|

| Exhibit 99.2 |

|

Earnings Presentation

Fourth Quarter 2011

January 25, 2011

Presenters:

Joseph P. Campanelli

Chief Executive Officer

Paul D. Borja

Chief Financial Officer

Legal Disclaimer

This presentation includes forward ? looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) and includes comments with respect to our objectives and strategies, and the results of our operations and our business. Forward ? looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “expects,” “assumes,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning, or future or conditional words such as “assuming,” “will,” “would,” “possible,” “proposed,” “projected,” “positioned,” “vision,” “opportunity,” “should,” “could,” “indicative,” “target” or “may.”

Forward ? looking statements provide our expectations or predictions of future conditions, events or results. They are not guarantees of future performance. By their nature, these forward ? looking statements involve numerous assumptions, uncertainties and opportunities, both general and specific. These statements speak only as of the date they are made. We do not undertake to update forward ? looking statements to reflect the impact of circumstances or events that arise after the date the forward ? looking statements were made. There a number of factors, many of which are beyond our control that could cause actual conditions, events or results to differ significantly from those described in the forward looking statements. Some of these are:

• Volatile interest rates that impact , amongst profit , , things business , other (i) the mortgage banking (ii) our ability to originate loans and sell assets at a (iii) prepayment speeds and (iv) our cost of funds, could adversely affect earnings, growth opportunities and our ability to pay dividends to shareholders.

• Our ability to maintain capital levels.

• Competitive factors for loans could negatively impact gain on loan sale margins.

• Competition from banking and non? banking companies for deposits and loans can affect our growth opportunities, earnings, gain on sale margins, market share and ability to transform business model.

• Changes in the regulation of financial services companies and government ? sponsored housing enterprises, and in particular, declines in the liquidity of the mortgage loan secondary market, could adversely affect business.

• Our ability to resolve representation and warranty claims from the government ? sponsored housing enterprises or private insurers.

• Our ability to achieve resolution in any pending or threatened litigation including the timing and ability to reach a settlement.

• Changes in regulatory capital requirements or an inability to achieve desired capital ratios could adversely affect our growth and earnings opportunities and our ability to originate certain types of loans, as well as our ability to sell certain types of assets for fair market value or to transform business model.

• General business and economic conditions, including unemployment rates, further movements in interest rates, the slope of the yield curve, any increase in fraud and other criminal activity and the further decline of asset values in certains ‘ geograp hic markets, may significantly affect the company business activities, loan losses, reserves, earnings and business prospects.

• Factors concerning the implementation of proposed enhancements and transformation of business model could result in slower implementation times than we anticipate and negate any competitive advantage that we may enjoy.

Readers should carefully review Flagstar’s financial statements and notes thereto, as well as the risk factors described in Flagstar’s Annual Report on Form 10? K for the year ended December 31, 2010, Form 10? Q for the period ended September 30, 2011, and other documents Flagstar files from time to time with the Securities and Exchange Commission. The information contained in this presentation does not constitute a solicitation to buy Flagstar securities.

Fourth Quarter 2011 Highlights

Net loss to common stockholders of $(44.9) million

$131.6 million in pre? tax, pre? credit? cost income, 28.4% improvement from prior quarter Credit related costs of $173.2, compared to $111.7 in prior quarter Gain on loan sale income increased to $106.9 million, or 102 bps Net loan fees and charges increased by 55.6% from prior quarter to $28.6 million Net servicing revenue increased by 71.3% from prior quarter to $29.0 million Bank net interest margin improved by 13 basis points from prior quarter to 2.43%

Maintained strong capital and liquidity levels

Tier 1 capital ratio of 9.2%

Cash and cash equivalents of $731.1 million, in addition to $244 million in unencumbered marketable securities and over $550 million in unused capacity at FHLB

Continued emphasis on credit risk management, primarily associated with loans originated prior to 2009

Fortified balance sheet, adding $71.0 million in total reserves

Converted to nationally recognized residential mortgage loan servicing system and made significant investments and enhancements in loss mitigation and default servicing

Completed previously announced divestitures of Indiana and Georgia bank franchises, resulting in net gain of $21.4 million

Grew interest earning assets, improved retail deposit mix and reduced overall cost of funds

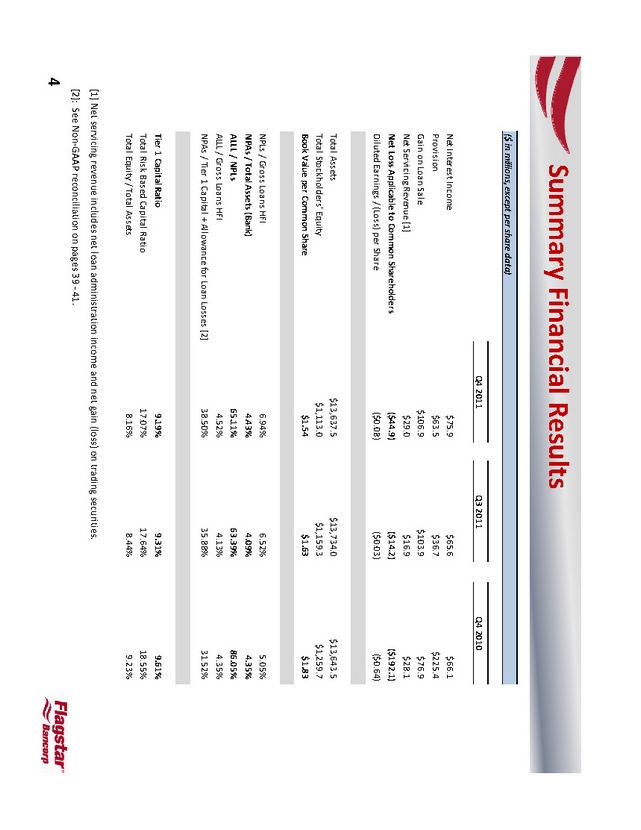

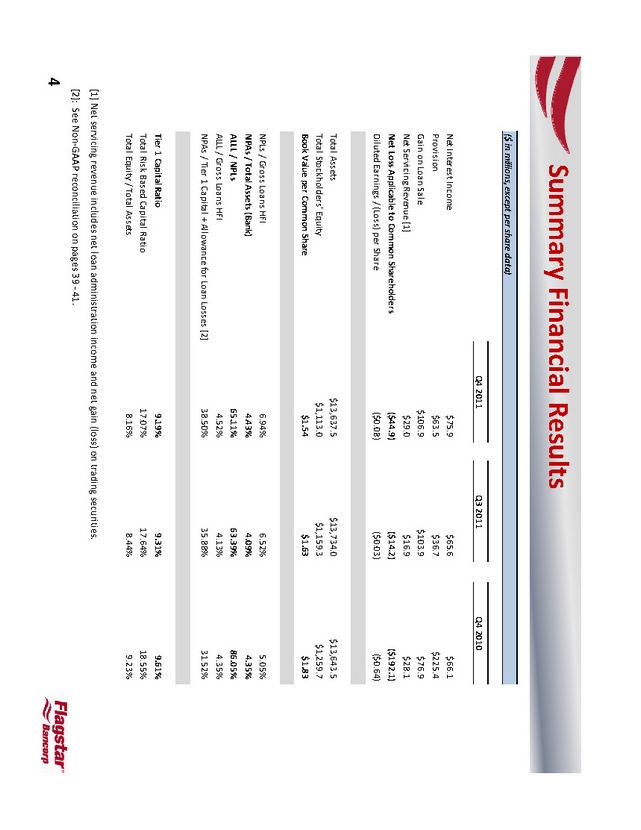

Summary Financial Results

($ in millions, except per share data)

Q4 2011 Q3 2011 Q4 2010

Net Interest Income $75.9 $65.6 $66.1

Provision $63.5 $36.7 $225.4

Gain on Loan Sale $106.9 $103.9 $76.9

Net Servicing Revenue [1] $29.0 $16.9 $28.1

Net Loss Applicable to Common Shareholders ($44.9) ($14.2) ($192.1)

Diluted Earnings / (Loss) per Share ($0.08) ($0.03) ($0.64)

Total Assets $13,637.5 $13,734.0 $13,643.5

Total Stockholders’ Equity $1,113.0 $1,159.3 $1,259.7

Book Value per Common Share $1.54 $1.63 $1.83

NPLs / Gross Loans HFI 6.94% 6.52% 5.05%

NPAs / Total Assets (Bank) 4.43% 4.09% 4.35%

ALLL / NPLs 65.11% 63.39% 86.05%

ALLL / Gross Loans HFI 4.52% 4.13% 4.35%

NPAs / Tier 1 Capital + Allowance for Loan Losses [2] 38.50% 35.88% 31.52%

Tier 1 Capital Ratio 9.19% 9.31% 9.61%

Total Risk Based Capital Ratio 17.07% 17.64% 18.55%

Total Equity / Total Assets 8.16% 8.44% 9.23%

[1] Net servicing revenue includes net loan administration income and net gain (loss) on trading securities.

[2]: See Non? GAAP reconciliation on pages 39 ? 41.

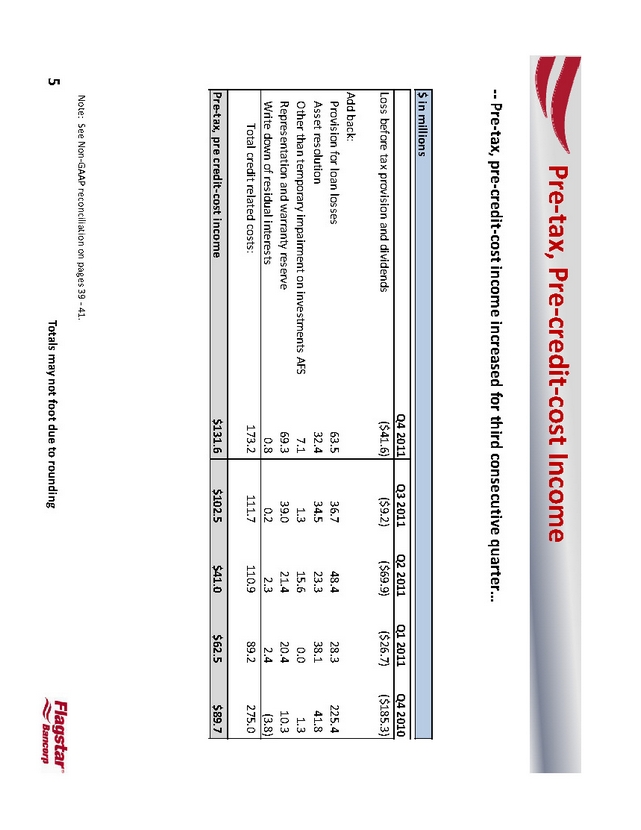

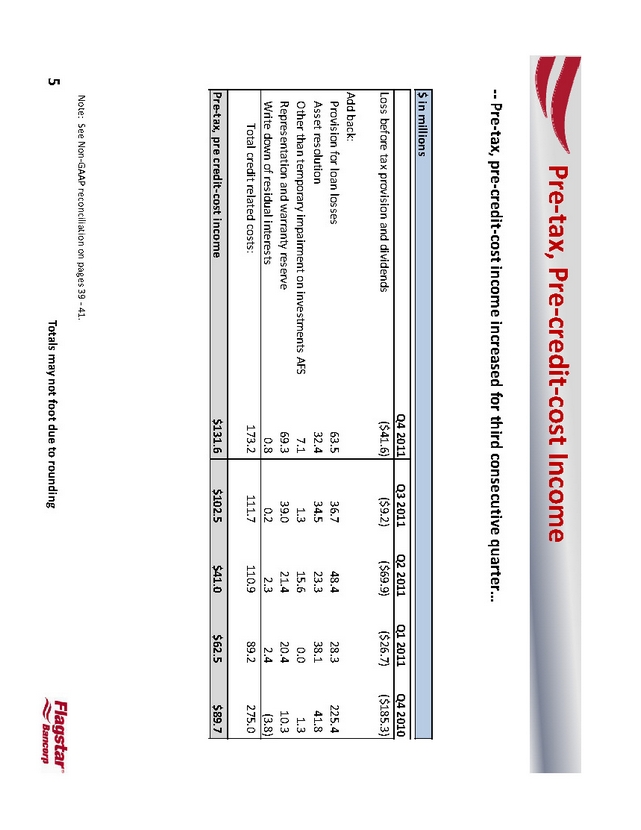

Pre? tax, Pre? credit? cost Income

?? Pre? tax, pre? credit? cost income increased for third consecutive quarter …

$ in millions

Q4 2011 Q3 2011 Q2 2011 Q1 2011 Q4 2010

Loss before tax provision and dividends ($41.6) ($9.2) ($69.9) ($26.7) ($185.3)

Add back:

Provision for loan losses 63.5 36.7 48.4 28.3 225.4

Asset resolution 32.4 34.5 23.3 38.1 41.8

Other than temporary impairment on investments AFS 7.1 1.3 15.6 0.0 1.3

Representation and warrant y reserve 69.3 39.0 21.4 20.4 10.3

Write down of residual interests 0.8 0.2 2.3 2.4 (3.8)

Total credit related costs: 173.2 111.7 110.9 89.2 275.0

Pre? tax, pre credit? cost income $131.6 $102.5 $41.0 $62.5 $89.7

Note: See Non? GAAP reconciliation on pages 39 ? 41.

Totals may not foot due to rounding

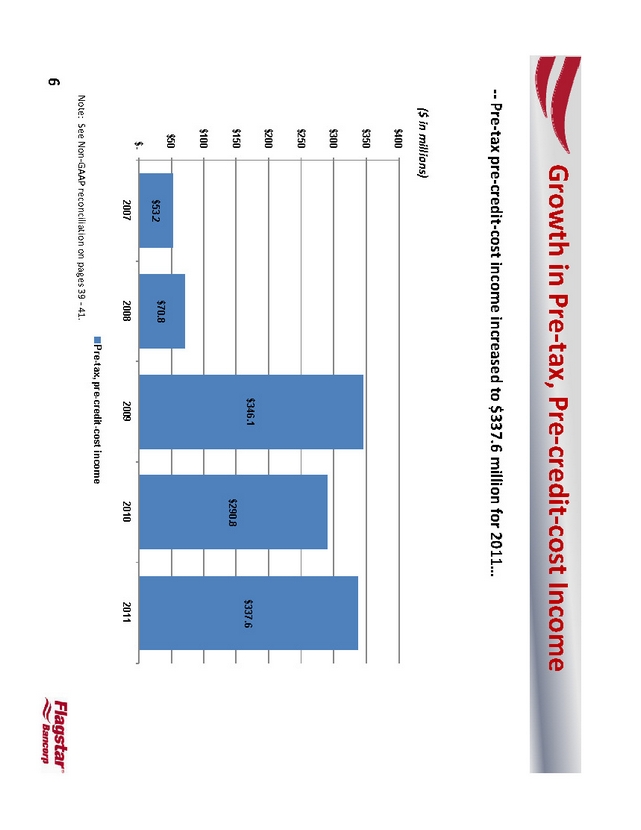

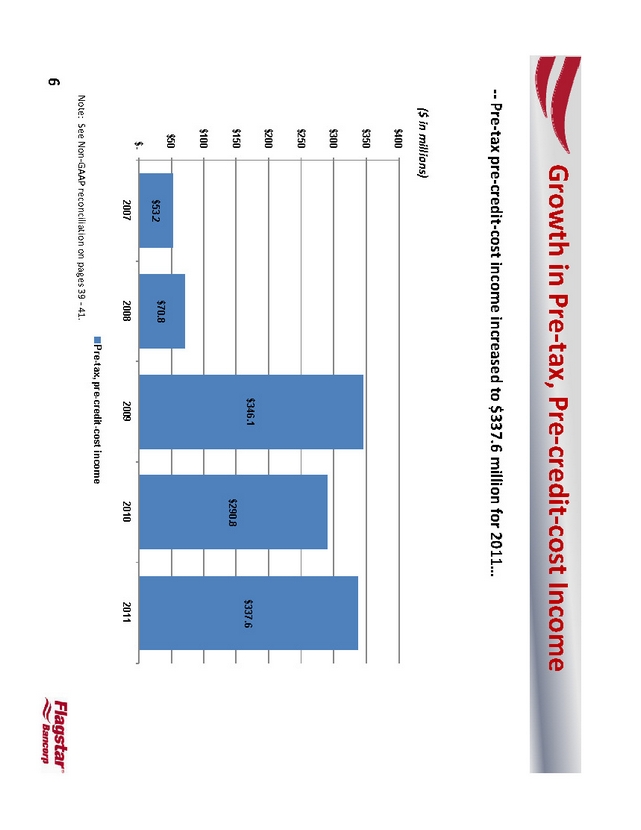

Growth in Pre? tax, Pre? credit? cost Income

?? Pre? tax pre? credit? cost income increased to $337.6 million for 2011…

($ in millions)

$400 $350 $300 $250 $200 $150 $100 $50 $-

$53.2

$70.8

$346.1

$290.8

$337.6

2007 2008 2009 2010 2011

Pre-tax, pre-credit-cost income

Note: See Non? GAAP reconciliation on pages 39 ? 41.

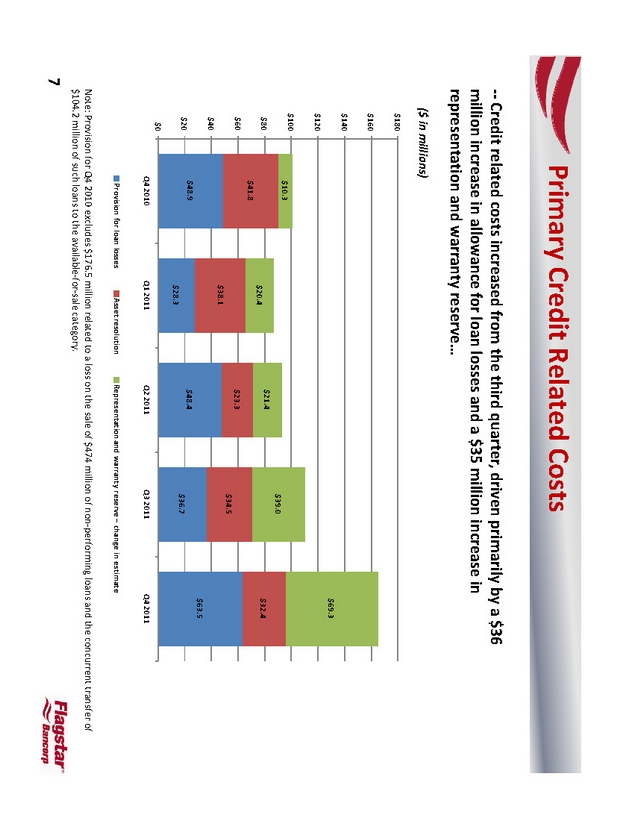

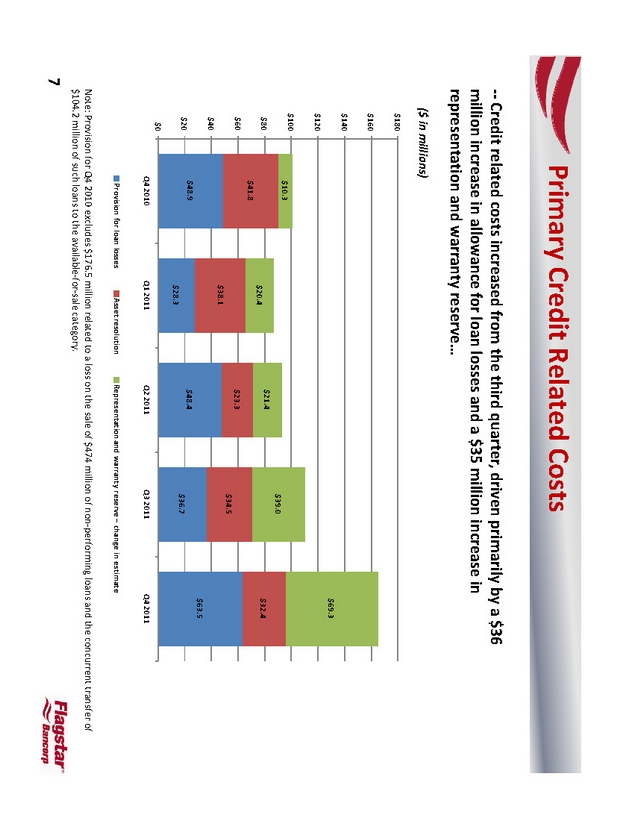

Primary Credit Related Costs

?? Credit related costs increased from the third quarter, driven primarily by a $36 million increase in allowance for loan losses and a $35 million increase in representation and warranty reserve …

($ in millions)

$180 $160 $140 $120 $100 $80 $60 $40 $20 $0

$10.3 $41.8 $48.9

$20.4 $38.1 $28.3

$21.4 $23.3 $48.4

$39.0 $34.5 $36.7

$69.3 $32.4 $63.5

Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

Provision for loan losses

Asset resolution

Representation and warranty reserve – change in estimate

Note: Provision for Q4 2010 excludes $176.5 million related to a loss on the sale of $474 million of non? performing loans and the concurrent transfer of $104.2 million of such loans to the available ? for? sale category.

