UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08071

Lazard Retirement Series, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Mark R. Anderson, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/22

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard Retirement Series

Annual Report

December 31, 2022

Equity

Lazard Retirement Emerging Markets Equity Portfolio

Lazard Retirement International Equity Portfolio

Lazard Retirement US Small-Mid Cap Equity Portfolio

Multi-Asset

Lazard Retirement Global Dynamic Multi-Asset Portfolio

Lazard Retirement Series, Inc. Table of Contents

Shares of the Portfolios are currently offered only to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. Portfolio shares may also be offered to certain qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis.

Please consider a Portfolio’s investment objective, risks, charges and expenses carefully before investing. For more complete information about Lazard Retirement Series, Inc. (the “Fund”), you may obtain a prospectus or a Portfolio’s summary prospectus by calling 800-823-6300, or online, at www.lazardassetmanagement.com. Read the prospectus or the Portfolio’s summary prospectus carefully before you invest. The prospectus and a Portfolio’s summary prospectus contain the investment objective, risks, charges, expenses and other information about the Portfolio, which are not detailed in this report.

Distributed by Lazard Asset Management Securities LLC.

Annual Report 1

Lazard Retirement Series, Inc. A Message from Lazard (unaudited)

Dear Shareholder:

The year 2022 saw some momentous events, including a lingering pandemic in its third year, the largest land war in Europe since World War II, and the rise of the most powerful Chinese leader in generations, whose ideology-driven policies pivoted China away from market reforms. From the perspective of global financial markets, however, 2022 can be summed up in less than 10 words: surging inflation and central bank actions to contain it.

Long-simmering concerns about inflation stemming from the renormalization of the global economy came to a boil in 2022. A European energy crisis triggered by Russia’s invasion of Ukraine and supply chain disruptions, made worse by COVID-driven lockdowns of major manufacturing hubs in China, turbocharged already-accelerating price growth. With global inflation reaching levels not seen in decades, central banks were forced to abandon their ultra-low interest rate policies and pivot to monetary tightening policies. At the forefront of these efforts was the US Federal Reserve (the “Fed”), the world’s most influential central bank, which pursued an aggressive rate-hiking campaign starting in March 2022 that would ultimately result in seven increases to its short-term interest rate during the year. The Fed’s actions rippled across global financial markets, stoking anxiety that these actions might tip the US economy into a recession while leading to a significant appreciation of the US dollar, which caused economic turmoil in the rest of the world.

At least 40 central banks from around the world raised rates in 2022, including the European Central Bank (the “ECB”), which lifted its benchmark rate four times, and the Bank of England (the “BoE”), which did so eight times. The Bank of Japan (the “BoJ”) was one of the few major central banks to swim against this global tide by maintaining an ultra-loose monetary policy; yet, by doing so, the Japanese yen depreciated significantly against the US dollar, which contributed to a weakening of Japan’s economy. With inflation in Japan rising, however, the BoJ took a small step away from this easy-money policy stance by letting a benchmark interest rate rise in the closing days of the year.

2 Annual Report

The global rate-hiking cycle began to yield results late in the year as key data indicators suggested that global inflation may have peaked. While prominent central banks such the Fed, the ECB, and the BoE tempered their rate increases in December, they also made clear that their fight against high inflation was not over yet, with more interest rate increases likely to occur in 2023.

Against this backdrop, global equity and bond markets tumbled in 2022, losing more than US$30 trillion in total value. The challenging market conditions in 2022 are a reminder of the importance of active portfolio management. Turbulent markets are likely to differentiate winners from losers. We remain confident that fundamental analysis and bottom-up security selection will be crucial drivers of performance going forward. We are privileged that you have turned to Lazard for your investment needs and value your continued confidence in our investment management capabilities.

Sincerely,

Lazard Asset Management LLC

Annual Report 3

Lazard Retirement Series, Inc. Market Overviews (unaudited)

Global Markets

A multi-year rally in global equity markets that was fueled by a low-interest rate environment ended in 2022, sending stock prices plummeting amid concerns about soaring inflation and the response of central banks to contain it.

Financial markets found themselves mired in uncertainty throughout the year. The renormalization of the global economy as pandemic-driven restrictions loosened was uneven, and supply chain bottlenecks and a European energy crisis triggered by Russia’s invasion of Ukraine combined to produce the worst inflation in decades. As a result, central banks abandoned their ultra-low interest rate policies and pivoted to monetary tightening policies. Markets were intently focused on the US Federal Reserve (the “Fed”), the world’s most influential central bank, as it pursued an aggressive rate-hiking campaign starting in March that would ultimately result in seven increases to its short-term interest rate during 2022, ending at its highest level in 15 years. Markets were volatile throughout most of 2022 as investors attempted to predict the path of the Fed’s interest rate policy, with stocks coming under increasing pressure when it became clear that the Fed, through its pronouncements and its actions, was determined to rein in soaring price growth even if it meant tipping the US economy into a recession. The steady drumbeat of rate hikes from the Fed led to a sell-off in the US government bond market in 2022, driving up the yield on the benchmark 10-year US Treasury note by 237 basis points, the largest yearly climb since at least 1953. The 10-year Treasury bond yield ended the year at 3.88%, which put significant pressure on stocks by undercutting their appeal.

The Fed’s actions were part of a larger wave of monetary tightening prescribed by at least 40 central banks around the world during the year. In Europe, where the protracted Russia-Ukraine conflict led to soaring energy prices that resulted in rampant inflation, the European Central Bank (ECB) raised its benchmark rate four times while the Bank of England (BoE) did so eight times.

Encouraging data during the last three months of 2022 suggesting that worldwide inflation may finally have peaked sparked a

4 Annual Report

two-month rally in global stock markets starting in October on hopes that central banks would soon tap the brakes on their rate-hiking campaigns. These hopes were dashed in December when the Fed affirmed its hawkish stance, despite downshifting to a 50-basis point rate hike after four consecutive 75-basis point hikes in earlier months. The Fed’s warning was quickly echoed by the ECB and the BoE after they implemented their own 50-basis point rate increases. The warning from these major central banks that they were committed to crushing stubbornly high inflation at a time when economies were already slowing or in recession unnerved investors and drove global stock markets downward in December. Notably, even the Bank of Japan, one of the last remaining holdouts among major central banks, moved to let a benchmark interest rate rise, a small but significant move suggesting that Japan’s central bank might be moving away from its dovish stance amid increasing domestic price pressure.

Against this backdrop, global equity markets, as measured by the MSCI All Country World Index, recorded its worst annual performance since 2008. The index lost about one-fifth of its value in 2022, the equivalent of US$18 trillion. The MSCI World Index, which measures developed markets, receded 18.1% while the MSCI Emerging Markets Index fell 20.1%. Notably, the S&P 500 Index—the bellwether of the US stock market—ended the year down 18.1%, also its worst yearly performance since 2008, having lost about US$8.2 trillion in value.

In terms of the MSCI All Country World Index, energy was the best-performing sector in the 12-month period, as shares of energy companies surged on bullish sentiment about the demand outlook for oil. Communication services was the worst-performing sector, as rising interest rates led investors to sell off technology stocks with high valuations and low dividend payments.

Emerging Markets Equities

The area encompassing emerging Europe, the Middle East, and Africa (EMEA) was the worst-performing region in 2022. In March, MSCI removed Russian stocks from its emerging markets indices after deeming them as “uninvestable” and wrote to zero the value of its Russia index after the country’s stock market was determined

Annual Report 5

to not be operating under normal rules. Emerging Asia underperformed, with China’s stock market plummeting on bearish sentiment about the country’s economic outlook amid coronavirus-driven lockdowns, a beleaguered real estate sector, and news that Xi Jinping had secured an unprecedented third term as the country’s president. Stock markets in Korea and Taiwan both tumbled on concerns about the demand outlook for semiconductor chips, the flagship industry for both countries.The steep drops recorded by Chinese, Korean, and Taiwanese stocks, which, in the aggregate, account for about 58% of the MSCI Emerging Markets Index, had an outsize impact on the benchmark’s overall performance. Latin America was the best-performing region, with the stock markets of commodities-exporting countries such as Brazil and Chile outperforming thanks to the increase in raw materials prices.

Information technology was the worst-performing sector, as the Chinese government’s crackdown on the country’s technology companies led to a steep sell-off of industry stocks. Utilities was the best-performing sector, as mounting global economic uncertainty led investors to rotate to defensive stocks.

International Equities

International developed markets, as measured by the MSCI EAFE Index, rallied sharply in the fourth quarter of 2022, reducing some of the significant year-to-date drawdown. This reversal was due mainly to two factors. First, signs of peaking inflation became evident which reduced investor expectations for significant future rate hikes by central banks. Second, the end of COVID lockdowns in China raised expectations for a pickup in global growth as China’s economy reopened. The very strong returns in the fourth quarter were led by lower-quality stocks, as is normally the case in a strong absolute return period, and this extended the lead for low quality compared to high quality for the full year. Foreign currency strength added to already strong local market performance for international benchmarks as peaking inflation data drove dollar weakness. As a result, despite fears of significant macroeconomic headwinds to international markets, the MSCI EAFE Index outperformed the MSCI USA Index, not only in local terms, but also in US dollars terms for the fourth quarter and the full year for the first

6 Annual Report

time since 2017. During the year, the MSCI EAFE Index fell 7.0% in local terms and 14.5% in US dollar terms versus the 19.8% decline for the MSCI USA Index.

