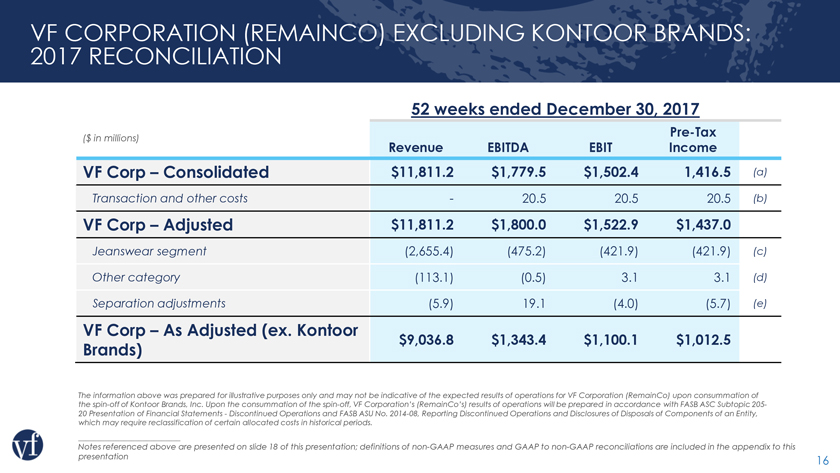

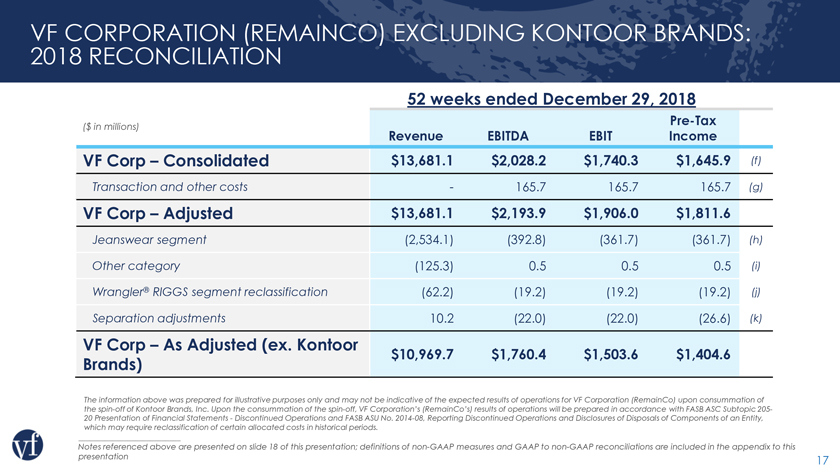

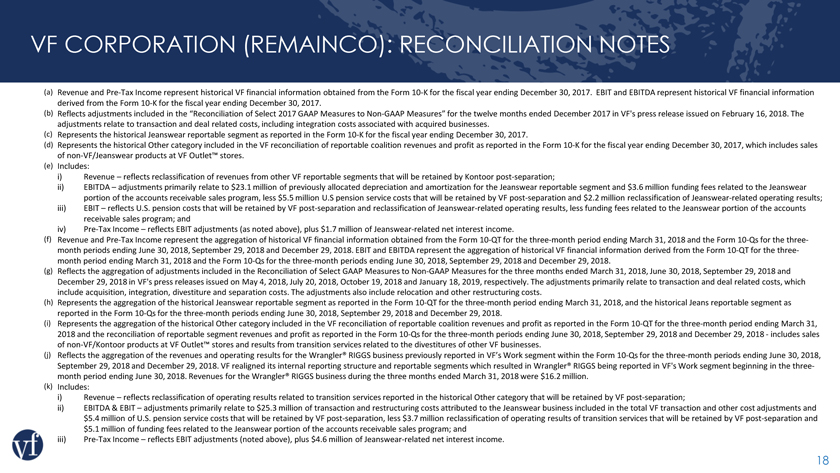

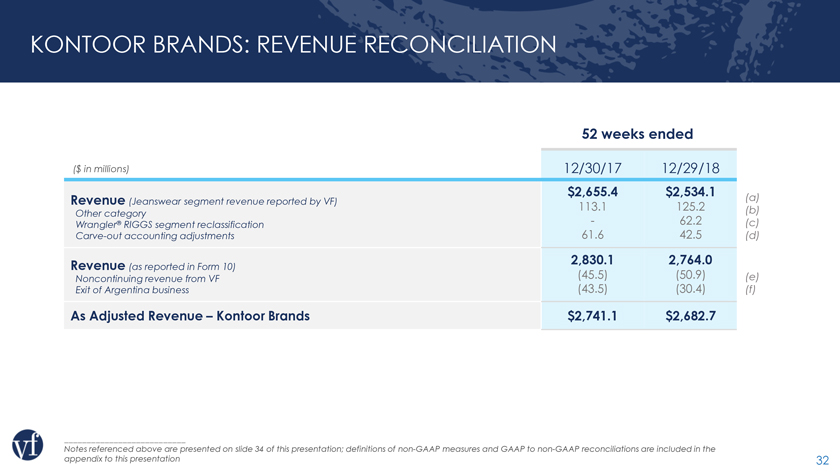

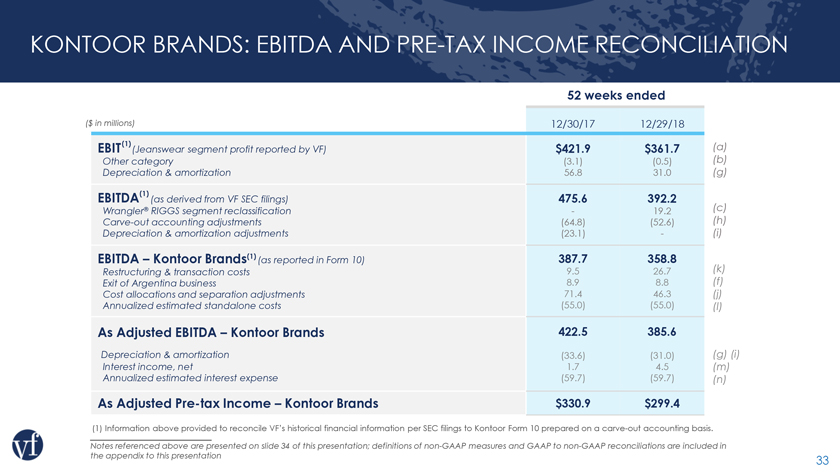

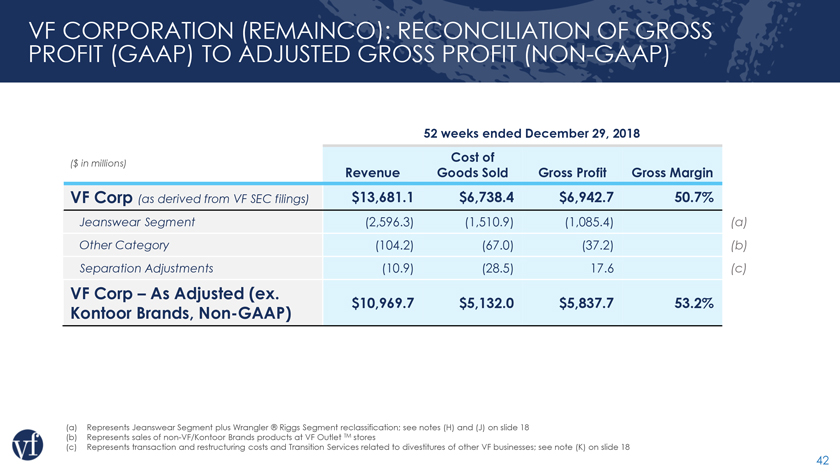

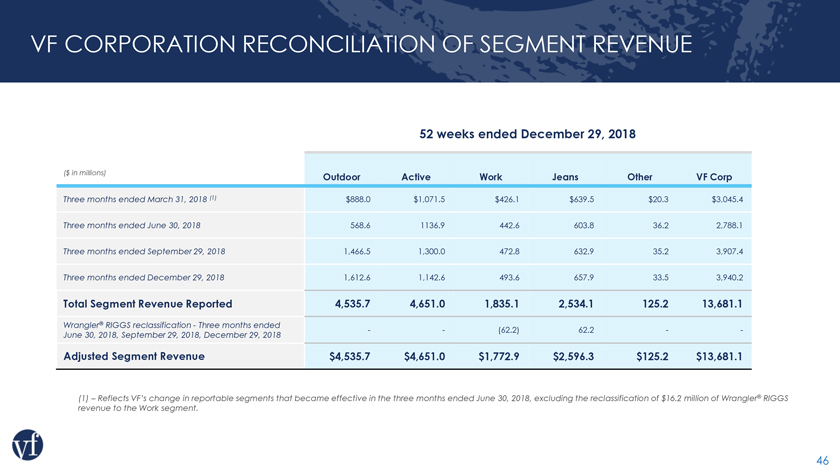

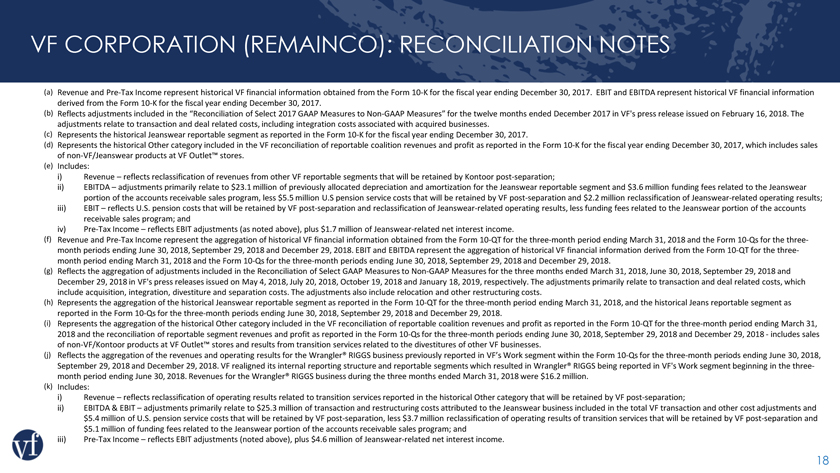

VF CORPORATION (REMAINCO): RECONCILIATION NOTES (a) Revenue andPre-Tax Income represent historical VF financial information obtained from the Form10-K for the fiscal year ending December 30, 2017. EBIT and EBITDA represent historical VF financial information derived from the Form10-K for the fiscal year ending December 30, 2017. (b) Reflects adjustments included in the “Reconciliation of Select 2017 GAAP Measures toNon-GAAP Measures” for the twelve months ended December 2017 in VF’s press release issued on February 16, 2018. The adjustments relate to transaction and deal related costs, including integration costs associated with acquired businesses. (c) Represents the historical Jeanswear reportable segment as reported in the Form10-K for the fiscal year ending December 30, 2017. (d) Represents the historical Other category included in the VF reconciliation of reportable coalition revenues and profit as reported in the Form10-K for the fiscal year ending December 30, 2017, which includes sales ofnon-VF/Jeanswear products at VF Outlet™ stores. (e) Includes: i) Revenue – reflects reclassification of revenues from other VF reportable segments that will be retained by Kontoor post-separation; ii) EBITDA – adjustments primarily relate to $23.1 million of previously allocated depreciation and amortization for the Jeanswear reportable segment and $3.6 million funding fees related to the Jeanswear portion of the accounts receivable sales program, less $5.5 million U.S pension service costs that