Exhibit 99.1

Exhibit 99.1

U.S. Restaurant Properties and CNL Restaurant Properties Merger September 2004

Forward Looking Statements

This presentation contains certain forward-looking statements. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies, anticipated events or trends and other

matters that are not historical facts. These forward-looking statements reflect U.S. Restaurant

Properties’ and CNL Restaurant Properties’ current views about future events and are subject to risks,

uncertainties, assumptions and changes in circumstances that may cause future events, achievements

or results to differ materially from those expressed by the forward-looking statements. Investors are

cautioned not to place undue reliance on these forward-looking statements. In particular, the

following factors, among others, could cause actual results to differ materially from those described in

the forward-looking statements: failure of the stockholders or limited partners to approve the mergers

and the risk that the businesses of the companies will not be integrated successfully. In addition, the

ability of the combined companies to achieve the expected revenues, accretion and synergy savings

also will be subject to the effects of competition, the effects of general economic conditions and other

factors beyond the control of the combined companies, along with other risks and uncertainties

described from time to time in public filings with the Securities and Exchange Commission.

1

In connection with the proposed transactions referenced below, U.S. Restaurant Properties and CNL

Restaurant Properties intend to file a joint proxy statement/prospectus on Form S-4 and other

materials with the Securities and Exchange Commission. SECURITY HOLDERS ARE URGED TO READ

THESE MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders may obtain a free copy of these materials when they

become available as well as other materials filed with the Securities and Exchange Commission

concerning U.S. Restaurant Properties and CNL Restaurant Properties at the Securities and Exchange

Commission’s website at http://www.sec.gov. In addition, these materials and other documents filed

by U.S. Restaurant Properties may be obtained for free by directing a request to U.S. Restaurant

Properties at 12240 Inwood Rd., Suite 300, Dallas, TX 75244; Attn: Investor Relations. In addition,

these materials and other documents filed by CNL Restaurant Properties may be obtained for free by

directing a request to CNL Restaurant Properties at 450 South Orange Avenue, Orlando, FL 32801;

Attn: Investor Relations.

U.S. Restaurant Properties and CNL Restaurant Properties, and their respective directors and executive

officers and other members of their management and employees, may be deemed to be participants in

the solicitation of proxies from the shareholders of U.S. Restaurant Properties and CNL Restaurant

Properties in connection with the merger. Information about the directors and executive officers of

U.S. Restaurant Properties and their ownership of U.S. Restaurant Properties’ shares is set forth in the

proxy statement for U.S. Restaurant Properties Annual Meeting of Shareholders, which was filed with

the Securities and Exchange Commission on April 19, 2004. Information about the directors and

executive officers of CNL Restaurant Properties and their ownership of CNL Restaurant Properties’

shares is set forth in the proxy statement for CNL Restaurant Properties Annual Meeting of

Shareholders, which was filed with the Securities and Exchange Commission on April 7, 2004.

Investors may obtain additional information regarding the interests of such participants by reading the

joint proxy statement/prospectus when it becomes available.

2

Table of Contents

Section I Transaction Overview……………………… 5

Section II Pro Forma Company Analysis…………… 10

Section III Financial Profile……………………….…….. 23

Section IV Transaction Timetable…………………….. 27

Section V Investment Highlights…………………….. 29

I. Transaction Overview

Transaction Overview

Summary

Merger between U.S. Restaurant Properties (“USRP”) and CNL Restaurant Properties (“CNLRP”) will

create the leading restaurant real estate and financial services REIT in the U.S.

.. USRP intends to also acquire all 18 CNL Income Fund Limited Partnerships (subject to approval by

USRP shareholders and the CNL Income Fund limited partners) for aggregate consideration of $542

million, including $30 million of excess cash on the CNL Income Funds’ balance sheet

.. Successor company will retain the CNL Restaurant Properties name and be the largest restaurant

REIT in the U.S.

.. Headquartered in Orlando, Florida

.. CNLRP’s executive management team will manage the combined company

.. Board to initially consist of nine directors, a majority of which will be nominated by CNLRP

.. Approximately 135 employees (excluding operating companies)