US Equities

US equity markets sold off during the year as several factors, including supply chain bottlenecks, rising energy prices, a tight labor market, and sustained consumer demand, combined to drive US inflation to its highest level in 40 years. As a result, the Fed reversed its ultra-low interest rate policy and embarked on an aggressive rate-hiking campaign, resulting in its benchmark rate ending December at its highest level in 15 years. Stocks were volatile throughout the year as investors grappled with two competing sentiments—relief that the Fed was taking aggressive actions to rein in rising prices and concerns that these same actions could slow economic growth. Investors were encouraged towards the end of the year that domestic inflation was showing signs of moderating, with November marking the fifth consecutive month of declines. Against this backdrop, large-cap equities, as measured by the S&P 500 Index, fell 18.1% in 2022, modestly outperforming small-cap and mid-cap equities, as measured by the Russell 2500 Index, which declined 18.4%.

Multi-Asset

Global equity markets fell sharply during 2022 as high inflation and softening company profits curbed investor appetite for stocks and riskier asset classes, leading the MSCI World Index to record its worst annual performance since 2008. Amid soaring inflation and the resulting global monetary tightening cycle, bond markets suffered their worst annual performance on record, sending yields surging. The Fed embarked on an aggressive rate-hiking campaign, taking the policy rate from 0.25% to 4.50% over the year, and markets responded as the yield on the benchmark US 10-year Treasury note ended the year at 3.88%, having traded throughout the year in a range of 1.73% to 4.24%. Across the Atlantic, the ECB pivoted to a hawkish stance and ended an eight-year experiment with zero interest (and negative deposit) rates, moving its main policy rate from 0.00% to 2.50%; the yield on the 10-year German bund, Europe’s principal safe-haven asset, ended the year at 2.57%, with

Annual Report 7

a range of -0.18% to 2.57%. Commodities was the major asset class to buck the negative trend, finishing the period up 15.79% on higher energy and grain prices, largely driven by the ongoing conflict in Ukraine.

PORTFOLIO PERFORMANCE

Lazard Retirement Emerging Markets Equity Portfolio

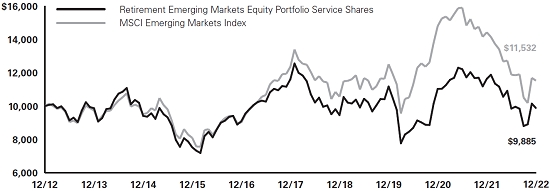

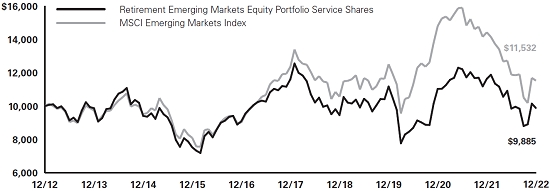

For the year ended December 31, 2022, the Lazard Retirement Emerging Markets Equity Portfolio’s Investor Shares posted a total return of -14.96%, while Service Shares posted a total return of -15.12%, as compared with the -20.09% return for its benchmark, the MSCI Emerging Markets Index.

Security selection in the energy and financials sectors and in China and Brazil boosted relative performance. Higher-than-benchmark exposure to the financials and energy sector and to Brazil, Indonesia and South Africa also contributed. BB Seguridade, a Brazilian insurance company, reported positive earnings and an improving outlook with higher interest rates and a normalization of pandemic-related loss ratios. Shares of energy companies Petróleo Brasileiro S.A (Petrobras), based in Brazil, and Galp, based in Portugal with global assets in Latin America and Africa, both jumped in sympathy with the rally in crude oil futures.

Security selection in the communication services sector and in Russia detracted from relative performance. The Portfolio was overweight Russia by nearly twice the index weighting prior to Russia’s invasion of Ukraine in late February 2022. A lower-than-benchmark exposure to India also undercut relative performance. Shares of Korea-based chipmakers Samsung Electronics and SK Hynix fell as part of a larger decline by semiconductor-related stocks on worries about a demand downcycle. China’s COVID-related lockdowns and rising concerns about a potential global recession brought about by rising interest rates were significant sources of these concerns.

Lazard Retirement International Equity Portfolio

For the year ended December 31, 2022, the Lazard Retirement International Equity Portfolio’s Service Shares posted a total

8 Annual Report

return of -15.01%, as compared with the -14.45% return for the MSCI EAFE® Index.

Stock selection in the healthcare sector detracted from relative performance for the period. Lower-than-index exposure to the financials sector detracted, as did higher-than-index exposure to the industrials sector. Shares of Olympus fell after the Japanese medical devices company reported second-quarter results that indicated cost inflation was running slightly higher than what management expected and operating profit guidance was revised down by 1%. Shares of Icon fell on concerns about the Ireland-based clinical research organization’s financial leverage in the aftermath of its acquisition of rival PRA Health Sciences, and its exposure to potentially weaker biotechnology funding. Shares of Roche declined on negative news relating to the Swiss pharmaceutical company’s Alzheimer’s drug (Gantenerumab) trial.

In contrast, stock selection in the consumer staples sector contributed to relative performance. Lower-than-index exposure to the information technology sector contributed, as did higher-than-index exposure to the energy. Shares of MatsukiyoCocokara traded higher after the Japanese drug store chain operator reported first-quarter results for the fiscal year ending March 2023 indicating that operating profit beating consensus estimates. Shares received another boost after management affirmed its outlook and a share buyback was announced. Elsewhere in the sector, the rise in the stock price of Mexican bottler Arca Continental was attributed to strong fundamentals throughout the year against the backdrop of a solid Mexican economy that was helped by companies shifting production closer to the end consumer markets in North America. Management signed a long-term agreement with Coca-Cola to cement and strengthen the strategic relationship. Lastly, greater-than-index exposure to the outperforming energy sector contributed to relative returns.

Lazard Retirement US Small-Mid Cap Equity Portfolio

For the year ended December 31, 2022, the Lazard Retirement US Small-Mid Cap Equity Portfolio’s Service Shares posted a total

Annual Report 9

return of -15.52%, as compared with the -18.37% return for the Russell 2500® Index.

Stock selection in the industrials sector contributed to relative performance. Shares of Altra gained on news that the power transmission and motion control products maker agreed to be acquired by Regal Rexnord in an all-cash deal that represented a 54% premium to share price. The team subsequently exited the position during the period. Stock selection and an overweight to the energy sector also contributed to performance. Antero benefitted from leverage to higher natural gas and natural gas liquid prices through most of 2022 due to their limited hedge position.

Stock selection in the communication services sector detracted from relative performance. Shares of video game developer Take-Two Interactive fell, as investors were concerned about in-game consumer spending and changes in the company’s game release schedule. Stock selection in the real estate sector also detracted from relative performance. Shares of West-Coast focused office and studio real estate investment trust Hudson Pacific fell amid a challenging environment with unexpected large tenant move outs creating occupancy pressure.

Lazard Retirement Global Dynamic Multi-Asset Portfolio

For the year ended December 31, 2022, the Lazard Retirement Global Dynamic Multi-Asset Portfolio’s Investor Shares posted a total return of -17.28%, while Service Shares posted a total return of -17.38%, as compared with the -18.14% return for the MSCI World Index and the -16.97% return of its blended benchmark, which is a 50/50 blend of the MSCI World Index and the Bloomberg Global Aggregate® Index (the “GDMA Index”).

Within the equity sleeve, stock selection in the information technology, consumer discretionary, and communication services sectors contributed to relative performance versus the MSCI World Index, as did stock selection in the US, Japan, and Canada. Within the fixed income sleeve, underweight exposure to bonds in the euro-zone, Japan, and South Korea also boosted relative performance.

10 Annual Report

Detracting from relative performance was an average overweight to fixed income versus equity relative to the MSCI World Index, as equities outperformed fixed income in the portfolio during the year. Overweight exposure to Australia, Canada, Norway, and New Zealand within fixed income also undercut relative performance.

Derivatives were used during the year for foreign exchange hedging purposes only and they marginally detracted during the year.

Annual Report 11

Lazard Retirement Series, Inc. Performance Overviews (unaudited)

Please see the “Notes to the Performance Overviews” for important information about the calculation of total returns, performance information generally, performance differences between Service Shares and Investor Shares, and the indexes shown below.

