UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-27241

KEYNOTE SYSTEMS, INC.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 94-3226488 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 777 Mariners Island Blvd, San Mateo, CA | | 94404 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(650) 403-2400

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value Per Share, and the Associated Stock Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. YES ¨ NO x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). YES x NO ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

As of March 31, 2005, the aggregate market value of voting stock held by non-affiliates of the Registrant was $209 million.

The number of shares of the Registrant’s common stock outstanding as of January 27, 2006 was 20,654,438 including 1,788,153 treasury shares.

EXPLANATORY NOTE

The registrant hereby amends its Annual Report on Form 10-K for the year ended September 30, 2005 to include Part III of Form 10-K, to the extent such information was not previously included in the Annual Report on Form 10-K, as set forth below. Items in the Annual Report on Form 10-K not referenced below are not amended, and this amendment does not reflect events occurring after the original filing of the Annual Report on Form 10-K, or modify or update those disclosures as presented in the Form 10-K except to the extent set forth herein. Items referenced herein are amended as set forth below.

PART III

Item 10. Directors and Executive Officers of the Registrant.

Information relating to our executive officers is presented under Item 4A in the Annual Report on Form 10-K for the year ended September 30, 2005 previously filed on December 6, 2005.

Directors

The following table and discussion set forth certain information with regard to the Company’s current directors.

| | | | | | |

Name

| | Age

| | Principal Occupation

| | Director

Since

|

Umang Gupta | | 56 | | Chairman of the Board and Chief Executive Officer of Keynote | | 1997 |

David Cowan | | 40 | | General Partner of Bessemer Venture Partners | | 1998 |

Deborah Rieman | | 56 | | Retired President and Chief Executive Officer of Check Point Software Technologies Inc. | | 2002 |

Mohan Gyani | | 54 | | Retired President and Chief Executive Officer of AT&T Wireless Mobility Services | | 2002 |

Geoffrey Penney | | 60 | | Retired Executive Vice President and Chief Information Officer, Charles Schwab Corporation | | 2002 |

Raymond L. Ocampo Jr. | | 52 | | President and Chief Executive Officer, Samurai Surfer LLC | | 2004 |

Jennifer J. Bolt | | 41 | | Senior Vice President and Chief Information Officer of Franklin Resources, Inc. | | 2004 |

Umang Gupta has served as one of our directors since September 1997 and as our Chief Executive Officer and Chairman of the board of directors since December 1997. Previously, he was a private investor and an advisor to high-technology companies and the founder and chairman of the board and chief executive officer of Centura Software Corporation. He previously held various positions with Oracle Corporation and IBM. Mr. Gupta holds a B.S. degree in chemical engineering from the Indian Institute of Technology, Kanpur, India, and an M.B.A. degree from Kent State University.

David Cowan has served as one of our directors since March 1998. Since August 1996, Mr. Cowan has served as a General Partner of Bessemer Venture Partners, a venture capital investment firm. Mr. Cowan is also a director of several private companies. Mr. Cowan holds an A.B. degree in mathematics and computer science and a M.B.A. degree from Harvard University.

Deborah Rieman has served as one of our directors since January 2002. Since June 1999, Dr. Rieman has managed a private investment fund. From July 1995 to June 1999, Dr. Rieman was the President and Chief Executive Officer of Check Point Software Technologies Inc., an Internet security software company. Dr. Rieman also serves as a director of Arbinet-thexchange Inc., Corning Inc., Kintera, Inc., and Tumbleweed Communications Inc. Dr. Rieman holds a Ph.D. degree in mathematics from Columbia University and a B.A. degree in mathematics from Sarah Lawrence College.

Mohan Gyani has served as one of our directors since January 2002. From May 2005 to December 2005, Mr. Gyani served as Chairman and CEO of Roamware, Inc. From January 2003 to December 2004, Mr. Gyani served as Senior Advisor, Office of the Chairman and Chief Executive Officer, of AT&T Wireless Mobility Services, a telecommunications company. From March 2000 to January 2003. he served as President and Chief Executive Officer and, from January 2000 to March 2000, as Chief Financial Officer of AT&T Wireless Mobility Services. From October 1999 to December 1999, Mr. Gyani served as President and Chief Financial Officer of PeoplePC, Inc., a computer company. From June 1999 to September 1999, he served as the Head of Strategy and Corporate Development and a member of the board of directors of Vodafone AirTouch Plc, a mobile telecommunications network company. He served as Executive Vice President and Chief Financial Officer of AirTouch, a telecommunications company, from September 1995 to June 1999, prior to its merger with Vodafone. Mr. Gyani is a member of the boards of directors of SIRF, Inc., Safeway Inc., Epiphany Inc. and a private company. Mr. Gyani holds an M.B.A. degree and a B.A. degree in business administration from San Francisco State University.

Geoffrey Penney has served as one of our directors since July 2002. From December 1998 to his retirement in June 2004, Mr. Penney served as Executive Vice President, and since November 2001, as Chief Information Officer, of the Charles Schwab Corporation, a financial services company. Mr. Penney holds a Ph.D. degree and B.A. degree in inorganic chemistry from St. John’s College, Cambridge (U.K.).

Raymond L. Ocampo Jr. has served as one of our directors since March 2004. Since April 2004, Mr. Ocampo has served as President and Chief Executive Officer of Samurai Surfer LLC, a consulting and investment company. In November 1996, Mr. Ocampo retired from Oracle Corporation, where he had served in various senior and executive positions since 1986, most recently as Senior Vice President, General Counsel and Secretary since September 1990. Mr. Ocampo is a member of the boards of directors of CytoGenix, Inc., Intraware, Inc., PMI Group, Inc. and VitalStream Holdings, Inc. Since January 2000, Mr. Ocampo has also served as a member of the board of directors of the Berkeley Center for Law & Technology, which he co-founded in 1996. Mr. Ocampo holds a J.D. degree from Boalt Hall School of Law at the University of California at Berkeley and an A.B. degree in Political Science from the University of California, Los Angeles.

