while telecom services, health care, and consumer staples lagged.

Lazard Retirement U.S. Strategic Equity Portfolio

For the six months ended June 30, 2009, the Lazard Retirement U.S. Strategic Equity Portfolio’s Service Shares posted a total return of 4.92%, as compared with the 3.16% return for the S&P 500® Index.

During the period, the Portfolio benefited from stock selection in the materials sector, as positions in Freeport-McMoRan Copper & Gold and Air Products & Chemicals performed well amid the difficult market environment. Freeport-McMoRan rose as copper prices rebounded from multiyear lows. The company also reported better-than-expected earnings as a result of management’s cost-cutting efforts. We subsequently sold the position during the period as it reached our valuation target. Air Products & Chemicals also reported better-than-expected earnings results, driven by strong pricing and cost-cutting efforts. Performance for the period was also positively impacted by a slightly overweight position in the financials sector, which rebounded sharply from lows achieved in March. However, stock selection in the sector diminished some of this benefit, as insurance holdings Allstate, Travelers, Marsh & McLennan, and PartnerRe lagged. We subsequently sold our positions in Allstate and Marsh & McLennan during the period. Less exposure to some of the diversified financial companies that rebounded sharply also detracted from performance. During the period, stock selection in the health care sector benefited returns, as shares of Wyeth rose sharply as a result of a takeover offer from Pfizer. We view this merger positively due to the potential for significant cost savings and robust cash flow generation of the combined companies.

On the negative side, stock selection in the information technology sector detracted from performance. While the majority of our technology holdings outperformed the overall market, and the sector was the best-performing group during the first half of 2009, a lack of exposure to certain technology hardware stocks that rebounded strongly during the period detracted from performance.

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio

As of June 1, 2009, the Portfolio changed its name from “Lazard Retirement U.S. Small Cap Equity Portfolio” to “Lazard Retirement U.S. Small-Mid Cap Equity Portfolio,” changed its investment strategy to invest in small-mid cap companies, and began comparing its performance to the Russell 2500® Index. Prior to June 1, 2009, the Portfolio focused on small-cap U.S. companies and compared its performance to the Russell 2000® Index.

For the six months ended June 30, 2009, the Lazard Retirement U.S. Small-Mid Cap Equity Portfolio’s Service Shares posted a total return of 14.98%, as compared with the 6.52% return for the Russell 2500 Index, and the 2.30% return for the Russell 2000/2500 Linked Index.*

Stock selection in the financials, industrials, consumer discretionary, and energy sectors were the main contributors to returns, while stock selection in the information technology and health care sectors detracted from performance over the period.

In the financials sector, we continued to selectively build positions and to seek to avoid financial firms with balance sheet risk. The bank segment was the largest relative contributor within the sector, as we focused on companies with healthy balance sheets

and that we believed would be able to grow their businesses. Within the diversified financials segment, shares of Waddell & Reed Financial and Jefferies Group were up strongly as the businesses gained market share.

Outperformance within the industrials sector was led by holdings in the capital goods segment. Shares of Middleby, Orion Marine Group, Dycom Industries, and Axsys Technologies were all up significantly over the period. Following the companies’ outperformance, we sold our positions in Orion Marine Group and Axsys Technologies during the period.

Underperformance in the information technology sector was due to weaker-than-average returns in the software and services business. Overall performance in this sector lagged due to negative returns in both United Online and CACI. We decided to exit both positions during the period.

Stock selection in the health care sector also detracted from performance over the period, as several positions within the pharmaceuticals and biotechnology industry more than offset gains from our equipment and services companies.

Lazard Retirement International Equity Portfolio

For the six months ended June 30, 2009, the Lazard Retirement International Equity Portfolio’s Service Shares posted a total return of 1.22%, as compared with the 7.95% return for the MSCI Europe, Australasia and Far East® Index (the EAFE Index).

The Portfolio’s underweight exposure to the materials, financials, and consumer discretionary sectors detracted from performance. In spite of the opportunistic purchase of several financial stocks, the financials sector was a drag on performance, as companies

that had been hurt over the past year rallied strongly due to recapitalization and an improvement in the credit markets. While positions in BNP Paribas, Banco Santander, and Mitsubishi Estate performed well, and our stock selection in the insurance segment was beneficial, it was not enough to compensate for our underweight position in financial stocks, which rallied strongly.

On a positive note, the Portfolio benefited from stock selection in the information technology and consumer staples sectors. Anheuser-Busch InBev performed well, driven by continued execution of management’s ambitious debt and cost reduction plans. Within the information technology sector, shares of Ericsson were up due to confidence that the world’s largest wireless network provider will continue to gain relative strength through this economic cycle.

Lazard Retirement Emerging Markets Equity Portfolio

For the six months ended June 30, 2009, the Lazard Retirement Emerging Markets Equity Portfolio’s Service Shares posted a total return of 31.23%, while Investor Shares posted a total return of 31.43%, as compared with the 36.01% return for the EM Index.

For the period, a position in Mobile TeleSystems, a Russian telecommunications services company, helped performance due to stabilization of the ruble and investors’ focus on the company’s cash flow generation. Shares of Oriflame Cosmetics, a cosmetics producer in Central and Eastern Europe, were up as the company announced strong earnings results that beat bearish expectations for the cosmetics industry. Advanced Semiconductor Engineering, a Taiwanese integrated circuit manufacturer, also helped performance, as its shares rose on signs of robust free cash flow. Stock selection in the telecom services sector, as well as within Argentina and Taiwan helped performance.

Semi-Annual Report 5

Conversely, shares of Satyam Computer Services, an Indian software company, hurt returns over the period, as shares were weak due to investor concerns over an alleged fraud. We subsequently sold the position. Shares of Turkcell Iletisim Hizmetleri, a Turkish telecommunications services company, also fell over concerns that the weak macroeconomic conditions in Turkey and a weak currency would negatively affect margins. A position in OTP Bank, a Hungarian

banking company, suffered from investor concerns over systemic risk in Eastern Europe. We also exited our position in OTP Bank during the period. Stock selection in the information technology and consumer discretionary sectors, as well as within India and Brazil hurt performance over the period. An underweight exposure to the energy sector, and overweight exposures to the telecom services sector, Argentina, and Mexico also detracted from performance.

Notes to Investment Overviews:

All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios have been waived or reimbursed by the Fund’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolios’ returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Past performance is not indicative, nor a guarantee, of future results.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

The views of the Fund’s management and the portfolio holdings described in this report are as of June 30, 2009; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in each Portfolio at the time you receive this report, or that securities sold will not have been repurchased. The specific portfolio securities may in aggregate represent only a small percentage of each Portfolio’s holdings. It should not be assumed that investments in the securities identified and discussed were, or will be, profitable, or that the investment decisions we make in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein. You should read the Fund’s prospectus for a more detailed discussion of each Portfolio’s investment objective, strategies, risks and fees.

| |

* | The Russell 2500 Index is comprised of the 2,500 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). The Russell 2000/2500 Linked Index is an index created by the Portfolio’s Investment Manager, which links the performance of the Russell 2000 Index for all periods prior to June 1, 2009 and the Russell 2500 Index for all periods after May 31, 2009. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000 Index. |

6 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Performance Overviews (unaudited) |

|

Lazard Retirement U.S. Strategic Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement U.S. Strategic Equity Portfolio and S&P 500® Index*

| | | | | | | | | | |

Average Annual Total Returns*

Periods Ended June 30, 2009 | | | | | | | | | | |

| | | | | | | | | |

| | One

Year | | Five

Years | | Ten

Years | |

|

Retirement U.S. Strategic Equity Portfolio | | | | | | | | | | |

| | | | | | | | | | | |

Service Shares | | | (24.37)% | | | (2.60)% | | | (1.64)% | |

| | | | | | | | | | | |

S&P 500 Index | | | (26.21)% | | | (2.24)% | | | (2.22)% | |

| | | | | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic economy through changes in the aggregate market value of these stocks, which represent all major industries. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

| Before May 1, 2007, the Portfolio was known as Lazard Retirement Equity Portfolio and had a different investment strategy. |