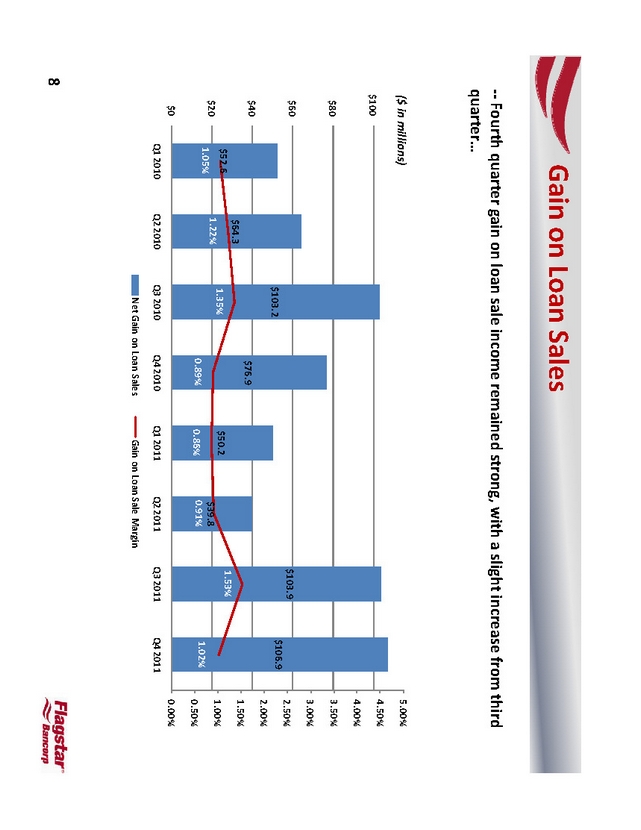

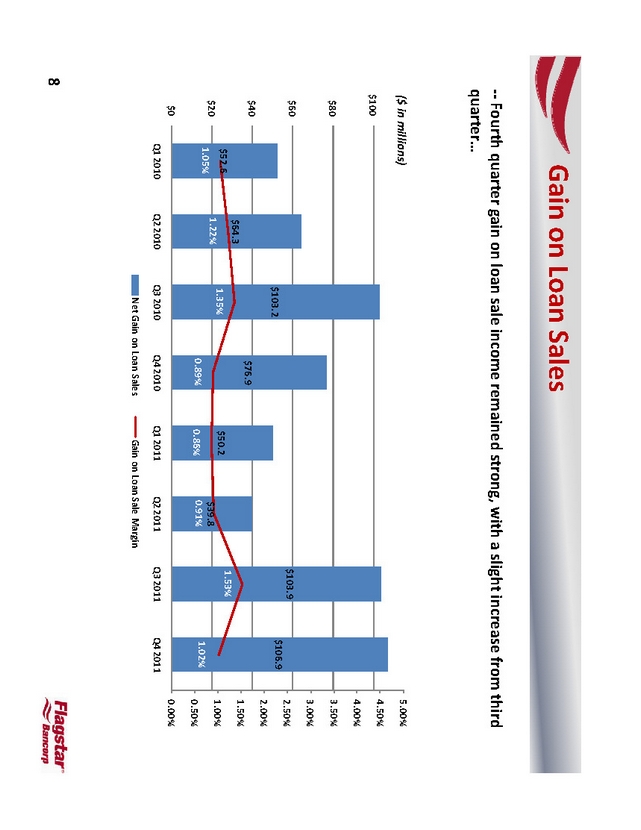

Gain on Loan Sales

?? Fourth quarter gain on loan sale income remained strong, with a slight increase from third quarter …

($ in millions)

$100 $80 $60 $40 $20 $0

$52.6

1.05%

$64.3

1.22%

$103.2

1.35%

$76.9

0.89%

$50.2

0.86%

$39.8 0.91%

$103.9

1.53%

$106.9

1.02%

5.00%

4.50%

4.00%

3.50%

3.00% 2.50% 2.00%

1.50%

1.00%

0.50%

0.00%

Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

Net Gain on Loan Sales

Gain on Loan Sale Margin

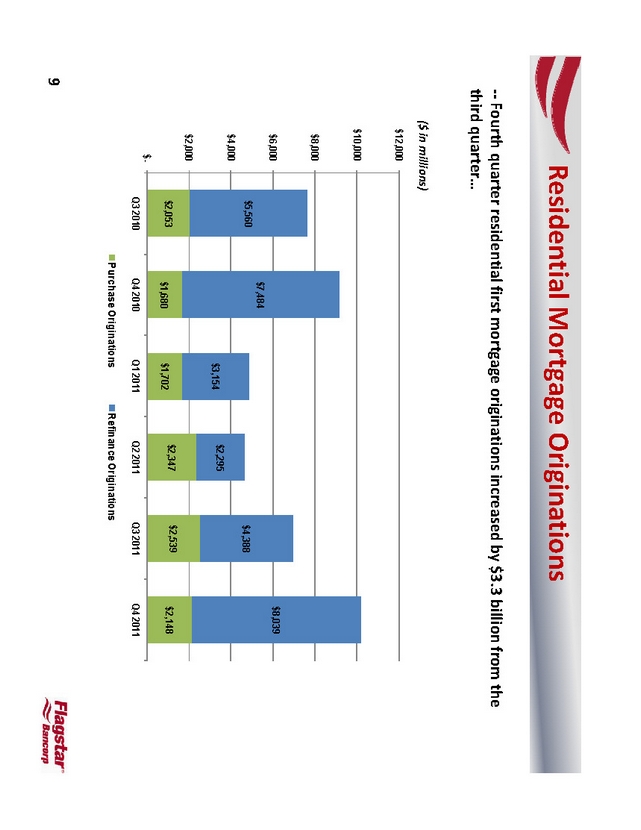

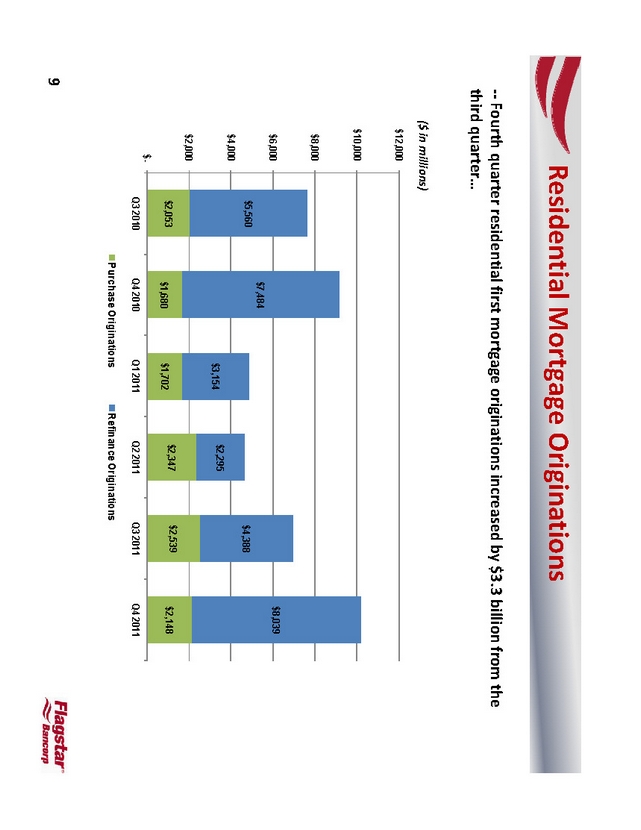

Residential Mortgage Originations

?? Fourth quarter residential first mortgage originations increased by $3.3 billion from the third quarter …

($ in millions)

$12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $-

$5,560

$2,053

$7,484

$1,680

$3,154

$1,702

$2,295

$2,347

$4,388

$2,539

$8,039

$2,148

Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

Purchase Originations

Refinance Originations

9

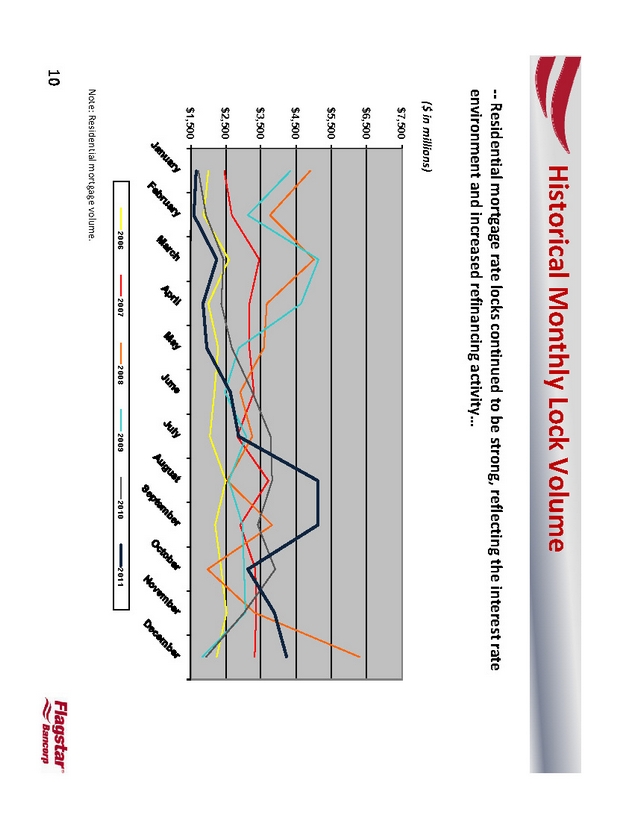

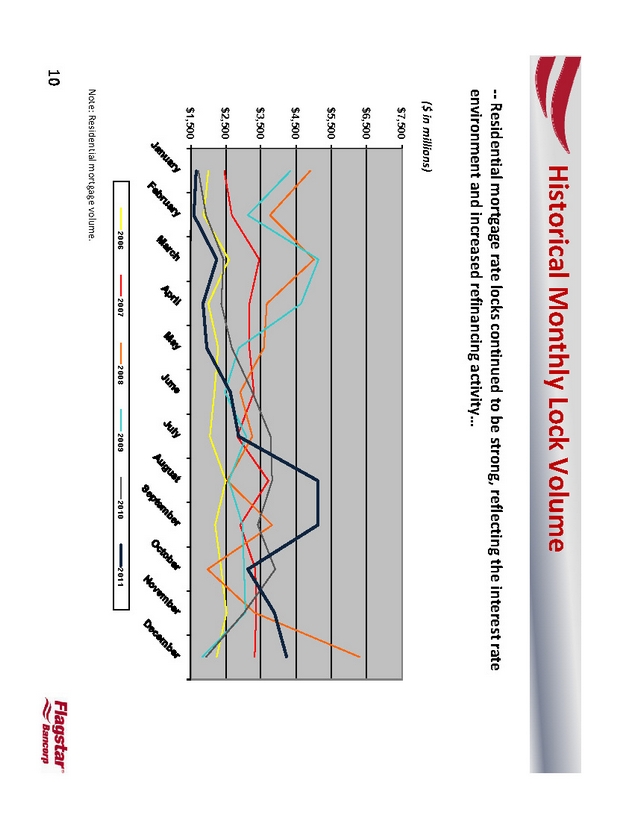

Historical Monthly Lock Volume

?? Residential mortgage rate locks continued to be strong, reflecting the interest rate environment and increased refinancing activity …

($ in millions)

$7,500 $6,500 $5,500 $4,500 $3,500 $2,500 $1,500

2006 2007 2008 2009 2010 2011

Note: Residential mortgage volume.

10

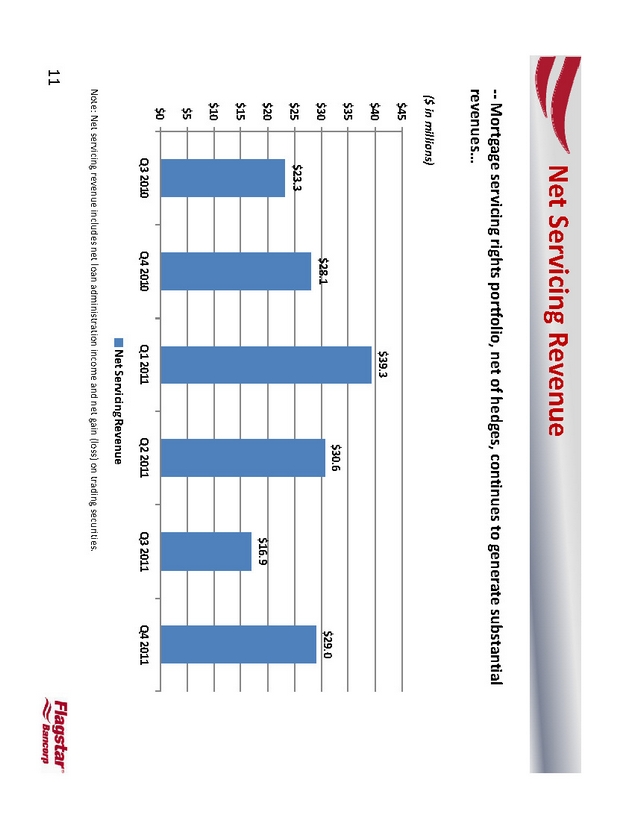

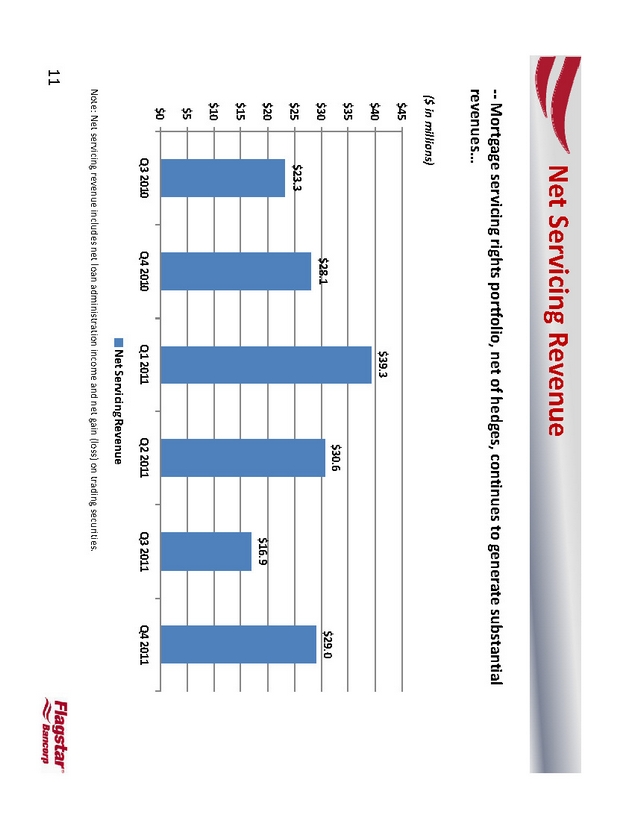

Net Servicing Revenue

?? Mortgage servicing rights portfolio, net of hedges, continues to generate substantial revenues …

($ in millions)

$45 $40 $35 $30 $25 $20 $15 $10 $5 $0

$23.3

$28.1

$39.3

$30.6

$16.9

$29.0

Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

Net Servicing Revenue

Note: Net servicing revenue includes net loan administration income and net gain (loss) on trading securities.

11

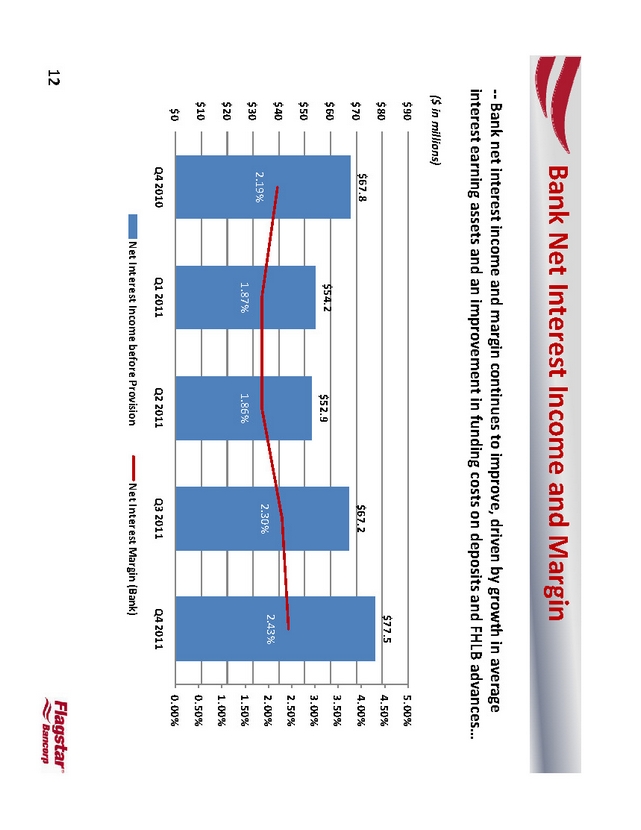

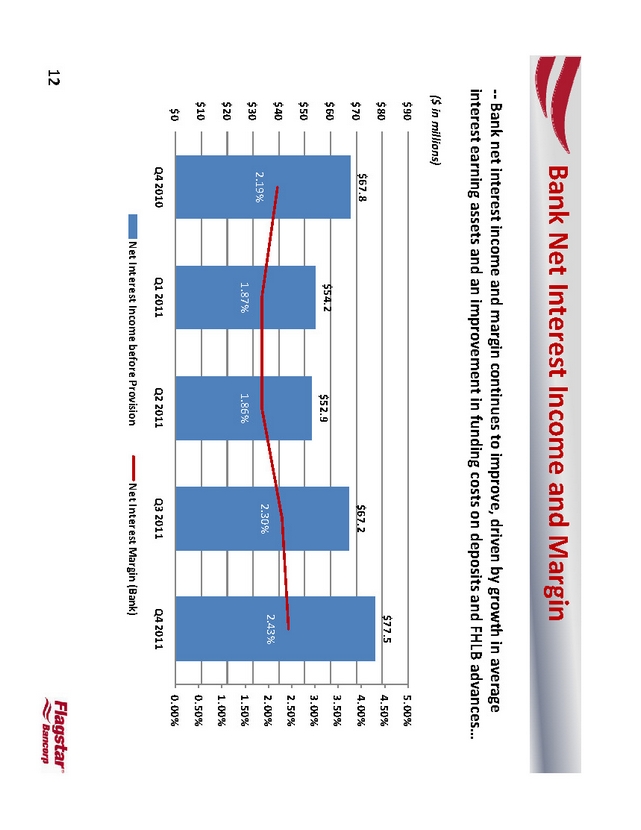

Bank Net Interest Income and Margin

?? Bank net interest income and margin continues to improve, driven by growth in average interest earning assets and an improvement in funding costs on deposits and FHLB advances …

($ in millions)

$90 $80 $70 $60 $50 $40 $30 $20 $10 $0

$67.8

2.19%

$54.2

1.87%

$52.9

1.86%

$67.2

2.30%

$77.5

2.43%

5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011

Net Interest Income before Provision

Net Interest Margin (Bank)