Jennifer Bolt has served as one of our directors since April, 2004. Ms. Bolt has served as senior vice president and chief information officer of Franklin Resources, Inc., a financial services company since May 2003. Prior to that time, she served in various other capacities for Franklin Resources, Inc. or its subsidiaries. She also serves as chairman of Franklin Capital Corporation and Franklin Templeton Bank & Trust, and is a member of Franklin Resources, Inc.’s Executive Committee. Ms. Bolt holds a B.A. degree in economics and physical education from the University of California at Davis.

At the Annual Meeting, stockholders will elect each director to hold office until the next Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until such director’s earlier resignation or removal.

Board Committees

Our board of directors has a compensation committee, an audit committee and a nominating and governance committee. Each committee operates pursuant to a written charter; copies of these written charters are available on our website at www.keynote.com.

Compensation Committee. The current members of our compensation committee are Mr. Cowan and Dr. Rieman. The board of directors has determined that each member of the compensation committee is an independent director as defined by the rules of the NASDAQ Stock Market, a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and an outside director within the meaning of Section 162(m) of the Internal Revenue Code. The compensation committee reviews and makes recommendations to our board concerning salaries and incentive compensation for our officers and employees. The compensation committee also administers our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan. The compensation committee met three times during the fiscal year ended September 30, 2005.

Audit Committee. The current members of our audit committee are Mr. Gyani, Mr. Penney and Mr. Ocampo. The board of directors has determined that each member of the audit committee is an independent director as defined by the rules of the Securities and Exchange Commission and the NASDAQ Stock Market, and that each of them is able to read and understand fundamental financial statements. The board of directors has also determined that Mr. Gyani is an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission and is “financially sophisticated” within the meaning of the rules of the NASDAQ Stock Market. Our audit committee reviews our financial statements, monitors our accounting policies and practices, makes recommendations to our board regarding the selection of independent auditors and reviews the results and scope of audits and other services provided by our independent auditors. The audit committee met twelve times during the fiscal year ended September 30, 2005.

Nominating and Governance Committee. The current members of our nominating and governance committee are Mr. Cowan and Mr. Penney. The board of directors has determined that each member of the nominating and governance committee is an independent director as defined by the rules of the NASDAQ Stock Market. Our nominating and governance committee identifies, considers and recommends candidates to serve as members of the board and makes recommendations

regarding the structure and composition of the board and board committees. The nominating and governance committee is also responsible for overseeing, reviewing and making periodic recommendations concerning Keynote’s corporate governance policies. The nominating and governance committee met once during the fiscal year ended September 30, 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Securities Exchange Act of 1934, as amended, requires our directors and officers, and persons who own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission and the NASDAQ National Market. Such persons are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of the copies of such forms furnished to us and written representations from our executive officers and directors, we found that the following filings were late:

Messrs. Donald Aoki, David Cowan, Mohan Gyani, Peter Maloney, Raymond L. Ocampo Jr., Geoffrey Penney, Mrs. Bolt and Dr. Reiman, each filed one late Form 4 Report. Each late Form 4 report contained one transaction which was not reported on a timely basis.

Code of Ethics

We have adopted a code of ethics that applies to our Chief Executive Officer and senior financial officers, including our chief financial officer, controller and all other employees engaged in the finance organization of Keynote. This code of ethics is posted on our website at http://www.keynote.com.

Item 11. Executive Compensation.

The following table presents compensation information for the fiscal years ending September 30, 2003, 2004 and 2005 paid or accrued to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2005.

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Fiscal

Year

| | Annual Compensation

| | Long Term

Compensation

Awards

| | All Other

Compensation(1)

|

| | | Salary

| | | Bonus

| | Other

Compensation

| | Securities

Underlying

Options

| |

Umang Gupta Chief Executive Officer | | 2005

2004

2003 | | $

| 237,000

225,000

237,500 |

(2) | | $

| 37,500

150,000

127,500 | | $

| —

—

— | | —

—

— | | $

$

| 2,000

2,000

— |

| | | | | | |

Donald Aoki Senior Vice President of Products, Engineering and Operations | | 2005

2004

2003 | |

| 206,298

169,305

176,504 |

| |

| 16,973

29,334

25,970 | |

| —

— | | 55,000

25,000

40,000 | |

| 2,000

2,000 |

| | | | | | |

Peter Maloney (3) Former Vice President of Finance and Chief Financial Officer | | 2005

2004

2003 | |

| 178,572

163,500

156,375 |

| |

| 17,786

37,247

28,194 | |

| —

—

— | | 30,000

25,000

50,000 | |

| 2,000

2,000

— |

| | | | | | |

Patrick Quirk Executive Vice President of Worldwide Customer Operations | | 2005

2004

2003 | |

| 106,667

—

— | (4)

| |

| 70,000

—

— | |

| —

—

— | | 600,000

—

— | |

| 2,000

—

— |

| | | | | | |

Vikram A. Chaudhary Vice President of Marketing and Business Development | | 2005