Semi-Annual Report 7

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement U.S. Small-Mid Cap Equity Portfolio, Russell 2500® Index, Russell 2000/2500 Linked Index and Russell 2000® Index*

| | | | | | | | | | |

Average Annual Total Returns*

Periods Ended June 30, 2009 | | | | | | | | | | |

| | | | | | | | | |

| | One

Year | | Five

Years | | Ten

Years | |

| | | | | | | | | | |

Retirement U.S. Small-Mid Cap Equity Portfolio | | | | | | | | | | |

| | | | | | | | | | | |

Service Shares | | | (19.80)% | | | (2.35)% | | | 3.64% | |

| | | | | | | | | | | |

Russell 2500 Index | | | (26.72)% | | | (0.93)% | | | 3.67% | |

| | | | | | | | | | | |

Russell 2000/2500 Linked Index | | | (25.26)% | | | (1.77)% | | | 2.34% | |

| | | | | | | | | | | |

Russell 2000 Index | | | (25.01)% | | | (1.71)% | | | 2.38% | |

| | | | | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The Russell 2500 Index is comprised of the 2,500 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). The Russell 2000/2500 Linked Index is an index created by the Portfolio’s Investment Manager, which links the performance of the Russell 2000 Index for all periods prior to June 1, 2009 and the Russell 2500 Index for all periods after May 31, 2009. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000 Index. The indices are unmanaged, have no fees or costs and are not available for investment. |

| |

| The Portfolio was previously known as Lazard Retirement Small Cap Portfolio (prior to May 1, 2008) and as Lazard Retirement U.S. Small Cap Equity Portfolio (between May 1, 2008 and May 31, 2009). As of June 1, 2009, the Portfolio changed its name to Lazard U.S. Small-Mid Cap Equity Portfolio and changed its investment strategy, to invest in equity securities of small-mid cap U.S. companies. |

8 Semi-Annual Report

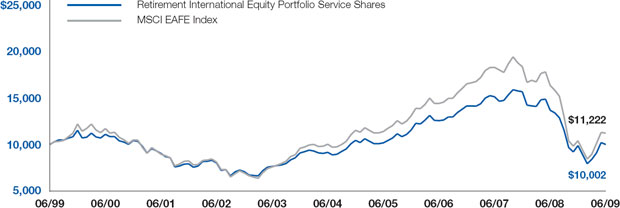

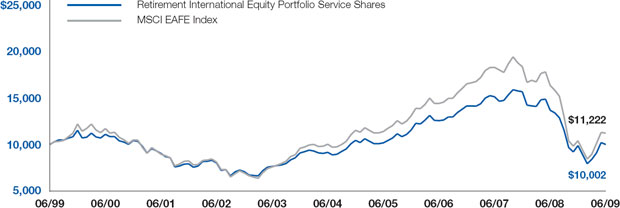

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement International Equity Portfolio and Morgan Stanley Capital International (MSCI®) Europe, Australasia and Far East (EAFE®) Index*

| | | | | | | | | | |

Average Annual Total Returns*

Periods Ended June 30, 2009 | | | | | | | |

| | | | | | |

| | One

Year | | Five

Years | | Ten

Years | |

Retirement International Equity Portfolio | | | | | | | | | | |

| | | | | | | | | | | |

Service Shares | | | (26.95)% | | | 1.79% | | | 0.00% | |

| | | | | | | | | | | |

MSCI EAFE Index | | | (31.35)% | | | 2.31% | | | 1.16% | |

| | | | | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located outside the United States. The index is unmanaged, has no fees or costs and is not available for investment. |

Semi-Annual Report 9

Lazard Retirement Emerging Markets Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Emerging Markets Equity Portfolio and MSCI Emerging Markets Index*

| | | | | | | | | | | | | | | | |

Average Annual Total Returns* | | | | | | | | | | | | | | | | |

Periods Ended June 30, 2009 | | | | | |

| | | Service Shares | | Investor Shares | |

| | One

Year | | Five

Years | | Ten

Years | | One

Year | | Since

Inception | † |

| | | | | | | | | | | | |

Retirement Emerging Markets Equity Portfolio** | | | (26.80)% | | | 16.69% | | | 10.02% | | | (26.58)% | | | (0.03)% | |

| | | | | | | | | | | | | | | | | |

MSCI Emerging Markets Index | | | (28.07)% | | | 14.72% | | | 8.70% | | | (28.07)% | | | (1.38)% | |

| | | | | | | | | | | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI Emerging Markets Index is comprised of emerging market securities in countries open to non-local investors. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

| Before May 1, 2008, the Portfolio was known as Lazard Retirement Emerging Markets Portfolio. |

| |

** | The performance of Service Shares may be greater than or less than the performance of Investor Shares, based on the differences in fees borne by shareholders investing in different classes. |

| |

† | The inception date for Investor Shares was May 1, 2006. |

10 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Information About Your Portfolio’s Expenses (unaudited) |

|

Expense Example

As a shareholder in a Portfolio of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from January 1, 2009 through June 30, 2009 and held for the entire period.

Actual Expenses

For each Share class of the Portfolios, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Share class of the Portfolios, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of the other funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing Account Value.

| | | | | | | | | | | | | | | | | | | |

| | Beginning

Account Value | | Ending

Account Value | | Expenses Paid

During Period* | | Annualized

Expense Ratio

During Period | |

| | | | | | | | |

| | 1/1/09 | | 6/30/09 | | 1/1/09 - 6/30/09 | | 1/1/09 - 6/30/09 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Retirement U.S. Strategic Equity Portfolio | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,049.20 | | | | $ | 6.35 | | | 1.25 | % | |

Hypothetical (5% Return Before Expenses) | | | $ | 1,000.00 | | | | $ | 1,018.60 | | | | $ | 6.26 | | | 1.25 | % | |

| | | | | | | | | | | | | | | | | | | |

Retirement U.S. Small-Mid Cap Equity Portfolio | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,149.80 | | | | $ | 6.66 | | | 1.25 | % | |

Hypothetical (5% Return Before Expenses) | | | $ | 1,000.00 | | | | $ | 1,018.60 | | | | $ | 6.26 | | | 1.25 | % | |

| | | | | | | | | | | | | | | | | | | |

Retirement International Equity Portfolio | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,012.20 | | | | $ | 6.15 | | | 1.23 | % | |

Hypothetical (5% Return Before Expenses) | | | $ | 1,000.00 | | | | $ | 1,018.68 | | | | $ | 6.17 | | | 1.23 | % | |

| | | | | | | | | | | | | | | | | | | |

Retirement Emerging Markets Equity Portfolio | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,312.30 | | | | $ | 9.17 | | | 1.60 | % | |

Hypothetical (5% Return Before Expenses) | | | $ | 1,000.00 | | | | $ | 1,016.86 | | | | $ | 8.00 | | | 1.60 | % | |

|

Investor Shares | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,314.30 | | | | $ | 7.75 | | | 1.35 | % | |

Hypothetical (5% Return Before Expenses) | | | $ | 1,000.00 | | | | $ | 1,018.10 | | | | $ | 6.76 | | | 1.35 | % | |

| |

* | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period). |

Semi-Annual Report 11

|

|

Lazard Retirement Series, Inc. Portfolio Holdings Presented by Sector June 30, 2009 (unaudited) |

|

| | | | | | | | | | | | | | | | | | | | | |

Sector* | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | |

Consumer Discretionary | | | 9.4 | % | | | | 16.0 | % | | | | 3.8 | % | | | | 7.1 | % | | |

Consumer Staples | | | 13.0 | | | | | 6.8 | | | | | 13.2 | | | | | 11.0 | | | |

Energy | | | 13.0 | | | | | 6.0 | | | | | 11.2 | | | | | 9.7 | | | |

Financials | | | 11.4 | | | | | 14.4 | | | | | 22.9 | | | | | 21.2 | | | |

Health Care | | | 15.2 | | | | | 10.6 | | | | | 7.4 | | | | | — | | | |

Industrials | | | 11.5 | | | | | 19.1 | | | | | 12.0 | | | | | 7.5 | | | |

Information Technology | | | 18.0 | | | | | 16.7 | | | | | 8.5 | | | | | 12.3 | | | |

Materials | | | 3.9 | | | | | 6.1 | | | | | 1.8 | | | | | 8.6 | | | |

Telecommunication Services | | | 1.9 | | | | | — | | | | | 8.0 | | | | | 13.1 | | | |

Utilities | | | 1.4 | | | | | 2.1 | | | | | 4.9 | | | | | 1.5 | | | |

Short-Term Investments | | | 1.3 | | | | | 2.2 | | | | | 6.3 | | | | | 8.0 | | | |

| | | | | | | | | | | | | | | | | | | | | |

Total Investments | | | 100.0 | % | | | | 100.0 | % | | | | 100.0 | % | | | | 100.0 | % | | |

| | | | | | | | | | | | | | | | | | | | | |

| |

* | Represents percentage of total investments. |

12 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Portfolios of Investments June 30, 2009 (unaudited) |

|

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Lazard Retirement U.S. Strategic Equity Portfolio | | | | |

