Flagstar Bank 4th Quarter 2013 Earnings Presentation January 23, 2014

Cautionary Statement This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts, assumptions, risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement. Examples of forward-looking statements include statements regarding our expectations, beliefs, plans, goals, objectives and future financial or other performance. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and variations of such words and similar expressions are intended to identify such forward-looking statements. Any forward- looking statement speaks only as of the date on which it is made. Except to fulfill our obligations under the U.S. securities laws, we undertake no obligation to update any such statement to reflect events or circumstances after the date on which it is made. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include: 1. General business and economic conditions, including unemployment rates, movements in interest rates, the slope of the yield curve, any increase in mortgage fraud and other related activity and the further decline of asset values in certain geographic markets, that affect us or our counterparties; 2. Volatile interest rates, and our ability to effectively hedge against them, could affect, among other things, (i) the mortgage business, (ii) our ability to originate loans and sell assets at a profit, (iii) prepayment speeds, (iv) our cost of funds and (v) investments in MSRs; 3. The adequacy of our allowance for loan losses and our representation and warranty reserves; 4. Changes in accounting standards generally applicable to us and our application of such standards, including in the calculation of the fair value of our assets and liabilities; 5. Our ability to borrow funds, maintain or increase deposits or raise capital on commercially reasonable terms or at all and our ability to achieve or maintain desired capital ratios; 6. Changes in material factors affecting our loan portfolio, particularly our residential mortgage loans, and the market areas where our business is geographically concentrated or further loan portfolio or geographic concentration; 7. Changes in, or expansion of, the regulation of financial services companies and government-sponsored housing enterprises, including new legislation, regulations, rulemaking and interpretive guidance, enforcement actions, the imposition of fines and other penalties by our regulators, the impact of existing laws and regulations, new or changed roles or guidelines of government-sponsored entities, changes in regulatory capital ratios, and increases in deposit insurance premiums and special assessments of the Federal Deposit Insurance Corporation; 8. Our ability to comply with the terms and conditions of the Supervisory Agreement with the Board of Governors of the Federal Reserve and the Bank’s ability to comply with the Consent Order with the Office of Comptroller of the Currency, and our ability to address matters raised by our regulators, including Matters Requiring Attention and Matters Requiring Immediate Attention, if any; 9. The Bank’s ability to make capital distributions and our ability to pay dividends on our capital stock or interest on our trust preferred securities; 10. Our ability to attract and retain senior management and other qualified personnel to execute our business strategy, including our entry into new lines of business, our introduction of new products and services and management of risks relating thereto, and our competing in the mortgage loan originations and servicing and commercial and retail banking lines of business; 11. Our ability to satisfy our servicing and sub-servicing obligations and manage repurchases and indemnity demands by mortgage loan purchasers, guarantors and insurers; 12. The outcome and cost of defending current and future legal or regulatory litigation proceedings or investigations; 13. Our ability to create and maintain an effective risk management framework and effectively manage risk, including, among other things, market, interest rate, credit and liquidity risk, including risks relating to the cyclicality and seasonality of our mortgage banking business, litigation and regulatory risk, operational risk, counterparty risk and reputational risk; 14. The control by, and influence of, our majority stockholder; 15. A failure of, interruption in or cybersecurity attack on our network or computer systems, our ability to properly collect, process and maintain personal data and system integrity with respect to funds settlement; 16. Our compliance with the terms and conditions of the agreement with the U.S. Department of Justice and the impact of compliance with that agreement, , and our ability to accurately estimate the financial impact of that agreement, including the fair value and timing of the future payments; and 17. The downgrade of the long-term credit rating of the U.S. by one or more ratings agencies could materially affect global and domestic financial markets and economic conditions. All of the above factors are difficult to predict, contain uncertainties that may materially affect actual results, and may be beyond our control. New factors emerge from time to time, and it is not possible for our management to predict all such factors or to assess the effect of each such factor on our business. Although we believe that these forward-looking statements are based on reasonable estimates and assumptions, they are not guaranties of future performance and are subject to known and unknown risks, uncertainties, contingencies and other factors. Accordingly, we cannot give you any assurance that our expectations will in fact occur or that actual results will not differ materially from those expressed or implied by such forward-looking statements. In light of the significant uncertainties inherent in forward- looking statements, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. 2 4th Quarter 2013 Earnings Presentation

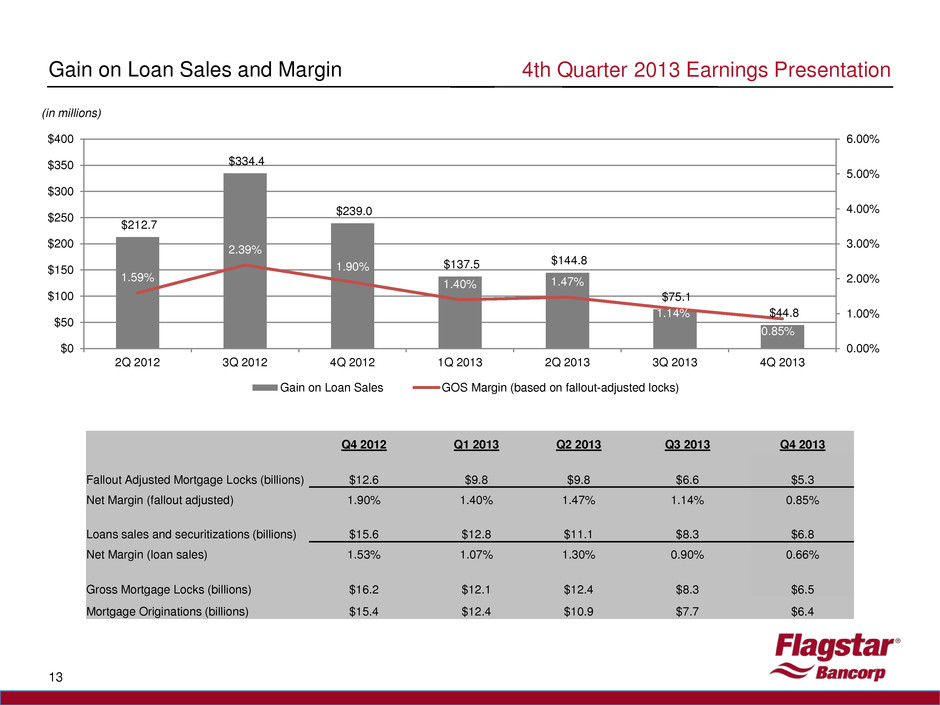

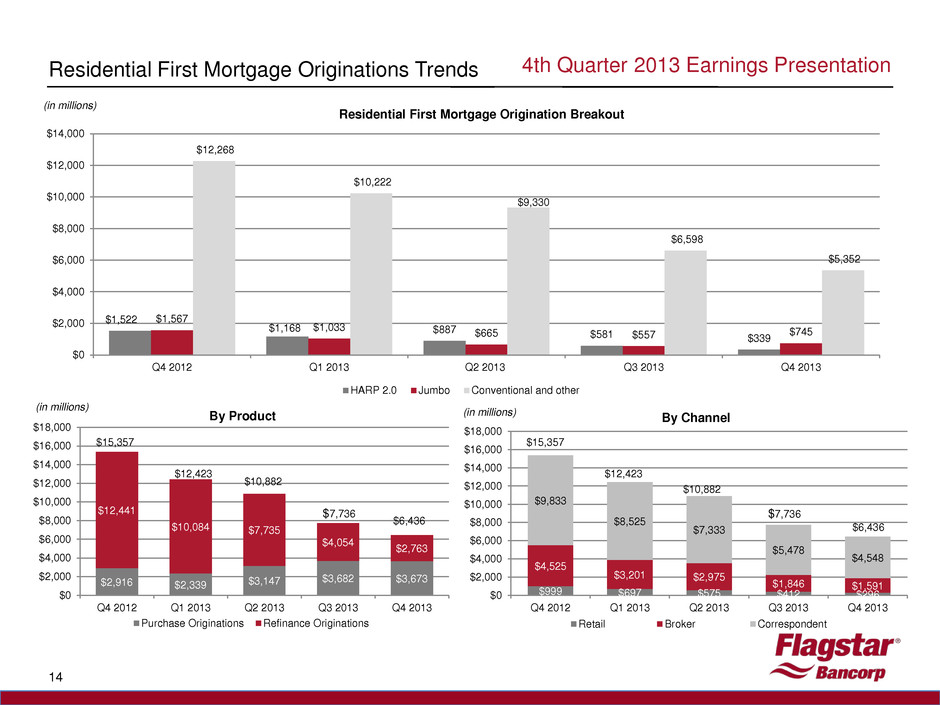

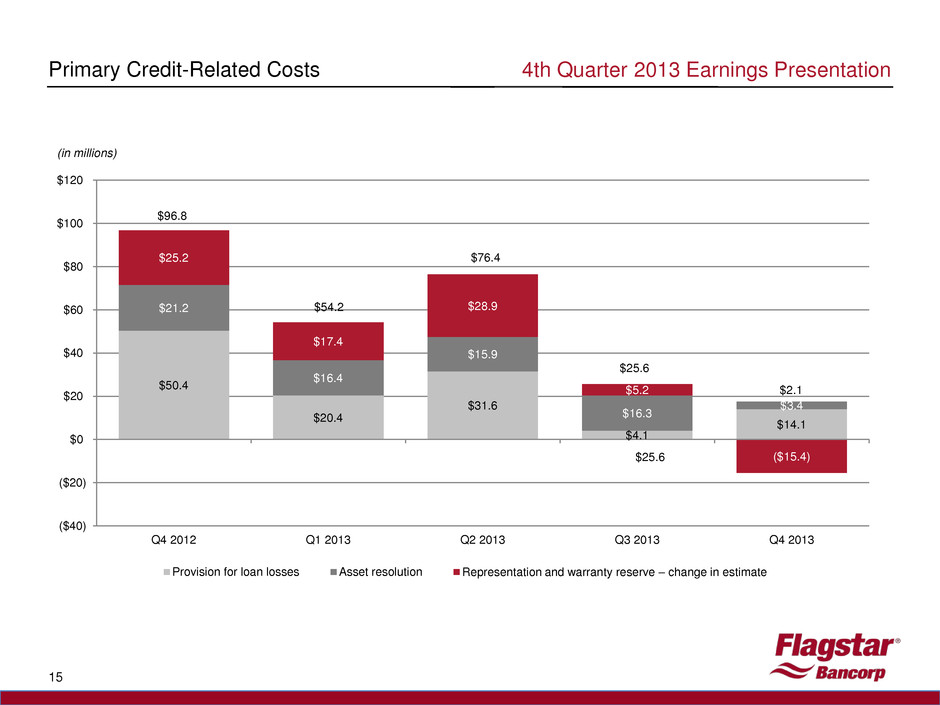

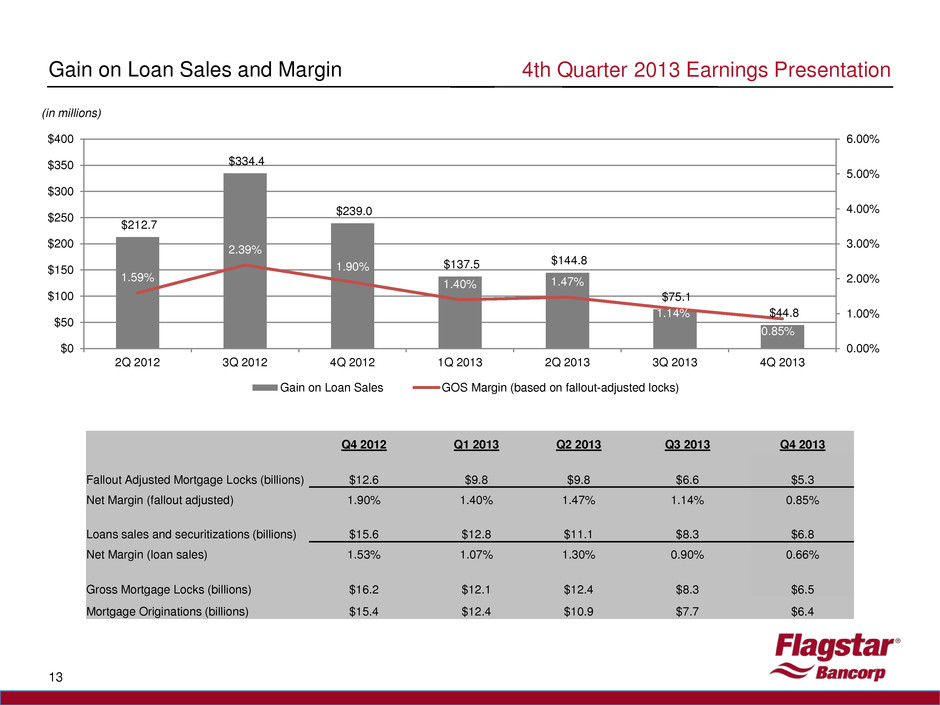

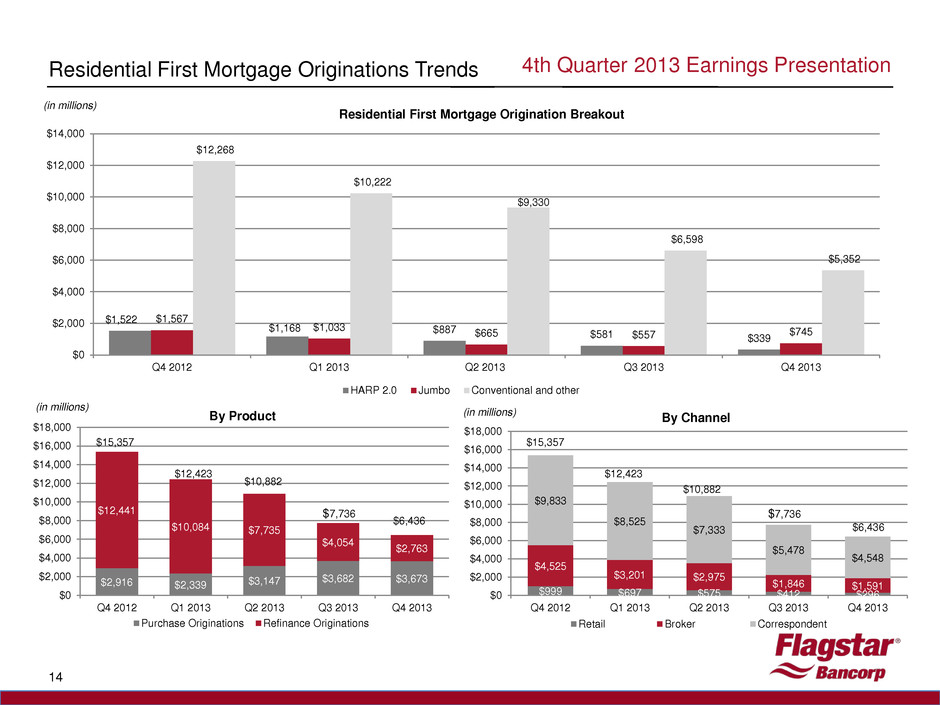

($94.2) $22.2 $65.8 $12.8 $160.5 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Income to Common Stockholders Fourth Quarter 2013 Highlights 3 4th Quarter 2013 Earnings Presentation (in millions) • Net income applicable to common stockholders of $160.5 million, or $2.77 per diluted share • Included $410.4 million tax benefit primarily due to the reversal of the deferred tax asset valuation allowance • Included $177.6 million loss on extinguishment of debt from prepayment of $2.9 billion in long-term FHLB advances • Included $64.5 million in expense related to Department of Justice settlement from February 2012 • Included $24.9 million benefit from releases of reserves related to settlement agreements with Fannie Mae and Freddie Mac • Net gain on loan sales decreased to $44.8 million, from $75.1 million in prior quarter (“PQ”) • Mortgage originations decreased to $6.4 billion, from $7.7 billion in PQ • Gain on sale margin (based on fallout-adjusted rate locks) decreased to 85 bps, from 114 bps in PQ • Sold $53.4 billion in aggregate UPB of mortgage servicing rights, reducing ratio of MSR-to-Tier 1 capital to 22.6% • Remain sub-servicer on $40.7 billion of UPB sold in Q4 • Continued improvement in credit-related costs and asset quality • Total credit-related costs (1) decreased to $2.1 million, from $25.6 million in PQ • Charge-offs, net of recoveries decreased to $14.1 million, from $40.1 million in PQ • Non-performing assets decreased to $182.3 million, from $205.3 million in PQ (1) See Non-GAAP reconciliation.

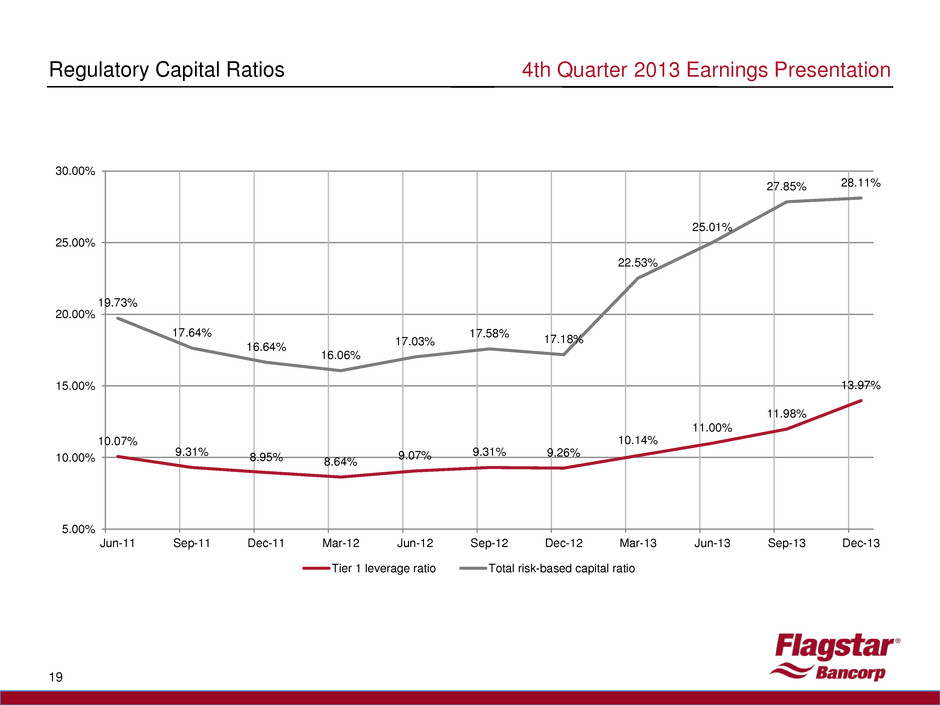

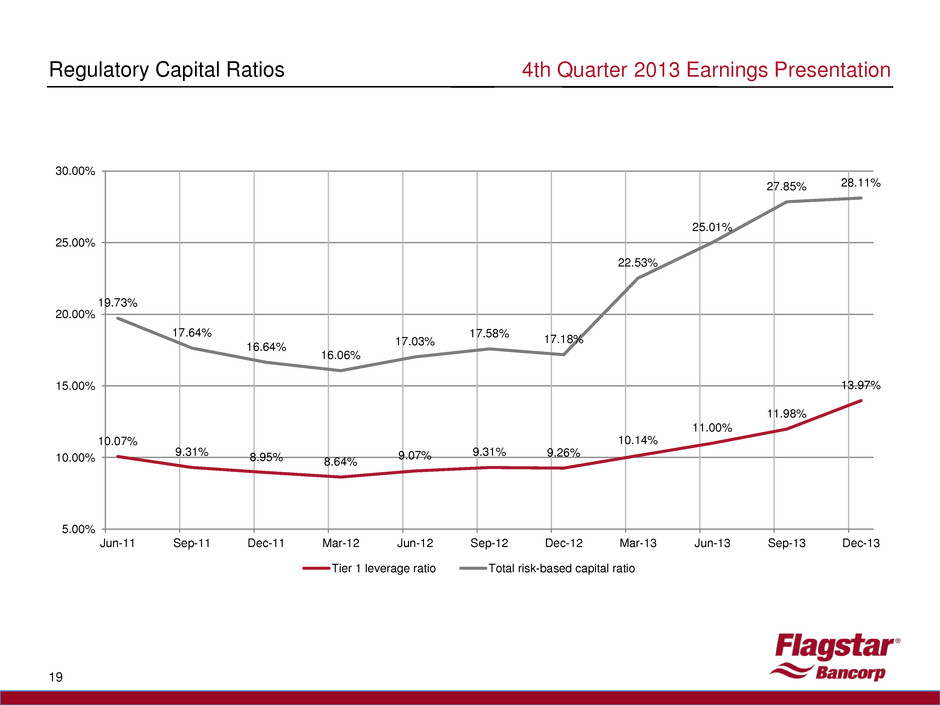

Summary of Financial Results 4 (1) Net servicing revenue includes net loan administration income and net gain (loss) on trading securities. (2) Excludes loans carried under the fair value option. (3) See Non-GAAP reconciliation. 4th Quarter 2013 Earnings Presentation (in millions, except per share data) For the Year Ended Q4 2013 Q3 2013 Q4 2012 Dec. 31, 2013 Dec. 31, 2012 Net Interest Income $41.2 $42.7 $73.9 $186.7 $297.2 Provision $14.1 $4.1 $50.4 $70.1 $276.0 Gain on Loan Sale $44.8 $75.1 $239.0 $402.2 $990.9 Net Servicing Revenue (1) $28.9 $30.4 $25.0 $115.9 $98.0 Net Income (Loss) Applicable to Common Shareholders $160.5 $12.8 ($94.2) $261.2 $62.7 Diluted Earnings (Loss) per Share $2.77 $0.16 ($1.75) $4.37 $0.87 Total Assets $9,407.3 $11,807.8 $14,082.0 $9,407.3 $14,082.0 Total Stockholders' Equity $1,425.9 $1,272.4 $1,159.4 $1,425.9 $1,159.4 Return on Average Assets 5.70% 0.42% (2.51%) 2.08% 0.43% Return on Average Equity 50.39% 4.05% (29.26%) 21.09% 5.26% Book Value per Common Share $20.66 $17.96 $16.12 $20.66 $16.12 NPLs / Gross Loans HFI 3.59% 3.46% 7.35% 3.59% 7.35% NPAs / Total Assets (Bank) 1.95% 1.74% 3.70% 1.95% 3.70% ALLL / NPLs (2) 145.9% 152.6% 76.3% 145.9% 76.3% ALLL / Gross Loans HFI (2) 5.42% 5.50% 5.61% 5.42% 5.61% NPAs / Tier 1 Capital + Allowance for Loan Losses (2) (3) 12.4% 12.8% 32.5% 12.4% 32.5% Tier 1 Leverage to Adjusted Assets Ratio 13.97% 11.98% 9.26% 13.97% 9.26% Total Risk Based Capital Ratio 28.11% 27.85% 17.18% 28.11% 17.18% Total Equity / Total Assets 15.16% 10.78% 8.23% 15.16% 8.23% MSR to Tier 1 Capital (3) 22.6% 56.8% 54.9% 22.6% 54.9%

