UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08071

Lazard Retirement Series, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Mark R. Anderson, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 6/30/23

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard Retirement Series

Semi-Annual Report

June 30, 2023

Equity

Lazard Retirement Emerging Markets Equity Portfolio

Lazard Retirement International Equity Portfolio

Lazard Retirement US Small-Mid Cap Equity Portfolio

Multi-Asset

Lazard Retirement Global Dynamic Multi-Asset Portfolio

Lazard Retirement Series, Inc. Table of Contents

Shares of the Portfolios are currently offered only to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. Portfolio shares may also be offered to certain qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis.

Please consider a Portfolio’s investment objective, risks, charges and expenses carefully before investing. For more complete information about Lazard Retirement Series, Inc. (the “Fund”), you may obtain a prospectus or a Portfolio’s summary prospectus by calling 800-823-6300, or online, at www.lazardassetmanagement.com. Read the prospectus or the Portfolio’s summary prospectus carefully before you invest. The prospectus and a Portfolio’s summary prospectus contain the investment objective, risks, charges, expenses and other information about the Portfolio, which are not detailed in this report.

Distributed by Lazard Asset Management Securities LLC.

Semi-Annual Report 1

Lazard Retirement Series, Inc. A Message from Lazard (unaudited)

Dear Shareholder:

After suffering through a dismal 2022, global financial markets made solid progress in the first half of 2023, as investors adopted a more optimistic view of mixed developments.

Yet, anxiety about persistent inflationary pressure continued to hang over markets during the six-month period, putting the actions of central banks front and center once again in the minds of investors. Early on, markets rallied on hopes that a severe worldwide economic recession could be avoided, and that slowing inflation would cause major central banks to ease up on monetary tightening efforts. That optimism faded in subsequent months, however, as the Federal Reserve (the “Fed”)—the world’s most influential central bank—continued with its rate-hiking and appeared committed to a “higher for longer” interest-rate policy in order to tame stubbornly high domestic inflation. After lifting interest rates seven times in 2022, the Fed raised rates three times during the first half of the year before pausing in June, in order to give the Fed time to gauge the impact of the rate hikes. It did, however, warn that it could lift interest rates twice more before the end of 2023.The risk of recession appeared to increase during the period, which saw three high-profile bank failures and tighter credit conditions in the aftermath of turmoil.

The interest-rate policy paths of other major central banks were also closely followed by markets. In Europe, the European Central Bank and the Bank of England both raised interest rates four consecutive times during the period and warned that there would be no easing of their aggressive efforts to stamp out stubbornly high inflation in the eurozone and the UK, respectively. Two major central banks in Asia were notable in resisting monetary tightening. The Bank of Japan maintained its ultra-low interest-rate policy stance despite inflationary pressures continuing to intensify in Japan. In addition, the People’s Bank of China cut its main interest rate in June as China’s post-pandemic economic recovery appeared to have stalled. Additionally, fears grew that China’s economy, the world’s second largest, was at risk of falling into a deflationary spiral.

Against this backdrop, global bond markets cautiously recovered after last year’s historic sell-off. Positive contributions arose despite central banks raising interest rates in order to tame pronounced levels of core inflation, which moderated during the period, though more slowly than many market participants expected. Hawkish

2 Semi-Annual Report

sentiment inverted yield curves as a result. Despite central banks shrinking their balance sheets, sovereign rates did not change much with coupon income from the bonds leading to positive performance. Although credit spreads narrowed in the beginning of 2023, the banking crisis in March led to investment grade and high-yield spreads widening. Thus, at the mid-point of this year, spreads were only slightly narrower compared to the end of 2022, leaving credit markets to also rely on coupon income to generate returns. Emerging markets debt also had low single-digit returns in hard currency, while local bonds outperformed and were among the best performing sectors in the first half of 2023. Notable among the group of bond indices was the Bloomberg Global Aggregate Bond Index, which gained 1.4% in the period. Despite bouts of risk aversion in the markets and a hawkish Fed, the US dollar could not defend the heights it had reached last year and sold off moderately versus a basket of US trade partners’ currencies.

Meanwhile, global equity markets, as measured by the MSCI All Country World Index, gained 13.9% in the first half of the year, propelled largely by the strong performance of growth stocks, which outperformed their value counterparts by nearly 20%.The S&P 500 Index—the bellwether of the US equity market—outpaced the broader global stock market and hovered near bull-market territory from its October lows. This was the result of a resilient US economy, hopes that the Fed would soon ease its rate-hiking campaign, and the stellar performance of a handful of top technology company stocks, especially those linked to artificial intelligence.

The challenging market conditions in the first half of 2023 are a reminder of the importance of active portfolio management. Turbulent markets are likely to differentiate winners from losers. We remain confident that fundamental analysis and bottom-up security selection will be crucial drivers of performance going forward. We are privileged that you have turned to Lazard for your investment needs and value your continued confidence in our investment management capabilities.

Sincerely,

Lazard Asset Management LLC

Semi-Annual Report 3

Lazard Retirement Series, Inc. Performance Overviews (unaudited)

Please see the “Notes to the Performance Overviews” for important information about the calculation of total returns, performance information generally, performance differences between Service Shares and Investor Shares, and the indexes shown below.

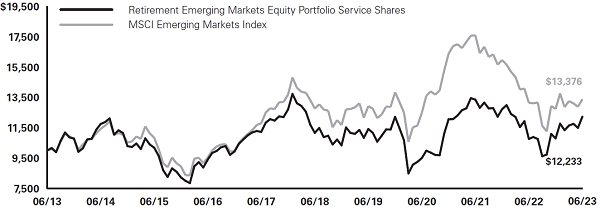

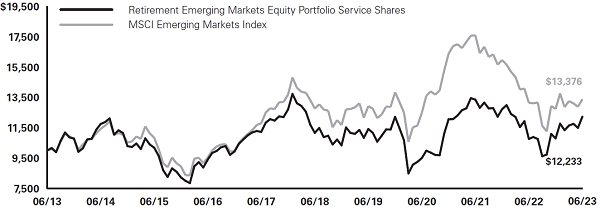

Lazard Retirement Emerging Markets Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Emerging Markets Equity Portfolio and the MSCI Emerging Markets® Index

Average Annual Total Returns

Periods Ended June 30, 2023

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | 13.57% | 1.84% | 2.04% | |

| Investor Shares | 13.83% | 2.08% | 2.29% | |

| MSCI Emerging Markets Index | 1.75% | 0.93% | 2.95% | |

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement International Equity Portfolio and the MSCI EAFE® Index

Average Annual Total Returns

Periods Ended June 30, 2023

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | 16.05% | 3.35% | 4.37% | |

| MSCI EAFE Index | 18.77% | 4.39% | 5.41% | |

4 Semi-Annual Report

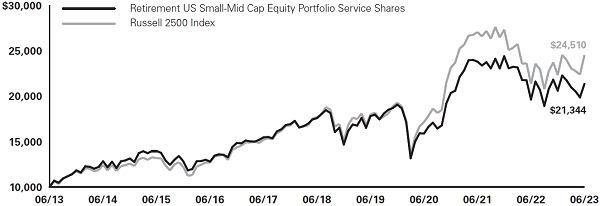

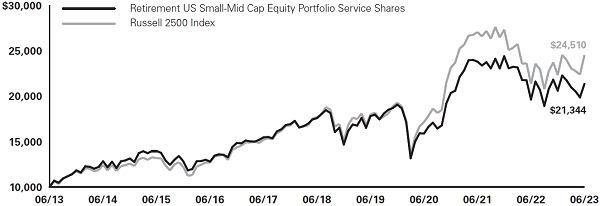

Lazard Retirement US Small-Mid Cap Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement US Small-Mid Cap Equity Portfolio and the Russell 2500® Index

Average Annual Total Returns

Periods Ended June 30, 2023

| | One

Year | Five

Years | Ten

Years | |

| Service Shares | 8.74% | 3.96% | 7.88% | |

| Russell 2500 Index | 13.58% | 6.55% | 9.38% | |

Semi-Annual Report 5

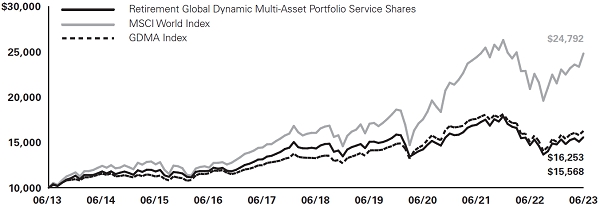

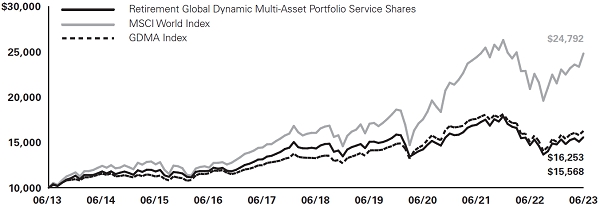

Lazard Retirement Global Dynamic Multi-Asset Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Global Dynamic Multi-Asset Portfolio, the MSCI World® Index and the GDMA Index

Average Annual Total Returns

Periods Ended June 30, 2023

| | One

Year | Five

Year | Ten

Years | Since

Inception | † |

| Service Shares | 5.88% | 1.69% | 4.53% | 5.08% | |

| Investor Shares | 6.11% | N/A | N/A | 3.43% | |

| MSCI World Index | 18.51% | 9.07% | 9.50% | 9.74%

(Service

Shares)

12.49%

(Investor

Shares) | |

| GDMA Index | 8.40% | 4.19% | 4.98% | 4.94%

(Service

Shares)

5.71%

(Investor

Shares) | |

| † | The inception date for the Service Shares was April 30, 2012 and for the Investor Shares was December 31, 2018. |

Notes to Performance Overviews:

Information About Portfolios Performance Shown Above

Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios may have been waived or reimbursed by Lazard Asset Management LLC, the Fund’s investment manager (the “Investment Manager”), State Street Bank and Trust Company, the Fund’s administrator (“State Street”), or SS&C Global Investor and Distribution Solutions, Inc., the Fund’s transfer agent and dividend disbursing agent (“SS&C GIDS”); without such waiver/reimbursement of expenses, the Portfolios’ returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Returns for a period of less than one year are not annualized.