| | | | | | | |

Common Stocks—99.1% | | | | | | | |

| | | | | | | |

Aerospace & Defense—1.6% | | | | | | | |

Raytheon Co. | | | 1,420 | | $ | 63,091 | |

| | | | | | | |

| | | | | | | |

Alcohol & Tobacco—2.5% | | | | | | | |

Molson Coors Brewing Co., Class B | | | 2,290 | | | 96,936 | |

| | | | | | | |

| | | | | | | |

Banking—5.8% | | | | | | | |

Bank of America Corp. | | | 4,000 | | | 52,800 | |

Bank of New York Mellon Corp. | | | 2,100 | | | 61,551 | |

JPMorgan Chase & Co. | | | 3,260 | | | 111,199 | |

| | | | | | | |

| | | | | | 225,550 | |

| | | | | | | |

| | | | | | | |

Cable Television—4.2% | | | | | | | |

Comcast Corp., Class A | | | 11,460 | | | 161,586 | |

| | | | | | | |

| | | | | | | |

Chemicals—1.9% | | | | | | | |

Air Products & Chemicals, Inc. | | | 1,145 | | | 73,956 | |

| | | | | | | |

| | | | | | | |

Commercial Services—2.2% | | | | | | | |

Corrections Corp. of America (a) | | | 2,300 | | | 39,077 | |

Republic Services, Inc. | | | 1,980 | | | 48,332 | |

| | | | | | | |

| | | | | | 87,409 | |

| | | | | | | |

| | | | | | | |

Computer Software—7.0% | | | | | | | |

Google, Inc., Class A (a) | | | 90 | | | 37,943 | |

Microsoft Corp. | | | 4,920 | | | 116,948 | |

Oracle Corp. | | | 2,940 | | | 62,975 | |

Symantec Corp. (a) | | | 3,550 | | | 55,238 | |

| | | | | | | |

| | | | | | 273,104 | |

| | | | | | | |

| | | | | | | |

Construction & Engineering—0.6% | | | | | | | |

Foster Wheeler AG (a) | | | 900 | | | 21,375 | |

| | | | | | | |

| | | | | | | |

Consumer Products—2.1% | | | | | | | |

Mattel, Inc. | | | 4,990 | | | 80,089 | |

| | | | | | | |

| | | | | | | |

Drugs—6.4% | | | | | | | |

Gilead Sciences, Inc. (a) | | | 1,040 | | | 48,714 | |

Merck & Co., Inc. | | | 1,500 | | | 41,940 | |

Pfizer, Inc. | | | 5,620 | | | 84,300 | |

Wyeth | | | 1,650 | | | 74,893 | |

| | | | | | | |

| | | | | | 249,847 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Electric—1.4% | | | | | | | |

American Electric Power Co., Inc. | | | 1,910 | | $ | 55,180 | |

| | | | | | | |

| | | | | | | |

Energy Exploration & Production—4.9% | | | | | | | |

Apache Corp. | | | 1,040 | | | 75,036 | |

EOG Resources, Inc. | | | 655 | | | 44,488 | |

Occidental Petroleum Corp. | | | 1,110 | | | 73,049 | |

| | | | | | | |

| | | | | | 192,573 | |

| | | | | | | |

| | | | | | | |

Energy Integrated—6.9% | | | | | | | |

Chevron Corp. | | | 800 | | | 53,000 | |

Exxon Mobil Corp. | | | 1,825 | | | 127,586 | |

Marathon Oil Corp. | | | 1,340 | | | 40,374 | |

Massey Energy Co. | | | 1,570 | | | 30,678 | |

Valero Energy Corp. | | | 1,100 | | | 18,579 | |

| | | | | | | |

| | | | | | 270,217 | |

| | | | | | | |

| | | | | | | |

Energy Services—1.2% | | | | | | | |

BJ Services Co. | | | 3,535 | | | 48,182 | |

| | | | | | | |

| | | | | | | |

Financial Services—2.2% | | | | | | | |

Ameriprise Financial, Inc. | | | 2,350 | | | 57,034 | |

Morgan Stanley | | | 1,000 | | | 28,510 | |

| | | | | | | |

| | | | | | 85,544 | |

| | | | | | | |

| | | | | | | |

Food & Beverages—3.8% | | | | | | | |

Campbell Soup Co. | | | 2,100 | | | 61,782 | |

Kellogg Co. | | | 900 | | | 41,913 | |

The Coca-Cola Co. | | | 950 | | | 45,590 | |

| | | | | | | |

| | | | | | 149,285 | |

| | | | | | | |

| | | | | | | |

Forest & Paper Products—2.3% | | | | | | | |

Kimberly-Clark Corp. | | | 1,730 | | | 90,704 | |

| | | | | | | |

| | | | | | | |

Health Services—1.8% | | | | | | | |

UnitedHealth Group, Inc. | | | 2,800 | | | 69,944 | |

| | | | | | | |

| | | | | | | |

Insurance—2.2% | | | | | | | |

PartnerRe, Ltd. | | | 675 | | | 43,841 | |

The Travelers Cos., Inc. | | | 1,050 | | | 43,092 | |

| | | | | | | |

| | | | | | 86,933 | |

| | | | | | | |

| | | | | | | |

Leisure & Entertainment—1.3% | | | | | | | |

Starbucks Corp. (a) | | | 3,630 | | | 50,421 | |

| | | | | | | |

| | | | | | | |

Manufacturing—5.2% | | | | | | | |

Deere & Co. | | | 1,180 | | | 47,141 | |

Dover Corp. | | | 1,320 | | | 43,679 | |

Honeywell International, Inc. | | | 2,350 | | | 73,790 | |

|

The accompanying notes are an integral part of these financial statements. |

|

Semi-Annual Report 13 |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Lazard Retirement U.S. Strategic Equity Portfolio

(concluded) |

|

Parker Hannifin Corp. | | | 860 | | $ | 36,945 | |

| | | | | | | |

| | | | | | 201,555 | |

| | | | | | | |

| | | | | | | |

Medical Products—7.1% | | | | | | | |

Becton, Dickinson & Co. | | | 600 | | | 42,786 | |

Johnson & Johnson | | | 3,280 | | | 186,304 | |

Medtronic, Inc. | | | 1,380 | | | 48,148 | |

| | | | | | | |

| | | | | | 277,238 | |

| | | | | | | |

| | | | | | | |

Metal & Glass Containers—2.0% | | | | | | | |

Ball Corp. | | | 1,700 | | | 76,772 | |

| | | | | | | |

| | | | | | | |

Real Estate—1.3% | | | | | | | |

Public Storage REIT | | | 745 | | | 48,783 | |

| | | | | | | |

| | | | | | | |

Retail—6.3% | | | | | | | |

CVS Caremark Corp. | | | 1,290 | | | 41,112 | |

The Gap, Inc. | | | 3,510 | | | 57,564 | |

The Kroger Co. | | | 1,700 | | | 37,485 | |

Tiffany & Co. | | | 690 | | | 17,499 | |

Walgreen Co. | | | 3,160 | | | 92,904 | |

| | | | | | | |

| | | | | | 246,564 | |

| | | | | | | |

| | | | | | | |

Semiconductors & Components—3.5% | | | | | | | |

Analog Devices, Inc. | | | 1,820 | | | 45,100 | |

Applied Materials, Inc. | | | 4,260 | | | 46,732 | |

Intel Corp. | | | 2,700 | | | 44,685 | |

| | | | | | | |

| | | | | | 136,517 | |

| | | | | | | |

| | | | | | | |

Technology—1.1% | | | | | | | |

eBay, Inc. (a) | | | 2,380 | | | 40,769 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Technology Hardware—6.5% | | | | | | | |

Cisco Systems, Inc. (a) | | | 5,000 | | $ | 93,200 | |

Hewlett-Packard Co. | | | 1,650 | | | 63,772 | |

International Business Machines Corp. | | | 940 | | | 98,155 | |

| | | | | | | |

| | | | | | 255,127 | |

| | | | | | | |

| | | | | | | |

Telecommunications—1.9% | | | | | | | |

Verizon Communications, Inc. | | | 2,370 | | | 72,830 | |

| | | | | | | |

| | | | | | | |

Transportation—1.9% | | | | | | | |

Union Pacific Corp. | | | 700 | | | 36,442 | |

United Parcel Service, Inc., Class B | | | 780 | | | 38,992 | |

| | | | | | | |

| | | | | | 75,434 | |

| | | | | | | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $3,860,411) | | | | | | 3,863,515 | |

| | | | | | | |

| | | | | | | |

Short-Term Investment—1.3% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund, 0.02% | | | | | | | |