12

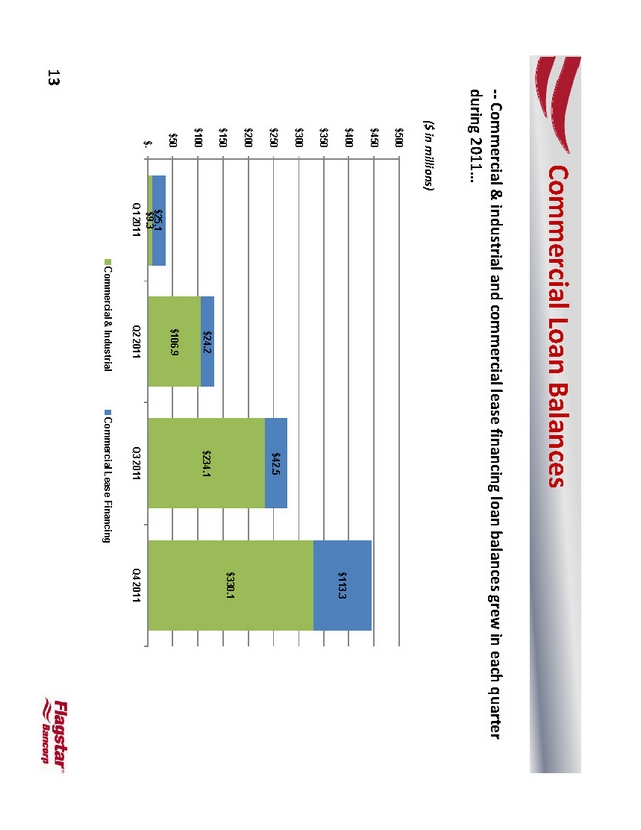

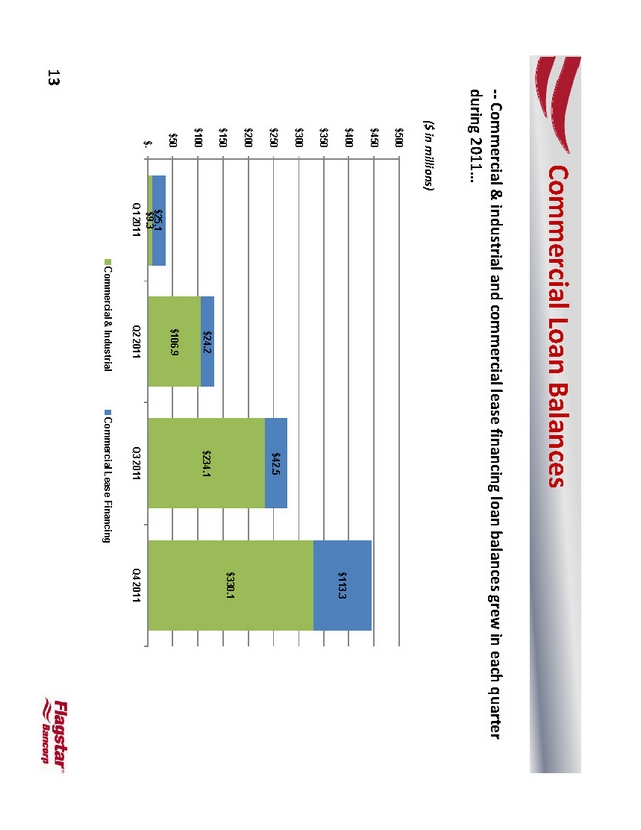

Commercial Loan Balances

?? Commercial & industrial and commercial lease financing loan balances grew in each quarter during 2011…

($ in millions)

$500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $-

$25.1 $9.3 Q1 2011

$24.2 $106.9 Q2 2011

$42.5 $234.1 Q3 2011

$113.3

$330.1

Q4 2011

Commercial & Industrial

Commercial Lease Financing

13

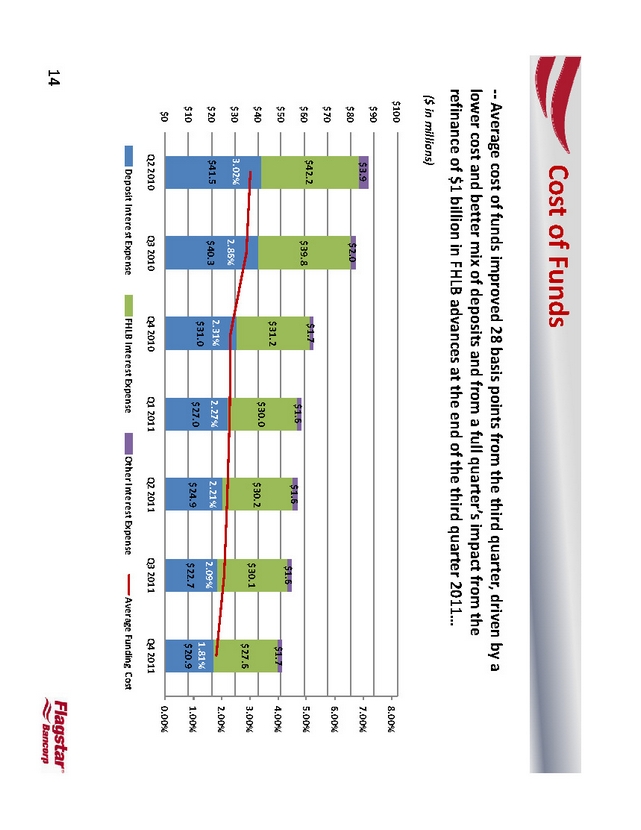

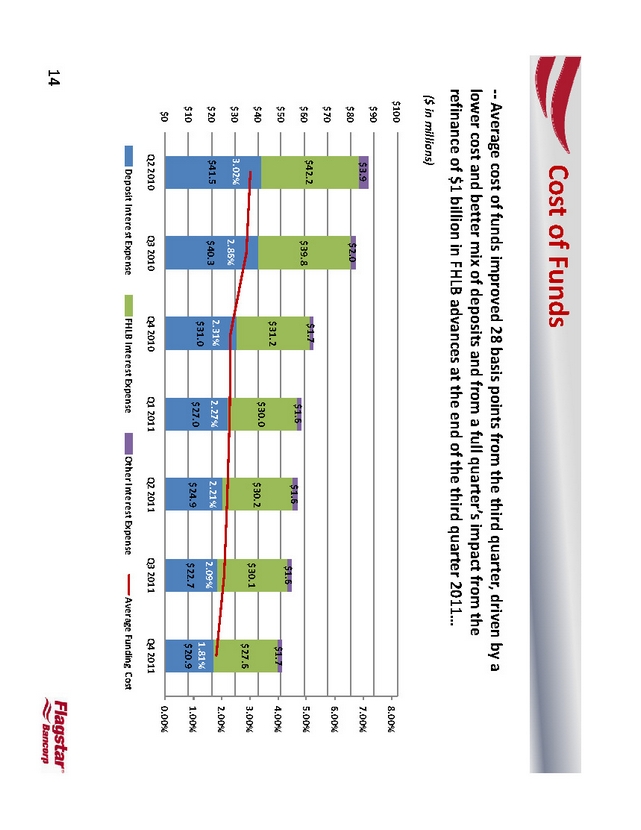

Cost of Funds

?? Average cost of funds improved 28 basis points from the third quarter, driven by a lower cost and better mix of deposits and from a full quarter’s impact from the refinance of $1 billion in FHLB advances at the end of the third quarter 2011…

($ in millions)

$100

$90

$80

$70

$60 $50 $40

$30

$20

$10

$0

$3.9

$42.2

3.02%

$41.5

Q2 2010

$2.0

$39.8

2.86%

$40.3

Q3 2010

$1.7

$31.2

2.31% $31.0

Q4 2010

$1.6

$30.0

2.27%

$27.0

Q1 2011

$1.6

$30.2

2.21%

$24.9

Q2 2011

$1.6

$30.1

2.09%

$22.7

Q3 2011

$1.7

$27.6

1.81% $20.9

Q4 2011

8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00%

Deposit Interest Expense

FHLB Interest Expense

Other Interest Expense

Average Funding Cost

14

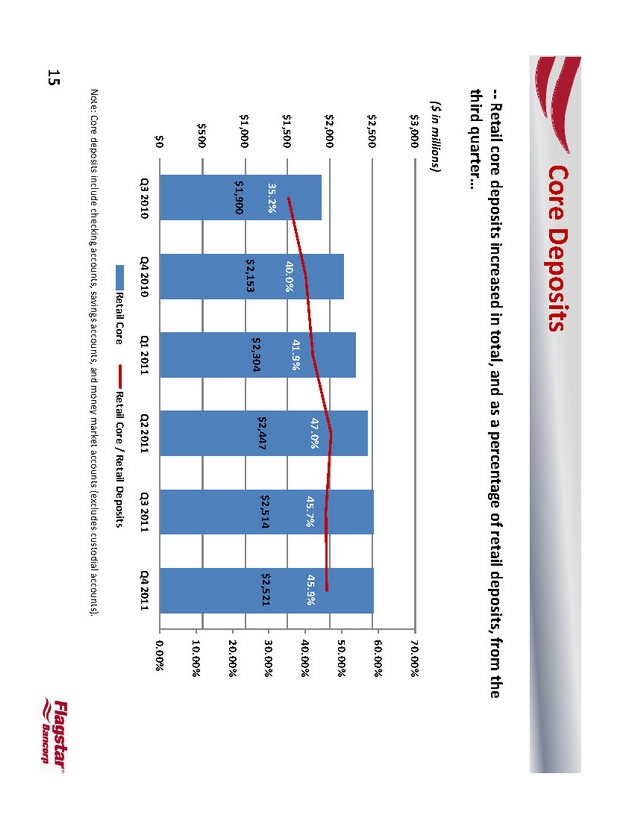

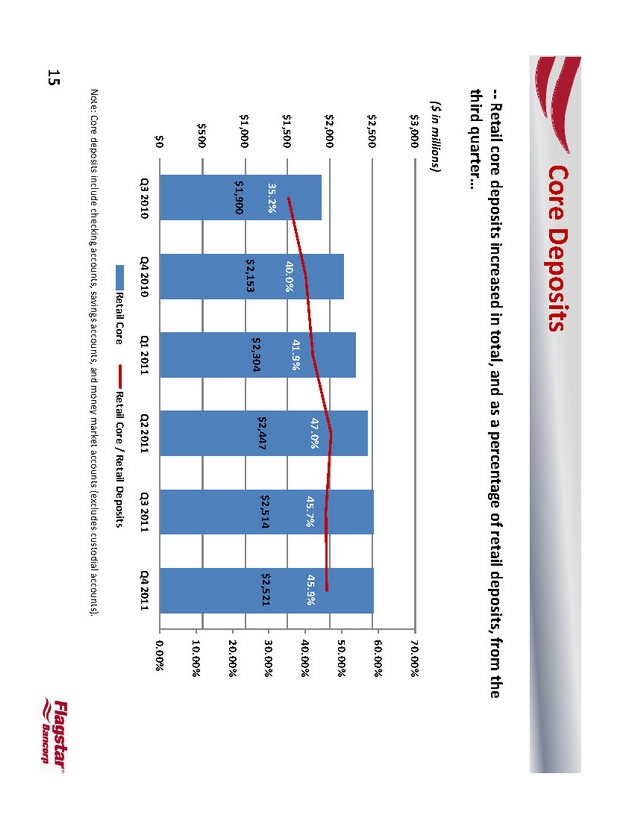

Core Deposits

?? Retail core deposits increased in total, and as a percentage of retail deposits, from the third quarter …

($ in millions)

$3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

35.2%

$1,900

Q3 2010

40.0%

$2,153

Q4 2010

41.9%

$2,304

47.0%

$2,447

45.7%

$2,514

45.9%

$2,521

70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Retail Core

Retail Core / Retail Deposits

Note: Core deposits include checking accounts, savings accounts, and money market accounts (excludes custodial accounts) .

15

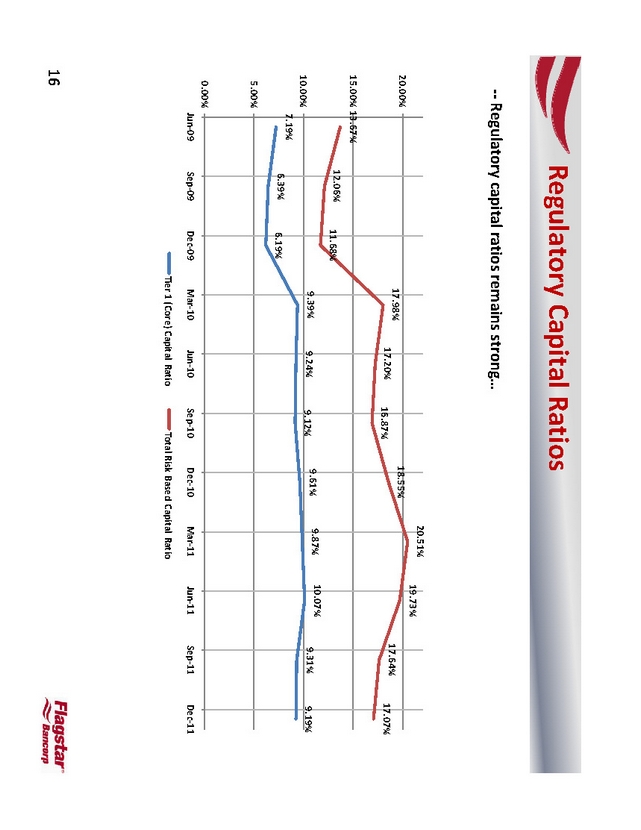

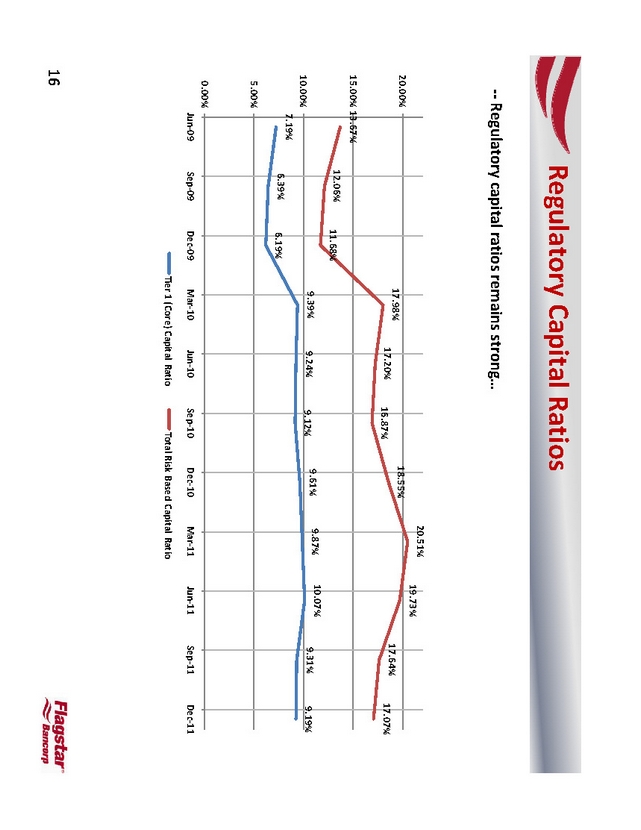

Regulatory Capital Ratios

?? Regulatory capital ratios remains strong…

19.73% 20.00% 18.55%

17.98% 17.20% 17.64%

16.87% 17.07%

15.00% 13.67%

12.06% 11.68%

9.87% 10.07%

9.39% 9.24% 9.61% 9.31%

9.12% 9.19% 10.00% 7.19% 6.39% 6.19%

5.00%

0.00%

Jun? 09 Sep? 09 Dec? 09 Mar? 10 Jun? 10 Sep? 10 Dec? 10 Mar? 11 Jun? 11 Sep? 11 Dec? 11

Tier 1 (Core) Capital Ratio Total Risk Based Capital Ratio

16

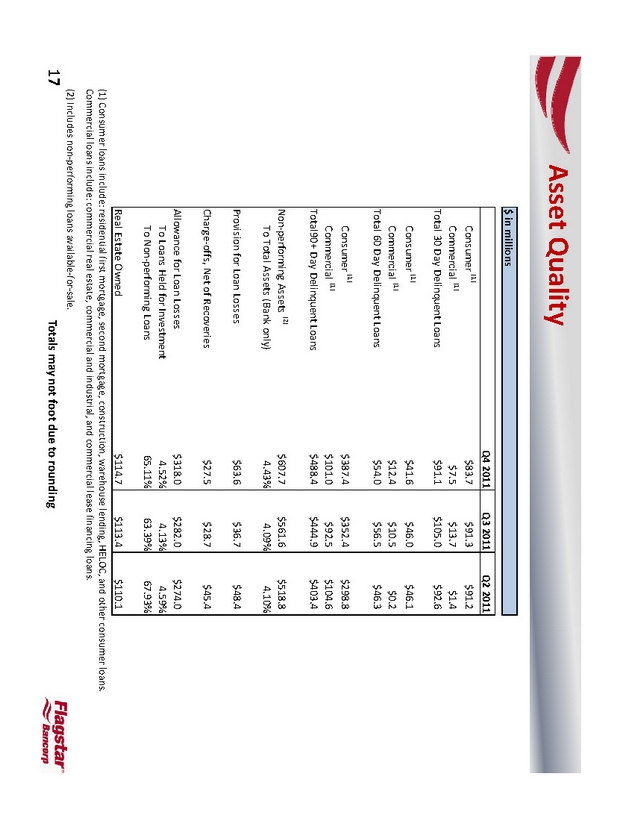

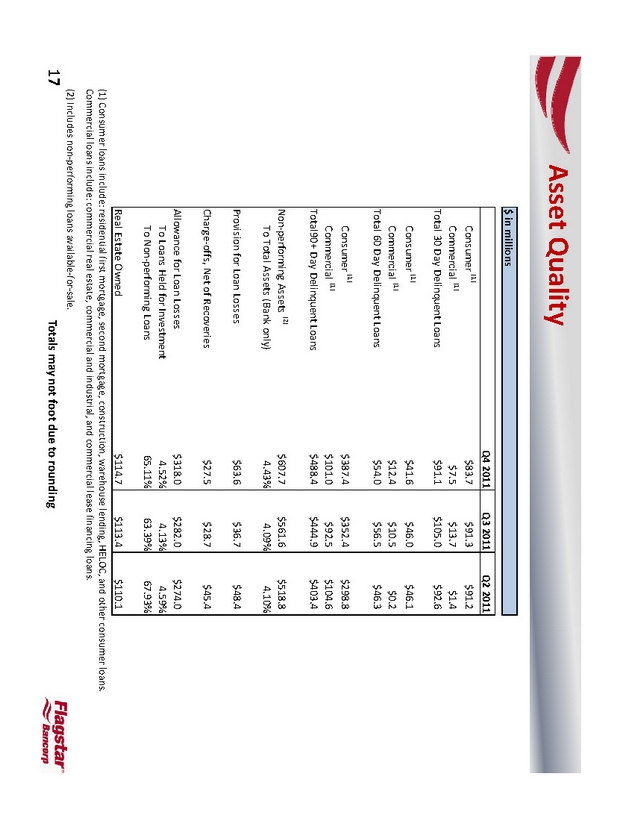

Asset Quality

$ in millions

Q4 2011 Q3 2011 Q2 2011

Consumer (1) $83.7 $91.3 $91.2

Commercial (1) $7.5 $13.7 $1.4

Total 30 Day Delinquent Loans $91.1 $105.0 $92.6

Consumer (1) $41.6 $46.0 $46.1

Commercial (1) $12.4 $10.5 $0.2

Total 60 Day Delinquent Loans $54.0 $56.5 $46.3

Consumer (1) $387.4 $352.4 $298.8

Commercial (1) $101.0 $92.5 $104.6

Total90+ Day Delinquent Loans $488.4 $444.9 $403.4

Non? performing Assets (2) 8 518. 607. 561. 7 6 $ $ $

To Total Assets (Bank only) 4.43% 4.09% 4.10%

Provision for Loan Losses $63.6 $36.7 $48.4

Charge? offs, Net of Recoveries $27.5 $28.7 $45.4

Allowance for Loan Losses $318.0 $282.0 $274.0

To Loans Held for Investment 4.52% 4.13% 4.59%

To Non? performing Loans 65.11% 63.39% 67.93%

Real Estate Owned $114. $113.110. 4 7 1 $

(1) Consumer loans include: residential first mortgage, second mortgage, construction, warehouse lending, HELOC, and other consumer loans. Commercial loans include: commercial real estate, commercial and industrial, and commercial lease financing loans.

