SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number

Tevecap S.A.

(Exact name of Registrant as specified in its charter)

TEVECAP INC. | THE FEDERATIVE REPUBLIC OF BRAZIL |

(Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Av. das Nações Unidas, 7221 - 7º andar

São Paulo, SP Brazil

05425-902

(Telephone: 55-11-3037-5127)

(Address and telephone number of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

12-5/8% Senior Notes due 2009 of Tevecap S.A. and guarantees thereof by each of TVA Sistema de Televisão S.A., TVA Communications Ltd., Comercial Cabo TV São Paulo S.A., TVA Sul Paraná S.A. and CCS Camboriú Cable System de Telecomunicações Ltda.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

485,220,440 Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES o NO x

If this report is an annual or transitional report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

LARGE ACCELERATED FILER o |

| ACCELERATED FILER o |

| NON-ACCELERATED FILER x |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO x

Indicate by check mark which financial statements item the registrant has elected to follow:

ITEM 17 o ITEM 18 x

TABLE OF CONTENTS

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

| |

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

i

EXPLANATORY NOTE

Presentation of Certain Information

This Annual Report on Form 20-F for the year ended December 31, 2006 is referred to herein as the Annual Report.

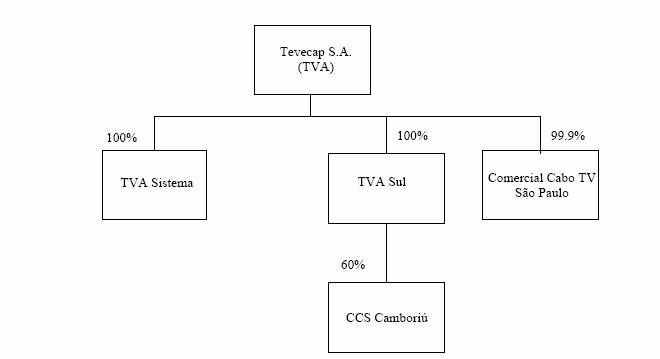

Tevecap S.A., which we refer to as Tevecap and, together with our subsidiaries, TVA or the Company, is a corporation (sociedade anônima) organized under the laws of the Federative Republic of Brazil. Unless the context otherwise requires, “we,” “our,” or “us” refers to TVA. Our accounts, which are maintained in Brazilian reais, were prepared in accordance with the accounting principles generally accepted in the United States of America, or U.S. GAAP, and translated into U.S. dollars on the basis set forth in Note 2.3 of our consolidated financial statements, or the Tevecap Financial Statements and, together with the financial statements of CCS Camboriú Cable System de Telecomunicações Ltda. included in this Annual Report, the Financial Statements. Certain amounts stated herein in U.S. dollars (other than as set forth in the Financial Statements and financial information derived therefrom) have been translated, for the convenience of the reader, from reais at the rate in effect on December 31, 2006 of R$2.1380 = U.S.$1.00. Such translations should not be construed as a representation that reais could have been converted at such rate on such date or at any other date. See Item 3, “Key Information—Selected Financial Data—Exchange Rates.”

Capitalized terms used in this Annual Report are defined, unless the context otherwise requires, in the Glossary attached hereto. All references in this Annual Report to (i) ”U.S. Dollars,” “dollars,” or “U.S.$” are to United States dollars and (ii) “reais,” “real” or “R$” are to Brazilian reais.

Unless otherwise specified, data regarding population or homes in a licensed area are projections based on 2000 population census figures compiled by the Instituto Brasileiro de Geografia e Estatística, or IBGE and our knowledge of our markets. There can be no assurance that the number of people or the number of households in a specified area has not increased or decreased by a higher or lower rate than those estimated by the IBGE since the 2000 census. Unless otherwise indicated, references to the number of our subscribers are based on our data as of December 31, 2006. Data concerning total MMDS and cable subscribers and penetration rates represent estimates made by us based on the data of Pay TV Survey, Associação Brasileira de Telecomunicações por Assinatura (ABTA), Kagan World Media, Inc., IBGE data, our knowledge of our pay television systems and public statements of other Brazilian pay television providers. Although we believe such estimates are reasonable, no assurance can be made as to their accuracy.

Forward-Looking Statements

This Annual Report contains statements which are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this Annual Report and include statements regarding the intent, belief or current expectations of the Company or our officers. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those in the forward-looking statements as a result of various factors. Neither our independent auditors, nor any other independent accountants, have compiled, examined, or performed any procedures, with respect to the prospective financial information contained herein, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the prospective financial information.

ii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS.

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

Not applicable.

A. Selected Financial Data

The selected financial data presented herein as of December 31, 2006 and 2005 and for each of the three years in the period ended December 31, 2006 have been derived from, and should be read in conjunction with, the Tevecap Financial Statements included in this Annual Report. The selected financial data as of December 31, 2004, 2003 and 2002 and for each of the two years in the period ended December 31, 2003 have been derived from our audited financial statements that are not included elsewhere in this Annual Report.

On October 29, 2006, we, TVA Sistema, Comercial Cabo TV São Paulo S.A., TVA Sul Paraná S.A., Abril Comunicações (our shareholder) and certain entities affiliated with Abril Comunicações entered into certain convergence and sale agreements with Telecomunicações de São Paulo S.A.-Telesp (an affiliate of Telefonica, the Spanish telecommunications concern), including an interim operating agreement for the period up to the approval of the transaction. Under these agreements, we expect to transfer all of our MMDS licenses and operations to a company to be owned by Telesp and to transfer our Cable operations and licenses (other than those related to CCS Camboriú Cable System de Telecomunicações Ltda., a Cable operator in the city of Camboriú, in which we hold a 60% equity interest) to certain entities to be owned by a joint venture company formed between Telesp and certain affiliates of Abril Comunicações. The transaction was structured such that upon consummation Telesp will become the owner of a minority stake in the Cable entities, within the limits set forth in applicable regulations and in Telesp’s concession agreement for telephony services, while certain affiliates of Abril Comunicações will continue to have a majority stake in the Cable entities. We may also transfer CCS Camboriú under the agreements described above if we are able to reach an agreement with our minority shareholder in CCS Camboriú regarding such transfer. The disposition of assets under these agreements is not expected to result in a loss to us.

The closing of the transaction described above is subject to regulatory approvals and certain other conditions precedent, including: (i) prior approval of ANATEL (the Brazilian National Telecommunications Agency) and (ii) the implementation of a corporate reorganization in order to transfer all target assets free and clear of encumbrances. In addition, the transaction is also subject to the analysis of CADE (the Brazilian Administrative Council for Economic Defense), Brazil’s federal antitrust authority. Our agreements with Telesp provide that Telesp and Tevecap will begin to jointly market their telephony, pay television and/or broadband internet and pay television services during the approval process period.

In addition, under our agreements with Telesp, we and our parent company, Abril Comunicações S.A., have assumed responsibility for potential contingencies that may arise after the sale of the operations described above relating to periods prior to the consummation of the sale.

On December 28, 2006, Telesp made an advance payment to us in the amount of U.S.$93.5 million (R$200.0 million). In addition, Telesp has granted us a line of credit of up to U.S.$52.6 million (R$112.5 million) for capital expenditure purposes, of which we have already borrowed U.S.$38.4 million (R$82.0 million) as of June 30, 2007. In the event the transaction does not close, we are obligated to return by April 30, 2008 the advance payment and any amounts borrowed under the line of credit together with, in each case, interest accrued thereon at the rate of 103% of the CDI rate (the interbank certificate of deposit rate in Brazil) from the date of the determination that the transaction will not close. Our obligation to repay these amounts was guaranteed by a pledge of our Cable networks. In addition, our operating agreements with Telesp will terminate on July 31, 2007 in the event the transaction does not close.