(Identified cost $51,889) (b) | | | 51,889 | | | 51,889 | |

| | | | | | | |

| | | | | | | |

Total Investments—100.4% | | | | | | | |

(Identified cost $3,912,300) (c) | | | | | $ | 3,915,404 | |

| | | | | | | |

Liabilities in Excess of Cash and | | | | | | | |

Other Assets—(0.4)% | | | | | | (17,257 | ) |

| | | | | | | |

| | | | | | | |

Net Assets—100.0% | | | | | $ | 3,898,147 | |

| | | | | | | |

|

The accompanying notes are an integral part of these financial statements. |

|

14 Semi-Annual Report |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio |

| | | | | | | |

Common Stocks—38.4% | | | | | | | |

| | | | | | | |

Aerospace & Defense—0.2% | | | | | | | |

Spirit AeroSystems Holdings, Inc., | | | | | | | |

Class A (a) | | | 14,900 | | $ | 204,726 | |

| | | | | | | |

| | | | | | | |

Alcohol & Tobacco—0.4% | | | | | | | |

Molson Coors Brewing Co., Class B | | | 9,300 | | | 393,669 | |

| | | | | | | |

| | | | | | | |

Banking—1.6% | | | | | | | |

PacWest Bancorp | | | 46,700 | | | 614,572 | |

Prosperity Bancshares, Inc. | | | 19,300 | | | 575,719 | |

Wintrust Financial Corp. | | | 25,900 | | | 416,472 | |

| | | | | | | |

| | | | | | 1,606,763 | |

| | | | | | | |

| | | | | | | |

Chemicals—0.9% | | | | | | | |

Innospec, Inc. | | | 5,600 | | | 60,200 | |

Rockwood Holdings, Inc. (a) | | | 53,700 | | | 786,168 | |

| | | | | | | |

| | | | | | 846,368 | |

| | | | | | | |

| | | | | | | |

Commercial Services—1.8% | | | | | | | |

Corrections Corp. of America (a) | | | 44,100 | | | 749,259 | |

DST Systems, Inc. (a) | | | 8,800 | | | 325,160 | |

Team, Inc. (a) | | | 19,800 | | | 310,266 | |

Waste Connections, Inc. (a) | | | 16,300 | | | 422,333 | |

| | | | | | | |

| | | | | | 1,807,018 | |

| | | | | | | |

| | | | | | | |

Computer Software—1.5% | | | | | | | |

Ariba, Inc. (a) | | | 37,500 | | | 369,000 | |

Informatica Corp. (a) | | | 24,600 | | | 422,874 | |

j2 Global Communications, Inc. (a) | | | 17,400 | | | 392,544 | |

Quest Software, Inc. (a) | | | 23,100 | | | 322,014 | |

| | | | | | | |

| | | | | | 1,506,432 | |

| | | | | | | |

| | | | | | | |

Construction & Engineering—0.9% | | | | | | | |

Dycom Industries, Inc. (a) | | | 52,500 | | | 581,175 | |

Great Lakes Dredge & Dock Co. | | | 71,200 | | | 340,336 | |

| | | | | | | |

| | | | | | 921,511 | |

| | | | | | | |

| | | | | | | |

Consumer Products—3.9% | | | | | | | |

Bare Escentuals, Inc. (a) | | | 55,600 | | | 493,172 | |

Central Garden & Pet Co., Class A (a) | | | 32,200 | | | 317,170 | |

Chattem, Inc. (a) | | | 6,700 | | | 456,270 | |

Mattel, Inc. | | | 36,500 | | | 585,825 | |

Matthews International Corp., Class A | | | 27,300 | | | 849,576 | |

Polaris Industries, Inc. | | | 11,100 | | | 356,532 | |

Tempur-Pedic International, Inc. | | | 26,200 | | | 342,434 | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

The Middleby Corp. (a) | | | 10,700 | | $ | 469,944 | |

| | | | | | | |

| | | | | | 3,870,923 | |

| | | | | | | |

| | | | | | | |

Drugs—1.3% | | | | | | | |

Myriad Genetics, Inc. (a) | | | 8,000 | | | 285,200 | |

United Therapeutics Corp. (a) | | | 5,000 | | | 416,650 | |

Warner Chilcott, Ltd., Class A (a) | | | 44,200 | | | 581,230 | |

| | | | | | | |

| | | | | | 1,283,080 | |

| | | | | | | |

| | | | | | | |

Electric—0.8% | | | | | | | |

Hawaiian Electric Industries, Inc. | | | 43,700 | | | 832,922 | |

| | | | | | | |

| | | | | | | |

Energy Exploration & Production—1.0% | | | | | | | |

Cabot Oil & Gas Corp. | | | 16,000 | | | 490,240 | |

Petrohawk Energy Corp. (a) | | | 22,700 | | | 506,210 | |

| | | | | | | |

| | | | | | 996,450 | |

| | | | | | | |

| | | | | | | |

Energy Services—1.0% | | | | | | | |

Helmerich & Payne, Inc. | | | 17,000 | | | 524,790 | |

Superior Energy Services, Inc. (a) | | | 26,000 | | | 449,020 | |

| | | | | | | |

| | | | | | 973,810 | |

| | | | | | | |

| | | | | | | |

Financial Services—1.7% | | | | | | | |

Genesis Lease, Ltd. ADS | | | 59,100 | | | 254,721 | |

Jefferies Group, Inc. (a) | | | 22,600 | �� | | 482,058 | |

Piper Jaffray Cos., Inc. (a) | | | 13,300 | | | 580,811 | |

Waddell & Reed Financial, Inc., Class A | | | 15,100 | | | 398,187 | |

| | | | | | | |

| | | | | | 1,715,777 | |

| | | | | | | |

| | | | | | | |

Food & Beverages—1.0% | | | | | | | |

American Italian Pasta Co., Class A (a) | | | 12,700 | | | 370,078 | |

McCormick & Co., Inc. | | | 18,600 | | | 605,058 | |

| | | | | | | |

| | | | | | 975,136 | |

| | | | | | | |

| | | | | | | |

Health Services—0.4% | | | | | | | |

Healthcare Services Group, Inc. | | | 24,700 | | | 441,636 | |

| | | | | | | |

| | | | | | | |

Housing—0.8% | | | | | | | |

Beacon Roofing Supply, Inc. (a) | | | 12,000 | | | 173,520 | |

Trex Co., Inc. (a) | | | 43,200 | | | 577,584 | |

| | | | | | | |

| | | | | | 751,104 | |

| | | | | | | |

| | | | | | | |

Insurance—1.0% | | | | | | | |

Max Capital Group, Ltd. | | | 33,800 | | | 623,948 | |

RenaissanceRe Holdings, Ltd. | | | 7,300 | | | 339,742 | |

| | | | | | | |

| | | | | | 963,690 | |

| | | | | | | |

| | | | | | | |

Leisure & Entertainment—1.5% | | | | | | | |

Burger King Holdings, Inc. | | | 21,200 | | | 366,124 | |

Lions Gate Entertainment Corp. (a) | | | 68,700 | | | 384,720 | |

Texas Roadhouse, Inc., Class A (a) | | | 26,200 | | | 285,842 | |

Viacom, Inc., Class B (a) | | | 18,400 | | | 417,680 | |

| | | | | | | |

| | | | | | 1,454,366 | |

| | | | | | | |

|

The accompanying notes are an integral part of these financial statements. |

|

Semi-Annual Report 15 |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | |

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio (concluded) |

| | | | | | | |

Manufacturing—2.0% | | | | | | | |

Dover Corp. | | | 9,000 | | $ | 297,810 | |

Ener1, Inc. (a) | | | 35,400 | | | 193,284 | |

FLIR Systems, Inc. (a) | | | 17,700 | | | 399,312 | |

Force Protection, Inc. (a) | | | 30,600 | | | 270,504 | |

Kaman Corp. | | | 19,600 | | | 327,320 | |

Maxwell Technologies, Inc. (a) | | | 5,700 | | | 78,831 | |

Regal-Beloit Corp. | | | 9,700 | | | 385,284 | |

| | | | | | | |

| | | | | | 1,952,345 | |

| | | | | | | |

Medical Products—2.9% | | | | | | | |

Boston Scientific Corp. (a) | | | 27,700 | | | 280,878 | |

Hospira, Inc. (a) | | | 19,800 | | | 762,696 | |

Intuitive Surgical, Inc. (a) | | | 3,300 | | | 540,078 | |

Life Technologies Corp. (a) | | | 14,000 | | | 584,080 | |

Wright Medical Group, Inc. (a) | | | 41,700 | | | 678,042 | |

| | | | | | | |

| | | | | | 2,845,774 | |

| | | | | | | |

Metal & Glass Containers—0.5% | | | | | | | |

Ball Corp. | | | 11,100 | | | 501,276 | |

| | | | | | | |

| | | | | | | |

Metals & Mining—1.1% | | | | | | | |

AK Steel Holding Corp. | | | 11,300 | | | 216,847 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 7,850 | | | 393,364 | |