(2) | | Includes non? performing loans available ? for? sale. |

Totals may not foot due to rounding

17

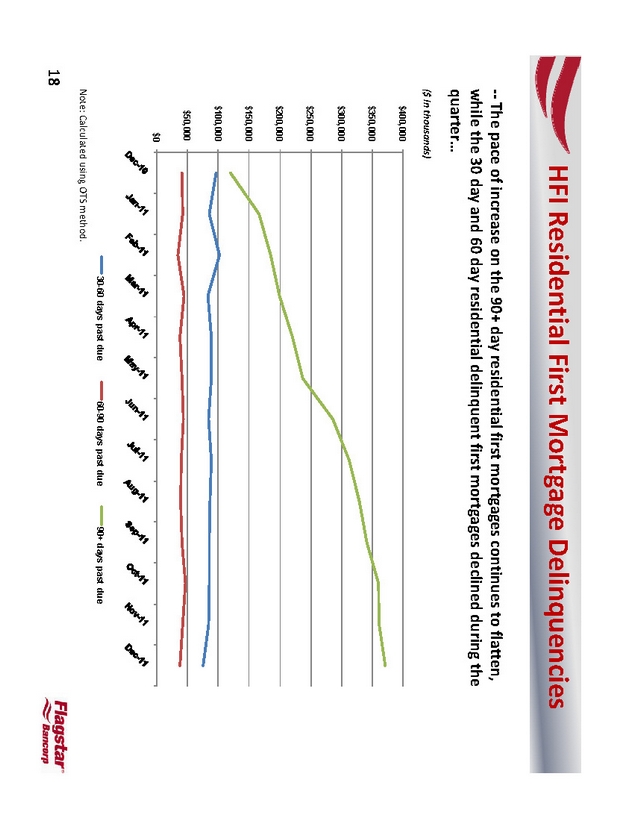

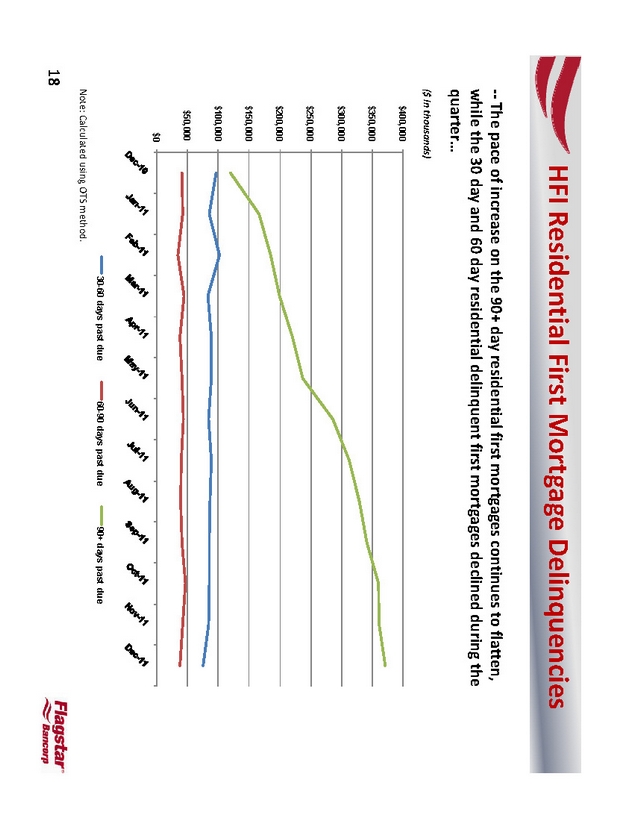

HFI Residential First Mortgage Delinquencies

?? The pace of increase on the 90+ day residential first mortgages continues to flatten, while the 30 day and 60 day residential delinquent first mortgages declined during the quarter …

($ in thousands)

$400,000 $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0

30-60 days past due 60-90 days past due 90+ days past due

Note: Calculated using OTS method.

18

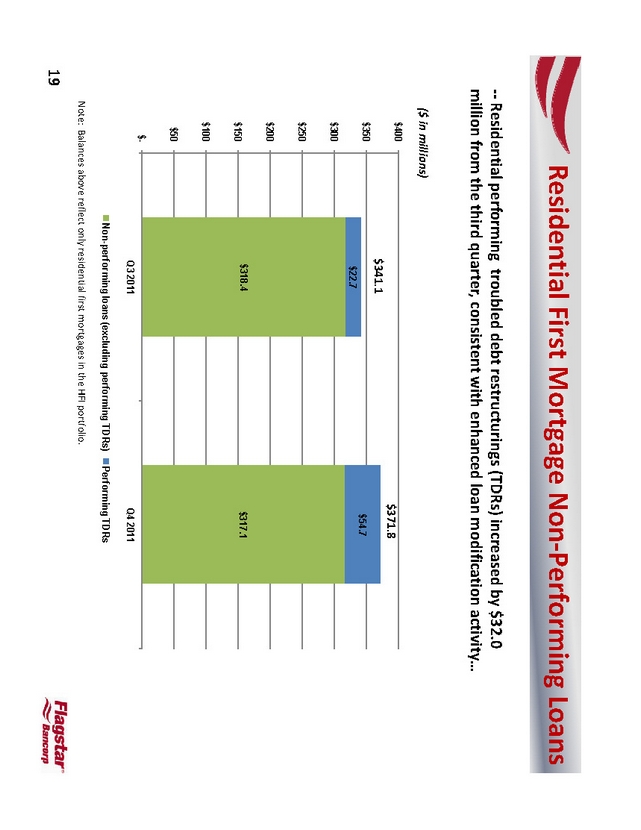

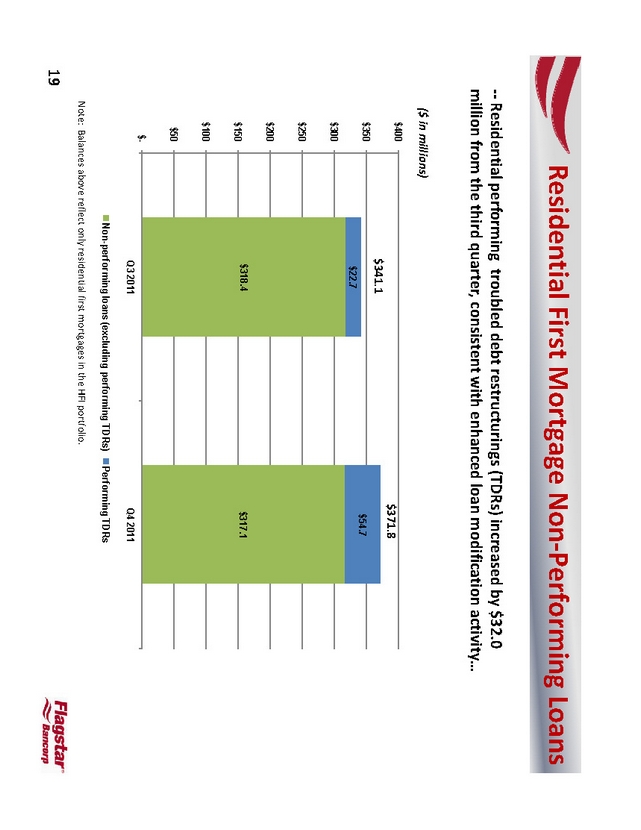

Residential First Mortgage Non? Performing Loans

?? Residential performing troubled debt restructurings (TDRs) increased by $32.0 million from the third quarter, consistent with enhanced loan modification activity …

($ in millions)

$400 $350 $300 $250 $200 $150 $100 $50 $-

$341.1

$22.7

$318.4

Q3 2011

$371.8

$54.7

$317.1

Q4 2011

Non-performing loans (excluding performing TDRs) Performing TDRs

Note: Balances above reflect only residential first mortgages in the HFI portfolio.

19

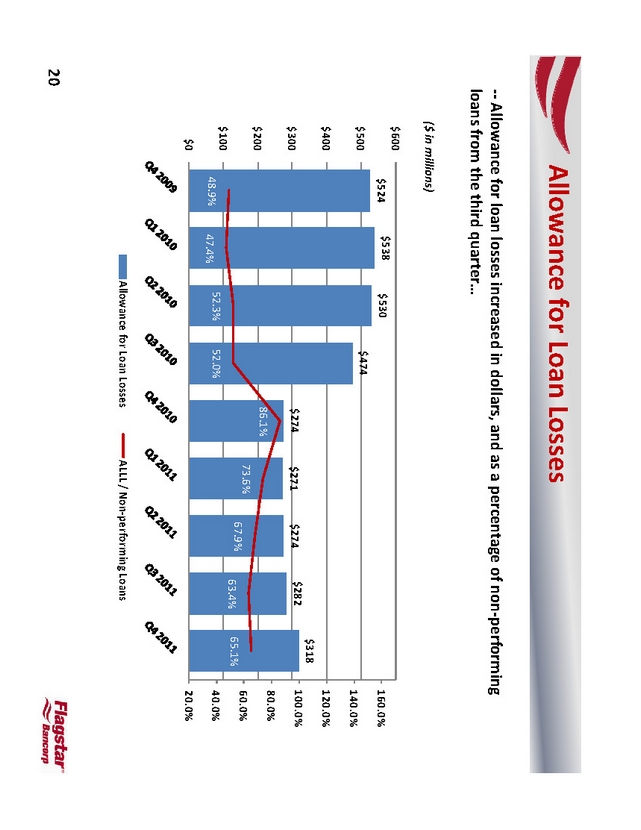

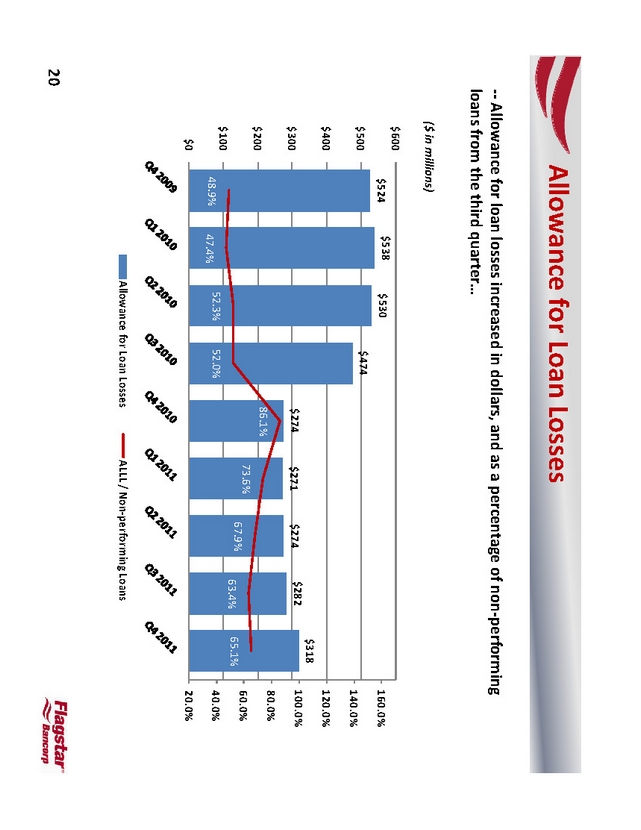

Allowance for Loan Losses

?? Allowance for loan losses increased in dollars, and as a percentage of non? performing loans from the third quarter …

($ in millions)

$600 $500 $400 $300 $200 $100 $0

$538 $530 $524 160.0% $474 140.0%

120.0% $318 $274 $274 $282 100.0% $271

80.0%

86.1%

73.6% 60.0% 67.9% 65.1% 63.4% 52.3% 52.0% 40.0% 48.9% 47.4%

20.0%

Allowance for Loan Losses ALLL / Non? performing Loans

20

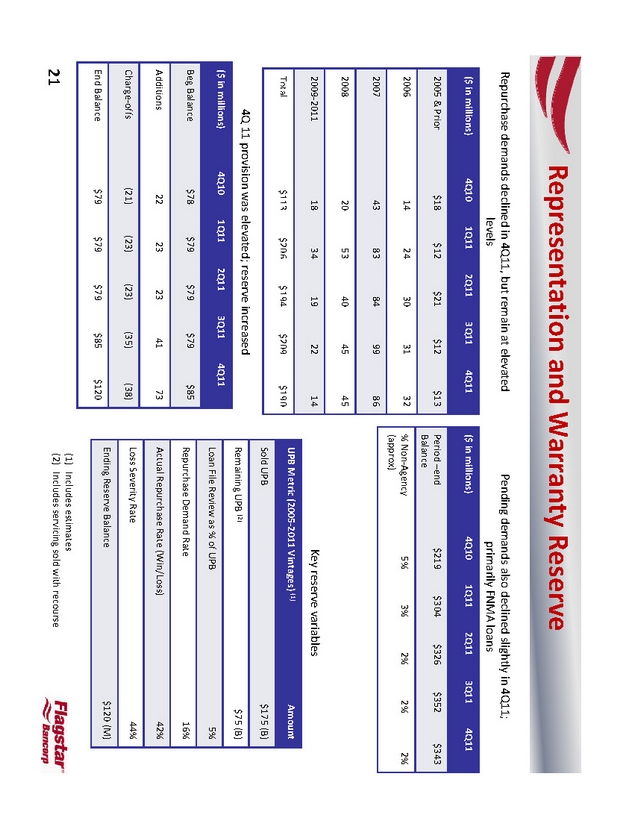

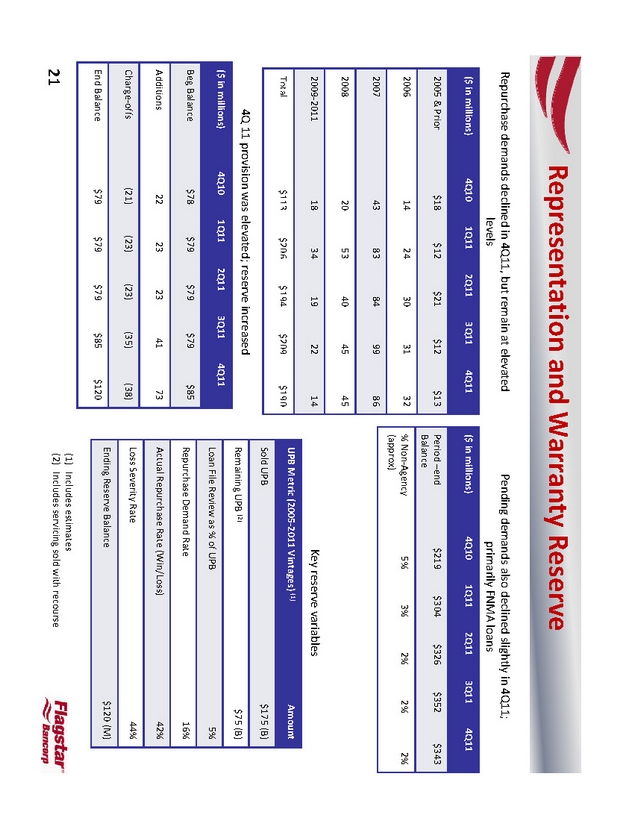

Representation and Warranty Reserve

Repurchase demands declined in 4Q11, but remain at elevated levels

($ in millions) 4Q10 1Q11 2Q11 3Q11 4Q11

2005 & Prior $18 $12 $21 $12 $13

2006 14 24 30 31 32

2007 43 83 84 99 86

2008 20 53 40 45 45

2009? 2011 18 34 19 22 14

Total $113 $206 $194 $209 $190

4Q 11 provision was elevated; reserve increased

($ in millions) 4Q10 1Q11 2Q11 3Q11 4Q11

Beg Balance $78 $79 $79 $79 $85

Additions 22 23 23 41 73

Charge? offs (21) (23) (23) (35) (38)

End Balance $79 $79 $79 $85 $120

21

Pending demands also declined slightly in 4Q11;

primarily FNMA loans

($ in millions) 4Q10 1Q11 2Q11 3Q11 4Q11

Period –end $219 $304 $326 $352 $343

Balance

% Non? Agency 5% 3% 2% 2% 2%

(approx)

Key reserve variables

UPB Metric (2005? 2011 Vintages) (1) Amount

Sold UPB $175 (B)

Remaining UPB (2) $75 (B)

Loan File Review as % of UPB 5%

Repurchase Demand Rate 16%

Actual Repurchase Rate (Win/Loss) 42%

Loss Severity Rate 44%

Ending Reserve Balance $120 (M)

(2) | | Includes servicing sold with recourse |

Appendix

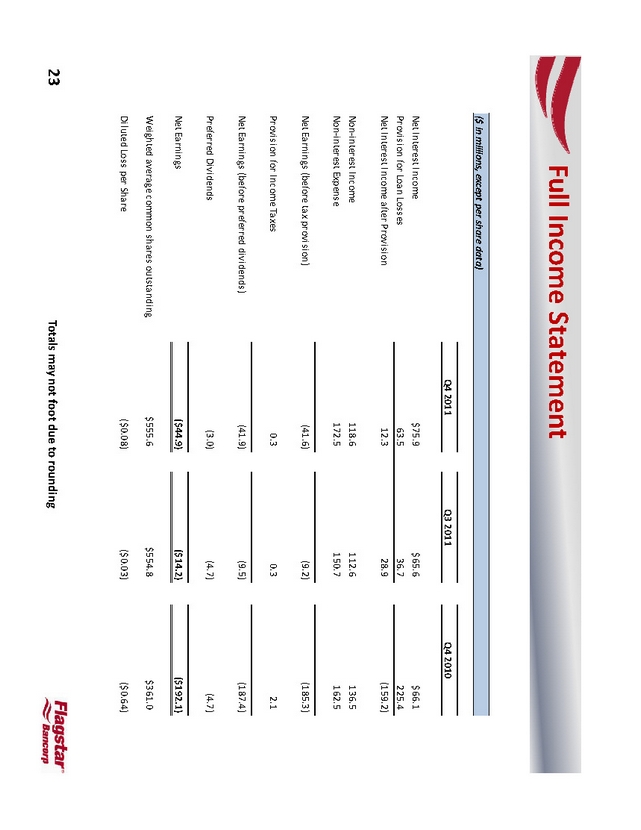

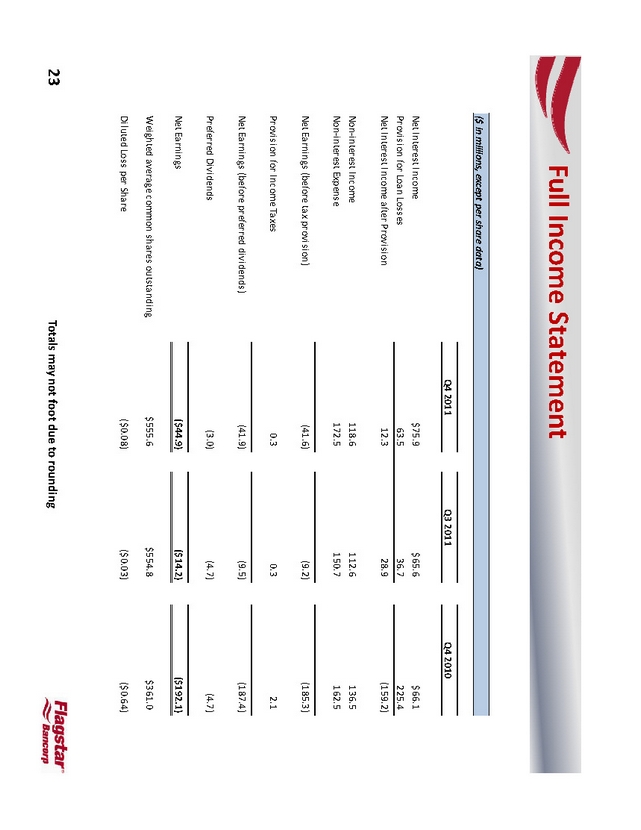

Full Income Statement

($ in millions, except per share data)

Q4 2011 Q3 2011 Q4 2010

Net Interest Income $75.9 $65.6 $66.1

Provision for Loan Losses 63.5 36.7 225.4

Net Interest Income after Provision 12.3 28.9 (159.2)

Non? interest Income 118.6 112.6 136.5

Non? interest Expense 172.5 150.7 162.5

Net Earnings (before tax provision) (41.6) (9.2) (185.3)

Provision for Income Taxes 0.3 0.3 2.1

Net Earnings (before preferred dividends) (41.9) (9.5) (187.4)

Preferred Dividends (3.0) (4.7) (4.7)

Net Earnings ($44.9) ($14.2) ($192.1)

Weighted average common shares outstanding $555.6 $554.8 $361.0

Diluted Loss per Share ($0.08) ($0.03) ($0.64)

23

Totals may not foot due to rounding

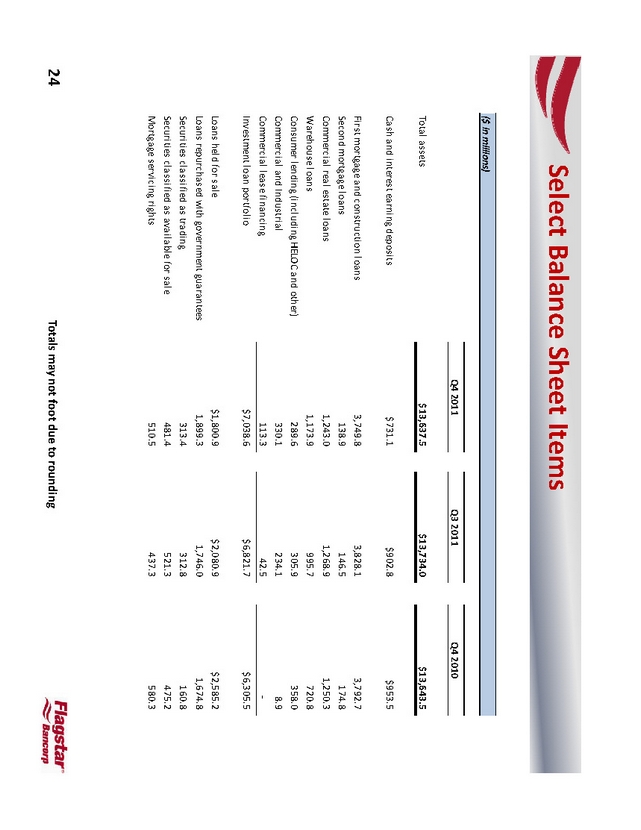

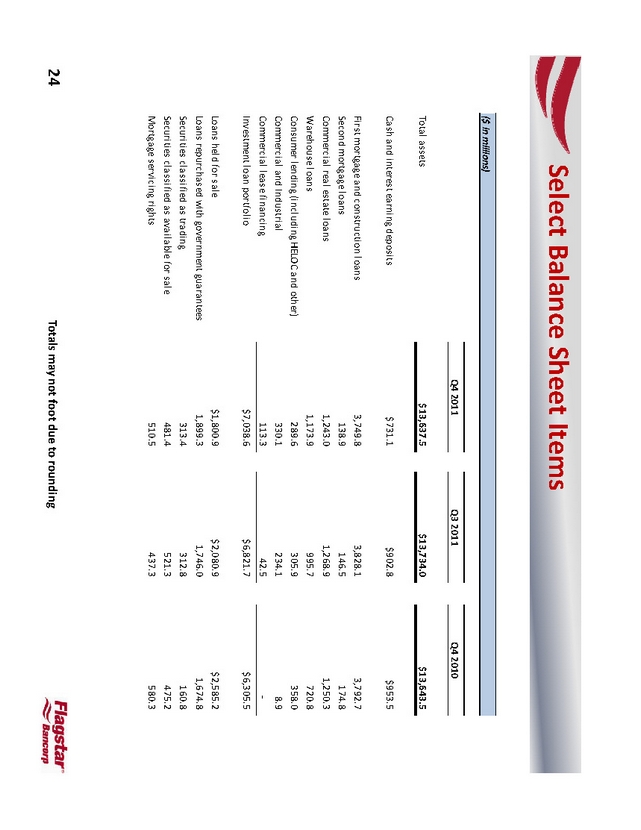

Select Balance Sheet Items

($ in millions)

Q4 2011 Q3 2011 Q4 2010

Total assets $13,637.5 $13,734.0 $13,643.5

Cash and interest earning deposits $731.1 $902.8 $953.5

First mortgage and construction loans 3,749.8 3,828.1 3,792.7

Second mortgage loans 138.9 146.5 174.8

Commercial real estate loans 1,243.0 1,268.9 1,250.3

Warehouse loans 1,173.9 995.7 720.8

Consumer lending (including HELOC and other) 289.6 305.9 358.0

Commercial and Industrial 9 234. 8. 1 1 330.