2004

2003 | |

| 153,333

127,116

119,602 | (5)

| |

| 11,375

36,531

32,563 | |

| —

—

— | | 75,000

—

— | |

| 2,000

—

— |

| (1) | The amounts disclosed in the All Other Compensation column consist of Keynote’s matching contributions under our 401(k) plan. |

| (2) | In fiscal 2003, Mr. Gupta voluntarily took a 10% cut to his annual base salary of $250,000, lowering his base salary to $225,000. On an annualized basis, his salary for fiscal 2003 was $237,500. |

| (3) | Mr. Maloney resigned as Vice President of Finance and Chief Financial Officer effective January 1, 2006. |

| (4) | Mr. Quirk was hired as an executive officer of Keynote on April 7, 2005. |

| (5) | Mr. Chaudhary became an executive officer of Keynote on May 1, 2005. |

Option Grants in Fiscal 2005

The following table presents the grants of stock options under our 1999 Equity Incentive Plan during the fiscal year ended September 30, 2005 to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2005.

| | | | | | | | | | | | | | | | | | |

Name

| | Individual Grants

| | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term

|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total Options

Granted to

Employees In

Fiscal 2005

| | | Exercise

Price

Per Share

| | | Expiration

Date

| | | 5%

| | 10%

|

Umang Gupta | | — | | — | % | | $ | — | | | — | | | $ | — | | $ | — |

Donald Aoki | | 55,000 | | 3.22 | % | | | 12.33 | (1) | | 11/16/2014 | (1) | | | 426,398 | | | 1,080,806 |

Peter Maloney | | 30,000 | | 1.75 | % | | | 11.98 | | | 06/30/2015 | | | | 225,780 | | | 572,402 |

| | | | | | |

Patrick Quirk | | 600,000 | | 35.00 | % | | | 11.95 | | | 04/03/2015 | | | | 4,509,174 | | | 11,427,133 |

Vikram A. Chaudhary | | 75,000 | | 4.39 | % | | | 10.95 | | | 04/30/2015 | | | | 516,480 | | | 1,308,861 |

| (1) | weighted average price is based on 25,000 shares at $12.76 and 30,000 shares at $11.98. The expiration date for the grant of 25,000 shares is 11/15/2014 and for the grant of 30,000 shares is 06/30/2015. |

All options granted under our 1999 Equity Incentive Plan are either incentive stock options or nonstatutory stock options. Options granted under our 1999 Equity Incentive Plan generally vest and become exercisable over a four-year period as to 25% of the shares subject to the option one year from the date of grant and as to 2.083% of the shares each succeeding month. Options expire 10 years from the date of grant. Options were granted at an exercise price equal to the fair market value of our common stock on the date of grant. In the year ending September 30, 2005, we granted to our employees options to purchase a total of 1,710,290 shares of our common stock.

Potential realizable values are computed by:

| | • | | multiplying the number of shares of common stock subject to a given option by the market price per share of our common stock on the date of grant; |

| | • | | assuming that the aggregate option exercise price derived from that calculation compounds at the annual 5% or 10% rates shown in the table for the entire 10-year term of the option; and |

| | • | | subtracting from that result the aggregate option exercise price. |

The 5% and 10% assumed annual rates of stock price appreciation are required by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future common stock prices. The closing price per share of our common stock as reported on the NASDAQ National Market on September 30, 2005, was $12.98.

Aggregated Option Exercises in Fiscal 2005 and Option Values at September 30, 2005

The following table presents the number of shares of common stock subject to vested and unvested stock options held as of September 30, 2005 by our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2005. Also reported is the value of in-the-money stock options as of September 30, 2005, which represents the positive difference between the aggregate exercise price of the outstanding options and the aggregate fair market value of the options based on $12.98, the closing price per share of our common stock on September 30, 2005, as reported on the NASDAQ National Market. The value of the unexercised in-the-money options has not been, and may never be, realized.

| | | | | | | | | | | | | | | |

Name

| | Number of

Shares

Acquired

on Exercise

| | Value

Realized

| | Number of

Securities Underlying

Unexercised Options

at September 30, 2005

| | Value of Unexercised

In-the-Money Options

at September 30, 2005

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Umang Gupta | | — | | $ | — | | 1,537,499 | | 62,501 | | $ | 6,756,745 | | $ | 341,225 |

Donald Aoki | | 57,850 | | | 250,695 | | 262,290 | | 101,460 | | | 967,842 | | | 136,233 |

Peter Maloney | | — | | | — | | 153,956 | | 76,044 | | | 718,977 | | | 111,973 |

Patrick Quirk | | — | | | — | | — | | 600,000 | | | — | | | 618,000 |

Vikram A. Chaudhary | | 5,000 | | | 29,509 | | 31,748 | | 98,252 | | | 108,969 | | | 182,871 |

Report of the Compensation Committee

The compensation committee of the board of directors administers Keynote’s executive compensation program. The current members of the compensation committee are Mr. Cowan and Dr. Rieman. Each is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and an outside director within the meaning of Section 162(m) of the Internal Revenue Code. Neither Mr. Cowan nor Dr. Rieman has any interlocking relationships as defined by the Securities and Exchange Commission.

General Compensation Philosophy

The role of the compensation committee is to set the salaries and other compensation of Keynote���s executive officers and other key employees, and to make grants of stock options and to administer the stock option and other employee equity and bonus plans. Keynote’s compensation philosophy for executive officers is to relate compensation to corporate performance and increases in stockholder value, while providing a total compensation package that is competitive and enables Keynote to attract, motivate, reward and retain key executive officers and employees. Accordingly, each executive officer’s compensation package may, in one or more years, be comprised of the following three elements:

| | • | | base salary that is designed primarily to be competitive with base salary levels in effect at high technology companies in the San Francisco Bay Area that are of comparable size to Keynote and with which Keynote competes for executive personnel; |

| | • | | annual variable performance awards, such as bonuses, payable in cash and/or stock-based incentive awards, tied to the achievement of goals based on Keynote’s performance either generally, or in the given area under the individual’s management, and using financial or other appropriate measures for determining achievement that are established by the compensation committee; and |

| | • | | long-term stock-based incentive awards that strengthen the mutuality of interests between Keynote’s executive officers and Keynote’s stockholders. |