Reliance Steel & Aluminum Co. | | | 11,400 | | | 437,646 | |

| | | | | | | |

| | | | | | 1,047,857 | |

| | | | | | | |

Real Estate—1.6% | | | | | | | |

Digital Realty Trust, Inc. REIT | | | 9,900 | | | 354,915 | |

Simon Property Group, Inc. REIT | | | 7,200 | | | 370,296 | |

Tanger Factory Outlet Centers, Inc. REIT | | | 18,100 | | | 586,983 | |

The Macerich Co. REIT | | | 14,972 | | | 263,657 | |

| | | | | | | |

| | | | | | 1,575,851 | |

| | | | | | | |

Retail—2.6% | | | | | | | |

American Eagle Outfitters, Inc. | | | 40,200 | | | 569,634 | |

Deckers Outdoor Corp. (a) | | | 4,400 | | | 309,188 | |

Iconix Brand Group, Inc. (a) | | | 42,300 | | | 650,574 | |

Liz Claiborne, Inc. | | | 92,500 | | | 266,400 | |

The Children’s Place Retail Stores, Inc. (a) | | | 16,200 | | | 428,166 | |

The Gymboree Corp. (a) | | | 11,500 | | | 408,020 | |

| | | | | | | |

| | | | | | 2,631,982 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | | |

Semiconductors & Components—1.6% | | | | | | | |

Analog Devices, Inc. | | | 12,800 | | $ | 317,184 | |

CPI International, Inc. (a) | | | 22,100 | | | 192,049 | |

ON Semiconductor Corp. (a) | | | 93,600 | | | 642,096 | |

Plexus Corp. (a) | | | 20,500 | | | 419,430 | |

| | | | | | | |

| | | | | | 1,570,759 | |

| | | | | | | |

Technology—0.4% | | | | | | | |

Solera Holdings, Inc. (a) | | | 16,700 | | | 424,180 | |

| | | | | | | |

| | | | | | | |

Technology Hardware—1.8% | | | | | | | |

Ingram Micro, Inc., Class A (a) | | | 38,400 | | | 672,000 | |

LogMeIn, Inc. | | | 900 | | | 14,400 | |

Polycom, Inc. (a) | | | 34,900 | | | 707,423 | |

Seagate Technology | | | 40,800 | | | 426,768 | |

| | | | | | | |

| | | | | | 1,820,591 | |

| | | | | | | |

Telecommunications—0.4% | | | | | | | |

Starent Networks Corp. (a) | | | 15,800 | | | 385,678 | |

| | | | | | | |

| | | | | | | |

Transportation—1.8% | | | | | | | |

Continental Airlines, Inc., Class B (a) | | | 56,000 | | | 496,160 | |

Genesee & Wyoming, Inc., Class A (a) | | | 18,000 | | | 477,180 | |

Tidewater, Inc. | | | 8,500 | | | 364,395 | |

UTI Worldwide, Inc. (a) | | | 41,500 | | | 473,100 | |

| | | | | | | |

| | | | | | 1,810,835 | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $35,968,365) | | | | | | 38,112,509 | |

| | | | | | | |

| | | | | | | |

Short-Term Investment—0.8% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund, 0.02% | | | | | | | |

(Identified cost $851,545) (b) | | | 851,545 | | | 851,545 | |

| | | | | | | |

| | | | | | | |

Total Investments—39.2% | | | | | | | |

(Identified cost $36,819,910) (c) | | | | | $ | 38,964,054 | |

| | | | | | | |

Cash and Other Assets in Excess | | | | | | | |

of Liabilities—60.8% | | | | | | 60,358,058 | |

| | | | | | | |

| | | | | | | |

Net Assets—100.0% | | | | | $ | 99,322,112 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

16 Semi-Annual Report

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | | |

Lazard Retirement International Equity Portfolio | | | |

| | | | | | | |

Common Stocks—108.4% | | | | | | | |

| | | | | | | |

Belgium—2.0% | | | | | | | |

Anheuser-Busch InBev NV | | | 126,900 | | $ | 4,582,275 | |

| | | | | | | |

| | | | | | | |

Brazil—2.4% | | | | | | | |

Banco do Brasil SA | | | 280,600 | | | 3,032,972 | |

Cia Brasileira de Meios de Pagamento | | | 160,900 | | | 1,383,600 | |

Vale SA Sponsored ADR | | | 67,100 | | | 1,182,973 | |

| | | | | | | |

Total Brazil | | | | | | 5,599,545 | |

| | | | | | | |

| | | | | | | |

Canada—1.5% | | | | | | | |

Telus Corp. | | | 129,800 | | | 3,442,660 | |

| | | | | | | |

| | | | | | | |

China—1.1% | | | | | | | |

Industrial and Commercial Bank of

China, Ltd., Class H | | | 3,435,800 | | | 2,398,395 | |

| | | | | | | |

| | | | | | | |

Denmark—1.1% | | | | | | | |

Novo Nordisk A/S | | | 46,625 | | | 2,520,769 | |

| | | | | | | |

| | | | | | | |

Finland—2.9% | | | | | | | |

Nokia Corp. | | | 459,840 | | | 6,734,700 | |

| | | | | | | |

| | | | | | | |

France—13.3% | | | | | | | |

BNP Paribas | | | 90,100 | | | 5,845,848 | |

Bouygues SA | | | 69,200 | | | 2,601,668 | |

Danone SA | | | 49,408 | | | 2,438,395 | |

GDF Suez | | | 132,400 | | | 4,929,466 | |

Sanofi-Aventis | | | 111,780 | | | 6,565,655 | |

Total SA | | | 151,172 | | | 8,160,512 | |

| | | | | | | |

Total France | | | | | | 30,541,544 | |

| | | | | | | |

| | | | | | | |

Germany—10.6% | | | | | | | |

Allianz SE | | | 56,800 | | | 5,229,519 | |

Daimler AG | | | 70,900 | | | 2,564,130 | |

Deutsche Bank AG | | | 39,300 | | | 2,381,426 | |

E.ON AG | | | 172,600 | | | 6,106,563 | |

Merck KGaA | | | 24,030 | | | 2,444,009 | |

Siemens AG | | | 79,438 | | | 5,478,367 | |

| | | | | | | |

Total Germany | | | | | | 24,204,014 | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | | |

Greece—1.3% | | | | | | | |

OPAP SA | | | 110,687 | | $ | 2,950,266 | |

| | | | | | | |

| | | | | | | |

Hong Kong—0.9% | | | | | | | |

Esprit Holdings, Ltd. | | | 359,000 | | | 2,012,703 | |

| | | | | | | |

| | | | | | | |

Ireland—1.6% | | | | | | | |

CRH PLC | | | 161,131 | | | 3,684,493 | |

| | | | | | | |

| | | | | | | |

Italy—3.7% | | | | | | | |

Atlantia SpA | | | 120,050 | | | 2,425,133 | |

Eni SpA | | | 260,195 | | | 6,150,492 | |

| | | | | | | |

Total Italy | | | | | | 8,575,625 | |

| | | | | | | |

| | | | | | | |

Japan—19.5% | | | | | | | |

Canon, Inc. | | | 159,100 | | | 5,218,830 | |

Daito Trust Construction Co., Ltd. | | | 102,600 | | | 4,856,553 | |

Fanuc, Ltd. | | | 30,800 | | | 2,481,009 | |

Hoya Corp. | | | 147,000 | | | 2,954,191 | |

Inpex Corp. | | | 339 | | | 2,716,645 | |

Japan Tobacco, Inc. | | | 1,396 | | | 4,376,312 | |

KDDI Corp. | | | 671 | | | 3,566,222 | |

Keyence Corp. | | | 14,500 | | | 2,965,174 | |

Kurita Water Industries, Ltd. | | | 67,900 | | | 2,199,076 | |

Mitsubishi Corp. | | | 186,100 | | | 3,454,059 | |

Mitsubishi Estate Co., Ltd. | | | 236,000 | | | 3,946,603 | |

Secom Co., Ltd. | | | 93,700 | | | 3,812,778 | |

T&D Holdings, Inc. | | | 35,400 | | | 1,017,886 | |

Tokio Marine Holdings, Inc. | | | 43,300 | | | 1,200,093 | |

| | | | | | | |

Total Japan | | | | | | 44,765,431 | |

| | | | | | | |

| | | | | | | |

Mexico—0.7% | | | | | | | |

Grupo Televisa SA Sponsored ADR | | | 91,800 | | | 1,560,600 | |

| | | | | | | |

| | | | | | | |

Netherlands—1.5% | | | | | | | |

TNT NV | | | 178,287 | | | 3,462,770 | |

| | | | | | | |

| | | | | | | |

Russia—1.2% | | | | | | | |

OAO LUKOIL Sponsored ADR | | | 64,050 | | | 2,841,898 | |

| | | | | | | |

| | | | | | | |

Singapore—2.3% | | | | | | | |

Singapore Telecommunications, Ltd. | | | 2,494,200 | | | 5,166,114 | |

| | | | | | | |

| | | | | | | |

Spain—1.7% | | | | | | | |

Banco Santander SA | | | 327,300 | | | 3,930,346 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 17