.. Total assets of approximately $2.5 billion

.. Total market capitalization of approximately $2.9 billion

.. Interests in approximately 3,000 properties, operated by over 550 franchisors and franchisees

representing 224 concepts

.. Current CNLRP shareholders will own 60.7% of the pro forma common shares in the combined

company with U.S. Restaurant shareholders owning 39.3%

Transaction Overview

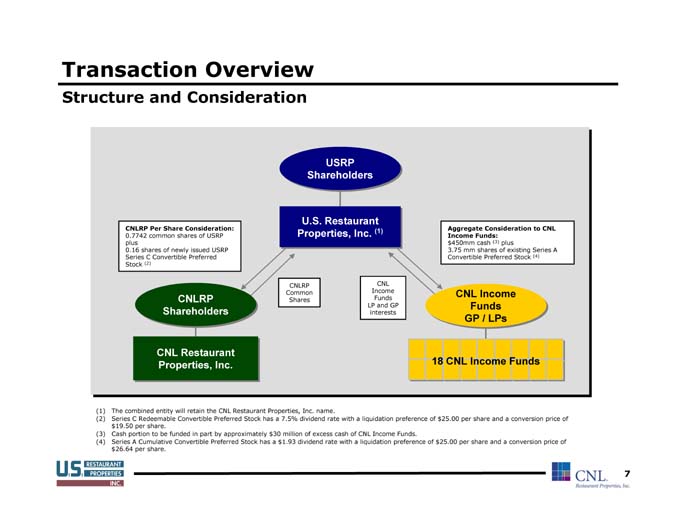

Structure and Consideration

Aggregate Consideration to CNL Income Funds: $450mm cash (3) plus 3.75 mm shares of existing Series A Convertible Preferred Stock (4)

CNL Income Funds GP / LPs 18 CNL Income Funds (1) CNL Income Funds LP and GP interests

USRP Shareholders U.S. Restaurant Properties, Inc.

CNLRP Common Shares

CNLRP Shareholders CNL Restaurant Properties, Inc.

CNLRP Per Share Consideration: 0.7742 common shares of USRP (2) plus 0.16 shares of newly issued USRP Series C Convertible Preferred Stock

1) The combined entity will retain the CNL Restaurant Properties, Inc. name.

(2) Series C Redeemable Convertible Preferred Stock has a 7.5% dividend rate with a liquidation preference of $25.00 per share and a conversion price of $19.50 per share.

(3) Cash portion to be funded in part by approximately $30 million of excess cash of CNL Income Funds.

(4) Series A Cumulative Convertible Preferred Stock has a $1.93 dividend rate with a liquidation preference of $25.00 per share and a conversion price of $26.64 per share.

Transaction Overview

Strategic Rationale

Platform

Leading restaurant real estate and financial services REIT with broad supporting capabilities including net lease financing, property redevelopment, investment property sales, M&A advisory as well as mortgage lending and other commercial and investment banking services through its strategic alliance with Bank of America

Scaleable infrastructure capable of supporting significantly larger operations

Broad range of experience and expertise allows the Company to take advantage of shifting market conditions

Scale

Largest restaurant property company in the U.S. with total market capitalization of approximately $2.9 billion

Industry-leading expertise and financial capacity to support the needs of the largest of restaurant chains

Strong opportunities to leverage position in industry and achieve economies of scale

Increased breadth of relationship with brands and franchisees

Broadened real estate acquisition, development and redevelopment opportunities

Transaction Overview

Strategic Rationale (Continued)

Diversification

Geography properties spread across 49 states

Operators 550 different franchisors and franchisees with no one operator constituting greater than 7.1% of annual base rent

Concepts 224 restaurant concepts with no single concept accounting for more than 9.0% of annual base rent

Financial

Expected to be accretive to FFO and Net Income within the first

year following the closing of the transaction

.. Strengthened coverage of U.S. Restaurant’s current $1.32

dividend with pro forma FFO payout ratio estimated to range

from 88% to 92%

.. Anticipated meaningful cost synergies in 2005 from reduction in

headcount via consolidation of corporate offices, reduced audit,

tax and investor relations fees, as well as asset management and

servicing related synergies

.. Greater financial and operating flexibility, improved access to

capital markets, as well as enhanced liquidity and return on

invested capital to all shareholders

II. Pro Forma Company Analysis

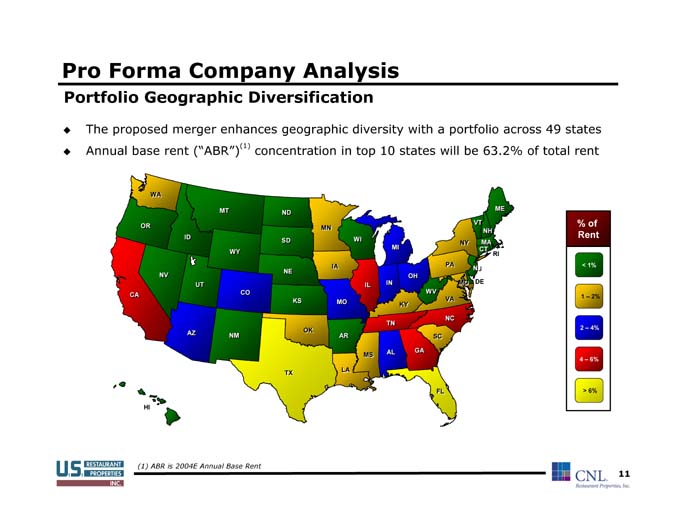

Pro Forma Company Analysis

Portfolio Geographic Diversification

The proposed merger enhances geographic diversity with a portfolio across 49 states

