We have adopted a pay for performance culture that we believe rewards shareholders and is aligned with our performance

The core of our executive compensation philosophy is that our executives’ pay should be linked to the performance of SBA. Accordingly, our executives’ compensation is heavily weighted toward compensation that is performance-based or equity-based. For 2018, 90% of our CEO’s target total compensation and an average of 85% of our other NEOs’ target total compensation was performance-based or equity-based. As a result, our executives only recognize value approaching their target compensation when our shareholders have enjoyed value creation.

We regularly lead the tower industry in a variety of financial metrics such as growth rates, tower cash flow and Adjusted EBITDA margins and AFFO per share. We believe that our financial performance for the one and three-year period ended December 31, 2018, reflects that our executive compensation program drives performance.

| | | | | | | | |

Metric | | 1-Year Results | | | 3-Year Results | |

Site Leasing Revenue | | | h 7 | % | | | h18 | % |

Tower Cash Flow | | | h 8 | % | | | h21 | % |

Adjusted EBITDA | | | h 8 | % | | | h19 | % |

AFFO | | | h 5 | % | | | h20 | % |

AFFO Per Share | | | h 9 | % | | | h33 | % |

One of the reasons ISS has concluded that SBA has apay-for-performance misalignment is the results of their financial performance assessment, which is a relative analysis comparing SBA’s financial performance on selected financial metrics against the ISS Peer Group, notwithstanding SBA’s relative TSR performance near the top of such peer group. Most of these metrics appear to be net income driven which, as SBA shareholders know, is not the primary focus of our management nor the basis upon which our company is valued. Our compensation program utilizes financial metrics that matter to our industry, and our management has delivered on those metrics to create shareholder value.

Confirmation that our performance has been well-aligned with our pay over a multi-year period is illustrated by both ISS and Glass Lewis’spay-for-performance tests. The ISS test calculates that our 2018 three-year relative TSR performance exceeded our three-year relative CEO pay by 19 percentile points while the Glass Lewis Pay for Performance Test ranked SBA in the second highest category, which includes companies whose performance has exceeded pay over the three-year period.

We believe all of the foregoing illustrates the responsible nature of our executive compensation program and a very strong alignment between pay and performance.

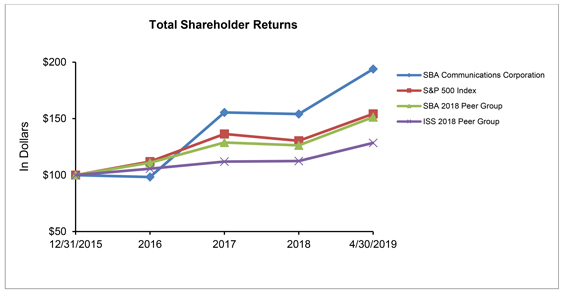

We believe that our long-term incentive program is a primary driver of our top quartile shareholder returns

Our philosophy is that a majority of an executive’s compensation should be derived from the value of long-term incentive compensation in the form of restricted stock units and stock option awards so as to align the financial interests of our executives with those of our shareholders. We believe that stock options provide strong alignment with shareholder interests as options have no value unless our stock price increases, which then benefits shareholders.

Our Compensation Committee believes that stock options are the single-most important component of our compensation program and the one that most closely aligns and incents management compensation with shareholder returns. In addition, to have a balanced mix, we use restricted stock units as a component of our long-term incentive compensation as they (1) facilitate our stock ownership program, (2) improve retention, (3) materially reduce projected future share usage in our equity compensation plans and (4) mitigate structural risk associated with using purely stock options as equity compensation.