Performance results do not include adjustments made for financial reporting purposes in accordance with US Generally Accepted Accounting Principles (“GAAP”), if any.

The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of an investment in

6 Semi-Annual Report

a Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated, there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods.

The performance of Service Shares and Investor Shares may vary, primarily based on the differences in fees borne by shareholders investing in different classes.

Information About Index Performance Shown Above

The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The indices are unmanaged, have no fees or costs and are not available for investment.

The GDMA Index is a blended index constructed by the Investment Manager that is comprised of 50% MSCI World Index and 50% Bloomberg Global Aggregate® Index and is rebalanced monthly. The Bloomberg Global Aggregate Index provides a broad-based measure of global investment-grade fixed-income debt markets, including government-related debt, corporate debt, securitized debt and global Treasury.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free-float-adjusted market capitalization index that is designed to measure developed markets equity performance, excluding the United States and Canada. The MSCI EAFE Index consists of 21 developed markets country indices.

The MSCI Emerging Markets Index is a free-float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The MSCI Emerging Markets Index consists of 24 emerging markets country indices.

The MSCI World Index is a free-float-adjusted market capitalization index that is designed to measure global developed markets equity performance. The MSCI World Index consists of 23 developed markets country indices.

The Russell 2500 Index measures the performance of the small- to mid-capitalization segment of the US equity universe, commonly referred to as “smid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. The Russell 3000 Index measures the performance of the largest 3000 US companies, representing approximately 98% of the investable US equity market. The Russell 2500 Index includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership.

Semi-Annual Report 7

Lazard Retirement Series, Inc.

Information About Your Portfolio’s Expenses (unaudited)

Expense Example

As a shareholder in a Portfolio, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from January 1, 2023 through June 30, 2023 and held for the entire period.

Actual Expenses

For each share class of the Portfolios, the first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each share class of the Portfolios, the second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the participating insurance companies. Such charges will have the effect of reducing account value.

8 Semi-Annual Report

| Portfolios | | Beginning

Account Value

1/1/23 | | Ending

Account

Value

6/30/23 | | Expenses Paid

During Period*

1/1/23- 6/30/23 | | Annualized

Expense Ratio

During Period

1/1/23- 6/30/23 |

| | | | | | | | | |

| Emerging Markets Equity | | | | | | | | |

| Service Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,132.30 | | $7.35 | | 1.39% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.90 | | $6.95 | | 1.39% |

| Investor Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,133.70 | | $6.08 | | 1.15% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.09 | | $5.76 | | 1.15% |

| | | | | | | | | |

| International Equity | | | | | | | | |

| Service Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,128.30 | | $6.54 | | 1.24% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.65 | | $6.21 | | 1.24% |

| | | | | | | | | |

| US Small-Mid Cap Equity | | | | | | | | |

| Service Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,035.90 | | $5.81 | | 1.15% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.09 | | $5.76 | | 1.15% |

| | | | | | | | | |

| Global Dynamic Multi-Asset | | | | | | | | |

| Service Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,054.20 | | $5.35 | | 1.05% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.59 | | $5.26 | | 1.05% |

| Investor Shares | | | | | | | | |

| Actual | | $1,000.00 | | $1,054.97 | | $4.59 | | 0.90% |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.33 | | $4.51 | | 0.90% |

| * | Expenses are equal to the annualized expense ratio, net of expenses waivers and reimbursements, of each share class multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period). |

Semi-Annual Report 9

Lazard Retirement Series, Inc.

Portfolio Holdings Presented by Sector June 30, 2023 (unaudited)

| Sector* | | Lazard

Retirement

Emerging

Markets

Equity

Portfolio | | Lazard

Retirement

International

Equity

Portfolio | | Lazard

Retirement

US Small-

Mid Cap

Equity

Portfolio | | Lazard

Retirement

Global

Dynamic

Multi-Asset

Portfolio# |

| | | | | | | | | | | | | | | | | |

| Communication Services | | | 5.7 | % | | | 2.1 | % | | | 5.2 | % | | | 6.0 | % |

| Consumer Discretionary | | | 10.5 | | | | 14.1 | | | | 10.5 | | | | 8.7 | |

| Consumer Staples | | | 6.7 | | | | 12.3 | | | | 3.8 | | | | 7.4 | |

| Energy | | | 10.0 | | | | 4.2 | | | | 5.4 | | | | 1.5 | |

| Financials | | | 26.4 | | | | 15.7 | | | | 13.6 | | | | 12.1 | |

| Health Care | | | 3.7 | | | | 8.3 | | | | 12.9 | | | | 9.7 | |

| Industrials | | | 4.0 | | | | 20.8 | | | | 19.4 | | | | 8.9 | |

| Information Technology | | | 21.3 | | | | 7.4 | | | | 13.8 | | | | 13.7 | |

| Materials | | | 6.7 | | | | 6.5 | | | | 5.7 | | | | 1.4 | |

| Real Estate | | | 1.0 | | | | 1.3 | | | | 5.5 | | | | 2.0 | |

| Utilities | | | 1.9 | | | | 5.5 | | | | 2.1 | | | | 1.9 | |

| Municipal | | | — | | | | — | | | | — | | | | 0.6 | |

| Sovereign Debt | | | — | | | | — | | | | — | | | | 23.7 | |

| U.S. Treasury Securities | | | — | | | | — | | | | — | | | | 1.1 | |

| Short-Term Investments | | | 2.1 | | | | 1.8 | | | | 2.1 | | | | 1.3 | |

| Total Investments | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| * | Represents percentage of total investments. |

| # | Equity sector breakdown is based upon the underlying holdings of exchange-traded funds held by the Portfolio. |

10 Semi-Annual Report

Lazard Retirement Series, Inc. Portfolios of Investments

June 30, 2023 (unaudited)

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 97.1% | | | | | | | | |

| | | | | | | | | |

| Brazil | 12.3% | | | | | | | | |

| Banco do Brasil SA | | | 773,802 | | | $ | 7,983,338 | |

| BB Seguridade Participacoes SA | | | 1,165,800 | | | | 7,491,681 | |

| CCR SA | | | 1,829,550 | | | | 5,368,443 | |

| Engie Brasil Energia SA | | | 335,798 | | | | 3,204,254 | |

| Petroleo Brasileiro SA ADR | | | 577,012 | | | | 7,980,076 | |

| Vale SA ADR | | | 289,342 | | | | 3,882,969 | |

| Vibra Energia SA | | | 880,000 | | | | 3,317,322 | |

| | | | | | | | 39,228,083 | |

| | | | | | | | | |

| Chile | 1.1% | | | | | | | | |

| Sociedad Quimica y Minera de Chile SA ADR | | | 46,886 | | | | 3,404,861 | |

| | | | | | | | | |

| China | 23.4% | | | | | | | | |

| A-Living Smart City Services Co. Ltd. | | | 385,500 | | | | 249,426 | |

| Anhui Conch Cement Co. Ltd., Class H | | | 1,099,375 | | | | 2,926,634 | |

| China Construction Bank Corp., Class H | | | 15,998,038 | | | | 10,374,044 | |

| China Medical System Holdings Ltd. | | | 1,762,000 | | | | 2,880,978 | |

| China Merchants Bank Co. Ltd., Class H | | | 1,016,737 | | | | 4,623,778 | |

| China Shenhua Energy Co. Ltd., Class H | | | 742,275 | | | | 2,277,401 | |

| China Vanke Co. Ltd., Class H | | | 2,061,694 | | | | 2,778,658 | |

| ENN Natural Gas Co. Ltd., Class A | | | 1,076,596 | | | | 2,819,110 | |

| Gree Electric Appliances, Inc. of Zhuhai, Class A | | | 811,699 | | | | 4,079,384 | |

| Hengan International Group Co. Ltd. | | | 1,020,027 | | | | 4,300,896 | |

| Huayu Automotive Systems Co. Ltd., Class A | | | 1,425,796 | | | | 3,629,893 | |

| Lenovo Group Ltd. | | | 6,208,000 | | | | 6,486,699 | |

| Midea Group Co. Ltd., Class A | | | 623,600 | | | | 5,075,657 | |

| Ping An Insurance (Group) Co. of China Ltd., Class H | | | 1,013,500 | | | | 6,493,685 | |

| Sinopharm Group Co. Ltd., Class H | | | 2,039,997 | | | | 6,395,351 | |

| Tingyi (Cayman Islands) Holding Corp. | | | 3,028,000 | | | | 4,706,437 | |

| Want Want China Holdings Ltd. | | | 684,000 | | | | 454,594 | |

| Weichai Power Co. Ltd., Class H | | | 2,956,958 | | | | 4,342,408 | |

| | | | | | | | 74,895,033 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 11

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Egypt | 0.7% | | | | | | | | |

| Commercial International Bank Egypt SAE GDR | | | 1,929,383 | | | $ | 2,199,360 | |

| | | | | | | | | |

| Greece | 1.0% | | | | | | | | |

| OPAP SA | | | 188,492 | | | | 3,288,838 | |

| | | | | | | | | |

| Hong Kong | 1.2% | | | | | | | | |

| ASMPT Ltd. | | | 396,988 | | | | 3,921,884 | |

| | | | | | | | | |

| Hungary | 3.1% | | | | | | | | |

| MOL Hungarian Oil & Gas PLC | | | 297,634 | | | | 2,604,929 | |

| OTP Bank Nyrt | | | 208,853 | | | | 7,420,565 | |

| | | | | | | | 10,025,494 | |

| | | | | | | | | |

| India | 7.6% | | | | | | | | |

| Axis Bank Ltd. | | | 255,656 | | | | 3,085,161 | |

| Bajaj Auto Ltd. | | | 41,776 | | | | 2,389,776 | |

| Bharat Petroleum Corp. Ltd. | | | 572,510 | | | | 2,543,799 | |

| Hindalco Industries Ltd. | | | 72,007 | | | | 371,049 | |

| Indus Towers Ltd. | | | 2,051,690 | | | | 4,114,400 | |

| Infosys Ltd. ADR | | | 198,844 | | | | 3,195,423 | |

| Petronet LNG Ltd. | | | 1,192,780 | | | | 3,237,981 | |

| UPL Ltd. | | | 631,106 | | | | 5,295,113 | |

| | | | | | | | 24,232,702 | |

| | | | | | | | | |

| Indonesia | 4.3% | | | | | | | | |

| PT Astra International Tbk | | | 6,776,304 | | | | 3,087,513 | |

| PT Bank Mandiri (Persero) Tbk | | | 14,809,060 | | | | 5,185,387 | |

| PT Telkom Indonesia (Persero) Tbk ADR | | | 127,044 | | | | 3,388,263 | |

| PT United Tractors Tbk | | | 1,437,300 | | | | 2,255,012 | |

| | | | | | | | 13,916,175 | |

| | | | | | | | | |

| Mexico | 4.4% | | | | | | | | |

| America Movil SAB de CV ADR (*) | | | 148,541 | | | | 3,214,427 | |

| Grupo Financiero Banorte SAB de CV, Class O | | | 424,265 | | | | 3,500,056 | |

| Grupo Mexico SAB de CV, Series B | | | 175,188 | | | | 843,445 | |

| Kimberly-Clark de Mexico SAB de CV, Series A | | | 1,875,189 | | | | 4,170,617 | |

| Ternium SA ADR | | | 58,193 | | | | 2,307,352 | |

| | | | | | | | 14,035,897 | |

The accompanying notes are an integral part of these financial statements.