1

The Senior Notes are not being transferred under the above agreements and will remain obligations of ours together with the following liabilities: (i) U.S.$119.1 million in obligations with respect to transactions with related companies (see note 6 to the Tevecap Financial Statements), (ii) U.S.$31.2 million in provisions for fiscal contingencies (see note 17 to the Tevecap Financial Statements) and (iii) US$59.5 million in deferred tax liabilities (see note 7.2 to the Tevecap Financial Statements).

Our direct and indirect subsidiaries TVA Sistema de Televisão S.A., TVA Communications Ltd., Comercial Cabo TV São Paulo Ltda., TVA Sul Paraná Ltda. and CCS Camboriú Cable System de Telecomunicações Ltda. are Guarantors of our Senior Notes. We expect that as a result of our transaction with Telesp, substantially all of the assets of TVA Sistema de Televisão S,A., Comercial Cabo TV São Paulo S.A. and TVA Sul Paraná S.A. (other than TVA Sul Paraná’s equity interests in CCS Camboriú Cable System de Telecomunicações Ltda.), will be transferred to the purchasers under the above agreements, although Comercial Cabo TV São Paulo S.A. and TVA Sul Paraná S.A. will not continue to be Guarantors under the Senior Notes. Our management is analyzing the effects of the transaction as a whole on the Senior Notes and firmly expects that, following the consummation of the transaction, we will continue to honor our payment obligations under the Senior Notes.

As a result of this anticipated disposition and the materiality of the operations being transferred, we have classified the operations being transferred as “Discontinued Operations,” the selected financial data of which is discussed separately under “Selected Financial and Other Data – Discontinued Operations” below. For more information on this transaction, see Item 4, “Information on the Company” and note 20 to the Tevecap Financial Statements included in this Annual Report.

As required by Brazilian law, and in accordance with local accounting practices, our financial records are maintained in the applicable Brazilian currency, or the real. However, the Financial Statements are presented in U.S. dollars in accordance with U.S. GAAP. In order to prepare the Financial Statements, our accounts have been translated from Brazilian reais, on the basis described in Note 2.3 to the Tevecap Financial Statements included in this Annual Report. Because of the differences between the evolution of the rates of inflation in Brazil and the changes in the rates of devaluation, amounts presented in U.S. dollars may show distortions when compared on a period-to-period basis.

2

SELECTED FINANCIAL AND OTHER DATA – CONTINUED OPERATIONS

|

| Year Ended December 31, |

| |||||||||||||

|

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (in thousands of US$ unless otherwise stated) |

| |||||||||||||

Consolidated Statement of Operation: |

|

|

|

|

|

|

|

|

|

|

| |||||

Gross revenues |

|

|

|

|

|

|

|

|

|

|

| |||||

Monthly subscriptions |

| $ | 4,518 |

| $ | 3,556 |

| $ | 2,447 |

| $ | 3,241 |

| $ | 4,139 |

|

Installation |

| 51 |

| 32 |

| 26 |

| 50 |

| 81 |

| |||||

Advertising |

| 107 |

| 110 |

| 16 |

| 609 |

| 158 |

| |||||

Additional services (a) |

| 102 |

| 69 |

| 45 |

| 291 |

| 637 |

| |||||

Taxes on revenue (b) |

| (706 | ) | (519 | ) | (367 | ) | (482 | ) | (550 | ) | |||||

Net revenue |

| 4,072 |

| 3,248 |

| 2,167 |

| 3,709 |

| 4,465 |

| |||||

Direct operating expenses (c) |

| 1,422 |

| 1,329 |

| 1,090 |

| 1,861 |

| 3,387 |

| |||||

Selling, general and administrative expenses |

| 1,656 |

| 948 |

| 766 |

| 1,774 |

| 752 |

| |||||

Depreciation |

| 579 |

| 161 |

| 195 |

| 1,012 |

| 1,138 |

| |||||

Amortization |

| 238 |

| 430 |

| 428 |

| 410 |

| 400 |

| |||||

Other operating expense, net |

| 4,609 |

| 341 |

| 216 |

| — |

| — |

| |||||

Income (loss) from operations |

| (4,432 | ) | 39 |

| (528 | ) | (1,348 | ) | (1,212 | ) | |||||

Interest income |

| (1,190 | ) | (523 | ) | (367 | ) | (1,503 | ) | (1,114 | ) | |||||

Interest expense |

| 25,108 |

| 22,977 |

| 16,252 |

| 10,860 |

| 11,273 |

| |||||

Foreign Currency transaction (income) loss, net |

| (3,819 | ) | (6,157 | ) | (3,496 | ) | (9,549 | ) | 23,321 |

| |||||

Other nonoperating expenses (income), net |

| — |

| — |

| (8,443 | ) | 6,414 |

| 74 |

| |||||

Loss before income taxes, equity in affiliates and minority interest |

| (24,531 | ) | (16,258 | ) | (4,474 | ) | (7,570 | ) | (34,766 | ) | |||||

Equity in (losses of) affiliates, net (d) |

| — |

| — |

| 468 |

| (3,585 | ) | 6,338 |

| |||||

Minority interest |

| 341 |

| 240 |

| 255 |

| 82 |

| 64 |

| |||||

Loss from continuing operations before income taxes |

| (24,872 | ) | (16,498 | ) | (5,197 | ) | (4,067 | ) | (41,168 | ) | |||||

Income tax from continuing operations - current |

| 493 |

| 308 |

| 304 |

| 328 |

| 79 |

| |||||

Income tax from continuing operations – deferred |

| 8,613 |

| 27,424 |

| 8,866 |

| 19,054 |

| — |

| |||||

Loss from continuing operations |

| (33,978 | ) | (44,230 | ) | (14,367 | ) | (23,449 | ) | (41,247 | ) | |||||

Discontinued operations |

|

|

|

|

|

|

|

|

|

|

| |||||

Income (loss) from discontinued operations, before income taxes |

| 5,326 |

| (18,782 | ) | (5,276 | ) | (16,550 | ) | (30,169 | ) | |||||

Income taxes on discontinued operations |

| (962 | ) | (314 | ) | — |

| — |

| — |

| |||||

Income (loss) from discontinued operations |

| 4,364 |

| (19,096 | ) | (5,276 | ) | (16,550 | ) | (30,169 | ) | |||||

Net loss |

| (29,614 | ) | (63,326 | ) | (19,643 | ) | (39,999 | ) | (71,416 | ) | |||||

3

|

| Year Ended December 31, |

| |||||||||||||

|

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (in thousands of US$ unless otherwise stated) |

| |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Other data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Purchase of property, plant and equipment |

| 161 |

| 26,583 |

| 13,608 |

| 11,223 |

| 11,195 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Ratio of earnings to fixed charges (e) |

| — |

| — |

| — |

| — |

| — |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Select Operating Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

Pay TV |

|

|

|

|

|

|

|

|

|

|

| |||||

Number of Subscribers (f) |

| 11,330 |

| 10,535 |

| 9,802 |

| 9,070 |

| 9,334 |

| |||||

Average monthly revenue per Subscriber (g) |

| $ | 37.71 |

| $ | 32.16 |

| $ | 26.60 |

| $ | 22.04 |

| $ | 14.86 |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents |

| 1,754 |

| 9,753 |

| 1,368 |

| 292 |

| 245 |

| |||||

Current assets held for sale |

| 135,647 |

| — |

| — |

| — |

| — |

| |||||

Property, plant and equipment, net |

| 2,352 |

| 71,898 |

| 68,220 |

| 76,317 |

| 76,907 |

| |||||

Total assets |

| 246,932 |

| 118,853 |

| 102,564 |

| 107,931 |

| 111,475 |

| |||||

Liabilities directly associated with current assets held for sale |

| 97,113 |

| — |

| — |

| — |

| — |

| |||||

Loans payable to related companies |

| 119,122 |

| 68,196 |

| 49,634 |

| 39,712 |

| 12,117 |

| |||||

Long-term liabilities |

| 240,417 |

| 231,175 |

| 152,084 |

| 69,380 |

| 86,298 |

| |||||

Redeemable common stock |

| — |

| 30,380 |

| 27,599 |

| 24,201 |

| 99,365 |

| |||||

Total shareholders’ deficiency |

| 216,067 |

| 199,655 |

| 120,317 |

| 89,431 |

| 119,618 |

| |||||

Notes to Selected Financial and Other Data

(a) Includes revenues (such as cable modem fee, frequencies lease, wholesale and technical assistance).

