Exhibit 99.1

SBA Communications Corporation October 2004

Introduction

Jeff Stoops

President & Chief Executive Officer and

Tony Macaione

Chief Financial Officer

2

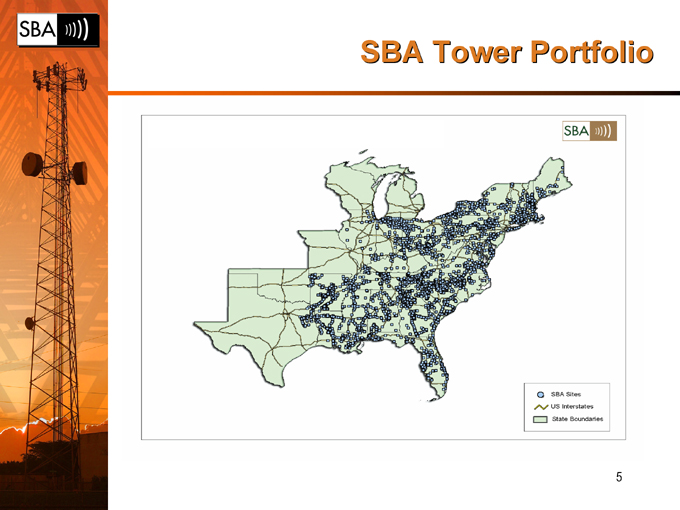

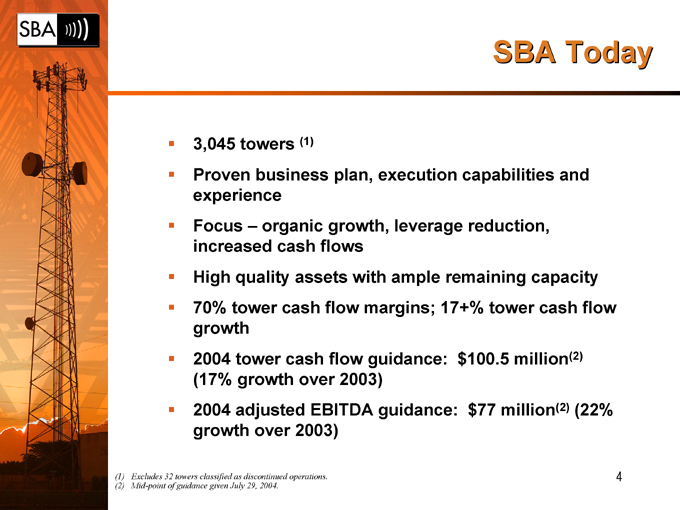

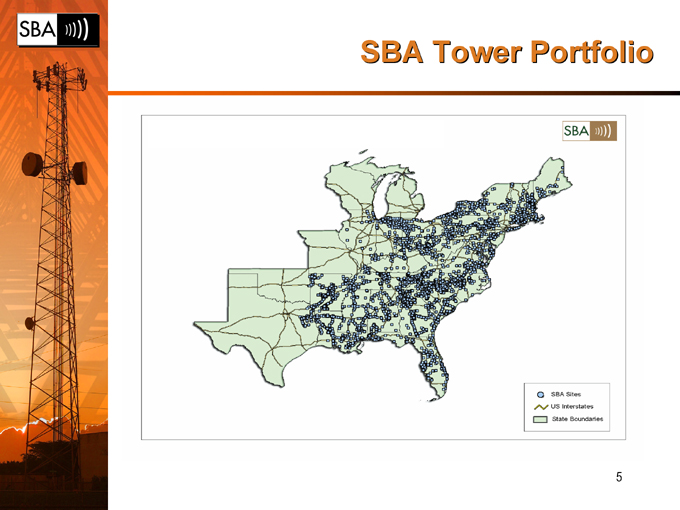

SBA Tower Portfolio

5

Tower Industry Fundamentals

Industry Dynamics Remain Strong

Mission critical to wireless carrier industry

Strong recurring cash flow from multi-year lease contracts High margins and significant projected free cash flow Substantial barriers to entry Exclusive assets provide pricing power Low maintenance capex No overcapacity No material threat of technical or operational obsolescence Highly scalable business / leveragable overhead