Lazard Retirement Emerging Markets Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Emerging Markets Equity Portfolio and the MSCI Emerging Markets® Index

Average Annual Total Returns

Periods Ended December 31, 2022

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | –15.12% | –3.19% | –0.12% | |

| Investor Shares | –14.96% | –2.95% | 0.13% | |

| MSCI Emerging Markets Index | –20.09% | –1.40% | 1.44% | |

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement International Equity Portfolio and the MSCI EAFE® Index

Average Annual Total Returns

Periods Ended December 31, 2022

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | –15.01% | 0.28% | 3.41% | |

| MSCI EAFE Index | –14.45% | 1.54% | 4.67% | |

12 Annual Report

Lazard Retirement US Small-Mid Cap Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement US Small-Mid Cap Equity Portfolio and the Russell 2500® Index

Average Annual Total Returns

Periods Ended December 31, 2022

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | –15.52% | 4.04% | 8.94% | |

| Russell 2500 Index | –18.37% | 5.89% | 10.03% | |

Annual Report 13

Lazard Retirement Global Dynamic Multi-Asset Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Global Dynamic Multi-Asset Portfolio, the MSCI World® Index and the GDMA Index

Average Annual Total Returns

Periods Ended December 31, 2022

| | One

Year | Five

Year | Ten

Years | Since

Inception | † |

| Service Shares | –17.38% | 0.52% | 4.55% | 4.81% | |

| Investor Shares | –17.28% | N/A | N/A | 2.49% | |

| MSCI World Index | –18.14% | 6.14% | 8.85% | 8.78%

(Service

Shares)

10.21%

(Investor

Shares) | |

| GDMA Index | –16.97% | 2.49% | 4.33% | 4.41%

(Service

Shares)

4.39%

(Investor

Shares) | |

| † | The inception date for the Service Shares was April 30, 2012 and for the Investor Shares was December 31, 2018. |

Notes to Performance Overviews:

Information About Portfolios Performance Shown Above

Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios may have been waived or reimbursed by Lazard Asset Management LLC, the Fund’s investment manager (the “Investment Manager”), State Street Bank and Trust Company, the Fund’s administrator (“State Street”), or SS&C Global Investor and Distribution Solutions, the Fund’s transfer agent and dividend disbursing agent (“SS&C GIDS”); without such waiver/reimbursement of expenses, the Portfolios’ returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Returns for a period of less than one year are not annualized.

Performance results do not include adjustments made for financial reporting purposes in accordance with US Generally Accepted Accounting Principles (“GAAP”), if any.

The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a

14 Annual Report

guarantee, of future results; the investment return and principal value of an investment in a Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated, there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods.

The performance of Service Shares and Investor Shares may vary, primarily based on the differences in fees borne by shareholders investing in different classes.

Information About Index Performance Shown Above

The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The indices are unmanaged, have no fees or costs and are not available for investment.

The GDMA Index is a blended index constructed by the Investment Manager that is comprised of 50% MSCI World Index and 50% Bloomberg Global Aggregate® Index and is rebalanced monthly. The Bloomberg Global Aggregate Index provides a broad-based measure of global investment-grade fixed-income debt markets, including government-related debt, corporate debt, securitized debt and global Treasury.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free-float-adjusted market capitalization index that is designed to measure developed markets equity performance, excluding the United States and Canada. The MSCI EAFE Index consists of 21 developed markets country indices.

The MSCI Emerging Markets Index is a free-float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The MSCI Emerging Markets Index consists of 24 emerging markets country indices.

The MSCI World Index is a free-float-adjusted market capitalization index that is designed to measure global developed markets equity performance. The MSCI World Index consists of 23 developed markets country indices.

The Russell 2500 Index measures the performance of the small- to mid-capitalization segment of the US equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. The Russell 3000 Index measures the performance of the largest 3000 US companies, representing approximately 98% of the investable US equity market. The Russell 2500 Index includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership.

Annual Report 15

Lazard Retirement Series, Inc.

Information About Your Portfolio’s Expenses (unaudited)

Expense Example

As a shareholder in a Portfolio, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from July 1, 2022 through December 31, 2022 and held for the entire period.

Actual Expenses

For each share class of the Portfolios, the first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each share class of the Portfolios, the second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the participating insurance companies. Such charges will have the effect of reducing account value.

16 Annual Report

| Portfolios | | Beginning

Account Value

7/1/22 | | Ending

Account

Value

12/31/22 | | Expenses Paid

During Period*

7/1/22- 12/31/22 | | Annualized

Expense Ratio

During Period

7/1/22- 12/31/22 |

| | | | | | | | | |

| Emerging Markets Equity | | | | | | | | | | |

| Service Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,003.00 | | | $6.66 | | 1.32% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,018.55 | | | $6.72 | | 1.32% |

| Investor Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,004.00 | | | $5.40 | | 1.07% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.81 | | | $5.45 | | 1.07% |

| | | | | | | | | | | |

| International Equity | | | | | | | | | | |

| Service Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,028.50 | | | $5.68 | | 1.11% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.61 | | | $5.65 | | 1.11% |

| | | | | | | | | | | |

| US Small-Mid Cap Equity | | | | | | | | | | |

| Service Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,049.70 | | | $5.94 | | 1.15% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.41 | | | $5.85 | | 1.15% |

| | | | | | | | | | | |

| Global Dynamic Multi-Asset | | | | | | | | | | |

| Service Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,005.20 | | | $5.31 | | 1.05% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.91 | | | $5.35 | | 1.05% |

| Investor Shares | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 1,005.80 | | | $4.55 | | 0.90% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,020.67 | | | $4.58 | | 0.90% |

| * | Expenses are equal to the annualized expense ratio, net of expenses waivers and reimbursements, of each share class multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Annual Report 17

Lazard Retirement Series, Inc.

Portfolio Holdings Presented by Sector December 31, 2022

| Sector* | | Lazard

Retirement

Emerging

Markets

Equity

Portfolio | | Lazard

Retirement

International

Equity

Portfolio | | Lazard

Retirement

US Small-

Mid Cap

Equity

Portfolio | | Lazard

Retirement

Global

Dynamic

Multi-Asset

Portfolio# |

| | | | | | | | | |

| Communication Services | | | 5.4 | % | | | 2.5 | % | | | 4.1 | % | | | 4.2 | % |

| Consumer Discretionary | | | 10.1 | | | | 12.9 | | | | 10.2 | | | | 7.1 | |

| Consumer Staples | | | 7.5 | | | | 11.1 | | | | 3.2 | | | | 6.8 | |

| Energy | | | 10.0 | | | | 6.4 | | | | 5.0 | | | | 0.9 | |

| Financials | | | 26.6 | | | | 15.3 | | | | 15.1 | | | | 13.3 | |

| Health Care | | | 4.0 | | | | 11.3 | | | | 12.9 | | | | 6.0 | |

| Industrials | | | 3.5 | | | | 20.4 | | | | 16.9 | | | | 7.0 | |

| Information Technology | | | 20.0 | | | | 5.1 | | | | 14.3 | | | | 6.5 | |

| Materials | | | 7.4 | | | | 6.5 | | | | 6.6 | | | | 1.0 | |

| Real Estate | | | 2.4 | | | | 1.9 | | | | 5.8 | | | | 2.2 | |

| Utilities | | | 1.8 | | | | 5.4 | | | | 2.4 | | | | 2.2 | |

| Municipal | | | — | | | | — | | | | — | | | | 0.8 | |

| Sovereign Debt | | | — | | | | — | | | | — | | | | 37.4 | |

| U.S. Treasury Securities | | | — | | | | — | | | | — | | | | 2.7 | |

| Short-Term Investments | | | 1.3 | | | | 1.2 | | | | 3.5 | | | | 1.9 | |

| Total Investments | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| * | Represents percentage of total investments. |

| # | The sector breakdown includes the underlying holdings of exchange-traded funds held by the Portfolio. |

18 Annual Report

Lazard Retirement Series, Inc. Portfolios of Investments

December 31, 2022

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 98.6% | | | | | | | | |

| | | | | | | | | |

| Brazil | 11.1% | | | | | | | | |

| Banco do Brasil SA | | | 822,002 | | | $ | 5,395,987 | |

| BB Seguridade Participacoes SA | | | 1,237,300 | | | | 7,856,492 | |

| CCR SA | | | 1,943,150 | | | | 3,980,047 | |

| Engie Brasil Energia SA | | | 356,698 | | | | 2,550,307 | |

| Petroleo Brasileiro SA ADR | | | 612,985 | | | | 6,528,290 | |

| Vale SA ADR | | | 272,007 | | | | 4,615,959 | |

| Vibra Energia SA | | | 840,100 | | | | 2,474,303 | |

| | | | | | | | 33,401,385 | |

| | | | | | | | | |

| China | 25.6% | | | | | | | | |

| A-Living Smart City Services Co. Ltd. | | | 2,195,750 | | | | 2,608,303 | |

| Anhui Conch Cement Co. Ltd., Class H | | | 1,167,875 | | | | 4,049,662 | |

| China Construction Bank Corp., Class H | | | 16,996,038 | | | | 10,649,034 | |

| China Medical System Holdings Ltd. | | | 1,872,000 | | | | 2,945,661 | |

| China Merchants Bank Co. Ltd., Class H | | | 696,737 | | | | 3,862,298 | |

| China Shenhua Energy Co. Ltd., Class H | | | 777,275 | | | | 2,237,563 | |

| China Vanke Co. Ltd., Class H | | | 2,190,294 | | | | 4,390,095 | |

| ENN Natural Gas Co. Ltd., Class A | | | 1,143,796 | | | | 2,645,070 | |

| Gree Electric Appliances, Inc. of Zhuhai, Class A | | | 862,299 | | | | 4,000,721 | |

| Hengan International Group Co. Ltd. | | | 1,083,527 | | | | 5,741,950 | |

| Huayu Automotive Systems Co. Ltd., Class A | | | 1,490,196 | | | | 3,715,887 | |

| Lenovo Group Ltd. | | | 6,276,000 | | | | 5,155,241 | |

| Midea Group Co. Ltd., Class A | | | 367,100 | | | | 2,726,831 | |

| Ping An Insurance (Group) Co. of China Ltd., Class H | | | 1,076,500 | | | | 7,105,106 | |

| Sinopharm Group Co. Ltd., Class H | | | 2,591,997 | | | | 6,573,352 | |

| Tingyi (Cayman Islands) Holding Corp. | | | 2,670,000 | | | | 4,702,374 | |

| Weichai Power Co. Ltd., Class H | | | 3,046,958 | | | | 4,060,054 | |

| | | | | | | | 77,169,202 | |

| | | | | | | | | |

| Czech Republic | 0.1% | | | | | | | | |

| CEZ AS | | | 6,685 | | | | 227,643 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 19