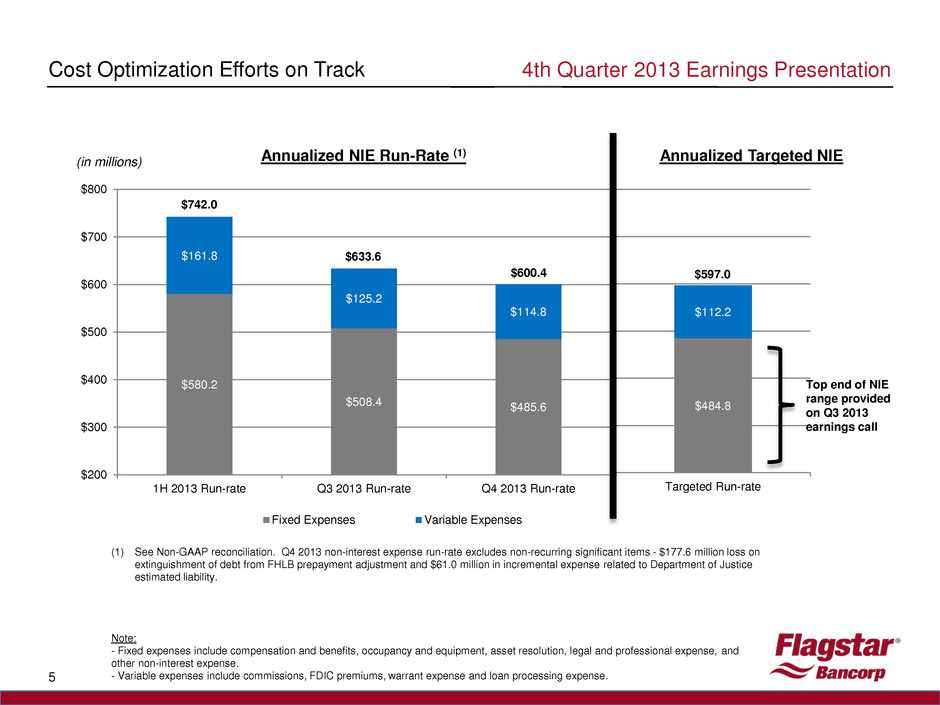

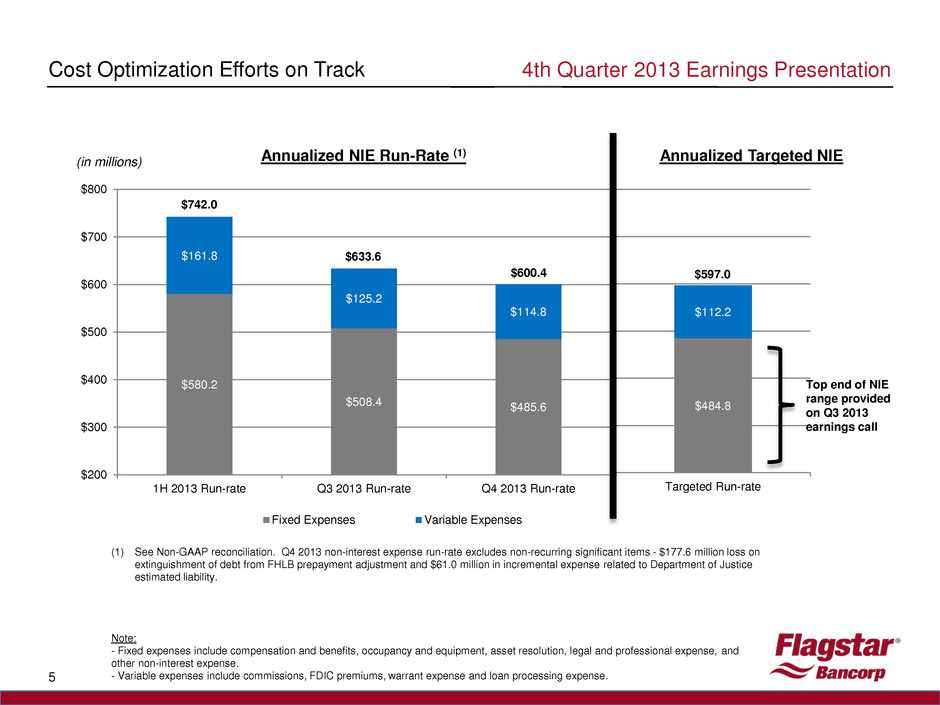

$484.8 $112.2 Targeted Run-rate Cost Optimization Efforts on Track 5 Note: - Fixed expenses include compensation and benefits, occupancy and equipment, asset resolution, legal and professional expense, and other non-interest expense. - Variable expenses include commissions, FDIC premiums, warrant expense and loan processing expense. 4th Quarter 2013 Earnings Presentation $580.2 $508.4 $485.6 $161.8 $125.2 $114.8 $200 $300 $400 $500 $600 $700 $800 1H 2013 Run-rate Q3 2013 Run-rate Q4 2013 Run-rate Fixed Expenses Variable Expenses (in millions) $742.0 $633.6 $600.4 $597.0 Top end of NIE range provided on Q3 2013 earnings call Annualized NIE Run-Rate (1) Annualized Targeted NIE (1) See Non-GAAP reconciliation. Q4 2013 non-interest expense run-rate excludes non-recurring significant items - $177.6 million loss on extinguishment of debt from FHLB prepayment adjustment and $61.0 million in incremental expense related to Department of Justice estimated liability.

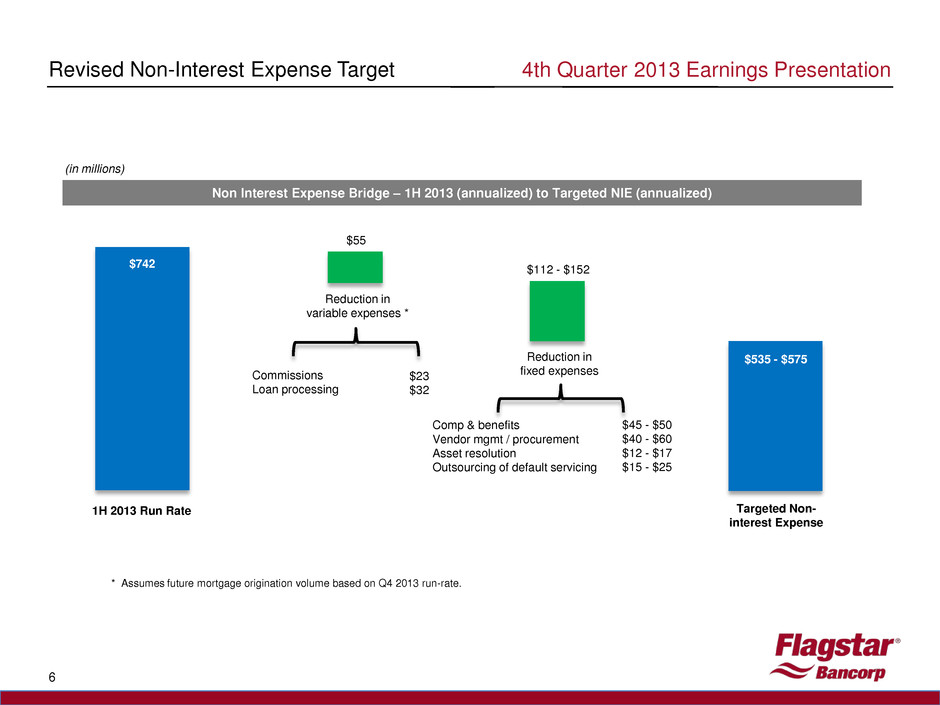

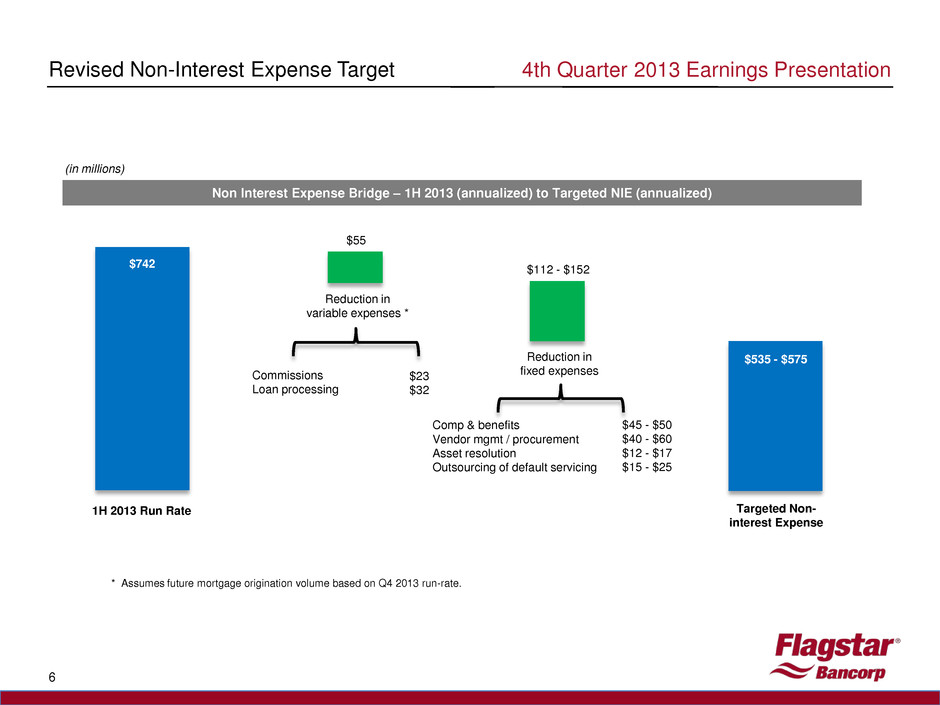

Revised Non-Interest Expense Target 6 4th Quarter 2013 Earnings Presentation 1H 2013 Run Rate Non Interest Expense Bridge – 1H 2013 (annualized) to Targeted NIE (annualized) Reduction in variable expenses * $55 Targeted Non- interest Expense $742 (in millions) Reduction in fixed expenses $112 - $152 Commissions Loan processing $23 $32 Comp & benefits Vendor mgmt / procurement Asset resolution Outsourcing of default servicing $45 - $50 $40 - $60 $12 - $17 $15 - $25 $535 - $575 * Assumes future mortgage origination volume based on Q4 2013 run-rate.

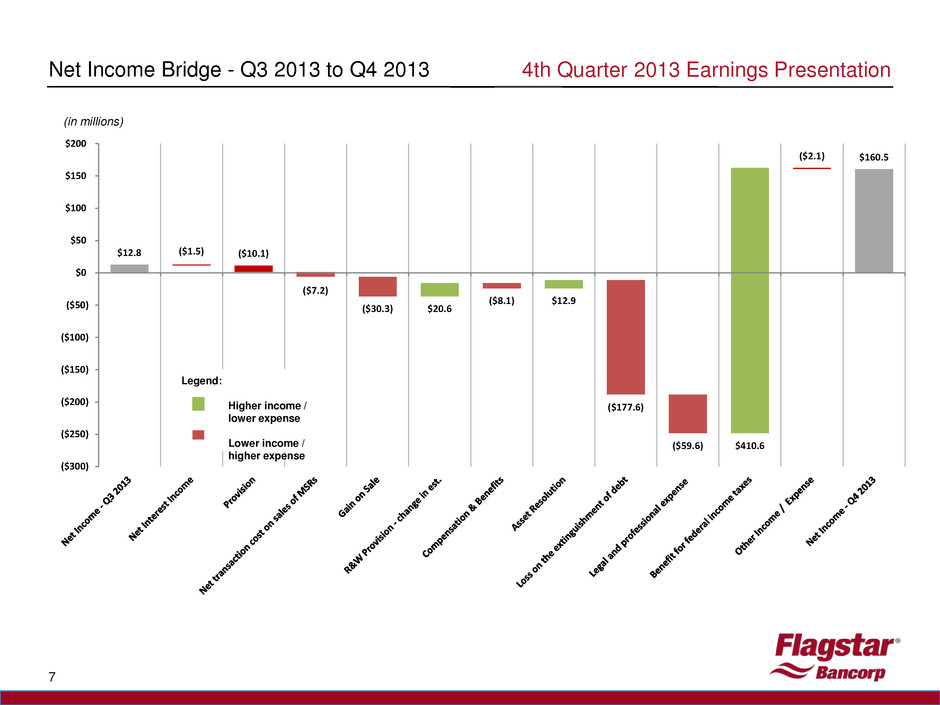

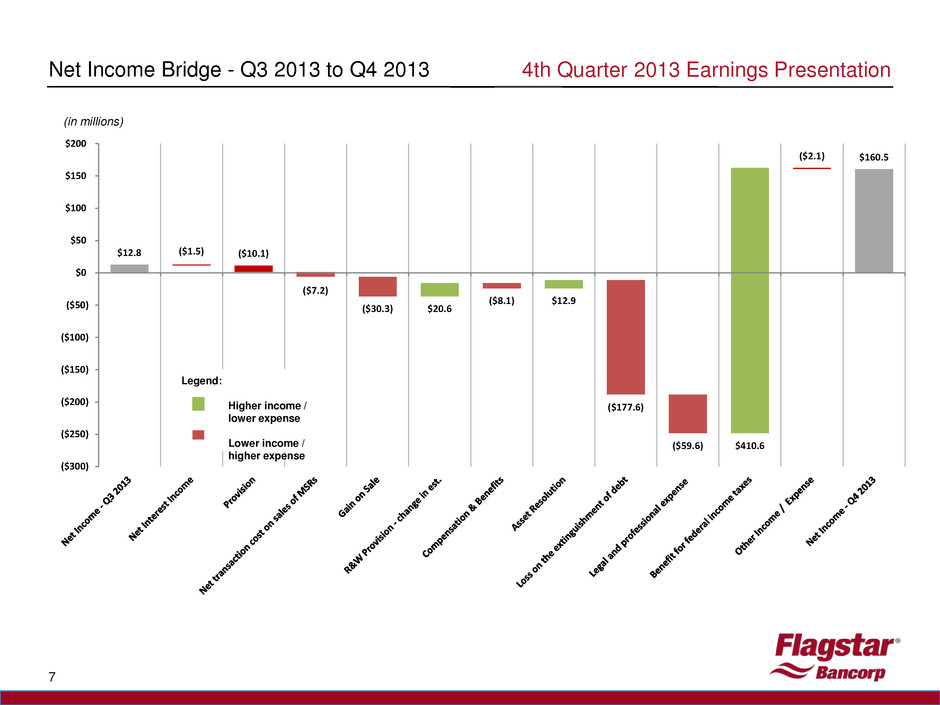

Net Income Bridge - Q3 2013 to Q4 2013 7 4th Quarter 2013 Earnings Presentation (in millions) $12.8 $160.5 ($1.5) ($10.1) ($7.2) ($30.3) $20.6 ($8.1) $12.9 ($177.6) ($59.6) $410.6 ($2.1) ($300) ($250) ($200) ($150) ($100) ($50) $0 $50 $100 $150 $200 Legend: Higher income / lower expense Lower income / higher expense

Condensed Income Statement 8 Totals may not foot due to rounding 4th Quarter 2013 Earnings Presentation (in millions, except per share data) Year Ended Q4 2013 Q3 2013 Q4 2012 Dec. 31, 2013 Dec. 31, 2012 Net interest income $41.2 $42.7 $73.9 $186.7 $297.2 Provision for loan losses 14.1 4.1 50.4 70.1 276.0 Net interest income after provision for loan losses 27.1 38.6 23.6 116.5 21.2 Non-interest income 113.1 134.3 285.8 652.3 1,021.2 Non-Interest expense 388.7 158.4 398.0 918.1 989.7 (Loss) income before federal income taxes (248.5) 14.5 (88.6) (149.3) 52.7 (Benefit) provision for federal income taxes (410.4) 0.2 4.2 (416.3) (15.6) Net income (loss) 161.9 14.3 (92.8) 267.0 68.4 Preferred stock dividend/accretion (1.4) (1.4) (1.4) (5.8) (5.7) Net income (loss) applicable to common stockholders $160.5 $12.8 ($94.2) $261.2 $62.7 Diluted earnings (loss) per share $2.77 $0.16 ($1.75) $4.37 $0.87

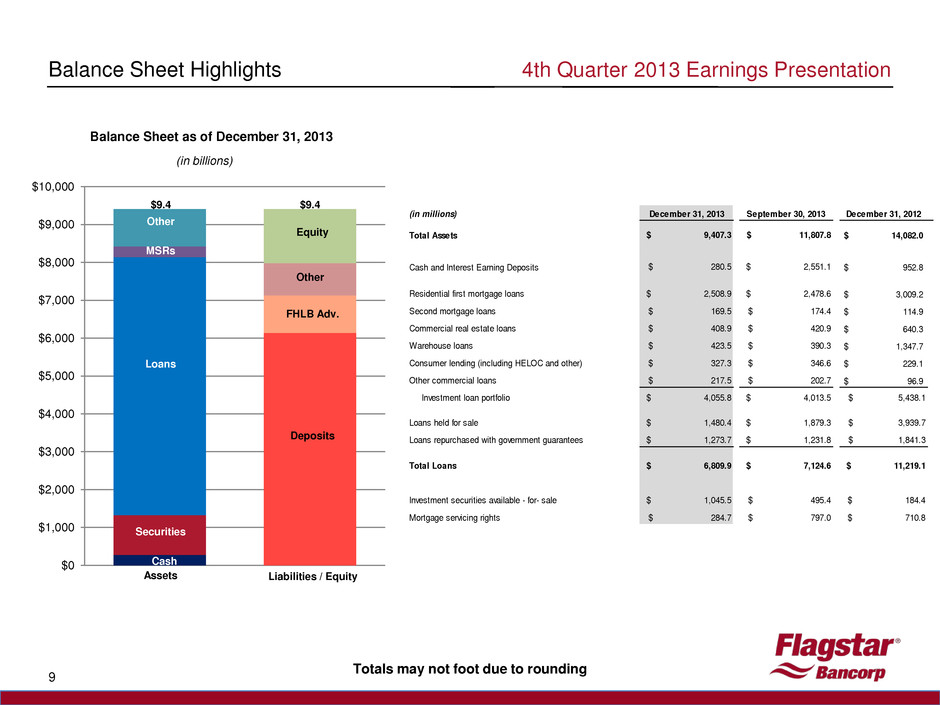

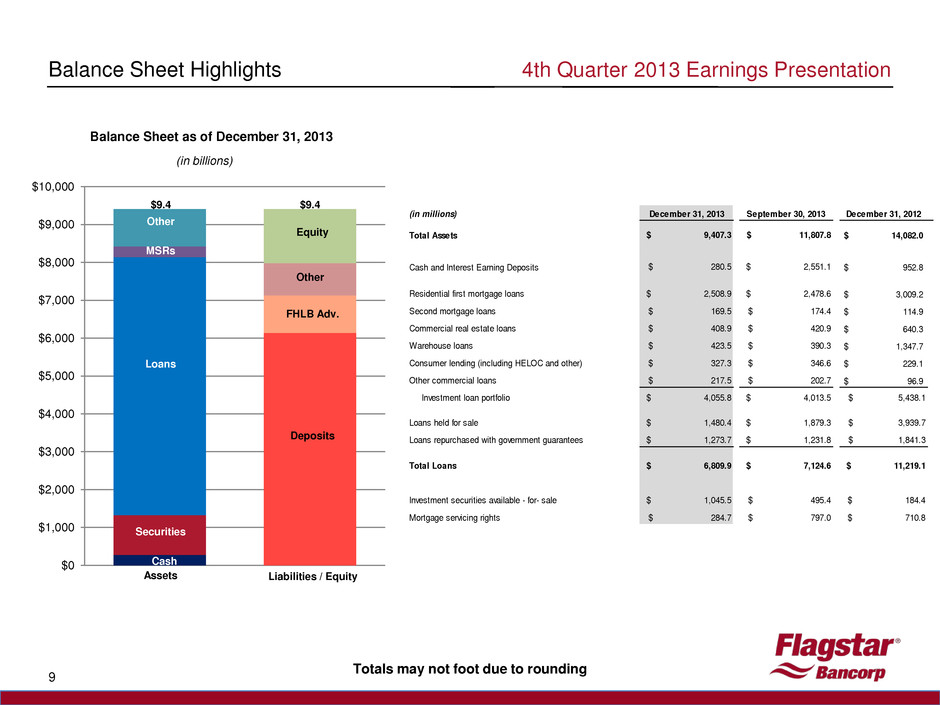

Balance Sheet Highlights 9 Totals may not foot due to rounding 4th Quarter 2013 Earnings Presentation (in millions) December 31, 2013 September 30, 2013 December 31, 2012 Total Assets $ 9,407.3 $ 11,807.8 14,082.0$ Cash and Interest Earning Deposits $ 280.5 $ 2,551.1 952.8$ Residential first mortgage loans $ 2,508.9 $ 2,478.6 3,009.2$ Second mortgage loans $ 169.5 $ 174.4 114.9$ Commercial real estate loans $ 408.9 $ 420.9 640.3$ Warehouse loans $ 423.5 $ 390.3 1,347.7$ Consumer lending (including HELOC and other) $ 327.3 $ 346.6 229.1$ Other commercial loans $ 217.5 $ 202.7 96.9$ Investment loan portfolio $ 4,055.8 $ 4,013.5 $ 5,438.1 Loans held for sale $ 1,480.4 $ 1,879.3 $ 3,939.7 Loans repurchased with government guarantees $ 1,273.7 $ 1,231.8 $ 1,841.3 Total Loans $ 6,809.9 $ 7,124.6 $ 11,219.1 Investment securities available - for- sale $ 1,045.5 $ 495.4 $ 184.4 Mortgage servicing rights $ 284.7 $ 797.0 $ 710.8 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 Balance Sheet as of December 31, 2013 (in billions) Assets Liabilities / Equity $9.4 $9.4 Cash Loans Securities MSRs Other Deposits FHLB Adv. Other Equity