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | | |

Lazard Retirement International Equity Portfolio

(concluded) |

| | | | | | | |

Sweden—1.4% | | | | | | | |

Telefonaktiebolaget LM Ericsson, B Shares | | | 334,160 | | $ | 3,278,945 | |

| | | | | | | |

| | | | | | | |

Switzerland—11.2% | | | | | | | |

Credit Suisse Group AG | | | 138,700 | | | 6,331,527 | |

Nestle SA | | | 132,440 | | | 4,987,755 | |

Novartis AG | | | 90,000 | | | 3,647,876 | |

Roche Holding AG | | | 33,300 | | | 4,526,630 | |

UBS AG (a) | | | 172,700 | | | 2,112,358 | |

Zurich Financial Services AG | | | 22,790 | | | 4,014,547 | |

| | | | | | | |

Total Switzerland | | | | | | 25,620,693 | |

| | | | | | | |

| | | | | | | |

Turkey—1.5% | | | | | | | |

Turkcell Iletisim Hizmetleri AS ADR | | | 250,536 | | | 3,472,429 | |

| | | | | | | |

| | | | | | | |

United Kingdom—25.0% | | | | | | | |

BAE Systems PLC | | | 821,600 | | | 4,575,491 | |

Barclays PLC | | | 887,600 | | | 4,132,590 | |

BG Group PLC | | | 140,900 | | | 2,359,812 | |

BP PLC | | | 708,518 | | | 5,569,492 | |

British American Tobacco PLC | | | 90,370 | | | 2,487,361 | |

BT Group PLC | | | 772,100 | | | 1,289,312 | |

Cairn Energy PLC (a) | | | 45,900 | | | 1,768,553 | |

HSBC Holdings PLC | | | 677,291 | | | 5,599,251 | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | | |

Imperial Tobacco Group PLC | | | 174,002 | | $ | 4,517,309 | |

Informa PLC | | | 314,900 | | | 1,134,581 | |

National Grid PLC | | | 221,023 | | | 1,990,858 | |

Prudential PLC | | | 693,600 | | | 4,718,492 | |

Qinetiq Group PLC | | | 513,600 | | | 1,212,538 | |

Reckitt Benckiser Group PLC | | | 59,000 | | | 2,684,867 | |

Tesco PLC | | | 608,300 | | | 3,538,740 | |

Unilever PLC | | | 232,600 | | | 5,449,269 | |

Vodafone Group PLC | | | 2,167,866 | | | 4,180,023 | |

| | | | | | | |

Total United Kingdom | | | | | | 57,208,539 | |

| | | | | | | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $274,417,622) | | | | | | 248,554,754 | |

| | | | | | | |

| | | | | | | |

Short-Term Investment—7.3% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund, 0.02% | | | | | | | |

(Identified cost $16,659,754) (b) | | | 16,659,754 | | | 16,659,754 | |

| | | | | | | |

| | | | | | | |

Total Investments—115.7% | | | | | | | |

(Identified cost $291,077,376) (c) | | | | | $ | 265,214,508 | |

| | | | | | | |

| | | | | | | |

Liabilities in Excess of Cash and | | | | | | | |

Other Assets—(15.7)% | | | | | | (36,032,010 | ) |

| | | | | | | |

| | | | | | | |

Net Assets—100.0% | | | | | $ | 229,182,498 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

18 Semi-Annual Report

| | | | | | | |

Description | | Shares | | Value | |

| |

Lazard Retirement Emerging Markets Equity Portfolio |

| | | | | | | |

Common Stocks—90.5% | | | | | | | |

| | | | | | | |

Argentina—1.1% | | | | | | | |

Tenaris SA ADR | | | 141,700 | | $ | 3,831,568 | |

| | | | | | | |

| | | | | | | |

Brazil—11.5% | | | | | | | |

Banco do Brasil SA | | | 1,051,800 | | | 11,368,780 | |

Cia Brasileira de Meios de | | | | | | | |

Pagamento | | | 459,900 | | | 3,954,741 | |

Companhia de Concessoes | | | | | | | |

Rodoviarias | | | 396,300 | | | 6,356,575 | |

Empresa Brasileira de Aeronautica | | | | | | | |

SA ADR | | | 90,300 | | | 1,495,368 | |

JHSF Participacoes SA | | | 610,100 | | | 572,893 | |

Redecard SA | | | 623,257 | | | 9,589,792 | |

Souza Cruz SA | | | 235,211 | | | 6,700,423 | |

| | | | | | | |

Total Brazil | | | | | | 40,038,572 | |

| | | | | | | |

| | | | | | | |

Egypt—4.1% | | | | | | | |

Commercial International Bank | | | 296,436 | | | 2,602,426 | |

Eastern Tobacco | | | 114,148 | | | 2,342,544 | |

Egyptian Company for Mobile Services | | | 100,987 | | | 3,504,036 | |

Orascom Construction Industries | | | 175,652 | | | 6,029,128 | |

| | | | | | | |

Total Egypt | | | | | | 14,478,134 | |

| | | | | | | |

| | | | | | | |

Hong Kong—1.0% | | | | | | | |

Huabao International Holdings, Ltd. | | | 1,355,000 | | | 1,311,282 | |

Shougang Concord International | | | | | | | |

Enterprises Co., Ltd. | | | 12,574,000 | | | 2,109,173 | |

| | | | | | | |

Total Hong Kong | | | | | | 3,420,455 | |

| | | | | | | |

| | | | | | | |

India—6.9% | | | | | | | |

Infosys Technologies, Ltd. | | | | | | | |

Sponsored ADR | | | 55,600 | | | 2,044,968 | |

Jindal Steel & Power, Ltd. | | | 50,467 | | | 2,649,294 | |

Oil and Natural Gas Corp., Ltd. | | | 584,585 | | | 12,999,252 | |

Punjab National Bank, Ltd. | | | 443,234 | | | 6,282,348 | |

| | | | | | | |

Total India | | | | | | 23,975,862 | |

| | | | | | | |

| | | | | | | |

Indonesia—5.5% | | | | | | | |

PT Astra International Tbk | | | 335,500 | | | 782,258 | |

PT Bank Mandiri Tbk | | | 20,179,200 | | | 6,276,656 | |

| | | | | | | |

Description | | Shares | | Value | |

| |

PT Telekomunikasi Indonesia Tbk | | | | | | | |

Sponsored ADR | | | 311,700 | | $ | 9,344,766 | |

PT United Tractors Tbk | | | 2,849,050 | | | 2,777,178 | |

| | | | | | | |

Total Indonesia | | | | | | 19,180,858 | |

| | | | | | | |

| | | | | | | |

Israel—3.9% | | | | | | | |

Bank Hapoalim BM (a) | | | 1,514,482 | | | 4,030,911 | |

Cellcom Israel, Ltd. | | | 20,200 | | | 536,714 | |

Delek Automotive Systems, Ltd. | | | 277,209 | | | 2,250,824 | |

Israel Chemicals, Ltd. | | | 668,173 | | | 6,632,425 | |

| | | | | | | |

Total Israel | | | | | | 13,450,874 | |

| | | | | | | |

| | | | | | | |

Malaysia—1.2% | | | | | | | |

British American Tobacco Malaysia | | | | | | | |

Berhad | | | 163,300 | | | 2,078,997 | |

PLUS Expressways Berhad | | | 2,524,200 | | | 2,297,992 | |

| | | | | | | |

Total Malaysia | | | | | | 4,376,989 | |

| | | | | | | |

| | | | | | | |

Mexico—7.9% | | | | | | | |

America Movil SAB de CV ADR,

Series L | | | 195,700 | | | 7,577,504 | |

Desarrolladora Homex SA de CV

ADR (a) | | | 157,190 | | | 4,384,029 | |

Fomento Economico Mexicano SAB | | | | | | | |

de CV Sponsored ADR | | | 215,090 | | | 6,934,501 | |

Grupo Televisa SA Sponsored ADR | | | 366,900 | | | 6,237,300 | |

Kimberly-Clark de Mexico SAB de CV, | | | | | | | |

Series A | | | 590,600 | | | 2,253,728 | |

| | | | | | | |

Total Mexico | | | | | | 27,387,062 | |

| | | | | | | |

| | | | | | | |

Pakistan—0.8% | | | | | | | |

Pakistan Petroleum, Ltd. | | | 1,142,770 | | | 2,665,481 | |

| | | | | | | |

| | | | | | | |

Philippines—3.0% | | | | | | | |

Philippine Long Distance Telephone | | | | | | | |

Co. Sponsored ADR | | | 207,300 | | | 10,306,956 | |

| | | | | | | |

| | | | | | | |

Russia—7.3% | | | | | | | |

Mobile TeleSystems Sponsored ADR | | | 260,800 | | | 9,631,344 | |

OAO LUKOIL Sponsored ADR | | | 255,600 | | | 11,340,972 | |

Oriflame Cosmetics SA SDR | | | 104,219 | | | 4,532,347 | |

| | | | | | | |

Total Russia | | | | | | 25,504,663 | |

| | | | | | | |

| | | | | | | |

South Africa—12.8% | | | | | | | |

Kumba Iron Ore, Ltd. | | | 312,413 | | | 7,333,020 | |

Massmart Holdings, Ltd. | | | 322,240 | | | 3,343,064 | |

Murray & Roberts Holdings, Ltd. | | | 1,056,508 | | | 6,850,433 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 19

| | | | | | | |

Description | | Shares | | Value | |

| |

Lazard Retirement Emerging Markets Equity Portfolio (concluded) |

|

Nedbank Group, Ltd. | | | 568,567 | | $ | 7,229,437 | |

Pretoria Portland Cement Co., Ltd. | | | 1,096,993 | | | 4,128,350 | |

Sanlam, Ltd. | | | 3,457,910 | | | 7,748,767 | |

Tiger Brands, Ltd. | | | 137,066 | | | 2,561,350 | |

Truworths International, Ltd. | | | 1,120,660 | | | 5,377,133 | |

| | | | | | | |

Total South Africa | | | | | | 44,571,554 | |

| | | | | | | |

| | | | | | | |

South Korea—10.0% | | | | | | | |

Amorepacific Corp. | | | 4,581 | | | 2,456,001 | |

Hite Brewery Co., Ltd. | | | 30,783 | | | 3,793,658 | |

KT&G Corp. | | | 36,400 | | | 2,057,224 | |

NHN Corp. (a) | | | 37,555 | | | 5,203,075 | |

S1 Corp. | | | 22,848 | | | 972,065 | |

Samsung Electronics Co., Ltd.