12 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Portugal | 2.4% | | | | | | | | |

| Galp Energia SGPS SA | | | 660,307 | | | $ | 7,720,568 | |

| | | | | | | | | |

| Russia | 0.0% | | | | | | | | |

| Mobile TeleSystems PJSC ADR (*), (¢) | | | 545,705 | | | | 1 | |

| Sberbank of Russia PJSC (¢) | | | 1,580,119 | | | | 1 | |

| | | | | | | | 2 | |

| | | | | | | | | |

| South Africa | 7.6% | | | | | | | | |

| Anglo American PLC | | | 83,534 | | | | 2,367,721 | |

| Bidvest Group Ltd. | | | 208,394 | | | | 2,896,725 | |

| Life Healthcare Group Holdings Ltd. | | | 2,369,545 | | | | 2,586,722 | |

| Nedbank Group, Ltd. | | | 463,008 | | | | 5,622,316 | |

| Sanlam Ltd. | | | 1,110,896 | | | | 3,452,879 | |

| Standard Bank Group, Ltd. | | | 408,453 | | | | 3,852,377 | |

| Vodacom Group, Ltd. | | | 556,572 | | | | 3,470,282 | |

| | | | | | | | 24,249,022 | |

| | | | | | | | | |

| South Korea | 11.1% | | | | | | | | |

| Coway Co. Ltd. | | | 71,017 | | | | 2,376,866 | |

| Doosan Bobcat, Inc. (*) | | | 4,846 | | | | 216,780 | |

| Hyundai Mobis Co., Ltd. | | | 20,035 | | | | 3,552,013 | |

| KB Financial Group, Inc. (*) | | | 139,597 | | | | 5,061,873 | |

| Kia Corp. | | | 37,602 | | | | 2,535,538 | |

| KT Corp. | | | 164,704 | | | | 3,732,947 | |

| KT&G Corp. | | | 38,528 | | | | 2,425,526 | |

| Samsung Electronics Co., Ltd. | | | 114,955 | | | | 6,335,910 | |

| Shinhan Financial Group Co., Ltd. | | | 163,917 | | | | 4,243,254 | |

| SK Hynix, Inc. | | | 56,870 | | | | 5,014,478 | |

| | | | | | | | 35,495,185 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 13

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (concluded) | | | | | | |

| | | | | | | |

| Taiwan | 13.3% | | | | | | |

| ASE Technology Holding Co., Ltd. | | | 2,083,000 | | | $ | 7,429,770 | |

| Globalwafers Co., Ltd. | | | 201,000 | | | | 3,225,386 | |

| Hon Hai Precision Industry Co., Ltd. | | | 852,320 | | | | 3,102,235 | |

| MediaTek, Inc. | | | 288,000 | | | | 6,392,784 | |

| Novatek Microelectronics Corp. | | | 270,000 | | | | 3,719,734 | |

| Quanta Computer, Inc. | | | 655,000 | | | | 3,208,901 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 682,989 | | | | 12,727,724 | |

| Wiwynn Corp. | | | 58,000 | | | | 2,662,581 | |

| | | | | | | | 42,469,115 | |

| | | | | | | | | |

| Thailand | 2.0% | | | | | | | | |

| Kasikornbank Public Co., Ltd. | | | 848,269 | | | | 3,118,071 | |

| PTT Exploration & Production PCL (‡) | | | 757,300 | | | | 3,203,921 | |

| | | | | | | | 6,321,992 | |

| | | | | | | | | |

| United Kingdom | 1.6% | | | | | | | | |

| Unilever PLC | | | 97,194 | | | | 5,059,846 | |

| | | | | | | | | |

Total Common Stocks

(Cost $289,826,982) | | | | | | | 310,464,057 | |

| | | | | | | | | |

| Short-Term Investments | 2.1% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 5.02% (7 day yield)

(Cost $6,628,062) | | | 6,628,062 | | | | 6,628,062 | |

| | | | | | | | | |

Total Investments | 99.2%

(Cost $296,455,044) | | | | | | $ | 317,092,119 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 0.8% | | | | | | | 2,485,064 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 319,577,183 | |

The accompanying notes are an integral part of these financial statements.

14 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement International Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 95.4% | | | | | | | | |

| | | | | | | | | |

| Canada | 3.5% | | | | | | | | |

| Gildan Activewear, Inc. | | | 34,304 | | | $ | 1,105,963 | |

| Suncor Energy, Inc. | | | 68,521 | | | | 2,009,984 | |

| TMX Group, Ltd. | | | 42,715 | | | | 961,188 | |

| | | | | | | | 4,077,135 | |

| | | | | | | | | |

| China | 4.2% | | | | | | | | |

| Alibaba Group Holding, Ltd. (*) | | | 109,800 | | | | 1,141,927 | |

| Autohome, Inc. ADR | | | 28,291 | | | | 824,966 | |

| ENN Energy Holdings, Ltd. | | | 79,700 | | | | 995,989 | |

| ESR Group Ltd. | | | 450,000 | | | | 774,710 | |

| Li Ning Co. Ltd. | | | 101,000 | | | | 546,222 | |

| Wuxi Lead Intelligent Equipment Co. Ltd., Class A | | | 127,899 | | | | 637,754 | |

| | | | | | | | 4,921,568 | |

| | | | | | | | | |

| Denmark | 2.3% | | | | | | | | |

| AP Moller - Maersk AS, Class B | | | 353 | | | | 621,032 | |

| Carlsberg AS, Class B | | | 12,695 | | | | 2,029,836 | |

| | | | | | | | 2,650,868 | |

| | | | | | | | | |

| Finland | 1.7% | | | | | | | | |

| Nordea Bank Abp | | | 182,248 | | | | 1,985,700 | |

| | | | | | | | | |

| France | 11.5% | | | | | | | | |

| Air Liquide SA | | | 12,309 | | | | 2,206,783 | |

| Airbus SE | | | 10,797 | | | | 1,560,764 | |

| Bureau Veritas SA | | | 39,676 | | | | 1,088,304 | |

| Capgemini SE | | | 8,141 | | | | 1,542,241 | |

| Engie SA | | | 208,821 | | | | 3,473,348 | |

| Pernod Ricard SA | | | 8,111 | | | | 1,792,039 | |

| Thales SA | | | 11,104 | | | | 1,662,135 | |

| | | | | | | | 13,325,614 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 15

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement International Equity Portfolio (continued) | | | | | | |

| | | | | | | |

| Germany | 10.1% | | | | | | |

| Continental AG | | | 24,364 | | | $ | 1,836,176 | |

| Covestro AG (*) | | | 17,381 | | | | 902,515 | |

| Infineon Technologies AG | | | 34,799 | | | | 1,435,129 | |

| Merck KGaA | | | 11,243 | | | | 1,858,832 | |

| MTU Aero Engines AG | | | 6,846 | | | | 1,773,830 | |

| Rheinmetall AG | | | 5,038 | | | | 1,383,283 | |

| Siemens Healthineers AG | | | 29,989 | | | | 1,697,295 | |

| Vonovia SE | | | 38,424 | | | | 750,210 | |

| | | | | | | | 11,637,270 | |

| | | | | | | | | |

| Hong Kong | 1.3% | | | | | | | | |

| AIA Group Ltd. | | | 145,200 | | | | 1,481,502 | |

| | | | | | | | | |

| Ireland | 2.0% | | | | | | | | |

| Ryanair Holdings PLC ADR (*) | | | 21,271 | | | | 2,352,573 | |

| | | | | | | | | |

| Israel | 1.6% | | | | | | | | |

| Bank Leumi Le-Israel BM | | | 241,246 | | | | 1,807,511 | |

| | | | | | | | | |

| Italy | 2.8% | | | | | | | | |

| Enel SpA | | | 266,302 | | | | 1,793,888 | |

| UniCredit SpA | | | 61,775 | | | | 1,440,604 | |

| | | | | | | | 3,234,492 | |

| | | | | | | | | |

| Japan | 16.1% | | | | | | | | |

| Asics Corp. | | | 66,700 | | | | 2,063,918 | |

| Bandai Namco Holdings, Inc. | | | 61,300 | | | | 1,418,444 | |

| BayCurrent Consulting, Inc. | | | 33,200 | | | | 1,247,308 | |

| Daikin Industries Ltd. | | | 9,900 | | | | 2,020,834 | |

| Disco Corp. | | | 10,000 | | | | 1,582,047 | |

| Hitachi Ltd. | | | 19,900 | | | | 1,231,643 | |

| MatsukiyoCocokara & Co. | | | 41,800 | | | | 2,348,931 | |

| Renesas Electronics Corp. (*) | | | 60,500 | | | | 1,144,949 | |

| Shimano, Inc. | | | 4,400 | | | | 736,502 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 42,300 | | | | 1,810,489 | |

| Suzuki Motor Corp. | | | 39,900 | | | | 1,449,915 | |

| Yamaha Corp. | | | 40,800 | | | | 1,568,997 | |

| | | | | | | | 18,623,977 | |

The accompanying notes are an integral part of these financial statements.