6

Asset Quality – Key Strength

60% of portfolio built by SBA

All towers built or bought with multi-tenant focus Average capacity – 4+ tenants Current use – 2.3 tenants per tower

Maintenance capex – approximately $1,000 per tower per year

Average remaining ground lease term (with renewal options) – 32 years

Average height – 226’

Structure – 74% guyed or lattice towers

Low monthly operating expense per tower

Result: Strong Lease-up and Tower Cash Flow Growth

7

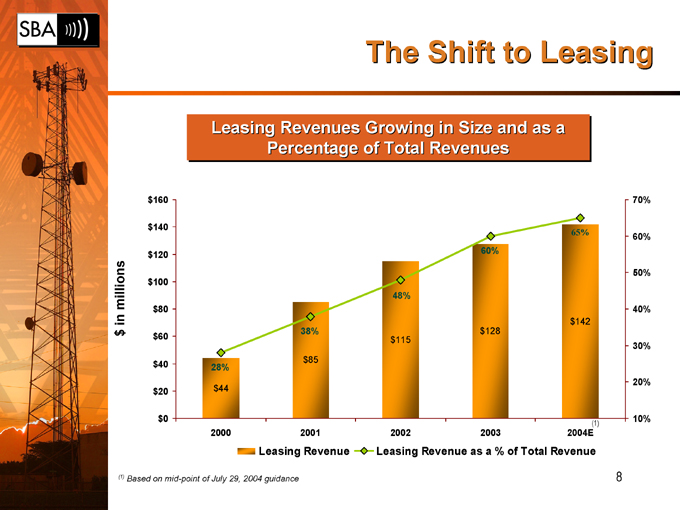

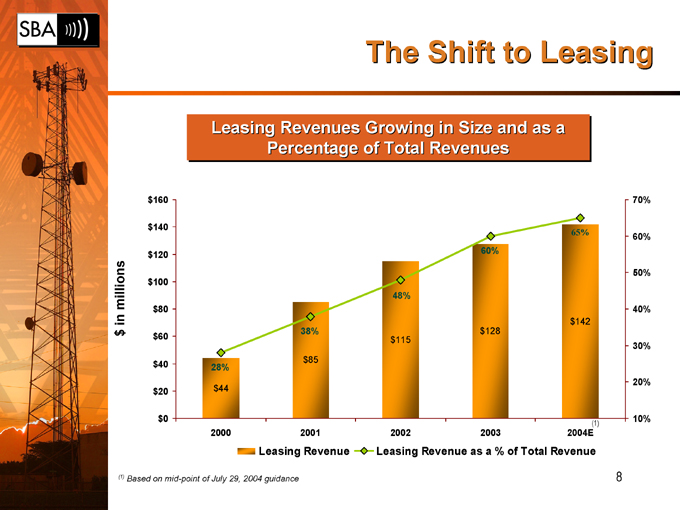

The Shift to Leasing

Leasing Revenues Growing in Size and as a Percentage of Total Revenues

$ in millions

$160 $140 $120 $100 $80 $60 $40 $20 $0

28%

$44

38%

$85

48%

$115

60%

$128

65%

$142

70% 60% 50% 40% 30% 20% 10%

(1)