(b) Represents various non-income based taxes paid on certain of our gross revenue items with rates ranging from 3.65% to 15.15%.

(c) Represents costs directly related to the subscriber base and new installations evolution.

(d) Represents our pro rata share of the Net loss or income of our equity investments and minority interest.

(e) For the five years ended December 31, 2006, earnings were insufficient to cover fixed charges by U.S.$24,531 U.S.$16,259, U.S.$4,475, U.S.$7,570 and U.S.$34,766, respectively. In calculating the Ratio of earnings to fixed charges, earnings represents pre-tax Net loss from continuing operations before minority interest, Equity income in (losses of) affiliates, plus fixed charges.

(f) Represents the number of subscribers as of the last day of each period.

(g) Average monthly revenue per subscriber refers to the average monthly subscription fee as of the last day of each period.

4

SELECTED FINANCIAL AND OTHER DATA – DISCONTINUED OPERATIONS

|

| Year Ended December 31, |

| |||||||||||||

|

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (in thousands of US$ unless otherwise stated) |

| |||||||||||||

Monthly subscriptions revenues |

| $ | 150,353 |

| $ | 123,085 |

| $ | 91,616 |

| $ | 80,553 |

| $ | 78,999 |

|

Installation revenues |

| 2,713 |

| 2,053 |

| 964 |

| 1,160 |

| 1,018 |

| |||||

Advertising revenues |

| 5,037 |

| 3,534 |

| 1,833 |

| 1,976 |

| 1,466 |

| |||||

Additional services revenues (a) |

| 9,767 |

| 6,725 |

| 6,151 |

| 3,491 |

| 3,270 |

| |||||

Taxes on revenue (b) |

| (23,842 | ) | (19,466 | ) | (14,026 | ) | (12,556 | ) | (11,894 | ) | |||||

Direct operating expenses (c) |

| (47,207 | ) | (42,670 | ) | (36,116 | ) | (35,358 | ) | (40,575 | ) | |||||

Selling, general and administrative expenses |

| (47,596 | ) | (47,015 | ) | (24,101 | ) | (19,575 | ) | (17,906 | ) | |||||

Depreciation |

| (25,197 | ) | (23,146 | ) | (19,634 | ) | (17,482 | ) | (20,103 | ) | |||||

Amortization |

| (3,508 | ) | (5,800 | ) | (4,099 | ) | (4,778 | ) | (6,376 | ) | |||||

Other operating expenses, net |

| (986 | ) | (6,587 | ) | (3,096 | ) | (3,671 | ) | (4,281 | ) | |||||

Interest income |

| 1,566 |

| 487 |

| 333 |

| 8 |

| 594 |

| |||||

Interest expense |

| (16,140 | ) | (10,205 | ) | (5,165 | ) | (7,274 | ) | (5,668 | ) | |||||

Foreign Currency transaction income (loss), net |

| 366 |

| 223 |

| 64 |

| 1,469 |

| (8,199 | ) | |||||

Other nonoperating income, net |

| — |

| — |

| — |

| (4,513 | ) | (514 | ) | |||||

Income tax expense |

| (962 | ) | (314 | ) | — |

| — |

| — |

| |||||

Income (loss) from discontinued operations |

| 4,364 |

| (19,096 | ) | (5,276 | ) | (16,550 | ) | (30,169 | ) | |||||

5

|

| Year Ended December 31, |

| |||||||||||||

|

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (in thousands of US$ unless otherwise stated) |

| |||||||||||||

Select Operating Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

Pay TV |

|

|

|

|

|

|

|

|

|

|

| |||||

Number of Subscribers (d) |

| 315,950 |

| 290,040 |

| 283,746 |

| 275,120 |

| 291,287 |

| |||||

Average monthly revenue per Subscriber (e) |

| $ | 39.25 |

| $ | 35.51 |

| $ | 29.67 |

| $ | 25.61 |

| $ | 21.44 |

|

Internet Broadband - Residential |

|

|

|

|

|

|

|

|

|

|

| |||||

Number of Subscribers (d) |

| 58,159 |

| 42,202 |

| 28,410 |

| 18,773 |

| 14,116 |

| |||||

Average monthly revenue per Subscriber (e) |

| $ | 30.64 |

| $ | 30.73 |

| $ | 28.31 |

| $ | 27.39 |

| $ | 21.65 |

|

Internet Broadband – SOHO |

|

|

|

|

|

|

|

|

|

|

| |||||

Number of Subscribers (d) |

| 3,739 |

| 2,174 |

| 1,780 |

| 1,410 |

| 839 |

| |||||

Average monthly revenue per Subscriber (e) |

| $ | 151.87 |

| $ | 185.79 |

| $ | 167.56 |

| $ | 161.12 |

| $ | 162.59 |

|

Notes to Selected Financial and Other Data

(a) Includes revenues (such as cable modem fee, frequencies lease, wholesale and technical assistance).

(b) Represents various non-income based taxes paid on certain of our gross revenue items with rates ranging from 3.65% to 15.15%.

(c) Represents costs directly related to the subscriber base and new installations evolution.

(d) Represents the number of subscribers as of the last day of each period.

(e) Average monthly revenue per subscriber refers to the average monthly subscription fee as of the last day of each period.

Exchange Rates

Until March 2005, there were two legal foreign exchange markets in Brazil: the commercial rate exchange market, or the Commercial Market, and the floating rate exchange market, or the Floating Market. The rate for the Commercial Market, or the Commercial Market Rate, was reserved primarily for foreign trade transactions and transactions that generally required prior approval from Brazilian monetary authorities, such as the purchase and sale of registered investments by foreign persons and related remittances of funds abroad. The rate for the Floating Market, or the Floating Market Rate, generally applied to transactions to which the Commercial Market Rate did not apply. On March 4, 2005, the National Monetary Council issued Resolution No. 3,265 unifying the Floating Market and the Commercial Market. Despite such unification of the foreign exchange markets, the transactions that used to be carried out in the Commercial Market generally still require prior registration with and the approval of the Central Bank.

Foreign exchange rates are freely negotiated but are strongly influenced by the Central Bank. After the implementation of the Real Plan in 1994, the Central Bank initially allowed the real to float with minimal intervention. On March 6, 1995, the Central Bank announced that it would intervene in the market and buy or sell U.S. dollars, establishing a trading band (faixa de flutuação) in which the exchange rate between the real and the U.S. dollar would fluctuate. From 1995 through 1998, the Central Bank periodically adjusted the trading band upward.