Commercial lease financing 113.3 42.5

Investment loan portfolio $7,038.6 $6,821.7 $6,305.5

Loans held for sale $1,800.9 $2,080.9 $2,585.2

Loans repurchased with government guarantees 1,8997461, .1, .3 .6748 0

Securities classified as trading 313.4 312.8 160.8

Securities classified as available for sale 481.4 521.3 475.2

Mortgage servicing rights 510.5 437.3 580.3

24

Totals may not foot due to rounding

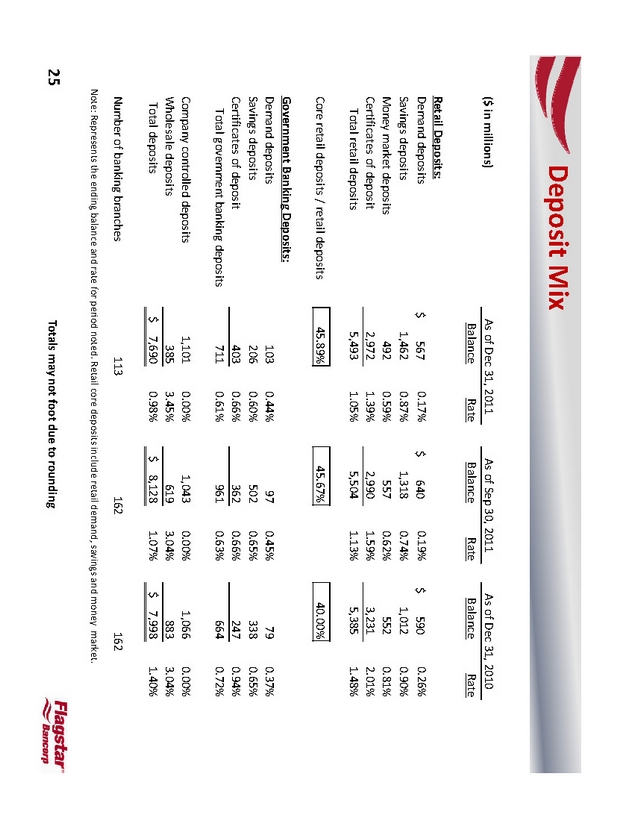

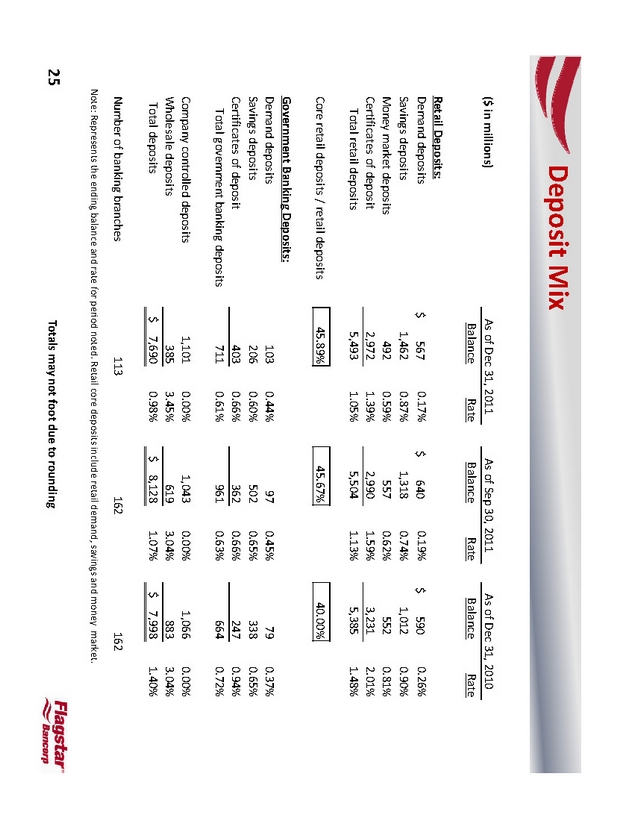

Deposit Mix

($ in millions) As of Dec 31, 2011 As of Sep 30, 2011 As of Dec 31, 2010

Balance Rate Balance Rate Balance Rate

Retail Deposits:

Demand deposits $ 567 0.17% $ 640 0.19% $ 590 0.26%

Savings deposits 1,462 0.87% 1,318 0.74% 1,012 0.90%

Money market deposits 492 0.59% 557 0.62% 552 0.81%

Certificates of deposit 2,972 1.39% 2,990 1.59% 3,231 2.01%

Total retail deposits 5,493 1.05% 5,504 1.13% 5,385 1.48%

Core retail deposits / retail deposits 45.89% 45.67% 40.00%

Government Banking Deposits:

Demand deposits 103 0.44% 97 0.45% 79 0.37%

Savings deposits 206 0.60% 502 0.65% 338 0.65%

Certificates of deposit 403 0.66% 362 0.66% 247 0.94%

Total government banking deposits 711 0.61% 961 0.63% 664 0.72%

Company controlled deposits 1,101 0.00% 1,043 0.00% 1,066 0.00%

Wholesale deposits 385 3.45% 619 3.04% 883 3.04%

Total deposits $ 7,690 0.98% $ 8,128 1.07% $ 7,998 1.40%

Number of banking branches 113 162 162

Note: Represents the ending balance and rate for period noted. Retail core deposits include retail demand, savings and money market.

Totals may not foot due to rounding

25

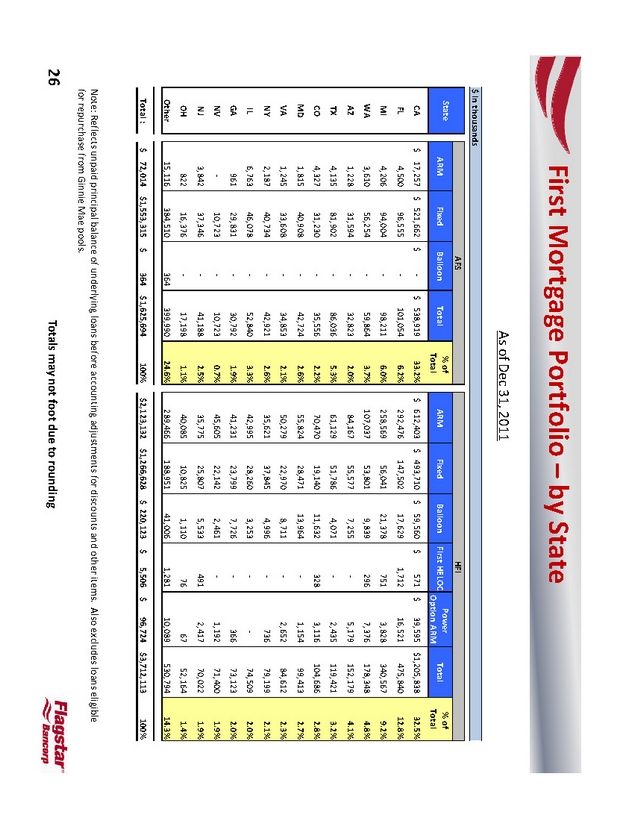

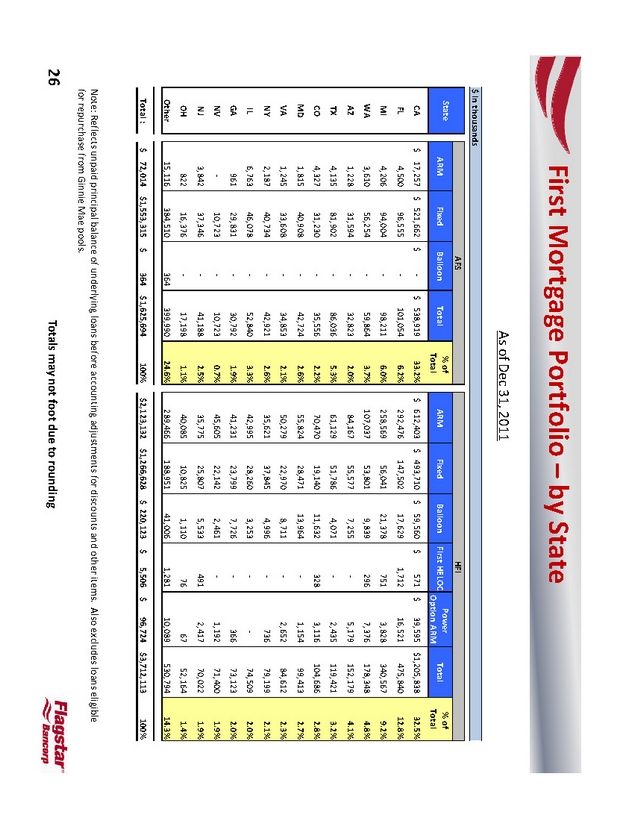

First Mortgage Portfolio – by State

As of Dec 31, 2011

$ in thousands

AFS HFI

State % of Power % of ARM Fixed Balloon Total ARM Fixed Balloon First HELOC Total Total Option ARM Total

CA $ 17,257 $ 521,662 $ $ ?538,919 33.2% $ 612,403 $ 493,710 $ 59,560 $ 571 $ 39,595 $ 1,205,838 32.5% FL 4,500 96,555 101,054 ? 6.2% 292,476 147,502 17,629 1,712 16,521 475,840 12.8% MI 4,206 94,004 98,211 ? 6.0% 258,569 56,041 21,378 751 3,828 340,567 9.2% WA 3,610 56,254 59,864 ? 3.7% 107,037 53,801 9,839 296 7,376 178,348 4.8% AZ 1,228 31,594 32,823 ? 2.0% 84,167 55,577 7,255 5,179 ? 152,179 4.1% TX 4,135 81,902 86,036 ? 5.3% 61,129 51,786 4,071 2,435 ? 119,421 3.2% CO 4,327 31,230 35,556 ? 2.2% 70,470 19,140 11,632 328 3,116 104,686 2.8% MD 1,815 40,908 42,724 ? 2.6% 55,824 28,471 13,964 1,154 ? 99,413 2.7% VA 1,245 33,608 34,853 ? 2.1% 50,279 22,970 8,711 2,652 ? 84,612 2.3% NY 2,187 40,734 42,921 ? 2.6% 35,621 37,845 4,996 736 ? 79,199 2.1% IL 6,763 46,078 52,840 ? 3.3% 42,995 28,260 3,253 ? 74,509 2.0% ?GA 961 29,831 30,792 ? 1.9% 41,231 23,799 7,726 366 ? 73,123 2.0% NV ? 10,723 10,723 ? 0.7% 45,605 22,142 2,461 1,192 ? 71,400 1.9% NJ 3, 842 37, 346 ? 41, 188 2.5% 35, 775417 5, 2, 25, 807 022 70, 533 491 1.9% OH 822 16,376 17,198 ? 1.1% 40,085 10,825 1,110 76 67 52,164 1.4% Other 15,116 384,510 364 399,990 24.6% 289,466 188,951 41,006 1,281 10,089 530,794 14.3%

Total : $ 72,014 $1,553,315 $ 364 $ 1,625,694 100% $ 2,123,132 $1,266,628 $ 220,123 $ 5,506 $ 96,724 $ 3,712,113 100%

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes loans eligible for repurchase from Ginnie Mae pools.

26

Totals may not foot due to rounding

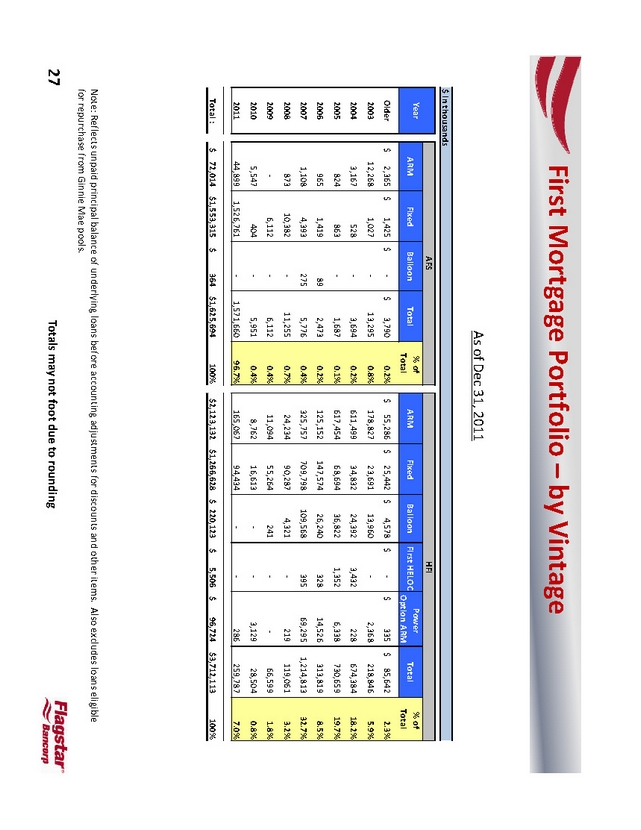

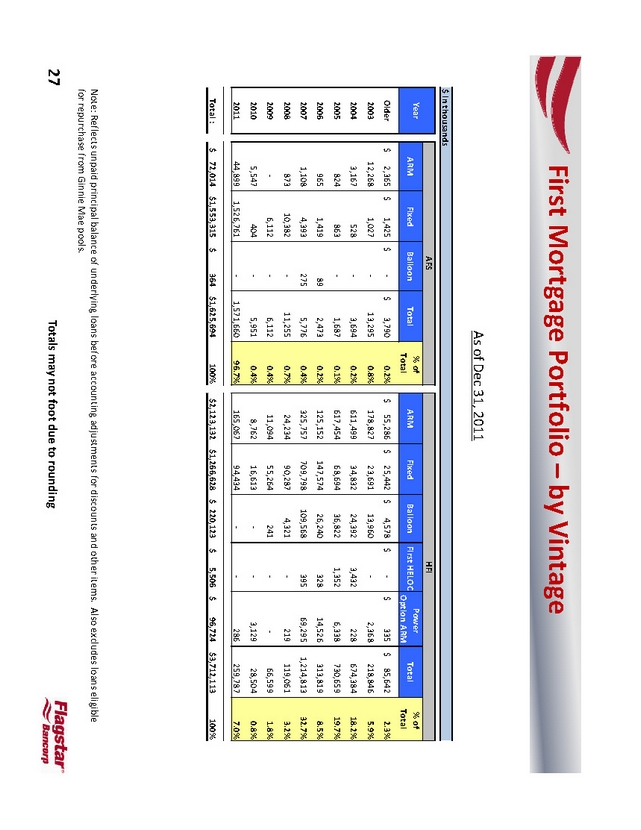

First Mortgage Portfolio – by Vintage

As of Dec 31, 2011

$ in thousands

AFS HFI

Year % of Power % of

ARM Fixed Balloon Total ARM Fixed Balloon First HELOC Total

Total Option ARM Total

Older $ 2,365 $ 1,425 $ $ 3,790 ? 0.2% $ 55,286 $ 25,442 $ 4,578 $ $ ? 335 $ 85,642 2.3%

2003 12,268 1,027 13,295 ? 0.8% 178,827 23,691 13,960 2,368 ? 218,846 5.9%

2004 3,167 528 3,694 0.2% ? 611,499 34,832 24,392 3,432 228 674,384 18.2%

2005 824 863 1,687 0.1% ? 617,454 68,694 36,822 1,352 6,338 730,659 19.7%

2006 965 1,419 89 2,473 0.2% 125,152 147,574 26,240 328 14,526 313,819 8.5%

2007 1,108 4,393 275 5,776 0.4% 325,757 709,798 109,568 395 69,295 1,214,813 32.7%

2008 873 10,382 11,255 ? 0.7% 24,234 90,287 4,321 219 ? 119,061 3.2%

2009 ? 6,112 6,112 ? 0.4% 11,094 55,264 241 ?66,599 1.8% ?

2010 5,547 404 5,951 0.4% ? 8,762 16,613 ? 3,129 ? 28,504 0.8%

2011 44,899 1,526,761 ? 1,571,660 96.7% 165,067 94,434 ? 286 259,787 ? 7.0%

Total : $ 72,014 $1,553,315 $ 364 $ 1,625,694 100% $ 2,123,132 $1,266,628 $ 220,123 $ 5,506 $ 96,724 $ 3,712,113 100%

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes loans eligible for repurchase from Ginnie Mae pools.

Totals may not foot due to rounding

27

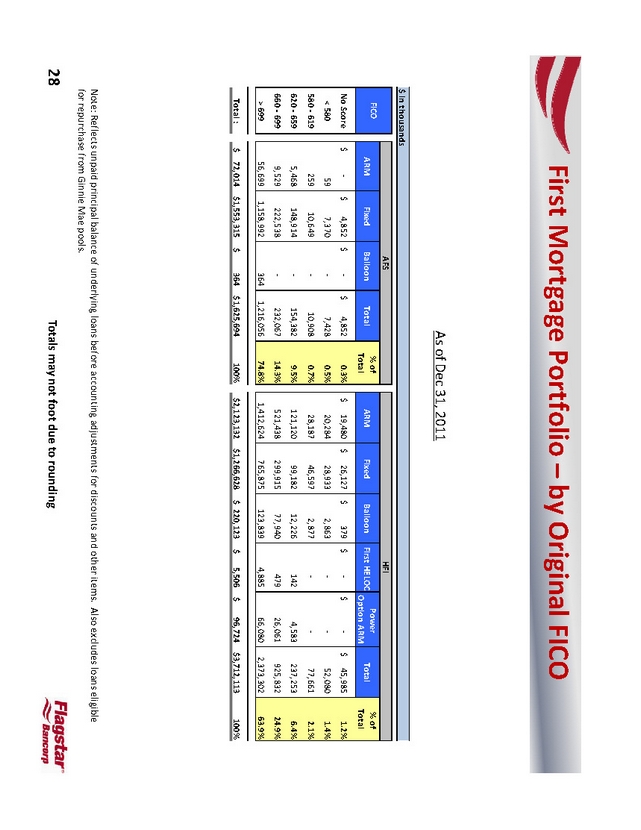

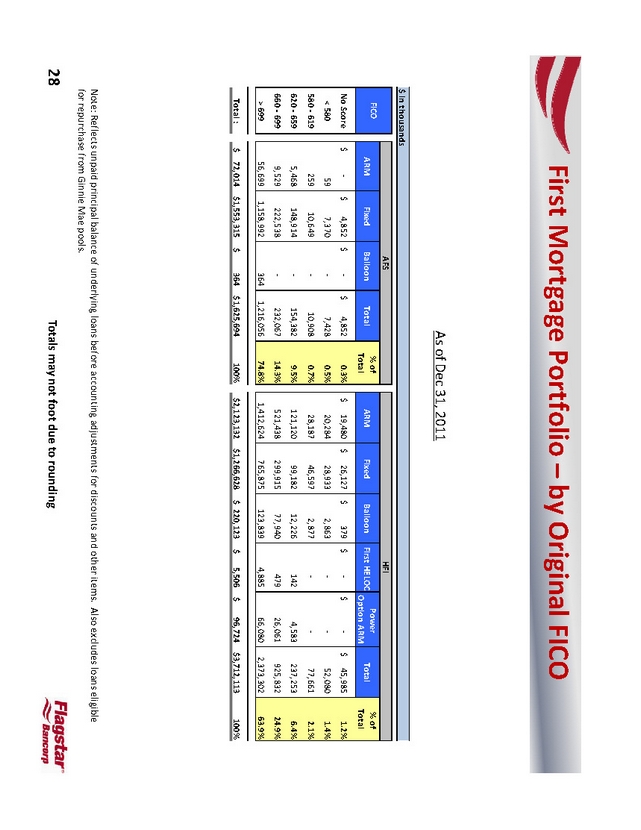

First Mortgage Portfolio – by Original FICO

, As of Dec 31 2011

$ in thousands

AFS HFI

FICO % of Power % of

ARM Fixed Balloon Total ARM Fixed Balloon First HELOC Total

Total Option ARM Total

No Score $ ? $ 4,852 $ $ 4,852 ? 0.3% $ 19,480 $ 26,127 $ 379 $ $ ?$ 45,985 ? 1.2%

< 580 59 7,370 7,428 ? 0.5% 20,284 28,933 2,863 ? 52,080 1.4% ?