Annual base rent (“ABR”) (1) concentration in top 10 states will be 63.2% of total rent

ME

NH MA CT VT NJ

NY

< 1% 2% 4% 6% > 6%

% of Rent 1 – 2 – 4 –

MI

RI

PA VA NC

OH

KY

IN

IL

DE MD

WV

TN AL

MS

SC

GA

FL

(1) ABR is 2004E Annual Base Rent

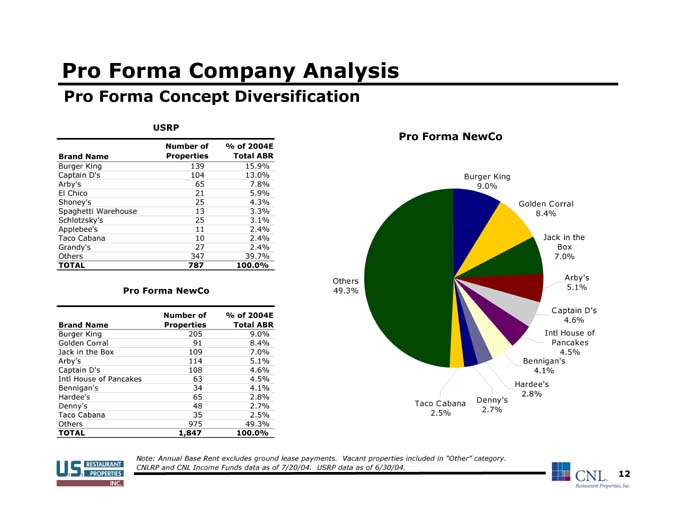

Pro Forma Company Analysis Pro Forma Concept Diversification

% of 2004E Total ABR 15.9% 13.0% 7.8% 5.9% 4.3% 3.3% 3.1% 2.4% 2.4% 2.4% 39.7% 100.0% Number of Properties 139 104 65 21 25 13 25 11 10 27 347 787

USRP ghetti Warehouse

Brand Name Burger King Captain D’s Arby’s El Chico Shoney’s Spa Schlotzsky’s Applebee’s Taco Cabana Grandy’s Others TOTAL

Pro Forma NewCo

Arby’s 5.1% 4.6% 4.5% Jack in the Box 7.0% Captain D’s Intl House of Pancakes 8.4% Bennigan’s 4.1% Golden Corral Hardee’s 2.8% Burger King 9.0% Denny’s 2.7% Taco Cabana 2.5% Others 49.3%

Pro Forma NewCo

% of 2004E Total ABR 9.0% 8.4% 7.0% 5.1% 4.6% 4.5% 4.1% 2.8% 2.7% 2.5% 49.3% 100.0% Number of Properties 205 91 109 114 108 63 34 65 48 35 975 1,847

gan’s

Brand Name Burger King Golden Corral Jack in the Box Arby’s Captain D’s Intl House of Pancakes Benni Hardee’s Denny’s Taco Cabana Others TOTAL

category. Vacant properties included in “Other” USRP data as of 6/30/04. Note: Annual Base Rent excludes ground lease payments. CNLRP and CNL Income Funds data as of 7/20/04.

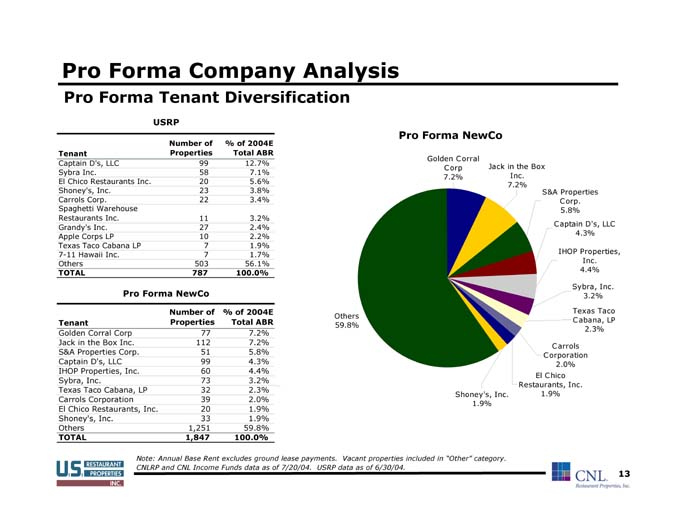

Pro Forma Company Analysis Pro Forma Tenant Diversification

% of 2004E Total ABR 12.7% 7.1% 5.6% 3.8% 3.4% 3.2% 2.4% 2.2% 1.9% 1.7% 56.1% 100.0% Number of Properties 99 58 20 23 22 11 27 10 7 7 503 787