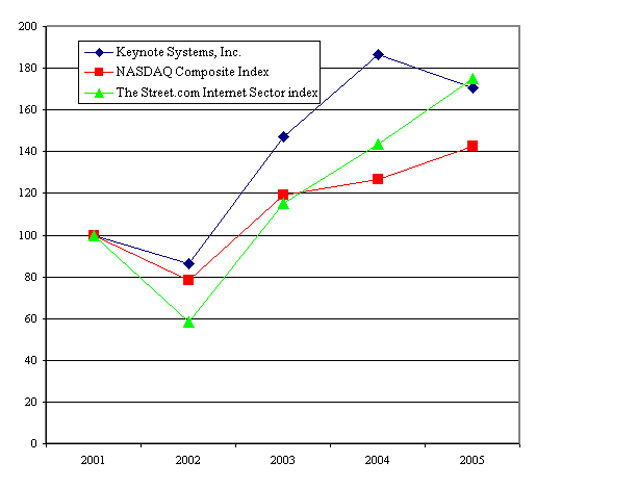

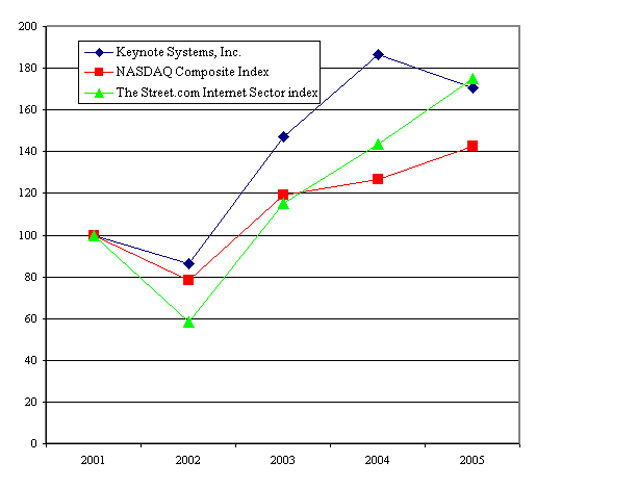

In preparing the Stock Price Performance Graph for this amendment, Keynote used The Street.com Internet Sector Index as its published line of business index. The compensation practices of most of the companies in that index were not reviewed by Keynote when the compensation committee reviewed the compensation information described above because such companies were determined not to be competitive with Keynote for executive talent. Instead, the compensation committee reviewed the compensation practices of a number of high technology companies in the San Francisco Bay Area for which adequate information was available for analysis.

Executive Compensation

Base Salary. Salaries for executive officers for the fiscal year ended September 30, 2005 were generally determined on an individual basis by evaluating each executive officer’s scope of responsibility, performance, prior experience and salary history, as well as the salaries for similar positions at comparable companies. We believe our executive’s salaries are generally in the mid-range of those companies that figured in our analysis.

Annual Incentive Awards. In the past, Keynote has included performance-based bonuses, payable in cash and/or stock-based incentive awards, as part of each executive officer’s annual compensation plan. Annual performance-based bonuses are based on mutually agreed upon goals and objectives. This practice is expected to continue and each executive officer’s annual performance will be measured by the achievement of established goals and objectives using quantitative and qualitative measures.

Long-Term Incentive Awards. The compensation committee believes that equity-based compensation in the form of stock options links the interests of executive officers with the long-term interests of Keynote’s stockholders and encourages executive officers to remain employed with Keynote. Stock options generally have value for executive officers only if the price of our stock increases above the fair market value on the grant date and the officer remains employed with Keynote for the period required for the shares to vest.

Keynote grants stock options in accordance with its 1999 Equity Incentive Plan. In the fiscal year ended September 30, 2005, stock options were granted to certain executive officers to aid in the retention of those executive officers and to align their interests with those of Keynote’s stockholders. Stock options typically are granted to an executive officer when he or she first joins us. The compensation committee may, however, grant additional stock options to executive officers for other reasons such as for retention or to attempt to ensure that a given executive officer’s actual and potential stockholdings (meaning shares held plus vested and unvested options) will align his or her interests with those of Keynote’s other stockholders. The number of shares subject to each stock option granted is within the discretion of the compensation committee and is based on anticipated future contribution and ability to impact Keynote’s results, past performance or consistency within the officer’s peer group, and the number of unvested options. In the fiscal year ended September 30, 2005, the compensation committee considered these factors and other factors as well. Stock options generally vest and become exercisable over a four-year period, remain exercisable for as long as nine years after vesting (so long as the executive remains in our employ), and are granted at a price that is equal to the fair market value of Keynote’s common stock on the date of grant.

Chief Executive Officer Compensation

The compensation committee reviewed Mr. Gupta’s performance and compensation package in October 2004. At that time it determined to adjust for fiscal 2005, Mr. Gupta’s base salary from $225,000 to $237,000 per year and determined not to make any adjustment to his target bonus of $150,000. The compensation committee believes that revenue growth is an important element in the long-term success of Keynote and the target bonus of the CEO should be paid primarily in relation to the improvement of Keynote’s financial and operating performance. For fiscal 2005, the compensation committee therefore determined that Mr. Gupta’s target bonus should be entirely based on Keynote achieving profit and revenue objectives contained in the operating plan approved by the Board of Directors. The compensation committee established fourth quarter revenues, rather than annual revenues, as the revenue objective for Mr. Gupta’s performance bonus on the rationale that fourth quarter revenues are a better indicator of revenue growth. Based on Keynote’s fiscal 2005 performance against these profit and revenue objectives, the compensation committee determined that Mr. Gupta had earned 25% of his target bonus, $37,500. The Board, with Mr. Gupta not present, reviewed and ratified this determination. With respect to long term incentive compensation, Mr. Gupta requested that he not be granted any stock options in fiscal 2005 to moderate the potential dilution from stock options to our stockholders. The compensation committee took account of this request, of the option grant awarded in fiscal 2002, and of the level of his existing shareholdings in concluding that Mr. Gupta’s interest in the long-term success of Keynote remains aligned with that of Keynote’s other stockholders.