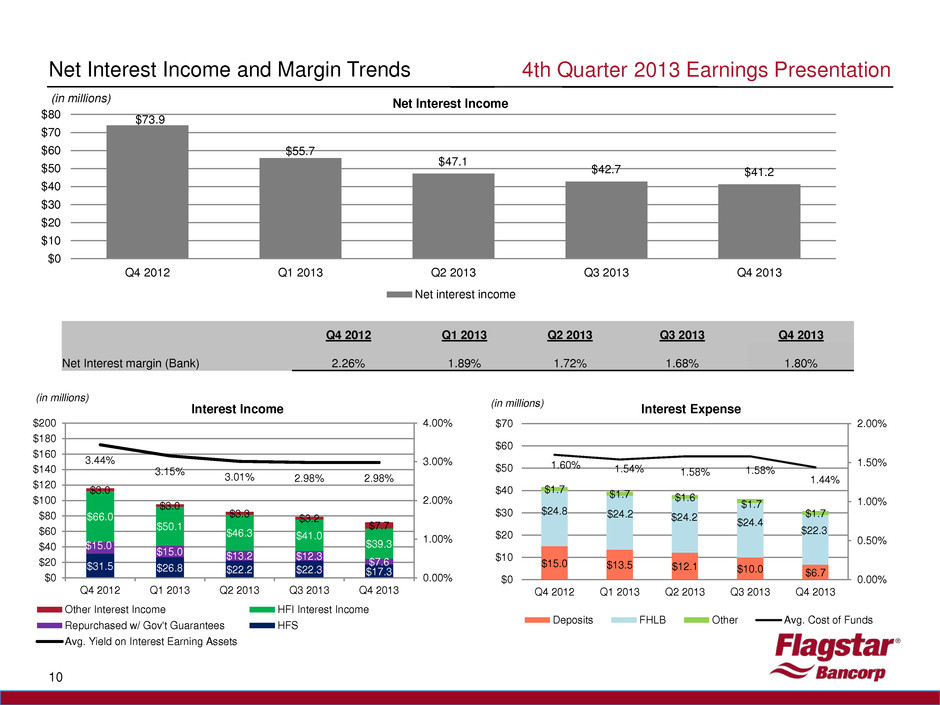

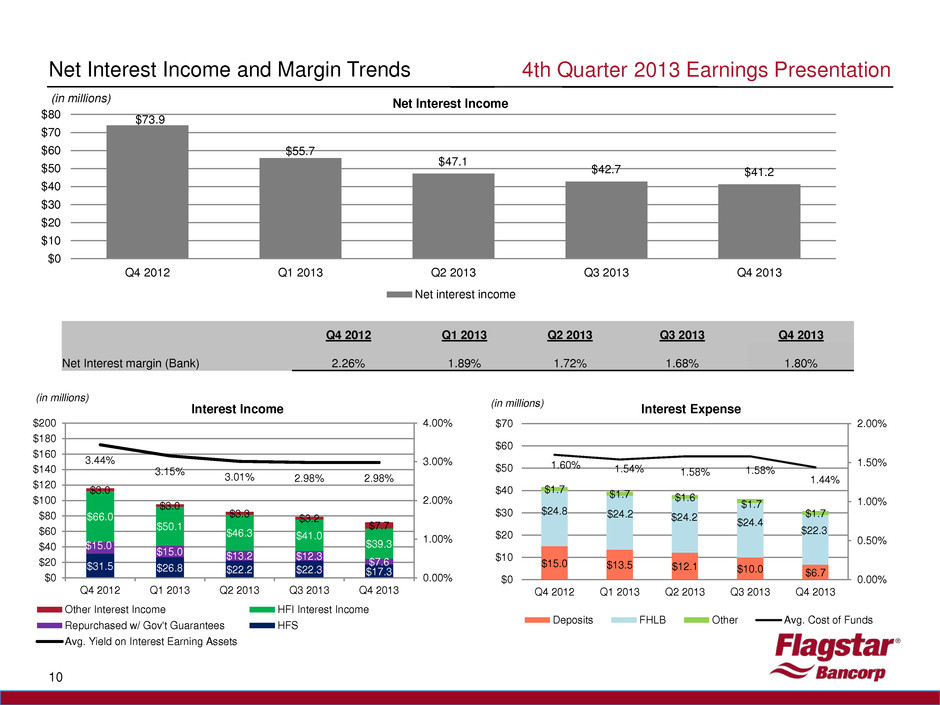

Net Interest Income and Margin Trends 10 (in millions) 4th Quarter 2013 Earnings Presentation $15.0 $13.5 $12.1 $10.0 $6.7 $24.8 $24.2 $24.2 $24.4 $22.3 $1.7 $1.7 $1.6 $1.7 $1.7 1.60% 1.54% 1.58% 1.58% 1.44% 0.00% 0.50% 1.00% 1.50% 2.00% $0 $10 $20 $30 $40 $50 $60 $70 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Interest Expense Deposits FHLB Other Avg. Cost of Funds $31.5 $26.8 $22.2 $22.3 $17.3 $15.0 $15.0 $13.2 $12.3 $7.6 $66.0 $50.1 $46.3 $41.0 $39.3 $3.0 $3.0 $3.3 $3.2 $7.7 3.44% 3.15% 3.01% 2.98% 2.98% 0.00% 1.00% 2.00% 3.00% 4.00% $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Interest Income Other Interest Income HFI Interest Income Repurchased w/ Gov't Guarantees HFS Avg. Yield on Interest Earning Assets (in millions) (in millions) $73.9 $55.7 $47.1 $42.7 $41.2 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Interest Income Net interest income Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Net Interest margin (Bank) 2.26% 1.89% 1.72% 1.68% 1.80%

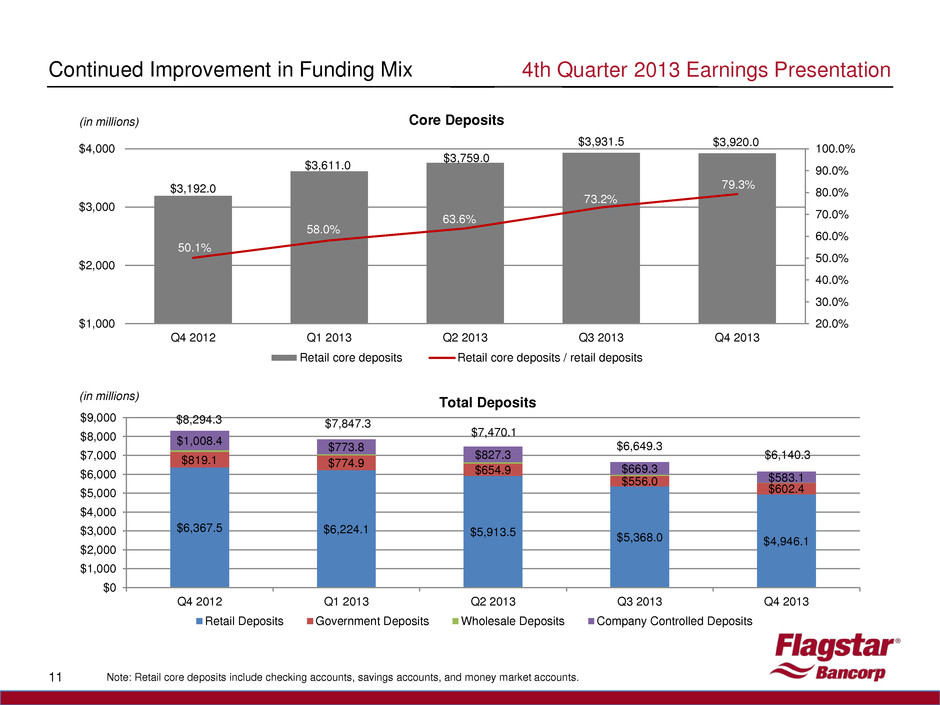

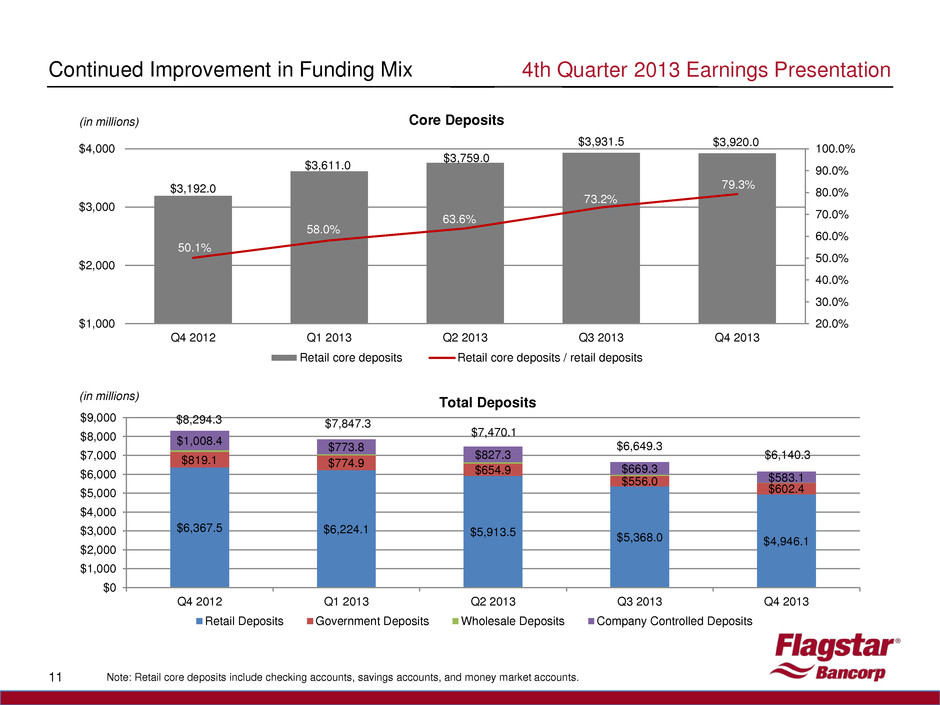

$6,367.5 $6,224.1 $5,913.5 $5,368.0 $4,946.1 $819.1 $774.9 $654.9 $556.0 $602.4 $1,008.4 $773.8 $827.3 $669.3 $583.1 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Total Deposits Retail Deposits Government Deposits Wholesale Deposits Company Controlled Deposits $3,192.0 $3,611.0 $3,759.0 $3,931.5 $3,920.0 50.1% 58.0% 63.6% 73.2% 79.3% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% $1,000 $2,000 $3,000 $4,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Core Deposits Retail core deposits Retail core deposits / retail deposits Note: Retail core deposits include checking accounts, savings accounts, and money market accounts. 11 Continued Improvement in Funding Mix (in millions) (in millions) $8,294.3 $7,847.3 $7,470.1 $6,649.3 4th Quarter 2013 Earnings Presentation $6,140.3

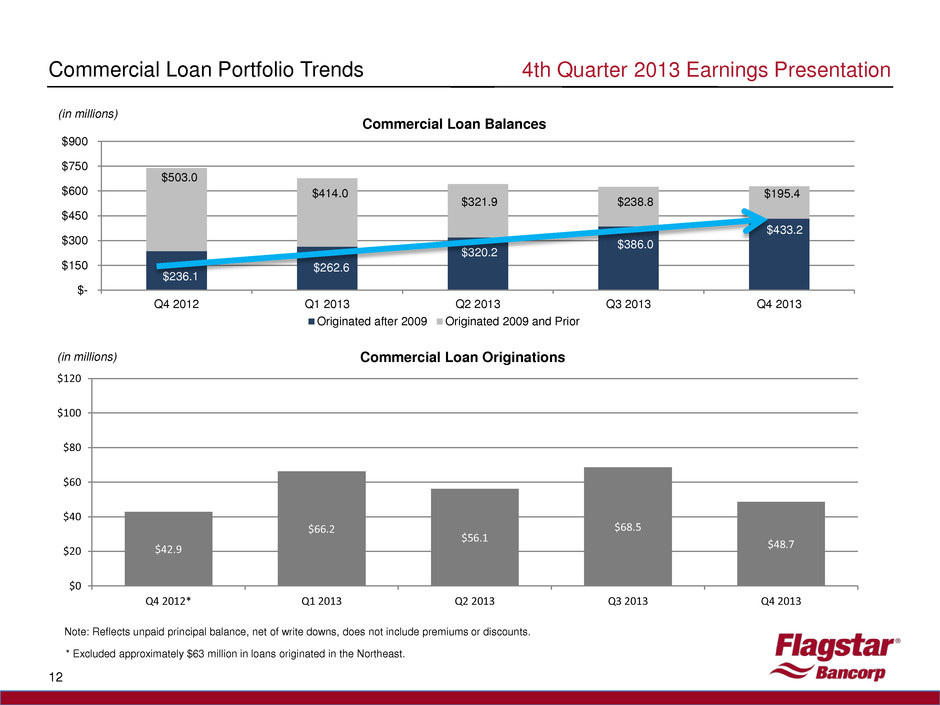

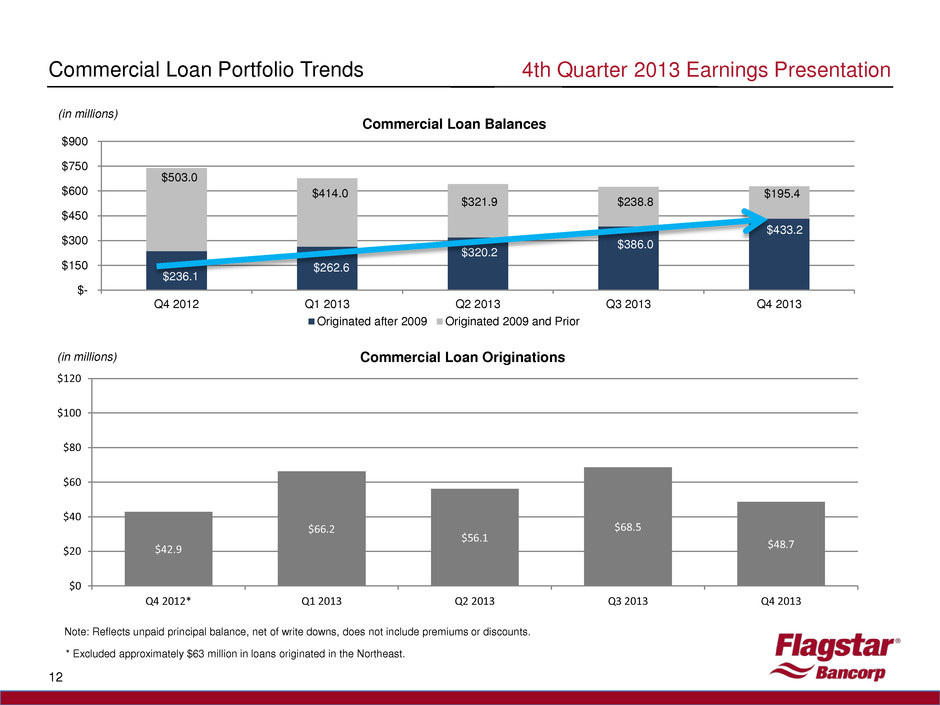

Commercial Loan Portfolio Trends 12 4th Quarter 2013 Earnings Presentation (in millions) $236.1 $262.6 $320.2 $386.0 $433.2 $503.0 $414.0 $321.9 $238.8 $195.4 $- $150 $300 $450 $600 $750 $900 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Commercial Loan Balances Originated after 2009 Originated 2009 and Prior Note: Reflects unpaid principal balance, net of write downs, does not include premiums or discounts. $42.9 $66.2 $56.1 $68.5 $48.7 $0 $20 $40 $60 $80 $100 $120 Q4 2012* Q1 2013 Q2 2013 Q3 2013 Q4 2013 Commercial Loan Originations (in millions) * Excluded approximately $63 million in loans originated in the Northeast.

13 Gain on Loan Sales and Margin (in millions) 4th Quarter 2013 Earnings Presentation Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Fallout Adjusted Mortgage Locks (billions) $12.6 $9.8 $9.8 $6.6 $5.3 Net Margin (fallout adjusted) 1.90% 1.40% 1.47% 1.14% 0.85% Loans sales and securitizations (billions) $15.6 $12.8 $11.1 $8.3 $6.8 Net Margin (loan sales) 1.53% 1.07% 1.30% 0.90% 0.66% Gross Mortgage Locks (billions) $16.2 $12.1 $12.4 $8.3 $6.5 Mortgage Originations (billions) $15.4 $12.4 $10.9 $7.7 $6.4 $212.7 $334.4 $239.0 $137.5 $144.8 $75.1 $44.8 1.59% 2.39% 1.90% 1.40% 1.47% 1.14% 0.85% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $0 $50 $100 $150 $200 $250 $300 $350 $400 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 Gain on Loan Sales GOS Margin (based on fallout-adjusted locks)

$999 $697 $575 $412 $296 $4,525 $3,201 $2,975 $1,846 $1,591 $9,833 $8,525 $7,333 $5,478 $4,548 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 By Channel Retail Broker Correspondent $6,436 $2,916 $2,339 $3,147 $3,682 $3,673 $12,441 $10,084 $7,735 $4,054 $2,763 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 By Product Purchase Originations Refinance Originations 14 Residential First Mortgage Originations Trends (in millions) $15,357 $12,423 $10,882 $7,736 (in millions) (in millions) $15,357 $12,423 $10,882 $7,736 4th Quarter 2013 Earnings Presentation $1,522 $1,168 $887 $581 $339 $1,567 $1,033 $665 $557 $745 $12,268 $10,222 $9,330 $6,598 $5,352 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Residential First Mortgage Origination Breakout HARP 2.0 Jumbo Conventional and other $6,436

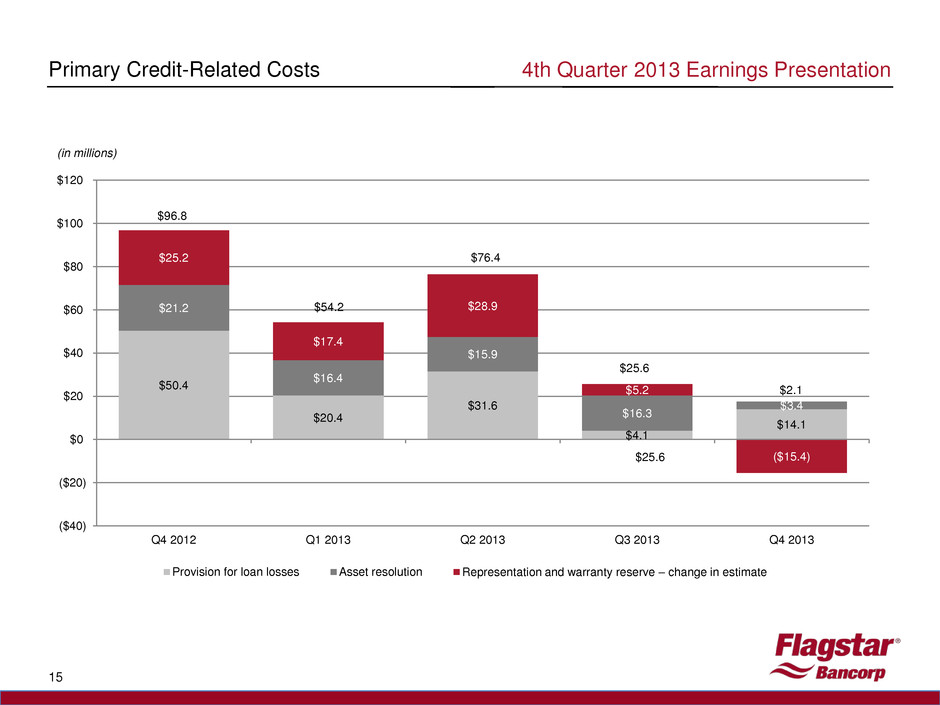

Primary Credit-Related Costs 15 4th Quarter 2013 Earnings Presentation $96.8 $54.2 $76.4 $25.6 $50.4 $20.4 $31.6 $4.1 $14.1 $21.2 16 4 $15.9 $16.3 $3.4 $25.2 $17.4 $28.9 $5.2 ($15.4) ($40) ($20) $0 $20 $40 $60 $80 $100 $120 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Provision for loan losses Asset resolution Representation and warranty reserve – change in estimate $96.8 $2.1 $54.2 $76.4 $25.6 (in millions)

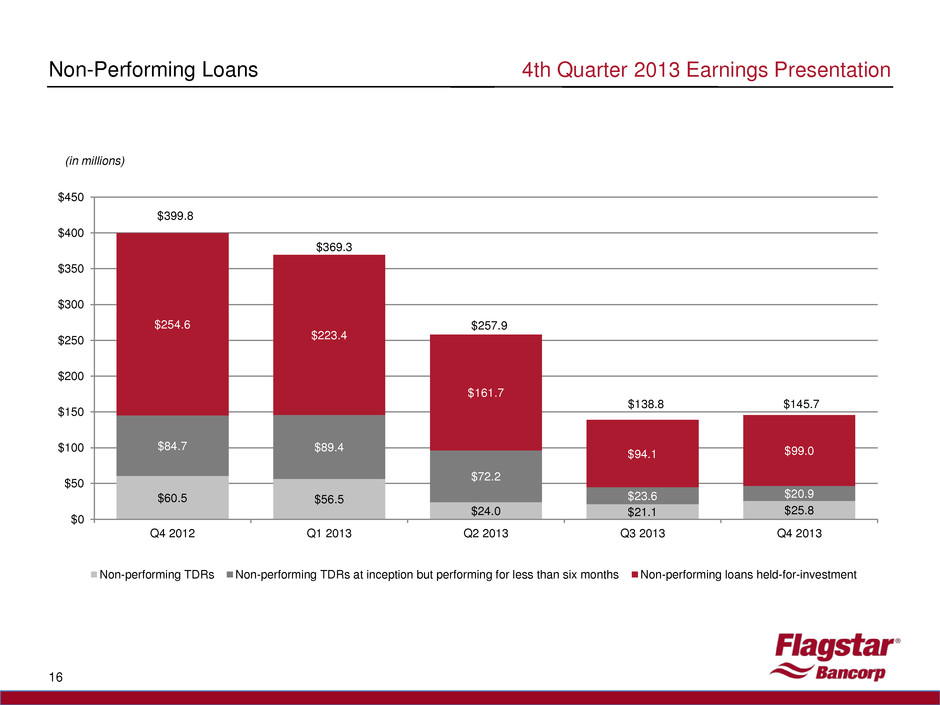

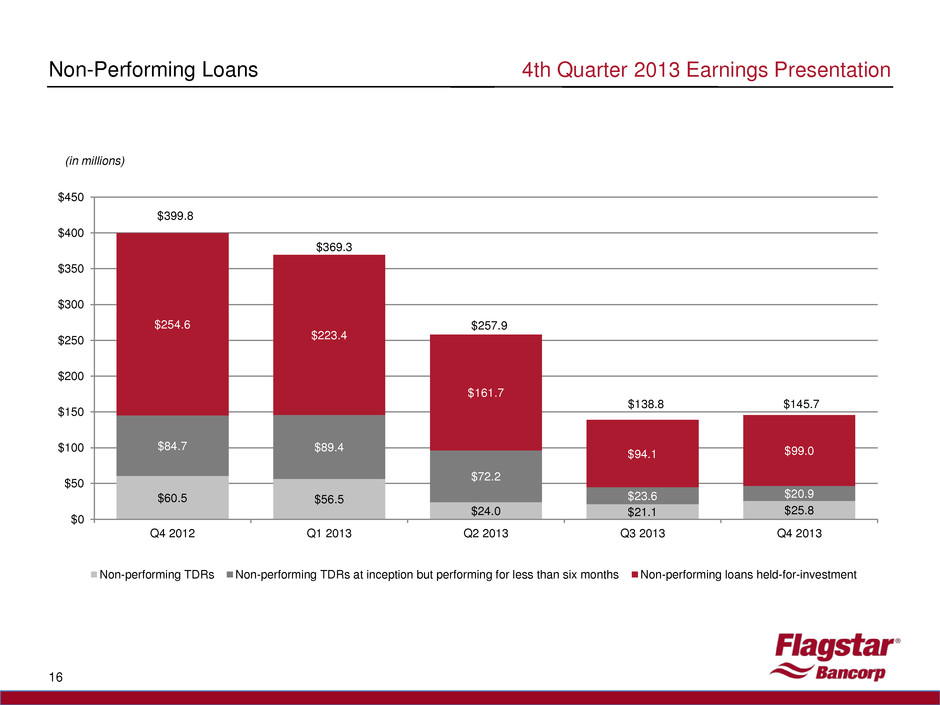

$60.5 $56.5 $24.0 $21.1 $25.8 $84.7 $89.4 $72.2 $23.6 $20.9 $254.6 $223.4 $161.7 $94.1 $99.0 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Non-performing TDRs Non-performing TDRs at inception but performing for less than six months Non-performing loans held-for-investment 16 Non-Performing Loans $399.8 $257.9 $369.3 $138.8 (in millions) 4th Quarter 2013 Earnings Presentation $145.7