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Egypt | 1.0% | | | | | | | | |

| Commercial International Bank Egypt SAE GDR | | | 2,481,006 | | | $ | 2,960,939 | |

| Commercial International Bank Egypt SAE GDR (United States) | | | 110,980 | | | | 132,510 | |

| | | | | | | | 3,093,449 | |

| | | | | | | | | |

| Greece | 1.2% | | | | | | | | |

| OPAP SA | | | 248,352 | | | | 3,520,883 | |

| | | | | | | | | |

| Hong Kong | 1.1% | | | | | | | | |

| ASMPT Ltd. | | | 459,488 | | | | 3,275,801 | |

| | | | | | | | | |

| Hungary | 2.4% | | | | | | | | |

| MOL Hungarian Oil & Gas PLC | | | 316,191 | | | | 2,208,577 | |

| OTP Bank Nyrt | | | 186,948 | | | | 5,054,899 | |

| | | | | | | | 7,263,476 | |

| | | | | | | | | |

| India | 6.7% | | | | | | | | |

| Axis Bank Ltd. | | | 271,318 | | | | 3,049,574 | |

| Bajaj Auto Ltd. | | | 57,842 | | | | 2,523,398 | |

| Bharat Petroleum Corp. Ltd. | | | 764,204 | | | | 3,047,621 | |

| Indus Towers Ltd. | | | 1,815,260 | | | | 4,169,130 | |

| Petronet LNG Ltd. | | | 1,267,143 | | | | 3,292,809 | |

| UPL Ltd. | | | 471,836 | | | | 4,085,085 | |

| | | | | | | | 20,167,617 | |

| | | | | | | | | |

| Indonesia | 4.2% | | | | | | | | |

| PT Astra International Tbk | | | 7,198,804 | | | | 2,622,668 | |

| PT Bank Mandiri (Persero) Tbk | | | 7,858,230 | | | | 4,993,923 | |

| PT Telkom Indonesia (Persero) Tbk ADR | | | 134,965 | | | | 3,218,915 | |

| PT United Tractors Tbk | | | 1,105,200 | | | | 1,850,613 | |

| | | | | | | | 12,686,119 | |

The accompanying notes are an integral part of these financial statements.

20 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Mexico | 5.1% | | | | | | | | |

| America Movil SAB de CV, Class L ADR | | | 175,447 | | | $ | 3,193,135 | |

| Grupo Financiero Banorte SAB de CV, Class O | | | 450,765 | | | | 3,236,422 | |

| Grupo Mexico SAB de CV, Series B | | | 750,123 | | | | 2,633,408 | |

| Kimberly-Clark de Mexico SAB de CV, Series A | | | 2,238,089 | | | | 3,798,199 | |

| Ternium SA ADR | | | 78,757 | | | | 2,406,814 | |

| | | | | | | | 15,267,978 | |

| | | | | | | | | |

| Portugal | 2.8% | | | | | | | | |

| Galp Energia SGPS SA | | | 633,625 | | | | 8,573,867 | |

| | | | | | | | | |

| Russia | 0.0% | | | | | | | | |

| Mobile TeleSystems PJSC ADR (*), (¢) | | | 545,705 | | | | 1 | |

| Sberbank of Russia PJSC (*), (¢) | | | 1,580,119 | | | | 1 | |

| | | | | | | | 2 | |

| | | | | | | | | |

| South Africa | 7.6% | | | | | | | | |

| Anglo American PLC | | | 60,195 | | | | 2,354,388 | |

| Bidvest Group Ltd. | | | 221,387 | | | | 2,790,165 | |

| Life Healthcare Group Holdings Ltd. | | | 2,517,274 | | | | 2,500,062 | |

| Nedbank Group Ltd. | | | 491,874 | | | | 6,154,283 | |

| Sanlam Ltd. | | | 953,438 | | | | 2,731,702 | |

| Standard Bank Group Ltd. | | | 379,341 | | | | 3,746,338 | |

| Vodacom Group Ltd. | | | 381,130 | | | | 2,734,097 | |

| | | | | | | | 23,011,035 | |

| | | | | | | | | |

| South Korea | 14.0% | | | | | | | | |

| Coway Co. Ltd. | | | 75,444 | | | | 3,349,989 | |

| Hyundai Mobis Co. Ltd. | | | 21,284 | | | | 3,393,087 | |

| KB Financial Group, Inc. | | | 148,301 | | | | 5,648,633 | |

| Kia Corp. | | | 49,564 | | | | 2,337,693 | |

| KT Corp. | | | 104,008 | | | | 2,787,628 | |

| KT&G Corp. | | | 40,930 | | | | 2,959,576 | |

| Samsung Electronics Co. Ltd. | | | 211,322 | | | | 9,318,896 | |

| Shinhan Financial Group Co. Ltd. | | | 174,137 | | | | 4,852,373 | |

| SK Hynix, Inc. | | | 124,727 | | | | 7,507,552 | |

| | | | | | | | 42,155,427 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 21

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (concluded) | | | | | | | | |

| | | | | | | | | |

| Taiwan | 11.6% | | | | | | | | |

| ASE Technology Holding Co. Ltd. | | | 2,177,000 | | | $ | 6,644,972 | |

| Globalwafers Co. Ltd. | | | 173,000 | | | | 2,403,261 | |

| Hon Hai Precision Industry Co. Ltd. | | | 905,320 | | | | 2,941,276 | |

| MediaTek, Inc. | | | 177,000 | | | | 3,595,238 | |

| Novatek Microelectronics Corp. | | | 395,000 | | | | 4,051,067 | |

| Quanta Computer, Inc. | | | 2,010,000 | | | | 4,726,067 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | | 595,989 | | | | 8,686,330 | |

| Wiwynn Corp. | | | 79,000 | | | | 2,047,001 | |

| | | | | | | | 35,095,212 | |

| | | | | | | | | |

| Thailand | 2.4% | | | | | | | | |

| Kasikornbank Public Co. Ltd. | | | 555,169 | | | | 2,362,760 | |

| PTT Exploration & Production PCL (‡) | | | 538,400 | | | | 2,743,687 | |

| Siam Cement Public Co. Ltd. (‡) | | | 212,308 | | | | 2,096,415 | |

| | | | | | | | 7,202,862 | |

| | | | | | | | | |

| United Kingdom | 1.7% | | | | | | | | |

| Unilever PLC | | | 101,396 | | | | 5,088,193 | |

| | | | | | | | | |

Total Common Stocks

(Cost $303,136,795) | | | | | | | 297,200,151 | |

| | | | | | | | | |

| Short-Term Investments | 1.3% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 3.79% (7 day yield)

(Cost $4,065,348) | | | 4,065,348 | | | | 4,065,348 | |

| | | | | | | | | |

Total Investments | 99.9%

(Cost $307,202,143) | | | | | | $ | 301,265,499 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 0.1% | | | | | | | 281,579 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 301,547,078 | |

The accompanying notes are an integral part of these financial statements.