580 ? 619 259 10,649 10,908 ? 0.7% 28,187 46,597 2,877 ? 77,661 2.1% ?

620 ? 659 5,468 148,914 154,382? 9.5% 121,120 99,182 12,226 142 4,583 237,253 6.4%

660 ? 699 9, 529 222, 538 232, ?067 14.3% 438 521, 299, 26, 77, 061 940 832 915 925, 479 24.9%

> 699 56,699 1,158,992 364 1,216,056 74.8% 1,412,624 765,875 123,839 4,885 66,080 2,373,302 63.9%

Total : $ 72,014 $1,553,315 $ 364 $ 1,625,694 100% $ 2,123,132 $1,266,628 $ 220,123 $ 5,506 $ 96,724 $ 3,712,113 100%

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes loans eligible for repurchase from Ginnie Mae pools.

Totals may not foot due to rounding

28

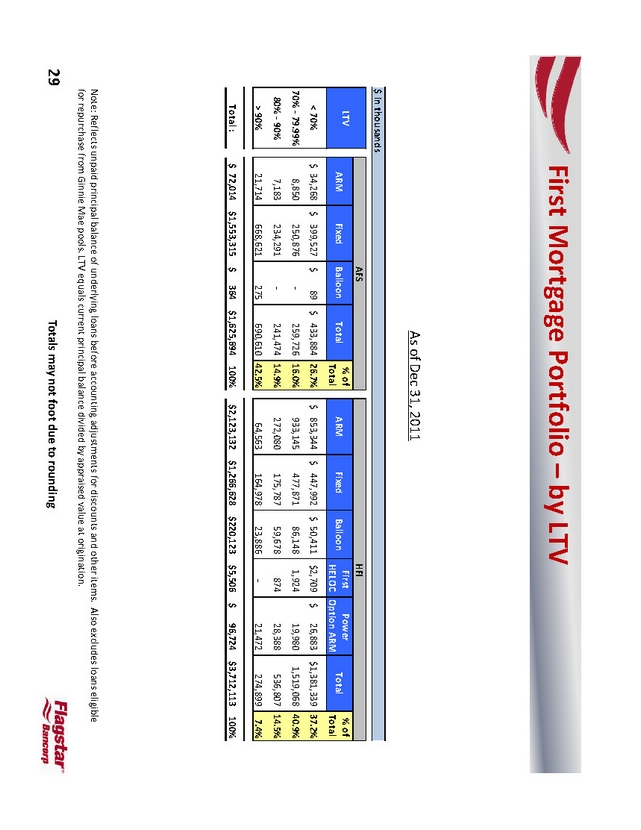

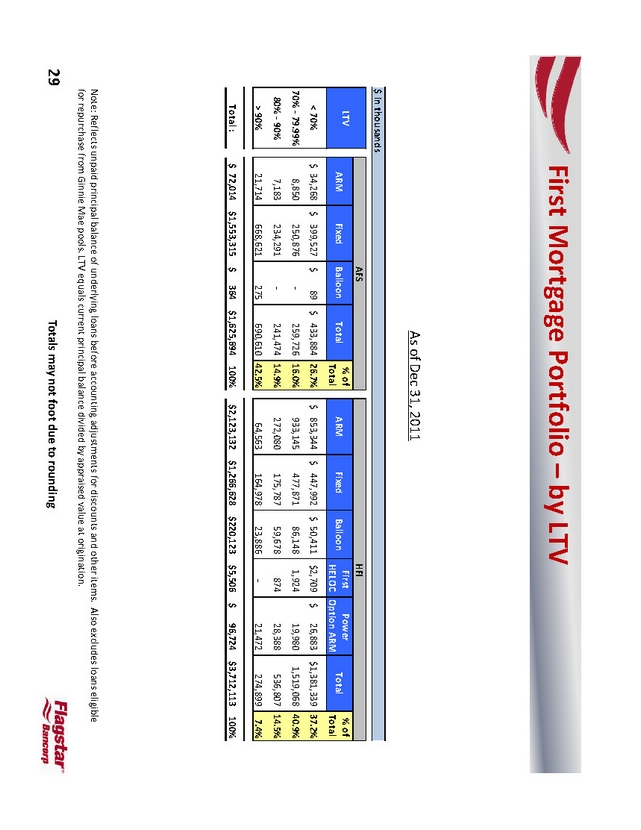

First Mortgage Portfolio – by LTV

As of Dec 31, 2011

$ in thousands

AFS HFI

LTV % of First Power % of

ARM Fixed Balloon Total ARM Fixed Balloon Total

Total HELOC Option ARM Total

< 70% $ 34,268 $ 399,527 $ 89 $ 433,884 26.7% $ 853,344 $ 447,992 $ 50,411 $2,709 $ 26,883 $1,381,339 37.2%

70% ? 79.99% 8,850 250,876 259,726? 16.0% 933,145 477,871 86,148 1,924 19,980 1,519,068 40.9%

80% ? 90% 7, 183 234, 291 241, ?474 14.9% 272, 175, 28, 59, 536, 678 080 807 388 787 874 14.5%

> 90% 21,714 668,621 275 690,610 42.5% 64,563 164,978 23,886 ?21,472 274,899 7.4%

Total : $ 72,014 $ 1,553,315 $ 364 $ 1,625,694 100% $2,123,132 $ 1,266,628 $ 220,123 $ 5,506 $ 96,724 $ 3,712,113 100%

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes loans eligible for repurchase from Ginnie Mae pools. LTV equals current principal balance divided by appraised value at origination.

Totals may not foot due to rounding

29

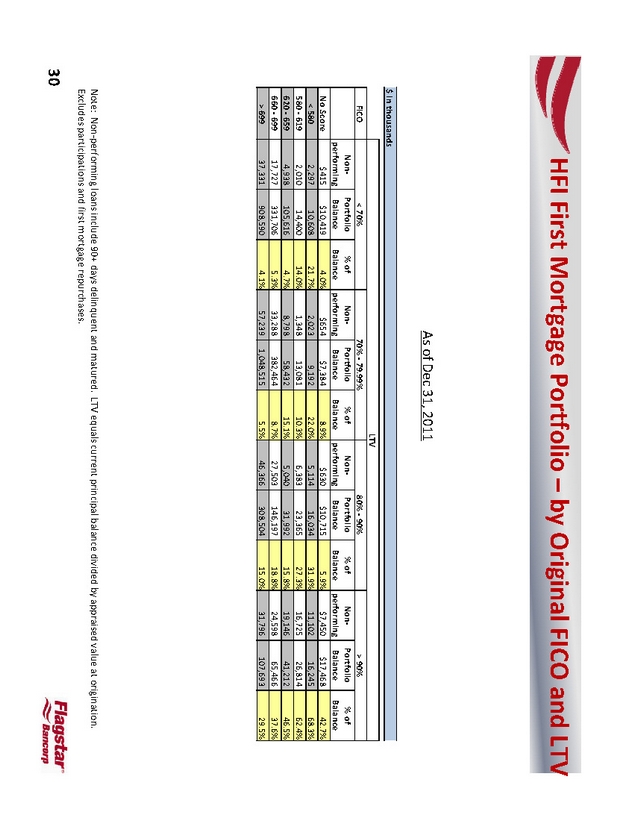

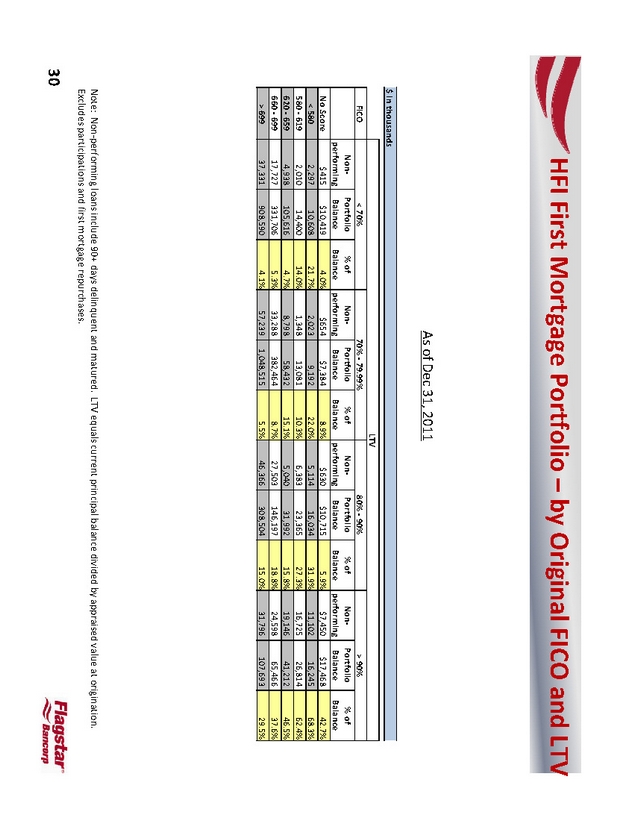

HFI First Mortgage Portfolio – by Original FICO and LTV

As of Dec 31, 2011

$ in thousands

LTV

FICO < 70% 70% ? 79.99% 80% ? 90% > 90%

Non? Portfolio % of Non? Portfolio % of Non? Portfolio % of Non? Portfolio % of

performing Balance Balance performing Balance Balance performing Balance Balance performing Balance Balance

No Score $415 $10,419 4.0% $654 $7,384 8.9% $630 $10,715 5.9% $7,450 $17,468 42.7%

< 580 2,297 10,608 21.7% 2,023 9,192 22.0% 5,114 16,034 31.9% 11,102 16,245 68.3%

580 ? 619 2,010 14,400 14.0% 1,348 13,081 10.3% 6,383 23,365 27.3% 16,725 26,814 62.4%

620 ? 659 4,938 105,616 4.7% 8,798 58,432 15.1% 5,040 31,992 15.8% 19,146 41,212 46.5%

660 ? 699 17,727 331,706 5.3% 33,288 382,464 8.7% 27,503 146,197 18.8% 24,598 65,466 37.6%

> 699 37,331 908,590 4.1% 57,239 1,048,515 5.5% 46,366 308,504 15.0% 31,796 107,693 29.5%

Note: Non? performing loans include 90+ days delinquent and matured. LTV equals current principal balance divided by appraised value at origination. Excludes participations and first mortgage repurchases.

30

Commercial RE Portfolio

As of Dec 31, 2011

$ in thousands

Percentage of Total ($) OTS 90+ Days (%) Specific General Total

Property Type Balance Loans 30 Days 60 Days 90+ Days Delinquent Delinquent Reserve Reserve Reserves

Land - Non Residential Development $29,855.9 2.40% - 11,942.6 - 11,942.6 40.00% 2,529.2 1,001.8 3,531.0

Land -Residential Development $6,100. 274274274600. 210. 811. 6, .3 .0 6, 3 00% 5 50% 0. 5 3 - -

1- 4 Family $6,541.5 0.53% - 4,829.7 - 4,829.7 73.83% 2,175.8 219.5 2,395.3

Commercial Auto Dealer $4,901.7 0.39% - - - - 164.5 164.5 -

Condo $10,878.1 0.88% - - - -315.6 365.0 680.6 -

Hospital / Nursing $13,769.2 1.11% - - - - 462.0 462.0 -

Industrial Warehouse $137,832.3 11.09% - 5.9 11,075.3 11,081.2 8.04% 4,589.5 4,624.9 9,214.4

Mini Storage $12,674.0 1.02% - 1,856.3 - 1,856.3 14.65% 150.5 425.3 575.7

Multi Family Apartment $139,622.9 11.23% - 8,448.2 - 8,448.2 6.05% 108.8 4,685.0 4,793.8

Office $342,640.9 27.57% 1,885.0 1,156.8 23,429.5 26,471.4 6.84% 11,052.7 11,497.2 22,549.9

Retail $102,953.8 8.28% 51.1 121.6 4,886.5 5,059.1 4.75% 2,118.8 3,454.6 5,573.4

Senior Living $64,639.0 5.20% - 11,038.5 -11,038.5 2,168.9 - 2,168.9 -

Shopping Center $293,685.5 23.63% 3,975.3 22,151.4 - 26,126.7 7.54% 24,935.6 9,854.5 34,790.2

Special Purpose $59,945.1 4.82% 636.4 3,165.0 - 3,801.4 5.28% 2,322.5 2,011.4 4,334.0

Other $19, 4 1. 54% 905. 3887.139.2, 181.6. 2, 2453 .5 642. 2, 6 3 2 67% 1, - 276

Negative Escrow $3,303.4 0.27% - - - - -

CIP, Premium, FAS 91, Rec’s - $5,687.6 - 0.46% - - - - -

Totals $1,242,969.5 100.00% $7,453.0 12,322.9 99,335.1 119,111.0 7.99% 53,144.8 41,787.5 94,932.3

Note: 90+ days delinquent includes performing non- accruals.

Totals may not foot due to rounding

31

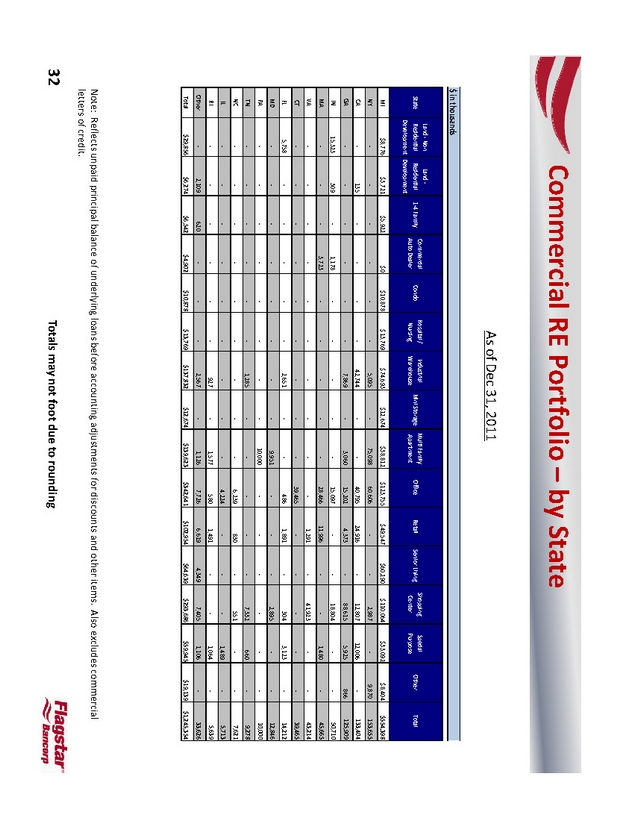

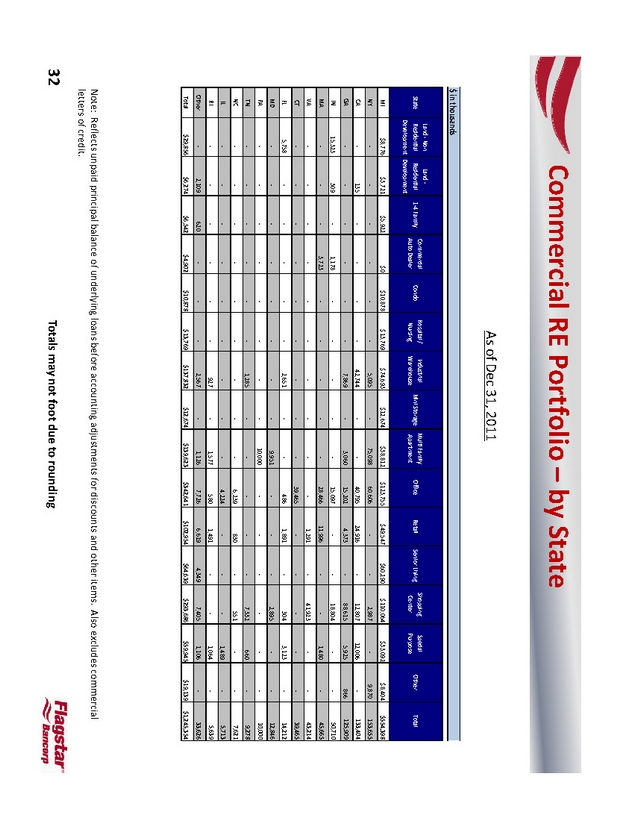

Commercial RE Portfolio – by State

As of Dec 31, 2011

$ in thousands

Land - Non Land - Commercial Hospital / Industrial Multi Family Shopping Special

State Residential Residential 1- 4 Family Auto Dealer Condo Nursing Warehouse Mini Storage Apartment Office Retail Senior Living Center Purpose Other Total

Development Development

MI $8,776 $3,721 $5,922 $0 $10,878 $13,769 $74,693 $12,674 $38,812 $123,755 $49,547 $60,290 $110,064 $33,092 $8,404 $554,398

NY - - - - 5,095 - - 75,098 -60,606 - 2,987 - 9,870 - 153,655

CA - 135 - - 42,744 - - - 40,795 24,916 - 12,807 - 12,006 133,404 -

GA - - - - 7,869 - - 3,060 -15,202 4,373 88,615 -5,925 866 125,909

IN 15,323 309 1,178 - - - - 15,097 - - - 18,804 - - 50,710

MA - 3,723 - - - - - 28,466 - 11,996 - - 1,480 - 45,665 -

VA - - - - - - - - 1,291 - - 41,923 - - 43,214

CT - - - - - - - 39,465 - - - - - 39,465 -

FL 5,758 - - - 2,651 - - - 486 1,891 - 304 - 3,123 14,212 -

MD - - - - - - 9,951 - - - 2,895 - - -12,846

PA - - - - - - 10,000 - - - - - - 10,000 -

TN - - - - 1,285 - - - - - 7,332 - 660 - 9,278

NC - - - - - - - 6,239 - 830 - 551 - 7,621 -

IL - - - - - - - 4,224 - - - 1,489 - - 5,713 -

RI - - - - 927 - - 1,577 580 - 1,491 -1,064 - 5,639 -

Other - 2, 109 620 - 2, -567 - 7, 1, 7, 1, 4, 349 405 126 726 6, 619 106 - 33,626 -

Total $29,856 $6,274 $6,542 $4,902 $10,878 $13,769 $137,832 $12,674 $139,623 $342,641 $102,954 $64,639 $293,686 $59,945 $19,139 $1,245,354

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes commercial letters of credit.