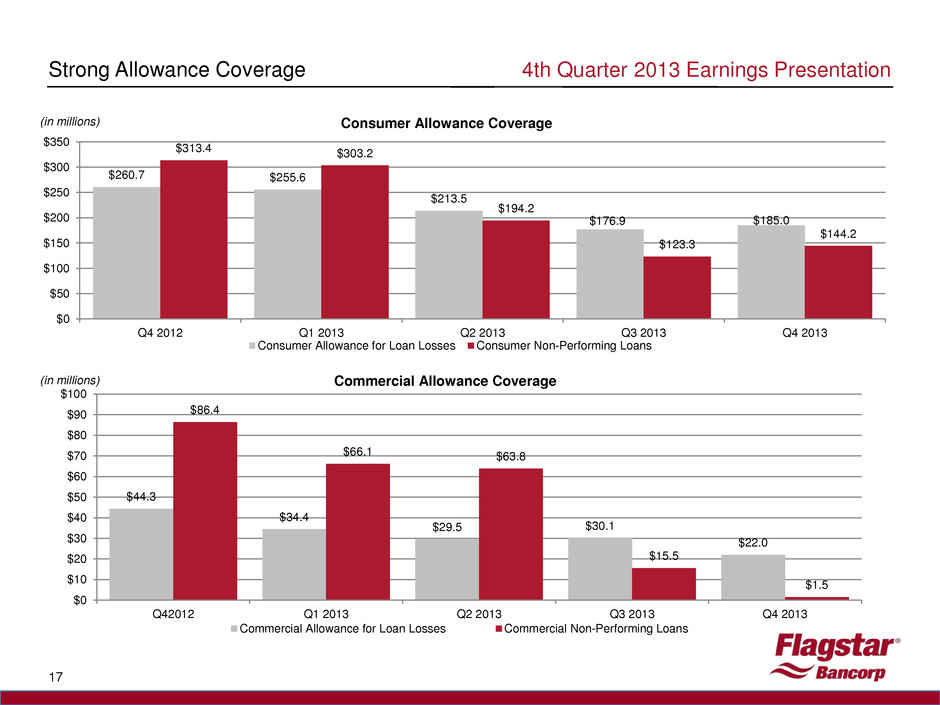

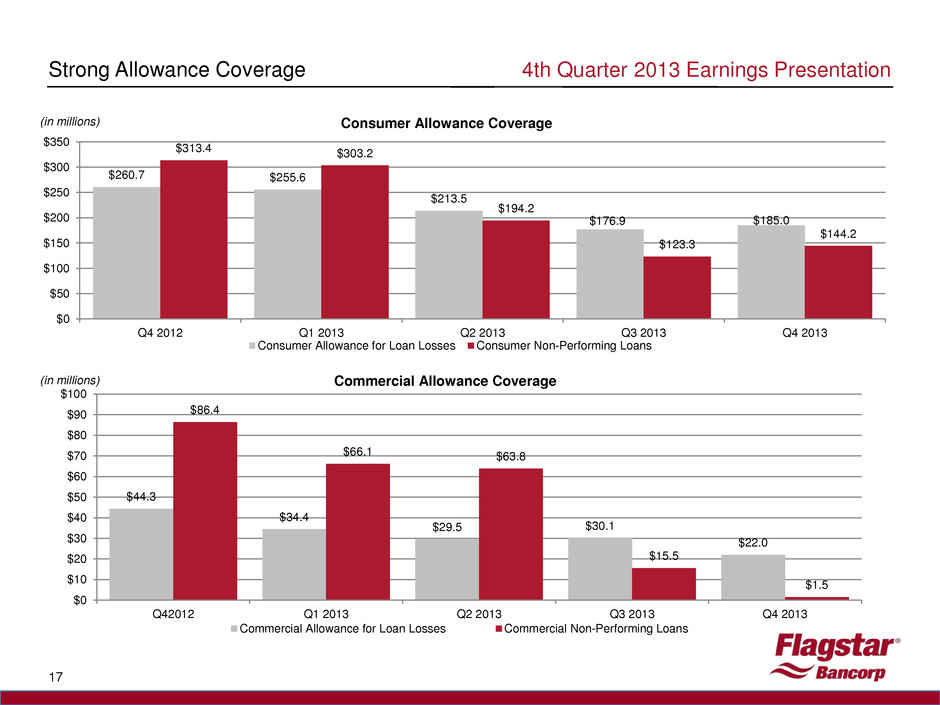

$260.7 $255.6 $213.5 $176.9 $185.0 $313.4 $303.2 $194.2 $123.3 $144.2 $0 $50 $100 $150 $200 $250 $300 $350 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Consumer Allowance Coverage Consumer Allowance for Loan Losses Consumer Non-Performing Loans 17 Strong Allowance Coverage (in millions) 4th Quarter 2013 Earnings Presentation (in millions) $44.3 $34.4 $29.5 $30.1 $22.0 $86.4 $66.1 $63.8 $15.5 $1.5 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Q42012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Commercial Allowance Coverage Commercial Allowance for Loan Losses Commercial Non-Performing Loans

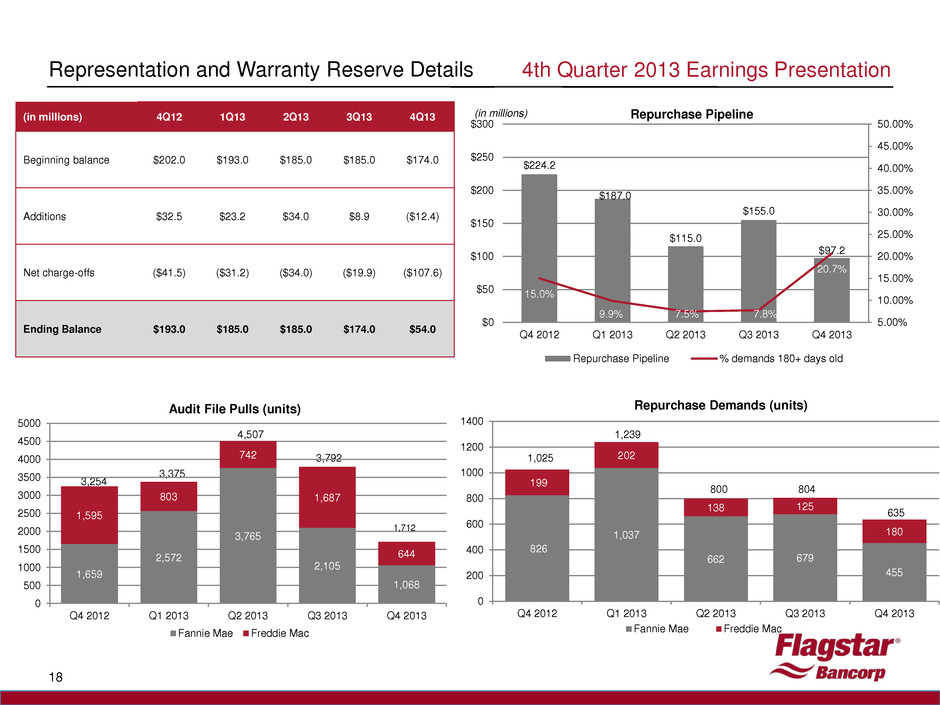

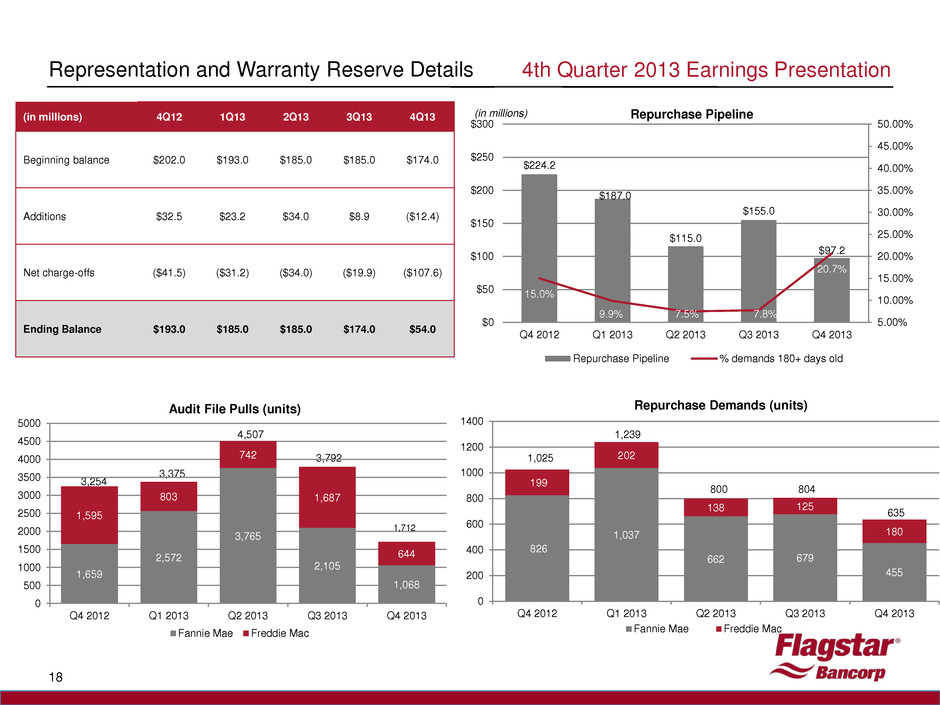

826 1,037 662 679 455 199 202 138 125 180 0 200 400 600 800 1000 1200 1400 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Repurchase Demands (units) Fannie Mae Freddie Mac 18 Representation and Warranty Reserve Details (in millions) 4Q12 1Q13 2Q13 3Q13 4Q13 Beginning balance $202.0 $193.0 $185.0 $185.0 $174.0 Additions $32.5 $23.2 $34.0 $8.9 ($12.4) Net charge-offs ($41.5) ($31.2) ($34.0) ($19.9) ($107.6) Ending Balance $193.0 $185.0 $185.0 $174.0 $54.0 (in millions) 3,254 1,025 3,375 1,239 4,507 800 3,792 804 4th Quarter 2013 Earnings Presentation 1,659 2,572 3,765 2,105 1,068 1,595 803 742 1,687 644 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Audit File Pulls (units) Fannie Mae Freddie Mac 1,712 635 $224.2 $187.0 $115.0 $155.0 $97.2 15.0% 9.9% 7.5% 7.8% 20.7% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% 45.00% 50.00% $0 $50 $100 $150 $200 $250 $300 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Repurchase Pipeline Repurchase Pipeline % demands 180+ days old

19 Regulatory Capital Ratios 4th Quarter 2013 Earnings Presentation 10.07% 9.31% 8.95% 8.64% 9.07% 9.31% 9.26% 10.14% 11.00% 11.98% 13.97% 19.73% 17.64% 16.64% 16.06% 17.03% 17.58% 17.18% 22.53% 25.01% 27.85% 28.11% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Tier 1 leverage ratio Total risk-based capital ratio

4th Quarter 2013 Earnings Presentation 20 Appendix

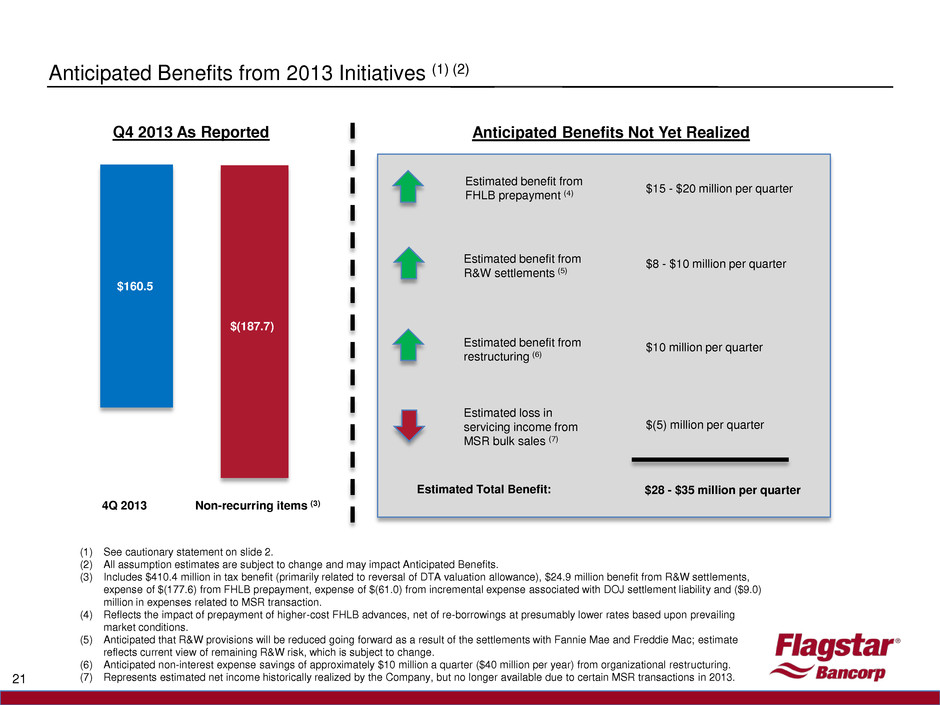

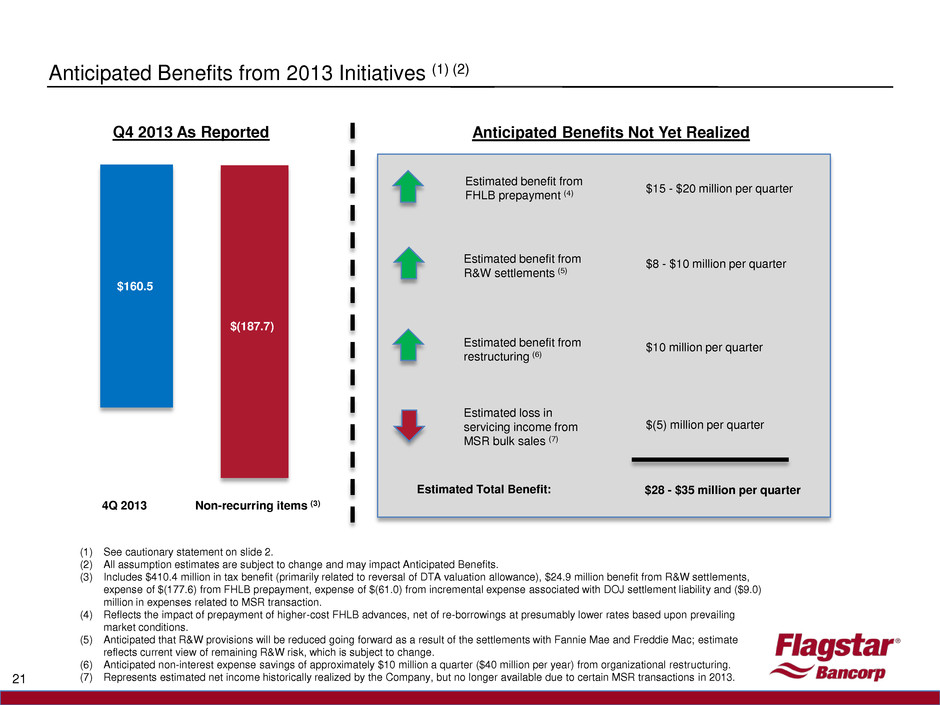

Anticipated Benefits from 2013 Initiatives (1) (2) 4Q 2013 $160.5 $(196.7) Non-recurring items (3) $15 - $20 million per quarter $(187.7) $160.5 Q4 2013 As Reported Anticipated Benefits Not Yet Realized Estimated benefit from FHLB prepayment (4) Estimated benefit from R&W settlements (5) Estimated benefit from restructuring (6) (1) See cautionary statement on slide 2. (2) All assumption estimates are subject to change and may impact Anticipated Benefits. (3) Includes $410.4 million in tax benefit (primarily related to reversal of DTA valuation allowance), $24.9 million benefit from R&W settlements, expense of $(177.6) from FHLB prepayment, expense of $(61.0) from incremental expense associated with DOJ settlement liability and ($9.0) million in expenses related to MSR transaction. (4) Reflects the impact of prepayment of higher-cost FHLB advances, net of re-borrowings at presumably lower rates based upon prevailing market conditions. (5) Anticipated that R&W provisions will be reduced going forward as a result of the settlements with Fannie Mae and Freddie Mac; estimate reflects current view of remaining R&W risk, which is subject to change. (6) Anticipated non-interest expense savings of approximately $10 million a quarter ($40 million per year) from organizational restructuring. (7) Represents estimated net income historically realized by the Company, but no longer available due to certain MSR transactions in 2013. $8 - $10 million per quarter $10 million per quarter Estimated loss in servicing income from MSR bulk sales (7) $(5) million per quarter $28 - $35 million per quarter Estimated Total Benefit: 21

2014 Outlook (1) (2) $160.5 FY 2014 Outlook Net Interest Income Gain on Loan Sales Non-Interest Expense Provision for Loan Losses • 8% – 10% increase in balance sheet from year-end 2013 level • Bank net interest margin range of 2.75% to 3.0% • 2014 production expected to track lower industry expectation in 2014 of $1.2 trillion • Expect to hold market share at approximately 2% • Gain on loan sale margin returns to level in Q3 2013 • Annualized non-interest expense between $535 million and $575 million • Provision for loan losses to average between $0 and $5 million per quarter (3) (1) See cautionary statement on slide 2 (2) All assumptions and estimates are subject to change and may impact FY 2014 Outlook. For additional details, see Anticipated Benefits from 2013 Initiatives (3) Reflects current view of remaining provision for loan loss risk, which is subject to change. 22

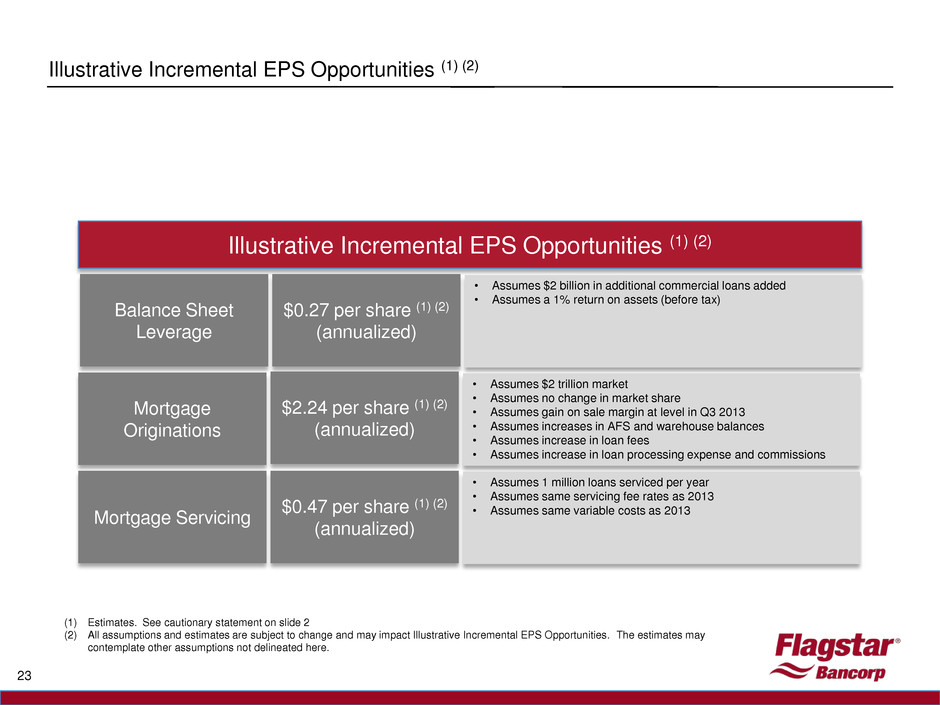

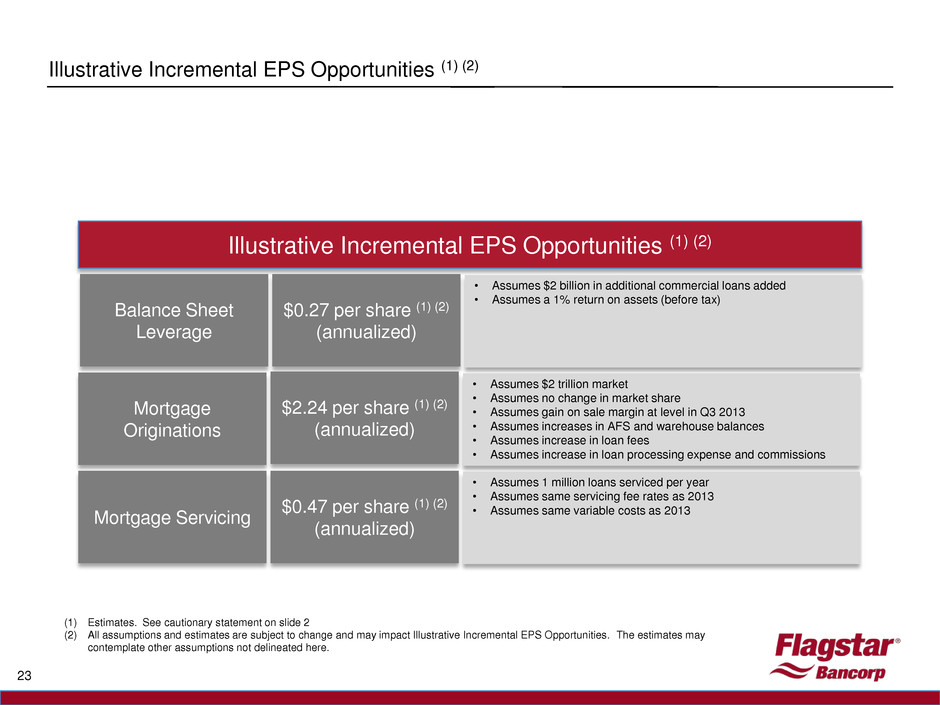

Illustrative Incremental EPS Opportunities (1) (2) $160.5 Illustrative Incremental EPS Opportunities (1) (2) Balance Sheet Leverage • Assumes $2 billion in additional commercial loans added • Assumes a 1% return on assets (before tax) $0.27 per share (1) (2) (annualized) Mortgage Originations • Assumes $2 trillion market • Assumes no change in market share • Assumes gain on sale margin at level in Q3 2013 • Assumes increases in AFS and warehouse balances • Assumes increase in loan fees • Assumes increase in loan processing expense and commissions Mortgage Servicing • Assumes 1 million loans serviced per year • Assumes same servicing fee rates as 2013 • Assumes same variable costs as 2013 $0.47 per share (1) (2) (annualized) $2.24 per share (1) (2) (annualized) 23 (1) Estimates. See cautionary statement on slide 2 (2) All assumptions and estimates are subject to change and may impact Illustrative Incremental EPS Opportunities. The estimates may contemplate other assumptions not delineated here.