2000 2001 2002 2003 2004E

Leasing Revenue

Leasing Revenue as a % of Total Revenue

(1) Based on mid-point of July 29, 2004 guidance

8

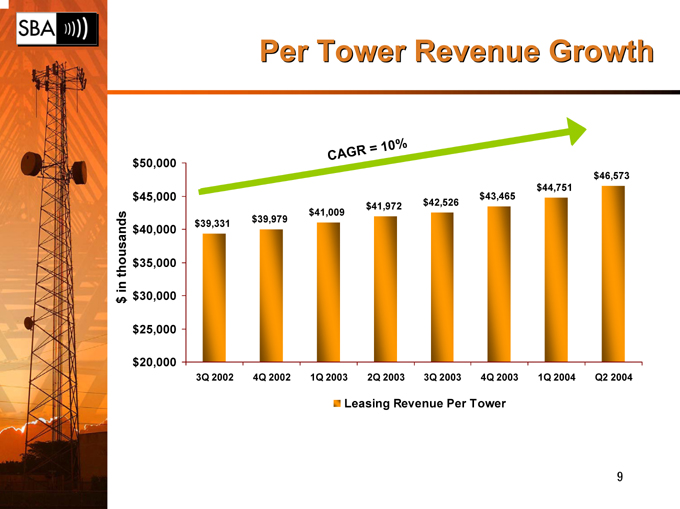

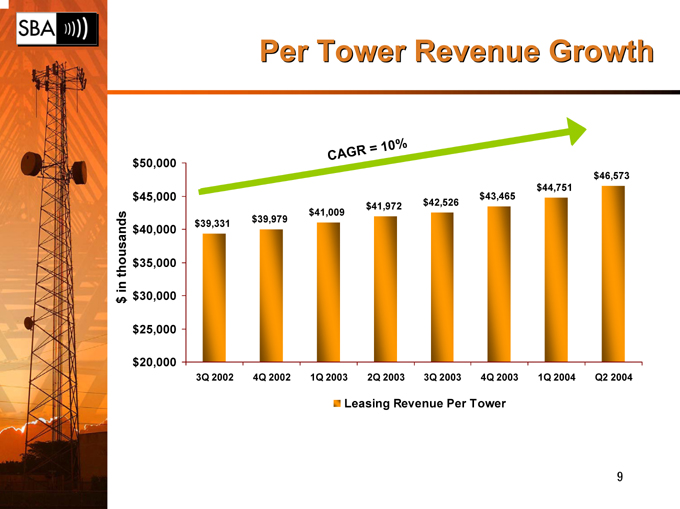

Per Tower Revenue Growth

$ in thousands

$50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000

CAGR = 10%

$46,573 $44,751 $43,465 $41,972 $42,526 $41,009 $39,331 $39,979

3Q 2002 4Q 2002 1Q 2003 2Q 2003 3Q 2003 4Q 2003 1Q 2004 Q2 2004

Leasing Revenue Per Tower

9

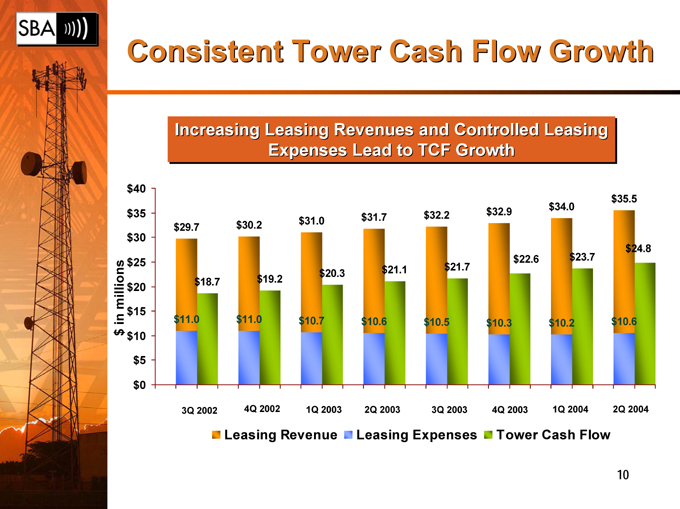

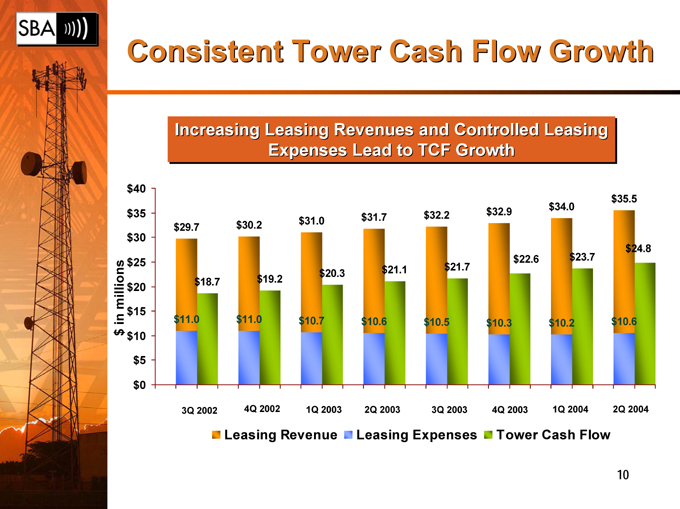

Consistent Tower Cash Flow Growth

Increasing Leasing Revenues and Controlled Leasing Expenses Lead to TCF Growth