Totals may not foot due to rounding

32

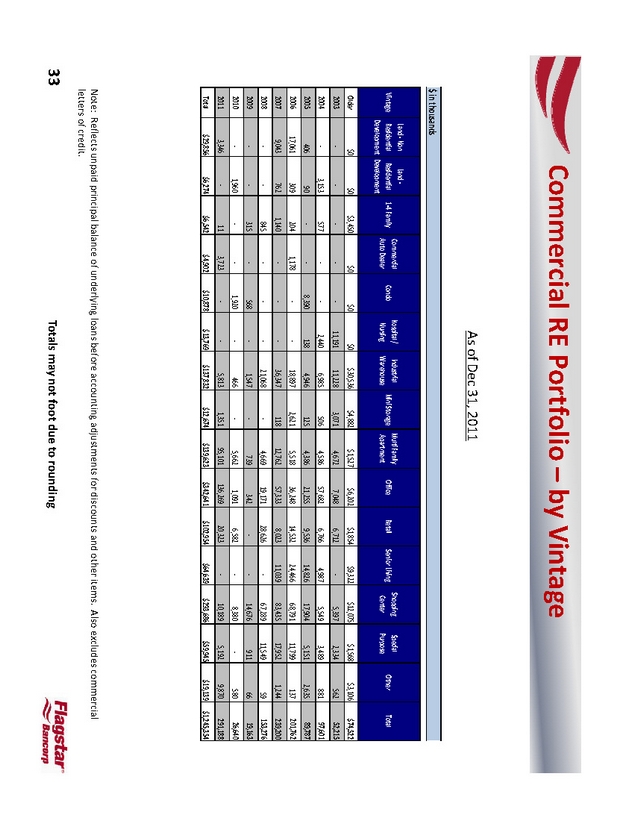

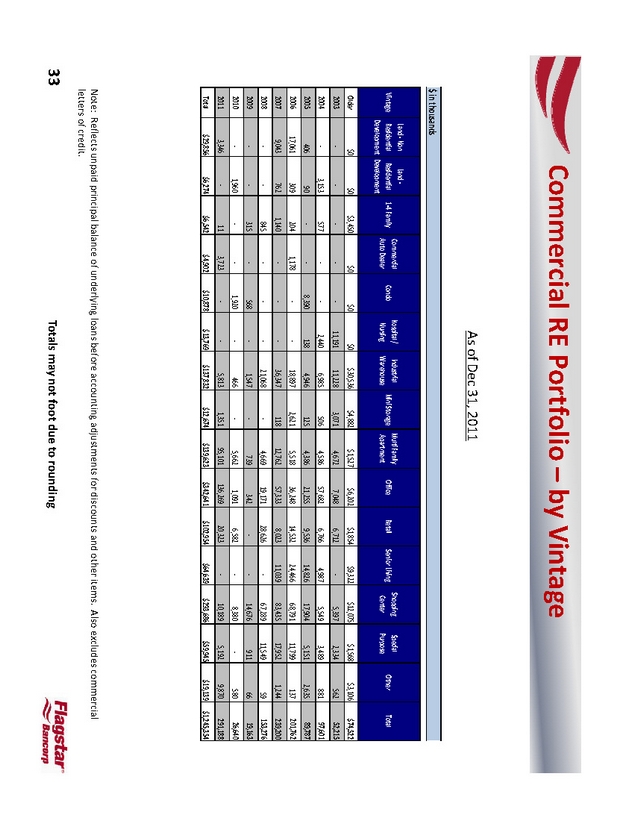

Commercial RE Portfolio – by Vintage

As of Dec 31, 2011

$ in thousands

Land - Non Land - Commercial Hospital / Industrial Multi Family Shopping Special

Vintage Residential Residential 1- 4 Family Auto Dealer Condo Nursing Warehouse Mini Storage Apartment Office Retail Senior Living Center Purpose Other Total

Development Development

Older $0 $0 $3,450 $0 $0 $0 $30,536 $4,882 $1,527 $6,202 $1,854 $9,322 $12,075 $1,568 $3,106 $74,522

2003 - - - 11,191 - 11,228 - 3,071 4,672 7,048 6,712 5,397 -2,334 562 52,215

2004 - 3,153 577 2,440 - 6,985 - 506 4,586 57,682 6,766 4,987 5,549 3,489 881 97,601

2005 406 90 8,390 - 138 - 4,946 125 4,386 21,255 9,536 14,826 17,904 5,151 2,635 89,787

2006 17,061 309 204 1,178 -18,897 2,621 - 5,518 36,248 14,532 24,466 68,791 11,799 137 201,762

2007 9, 043 762 1, 140 - 83, 57, 039 8, 12, 11, 435 17, 1, 347 023 36, 244 762 952 333 - - 118 239,200

2008 - 845 - - 21,068 - - 4,669 - 19,171 28,626 67,289 - 11,549 59 153,276

2009 - 315 - 568 - 1,547 - 739 - 342 14,676 - 911 - 66 19,163

2010 - 1,960 -1,920 - 466 - 5,662 1,091 - 6,582 8,380 - 580 -26,640

2011 3,346 11 -3,723 -5,813 1,351 - 95,101 136,269 20,323 10,189 - 5,192 9,870 291,188

Total $29,856 $6,274 $6,542 $4,902 $10,878 $13,769 $137,832 $12,674 $139,623 $342,641 $102,954 $64,639 $293,686 $59,945 $19,139 $1,245,354

Note: Reflects unpaid principal balance of underlying loans before accounting adjustments for discounts and other items. Also excludes commercial letters of credit.

Totals may not foot due to rounding

33

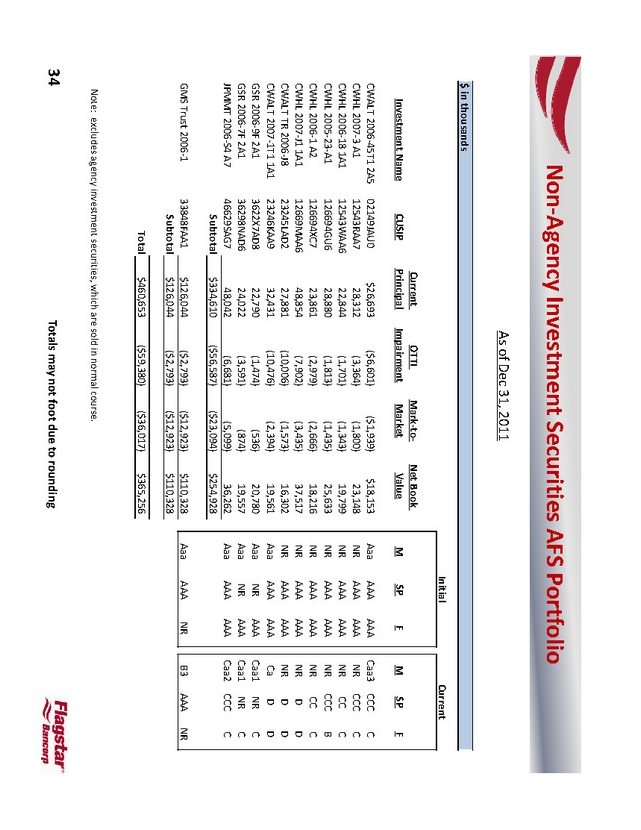

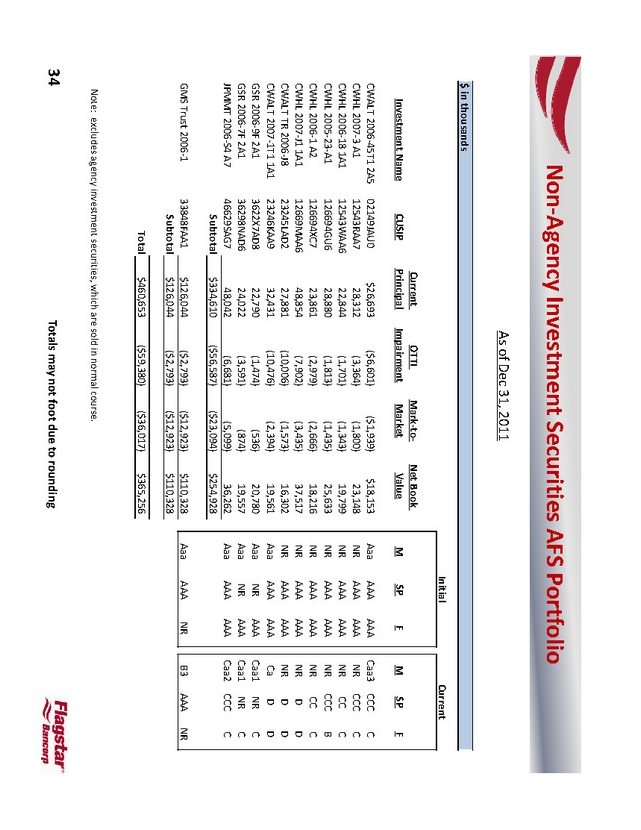

Non- Agency Investment Securities AFS Portfolio

As of Dec 31, 2011

$ in thousands

Initial Current

Current OTTI Mark- to- Net Book

Investment Name CUSIP Principal Impairment Market Value M SP F M SP F

CWALT 2006- 45T1 2A5 02149JAU0 $26,693 ($6,601) ($1,939) $18,153 Aaa AAA AAA Caa3 CCC C

CWHL 2007- 3 A1 12543RAA7 28,312 (3,364) (1,800) 23,148 NR AAA AAA NR CCC C

CWHL 2006- 18 1A1 12543WAA6 22,844 (1,701) (1,343) 19,799 NR AAA AAA NR CC C

CWHL 2005- 23- A1 126694GU6 28,880 (1,813) (1,435) 25,633 NR AAA AAA NR CCC B

CWHL 2006- 1 A2 126694XC7 23,861 (2,979) (2,666) 18,216 NR AAA AAA NR CC C

CWHL 2007- J1 1A1 12669MAA6 48,854 (7,902) (3,435) 37,517 NR AAA AAA NR D D

CWALT TR 2006- J8 23245LAD2 27,881 (101 ,) 573,006) ( 16,302 NR AAA AAA NR D D

CWALT 2007- 1T1 1A1 23246KAA9 32,431 (10,476) (2,394) 19,561 Aaa AAA AAA Ca D D

GSR 2006- 9F 2A1 3622X7AD8 22,790 (1,474) (536) 20,780 Aaa NR AAA Caa1 NR C

GSR 2006- 7F 2A1 36298NAD6 24,022 (3,591) (874) 19,557 Aaa NR AAA Caa1 NR C

JPMMT 2006- S4 A7 46629SAG7 48,042 (6,681) (5,099) 36,262 Aaa AAA AAA Caa2 CCC C

Subtotal $334,610 ($56,587) ($23,094) $254,928

GMS Trust 2006- 1 33848FAA1 $126,044 ($2,793) ($12,923) $110,328 Aaa AAA NR B3 AAA NR

Subtotal $126,044 ($2,793) ($12,923) $110,328

Total $460,653 ($59,380) ($36,017) $365,256

Note: excludes agency investment securities, which are sold in normal course.

Totals may not foot due to rounding

34

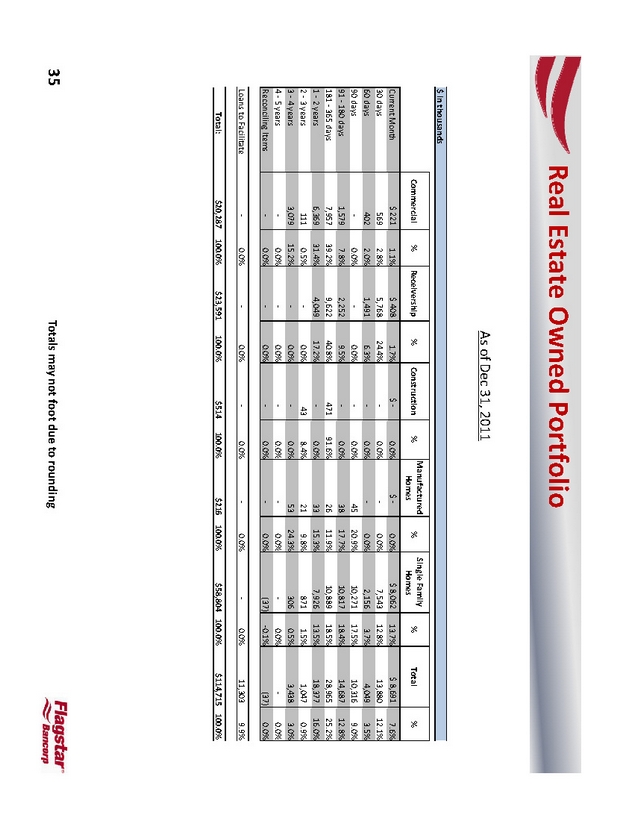

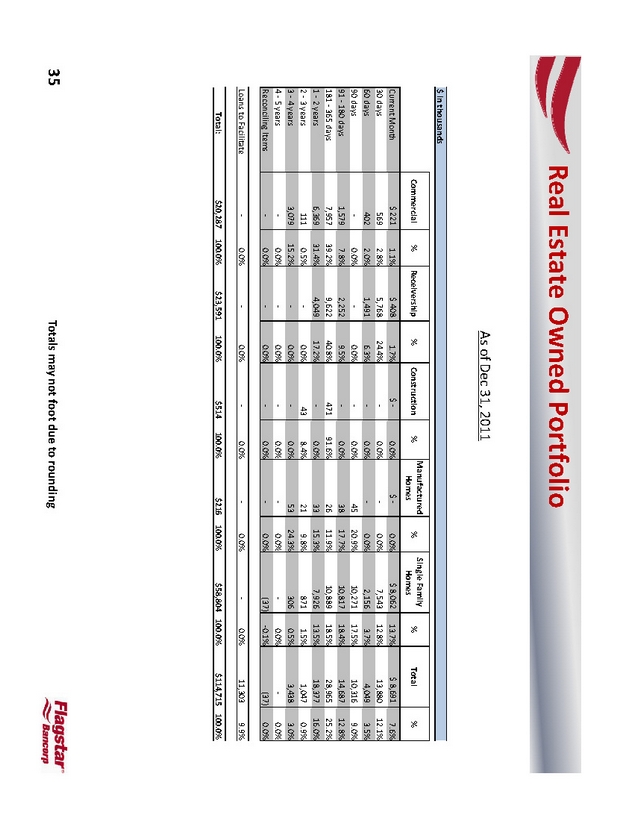

Real Estate Owned Portfolio

As of Dec 31, 2011

$ in thousands

Manufactured Single Family

Commercial % Receivership % Construction % % % Total %

Homes Homes

Current Month $ 221 1.1% $ 408 1.7% $ - 0.0% $ - 0.0% $ 8,062 13.7% $ 8,691 7.6%

30 days 569 2.8% 5,768 24.4% - 0.0% - 0.0% 7,543 12.8% 13,880 12.1%

60 days 402 2.0% 1,491 6.3% - 0.0% - 0.0% 2,156 3.7% 4,049 3.5%

90 days - 0.0% - 0.0% - 0.0% 45 20.9% 10,271 17.5% 10,316 9.0%

91 - 180 days 1,579 7.8% 2,252 9.5% - 0.0% 38 17.7% 10,817 18.4% 14,687 12.8%

181 - 365 days 7,957 39.2% 9,622 40.8% 471 91.6% 26 11.9% 10,889 18.5% 28,965 25.2%

1 | | - 2 years 6,369 31.4% 4,049 17.2% - 0.0% 33 15.3% 7,926 13.5% 18,377 16.0% |

2 | | - 3 years 111 0.5% - 0.0% 43 8.4% 21 9.8% 871 1.5% 1,047 0.9% |

3 | | - 4 years 3,079 15.2% - 0.0% - 0.0% 53 24.3% 306 0.5% 3,438 3.0% |

4 | | - 5 years - 0. - 0.0% 0. 0. 0% 0. 0. 0% 0% 0% 0% - - - - |

Reconciling Items - 0.0% - 0.0% - 0.0% - 0.0% (37) 0.1% (37) 0.0% -

Loans to Facilitate - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% 11,303 9.9%

Total: $20,287 100.0% $23,591 100.0% $514 100.0% $216 100.0% $58,804 100.0% $114,715 100.0%

Totals may not foot due to rounding

35

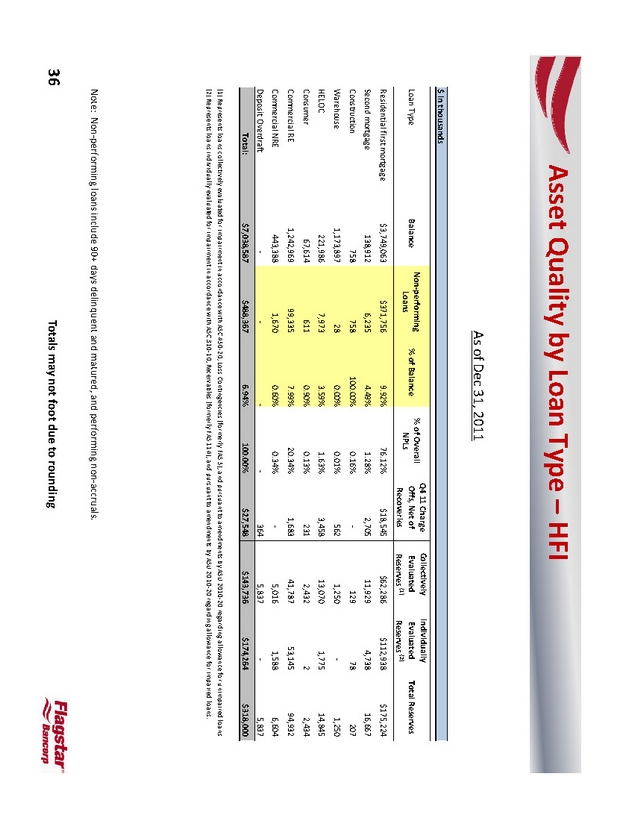

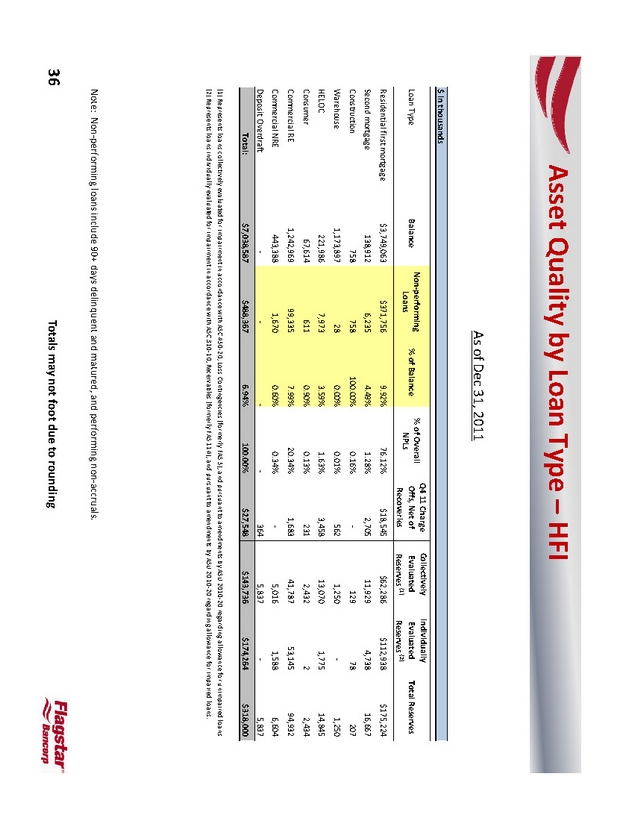

Asset Quality by Loan Type – HFI

As of Dec 31, 2011

$ in thousands

Non- performing % of Overall Q4 11 Charge Collectively Individually

Loan Type Balance Loans % of Balance NPLs Offs, Net of Evaluated Evaluated Total Reserves

Recoveries Reserves (1) Reserves (2)

Residential first mortgage $3,749,063 $371,756 9.92% 76.12% $18,545 $62,286 $112,938 $175,224

Second mortgage 138,912 6,235 4.49% 1.28% 2,705 11,929 4,738 16,667

Construction 758 758 100.00% 0.16% - 129 78 207

Warehouse 1,173,897 28 0.00% 0.01% 562 1,250 1,250 -

HELOC 221,986 7,973 3.59% 1.63% 3,458 13,070 1,775 14,845

Consumer 67,614 611 0.90% 0.13% 231 2,432 2 2,434

Commercial RE 1,242,969 99,335 7.99% 20.34% 1,683 41,787 53,145 94,932

Commercial NRE 443,388 1,670 0.60% 0.34% - 5,016 1,588 6,604

Deposit Overdraft - - 364 - 5,837 - 5,837 -

Total: $7,038,587 $488,367 6.94% 100.00% $27,548 $143,736 $174,264 $318,000

(1) Represents loans collectively evaluated for impairment in accordance with ASC 450- 20, Loss Contingencies (formerly FAS 5), and pursuant to amendments by ASU 2010- 20 regarding allowance for unimpaired loans (2) Represents loans individually evaluated for impairment in accordance with ASC 310- 10, Receivables (formerly FAS 114), and pursuant to amendments by ASU 2010- 20 regarding allowance for impaired loans.

Note: Non- performing loans include 90+ days delinquent and matured, and performing non- accruals.