On January 13, 1999, the Central Bank attempted a limited devaluation of the real by modestly elevating the band width in which the real was allowed to trade. When this limited devaluation proved unsuccessful, the

6

Central Bank announced that it would no longer use its foreign currency reserves to protect the value of the real (with the exception of limited interventions to restrain abrupt fluctuations in the exchange rate), thereby allowing the real to float freely against other currencies. Consequently, in the weeks following the initial devaluation, the real lost more than 40% of its value against the U.S. dollar. There can be no assurance that the Central Bank will not institute a new band in the future or that the real will not devalue further.

On January 25, 1999, in the wake of the devaluation and the adoption of a floating exchange regime, the National Monetary Council adopted Resolution No. 2588, effective as of February 1, 1999. Pursuant to such resolution, the Central Bank ordered the banks authorized to operate in the Commercial Market to unify their positions in the two different markets then in place. During the period from the unification of the banks’ positions in the Commercial Market and the Floating Market until the final unification of such markets into one single foreign exchange market in 2005, the exchange rates offered in both markets had identical pricing and liquidity.

The following table provides the foreign exchange rate for the purchase of U.S. dollars expressed in reais per U.S. dollar for the periods and dates indicated.

| Exchange Rates of reais per U.S.$1.00 |

| |||||||

|

| Low |

| High |

| Average(1) |

| Period End |

|

Year Ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2002 |

| 2.2709 |

| 3.9552 |

| 2.9236 |

| 3.5333 |

|

December 31, 2003 |

| 2.8219 |

| 3.6623 |

| 3.0783 |

| 2.8892 |

|

December 31, 2004 |

| 2.6544 |

| 3.2051 |

| 2.9262 |

| 2.6544 |

|

December 31, 2005 |

| 2.1633 |

| 2.7621 |

| 2.4352 |

| 2.3407 |

|

December 31, 2006 |

| 2.0586 |

| 2.3711 |

| 2.1761 |

| 2.1380 |

|

|

|

|

|

|

|

|

|

|

|

Month Ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 31, 2007 |

| 2.1247 |

| 2.1556 |

| 2.1385 |

| 2.1247 |

|

February 28, 2007 |

| 2.0766 |

| 2.1182 |

| 2.0963 |

| 2.1182 |

|

March 31, 2007 |

| 2.0504 |

| 2.1388 |

| 2.0882 |

| 2.0504 |

|

April 30, 2007 |

| 2.0231 |

| 2.0478 |

| 2.0320 |

| 2.0339 |

|

May 31, 2007 |

| 1.9289 |

| 2.0309 |

| 1.9816 |

| 1.9289 |

|

June 30, 2007 |

| 1.9047 |

| 1.9638 |

| 1.9319 |

| 1.9262 |

|

(1) Calculated as the average of the month-end exchange rates during the relevant period.

Source: Central Bank.

On July 10, 2007, the Commercial Market rate (sell) as reported by the Central Bank was R$1.8947 per U.S.$1.00.

For a description of certain applicable exchange controls, see Item 10, “Additional Information—Exchange Controls.” See also Item 3, “Key Information—Risk Factors—Factors Relating to Brazil.”

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following discussion is based on our operations as of December 31, 2006 and is qualified in its entirety by reference to the convergence and sale agreements entered into as of October 29, 2006, by us, TVA Sistema, Comercial Cabo TV São Paulo S.A ., TVA Sul Paraná S.A., Abril Comunicações (our shareholder), certain entities

7

affiliated with Abril Comunicações and Telecomunicações de São Paulo S.A.-Telesp (an affiliate of Telefonica, the Spanish telecommunications concern) pursuant to which, subject to regulatory approvals and other conditions precedent, we have agreed to transfer substantially all of our operating assets to certain entities controlled by Telefonica and certain affiliates of Abril Comunicações. We expect that our gross revenues will significantly decrease as a result of this transaction. For more information on this transaction, see Item 3, “Key Information—Selected Financial Data,” Item 4, “Information on the Company” and note 20 to the Tevecap Financial Statements included in this Annual Report.

Before making any investment decision, investors should carefully read this entire Annual Report and should consider carefully, in light of their own financial circumstances and investment objectives, all the information set forth herein and, in particular, certain matters with respect to debt securities issued by Brazilian companies, including, without limitation, those set forth below.

Factors Relating to the Company

In the event our transaction with Telesp is consummated, substantially all of our assets, including substantially all of the assets of the Guarantors, will be transferred to entities that are not obligors of our Senior Notes.

Our Senior Notes are obligations of Tevecap S.A. and are guaranteed by our Guarantors (TVA Sistema de Televisão S.A., TVA Communications Ltd., Comercial Cabo TV São Paulo S.A., TVA Sul Paraná S.A. and CCS Camboriú Cable System de Telecomunicações Ltda.). We expect that as a result of our agreements with Telesp, substantially all of the assets of TVA Sistema de Televisão S,A., Comercial Cabo TV São Paulo S.A. and TVA Sul Paraná S.A. (other than TVA Sul Paraná’s equity interests in CCS Camboriú Cable System de Telecomunicações Ltda.), will be transferred to the purchasers under these agreements. As a result, following the consummation of our transaction with Telesp, we expect that our gross revenues will significantly decrease, and investors will have no recourse to the assets being transferred, or the cash flow generated by these assets.

We have incurred substantial operating losses and have a working capital deficiency.

Since our inception in 1989, we have been developing our businesses and continue to sustain substantial operating losses due primarily to insufficient revenue with which to fund build-out, interest expense and charges for depreciation and amortization. Net losses incurred have been funded principally by capital contributions from shareholders, borrowings under shareholder loans, dispositions of non-strategic assets, bank loans and other borrowings made from time to time. Our management has undertaken efforts to generate the cash flow necessary to meet our cost structure, including the sale of non-strategic assets, the reduction of indebtedness and internal cost-cutting measures. We cannot assure that these efforts will be successful in the long term.

Voice over Internet Protocol is an uncertain regulatory area, and changes in regulation may affect our ability to succeed in this market.

Voice over Internet Protocol, or VoIP, is a new industry in Brazil, and the regulatory environment with respect to this technology is still uncertain. Changes in the regulation of our business activities with respect to VoIP, including decisions by regulators affecting our operations (such as the granting or renewal of licenses or decisions as to the telephone rates we may charge our customers) or changes in interpretations of existing regulations by courts or regulators, could adversely affect our ability to succeed in the VoIP market and hurt our financial position. Although we have attempted to minimize this risk by utilizing our own SCM license and entering into a partnership with a telephony provider licensed for STFC services by the Brazilian federal telecommunications agency (Agência Nacional de Telecomunicações or ANATEL) in the provision of VoIP services, any new regulations could have a material adverse effect on the VoIP industry as a whole and on us in particular.

8

We must experience growth in our subscriber base in order to sustain our business operations and prospects.

Over the past three years, we have pursued a strategy of reduction of the number of unprofitable customers, allowing us to improve the programming and customer service that we are able to provide to profitable customers. In 2004 our pay television subscriber base returned to growth, with a 3% increase during the year (7% in our cable operations in São Paulo), while the broadband internet customer base grew by 51% (71% in São Paulo). This growth continued in 2005 and 2006, with a growth of 2.5% and 8.9%, respectively, in our pay television subscriber base and a growth of 47% and 38%, respectively, in our internet customer base. In order for us to sustain our business operations and prospects, we must continue to experience growth in the ensuing years. We cannot assure you that we will experience growth in our subscriber base, or that the rate of growth will be sufficient to allow us to continue our operations.

Our activities are extensively regulated.