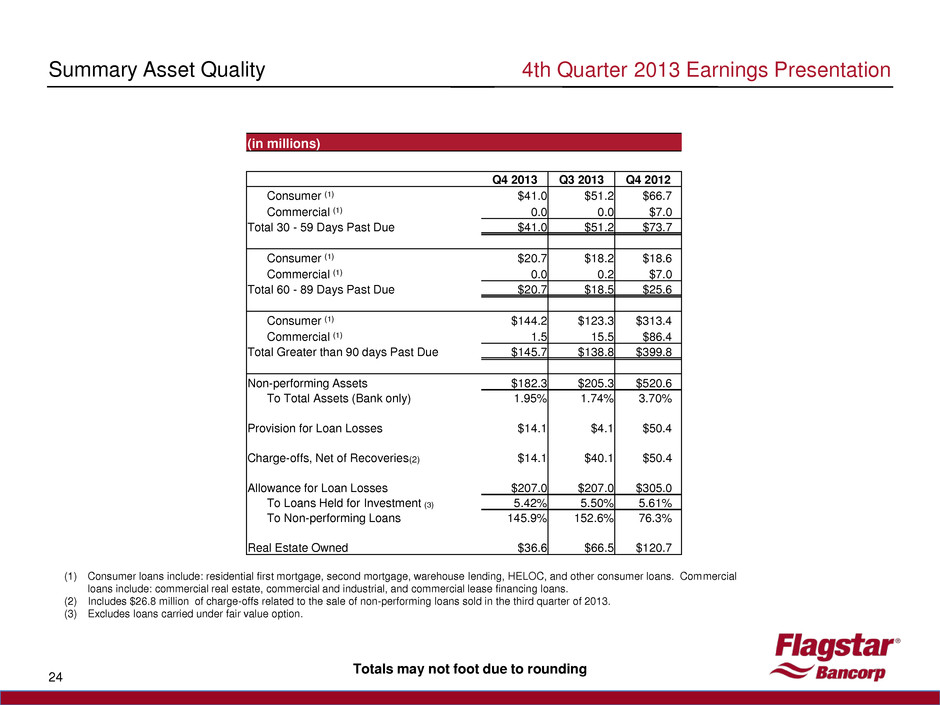

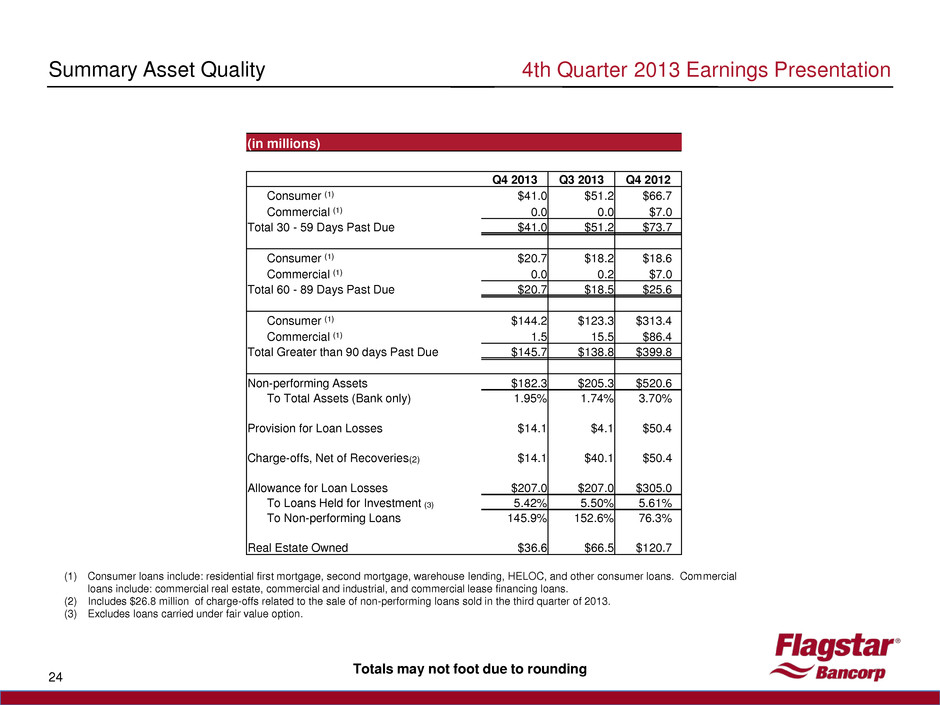

4th Quarter 2013 Earnings Presentation 24 Summary Asset Quality (1) Consumer loans include: residential first mortgage, second mortgage, warehouse lending, HELOC, and other consumer loans. Commercial loans include: commercial real estate, commercial and industrial, and commercial lease financing loans. (2) Includes $26.8 million of charge-offs related to the sale of non-performing loans sold in the third quarter of 2013. (3) Excludes loans carried under fair value option. Totals may not foot due to rounding (in millions) Q4 2013 Q3 2013 Q4 2012 Consumer (1) $41.0 $51.2 $66.7 Commercial (1) 0.0 0.0 $7.0 Total 30 - 59 Days Past Due $41.0 $51.2 $73.7 Consumer (1) $20.7 $18.2 $18.6 Commercial (1) 0.0 0.2 $7.0 Total 60 - 89 Days Past Due $20.7 $18.5 $25.6 Consumer (1) $144.2 $123.3 $313.4 Commercial (1) 1.5 15.5 $86.4 Total Greater than 90 days Past Due $145.7 $138.8 $399.8 Non-performing Assets $182.3 $205.3 $520.6 To Total Assets (Bank only) 1.95% 1.74% 3.70% Provision for Loan Losses $14.1 $4.1 $50.4 Charge-offs, Net of Recoveries(2) $14.1 $40.1 $50.4 Allowance for Loan Losses $207.0 $207.0 $305.0 To Loans Held for Investment (3) 5.42% 5.50% 5.61% To Non-performing Loans 145.9% 152.6% 76.3% Real Estate Owned $36.6 $66.5 $120.7

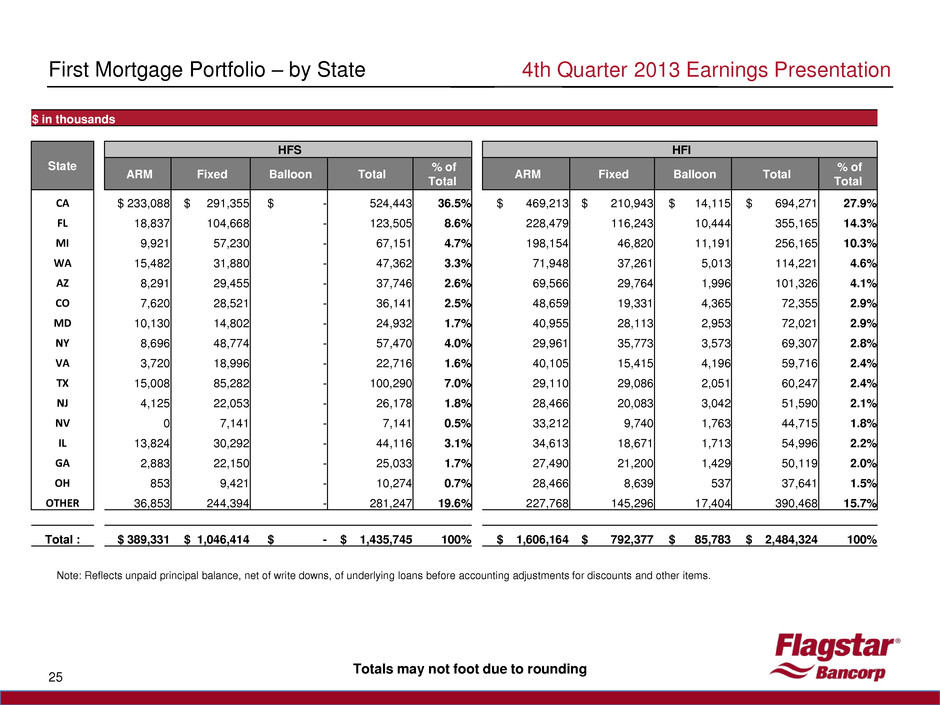

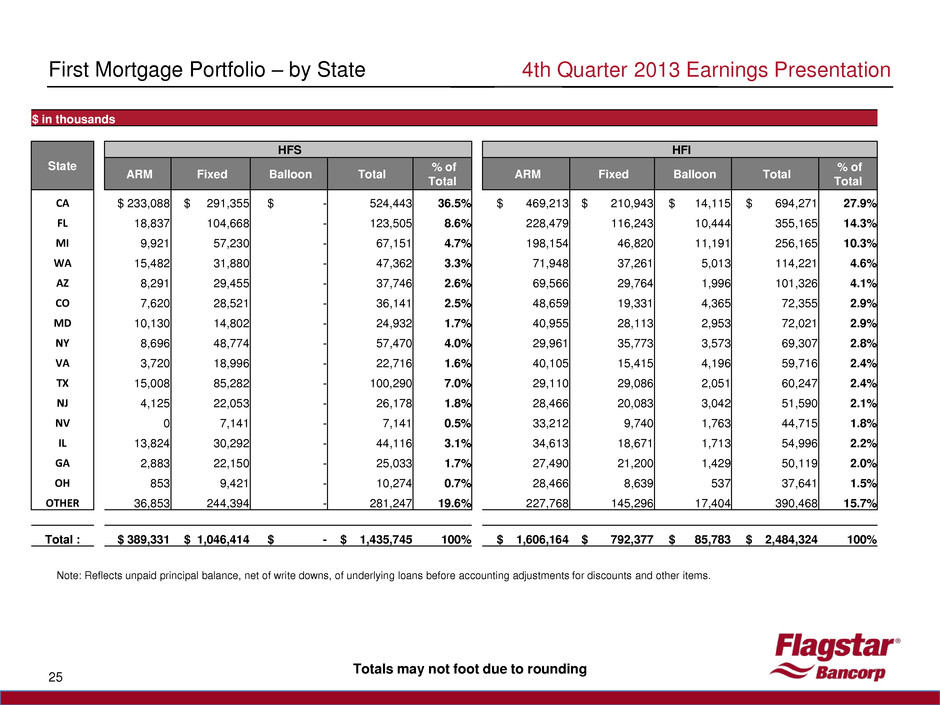

4th Quarter 2013 Earnings Presentation 25 First Mortgage Portfolio – by State Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. Totals may not foot due to rounding $ in thousands State HFS HFI ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total CA $ 233,088 $ 291,355 $ - 524,443 36.5% $ 469,213 $ 210,943 $ 14,115 $ 694,271 27.9% FL 18,837 104,668 - 123,505 8.6% 228,479 116,243 10,444 355,165 14.3% MI 9,921 57,230 - 67,151 4.7% 198,154 46,820 11,191 256,165 10.3% WA 15,482 31,880 - 47,362 3.3% 71,948 37,261 5,013 114,221 4.6% AZ 8,291 29,455 - 37,746 2.6% 69,566 29,764 1,996 101,326 4.1% CO 7,620 28,521 - 36,141 2.5% 48,659 19,331 4,365 72,355 2.9% MD 10,130 14,802 - 24,932 1.7% 40,955 28,113 2,953 72,021 2.9% NY 8,696 48,774 - 57,470 4.0% 29,961 35,773 3,573 69,307 2.8% VA 3,720 18,996 - 22,716 1.6% 40,105 15,415 4,196 59,716 2.4% TX 15,008 85,282 - 100,290 7.0% 29,110 29,086 2,051 60,247 2.4% NJ 4,125 22,053 - 26,178 1.8% 28,466 20,083 3,042 51,590 2.1% NV 0 7,141 - 7,141 0.5% 33,212 9,740 1,763 44,715 1.8% IL 13,824 30,292 - 44,116 3.1% 34,613 18,671 1,713 54,996 2.2% GA 2,883 22,150 - 25,033 1.7% 27,490 21,200 1,429 50,119 2.0% OH 853 9,421 - 10,274 0.7% 28,466 8,639 537 37,641 1.5% OTHER 36,853 244,394 - 281,247 19.6% 227,768 145,296 17,404 390,468 15.7% Total : $ 389,331 $ 1,046,414 $ - $ 1,435,745 100% $ 1,606,164 $ 792,377 $ 85,783 $ 2,484,324 100%

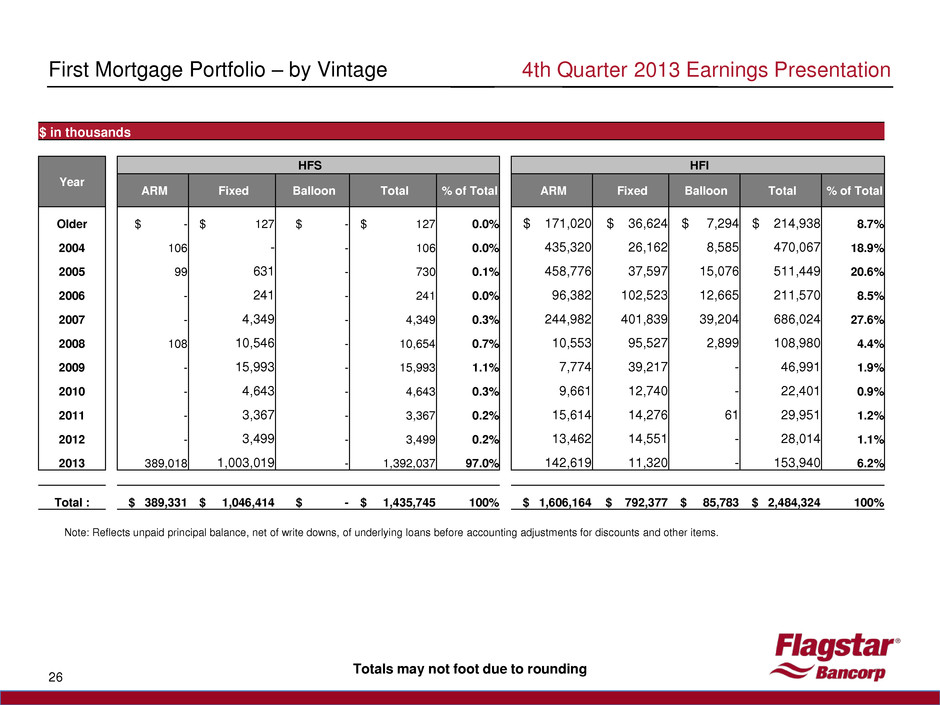

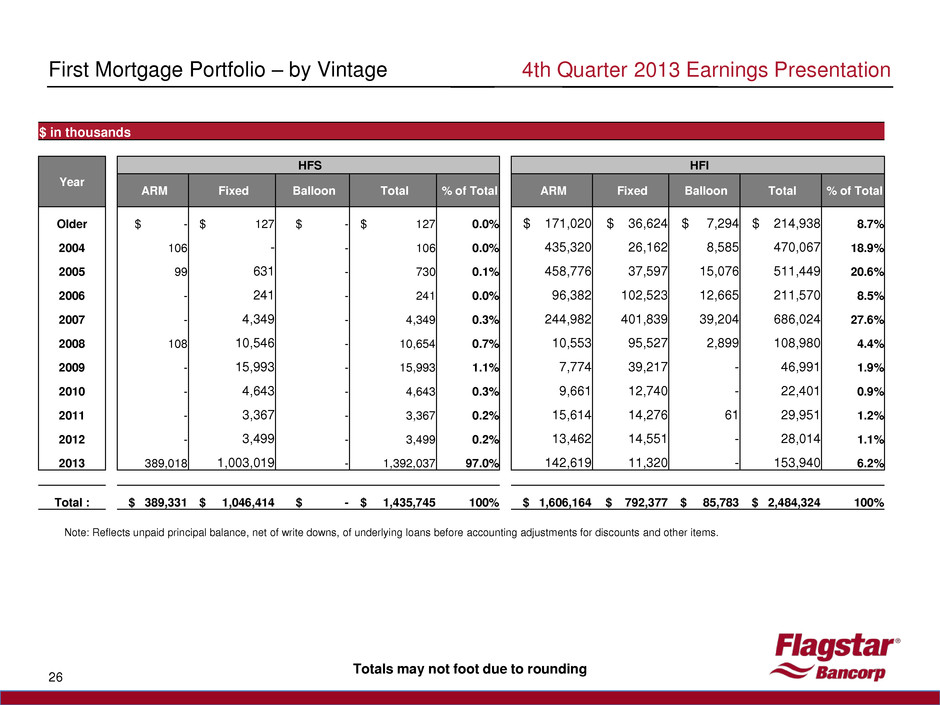

4th Quarter 2013 Earnings Presentation 26 First Mortgage Portfolio – by Vintage Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. Totals may not foot due to rounding $ in thousands Year HFS HFI ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total Older $ - $ 127 $ - $ 127 0.0% $ 171,020 $ 36,624 $ 7,294 $ 214,938 8.7% 2004 106 - - 106 0.0% 435,320 26,162 8,585 470,067 18.9% 2005 99 631 - 730 0.1% 458,776 37,597 15,076 511,449 20.6% 2006 - 241 - 241 0.0% 96,382 102,523 12,665 211,570 8.5% 2007 - 4,349 - 4,349 0.3% 244,982 401,839 39,204 686,024 27.6% 2008 108 10,546 - 10,654 0.7% 10,553 95,527 2,899 108,980 4.4% 2009 - 15,993 - 15,993 1.1% 7,774 39,217 - 46,991 1.9% 2010 - 4,643 - 4,643 0.3% 9,661 12,740 - 22,401 0.9% 2011 - 3,367 - 3,367 0.2% 15,614 14,276 61 29,951 1.2% 2012 - 3,499 - 3,499 0.2% 13,462 14,551 - 28,014 1.1% 2013 389,018 1,003,019 - 1,392,037 97.0% 142,619 11,320 - 153,940 6.2% Total : $ 389,331 $ 1,046,414 $ - $ 1,435,745 100% $ 1,606,164 $ 792,377 $ 85,783 $ 2,484,324 100%

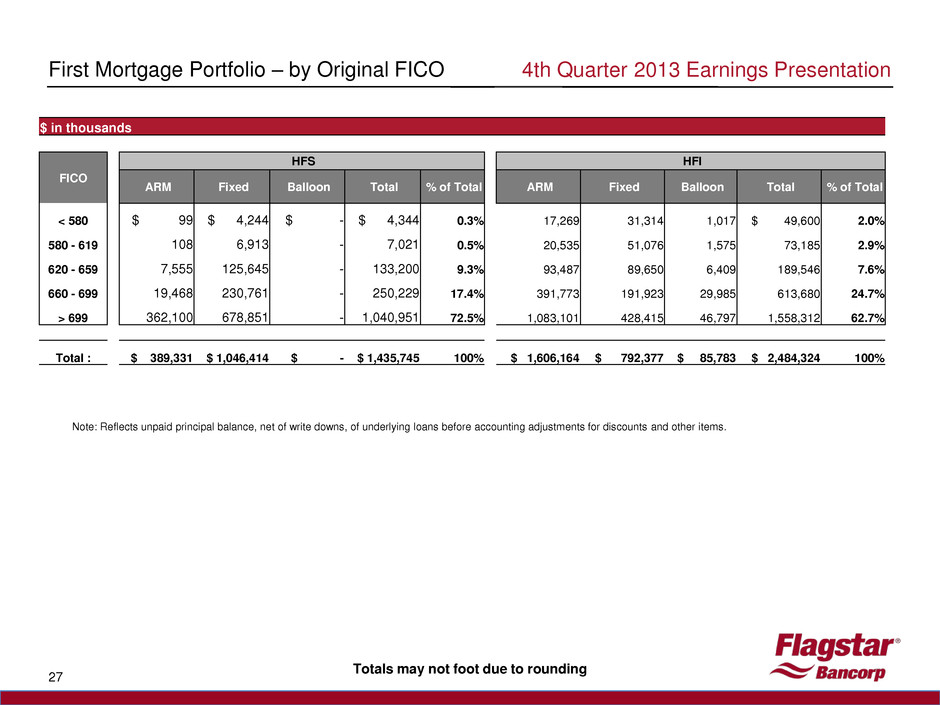

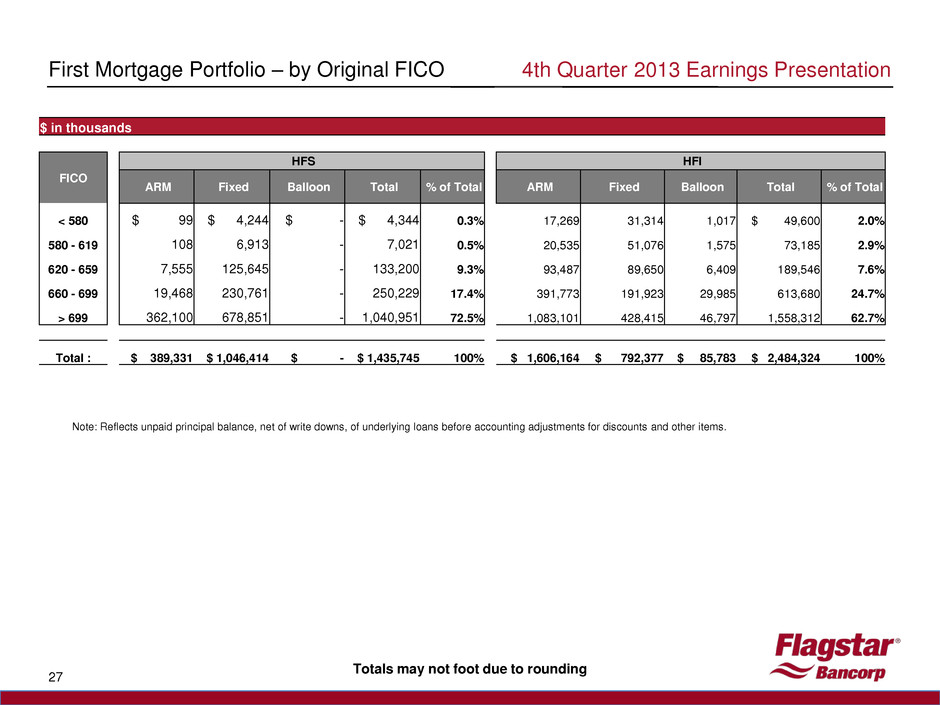

4th Quarter 2013 Earnings Presentation 27 First Mortgage Portfolio – by Original FICO Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. Totals may not foot due to rounding $ in thousands FICO HFS HFI ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total < 580 $ 99 $ 4,244 $ - $ 4,344 0.3% 17,269 31,314 1,017 $ 49,600 2.0% 580 - 619 108 6,913 - 7,021 0.5% 20,535 51,076 1,575 73,185 2.9% 620 - 659 7,555 125,645 - 133,200 9.3% 93,487 89,650 6,409 189,546 7.6% 660 - 699 19,468 230,761 - 250,229 17.4% 391,773 191,923 29,985 613,680 24.7% > 699 362,100 678,851 - 1,040,951 72.5% 1,083,101 428,415 46,797 1,558,312 62.7% Total : $ 389,331 $ 1,046,414 $ - $ 1,435,745 100% $ 1,606,164 $ 792,377 $ 85,783 $ 2,484,324 100%