22 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 98.3% | | | | | | | | |

| | | | | | | | | |

| Canada | 3.5% | | | | | | | | |

| Suncor Energy, Inc. | | | 73,523 | | | $ | 2,332,210 | |

| TMX Group Ltd. | | | 15,785 | | | | 1,579,899 | |

| | | | | | | | 3,912,109 | |

| | | | | | | | | |

| China | 5.4% | | | | | | | | |

| Alibaba Group Holding Ltd. (*) | | | 117,900 | | | | 1,301,753 | |

| Autohome, Inc. ADR | | | 30,357 | | | | 928,924 | |

| ENN Energy Holdings Ltd. | | | 85,500 | | | | 1,192,795 | |

| ESR Group Ltd. | | | 509,200 | | | | 1,068,796 | |

| Li Ning Co. Ltd. | | | 108,500 | | | | 931,065 | |

| Wuxi Lead Intelligent Equipment Co. Ltd., Class A | | | 101,499 | | | | 587,975 | |

| | | | | | | | 6,011,308 | |

| | | | | | | | | |

| Denmark | 3.2% | | | | | | | | |

| AP Moller - Maersk AS, Class B | | | 378 | | | | 849,012 | |

| Carlsberg AS, Class B | | | 13,621 | | | | 1,803,101 | |

| Vestas Wind Systems AS | | | 30,868 | | | | 901,844 | |

| | | | | | | | 3,553,957 | |

| | | | | | | | | |

| Finland | 1.6% | | | | | | | | |

| Nordea Bank Abp | | | 168,830 | | | | 1,805,557 | |

| | | | | | | | | |

| France | 10.3% | | | | | | | | |

| Air Liquide SA | | | 16,293 | | | | 2,317,505 | |

| Capgemini SE | | | 6,066 | | | | 1,017,352 | |

| Engie SA | | | 224,068 | | | | 3,209,559 | |

| Pernod Ricard SA | | | 8,702 | | | | 1,710,462 | |

| Teleperformance | | | 6,680 | | | | 1,594,014 | |

| Thales SA | | | 11,912 | | | | 1,522,787 | |

| | | | | | | | 11,371,679 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 23

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Germany | 10.3% | | | | | | | | |

| Continental AG | | | 20,700 | | | $ | 1,236,740 | |

| Infineon Technologies AG | | | 66,043 | | | | 2,011,517 | |

| Merck KGaA | | | 12,063 | | | | 2,336,123 | |

| MTU Aero Engines AG | | | 10,729 | | | | 2,322,188 | |

| Rheinmetall AG | | | 7,400 | | | | 1,473,968 | |

| Siemens Healthineers AG | | | 20,640 | | | | 1,032,536 | |

| Vonovia SE | | | 41,230 | | | | 971,682 | |

| | | | | | | | 11,384,754 | |

| | | | | | | | | |

| Hong Kong | 1.5% | | | | | | | | |

| Prudential PLC | | | 120,255 | | | | 1,627,367 | |

| | | | | | | | | |

| Ireland | 1.4% | | | | | | | | |

| Ryanair Holdings PLC ADR (*) | | | 20,175 | | | | 1,508,283 | |

| | | | | | | | | |

| Israel | 1.6% | | | | | | | | |

| Bank Leumi Le-Israel BM | | | 219,763 | | | | 1,831,897 | |

| | | | | | | | | |

| Italy | 1.4% | | | | | | | | |

| Enel SpA | | | 285,749 | | | | 1,536,840 | |

| | | | | | | | | |

| Japan | 16.5% | | | | | | | | |

| Asics Corp. | | | 71,600 | | | | 1,588,873 | |

| Bandai Namco Holdings, Inc. | | | 21,900 | | | | 1,373,382 | |

| Daikin Industries Ltd. | | | 9,100 | | | | 1,399,849 | |

| Disco Corp. | | | 6,400 | | | | 1,839,794 | |

| Hitachi Ltd. | | | 21,400 | | | | 1,076,952 | |

| Hoya Corp. | | | 14,500 | | | | 1,402,950 | |

| MatsukiyoCocokara & Co. | | | 44,900 | | | | 2,257,497 | |

| Olympus Corp. | | | 97,300 | | | | 1,719,845 | |

| Shimano, Inc. | | | 4,800 | | | | 764,774 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 45,400 | | | | 1,829,360 | |

| Suzuki Motor Corp. | | | 42,800 | | | | 1,377,011 | |

| Yamaha Corp. | | | 43,800 | | | | 1,615,923 | |

| | | | | | | | 18,246,210 | |

The accompanying notes are an integral part of these financial statements.

24 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Mexico | 1.6% | | | | | | | | |

| Arca Continental SAB de CV | | | 216,400 | | | $ | 1,757,275 | |

| | | | | | | | | |

| Netherlands | 6.1% | | | | | | | | |

| Akzo Nobel NV | | | 25,003 | | | | 1,668,351 | |

| Koninklijke DSM NV | | | 11,101 | | | | 1,360,933 | |

| Universal Music Group NV | | | 79,755 | | | | 1,925,219 | |

| Wolters Kluwer NV | | | 17,624 | | | | 1,840,987 | |

| | | | | | | | 6,795,490 | |

| | | | | | | | | |

| Norway | 0.6% | | | | | | | | |

| Equinor ASA | | | 19,728 | | | | 707,612 | |

| | | | | | | | | |

| Portugal | 1.6% | | | | | | | | |

| Galp Energia SGPS SA | | | 131,433 | | | | 1,778,479 | |

| | | | | | | | | |

| Singapore | 1.7% | | | | | | | | |

| DBS Group Holdings Ltd. | | | 73,260 | | | | 1,854,681 | |

| | | | | | | | | |

| South Africa | 1.7% | | | | | | | | |

| Anglo American PLC | | | 49,323 | | | | 1,929,155 | |

| | | | | | | | | |

| South Korea | 1.4% | | | | | | | | |

| Osstem Implant Co. Ltd. | | | 8,177 | | | | 899,140 | |

| SK Hynix, Inc. | | | 10,777 | | | | 648,688 | |

| | | | | | | | 1,547,828 | |

| | | | | | | | | |

| Spain | 1.4% | | | | | | | | |

| Industria de Diseno Textil SA | | | 57,665 | | | | 1,535,512 | |

| | | | | | | | | |

| Sweden | 1.1% | | | | | | | | |

| Sandvik AB | | | 67,880 | | | | 1,225,589 | |

| | | | | | | | | |

| Switzerland | 1.7% | | | | | | | | |

| ABB Ltd. | | | 61,670 | | | | 1,878,331 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 25

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio (concluded) | | | | | | | | |

| | | | | | | | | |

| United Kingdom | 13.2% | | | | | | | | |

| 3i Group PLC | | | 95,061 | | | $ | 1,543,475 | |

| Barclays PLC | | | 756,454 | | | | 1,454,348 | |

| BP PLC | | | 357,976 | | | | 2,081,714 | |

| Coca-Cola Europacific Partners PLC | | | 36,125 | | | | 1,984,724 | |

| Compass Group PLC | | | 72,858 | | | | 1,683,526 | |

| Petershill Partners PLC | | | 53,625 | | | | 109,658 | |

| RELX PLC | | | 108,115 | | | | 2,995,411 | |

| Unilever PLC | | | 54,489 | | | | 2,748,915 | |

| | | | | | | | 14,601,771 | |

| | | | | | | | | |

| United States | 9.5% | | | | | | | | |

| Aon PLC, Class A | | | 10,687 | | | | 3,207,596 | |

| BRP, Inc. | | | 12,165 | | | | 927,469 | |

| Ferguson PLC | | | 10,795 | | | | 1,363,874 | |

| ICON PLC (*) | | | 11,709 | | | | 2,274,473 | |

| Roche Holding AG | | | 8,636 | | | | 2,713,966 | |

| | | | | | | | 10,487,378 | |

Total Common Stocks

(Cost $109,184,434) | | | | | | | 108,889,062 | |

| | | | | | | | | |

| Short-Term Investments | 1.2% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 3.79% (7 day yield)

(Cost $1,370,530) | | | 1,370,530 | | | | 1,370,530 | |

| | | | | | | | | |

Total Investments | 99.5%

(Cost $110,554,964) | | | | | | $ | 110,259,592 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 0.5% | | | | | | | 508,571 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 110,768,163 | |

The accompanying notes are an integral part of these financial statements.

26 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 96.6% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense | 2.5% | | | | | | | | |

| Curtiss-Wright Corp. | | | 3,466 | | | $ | 578,787 | |

| HEICO Corp. | | | 2,467 | | | | 379,030 | |

| | | | | | | | 957,817 | |

| | | | | | | | | |

| Airlines | 1.1% | | | | | | | | |

| Alaska Air Group, Inc. (*) | | | 9,666 | | | | 415,058 | |

| | | | | | | | | |

| Banks | 9.7% | | | | | | | | |

| Commerce Bancshares, Inc. | | | 11,687 | | | | 795,534 | |

| East West Bancorp, Inc. | | | 11,236 | | | | 740,452 | |

| Home BancShares, Inc. | | | 36,424 | | | | 830,103 | |

| Pinnacle Financial Partners, Inc. | | | 7,490 | | | | 549,766 | |

| Wintrust Financial Corp. | | | 9,529 | | | | 805,391 | |

| | | | | | | | 3,721,246 | |

| | | | | | | | | |

| Biotechnology | 3.0% | | | | | | | | |

| Halozyme Therapeutics, Inc. (*) | | | 9,168 | | | | 521,659 | |

| United Therapeutics Corp. (*) | | | 2,218 | | | | 616,804 | |

| | | | | | | | 1,138,463 | |

| | | | | | | | | |

| Building Products | 3.3% | | | | | | | | |

| Armstrong World Industries, Inc. | | | 8,391 | | | | 575,539 | |

| Carlisle Cos., Inc. | | | 1,822 | | | | 429,354 | |

| PGT Innovations, Inc. (*) | | | 14,793 | | | | 265,682 | |

| | | | | | | | 1,270,575 | |

| | | | | | | | | |

| Capital Markets | 1.4% | | | | | | | | |

| Morningstar, Inc. | | | 2,486 | | | | 538,443 | |

| | | | | | | | | |

| Chemicals | 2.9% | | | | | | | | |

| Ashland, Inc. | | | 5,243 | | | | 563,780 | |

| Ingevity Corp. (*) | | | 7,924 | | | | 558,166 | |

| | | | | | | | 1,121,946 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 27