Substantially all of our business activities are regulated by ANATEL. Such regulation relates to, among other things, licensing, local access to cable and MMDS systems, commercial advertising, and foreign investment in cable and MMDS systems. Changes in the regulation of our business activities, including decisions by regulators affecting our operations (such as the granting or renewal of licenses or decisions as to the subscription rates we may charge our customers) or changes in interpretations of existing regulations by courts or regulators, could adversely affect us. ANATEL has the authority to grant cable and MMDS licenses pursuant to public bidding processes. We are unable to predict what impact, if any, such public bidding will have on our ability to launch and operate new systems. Any new regulations could have a material adverse effect on the subscription television industry as a whole and on us in particular.

We have a high level of indebtedness and a current deficit.

We had approximately U.S.$81.3 million of net consolidated indebtedness to unaffiliated third parties as of December 31, 2006. As of the same date, we had current assets of approximately U.S.$138.1 million and current liabilities of approximately U.S.$221.8 million, resulting in negative working capital of approximately U.S.$83.7 million. In the event our transaction with Telesp is not consummated, we may not be able to repay our debts, implement our business strategy or obtain financing for working capital or investments or other purposes. Furthermore, our indebtedness may limit our ability to implement strategies or adapt to market changes, such as downturns in economic activity, which would adversely affect our ability to face those competitors of lower leverage, resulting in adverse effects on our financial condition and results of operations.

We may require additional financing, which may not be readily available when necessary.

If we fail to generate sufficient operating results, or if our capital needs exceed our projected capital requirements, we may require substantial additional investment on a continuing basis to finance our corresponding capital expenditures. In addition, in order to implement our business strategies, we may require substantial additional capital to acquire new pay television licenses or entities holding such licenses, or to make any investments in or acquire other existing pay television operations. Also, our future cash requirements may increase as a result of unexpected developments in the Brazilian pay television or broadband internet markets and the amount and timing of our future capital requirements will depend on a number of factors, many of which are not within our control, including subscriber growth and retention, capital costs, currency devaluation, regulatory changes and competitive conditions. Our failure to obtain any needed financing in the future may adversely affect our financial condition and results of operations.

9

Our debt obligations are subject to foreign exchange risk.

A significant portion of our debt obligations (i.e., our senior notes) are denominated in U.S. dollars, while we generate revenues only in Brazilian reais. We also incur a significant portion of our programming costs in U.S. dollars. Consequently, a significant devaluation of the real against the U.S. dollar can significantly affect our ability to meet our obligations and fund our capital expenditures, and could adversely affect our results of operations. In addition, shifts in currency exchange rates may have a material adverse effect on us and may force us to seek additional capital, which may not be available to us. While we may consider entering into transactions to hedge or otherwise share with programmers the risk of exchange rate fluctuations, it may not be possible for us to obtain such arrangements on commercially satisfactory terms.

Tevecap has limited assets and depends on its subsidiaries to repay indebtedness.

Tevecap’s operations are conducted through, and substantially all of Tevecap’s assets are owned by, Tevecap’s direct and indirect subsidiaries. In the event our transaction with Telesp is not consummated, the ability of Tevecap to meet its obligations in respect of its indebtedness, including the Senior notes, will depend on, among other things, the future performance of such subsidiaries (including the Guarantors) and the ability of Tevecap to refinance such indebtedness at maturity (or upon early redemption or otherwise). In addition, the ability of Tevecap’s subsidiaries to pay dividends and make other payments to Tevecap may be restricted by, among other things, applicable corporate and other laws and regulations and by the terms of agreements to which such subsidiaries may become subject. In particular, Brazilian companies are allowed to distribute dividends only if, after a given fiscal year, their net profits exceed accumulated losses. In addition, the property and assets (including receivables) of certain of Tevecap’s subsidiaries have, and may in the future have, liens placed upon them pursuant to existing and future financings.

Because we have engaged in a significant number of related party transactions, our financial statements may not be truly representative of our financial position.

We have engaged in a significant number and variety of related party transactions, including, without limitation, transactions with respect to administrative services, including payroll, human resources, accounting, tax, finance and legal services; publishing and advertising; financing transactions; and licenses. Although we believe such transactions are conducted on an arm’s-length basis, we have not performed any studies or analyses to determine whether the terms of past transactions with related parties have been equivalent to arm’s-length transactions and cannot state with any certainty the extent to which such transactions are comparable to those which might have been obtained from a non-affiliated third party. If we were to be unable to obtain these services from our affiliates, our financial position may be adversely or positively affected.

We may experience high churn rates among our pay television and internet subscribers.

Our ability to generate pay television and broadband internet subscription revenues is dependent on our attraction and retention of subscribers, which requires us to incur acquisition and installation costs, including sales commissions, marketing costs and equipment installation costs. Our ability to recover these costs requires us to retain our clients as subscribers of our services.

High rates of subscriber churn could have a material adverse effect on our revenues and profitability given the costs that we incur to attract each new subscriber. We may experience high churn rates in the future and we cannot assure you that we will experience growth in our subscriber base that will offset subscriber customer churn rates. If this occurs, our financial condition and results of operations may be adversely affected.

We face significant competition in the pay television and broadband internet industries.

The pay television industry and broadband internet segment in Brazil are, and are expected to continue to be, highly competitive. New competitors may emerge as a result of changing technology, changes in regulations governing the pay television and high-speed data industries or as a result of new licenses granted by ANATEL in markets in which we currently operate. Similarly, if we expand into additional services, we will face competition from other service providers.

10

For pay television services, we primarily compete with other main pay television service providers in the markets in which we operate, as well as with satellite direct-to-home, or DTH, service providers and Brazilian broadcast networks and their local affiliates. For broadband internet services, we compete with fixed line telephony carriers that provide digital subscriber line, or DSL, service, a technology that transmits data through copper lines used in telephone networks, and with other dial-up internet service providers. For pay television and broadband internet services, cable and MMDS services, we compete indirectly with movie theaters and video rental stores, as well as with other entertainment and leisure activities.

For VoIP services, we presently compete with fixed line telephony carriers, including Telecomunicações de São Paulo S.A. – Telesp in the State of São Paulo and Telemar Norte Leste S.A. in the State of Rio de Janeiro, in addition to other pay television and broadband internet service providers.

Some of our competitors have greater financial resources than we do. In addition, further consolidation among our competitors may increase the economies of scale of certain of our competitors. As a result, we cannot assure you that we will be able to compete successfully, which could adversely affect our business and results of operations.

Existing and future technological developments may allow new competitors to emerge.

Technology in the communications industry is subject to rapid and significant change. Technological advances could require us to expend substantial financial resources to develop or implement new technologies or to upgrade our existing equipment in order to ensure that our existing equipment and services do not become obsolete. We may not have sufficient financial resources to fund new technology or access new resources. Our failure to introduce new technology and services as rapidly as those of our competitors could adversely affect our financial condition and results of operations.

We have upgraded our cable and MMDS systems to offer digital services and believe that, for the foreseeable future, existing and developing alternative technologies will not materially adversely affect the viability or competitiveness of our pay television business. Although we believe that our recently implemented technological changes have produced and will continue to produce positive results, future technological advances may require us to expend substantial financial resources in the development or implementation of new competitive technologies.

We may be subject to substantial additional taxes or obligations.

We may be subject to substantial additional taxes on our network, the most significant of which is a charge (preço público or tarifa) on the use of public thoroughfares (which includes the installation and passage of cables, as well as the use of soil, subsoil and aerial space) which has been approved by several Brazilian municipalities. This tax is assessed per meter of cable installed in the relevant municipality, with the tax rate varying widely by municipality. We have over 4,394 kilometers of installed cable in municipalities that have approved this tax. We have challenged the application of this tax and have not made any judicial deposits or provisions for our payment based on the favorable opinion of our lawyers as to the merits of the challenge. In a related lawsuit, the Brazilian Superior Court of Justice (Superior Tribunal de Justiça) recently ruled that municipalities do not have the power to create charges or taxes on the use of public thoroughfares.