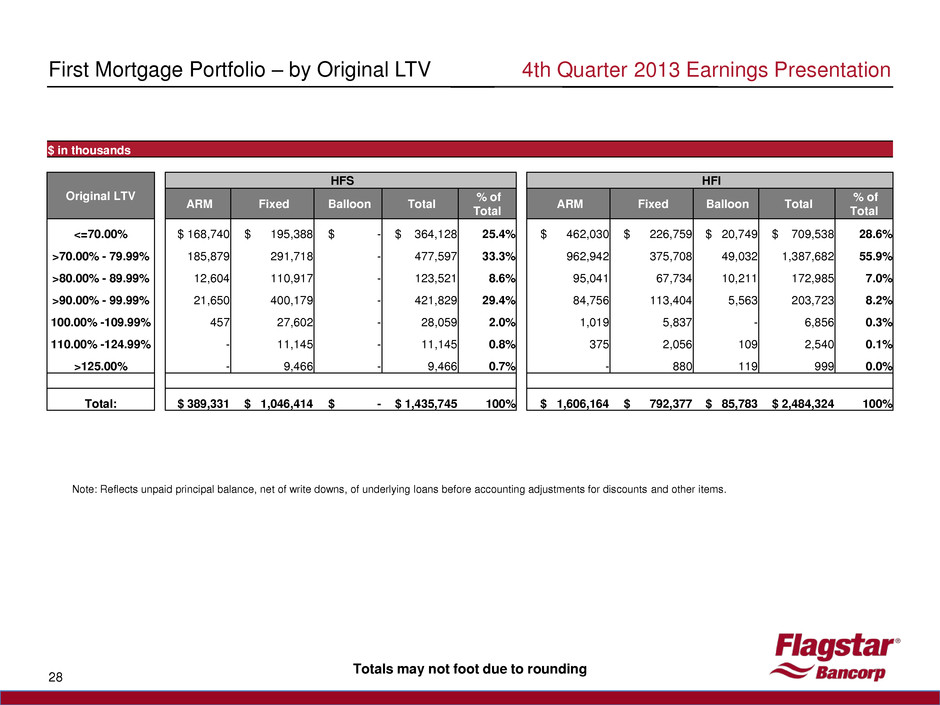

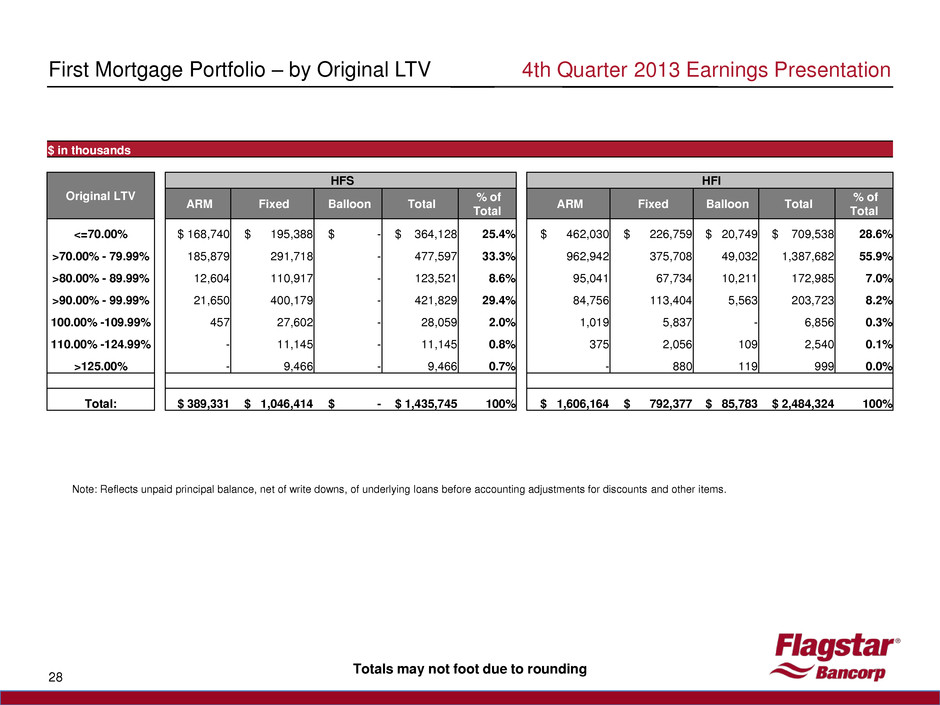

4th Quarter 2013 Earnings Presentation 28 First Mortgage Portfolio – by Original LTV Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. Totals may not foot due to rounding $ in thousands Original LTV HFS HFI ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total <=70.00% $ 168,740 $ 195,388 $ - $ 364,128 25.4% $ 462,030 $ 226,759 $ 20,749 $ 709,538 28.6% >70.00% - 79.99% 185,879 291,718 - 477,597 33.3% 962,942 375,708 49,032 1,387,682 55.9% >80.00% - 89.99% 12,604 110,917 - 123,521 8.6% 95,041 67,734 10,211 172,985 7.0% >90.00% - 99.99% 21,650 400,179 - 421,829 29.4% 84,756 113,404 5,563 203,723 8.2% 100.00% -109.99% 457 27,602 - 28,059 2.0% 1,019 5,837 - 6,856 0.3% 110.00% -124.99% - 11,145 - 11,145 0.8% 375 2,056 109 2,540 0.1% >125.00% - 9,466 - 9,466 0.7% - 880 119 999 0.0% Total: $ 389,331 $ 1,046,414 $ - $ 1,435,745 100% $ 1,606,164 $ 792,377 $ 85,783 $ 2,484,324 100%

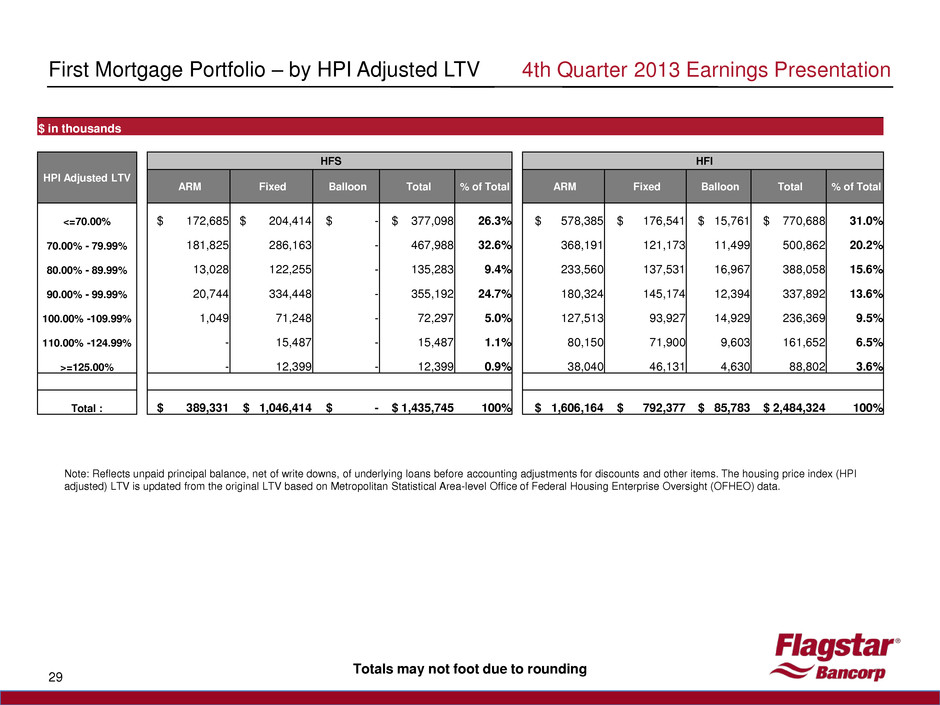

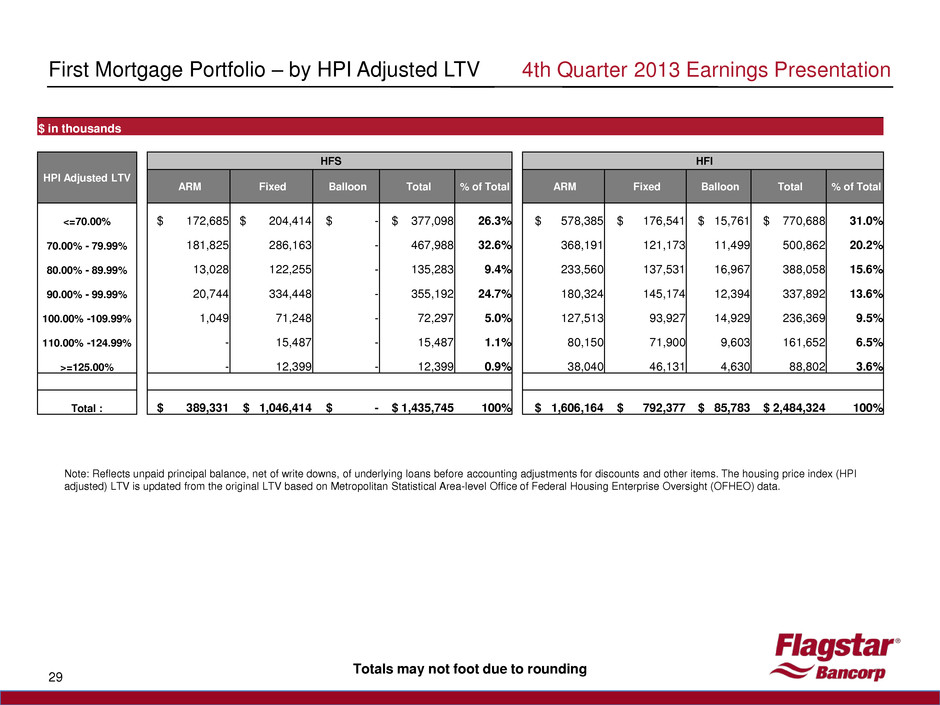

4th Quarter 2013 Earnings Presentation 29 First Mortgage Portfolio – by HPI Adjusted LTV Note: Reflects unpaid principal balance, net of write downs, of underlying loans before accounting adjustments for discounts and other items. The housing price index (HPI adjusted) LTV is updated from the original LTV based on Metropolitan Statistical Area-level Office of Federal Housing Enterprise Oversight (OFHEO) data. Totals may not foot due to rounding $ in thousands HPI Adjusted LTV HFS HFI ARM Fixed Balloon Total % of Total ARM Fixed Balloon Total % of Total <=70.00% $ 172,685 $ 204,414 $ - $ 377,098 26.3% $ 578,385 $ 176,541 $ 15,761 $ 770,688 31.0% 70.00% - 79.99% 181,825 286,163 - 467,988 32.6% 368,191 121,173 11,499 500,862 20.2% 80.00% - 89.99% 13,028 122,255 - 135,283 9.4% 233,560 137,531 16,967 388,058 15.6% 90.00% - 99.99% 20,744 334,448 - 355,192 24.7% 180,324 145,174 12,394 337,892 13.6% 100.00% -109.99% 1,049 71,248 - 72,297 5.0% 127,513 93,927 14,929 236,369 9.5% 110.00% -124.99% - 15,487 - 15,487 1.1% 80,150 71,900 9,603 161,652 6.5% >=125.00% - 12,399 - 12,399 0.9% 38,040 46,131 4,630 88,802 3.6% Total : $ 389,331 $ 1,046,414 $ - $ 1,435,745 100% $ 1,606,164 $ 792,377 $ 85,783 $ 2,484,324 100%

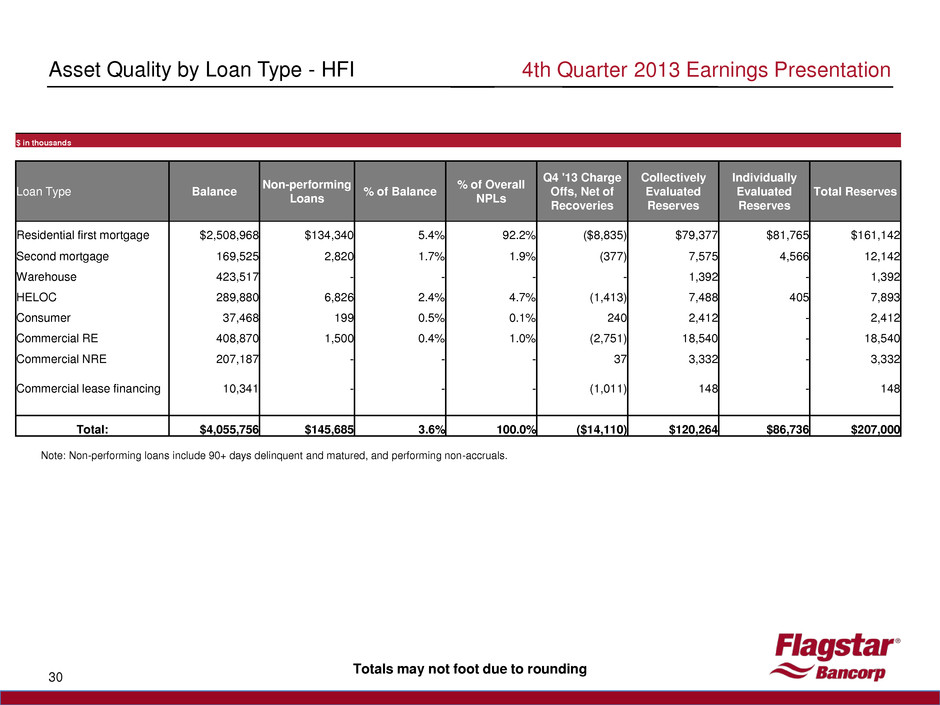

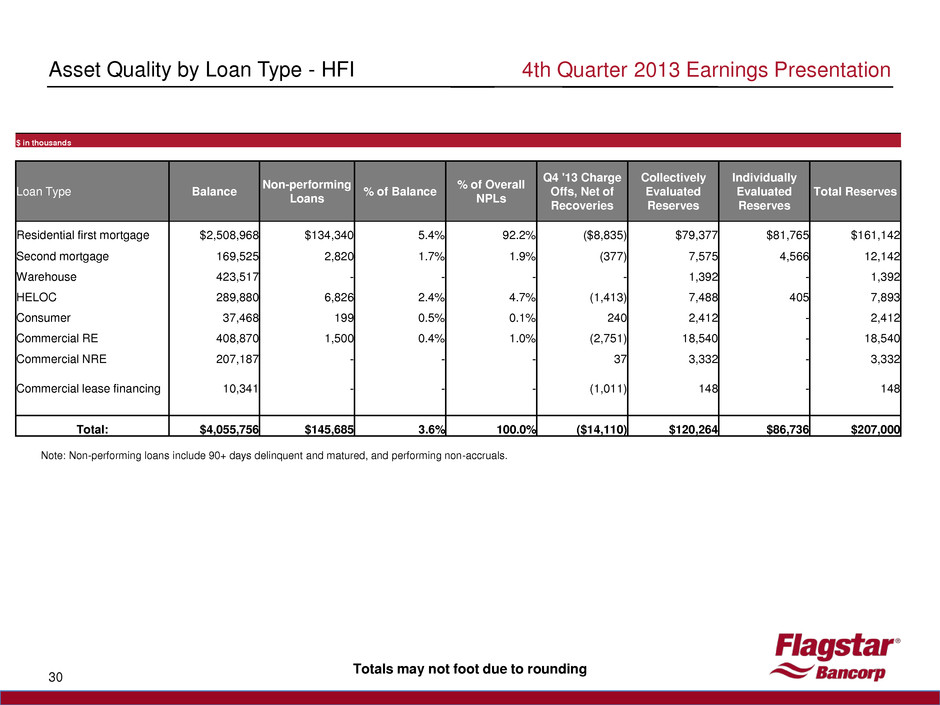

4th Quarter 2013 Earnings Presentation 30 Asset Quality by Loan Type - HFI Note: Non-performing loans include 90+ days delinquent and matured, and performing non-accruals. Totals may not foot due to rounding $ in thousands Loan Type Balance Non-performing Loans % of Balance % of Overall NPLs Q4 '13 Charge Offs, Net of Recoveries Collectively Evaluated Reserves Individually Evaluated Reserves Total Reserves Residential first mortgage $2,508,968 $134,340 5.4% 92.2% ($8,835) $79,377 $81,765 $161,142 Second mortgage 169,525 2,820 1.7% 1.9% (377) 7,575 4,566 12,142 Warehouse 423,517 - - - - 1,392 - 1,392 HELOC 289,880 6,826 2.4% 4.7% (1,413) 7,488 405 7,893 Consumer 37,468 199 0.5% 0.1% 240 2,412 - 2,412 Commercial RE 408,870 1,500 0.4% 1.0% (2,751) 18,540 - 18,540 Commercial NRE 207,187 - - - 37 3,332 - 3,332 Commercial lease financing 10,341 - - - (1,011) 148 - 148 Total: $4,055,756 $145,685 3.6% 100.0% ($14,110) $120,264 $86,736 $207,000

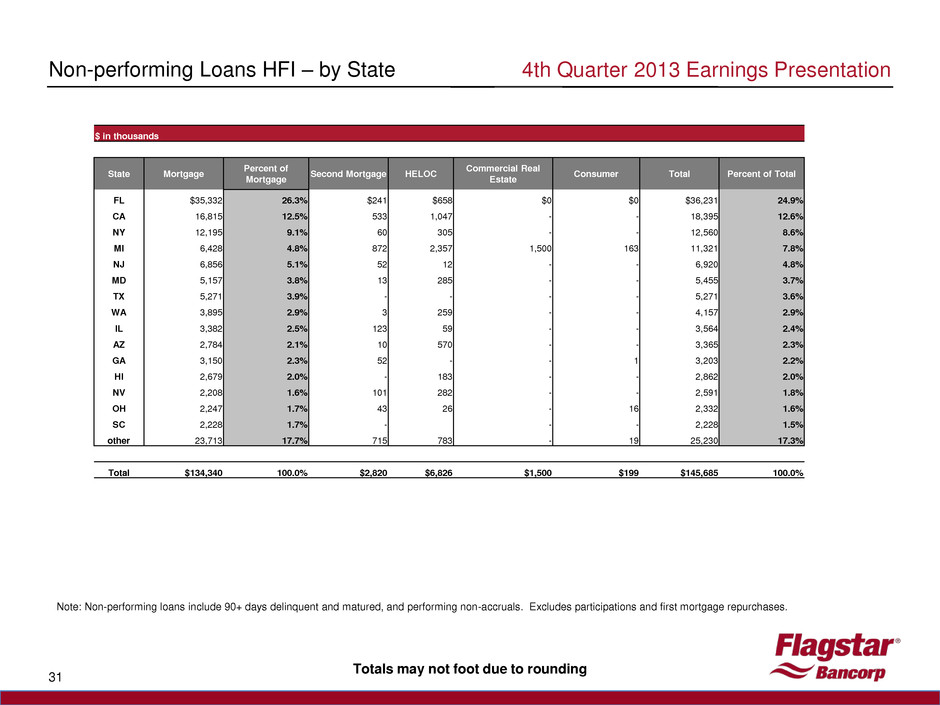

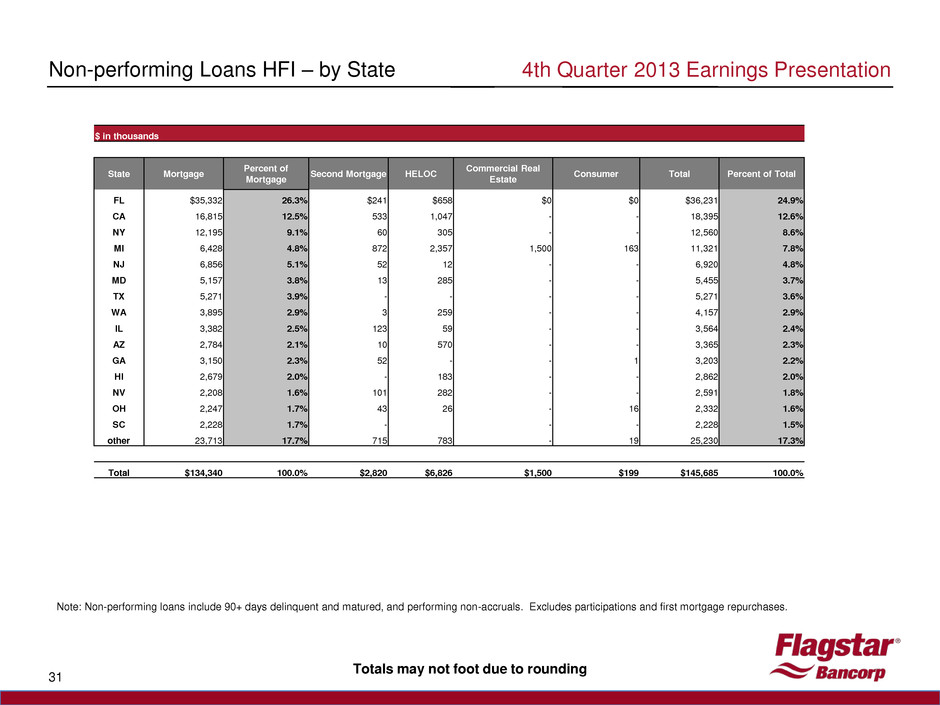

4th Quarter 2013 Earnings Presentation 31 Non-performing Loans HFI – by State Note: Non-performing loans include 90+ days delinquent and matured, and performing non-accruals. Excludes participations and first mortgage repurchases. Totals may not foot due to rounding $ in thousands State Mortgage Percent of Mortgage Second Mortgage HELOC Commercial Real Estate Consumer Total Percent of Total FL $35,332 26.3% $241 $658 $0 $0 $36,231 24.9% CA 16,815 12.5% 533 1,047 - - 18,395 12.6% NY 12,195 9.1% 60 305 - - 12,560 8.6% MI 6,428 4.8% 872 2,357 1,500 163 11,321 7.8% NJ 6,856 5.1% 52 12 - - 6,920 4.8% MD 5,157 3.8% 13 285 - - 5,455 3.7% TX 5,271 3.9% - - - - 5,271 3.6% WA 3,895 2.9% 3 259 - - 4,157 2.9% IL 3,382 2.5% 123 59 - - 3,564 2.4% AZ 2,784 2.1% 10 570 - - 3,365 2.3% GA 3,150 2.3% 52 - - 1 3,203 2.2% HI 2,679 2.0% - 183 - - 2,862 2.0% NV 2,208 1.6% 101 282 - - 2,591 1.8% OH 2,247 1.7% 43 26 - 16 2,332 1.6% SC 2,228 1.7% - - - 2,228 1.5% other 23,713 17.7% 715 783 - 19 25,230 17.3% Total $134,340 100.0% $2,820 $6,826 $1,500 $199 $145,685 100.0%