16 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement International Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Mexico | 1.8% | | | | | | | | |

| Arca Continental SAB de CV | | | 201,700 | | | $ | 2,073,208 | |

| | | | | | | | | |

| Netherlands | 3.8% | | | | | | | | |

| Akzo Nobel NV | | | 23,303 | | | | 1,904,100 | |

| Universal Music Group NV | | | 74,328 | | | | 1,651,389 | |

| Wolters Kluwer NV | | | 6,786 | | | | 861,651 | |

| | | | | | | | 4,417,140 | |

| | | | | | | | | |

| Portugal | 0.8% | | | | | | | | |

| Galp Energia SGPS SA | | | 78,642 | | | | 919,513 | |

| | | | | | | | | |

| Singapore | 1.4% | | | | | | | | |

| DBS Group Holdings Ltd. | | | 68,360 | | | | 1,598,416 | |

| | | | | | | | | |

| South Africa | 1.1% | | | | | | | | |

| Anglo American PLC | | | 45,967 | | | | 1,302,907 | |

| | | | | | | | | |

| South Korea | 0.9% | | | | | | | | |

| SK Hynix, Inc. | | | 11,815 | | | | 1,041,781 | |

| | | | | | | | | |

| Spain | 1.3% | | | | | | | | |

| Industria de Diseno Textil SA | | | 37,770 | | | | 1,467,450 | |

| | | | | | | | | |

| Sweden | 1.1% | | | | | | | | |

| Sandvik AB | | | 63,260 | | | | 1,235,253 | |

| | | | | | | | | |

| Switzerland | 2.9% | | | | | | | | |

| ABB, Ltd. | | | 57,474 | | | | 2,261,504 | |

| DSM-Firmenich AG (*) | | | 10,664 | | | | 1,147,609 | |

| | | | | | | | 3,409,113 | |

| | | | | | | | | |

| Taiwan | 1.5% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | | 16,974 | | | | 1,713,016 | |

| | | | | | | | | |

| United Kingdom | 13.6% | | | | | | | | |

| 3i Group PLC | | | 88,593 | | | | 2,200,139 | |

| BP PLC | | | 333,614 | | | | 1,954,592 | |

| Coca-Cola Europacific Partners PLC | | | 33,668 | | | | 2,167,643 | |

| Compass Group PLC | | | 67,900 | | | | 1,899,383 | |

| RELX PLC | | | 117,102 | | | | 3,903,995 | |

| Unilever PLC | | | 50,782 | | | | 2,647,901 | |

| WPP PLC | | | 90,085 | | | | 941,662 | |

| | | | | | | | 15,715,315 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 17

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement International Equity Portfolio (concluded) | | | | | | | | |

| | | | | | | | | |

| United States | 8.1% | | | | | | | | |

| Aon PLC, Class A | | | 9,961 | | | $ | 3,438,537 | |

| ICON PLC (*) | | | 10,913 | | | | 2,730,433 | |

| Roche Holding AG | | | 10,600 | | | | 3,239,312 | |

| | | | | | | | 9,408,282 | |

| | | | | | | | | |

Total Common Stocks

(Cost $100,885,117) | | | | | | | 110,399,604 | |

| | | | | | | | | |

| Preferred Stocks | 2.1% | | | | | | | | |

| | | | | | | | | |

| Brazil | 1.1% | | | | | | | | |

| Itau Unibanco Holding SA | | | 215,500 | | | | 1,279,084 | |

| | | | | | | | | |

| Germany | 1.0% | | | | | | | | |

| Henkel AG & Co. KGaA | | | 13,948 | | | | 1,114,957 | |

| | | | | | | | | |

Total Preferred Stocks

(Cost $2,212,236) | | | | | | | 2,394,041 | |

| | | | | | | | | |

| Short-Term Investments | 1.8% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 5.02% (7 day yield)

(Cost $2,048,855) | | | 2,048,855 | | | | 2,048,855 | |

| | | | | | | | | |

Total Investments | 99.3%

(Cost $105,146,208) | | | | | | $ | 114,842,500 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 0.7% | | | | | | | 865,611 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 115,708,111 | |

The accompanying notes are an integral part of these financial statements.

18 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 96.8% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense | 2.7% | | | | | | | | |

| Curtiss-Wright Corp. | | | 3,453 | | | $ | 634,178 | |

| HEICO Corp. | | | 2,851 | | | | 504,456 | |

| | | | | | | | 1,138,634 | |

| | | | | | | | | |

| Automobile Components | 1.0% | | | | | | | | |

| Gentherm, Inc. (*) | | | 7,107 | | | | 401,617 | |

| | | | | | | | | |

| Banks | 6.2% | | | | | | | | |

| Comerica, Inc. | | | 13,559 | | | | 574,359 | |

| Commerce Bancshares, Inc. | | | 12,079 | | | | 588,247 | |

| Home BancShares, Inc. | | | 31,357 | | | | 714,940 | |

| Wintrust Financial Corp. | | | 9,872 | | | | 716,905 | |

| | | | | | | | 2,594,451 | |

| | | | | | | | | |

| Biotechnology | 3.0% | | | | | | | | |

| Halozyme Therapeutics, Inc. (*) | | | 16,718 | | | | 603,018 | |

| United Therapeutics Corp. (*) | | | 2,952 | | | | 651,654 | |

| | | | | | | | 1,254,672 | |

| | | | | | | | | |

| Building Products | 2.7% | | | | | | | | |

| Armstrong World Industries, Inc. | | | 6,204 | | | | 455,746 | |

| Carlisle Cos., Inc. | | | 2,536 | | | | 650,560 | |

| | | | | | | | 1,106,306 | |

| | | | | | | | | |

| Capital Markets | 1.1% | | | | | | | | |

| Morningstar, Inc. | | | 2,426 | | | | 475,666 | |

| | | | | | | | | |

| Chemicals | 2.0% | | | | | | | | |

| Ingevity Corp. (*) | | | 9,443 | | | | 549,205 | |

| Livent Corp. (*) | | | 9,744 | | | | 267,278 | |

| | | | | | | | 816,483 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 19

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Communications Equipment | 2.2% | | | | | | | | |

| Ciena Corp. (*) | | | 11,348 | | | $ | 482,176 | |

| F5, Inc. (*) | | | 2,834 | | | | 414,501 | |

| | | | | | | | 896,677 | |

| | | | | | | | | |

| Construction Materials | 0.8% | | | | | | | | |

| Eagle Materials, Inc. | | | 1,742 | | | | 324,744 | |

| | | | | | | | | |

| Consumer Staples Distribution & Retail | 1.3% | | | | | | | | |

| US Foods Holding Corp. (*) | | | 12,268 | | | | 539,792 | |

| | | | | | | | | |

| Containers & Packaging | 2.9% | | | | | | | | |

| Avery Dennison Corp. | | | 3,645 | | | | 626,211 | |

| Graphic Packaging Holding Co. | | | 24,817 | | | | 596,352 | |

| | | | | | | | 1,222,563 | |

| | | | | | | | | |

| Electrical Equipment | 4.5% | | | | | | | | |

| Array Technologies, Inc. (*) | | | 21,505 | | | | 486,013 | |

| Atkore, Inc. (*) | | | 4,557 | | | | 710,619 | |

| EnerSys | | | 6,041 | | | | 655,569 | |

| | | | | | | | 1,852,201 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components | 2.6% | | | | | | | | |

| Cognex Corp. | | | 9,515 | | | | 533,030 | |

| Littelfuse, Inc. | | | 1,891 | | | | 550,867 | |

| | | | | | | | 1,083,897 | |

| | | | | | | | | |

| Energy Equipment & Services | 2.8% | | | | | | | | |

| Cactus, Inc., Class A | | | 12,309 | | | | 520,917 | |

| Liberty Energy, Inc. | | | 46,898 | | | | 627,026 | |

| | | | | | | | 1,147,943 | |

| | | | | | | | | |

| Entertainment | 1.5% | | | | | | | | |

| Take-Two Interactive Software, Inc. (*) | | | 4,187 | | | | 616,159 | |

The accompanying notes are an integral part of these financial statements.

20 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Financial Services | 1.4% | | | | | | | | |

| Voya Financial, Inc. | | | 8,024 | | | $ | 575,401 | |

| | | | | | | | | |

| Food Products | 2.4% | | | | | | | | |

| Hostess Brands, Inc. (*) | | | 21,915 | | | | 554,888 | |

| Utz Brands, Inc. | | | 28,142 | | | | 460,403 | |

| | | | | | | | 1,015,291 | |

| | | | | | | | | |

| Gas Utilities | 2.1% | | | | | | | | |

| New Jersey Resources Corp. | | | 18,169 | | | | 857,577 | |

| | | | | | | | | |

| Health Care Equipment & Supplies | 4.0% | | | | | | | | |

| Envista Holdings Corp. (*) | | | 19,028 | | | | 643,908 | |

| Lantheus Holdings, Inc. (*) | | | 4,483 | | | | 376,213 | |

| QuidelOrtho Corp. (*) | | | 7,652 | | | | 634,045 | |

| | | | | | | | 1,654,166 | |

| | | | | | | | | |

| Health Care Providers & Services | 1.6% | | | | | | | | |

| Henry Schein, Inc. (*) | | | 8,182 | | | | 663,560 | |

| | | | | | | | | |

| Hotel & Resort REITs | 1.0% | | | | | | | | |

| Summit Hotel Properties, Inc | | | 66,141 | | | | 430,578 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure | 2.4% | | | | | | | | |

| Brinker International, Inc. (*) | | | 10,066 | | | | 368,416 | |

| Wyndham Hotels & Resorts, Inc. | | | 9,185 | | | | 629,815 | |

| | | | | | | | 998,231 | |

| | | | | | | | | |

| Household Durables | 1.7% | | | | | | | | |

| Helen of Troy Ltd. (*) | | | 6,652 | | | | 718,549 | |

| | | | | | | | | |

| Insurance | 4.7% | | | | | | | | |

| Brown & Brown, Inc. | | | 12,237 | | | | 842,395 | |

| Globe Life, Inc. | | | 3,969 | | | | 435,082 | |

| Reinsurance Group of America, Inc. | | | 4,814 | | | | 667,653 | |

| | | | | | | | 1,945,130 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 21