In addition, the Brazilian Superior Court of Justice recently judged that internet service is not a communication service, and therefore, is not subject to state value-added tax (Imposto sobre a Circulação de Mercadorias e Serviços or ICMS). If this decision is confirmed, it may result in our being subject to municipal services tax (Imposto sobre Serviços de Qualquer Natureza or ISS) taxation at a rate of 5.0% on our gross revenues, for as long as internet services are included on a list of services under Supplementary Law No. 116/03. On the other hand, if internet services are deemed to be a type of communication services, these activities would be subject to ICMS taxation, with a rate that is currently reduced. If we become subject to increased tax obligations as a result of the taxes described above or otherwise, our financial condition and results of operations may be adversely affected.

11

We may have to remove our aerial cables and transfer them underground.

The municipalities in which we operate may require us to remove our aerial cables and transfer them underground. In July 2005, the municipality of São Paulo enacted Municipal Law No. 14,023, requiring that all cables and wire (including the electricity, telecommunications and pay television cables) poles be transferred underground to the extent of 250 kilometers per year. This law was followed by a regulatory decree stipulating that the burying costs should be borne entirely by the owners of such cable and wire networks. TVA and other telecommunications and electricity companies intend to challenge, administratively or judicially, as the case may be, the validity of this decree. Currently, all of our cable network in São Paulo is installed through aerial poles. In addition, we cannot assure that other municipalities in which we operate will not enact similar laws. If we are required to transfer a significant portion of our cables underground, our financial condition and results of operations may be adversely affected.

Factors Relating to Brazil

The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy.

Since substantially all of our operations and customers are located in Brazil, our financial condition and results of operations are substantially dependent on Brazil’s economy and may be negatively affected as a result of the intervention by the Brazilian government in the economy.

The Brazilian economy has been characterized by significant volatility and by frequent and significant interventions by the Brazilian government. During the 1980s and the beginning of the 1990s, in response to periods of high inflation, recession and fiscal imbalances, the Brazilian government often changed monetary, tax, credit, tariff and other policies to influence the course of Brazil’s economy. Governmental actions to control inflation and implement other policies have, at times, involved wage and price controls as well as other interventionist measures, such as raising interest rates, freezing bank accounts, imposing capital controls and inhibiting international trade in Brazil. Changes in policy involving tariffs, exchange controls, regulation and taxation could adversely affect our business and financial results, as could inflation, currency devaluation, social unrest and other political, economic or diplomatic developments, and the Brazilian government’s response to such developments. In particular, a number of members of the Brazilian Congress and the administration of President Luiz Inácio Lula da Silva are presently under investigation regarding allegations of corruption. In October 2006, presidential elections were held and President da Silva was re-elected. We cannot predict what policies will be maintained or adopted by the Brazilian government and whether these policies will negatively affect the Brazilian economy or our results of operations.

Government intervention in the Brazilian economy may increase our costs and restrict our capacity to conduct our business as presently being conducted. Moreover, social, political or economic developments resulting from the Brazilian government’s imposition of new economic policies, or the Brazilian government’s response to those developments, could also adversely affect our operations.

Brazilian political and economic conditions have been unstable in the past.

The Brazilian government’s political and economic policies may have important effects on Brazilian corporations and other entities, including us, and on market conditions and prices of Brazilian securities. Our financial condition and results of operations may be adversely affected by the following factors and the Brazilian government’s response to these factors:

· devaluations and other exchange rate movements;

· inflation;

· exchange control policies;

· social instability;

· price instability;

· energy shortages;

· interest rates;

· liquidity of domestic capital and lending markets;

12

· tax policy; and

· other political, diplomatic, social and economic developments in or affecting Brazil.

The Brazilian currency has fluctuated significantly in the past.

The Brazilian currency has been devalued repeatedly during the last four decades primarily as a result of inflationary pressures. Throughout this period, the Brazilian government has implemented various economic plans and utilized a number of exchange rate policies, including sudden devaluations, periodic mini-devaluations (with the frequency of adjustments ranging from daily to monthly), floating exchange rate systems, exchange controls and dual exchange rate markets. Although over long periods of time devaluations of the Brazilian currency generally have correlated with the rate of inflation in Brazil, such governmental actions over shorter periods have resulted in significant fluctuations in the real exchange rate between the Brazilian currency and the U.S. dollar.

The exchange rate between the real and the U.S. dollar, the relative rates of real devaluation and the prevailing rates of inflation have affected our financial results and may continue to do so in the future. A substantial portion of our indebtedness and some of our operating expenses and capital expenditures are, and are expected to continue to be, denominated in or indexed to the U.S. dollar and other foreign currencies. See Item 3, “Key Information—Selected Financial Data—Exchange Rates.”

Devaluations of the real relative to the U.S. dollar also create additional inflationary pressures in Brazil that may negatively affect us. In addition, a significant devaluation generally results in a curtailment of access to foreign financial markets for Brazilian issuers and can lead to government intervention, including recessionary government policies.

The Brazilian economy has experienced extreme inflation in the past.

Until mid-1994 Brazil experienced extremely high rates of inflation, with annual rates of inflation reaching as high as 2,708.6% in 1993 and 909.61% in 1994, as measured by the General Price Index—Domestic Availability (Índice Geral de Preços Disponibilidade Interna, or the IGP-DI). Inflation contributed materially to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets.

After the introduction of the Real Plan in 1994, the rate of inflation as measured by the IGP-DI fell steadily to 1.71% in 1998. Inflation increased to 19.98% in 1999 as a result of the devaluation of the real in January 1999, decreased to 9.81% for 2000, and reached 10.40% in 2001 and 26.41% in 2002. In 2003, 2004, 2005 and 2006 the annual inflation rate was 7.7%, 12.1%, 1.2% and 3.79%, respectively. Inflation itself and governmental actions taken to combat inflation have in the past had significant negative effects on the Brazilian economy. Inflation, actions taken to combat inflation and public speculation about possible future actions have also contributed to economic uncertainty in Brazil and heightened volatility in the Brazilian securities markets. In an effort to control the inflationary pressures derived from the devaluation of the real, the Brazilian government has taken deflationary actions, such as raising interest rates and imposing credit restrictions, which are highly unpopular and may be unsustainable for long periods of time. Periods of substantial inflation may in the future have material adverse effects on the Brazilian economy, the Brazilian market for television advertising and on our business, condition (financial or other), properties, prospects and results of operations.

The availability of credit in the Brazilian market may be limited by external events.

A number of developments or conditions have significantly affected the availability of credit in the Brazilian economy. External events have from time to time resulted in considerable outflows of funds and declines in the amount of foreign currency invested in Brazil. Such events include the devaluation of the Mexican peso in December 1994, the Asian economic crisis of 1997, the Russian currency crisis of 1998, the currency instability that Brazil faced in 1999, and the recent recession in Argentina. To defend the real during such events and to control inflation, the Brazilian government has maintained a tight monetary policy, with associated high interest rates, and has constrained the growth of credit. It is uncertain whether these disruptions in the Brazilian economy will adversely affect our financial condition or results of operations.

13

The Brazilian government has enacted tax and social security reforms in the past.