$ in millions

$40 $35 $30 $25 $20 $15 $10 $5 $0

$35.5 $34.0 $32.2 $32.9 $31.0 $31.7 $29.7 $30.2

$24.8 $22.6 $23.7 $21.1 $21.7 $20.3 $18.7 $19.2

$11.0 $11.0 $10.7 $10.6 $10.5 $10.3 $10.2 $10.6

3Q 2002 4Q 2002 1Q 2003 2Q 2003 3Q 2003 4Q 2003 1Q 2004 2Q 2004

Leasing Revenue

Leasing Expenses

Tower Cash Flow

10

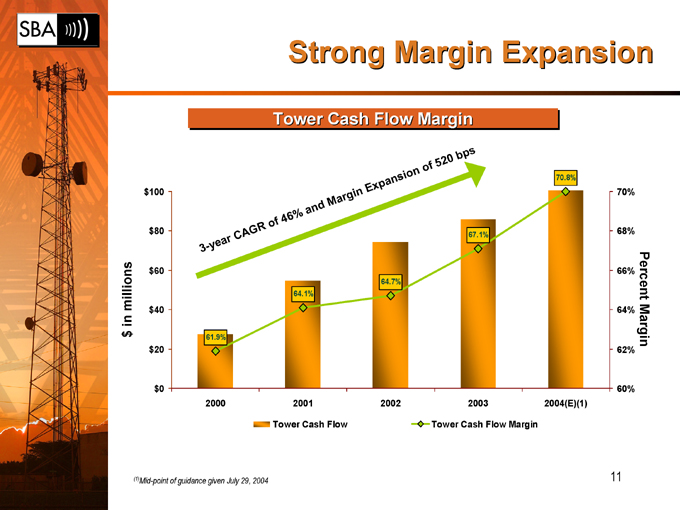

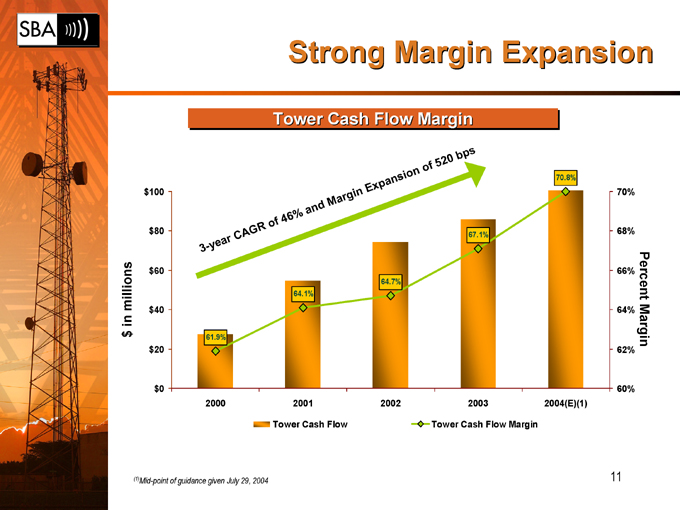

Strong Margin Expansion

Tower Cash Flow Margin

$ in millions

$100

$80

$60

$40

$20

$0

3-year

CAGR o f

and Margin Expansion of 520 bps

61.9%

64.1%

64.7%

67.1%

70.8%

70%

68%

66%

64%

62%

60%

Percent Margin

2000 2001 2002 2003 2004(E)(1)