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Communications Equipment | 2.7% | | | | | | | | |

| Ciena Corp. (*) | | | 12,282 | | | $ | 626,137 | |

| F5, Inc. (*) | | | 2,826 | | | | 405,559 | |

| | | | | | | | 1,031,696 | |

| | | | | | | | | |

| Construction Materials | 0.9% | | | | | | | | |

| Eagle Materials, Inc. | | | 2,480 | | | | 329,468 | |

| | | | | | | | | |

| Containers & Packaging | 2.9% | | | | | | | | |

| Avery Dennison Corp. | | | 2,764 | | | | 500,284 | |

| Graphic Packaging Holding Co. | | | 26,682 | | | | 593,674 | |

| | | | | | | | 1,093,958 | |

| | | | | | | | | |

| Electrical Equipment | 3.4% | | | | | | | | |

| Array Technologies, Inc. (*) | | | 10,141 | | | | 196,025 | |

| Atkore, Inc. (*) | | | 4,359 | | | | 494,398 | |

| EnerSys | | | 8,219 | | | | 606,891 | |

| | | | | | | | 1,297,314 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components | 2.3% | | | | | | | | |

| Cognex Corp. | | | 10,959 | | | | 516,278 | |

| Littelfuse, Inc. | | | 1,653 | | | | 363,991 | |

| | | | | | | | 880,269 | |

| | | | | | | | | |

| Energy Equipment & Services | 2.5% | | | | | | | | |

| Cactus, Inc., Class A | | | 6,438 | | | | 323,574 | |

| Liberty Energy, Inc. | | | 40,101 | | | | 642,017 | |

| | | | | | | | 965,591 | |

| | | | | | | | | |

| Entertainment | 1.6% | | | | | | | | |

| Take-Two Interactive Software, Inc. (*) | | | 6,054 | | | | 630,403 | |

The accompanying notes are an integral part of these financial statements.

28 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) | 5.8% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 4,627 | | | $ | 674,015 | |

| Brixmor Property Group, Inc. | | | 25,374 | | | | 575,228 | |

| Camden Property Trust | | | 5,103 | | | | 570,924 | |

| Summit Hotel Properties, Inc. | | | 57,453 | | | | 414,811 | |

| | | | | | | | 2,234,978 | |

| | | | | | | | | |

| Food & Staples Retailing | 1.1% | | | | | | | | |

| US Foods Holding Corp. (*) | | | 12,718 | | | | 432,666 | |

| | | | | | | | | |

| Food Products | 2.1% | | | | | | | | |

| Hostess Brands, Inc. (*) | | | 18,048 | | | | 404,997 | |

| Utz Brands, Inc. | | | 24,370 | | | | 386,508 | |

| | | | | | | | 791,505 | |

| | | | | | | | | |

| Gas Utilities | 2.4% | | | | | | | | |

| New Jersey Resources Corp. | | | 18,222 | | | | 904,176 | |

| | | | | | | | | |

| Health Care Equipment & Supplies | 2.1% | | | | | | | | |

| Envista Holdings Corp. (*) | | | 9,215 | | | | 310,269 | |

| QuidelOrtho Corp. (*) | | | 5,611 | | | | 480,694 | |

| | | | | | | | 790,963 | |

| | | | | | | | | |

| Health Care Providers & Services | 1.5% | | | | | | | | |

| Henry Schein, Inc. (*) | | | 7,103 | | | | 567,317 | |

| | | | | | | | | |

| Health Care Technology | 0.9% | | | | | | | | |

| Certara, Inc. (*) | | | 20,952 | | | | 336,699 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure | 2.4% | | | | | | | | |

| Brinker International, Inc. (*) | | | 14,180 | | | | 452,484 | |

| Wyndham Hotels & Resorts, Inc. | | | 6,346 | | | | 452,533 | |

| | | | | | | | 905,017 | |

| | | | | | | | | |

| Household Durables | 1.2% | | | | | | | | |

| Leggett & Platt, Inc. | | | 14,520 | | | | 467,980 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 29

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Insurance | 3.9% | | | | | | | | |

| Brown & Brown, Inc. | | | 12,065 | | | $ | 687,343 | |

| Reinsurance Group of America, Inc. | | | 5,739 | | | | 815,455 | |

| | | | | | | | 1,502,798 | |

| | | | | | | | | |

| Interactive Media & Services | 2.5% | | | | | | | | |

| Cars.com, Inc. (*) | | | 39,183 | | | | 539,550 | |

| Ziff Davis, Inc. (*) | | | 5,262 | | | | 416,224 | |

| | | | | | | | 955,774 | |

| | | | | | | | | |

| IT Services | 1.9% | | | | | | | | |

| Amdocs Ltd. | | | 5,690 | | | | 517,221 | |

| Thoughtworks Holding, Inc. (*) | | | 20,392 | | | | 207,794 | |

| | | | | | | | 725,015 | |

| | | | | | | | | |

| Leisure Products | 2.2% | | | | | | | | |

| Brunswick Corp. | | | 4,412 | | | | 318,017 | |

| Hasbro, Inc. | | | 8,292 | | | | 505,895 | |

| | | | | | | | 823,912 | |

| | | | | | | | | |

| Life Sciences Tools & Services | 4.3% | | | | | | | | |

| AbCellera Biologics, Inc. (*) | | | 35,850 | | | | 363,160 | |

| Charles River Laboratories International, Inc. (*) | | | 1,313 | | | | 286,103 | |

| ICON PLC (*) | | | 2,720 | | | | 528,360 | |

| Stevanato Group SpA | | | 25,177 | | | | 452,431 | |

| | | | | | | | 1,630,054 | |

| | | | | | | | | |

| Machinery | 3.8% | | | | | | | | |

| Columbus McKinnon Corp. | | | 14,825 | | | | 481,368 | |

| Gates Industrial Corp. PLC (*) | | | 26,514 | | | | 302,525 | |

| Middleby Corp. (*) | | | 5,115 | | | | 684,898 | |

| | | | | | | | 1,468,791 | |

The accompanying notes are an integral part of these financial statements.

30 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels | 2.5% | | | | | | | | |

| Antero Resources Corp. (*) | | | 16,759 | | | $ | 519,362 | |

| Magnolia Oil & Gas Corp., Class A | | | 18,945 | | | | 444,260 | |

| | | | | | | | 963,622 | |

| | | | | | | | | |

| Pharmaceuticals | 1.2% | | | | | | | | |

| Catalent, Inc. (*) | | | 10,013 | | | | 450,685 | |

| | | | | | | | | |

| Professional Services | 2.8% | | | | | | | | |

| Leidos Holdings, Inc. | | | 6,906 | | | | 726,442 | |

| Sterling Check Corp. (*) | | | 21,816 | | | | 337,494 | |

| | | | | | | | 1,063,936 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment | 2.0% | | | | | | | | |

| MKS Instruments, Inc. | | | 4,754 | | | | 402,807 | |

| ON Semiconductor Corp. (*) | | | 5,971 | | | | 372,411 | |

| | | | | | | | 775,218 | |

| | | | | | | | | |

| Software | 5.3% | | | | | | | | |

| CyberArk Software Ltd. (*) | | | 3,049 | | | | 395,303 | |

| Dolby Laboratories, Inc., Class A | | | 4,941 | | | | 348,538 | |

| N-Able, Inc. (*) | | | 42,206 | | | | 433,878 | |

| PTC, Inc. (*) | | | 4,214 | | | | 505,848 | |

| Tyler Technologies, Inc. (*) | | | 1,012 | | | | 326,279 | |

| | | | | | | | 2,009,846 | |

| | | | | | | | | |

| Specialty Retail | 3.1% | | | | | | | | |

| Five Below, Inc. (*) | | | 3,247 | | | | 574,297 | |

| Leslie’s, Inc. (*) | | | 30,418 | | | | 371,404 | |

| Warby Parker, Inc., Class A (*) | | | 16,640 | | | | 224,473 | |

| | | | | | | | 1,170,174 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 31

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (concluded) | | | | | | | | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods | 1.4% | | | | | | | | |

| Tapestry, Inc. | | | 13,895 | | | $ | 529,122 | |

| | | | | | | | | |

Total Common Stocks

(Cost $35,074,759) | | | | | | | 36,892,495 | |

| | | | | | | | | |

| Short-Term Investments | 3.5% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 3.79% (7 day yield)

(Cost $1,333,674) | | | 1,333,674 | | | | 1,333,674 | |

| | | | | | | | | |

Total Investments | 100.1%

(Cost $36,408,433) | | | | | | $ | 38,226,169 | |

| | | | | | | | | |

| Liabilities in Excess of Cash and Other Assets l (0.1)% | | | | | | | (41,105 | ) |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 38,185,064 | |

The accompanying notes are an integral part of these financial statements.