Internal Revenue Code Section 162(m) Limitation

Section 162(m) of the Internal Revenue Code limits the tax deduction in any taxable year of a publicly held company to one million dollars for compensation paid to the Chief Executive Officer and its four other most highly compensated

executive officers. Having considered the requirements of Section 162(m), the compensation committee believes that grants made pursuant to Keynote’s 1999 Equity Incentive Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations of Section 162(m) on deductibility. Historically, and for fiscal year 2005 as well, the combined salary and bonus of each executive officer covered by Section 162(m) has been below one million dollars. The compensation committee’s present intention is to structure compensation arrangements to maximize Keynote’s available deductions consistent with Section 162(m) unless the occasion should arise that the compensation committee reasonably believes that the best interests of Keynote and its stockholders will be served by structuring compensation for a given executive officer, or executive officers, differently.

| | | | |

| | | | | Compensation Committee David Cowan Deborah Rieman |

Employment Agreement with Chief Executive Officer

We entered into an employment agreement with Umang Gupta, our Chief Executive Officer, in December 1997 and amended this agreement in November 2001. This agreement, as amended, establishes Mr. Gupta’s annual base salary and eligibility for benefits and bonuses. This agreement continues until it is terminated upon written notice by Mr. Gupta or us. We must pay Mr. Gupta his salary and other benefits through the date of any termination of his employment. If his employment is terminated by us without cause or through his constructive termination due to a material reduction in his salary or benefits, a material change in his responsibilities or a sale of us if he is not the Chief Executive Officer of the resulting combined company, we must also pay his salary for six additional months after that date.

In connection with the November 2001 amendment of this agreement, Mr. Gupta was granted an option to purchase 1,300,000 shares of common stock at an exercise price of $7.52 per share. This option is immediately exercisable, subject to our right to repurchase the shares of common stock upon termination of his employment. This option vested as to 20,833 shares on January 7, 2002, vested as to 33,333 shares each month thereafter through January 7, 2004, and vested as to 20,833 shares each month thereafter. This option is currently fully vested.

Under the employment agreement, as amended, all shares subject to Mr. Gupta’s options would vest in full 90 days following a sale of us if Mr. Gupta is not the Chief Executive Officer of the resulting combined company. If his employment is terminated by us without cause or through his voluntary termination, and if he assists in the transition to a successor Chief Executive Officer, vesting of the shares subject to his options would continue for an additional 12 months. If his employment is terminated by us without cause or due to his death or through his constructive termination due to a material reduction in his salary or benefits or a material change in his responsibilities, the shares subject to his options would vest in an amount equal to the number that would vest during the six months following this termination. If his employment is terminated by us for cause or due to his disability or through his voluntarily termination, the vesting of any shares subject to his options would cease on the date of termination. During the fiscal year ended September 30, 2005, these terms applied to Mr. Gupta’s options, however this option is now currently fully vested.

Other Change-of-Control Arrangements

The options that we grant to our executive officers other than our Chief Executive Officer, as described above, under our 1999 Equity Incentive Plan generally provide for acceleration of the vesting of such options upon the occurrence of specified events. If the executive officer is terminated without cause following a sale of our company that occurs within 12 or less months after the date of grant of the option, 25% of that option vests immediately with respect to the shares subject to that option. If the executive officer is terminated without cause following a sale of our company that occurs more than 12 months after the date of grant of the option, that option vests immediately with respect to all of the shares subject to that option. For the purposes of this provision, a sale of our company includes any sale of all or substantially all of our assets, or any merger or consolidation of us with or into any other corporation, corporations, or other entity in which more than 50% of our voting power is transferred. For purposes of this provision, cause means (i) willfully engaging in gross misconduct that is materially and demonstrably injurious to us; (ii) willful and continued failure to substantially perform the executive officer’s duties (other than incapacity due to physical or mental illness), provided that this failure continues after our Board of Directors has provided the executive officer with a written demand for substantial performance, setting forth in detail the

specific respects in which it believes the executive officer has willfully and not substantially performed his or her duties and a reasonable opportunity (to be not less than 30 days) to cure the failure. A termination without cause includes a termination of employment by the executive officer within 30 days following any one of the following events: (x) a 10% or more reduction in the executive officer’s salary that is not part of a general salary reduction plan applicable to all officers of the successor company; (y) a change in the executive officer’s position or status to a position that is not at the level of Vice President or above with the successor; or (z) relocating the executive officer’s principal place of business, in excess of fifty (50) miles from the current location of such principal place of business. In addition, if any of these executive officers is terminated without cause, he or she is entitled to receive a payment equal to three months of his or her base salary.

The options that we grant to our non-employee directors under the automatic option grant provision of our 1999 Equity Incentive Plan provide that any unvested shares subject to these options will become immediately exercisable upon a transaction that results in a change of control.

Director Compensation

Cash Compensation. Each member of the board of directors who is not employed by Keynote is paid an annual retainer of $20,000, provided that each such non-employee director must attend at least three of the four regularly scheduled board meetings during the fiscal year and at least 75% of the total number of board meetings held during such year. Directors who are employees do not receive cash compensation from Keynote for the services they provide as directors. All directors are reimbursed for their reasonable expenses in attending board and board committee meetings.