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Interactive Media & Services | 3.6% | | | | | | | | |

| Cars.com, Inc. (*) | | | 28,549 | | | $ | 565,841 | |

| Ziff Davis, Inc. (*) | | | 7,389 | | | | 517,673 | |

| ZoomInfo Technologies, Inc. (*) | | | 16,828 | | | | 427,263 | |

| | | | | | | | 1,510,777 | |

| | | | | | | | | |

| IT Services | 1.1% | | | | | | | | |

| Amdocs, Ltd. | | | 4,215 | | | | 416,653 | |

| Squarespace, Inc., Class A (*) | | | 1,725 | | | | 54,406 | |

| | | | | | | | 471,059 | |

| | | | | | | | | |

| Leisure Products | 1.1% | | | | | | | | |

| Brunswick Corp. | | | 5,087 | | | | 440,738 | |

| | | | | | | | | |

| Life Sciences Tools & Services | 4.2% | | | | | | | | |

| AbCellera Biologics, Inc. (*) | | | 60,946 | | | | 393,711 | |

| Charles River Laboratories International, Inc. (*) | | | 1,505 | | | | 316,426 | |

| ICON PLC (*) | | | 2,213 | | | | 553,693 | |

| Stevanato Group SpA | | | 14,787 | | | | 478,803 | |

| | | | | | | | 1,742,633 | |

| | | | | | | | | |

| Machinery l 5.1% | | | | | | | | |

| Columbus McKinnon Corp. | | | 11,941 | | | | 485,402 | |

| Gates Industrial Corp. PLC (*) | | | 35,711 | | | | 481,384 | |

| Middleby Corp. (*) | | | 5,201 | | | | 768,864 | |

| Nordson Corp. | | | 1,496 | | | | 371,277 | |

| | | | | | | | 2,106,927 | |

| | | | | | | | | |

| Office REITs | 1.3% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 2,393 | | | | 271,582 | |

| Kilroy Realty Corp. | | | 9,213 | | | | 277,219 | |

| | | | | | | | 548,801 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels | 2.6% | | | | | | | | |

| Antero Resources Corp. (*) | | | 22,368 | | | | 515,135 | |

| Magnolia Oil & Gas Corp., Class A | | | 26,365 | | | | 551,029 | |

| | | | | | | | 1,066,164 | |

The accompanying notes are an integral part of these financial statements.

22 Semi-Annual Report

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Professional Services | 4.2% | | | | | | | | |

| Jacobs Solutions, Inc. | | | 5,119 | | | $ | 608,598 | |

| Leidos Holdings, Inc. | | | 6,117 | | | | 541,232 | |

| Sterling Check Corp. (*) | | | 49,128 | | | | 602,309 | |

| | | | | | | | 1,752,139 | |

| | | | | | | | | |

| Residential REITs | 1.5% | | | | | | | | |

| Camden Property Trust | | | 5,875 | | | | 639,611 | |

| | | | | | | | | |

| Retail REITs | 1.5% | | | | | | | | |

| Brixmor Property Group, Inc. | | | 28,731 | | | | 632,082 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment | 1.3% | | | | | | | | |

| MKS Instruments, Inc. | | | 5,019 | | | | 542,554 | |

| | | | | | | | | |

| Software | 6.5% | | | | | | | | |

| CyberArk Software, Ltd. (*) | | | 2,866 | | | | 448,042 | |

| Dolby Laboratories, Inc., Class A | | | 6,863 | | | | 574,296 | |

| Dynatrace, Inc. (*) | | | 5,316 | | | | 273,614 | |

| N-Able, Inc. (*) | | | 28,281 | | | | 407,529 | |

| PTC, Inc. (*) | | | 3,469 | | | | 493,639 | |

| Tyler Technologies, Inc. (*) | | | 1,175 | | | | 489,352 | |

| | | | | | | | 2,686,472 | |

| | | | | | | | | |

| Specialty Retail | 1.8% | | | | | | | | |

| Five Below, Inc. (*) | | | 2,751 | | | | 540,682 | |

| Warby Parker, Inc., Class A (*) | | | 19,200 | | | | 224,448 | |

| | | | | | | | 765,130 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 23

| | | | | | | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (concluded) | | | | | | | | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods | 2.4% | | | | | | | | |

| Steven Madden Ltd. | | | 9,668 | | | $ | 316,047 | |

| Tapestry, Inc. | | | 15,991 | | | | 684,415 | |

| | | | | | | | 1,000,462 | |

| | | | | | | | | |

Total Common Stocks

(Cost $36,392,148) | | | | | | | 40,235,837 | |

| | | | | | | | | |

| Short-Term Investments | 2.1% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 5.02% (7 day yield)

(Cost $856,296) | | | 856,296 | | | | 856,296 | |

| | | | | | | | | |

Total Investments | 98.9%

(Cost $37,248,444) | | | | | | $ | 41,092,133 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 1.1% | | | | | | | 469,150 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 41,561,283 | |

The accompanying notes are an integral part of these financial statements.

24 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 58.6% | | | | | | | | |

| | | | | | | | | |

| Australia | 1.1% | | | | | | | | |

| AGL Energy Ltd. | | | 14,609 | | | $ | 105,647 | |

| BlueScope Steel Ltd. | | | 7,939 | | | | 109,526 | |

| Brambles Ltd. | | | 31,643 | | | | 304,557 | |

| Coles Group Ltd. | | | 13,269 | | | | 163,083 | |

| Computershare Ltd. ADR | | | 26,779 | | | | 421,769 | |

| Coronado Global Resources, Inc. | | | 70,177 | | | | 72,279 | |

| GrainCorp Ltd., Class A | | | 18,416 | | | | 96,523 | |

| Incitec Pivot Ltd. | | | 34,360 | | | | 63,110 | |

| Newcrest Mining Ltd. | | | 6,127 | | | | 109,471 | |

| Northern Star Resources Ltd. | | | 11,810 | | | | 95,874 | |

| Perseus Mining Ltd. | | | 125,002 | | | | 138,817 | |

| Qantas Airways Ltd. (*) | | | 51,824 | | | | 214,897 | |

| Sandfire Resources Ltd. (*) | | | 21,421 | | | | 84,927 | |

| Telstra Group Ltd. | | | 115,658 | | | | 331,957 | |

| Ventia Services Group Pty. Ltd. | | | 52,350 | | | | 106,036 | |

| WiseTech Global Ltd. | | | 3,331 | | | | 178,452 | |

| Yancoal Australia Ltd. | | | 86,669 | | | | 265,822 | |

| | | | | | | | 2,862,747 | |

| | | | | | | | | |

| Austria | 0.0% | | | | | | | | |

| ANDRITZ AG | | | 1,867 | | | | 104,184 | |

| | | | | | | | | |

| Belgium | 0.0% | | | | | | | | |

| Warehouses De Pauw CVA REIT | | | 2,523 | | | | 69,208 | |

| | | | | | | | | |

| Canada | 2.0% | | | | | | | | |

| Alamos Gold, Inc., Class A | | | 9,257 | | | | 110,267 | |

| Atco Ltd., Class I | | | 2,689 | | | | 80,056 | |

| Birchcliff Energy Ltd. | | | 12,039 | | | | 71,248 | |

| Canadian Natural Resources, Ltd. | | | 1,687 | | | | 94,846 | |

| CGI, Inc. (*) | | | 906 | | | | 95,541 | |

| Constellation Software, Inc. | | | 432 | | | | 895,064 | |

| Dollarama, Inc. | | | 4,364 | | | | 295,556 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 25

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Fairfax Financial Holdings Ltd. | | | 155 | | | $ | 116,101 | |

| Hydro One Ltd. | | | 15,167 | | | | 433,343 | |

| International Petroleum Corp. (*) | | | 14,853 | | | | 121,662 | |

| Loblaw Cos. Ltd. | | | 843 | | | | 77,176 | |

| Manulife Financial Corp. | | | 40,621 | | | | 767,805 | |

| Metro, Inc. | | | 7,305 | | | | 412,576 | |

| Parex Resources, Inc. | | | 5,686 | | | | 113,999 | |

| Quebecor, Inc., Class B | | | 7,759 | | | | 191,230 | |

| Rogers Communications, Inc., Class B | | | 1,797 | | | | 81,986 | |

| Shopify, Inc. Class A (*) | | | 2,016 | | | | 130,296 | |

| Teck Resources, Ltd., Class B | | | 2,814 | | | | 118,402 | |

| Teekay Tankers Ltd., Class A | | | 2,413 | | | | 92,249 | |

| Toronto-Dominion Bank | | | 12,807 | | | | 794,162 | |

| | | | | | | | 5,093,565 | |

| | | | | | | | | |

| China | 0.3% | | | | | | | | |

| NXP Semiconductors NV | | | 3,672 | | | | 751,585 | |

| | | | | | | | | |

| Denmark | 0.8% | | | | | | | | |

| Carlsberg AS, Class B ADR | | | 20,450 | | | | 655,013 | |

| Novo Nordisk AS, Class B | | | 8,733 | | | | 1,410,500 | |

| | | | | | | | 2,065,513 | |

| | | | | | | | | |

| Finland | 0.3% | | | | | | | | |

| Kone Oyj, ADR | | | 18,076 | | | | 472,326 | |

| Nordea Bank Abp | | | 19,924 | | | | 217,414 | |

| | | | | | | | 689,740 | |

| | | | | | | | | |

| France | 2.1% | | | | | | | | |

| AXA SA | | | 3,535 | | | | 104,436 | |

| BNP Paribas SA | | | 5,640 | | | | 356,275 | |

| Bureau Veritas SA ADR | | | 7,493 | | | | 413,464 | |

| Cie de Saint-Gobain | | | 6,369 | | | | 387,983 | |

| Cie Generale des Etablissements Michelin SCA | | | 2,373 | | | | 70,149 | |

| Hermes International | | | 51 | | | | 110,948 | |

The accompanying notes are an integral part of these financial statements.