GDR (d) | | | 22,876 | | | 5,335,827 | |

Shinhan Financial Group Co., Ltd. (a) | | | 363,588 | | | 9,204,218 | |

Woongjin Coway Co., Ltd. | | | 237,922 | | | 5,789,538 | |

| | | | | | | |

Total South Korea | | | | | | 34,811,606 | |

| | | | | | | |

| | | | | | | |

Taiwan—5.1% | | | | | | | |

Advanced Semiconductor | | | | | | | |

Engineering, Inc. | | | 4,957,011 | | | 2,863,010 | |

Hon Hai Precision Industry Co., Ltd. | | | 1,613,892 | | | 4,992,686 | |

HTC Corp. | | | 432,000 | | | 6,109,357 | |

Taiwan Semiconductor Manufacturing | | | | | | | |

Co., Ltd. | | | 2,188,699 | | | 3,648,944 | |

| | | | | | | |

Total Taiwan | | | | | | 17,613,997 | |

| | | | | | | |

| | | | | | | |

Thailand—2.1% | | | | | | | |

Banpu Public Co., Ltd. | | | 345,900 | | | 3,431,588 | |

Kasikornbank PCL | | | 1,865,300 | | | 3,969,306 | |

| | | | | | | |

Total Thailand | | | | | | 7,400,894 | |

| | | | | | | |

| | | | | | | |

Turkey—6.3% | | | | | | | |

Akbank TAS | | | 1,408,167 | | | 6,306,044 | |

| | | | | | | |

Description | | Shares | | Value | |

| |

Ford Otomotiv Sanayi AS | | | 75,653 | | $ | 294,599 | |

Turkcell Iletisim Hizmetleri AS | | | 1,024,786 | | | 5,686,605 | |

Turkiye Is Bankasi AS, C Shares | | | 3,232,216 | | | 9,523,793 | |

| | | | | | | |

Total Turkey | | | | | | 21,811,041 | |

| | | | | | | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $334,701,110) | | | | | | 314,826,566 | |

| | | | | | | |

| | | | | | | |

Preferred Stocks—3.4% | | | | | | | |

| | | | | | | |

Brazil—3.4% | | | | | | | |

AES Tiete SA | | | 301,778 | | | 3,141,756 | |

Eletropaulo Metropolitana SA, B Shares | | | 125,900 | | | 2,231,440 | |

Fertilizantes Fosfatados SA | | | 26,700 | | | 203,708 | |

Klabin SA | | | 191,300 | | | 291,904 | |

Suzano Papel e Celulose SA (a) | | | 362,256 | | | 2,802,654 | |

Usinas Siderurgicas de Minas Gerais | | | | | | | |

SA, A Shares | | | 124,300 | | | 2,639,512 | |

Vale SA, A Shares | | | 36,200 | | | 551,452 | |

| | | | | | | |

Total Brazil | | | | | | 11,862,426 | |

| | | | | | | |

| | | | | | | |

Total Preferred Stocks | | | | | | | |

(Identified cost $12,964,149) | | | | | | 11,862,426 | |

| | | | | | | |

| | | | | | | |

Short-Term Investment—8.2% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund, 0.02% | | | | | | | |

(Identified cost $28,538,754) (b) | | | 28,538,754 | | | 28,538,754 | |

| | | | | | | |

| | | | | | | |

Total Investments—102.1% | | | | | | | |

(Identified cost $376,204,013) (c) | | | | | $ | 355,227,746 | |

| | | | | | | |

Liabilities in Excess of Cash and | | | | | | | |

Other Assets—(2.1)% | | | | | | (7,214,732 | ) |

| | | | | | | |

| | | | | | | |

Net Assets—100.0% | | | | | $ | 348,013,014 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

20 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Notes to Portfolios of Investments June 30, 2009 (unaudited) |

|

| |

(a) | Non-income producing security. |

(b) | Rate shown reflects 7 day yield as of June 30, 2009. |

(c) | For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation (depreciation) are as follows: |

| | | | | | | | | | | | | | | |

| Portfolio | | | Aggregate

Cost | | Aggregate Gross

Unrealized

Appreciation | | Aggregate Gross

Unrealized

Depreciation | | Net Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | | |

| Retirement U.S. Strategic Equity | | $ | 3,912,300 | | $ | 198,904 | | $ | 195,800 | | $ | 3,104 | |

| Retirement U.S. Small-Mid Cap Equity | | | 36,819,910 | | | 3,665,734 | | | 1,521,590 | | | 2,144,144 | |

| Retirement International Equity | | | 291,077,376 | | | 9,989,693 | | | 35,852,561 | | | (25,862,868 | ) |

| Retirement Emerging Markets Equity | | | 376,204,013 | | | 20,368,684 | | | 41,344,951 | | | (20,976,267 | ) |

| |

(d) | Pursuant to Rule 144A under the Securities Act of 1933, this security may only be traded among “qualified institutional buyers.” At June 30, 2009, it amounted to 1.5% of net assets of Lazard Retirement Emerging Markets Equity Portfolio and is considered to be liquid. |

Security Abbreviations:

|

ADR — American Depositary Receipt |

ADS — American Depositary Share |

GDR — Global Depositary Receipt |

REIT — Real Estate Investment Trust |

SDR — Swedish Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 21

Portfolio holdings by industry (as percentage of net assets), for those Portfolios previously presented by country:

| | | | | | | | | | | | |

Industry | | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | |

Agriculture | | | — | % | | | | 2.0 | % | | |

Alcohol & Tobacco | | | 7.0 | | | | | 4.9 | | | |

Automotive | | | 1.1 | | | | | 0.3 | | | |

Banking | | | 14.7 | | | | | 16.6 | | | |

Building Materials | | | — | | | | | 1.2 | | | |

Commercial Services | | | 3.2 | | | | | 0.9 | | | |

Computer Software | | | — | | | | | 1.5 | | | |

Construction & Engineering | | | 1.1 | | | | | 3.7 | | | |

Consumer Products | | | 1.2 | | | | | 4.0 | | | |

Drugs | | | 8.6 | | | | | — | | | |

Electric | | | 3.5 | | | | | 1.5 | | | |

Energy Exploration & Production | | | 2.0 | | | | | 4.5 | | | |

Energy Integrated | | | 10.9 | | | | | 4.2 | | | |

Energy Services | | | — | | | | | 1.1 | | | |

Financial Services | | | 1.5 | | | | | 8.8 | | | |

Food & Beverages | | | 5.6 | | | | | 2.7 | | | |

Forest & Paper Products | | | — | | | | | 1.5 | | | |

Gas Utilities | | | 2.2 | | | | | — | | | |

Housing | | | 3.7 | | | | | 1.3 | | | |

Insurance | | | 7.1 | | | | | — | | | |

Leisure & Entertainment | | | 2.5 | | | | | 1.8 | | | |

Manufacturing | | | 8.3 | | | | | 1.8 | | | |

Metals & Mining | | | 0.5 | | | | | 3.8 | | | |

Real Estate | | | 1.7 | | | | | 0.2 | | | |

Retail | | | 2.4 | | | | | 2.5 | | | |

Semiconductors & Components | | | 3.5 | | | | | 3.4 | | | |

Technology | | | — | | | | | 0.6 | | | |

Technology Hardware | | | 4.4 | | | | | 3.2 | | | |

Telecommunications | | | 9.2 | | | | | 13.4 | | | |

Transportation | | | 2.5 | | | | | 2.5 | | | |

| | | | | | | | | | | |

Subtotal | | | 108.4 | | | | | 93.9 | | | |

Short-Term Investments | | | 7.3 | | | | | 8.2 | | | |

| | | | | | | | | | | |

Total Investments | | | 115.7 | % | | | | 102.1 | % | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

22 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Statements of Assets and Liabilities (unaudited) |

|

| | | | | | | | | | | | | |

June 30, 2009 | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | |

ASSETS | | | | | | | | | | | | | |

Investments in securities, at value | | $ | 3,915,404 | | $ | 38,964,054 | | $ | 265,214,508 | | $ | 355,227,746 | |