Tower Cash Flow Tower Cash Flow Margin

(1)Mid-point of guidance given July 29, 2004 11

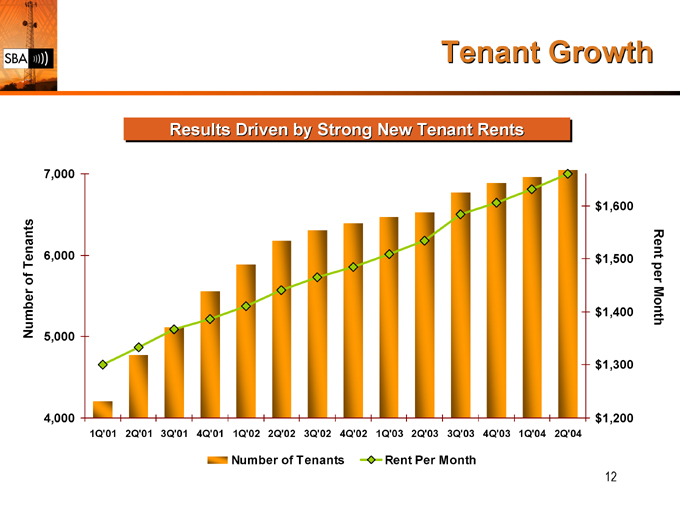

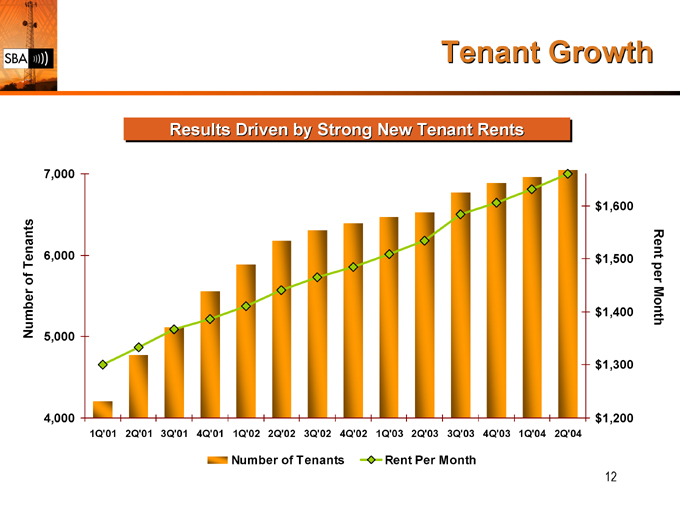

Tenant Growth

Results Driven by Strong New Tenant Rents

Number of Tenants

7,000 6,000 5,000 4,000

Rent per Month

$1,600 $1,500 $1,400 $1,300 $1,200

1Q’01 2Q’01 3Q’01 4Q’01 1Q’02 2Q’02 3Q’02 4Q’02 1Q’03 2Q’03 3Q’03 4Q’03 1Q’04 2Q’04