26 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Legrand SA ADR | | | 21,821 | | | $ | 432,056 | |

| LVMH Moet Hennessy Louis Vuitton SE ADR | | | 3,791 | | | | 715,893 | |

| Orange SA | | | 45,521 | | | | 532,427 | |

| Pernod Ricard SA ADR | | | 12,061 | | | | 529,478 | |

| Societe Generale SA | | | 10,612 | | | | 276,250 | |

| Thales SA ADR | | | 20,987 | | | | 629,820 | |

| TotalEnergies SE | | | 10,499 | | | | 601,724 | |

| Vinci SA | | | 2,511 | | | | 291,847 | |

| | | | | | | | 5,452,750 | |

| | | | | | | | | |

| Germany | 0.8% | | | | | | | | |

| Bayerische Motoren Werke AG | | | 4,964 | | | | 609,661 | |

| Beiersdorf AG | | | 2,401 | | | | 317,669 | |

| Commerzbank AG | | | 9,191 | | | | 101,772 | |

| Deutsche Bank AG | | | 32,350 | | | | 339,458 | |

| Mercedes-Benz Group AG | | | 1,322 | | | | 106,397 | |

| Merck KGaA ADR | | | 13,135 | | | | 435,425 | |

| Rheinmetall AG | | | 351 | | | | 96,374 | |

| Telefonica Deutschland Holding AG | | | 37,776 | | | | 106,159 | |

| | | | | | | | 2,112,915 | |

| | | | | | | | | |

| Hong Kong | 0.3% | | | | | | | | |

| AIA Group, Ltd. ADR | | | 11,823 | | | | 481,551 | |

| Jardine Matheson Holdings, Ltd. | | | 1,600 | | | | 81,153 | |

| Swire Pacific, Ltd., Class A | | | 24,000 | | | | 184,648 | |

| WH Group, Ltd. | | | 216,000 | | | | 114,789 | |

| | | | | | | | 862,141 | |

| | | | | | | | | |

| Israel | 0.3% | | | | | | | | |

| Bank Hapoalim BM | | | 38,622 | | | | 316,754 | |

| Bezeq The Israeli Telecommunication Corp. Ltd. | | | 132,219 | | | | 161,890 | |

| Elbit Systems Ltd. | | | 570 | | | | 118,805 | |

| Perion Network, Ltd. (*) | | | 2,739 | | | | 84,005 | |

| | | | | | | | 681,454 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 27

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Italy | 0.4% | | | | | | | | |

| Banco BPM SpA | | | 25,919 | | | $ | 120,671 | |

| Intesa Sanpaolo SpA | | | 113,373 | | | | 297,980 | |

| Poste Italiane SpA | | | 18,383 | | | | 199,440 | |

| Saras SpA | | | 84,742 | | | | 105,179 | |

| Terna - Rete Elettrica Nazionale | | | 12,328 | | | | 105,010 | |

| UniCredit SpA | | | 5,084 | | | | 118,560 | |

| | | | | | | | 946,840 | |

| | | | | | | | | |

| Japan | 4.4% | | | | | | | | |

| ABC-Mart, Inc. | | | 5,400 | | | | 292,579 | |

| Bank of Kyoto Ltd. | | | 2,300 | | | | 115,541 | |

| Concordia Financial Group Ltd. | | | 56,100 | | | | 221,098 | |

| Daiwa House Industry Co., Ltd. | | | 4,100 | | | | 108,361 | |

| Daiwa Securities Group, Inc. | | | 46,600 | | | | 241,118 | |

| Electric Power Development Co., Ltd. | | | 42,400 | | | | 623,235 | |

| FUJIFILM Holdings Corp. | | | 1,800 | | | | 106,904 | |

| Hachijuni Bank Ltd. | | | 37,600 | | | | 164,010 | |

| Honda Motor Co., Ltd. | | | 12,200 | | | | 368,545 | |

| Japan Post Bank Co., Ltd. | | | 48,000 | | | | 376,066 | |

| Japan Post Holdings Co., Ltd. | | | 166,900 | | | | 1,200,104 | |

| Japan Post Insurance Co., Ltd. | | | 5,700 | | | | 85,698 | |

| Japan Real Estate Investment Corp. REIT | | | 28 | | | | 106,534 | |

| Japan Tobacco, Inc. | | | 4,900 | | | | 107,403 | |

| Kansai Electric Power Co., Inc. | | | 41,400 | | | | 520,142 | |

| Kawasaki Heavy Industries Ltd. | | | 4,400 | | | | 112,991 | |

| KDDI Corp. | | | 10,800 | | | | 333,783 | |

| Kyushu Railway Co. | | | 9,900 | | | | 212,677 | |

| Lawson, Inc. | | | 4,800 | | | | 213,228 | |

| Mazda Motor Corp. | | | 10,700 | | | | 104,570 | |

| Mebuki Financial Group, Inc. | | | 52,900 | | | | 126,500 | |

| Mitsubishi Motors Corp. | | | 26,600 | | | | 93,632 | |

| Mizuho Financial Group, Inc. | | | 30,100 | | | | 459,419 | |

| MS&AD Insurance Group Holdings, Inc. | | | 6,100 | | | | 217,353 | |

| Nihon Kohden Corp. | | | 7,900 | | | | 211,145 | |

| Nintendo Co., Ltd. ADR | | | 45,437 | | | | 517,073 | |

The accompanying notes are an integral part of these financial statements.

28 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Nippon Building Fund, Inc. REIT | | | 22 | | | $ | 86,537 | |

| Nippon Express Holdings, Inc. | | | 3,400 | | | | 191,753 | |

| Nippon Telegraph & Telephone Corp. | | | 255,000 | | | | 302,148 | |

| Nisshinbo Holdings, Inc. | | | 27,000 | | | | 224,311 | |

| Nomura Real Estate Holdings, Inc. | | | 4,200 | | | | 99,908 | |

| Osaka Gas Co., Ltd. | | | 20,900 | | | | 320,607 | |

| Otsuka Holdings Co., Ltd. | | | 9,700 | | | | 355,511 | |

| Rengo Co. Ltd. | | | 12,900 | | | | 79,615 | |

| Sankyo Co. Ltd. | | | 6,100 | | | | 246,876 | |

| Sega Sammy Holdings, Inc. | | | 11,600 | | | | 248,241 | |

| Shimano, Inc. ADR | | | 20,987 | | | | 349,853 | |

| Shin-Etsu Chemical Co. Ltd. | | | 3,900 | | | | 129,623 | |

| Shizuoka Financial Group, Inc. | | | 29,900 | | | | 217,216 | |

| Softbank Corp. | | | 30,100 | | | | 322,009 | |

| Sumco Corp. | | | 6,600 | | | | 93,414 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 1,300 | | | | 55,642 | |

| Tokyo Gas Co. Ltd. | | | 14,600 | | | | 318,975 | |

| Tokyu Fudosan Holdings Corp. | | | 39,000 | | | | 223,225 | |

| Toyota Motor Corp. | | | 6,900 | | | | 110,269 | |

| Yamazaki Baking Co., Ltd. | | | 6,200 | | | | 83,947 | |

| | | | | | | | 11,299,389 | |

| | | | | | | | | |

| Luxembourg | 0.0% | | | | | | | | |

| ArcelorMittal SA | | | 3,560 | | | | 96,990 | |

| | | | | | | | | |

| Netherlands | 1.2% | | | | | | | | |

| ASM International NV | | | 1,104 | | | | 470,326 | |

| ASML Holding NV | | | 79 | | | | 57,186 | |

| Eurocommercial Properties NV REIT | | | 8,079 | | | | 187,558 | |

| ING Groep NV | | | 20,828 | | | | 281,273 | |

| Koninklijke Ahold Delhaize NV | | | 3,119 | | | | 106,389 | |

| Koninklijke KPN NV | | | 23,945 | | | | 85,481 | |

| NN Group NV | | | 2,219 | | | | 82,338 | |

| Shell PLC | | | 18,759 | | | | 558,523 | |

| Wolters Kluwer NV | | | 2,474 | | | | 314,136 | |

| Wolters Kluwer NV ADR | | | 8,240 | | | | 1,047,469 | |

| | | | | | | | 3,190,679 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 29

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| New Zealand | 0.1% | | | | | | | | |

| Spark New Zealand, Ltd. | | | 66,434 | | | $ | 207,653 | |

| | | | | | | | | |

| Norway | 0.0% | | | | | | | | |

| Orkla ASA | | | 13,286 | | | | 95,412 | |

| | | | | | | | | |

| Portugal | 0.0% | | | | | | | | |

| Jeronimo Martins SGPS SA | | | 4,010 | | | | 110,557 | |

| | | | | | | | | |

| Singapore | 0.4% | | | | | | | | |

| Jardine Cycle & Carriage, Ltd. | | | 8,100 | | | | 209,066 | |

| Sembcorp Industries Ltd. | | | 92,800 | | | | 394,971 | |

| STMicroelectronics NV | | | 6,110 | | | | 303,963 | |

| | | | | | | | 908,000 | |

| | | | | | | | | |

| Spain | 0.6% | | | | | | | | |

| Banco Bilbao Vizcaya Argentaria SA | | | 30,141 | | | | 232,409 | |

| Banco Santander SA | | | 20,292 | | | | 75,293 | |

| Iberdrola SA | | | 43,504 | | | | 568,244 | |

| Industria de Diseno Textil SA | | | 2,474 | | | | 96,120 | |

| Industria de Diseno Textil SA ADR | | | 27,197 | | | | 528,438 | |

| | | | | | | | 1,500,504 | |

| | | | | | | | | |

| Sweden | 0.8% | | | | | | | | |

| Assa Abloy AB ADR | | | 31,735 | | | | 382,089 | |

| Epiroc AB ADR | | | 44,631 | | | | 844,419 | |

| Hexagon AB ADR | | | 57,469 | | | | 704,570 | |

| | | | | | | | 1,931,078 | |

| | | | | | | | | |

| Switzerland | 0.7% | | | | | | | | |

| ABB, Ltd. ADR | | | 21,437 | | | | 841,402 | |

| Swatch Group AG ADR | | | 44,273 | | | | 646,386 | |

| Swisscom AG | | | 594 | | | | 370,571 | |

| | | | | | | | 1,858,359 | |

The accompanying notes are an integral part of these financial statements.