USRP

Tenant Captain D’s, LLC Sybra Inc. El Chico Restaurants Inc. Shoney’s, Inc. Carrols Corp. Spaghetti Warehouse Restaurants Inc. Grandy’s Inc. Apple Corps LP Texas Taco Cabana LP 7-11 Hawaii Inc. Others TOTAL

Pro Forma NewCo Golden Corral

4.3% Inc. 4.4% Sybra, Inc. 3.2% Texas Taco Cabana, LP 2.3%

S&A Properties Corp. 5.8% Captain D’s, LLC IHOP Properties, Carrols Corporation 2.0% El Chico Restaurants, Inc. 1.9% Jack in the Box Inc. 7.2% Shoney’s, Inc. 1.9% Corp 7.2%

Others 59.8%

Pro Forma NewCo

% of 2004E Total ABR 7.2% 7.2% 5.8% 4.3% 4.4% 3.2% 2.3% 2.0% 1.9% 1.9% 59.8% 100.0% Number of Properties 77 112 51 99 60 73 32 39 20 33 1,251 1,847 Tenant Golden Corral Corp Jack in the Box Inc. S&A Properties Corp. Captain D’s, LLC IHOP Properties, Inc. Sybra, Inc. Texas Taco Cabana, LP Carrols Corporation El Chico Restaurants, Inc. Shoney’s, Inc. Others TOTAL

category. Vacant properties included in “Other” USRP data as of 6/30/04. Note: Annual Base Rent excludes ground lease payments. CNLRP and CNL Income Funds data as of 7/20/04.

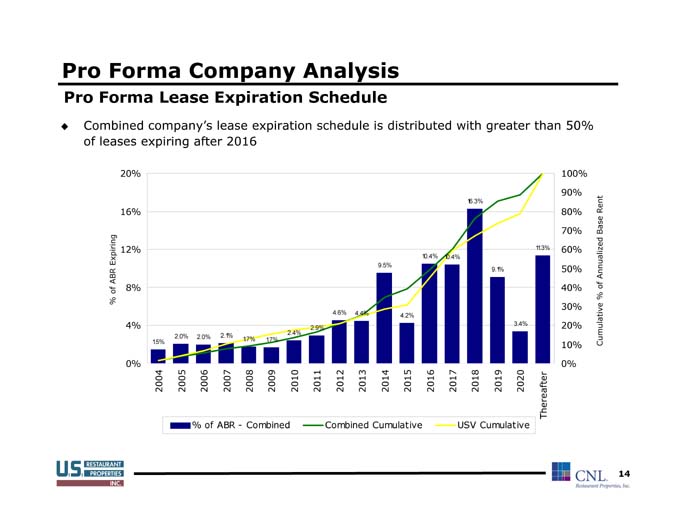

Pro Forma Company Analysis

Pro Forma Lease Expiration Schedule

Combined company’s lease expiration schedule is distributed with greater than 50% of leases expiring after 2016

Base RentAnnualized % of Cumulative

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

11.3% Thereafter

3.4% 2020 9.1% 2019

16.3% 2018 USV Cumulative

10.4% 2017 10.4% 2016 4.2% 2015 9.5% 2014 4.4% 2013

4.6% 2012 Combined Cumulative

2.9% 2011 2.4% 2010 1.7% 2009 1.7% 2008 2.1% 2007

2.0% 2006 % of ABR—Combined

2.0% 2005 1.5% 2004

20% 16% 12% 8% 4% 0%

Expiring % of ABR

Pro Forma Company Analysis

Attractive Investment Characteristics

Location Is the Business

Siting Barrier

Curbside and within 200 yards of major intersection

Zoning Barrier

Municipalities minimize fast food and service stations

Maturity Barrier

Street already fully developed at end of 20 year lease

Franchise Barrier

Cannot cannibalize existing stores

These Barriers translate into High Renewal and Collection Performance

Pro Forma Company Analysis

Significant Market Opportunity

Research from the National Restaurant Association indicates U.S. consumer spending