will be retained by VF post-separation and $2.2 million reclassification of Jeanswear-related operating results; iii) EBIT – reflects U.S. pension costs that will be retained by VF post-separation and reclassification of Jeanswear-related operating results, less funding fees related to the Jeanswear portion of the accounts receivable sales program; and iv)Pre-Tax Income – reflects EBIT adjustments (as noted above), plus $1.7 million of Jeanswear-related net interest income. (f) Revenue andPre-Tax Income represent the aggregation of historical VF financial information obtained from the Form10-QT for the three-month period ending March 31, 2018 and the Form10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. EBIT and EBITDA represent the aggregation of historical VF financial information derived from the Form10-QT for the three-month period ending March 31, 2018 and the Form10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. (g) Reflects the aggregation of adjustments included in the Reconciliation of Select GAAP Measures toNon-GAAP Measures for the three months ended March 31, 2018, June 30, 2018, September 29, 2018 and December 29, 2018 in VF’s press releases issued on May 4, 2018, July 20, 2018, October 19, 2018 and January 18, 2019, respectively. The adjustments primarily relate to transaction and deal related costs, which include acquisition, integration, divestiture and separation costs. The adjustments also include relocation and other restructuring costs. (h) Represents the aggregation of the historical Jeanswear reportable segment as reported in the Form10-QT for the three-month period ending March 31, 2018, and the historical Jeans reportable segment as reported in the Form10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. (i) Represents the aggregation of the historical Other category included in