30 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| United Kingdom | 1.9% | | | | | | | | |

| BAE Systems PLC | | | 8,767 | | | $ | 103,441 | |

| Barclays PLC | | | 55,339 | | | | 108,096 | |

| Coca-Cola Europacific Partners PLC | | | 10,210 | | | | 657,830 | |

| Diageo PLC ADR | | | 4,956 | | | | 859,767 | |

| Harbour Energy PLC | | | 29,927 | | | | 87,001 | |

| HSBC Holdings PLC | | | 22,095 | | | | 174,758 | |

| Investec PLC | | | 25,030 | | | | 140,678 | |

| Man Group PLC | | | 33,145 | | | | 91,942 | |

| RELX PLC ADR | | | 31,705 | | | | 1,059,898 | |

| Serco Group PLC | | | 49,138 | | | | 97,165 | |

| Standard Chartered PLC | | | 16,951 | | | | 147,832 | |

| Unilever PLC | | | 7,235 | | | | 377,251 | |

| Unilever PLC ADR | | | 17,435 | | | | 908,887 | |

| | | | | | | | 4,814,546 | |

| | | | | | | | | |

| United States | 40.1% | | | | | | | | |

| Abbott Laboratories | | | 5,533 | | | | 603,208 | |

| Accenture PLC, Class A | | | 5,378 | | | | 1,659,543 | |

| Activision Blizzard, Inc. (*) | | | 2,682 | | | | 226,093 | |

| Adobe, Inc. (*) | | | 2,468 | | | | 1,206,827 | |

| Affiliated Managers Group, Inc. | | | 1,363 | | | | 204,300 | |

| Agilent Technologies, Inc. | | | 733 | | | | 88,143 | |

| Agree Realty Corp. REIT | | | 1,656 | | | | 108,286 | |

| Alaska Air Group, Inc. (*) | | | 1,952 | | | | 103,807 | |

| Align Technology, Inc. (*) | | | 174 | | | | 61,533 | |

| Allison Transmission Holdings, Inc. | | | 2,896 | | | | 163,508 | |

| Alphabet, Inc., Class A (*) | | | 14,061 | | | | 1,683,102 | |

| Alphabet, Inc., Class C (*) | | | 11,789 | | | | 1,426,115 | |

| Altria Group, Inc. | | | 4,743 | | | | 214,858 | |

| Amazon.com, Inc. (*) | | | 13,693 | | | | 1,785,019 | |

| Amdocs, Ltd. | | | 5,749 | | | | 568,289 | |

| Ameren Corp. | | | 1,174 | | | | 95,881 | |

| American International Group, Inc. | | | 5,466 | | | | 314,514 | |

| AmerisourceBergen Corp. | | | 1,721 | | | | 331,172 | |

| AMETEK, Inc. | | | 1,405 | | | | 227,441 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 31

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| AMN Healthcare Services, Inc. (*) | | | 1,147 | | | $ | 125,161 | |

| Amphenol Corp., Class A | | | 10,390 | | | | 882,631 | |

| Aon PLC, Class A | | | 4,312 | | | | 1,488,502 | |

| Apple, Inc. | | | 26,776 | | | | 5,193,741 | |

| AptarGroup, Inc. | | | 1,733 | | | | 200,785 | |

| Assurant, Inc. | | | 707 | | | | 88,884 | |

| Autodesk, Inc. (*) | | | 494 | | | | 101,077 | |

| Automatic Data Processing, Inc. | | | 572 | | | | 125,720 | |

| Avery Dennison Corp. | | | 2,240 | | | | 384,832 | |

| Bank of America Corp. | | | 18,090 | | | | 519,002 | |

| Becton, Dickinson & Co. | | | 365 | | | | 96,364 | |

| Biogen, Inc. (*) | | | 287 | | | | 81,752 | |

| BJ’s Wholesale Club Holdings, Inc. (*) | | | 1,227 | | | | 77,313 | |

| BlueLinx Holdings, Inc. (*) | | | 1,555 | | | | 145,828 | |

| Booking Holdings, Inc. (*) | | | 145 | | | | 391,548 | |

| Booz Allen Hamilton Holding Corp. | | | 8,927 | | | | 996,253 | |

| BorgWarner, Inc. | | | 2,064 | | | | 100,950 | |

| Brighthouse Financial, Inc. (*) | | | 1,737 | | | | 82,247 | |

| Bristol-Myers Squibb Co. | | | 11,336 | | | | 724,937 | |

| Broadcom, Inc. | | | 1,314 | | | | 1,139,803 | |

| BRP, Inc. | | | 6,030 | | | | 510,138 | |

| Cadence Design Systems, Inc. (*) | | | 751 | | | | 176,125 | |

| Cal-Maine Foods, Inc. | | | 5,258 | | | | 236,610 | |

| California Resources Corp. | | | 2,081 | | | | 94,248 | |

| Campbell Soup Co. | | | 3,285 | | | | 150,157 | |

| Cardinal Health, Inc. | | | 7,559 | | | | 714,855 | |

| Caterpillar, Inc. | | | 1,407 | | | | 346,192 | |

| Cboe Global Markets, Inc. | | | 443 | | | | 61,138 | |

| CDW Corp. | | | 885 | | | | 162,398 | |

| Charles Schwab Corp. | | | 9,703 | | | | 549,966 | |

| Charter Communications, Inc., Class A (*) | | | 444 | | | | 163,112 | |

| Cheniere Energy, Inc. | | | 551 | | | | 83,950 | |

| Chesapeake Energy Corp. | | | 1,124 | | | | 94,056 | |

| Chevron Corp. | | | 1,055 | | | | 166,004 | |

| Chipotle Mexican Grill, Inc. (*) | | | 201 | | | | 429,939 | |

| Chubb, Ltd. | | | 655 | | | | 126,127 | |

| Cigna Group | | | 481 | | | | 134,969 | |

| Cirrus Logic, Inc. (*) | | | 1,172 | | | | 94,944 | |

The accompanying notes are an integral part of these financial statements.

32 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Cisco Systems, Inc. | | | 12,351 | | | $ | 639,041 | |

| Citigroup, Inc. | | | 3,867 | | | | 178,037 | |

| Clearway Energy, Inc., Class C | | | 5,737 | | | | 163,849 | |

| CME Group, Inc. | | | 577 | | | | 106,912 | |

| Coca-Cola Co. | | | 18,240 | | | | 1,098,413 | |

| Cognizant Technology Solutions Corp., Class A | | | 3,555 | | | | 232,070 | |

| Colgate-Palmolive Co. | | | 6,936 | | | | 534,349 | |

| Commercial Metals Co. | | | 1,147 | | | | 60,401 | |

| CommVault Systems, Inc. (*) | | | 1,236 | | | | 89,758 | |

| Concentrix Corp. | | | 802 | | | | 64,762 | |

| Consolidated Edison, Inc. | | | 5,278 | | | | 477,131 | |

| Corebridge Financial, Inc. | | | 10,354 | | | | 182,852 | |

| Coterra Energy, Inc. | | | 4,908 | | | | 124,172 | |

| Crowdstrike Holdings, Inc., Class A (*) | | | 602 | | | | 88,416 | |

| CTS Corp. | | | 1,892 | | | | 80,656 | |

| CVS Health Corp. | | | 7,700 | | | | 532,301 | |

| D.R. Horton, Inc. | | | 852 | | | | 103,680 | |

| Danaher Corp. | | | 4,582 | | | | 1,099,680 | |

| Darden Restaurants, Inc. | | | 1,278 | | | | 213,528 | |

| Dave & Buster’s Entertainment, Inc. (*) | | | 2,578 | | | | 114,876 | |

| DaVita, Inc. (*) | | | 934 | | | | 93,839 | |

| Deckers Outdoor Corp. (*) | | | 219 | | | | 115,558 | |

| Deere & Co. | | | 1,582 | | | | 641,011 | |

| Edwards Lifesciences Corp. (*) | | | 8,191 | | | | 772,657 | |

| Electronic Arts, Inc. | | | 3,170 | | | | 411,149 | |

| Elevance Health, Inc. | | | 168 | | | | 74,641 | |

| Eli Lilly & Co. | | | 3,248 | | | | 1,523,247 | |

| EOG Resources, Inc. | | | 931 | | | | 106,544 | |

| Equinix, Inc. REIT | | | 1,077 | | | | 844,303 | |

| Equitable Holdings, Inc. | | | 3,433 | | | | 93,240 | |

| Estee Lauder Cos., Inc., Class A | | | 5,309 | | | | 1,042,581 | |

| Everest Re Group, Ltd. | | | 1,345 | | | | 459,802 | |

| Expedia Group, Inc. (*) | | | 560 | | | | 61,258 | |

| Exxon Mobil Corp. | | | 529 | | | | 56,735 | |

| Fair Isaac Corp. (*) | | | 146 | | | | 118,145 | |

| FedEx Corp. | | | 463 | | | | 114,778 | |

| First Citizens BancShares, Inc., Class A | | | 83 | | | | 106,526 | |

| Fiserv, Inc. (*) | | | 5,008 | | | | 631,759 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 33