Option Grants. Under our 1999 Equity Incentive Plan, each new non-employee director is automatically granted an option to purchase 50,000 shares of common stock on the date he or she becomes a director. In addition, each new member of the audit committee or of the compensation committee is generally granted an option to purchase 10,000 shares of common stock on the date he or she is elected or appointed to serve on such committee. The chair of the audit committee generally is granted an option to purchase an additional 5,000 shares of common stock on the date of his or her appointment as chair. The options have an exercise price equal to the fair market value of our common stock on the date of grant, have ten-year terms and vest over three years. One-third of the shares subject to these options vest on the earlier of one year following the director’s appointment to the board of directors or committee, as applicable, or the first annual meeting of our stockholders following the grant of the option. The remaining shares subject to these options vest ratably monthly over the two years from the date on which shares first vest. Under our 1999 Equity Incentive Plan, the compensation committee may grant discretionary awards to non-employee directors.

On July 1, 2005, each of Messrs. Cowan, Gyani, Penney and Dr. Rieman was granted an option to purchase 60,000 shares of our common stock, with an exercise price of $11.98 per share, the fair market value on the date of grant. One-quarter of the shares subject to these options shall vest on March 23, 2006, the date of the 2006 Annual Meeting of Keynote Stockholders. The remaining shares subject to these options vest ratably monthly over the three years from the date on which shares first vest, with the option to be fully vested at the 2009 Annual Meeting of Keynote Stockholders. Also on July 1, 2005, Ms. Bolt and Mr. Ocampo each was granted an option to purchase 30,000 shares of our common stock, with an exercise price of $11.98 per share, the fair market value on the date of grant. Commencing at the 2007 Annual Meeting of Keynote Stockholders, the shares subject to these options shall vest ratably monthly with the option to be fully vested at the 2009 Annual Meeting of Keynote Stockholders. Each of the options granted on July 1, 2005 were discretionary grants.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee has at any time since our formation been one of our officers or employees. None of our executive officers currently serves or in the past has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board or compensation committee.

Stock Price Performance Graph

The following graph and table compare the cumulative total stockholder return on our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index. The graph and table assume that $100 was invested in our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index on September 30, 2001, and calculates the annual return through September 30, 2005. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

| | | | | | | | | |

| | | Keynote Systems, Inc.

| | NASDAQ Composite Index

| | The Street.com Internet Sector index

|

September 30, 2001 | | $ | 100 | | $ | 100 | | $ | 100 |

September 30, 2002 | | | 86 | | | 78 | | | 58 |

September 30, 2003 | | | 147 | | | 119 | | | 115 |

September 30, 2004 | | | 186 | | | 127 | | | 143 |

September 30, 2005 | | | 171 | | | 143 | | | 175 |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Securities Authorized for Issuance Under Equity Compensation Plans

As of September 30, 2005, we maintained our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan, both of which were approved by our stockholders. The following table gives information about equity awards under those plans as of September 30, 2005:

| | | | | | | | |

Plan Category

| | (a) Number of Shares to be Issued Upon Exercise of Outstanding Options

| | (b) Weighted-Average Exercise Price of Outstanding Options

| | (c) Number of Shares Remaining Available for Equity Compensation Plans (Excluding Shares Reflected in Column (a))

| |

| | | |

Equity compensation plans approved by stockholders | | 6,236,436 | | $ | 13.42 | | 3,742,089 | (1) |

| | | |

Total | | 6,236,436 | | $ | 13.42 | | 3,742,089 | |

| (1) | Of these, 2,955,826 shares remained available for grant under the 1999 Equity Incentive Plan and 787,073 shares remained available for grant under the 1999 Employee Stock Purchase Plan. All of the shares available for grant under the 1999 Equity Incentive Plan may be issued as restricted stock, although we do not currently intend to do so. |

Security Ownership of Certain Beneficial Owners and Management

The following table presents information as to the beneficial ownership of our common stock as of December 31, 2005 by:

| | • | | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | | our Chief Executive Officer and four other most highly compensated executive officers who were serving as executive officers as of September 30, 2005; and |

| | • | | all of our directors and executive officers as a group. |

The percentage ownership is based on 20,654,438 shares of common stock outstanding as of December 31, 2005. Shares of common stock that are subject to options currently exercisable or exercisable within 60 days of December 31, 2005, are deemed outstanding for the purposes of computing the percentage ownership of the person holding these options but are not deemed outstanding for computing the percentage ownership of any other person. Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Unless indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise noted, the address for each stockholder listed below is c/o Keynote Systems, Inc., 777 Mariners Island Boulevard, San Mateo, CA 94404.

| | | | | |

Name of Beneficial Owner

| | Shares Beneficially Owned

| |

| | Number of Shares

| | Percent

| |

Umang Gupta(1) | | 3,710,910 | | 16.67 | % |

David J. Greene & Co (2) | | 1,223,977 | | 5.92 | % |

Royal Capital Management, LLC (3) | | 1,100,000 | | 5.33 | % |

Donald Aoki (4) | | 361,953 | | 1.73 | % |

Raymond L. Ocampo Jr.(5) | | 114,110 | | * | |

David Cowan(6) | | 100,345 | | * | |

Mohan Gyani(7) | | 64,722 | | * | |

Geoffrey Penney(8) | | 59,722 | | * | |

| | |

Deborah Rieman(9) | | 59,722 | | * | |

Peter Maloney(10) | | 41,042 | | * | |

| | |

Jennifer Bolt(11) | | 47,222 | | * | |

Vikram A. Chaudhary (12) | | 33,830 | | * | |

Patrick Quirk | | — | | * | |

All 11 directors and executive officers as a group(13) | | 4,593,578 | | 20.01 | % |