the VF reconciliation of reportable coalition revenues and profit as reported in the Form10-QT for the three-month period ending March 31, 2018 and the reconciliation of reportable segment revenues and profit as reported in the Form10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018—includes sales ofnon-VF/Kontoor products at VF Outlet™ stores and results from transition services related to the divestitures of other VF businesses. (j) Reflects the aggregation of the revenues and operating results for the Wrangler® RIGGS business previously reported in VF’s Work segment within the Form10-Qs for the three-month periods ending June 30, 2018, September 29, 2018 and December 29, 2018. VF realigned its internal reporting structure and reportable segments which resulted in Wrangler® RIGGS being reported in VF’s Work segment beginning in the three-month period ending June 30, 2018. Revenues for the Wrangler® RIGGS business during the three months ended March 31, 2018 were $16.2 million. (k) Includes: i) Revenue – reflects reclassification of operating results related to transition services reported in the historical Other category that will be retained by VF post-separation; ii) EBITDA & EBIT – adjustments primarily relate to $25.3 million of transaction and restructuring costs attributed to the Jeanswear business included in the total VF transaction and other cost adjustments and $5.4 million of U.S. pension service costs that will be retained by VF post-separation, less $3.7 million reclassification of operating results of transition services that will be retained by VF post-separation and $5.1 million of funding fees related to the Jeanswear portion of the accounts receivable sales program; and iii)Pre-Tax Income – reflects EBIT adjustments (noted above), plus $4.6 million of Jeanswear-related net interest income. 18