Number of Tenants Rent Per Month

12

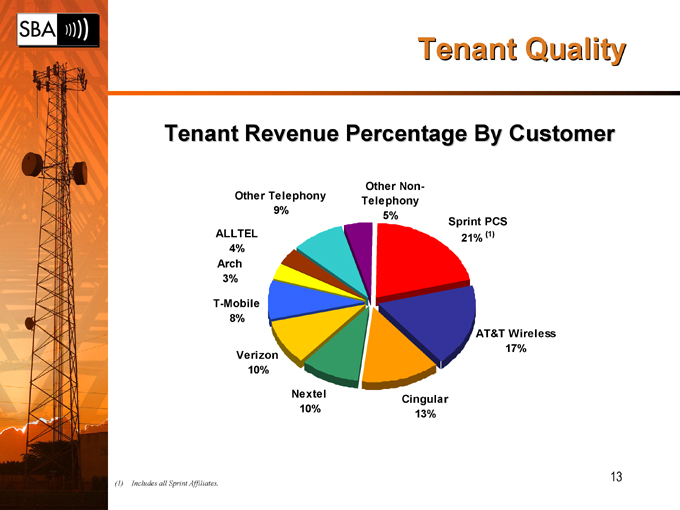

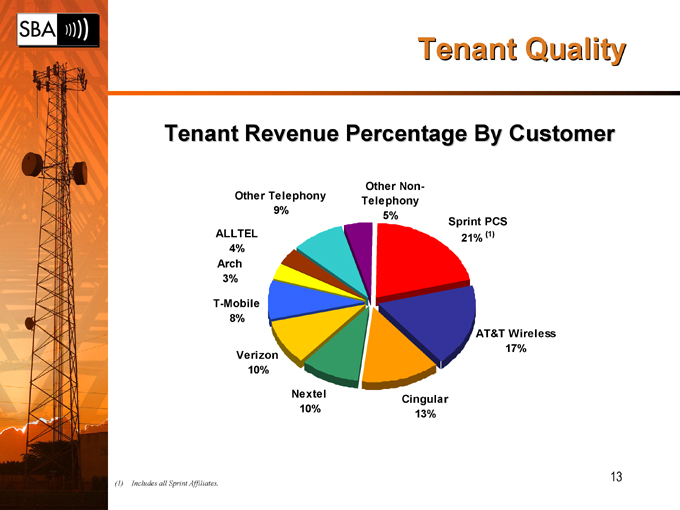

Tenant Quality

Tenant Revenue Percentage By Customer

Other Non-Telephony 5%

Sprint PCS

21% (1)

AT&T Wireless 17%

Cingular 13%

Nextel 10%

Verizon 10%

T-Mobile 8%

Arch 3%

ALLTEL

4%

Other Telephony 9%

(1) Includes all Sprint Affiliates.