| * | Indicates beneficial ownership of less than 1%. |

| (1) | Includes 70,000 shares held by the Gupta Family 1999 Irrevocable Trust. Mr. Gupta disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 1,600,000 shares subject to options exercisable within 60 days of December 31, 2005. |

| (2) | Based solely on information provided by David J. Greene & Co. in its Schedule 13F filed with the Securities and Exchange Commission on or prior to December 31, 2005. |

| (3) | Based solely on information provided by RS Investment Management in its Schedule 13F filed with the Securities and Exchange Commission on or prior to December 31, 2005. |

| (4) | Includes 74,172 shares held by the Aoki family trust, 3,842 shares held by Mr. Aoki as trustee for his minor children and 650 shares held by the Frank and Jeanne Aoki Revocable Trust, over which Mr. Aoki exercises investment power. Mr. Aoki disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 282,080 shares subject to options exercisable within 60 days of December 31, 2005. |

| (5) | Includes 34,716 shares held by Raymond L. Ocampo Jr. and Sandra O. Ocampo, Trustees of Ocampo Revocable Trust UTA May 30, 1996, and 56,666 shares subject to options exercisable within 60 days of December 31, 2005. |

| (6) | Includes 59,722 shares subject to options exercisable within 60 days of December 31, 2005. |

| (7) | Represents 64,722 shares subject to options exercisable within 60 days of December 31, 2005. |

| (8) | Represents 59,722 shares subject to options exercisable within 60 days of December 31, 2005. |

| (9) | Represents 59,722 shares subject to options exercisable within 60 days of December 31, 2005. |

| (10) | Includes 38,516 shares subject to options exercisable within 60 days of December 31, 2005. |

| (11) | Represents 47,222 shares subject to options exercisable within 60 days of December 31, 2005. |

| (12) | Represents 33,830 shares subject to options exercisable within 60 days of December 31, 2005. |

| (13) | Includes 2,302,202 shares subject to options exercisable within 60 days of December 31, 2005. |

Item 13. Certain Relationships and Related Transactions.

Other than the compensation arrangements that are described above in “Director Compensation” and “Employment Agreement with Chief Executive Officer,” since October 1, 2004, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a party in which the amount involved exceeds $60,000 and in which any director, executive officer, holder of more than 5% of our common stock or any member of their immediate family had or will have a direct or indirect material interest.

Item 14. Principal Accountant Fees and Services.

During the fiscal years ended September 30, 2004 and 2005, the aggregate fees billed by Keynote’s independent auditors, KPMG LLP, for professional services were as follows:

| | • | | Audit Fees. The aggregate fees billed by KPMG LLP for professional services rendered for the audit of Keynote’s annual consolidated financial statements, review of the consolidated financial statements included in Keynote’s quarterly reports on Form 10-Q and services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements were $488,700, including auditing services related to acquisitions, for the fiscal year ended September 30, 2005 and $659,320, including auditing services related to acquisitions, for the fiscal year ended September 30, 2004; |

| | • | | Audit-Related Fees. The aggregate fees billed by KPMG LLP for assurance and related services that are reasonably related to the performance of Keynote’s consolidated financial statements that are not reported above under “Audit Fees” were $270,000 for the fiscal year ended September 30, 2005. The services for the fees disclosed under this category primarily included reviews per the new Statement on Auditing Standards No. 100. The fees for assurance and related services were $18,400 for the fiscal year ended September 30, 2004. The services primarily included for Accounting consultations in connection with acquisitions. |

| | • | | Tax Fees. The aggregate fees billed by KPMG LLP for professional services rendered for tax compliance and tax advice planning were $143,855 for the fiscal year ended September 30, 2005 and $149,427 for the fiscal year ended September 30, 2004. The services for the fees disclosed under this category include tax consultation and the preparation of tax returns; and |

| | • | | All Other Fees. For the fiscal year ended September 30, 2005, KPMG LLP billed aggregate fees of $243,000 for consultants related to Sarbanes-Oxley 404 compliance. The fees under this category were $1,500 for the fiscal year ended September 30, 2004. |

The Audit Committee has determined that the provision of these services is compatible with maintaining KPMG LLP’s independence.

PART IV

Item 15. Exhibits and Financial Statement Schedules.

| (a) | Documents to be filed as part of this report: |

(3) Exhibits

The following table lists the exhibits filed as part of this report. In some cases, these exhibits are incorporated into this report by reference to exhibits to our other filings with the Securities and Exchange Commission. Where an exhibit is incorporated by reference, we have noted the type of form filed with the Securities and Exchange Commission, the file number of that form, the date of the filing and the number of the exhibit referenced in that filing.

| | | | | | | | | | | | |

Exhibit

No.

| | Exhibit

| | Incorporated by Reference

| | Filed

Herewith

|

| | | | | Form

| | File No.

| | Filing

Date

| | Exhibit No.

| |

| 2.01 | | Agreement and Plan of Reorganization by and between Keynote, Vivid Acquisition Corporation, Vividence Corporation and the Shareholders’ Representative named therein | | 8-K | | 000-27241 | | 11-29-04 | | 2.01 | | |

| | | | | | |

| 3.01 | | Amended and Restated Certificate of Incorporation. | | S-1 | | 333-94651 | | 01-14-00 | | 3.04 | | |

| | | | | | |

| 3.02 | | Bylaws. | | 14A | | 000-27241 | | 01-19-00 | | Annex B | | |

| | | | | | |

| 3.03 | | Certificate of Designations specifying the terms of the Series A Junior Participating Preferred Stock of registrant, as filed with the Secretary of State of the State of Delaware on October 28, 2002 | | 8-A | | 000-27241 | | 10-29-02 | | 3.02 | | |