To implement its fiscal policies, the Brazilian government regularly enacts reforms to the tax and other assessment regimes to which we are subject. These reforms include the enactment of new taxes or assessments, changes in the bases of calculation or rates of assessment and, occasionally, enactment of temporary taxes, the proceeds of which are earmarked for designated governmental purposes. The effects of these changes and any other changes that could result from enactment of additional tax reforms cannot be quantified but may reduce our volume of transactions, increase our costs or limit our profitability. There can be no assurance that these changes will occur in the future. If these changes do occur, they may adversely affect our operations or financial condition.

President da Silva’s coalition controls less than a majority of the Senate and less than the 60% required in each house to approve constitutional amendments. President da Silva’s success in enacting his initiatives will, therefore, depend on his ability to form and maintain alliances with other major parties in the Brazilian Congress. The success of President da Silva’s initiatives will also be influenced by public opinion toward the reforms and the strength of any opposition to the reforms by affected interest groups. If the reforms are not approved by the Congress, Brazil’s economic growth may be impeded, which in turn could have a negative impact on our business.

The Brazilian currency is subject to exchange controls and restrictions.

The purchase and sale of foreign currency in Brazil is subject to governmental control through the Central Bank. Brazilian law provides that, in the event of a serious imbalance in Brazil’s balance of payments or a foreseeable likelihood of such an imbalance, the Brazilian government may, for a limited period of time, impose restrictions on the remittance of foreign currency and on the conversion of Brazilian currency into foreign currencies. Brazil has not restricted the remittance of foreign currency since 1990. However, no assurance can be given that such measures, which could affect our ability to make principal and interest payments with respect to the Senior notes will not be instituted in the future.

Many factors beyond our control could affect the likelihood of the Brazilian government imposing exchange control restrictions. Among these factors are:

· the level of Brazil’s foreign currency reserves;

· the availability of sufficient foreign exchange on the date a payment is due;

· the size of Brazil’s debt service burden relative to the economy as a whole; and

· political constraints to which Brazil may be subject.

ITEM 4. INFORMATION ON THE COMPANY

The following discussion is based on our operations as of December 31, 2006 and is qualified in its entirety by the following information:

On October 29, 2006, we, TVA Sistema, Comercial Cabo TV São Paulo S.A., TVA Sul Paraná S.A., Abril Comunicações (our shareholder) and certain entities affiliated with Abril Comunicações entered into certain convergence and sale agreements with Telecomunicações de São Paulo S.A.-Telesp (an affiliate of Telefonica, the Spanish telecommunications concern), including an interim operating agreement for the period up to the approval of the transaction. Under these agreements, we expect to transfer all of our MMDS licenses and operations to a company to be owned by Telesp and to transfer our Cable operations and licenses (other than those related to CCS Camboriú Cable System de Telecomunicações Ltda., a Cable operator in the city of Camboriú, in which we hold a 60% equity interest) to certain entities to be owned by a joint venture company formed between Telesp and certain affiliates of Abril Comunicações. The transaction was structured such that upon consummation Telesp will become the owner of a minority stake in the Cable entities, within the limits set forth in applicable regulations and in Telesp’s concession agreement for telephony services, while certain affiliates of Abril Comunicações will continue to have a majority stake in the Cable entities. We may also transfer CCS Camboriú under the agreements described above if we are able to reach an agreement with our minority shareholder in CCS Camboriú regarding such transfer. The disposition of assets under these agreements is not expected to result in a loss to us.

14

The closing of the transaction described above is subject to regulatory approvals and certain other conditions precedent, including: (i) prior approval of ANATEL (the Brazilian National Telecommunications Agency) and (ii) the implementation of a corporate reorganization in order to transfer all target assets free and clear of encumbrances. In addition, the transaction is also subject to the analysis of CADE (the Brazilian Administrative Council for Economic Defense), Brazil’s federal antitrust authority. Our agreements with Telesp provide that Telesp and Tevecap will begin to jointly market their telephony, pay television and/or broadband internet and pay television services during the approval process period.

In addition, under our agreements with Telesp, we and our parent company, Abril Comunicações S.A., have assumed responsibility for potential contingencies that may arise after the sale of the operations described above relating to periods prior to the consummation of the sale.

On December 28, 2006, Telesp made an advance payment to us in the amount of U.S.$93.5 million (R$200.0 million). In addition, Telesp has granted us a line of credit of up to U.S.$52.6 million (R$112.5 million) for capital expenditure purposes, of which we have already borrowed U.S.$38.4 million (R$82.0 million) as of June 30, 2007. In the event the transaction does not close, we are obligated to return by April 30, 2008 the advance payment and any amounts borrowed under the line of credit together with, in each case, interest accrued thereon at the rate of 103% of the CDI rate (the interbank certificate of deposit rate in Brazil) from the date of the determination that the transaction will not close. Our obligation to repay these amounts was guaranteed by a pledge of our Cable and MMDS networks. In addition, our operating agreements with Telesp will terminate on July 31, 2007 in the event the transaction does not close.

The Senior Notes are not being transferred under the above agreements and will remain obligations of ours following the corporate reorganization of the Abril group mentioned above, together with the following liabilities: (i) U.S.$119.1 million in obligations with respect to transactions with related companies (see note 6 to the Tevecap Financial Statements), (ii) U.S.$31.2 million in provisions for fiscal contingencies (see note 17 to the Tevecap Financial Statements) and (iii) US$59.5 million in deferred tax liabilities (see note 7.2 to the Tevecap Financial Statements).

Our direct and indirect subsidiaries TVA Sistema de Televisão S.A., TVA Communications Ltd., Comercial Cabo TV São Paulo Ltda., TVA Sul Paraná Ltda. and CCS Camboriú Cable System de Telecomunicações Ltda. are Guarantors of our Senior Notes. We expect that as a result of our transaction with Telesp, substantially all of the assets of TVA Sistema de Televisão S,A., Comercial Cabo TV São Paulo S.A. and TVA Sul Paraná S.A. (other than TVA Sul Paraná’s equity interests in CCS Camboriú Cable System de Telecomunicações Ltda.), will be transferred to the purchasers under the above agreements, although Comercial Cabo TV São Paulo S.A. and TVA Sul Paraná S.A. will not continue to be Guarantors under the Senior Notes. Our management is analyzing the effects of the transaction as a whole on the Senior Notes and firmly expects that, following the consummation of the transaction, we will continue to honor our payment obligations under the Senior Notes.

For more information in respect of the assets and liabilities being transferred under our agreements with Telesp, please refer to Item 3, “Key Information—Selected Financial Data” and note 20 to the Tevecap Financial Statements included in this Annual Report.

A. History and Development

We are one of the major multiservice telecommunications operators in Brazil. We provide the following services to our subscribers:

· pay television services (through digital and analog MMDS and cable technologies);

· broadband internet services; and

· VoIP and other telecommunications services.

15

In 1991 we launched the first pay television service in Brazil and, in 1999, became the first high speed internet services provider in Brazil under the name Ajato. Today Ajato offers broadband internet access and Editora Abril content to residential and corporate subscribers. In 2004 we became the first Brazilian pay television operator to offer digital services by launching TVA Digital, our digital pay television service, to our cable subscribers in São Paulo. In 2005 we digitalized our MMDS network in São Paulo, which permitted the supply of digital service to the city’s entire metropolitan region. In February and April 2007 we also digitalized our MMDS networks in Rio de Janeiro and Curitiba, respectively.

With the launching of TVA Voz (“TVA Voice,” a VoIP service) in 2005, we became the first “triple-play” operator in the Brazilian market, offering pay television, broadband internet and voice services. In 2005 we also became the first Brazilian pay television operator to offer digital video recorder (DVR) service, which is a first step towards the launch of video-on-demand (VOD) services for our digital TVA subscribers. Being the triple-play pioneer in Brazil strengthens our reputation as an innovator in the segments in which we operate.