in restaurants is continuing to show strong growth

.. Forecasts predict that by 2010, 53% of every food dollar will be spent in

restaurants

.. Restaurant revenue projected to grow by 5.2% annually through 2006

.. Top 60 publicly traded restaurant companies have approximately $30 billion of real

estate on balance sheet

.. Approximately 150,000 stores are operated by restaurants in the companies’ target

markets

.. Sale leaseback offers significant benefits to restaurant operators

.. Allows greater corporate leverage and improved financial ratios via off-balance

sheet financing

.. Earnings improvement through depreciation elimination

.. Offers long-term financing with lower monthly cash payment versus traditional

debt financing alternatives

Sources: National Restaurant Association, SEC filings and internal market analysis.

Pro Forma Company Analysis

Significant Market Opportunity (Continued)

Recent increase in restaurant M&A activity

.. Intensified focus by private equity sponsors seeking stable cash flows

.. Franchisees seeking acquisitions for growth and brand diversification

.. Strong demand from investors for restaurant properties

.. Tax motivation

.. Optimal price ranges

.. Recognizable brands in local markets

.. Broad supply of real estate redevelopment opportunities

.. Highly fragmented real estate market

.. Ability to move quickly with access to capital

.. Ability to leverage relationships with franchisors and franchisees

.. Since 1998, the restaurant real estate financing industry has experienced fierce

competition and periods of considerable volatility

.. As a result, numerous competitors in the industry have either consolidated to

remain viable or liquidated entirely

.. Through industry expertise and foresight, USRP and CNLRP have emerged as the

two largest surviving companies in the sector

Pro Forma Company Analysis

Strong Operating Platform

Asset Management

CNLRP and its affiliates have been providing asset and property

management services for company and third party owned real

estate for over 25 years

.. Approximately $2.2 billion in assets managed by CNLRP prior to

the combination

.. The combined company expects to maintain CNLRP’s current

“Above Average” loan and lease servicing rating by Standard &

Poor’s (highest rating provided to any franchise servicer)

Acquisitions & M&A Activity

Significant acquisitions experience with both large real estate

portfolios and single assets

.. Over $185 million in acquisitions in 2003 for both CNLRP and

USRP with year-to-date acquisitions of approximately $225 million

.. CNLRP has provided over $2 billion of financing to the restaurant

industry since 1995

.. Demonstrated acquisitions capabilities and broader access to

capital will provide basis for significant potential growth

.. Originations team consists of four senior account professionals

who maintain relationships with 2,000 restaurant operators

Pro Forma Company Analysis

Strong Operating Platform (Continued)

Financing Services

Leading provider of sale/leaseback financing to restaurant operators

Ability to customize financing alternatives due to multiple funding sources and product lines

Expertise in loan origination and loan servicing complements broader financing capabilities

Strategic alliance with Bank of America provides mortgage lending, cash and wealth management, and other commercial and investment banking services

Investment Property Sales

Program formally established in January 2001 following favorable tax legislation (Section 1031)

Over $800 million of properties sold since inception

Demonstrated disposition capabilities exhibit willingness and ability of Company to re-cycle capital at attractive returns and to exploit inefficiencies in real estate pricing

Ability to manage concentration risk associated with large portfolio acquisitions

Pro Forma Company Analysis

Strong Operating Platform (Continued)

Property Improvement & Redevelopment

Active program to seek real estate redevelopment opportunities within existing portfolio and in selected external situations

Ability to leverage existing long-term relationships with franchisors and franchisees

Specialized teams focused on penetrating opportunities within highly fragmented real estate markets, particularly with retail real estate developers

Leverages established real estate expertise to broaden the served market through penetration of the build-to-suit segment

Pro Forma Company Analysis

CNL Restaurant Properties - Senior Management

Curtis B. McWilliams, President and CEO

Mr. McWilliams has served as President of CNL Restaurant Properties since May of 2001 and Chief Executive

Officer of the Company since September 2003. He previously served as co-Chief Executive Officer of the

Company from December 2000 to September 2003. In addition, Mr. McWilliams served in other CNL executive

positions from 1997 through 2000. From September 1983 through March 1997, Mr. McWilliams was employed by

Merrill Lynch & Co. where he served as a Managing Director in the Investment Banking division. Mr. McWilliams

received a B.S.E. in Chemical Engineering from Princeton University in 1977 and a Master of Business

Administration degree with a concentration in finance from the University of Chicago in 1983.