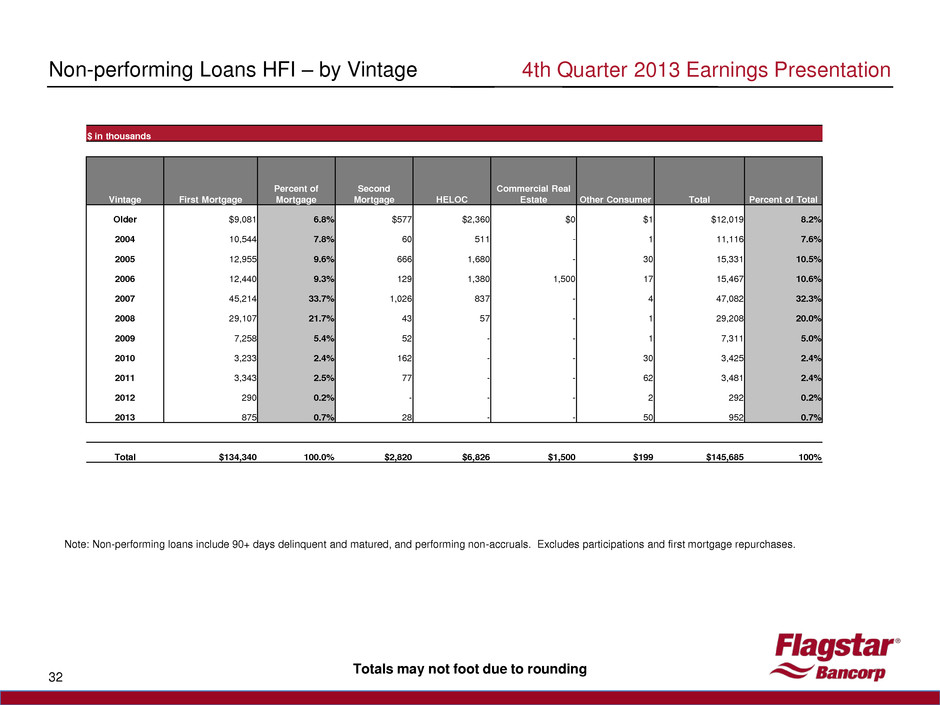

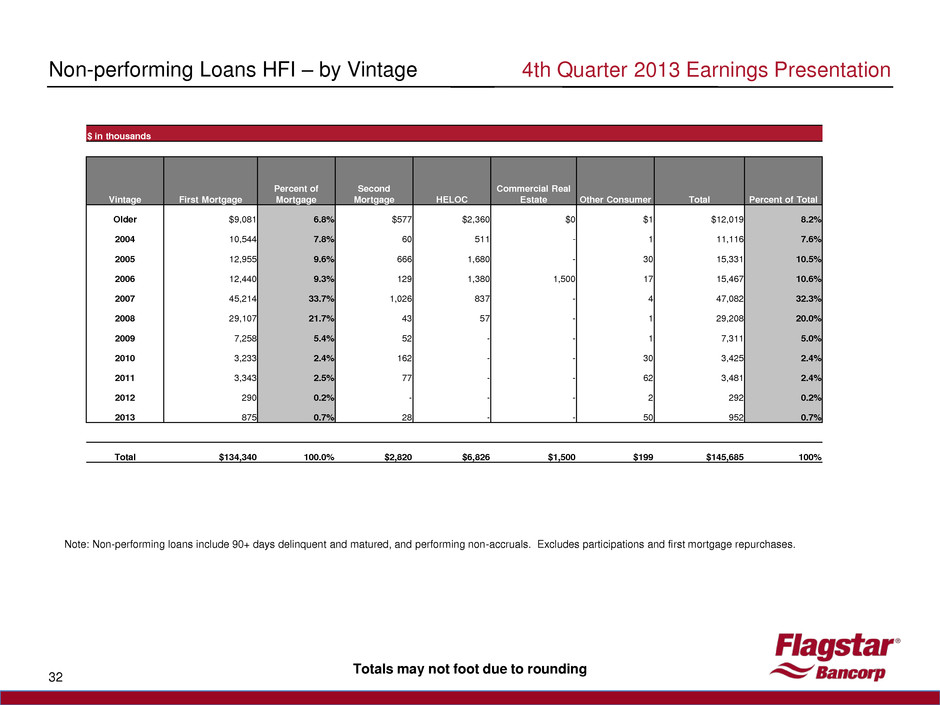

4th Quarter 2013 Earnings Presentation 32 Non-performing Loans HFI – by Vintage Totals may not foot due to rounding Note: Non-performing loans include 90+ days delinquent and matured, and performing non-accruals. Excludes participations and first mortgage repurchases. $ in thousands Vintage First Mortgage Percent of Mortgage Second Mortgage HELOC Commercial Real Estate Other Consumer Total Percent of Total Older $9,081 6.8% $577 $2,360 $0 $1 $12,019 8.2% 2004 10,544 7.8% 60 511 - 1 11,116 7.6% 2005 12,955 9.6% 666 1,680 - 30 15,331 10.5% 2006 12,440 9.3% 129 1,380 1,500 17 15,467 10.6% 2007 45,214 33.7% 1,026 837 - 4 47,082 32.3% 2008 29,107 21.7% 43 57 - 1 29,208 20.0% 2009 7,258 5.4% 52 - - 1 7,311 5.0% 2010 3,233 2.4% 162 - - 30 3,425 2.4% 2011 3,343 2.5% 77 - - 62 3,481 2.4% 2012 290 0.2% - - - 2 292 0.2% 2013 875 0.7% 28 - - 50 952 0.7% Total $134,340 100.0% $2,820 $6,826 $1,500 $199 $145,685 100%

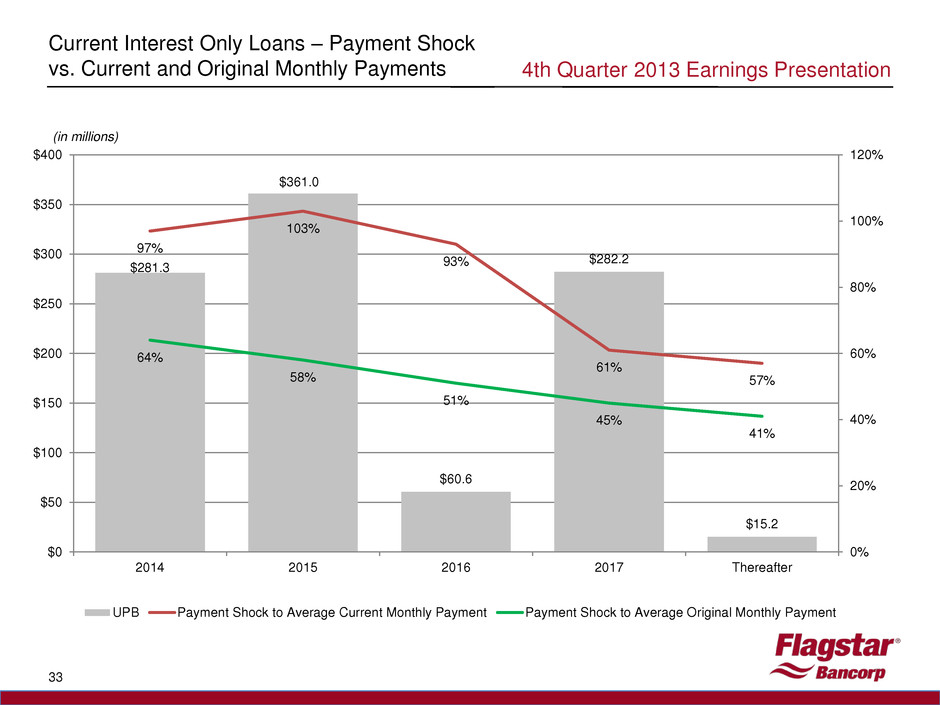

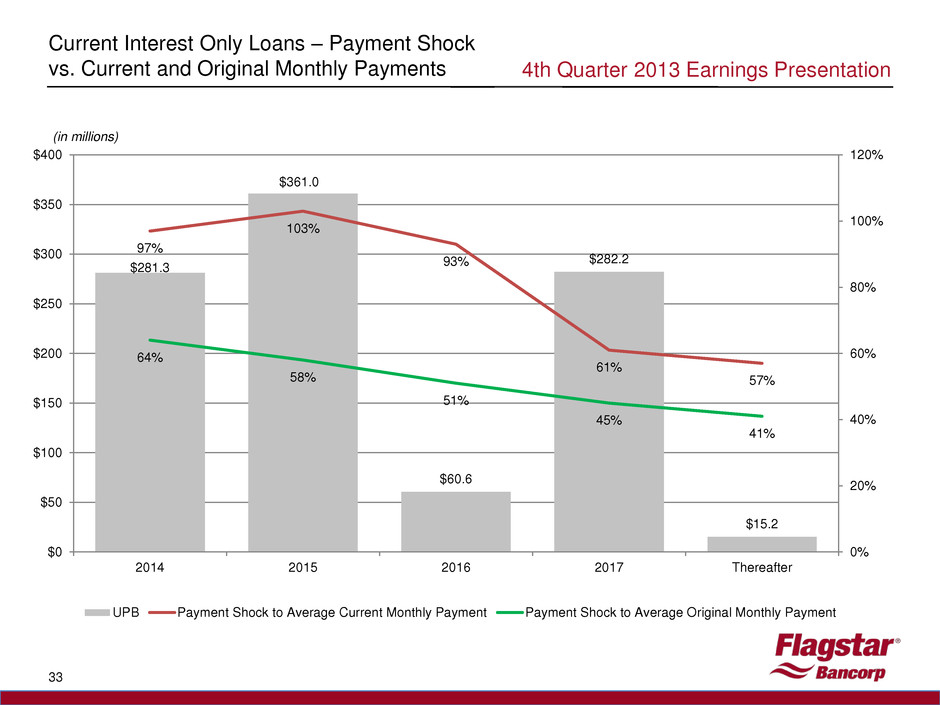

33 4th Quarter 2013 Earnings Presentation Current Interest Only Loans – Payment Shock vs. Current and Original Monthly Payments (in millions) $281.3 $361.0 $60.6 $282.2 $15.2 97% 103% 93% 61% 57% 64% 58% 51% 45% 41% 0% 20% 40% 60% 80% 100% 120% $0 $50 $100 $150 $200 $250 $300 $350 $400 2014 2015 2016 2017 Thereafter UPB Payment Shock to Average Current Monthly Payment Payment Shock to Average Original Monthly Payment

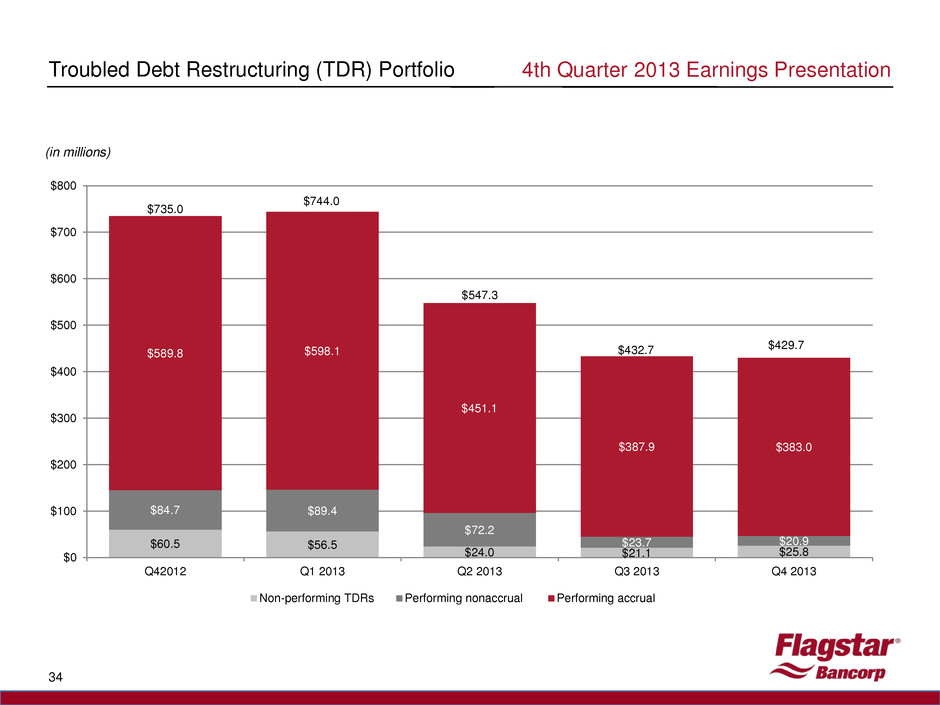

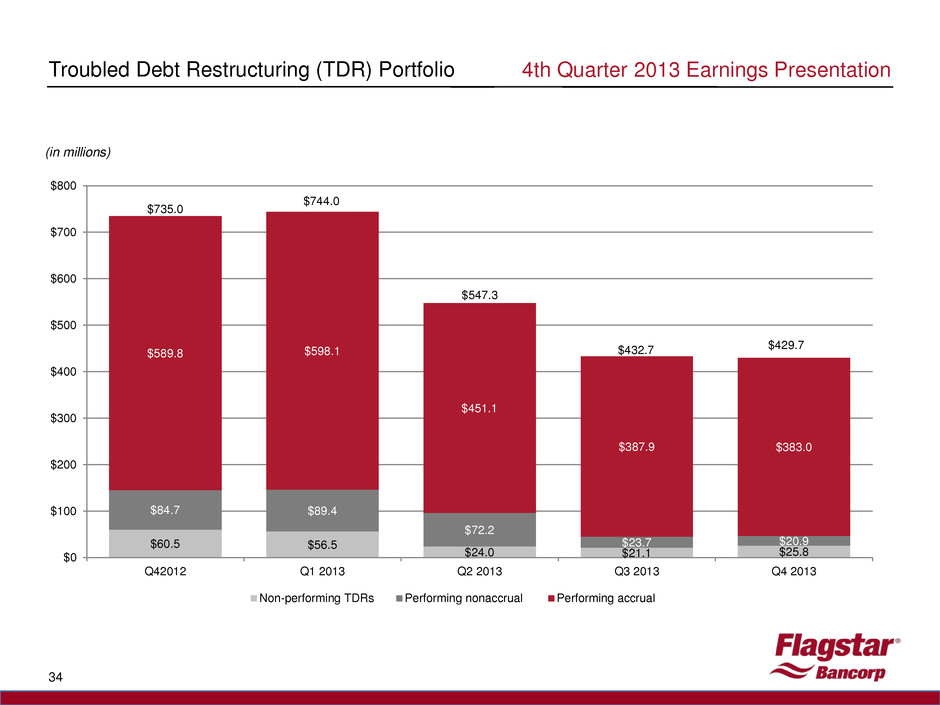

34 Troubled Debt Restructuring (TDR) Portfolio 4th Quarter 2013 Earnings Presentation (in millions) $60.5 $56.5 $24.0 $21.1 $25.8 $84.7 $89.4 $72.2 $23.7 $20.9 $589.8 $598.1 $451.1 $387.9 $383.0 $0 $100 $200 $300 $400 $500 $600 $700 $800 Q42012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Non-performing TDRs Performing nonaccrual Performing accrual $735.0 $744.0 $547.3 $432.7 $429.7

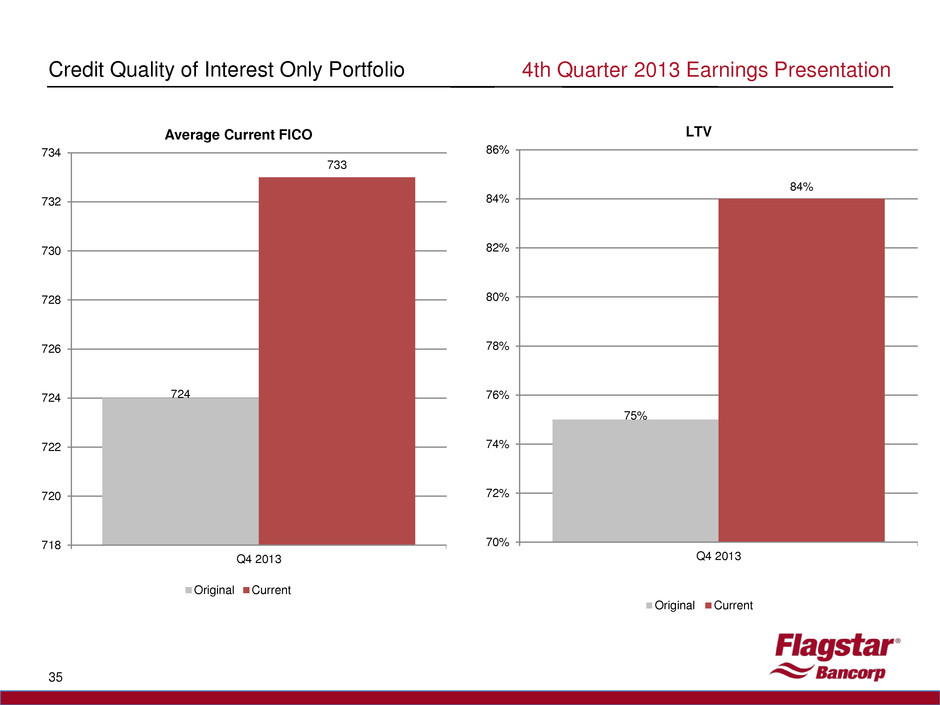

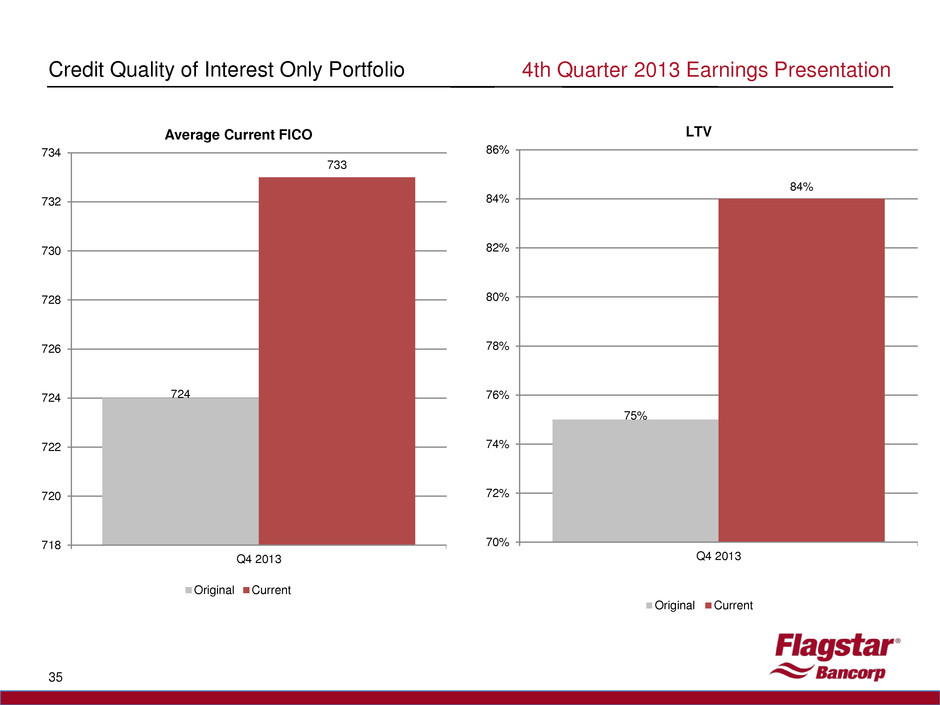

35 4th Quarter 2013 Earnings Presentation Credit Quality of Interest Only Portfolio 724 733 718 720 722 724 726 728 730 732 734 Q4 2013 Average Current FICO Original Current 75% 84% 70% 72% 74% 76% 78% 80% 82% 84% 86% Q4 2013 LTV Original Current

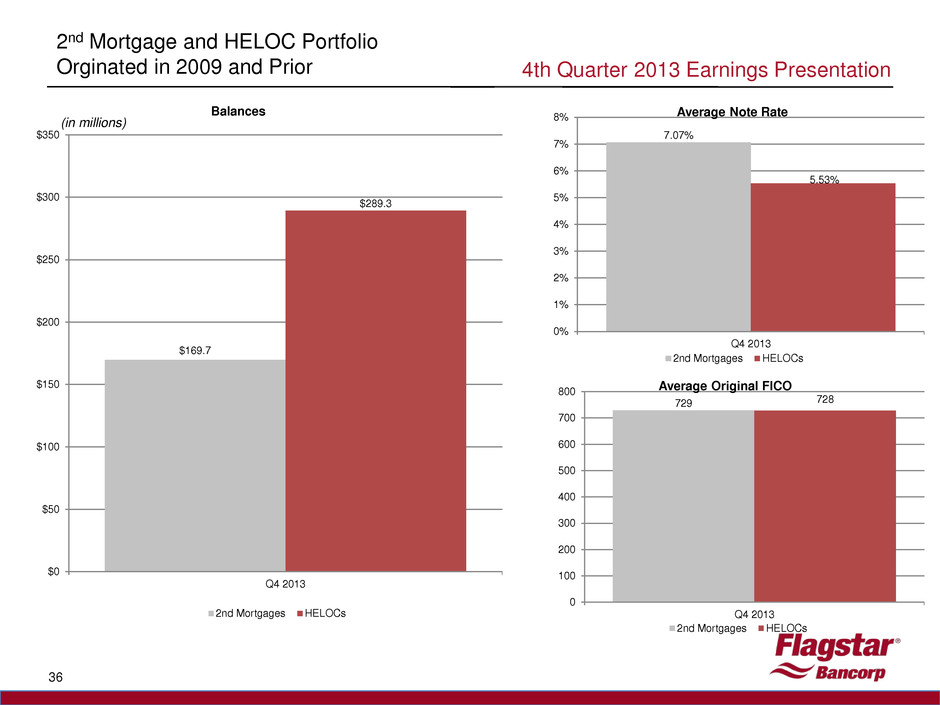

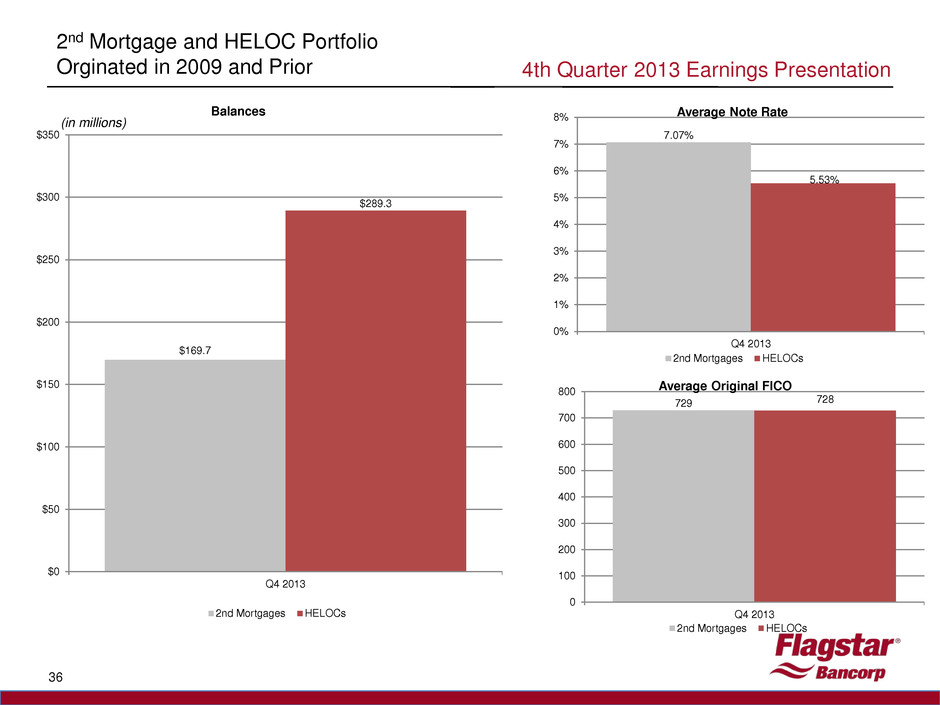

36 4th Quarter 2013 Earnings Presentation 2nd Mortgage and HELOC Portfolio Orginated in 2009 and Prior (in millions) 729 728 0 100 200 300 400 500 600 700 800 Q4 2013 Average Original FICO 2nd Mortgages HELOCs 7.07% 5.53% 0% 1% 2% 3% 4% 5% 6% 7% 8% Q4 2013 Average Note Rate 2nd Mortgages HELOCs $169.7 $289.3 $0 $50 $100 $150 $200 $250 $300 $350 Q4 2013 Balances 2nd Mortgages HELOCs