Foreign currency | | | — | | | — | | | 77,928 | | | 686,410 | |

Receivables for: | | | | | | | | | | | | | |

Capital stock sold | | | 6,352 | | | 60,087,263 | | | 1,856,297 | | | 2,291,850 | |

Investments sold | | | — | | | 1,238,704 | | | — | | | 2,309,987 | |

Dividends and interest | | | 4,409 | | | 6,977 | | | 1,337,784 | | | 1,173,914 | |

Amount due from Investment Manager (Note 3) | | | 8,166 | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

Total assets | | | 3,934,331 | | | 100,296,998 | | | 268,486,517 | | | 361,689,907 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | |

Payables for: | | | | | | | | | | | | | |

Management fees | | | — | | | 14,993 | | | 157,488 | | | 313,688 | |

Accrued distribution fees | | | 796 | | | 8,036 | | | 54,386 | | | 49,197 | |

Accrued directors’ fees | | | 53 | | | 575 | | | 3,496 | | | 3,883 | |

Capital stock redeemed | | | 566 | | | 372,099 | | | 30,132,657 | | | 6,559,369 | |

Investments purchased | | | — | | | 529,682 | | | 8,814,578 | | | 6,393,146 | |

Other accrued expenses and payables | | | 34,769 | | | 49,501 | | | 141,414 | | | 357,610 | |

| | | | | | | | | | | | | |

Total liabilities | | | 36,184 | | | 974,886 | | | 39,304,019 | | | 13,676,893 | |

| | | | | | | | | | | | | |

Net assets | | $ | 3,898,147 | | $ | 99,322,112 | | $ | 229,182,498 | | $ | 348,013,014 | |

| | | | | | | | | | | | | |

|

NET ASSETS | | | | | | | | | | | | | |

Paid in capital | | $ | 5,595,993 | | $ | 118,582,337 | | $ | 330,489,528 | | $ | 457,947,107 | |

Undistributed net investment income (loss) | | | 35,015 | | | (16,278 | ) | | 6,064,954 | | | 4,105,459 | |

Accumulated net realized loss | | | (1,735,965 | ) | | (21,388,091 | ) | | (81,544,775 | ) | | (92,950,429 | ) |

Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | |

Investments | | | 3,104 | | | 2,144,144 | | | (25,862,868 | ) | | (21,107,630 | ) |

Foreign currency | | | — | | | — | | | 35,659 | | | 18,507 | |

| | | | | | | | | | | | | |

Net assets | | $ | 3,898,147 | | $ | 99,322,112 | | $ | 229,182,498 | | $ | 348,013,014 | |

| | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | |

Net assets | | $ | 3,898,147 | | $ | 99,322,112 | | $ | 229,182,498 | | $ | 244,876,242 | |

Shares of capital stock outstanding* | | | 570,883 | | | 13,625,309 | | | 27,534,787 | | | 16,101,807 | |

Net asset value, offering and redemption price per share | | $ | 6.83 | | $ | 7.29 | | $ | 8.32 | | $ | 15.21 | |

Investor Shares | | | | | | | | | | | | | |

Net assets | | | — | | | — | | | — | | $ | 103,136,772 | |

Shares of capital stock outstanding* | | | — | | | — | | | — | | | 6,796,223 | |

Net asset value, offering and redemption price per share | | | — | | | — | | | — | | $ | 15.18 | |

| | | | | | | | | | | | | |

Cost of investments in securities | | $ | 3,912,300 | | $ | 36,819,910 | | $ | 291,077,376 | | $ | 376,204,013 | |

Cost of foreign currency | | | — | | | — | | $ | 78,028 | | $ | 685,663 | |

* $0.001 par value 1,400,000,000 shares authorized for the Portfolios in total.

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 23

|

|

Lazard Retirement Series, Inc. Statements of Operations (unaudited) |

|

| | | | | | | | | | | | | |

For the Six Months Ended June 30, 2009 | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | |

Investment Income (Loss) | | | | | | | | | | | | | |

|

Income | | | | | | | | | | | | | |

Dividends | | $ | 42,087 | | $ | 194,786 | | $ | 5,308,873 | | $ | 5,788,692 | |

Interest | | | 17 | | | 198 | | | 1,978 | | | 3,124 | |

| | | | | | | | | | | | | |

Total investment income* | | | 42,104 | | | 194,984 | | | 5,310,851 | | | 5,791,816 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | |

Management fees | | | 12,855 | | | 126,754 | | | 822,823 | | | 1,285,663 | |

Distribution fees (Service Shares) | | | 4,285 | | | 42,252 | | | 274,275 | | | 234,303 | |

Custodian fees | | | 26,187 | | | 34,637 | | | 81,804 | | | 299,872 | |

Professional services | | | 16,647 | | | 22,669 | | | 53,157 | | | 50,509 | |

Administration fees | | | 21,495 | | | 24,456 | | | 43,018 | | | 46,789 | |

Shareholders’ reports | | | 3,582 | | | 13,977 | | | 49,740 | | | 36,155 | |

Shareholders’ services | | | 6,812 | | | 7,995 | | | 10,473 | | | 15,890 | |

Directors’ fees and expenses | | | 128 | | | 1,335 | | | 8,958 | | | 9,033 | |

Other | | | 1,004 | | | 2,079 | | | 8,670 | | | 8,506 | |

| | | | | | | | | | | | | |

Total gross expenses | | | 92,995 | | | 276,154 | | | 1,352,918 | | | 1,986,720 | |

| | | | | | | | | | | | | |

Management fees waived and expenses reimbursed | | | (62,196 | ) | | (64,880 | ) | | — | | | (16,772 | ) |

Administration fees waived | | | (9,375 | ) | | — | | | — | | | — | |

Expense reductions | | | — | | | (12 | ) | | (81 | ) | | — | |

| | | | | | | | | | | | | |

Total net expenses | | | 21,424 | | | 211,262 | | | 1,352,837 | | | 1,969,948 | |

| | | | | | | | | | | | | |

Net investment income (loss) | | | 20,680 | | | (16,278 | ) | | 3,958,014 | | | 3,821,868 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | | | | | | | | | | | |

Net realized loss on: | | | | | | | | | | | | | |

Investments | | | (546,670 | ) | | (6,405,424 | ) | | (71,064,154 | ) | | (64,459,321 | ) |

Foreign currency | | | — | | | — | | | (58,162 | ) | | (274,408 | ) |

Net change in unrealized appreciation on: | | | | | | | | | | | | | |

Investments** | | | 726,834 | | | 11,383,146 | | | 64,559,143 | | | 136,103,590 | |

Foreign currency | | | — | | | — | | | 42,421 | | | 17,108 | |

| | | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 180,164 | | | 4,977,722 | | | (6,520,752 | ) | | 71,386,969 | |

| | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 200,844 | | $ | 4,961,444 | | $ | (2,562,738 | ) | $ | 75,208,837 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

* Net of foreign withholding taxes of | | $ | — | | $ | — | | $ | 593,243 | | $ | 356,614 | |

| | | | | | | | | | | | | |

** Includes net change in unrealized foreign capital gains taxes of | | $ | — | | $ | — | | $ | — | | $ | (131,363 | ) |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

24 Semi-Annual Report

|

|

Lazard Retirement Series, Inc. Statements of Changes in Net Assets |

|

| | | | | | | | | | | | | |

| | Lazard Retirement

U.S. Strategic Equity Portfolio | | Lazard Retirement

U.S. Small-Mid Cap Equity Portfolio |

| | | | | |

| | Six Months Ended

June 30, 2009

(unaudited) | | Year Ended

December 31,

2008 | | Six Months Ended

June 30, 2009

(unaudited) | | Year Ended

December 31,

2008 | |

| | | | | | | | | | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | | |

|

Operations | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 20,680 | | $ | 49,312 | | $ | (16,278 | ) | $ | (53,668 | ) |

Net realized loss on investments | | | (546,670 | ) | | (1,147,981 | ) | | (6,405,424 | ) | | (14,364,336 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 726,834 | | | (501,960 | ) | | 11,383,146 | | | (6,798,323 | ) |

| | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 200,844 | | | (1,600,629 | ) | | 4,961,444 | | | (21,216,327 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Distributions to shareholders | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | |

From net investment income | | | — | | | (34,641 | ) | | — | | | — | |

| | | | | | | | | | | | | |

Net decrease in net assets resulting from distributions | | | — | | | (34,641 | ) | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Capital stock transactions | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | |

Net proceeds from sales | | | 1,268,493 | | | 1,511,286 | | | 64,445,796 | | | 7,873,436 | |

Net proceeds from reinvestment of distributions | | | — | | | 34,641 | | | — | | | — | |

Cost of shares redeemed | | | (883,100 | ) | | (1,557,278 | ) | | (5,054,267 | ) | | (14,459,743 | ) |

| | | | | | | | | | | | | |

Net increase (decrease) in net assets from capital stock transactions | | | 385,393 | | | (11,351 | ) | | 59,391,529 | | | (6,586,307 | ) |

| | | | | | | | | | | | | |