13

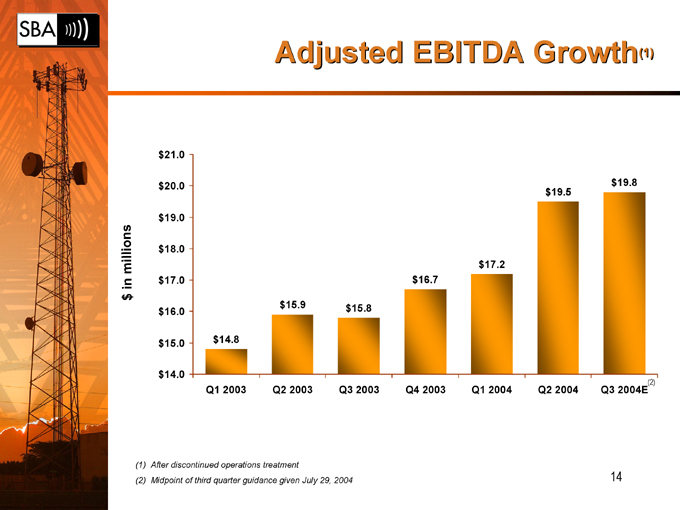

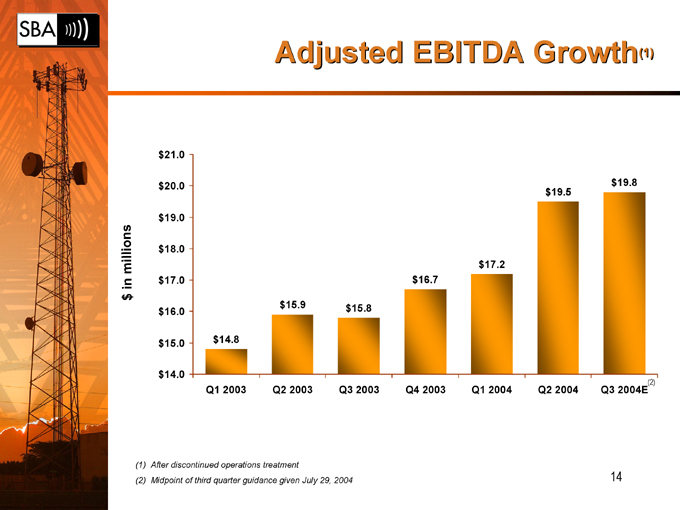

Adjusted EBITDA Growth(1)

$ in millions

$21.0 $20.0 $19.0 $18.0 $17.0 $16.0 $15.0 $14.0

$14.8

$15.9

$15.8

$16.7

$17.2

$19.5

$19.8

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004 Q3 2004E(2)

(1) After discontinued operations treatment

(2) Midpoint of third quarter guidance given July 29, 2004

14

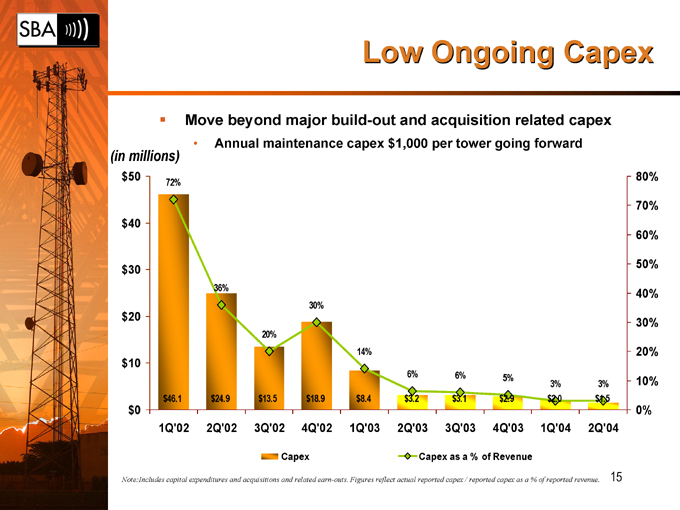

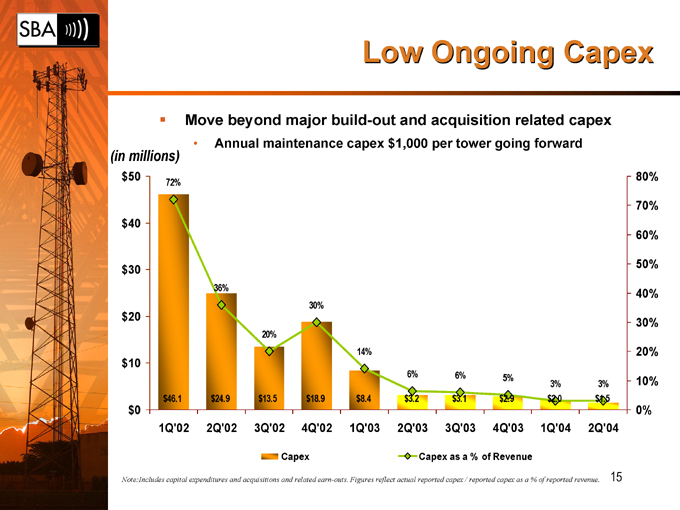

Low Ongoing Capex

Move beyond major build-out and acquisition related capex

Annual maintenance capex $1,000 per tower going forward

(in millions)