Totals may not foot due to rounding

36

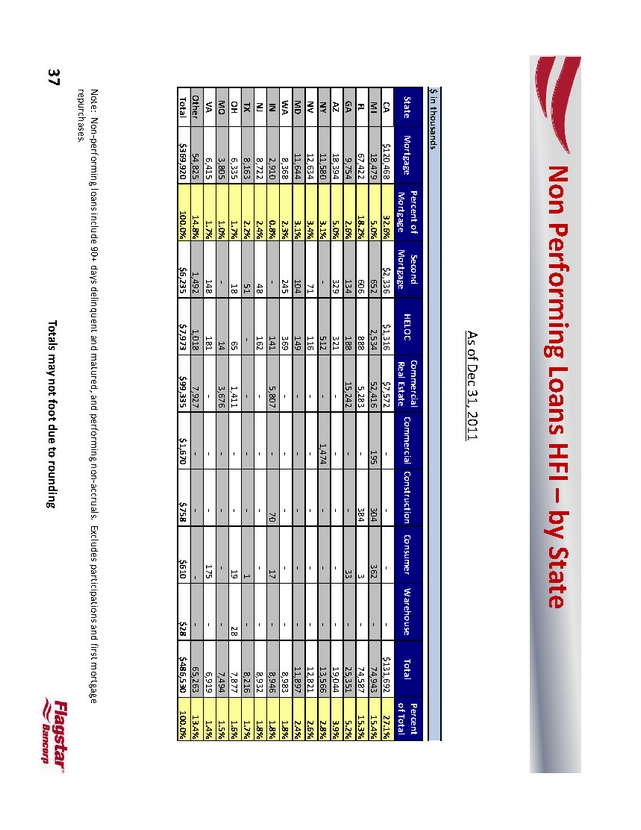

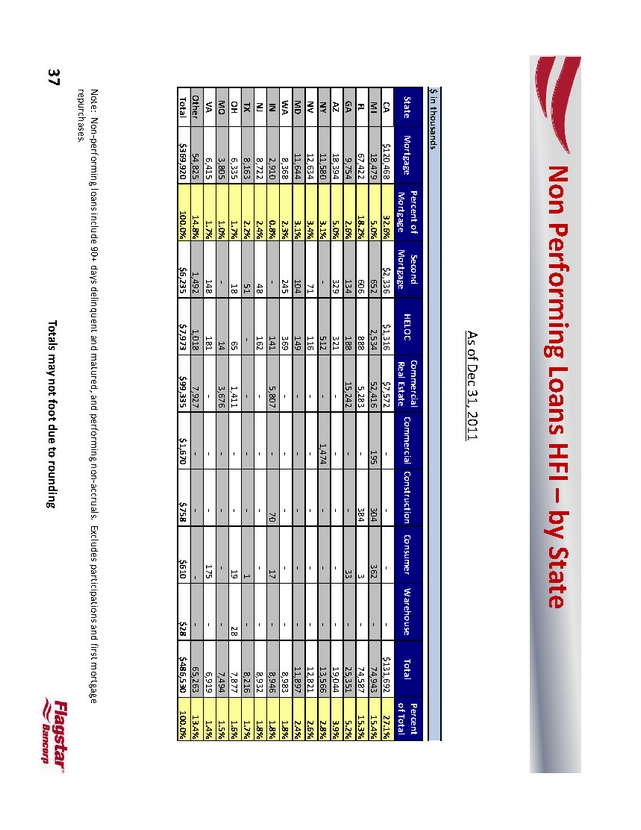

Non Performing Loans HFI – by State

As of Dec 31, 2011

$ in thousands

Percent of Second Commercial Percent

State Mortgage HELOC Commercial Construction Consumer Warehouse Total

Mortgage Mortgage Real Estate of Total

CA $120,468 32.6% $2,336 $1,316 $7,572 - - $131,692 - 27.1% -

MI 18,479 5.0% 652 2,534 52,416 195 304 362 74,943 15.4% -

FL 67, 422 18.2% 606 5, 587 74, 283 888 384 - 3 15.3% -

GA 9,754 2.6% 134 188 15,242 - 33 - 25,351 5.2% -

AZ 18,394 5.0% 329 321 - - - 19,044 - 3.9% -

NY 11,580 3.1% - 512 1,474 - - 13,566 - 2.8% -

NV 12,634 3.4% 71 116 - - - 12,821 - 2.6% -

MD 11,644 3.1% 104 149 - - - 11,897 - 2.4% -

WA 8,368 2.3% 245 369 - - - - 8,983 - 1.8%

IN 2,910 0.8% - 141 5,807 70 - 17 8,946 1.8% -

NJ 8,722 2.4% 48 162 - - - 8,932 - 1.8% -

TX 8,163 2.2% 51 - - -1 - 8,216 1.7% -

OH 6,335 1.7% 18 65 1,411 - 19 -28 7,877 1.6%

MO 3,805 1.0% - 14 3,676 - - 7,494 - 1.5% -

VA 6,415 1.7% 148 181 - - 175 - 6,919 1.4% -

Other 54, 825 14.8% 1, 492 1, 018 7, 927 263 - - 65, - 13.4% -

Total $369,920 100.0% $6,235 $7,973 $99,335 $1,670 $758 $610 $28 $486,530 100.0%

Note: Non- performing loans include 90+ days delinquent and matured, and performing non- accruals. Excludes participations and first mortgage repurchases.

Totals may not foot due to rounding

37

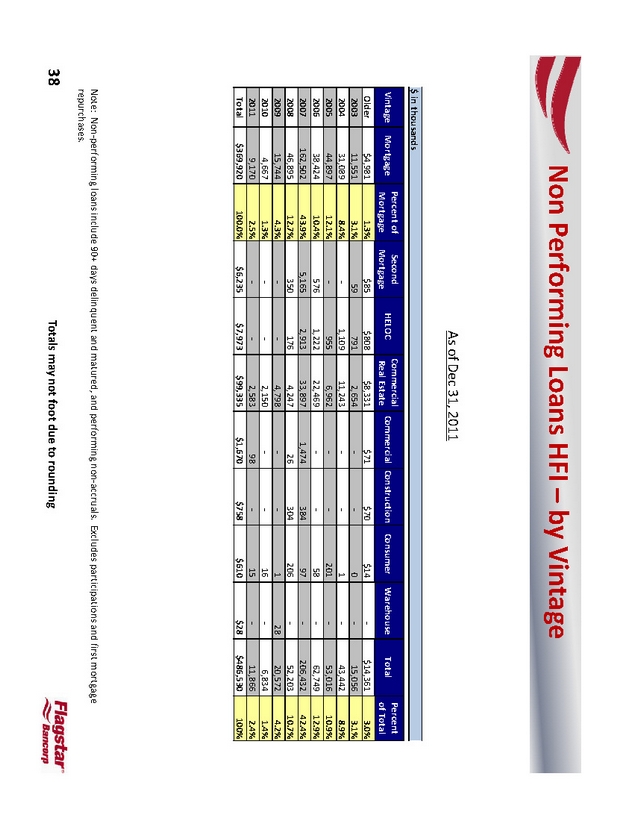

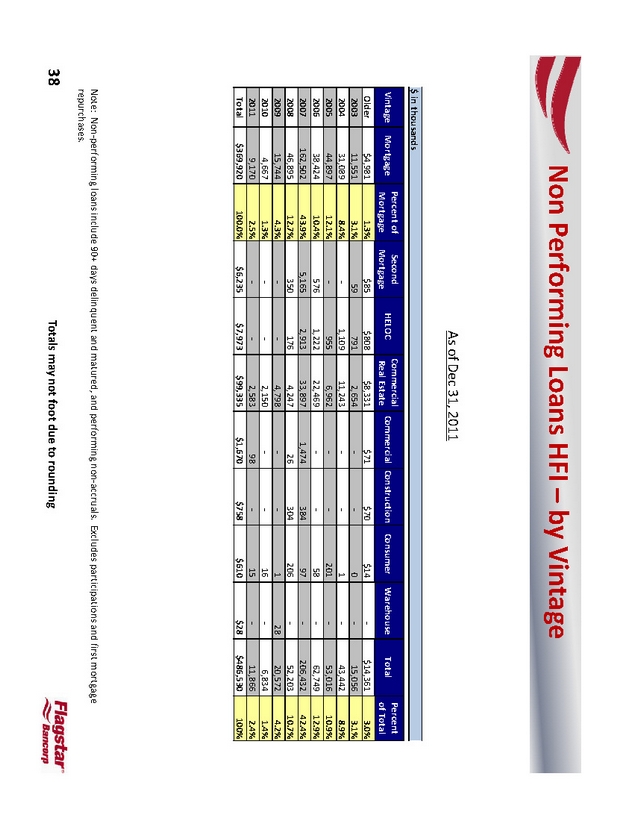

Non Performing Loans HFI – by Vintage

As of Dec 31, 2011

$ in thousands

Percent of Second Commercial Percent

Vintage Mortgage HELOC Commercial Construction Consumer Warehouse Total

Mortgage Mortgage Real Estate of Total

Older $4,981 1.3% $85 $808 $8,331 $71 $70 $14 - $14,361 3.0%

2003 11,551 3.1% 59 791 2,654 - 0 - 15,056 3.1%

2004 31,089 8.4% - 1,109 11,243 - 1 - 43,442 8.9%

2005 44,897 12.1% - 955 6,962 - 201 - 53,016 10.9% -

2006 38,424 10.4% 576 1,222 22,469 - 58 - 62,749 12.9% -

2007 162,502 43.9% 5,165 2,913 33,897 1,474 384 97 206,432 42.4% -

2008 46,895 12.7% 350 176 4,247 26 304 206 52,203 10.7% -

2009 15, 744 4.3% - 20, 798 4, 572 - - 1 - 28 4.2%

2010 4,667 1.3% - 2,150 - - 16 - 6,834 1.4% -

2011 9,170 2.5% - 2,583 - 98 15 - 11,866 2.4% -

Total $369,920 100.0% $6,235 $7,973 $99,335 $1,670 $758 $610 $28 $486,530 100%

Note: Non- performing loans include 90+ days delinquent and matured, and performing non- accruals. Excludes participations and first mortgage repurchases.

Totals may not foot due to rounding

38

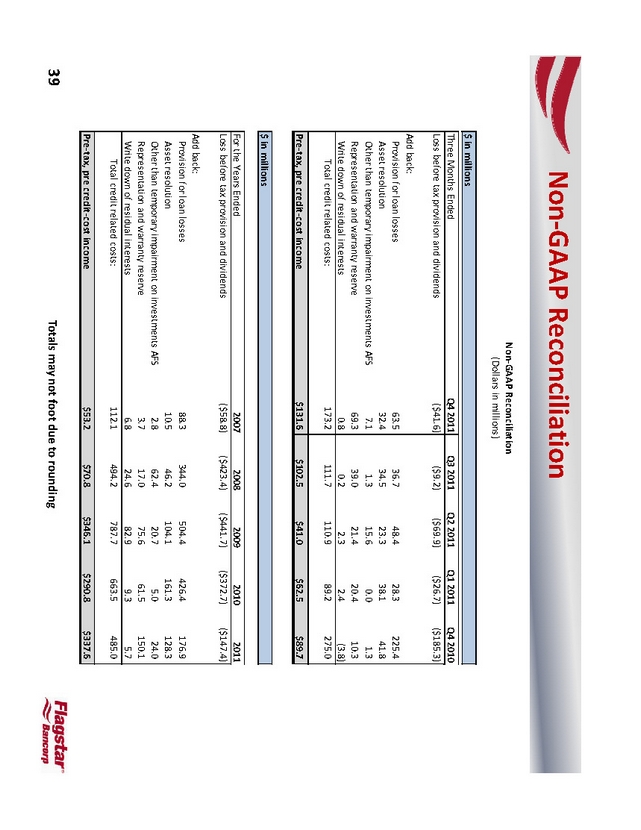

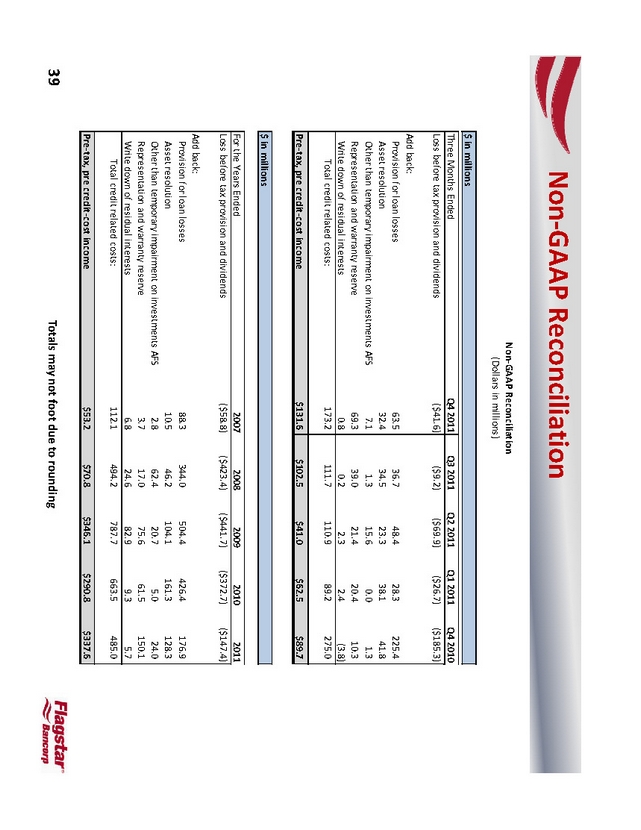

Non- GAAP Reconciliation

Non- GAAP Reconciliation

(Dollars in millions)

$ in millions

Three Months Ended Q4 2011 Q3 2011 Q2 2011 Q1 2011 Q4 2010

Loss before tax provision and dividends ($41.6) ($9.2) ($69.9) ($26.7) ($185.3)

Add back:

Provision for loan losses 63.5 36.7 48.4 28.3 225.4

Asset resolution 32.4 34.5 23.3 38.1 41.8

Other than temporary impairment on investments AFS 7.1 1.3 15.6 0.0 1.3

Representation and warranty reserve 69.3 39.0 21.4 20.4 10.3

Write down of residual interests 0.8 0.2 2.3 2.4 (3.8)

Total credit related costs: 173.2 111.7 110.9 89.2 275.0

Pre- tax, pre credit- cost income $131.6 $102.5 $41.0 $62.5 $89.7

$ in millions

For the Years Ended 2007 2008 2009 2010 2011

Loss before tax provision and dividends ($58.8) ($423.4) ($441.7) ($372.7) ($147.4)

Add back:

Provision for loan losses 88.3 344.0 504.4 426.4 176.9

Asset resolution 10.5 46.2 104.1 161.3 128.3

Other than temporary impairment on investments AFS 2.8 62.4 20.7 5.0 24.0

Representation and warranty reserve 3.7 17.0 75.6 61.5 150.1

Write down of residual interests 6.8 24.6 82.9 9.3 5.7

Total credit related costs: 112. 494. 2 787.663. 485. 1 7 0 5

Pre- tax, pre credit- cost income $53.2 $70.8 $346.1 $290.8 $337.6

Totals may not foot due to rounding

39

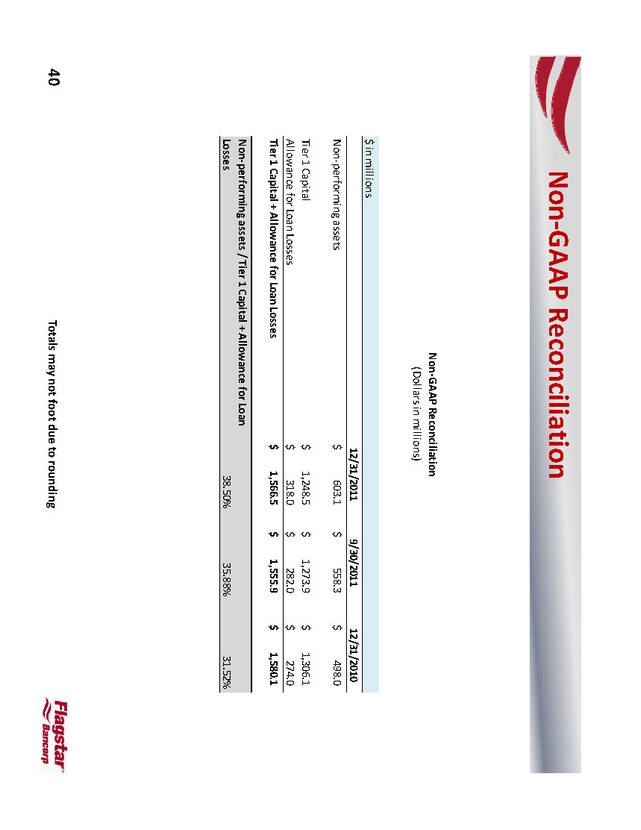

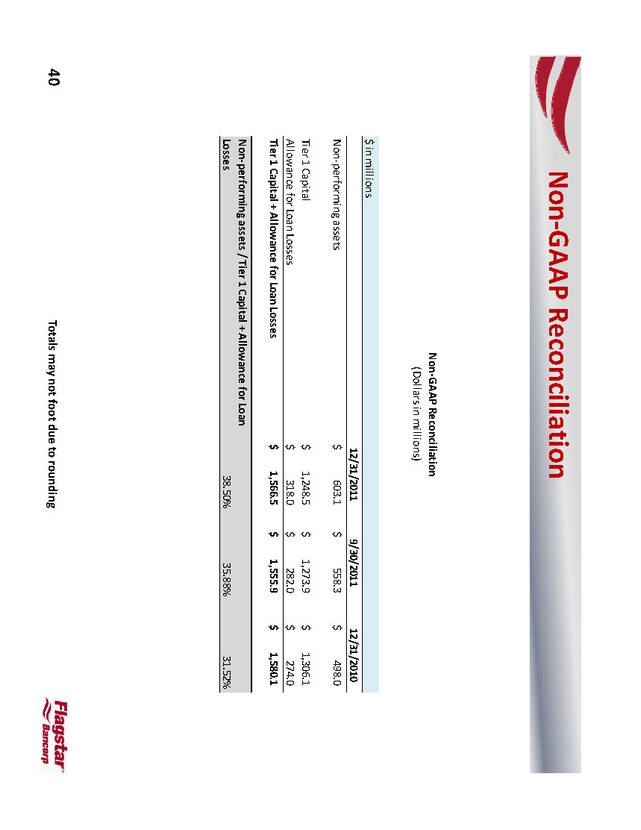

Non- GAAP Reconciliation

Non- GAAP Reconciliation

(Dollars in millions)

$ in millions

12/31/2011 9/30/2011 12/31/2010

Non- performing assets $ 603.1 $ 558.3 $ 498.0

Tier 1 Capital $ 1,248.5 $ 1,273.9 $ 1,306.1

Allowance for Loan Losses $ 318.0 $ 282.0 $ 274.0

Tier 1 Capital + Allowance for Loan Losses $ 1,566.5 $ 1,555.9 $ 1,580.1

Non- performing assets / Tier 1 Capital + Allowance for Loan

Losses 38.50% 35.88% 31.52%

Totals may not foot due to rounding

40

Non- GAAP Reconciliation

Use of Non- GAAP Financial measures

Pre- tax pre- credit- cost income. Pre- tax pre- credit- cost income, as defined by our management, represents net income before taxes, and excludes credit related expenses (defined by management as provision for loan losses, asset resolution expense, other than temporary impairment, representation and warranty reserve provision, write down of residual and transferors’ interest and reserve increases for our reinsurance subsidiary) . While these items represent an, , operations case integral part of our banking in each the excluded items are items that management believes are particularly impacted or increased due to economic stress or significant changes in the credit cycle and are therefore likely to make it more difficult to understand our underlying performance trends and our ability to generate revenue from our mortgage and banking operations. Net interest income, noninterest income and noninterest expense are all calculated in accordance with GAAP and are presented in the Consolidated Statements of Operations. Net income is adjusted only for the specific items listed above in the calculation of pre- tax pre- credit- cost income, and these adjustments represent the excluded items in their entirety for each period presented to better facilitate period to period comparisons.

Viewed together with our GAAP results, management believes pre- tax pre- credit cost income provides investors and stakeholders with a functional measurement to evaluate and better understand trends in our period to period ability to generate revenues and capital to offset credit related expenses, in each case exclusive of the effects of and past and current economic stress and the credit cycle. As recent results for the banking industry demonstrate, provisions for loan losses, increased in representation and warranty reserve, asset impairments and mark- downs and expenses related to the resolution and disposition of assets can vary significantly from period to period, making a measure that helps isolate the impact of those credit related expenses on profitability integral to helping investors understand the business model. The “Quality of Earning Assets” sections of this report isolate the different credit quality challenges and issues and the impact of the associated credit related expenses on our income statement.

Like all non- GAAP measurements, pre- tax pre- credit- cost income usefulness is inherently limited. Because our calculation of pre- tax pre- credit- cost income may differ from the calculation of similar measures used by other bank and thrift holding companies, pre- tax pre- credit- cost income should be used to determine and evaluate period to period trends in our performance, rather than in comparison to other similar non- GAAP measurements utilized by other companies. In addition, investors should keep in mind that income tax expense (benefit), the provision for loan losses, and the other items excluded from revenues and expenses in the pre- tax pre- credit cost income calculation are recurring and integral expenses to our operations, and that these expenses will still accrue under GAAP, thereby reducing GAAP earnings and, ultimately, shareholders’ equity.

Non- performing assets / Tier 1 + Allowance for Loan Losses. The ratio of non- performing assets to Tier 1 and allowance for loan losses divides the total level of non- performin g assets held for investment by Tier 1 capital as defined by bank regulations, , plus allowance for loan losses. The Company believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of capital in comparison to other companies in the industry.

41

FBC