Company. The promissory note provides for an interest rate of 7.0% per annum and quarterly payments of interest only through December 2005, with a final payment of principal and interest due in March 2006. Pursuant to the note agreement, Mr. Stetson has pledged the Common Stock purchased with the note proceeds as collateral for the loans.

Effective September 22, 2000, the Company and Mr. Stetson entered into an Amendment to the Settlement Agreement providing for two changes to the original Settlement Agreement. First, Mr. Stetson executed a second promissory note in the amount of $300,000 in exchange for which he received 35,037 restricted shares of USRP Common Stock (calculated based on a value of $8.5625 per share). Second, the Company advanced Mr. Stetson $75,000 under a third promissory note to be used for the purpose of acquiring shares of Common Stock in the open market. Both notes bear interest at 7.0% per annum and provide for quarterly payments of interest only through July 2006, with a final payment of principal and interest due in October 2006, and are secured by the restricted Common Stock and the Common Stock purchased in the open market with the note proceeds.

On December 11, 2001, the Board of Directors agreed that at such time as Mr. Stetson paid down the aggregate principal amount due under the promissory notes to $275,000, the Company would release the shares of Common Stock pledged by Mr. Stetson as security for the repayment of the indebtedness evidenced by the notes. Mr. Stetson made such payment in September 2002 and currently owes $275,000 to the Company under the promissory notes.

In January 2002, the Company advanced $24,000 to Harry O. Davis for the purchase of Common Stock of the Company. The promissory note provides for an interest rate of 6% per annum and quarterly payments of interest only through December 2006, with a final payment of principal and interest due in January 2007.

On April 10, 2002, LSF 4 Acquisition (owned 90.1% by Lone Star U.S. Acquisitions LLC and 9.9% by U.S. Restaurant Properties Operating L.P.) merged into Shoney's, with Shoney's being the surviving entity. Pursuant to the terms of the merger, all of the outstanding shares of common stock of Shoney's were cancelled and converted into the right to receive $.36 in cash and each outstanding membership interest in LSF 4 Acquisition were converted into and exchanged for 100 shares of common stock of Shoney's, as the surviving entity in the merger. Pursuant to the terms of the LSF 4 Acquisition limited liability company agreement, U.S. Restaurant Properties Operating Partnership may not own more than 9.9% of the outstanding equity of the entity or its successor. Pursuant to the terms of the financing arrangements entered into in connection with the financing of the merger, U.S. Restaurant Properties Operating L.P. now owns 7.5% of the equity of the sole shareholder of Shoney's. In addition, U.S. Restaurant Properties Operating Partnership has no obligation to fund any additional capital requirements of the entity, other than its initial capital contribution. As of December 31, 2002, the Company's investments in Shoney's consisted of an investment in common stock of $2,384,000, mortgage loans receivable of $18,498,000 and real estate purchased and leased back to Shoney's of approximately $37,332,000.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table and the notes thereto set forth certain information with respect to the beneficial ownership of shares of Common Stock, as of March 31, 2003, by each person or group within the meaning of Section 13(d)(3) of the Exchange Act who is known to the management of the Company to be the beneficial owner of more than five percent of the outstanding Common Stock of the Company:

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class | |||

|---|---|---|---|---|---|

| Lone Star Fund III (U.S.), L.P. and Entities affiliated with Lone Star Fund III (U.S.), L.P.(1) | 3,729,765 | 18.8 | % |

- (1)

- Includes 2,312,753 shares of Common Stock owned or available for purchase pursuant to agreement with the Company held by LSF3 Capital Investments I, LLC, a Delaware limited liability company ("Investments I") and 1,417,012 shares of Common Stock owned or available for purchase pursuant to agreement with the Company held by LSF3 Capital Investments II, LLC, a Delaware limited liability company ("Investments II"). The sole member of Investments I is LSF3 REOC I, L.P., a Delaware limited partnership ("REOC"). The general partner of REOC is LSF3 GenPar I, LLC, a Delaware limited liability company ("GenPar"). The sole member of GenPar is Lone Star Funds III (U.S.), L.P., a Delaware limited partnership ("Lone Star Funds"). The general partner of Lone Star Funds is Lone Star Partners III, L.P., a Bermuda limited partnership ("Partners III"). The general partner of Partners III is Lone Star Management Co. III, Ltd., a Bermuda exempted limited liability company ("Management III"). John P. Grayken ("Grayken"), a citizen of Ireland, is the sole stockholder, a director and President of Management III. Grayken is also sole shareholder and director of Advisors GenPar, Inc., a Texas corporation ("Advisors GenPar"). The managing member of Investments II is Partners III. Hudson Advisors, LLC, a Texas limited liability company ("Hudson"), is an asset manager, and, pursuant to a proxy granted by Investments I and Investments II, has certain voting rights with respect to the shares of Common Stock owned by Investments I and II, pursuant to an agreement among Investments I, Investments II and Hudson (the "Asset Management Agreement"). The managing member of Hudson is Hudson Advisors Association, L.P., a Texas limited partnership ("Advisors"). The general partner of Advisors is Advisors GenPar. The Percent of Class is computed assuming that Investments I and Investments II are issued the maximum number of shares of Common Stock which they are contractually due (3,729,765 shares), which will increase the Company's issued and outstanding Common Stock to a total of 19,294,607 shares (without giving effect to any other transaction that might occur).