$50 $40 $30 $20 $10 $0

72%

36%

20%

30%

14%

6% 6% 5%

3% 3%

$46.1 $24.9 $13.5 $18.9 $8.4 $3.2 $3.1 $2.9 $2.0 $1.5

80% 70% 60% 50% 40% 30% 20% 10% 0%

1Q’02 2Q’02 3Q’02 4Q’02 1Q’03 2Q’03 3Q’03 4Q’03 1Q’04 2Q’04

Capex Capex as a % of Revenue

Note:Includes capital expenditures and acquisitions and related earn-outs. Figures reflect actual reported capex / reported capex as a % of reported revenue. 15

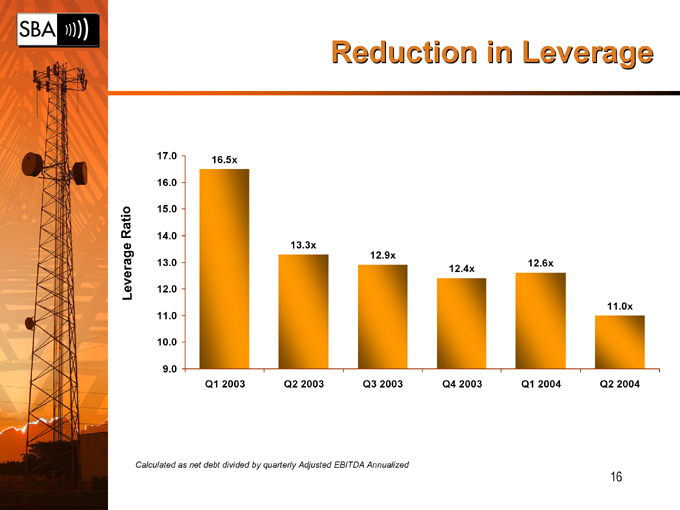

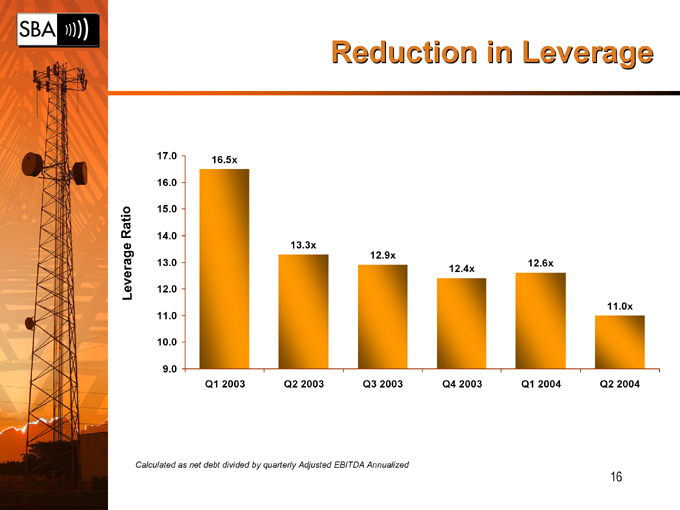

Reduction in Leverage

Leverage Ratio

17.0

16.0

15.0

14.0

13.0

12.0

11.0

10.0

9.0

16.5x

13.3x

12.9x

12.4x

12.6x

11.0x

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004

Calculated as net debt divided by quarterly Adjusted EBITDA Annualized

16

SBA – Goals For The Foreseeable Future

Reduce leverage each year and transfer enterprise value to shareholders

Resume discretionary portfolio growth while maintaining comfortable liquidity cushion

Maximize tower cash flow and adjusted EBITDA growth

Steadily increase equity free cash flow per share

Opportunistically refinance to reduce weighted average cost of debt

A Growth Company in a Growth Industry

17

Multiple Paths to Increase Free Cash Flow

More tenants

More equipment from existing tenants

Escalators and renewals Reduce tower expense Reduce capex Increase services revenue Increase services margin

Refinance debt at lower rates Reduce overhead expense Buy underlying ground leases Repurchase high yield debt

Reinvest in additional tower assets

18