32 Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 28.8% | | | | | | | | |

| | | | | | | | | |

| Australia | 0.3% | | | | | | | | |

| AGL Energy Ltd. | | | 6,911 | | | $ | 37,946 | |

| Allkem Ltd. (*) | | | 10,488 | | | | 79,676 | |

| Aristocrat Leisure Ltd. | | | 872 | | | | 18,008 | |

| BHP Group Ltd. | | | 2,117 | | | | 65,545 | |

| Coronado Global Resources, Inc. | | | 29,719 | | | | 39,644 | |

| GrainCorp Ltd., Class A | | | 7,798 | | | | 39,358 | |

| Incitec Pivot Ltd. | | | 14,550 | | | | 36,756 | |

| Northern Star Resources Ltd. | | | 5,000 | | | | 36,613 | |

| Pilbara Minerals Ltd. (*) | | | 10,626 | | | | 27,077 | |

| WiseTech Global Ltd. | | | 1,411 | | | | 48,657 | |

| Yancoal Australia Ltd. | | | 71,909 | | | | 293,808 | |

| | | | | | | | 723,088 | |

| | | | | | | | | |

| Belgium | 0.0% | | | | | | | | |

| Warehouses De Pauw CVA REIT | | | 4,298 | | | | 122,900 | |

| | | | | | | | | |

| Canada | 1.0% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 783 | | | | 40,688 | |

| Alimentation Couche-Tard, Inc. | | | 1,991 | | | | 87,492 | |

| ARC Resources Ltd. | | | 3,260 | | | | 43,940 | |

| Atco Ltd., Class I | | | 3,030 | | | | 94,839 | |

| Birchcliff Energy Ltd. | | | 5,097 | | | | 35,498 | |

| Canadian National Railway Co. | | | 1,308 | | | | 155,495 | |

| Element Fleet Management Corp. | | | 5,389 | | | | 73,432 | |

| H&R Real Estate Investment Trust | | | 7,089 | | | | 63,403 | |

| Hydro One Ltd. | | | 15,960 | | | | 427,525 | |

| International Petroleum Corp. (*) | | | 6,289 | | | | 70,769 | |

| Loblaw Cos. Ltd. | | | 7,950 | | | | 702,935 | |

| Metro, Inc. | | | 10,673 | | | | 590,956 | |

| Nutrien Ltd. | | | 620 | | | | 45,264 | |

| Toronto-Dominion Bank | | | 2,973 | | | | 192,532 | |

| Tourmaline Oil Corp. | | | 2,085 | | | | 105,205 | |

| | | | | | | | 2,729,973 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 33

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| China | 0.1% | | | | | | | | |

| NXP Semiconductors NV | | | 850 | | | $ | 134,325 | |

| SITC International Holdings Co. Ltd. | | | 20,000 | | | | 44,147 | |

| | | | | | | | 178,472 | |

| | | | | | | | | |

| Denmark | 0.3% | | | | | | | | |

| AP Moller - Maersk AS, Class B | | | 35 | | | | 78,612 | |

| Carlsberg AS, Class B ADR | | | 4,766 | | | | 126,442 | |

| Novo Nordisk AS, Class B | | | 5,148 | | | | 697,039 | |

| | | | | | | | 902,093 | |

| | | | | | | | | |

| Finland | 0.0% | | | | | | | | |

| Neste Oyj | | | 874 | | | | 40,368 | |

| | | | | | | | | |

| France | 0.8% | | | | | | | | |

| BNP Paribas SA | | | 2,388 | | | | 135,895 | |

| Bureau Veritas SA ADR | | | 1,744 | | | | 91,787 | |

| Cie de Saint-Gobain | | | 2,698 | | | | 132,455 | |

| Cie Generale des Etablissements Michelin SCA | | | 4,807 | | | | 133,668 | |

| Hermes International | | | 78 | | | | 120,365 | |

| Legrand SA ADR | | | 5,080 | | | | 81,128 | |

| LVMH Moet Hennessy Louis Vuitton SE ADR | | | 886 | | | | 128,355 | |

| Orange SA | | | 50,815 | | | | 505,273 | |

| Pernod Ricard SA ADR | | | 2,794 | | | | 109,888 | |

| Societe Generale SA | | | 4,494 | | | | 112,755 | |

| Thales SA ADR | | | 4,888 | | | | 124,693 | |

| TotalEnergies SE | | | 3,747 | | | | 233,869 | |

| Vinci SA | | | 1,063 | | | | 106,167 | |

| | | | | | | | 2,016,298 | |

| | | | | | | | | |

| Germany | 0.3% | | | | | | | | |

| Bayerische Motoren Werke AG | | | 1,386 | | | | 123,708 | |

| Deutsche Bank AG | | | 9,549 | | | | 108,233 | |

| Deutsche Post AG | | | 7,669 | | | | 288,675 | |

| Mercedes-Benz Group AG | | | 593 | | | | 38,915 | |

| Mercer International, Inc. | | | 6,123 | | | | 71,272 | |

The accompanying notes are an integral part of these financial statements.

34 Annual Report

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Merck KGaA ADR | | | 3,044 | | | $ | 117,437 | |

| Telefonica Deutschland Holding AG | | | 59,451 | | | | 146,481 | |

| | | | | | | | 894,721 | |

| | | | | | | | | |

| Hong Kong | 0.2% | | | | | | | | |

| AIA Group Ltd. ADR | | | 2,736 | | | | 121,560 | |

| Jardine Matheson Holdings Ltd. | | | 1,800 | | | | 91,526 | |

| Swire Pacific Ltd., Class A | | | 28,500 | | | | 249,958 | |

| | | | | | | | 463,044 | |

| | | | | | | | | |

| Ireland | 0.0% | | | | | | | | |

| AerCap Holdings NV (*) | | | 924 | | | | 53,888 | |

| | | | | | | | | |

| Israel | 0.1% | | | | | | | | |

| Bezeq The Israeli Telecommunication Corp. Ltd. | | | 80,900 | | | | 139,569 | |

| Perion Network Ltd. (*) | | | 1,160 | | | | 29,348 | |

| | | | | | | | 168,917 | |

| | | | | | | | | |

| Italy | 0.1% | | | | | | | | |

| Poste Italiane SpA | | | 7,784 | | | | 75,909 | |

| UniCredit SpA | | | 8,497 | | | | 120,830 | |

| | | | | | | | 196,739 | |

| | | | | | | | | |

| Japan | 3.3% | | | | | | | | |

| ABC-Mart, Inc. | | | 6,000 | | | | 340,758 | |

| Canon, Inc. | | | 10,000 | | | | 216,230 | |

| Cosmo Energy Holdings Co. Ltd. | | | 1,100 | | | | 29,092 | |

| Daiwa House Industry Co. Ltd. | | | 3,800 | | | | 87,194 | |

| Electric Power Development Co. Ltd. | | | 26,700 | | | | 424,740 | |

| FUJIFILM Holdings Corp. | | | 2,200 | | | | 110,997 | |

| Hachijuni Bank Ltd. | | | 29,800 | | | | 124,339 | |

| Hirose Electric Co. Ltd. | | | 700 | | | | 87,562 | |

| Honda Motor Co. Ltd. | | | 15,900 | | | | 363,540 | |

| Hulic Co. Ltd. | | | 11,900 | | | | 93,655 | |

| Japan Post Bank Co. Ltd. | | | 13,200 | | | | 113,417 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 35

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Japan Post Holdings Co. Ltd. | | | 115,000 | | | $ | 969,514 | |

| Japan Post Insurance Co. Ltd. | | | 13,700 | | | | 241,105 | |

| Japan Real Estate Investment Corp. REIT | | | 32 | | | | 140,152 | |

| Japan Tobacco, Inc. | | | 26,600 | | | | 537,854 | |

| Kansai Electric Power Co., Inc. | | | 10,200 | | | | 99,012 | |

| KDDI Corp. | | | 10,600 | | | | 320,376 | |

| Lawson, Inc. | | | 6,900 | | | | 264,420 | |

| McDonald’s Holdings Co. Japan Ltd. | | | 3,200 | | | | 121,757 | |

| Mizuho Financial Group, Inc. | | | 18,000 | | | | 254,407 | |

| MS&AD Insurance Group Holdings, Inc. | | | 4,200 | | | | 134,425 | |

| NGK Spark Plug Co. Ltd. | | | 1,300 | | | | 23,987 | |

| Nihon Kohden Corp. | | | 9,100 | | | | 222,039 | |

| Nintendo Co. Ltd. ADR | | | 10,575 | | | | 110,192 | |

| Nippon Building Fund, Inc. REIT | | | 36 | | | | 160,767 | |

| Nippon Steel Corp. | | | 2,500 | | | | 43,527 | |

| Nippon Telegraph & Telephone Corp. | | | 11,400 | | | | 325,402 | |

| Nisshinbo Holdings, Inc. | | | 11,400 | | | | 83,854 | |

| Nomura Real Estate Holdings, Inc. | | | 1,800 | | | | 38,482 | |

| Olympus Corp. ADR | | | 5,880 | | | | 105,134 | |

| Osaka Gas Co. Ltd. | | | 16,000 | | | | 258,787 | |

| Rengo Co. Ltd. | | | 14,700 | | | | 100,982 | |

| Sankyo Co. Ltd. | | | 9,600 | | | | 393,072 | |

| Sega Sammy Holdings, Inc. NA | | | 6,100 | | | | 91,837 | |

| Shimano, Inc. ADR | | | 4,887 | | | | 76,701 | |

| Shin-Etsu Chemical Co. Ltd. | | | 1,600 | | | | 194,937 | |

| Shizuoka Financial Group, Inc. | | | 6,900 | | | | 55,459 | |

| Softbank Corp. | | | 8,200 | | | | 92,715 | |

| Sumco Corp. | | | 2,800 | | | | 37,466 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 5,800 | | | | 233,707 | |

| Tokyo Gas Co. Ltd. | | | 30,400 | | | | 597,629 | |

| Tokyo Ohka Kogyo Co. Ltd. | | | 1,200 | | | | 54,057 | |

| Tokyu Fudosan Holdings Corp. | | | 8,500 | | | | 40,344 | |

| Toshiba Corp. | | | 1,300 | | | | 45,569 | |

| Yamazaki Baking Co. Ltd. | | | 14,800 | | | | 177,490 | |

| | | | | | | | 8,638,682 | |

The accompanying notes are an integral part of these financial statements.