The address of the principal offices and business address of Investments I, Investments II, REOC, GenPar and Lone Star Funds is 717 N. Harwood, Street, Suite 2200, Dallas, Texas 75201. The address of the principal offices and business address of Hudson, Advisors and Advisors GenPar is 717 N. Harwood, Street, Suite 2200, Dallas, Texas 75201. The address of the principal offices and business address of Partners III and Management III is Claredon House, Two Church Street, Hamilton, HM 11, Bermuda. The business address of Grayken is 50 Welbeck Street, London, United Kingdom, W1M7HE.

Security Ownership of Management

The following table and the notes thereto set forth certain information with respect to the beneficial ownership of shares of Common Stock of the Company, as of March 31, 2003 (except as

17

noted in the footnotes to such table), by each Director, each Executive Officer and by all Executive Officers and Directors as a group:

| Name and Address of Beneficial Owner | Number of Shares Beneficially Owned(1) | Percent of Class | |||

|---|---|---|---|---|---|

| Robert J. Stetson 12240 Inwood Road, Suite 300 Dallas TX 75246 | 678,400 | (2) | 3.4 | % | |

Harry O. Davis 12240 Inwood Road, Suite 300 Dallas TX 75246 | 20,851 | (3) | * | ||

Stacy M. Riffe 12240 Inwood Road, Suite 300 Dallas TX 75244 | — | — | |||

David M. West 717 N. Harwood Street, Suite 2200 Dallas TX 75201 | 12,000 | * | |||

Len W. Allen, Jr. 717 N. Harwood Street, Suite 2200 Dallas TX 75201 | — | ||||

G. Steven Dawson Three Greenway Plaza, Suite 1300 Houston TX 77046 | 15,161 | (4) | * | ||

John C. Deterding 107 N. Waterview Richardson TX 75080 | 9,122 | (5) | * | ||

Robert Gidel 677 N. Washington Blvd. Sarasota FL 34236 | 8,000 | (6) | * | ||

James H. Kropp 6150 Lusk Boulevard, Suite B-205 San Diego CA 92121 | 9,000 | (2) | * | ||

Gregory I. Strong 717 N. Harwood Street, Suite 2200 Dallas TX 75201 | — | ||||

All Directors and Executive Officers (10 persons) | 752,535 | 3.8 | % |

- *

- Less than 1%

- (1)

- Except as otherwise indicated, (i) the persons named in this table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, and (ii) none of the shares shown in this table or referred to in the footnotes hereto are shares of which the persons named in this table have the right to acquire beneficial ownership as specified in Rule 13d-3(d)(1) promulgated under the Exchange Act.

- (2)

- Includes 108,000 shares of Common Stock subject to options currently exercisable or exercisable within 60 days.

18

- (3)

- Includes 1,851 shares of Common Stock held in a 401(k) plan and 7,500 shares of Common Stock subject to options currently exercisable or exercisable within 60 days. Does not include 3,568 shares of Common Stock beneficially owned by his wife as to which he disclaims any beneficial ownership.

- (4)

- Includes 8,000 shares of Common Stock subject to options currently exercisable and 5,161 shares of Common Stock issuable upon conversion of 5,500 shares of Series A Preferred Stock currently owned by Mr. Dawson.

- (5)

- Includes 8,000 shares of Common Stock subject to options currently exercisable.

- (6)

- Includes 8,000 shares of Common Stock subject to options currently exercisable.

- (7)

- Includes 1,000 shares held in an IRA account in his name and 6,000 shares of Common Stock subject to options currently exercisable.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires that Company directors, executive officers and persons who own more than 10% of the Common Stock file initial reports of ownership and reports of changes in ownership of Common Stock with the SEC. Officers, directors and stockholders who own more than 10% of the Common Stock are required by the SEC to furnish the Company with copies of all Section 16(a) reports they file.

To the Company's knowledge, based solely on the review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2002, the Company's officers, directors and 10% stockholders complied with all Section 16(a) filing requirements applicable to them.

Deloitte & Touche LLP served as the Company's independent accountants for the fiscal year ended December 31, 2002. Deloitte & Touche LLP has audited the Company's financial statements and those of its predecessors for each of the fiscal years ended December 31, 1985 through December 31, 2002. Deloitte & Touche LLP's representative is expected to be present at the Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Proposals of stockholders intended to be presented at the annual meeting of stockholders of the Company in 2004 must be received by the Secretary of the Company at the Company's principal executive office no later than January 13, 2004, in order to be included in the proxy statement and form of proxy for such meeting.