Steven D. Shackelford, EVP, COO and CFO

Mr. Shackelford was appointed Executive Vice President and Chief Operating Officer of CNL Restaurant Properties

in September 2003. Mr. Shackelford has also served as Chief Financial Officer since January 1997. He served as

Senior Vice President of the Company from January 1997 until July 2000, when he was promoted to Executive

Vice President. From 1992 to 1996, he was a senior manager in New York and Europe with Price Waterhouse

serving multinational clients. Mr. Shackelford received a Bachelor of Arts degree in Accounting, with honors, and

a Master of Business Administration degree from Florida State University and is a certified public accountant.

Michael T. Shepardson, EVP

Mr. Shepardson has served as Executive Vice President of CNL Franchise Network Corp. since June 2000. He has

served as President of CNL Advisory Services, Inc., a wholly owned subsidiary of the Company that advises

restaurant operators on merger and acquisition opportunities, since September 1998. Prior to joining CNL, Mr.

Shepardson was from June 1995 to September 1998 Managing Director, Corporate Finance for CMC, Ltd., a

financial and marketing boutique in the promotional products and direct marking sectors. Mr. Shepardson

received both his Bachelor of Arts degree in Political Science and Master of Business Administration degree with a

concentration in Finance from the University of Notre Dame. As part of his MBA curriculum, he studied at both the

London Business School and the London School of Economics.

Pro Forma Company Analysis

CNL Restaurant Properties - Senior Management (Continued)

Robert W. Chapin, Jr., EVP

Mr. Chapin has served as Executive Vice President and National Sales Manager since September 2002. He

previously served as Senior Vice President and Chief Development Officer of CNL Franchise Network Corp. from

July 2000 to August 2002. Additionally, he served in the capacity of Senior Vice President of Operations for the

Company and as Senior Vice President of Development for CNL Restaurant Services, Inc., which provided turnkey

real estate development services on a fee for services basis exclusively to the restaurant industry. From July 1997

to June 1998, Mr. Chapin served as a full-time consultant with CNL Financial Group, Inc., working on a number of

strategic project initiatives. Mr. Chapin received his Bachelor of Science degree from Appalachian State University

in North Carolina.

T. Glenn Kindred, SVP

As Senior Vice President, Mr. Kindred is responsible for maintaining the real estate quality and rental income of all

managed portfolios and runs a group that strategically liquidates, acquires, and develops real estate to maximize

assets value of portfolios representing investments of over $2 Billion. Prior to joining CNL, Mr. Kindred worked in

commercial real estate acquisition and underwriting roles for several national banks and for a top tier Wall Street

investment bank. With nearly fifteen years of experience in commercial real estate management and finance, Mr.

Kindred holds a Bachelor’s degree in economics from Stetson University and a Master’s degree in business

administration from Florida Atlantic University.

Robert E. Lawless, SVP and Treasurer

Mr. Lawless is Senior Vice President and Treasurer for CNL Restaurant Properties, Inc. and currently oversees the

treasury, capital markets, finance, and investor reporting and relations departments. Mr. Lawless joined CNL in

early 1998 and was Senior Treasury Manager until June 1999. From July 1999 until May 2000, Mr. Lawless served

first as Assistant Treasurer and then as Director of Capital Markets & Treasury for CNL Restaurant Properties, Inc.

Prior to joining CNL, Mr. Lawless worked as an Assistant Controller for a New York-based architectural &

engineering firm, an Equity/Fixed Income Analyst for an asset management firm in London and a Treasury

Associate for Barnett Bank in Florida. Mr. Lawless received his Bachelor of Science degree from Sacred Heart

University, his Master’s of Business Administration degree from Vanderbilt University and he is a Chartered

Financial Analyst (CFA) and a Certified Treasury Professional (CTP).

III. Financial Profile

Financial Profile

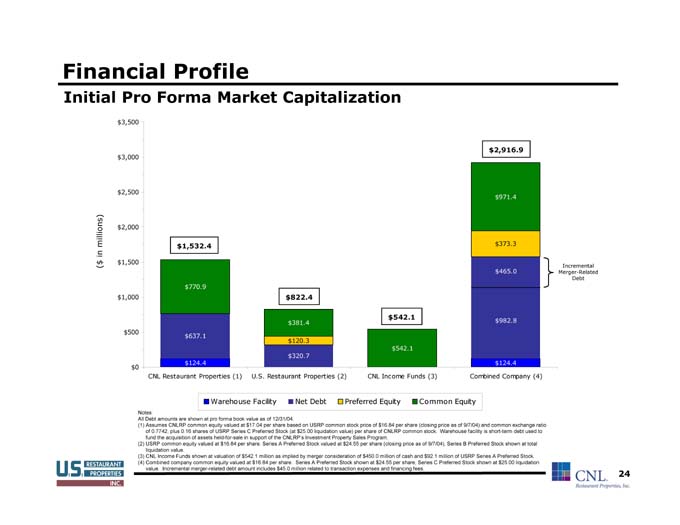

Initial Pro Forma Market Capitalization

Incremental Merger-Related Debt $2,916.9 $971.4 $373.3 $465.0 $982.8 $124.4 Combined Company (4) $542.1 $542.1 CNL Income Funds (3) $822.4 $381.4 $120.3 $320.7 U.S. Restaurant Properties (2) $1,532.4 $770.9 $637.1 $124.4 CNL Restaurant Properties (1) $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

