Exhibit 99.1

[GRAPHIC APPEARS HERE]

Investor News

SBA Communications Corp. SBAC

A Letter from the CEO

Dear Investors

We at SBA are very happy with our first quarter results and believe that they continue to prove out the basic attractions of the tower business. We have produced these results while at the same time restructuring our company, which entailed reducing headcount by 25% and offices by 33%. As a result of the restructuring, we experienced healthy expense savings and reduced cash consumption in the first quarter. We expect to see additional improvement throughout 2002 in these areas as we drive down SG&A expense as a percentage of revenue and manage our capital expenditure budget. With the majority of the restructuring now behind us, we can once again focus on executing our plan.

In addition to our expense controls, we have encouraging opportunities for top line revenue growth. Although the first quarter is seasonally slow, carriers are actively deploying their capex budgets as they address the need to upgrade their network performance to compensate for increased subscribers and minutes of use. We are also encouraged by increasing 2.5G deployments, which present us with opportunities to grow both services and leasing revenues.

Our first quarter leasing revenues were a tremendous start for the year, and as a result make us comfortable with our full year guidance of $7,000 to $8,000 of added gross revenue per tower. We are seeing strong demand for new tenant installations as well as an increasing contribution from new equipment added by existing tenants. As the GSM overlays continue, we expect to see more of this trend.

Our most important goal remains getting to free cash flow as quickly as possible and reducing our net debt balances, We continue to be on track to be free cash flow positive in early 2003, and we are carefully managing our liquidity and our balance sheet as we get there. Our existing cash resources and availability are more than sufficient to get us there, and we remain confident in our ability to remain in compliance with our bank covenants.

At SBA, we continue to have the ultimate confidence in our business plan and in our ability and resources to carry it out. We have a great management team whose strengths and experience are in operations. We believe our focus, operational excellence, good customer service and continued execution on expense control will be more than sufficient to allow us to achieve our operational and financial goals.

Sincerely,

Jeffrey Stoops, President & CEO

FOR FURTHER INFORMATION CONTACT PAM KLINE OR DUNCAN SIMMONS @ (561) 995-7670 OR IR@SBASITE.COM

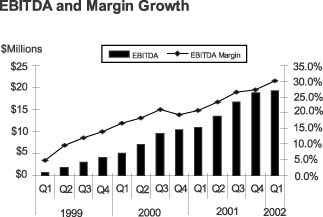

On Monday, May 6, SBA Communications, Inc. announced record financial results showing strong year-over-year growth in all areas. Revenue, tower cash flow, and EBITDA were all record highs.

Conference Call Highlights:

Lease-Up

| | • | | SBA posted solid lease-up numbers, adding annualized gross revenues at a rate of over $7,650 per tower per year (0.43 BBE) |

| | • | | Same tower revenue and cash flow growth came in at 20% and 24%, respectively, for the 2,839 towers owned on March 31, 2001 |

Expense Controls

| | • | | As discussed in SBA’s announcement February 6, the Company has undergone a restructuring related to the scale-back of its new build program |

| | • | | These measures allowed for sequential declines in SG&A not only as a percentage of revenues but also on an absolute basis |

Liquidity

| | • | | On March 31, SBA had cash and restricted cash of $39.8 million and total debt of $950 million |

| | • | | SBA is in full compliance with its debt covenants, and expects to be so in all of 2002 and going forward |

| | • | | On March 31, the full remaining $92 million under the senior credit facility was immediately available to SBA |

| | • | | Debt is expected to peak in the third quarter of 2002, remain flat for two quarters and then begin to decline |

Operations

| | • | | Despite wireless carriers spending only 14% of their annual capex budgets, SBA posted strong services results |

| | • | | GSM overlay programs are active, and expected to stay active through 2002 |

| | • | | Affiliates still have much to do to meet mandated covered pop requirements and geographical coverage requirements |

| | • | | Each carrier has much to do in terms of capacity and network performance |

1st Quarter 2002 Results

| | | Three Months Ended March 31,

|

| | | 2002

| | 2001

|

| | | ($ in thousands) |

| Revenues: | | | | | | |

| Site Development | | $ | 31,404 | | $ | 32,673 |

| Site Leasing | | | 32,540 | | | 20,283 |

| | |

|

| |

|

|

| Total | | $ | 63,944 | | $ | 52,956 |

| Expenses: | | | | | | |

| Site Development | | $ | 24,680 | | $ | 25,018 |

| Site Leasing | | | 11,240 | | | 7,128 |

| | |

|

| |

|

|

| Total | | $ | 35,920 | | $ | 32,146 |

| SG&A(1) | | $ | 9,374 | | $ | 10,641 |

| Non-cash Comp. | | $ | 652 | | $ | 788 |

| EBITDA(2) | | $ | 19,302 | | $ | 10,957 |

| (1) | | Excludes non-cash compensation expense |

| (2) | | Earnings before interest, taxes, depreciation, amorization, non-cash compensation, and non-recurring developmental charge |

Guidance

| | | Guidance(1)

| |

| | | 2Q2002

| |

| | | ($ in millions) | |

| Revenues: | | | | | | | | | | |

| Site Development | | $ | 32.0 | | | – | | $ | 35.0 | |

| Site Leasing | | | 33.0 | | | – | | | 35.0 | |

| | |

|

|

| | | |

|

|

|

| Total | | $ | 65.0 | | | – | | $ | 70.0 | |

| EBITDA (2) | | $ | 19.5 | | | – | | $ | 22.0 | |

| Net Interest Expense | | $ | 21.0 | | | – | | | 24.0 | |

| Net Loss/Share (3) | | $ | (0.60 | ) | | – | | $ | (0.80 | ) |

| Cash Interest Expense | | $ | 14.0 | | | – | | $ | 16.0 | |

| Cash Capex | | $ | 18.0 | | | – | | $ | 25.0 | |

| (1) | | Please see language regarding forward-looking included in this mailing |

| (2) | | Earnings before interest, taxes, depreciation, amorization, non-cash compensation and non-recurring development charge |

| (3) | | Excludes any impact of a FAS 142 charge |

Notice Regarding Forward-Looking Statements

This letter contains forward-looking statements, including statements regarding further reductions in SG&A expenses, future revenue growth, our ability to be free cash flow positive by early 2003 and all our 2Q financial guidance. These forward-looking statements may be affected by the risks and uncertainties in our business, including our ability to expand our site leasing business and maintain or expand our site development business, the general health of the economy, the inability of our clients to access sufficient capital or their unwillingness to expend capital to fund network expansion or enhancements, our inability to sufficiently increase our revenues and maintain or decrease expenses and cash capital expenditures sufficiently to permit us to be positive free cash flow by early 2003, and the other cautionary statements and risk factors disclosure contained in our Securities and Exchange Commission filings, including its Annual Report on Form 10-K for the year ended December 31, 2001. We have no obligation to update any forward-looking statement we may make.

2