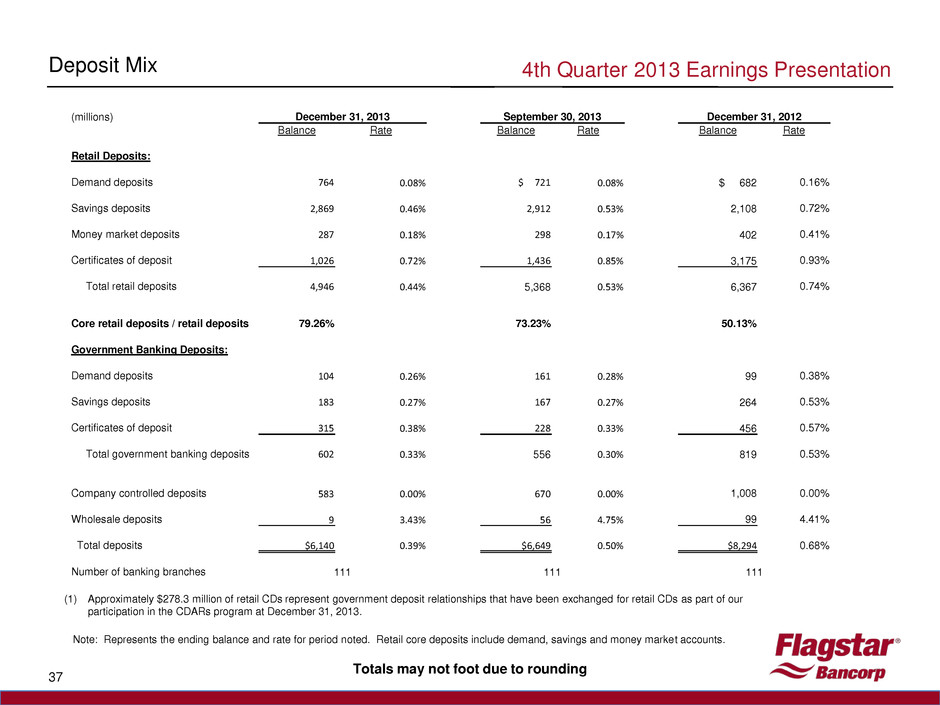

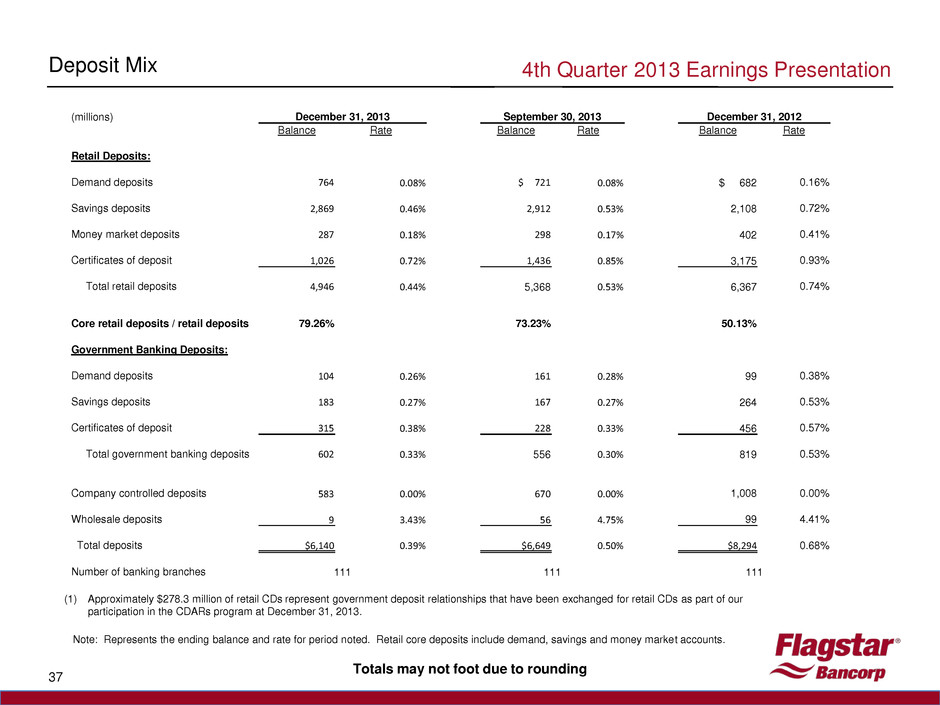

4th Quarter 2013 Earnings Presentation 37 Deposit Mix Note: Represents the ending balance and rate for period noted. Retail core deposits include demand, savings and money market accounts. Totals may not foot due to rounding (1) Approximately $278.3 million of retail CDs represent government deposit relationships that have been exchanged for retail CDs as part of our participation in the CDARs program at December 31, 2013. (millions) December 31, 2013 September 30, 2013 December 31, 2012 Balance Rate Balance Rate Balance Rate Retail Deposits: Demand deposits 764 0.08% $ 721 0.08% $ 682 0.16% Savings deposits 2,869 0.46% 2,912 0.53% 2,108 0.72% Money market deposits 287 0.18% 298 0.17% 402 0.41% Certificates of deposit 1,026 0.72% 1,436 0.85% 3,175 0.93% Total retail deposits 4,946 0.44% 5,368 0.53% 6,367 0.74% Core retail deposits / retail deposits 79.26% 73.23% 50.13% Government Banking Deposits: Demand deposits 104 0.26% 161 0.28% 99 0.38% Savings deposits 183 0.27% 167 0.27% 264 0.53% Certificates of deposit 315 0.38% 228 0.33% 456 0.57% Total government banking deposits 602 0.33% 556 0.30% 819 0.53% Company controlled deposits 583 0.00% 670 0.00% 1,008 0.00% Wholesale deposits 9 3.43% 56 4.75% 99 4.41% Total deposits $6,140 0.39% $6,649 0.50% $8,294 0.68% Number of banking branches 111 111 111

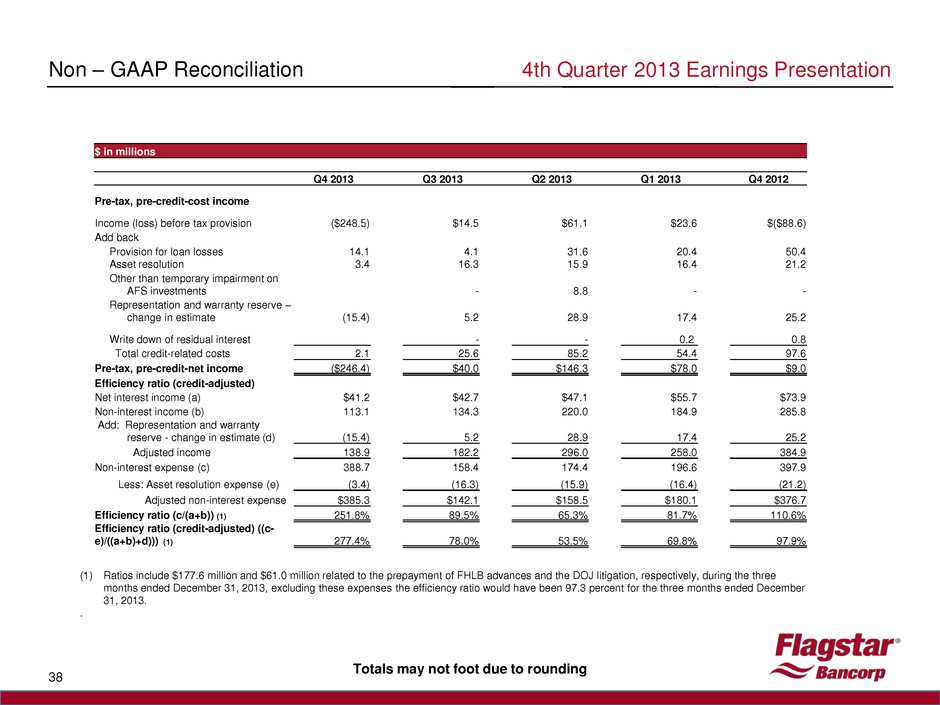

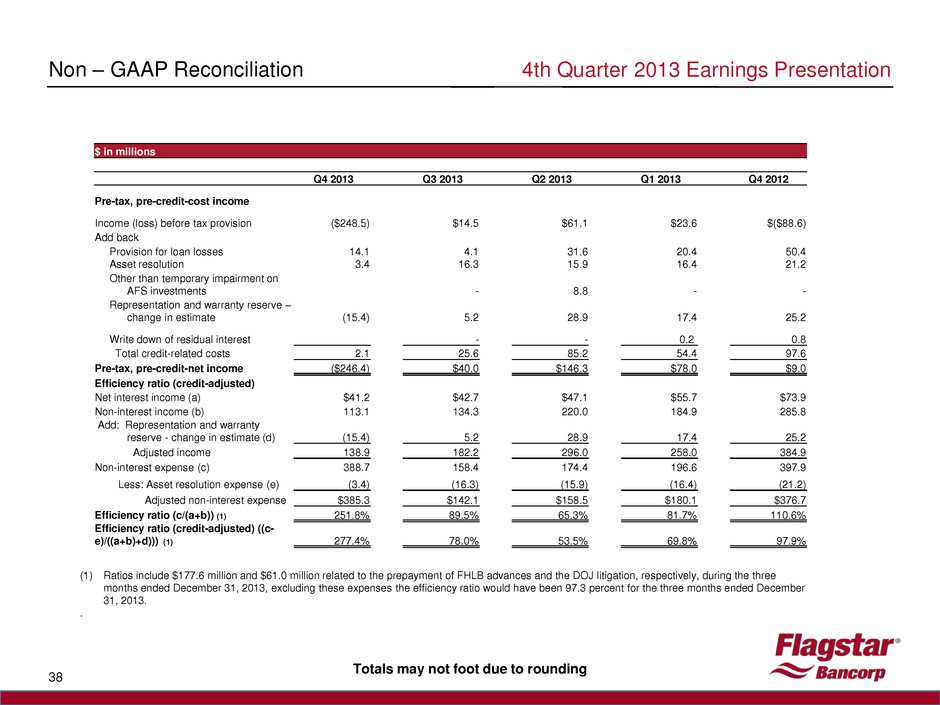

4th Quarter 2013 Earnings Presentation 38 Non – GAAP Reconciliation Totals may not foot due to rounding $ in millions Q4 2013 Q3 2013 Q2 2013 Q1 2013 Q4 2012 Pre-tax, pre-credit-cost income Income (loss) before tax provision ($248.5) $14.5 $61.1 $23.6 $($88.6) Add back Provision for loan losses 14.1 4.1 31.6 20.4 50.4 Asset resolution 3.4 16.3 15.9 16.4 21.2 Other than temporary impairment on AFS investments - 8.8 - - Representation and warranty reserve – change in estimate (15.4) 5.2 28.9 17.4 25.2 Write down of residual interest - - 0.2 0.8 Total credit-related costs 2.1 25.6 85.2 54.4 97.6 Pre-tax, pre-credit-net income ($246.4) $40.0 $146.3 $78.0 $9.0 Efficiency ratio (credit-adjusted) Net interest income (a) $41.2 $42.7 $47.1 $55.7 $73.9 Non-interest income (b) 113.1 134.3 220.0 184.9 285.8 Add: Representation and warranty reserve - change in estimate (d) (15.4) 5.2 28.9 17.4 25.2 Adjusted income 138.9 182.2 296.0 258.0 384.9 Non-interest expense (c) 388.7 158.4 174.4 196.6 397.9 Less: Asset resolution expense (e) (3.4) (16.3) (15.9) (16.4) (21.2) Adjusted non-interest expense $385.3 $142.1 $158.5 $180.1 $376.7 Efficiency ratio (c/(a+b)) (1) 251.8% 89.5% 65.3% 81.7% 110.6% Efficiency ratio (credit-adjusted) ((c- e)/((a+b)+d))) (1) 277.4% 78.0% 53.5% 69.8% 97.9% (1) Ratios include $177.6 million and $61.0 million related to the prepayment of FHLB advances and the DOJ litigation, respectively, during the three months ended December 31, 2013, excluding these expenses the efficiency ratio would have been 97.3 percent for the three months ended December 31, 2013. .

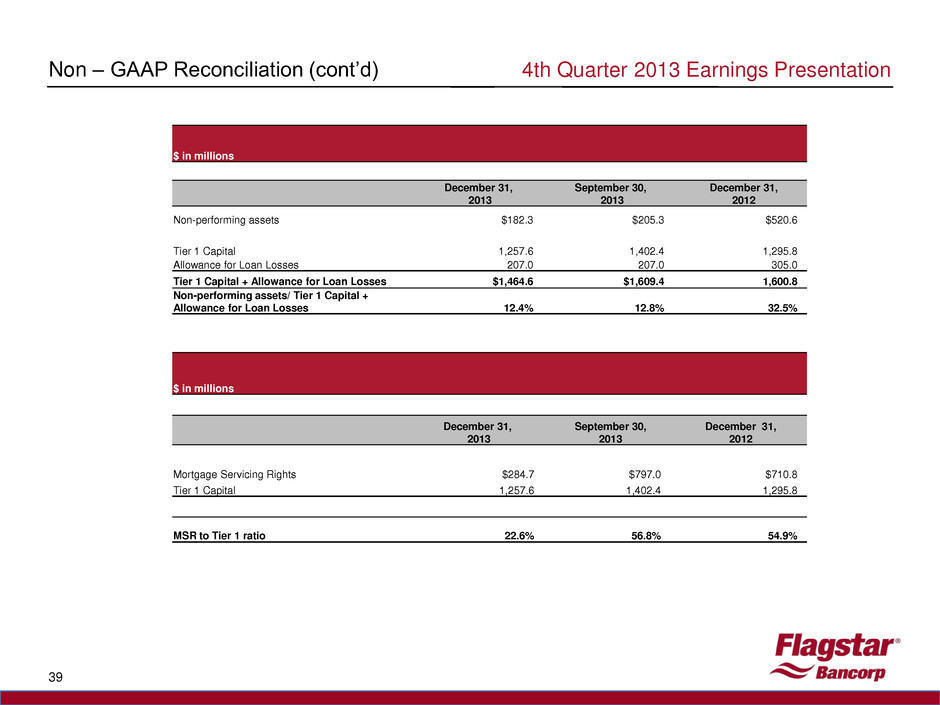

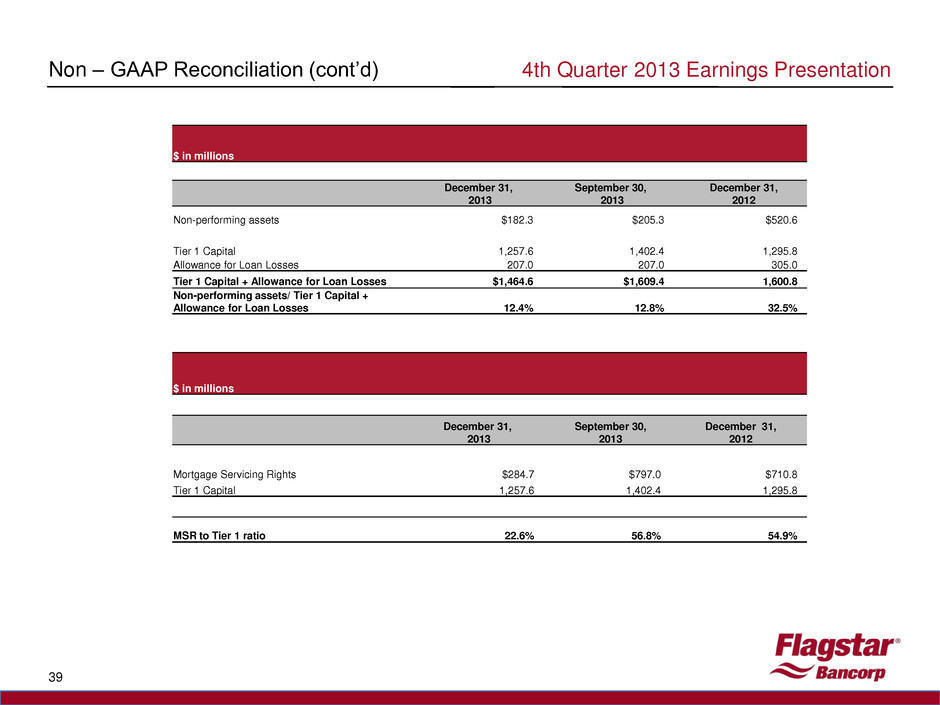

$ in millions December 31, 2013 September 30, 2013 December 31, 2012 Non-performing assets $182.3 $205.3 $520.6 Tier 1 Capital 1,257.6 1,402.4 1,295.8 Allowance for Loan Losses 207.0 207.0 305.0 Tier 1 Capital + Allowance for Loan Losses $1,464.6 $1,609.4 1,600.8 Non-performing assets/ Tier 1 Capital + Allowance for Loan Losses 12.4% 12.8% 32.5% Non – GAAP Reconciliation (cont’d) 4th Quarter 2013 Earnings Presentation 39 $ in millions December 31, 2013 September 30, 2013 December 31, 2012 Mortgage Servicing Rights $284.7 $797.0 $710.8 Tier 1 Capital 1,257.6 1,402.4 1,295.8 MSR to Tier 1 ratio 22.6% 56.8% 54.9%

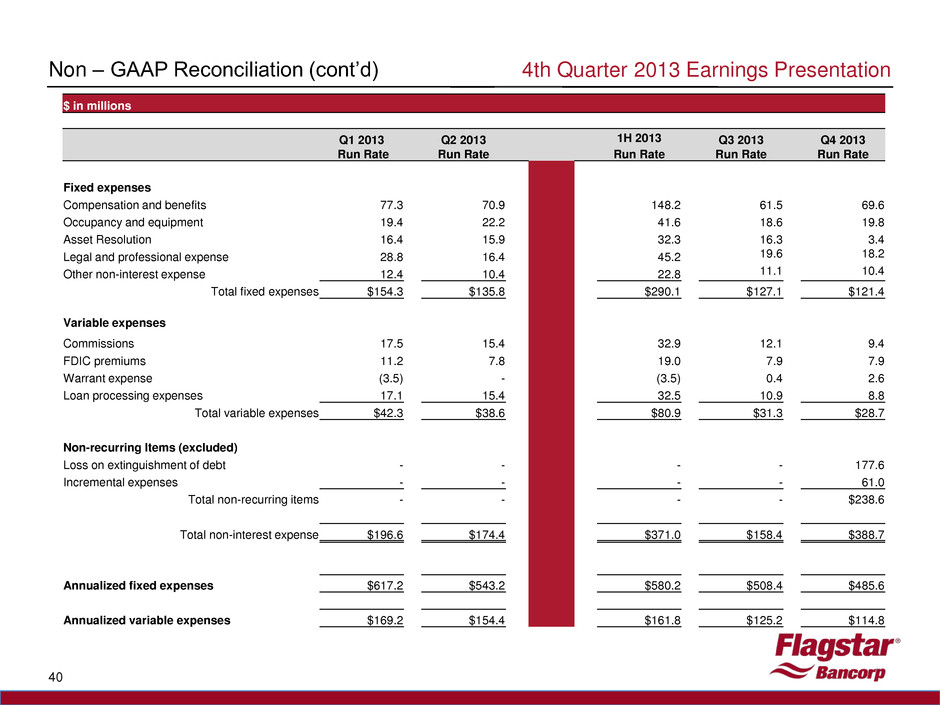

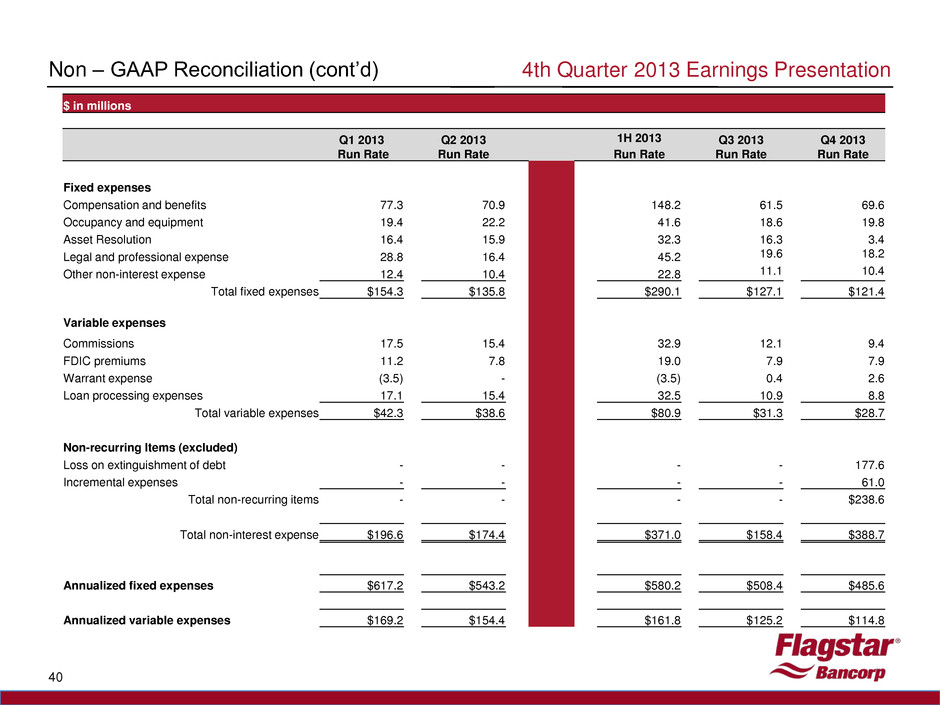

Non – GAAP Reconciliation (cont’d) 4th Quarter 2013 Earnings Presentation 40 $ in millions Q1 2013 Run Rate Q2 2013 Run Rate 1H 2013 Q3 2013 Run Rate Q4 2013 Run Rate Run Rate Fixed expenses Compensation and benefits 77.3 70.9 148.2 61.5 69.6 Occupancy and equipment 19.4 22.2 41.6 18.6 19.8 Asset Resolution 16.4 15.9 32.3 16.3 3.4 Legal and professional expense 28.8 16.4 45.2 19.6 18.2 Other non-interest expense 12.4 10.4 22.8 11.1 10.4 Total fixed expenses $154.3 $135.8 $290.1 $127.1 $121.4 Variable expenses Commissions 17.5 15.4 32.9 12.1 9.4 FDIC premiums 11.2 7.8 19.0 7.9 7.9 Warrant expense (3.5) - (3.5) 0.4 2.6 Loan processing expenses 17.1 15.4 32.5 10.9 8.8 Total variable expenses $42.3 $38.6 $80.9 $31.3 $28.7 Non-recurring Items (excluded) Loss on extinguishment of debt - - - - 177.6 Incremental expenses - - - - 61.0 Total non-recurring items - - - - $238.6 Total non-interest expense $196.6 $174.4 $371.0 $158.4 $388.7 Annualized fixed expenses $617.2 $543.2 $580.2 $508.4 $485.6 Annualized variable expenses $169.2 $154.4 $161.8 $125.2 $114.8

FBC LISTED NYSE 4th Quarter 2013 Earnings Presentation