36 Annual Report

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Monaco | 0.0% | | | | | | | | |

| Scorpio Tankers, Inc. | | | 738 | | | $ | 39,682 | |

| | | | | | | | | |

| Netherlands | 0.8% | | | | | | | | |

| Adyen NV (*) | | | 40 | | | | 55,353 | |

| ASML Holding NV | | | 475 | | | | 257,119 | |

| BNP Paribas Emissions- und Handelsgesellschaft mbH | | | 8,819 | | | | 107,595 | |

| Eurocommercial Properties NV REIT | | | 3,421 | | | | 82,525 | |

| Koninklijke Ahold Delhaize NV | | | 6,989 | | | | 200,821 | |

| Koninklijke KPN NV | | | 26,983 | | | | 83,484 | |

| NN Group NV | | | 940 | | | | 38,391 | |

| Shell PLC | | | 22,844 | | | | 649,174 | |

| Wolters Kluwer NV | | | 4,332 | | | | 452,517 | |

| Wolters Kluwer NV ADR | | | 1,928 | | | | 201,958 | |

| | | | | | | | 2,128,937 | |

| | | | | | | | | |

| New Zealand | 0.1% | | | | | | | | |

| Spark New Zealand Ltd. | | | 74,158 | | | | 254,190 | |

| | | | | | | | | |

| Norway | 0.1% | | | | | | | | |

| Orkla ASA | | | 28,415 | | | | 205,297 | |

| | | | | | | | | |

| Puerto Rico | 0.0% | | | | | | | | |

| OFG Bancorp | | | 671 | | | | 18,493 | |

| | | | | | | | | |

| Singapore | 0.2% | | | | | | | | |

| Jardine Cycle & Carriage Ltd. | | | 8,800 | | | | 188,017 | |

| Oversea-Chinese Banking Corp. Ltd. | | | 15,000 | | | | 136,107 | |

| Sembcorp Industries Ltd. | | | 55,900 | | | | 140,737 | |

| Singapore Telecommunications Ltd. NA | | | 46,100 | | | | 88,505 | |

| STMicroelectronics NV | | | 1,603 | | | | 56,987 | |

| | | | | | | | 610,353 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 37

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Spain | 0.2% | | | | | | | | |

| Banco Bilbao Vizcaya Argentaria SA | | | 6,974 | | | $ | 42,115 | |

| Banco Santander SA | | | 8,592 | | | | 25,732 | |

| Corporacion Financiera Alba SA | | | 598 | | | | 27,618 | |

| Iberdrola SA | | | 1,725 | | | | 20,178 | |

| Industria de Diseno Textil SA | | | 7,459 | | | | 198,619 | |

| Industria de Diseno Textil SA ADR | | | 6,316 | | | | 84,224 | |

| | | | | | | | 398,486 | |

| | | | | | | | | |

| Sweden | 0.2% | | | | | | | | |

| Assa Abloy AB ADR | | | 7,381 | | | | 78,977 | |

| Epiroc AB ADR | | | 10,390 | | | | 189,513 | |

| Hexagon AB ADR | | | 13,376 | | | | 139,244 | |

| Telefonaktiebolaget LM Ericsson, B Shares | | | 18,757 | | | | 109,848 | |

| | | | | | | | 517,582 | |

| | | | | | | | | |

| Switzerland | 0.2% | | | | | | | | |

| ABB Ltd. ADR | | | 4,988 | | | | 151,934 | |

| Novartis AG | | | 1,166 | | | | 105,618 | |

| PSP Swiss Property AG | | | 1,787 | | | | 210,147 | |

| Swatch Group AG | | | 10,311 | | | | 146,313 | |

| | | | | | | | 614,012 | |

| | | | | | | | | |

| United Kingdom | 1.1% | | | | | | | | |

| Barclays PLC | | | 67,081 | | | | 128,969 | |

| Coca-Cola Europacific Partners PLC | | | 2,380 | | | | 131,662 | |

| Compass Group PLC | | | 4,393 | | | | 101,509 | |

| Diageo PLC ADR | | | 1,165 | | | | 207,591 | |

| HSBC Holdings PLC | | | 30,907 | | | | 192,751 | |

| Investec PLC | | | 10,599 | | | | 65,539 | |

| Linde PLC | | | 135 | | | | 44,034 | |

| LXI REIT PLC REIT | | | 33,516 | | | | 45,586 | |

| National Grid PLC | | | 13,075 | | | | 157,049 | |

| NatWest Group PLC | | | 43,953 | | | | 140,304 | |

| RELX PLC ADR | | | 7,374 | | | | 204,407 | |

| Serco Group PLC | | | 64,584 | | | | 120,778 | |

The accompanying notes are an integral part of these financial statements.

38 Annual Report

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| SSE PLC | | | 6,257 | | | $ | 129,056 | |

| Standard Chartered PLC | | | 51,715 | | | | 388,158 | |

| Unilever PLC | | | 14,312 | | | | 722,026 | |

| Unilever PLC ADR | | | 4,045 | | | | 203,666 | |

| | | | | | | | 2,983,085 | |

| | | | | | | | | |

| United States | 19.4% | | | | | | | | |

| 3M Co. | | | 732 | | | | 87,781 | |

| Abbott Laboratories | | | 7,502 | | | | 823,645 | |

| Academy Sports & Outdoors, Inc. | | | 1,259 | | | | 66,148 | |

| Accenture PLC, Class A | | | 1,028 | | | | 274,312 | |

| Activision Blizzard, Inc. | | | 1,990 | | | | 152,334 | |

| Adobe, Inc. (*) | | | 58 | | | | 19,519 | |

| Affiliated Managers Group, Inc. | | | 577 | | | | 91,414 | |

| Allison Transmission Holdings, Inc. | | | 3,264 | | | | 135,782 | |

| Alphabet, Inc., Class A (*) | | | 3,294 | | | | 290,630 | |

| Alphabet, Inc., Class C (*) | | | 5,967 | | | | 529,452 | |

| Altria Group, Inc. | | | 9,374 | | | | 428,486 | |

| Amazon.com, Inc. (*) | | | 2,709 | | | | 227,556 | |

| Amdocs Ltd. | | | 6,454 | | | | 586,669 | |

| Ameren Corp. | | | 2,331 | | | | 207,273 | |

| American Electric Power Co., Inc. | | | 4,827 | | | | 458,324 | |

| American Express Co. | | | 127 | | | | 18,764 | |

| American International Group, Inc. | | | 1,411 | | | | 89,232 | |

| AmerisourceBergen Corp. | | | 1,921 | | | | 318,329 | |

| AMN Healthcare Services, Inc. (*) | | | 1,697 | | | | 174,486 | |

| Amphenol Corp., Class A | | | 2,429 | | | | 184,944 | |

| Aon PLC, Class A | | | 1,767 | | | | 530,347 | |

| Apple, Inc. | | | 12,475 | | | | 1,620,877 | |

| Applied Materials, Inc. | | | 1,921 | | | | 187,067 | |

| AT&T, Inc. | | | 49,335 | | | | 908,257 | |

| Automatic Data Processing, Inc. | | | 920 | | | | 219,751 | |

| AutoZone, Inc. (*) | | | 135 | | | | 332,934 | |

| Avery Dennison Corp. | | | 515 | | | | 93,215 | |

| Bank of America Corp. | | | 4,169 | | | | 138,077 | |

| Bath & Body Works, Inc. | | | 1,887 | | | | 79,518 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 39

| | | | | | | |

| | | | | | Fair | |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Biogen, Inc. (*) | | | 326 | | | $ | 90,276 | |

| BJ’s Wholesale Club Holdings, Inc. (*) | | | 2,481 | | | | 164,143 | |

| BlueLinx Holdings, Inc. (*) | | | 659 | | | | 46,861 | |

| Booking Holdings, Inc. (*) | | | 13 | | | | 26,199 | |

| Booz Allen Hamilton Holding Corp. | | | 2,079 | | | | 217,297 | |

| Boston Scientific Corp. (*) | | | 3,409 | | | | 157,734 | |

| Bristol-Myers Squibb Co. | | | 9,202 | | | | 662,084 | |

| Broadcom, Inc. | | | 539 | | | | 301,371 | |

| BRP, Inc. | | | 1,392 | | | | 106,279 | |