millions) ($ in

Common Equity Preferred Equity Net Debt Warehouse Facility

Notes:

All Debt amounts are shown at pro forma book value as of 12/31/04.

1) Assumes CNLRP common equity valued at $17.04 per share based on USRP common stock price of $16.84 per share (closing price as of 9/7/04) and common exchange ratio

of 0.7742, plus 0.16 shares of USRP Series C Preferred Stock (at $25.00 liquidation value) per share of CNLRP common stock. Warehouse facility is short-term debt used to

fund the acquisition of assets held-for-sale in support of the CNLRP’s Investment Property Sales Program.

(2) USRP common equity valued at $16.84 per share. Series A Preferred Stock valued at $24.55 per share (closing price as of 9/7/04), Series B Preferred Stock shown at total

liquidation value.

(3) CNL Income Funds shown at valuation of $542.1 million as implied by merger consideration of $450.0 million of cash and $92.1 million of USRP Series A Preferred Stock.

(4) Combined company common equity valued at $16.84 per share. Series A Preferred Stock shown at $24.55 per share, Series C Preferred Stock shown at $25.00 liquidation

value. Incremental merger-related debt amount includes $45.0 million related to transaction expenses and financing fees.

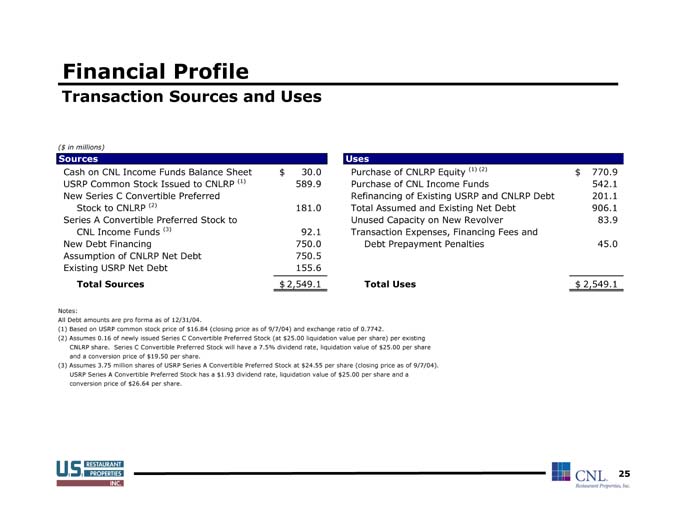

Financial Profile

Uses

Sources

770.9 542.1 201.1 906.1 83.9 45.0 2,549.1 $ $

(1) (2)

Purchase of CNLRP Equity Purchase of CNL Income Funds Refinancing of Existing USRP and CNLRP Debt Total Assumed and Existing Net Debt Unused Capacity on New Revolver Transaction Expenses, Financing Fees and Debt Prepayment Penalties Total Uses 30.0 589.9 181.0 92.1 750.0 750.5 155.6 2,549.1 $ $

(1)

(3) (2)

Transaction Sources and Uses ($ in millions) Cash on CNL Income Funds Balance Sheet USRP Common Stock Issued to CNLRP New Series C Convertible Preferred Stock to CNLRP Series A Convertible Preferred Stock to CNL Income Funds New Debt Financing Assumption of CNLRP Net Debt Existing USRP Net Debt Total Sources

Notes: All Debt amounts are pro forma as of 12/31/04.

Series C Convertible Preferred Stock will have a 7.5% dividend rate, liquidation value of $25.00 per share

(1) Based on USRP common stock price of $16.84 (closing price as of 9/7/04) and exchange ratio of 0.7742. (2) Assumes 0.16 of newly issued Series C Convertible Preferred Stock (at $25.00 liquidation value per share) per existing CNLRP share. and a conversion price of $19.50 per share. (3) Assumes 3.75 million shares of USRP Series A Convertible Preferred Stock at $24.55 per share (closing price as of 9/7/04). USRP Series A Convertible Preferred Stock has a $1.93 dividend rate, liquidation value of $25.00 per share and a conversion price of $26.64 per share.