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Fortinet, Inc. (*) | | | 6,420 | | | $ | 485,288 | |

| Freeport-McMoRan, Inc. | | | 2,170 | | | | 86,800 | |

| General Electric Co. | | | 1,890 | | | | 207,617 | |

| General Mills, Inc. | | | 6,092 | | | | 467,256 | |

| Gilead Sciences, Inc. | | | 8,052 | | | | 620,568 | |

| Global Payments, Inc. | | | 3,038 | | | | 299,304 | |

| GoDaddy, Inc., Class A (*) | | | 1,684 | | | | 126,519 | |

| Graco, Inc. | | | 6,720 | | | | 580,272 | |

| Grand Canyon Education, Inc. (*) | | | 696 | | | | 71,834 | |

| Graphic Packaging Holding Co. | | | 3,741 | | | | 89,896 | |

| GSK PLC | | | 5,167 | | | | 91,273 | |

| H&R Block, Inc. | | | 2,319 | | | | 73,907 | |

| Hartford Financial Services Group, Inc. | | | 1,514 | | | | 109,038 | |

| HCA Healthcare, Inc. | | | 2,938 | | | | 891,624 | |

| Hershey Co. | | | 2,270 | | | | 566,819 | |

| Hess Corp. | | | 637 | | | | 86,600 | |

| Hess Midstream LP, Class A | | | 2,759 | | | | 84,646 | |

| Hilton Grand Vacations, Inc. (*) | | | 2,267 | | | | 103,012 | |

| Hologic, Inc. (*) | | | 1,126 | | | | 91,172 | |

| Hostess Brands, Inc. (*) | | | 3,416 | | | | 86,493 | |

| Huntington Ingalls Industries, Inc. | | | 422 | | | | 96,047 | |

| Ingles Markets, Inc., Class A | | | 932 | | | | 77,030 | |

| Intercontinental Exchange, Inc. | | | 10,110 | | | | 1,143,239 | |

| International Seaways, Inc. | | | 2,402 | | | | 91,852 | |

| Intuitive Surgical, Inc. (*) | | | 2,026 | | | | 692,770 | |

| IQVIA Holdings, Inc. (*) | | | 4,270 | | | | 959,768 | |

| J.M. Smucker Co. | | | 1,008 | | | | 148,851 | |

| Johnson & Johnson | | | 11,783 | | | | 1,950,322 | |

| Kellogg Co. | | | 4,249 | | | | 286,383 | |

| Keysight Technologies, Inc. (*) | | | 490 | | | | 82,051 | |

| Kimberly-Clark Corp. | | | 12,840 | | | | 1,772,690 | |

| Kroger Co. | | | 6,508 | | | | 305,876 | |

| Lamb Weston Holdings, Inc. | | | 1,786 | | | | 205,301 | |

| Lattice Semiconductor Corp. (*) | | | 3,261 | | | | 313,284 | |

| Lennar Corp., Class A | | | 883 | | | | 110,649 | |

| Lockheed Martin Corp. | | | 538 | | | | 247,684 | |

| Lululemon Athletica, Inc. (*) | | | 293 | | | | 110,901 | |

| Martin Marietta Materials, Inc. | | | 488 | | | | 225,305 | |

The accompanying notes are an integral part of these financial statements.

34 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| MasterCard, Inc., Class A | | | 2,665 | | | $ | 1,048,145 | |

| Matador Resources Co. | | | 2,376 | | | | 124,312 | |

| McDonald’s Corp. | | | 4,303 | | | | 1,284,058 | |

| McGrath RentCorp | | | 875 | | | | 80,920 | |

| McKesson Corp. | | | 817 | | | | 349,112 | |

| Medpace Holdings, Inc. (*) | | | 410 | | | | 98,470 | |

| Merck & Co., Inc. | | | 17,350 | | | | 2,002,016 | |

| Meta Platforms, Inc., Class A (*) | | | 6,837 | | | | 1,962,082 | |

| Microchip Technology, Inc. | | | 6,069 | | | | 543,722 | |

| Microsoft Corp. | | | 13,596 | | | | 4,629,982 | |

| Molina Healthcare, Inc. (*) | | | 408 | | | | 122,906 | |

| Moody’s Corp. | | | 343 | | | | 119,268 | |

| Motorola Solutions, Inc. | | | 1,733 | | | | 508,254 | |

| Nasdaq, Inc. | | | 2,108 | | | | 105,084 | |

| NetApp, Inc. | | | 2,767 | | | | 211,399 | |

| Netflix, Inc. (*) | | | 1,952 | | | | 859,836 | |

| NewMarket Corp. | | | 339 | | | | 136,319 | |

| NexTier Oilfield Solutions, Inc. (*) | | | 14,243 | | | | 127,332 | |

| NIKE, Inc., Class B | | | 5,732 | | | | 632,641 | |

| NiSource, Inc. | | | 3,184 | | | | 87,082 | |

| Northrop Grumman Corp. | | | 217 | | | | 98,909 | |

| Nucor Corp. | | | 370 | | | | 60,673 | |

| NVIDIA Corp. | | | 4,844 | | | | 2,049,109 | |

| NVR, Inc. (*) | | | 17 | | | | 107,961 | |

| O’Reilly Automotive, Inc. (*) | | | 1,162 | | | | 1,110,059 | |

| O-I Glass, Inc. (*) | | | 5,541 | | | | 118,190 | |

| Omnicom Group, Inc. | | | 1,367 | | | | 130,070 | |

| ON Semiconductor Corp. (*) | | | 2,823 | | | | 266,999 | |

| Oracle Corp. | | | 5,449 | | | | 648,921 | |

| Owens Corning | | | 1,631 | | | | 212,846 | |

| PACCAR, Inc. | | | 1,426 | | | | 119,285 | |

| Palo Alto Networks, Inc. (*) | | | 443 | | | | 113,191 | |

| Paychex, Inc. | | | 498 | | | | 55,711 | |

| PepsiCo, Inc. | | | 6,375 | | | | 1,180,778 | |

| Pfizer, Inc. | | | 18,333 | | | | 672,454 | |

| Piedmont Lithium, Inc. (*) | | | 1,672 | | | | 96,491 | |

| Piedmont Office Realty Trust, Inc. REIT Class A | | | 8,122 | | | | 59,047 | |

| Pinnacle West Capital Corp. | | | 927 | | | | 75,513 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report 35

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Pioneer Natural Resources Co. | | | 373 | | | $ | 77,278 | |

| PNM Resources, Inc. | | | 2,953 | | | | 133,180 | |

| Premier, Inc., Class A | | | 2,543 | | | | 70,339 | |

| Procter & Gamble Co. | | | 10,908 | | | | 1,655,180 | |

| PTC, Inc. (*) | | | 4,539 | | | | 645,900 | |

| Public Storage REIT | | | 1,197 | | | | 349,380 | |

| PulteGroup, Inc. | | | 3,022 | | | | 234,749 | |

| Qualys, Inc. (*) | | | 743 | | | | 95,973 | |

| Regency Centers Corp. REIT | | | 1,360 | | | | 84,007 | |

| Regeneron Pharmaceuticals, Inc. (*) | | | 258 | | | | 185,383 | |

| Republic Services, Inc. | | | 1,399 | | | | 214,285 | |

| Roche Holding AG | | | 1,674 | | | | 511,567 | |

| Rockwell Automation, Inc. | | | 2,240 | | | | 737,968 | |

| Ryman Hospitality Properties, Inc. REIT | | | 1,356 | | | | 126,000 | |

| S&P Global, Inc. | | | 2,508 | | | | 1,005,432 | |

| Salesforce, Inc (*) | | | 503 | | | | 106,264 | |

| SandRidge Energy, Inc. | | | 5,676 | | | | 86,559 | |

| SBA Communications Corp. REIT | | | 860 | | | | 199,314 | |

| Schlumberger NV | | | 1,898 | | | | 93,230 | |

| ServiceNow, Inc. (*) | | | 922 | | | | 518,136 | |

| Sherwin-Williams Co. | | | 903 | | | | 239,765 | |

| Simon Property Group, Inc. REIT | | | 2,601 | | | | 300,363 | |

| SLM Corp. | | | 6,781 | | | | 110,666 | |

| Southwestern Energy Co. (*) | | | 11,520 | | | | 69,235 | |

| Starbucks Corp. | | | 4,505 | | | | 446,265 | |

| State Street Corp. | | | 2,143 | | | | 156,825 | |

| Steel Dynamics, Inc. | | | 525 | | | | 57,188 | |

| Stellantis NV | | | 17,467 | | | | 307,467 | |

| Stride, Inc. (*) | | | 2,059 | | | | 76,657 | |

| Stryker Corp. | | | 2,297 | | | | 700,792 | |

| Synchrony Financial | | | 2,244 | | | | 76,116 | |

| Synopsys, Inc. (*) | | | 1,502 | | | | 653,986 | |

| Sysco Corp. | | | 5,253 | | | | 389,773 | |

| Talos Energy, Inc. (*) | | | 7,371 | | | | 102,236 | |

| Target Corp. | | | 1,174 | | | | 154,851 | |

| Tecnoglass, Inc. | | | 2,601 | | | | 134,368 | |

| Tesla, Inc. (*) | | | 4,806 | | | | 1,258,067 | |

| Texas Instruments, Inc. | | | 4,716 | | | | 848,974 | |

| Texas Pacific Land Corp. | | | 47 | | | | 61,876 | |

| Texas Roadhouse, Inc. | | | 706 | | | | 79,270 | |

The accompanying notes are an integral part of these financial statements.

36 Semi-Annual Report

| | | | | |

| | | | | Fair |

| Description | | Shares | | Value |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi-Asset Portfolio (continued) | | | | | | | | |

| | | | | | | | | |

| Thermo Fisher Scientific, Inc. | | | 2,118 | | | $ | 1,105,067 | |

| TJX Cos., Inc. | | | 5,444 | | | | 461,597 | |

| Toll Brothers, Inc. | | | 1,435 | | | | 113,465 | |

| TopBuild Corp. (*) | | | 1,522 | | | | 404,882 | |

| Toro Co. | | | 941 | | | | 95,653 | |

| Tractor Supply Co. | | | 246 | | | | 54,391 | |

| Trane Technologies PLC | | | 522 | | | | 99,838 | |

| Travelers Cos., Inc. | | | 629 | | | | 109,232 | |

| U-Haul Holding Co | | | 1,287 | | | | 71,197 | |

| Ulta Beauty, Inc. (*) | | | 126 | | | | 59,295 | |

| UMH Properties, Inc. REIT | | | 5,005 | | | | 79,980 | |