| | | | | | |

| 4.01 | | Form of Specimen Stock Certificate for Keynote common stock. | | S-1 | | 333-82781 | | 09-22-99 | | 4.01 | | |

| | | | | | |

| 10.01 | | Form of Indemnity Agreement between Keynote and each of its directors and executive officers. | | S-1 | | 333-94651 | | 01-14-00 | | 10.01A | | |

| | | | | | |

| 10.02 | | 1996 Stock Option Plan. | | S-1 | | 333-82781 | | 07-13-99 | | 10.02 | | |

| | | | | | |

| 10.03 | | 1999 Stock Option Plan. | | S-1 | | 333-82781 | | 07-13-99 | | 10.03 | | |

| | | | | | |

| 10.04 | | 1999 Equity Incentive Plan and related forms of stock option agreement and stock option exercise agreement. | | S-1 | | 333-82781 | | 08-23-99 | | 10.04 | | |

| | | | | | |

| 10.05 | | 1999 Employee Stock Purchase Plan and related forms of enrollment form, subscription agreement, notice of withdrawal and notice of suspension. | | S-1 | | 333-82781 | | 08-23-99 | | 10.05 | | |

| | | | | | |

| 10.06 | | 401(k) Plan. | | S-1 | | 333-82781 | | 07-13-99 | | 10.06 | | |

| | | | | | |

| 10.07* | | Employment Agreement dated as of December 9, 1997 between Keynote and Umang Gupta. | | S-1 | | 333-82781 | | 07-13-99 | | 10.08 | | |

| | | | | | |

| 10.08* | | Amendment Agreement dated as of November 12, 2001 between Keynote and Umang Gupta. | | 10-Q | | 000-27241 | | 02-14-02 | | 10.01 | | |

| | | | | | |

| 10.09 | | Agreement with UBS Securities LLC dated January 27, 2005 | | 10-Q | | 000-27241 | | 5-10-05 | | 10.1 | | |

| | | | | | |

| 10.10* | | Separation Agreement with Arnold Waldstein dated March 28, 2005 | | 10-Q | | 000-27241 | | 5-10-05 | | 10.2 | | |

| | | | | | | | | | | | |

Exhibit

No.

| | Exhibit

| | Incorporated by Reference

| | Filed

Herewith

|

| | | | | Form

| | File No.

| | Filing

Date

| | Exhibit No.

| |

| 10.11* | | Employment Offer Letter dated as of April 7, 2005 between Keynote Systems, Inc. and Patrick Quirk. | | 8-K | | 000-27241 | | 04-12-05 | | 99.1 | | |

| | | | | | |

| 10.12* | | Promotion Letter Agreement dated as of May 1, 2005 between Keynote Systems, Inc. and Vikram Chaudhary. | | 8-K | | 000-27241 | | 05-05-05 | | 99.1 | | |

| | | | | | |

| 10.13* | | Addendum to Stock Option Agreement dated as of May 1, 2005 between Keynote Systems, Inc. and Vikram Chaudhary. | | 8-K | | 000-27241 | | 05-05-05 | | 99.2 | | |

| | | | | | |

| 21.01 | | Subsidiaries of Keynote. | | 10-K | | 000-27241 | | 12-08-05 | | 21.01 | | |

| | | | | | |

| 23.01 | | Consent of KPMG LLP, Independent Registered Public Accounting Firm. | | 10-K | | 000-27241 | | 12-08-05 | | 23.01 | | |

| | | | | | |

| 31.1 | | Certification of Periodic Report by Chief Executive Officer under Section 302 of the Sarbanes-Oxley Act of 2002 | | | | | | | | | | X |

| | | | | | |

| 31.2 | | Certification of Periodic Report by Chief Financial Officer under Section 302 of the Sarbanes-Oxley Act of 2002 | | | | | | | | | | X |

| | | | | | |

| 32.1 | | Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 ** | | | | | | | | | | X |

| | | | | | |

| 32.2 | | Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 ** | | | | | | | | | | X |

| * | Management contract or compensatory plan. |

| ** | As contemplated by SEC Release No. 33-8212, these exhibits are furnished with this Annual Report on Form 10-K and are not deemed filed with the Securities and Exchange Commission and are not incorporated by reference in any filing of Keynote Systems, Inc. Under the Securities Act of 1933 or the Securities Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in such filings. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this amendment to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Mateo, State of California, on this 30th day of January 2006.

| | |

| KEYNOTE SYSTEMS INC. |

| |

| By: | | /S/ UMANG GUPTA

|

| | | Umang Gupta |

| | | Chairman of the Board and Chief Executive Officer |

Pursuant to the requirements of the Securities Exchange Act, this report has been signed by the following persons on behalf of the Registrant in the capacities and on the date indicated.

| | | | |

Name

| | Title

| | Date

|

| Principal Executive Officer: | | | | |

| | |

/S/ UMANG GUPTA

Umang Gupta | | Chairman of the Board, Chief Executive Officer and Director | | January 30, 2006 |

| | |

| Principal Financial and Accounting Officer: | | | | |

| | |

/S/ ANDREW HAMER

Andrew Hamer | | Vice President and Chief Financial Officer | | January 30, 2006 |

| | |

| Additional Directors: | | | | |

| | |

*

Jennifer Bolt | | Director | | January 30, 2006 |

| | |

*

David Cowan | | Director | | January 30, 2006 |

| | |

*

Mohan Gyani | | Director | | January 30, 2006 |

*

Geoffrey Penney | | Director | | January 30, 2006 |

| | |

*

Raymond L Ocampo Jr | | Director | | January 30, 2006 |

| | |

*

Dr. Deborah Rieman | | Director | | January 30, 2006 |

| | |

/S/ ANDREW HAMER

Andrew Hamer | | Attorney-in-fact | | January 30, 2006 |