In terms of number of subscribers, according to Pay TV Survey, as of December 31, 2006 we were among the largest terrestrial pay television companies and digital television operators in Brazil, and one of the main broadband internet providers in the country.

Through our digital and analog MMDS and cable networks, we serve both residential and corporate customers. We offer services in seven cities (São Paulo, Rio de Janeiro, Curitiba, Porto Alegre, Foz do Iguaçu, Florianópolis and Balneário Camboriú), with a total population of approximately 26.9 million people as of December 31, 2006. In Balneário Camboriú, we are the only terrestrial pay television operator. According to IBGE statistics, the States of São Paulo, Rio de Janeiro and Paraná (the capital of which is Curitiba) alone represented approximately 51% of Brazil’s GDP in 2004. Residents of these areas have substantially higher average household income, per capita consumption and receptivity to products with technological innovations than the respective national averages. In addition, the population density in these states is substantially higher than the national average and has a higher concentration of classes with greater purchasing power. Thus, we believe we are active in the largest and most attractive markets in Brazil.

From 2001 to 2003 we implemented a strategic and financial restructuring, following which we significantly improved our results, increased our profitability and subscriber base and created a new business model with the launch of new products and services focused on the triple-play concept.

We believe that the profitability of our operations in São Paulo, where we operate in the triple play business model, is in line with benchmarks worldwide. With the recent digitalization of MMDS networks in Rio de Janeiro and Curitiba (and the expected digitalization of our MMDS network in Porto Alegre, where we expect to roll out services in the near future), we expect significant improvements in our profitability through our offer of bundled services and new products to our subscriber base.

We believe that there is high potential for growth in the markets in which we operate because, with the digitalization of our MMDS network in São Paulo (2005), Rio de Janeiro (2007) and Curitiba (2007), we will have a highly competitive product in metropolitan areas with more than 4.5 million class ABC households, of which more than 3.2 million did not have pay television services as of December 31, 2006. In addition, when compared with cable, our MMDS network requires lower infrastructure development and operating costs, while allowing us to supply the same services as cable, plus mobile services.

16

The chart below shows the evolution of our subscriber base in each of the services that we provide:

We believe the increase in our subscriber base and profitability is due in large part to the flexibility of options we offer to our subscriber base and our dedication to customer service. We take a long-term approach to our relations with our subscribers by offering bundled video, voice and data services, with a wide variety of pricing options.

We hope to expand our portfolio of innovative and quality products and services with WiMAX technology, which will add restricted portability and mobility to our video, data and voice services. In 2006 we tested WiMAX technology in São Paulo, thereby becoming the first company to conduct such tests in Latin America using the IEEE standard 802.16e, which allows the offer of fixed access broadband service with wireless technology.

We believe that MMDS has gained increasing importance as a distribution platform. Our digital MMDS network, together with the use of WiMAX technology, makes it possible to add portability and restricted mobility to the video, voice and data services we already offer. This should provide a new experience and entertainment concept for our subscribers, as we will be able to offer access to our content in different platforms and terminals (“anytime, anywhere, any device”). This development of our business model will expand the market of consumers for our services beyond households as a whole and into different consumers in each household. We also believe that there are significant barriers to entry for new service providers in this segment, including regulatory issues (such as the limited MMDS radiofrequency spectrum available to new providers, especially in São Paulo and Rio de Janeiro, where we hold concessions for the entire MMDS spectrum.

Through our cable and MMDS licenses, we are able to provide multiservices in our major markets until the expiration date of these licenses. We believe that, as we use the MMDS spectrum in an efficient manner, and satisfy other applicable requirements, we will obtain the renewal of each of our licenses for a further 15 years. In 2006, we requested renewal of our MMDS licenses (which presently expire in 2009) by ANATEL, together with the permission to supply wireless multiservices with portability and restricted mobility in the 2.5GHZ band of the MMDS spectrum. To date there has been no final decision of ANATEL on the renewal of our MMDS licenses. With the renewal of these MMDS licenses, we expect to obtain the first wireless multiservices license in Brazil.

As of December 31, 2003, we also held a minority interest in several companies known as “Canbras TVA”, which collectively provided cable television services to an additional 19 cities in southern Brazil with a total population of 2.9 million. In October 2003, we entered into an agreement to sell our entire equity interest in each of the Canbras TVA companies to Horizon Cablevision do Brasil S.A. The federal Agência Nacional de Telecomunicações (Brazilian Telecommunications Agency, or ANATEL) approved this sale on June 16, 2004, and all other conditions precedent to the closing of the sale were waived by the parties during the first half of 2004. Abril Comunicações S.A., our main shareholder, received the entire proceeds of the sale in the amount of US$5.5 million, for which we recognized a shareholders’ receivable. In addition, upon the consummation of this sale, we and the Canbras TVA companies terminated our Association Agreement, dated June 14, 1995.

17

During the three years ended December 31, 2006, we incurred capital expenditures of $82.0 million, primarily in connection with the purchase of reception equipment, converters for installation throughout our cable and MMDS systems, other equipment required to upgrade our cable and MMDS networks (including the introduction of digital services in São Paulo) and the increase of our pay television and internet subscriber base. We estimate that approximately $85.0 million will be required in 2007, principally in connection with the purchase of installation materials and equipment, technological upgrades (including the introduction of digital services in Rio de Janeiro) and the increase of our pay television and internet subscriber base. We estimate that approximately 85% of these investments are variable (due to growth of the subscriber base and Churn replacement) and that the payback for such investments will occur within a six-month period (for analog services and broadband internet services) or a 12 to 15-month period (for digital services).

On October 29, 2006 we, TVA Sistema, Comercial Cabo TV São Paulo S.A., TVA Sul Paraná S.A., Abril Comunicações (our shareholder) and certain entities affiliated with Abril Comunicações entered into certain convergence and sale agreements with Telecomunicações de São Paulo S.A.-Telesp (an affiliate of Telefonica, the Spanish telecommunications concern), as described above. For more information on this transaction, see Item 3, “Key Information—Selected Financial Data” and note 20 to the Tevecap Financial Statements included in this Annual Report.

Tevecap S.A. is a corporation of unlimited duration under the laws of the Federative Republic of Brazil. Our registered office is located at Av. das Nações Unidas, 7221 - 7º andar, São Paulo, 05425-902 SP, Brazil (telephone: +55-11-3037-5127).

B. Business Overview

Our Strategy

Our business strategy is focused on creating long-term relationships with our customers by offering quality programming and multiple communications services for all age groups. We are taking advantage of technological developments to use our core cable and MMDS infrastructure to provide high speed data transmission, interactive services and other telecommunications services and expect to take advantage of possible deregulation and the growing demand for these services in Brazil. We were the first company in Brazil to provide customers with a single source of “triple-play” (video, data and voice) multimedia services, and through the development of our WiMAX services we expect to become the first company in Brazil to provide a single source of “quadruple-play” (video, data, voice and portability) services.

The Brazilian Pay Television Market

Brazil is the largest television and video market in Latin America with an estimated 51.8 million TV Homes which, as of December 31, 2006, watched on average approximately 3.4 hours of television per day. In residences that have access to free television, pay television, Internet services, newspapers and magazines, pay television is the leader in terms of share of time, with a 24% share, in spite of its relatively recent entry into the market. Approximately 11 million television sets (10.5 million common television sets and 350,000 plasma and LCD television sets) and 8 million DVD players were sold in Brazil in 2006.