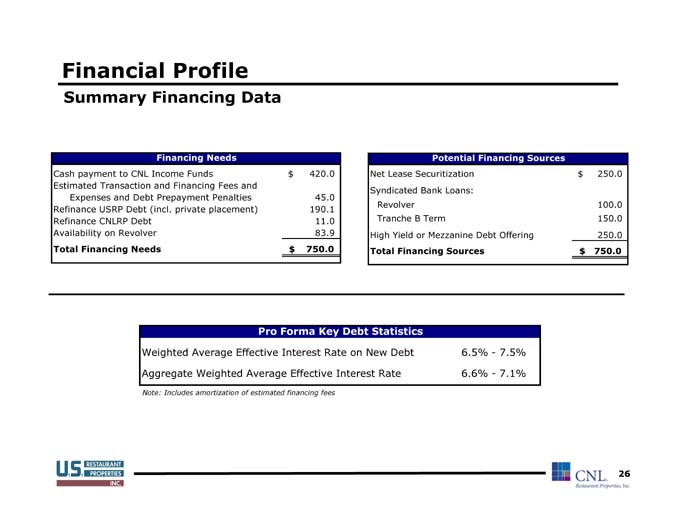

Financial Profile Summary Financing Data

420.0 45.0 190.1 11.0 83.9 750.0 $ $

Financing Needs Expenses and Debt Prepayment Penalties

Cash payment to CNL Income Funds Estimated Transaction and Financing Fees and Refinance USRP Debt (incl. private placement) Refinance CNLRP Debt Availability on Revolver Total Financing Needs

6.5%—7.5% 6.6%—7.1%

Pro Forma Key Debt Statistics

Weighted Average Effective Interest Rate on New Debt Aggregate Weighted Average Effective Interest Rate Note: Includes amortization of estimated financing fees

250.0 100.0 150.0 250.0 750.0 $ $

Sources Potential Financing

Net Lease Securitization Syndicated Bank Loans: Revolver Tranche B Term High Yield or Mezzanine Debt Offering Total Financing Sources

IV. Transaction Timetable

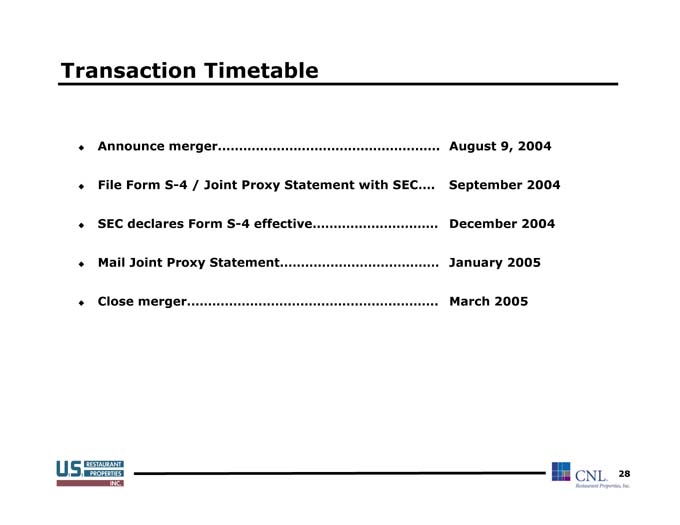

Transaction Timetable

Announce merger August 9, 2004

File Form S-4 / Joint Proxy Statement with SEC September 2004

SEC declares Form S-4 effective December 2004

Mail Joint Proxy Statement January 2005

Close merger March 2005

V. Investment Highlights

Investment Highlights

The merger combines the best of both companies

Market Opportunity - Consolidated company focused on a $440 billion

(4.0% of GDP), non-cyclical and steady growth industry

.. Enhanced Platform - Expansive product offering, long-term

relationships, enhanced scale, and a broad range of expertise creates the

leading restaurant real estate and financial services REIT

.. Diversification - Increased diversification within combined portfolio will

be comprised of approximately 550 differing franchisors and franchisees

operating within approximately 224 restaurant concepts

.. Short and Long-Term Growth - Transaction is expected to be accretive

to FFO and Net Income within the first 12 months after the closing and

will enhance future shareholder returns based on greater financial and

operating flexibility and improved access to capital markets

.. Current Returns – With an estimated dividend yield of 7.8%(1) and

expected payout ratio of 88% to 92%, the combined company offers a

stable and attractive current return

(1) Assuming a dividend of $1.32 per share and common stock price of $16.84 per share.

U.S. Restaurant Properties and CNL Restaurant Properties Merger