The expense of the solicitation of proxies will be borne by the Company. In addition to the solicitation of proxies by mail, solicitation may be made by the directors, officers and employees of the Company by other means, including telephone, telecopy or in person. No special compensation will be paid to directors, officers or employees for the solicitation of proxies. To solicit proxies, the Company also will request the assistance of banks, brokerage houses and other custodians, nominees or fiduciaries, and, upon request, will reimburse such organizations or individuals for their reasonable expenses in forwarding soliciting materials to their principals and in obtaining authorization for the execution of proxies. ADP Financial Information Services, Inc. ("ADP") has been retained to assist in the solicitation of proxies for an administration fee of $3,000, plus reimbursement of out-of-pocket

19

expenses. No officer or director of the Company has an interest in, or is related to any principal of, ADP.

The management of the Company is not aware of any other matters to be presented for action at the Meeting; however, if any such matters are properly presented for action, it is the intention of the persons named in the enclosed form of proxy to vote in accordance with their best judgment on such matters.

By Order of the Board of Directors,

/s/ DAVID M. WEST

DAVID M. WEST

Chairman of the Board

May 14, 2003

Dallas, Texas

STOCKHOLDERS ARE URGED, REGARDLESS OF THE NUMBER OF SHARES OF COMMON STOCK OF THE COMPANY OWNED, TO DATE, SIGN AND RETURN THE ENCLOSED PROXY. YOUR COOPERATION IN GIVING THESE MATTERS YOUR IMMEDIATE ATTENTION AND IN RETURNING YOUR PROXY PROMPTLY IS APPRECIATED.

20

U.S. RESTAURANT PROPERTIES, INC.

ANNUAL MEETING TO BE HELD ON 5/20/03 AT 10:00 A.M. CDT

FOR HOLDERS AS OF 4/15/03

This Proxy is Solicited By the Board of Directors

The undersigned shareholder(s) of U.S. Restaurant Properties, Inc., hereby constitute and appoint David M. West and G. Steven Dawson, as proxies of the undersigned at the Annual Meeting of Stockholders of said corporation to be held on June 17, 2003, at 10:00 a.m., and at any adjournment thereof, and to vote all the shares of said corporation standing in the name of the undersigned, or which the undersigned may be entitled to vote, as fully as the undersigned might or could do if personally present, as set forth herein.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder(s). If no direction is made, this proxy will be voted FOR the election of directors and the ratification of Deloitte & Touche LLP as the corporation's independent auditors for the fiscal year ending December 31, 2002.

(Continued and to be signed on the reverse side)

| U.S. RESTAURANT PROPERTIES, INC. C/O PROXY SERVICES P.O. BOX 9141 FARMINGDALE, NY 11735 | VOTE BY MAIL— Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to U.S. Restaurant Properties, Inc. c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. | |

CONTROL NUMBER ACCOUNT NUMBER | ||

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: X PAGE 1 OF 2 | ||

| USRP11 | ||

KEEP THIS PORTION FOR YOUR RECORDS | ||

DETACH AND RETURN THIS PORTION ONLY | ||

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

U.S. RESTAURANT PROPERTIES, INC.

DIRECTORS RECOMMEND: A VOTE FOR ELECTION OF THE FOLLOWING NOMINEES

| 1. | 01 — David M. West 02 — Len W. Allen, Jr. 03 — G. Steven Dawson 04 — John C. Deterding 05 — Robert Gidel 06 — James H. Kropp 07 — Robert J. Stetson 08 — Gregory I. Strong | For All o | Withhold All o | For All Except: o | ||||||

To withhold authority to vote, mark "For All Except" and write the nominee's number on the line below. | ||||||||||

| 2. | Ratification of Deloitte & Touche LLP, as the Company's independent auditors for the fiscal year ending December 31, 2003 | For o | Against o | Abstain o | ||||||

"NOTE" SUCH OTHER BUSINESS AS MAY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF

| Signature | Date | Signature (Joint Owners) | Date | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD JUNE 17, 2003

PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS

PROPOSAL ONE ELECTION OF DIRECTORS

EXECUTIVE OFFICERS AND DIRECTORS

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

OPTION/SAR GRANTS IN LAST FISCAL YEAR

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION/SAR VALUES

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE OFFICER COMPENSATION

STOCK PERFORMANCE GRAPH

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG THE COMPANY, S&P 500 INDEX AND NAREIT EQUITY REIT INDEX

REPORT OF THE AUDIT COMMITTEE

PROPOSAL TWO RATIFICATION OF INDEPENDENT AUDITORS

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

INDEPENDENT ACCOUNTANTS

STOCKHOLDER PROPOSALS

EXPENSES OF SOLICITATION

OTHER MATTERS